Attached files

| file | filename |

|---|---|

| EX-10 - EXHIBIT 10.4 - Crank Media Inc | ex104.htm |

| EX-10 - EXHIBIT 10.3 - Crank Media Inc | ex103.htm |

| EX-10 - EXHIBIT 10.2 - Crank Media Inc | ex102.htm |

| EX-10 - EXHIBIT 10.1 - Crank Media Inc | ex101.htm |

| EX-5 - EXHIBIT 5.1 - Crank Media Inc | ex51.htm |

| EX-3 - EXHBITI 3.2 - Crank Media Inc | ex32.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1 /A

REGISTRATION STATEMENT UNDER

THE SECURITIES ACT OF 1933

TEAM 360 SPORTS INC.

(Exact Name of Registrant as Specified in its Charter)

| Nevada | 7372 | 33-1227600 |

| (State or other jurisdiction Incorporation or organization) | (Primary Standard Industrial Classification Code Number) | (I.R.S. Employer Identification Number) |

163 Killian Rd.

Maple, Ontario, Canada LGA 1A8

775-882-4641

(Address, Including Zip Code, and Telephone Number, Including Area Code, of Registrant’s Principal Executive Offices)

Sandor Miklos

711 S. Carson St. Ste 4

Carson City, NV 89701

(Name, address, including zip code, and telephone number, including area code, of agent for service)

With copies to:

Darian B. Andersen

General Counsel, PC

1015 Waterwood Parkway, Suite GA1

Edmond, Oklahoma 73034

(405) 330-2235 telephone

(405) 330-2236 fax

darianandersen@gmail.com

| 1 |

Approximate date of commencement of proposed sale to the public:

As soon as practicable after this registration statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. |X|

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act of 1933, please check the following box and list the Securities Act registration Statement number of the earlier effective registration statement for the same offering. [ ]

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act of 1933, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. [ ]

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act of 1933, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions “large accelerated filer,”“accelerated file,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer | [ ] | Accelerated filer | [ ] |

| Non-accelerated filer | [ ] | Smaller reporting company | [X] |

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall hereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Commission, acting pursuant to such Section 8(a), may determine.

CALCULATION OF REGISTRATION FEE CHART

| Proposed | Proposed | |||||||||||||

| Amount | Maximum | Maximum | Amount of | |||||||||||

| Title of Each Class of to be | to be | Offering Price | Aggregate | Registration | ||||||||||

| Securities to be Registered Common Stock, $0.001 par value per share | Registered | Per Share (1) | Offering Price (2) | Fee (3) |

||||||||||

| Common Stock held by Selling Shareholders | 1,273,612 Shares | $ | 0.25 | $ | 318,403 | $ | 36.90 | |||||||

(1) There is no current market for the securities and the price at which the Shares are being offered has been arbitrarily determined by the Company and used for the purpose of computing the amount of the registration fee in accordance with Rule 457(a) under the Securities Act of 1933, as amended.

(2) Estimated solely for the purpose of calculating the registration fee pursuant to Rule 457(c) under the Securities Act of 1933, as amended. The shares to be sold by the Selling Stockholders will be sold at a fixed price to be determined prior to effectiveness of this Registration Statement. Any increased fees will be paid prior to effectiveness.

(3) The Registrant previously paid $36.90 of the total registration fee in connection with the prior filing of this Registration Statement.

| 2 |

EXPLANATORY NOTE

This registration statement and the prospectus therein covers the registration of 1,273,612 shares of common stock offered by the holders thereof.

| 3 |

The information contained in this prospectus is not complete and may be changed. A registration statement relating to these securities has been filed with the Securities and Exchange Commission and these securities may not be sold until that registration statement becomes effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

PROSPECTUS

Subject

to Completion, Dated May ______, 2017

TEAM 360 SPORTS INC.

| 1,273,612 Shares |

| Common Stock |

This prospectus relates to the offer and sale

of 1,273,612 Shares of common stock of TEAM 360 SPORTS INC. (the “Company”), $0.001 par value per share, offered by

the holders thereof (the “Shares”). The selling shareholders will offer their Shares at a price of $0.25 per share,

until the Company’s common stock is listed on a national securities exchange or is quoted on the OTC Bulletin Board (or a

successor); after which, the selling shareholders may sell their shares at prevailing market or privately negotiated prices, including

(without limitation) in one or more transactions that may take place by ordinary broker’s transactions, privately-negotiated

transactions or through sales to one or more dealers for resale. The selling shareholders are deemed to be statutory underwriters.

The maximum number of Shares that can be sold pursuant to the terms of this offering by all the selling shareholders is 1,273,612 Shares. Funds received from the sale of Shares by the selling shareholders will be immediately available to such selling shareholder. The Company will not receive any proceeds from the sale of the Shares.

The offering will terminate twenty four (24) months from the date that the registration statement relating to the Shares is declared effective, unless earlier fully subscribed or terminated by the Company. The Company intends to maintain the current status and accuracy of this prospectus and to allow selling shareholders to offer and sell the Shares for a period of up to two (2) years, unless earlier completely sold, pursuant to Rule 415 of the General Rules and Regulations of the Securities and Exchange Commission. All costs incurred in the registration of the Shares are being borne by the Company.

Prior to this offering, there has been no public market for the Company’s common stock. No assurances can be given that a public market will develop following completion of this offering or that, if a market does develop, it will be sustained. The offering price for the Shares has been arbitrarily determined by the Company and does not necessarily bear any direct relationship to the assets, operations, book or other established criteria of value of the Company. The Shares will become tradable on the effective date of the registration statement of which this prospectus is a part.

Neither the Company nor any selling shareholders has any current arrangements nor entered into any agreements with any underwriters, broker-dealers or selling agents for the sale of the Shares. If the Company or any selling shareholder can locate and enter into any such arrangement(s), the Shares of such selling shareholder(s) will be sold through such licensed underwriter(s), broker-dealer(s) and/or selling agent(s).

| Offering Price | Underwriting Discounts and Commissions |

Proceeds to Selling Shareholders | |

| Per Share | $0.25 | None |

$318,282.25 |

| Total | $0.25 | None | $318,282.25 |

The Company is an “emerging growth company,” as defined in the Jumpstart Our Business Startups Act.

Investing in our Common Stock involves a high degree of risk. You should purchase shares only if you can afford a complete loss of your investment. See “Risk Factors” beginning on page 18.

| 4 |

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is May __, 2017.

