Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - PATTERSON UTI ENERGY INC | d400967d8k.htm |

UBS Global Oil and Gas Conference May 23, 2017 Exhibit 99.1

Forward-Looking Statements This material and any oral statements made in connection with this material include "forward-looking statements" within the meaning of the Securities Act of 1933 and the Securities Exchange Act of 1934. Statements made which provide the Company’s or management’s intentions, beliefs, expectations or predictions for the future are forward-looking statements and are inherently uncertain. The opinions, forecasts, projections or other statements other than statements of historical fact, including, without limitation, plans and objectives of management of the Company are forward-looking statements. It is important to note that actual results could differ materially from those discussed in such forward-looking statements. Important factors that could cause actual results to differ materially include the risk factors and other cautionary statements contained from time to time in the Company’s SEC filings, which may be obtained by contacting the Company or the SEC. These filings are also available through the Company’s web site at http://www.patenergy.com or through the SEC’s Electronic Data Gathering and Analysis Retrieval System (EDGAR) at http://www.sec.gov. We undertake no obligation to publicly update or revise any forward-looking statement. Statements made in this presentation include non-U.S. GAAP financial measures. The required reconciliation to U.S. GAAP financial measures are included on our website and/or at the end of this presentation. 2

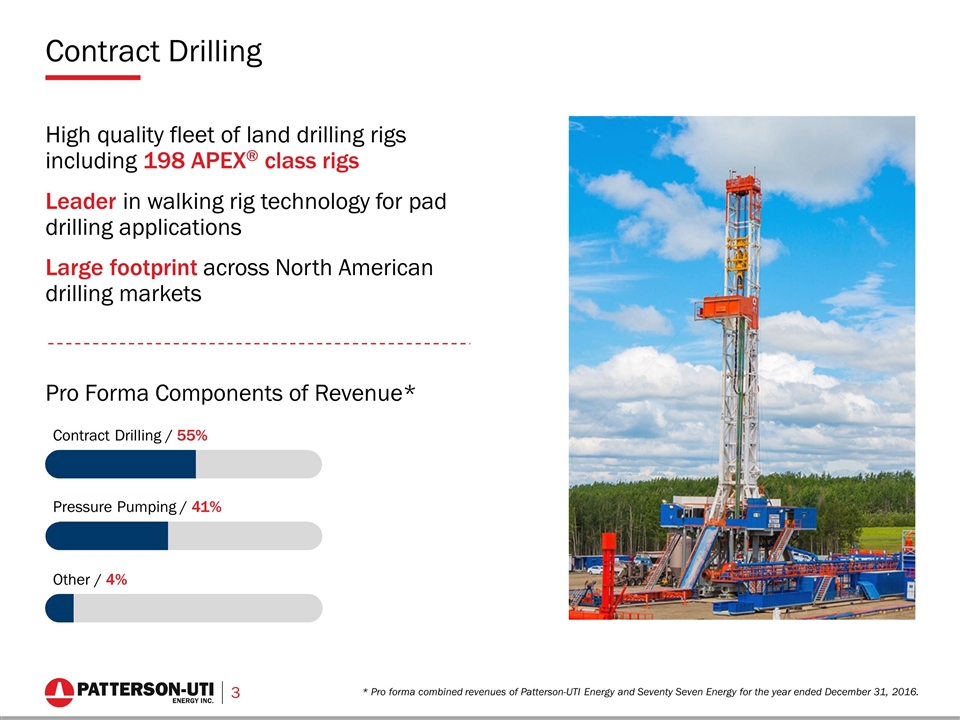

Contract Drilling High quality fleet of land drilling rigs including 198 APEX® class rigs Leader in walking rig technology for pad drilling applications Large footprint across North American drilling markets * Pro forma combined revenues of Patterson-UTI Energy and Seventy Seven Energy for the year ended December 31, 2016. 55% Contract Drilling / 55% Pressure Pumping / 41% Other / 4% Pro Forma Components of Revenue*

