Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Federal Home Loan Bank of New York | d394628d8k.htm |

Exhibit 99.1

TO OUR MEMBERS

On October 12, 2016, the Federal Home Loan Bank of New York hosted a Community Pillar award ceremony to recognize M&T Bank for its ongoing dedication to supporting the community and creating affordable housing opportunities.

4

A MESSAGE TO OUR MEMBERS

5

A MESSAGE TO OUR MEMBERS

“We take pride in being a reliable partner for our members. Just as your customers rely on you to make the loans that allow them to become homeowners, grow their business or send their children to college, so too do our members rely on us to help meet your funding needs.”

6

A MESSAGE TO OUR MEMBERS

|

| |

| Michael M. Horn Chairman |

José R. González President and CEO | |

2016 BUSINESS UPDATE

FINANCIAL HIGHLIGHTS

| (Dollars in millions) | 2016 | 2015 | 2014 | 2013 | 2012 | |||||||||||||||

| SELECTED BALANCES AT YEAR-END |

||||||||||||||||||||

| Total Assets |

$ | 143,606 | $ | 123,239 | $ | 132,825 | $ | 128,333 | $ | 102,989 | ||||||||||

| Advances |

109,257 | 93,874 | 98,797 | 90,765 | 75,888 | |||||||||||||||

| Investments |

30,864 | 26,167 | 25,201 | 20,084 | 17,459 | |||||||||||||||

| Mortgage Loans |

2,747 | 2,524 | 2,129 | 1,928 | 1,843 | |||||||||||||||

| Capital Stock |

6,308 | 5,585 | 5,580 | 5,571 | 4,797 | |||||||||||||||

| Retained Earnings |

1,412 | 1,270 | 1,083 | 999 | 894 | |||||||||||||||

| ANNUAL OPERATING RESULTS |

||||||||||||||||||||

| Net Income |

$ | 401 | $ | 415 | $ | 315 | $ | 305 | $ | 361 | ||||||||||

| Dividends Paid |

259 | 228 | 231 | 200 | 213 | |||||||||||||||

| Dividend Rate |

4.73 | % | 4.22 | % | 4.19 | % | 4.12 | % | 4.63 | % | ||||||||||

| PERFORMANCE RATIOS |

||||||||||||||||||||

| Return on Average Equity |

5.86 | % | 6.61 | % | 4.88 | % | 5.22 | % | 6.88 | % | ||||||||||

| Return on Average Assets |

0.31 | % | 0.34 | % | 0.25 | % | 0.27 | % | 0.35 | % | ||||||||||

| Equity to Average Asset |

5.31 | % | 5.45 | % | 4.91 | % | 5.05 | % | 5.33 | % | ||||||||||

| Net Interest Margin |

0.43 | % | 0.46 | % | 0.36 | % | 0.38 | % | 0.46 | % | ||||||||||

The Federal Home Loan Bank of New York’s 2016 annual report on Form 10-K, as filed with the Securities and Exchange Commission, contains additional information about the FHLBNY’s financial performance. The report is available on the FHLBNY’s public website, www.fhlbny.com, under the “About Us” tab; select “Investor Relations,” and look under the right-hand column labeled “Financial Reports.” For a copy of the FHLBNY’s Form 10-K, please send a request to fhlbny@fhlbny.com.

11

AN FHLBNY BUSINESS UPDATE

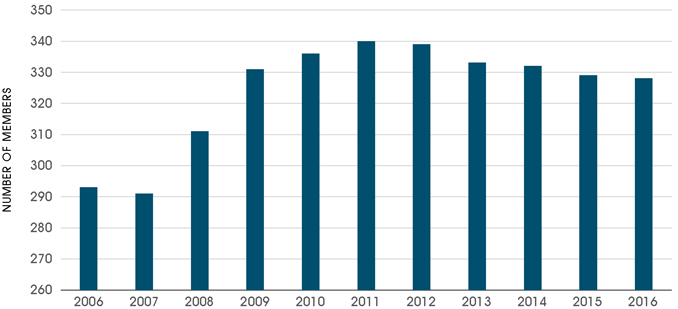

FHLBNY MEMBERSHIP TREND

Membership has remained stable despite consolidation in the industry as we continually onboard new members.

