Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - Medtronic plc | exhibit991-fy17q4earningsr.htm |

| 8-K - 8-K - Medtronic plc | fy17q4earningsrelease.htm |

MEDTRONIC PLC

Q4 FY17

EARNINGS PRESENTATION

MAY 25, 2017

• FY17 FINANCIAL HIGHLIGHTS

• Q4 FY17 CONSOLIDATED RESULTS &

GROUP REVENUE HIGHLIGHTS

• REVENUE / EPS GUIDANCE & OTHER

ASSUMPTIONS

Exhibit 99.2

Q4 FY17 Earnings Results | May 25, 2017 | 2

FORWARD LOOKING STATEMENTS

This presentation contains forward-looking statements which provide current expectations or forecasts, including those

relating to market and sales growth, growth strategies, changes to the healthcare system, financial results, use of capital,

balance sheet changes, the creation of shareholder value and shareholder returns, product and service development,

introduction, and adoption, partnerships, regulatory matters, restructuring initiatives, mergers/acquisitions/divestitures and

related effects, accounting estimates, working capital adequacy, currency exchange rates, competitive strengths and sales

efforts. They are based on current assumptions and expectations that involve uncertainties or risks. These uncertainties and

risks include, but are not limited to, those described in the filings we make with the U.S. Securities and Exchange Commission

(SEC). Actual results may differ materially from anticipated results. Forward-looking statements are made as of today's date,

and we undertake no duty to update them or any of the information contained in this presentation.

Financial Data

Certain information in this presentation includes calculations or figures that have been prepared internally and have not been

reviewed or audited by our independent registered public accounting firm. Use of different methods for preparing, calculating

or presenting information may lead to differences and such differences may be material. This presentation contains financial

measures and guidance, including free cash flow figures (defined as operating cash flows less property, plant and equipment

additions), revenue, margin and growth rates on a constant currency and constant week basis, and adjusted EPS, all of which are

considered “non-GAAP” financial measures under applicable SEC rules and regulations. We believe these non-GAAP measures

provide a useful way to evaluate our underlying performance. Medtronic calculates forward-looking non-GAAP financial

measures based on internal forecasts that omit certain amounts that would be included in GAAP financial measures. For

instance, forward-looking revenue growth and EPS projections exclude the impact of foreign currency exchange fluctuations.

Forward-looking non-GAAP EPS guidance also excludes other potential charges or gains that would be recorded as non-GAAP

adjustments to earnings during the fiscal year, such as amortization of intangible assets and acquisition-related, certain tax and

litigation, and restructuring charges or gains. Medtronic does not attempt to provide reconciliations of forward-looking non-

GAAP EPS guidance to projected GAAP EPS guidance because the combined impact and timing of recognition of these

potential charges or gains is inherently uncertain and difficult to predict, and is unavailable without unreasonable efforts. In

addition, we believe such reconciliations would imply a degree of precision and certainty that could be confusing to investors.

Such items could have a substantial impact on GAAP measures of financial performance. Detail concerning how all non-GAAP

measures are calculated, including all GAAP to non-GAAP reconciliations, are provided on our website and can be accessed

using this link.

Q4 FY17 Earnings Results | May 25, 2017 | 3

Executed steady cadence of meaningful product launches,

expanded our global footprint, and extended our leadership in

value-based healthcare offerings

• Mid-Single Digit Organic Growth2: ~4%

• Acquisitions contributed ~100 – 110 bps

• Foreign currency had a negative ~10 – 20 bps impact

• New product launches driving growth:

• Evolut® R 34mm, LigaSure™ instruments, Signia™ powered stapler, Solera®

Voyager®, and MiniMed® 6 series

• Double-digit Emerging Market revenue growth2

Solid operating margin improvement; double-digit EPS2 growth

• EPS: ~11 - 12%2 growth; EPS leverage ~650 bps2

• Operating Margin: ~100 bps improvement Y/Y2; ~140bps improvement Y/Y

on organic basis2; Operating leverage ~400 bps2

• Covidien synergies: on track for a minimum of $850M in cost savings by FY18

• Delivered more than $600M in synergy savings to-date through FY17

Outlook: Reiterate long-term expectation of mid-single digit

revenue growth and double-digit EPS growth2

• FY18 Revenue1 growth: 4 – 5%

• FY18 EPS1 growth: 9 – 10%

Balanced return to shareholders with disciplined reinvestment

• FY17: 86% Payout Ratio4; $2,376M in dividends and $3,116M in net share

repurchases

• Closed five tuck-in acquisitions and several strategic investments, totaling

approximately $1.5B

• Announced strategic sale of a portion of our PMR division to Cardinal Health

MDT

FY17 HIGHLIGHTS

1 Figures represent comparison to prior year on a constant currency basis (non-GAAP).

2 Figures represent comparison to prior year on a constant currency, constant week basis (non-GAAP).

3 Operating cash flows less property, plant and equipment additions (non-GAAP)

4 Dividends plus net share repurchases divided by adjusted net income (non-GAAP)

SOLID YEAR OVERALL; FIFTH CONSECTUTIVE YEAR

OF MID-SINGLE DIGIT REVENUE GROWTH

Revenue:

Other Financial Highlights:

U.S.

