Attached files

| file | filename |

|---|---|

| 8-K - 8-K - FARMER BROTHERS CO | form8-kinvestorpresentatio.htm |

May 2017INVESTOR PRESENTATION

Certain statements contained in this presentation are not based on historical fact and are forward-looking statements within the meaning

of federal securities laws and regulations. These statements are based on management’s current expectations, assumptions, estimates

and observations of future events and include any statements that do not directly relate to any historical or current fact; actual results may

differ materially due in part to the risk factors set forth in our most recent 10-K and 10-Q filings. These forward-looking statements can be

identified by the use of words like “anticipates,” “estimates,” “projects,” “expects,” “plans,” “believes,” “intends,” “will,” “assumes” and other

words of similar meaning. Owing to the uncertainties inherent in forward-looking statements, actual results could differ materially from

those set forth in forward-looking statements. We intend these forward-looking statements to speak only at the time of this presentation

and do not undertake to update or revise these statements as more information becomes available except as required under federal

securities laws and the rules and regulations of the SEC. Factors that could cause actual results to differ materially from those in forward-

looking statements include, but are not limited to, the timing and success of the Company’s Corporate Relocation Plan, the timing and

success of the Company in realizing estimated savings from third party logistics and vendor managed inventory, the realization of the

Company’s cost savings estimates, the relative effectiveness of compensation-based employee incentives in causing improvements in

Company performance, the capacity to meet the demands of the Company’s large national account customers, the extent of execution of

plans for the growth of Company business and achievement of financial metrics related to those plans, the effect of the capital markets as

well as other external factors on stockholder value, fluctuations in availability and cost of green coffee, competition, organizational

changes, our ability to retain employees with specialized knowledge, the effectiveness of our hedging strategies in reducing price risk,

changes in consumer preferences, our ability to provide sustainability in ways that do not materially impair profitability, changes in the

strength of the economy, business conditions in the coffee industry and food industry in general, our continued success in attracting new

customers, variances from budgeted sales mix and growth rates, weather and special or unusual events, changes in the quality or dividend

stream of third parties’ securities and other investment vehicles in which we have invested our assets, as well as other risks described in

this report and other factors described from time to time in our filings with the SEC.

Note: All of the financial information presented herein is unaudited.

2

FORWARD-LOOKING STATEMENTS

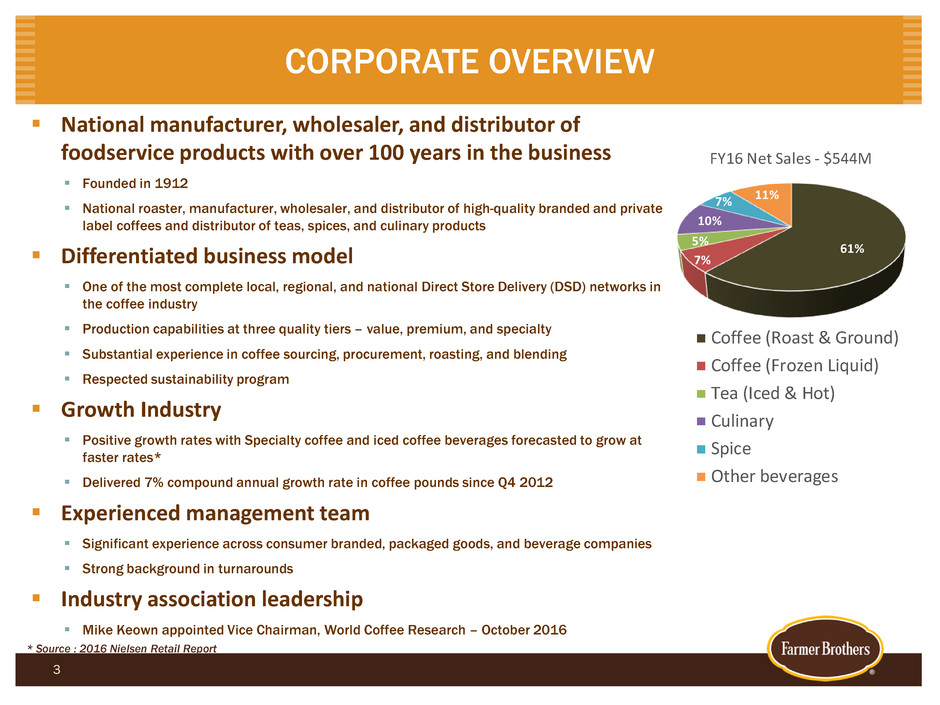

* Source : 2016 Nielsen Retail Report

61%

7%

5%

10%

7% 11%

FY16 Net Sales - $544M

Coffee (Roast & Ground)