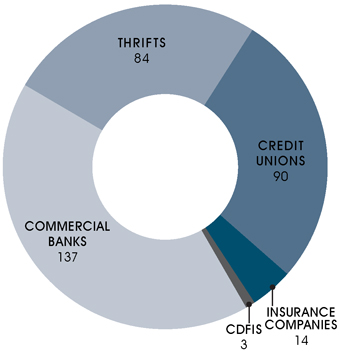

2016 FHLBNY MEMBERSHIP COMPOSITION

The sustainability of membership is due to the diversity of institution types.

|

2016 NEW MEMBERS

Brunswick Bank and Trust Company New Jersey

Caribe Federal Credit Union Puerto Rico

Countryside Federal Credit Union New York

Edge Federal Credit Union New York

Industrial and Commercial Bank of China (USA) N.A New York

National Federation of Community Development Credit Unions, Inc. New York

Palisades Federal Credit Union New York

St. Joseph’s Parish Buffalo Federal Credit Union New York |

12

AN FHLBNY BUSINESS UPDATE

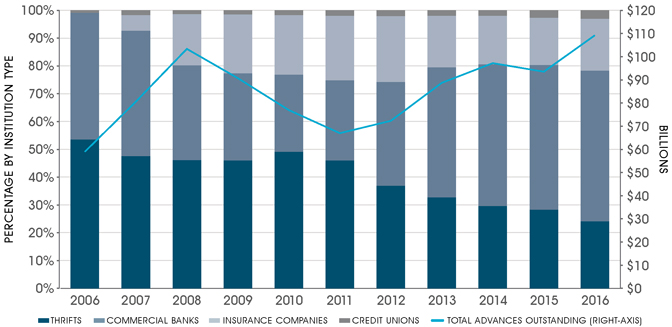

BORROWINGS BY MEMBER TYPE & ADVANCES OUTSTANDING

The reliability of FHLBNY advances appeals to our diverse membership base.

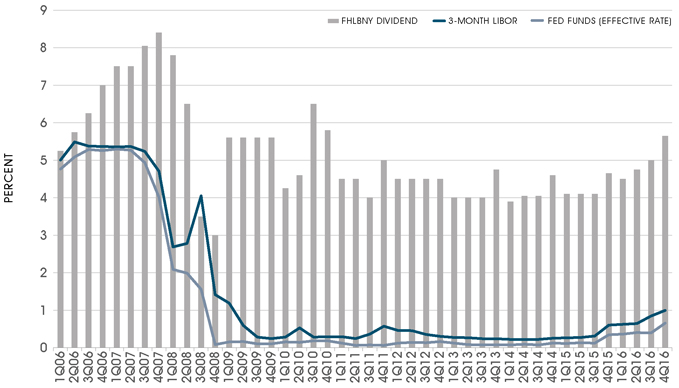

FHLBNY DIVIDEND HISTORY

Our dividends have continued to remain strong, exceeding market reference rates.

Please note: Dividends as shown for each quarter were paid out in the following quarter. Although FHLBNY capital stock has been high-performing and has had a very competitive dividend rate for an extended period of time, the dividend rate is not guaranteed, and as such, it may fluctuate in the future.

“Our Federal Home Loan Bank of New York membership has always enhanced our ability to meet the needs of our customers and support our community. As these needs change over time and in different economic environments, it is the reliability of FHLBNY products and the consistent availability of FHLBNY liquidity that creates the true value of membership.

We know that the FHLBNY will always be there as a stable partner for us, and all of its members.”

16

THE VALUE OF MEMBERSHIP

JAMES W. FULMER

CHAIRMAN, THE BANK OF CASTILE

VICE CHAIRMAN, FHLBNY

At the end of 2016, the FHLBNY counted 328 local lenders in New Jersey, New York, Puerto Rico and the U.S. Virgin Islands as members of its cooperative. Ours is a diverse membership, spanning institutions of all shapes and sizes, from those that operate in the global arena to those which are centralized in a single town. But all are bound together by a common focus on supporting and strengthening the communities they serve. The FHLBNY proudly shares this focus with each and every one of our members, and offers various products and programs to support our members as they work to meet the needs of their customers and communities.

