Attached files

| file | filename |

|---|---|

| 8-K - 8-K - United Financial Bancorp, Inc. | a8-kannualmeetingpresentat.htm |

Create Your Balance

Annual Shareholders Meeting

NASDAQ: UBNK

This Presentation contains forward-looking statements that are within the meaning of the Private Securities

Litigation Reform Act of 1995. Such statements are based upon the current beliefs and expectations of our

management and are subject to significant risks and uncertainties. These risks and uncertainties could cause

our results to differ materially from those set forth in such forward-looking statements. Forward-looking

statements can be identified by the fact that they do not relate strictly to historical or current facts. Words such

as “believes,” “anticipates,” “expects,” “intends,” “plans,” “estimates,” “targeted” and similar expressions, and

future or conditional verbs, such as “will,” “would,” “should,” “could” or “may” are intended to identify forward-

looking statements but are not the only means to identify these statements. Forward-looking statements

involve risks and uncertainties. Actual conditions, events or results may differ materially from those

contemplated by a forward-looking statement. Factors that could cause this difference — many of which are

beyond our control — include without limitation the following: Any forward-looking statements made by or on

behalf of us in this Presentation speak only as of the date of this Presentation. We do not undertake to update

forward-looking statements to reflect the impact of circumstances or events that arise after the date the

forward-looking statement was made. The reader should; however, consult any further disclosures of a

forward-looking nature we may make in future filings.

Forward Looking Statements

Chief Executive Officer

Presentation of Results

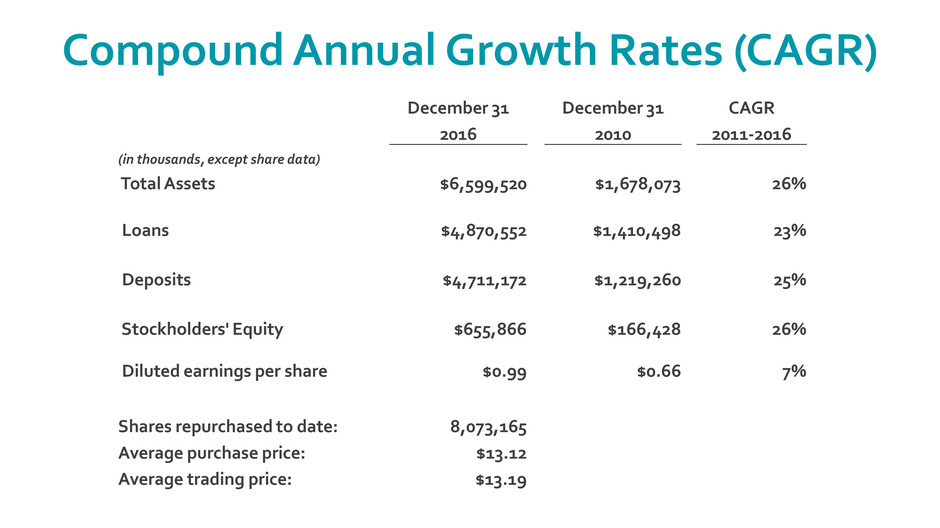

Compound Annual Growth Rates (CAGR)

December 31 December 31 CAGR

2016 2010 2011-2016

(in thousands, except share data)