Coffee (Frozen Liquid)

Tea (Iced & Hot)

Culinary

Spice

Other beverages

National manufacturer, wholesaler, and distributor of

foodservice products with over 100 years in the business

Founded in 1912

National roaster, manufacturer, wholesaler, and distributor of high-quality branded and private

label coffees and distributor of teas, spices, and culinary products

Differentiated business model

One of the most complete local, regional, and national Direct Store Delivery (DSD) networks in

the coffee industry

Production capabilities at three quality tiers – value, premium, and specialty

Substantial experience in coffee sourcing, procurement, roasting, and blending

Respected sustainability program

Growth Industry

Positive growth rates with Specialty coffee and iced coffee beverages forecasted to grow at

faster rates*

Delivered 7% compound annual growth rate in coffee pounds since Q4 2012

Experienced management team

Significant experience across consumer branded, packaged goods, and beverage companies

Strong background in turnarounds

Industry association leadership

Mike Keown appointed Vice Chairman, World Coffee Research – October 2016

3

CORPORATE OVERVIEW

4

COFFEE CONSUMPTION TRENDS

Sources : The Hartman Group, SCAA, Datassential, Mintel

CONSUMPTION & OCCASION

Gourmet penetration has surpassed traditional coffee

among Millennials

Specialty coffee consumption surpassed “traditional”

coffee in 2014 and has remained steady

“SPECIALTY”IZATION COLD BREW

26%

22%

16%

9%

12%

7%

8%

Early Morning

With Breakfast

Mid-Morning

Lunch

Afternoon

Dinner

Evening/Night

Coffee is no longer just a “morning” drink.

% Consuming Any Coffee

B

EV

ER

A

G

E

TY

P

ES

Traditional

Coffee – Not

Gourmet

Gourmet

Coffee

Beverages

18-24 (A)

25-39 (B)

40-59 (C)

60+ (D)

33

43

44

53

56CD

58CD

36

33

$7.9M retail sales

339% growth since 2010

Quality improving; line

extensions hitting the market

(e.g., nitro brew)

115% Growth (All Channels ‘15)

5

2017 MEGA COFFEE TRENDS

Source : Datassential Foodbytes; June 2015; July 2015

Reuse & Upcycle

Farmers use the coffee cherry skins to

produce coffee flour so they can use it

for baking

Consumers enjoyed steeped skins

(Cascara) as an emerging specialty

beverage

Next: Cascara sodas and

adult beverages

According to Mintel research, 57% of consumers say they are adventurous eaters while 82% claim to be open to trying new flavors.

The millennial generation has proven to be the most adventurous, driving the growth of ethnic flavors in retail and foodservice.

Farmer to Consumer Beneficial Cred Processing Protocol

Cold Brew Culinary Elite Flavor(full)

Coffee Reputation gets a healthy

boost

Off the line: Bulletproof Coffee

Media Blitz on healthy benefits

Further support from health Experts

(Webmd, Mayo Clinic)

Focus: Phytochemicals &

Caffeine

Pre-Harvest to Pre-Cup

Coffee houses are beginning to

entice consumers by promoting

“least processed”

This is new-age transparency

that furthers authenticity and

goodwill

Nitro Goes Mainstream

• Small but expanding as early adopters

drive growth

• Reduces need for sweetener due to

creamy mouthful

• RTD options starting to surface.

Will they make the grade?

Coffee as Culinary Star

Coffee becomes a go-to ingredient for

chefs, making an increased

appearance on menus.

Trending: Food & Alcohol pairings,

Season pushes; varietals

Flavor with Purpose

Consumers seeking health benefits

and flavors as a single solution

Coffee & tea offer a viable foundation

Trending: Ethnic spices, seeds, nut

milks, antioxidants, flavanoids

6

MULTI-TIER COFFEE & TEA PORTFOLIO

TRADITIONAL — Traditional coffees for the classic consumer

SPECIALTY — Handcrafted. Fresh. Sustainable.