| YOUR STRATEGIC PARTNER | ||

| FEATURED MEMBERS

AXA Equitable Life Insurance Company Institution Type: Insurance Headquarters: New York, NY Member Since: 2008

Affinity Federal Credit Union Institution Type: Credit Union Headquarters: Basking Ridge, NJ Member Since: 2000

Caribe Federal Credit Union Institution Type: Credit Union Headquarters: San Juan, PR Member Since: 2016 |

Insurance companies and credit unions are among the FHLBNY’s fastest-growing member types: the number of insurance company members in our cooperative has doubled since 2012, and our credit union members have increased by threefold over the past decade. Representatives from two such institutions – AXA Equitable Life Insurance Company and Affinity Federal Credit Union – spoke about the benefits their institutions realize from membership in the FHLBNY:

“AXA originally set up the line with FHLBNY for liquidity contingency purposes. Now we use advances to extend duration/fix mismatch and match fund assets using funding agreements to earn a spread.”

- Julia Zhang, Lead Director and Assistant Treasurer, AXA Equitable Life Insurance Company

“The FHLBNY is a valued partner in Affinity’s mission to improve the financial lives of our members and the communities we serve. The FHLBNY provides us with a dependable funding source, helping us provide affordable home loans to our members. Flexible borrowing terms can be tailored to our balance sheet management objectives, optimizing liquidity and maximizing capital creation for our members. Having access to FHLBNY funding has given Affinity the flexibility to grow its loan portfolios and serve our members’ borrowing needs at times when our deposit portfolios have not been growing as quickly. FHLBNY has helped Affinity achieve ambitious growth goals by providing a funding source that supplements our deposit growth. We’ve been able to launch new products and enter new markets knowing that we have a reliable funding source to back up our deposits.”

– Frank Madeira, Senior Vice President, Finance & Treasurer, Affinity Federal Credit Union. | |

18

THE VALUE OF MEMBERSHIP

A HISTORIC WELCOME TO THE COOPERATIVE

In 2016, Caribe Federal Credit Union, headquartered in San Juan, Puerto Rico, joined our cooperative, making it the FHLBNY’s first federally insured credit union member in Puerto Rico.

When asked how Caribe FCU planned on utilizing its FHLBNY membership to expand its lending footprint and support for small business and job growth in Puerto Rico, Jorge Vadell, General Manager of Caribe FCU, stated:

“FHLBNY membership provides a strong, reliable and additional liquidity source for various needs at Caribe FCU. The FHLBNY offers competitive borrowing rates which in turn can be passed on to our credit union programs. In addition, there are other business lines available to us such as the Community Lending Program, Affordable Housing Program and First Home Clubsm which can greatly help low- to moderate-income families in Puerto Rico that greatly need it. It was an honor to become the first federally insured credit union from Puerto Rico and join the existing group of members in the Caribbean region.”

19

THE VALUE OF MEMBERSHIP

Since 1999, the FHLBNY has offered the Mortgage Partnership Finance® (MPF®) Program as an alternate way for members to manage fixed-rate residential mortgage loan products efficiently. This partnership with our members combines our respective strengths to better manage inherent mortgage risks — the expertise of the local member, who understands their customers and their credit risks, and the FHLBNY’s expertise in handling interest rate risk.

| A COMPETITIVE EDGE IN LENDING | ||

| FEATURED MEMBER

Manasquan Bank Institution Type: Thrift Headquarters: Manasquan, NJ Member Since: 1950 |

In 2016, alone the FHLBNY funded just under $555 million through the MPF Program. Cumulatively since program inception, 130 members have enrolled in the MPF Program, and more than 38,000 residential mortgage loans — totaling more than $6.6 billion — have been sold. The performance of the MPF portfolio has been outstanding; of the $6.6 billion sold, our MPF portfolio has only experienced $2.7 million in losses, and total delinquencies were at 2.48 percent as compared to the national average for fixed-rate loans, which was 3.76 percent as of year-end 2016. Performance is a reflection of our members’ sound underwriting practices, making loans based on the borrower’s ability to repay them. | |

| Robert A. Hart, Senior Vice President at member Manasquan Bank — a participating member since 2003 — shared his institution’s experience using the MPF Program:

“At Manasquan Bank, the MPF Program allowed us to become more competitive in our local marketplace. The higher loan limits offered allow us to provide better rate offerings than local competitors on high balance loans. With no loan level price adjustments or hidden market fees passed down to our borrowers, and since MPF pricing is the same for all sellers into the program no matter the volume of loans sold, it makes the program a win-win situation for us and our customers.