56%

Non-

U.S.

Dev

31%

EM

13%

1

Diluted

EPS

Y/Y

CC1

Y/Y%

CCCW2

Y/Y %

GAAP $2.89 17% NC NC

Non-GAAP $4.60 5% 9% ~11 - 12%

Cash Flow

from Ops $6.9B

Free Cash

Flow3 $5.6B

CVG

35%

MITG

33%

RTG

25%

DIAB

7%

Revenue

$M

As Rep

Y/Y %

CC1

Y/Y %

CCCW2

Y/Y %

CVG 10,498 3 3 MSD

MITG 9,919 4 4 MSD

RTG 7,366 2 2 MSD

Diabetes 1,927 3 4 MSD

Total $29,710 3% 3% ~5%

U.S. 16,663 1 1 LSD

Non-U.S. Dev 9,085 4 4 MSD

EM 3,962 7 9 DD

Total $29,710 3% 3% ~5%

Q4 FY17 Earnings Results | May 25, 2017 | 4

MDT

FY17 GAAP SELECT FINANCIAL INFORMATION

FY17

FY16

Y/Y Growth /

Y/Y Change

Net Sales ($M) 29,710 28,833 3%

Cost of Products Sold 9,291 9,142 2%

Gross Margin 68.7% 68.3% 40 bps

SG&A ($M) 9,711 9,469 3%

% of Sales 32.7% 32.8% 10 bps

R&D ($M) 2,193 2,224 (1%)

% of Sales 7.4% 7.7% 30 bps

Other Expense, Net ($M) 222 107 107%

Operating Profit 5,330 5,291 1%

Operating Margin 17.9% 18.4% (50) bps

Diluted EPS ($) 2.89 2.48 17%

Q4 FY17 Earnings Results | May 25, 2017 | 5

MDT

FY17 Y/Y EPS WALK

0.00

1.00

2.00

3.00

4.00

5.00

6.00

FY16,

GAAP

Non-GAAP

Adjustments

FY16,

Non-GAAP

Extra Week

Impact

FY16,

Non-GAAP

Adj.

Performance FY17

CC

FX FY17,

Non-GAAP

Non-GAAP

Adjustments

FY17,

GAAP

EPS Growth1: Double Digits; EPS Leverage1: ~650 bps EPS

$2.48

$1.89 $4.37

~($0.08)-

($0.10)

1 Comparison to FY16 on a constant currency, extra-week adjusted basis

Note: See FY17 Financial Schedules & Non-GAAP Reconciliations tables for additional information on reconciliations of non-GAAP information.

$4.29-

4.27

~$0.48-

$0.50 $4.77 ($0.17) $4.60 ($1.71)

$2.89

~11%-12% Y/Y1

FY16 FY17

Q4 FY17 Earnings Results | May 25, 2017 | 6

MDT

FY17 Y/Y OPERATING MARGIN CHANGES

0.0%

5.0%

10.0%

15.0%

20.0%

25.0%

30.0%

35.0%

FY16,

GAAP

Non-GAAP

Adjustments

FY16,

Non-GAAP

Extra Week

Impact

FY16,

Non-GAAP

Adj.

Performance FY17

CC

FX FY17,

Non-GAAP

Non-GAAP

Adjustments

FY17,

GAAP

~100 bps Operational Improvement1; 140 bps Organic Improvement1 Operating Margin

18.4%

9.8% 28.2% ~(0.2%) 29.0% (0.9%) 28.1% (10.2%)

17.9%

1 Comparison to FY16 on a constant currency, extra-week adjusted basis

Note: See FY17 Financial Schedules & Non-GAAP Reconciliations tables for additional information on reconciliations of non-GAAP information.