| 5 |

TABLE OF CONTENTS

| Page | |

| PROSPECTUS SUMMARY | 7 |

| DESCRIPTION OF SECURITIES TO BE REGISTERED | 7 |

| LEGAL PROCEEDINGS | 14 |

| RISK FACTORS | 18 |

| SPECIAL NOTE REGARDING FORWARD LOOKING STATEMENTS | 43 |

| DETERMINATION OF OFFERING PRICE | 29 |

| DILUTION | 29 |

| SELLING STOCKHOLDERS | 40 |

| MARKET FOR COMMON STOCK HOLDERS AND RELATED MATTERS | 30 |

| PLAN OF DISTRIBUTION | 43 |

| DESCRIPTION OF BUSINESS | |

| MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS | 31 |

| MANAGEMENT | 34 |

| SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERSHIP AND MANAGEMENT | 35 |

| EXECUTIVE COMPENSATION | 38 |

| DISCLOSURE OF COMMISSION POSITION ON INDEMNIFICATION FOR SECURITIES ACT LIABILITIES | 39 |

| CERTAIN RELATIONSHIPS AND RELATED PERSONS TRANSACTIONS | 40 |

| EXPERTS | 46 |

| FINANCIAL STATEMENTS | F-1 |

| EXHIBIT TABLE | 48 |

| SIGNATURES | 50 |

You

may only rely on the information contained in this prospectus or that we have referred you to. We have not authorized anyone to

provide you with different information. This prospectus does not constitute an offer to sell or a solicitation of an offer to buy

any securities other than the Common Stock offered by this prospectus. This prospectus does not constitute an offer to sell or

a solicitation of an offer to buy any Common Stock in any circumstances in which such offer or solicitation is unlawful. Neither

the delivery of this prospectus nor any sale made in connection with this prospectus shall, under any circumstances, create any

implication that there has been no change in our affairs since the date of this prospectus or that the information contained by

reference to this prospectus is correct as of any time after its date.

| 6 |

PROSPECTUS SUMMARY

This summary highlights selected information contained elsewhere in this Prospectus and does not contain all of the information you should consider in making your investment decision. Before investing in the securities offered hereby, you should read the entire Prospectus, including our consolidated financial statements and related notes included in this Prospectus and the information set forth under the headings “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” In this Prospectus, the terms “Team 360 Sports,” “the Company,” “we,” “us,” and “our” refer to TEAM 360 SPORTS INC., a Nevada corporation.

TEAM 360 SPORTS INC.

Corporate History

Team 360 Sports, Inc. formerly, TSI Sports Inc., was incorporated in the State of Nevada on February 26, 2013, and amended its name to TEAM 360 SPORTS INC., (“Team 360 Sports”) on April 4, 2016 with the State of Nevada. TSI Sports Inc was formed for the purpose of developing software to facilitate sports team management.

The Company has its Nevada registered office at 711 S. Carson Street, Suite 4, Carson City, Nevada 89701. The Company’s main phone number is 775-882-4641. Its principal operations are conducted from its office at 163 Killian Rd., Maple, Ontario L6A 1A8. We are located on the Internet at www.team360apps.com.

Business

The Amateur sports market is a multi-billion dollar industry. We plan to address the need to make life easier and save time of amateur sports administrators and coaches by providing easy to use app for them to manage their team mobile web app service to coaches and sports.

Team 360 Sports is planning to fulfill the need for time saving team management app for today’s busy sports volunteer to help them better organize, coach and administer a team.

- Developing easy to use web and mobile applications with powerful time saving tools. In amateur sports, volunteers are coaches and administrators who make up the backbone of the organization. The biggest challenge facing them is the time commitment required to do their job effectively while maintaining regular jobs, family and kids. Our goal is to help coaches and managers effectively administer their teams and save time doing it by providing easy to use tools.

- Leverage off managements' experience. The Team360 Sports Inc management has been involved in the past with sports administrative services and were the founders of a company that sold its primary asset in 2016, which was software somewhat similar to the software being produced by the Company in 2016. Its customers were some of the largest leagues and clubs in North America representing over 300,000 players. See the biography of Mr. Miklos on pages 33-34.

- Maximizing profits by selling services online. The company plans to make the entire sales funnel automated and online therefore maximizing profit margins.

- Maintaining low overhead costs. The company plans to outsource certain front end design, and coding/programming services overseen by the company CTO. An offshore call center will be used for customer service.

- Effective Marketing. We have an outstanding product and to "tell" the amateur sports world about it we will utilize, print, media, content, and online marketing.

- E web and mobile applications with powerful time saving tools. In amateur sports, volunteers are coaches and administrators who make up the backbone of the organization. The biggest challenge facing them is the time commitments required to do their job effectively while maintaining regular jobs, family and kids. Our goal is to help coaches and managers effectively administer their teams and save time doing it by providing easy to use tools.

| 7 |

Team 360 Sports Inc. has its Nevada registered office in Carson City Nevada and operates its administrative office in Ontario, Canada The company addresses a unique need in the Sports Industry that has over 60 million players and revenues in excess of $ 400 billion dollars.

Team 360 Sports Inc offers several proven solutions for the Sports Industry:

Team360Apps

The Company has a customized mobile website to manage teams. (Web, Native IOS and Android app). Available as "freemium" with limited functions or as a pay account. The full features include: drag and drop templates for customized team mobile website; Blog section for team specific content; Communications function to custom or auto notify participants by email or text of events, practice and game schedules and track who will or will not be attending; Schedule practices, games and events; Collect dues and fees and track who paid and who did not.

The software features include an auto prompt that is delivered by email or text to those who have not paid. The Team is charged a monthly recurring fee of $4.99. Another feature is Team mobile website builder which is designed to provide an easy and quick means to create and maintain a mobile team website and integrate with a league, club or federation (if the league using Team360Clubs software). A team coach, administrator or manager signs up by quickly and easily by providing an email address or an existing social media account. The software allows the team to use a team logo and photos upload (the freemium version limits the number of photos); and provides space for a description and history of the team and using 40 different drag and drop templates to create a Team mobile website (the freemium version allows only one set template. Players may provide additional information. (Contact details, photos, videos) and may provide their own unique content and blog.

Activities are easily scheduled, players auto notified via text or email. Confirmation of attendance is sent back to administrator who then sets a roster for practice or a game.

The team site may be integrated with each member’s social media to allow for a wider audience and fan base.

A fundraising campaign option is available for teams to make use of the company's crowdfunding platform. A fundraising campaign is initiated and managed by the administrator. The platform leverages the team's social media to help them achieve their goal.

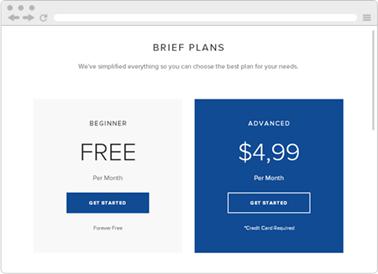

The cost of the packages is:

Freemium Version. No cost

Full Coaching Package $4.99 per month.

Crowdfunding Add On $9.99 per month and 5% of funds raised.

The primary app for Team 360 Sports Inc. is Team 360 apps.com It is operational but is still in beta testing with a few users. Final testing is now in progress and the program is expected to be released in 90 days.

| 8 |

Team360Funding

The Team 360 Funding part of the app may be used in web format, Native IOS and Android app format. Social media is integrated into the Team crowdfunding platform. A registered user of any of the Company's products automatically get a Team crowdfunding profile. The account may be activated at any time to launch a donation or reward based crowdfunding campaign and leverage social media contacts of the team. The platform will keep track of funds raised, from whom, what and when the reward was shipped, keep the whole process compliant with regulations. For use of the Team360Funding feature, the company charges a recurring monthly fee of $9.99 and 5 % of the funds raised. This software is in development and is not operational at this time.

Team360Clubs. The Team360Clubs software provides an online suite of professional tools for managers of sports leagues and clubs to effectively administer their organizations consisting of hundreds of teams and thousands of players. The App features include: Coaches, Certification maintenance, training, scheduling and pay; Players. Signup, team roster referees, schedules, tournaments. It functions in web format, Native IOS and Android app. This software is in development and is not operational at this time.