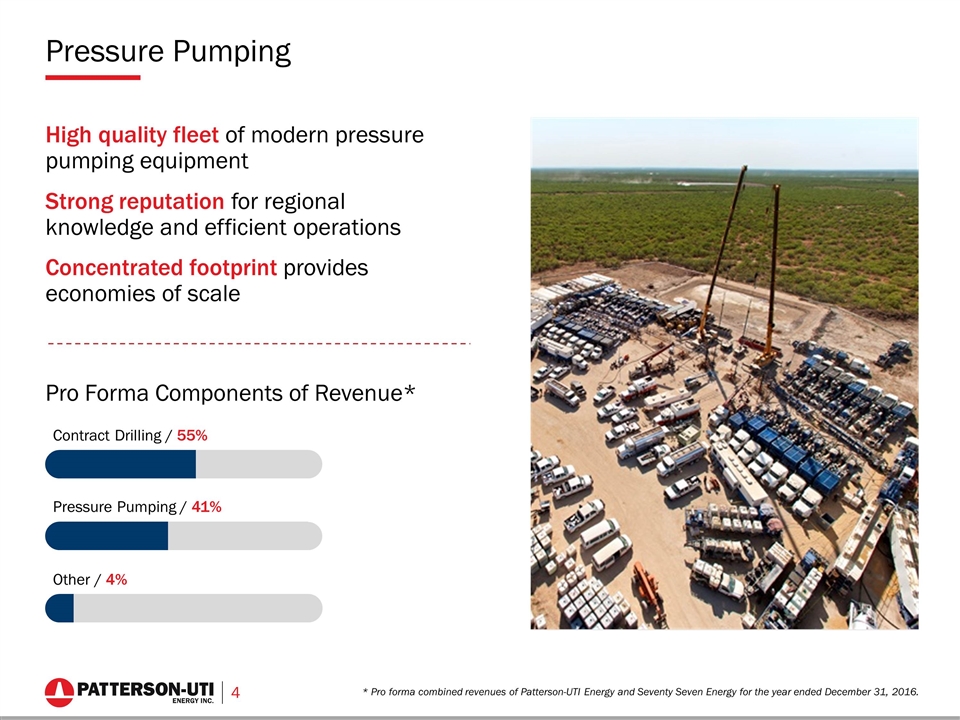

Pressure Pumping High quality fleet of modern pressure pumping equipment Strong reputation for regional knowledge and efficient operations Concentrated footprint provides economies of scale * Pro forma combined revenues of Patterson-UTI Energy and Seventy Seven Energy for the year ended December 31, 2016. 55% Contract Drilling / 55% Pressure Pumping / 41% Other / 4% Pro Forma Components of Revenue*

Contract Drilling

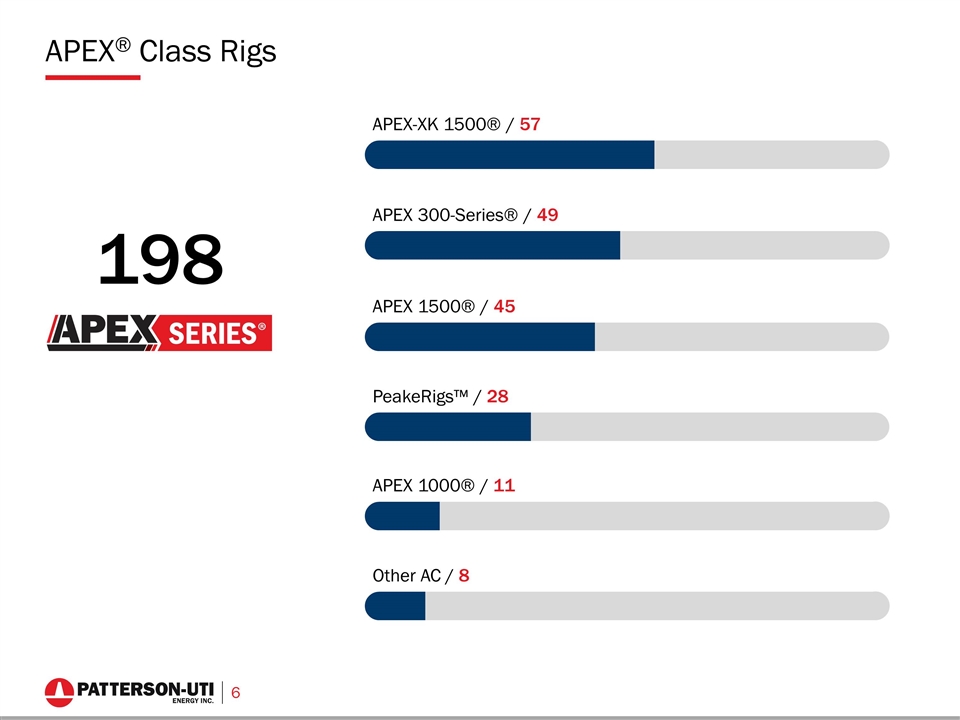

APEX® Class Rigs 198 APEX-XK 1500® / 57 APEX 300-Series® / 49 APEX 1500® / 45 PeakeRigs™ / 28 APEX 1000® / 11 Other AC / 8