Product Categories

PREMIUM — Fresh. Contemporary. Diverse.

SPECIALTY — Handcrafted. Fresh. Sustainable.

TRADITIONAL — Traditional coffees for the classic consumer

7

PRIVATE BRAND PROGRAM DEVELOPMENT

8

NATIONWIDE DISTRIBUTION NETWORK

7 Manufacturing Facilities/Distribution Centers and 114 branch warehouses

Manufacturing Facility

Distribution Center

Branch Location

9

OUR SUSTAINABILITY PROGRAMS

Our focused sustainability programs are a key component to winning new business

ENVIRONMENTAL SOCIAL

First roaster in the Northwest to be LEED®

Silver Certified

Innovative direct trade program pays

farmers more for quality and invests in

their long term coffee productivity

100% renewable energy is part of our

ongoing carbon footprint reduction

strategy at our roasting facilities

Strong partnership with FairTrade USA,

offering a wide range of single origins

and blends. Ethical consumers place

emphasis here.

14% reduction in our electric use, 28,000

MT (or 6.8%) reduction in our carbon

footprint while increasing volume

Active participation and supporter

Rainforest Alliance that helps farmers

farm while conserving the environment

while boosting crop yields.

Certified USDA and OCIA coffees from all

major growing regions, including blends

and single origins.

Long term “Cause Coffee” programs with

MercyCorps® and Philanthropy Partners

support community aid projects at origin

* LEED certification at our Northlake Tx headquarters facility projected in 2017

Name Title Prior Experience

Mike Keown President and Chief Executive Officer

David Robson Treasurer and Chief Financial Officer

Tom Mattei General Counsel and Assistant Secretary

Ellen Iobst Chief Operations Officer

Scott Bixby Senior Vice President/General Manager of DSD

Scott Siers Senior Vice President/General Manager of Direct-Ship

Gerard Bastiaanse Senior Vice President, Marketing

Suzanne Gargis Vice President, Human Resources

EXPERIENCED SENIOR MANAGEMENT TEAM

Note: The marks displayed above are the properties of these companies. Use in this presentation does not imply endorsement of this presentation.

10

World Coffee Research

Mike Keown appointed Vice Chairman of the Board of Directors

Specialty Coffee Association of Sustainability Council

Council Member

Pacific Coast Coffee Association

Board Member

Roasters Guild

Charitable Support

Coalition for Coffee Communities Board Member

FMI Leadership Counsel, Feeding America

11

INDUSTRY ASSOCIATION LEADERSHIP

The marks displayed above are the properties of those organizations.

May 2017MOVING FORWARD

13

CURRENT STRATEGIC OBJECTIVES

Increase production efficiency to improve competitiveness

Completed Corporate Relocation Plan

Implement supply chain cost reduction and efficiency initiatives

Leverage ERP system to reduce unnecessary costs

Maintain quality reputation as a competitive strength

Improve planning, forecasting, and further simplifying the supply chain

Reassess work processes

Drive volume growth from a larger national account base and enhance

teamwork across the National Account and DSD organizations

Redefine the DSD Model

Announced restructuring of the Company’s DSD sales model in February 2017

Leverage mobile sales and fleet routing tools to improve efficiency

Invest in high-growth and profitable markets and consider leaving low-profit markets

Continue to pursue strategies to improve or create profitable scale in targeted markets

Positive industry trends

~3-5% aggregate annual growth rates expected with specialty coffee and iced coffee

beverages growing at higher rates1

Consumption dynamic changing

Large addressable market

Potential market share improvement through new customers and territory objectives

Currently hold small percentage of the addressable market

Less than 1% market share2

Capitalize on consumers increasing interest in sustainability

Market continues to expand with new categories and products

Ice coffee, cold brew, premium coffee channels

Opportunistic M&A activities

Fragmented market with many regional players

Strong balance sheet and equity position

Low debt, with net borrowings net of cash and short term investments of $12.0 million as of