Overview

Amateur sports teams are typically coached, administered, and managed by volunteers with day jobs, families, and busy lives. As such they lack time and resources to effectively manage their teams. The company provides an easy to use time saving web and native apps to help coach or administrator effectively manage their team. A coach or administrator can easily create a mobile team website, upload team logo, photos, and videos to customize it using drag and drop templates, collect fees, schedule games and events, auto notify all participants, keep track of who is attending and communicate with team members.

| 9 |

Another big challenge for amateur sports organizations is fundraising. The company provides a donation and rewards based "crowdfunding" portal help to raise money for trips, equipment and uniforms by leveraging and utilizing participants’ social media connections.

The founders of the company have over 35 years experience with team coaching and sports management software administration and development. The founders , as owners of a company based in Canada sold late 2016the primary asset of that company which has some similarities to the software being produced by the Company, which was the the primary asset of that leading sports management company in Canada . See Mr. Miklos' biography for more details at pages 33-34.

Team 360 Sports Inc is Nevada Corporation. Sandor Miklos is the Chief Executive Officer and he and Mario Discepola own majority of the company. We are located on the Internet at www.team360apps.com

Customers, Distribution and Marketing

The world of amateur athletics goes far beyond the confines of high school and collegiate sports and is changing rapidly in size and demographics. Amateur athletics and their corresponding leagues create industries which not only continue to increase membership, but generate billions of dollars in revenues in the U.S. and Canada. While the amateur segment is fragmented at the commercial level, youth athletics alone (including all sports) represents an industry that generates an estimated $5 billion (in the U.S.) in annual revenues and provides services to an estimated 44 million youth between the ages of 6 and 17 annually. [1]

Adults in the U.S. spend more than $100 billion on recreational sports and sports-related sectors each year, with a large part going to league/association memberships as dues and subscriptions. There is strong potential for companies that can capitalize on underrepresented market niches including sports team management and data collection services.

Youth Sports

| Sport | US Participants (in millions) |

| Basketball | 24.4 |

| Baseball/Softball | 23.3 |

| Soccer | 13.6 |

| Volleyball | 10.7 |

| Football | 8.9 |

| Disc Ultimate | 4.9 |

| Ice Hockey | 3.1 |

| Lacrosse | 0.7 |

Source: Humphreys Ruesky Sports Industry Study

Adult Participation in Youth Sports (in millions)

| Coaches | 2.4 |

| Officials | 0.9 |

| Administrative | 0.8 |

| Other | 3.2 |

| Total | 7.3 |

Source: National Council on Youth Sports

___________________________

[1]As reported in a report by the North American Association of Sports Economists, IASE/NAASE Working Paper Series, No. 08-11. The abstract of the report states: "We estimate the economic scope of the sports industry in the United States. Drawing on a variety of data sources, we investigate the economic size of sport participation, sports viewing, and the supply and demand side of the sports market in the United States. Estimates of the size of the sports industry based on aggregate demand and aggregate supply range from $44 to $73 billion in 2005. In addition, participation in sports and the opportunity time cost of attending sporting events are important, but hard to value, components of the industry."

| 10 |

| Golf | 5.0 |

| Basketball | 3.4 |

| Soccer | 0.9 |

| Bowling | 0.6 |

| Volleyball | 0.4 |

| Touch Football | 0.2 |

| Softball | 0.1 |

Estimated Adult Team Sport Participants (in millions)

Source: BRFS Survey

| Baseball | 9 |

| Basketball | 5 |

| Field Hockey | 11 |

| Football | 11 |

| Hockey | 6 |

| Lacrosse | 10 |

| Soccer | 11 |

| Softball (Fast Pitch) | 9 |

| Softball (Slow Pitch) | 10 |

| Ultimate Frisbee | 7 |

| Volleyball | 6 |

Numbers of Players on a Team

The Humphreys and Ruesky Sports Industry Report (2008) estimates that 50% of the US population participates in some sport regularly and a more significant number participates in a sport irregularly. (See Footnote 1).

The Company's target market is US/Canadian amateur sports team market (with players of any age).

The US target market is 7.93 million teams.

Calculation: 95.2 million (participants in team sports) divided by 12 (players per team). The average number of player per team is approximately 9, but for our calculations we use a more conservative number 12 i.e. larger number of participants per team accounts for potentially larger team rosters in junior youth sports.

While UK, Canada, Australia, New Zealand, South Africa represents a substantial market opportunity the company plans to target, these numbers have not been factored in to the calculations.

The company plans to develop the market through social media, email, pay per click marketing and through developing a strong presence at industry tradeshows.

Marketing

Our target markets are the 7.93 million U.S. amateur sports teams and more specifically the team coach or assistant coach. Volunteers coach most amateur sports teams. In youth sports specifically parents typically take on the coaching roles while their children play on the team. On average these volunteers come with no previous coaching experience and not a lot of excess time to devote to learning difficult to use software. They may volunteer to coach or assist the coach because they want to help out; there is no one else who will take on the role; (not necessarily for the love of the game). In adult team sports, coaches are also players.

| 11 |

- Amateur coaches need a time saving solution as they have jobs, families, and lives.

- Amateur coaches need an easy to learn and use product as they are not interested in taking on a huge learning curve.

- Amateur coaches need to efficiently schedule games, venues and tournaments rather than using spreadsheets and paper based notes.

- Amateur coaches need an automated and efficient way to collect dues and fees from players. Collecting money from participants consumes much time and is a major hassle.

- Amateur coaches need help to fundraise for team trips and equipment. Lack of funding and difficulty in achieving fundraising goals is one of the major obstacles facing sports organizations

The company services the needs of the market with a robust solution that is:

- Easy to learn and use

- Robust and customizable

- Web based or native (IOS and Android) application

- Provides a crowdfunding optional package unique to the industry

As the economy rebounds more money is being spent on sports and recreation. The market is anticipated to grow by 4.5% annually.

Competition

The Company is engaged in the amateur sports administration market in which there are many competitors. Some competitors focus on the top of the pyramid, for example; sports federations, leagues and clubs providing data storage and manipulation for the league and club management. Other competitors focus on providing more specific services at the lower end of the pyramid to amateur sports teams. These services typically include player sign up, scheduling and communications, data collection, storage and data manipulation. The services are typically provided using downloadable native applications. There are some companies that address both markets the leagues and providing federations, leagues and clubs and teams.

The most significant competitors are Teamsnap and Sportsngn. They are both well funded organization competing in the same marketplace. Their products are well designed and popular in the market place. However from a user’s prospective, their services are not as easy to identify. We intend to compete by making our products easy to use and understand. Our prices and services are clearly listed on the website. They do not have to search and go through a series of hoops to find out the actual cost of our services. Our main competitors have large marketing budgets and will be difficult to compete with

Competitors to a lesser extent are Eteamz and Sportslogic. Their product is equally concentrated on larger sports organizations leagues and clubs versus teams. These companies also provide a mix of applications that are similar to ours. They are also well capitalized with large marketing budgets and will be difficult to compete with.

Other competitors. There is a myriad of small companies that provide some or all or more of the services we provide.

| 13 |

Overall there is a barrier to entry to this market due to the amount of time and effort required to develop a robust software platform and design and create native applications.