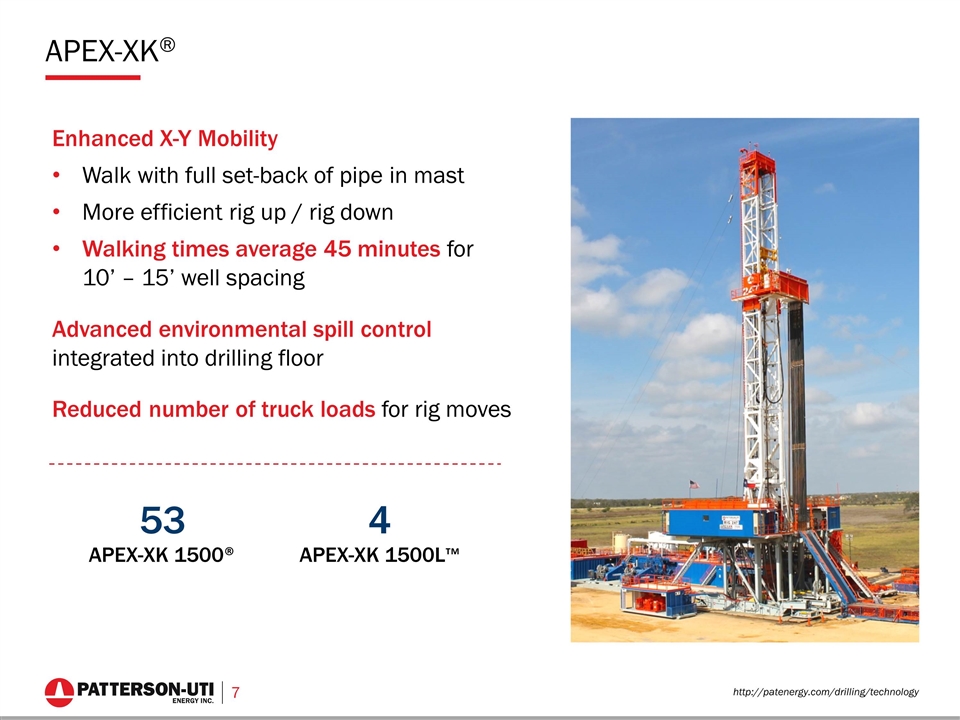

APEX-XK® http://patenergy.com/drilling/technology Enhanced X-Y Mobility Walk with full set-back of pipe in mast More efficient rig up / rig down Walking times average 45 minutes for 10’ – 15’ well spacing Advanced environmental spill control integrated into drilling floor Reduced number of truck loads for rig moves 53 APEX-XK 1500® 4 APEX-XK 1500L™

APEX-XK® Integrated Walking System

APEX-XK® Rig Walking on Pad http://patenergy.com/drilling/technology/apexwalk/ Video of APEX-XK® Rig

