Attached files

| file | filename |

|---|---|

| EX-23.1 - EX-23.1 - Camping World Holdings, Inc. | a2232161zex-23_1.htm |

| EX-5.1 - EX-5.1 - Camping World Holdings, Inc. | a2232161zex-5_1.htm |

| EX-1.1 - EX-1.1 - Camping World Holdings, Inc. | a2232161zex-1_1.htm |

As filed with the Securities and Exchange Commission on May 22, 2017

Registration No. 333-217012

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 2

To

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

CAMPING WORLD HOLDINGS, INC.

(Exact name of registrant as specified in its charter)

| Delaware (State or other jurisdiction of incorporation or organization) |

5561 (Primary Standard Industrial Classification Code Number) |

81-1737145 (I.R.S. Employer Identification No.) |

250 Parkway Drive, Suite 270

Lincolnshire, IL 60069

Telephone: (847) 808-3000

(Address, including zip code, and telephone number, including

area code, of registrant's principal executive offices)

Thomas F. Wolfe

Chief Financial Officer

250 Parkway Drive, Suite 270

Lincolnshire, IL 60069

Telephone: (847) 808-3000

(Name, address, including zip code, and telephone number, including

area code, of agent for service)

| Copies to: | ||

Marc D. Jaffe, Esq. Ian D. Schuman, Esq. Latham & Watkins LLP 885 Third Avenue New York, NY 10022 Telephone: (212) 906-1200 Fax: (212) 751-4864 |

Alexander D. Lynch, Esq. Faiza N. Rahman, Esq. Weil, Gotshal & Manges LLP 767 Fifth Avenue New York, NY 10153 Telephone: (212) 310-8000 Fax: (212) 310-8007 |

|

APPROXIMATE DATE OF COMMENCEMENT OF PROPOSED SALE TO THE PUBLIC:

AS SOON AS PRACTICABLE AFTER THIS REGISTRATION STATEMENT IS DECLARED EFFECTIVE.

If any of the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. o

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of "large accelerated filer," "accelerated filer," "smaller reporting company," and "emerging growth company" in Rule 12b-2 of the Exchange Act.

| Large accelerated filer o | Accelerated filer o | Non-accelerated filer ý (Do not check if a smaller reporting company) |

Smaller reporting company o Emerging growth company o |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. o

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

The information in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell nor does it seek an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

Subject to Completion. Dated May 22, 2017.

PRELIMINARY PROSPECTUS

10,000,000 Shares

Camping World Holdings, Inc.

Class A Common Stock

We are offering 3,500,000 shares of Class A common stock. The Selling Stockholders identified in this prospectus are offering an aggregate of 6,500,000 shares of Class A common stock.

Our Class A common stock is listed on the New York Stock Exchange (the "NYSE") under the symbol "CWH." We have three classes of common stock: Class A common stock, Class B common stock and Class C common stock. Each share of our Class A common stock and Class B common stock entitles its holders to one vote per share on all matters presented to our stockholders generally; provided that, for as long as the ML Related Parties (as defined herein and currently indirectly owned by each of Stephen Adams and our Chairman and Chief Executive Officer, Marcus Lemonis), directly or indirectly, beneficially own in the aggregate 27.5% or more of all of the outstanding common units of CWGS Enterprises, LLC ("CWGS, LLC"), the shares of Class B common stock held by the ML Related Parties entitle the ML Related Parties to the number of votes necessary such that the ML Related Parties, in the aggregate, cast 47% of the total votes eligible to be cast by all of our stockholders on all matters presented to a vote of our stockholders generally. Additionally, we have one authorized and outstanding share of Class C common stock that entitles its holder, ML RV Group, LLC, a Delaware limited liability company, wholly-owned by our Chairman and Chief Executive Officer, Marcus Lemonis ("ML RV Group"), to the number of votes necessary such that ML RV Group casts 5% of the total votes eligible to be cast by all of our stockholders on all matters presented to a vote of our stockholders generally. Upon a Class C Change of Control (as defined herein under "Description of Capital Stock"), our Class C common stock shall no longer have any voting rights, such share of our Class C common stock will be cancelled for no consideration and will be retired, and we will not reissue such share of Class C common stock. See "Basis of Presentation — Our Organizational Structure" and "Prospectus Summary."

The last reported sale price for our Class A common stock as reported on the NYSE on May 19, 2017 was $29.37 per share.

We currently are, and following this offering we will continue to be a "controlled company" within the meaning of the corporate governance rules of the NYSE. See the section entitled "Corporate Governance" in our 2016 Proxy Statement (as defined herein), which is incorporated by reference herein.

See "Risk Factors" on page 25 and "Risk Factors" in our 2016 10-K (as defined herein) to read about factors you should consider before buying shares of the Class A common stock.

Neither the Securities and Exchange Commission nor any other regulatory body has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

|

Per Share | Total |

|||

| | | | | | |

Public offering price |

$ | $ | |||

Underwriting discounts and commissions(1) |

$ | $ | |||

Proceeds, before expenses, to us |

$ | $ | |||

Proceeds, before expenses, to the Selling Stockholders |

$ | $ |

- (1)

- We have agreed to reimburse the underwriters for certain expenses in connection with this offering. See "Underwriting."

To the extent that the underwriters sell more than 10,000,000 shares of Class A common stock, the underwriters have the option to purchase up to an additional 1,500,000 shares from us and the Selling Stockholders at the price to public less the underwriting discount.

