Attached files

| file | filename |

|---|---|

| 8-K - 8-K - KEMET CORP | fy2017_q4x8kxinvestpres.htm |

1

B. Riley & Company

18th Annual Investor Conference

May 25, 2017

Presenters: Per Loof – Chief Executive Officer

William M. Lowe, Jr.

EVP & Chief Financial Officer

2

Cautionary Statement

Certain statements included herein contain forward-looking statements within the meaning of federal securities laws about

KEMET Corporation's (the "Company") financial condition and results of operations that are based on management's current

expectations, estimates and projections about the markets in which the Company operates, as well as management's beliefs and

assumptions. Words such as "expects," "anticipates," "believes," "estimates," variations of such words and other similar expressions

are intended to identify such forward-looking statements. These statements are not guarantees of future performance and involve

certain risks, uncertainties and assumptions, which are difficult to predict. Therefore, actual outcomes and results may differ

materially from what is expressed or forecasted in, or implied by, such forward-looking statements. Readers are cautioned not to

place undue reliance on these forward-looking statements, which reflect management's judgment only as of the date hereof. The

Company undertakes no obligation to update publicly any of these forward-looking statements to reflect new information, future

events or otherwise.

Factors that may cause actual outcomes and results to differ materially from those expressed in, or implied by, these forward-looking

statements include, but are not necessarily limited to, the following: (i) adverse economic conditions could impact our ability to realize

operating plans if the demand for our products declines, and such conditions could adversely affect our liquidity and ability to continue

to operate and cause a write down of long-lived assets or goodwill; (ii) an increase in the cost or a decrease in the availability of our

principal or single-sourced purchased raw materials; (iii) changes in the competitive environment; (iv) uncertainty of the timing of

customer product qualifications in heavily regulated industries; (v) economic, political, or regulatory changes in the countries in which

we operate; (vi) difficulties, delays or unexpected costs in completing the restructuring plans; (vii) acquisitions and other strategic

transactions expose us to a variety of risks; (viii) acquisition of TOKIN may not achieve all of the anticipated results; (ix) our business

could be negatively impacted by increased regulatory scrutiny and litigation; (x) difficulties associated with retaining, attracting and

training effective employees and management; (xi) the need to develop innovative products to maintain customer relationships and

offset potential price erosion in older products; (xii) exposure to claims alleging product defects; (xiii) the impact of laws and

regulations that apply to our business, including those relating to environmental matters; (xiv) the impact of international laws relating

to trade, export controls and foreign corrupt practices; (xv) changes impacting international trade and corporate tax provisions related

to the global manufacturing and sales of our products may have an adverse effect on our financial condition and results of operations;

(xvi) volatility of financial and credit markets affecting our access to capital; (xvii) the need to reduce the total costs of our products to

remain competitive; (xviii) potential limitation on the use of net operating losses to offset possible future taxable income;

(xix) restrictions in our debt agreements that could limit our flexibility in operating our business; (xx) disruption to our information

technology systems to function properly or control unauthorized access to our systems may cause business disruptions;

(xxi) additional exercise of the warrant by K Equity, LLC which could potentially result in the existence of a significant stockholder who

could seek to influence our corporate decisions; (xxii) fluctuation in distributor sales could adversely affect our results of operations,

(xxiii) earthquakes and other natural disasters could disrupt our operations and have a material adverse effect on our financial

condition and results of operations.

2

3

TOKIN Acquisition Closure

4

“The Deal”

Cash Facts

Cost of acquiring TOKIN

$104M

o $50M in 2013

o $54M now

100% of TOKIN cash

$165M

Used $52.5 to pay down debt post closing

Combined cash after closing, refinance & debt

reduction

$216M

5

TOKIN OVERVIEW

Founded: April 8, 1938

• 5,348 employees

• 978 in Japan

6 manufacturing locations

• Japan (3)

• Thailand

• Vietnam

• China

• Capacitors

Tantalum Polymer (NeoCap)

Supercapacitors

• Electromagnetic Compatibility (EMC)

Power Inductors

Ferrite Cores

Transformers

Noise Suppression sheets

• Sensors & Actuators

Piezoelectric Actuators

Current & Temperature Sensors

High-Yield

Bonds

Refinanced

1) Fund redemption of all outstanding

$353 million 10.5% Senior notes due

2018

2) Repaid outstanding amount on

revolver of $34 million

3) New Term Loan:

$345M US$

Rate = LIBOR + 600 bps

$13M / year interest savings

5% annual principal amortization

Matures April 28, 2024

7

Company Overview

Post TOKIN Acquisition

Simpsonville

Ciudad Victoria,

Monterrey & Matamoros,

Mexico

Evora,

Portugal

Pontecchio, Italy

Kyustendil, Bulgaria

Anting, China

Carson City, NV

Batam,

Indonesia

Suomussalmi, FinlandGranna & Farjestaden,

Sweden

Suzhou, China

Skopje, Macedonia

Xiamen, China

Toyama, Japan

Shiroishi, Japan

Sendai, Japan

Bang Pakong,

Thailand

Biên Hòa, Vietnam

• Global manufacturer of tantalum, multilayer ceramic, solid and electrolytic, aluminum and film and paper

capacitors, electro magnetic capability devices, and sensors and actuators

• 24 manufacturing plants located in North America, Europe and Asia

• employees worldwide (15,000+)

– USA 618 Mexico 5,398 Japan 978

– Asia 6,428 Europe 1,580

• Recognized as the “Easy to buy from Company” (ETBF) and “Easy to design in” (E2Di)

8

Combined Company Product Overview

Capacitors (KEMET/TOKIN)

Electro-Magnetic compatible

Devices (TOKIN)

Sensors / Actuators (TOKIN)

Market

Segment /

Selected

Application

Detail

• Computer – Microprocessor Decoupling

• Telecommunications – Transceiver Cards

• Mobile Phones – Audio & Battery Backup

• Gaming – Processor Decoupling

• LCD TV – Video Converter

• Automotive – Engine Control/Safety/HID

lighting

• Military/Aerospace – Avionics/Comm

• Downhole drilling

• Medical

• Motor Start & Drives

• Renewable Energy – Power Inverters

• Consumer/Industrial – Power Supplies

• Computer - Notebook PCs/Servers

• Telecom Infrastructure

• Gaming

• Automotive - Infotainment

• Telecom Infrastructure

• Consumer – Battery chargers/AC

adapters/Power supply

• Mobile phones

• Industrial

• Consumer Appliances – Refrigerators,

inductive Cooking, and Air conditioning

• Automotive – Power supply

• Consumer – Power supply

• Medical

Market

Demand

• Tantalum (Polymer/Mno2): high

reliability and high capacitance. (Tablets

/ laptops and high reliability applications)

• Ceramic: smaller capacitance and

smaller sizes

• DC film: high current per capacitance.

Ability to withstand wide temperature

ranges in harsh environment

• Supercapacitors: Rapid charging and

approaching infinite charge/discharge

cycles (Internal clock/Smart meters/Test

equipment applications)

• Inductors: Low frequency pass

through inductor / High frequency

pass through Capacitor

• Filters: Reduces electro magnetic

interference

• Flex suppressors: Absorbs

electromagnetic noise and converts

it into heat

• Current sensors: Designed to detect

AC/DC or leakage current through magnetic

field

• Thermal sensors: Designed to shutdown

electric equipment when a specific

temperature is exceeded.

• Piezo Actuators: Converts electrical

energy into mechanical energy (precision

Stepper Motors/Microscopes applications)

9

KEMET/TOKIN by segment, region, channel

(Est. Q1FY18 sales)