Manasquan has seen a 24 percent increase in annual loan originations from 2013 to 2016. Over that same period, MPF helped us increase the total dollar amount sold by 10 percent.

Earning additional income from our participation in the MPF Program has also provided value. As participants know, the MPF Program pays members for taking on the credit risk in the form of Credit Enhancement (CE) fees. Selling loans into MPF also requires the purchase of FHLBNY capital stock, which is seen as a benefit since MPF activity is accretive to our overall return. Manasquan has received more than $85,000 in CE fee income and more than $327,000 in dividends (total activity based stock, inclusive of MPF activity) for 2016 — a total estimate of more than $412,000 in additional income.

Joining the MPF Program gave Manasquan Bank access to the secondary market. MPF’s service levels are exceptional — similar to the service a customer expects when dealing with a local community bank, we are always able to reach an MPF representative for assistance. The FHLBNY is a committed partner, and we are committed to remain an MPF participant.”

NEW INITIATIVE: MAX EXCHANGE PILOT PROGRAM

To help our members improve their capacity to serve their markets, the FHLBNY has been developing a pilot program with the MAX Exchange — a multi-seller to multi-buyer exchange and clearing house for residential loans to enable our members to sell conforming and jumbo whole loan mortgages on an open exchange platform. Special thanks to our members participating in the pilot program to help us determine the potential value of offering the exchange platform across our membership.

If your institution is interested in participating in the pilot program, please contact a Calling Officer at (212) 441-6700 for more information.

MAX Exchange is a wholly-owned subsidiary of MAXEX, LLC, a financial services technology company that has developed business processes and a technology platform to connect participants in the secondary mortgage market. See www.maxex.com.

“MPF” and “Mortgage Partnership Finance” are registered trademarks of the Federal Home Loan Bank of Chicago. |

MPF ACTIVITY

Total Amount of Residential Mortgage Loans Funded in 2016:

$554.7 MILLION

Total Amount of Residential Mortgage Loans Funded Since Program Inception:

$6.6 BILLION

Total Number of Residential Mortgage Loans Sold in 2016:

2,001

Total Number of Residential Mortgage Loans Sold Since Program Inception:

38,759

Total CE Fees Received by Members in 2016:

$2.4 MILLION

Total CE Fees Received by Members Since Program Inception:

$23.3 BILLION |

21

THE VALUE OF MEMBERSHIP

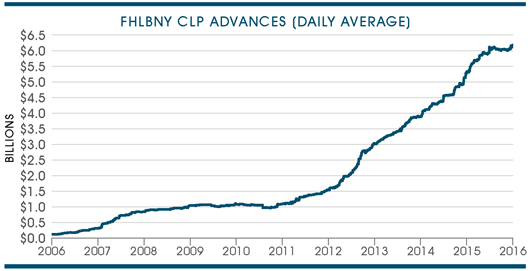

The FHLBNY’s Community Lending Program (CLP) provides members with an opportunity to gain access to a reliable source of funding at our lowest advance rates for projects that create housing, improve business districts and strengthen neighborhoods. These programs include the Community Investment Program (CIP), the Urban Development Advance (UDA) and the Rural Development Advance (RDA).

| PRODUCTS TO STRENGTHEN OUR COMMUNITIES | ||

| FEATURED MEMBER

Five Star Bank Institution Type: Commercial Bank Headquarters: Warsaw, NY Member Since: 1996 |

In 2016, the FHLBNY approved more than $2.5 billion in CLP applications, and funded just under $2 billion in advances. CLP advances are powerful products to support our members’ efforts to revitalize communities and to benefit those in need of vital funding throughout our district. Kevin B. Klotzbach, Chief Financial Officer of Five Star Bank, a member serving Western and Central New York, discussed the value of utilizing CLP funding at his institution:

“Five Star Bank’s participation in the CLP has allowed us to support numerous development projects throughout our footprint. It has enabled us to assist a wide array of business types and sizes, primarily through the UDA. This past summer, our institution utilized the program to help a manufacturing company expand its operations plant. As a result of the completed expansion, the company is meeting the growing demand for its products, and the community benefitted as well with the creation of nearly one hundred new jobs. | |

| CLP PERFORMANCE STATISTICS (PROGRAM USAGE IN 2016)

Applications Approved $2,526,455,000

Advances Funded: $1,932,789,547

CLP PERFORMANCE STATISTICS (PROGRAM TOTALS AS OF 12/31/16)

Applications Approved $11,435,394,309

Advances Funded $10,167,575,851 |

We are currently reviewing the use of CLP funding for costs associated with our expansion into downtown Rochester and downtown Buffalo. Recently we opened branches in both cities and are in the process of moving our regional operations center into downtown Rochester. CLP funding will allow us to reduce costs associated with the branch and office building improvements, all of which are helping to stimulate the economies in these urban areas. Five Star Bank has been able to save more than $100,000 in costs-to-date as a result of the discounted funding rate on UDA advances, enabling us to save in both branch and office building improvements.

The lower advance rates on CLP funding has helped Five Star Bank offer lending programs to benefit small business and commercial customers throughout our footprint. Included in this program for the full year 2016 was more than $5 million in SBA loans and more than $31 million in commercial mortgages. The loans in this program help customers and communities by creating jobs and allowing borrowers to grow their businesses by rehabbing or refinancing existing locations, purchasing or constructing new locations, or expanding existing sites. | |

22

THE VALUE OF MEMBERSHIP

| In 2016, Five Star Bank was the lead in a three-bank partnership that provided the financing for an expansion of a downtown Rochester Charter School. The expansion project was completed and doors opened in September of 2016. The 30,000 square foot addition includes music and art classrooms, a nurse’s office and a two-story gymnasium. The expansion created the instructional space needed to house two additional grades at the school, and provides additional parking and outdoor play areas. The borrower was a grassroots, community-based, not-for-profit organization formed to recruit, launch and support high-quality public charter schools in the City of Rochester.

FHLBNY programs have provided a myriad of positive opportunities for Five Star Bank and our customers. We very much look forward to expanding this relationship in the future.” |

ELIGIBLE USES OF CIP, UDA & RDA FUNDS

Commercial/Economic Development

• Equipment Purchase for Small Business Expansion

• Debt Refinancing for Small Businesses

• Debt Consolidation for Small Businesses

• Handicapped-Accessible Vans

• Fire Stations and Trucks

• Grocery Stores

• Retail Stores

• Educational Facilities

• Healthcare Facilities

• Office Buildings

• Daycare Centers

• Origination of single-family mortgages | |

|

Housing

• Refinancing of single-family mortgages

• Financing of housing projects:

• Property acquisition

• Construction

• Permanent financing

• Re-financing

• Renovation/Rehabilitation

• Home Improvement | |

| Members may submit CIP, UDA and RDA applications on a project-specific basis or on a program-specific basis, which allows members to fund multiple projects with one application. A total limit of the greater of $100 million or five percent of outstanding advances (as of 12/31 of the previous year) per member institution is in effect for both program-specific and project-specific applications. Exceptions for CLP funding in excess of the established CLP limit are considered on a case-by-case basis. | ||

In 2015, Hidelki – a mother of two young children – was renting a two-bedroom apartment that was not big enough for her young family. Today, she is a homeowner, thanks, in part, to a $7,500 First Home Clubsm (FHC) program grant. Hidelki and her children are one of nearly 13,000 households who have utilized the FHC on their path to homeownership since the program’s inception in 1995. In 2016, the FHC helped create 1,693 new homeowners through its grant funding, which totaled over $14 million for the year.

| TOOLS TO EXPAND HOMEOWNERSHIP | ||||

| FEATURED MEMBERS

Oritani Bank Institution Type: Thrift Headquarters: Township of Washington, NJ Member Since: 1934

M&T Bank Institution Type: Commercial Bank Headquarters: Buffalo, NY Member Since: 1993 |