~28.0% ~1.0%

FY16 FY17

Q4 FY17 Earnings Results | May 25, 2017 | 7

MDT

FY17 NON-GAAP SELECT FINANCIAL INFORMATION

FY16

FY16

Estimated

Extra week

Impact

FY16

Adj for extra

week

FY17

FX

Impact

$M / Change

FY17

Constant

Currency1

FY17

CC Adj2

Growth

/Change

Net Sales ($M) 28,833 ~($450) -- 29,710 (34) -- ~5%

Gross Margin1 69.1%

~(0)-(20)

bps

~69.0%-

69.2%

68.9% (30) bps 69.2%

~(0)- (20)

bps

SG&A ($M) 9,469 -- -- 9,711 (19) -- --

% of Sales 32.8% ~20-30 bps

33.0%-

33.1%

32.7% Flat 32.7% ~30-40 bps

R&D ($M) 2,224 -- -- 2,193 (4) -- --

% of Sales 7.7% ~0 bps ~7.7% 7.4% Flat 7.4% ~(30) bps

Other Expense, Net

($M)

107 -- -- 222 213 -- --

Operating Profit1 8,126 -- -- 8,351 (289) -- HSD

Operating Margin 1 28.2% ~(20) bps ~28.0% 28.1% (90) bps 29.0% ~100 bps

Diluted EPS1 ($) 4.37

~$0.08 –

0.10

~$4.29–

4.27

4.60 (0.17) -- ~11-12%

1 Non-GAAP measure – see FY17 Financial Schedules & Non-GAAP Reconciliations tables for additional information on reconciliations of non-GAAP information

2 Figures represent comparison to FY16 on a constant currency, extra-week adjusted basis

Operating

Leverage

~+400 bps

EPS

Leverage

~+650 bps

Q4 FY17 CONSOLIDATED

RESULTS & GROUP

REVENUE HIGHLIGHTS

Q4 FY17 Earnings Results | May 25, 2017 | 9

Balanced, diversified growth across groups and geographies

• CVG, MITG, RTG and Diabetes all MSD growth1

• US MSD growth1; Non-US Developed MSD growth1; Emerging Markets DD

growth1

• Korea and Japan: HSD growth1

• Strong DD growth1 in China, Latin America, and Southeast Asia; HSD growth1

in Eastern Europe

• Growth Vector Performance:

• New Therapies: above our 200 to 350 bps goal, contributing ~370 bps

• Emerging Markets: below our 150 to 200 bps goal, contributing ~125 bps

• Services & Solutions: below our 40 to 60 bps goal, contributing ~15 bps

• Mid-Single Digit Organic Growth1: 4%

• Acquisitions contributed 110 bps

• Foreign currency had a negative 50 bps impact

Solid organic operating margin improvement

• Operating Margin: ~40 bps improvement Y/Y1; ~70bps improvement Y/Y1

on organic basis2; Operating leverage ~160 bps1

• Continued to cover dilution from acquisitions while investing in future

product launches

Capital allocation: Strategically deploying capital against priorities

• Q4: 33% Payout Ratio4; $594M in dividends and $16M in net share

repurchases

MDT

Q4 FY17 HIGHLIGHTS

1 Figures represent comparison to Q4 FY16 on a constant currency basis (non-GAAP).

2 Non-GAAP measure

3 Operating cash flows less property, plant and equipment additions (non-GAAP)

4 Dividends plus net share repurchases divided by adjusted net income (non-GAAP)

STRONG FINISH; SOLID YEAR OVERALL

Revenue:

Other Financial Highlights:

U.S.

56%

Non-

U.S.