The underwriters expect to deliver the shares of Class A common stock against payment in New York, New York on , 2017.

| Goldman Sachs & Co. LLC | J.P. Morgan | |

BofA Merrill Lynch |

Credit Suisse |

| Baird | BMO Capital Markets | KeyBanc Capital Markets | Stephens Inc. | Wells Fargo Securities |

Prospectus dated , 2017.

TABLE OF CONTENTS

You should rely only on the information contained, or incorporated by reference, in this prospectus or in any free writing prospectus we may authorize to be delivered or made available to you. We have not, the Selling Stockholders have not, and the underwriters have not, authorized anyone to provide any information or to make any representations other than those contained, or incorporated by reference, in this prospectus or in any free writing prospectuses we have prepared. We, the Selling Stockholders and the underwriters take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. This prospectus is an offer to sell only the shares offered hereby, but only under circumstances and in jurisdictions where it is lawful to do so. The information contained, or incorporated by reference, in this prospectus is current only as of its date. Our business, financial condition, results of operations and prospectus may have changed since that date.

For investors outside the United States: we have not, the Selling Stockholders have not, and the underwriters have not, done anything that would permit this offering or possession or distribution of this prospectus or any free writing prospectus we may provide to you in connection with this offering in any jurisdiction where action for purpose is required, other than in the United States. Persons outside the United States who come into possession of this prospectus must inform themselves about, and observe any restrictions relating to, the offering of the shares of Class A common stock and the distribution of this prospectus outside the United States. See "Underwriting."

i

Organizational Structure

As used in this prospectus, unless the context otherwise requires, references to:

- •

- "2016 10-K" refers to our Annual Report on Form 10-K for the year ended

December 31, 2016, filed with the Securities and Exchange Commission (the "SEC") on March 13, 2017, which is incorporated by reference herein.

- •

- "2016 Proxy Statement" refers to our Definitive Proxy Statement on Schedule 14A for the

year ended December 31, 2016, filed with the SEC on March 31, 2017, which is incorporated by reference herein.

- •

- "2017 First Quarter 10-Q" refers to our Quarterly Report on Form 10-Q, filed with the

SEC on May 4, 2017 which is incorporated by reference herein.

- •

- "we," "us," "our," the "Company," "Camping World," "Good Sam" and similar references refer to

Camping World Holdings, Inc., and, unless otherwise stated, all of its subsidiaries, including CWGS Enterprises, LLC, which we refer to as "CWGS, LLC" and, unless otherwise

stated, all of its subsidiaries.

- •

- "Continuing Equity Owners" refers, collectively, to ML Acquisition, funds controlled by

Crestview Partners II GP, L.P. and the Former Profit Unit Holders and each of their permitted transferees that continue to own common units in CWGS, LLC after the IPO and the

Reorganization Transactions (as defined herein) and who may redeem (including in connection with this offering), at each of their options, their common units for, at our election (determined solely by

our independent directors (within the meaning of the rules of the New York Stock Exchange) who are disinterested), cash or newly-issued shares of our Class A common stock as described in

"Certain Relationships and Related Person Transactions — CWGS LLC Agreement."

- •

- "Crestview" refers to Crestview Advisors, L.L.C., a registered investment adviser to private

equity funds, including funds affiliated with Crestview Partners II GP, L.P.

- •

- "CWGS LLC Agreement" refers to CWGS, LLC's amended and restated limited liability

company agreement, as amended to date.

- •

- "Former Equity Owners" refers to those Original Equity Owners controlled by Crestview Partners

II GP, L.P. that exchanged their direct or indirect ownership interests in CWGS, LLC for shares of our Class A common stock in connection with the consummation of our IPO

(as defined herein).

- •

- "Former Profit Unit Holders" refers, collectively, to our named executive officers (excluding

Marcus Lemonis), Andris A. Baltins and K. Dillon Schickli, who are members of our board of directors, and certain other current and former non-executive employees and former directors, in each case,

who held existing profit units in CWGS, LLC pursuant to CWGS, LLC's equity incentive plan that was in existence prior to our IPO and who received common units of CWGS, LLC in

exchange for their profit units in connection with our IPO.

- •

- "ML Acquisition" refers to ML Acquisition Company, LLC, a Delaware limited liability

company, indirectly owned by each of Stephen Adams and our Chairman and Chief Executive Officer, Marcus Lemonis.

- •

- "ML Related Parties" refers to ML Acquisition and its permitted transferees of common units, as set forth in "Certain Relationships and Related Person Transactions — CWGS LLC Agreement."

ii

- •

- "ML RV Group" refers to ML RV Group, LLC, a Delaware limited liability company,

wholly-owned by our Chairman and Chief Executive Officer, Marcus Lemonis.

- •

- "Original Equity Owners" refers to the direct and certain indirect owners of interests in

CWGS, LLC, collectively, prior to the Reorganization Transactions, which includes ML Acquisition, funds controlled by Crestview Partners II GP, L.P. and the Former Profit Unit

Holders.

- •

- "Selling Stockholders" refers to CVRV Acquisition LLC and CVRV Acquisition II LLC, each affiliates of Crestview.

We are a holding company and the sole managing member of CWGS, LLC, and our principal asset consists of common units of CWGS, LLC.