March 31, 2017

Additional borrowing capacity, with a $75.0 million revolving credit facility and a $50.0 million

accordion feature in place

$13.1m in availability as of 3/31/17

14

GROWTH EXPANSION OPPORTUNITIES

Source : (1) 2016 Nielsen Retail Report (2) Specialty Coffee Association of American Dec 2015

Strengthened management team

Adding talent to manage for future growth

Expertise in turnaround stories

Recently announced supply chain rationalization/simplification

DSD restructure targets annual savings of $2.0 million - $2.6 million to be realized fully

by fiscal Q2-18 after incurring 1x costs of $3.7 million - $4.9 million

Better addresses unique needs of customers and quicker response to industry trends

Recent customer wins in fiscal 2017

Examples: Allsup, SSP, Comcast, Skyline Healthcare, Stop N Save convenience stores

Enhanced specialty coffee program and resources

Added new capabilities – i.e., in national account sales, sustainability

Expanded grower sustainability programs at home and abroad

15

RECENT ACCOMPLISHMENTS

New HQ and distribution center in Northlake, Texas up and running

Effectively transitioned all remaining key functions into the new facility

Installed roasters in new state-of-the-art facility

Expect to be fully operational by fiscal year end 2017

Annual savings estimated $18 million - $20 million

Third Party Logistics (3PL) for long-haul deliveries added

Vendor - managed inventories added for select items

Closure of Torrance facility has driven improvement in Gross Margin

Expect to realize full savings by the back half of FY2018

Recently consolidated Oklahoma Distribution Center activity into our Northlake, Texas Distribution

Center

$3 – $5m in savings expected to be realized in FY18

Restructuring costs related to corporate relocation plan estimated at $31.6

million cash costs

$30.7 million of cash costs recognized through Q3 2017

Continue to assess manufacturing, distribution, and supply chain activities for

additional savings

16

CORPORATE RELOCATION PLAN

China Mist Brands, Inc.

Acquired October 2016 for ~$11.2 million including working

capital adjustments (before earnout)

Strong premium tea brand

Fast growing market segment

National distribution in over 20,000 foodservice locations

Strong management team

West Coast Coffee

Acquired in February 2017 for ~$14.7 million including

working capital adjustments (before earnout)