Dev

31%

EM

13%

1

Diluted

EPS

Y/Y

CC1

Y/Y%

GAAP $0.84 8% NC

Non-GAAP $1.33 5% 6%

Cash Flow

from Ops $1.8B

Free Cash

Flow3 $1.4B

CVG

36%

MITG

33%

RTG

25%

DIAB

6%

Revenue

$M

As Rep

Y/Y %

CC1

Y/Y %

CVG 2,848 4 5

MITG 2,605 6 6

RTG 1,951 4 5

Diabetes 512 3 4

Total $7,916 5% 5%

U.S. 4,403 4 4

Non-U.S. Dev 2,452 2 4

EM 1,061 11 10

Total $7,916 5% 5%

Q4 FY17 Earnings Results | May 25, 2017 | 10

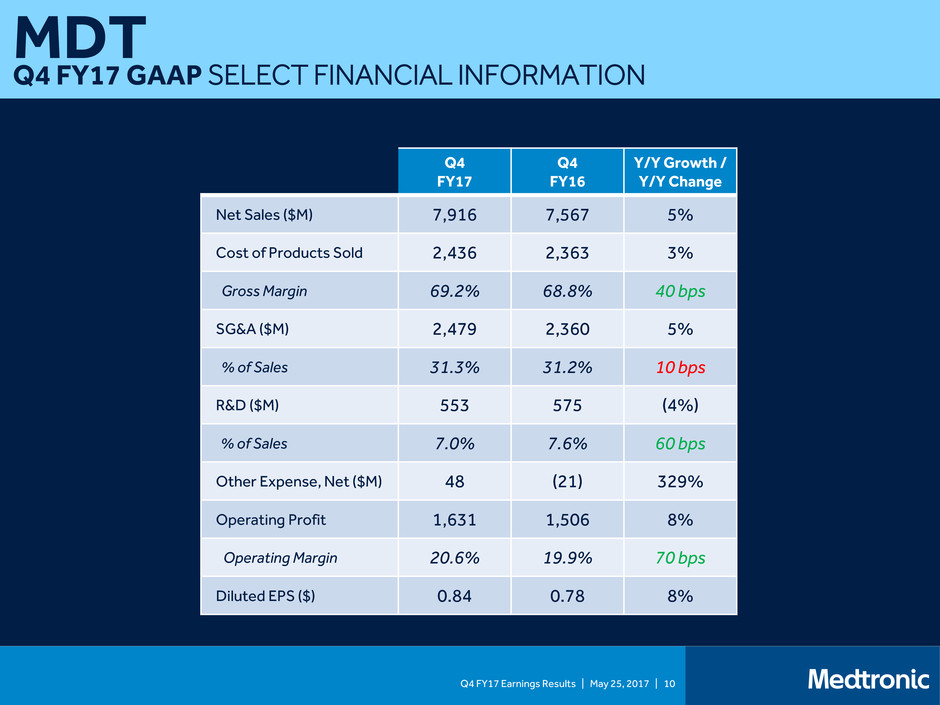

MDT

Q4 FY17 GAAP SELECT FINANCIAL INFORMATION

Q4

FY17

Q4

FY16

Y/Y Growth /

Y/Y Change

Net Sales ($M) 7,916 7,567 5%

Cost of Products Sold 2,436 2,363 3%

Gross Margin 69.2% 68.8% 40 bps

SG&A ($M) 2,479 2,360 5%

% of Sales 31.3% 31.2% 10 bps

R&D ($M) 553 575 (4%)

% of Sales 7.0% 7.6% 60 bps

Other Expense, Net ($M) 48 (21) 329%

Operating Profit 1,631 1,506 8%

Operating Margin 20.6% 19.9% 70 bps

Diluted EPS ($) 0.84 0.78 8%

Q4 FY17 Earnings Results | May 25, 2017 | 11

MDT

Q4 FY17 Y/Y EPS WALK

0.00

0.20

0.40

0.60

0.80

1.00

1.20

1.40

1.60

Q4 FY16,

GAAP

Q4 FY16,

Non-GAAP

Adjustments

Q4 FY16,

Non-GAAP

Performance Q4 FY17

CC

FX Q4 FY17,

Non-GAAP

Q4 FY17,

Non-GAAP

Adjustments

Q4 FY17,

GAAP

EPS Growth1: Mid-Single Digit; EPS Leverage1: ~120 bps EPS

$0.78

$0.49 $1.27

1 Figures represent comparison to Q4 FY16 on a constant currency basis (Non-GAAP).

$1.35 ($0.02) $1.33 ($0.49)

$0.84

6% Y/Y1

$0.08

FY16 FY17

Q4 FY17 Earnings Results | May 25, 2017 | 12

MDT

Q4 FY17 Y/Y OPERATING MARGIN CHANGES

0.0%

5.0%

10.0%

15.0%

20.0%

25.0%

30.0%

35.0%

Q4 FY16,

GAAP

Q4 FY16,

Non-GAAP

Adjustments

Q4 FY16,

Non-GAAP

Performance Q4 FY17

CC

FX Q4 FY17,

Non-GAAP

Q4 FY17,

Non-GAAP

Adjustments

Q4 FY17,

GAAP

~40 bps Operational Improvement1; 70 bps Organic Improvement1 Operating Margin

19.9%

10.4% 30.3% 0.4% 30.7% (0.3%) 30.4% (9.8%)

20.6%

FY16 FY17

1 Figures represent comparison to Q4 FY16 on a constant currency basis (Non-GAAP).

Q4 FY17 Earnings Results | May 25, 2017 | 13

MDT

Q4 FY17 NON-GAAP SELECT FINANCIAL INFORMATION

Q4

FY17

Q4

FY16

FX

Impact

$M / Change

Q4 FY17

Constant

Currency1

Q4 FY17

CC Growth /

Change2

Net Sales ($M) 7,916 7,567 (37) -- 5%

Cost of Products Sold1 2,426 2,363 (22) -- 4%

Gross Margin1 69.4% 68.8% 20 bps 69.2% 40 bps

SG&A ($M) 2,479 2,360 (9) -- 5%

% of Sales 31.3% 31.2% Flat 31.3% (10) bps

R&D ($M) 553 575 (3) -- (3%)

% of Sales 7.0% 7.6% Flat 7.0% 60 bps

Other (Income) Expense, Net ($M) 48 (21) 30 -- (186%)

Operating Profit1 2,410 2,290 (33) -- 7%

Operating Margin1 30.4% 30.3% (30) bps 30.7% 40 bps

Diluted EPS1 ($) 1.33 1.27 (0.02) -- 6%

1 Non-GAAP

2 Figures represent comparison to Q4 FY16 on a constant currency basis (Non-GAAP).

Operating

Leverage2

+160bps

EPS

Leverage2

+120bps

Q4 FY17 Earnings Results | May 25, 2017 | 14

CVG

Q4 FY17 HIGHLIGHTS

CRHF

54%

CSH

30%

APV

16%

U.S.