Initial Public Offering and Reorganization Transactions

On October 13, 2016, we completed our initial public offering (the "IPO") of 11,363,636 shares of our Class A common stock at an initial public offering price of $22.00 per share. Additionally, on November 9, 2016, we sold an additional 508,564 shares of our Class A common stock at a price of $22.00 per share pursuant to the underwriters' exercise of their option, in part, to purchase additional shares of our Class A common stock. We received net proceeds of approximately $243.8 million, net of underwriting discounts and commissions, including the net proceeds received from the underwriters' exercise of their option to purchase additional shares of our Class A common stock, in part. We used all of the net proceeds from our IPO to purchase 11,872,200 newly-issued common units directly from CWGS, LLC at a price per unit equal to the initial public offering price per share of Class A common stock in the IPO less underwriting discounts and commissions.

On September 21, 2016, we amended the credit agreement governing our Previous Senior Secured Credit Facilities (as defined herein) to, among other things, permit the IPO, provide for incremental term loan borrowings of $135.0 million, increase the capacity for payments by the Borrower (as defined herein) to CWGS, LLC for payment of regular quarterly distributions to its common unit holders, including us, and permit a $100.0 million special distribution of a portion of such incremental borrowings under our Previous Senior Secured Credit Facilities from the Borrower to CWGS, LLC for a distribution to its members, which was also made on September 21, 2016. The remainder of the proceeds were used for general corporate purposes, including the acquisition of RV dealerships. We refer to these transactions, collectively, as the "Recapitalization."

In connection with our IPO, we completed the following transactions (together with the Recapitalization, the "Reorganization Transactions"):

- •

- we amended and restated CWGS, LLC's limited liability company agreement to, among other things, (i) convert all then-existing

membership interests in CWGS, LLC into a new single class of common units of CWGS, LLC and (ii) appoint Camping World Holdings, Inc. as the sole managing member of

CWGS, LLC;

- •

- we amended and restated Camping World Holdings, Inc.'s certificate of incorporation to, among other things, provide (i) for Class A common stock and Class B common stock, with each share of our Class A common stock and Class B common stock entitling its holders to one vote per share on all matters presented to our stockholders generally; provided that, for as long as the ML Related Parties, directly or indirectly, beneficially own in the aggregate 27.5% or more of all of the outstanding common units of CWGS, LLC, the shares of our Class B common stock held by the ML Related Parties entitle the ML Related Parties to the number of votes necessary such that the ML Related Parties, in the aggregate, cast 47% of the total votes eligible to be cast by all of our stockholders on all matters presented to a

iii

- •

- we issued 69,066,445 shares of Class B common stock to the Continuing Equity Owners (other than the Former Profit Unit Holders) on a

one-to-one basis with the number of common units of CWGS, LLC that they owned immediately prior to the consummation of the IPO (of which 7,063,716 shares of Class B common stock were

subsequently canceled for no consideration as described below) for nominal consideration and one share of Class C common stock to ML RV Group for nominal consideration; and

- •

- we acquired, by merger, an entity that was owned by the Former Equity Owners, for which we issued 7,063,716 shares of Class A common stock as merger consideration (the "Merger"). The only significant asset held by the merged entity prior to the Merger was 7,063,716 common units of CWGS, LLC and a corresponding number of shares of Class B common stock. Upon consummation of the Merger, we canceled the 7,063,716 shares of Class B common stock.

vote of our stockholders generally and (ii) for one share of Class C common stock entitling its holder to the number of votes necessary such that the holder casts 5% of the total votes eligible to be cast by all of our stockholders on all matters presented to a vote of our stockholders generally for as long as there is no Class C Change of Control (as defined herein under "Description of Capital Stock");

As of March 31, 2017, we owned 22.6% of CWGS, LLC and the Continuing Equity Owners owned the remaining 77.4% of CWGS, LLC. Immediately following this offering, the holders of our Class A common stock, including the Former Equity Owners, will hold 100% of the economic interests in us and 27.5% of the voting power in us (or 100% of the economic interests in us and 28.5% of the voting power in us, if the underwriters exercise in full their option to purchase additional shares of Class A common stock), the Continuing Equity Owners (other than the Former Profit Unit Holders), through their ownership of 56,893,631 shares of Class B common stock, collectively, will hold no economic interest in us and 67.5% of the voting power in us (or 56,127,266 shares of Class B common stock, no economic interest in us and 66.5% of the voting power in us, if the underwriters exercise in full their option to purchase additional shares of Class A common stock) and ML RV Group, through its ownership of one share of Class C common stock, will hold no economic interest in us and the remaining 5.0% of the voting power in us. We are a holding company, and upon the consummation of this offering, our principal asset will be our 27,960,703 common units of CWGS, LLC, representing an aggregate 32.0% economic interest in CWGS, LLC (or 29,252,068 common units of CWGS, LLC, representing an aggregate 33.3% economic interest in CWGS, LLC, if the underwriters exercise in full their option to purchase additional shares of Class A common stock). The remaining 68.0% economic interest in CWGS, LLC will continue to be owned by Continuing Equity Owners through their ownership of 59,311,269 common units of CWGS, LLC (or 66.7% economic interest in CWGS, LLC and 58,544,904 common units of CWGS, LLC, if the underwriters exercise in full their option to purchase additional shares of Class A common stock). We are the sole managing member of CWGS, LLC and, although we will continue to have a minority economic interest CWGS, LLC, we have the sole voting power in, and control the management of, CWGS, LLC. Accordingly, we consolidate the financial results of CWGS, LLC and report a non-controlling interest in our consolidated financial statements incorporated by reference herein.