Portland, Oregon-based coffee manufacturer and distributor

Primarily focused on convenience store, grocery and

foodservice channels

Distribution to over 2,000 locations

Broadens Farmer Bros.’ reach in Northwest

17

RECENT ACQUISITIONS

May 2017FINANCIAL OVERVIEW

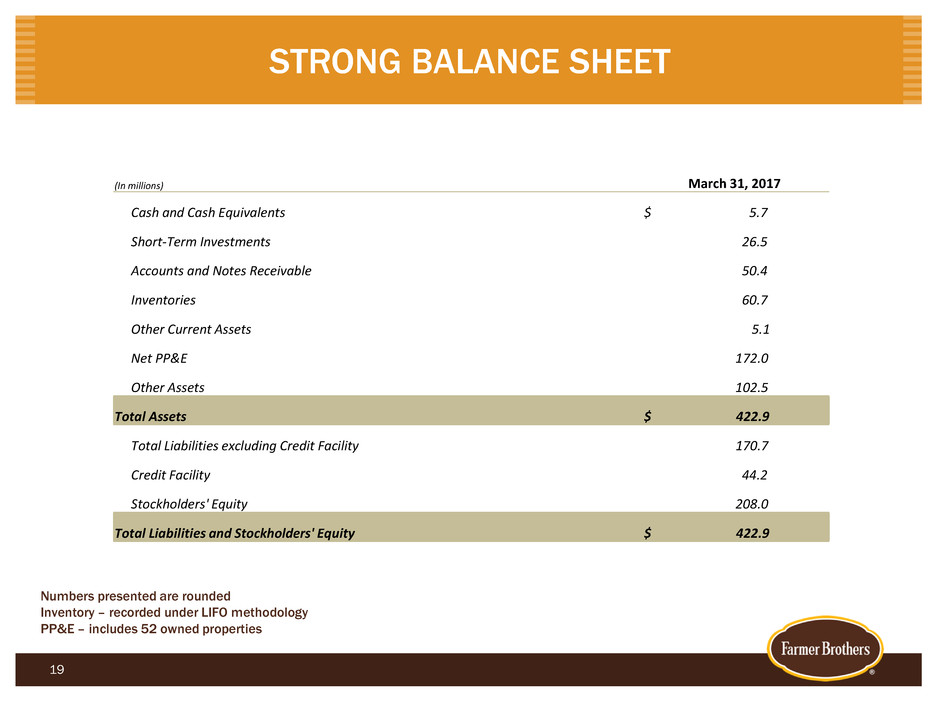

STRONG BALANCE SHEET

Numbers presented are rounded

Inventory – recorded under LIFO methodology

PP&E – includes 52 owned properties

19

(In millions) March 31, 2017

Cash and Cash Equivalents $ 5.7

Short-Term Investments 26.5

Accounts and Notes Receivable 50.4

Inventories 60.7

Other Current Assets 5.1

Net PP&E 172.0

Other Assets 102.5

Total Assets $ 422.9

Total Liabilities excluding Credit Facility 170.7

Credit Facility 44.2

Stockholders' Equity 208.0

Total Liabilities and Stockholders' Equity $ 422.9

20

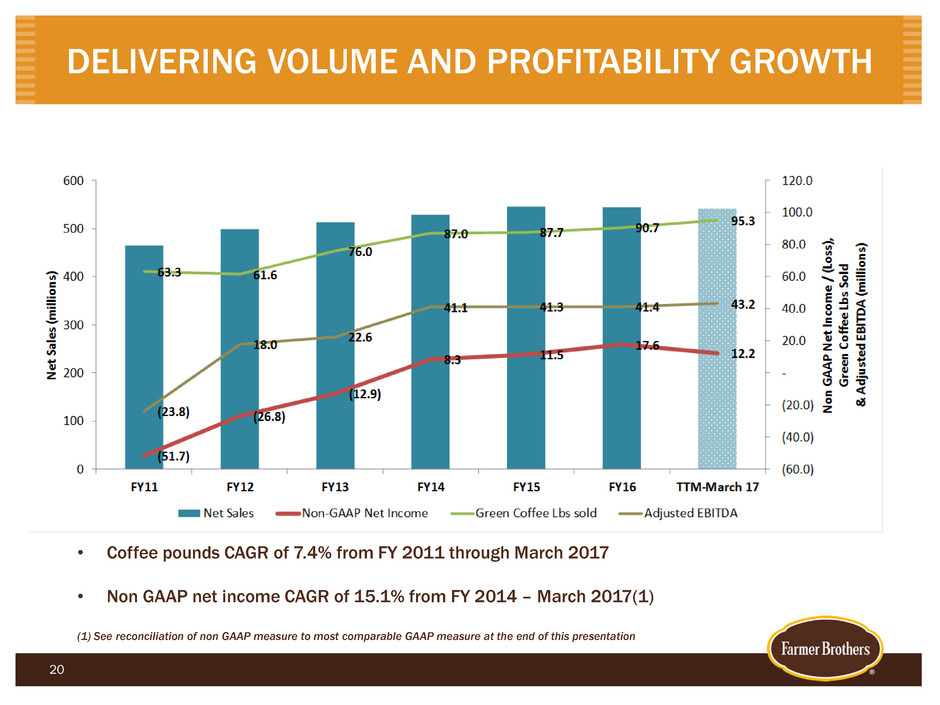

DELIVERING VOLUME AND PROFITABILITY GROWTH

• Coffee pounds CAGR of 7.4% from FY 2011 through March 2017

• Non GAAP net income CAGR of 15.1% from FY 2014 – March 2017(1)

(1) See reconciliation of non GAAP measure to most comparable GAAP measure at the end of this presentation

21

FY 18 OUTLOOK

We believe we can grow coffee pounds at market rates or faster

Our acquisition of China Mist provides new opportunities to expand tea products across our existing

customer base as well as increase coffee penetration within China Mist’s existing customer base

Net revenues outside of tea and coffee are expected to grow at slower rates

We currently believe that gross margins in FY 18 will be impacted by approximately 60 – 80bps from

higher depreciation at our new Northlake, Tx facilities

We currently believe that gross margin dollars are expected to grow approximately in the 2% - 3%

range

We anticipate continued adjusted EBITDA growth, improving 50bps to 100bps in FY 18 over FY 17