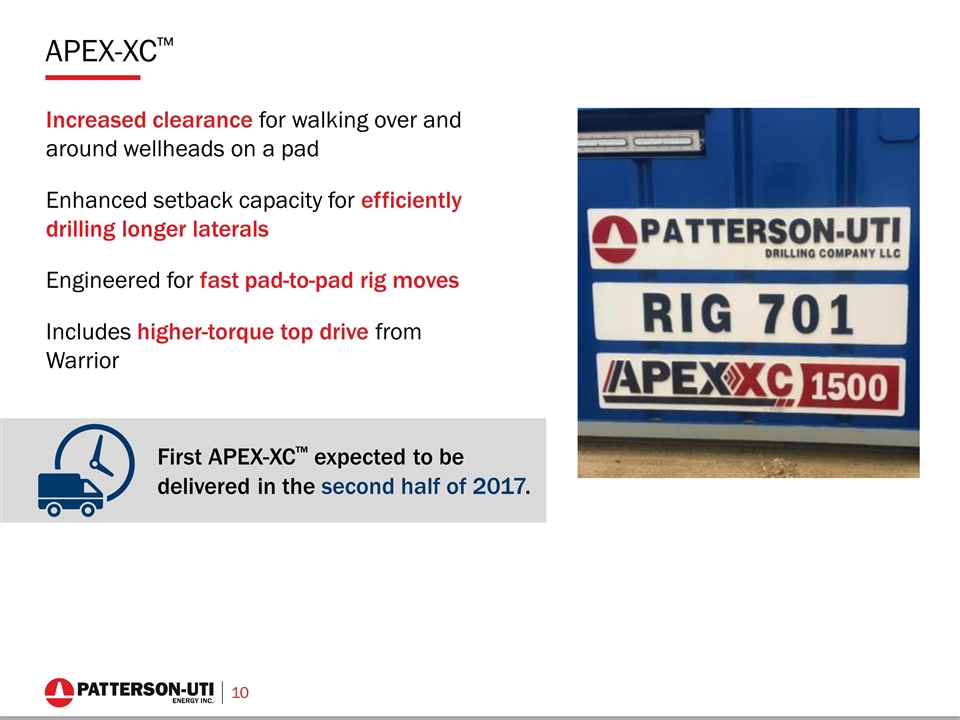

APEX-XC™ Increased clearance for walking over and around wellheads on a pad Enhanced setback capacity for efficiently drilling longer laterals Engineered for fast pad-to-pad rig moves Includes higher-torque top drive from Warrior First APEX-XC™ expected to be delivered in the second half of 2017.

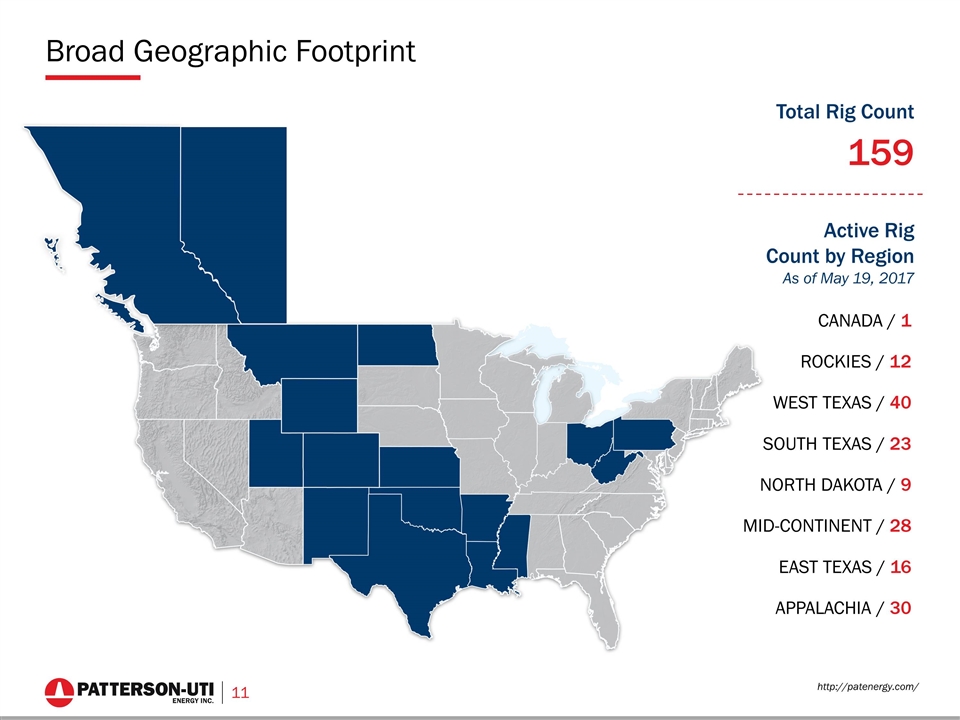

Broad Geographic Footprint http://patenergy.com/ CANADA / 1 ROCKIES / 12 WEST TEXAS / 40 SOUTH TEXAS / 23 NORTH DAKOTA / 9 MID-CONTINENT / 28 EAST TEXAS / 16 APPALACHIA / 30 Active Rig Count by Region As of May 19, 2017 Total Rig Count 159

Drilling Technologies Designs, manufactures and services high-spec rig components with a recent focus on top drive technology Enhances the Patterson-UTI technology portfolio and engineering capabilities A highly talented group of people with a tremendous amount of experience