Presentation of Financial and Other Information

As the Reorganization Transactions are considered to be transactions between entities under common control, the financial statements for periods prior to the IPO and Reorganization Transactions have been adjusted to combine the previously separate entities for presentation purposes.

iv

We define an "Active Customer" as a customer who has transacted with us in any of the eight most recently completed fiscal quarters prior to the date of measurement. Unless otherwise indicated, the date of measurement is March 31, 2017, our most recently completed fiscal quarter.

Certain monetary amounts, percentages and other figures included, or incorporated by reference, in this prospectus have been subject to rounding adjustments. Percentage amounts included in this prospectus have not in all cases been calculated on the basis of such rounded figures, but on the basis of such amounts prior to rounding. For this reason, percentage amounts included, or incorporated by reference, in this prospectus may vary from those obtained by performing the same calculations using the figures in our consolidated financial statements incorporated by reference in this prospectus. Certain other amounts that appear in this prospectus may not sum due to rounding.

This prospectus includes, or incorporates by reference, our trademarks, trade names and service marks, such as "Camping World" and "Good Sam," which are protected under applicable intellectual property laws and are our property. This prospectus also contains, or incorporates by reference, trademarks, trade names and service marks of other companies, which are the property of their respective owners. Solely for convenience, trademarks, trade names and service marks referred to, or incorporated by reference, in this prospectus may appear without the ®, TM or SM symbols, but such references are not intended to indicate, in any way, that we will not assert, to the fullest extent permitted under applicable law, our rights or the right of the applicable licensor to these trademarks, trade names and service marks. We do not intend our use or display of other parties' trademarks, trade names or service marks to imply, and such use or display should not be construed to imply, a relationship with, or endorsement or sponsorship of us by, these other parties.

Unless otherwise indicated, information contained, or incorporated by reference, in this prospectus concerning our industry and the markets in which we operate is based on information from independent industry and research organizations, other third-party sources and management estimates. Management estimates are derived from publicly available information released by independent industry analysts and third-party sources, as well as data from our internal research, and are based on assumptions made by us upon reviewing such data and our experience in, and knowledge of, such industry and markets, which we believe to be reasonable. References herein to the approximately 9 million U.S. households that own a recreational vehicle ("RV") are based on The RV Consumer in 2011, an industry report published by the University of Michigan in 2011 (the "RV Survey"), which we believe to be the most recent such survey. In addition, projections, assumptions and estimates of the future performance of the industry in which we operate and our future performance are necessarily subject to uncertainty and risk due to a variety of factors, including those described in "Risk Factors," "Risk Factors" in our 2016 10-K, which is incorporated by reference herein, and "Cautionary Note Regarding Forward-Looking Statements." These and other factors could cause results to differ materially from those expressed in the estimates made by the independent parties and by us.

v

Certain financial measures presented or incorporated by reference in this prospectus, such as EBITDA, Adjusted EBITDA, Adjusted EBITDA Margin, Adjusted Pro Forma Net Income and Adjusted Pro Forma Earnings Per Fully Exchanged and Diluted Share, are not recognized under accounting principles generally accepted in the United States, which we refer to as "GAAP." We define these terms as follows:

- •

- "EBITDA" is defined as net income before other interest expense (excluding floor plan interest expense), provision for income taxes and

depreciation and amortization.

- •

- "Adjusted EBITDA" is defined as EBITDA, further adjusted for the impact of certain non-cash and other items that we do not consider in our

evaluation of ongoing operating performance. These items include, among other things, loss (gain) and expense on debt restructure, loss (gain) on sale of assets and disposition of stores, gain on

derivative instruments, monitoring fees, equity-based compensation expense, an adjustment to rent on right to use assets, gain on remeasurement of Tax Receivable Agreement (as defined herein) and

other unusual or one-time items. We believe that Adjusted EBITDA is an appropriate measure of operating performance because it eliminates the impact of certain items that do not relate to our business

performance.

- •

- "Adjusted EBITDA Margin" is defined as Adjusted EBITDA as a percentage of total revenue.

- •

- "Adjusted Pro Forma Net Income" is defined as net income attributable to Camping World Holdings, Inc., adjusted for the reallocation of

income attributable to non-controlling interests from the assumed exchange of all outstanding common units in CWGS, LLC (or the common unit equivalent of membership interests in

CWGS, LLC for periods prior to the IPO) for shares of Class A common stock of Camping World Holdings, Inc. and further adjusted for the impact of certain non-cash and other items

that we do not consider in our evaluation of our ongoing operating performance. These items include, among other things, loss (gain) and expense on debt restructure, loss (gain) on sale of assets and

disposition of stores, gain on derivative instruments, monitoring fees, equity-based compensation expense, an adjustment to rent on right to use assets, interest expense on our Series B Notes

(as defined herein), gain on remeasurement of Tax Receivable Agreement, other unusual or one-time items and the income tax expense effect of (i) these adjustments and (ii) the

pass-through entity taxable income as if the parent company was a subchapter C corporation in periods prior to the IPO.