Through the FHC, a non-competitive set-aside program which encourages low- and moderate-income households to plan and save for the purchase of their first home, the FHLBNY provides four dollars in grants for each dollar that eligible participants save in a dedicated savings account at a participating member institution. Hidelki chose FHLBNY member Oritani Bank for her enrollment in the program. She said that the bank’s friendly staff was helpful in guiding her through the program and educating her on mortgage financing. Oritani Bank has helped 16 households complete the program and move into new homes, and is currently working with more than 100 soon-to-be homeowners enrolled in the program. The opportunity that assistance provided to Hidelki is immeasurable. Hidelki closed on her new home in July 2016, and when asked what that meant to her, she said, “It’s everything to me.”

“The First Home Club program has given us an opportunity to offer assistance to potential first-time homebuyers who, without programs like this, could never afford a home. The FHC has also forged relations with realtors in our community – they have referred numerous clients to us from home ownership workshops.”

– John Krantz, Vice President of Residential Lending, Oritani Bank

| |||

| FHC PERFORMANCE STATISTICS (PROGRAM USAGE IN 2016)

Households Enrolled 3,288

Closings 1,693

Subsidies Funded $14,445,950 |

FHC PERFORMANCE STATISTICS (PROGRAM TOTALS AS OF 12/31/16)

Households Enrolled 38,483

Closings 12,756

Subsidies Funded $91,818,600 | |||

|

The Affordable Housing Program (AHP) is another tool the FHLBNY offers its members to enhance their ability to meet the needs of their communities. In 2016, the FHLBNY awarded $34.5 million in AHP grants to help fund 42 affordable housing initiatives, which created or preserved more than 3,300 affordable homes.

Each year, the FHLBNY sets aside 10 percent of its earnings to support the creation and preservation of affordable housing through AHP grants. These funds are awarded to members who submit applications on behalf of project sponsors. | ||||

24

THE VALUE OF MEMBERSHIP

|

| ||

| In 2016, M&T Bank was recognized with the FHLBNY’s Community Pillar Award for its ongoing dedication to supporting the community and creating affordable housing opportunities. This dedication to the community is shared by all the FHLBNY’s members, and the AHP program works because it supports the strong partnerships that exist between these members, locally focused community organizations, dedicated developers and elected officials at the city, state and federal levels, all working together to build affordable housing for all in need.

“M&T Bank’s active participation with the AHP allows us to play an active role with the most forward-thinking affordable and special needs housing projects in our diverse communities. AHP has further allowed us to nurture strategic partnerships with both for- and non-profit housing developers. This recipe is a key ingredient to the bank’s overall successful CRA programming. Commercial real estate customers have come to rely on M&T for consistent and reliable participation in AHP – funds pair perfectly with M&T Bank construction financing.”

– Kate Bukowski, Vice President, M&T Bank |

AHP PERFORMANCE STATISTICS (PROGRAM USAGE IN 2016)

Projects Approved 42

Units Created 3,362

Subsidies Approved $34,463,510

AHP PERFORMANCE STATISTICS (PROGRAM TOTALS AS OF 12/31/16)

Projects Approved 1,481

Units Created 67,437

Subsidies Approved $544,751,679 | |

AFFORDABLE HOUSING ADVISORY COUNCIL

| CHAIR Melody Federico Chief Real Estate Officer | NewBridge Services, Inc. Pequannock, New Jersey

VICE CHAIR Carrie Michel-Wynne Director of Housing | YWCA of Rochester & Monroe County, Rochester, New York |

Robert Di Vincent Executive Director | West New York Housing Authority West New York, New Jersey

Tyrone Garrett Executive Director | Long Branch Housing Authority Long Branch, New Jersey |

Faith Moore Executive Director | Orange County Rural Development Advisory Council, Walden, New York

Maria G. Rodriguez-Collazo Director of Housing Programs | PathStone Corporation Walden, New York | ||

|

Staci A. Berger President and CEO | The Housing and Community Development Network of NJ, Trenton, New Jersey

James Britz Senior Vice President | Long Island Housing Partnership, Inc., Hauppauge, New York

Susan Cotner Executive Director | Affordable Housing Partnership & Albany Community Land Trust, Albany, New York |