ChannelSegment

Region

Telecom

14%

Computer

19%

Consumer

10%

Ind/Light

26%

Automotive

17%

Def/Med

9%

Other

4%

Product

Film and

Electrolytics

16.8%

Ceramics

21.5%

Tantalum/Polymer

42.3%

EMC

15.2%

S&A

4.2%

Japan

15%

Asia

41%

Americas

22%

EMEA

22%

Dist / Agent

41%

OEM

44%

EMS

15%

10

KEMET/TOKIN Market Share

Tantalum / Polymer (est. $1.3B)*

KEMET

27.2%

TOKIN

7.6%

AVX

30.0%

Sanyo

12.0%

Others

23.2%

34.8%

* Management estimates

11

Market Trends

12

Semiconductor Industry vs. Capacitor Industry

Billion US$

$-

$10

$20

$30

$40

$50

$60

$70

$80

$90

$100

$0.0

$0.5

$1.0

$1.5

$2.0

$2.5

$3.0

$3.5

$4.0

$4.5

$5.0

CY1

3

Q

1

Q

2

Q

3

Q

4

CY1

4

Q

1

Q

2

Q

3

Q

4

CY1

5

Q

1

Q

2

Q

3

Q

4

CY1

6

Q

1

Q

2

Q

3

Q

4

C

A

P

A

CITOR

IND

U

S

T

R

Y

Capacitors Semiconductors

Sources: WSTS Rpt. (act/est CY16 Q4, October ‘16), WCTS Rpt. (actual CY16 Q3) & KEMET Sales (actual CY16 Q4, December ‘16)

13

Critical for Success: Distribution Trends

*Data as of the end of Q4FY17

Asia Increases:

4 Local Distributors –

MnO2 Stocking

Best POS for FY17 - Up 5% Q/Q (9% Q-Y/Y)Best POA for FY17

Up 16% Q/Q

(20% Q –Y/Y)

CE

MnO2

Poly

Film

Al

TOK

$-

$20

$40

$60

$80

Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4

FY16 FY17

M

ill

io

n s

INVENTORY

$20

$25

$30

$35

$40

Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4

FY16 FY17

POA

AME EMEA ASIA

$25

$30

$35

$40

$45

Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4

FY16 FY17

POS

$-

$10

$20

$30

$40

Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4

FY16 FY17

POS BY PRODUCT

14

Revenues Distribution

From concept to first demo

in 4 Months

Project remains on track,

”Alpha 2” demo @ EDS

Beta – User Acceptance

Testing to commence in

July

“…Industry Leading…”

$757.8M

5 Quarters of sequential growth

TOK

4%

+$6.2

M

19%

$12.8

1%

$1.6

8%

$5.2

4%

$0.7

48%

$1.8

6.2% Y/YPOS$

POA$ 15.6% Y/Y

INV$

No Inventory

Increase

3.1% Y/Y

FY17 Global Sales

KEMET (excluding TOKIN)

15

6.2% Y/Y

FY17 Highlights - Distribution

POS$

2.4% Unique Customers

– (Now over 130K with top 4 )

POA$ 15.6% Y/Y

INV$ No Inventory

Increase 12.3% Unique PN Sold

8.2% Y/YPOS$

Growth with Balanced

POA/POS

Growth in the High Service Channel

Longer and Taller ”Tail”

From concept to first demo

in 4 Months

Project remains on track,

”Alpha 2” demo @ EDS (May)

Beta – User Acceptance

Testing to commence in July

“…Industry Leading…”