- •

- "Adjusted Pro Forma Earnings Per Fully Exchanged and Diluted Share" is defined as Adjusted Pro Forma Net Income divided by the weighted-average shares of Class A common stock outstanding, assuming: (i) the full exchange of all outstanding common units in CWGS, LLC (or the common unit equivalent of membership interests in CWGS, LLC for periods prior to the IPO) for shares of Class A common stock of Camping World Holdings, Inc., (ii) the Class A common stock issued in connection with the IPO was outstanding as of January 1 of each year presented and (iii) the dilutive effect of stock options and restricted stock units, if any.

EBITDA, Adjusted EBITDA, Adjusted EBITDA Margin, Adjusted Pro Forma Net Income and Adjusted Pro Forma Earnings Per Fully Exchanged and Diluted Share are included, or incorporated by reference, in this prospectus because they are key metrics used by management and our board of directors as follows:

- •

- as a measurement of operating performance because they assist us in comparing the operating performance of our business on a consistent basis, as they remove the impact of items not directly resulting from our core operations;

vi

- •

- for planning purposes, including the preparation of our internal annual operating budget and financial projections;

- •

- to evaluate the performance and effectiveness of our operational strategies; and

- •

- to evaluate our capacity to fund capital expenditures and expand our business.

We believe that EBITDA, Adjusted EBITDA, Adjusted EBITDA Margin, Adjusted Pro Forma Net Income and Adjusted Pro Forma Earnings Per Fully Exchanged and Diluted Share, when used in conjunction with GAAP financial measures, provide useful information about our operating results, enhance the overall understanding of past financial performance and future prospects and allow for greater transparency with respect to the key metrics we use in our financial and operational decision making. We present EBITDA, Adjusted EBITDA, Adjusted EBITDA Margin, Adjusted Pro Forma Net Income and Adjusted Pro Forma Earnings Per Fully Exchanged and Diluted Share because we consider them to be important supplemental measures of our performance and believe certain of these metrics are also frequently used by securities analysts, investors and other interested parties to evaluate companies in our industry. EBITDA, Adjusted EBITDA, Adjusted EBITDA Margin, Adjusted Pro Forma Net Income and Adjusted Pro Forma Earnings Per Fully Exchanged and Diluted Share are not GAAP measures of our financial performance and should not be considered as alternatives to net income as a measure of financial performance, or any other performance measure derived in accordance with GAAP. Adjusted EBITDA, Adjusted EBITDA Margin, Adjusted Pro Forma Net Income and Adjusted Pro Forma Earnings Per Fully Exchanged and Diluted Share should not be construed as an inference that our future results will be unaffected by unusual or non-recurring items. Additionally, EBITDA, Adjusted EBITDA, Adjusted EBITDA Margin, Adjusted Pro Forma Net Income and Adjusted Pro Forma Earnings Per Fully Exchanged and Diluted Share are not intended to be measures of discretionary cash to invest in the growth of our business, as they do not reflect tax payments, debt service requirements, capital expenditures and certain other cash costs that may recur in the future, including, among other things, cash requirements for working capital needs and cash costs to replace assets being depreciated and amortized. Management compensates for these limitations by relying on our GAAP results in addition to using EBITDA, Adjusted EBITDA, Adjusted EBITDA Margin, Adjusted Pro Forma Net Income and Adjusted Pro Forma Earnings Per Fully Exchanged and Diluted Share supplementally. Our measures of EBITDA, Adjusted EBITDA, Adjusted EBITDA Margin, Adjusted Pro Forma Net Income and Adjusted Pro Forma Earnings Per Fully Exchanged and Diluted Share are not necessarily comparable to similarly titled captions of other companies due to different methods of calculation.

vii

This summary highlights selected information contained elsewhere, or incorporated by reference, in this prospectus. This summary does not contain all of the information that you should consider before deciding to invest in our Class A common stock. You should read the entire prospectus carefully, including "Risk Factors" included elsewhere in this prospectus, the sections entitled "Risk Factors" and "Management's Discussion and Analysis of Financial Condition and Results of Operations" and our audited consolidated financial statements and the related notes, each included in our 2016 10-K, which is incorporated by reference herein, and the section entitled "Management's Discussion and Analysis of Financial Condition and Results of Operations" and our unaudited consolidated financial statements and the related notes, each included in our 2017 First Quarter 10-Q, which is incorporated by reference herein, before making an investment decision. Some of the statements in this prospectus and in our 2016 10-K and in our 2017 First Quarter 10-Q, each of which is incorporated by reference herein, constitute forward-looking statements. See "Cautionary Note Regarding Forward-Looking Statements."