52%

Non-

U.S.

Dev

33%

EM

15%

Cardiac Rhythm & Heart Failure (CRHF)

KEY PERFORMANCE DRIVERS1

Heart Failure: +MSD

• Driven by HeartWare acquisition

• CRT-D: highest CRT-D share in 7

years in the US initial market

• Japan: continued share gains from

Compia MRI™ and Amplia MRI™

• CRT-P: above-market growth from

Quad

Arrhythmia Mgmt: +MSD

• WW Tachy: LSD decline; strength in US

• WW Brady: LSD decline

• Strength across several OUS

geographies offset by US decline

• CMS coverage approval of Micra®

• Diagnostics: Low-20s – Launched Reveal

LINQ® with TruRhythm™ detection

• AF Solutions: High-teens – Continued

share gain WW; strong growth in Japan

Coronary & Structural Heart (CSH)

Aortic & Peripheral Vascular (APV)

Services & Solutions: +MSD

Heart Valve Therapies:

+Low-Twenties

• WW TAVR market growing ~30%; MDT

above WW market growth

•US and EU: continued share gain from

Evolut® R 34mm expanded adoption

•SURTAVI intermediate risk data

submitted to FDA in March; expect H1

FY18 approval

•Evolut® PRO US Launch Q4; CE Mark/EU

launch anticipated late summer

Coronary: -MSD

• DES: LDD decline driven by market

pricing and US share loss

• Received US approval of Resolute

Onyx™ post-Q4 and Japan approval

expected H1 FY18; expected to

drive growth in FY18

Aortic: +MSD

• US: LSD growth led by Endurant® IIs

penetration, stable pricing, and Heli-FX®

EndoAnchor® adoption

• OUS: MSD growth

• AAA: LSD growth with recent Endurant®

ChEVAR CE Mark

• TAA: Above-market WW growth

Peripheral & endoVenous:

+HSD

• DCB: SFA US, EU & WW share leader

• IN.PACT® Admiral® DCB low-20s

• Price uplift from 150mm length

• Maintained market leadership in EU

• Atherectomy: HSD growth on strong

adoption of HawkOne™ 6F

Balanced MSD Growth across

CRHF, CSH and APV

Extracorp. Therapies: -LSD

• Cannulae and Revasc growth offset

by Surgical Ablation decline

Compia

MRI™

SureScan®

CRT-D

CoreValve®

Evolut® R

34mm

Resolute

Onyx™

IN.PACT®

Admiral®

Heli-FX®

EndoAnchor®

Revenue

$M

As Rep

Y/Y %

CC1

Y/Y %

CRHF 1,544 3 4

CSH 847 4 4

APV 457 5 6

Total $2,848 4% 5%

U.S. 1,484 5 5

Non-U.S. Dev 926 2 5

EM 438 4 4

Total $2,848 4% 5%

Arctic Front

Advance®

1 Figures represent comparison to Q4 FY16 on a constant currency basis (Non-GAAP).

FY18 Growth Outlook: 5 - 6%

Q4 FY17 Earnings Results | May 25, 2017 | 15

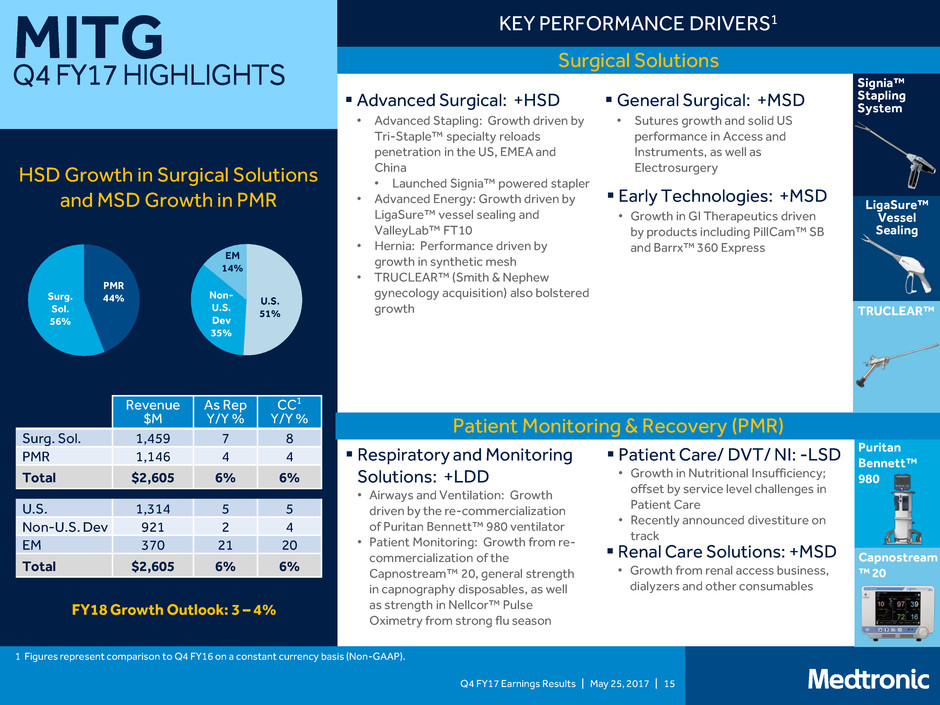

MITG

Q4 FY17 HIGHLIGHTS

Surgical Solutions

KEY PERFORMANCE DRIVERS1

HSD Growth in Surgical Solutions

and MSD Growth in PMR

Patient Monitoring & Recovery (PMR)

Early Technologies: +MSD

• Growth in GI Therapeutics driven

by products including PillCam™ SB

and Barrx™ 360 Express

General Surgical: +MSD

• Sutures growth and solid US

performance in Access and

Instruments, as well as

Electrosurgery

Patient Care/ DVT/ NI: -LSD

• Growth in Nutritional Insufficiency;

offset by service level challenges in

Patient Care

• Recently announced divestiture on

track

Endo GIA™

Renal Care Solutions: +MSD

• Growth from renal access business,

dialyzers and other consumables

Revenue

$M

As Rep

Y/Y %

CC1

Y/Y %

Surg. Sol. 1,459 7 8

PMR 1,146 4 4

Total $2,605 6% 6%

U.S. 1,314 5 5

Non-U.S. Dev 921 2 4

EM 370 21 20

Total $2,605 6% 6%

Signia™

Stapling

System

PMR

44% Surg.

Sol.

56%

U.S.

51%

Non-

U.S.

Dev

35%

EM

14%

Capnostream

™ 20

1 Figures represent comparison to Q4 FY16 on a constant currency basis (Non-GAAP).

LigaSure™

Vessel

Sealing

TRUCLEAR™

Advanced Surgical: +HSD

• Advanced Stapling: Growth driven by

Tri-Staple™ specialty reloads

penetration in the US, EMEA and

China

• Launched Signia™ powered stapler

• Advanced Energy: Growth driven by

LigaSure™ vessel sealing and

ValleyLab™ FT10

• Hernia: Performance driven by

growth in synthetic mesh

• TRUCLEAR™ (Smith & Nephew

gynecology acquisition) also bolstered

growth

Respiratory and Monitoring

Solutions: +LDD

• Airways and Ventilation: Growth

driven by the re-commercialization

of Puritan Bennett™ 980 ventilator

• Patient Monitoring: Growth from re-

commercialization of the

Capnostream™ 20, general strength

in capnography disposables, as well

as strength in Nellcor™ Pulse

Oximetry from strong flu season

FY18 Growth Outlook: 3 – 4%

Puritan

Bennett™

980

Q4 FY17 Earnings Results | May 25, 2017 | 16

RTG

Q4 FY17 HIGHLIGHTS

Spine

35%

Brain

30%

Specialty

20%

Pain

15%

[CATE

GORY

NAME]

[VALU

E]

[CATEG

ORY

NAME]

[VALUE]

[CATEG

ORY

NAME]

[VALUE

]

KEY PERFORMANCE DRIVERS1

Sustained Improvement in Spine;

Solid Brain & Specialty Therapies

Growth Offsets Declines in Pain

Neurosurgery: +LDD

• Growth driven by strong O-arm® O2 sales

• StealthStation® S8 approved late Q4

Core Spine: +LSD

• Continued success of new product

launches: Solera® Voyager® and

Elevate™ from Speed to Scale

initiative

• Strong growth in Other Biologics

• Surgical SynergySM initiative driving

implant growth

BMP: +LDD

• US: Strong growth (+LDD)

• OUS: InductOs™ return to market

expected mid-FY18

Brain Modulation: +LSD

• Growth driven by strength in the US

• Maintaining significant share despite

new competitive entrants

ENT: +MSD

• Continued strong growth in NuVent®

balloons and Fusion® Compact

navigation

Advanced Energy: +LDD

• Ortho / spine penetration driving

Aquamantys® growth

• Strong PEAK PlasmaBlade® growth in

breast oncology market

InterStim® II

StealthStationTM

S8

Infuse®

Bone Graft

Spine

Brain Therapies

Specialty Therapies

Pain Therapies

Pelvic Health: +HSD

• US growth driven by new InterStim® II

implants

Neurovascular: +Mid-Teens

• Strong growth driven by coils (Axium™

Prime) and stents (Solitaire™)