Pressure Pumping

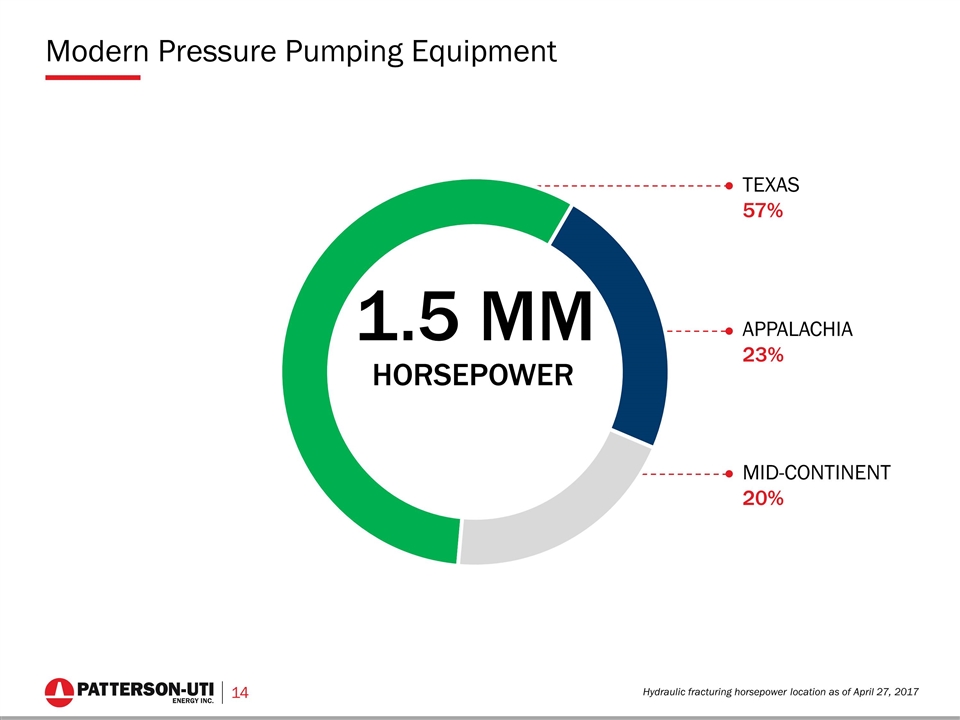

Modern Pressure Pumping Equipment Hydraulic fracturing horsepower location as of April 27, 2017 14 1.5 MM HORSEPOWER MID-CONTINENT 20% TEXAS 57% APPALACHIA 23%

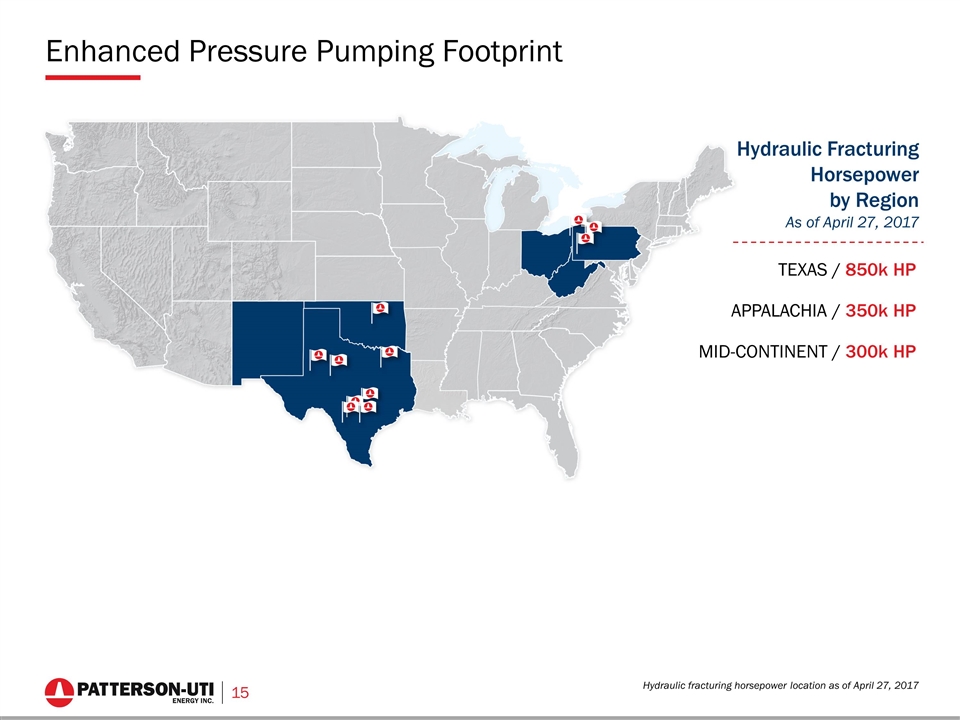

Enhanced Pressure Pumping Footprint Hydraulic fracturing horsepower location as of April 27, 2017 TEXAS / 850k HP APPALACHIA / 350k HP MID-CONTINENT / 300k HP Hydraulic Fracturing Horsepower by Region As of April 27, 2017