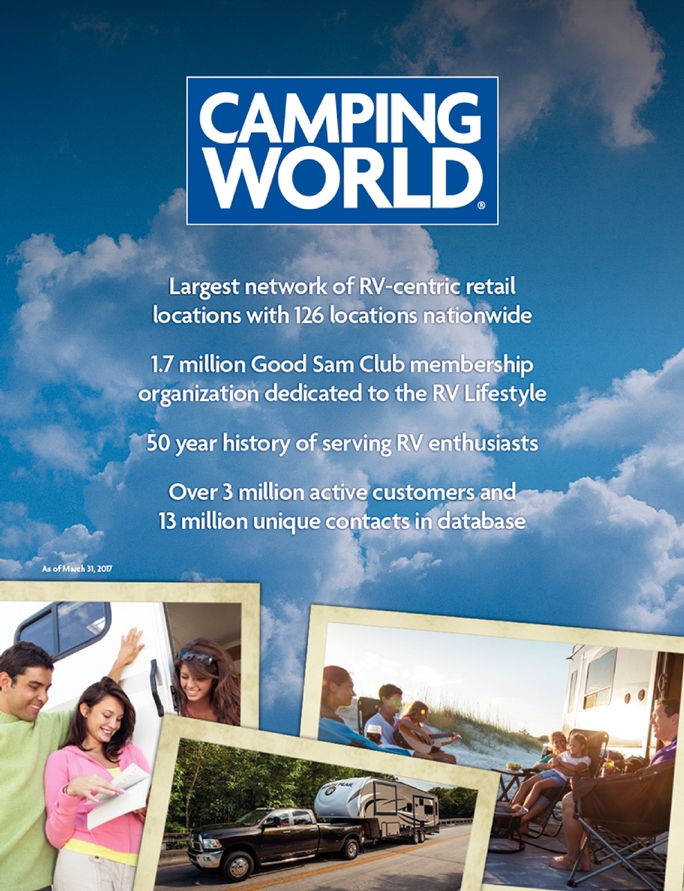

Our Company

We believe we are the only provider of a comprehensive portfolio of services, protection plans, products and resources for recreational vehicle ("RV") enthusiasts. Approximately 9 million households in the U.S. own an RV, and of that installed base, we have approximately 3.4 million Active Customers. We generate recurring revenue by providing RV owners and enthusiasts the full spectrum of services, protection plans, products and resources that we believe are essential to operate, maintain and protect their RV and to enjoy the RV lifestyle. We provide these offerings through our two iconic brands: Good Sam and Camping World.

|

Good Sam Consumer Services and Plans |

Camping World Retail |

|||||

| Consumer Services and Plans |

New and Used Vehicles |

Parts, Service and Other |

Dealership Finance and Insurance |

|||

| | | | | | | |

• Extended vehicle service contracts

• Emergency roadside assistance

• Property and casualty insurance programs

• Membership clubs

• Vehicle financing and refinancing

• Travel protection

• Co-branded credit cards

• Consumer activities and resources:

— Membership events and chapters

— Consumer shows

— Trip planning, travel directories and campground / fuel discounts

— Consumer magazines

— E-commerce and social media

— Contact centers and technical hotlines

— Hosted online forums |

• New and used travel trailers

• New and used fifth wheel trailers

• New and used motorhomes |

• RV and auto repair and

maintenance

• Installation of parts and accessories

• Collision repair

• OEM and aftermarket parts

• RV accessories, maintenance products and supplies

— Outdoor lifestyle products

— Generators and electrical

— Satellite receivers and GPS

— Towing and hitching

— RV appliances

— Essential supplies |

• Vehicle financing

• Protection plans

— Extended vehicle service contracts

— Tire, wheel, paint and fabric protection

— Gap protection

— Travel protection

— Emergency roadside assistance and alert notifications |

|||

We believe our Good Sam branded offerings provide the industry's broadest and deepest range of services, protection plans, products and resources, including: extended vehicle service contracts and insurance protection plans, roadside assistance, membership clubs and financing

1

products. A majority of these programs are on a multi-year or annually renewable basis. Across our extended vehicle service contracts, emergency roadside assistance, property and casualty insurance programs and membership clubs, for each of the years ended December 31, 2016, 2015 and 2014, we experienced high annual retention rates that ranged between 65% and 74%, 66% and 74% and 63% and 76%, respectively. We also operate the Good Sam Club, which we believe is the largest RV organization in the world, with approximately 1.7 million members as of March 31, 2017. Membership benefits include a variety of discounts, exclusive benefits, specialty publications and other membership benefits, all of which we believe enhance the RV experience, drive customer engagement and provide cross-selling opportunities for our other services, protection plans and products.

Our Camping World brand operates the largest national network of RV-centric retail locations in the United States through our 126 retail locations in 36 states, as of March 31, 2017, and through our e-commerce platforms. We believe we are significantly larger in scale than our next largest competitor. We provide new and used RVs, repair parts, RV accessories and supplies, RV repair and maintenance services, protection plans, travel assistance plans, RV financing, and lifestyle products and services for new and existing RV owners. Our retail locations are staffed with knowledgeable local team members, providing customers access to extensive RV expertise. Our retail locations are strategically located in key national RV markets. In 2016, our network generated approximately 3.7 million transactions, continuing to build our Active Customer database.

We attract new customers primarily through our retail locations, e-commerce platforms and direct marketing. Once we acquire our customers through a transaction, they become part of our customer database where we leverage customized customer relationship management ("CRM") tools and analytics to actively engage, market and sell multiple products and services. Our goal is to consistently grow our customer database through our various channels to increasingly cross-sell our products and services.

Summary of 2016 Financial Performance and Key Metrics

We believe our strong, trusted Good Sam and Camping World brands, customer database, leading market position and scale, industry specific technical expertise, and disciplined and variable cost structure have been key drivers of our growth and strong financial performance:

- •

- our Active Customer database had approximately 3.3 million customers on December 31, 2016, representing a 6.4% five-year compound

annual growth rate ("CAGR");

- •

- our total revenue was $3.5 billion for the fiscal year ended December 31, 2016, representing a 17.4% five-year CAGR;

- •

- our net income was $203.2 million for the fiscal year ended December 31, 2016, representing a 48.0% five-year CAGR; and

- •

- our Adjusted EBITDA was $291.3 million for the fiscal year ended December 31, 2016, representing a 22.5% five-year CAGR.