Total Assets $6,599,520 $1,678,073 26%

Loans $4,870,552 $1,410,498 23%

Deposits $4,711,172 $1,219,260 25%

Stockholders' Equity $655,866 $166,428 26%

Diluted earnings per share $0.99 $0.66 7%

Shares repurchased to date: 8,073,165

Average purchase price: $13.12

Average trading price: $13.19

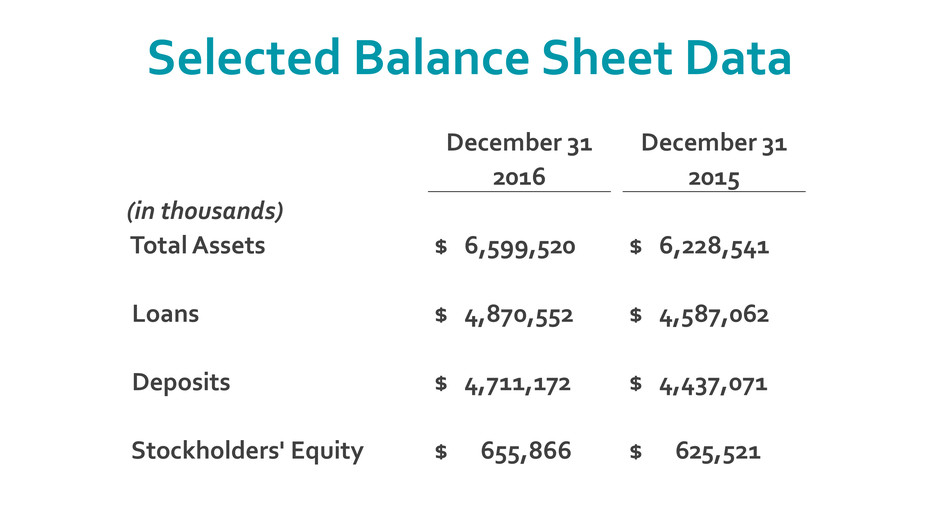

Selected Balance Sheet Data

December 31 December 31

2016 2015

(in thousands)

Total Assets $ 6,599,520 $ 6,228,541

Loans $ 4,870,552 $ 4,587,062

Deposits $ 4,711,172 $ 4,437,071

Stockholders' Equity $ 655,866 $ 625,521

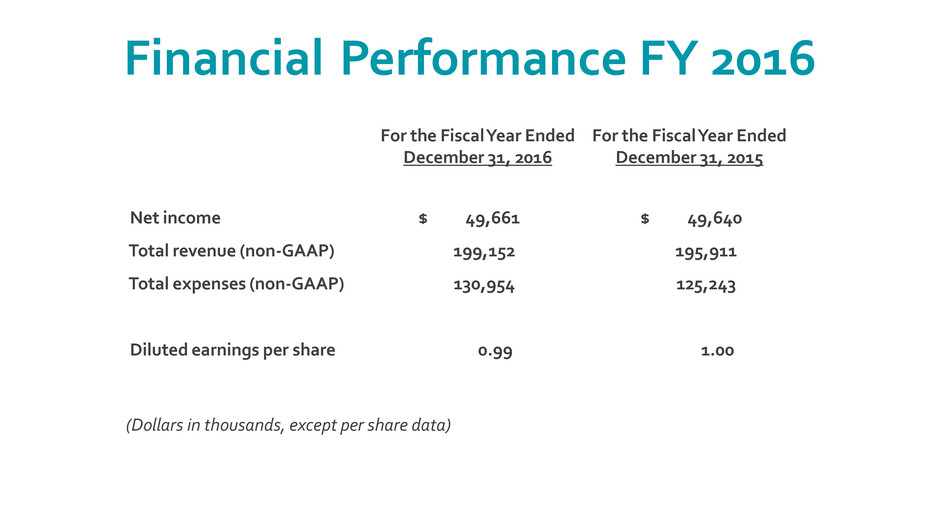

Financial Performance FY 2016

For the Fiscal Year Ended

December 31, 2016

For the Fiscal Year Ended

December 31, 2015

Net income $ 49,661 $ 49,640

Total revenue (non-GAAP) 199,152 195,911

Total expenses (non-GAAP) 130,954 125,243

Diluted earnings per share 0.99 1.00

(Dollars in thousands, except per share data)

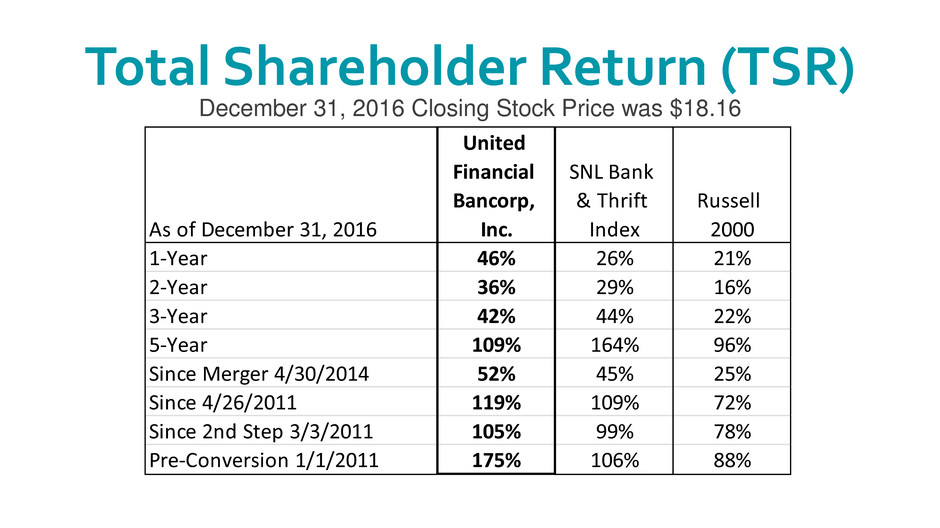

Total Shareholder Return (TSR)

As of December 31, 2016

United

Financial

Bancorp,

Inc.