Team 360 Sports Inc technology was designed and developed in house. The founders have previously designed, developed and operated a SaaS company (Software as a Service) that provided sports administration services to leagues with over 250,000 players. That previous experience provides the company with a competitive advantage. The current technology is a cloud based web application. The Company is in the process of further improving developing IOS and Android Native applications for smart devices. We are located on the Internet at www.team360apps.com

Employees

As of December 31, 2016, Team 360 Sports Inc employed a total of 2 persons. Team 360 Sports Inc considers its relationship with its employees to be stable.

Facilities and Logistics

Team 360 Sports Inc is headquartered with its executive offices located in the residence of Sandor Miklos at 163 Killian Road, Maple, Ontario, Canada L6A 1A8. The Company does not have a formal lease, but expects that as it grows, it will lease offices as needed.

Involvement in Certain Legal Proceedings

The Company and none of our officer nor directors, promoters or control persons have been involved in the past ten years in any of the following:

| (1) | Any bankruptcy petition filed by or against any business of which such person was a general partner or executive officer either at the time of the bankruptcy or within two years prior to that time; |

| (2) | Any conviction in a criminal proceeding or being subject to a pending criminal proceeding (excluding traffic violations and other minor offenses); |

| (3) | Being subject to any order, judgment or decree, not subsequently reversed, suspended or vacated, or any court of competent jurisdiction, permanently or temporarily enjoining, barring, suspending or otherwise limiting his involvement in any type of business, securities or banking activities; or |

| (4) | Being found by a court of competent jurisdiction (in a civil action), the Commission or the Commodity Futures Trading Commission to have violated a federal or state securities or commodities law, and the judgment has not been reversed, suspended, or vacated. |

Patents

The Company has no current patents or trademarks.

Seasonality

We generally do not have a strong seasonality trend to our business.

Trading Market

Currently, there is no trading market for the securities of the Company. The Company intends to initially apply for admission to quotation of its securities on the OTC Bulletin Board as soon as possible, which may be while this offering is still in process. There can be no assurance that the Company will qualify for quotation of its securities on the OTC Bulletin Board. See “RISK FACTORS” and “DESCRIPTION OF SECURITIES”.

| 14 |

The Offering

The maximum number of Shares that can be sold pursuant to the terms of this offering is 1,273,612. The offering will terminate twenty four (24) months from the date of this prospectus unless earlier fully subscribed or terminated by the Company.

This prospectus relates to the offer and sale by certain shareholders of the Company of up to 1,273,612 Shares. The selling shareholders, who are deemed to be statutory underwriters, will offer their shares at a price of $0.25 per share . When and if the Company’s common stock is listed on a national securities exchange or is quoted on the OTC Bulletin Board (or a successor); after which, the selling shareholders may sell their shares at prevailing market or privately negotiated prices, including (without limitation) in one or more transactions that may take place by ordinary broker’s transactions, privately-negotiated transactions or through sales to one or more dealers for resale.

The Offering

| Common Stock offered by Selling Stockholders | 1,273,612 shares of Common Stock (the “Shares”). No shares of Common Stock are offered by the Company under this Prospectus. |

| Common Stock outstanding before the Offering | 4,831,612 shares of Common Stock. |

| Common Stock outstanding after the Offering | 4,831,612 shares of Common Stock. |

| Terms of the Offering | The Selling Stockholders may sell their shares at $0.25 . |

| After Termination of the Offering | After termination of the offering, if the shares are then quoted on the OTC Bulletin Board, t he Selling Stockholders may sell their shares at prevailing market or privately negotiated prices, including (without limitation) in one or more transactions that may take place by ordinary broker’s transactions, privately-negotiated transactions or through sales to one or more dealers for resale. |

| Use of Proceeds | The Company will not receive any proceeds from the sale of the Shares offered by the Selling Stockholders. |

| Risk Factors | The investment in the Shares offered hereby involves a high degree of risk and the Shares should not be purchased by investors who cannot afford the loss of their entire investment. See, “Risk Factors” beginning on page 18. |

| 15 |

The Company is not receiving any proceeds from the sale of the Shares offered by the selling shareholders. The selling shareholders are offering their shares at $0.25 per share and if the shareholders are successful in the sale of the shares at that price, the value of all the outstanding shares at that time (4,831,612) could be assumed to be $1,207,903.

Once the registration statement of which this Prospectus is part becomes effective with the SEC, and once a public market develops, the Selling Stockholders may sell the Shares indicated above in public transactions or otherwise, on the Over-the-Counter Bulletin Board (or such other public market as may develop) or in privately negotiated transactions. Those resales may be at the then-prevailing market price or at any other price that a particular Selling Stockholders may negotiate. The Selling Stockholders act independently of one another in making a determination to sell the Shares owned by them and they do not act as or form a group for purposes of their ownership or disposition of the Shares offered hereunder. There is no guarantee that a public market in the Common Stock will develop in the foreseeable future or ever.

Summary

Financial Information

The statement of operations data for the period from January 1, 2015 to December 31, 2016 and the balance sheet data at December 31, 2016 are derived from the Company’s audited financial statements and related notes thereto included elsewhere in this prospectus.

You should read the following table in conjunction with “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and the financial statements and the accompanying notes included elsewhere in this Prospectus. Among other things, those financial statements include more detailed information regarding the basis of presentation for the following financial data.

| 16 |

TEAM 360 SPORTS INC. STATEMENTS OF OPERATIONS

FOR THE YEARS ENDED DECEMBER 31, 2016 AND 2015 (Audited)

| For the Years Ended | ||||||||

| December 31, * | ||||||||

| 2016 | 2015 | |||||||

| Revenue: | $ | 14,250 | $ | — | ||||

| Operating Expenses: | ||||||||

| General & administrative expenses | 10,947 | 745 | ||||||

| Website development, related party | — | 45,000 | ||||||

| Total operating expenses | 10,947 | 45,745 | ||||||

| Income (loss) from operations | 3,303 | (45,745 | ) | |||||

| Income (loss) before income taxes | 3,303 | (45,745 | ) | |||||

| Provision for income taxes | — | — | ||||||

| Net income (loss) | $ | 3,303 | $ | (45,745 | ) | |||

| Basic income (loss) per share | $ | 0.00 | $ | (0.01 | ) | |||

| Basic weighted average shares | 4,409,531 | 4,186,112 | ||||||

*Note:

All financial numbers are in US dollars.

Jumpstart Our Business Startups Act:

The Company qualifies as an “emerging growth company” as defined in the Jumpstart Our Business Startups Act (the “JOBS Act”). For so long as we are an emerging growth company, we will not be required to:

| · | have an auditor report on our internal controls over financial reporting pursuant to Section 404(b) of the Sarbanes-Oxley Act; |

| · | comply with any requirement that may be adopted by the Public Company Accounting Oversight Board regarding mandatory audit firm rotation or a supplement to the auditor’s report providing additional information about the audit and the financial statements (i.e., an auditor discussion and analysis); | |

| · | submit certain executive compensation matters to shareholder advisory votes, such as “say-on-pay” and “say-on-frequency;” and |

| · | disclose certain executive compensation related items such as the correlation between executive compensation and performance and comparisons of the CEO’s compensation to median employee compensation. |

In addition, Section 107 of the JOBS Act also provides that an emerging growth company can take advantage of the extended transition period provided in Section 7(a)(2)(B) of the Securities Act for complying with new or revised accounting standards. In other words, an emerging growth company can delay the adoption of certain accounting standards until those standards would otherwise apply to private companies. We will remain an emerging growth company for up to five full fiscal years, although if the market value of our common stock that is held by non-affiliates exceeds $700 million as of any September 30 before that time, we would cease to be an emerging growth company as of the following September 30, or if our annual revenues exceed $1 billion, we would cease to be an emerging growth company the following fiscal year, or if we issue more than $1 billion in non-convertible debt in a three-year period, we would cease to be an emerging growth company immediately.

| 17 |

We will elect to take advantage of the extended transition period for complying with new or revised accounting standards under section 102(b)(1). This election allows us to delay the adoption of new or revised accounting standards that have different effective dates for public and private companies until those standards apply to private companies.