Adjusted EBITDA is a non-GAAP measure. For a reconciliation of Adjusted EBITDA to net income, the most closely comparable GAAP measure, see "— Summary Historical Consolidated Financial and Other Data."

Our Market and Our Customer

The estimated number of U.S. households that own an RV is approximately 9 million, which we believe has grown consistently over the past 20 years, including during the last economic downturn. We have approximately 3.4 million Active Customers and aim to market and sell our services, protection plans, products and resources to the growing number of new market entrants.

2

The recreational vehicle industry is characterized by RV enthusiasts' investment in, and steadfast commitment to, the RV lifestyle. Owners spend on insurance, extended service contracts, roadside assistance and regular maintenance in order to protect and maintain their RV. They typically invest in new accessories and the necessary installation costs as they upgrade their RV. They also spend on services and resources as they plan, engage in, and return from their road trips. Furthermore, based on industry research and management's estimates, we believe that RV owners typically trade-in to buy another RV every four to five years.

A key factor supporting the growth of the installed base of RV owners is continued positive demographic trends within the consumer base. The RV owner installed base has benefited positively from the aging and the increased industry penetration of the baby boomer consumer demographic, those aged 52 to 70 years old. In addition to growth from baby boomers, the Recreational Vehicle Industry Association ("RVIA") estimates the fastest growing RV owner age group includes Generation X consumers, those currently 35 to 54 years old. The U.S. Census Bureau estimates that approximately 84 million Americans were of the age 35 to 54 years old in 2014. Our strong brand awareness, breadth of services, scale of operations, and our targeted marketing and sponsorship have enabled us to generate meaningful growth with this younger demographic of new market entrants. This is evidenced by the decline in the average age of our customers in recent years.

In addition to positive age trends, according to the RV Survey, the typical RV customer has, on average, a household income of approximately $75,000. This is approximately 50% higher than the median household income of the broader United States population at the time of the RV survey, according to the U.S. Census Bureau. The higher average income has resulted in a more resilient RV consumer with greater buying power across economic cycles.

Taken together, we believe the growing installed base of RV owners, an increase in the pool of potential RV customers due to an aging baby boomer demographic, and the increased RV ownership amongst younger consumers should continue to grow the installed base of RV owners, and will have a positive impact on RV usage.

Our Strengths

Our Iconic Brands. With over fifty years of history dating back to 1966, we believe Camping World and Good Sam are iconic, industry defining brands that are synonymous with the RV lifestyle. Our consistent quality, breadth and depth of offerings, as well as our comprehensive range of RV lifestyle resources, have resulted in our customers having passionate loyalty to and enduring trust in our brands.

Comprehensive Portfolio of Services, Protection Plans and Products. We believe we are the only provider of a comprehensive portfolio of services, protection plans, products and resources for RV enthusiasts. We offer more than 10,000 products and services through our retail locations and membership clubs. Our offerings are based on 50 years of experience and customer feedback from RV enthusiasts. Further, we evaluate new products and, through acquisitions or our supplier collaborations, offer certain unique products that are developed based on customer feedback, including private label products.

Customer Database. We have over 13 million unique contacts in our database and we have approximately 3.4 million Active Customers. We use a customized CRM system and database analytics to track customers and selectively market and cross-sell our offerings. We believe our customer database is a competitive advantage and significant barrier to entry.

Leading Market Position and Scale. Camping World is the largest national RV retail network in the United States, and we believe Good Sam is the largest RV organization in the world, with each of our businesses having a distinct web presence through our e-commerce platforms. Our

3

scale and our long-term stability make us attractive to our suppliers, financiers and real estate investors. The strong relationship with our suppliers enables us to negotiate attractive product pricing and availability. We also align with our suppliers on product development in which we leverage our customer base to provide feedback in exchange for exclusive early launch periods for new products. In recent years, we have also leveraged our supplier relationships to introduce private label products, which has improved our product availability.

Core of High Margin, Recurring Revenue. At the core of our offerings are certain high margin products and services targeting the installed base of RV households that generate recurring revenue streams. These offerings include certain Consumer Services and Plan offerings, which we believe are characterized by increased customer engagement, such as our extended vehicle service contracts, emergency roadside assistance, property and casualty insurance programs and membership clubs. As of March 31, 2017 and December 31, 2016, 2015 and 2014, we had 2.7 million, 2.6 million, 2.5 million and 2.4 million participants, respectively, across these Consumer Services and Plan offerings, including those who participated in more than one of our offerings. The increased engagement of our customers in these areas has led to high annual retention rates. Across our extended vehicle service contracts, emergency roadside assistance, property and casualty insurance programs and membership clubs, for each of the years ended December 31, 2016, 2015 and 2014, we experienced high annual retention rates that ranged between 65% and 74%, 66% and 74% and 63% and 76%, respectively. These offerings also include our Retail parts, services and other offerings, which we believe to be stable and more consistent than the sale of new and used vehicles. Concentrating on our Consumer Services and Plans and Retail parts, services and other offerings has allowed us to grow a core of recurring revenue with gross margins of 57.1% and 46.4%, respectively, for the year ended December 31, 2016, which is significantly higher than our consolidated gross margins of 28.3% for the year ended December 31, 2016.