TOK

4%

+$6.2M

19%

$12.8

1%

$1.6

8%

$5.2

4%

$0.7

48%

$1.8

TOK

7%

+$1.5

9%

$0.5

4%

$0.5

18%

$0.9

14%

$0.5

60%

$0.8

16

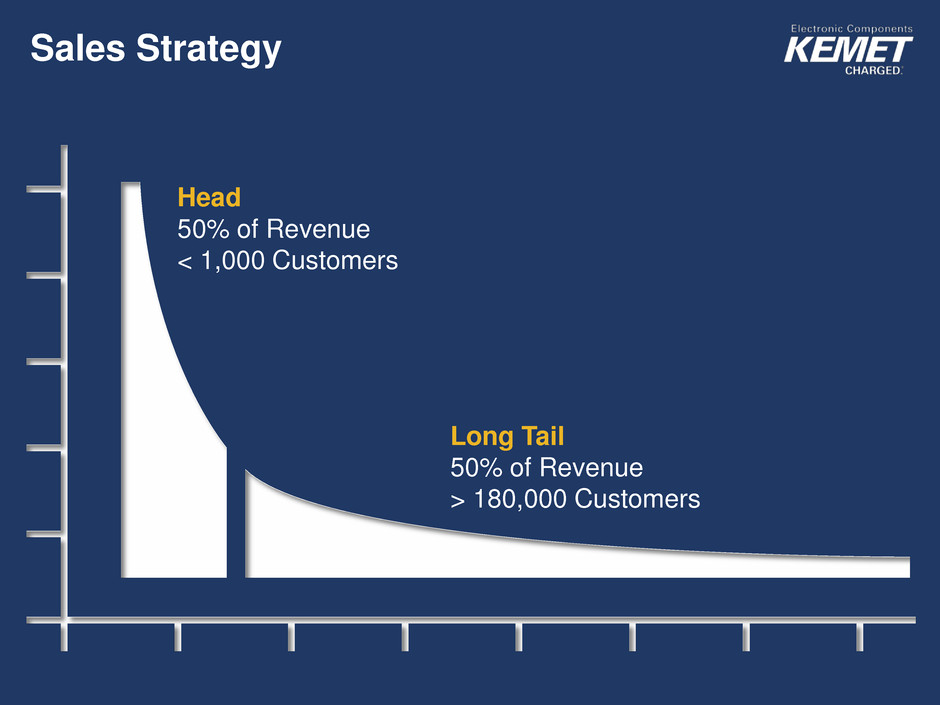

Sales Strategy

Head

50% of Revenue

< 1,000 Customers

Long Tail

50% of Revenue

> 180,000 Customers

17

Sales Strategy

• Direct engagements

• Design in and Solution selling –

• Balanced Pipeline of opportunities

Head

50% of Revenue

< 1,000 Customers

18

Sales Strategy

• Make more products available and easy to

find

• Channel Focus – Leverage our strong

position

• ”Using bits to sell atoms”

– KEMET’s Digital Engagement Platform

Long Tail

50% of Revenue

> 180,000 Customers

19

Sales Strategy

Long Tail

Apps

Engineering

Center

On Line

Simulation

Search

API

Stream

Content

Quoting &

Pricing Mgmt

DIGITAL ENGAGEMENT PLATFORM

“…Industry leading”

Discovery Decision Close

20

1990’s

Information

Flow

Teams &

Business

Response

Today

Over 50,000 Items

quoted every month -

Globally

(and Growing)

Speed Wins – Offer

the Right Price Faster

System Integration

AI providing IA

Data

Mining

Analytics

Seamless Digital

Collaboration

Machine

Learning

BI

Software

Connected

API

To further leverage our ”Easy To Buy From” reputation,

our channel management processes need to be faster,

smarter and more collaborative.

21

Looking Ahead

22

Next 10 years

Major Drivers

More Personal

Smartphone, TVs,

Medical, Consumer

Devices, PCs

Big Data

Computer,

Communication,

Medical

Infrastructure

Energy

Efficiency

Automotive,

Industrial,

Consumer

Uberization

Seamless Digital

Experience

PEOPLE

ADJACENCY 2.0

M&A

ATOMS & BITS

Looking

Ahead

Summary Financial Information

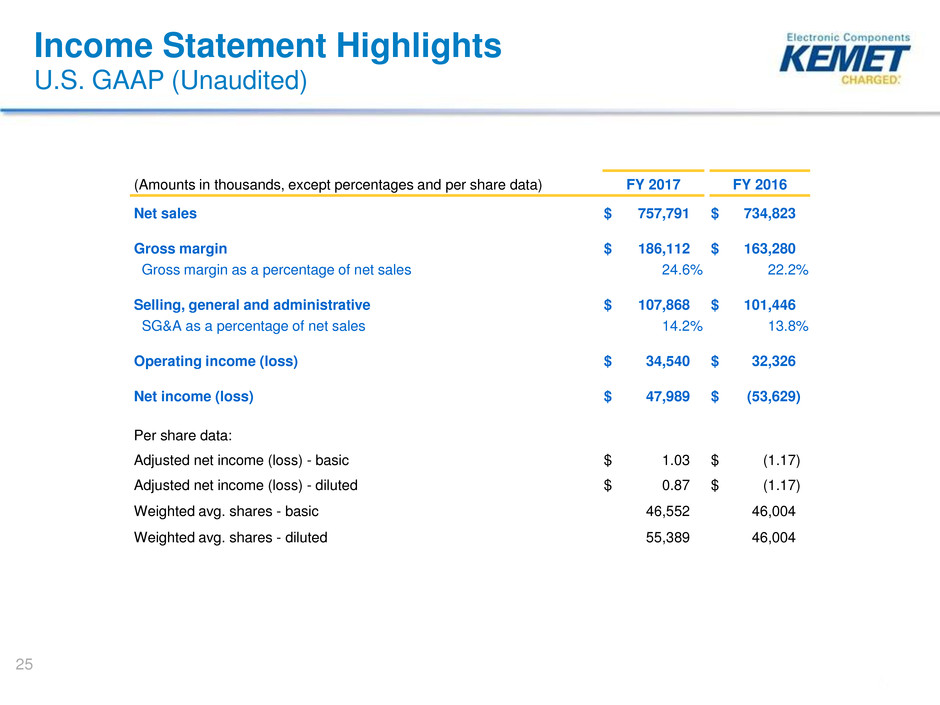

Income Statement Highlights

U.S. GAAP (Unaudited)