Daniel Kelly President | Community Quest, Egg Harbor Township, New Jersey

Daniel Martin Chief Executive Officer | Housing Partnership Development Corp., New York, New York

Colin McKnight Deputy Director | New York State Rural Housing Coalition Albany, New York

Wayne T. Meyer President | New Jersey Community Capital New Brunswick, New Jersey |

David A. Rowe Executive Vice President | CAMBA Housing Ventures Brooklyn, New York | ||

|

Note: This list reflects the FHLBNY’s Affordable Housing Advisory Council as of December 31, 2016. |

| BOARD OF DIRECTORS |

STANDING LEFT TO RIGHT

Larry E. Thompson * Vice Chairman & General Counsel | The Depository Trust & Clearing Corporation (DTCC), New York, New York

Anne Evans Estabrook *# Chairman | Elberon Development Co., Elizabeth, New Jersey

Monte N. Redman + President & CEO | Astoria Bank, Lake Success, New York

David J. Nasca + President & CEO | Evans Bank, N.A., Hamburg, New York

Thomas L. Hoy + Chairman | Glens Falls National Bank & Trust Company, Glens Falls, New York |

Christopher P. Martin + Chairman, President & CEO | The Provident Bank, Jersey City, New Jersey

C. Cathleen Raffaeli * CEO & Managing Director | Hamilton Management Company, New York, New York

Rev. DeForest B. Soaries, Jr. * Senior Pastor | First Baptist Church of Lincoln Gardens, Somerset, New Jersey

Kenneth J. Mahon + President & CEO | Dime Community Bank, Brooklyn, New York

SEATED, LEFT TO RIGHT

John R. Buran + President & CEO | Flushing Bank, Uniondale, New York |

|

* INDEPENDENT DIRECTOR # PUBLIC INTEREST DIRECTOR + MEMBER DIRECTOR

Note: This list reflects the FHLBNY’s Board of Directors as of January 1, 2017. Independent Director Caren S. Franzini passed away on January 25, 2017. |

Carlos J. Vázquez + Senior Executive Vice President | Banco Popular de Puerto Rico, San Juan, Puerto Rico

Kevin Cummings + President & CEO | Investors Bank, Short Hills, New Jersey

Gerald H. Lipkin + Chairman & CEO | Valley National Bank, Wayne, New Jersey

Richard S. Mroz * President | New Jersey Board of Public Utilities, Trenton, New Jersey |

Jay M. Ford + President & CEO | Crest Savings Bank, Wildwood, New Jersey

James W. Fulmer - Vice Chairman + Chairman | The Bank of Castile, Castile, New York

Michael M. Horn - Chairman * Partner | McCarter & English, LLP, Newark, New Jersey

Rev. Edwin C. Reed *# Founder & CEO | GGT Development, LLC, Jamaica Estates, New York |

| STANDING BACK, LEFT TO RIGHT

Eric Amig Senior Vice President & Head of Bank Relations

Stephen Angelo Senior Vice President & Chief Audit Officer

Edwin Artuz Senior Vice President, Head of Corporate Services & Director of the Office of Minority and Women Inclusion |

STANDING FRONT, LEFT TO RIGHT

Jonathan West Senior Vice President & Chief Legal Officer

José R. González President & Chief Executive Officer

Kevin Neylan Senior Vice President & Chief Financial Officer |

EXECUTIVE LEADERSHIP | ||

|

Melody Feinberg Senior Vice President & Acting Chief Risk Officer

Adam Goldstein Senior Vice President & Chief Business Officer

Bob Fusco Senior Vice President, Chief Information Officer & Head of Enterprise Services

Phil Scott Senior Vice President & Chief Capital Markets Officer

Paul Héroux Senior Vice President, Chief Bank Operations Officer & Community Investment Officer |

29

FHLBNY LEADERSHIP

| FHLBNY OFFICERS | ||||

| José R. González President & CEO

SENIOR VICE PRESIDENTS

Eric Amig Head of Bank Relations

Stephen Angelo Chief Audit Officer

Edwin Artuz Head of Corporate Services & Director of the Office of Minority & Women Inclusion