Centralized Logistics Center Efficient procurement and logistics of sand and chemicals is important to being successful in hydraulic fracturing. Centralized logistics center includes: 24/7 dispatch personnel Central scheduling and tracking software Smart phone apps in the field Central logistics center supported all of Texas operations at March 31, 2017, and intend to roll out to all pressure pumping operations.

Strong Financial Position

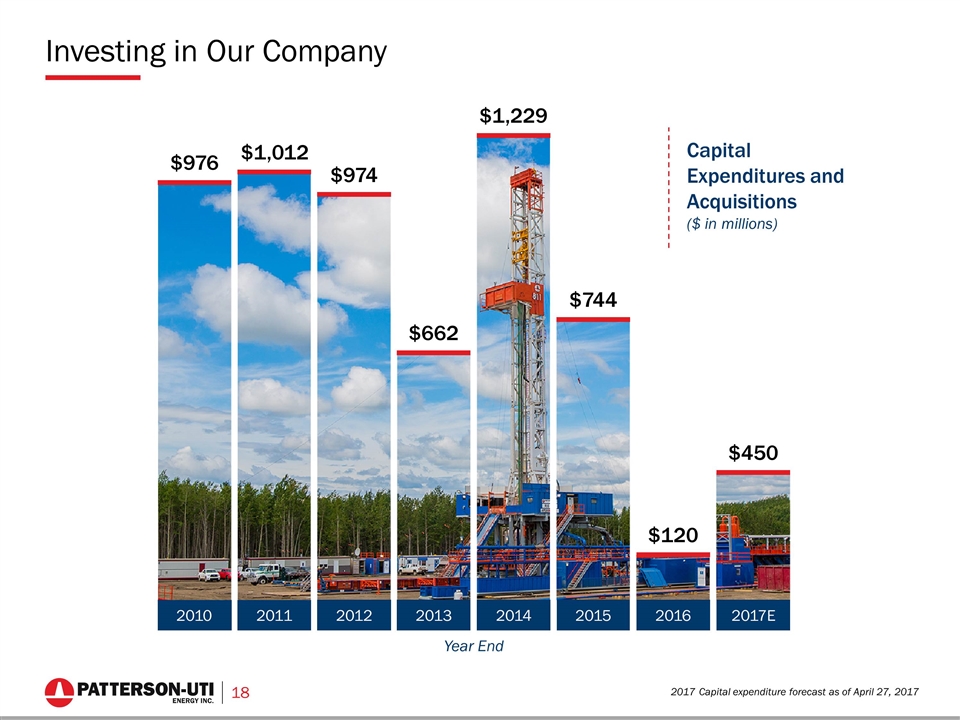

Investing in Our Company 2017 Capital expenditure forecast as of April 27, 2017 $976 $1,012 $974 $662 $1,229 $744 $120 $450 2011 2010 2012 2013 2014 2015 2016 2017E Year End Capital Expenditures and Acquisitions ($ in millions)