The Company meets the definition of an emerging growth company will be affected by some of the changes provided in the JOBS Act and certain of the new exemptions. The JOBS Act provides additional new guidelines and exemptions for non-reporting companies and for non-public offerings. Those exemptions that impact the Company are discussed below.

Financial Disclosure. The financial disclosure in a registration statement filed by an emerging growth company pursuant to the Securities Act of 1933 will differ from registration statements filed by other companies as follows:

(i) audited financial statements required for only two fiscal years;

(ii) selected financial data required for only the fiscal years that were audited;

(iii) executive compensation only needs to be presented in the limited format now required for smaller reporting companies. (A smaller reporting company is one with a public float of less than $75 million as of the last day of its most recently completed second fiscal quarter)

However, the requirements for financial disclosure provided by Regulation S-K promulgated by the Rules and Regulations of the SEC already provide certain of these exemptions for smaller reporting companies. The Company is a smaller reporting company. Currently a smaller reporting company is not required to file as part of its registration statement selected financial data and only needs audited financial statements for its two most current fiscal years and no tabular disclosure of contractual obligations.

The JOBS Act also exempts the Company’s independent registered public accounting firm from complying with any rules adopted by the Public Company Accounting Oversight Board (“PCAOB”) after the date of the JOBS Act’s enactment, except as otherwise required by SEC rule.

The JOBS Act also exempts an emerging growth company from any requirement adopted by the PCAOB for mandatory rotation of the Company’s accounting firm or for a supplemental auditor report about the audit.

Internal Control Attestation. The JOBS Act also provides an exemption from the requirement of the Company’s independent registered public accounting firm to file a report on the Company’s internal control over financial reporting, although management of the Company is still required to file its report on the adequacy of the Company’s internal control over financial reporting.

Section 102(a) of the JOBS Act goes on to exempt emerging growth companies from the requirements in 1934 Act Section 14A(e) for companies with a class of securities registered under the 1934 Act to hold shareholder votes for executive compensation and golden parachutes.

Other Items of the JOBS Act. The JOBS Act also provides that an emerging growth company can communicate with potential investors that are qualified institutional buyers or institutions that are accredited to determine interest in a contemplated offering either prior to or after the date of filing the respective registration statement. The Act also permits research reports by a broker or dealer about an emerging growth company regardless if such report provides sufficient information for an investment decision. In addition the JOBS Act precludes the SEC and FINRA from adopting certain restrictive rules or regulations regarding brokers, dealers and potential investors, communications with management and distribution of a research reports on the emerging growth company IPO.

| 18 |

Section 106 of the JOBS Act permits emerging growth companies to submit 1933 Act registration statements on a confidential basis provided that the registration statement and all amendments are publicly filed at least 21 days before the issuer conducts any road show. This is intended to allow the emerging growth company to explore the IPO option without disclosing to the market the fact that it is seeking to go public or disclosing the information contained in its registration statement until the company is ready to conduct a road show.

Election to Opt Out of Transition Period

Section 102(b)(1) of the JOBS Act exempts emerging growth companies from being required to comply with new or revised financial accounting standards until private companies (that is, those that have not had a 1933 Act registration statement declared effective or do not have a class of securities registered under the 1934 Act) are required to comply with the new or revised financial accounting standard.

The JOBS Act provides a company can elect to opt out of the extended transition period and comply with the requirements that apply to non-emerging growth companies but any such an election to opt out is irrevocable. The Company has elected not to opt out of the transition period.

RISK FACTORS

INVESTING IN OUR COMMON STOCK

INVOLVES A HIGH DEGREE OF RISK. PROSPECTIVE INVESTORS SHOULD CAREFULLY CONSIDER THE RISKS DESCRIBED BELOW, TOGETHER WITH ALL OF

THE OTHER INFORMATION INCLUDED IN OR REFERRED TO IN THIS REPORT, BEFORE PURCHASING SHARES OF OUR COMMON STOCK. THERE ARE NUMEROUS

AND VARIED RISKS, KNOWN AND UNKNOWN, THAT MAY PREVENT US FROM ACHIEVING OUR GOALS. THE RISKS DESCRIBED BELOW ARE NOT THE ONLY

ONES WE WILL FACE. IF ANY OF THESE RISKS ACTUALLY OCCURS, OUR BUSINESS, FINANCIAL CONDITION OR RESULTS OF OPERATION MAY BE MATERIALLY

ADVERSELY AFFECTED. IN SUCH CASE, THE TRADING PRICE OF OUR COMMON STOCK COULD DECLINE AND INVESTORS IN OUR COMMON STOCK COULD

LOSE ALL OR PART OF THEIR INVESTMENT.

Risks Related to our Business and Current Market Position

While our model is strong and we serve a highly valuable market, the fact is that we are in a sector where our product is unique, and we are in the development stage of operations, and while we estimate strong and growing demand this may not occur.

As is the case with many firms that achieve success by implementing a unique model into a sizable market; there is a risk that our success may not scale at the level of our projections which can pose a risk for our investors. Our auditors have issued a going concern opinion on the audited financial statements in Note 3. The financial note states that: "The Company requires capital for its contemplated operational and marketing activities. The Company’s ability to raise additional capital through the future issuances of common stock is unknown. The obtainment of additional financing, the successful development of the Company’s contemplated plan of operations, and its transition, ultimately, to the attainment of profitable operations are necessary for the Company to continue operations. These conditions and the ability to successfully resolve these factors raise substantial doubt about the Company’s ability to continue as a going concern." There is a substantial risk that the Company will not be able to obtain the funding that it needs to complete the development of its software, carry out its plan of operations and market its products effectively or that its software will be accepted in the marketplace.

Our existing and anticipated working capital needs, the acceleration or modification of our expansion plans, or increased expenses or other events will all affect our ability to continue as a going concern.

We intend to use part of the proceeds of this and future offerings to assist with our operational costs as well as to put us in a position to go public, thereby increasing our exposure and our ability to raise funds in the future. Supporting the increased costs of infrastructure as well as expanding business development to attract new contracts may significantly increase our costs of operations. If we can’t generate the necessary contracts or we experience moderate to major contraction in our current contract portfolio there may be a detrimental effect to our ability to progress as a company.

While we hope to be able to generate strong sales in the foreseeable future there is no guarantee that we will do so which could result in uncertainty as it relates to future profitability and could create limitations within our operations infrastructure.

While the contacts of our principals, along with the existing operations infrastructure of our primary acquisition target place us in a good position to grow quickly, we are implementing a new phase of our business model which may cause some stability issues moving forward. Our ability to succeed is directly dependent on that business model’s ability to adapt to the needs and wishes of the market.

| 19 |

Our growth plan is based upon management’s projection of what may happen in the future and the assumption that our services will continue to be in high demand to the market. Actual results may differ materially.