Steve Christatos Director, Compliance

Melody Feinberg Acting Chief Risk Officer

Bob Fusco Chief Information Officer & Head of Enterprise Services |

Adam Goldstein Chief Business Officer

Paul Héroux Chief Bank Operations Officer & Community Investment Officer

Kevin Neylan Chief Financial Officer

Philip Scott Chief Capital Markets Officer

Jonathan West Chief Legal Officer | |||

| VICE PRESIDENTS | ||||

| Backer Ali Controller

Dennis Bennett Model Risk Manager

Sean Borde Director, Project Management Office

James Boyle Senior Manager, Operations Risk

John Brandon Senior Manager, Business Research & Development

Kenneth Brothers Director, Information Security Office |

Vikram Dongre Director, Trading

Brian Finnegan Corporate Secretary

Paul Friend General Counsel

Bryan Gallagher Director, Collateral Analytical Services

Rodger Hicks Director, Technical Services

Susan Isquith Director, Credit Risk Management | |||

|

Muriel Brunken Senior Manager, Acquired Member Assets

Judy Chiu Senior Manager, Derivatives Accounting & Operations Officer

Mark Dankenbrink Senior Manager, Financial Audits

Bernard DeSiena Director, Business Technology

Michael Desiderio Director, Member Services Desk |

Maureen Kalena Calling Officer

Claudia Kim 3Director, Management Reporting

Eugene Khesin Senior Trader/Portfolio Officer

Phillip Mack Manager, Credit & Collateral Risk Analytics

Gregory Marposon Director, Financial Risk Management | |||

30

FHLBNY LEADERSHIP

| Walter Moran Director, Facilities Services

Alfred O’Connell Calling Officer

Deborah Palladino Director, Collateral & Affordable Housing Services

Diahann Rothstein Director, Investment & Portfolio Management

Edward Samson Senior Manager, Reporting

Thomas Settino Director, Sales

Rei Shinozuka Director, Asset Liability Modeling & Strategy |

Candice Soldano Director, Marketing & Corporate Events

Louis Solimine Director, Funding and Derivatives/Treasurer

Alexies Sornoza Calling Officer

Mildred Tse-Gonzalez Director, Human Resources

Michael Volpe Director, Bank Operations

Kimberly Whitenack Senior Manager, Financial Risk Management |

|||

| ASSISTANT VICE PRESIDENTS | ||||

| Jessey Abraham Senior Manager, Compliance

Mary Alvarez Residential Loan Review Officer

Beth Bentley Program Administration Officer

Devika Bharrat Financial Audit Officer

Erika Buglione Senior Manager, Quality Assurance

Christine Campbell Manager, Electronic Payments

Joseph Garofalo Risk Management Audit Manager

Sekar Gopinathan Senior Manager, Application Services |

Christina Levatino Senior Manager, Information Technology Audit

Anthony Merli Credit/Capital Market Audit Manager

Ching Ngai Manager, Financial Reporting

Bruce Petersel Accounting Policy Officer

Frederick Puorro Senior Credit Risk Officer

Michael Schoffelen MPF Business Manager

Eric Shumsky Senior Manager, Systems & Support Services

Eric Suber Senior Manager, Database Services |

|||

|

John Gurrieri Senior Manager, Collateral, Custody & Pledging Services

Mimi Hur Financial/Operational Audit Manager

Jason Kannenberg Senior Manager, Network Storage & Security Services

Ahmet Kargi Senior Manager, Systems & Operations Services

Kenneth T. Knight Commercial Loan Review Officer

Shu-Yam Ip Lead Network & Storage Engineer Officer |

Angel Santos Calling Officer

Anthony Scalzo Custody & Pledging Services Officer

Alberto Suarez Risk Reporting Manager

Tisa Surat Manager, Collateral Initiatives and Support

Catherine Sze Senior Manager, Management Reporting

Benjamin Tan Assistant Treasurer

Brian Wiedl Senior Manager, Records & Continuity Services |

|||

|

Kristen Lalama Senior Credit Risk Officer |

||||

|

Note: This list reflects FHLBNY officers as of December 31, 2016. | ||||

FEDERAL HOME LOAN BANK OF NEW YORK

101 PARK AVENUE, NEW YORK, NY 10178-0599

212.681.6000 • WWW.FHLBNY.COM