Expected cash tax rate of 3% - 4% with $66m in deferred tax assets remaining to utilize

Annual maintenance CapX of $20m - $22m anticipated for FY18

Investment CapX for FY18 still under review

We expect that our strong balance sheet would allow us to pursue opportunistic acquisitions or future

investment in our production facilities

Strong product market with growing categories

Increased coffee and tea consumption

Upgrading manufacturing facilities and distribution practices

New Northlake facility can initially increase system wide roasting capacity by up to 25%

to support increased demand with longer term potential to nearly double capacity

Initiating programs to win new customers

Cost and innovation programs

Coffee sourcing leadership

Sustainability leadership

Strong senior management with experience in turnarounds

Acquiring select capabilities and brands to broaden our reach

China Mist Brands – acquired October 2016

West Coast Coffee – acquired February 2017

KEY ACTIVITIES TO PROPEL FUTURE GROWTH

Positioning Farmer Bros. for Profitable Revenue Growth

22

May 2017INVESTOR PRESENTATION

APPENDIX

25

MOST RECENT RESULTS – Q3 2017 VS Q3 2016

Green coffee pounds increased 6.9%

Revenue increased 2.8%

Solid margins of 38.9%, essentially flat with last year when excluding start up

costs for our new Northlake facility

EBITDA increased 52.7%

Adjusted EBITDA increased 24.0%

Adjusted EBITDA margin increased to 8.8%, or 150 bps, over last year and the

highest EBITDA % performance this year

Adjusted EBITDA dollars reached $12.2m Vs. $9.8M last year

Three Months Ended March 31,

(In thousands, except per share data) 2017 2016 Y-o-Y Change

Income statement data:

Net sales $ 138,187 $ 134,468 2.80%

Gross margin 38.9% 39.1% -20 bps

Income from operations $ 2,058 $ 306 572.50%

Net income $ 1,594 $ 1,192 33.70%

Net income per common share—diluted $ 0.10 $ 0.07 $ 0.03

Operating data:

Coffee pounds 24,395 22,821 6.90%

Non-GAAP net income $ 3,049 $ 4,022 -24.20%

Non-GAAP net income per diluted common share $ 0.17 $ 0.24 $ (0.07)

EBITDA $ 10,049 $ 6,580 52.70%

EBITDA Margin 7.30% 4.90% +240 bps

Adjusted EBITDA $ 12,180 $ 9,820 24.00%

Adjusted EBITDA Margin 8.80% 7.30% +150 bps

Balance sheet and other data:

Total capital expenditures excluding new facility $ 6,421 $ 2,876 123.30%

Total capital expenditures $ 13,503 $ 12,564 7.50%

Depreciation and amortization expense $ 6,527 $ 5,234 24.70%

SELECTED FINANCIAL DATA

26

Q3 FY17 STATEMENTS OF OPERATIONS

Three Months Ended March 31, Nine Months Ended March 31,

($ in thousands, except per share data) 2017 2016 2017 2016

Net sales $ 138,187 $ 134,468 $ 407,700 $ 410,220

Cost of goods sold 84,367 81,908 247,586 254,173

Gross profit 53,820 52,560 160,114 156,047

GM 38.9 % 39.1 % 39.3 % 38.0 %

Selling expenses 40,377 38,447 117,912 112,741

General and administrative expenses 9,196 10,977 31,925 29,951

Restructuring and other transition expenses 2,547 3,169 9,542 13,855

Net gain from sale of Torrance Facility — — (37,449) —

Net gains from sales of Spice Assets (272) (335) (764) (5,441)

Net gains from sales of assets-other (86) (4) (1,525) (163)

Operating expenses 51,762 52,254 119,641 150,943

Income from operations 2,058 306 40,473 5,104

Other income (expense):

Dividend income 273 288 808 840

Interest income 147 139 435 359

Interest expense (517) (111) (1,430) (341)