Our growth plan is based upon management's projections of estimated available cash flow, expenses, revenue, over profit, earnings before interest, taxes and depreciation, sales cycle time and other measures of projected economic performance. These projections are made in management's view of what may happen in the future, and are not based upon historical projections. These statements, facts and the views of Company management constitute forward-looking statements within the meaning of Section 27A of the 1933 Securities Act and Section 21E of the Securities Exchange Act of 1934. The outcome of the events described in such forward-looking statements is subject to risks and uncertainties. Projections or predictions of future events may not occur and actual results may differ materially from those expressed in or implied by such forward-looking statements.

The projections in management's view are based in part on marketing expenditures to generate customers and compete in the marketplace.

No part of the proceeds of this offering will go to assist with our operational costs. It will be necessary to raise funds by stock or debt/note offering or other method of financing, if available. Supporting the increased costs of infrastructure as well as expanding business development to attract new contracts may significantly increase our costs of operations. Furthermore, our existing and anticipated working capital needs, the acceleration or modification or our expansion plans, or increased expenses or other events will all affect our ability to continue as a going concern.

Our growth plan is based on our ability to consistently secure contracts. Any adverse economic situations that affect our primary target market may affect our ability to secure contracts in a manner that provides the revenue that will offset our expected growth in infrastructure costs.

While we operate in a strong niche of the Amateur Sports Industry we are still exposed to the adversity of that market. Considering how the economic climate affects how people spend their extra money, this is a risk that must be taken into consideration.

Growth of internal operations and business may strain our financial resources.

We will be significantly expanding the scope of our operating and financial systems in order to increase our capacity to the point where we can serve a larger number of clients. Our growth rate may place a significant strain on our financial resources for a number of reasons, including increased staff, physical operating costs, marketing costs, insurance/liability costs, legal costs, etc.

We cannot give you any assurance that we will adequately address these risks and, if we do not, our ability to successfully expand our business could be adversely affected.

Failure to manage growth effectively could prevent us from achieving our goals.

Our strategy envisions a period of rapid growth once we initiate this new stage of operations; this growth may impose a significant burden on our administrative and operational resources. Our ability to effectively manage growth will require us to substantially expand the capabilities of our administrative and operational resources and to attract, train, manage and retain qualified management and other personnel. Our failure to successfully manage growth could result in our sales not increasing commensurately with capital investments. Our inability to successfully manage growth could materially adversely affect our business.

The departure of key personnel could compromise our ability to execute our strategic plan, especially if that person(s) is responsible for managing or building key relationships, and may result in additional severance costs to us.

Our success largely depends on the skills, experience and efforts of our key personnel. The loss of key personnel would jeopardize our ability to execute our strategic plan and materially harm our business. In addition, we intend to enter into a written employment agreement with most of our key personnel that can be terminated at any time by us or the executives.

Technology and software development risks

The technology is developed in house using software developers located in Ho Chi Minh City, Vietnam and elsewhere. While all development takes place on servers in the company’s control, and the company has saved and backed up copies of the software, there is a risk that the developers may intentionally cause some damage to the code. We cannot make any assurances that an event causing damage to our development will not happen.

We will incur ongoing costs and expenses for SEC reporting and compliance, without increased revenue we may not be able to remain in compliance, making it difficult for investors to sell their shares, if at all.

If we are able to become a public company, we will incur significant legal, accounting and other expenses. We expect the laws, rules and regulations governing public companies to increase our legal and financial compliance

| 20 |

costs and to make some activities more time-consuming and costly. Going forward, the Company will have ongoing SEC compliance and reporting obligations, estimated as approximately $25,000 annually. Such ongoing obligations will require the Company to expend additional amounts on compliance, legal and auditing costs. In order for us to remain in compliance, we will require increased revenues to cover the cost of these filings, which could comprise a substantial portion of our available cash resources. If we are unable to generate sufficient revenues to remain in compliance, it may be difficult for you to resell any shares you may purchase, if at all.

Risks Associated With This Offering

If we do not file a Registration Statement on Form 8-A to become a mandatory reporting company under Section 12(g) of the Securities Exchange Act of 1934 ("Exchange Act"), we will continue as a reporting company and will not be subject to the proxy statement requirements, and our officers, directors and 10% stockholders will not be required to submit reports to the SEC on their stock ownership and stock trading activity, all of which could reduce the value of your investment and the amount of publicly available information about us.

As a result of this offering as required under Section 15(d) of the Securities Exchange Act of 1934, we will file periodic reports with the Securities and Exchange Commission through December 31, 2017, including a Form 10-K for the year ended December 31, 2017, assuming this registration statement is declared effective before that date. At or prior to December 31, 2017, we intend to voluntarily file a registration statement on Form 8-A which will subject us to all of the reporting requirements of the Exchange Act. This will require us to file quarterly and annual reports with the SEC and will also subject us to the proxy rules of the SEC. If we do not register our securities under Section 12(g) we will face automatic suspension of reporting requirements. We are not required under Section 12(g) or otherwise to become a mandatory Exchange Act filer unless we have more than 2,000 shareholders (of which 500 may be unaccredited) and total assets of more than $10 million on December 31, 2017. If we do not file a registration statement on Form 8-A at or prior to December 31, we will continue as a voluntary reporting company that we could terminate at any time and will not be subject to the proxy statement requirements of the Exchange Act, and our officer, directors and 10% stockholders will not be required to submit reports to the SEC on their stock ownership and stock trading activity. After this offering, Team 360 Sports, Inc. will file periodic and current reports with the Securities and Exchange Commission as required to maintain the fully reporting status which includes filing quarterly and annual reports. The Company is filing a Form 8A at or prior to December 31, 2017.

Our financial statements may not be comparable to those of companies that comply with new or revised accounting standards.

We have elected to take advantage of the benefits of the extended transition period that Section 107 of the JOBS Act provides an emerging growth company, as provided in Section 7(a)(2)(B) of the Securities Act for complying with new or revised accounting standards. Our financial statements may, therefore, not be comparable to those of companies that comply with such new or revised accounting standards. We cannot predict if investors will find our common stock less attractive because we may rely on these exemptions. If some investors find our common stock less attractive as a result, there may be a less active trading market for our common stock and our stock price may be more volatile.

Our status as an "emerging growth company" under the JOBS Act OF 2012 may make it more difficult to raise capital when we need to do it.

Because of the exemptions from various reporting requirements provided to us as an "emerging growth company" and because we will have an extended transition period for complying with new or revised financial accounting standards, we may be less attractive to investors and it may be difficult for us to raise additional capital as and when we need it. Investors may be unable to compare our business with other companies in our industry if they believe that our financial accounting is not as transparent as other companies in our industry. If we are unable to raise additional capital as and when we need it, our financial condition and results of operations may be materially and adversely affected.

We will not be required to comply with certain provisions of the Sarbanes-Oxley Act for as long as we remain an "emerging growth company."

We are not currently required to comply with the SEC rules that implement Sections 302 and 404 of the Sarbanes-Oxley Act, and are therefore not required to make a formal assessment of the effectiveness of our internal controls over financial reporting for that purpose. Upon becoming a public company, we will be required to comply with certain of these rules, which will require management to certify financial and other information in our quarterly and annual reports and provide an annual management report on the effectiveness of our internal control over financial reporting. Though we will be required to disclose changes made in our internal control procedures on a quarterly basis, we will not be required to make our first annual assessment of our internal control over financial reporting pursuant to Section 404 until the later of the year following our first annual report required to be filed with the SEC, or the date we are no longer an "emerging growth company" as defined in the JOBS Act.