(Amounts in thousands, except percentages and per share data) FY 2017 FY 2016

Net sales $ 757,791 $ 734,823

Gross margin $ 186,112 $ 163,280

Gross margin as a percentage of net sales 24.6% 22.2%

Selling, general and administrative $ 107,868 $ 101,446

SG&A as a percentage of net sales 14.2% 13.8%

Operating income (loss) $ 34,540 $ 32,326

Net income (loss) $ 47,989 $ (53,629)

Per share data:

Adjusted net income (loss) - basic $ 1.03 $ (1.17)

Adjusted net income (loss) - diluted $ 0.87 $ (1.17)

Weighted avg. shares - basic 46,552 46,004

Weighted avg. shares - diluted 55,389 46,004

25

Income Statement Highlights

Non-GAAP (Unaudited)

(Amounts in thousands, except percentages and per share data) FY 2017 FY 2016

Net sales $ 757,791 $ 734,823

Adjusted Gross margin $ 187,923 $ 165,931

Adjusted gross margin as a percentage of net sales 24.8% 22.6%

Adjusted selling, general and administrative $ 93,952 $ 88,354

Adjusted SG&A as a percentage of net sales 12.4% 12.0%

Adjusted operating income (loss) $ 66,548 $ 52,816

Adjusted net income (loss) $ 23,916 $ 8,917

Adjusted EBITDA $ 105,255 $ 91,144

Per share data:

Adjusted net income (loss) - basic $ 0.51 $ 0.19

Adjusted net income (loss) - diluted $ 0.43 $ 0.17

Weighted avg. shares - basic 46,552 46,004

Weighted avg. shares - diluted 55,389 51,436

26

Quarterly Financial Summary

U.S. GAAP (Unaudited)

27

1. TOKIN results exclude the EMD business which was sold on April 14, 2017.

2. Net sales include sales between KEMET and TOKIN of $5.0 million, $7.0 million, $7.2 million and $6.2 million for the quarters

ended June 30, 2016, September 30, 2016, December 31, 2016 and March 31, 2017, respectively. Upon acquisition, inter-company

sales will be eliminated.

Financial Trends

Cash and Cash Equivalents (Unaudited)

28

1. TOKIN results exclude the EMD business which was sold on April 14, 2017.

Forecast Assumptions

Net Sales

l Total Net Sales projected to grow at a 2.2% CAGR from FY 2017 to FY 2022

Forecast does not include increase potential market synergies from cross selling

Gross Margin l Combined Gross Margin projected to expand from 23.6% in FY 2017 to 26.5% in FY 2022

Adjusted

EBITDA

l Total Adjusted EBITDA (excluding unrealized synergies) projected to grow at a 7.8% CAGR

from FY 2017 to FY 2022. Depreciation expense approximately $57 million prior to purchase

accounting effects.

Synergies

l Synergies of $11.3 million, $11.0 million and $8.4 million achieved in FY 2018, FY 2019 and

FY 2020, respectively

l One-time equivalent cash costs to achieve overhead reductions of $9 million, $7 million and

$4 million in FY 2018, FY 2019 and FY 2020, respectively

Other Cash

Flow Items

l Capital expenditures projected to increase to support increased production capacity to meet

additional demand, primarily for polymer products

l Working capital projected to remain consistent as a percentage of Net Sales

29

Forecasted Financials

30

$769 $792 $815

$340

$360

$392

$-

$200

$400

$600

$800

$1,000

$1,200

F Y 2 0 1 8 F Y 2 0 1 9 F Y 2 0 2 0

$

IN

M

ILL

IO

N

S

NET SALES

KEMET TOKIN

Sales includes ~ $25M/year of intercompany sales.