Other, net 1,044 613 (1,088) 35

Total other income (expense) 947 929 (1,275) 893

Income before taxes 3,005 1,235 39,198 5,997

Income tax expense 1,411 43 15,910 318

Net income $ 1,594 $ 1,192 $23,288 $5,679

Basic net income per common share $ 0.10 $ 0.07 $ 1.40 $ 0.34

Diluted net income per common share $ 0.10 $ 0.07 $ 1.39 $ 0.34

Weighted average common shares outstanding—basic

16,605,754 16,539,479 16,584,125 16,486,469

Weighted average common shares outstanding—diluted

16,721,774 16,647,415 16,704,200 16,614,275

27

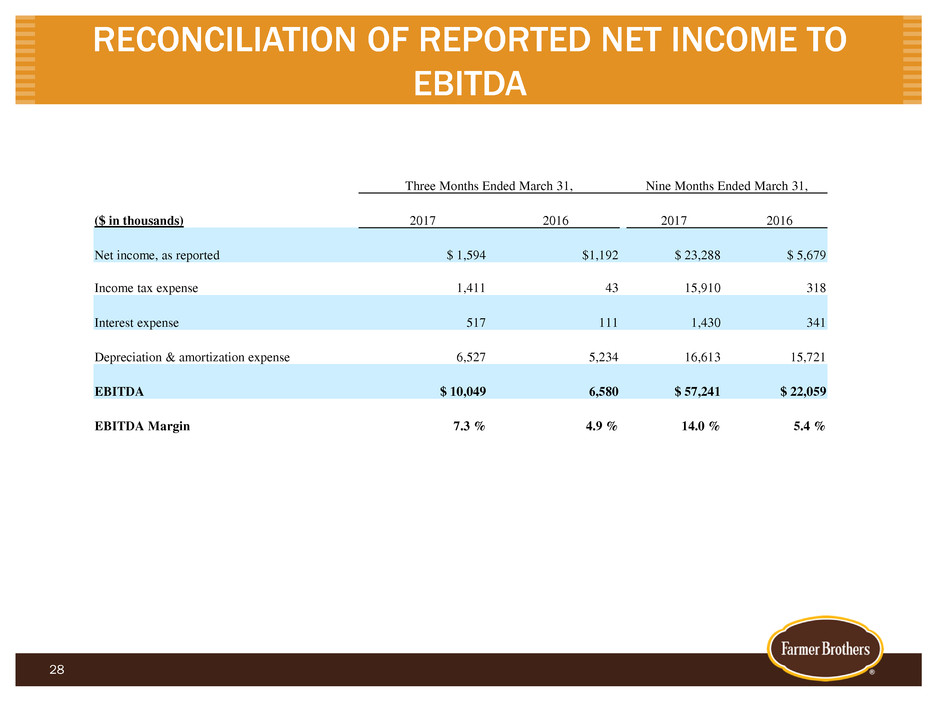

RECONCILIATION OF REPORTED NET INCOME TO

EBITDA

Three Months Ended March 31, Nine Months Ended March 31,

($ in thousands) 2017 2016 2017 2016

Net income, as reported $ 1,594 $1,192 $ 23,288 $ 5,679

Income tax expense 1,411 43 15,910 318

Interest expense 517 111 1,430 341

Depreciation & amortization expense 6,527 5,234 16,613 15,721

EBITDA $ 10,049 6,580 $ 57,241 $ 22,059

EBITDA Margin 7.3 % 4.9 % 14.0 % 5.4 %

28

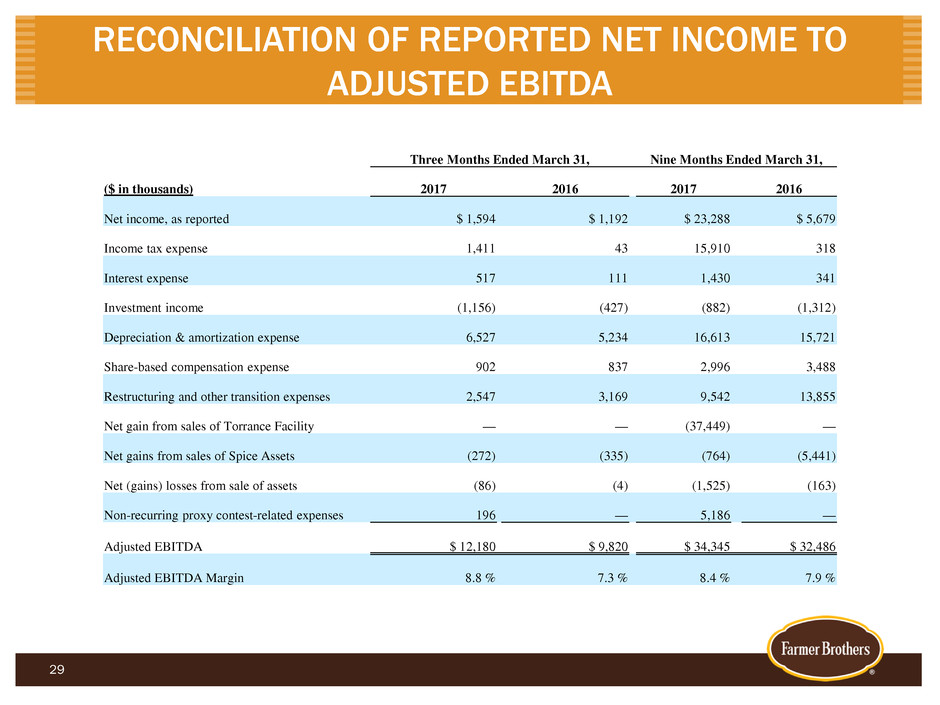

RECONCILIATION OF REPORTED NET INCOME TO

ADJUSTED EBITDA

Three Months Ended March 31, Nine Months Ended March 31,

($ in thousands) 2017 2016 2017 2016

Net income, as reported $ 1,594 $ 1,192 $ 23,288 $ 5,679

Income tax expense 1,411 43 15,910 318

Interest expense 517 111 1,430 341

Investment income (1,156) (427) (882) (1,312)

Depreciation & amortization expense 6,527 5,234 16,613 15,721

Share-based compensation expense 902 837 2,996 3,488

Restructuring and other transition expenses 2,547 3,169 9,542 13,855

Net gain from sales of Torrance Facility — — (37,449) —

Net gains from sales of Spice Assets (272) (335) (764) (5,441)

Net (gains) losses from sale of assets (86) (4) (1,525) (163)