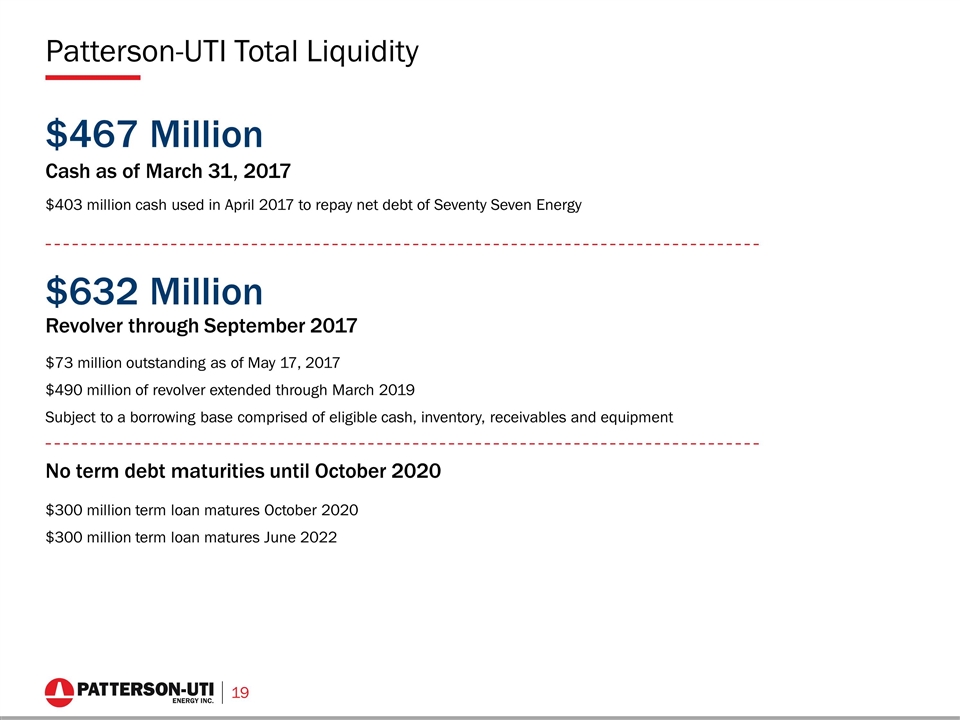

Patterson-UTI Total Liquidity 19 $467 Million Cash as of March 31, 2017 $632 Million Revolver through September 2017 $73 million outstanding as of May 17, 2017 $490 million of revolver extended through March 2019 Subject to a borrowing base comprised of eligible cash, inventory, receivables and equipment No term debt maturities until October 2020 $300 million term loan matures October 2020 $300 million term loan matures June 2022 $403 million cash used in April 2017 to repay net debt of Seventy Seven Energy

Why Invest in Patterson-UTI Energy? HIGH QUALITY ASSETS 198 APEX® class rigs Creating value through focus on well site execution TECHNOLOGY LEADER Leader in walking rigs for pad drilling Innovator in deploying latest technologies for pressure pumping FINANCIALLY FLEXIBLE Strong balance sheet History of share buybacks Dividends Scalable business structure