Forecasted Financials

31

$113 $116

$127

$37

$45

$55

$-

$20

$40

$60

$80

$100

$120

$140

$160

$180

F Y 2 0 1 8 F Y 2 0 1 9 F Y 2 0 2 0

$

IN

M

ILL

IO

N

S

ADJUSTED EBITDA

KEMET TOKIN

Forecasted Financials

32

$44 $44 $44

$-

$10

$20

$30

$40

$50

F Y 2 0 1 8 F Y 2 0 1 9 F Y 2 0 2 0

$

IN

M

ILL

IO

N

S

CAPITAL EX PENDITURES

Forecasted Credit Statistics

33

QUESTIONS

Appendix

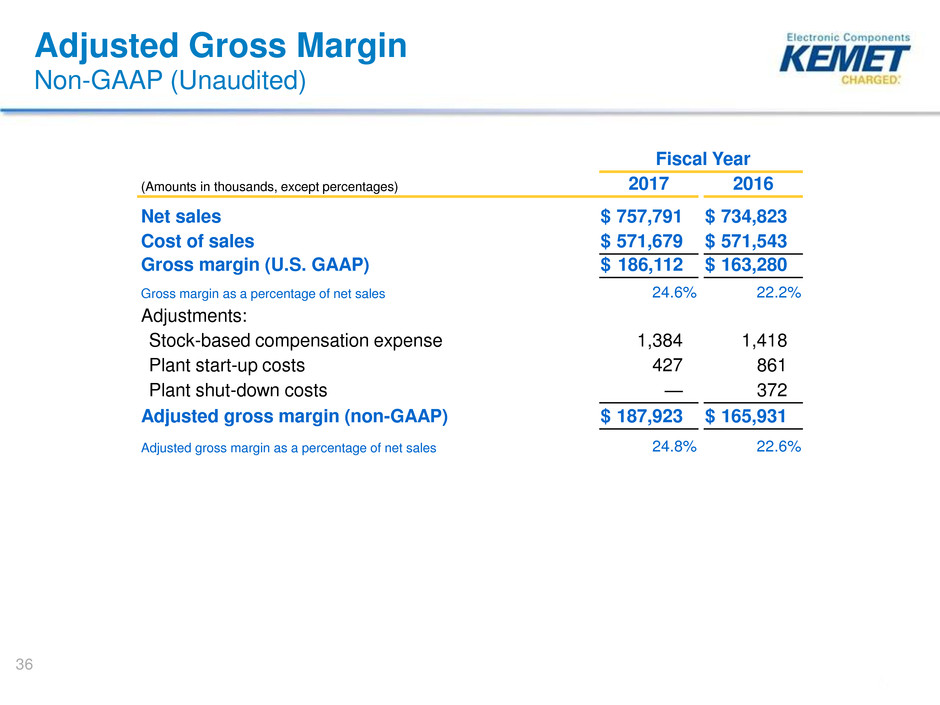

Adjusted Gross Margin

Non-GAAP (Unaudited)

Fiscal Year

(Amounts in thousands, except percentages) 2017 2016

Net sales $ 757,791 $ 734,823

Cost of sales $ 571,679 $ 571,543

Gross margin (U.S. GAAP) $ 186,112 $ 163,280

Gross margin as a percentage of net sales 24.6% 22.2%

Adjustments:

Stock-based compensation expense 1,384 1,418

Plant start-up costs 427 861

Plant shut-down costs — 372

Adjusted gross margin (non-GAAP) $ 187,923 $ 165,931

Adjusted gross margin as a percentage of net sales 24.8% 22.6%

36

Adjusted Selling, General & Administrative

Expenses

Non-GAAP (Unaudited)

Fiscal Year

(Amounts in thousands, except percentages) 2017 2016

Net sales $ 757,791 $ 734,823

Selling, general and administrative expenses (U.S.