SNL Bank

& Thrift

Index

Russell

2000

1-Year 46% 26% 21%

2-Year 36% 29% 16%

3-Year 42% 44% 22%

5-Year 109% 164% 96%

Since Merger 4/30/2014 52% 45% 25%

Since 4/26/2011 119% 109% 72%

Since 2nd Step 3/3/2011 105% 99% 78%

Pre-Conversion 1/1/2011 175% 106% 88%

December 31, 2016 Closing Stock Price was $18.16

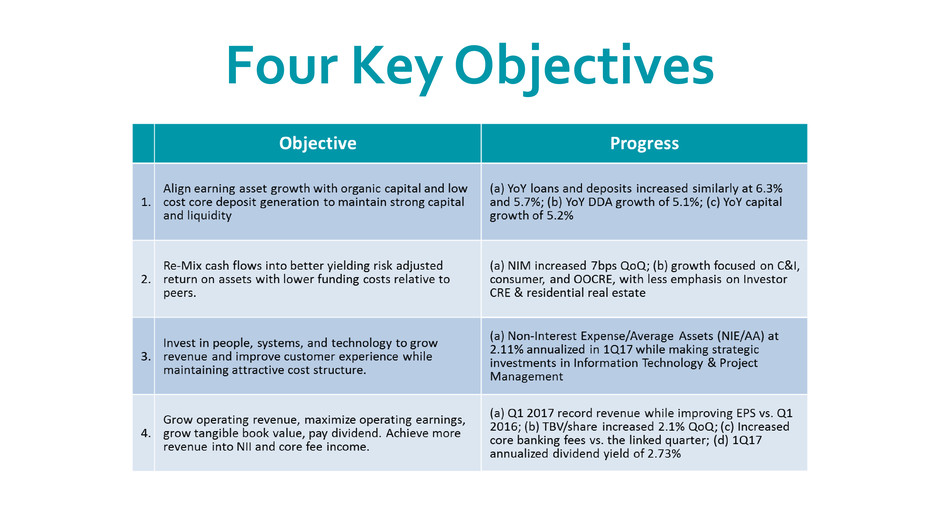

Four Key Objectives

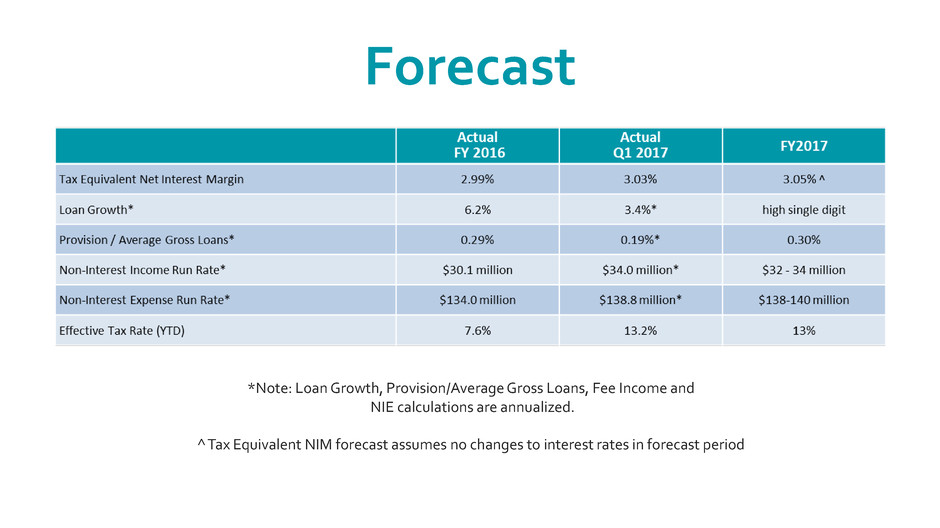

Forecast

*Note: Loan Growth, Provision/Average Gross Loans, Fee Income and

NIE calculations are annualized.

^ Tax Equivalent NIM forecast assumes no changes to interest rates in forecast period

Questions & Answers

Thank you for attending