Our independent registered public accounting firm is not required to formally attest to the effectiveness of our internal control over financial reporting until the later of the year following our first annual report required to be filed with the SEC, or the date we are no longer an "emerging growth company." At such time, our independent registered public accounting firm may issue a report that is adverse in the event it is not satisfied with the level at which our controls are documented, designed or operating.

Reduced disclosure requirements applicable to emerging growth companies may make our common stock less attractive to investors.

As an "emerging growth company," we may take advantage of certain exemptions from various reporting requirements that are applicable to other public companies that are not "emerging growth companies," including not being required to comply with the auditor attestation requirements of section 404 of the Sarbanes-Oxley Act, reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements, and exemptions from the requirements of holding a nonbinding advisory vote on executive compensation and shareholder approval of any golden parachute payments not previously approved. We cannot predict if investors will find our common stock less attractive because we may rely on these exemptions. If some investors find our common stock less attractive as a result, there may be a less active trading market for our common stock and our stock price may be more volatile.

| 21 |

As an "emerging growth company" under the jumpstart our business startups act (JOBS), we are permitted to rely on exemptions from certain disclosure requirements.

We qualify as an "emerging growth company" under the JOBS Act. As a result, we are permitted to, and intend to, rely on exemptions from certain disclosure requirements. For so long as we are an emerging growth company, we will not be required to:

| * | have an auditor report on our internal controls over financial reporting pursuant to Section 404(b) of the Sarbanes-Oxley Act; |

| * | comply with any requirement that may be adopted by the Public Company Accounting Oversight Board regarding mandatory audit firm rotation or a supplement to the auditor's report providing additional information about the audit and the financial statements (i.e., an auditor discussion and analysis); |

| * | submit certain executive compensation matters to shareholder advisory votes, such as "say-on-pay" and "say-on-frequency;" and |

| * | disclose certain executive compensation related items such as the correlation between executive compensation and performance and comparisons of the CEO's compensation to median employee compensation. |

In addition, Section 107 of the JOBS Act also provides that an emerging growth company can take advantage of the extended transition period provided in Section 7(a)(2)(B) of the Securities Act for complying with new or revised accounting standards. In other words, an emerging growth company can delay the adoption of certain accounting standards until those standards would otherwise apply to private companies. We will remain an emerging growth company for up to five full fiscal years, although if the market value of our common stock that is held by non-affiliates exceeds $700 million as of any January 31 before that time, we would cease to be an emerging growth company as of the following December 31, or if our annual revenues exceed $1 billion, we would cease to be an emerging growth company the following fiscal year, or if we issue more than $1 billion in non-convertible debt in a three-year period, we would cease to be an emerging growth company immediately.

Compliance with changing regulation of corporate governance and public disclosure may result in additional expenses.

Changing laws, regulations and standards relating to corporate governance and public disclosure, including the Sarbanes-Oxley Act of 2002, new SEC regulations and OTCBB rules, are creating uncertainty for companies such as ours. These new or changed laws, regulations and standards are subject to varying interpretations in many cases due to their lack of specificity, and as a result, their application in practice may evolve over time as new guidance is provided by regulatory and governing bodies, which could result in continuing uncertainty regarding compliance matters and higher costs necessitated by ongoing revisions to disclosure and governance practices. Also, while there is limited regulation of our business at the state and federal levels, any change to such regulation could adversely affect our business. Also, our clients are often regulated, and their ability to pay us or our ability to provide services may be affected by changes in regulation. We are committed to maintaining high standards of corporate governance and public disclosure. As a result, we intend to invest resources to comply with evolving laws, regulations and standards, and this investment may result in increased general and administrative expenses and a diversion of management time and attention from revenue-generating activities to compliance activities. If our efforts to comply with new or changed laws, regulations and standards differ from the activities intended by regulatory or governing bodies due to ambiguities related to practice, our business may be materially affected and our reputation may be harmed.

Risks Related to our Common Stock

| 22 |

The share being sold under this offering are

being sold at $0.25 per share. If the market does not develop so that the shares are tradeable in the public market either by

being listed on a national securities exchange or Company is not successful or is quoted

on the OTC Bulletin Board (or a successor); then the selling shareholders will not have a public market int which to trade their

shares.

If

we are not successful in establishing a public market, the shares may not be readily tradeable. We cannot make any assurances

that a public market will develop.

If our Company is able to register publicly, our shares would be considered “penny stocks,” which imposes additional sales practice requirements on broker/dealers; as such many broker/dealers may not want to offer our shares, which could affect your ability to sell your shares in the future.

If we are able to register our Company publicly with the Securities and Exchange Commission, our shares will be considered “penny stocks” covered by Section 15(g) of the Exchange Act and Rules 15g-1 through 15g-6 promulgated hereunder, which impose additional sales practice requirements on broker/dealers who sell our securities to persons other than established customers and accredited investors (generally institutions with assets in excess of $5,000,000 or individuals with net worth in excess of $250,000 or annual income exceeding $200,000 or $300,000 jointly with their spouses). Since our shares are covered by Section 15(g) of the Securities Exchange Act of 1934, many broker/dealers may not want to make a market in our shares or conduct any transactions in our shares. As such, even if we become a public company, your ability to dispose of your shares may be adversely affected.

We do not expect to pay dividends and investors should not buy our Common Stock expecting to receive dividends.

We do not anticipate that we will declare or pay any dividends on our Common Stock in the foreseeable future. Consequently, you will only realize an economic gain on your investment in our Common Stock if the price appreciates. You should not purchase our Common Stock expecting to receive cash dividends. Since we do not pay dividends, and if we are not successful in establishing an orderly public trading market for our shares, then you may not have any means to liquidate or receive any payment on your investment. Therefore our failure to pay dividends may cause you to not see any return on your investment even if we are successful in our business operations. In addition, because we do not pay dividends we may have trouble raising additional funds, which could affect our ability to expand our business operations.

Trends, Risks and Uncertainties

We have sought to identify what we believe to be the most significant risks to our business, but we cannot predict whether, or to what extent, any of such risks may be realized nor can we guarantee that we have identified all possible risks that might arise. Investors should carefully consider all such risk factors before making an investment decision with respect to our Common Stock.

Management control

We operate in the highly competitive industry. Many of our current and potential competitors, including larger multinational companies, domestic manufacturing companies with multiple product lines in radiation detection products have existed longer and have larger customer bases, greater brand recognition and significantly greater financial, marketing, personnel, technical and other resources than TEAM 360 SPORTS INC. In addition, many of these competitors may be able to devote significantly greater resources to:

· research and development of new products

· attracting and retaining key employees;

· maintaining a large budget for marketing and promotional expenses

· providing more favorable credit terms to suppliers

The relative lack of public company experience of our management team may put us at a competitive disadvantage.