Revenue

$M

As Rep

Y/Y %

CC1

Y/Y %

Spine 676 3 3

Brain 585 9 9

Specialty 396 7 7

Pain 294 (2) (2)

Total $1,951 4% 5%

U.S. 1,302 4 4

Non-U.S. Dev 437 4 5

EM 212 10 8

Total $1,951 4% 5%

Kanghui: +HSD

• Continued market penetration driving

growth in Latin America and SE Asia

SCS/Pumps: -MSD

• EvolveSM Workflow launch in Q4; implant

impact beginning in Q1

• Ongoing SCS competitive pressure

leading to share loss

• Intellis™ approval expected late CY17

Interventional: +LSD

• Strong BKP performance in the US

driven by pull-through from

OsteoCool®

• Double-digit growth in Japan despite

competitive headwinds

OsteoCool®

1 Figures represent comparison to Q4 FY16 on a constant currency basis (Non-GAAP).

FY18 Growth Outlook: ~4%

Q4 FY17 Earnings Results | May 25, 2017 | 17

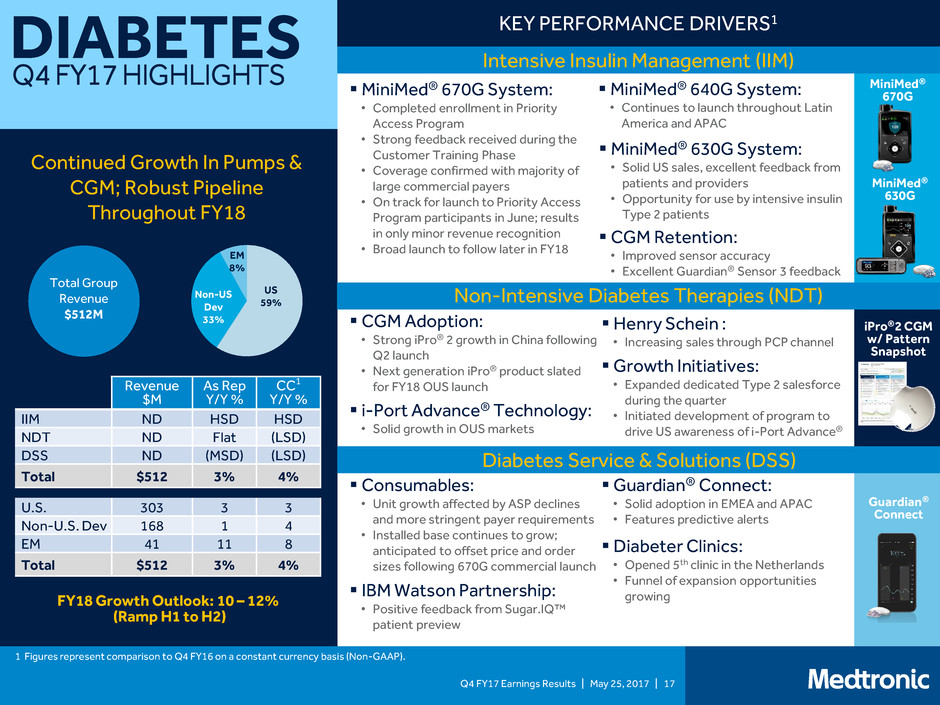

DIABETES

Q4 FY17 HIGHLIGHTS

US

59%

Non-US

Dev

33%

EM

8%

KEY PERFORMANCE DRIVERS1

Intensive Insulin Management (IIM)

Continued Growth In Pumps &

CGM; Robust Pipeline

Throughout FY18

MiniMed®

630G

Guardian®

Connect

17

Total Group

Revenue

$512M

Revenue

$M

As Rep

Y/Y %

CC1

Y/Y %

IIM ND HSD HSD

NDT ND Flat (LSD)

DSS ND (MSD) (LSD)

Total $512 3% 4%

U.S. 303 3 3

Non-U.S. Dev 168 1 4

EM 41 11 8

Total $512 3% 4%

FY18 Growth Outlook: 10 – 12%

(Ramp H1 to H2)

MiniMed®

670G

Non-Intensive Diabetes Therapies (NDT)

iPro®2 CGM

w/ Pattern

Snapshot

Diabetes Service & Solutions (DSS)

CGM Retention:

• Improved sensor accuracy

• Excellent Guardian® Sensor 3 feedback

MiniMed® 640G System:

• Continues to launch throughout Latin

America and APAC

MiniMed® 670G System:

• Completed enrollment in Priority

Access Program

• Strong feedback received during the

Customer Training Phase

• Coverage confirmed with majority of

large commercial payers

• On track for launch to Priority Access

Program participants in June; results

in only minor revenue recognition

• Broad launch to follow later in FY18

CGM Adoption:

• Strong iPro® 2 growth in China following

Q2 launch

• Next generation iPro® product slated

for FY18 OUS launch

i-Port Advance® Technology:

• Solid growth in OUS markets

Consumables:

• Unit growth affected by ASP declines

and more stringent payer requirements

• Installed base continues to grow;

anticipated to offset price and order

sizes following 670G commercial launch

Guardian® Connect:

• Solid adoption in EMEA and APAC

• Features predictive alerts

IBM Watson Partnership:

• Positive feedback from Sugar.IQ™

patient preview

MiniMed® 630G System:

• Solid US sales, excellent feedback from

patients and providers

• Opportunity for use by intensive insulin

Type 2 patients

1 Figures represent comparison to Q4 FY16 on a constant currency basis (Non-GAAP).

Diabeter Clinics:

• Opened 5th clinic in the Netherlands

• Funnel of expansion opportunities

growing

Henry Schein :

• Increasing sales through PCP channel

Growth Initiatives:

• Expanded dedicated Type 2 salesforce

during the quarter

• Initiated development of program to

drive US awareness of i-Port Advance®

FY18 EPS GUIDANCE,

REVENUE OUTLOOK, &

OTHER ASSUMPTIONS

Q4 FY17 Earnings Results | May 25, 2017 | 19

MDT

FY18 REVENUE / EPS GUIDANCE & OTHER ASSUMPTIONS

FY18

Revenue Growth – CC 4 - 5%

CVG Growth – CC 5 - 6%

MITG Growth – CC 3 - 4%

RTG Growth – CC ~4%

Diabetes Growth – CC 10-12% (Ramp H1 to H2)

COV Synergies ~$250 - $275M

EPS Growth1 – CC 9 - 10%

Other than noted, revenue and EPS growth guidance do not include any charges or gains that would be recorded as non-GAAP adjustments to earnings during the fiscal year

1 Figures represent comparison to prior year on a constant currency basis (non-GAAP).

Guidance

FX Assumptions

FY18 Q1FY18

Revenue ~$75M – $175M

(Headwind in H1; Tailwind in H2)

~($10M) – ($60M)

EPS ~($0.05) – ($0.10) ~(0.03) - ($0.05)

Note: While FX rates are fluid, assumptions above are based on current rates.

Q4 FY17 Earnings Results | May 25, 2017 | 20

APPENDIX

ACRONYMS / ABBREVIATIONS

1

Other

Adj Adjusted FCF Free Cash Flow

APAC Asia Pacific FDA

Food and Drug

Administration

ASEAN

Association of

Southeast Asian

Nations

FX Foreign Exchange

ASP Average Selling Price FY Fiscal Year

Bps Basis Points GAAP

Generally Accepted

Accounting Principles

CC Constant Currency NC Not Comparable

CCCW

Constant Currency

Constant Weeks

Ops Operations

CMS

Centers for Medicare

and Medicaid Services

OM Operating Margins

Dev Developed OUS

Outside the United

States

EM Emerging Markets R&D

Research &

Development

EMEA

Europe, Middle East &

Africa

Rep Reported

EPS Earnings Per Share SG&A

Selling, General &

Administrative

EU European Union WW Worldwide

Y/Y Year-over-Year

Business Specific

AAA Abdominal Aortic Aneurysm DSS Diabetes Services & Solutions

AF Atrial Fibrillation IIM Intensive Insulin Management

APV Aortic & Peripheral Vascular MDT Medtronic

BKP Balloon Kyphoplasty MITG Minimally Invasive Therapies Group

BMP Bone Morphogenetic Protein MRI Magnetic Resonance Imaging

Brady Bradycardia NDT Non-Intensive Diabetes Therapies

CGM

Continuous Glucose

Monitoring

NI Nutritional Insufficiency

CRHF

Cardiac Rhythm & Heart

Failure PCP Primary Care Providers

CRT-D

Cardiac Resynchronization

Therapy – Defibrillator PMR Patient Monitoring & Recovery

CRT-P

Cardiac Resynchronization

Therapy – Pacemakers RTG Restorative Therapies Group

CSH Coronary & Structural Heart SCS Spinal Cord Stimulation

CVG Cardiac & Vascular Group

SFA Superficial Femoropopliteal Artery

DVT Deep Vein Thrombosis Surg Sol Surgical Solutions

DCB Drug Coated Balloon TAVR

Transcatheter Aortic Valve

Replacement

DES Drug Eluting Stent Tachy Tachycardia

Growth

DD Double Digits

HSD High-Single Digit

LDD Low-Double Digits

LSD Low-Single Digit

MSD Mid-Single Digit