Non-recurring proxy contest-related expenses 196 — 5,186 —

Adjusted EBITDA $ 12,180 $ 9,820 $ 34,345 $ 32,486

Adjusted EBITDA Margin 8.8 % 7.3 % 8.4 % 7.9 %

29

RECONCILIATION OF REPORTED NET INCOME TO

NON-GAAP NET INCOME

30

($ in thousands) 2017 2016 2017 2016

Net income, as reported 1,594$ 1,192$ 23,288$ 5,679$

Non-recurring proxy contest-related expense 196 — 5,186 —

Restructuring and other transition expenses 2,547 3,169 9,542 13,855

Net gain from sales of Torrance Facility — — (37,449) —

Net gains on Spice Assets (272) (335) (764) (5,441)

Net (gains) losses on sale of assets-other (86) (4) (1,525) (163)

Interest expense on sale-leaseback financing

obligations — — 681 —

Tax impact of non-GAAP adjustments (930) — 9,488 —

Non-GAAP net income 3,049$ 4,022$ 8,447$ 13,930$

Weighted average common shares

outstanding—basic 16,605,754 16,539,479 16,584,125 16,486,469

Weighted average common shares

outstanding—diluted 16,721,774 16,647,415 16,704,200 16,614,275

GAAP net income per common share—diluted 0.10$ 0.07$ 1.39$ 0.34$

Impact of expenses related to additional

resources for proxy contest 0.01$ —$ 0.31$ —$

Impact of restructuring and other transition

expenses 0.15$ 0.19$ 0.57$ 0.83$

Impact of gain on sale of Torrance Facility —$ —$ (2.24)$ —$

Impact of gains from sale of Spice Assets (0.02)$ (0.02)$ (0.05)$ (0.33)$

Impact of net (gains) losses on sale of assets (0.01)$ (0.00)$ (0.09)$ (0.01)$

Impact of interest expense on sale-leaseback

financing obligation —$ —$ 0.04$ —$

Impact of income taxes on non-GAAP

adjustments (0.06)$ —$ 0.57$ —$

Non-GAAP net income per common

share—diluted 0.17$ 0.24$ 0.50$ 0.83$

Three Months Ended March 31, Nine Months Ended March 31,

May 2017INVESTOR PRESENTATION