As a company with a class of securities registered under the Exchange Act, we are subject to reporting and other legal, accounting, corporate governance, and regulatory requirements imposed by the Exchange Act and rules and regulations promulgated under the Exchange Act. Our Chairman and CEO lacks public company experience which could impair our ability to comply with these legal, accounting, and regulatory requirements. Such responsibilities include complying with Federal securities laws and making required disclosures on a timely basis. Our senior management may not be able to implement and effect programs and policies in an effective and timely manner that adequately responds to such increased legal and regulatory compliance and reporting requirements. Our failure to do so could lead to the imposition of fines and penalties and further result in the deterioration of our business.

| 23 |

Regulations, including those contained in and issued under the Sarbanes-Oxley Act of 2002 (“SOX”) and the Dodd–Frank Wall Street Reform and Consumer

Protection Act of 2010 (“Dodd-Frank”), increase the cost of doing business and may make it difficult for us to retain or attract qualified officers and directors, which could adversely affect the management of our business and our ability to obtain or retain listing of our Common Stock.

With

the filing of our Form S-1, we are planning to become a public company. The current regulatory climate for public companies, even

small and emerging growth companies such as ours, may make it difficult or prohibitively expensive to attract and retain qualified

officers, directors and members of board committees required to provide for our effective management in compliance with the rules

and regulations which govern publicly-held companies, including, but not limited to, certifications from executive officers and

requirements for financial experts on boards of directors. The perceived increased personal risk associated with these recent

changes may deter qualified individuals from accepting these roles. For example, the enactment of the Sarbanes-Oxley Act of 2002

has resulted in the issuance of a series of new rules and regulations and the strengthening of existing rules and regulations

by the SEC. Further, recent and proposed regulations under Dodd-Frank heighten the requirements for board or committee membership,

particularly with respect to an individual’s independence from the corporation and level of experience in finance and accounting

matters. We may have difficulty attracting and retaining directors with the requisite qualifications. If we are unable to attract

and retain qualified officers and directors, the management of our business could be adversely affected.

Our internal controls

over financial reporting may not be effective, and our independent auditors may not be able to certify as to their effectiveness,

which could have a significant and adverse effect on our business.

As we become a public company, we will be subject to various SEC reporting and other regulatory requirements. We will incur expenses and, to a lesser extent, diversion of our management’s time in our efforts to comply with SOX Section 404 regarding internal controls over financial reporting. Our management’s evaluation over our internal controls over financial reporting may determine that material weaknesses in our internal control exist. If, in the future, management identifies material weaknesses, or our external auditors are unable to attest that our management’s report is fairly stated or to express an opinion on the effectiveness of our internal controls, this could result in a loss of investor confidence in our financial reports, have an adverse effect on our stock price, and subject us to sanctions or investigation by regulatory authorities.

Limitations on director and officer liability and our indemnification of our officers and directors may discourage stockholders from bringing suit against a director.

Our Certificate of Incorporation and By-Laws provide, with certain exceptions as permitted by Nevada corporation law, that a director or officer shall not be personally liable to us or our stockholders for breach of fiduciary duty as a director, except for acts or omissions which involve intentional misconduct, fraud or knowing violation of law, or unlawful payments of dividends. These provisions may discourage stockholders from bringing suit against a director for breach of fiduciary duty and may reduce the likelihood of derivative litigation brought by stockholders on our behalf against a director. In addition, our Certificate of Incorporation and By-Laws provide for mandatory indemnification of directors and officers to the fullest extent permitted by governing state law.

We may incur a variety of costs to engage in future acquisitions of companies, products or technologies, to grow our business, to expand into new markets, or to provide new services. As such, the anticipated benefits of those acquisitions may never be realized.

It is management’s intention to acquire other businesses to grow our customer base, to expand into new markets, and to provide new product lines. We may make acquisitions of, or significant investments in, complementary companies, products or technologies, although no additional material acquisitions or investments are currently pending. Acquisitions may be accompanied by risks such as:

| 24 |

| · | difficulties in assimilating the operations and employees of acquired companies; | |

| · | diversion of our management’s attention from ongoing business concerns; | |

| · | our potential inability to maximize our financial and strategic position through the successful incorporation of acquired technology and rights into our products and services; |

| · | additional expense associated with amortization of acquired assets; | |

| · | additional expense associated with understanding and development of acquired business; | |

| · | maintenance and implementation of uniform standards, controls, procedures and policies; and | |

| · | impairment of existing relationships with employees, suppliers and customers as a result of the integration of new management employees. |

We must attract and retain skilled personnel. If we are unable to hire and retain technical, sales and marketing, and operational employees, our business could be harmed.

Our

revenues are generated by the sales of our team management software from our direct sales, online marketing and our website.

Our ability to manage our growth will be particularly dependent on our ability to develop and retain an effective sales force and qualified managerial personnel. We intend to hire additional employees, including sales and marketing employees and operational employees. The competition for qualified sales, technical, and managerial personnel in the technology community, is intense, and we may not be able to hire and retain sufficient qualified personnel. In addition, we may not be able to maintain the quality of our operations, control our costs, maintain compliance with all applicable regulations, and expand our internal management, technical, information and accounting systems in order to support our desired growth, which could have an adverse impact on our operations.

Our failure to manage growth effectively could harm our ability to attract and retain key personnel and adversely impact our operating results.

There can be no assurance that we will be able to manage our expansion effectively. Our current and planned personnel, systems, procedures and controls may not be adequate to support and effectively manage our future operations, especially as we employ personnel in multiple geographic locations. We may not be able to hire, train, retain, motivate and manage required personnel, which may limit our growth, damage our reputation and negatively affect our financial performance and harm our business.

If we obtain financing, existing shareholder interests may be diluted.

If we raise additional funds by issuing equity or convertible debt securities, the percentage ownership of our shareholders will be diluted. In addition, any new securities could have rights, preferences and privileges senior to those of our common stock. Furthermore, we cannot assure you that additional financing will be available when and to the extent we require or that, if available, it will be on acceptable terms.

The requirements of being a public company may strain our resources and distract our management, which could make it difficult to manage our business, particularly after we are no longer an “emerging growth company.”

We are required to comply with various regulatory and reporting requirements, including those required by the SEC. Complying with these reporting and other regulatory requirements are time-consuming and expensive and could have a negative effect on our business, results of operations and financial condition.

As we become a public company, we will be subject to the reporting requirements of the Exchange Act, and requirements of SOX. The cost of complying with these requirements may place a strain on our systems and resources. The Exchange Act will require that we file annual, quarterly and current reports with respect to our

| 25 |

business and financial condition. SOX will require that we maintain effective disclosure controls and procedures and internal controls over financial reporting. To maintain and improve the effectiveness of our disclosure controls and procedures, we will need to commit significant resources, may be required to hire additional staff and need to continue to provide effective management oversight. We will be implementing additional procedures and processes for the purpose of addressing the standards and requirements applicable to public companies. Sustaining our growth also will require us to commit additional management, operational and financial resources to identify new professionals to join the Company and to maintain appropriate operational and financial systems to adequately support expansion. These activities may divert management’s attention from other business concerns, which could have a material adverse effect on our business, financial condition, results of operations and cash flows. As an “emerging growth company” as defined in the Jumpstart Our Business Startups Act of 2012 (“JOBS Act”) enacted on April 5, 2012, we may take advantage of certain temporary exemptions from various reporting requirements including, but not limited to, not being required to comply with the auditor attestation requirements of Section 404 of SOX (and rules and regulations of the SEC thereunder, which we refer to as Section 404) and reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements. When these exemptions cease to apply, we expect to incur additional expenses and devote increased management effort toward ensuring compliance with them.