Additional References

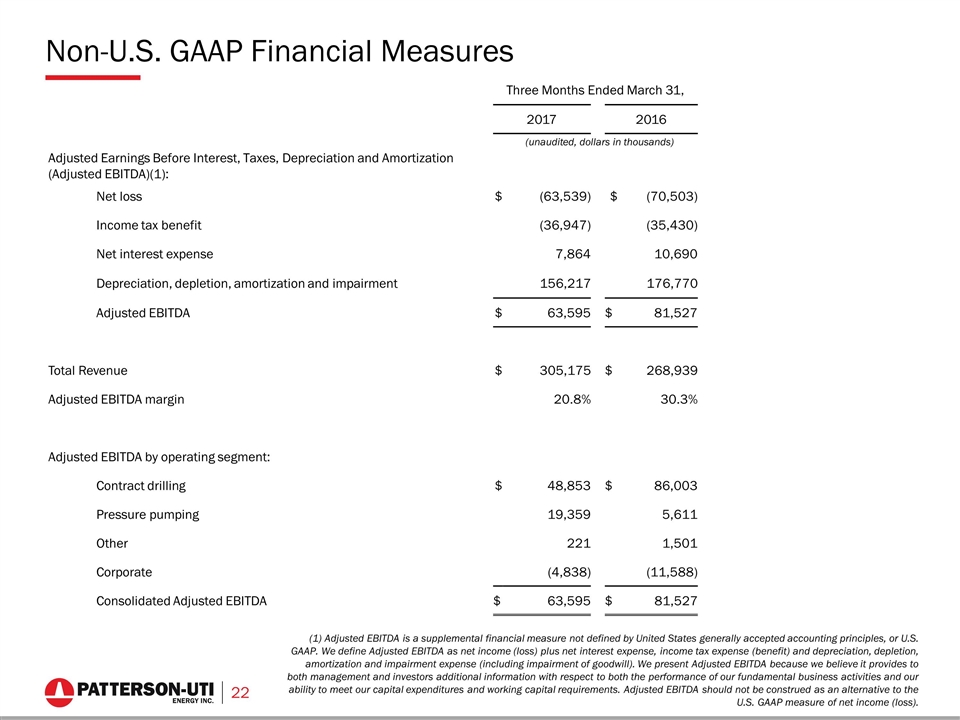

Non-U.S. GAAP Financial Measures (1) Adjusted EBITDA is a supplemental financial measure not defined by United States generally accepted accounting principles, or U.S. GAAP. We define Adjusted EBITDA as net income (loss) plus net interest expense, income tax expense (benefit) and depreciation, depletion, amortization and impairment expense (including impairment of goodwill). We present Adjusted EBITDA because we believe it provides to both management and investors additional information with respect to both the performance of our fundamental business activities and our ability to meet our capital expenditures and working capital requirements. Adjusted EBITDA should not be construed as an alternative to the U.S. GAAP measure of net income (loss). Three Months Ended March 31, 2017 2016 (unaudited, dollars in thousands) Adjusted Earnings Before Interest, Taxes, Depreciation and Amortization (Adjusted EBITDA)(1): Net loss $ (63,539) $ (70,503) Income tax benefit (36,947) (35,430) Net interest expense 7,864 10,690 Depreciation, depletion, amortization and impairment 156,217 176,770 Adjusted EBITDA $ 63,595 $ 81,527 Total Revenue $ 305,175 $ 268,939 Adjusted EBITDA margin 20.8% 30.3% Adjusted EBITDA by operating segment: Contract drilling $ 48,853 $ 86,003 Pressure pumping 19,359 5,611 Other 221 1,501 Corporate (4,838) (11,588) Consolidated Adjusted EBITDA $ 63,595 $ 81,527

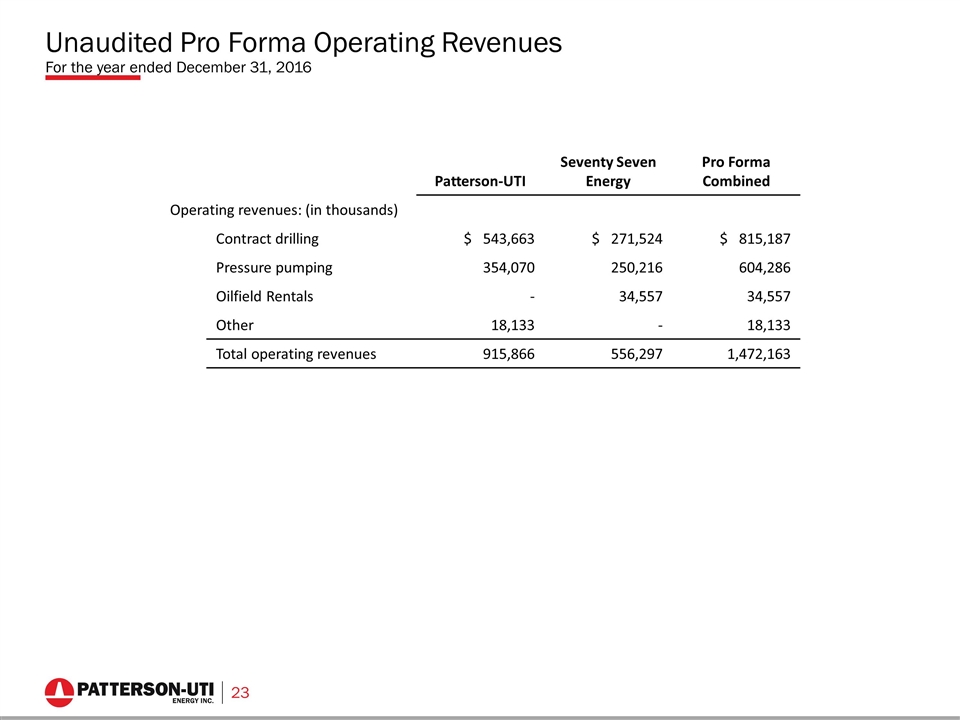

Unaudited Pro Forma Operating Revenues For the year ended December 31, 2016 23 Patterson-UTI Seventy Seven Energy Pro Forma Combined Operating revenues: (in thousands) Contract drilling $ 543,663 $ 271,524 $ 815,187 Pressure pumping 354,070 250,216 604,286 Oilfield Rentals - 34,557 34,557 Other 18,133 - 18,133 Total operating revenues 915,866 556,297 1,472,163