GAAP) $ 107,868 $ 101,446

Selling, general, and administrative as a percentage of net sales 14.2% 13.8%

Less adjustments:

ERP integration costs/IT transition costs 7,045 5,677

Stock-based compensation expense 3,130 3,162

Legal expenses related to antitrust class actions 2,640 3,041

NEC TOKIN investment related expenses 1,101 900

Pension plan adjustment — 312

Adjusted selling, general and administrative expenses

(non-GAAP) $ 93,952 $ 88,354

Adjusted selling, general, and administrative as a percentage of net sales 12.4% 12.0%

37

Adjusted Operating Income

Non-GAAP (Unaudited)

Fiscal Year

(Amounts in thousands) 2017 2016

Operating income (loss) (U.S. GAAP) $ 34,540 $ 32,326

Adjustments:

ERP integration costs/IT transition costs 7,045 5,677

Stock-based compensation expense 4,720 4,774

Restructuring charges 5,404 4,178

Legal expenses related to antitrust class actions 2,640 3,041

NEC TOKIN investment related expenses 1,101 900

Net (gain) loss on sales and disposals of assets 392 375

Plant start-up costs 427 861

Plant shut-down costs — 372

Pension plan adjustment — 312

Write down of long-lived assets 10,279 —

Adjusted operating income (loss) (non-GAAP) $ 66,548 $ 52,816

38

Adjusted Net Income (Loss) and Adjusted

EBITDA

Non-GAAP (Unaudited)

Fiscal Year

(Amounts in thousands) 2017 2016

Net income (loss) (U.S. GAAP) $ 47,989 $ (53,629)

Adjustments:

Change in value of TOKIN options (10,700) 26,300

Net foreign exchange (gain) loss (3,758) (3,036)

ERP integration costs/IT transition costs 7,045 5,677

Stock-based compensation 4,720 4,774

Income tax effect of non-GAAP adjustments (741) 652

Restructuring charges 5,404 4,178

Legal expenses related to antitrust class actions 2,640 3,041

TOKIN investment related expenses 1,101 900

Amortization included in interest expense 761 859

Equity (gain) loss from TOKIN (41,643) 16,406

Net (gain) loss on sales and disposals of assets 392 375

Write down of long-lived assets 10,279 —

Income tax effect of pension curtailment — 875

Plant start-up costs 427 861

Plant shut-down costs — 372

Pension plan adjustment — 312

Adjusted net income (loss) (non-GAAP) $ 23,916 $ 8,917

Adjusted net income (loss) per share - basic $ 0.51 $ 0.19

Adjusted net income (loss) per share - diluted $ 0.43 $ 0.17

Adjusted EBITDA (non-GAAP) $ 105,255 $ 91,144

Weighted avg. shares - basic 46,552 46,004

Weighted avg. shares - diluted 55,389 51,436

39

Adjusted EBITDA Reconciliation

Non-GAAP (Unaudited)

Fiscal Year

(Amounts in thousands) 2017 2016

Net income (loss) (U.S. GAAP) $ 47,989 $ (53,629)

Interest expense, net 39,731 39,591

Income tax expense (benefit) 4,290 6,006

Depreciation and amortization 37,338 39,016

EBITDA (non-GAAP) 129,348 30,984

Excluding the following items

Change in value of TOKIN options (10,700) 26,300

Net foreign exchange (gain) loss (3,758) (3,036)

ERP integration costs/IT transition costs 7,045 5,677

Stock-based compensation 4,720 4,774

Restructuring charges 5,404 4,178

Legal expenses related to antitrust class actions 2,640 3,041

TOKIN investment related expenses 1,101 900

Equity (gain) loss from TOKIN (41,643) 16,406

Net (gain) loss on sales and disposals of assets 392 375

Write down of long-lived assets 10,279 —

Plant start-up costs 427 861

Plant shut-down costs — 372

Pension plan adjustment — 312

Adjusted EBITDA (non-GAAP) $ 105,255 $ 91,144

40

Forecast: Non-GAAP Reconciliation

41

A reconciliation of net income to Adjusted EBITDA as projected for 2018, 2019

and 2020 is not provided. KEMET does not forecast net income as we cannot,

without unreasonable effort, estimate or predict with certainty various

components of net income. These components include net foreign exchange

(gain) loss, further restructuring and other income or charges incurred in 2018,

2019 or 2020 as well as the related tax impacts of these items. Additionally,

discrete tax items could drive variability in our projected effective tax rate. All

of these components could significantly impact such financial measures.

Further, in the future, other items with similar characteristics to those currently

included in Adjusted EBITDA that have a similar impact on comparability of

periods, and which are not known at this time, may exist and impact adjusted

EBITDA.