Variable Cost Structure and Capital Efficient Model. Our decentralized and flat management structure coupled with incentive programs focused on profitability have allowed us to achieve a highly variable cost structure. Our database analytics provide us significant flexibility and meaningfully improve our marketing efficiency via nimble, targeted marketing programs. We believe our model leads to strong and stable margins through economic cycles, resulting in what we believe to be high cash flow generation, low capital expenditure requirements and impressive returns on invested capital. As a result, we have been successful in generating access to highly attractive real estate and floor plan financing terms, thereby reducing costs and significantly reducing our need for capital. This capital efficient model provides a large share of capital funding at attractive terms for new locations and acquisitions.

Experienced Team. Our management team has an average of 21 years of industry experience. We offer highly competitive compensation tightly tied to performance, which has allowed us to attract and retain our highly experienced management team. Since 2012, our team has increased total revenue from $1,854.2 million to $3,526.7 million for the year ended December 31, 2016, increased net income from $42.3 million to $203.2 million for the year ended December 31, 2016 and increased Adjusted EBITDA from $129.5 million to $291.3 million for the year ended December 31, 2016. Adjusted EBITDA is a non-GAAP measure. For a reconciliation of Adjusted EBITDA to net income, the most closely comparable GAAP measure, see "— Summary Historical Consolidated Financial and Other Data."

Our Growth Strategy

Grow Our Active Base of Customers. We believe our strong brands, leading market position, ongoing investment in our service platform, broad product portfolio and full suite of resources will continue to provide us with competitive advantages in targeting and capturing a larger share of consumers with whom we do not currently transact in addition to the growing

4

number of new RV enthusiasts that will enter the market. We expect to continue to grow the Active Customer base primarily through three strategies:

- •

- Targeted Marketing. We

continuously work to attract new customers to our existing retail and online locations through targeted marketing, attractive introductory offerings and access to our wide array of resources for RV

enthusiasts. We have focused specifically on marketing to the fast-growing demographic of younger market entrants, and through our NASCAR Truck Series and participation at college athletic events and

music festivals, we believe we attract an outsized share of younger RV owners to our platform.

- •

- Greenfield Retail Locations. We

establish retail locations in new and existing markets to expand our customer base. Target markets and locations are identified by employing proprietary data and analytical tools. We believe there is

ample white space for additional development opportunities which, consistent with most of our locations, have the benefit of what we believe to be low-cost land acquisition prices. We typically take

eight to 14 months from site identification until we open the doors to the new store. Since 2012 we have successfully opened 13 new greenfield locations. We intend to continue to open sites

that will grow our Active Customer base and present attractive risk-adjusted returns and significant value-creation opportunities. Our greenfield locations typically reach profitability within three

months.

- •

- Retail Location Acquisitions. The RV dealership industry is highly fragmented with a large number of independent RV dealers. We use acquisitions of independent dealers as a fast and capital efficient alternative to new retail location openings to expand our business and grow our customer base. While acquired sites typically remain open following an acquisition, in certain instances we may close a location following an acquisition for remodeling for a period of time generally not in excess of eight weeks. We believe our experience and scale allow us to operate these acquired locations more efficiently. Since 2012, we have successfully acquired and integrated 37 new retail locations, and in 2015, we sold two retail locations. Our acquisitions are typically profitable within two full calendar months after an acquisition, with the exception of acquisitions we consider turn-around opportunities, which are typically profitable within two to four months. We intend to continue to pursue acquisitions that will grow our Active Customer base and present attractive risk-adjusted returns and significant value-creation opportunities.

Cross-Sell Growing Portfolio of Services, Protection Plans and Products. We believe our customer database of over 13 million unique contacts provides us with the opportunity to continue our growth through the cross-selling of our products and services. We use our customized CRM system and database analytics to proactively market and cross-sell to Active Customers. We also seek to increase the penetration of our customers who exhibit higher multi-product attachment rates.

New Products and Vertical Acquisitions. Introduction of new products enhances our cross-selling effort, both by catering to evolving customer demands and by bringing in new customers. Through relationships with existing suppliers and through acquisitions, we will look to increase the new products we can offer to our customers. Similarly, an opportunistic vertical acquisition strategy allows us to earn an increased margin on our services, protection plans and products, and we evaluate such acquisitions that can allow us to capture additional sales from our customers at attractive risk-adjusted returns.

5

Recent Developments

Retail Acquisitions

Since March 31, 2017, we have acquired seven retail locations, two in Idaho, three in Texas, and two in Virginia. We have also entered into agreements to acquire an additional two retail locations in Virginia, which we anticipate will close in the second quarter of 2017, subject to customary closing conditions. See "Risk Factors — Risks Related to Our Business — Unforeseen expenses, difficulties, and delays frequently encountered in connection with expansion through acquisitions could inhibit our growth and negatively impact our profitability."

Gander Mountain Acquisition

On May 5, 2017, CWI, Inc. ("CWI"), an indirect subsidiary of Camping World, entered into an asset purchase agreement (the "Asset Purchase Agreement") for certain assets of Gander Mountain Company ("Gander Mountain") and its Overton's, Inc. ("Overton's") boating business (the "Gander Mountain Acquisition"). Gander Mountain previously filed for Chapter 11 bankruptcy protection on March 10, 2017. On April 27, 2017 and April 28, 2017, CWI participated in a bankruptcy auction for the aforementioned assets and was chosen as the winning bidder at the conclusion of the auction on April 28, 2017. Simultaneously, a group of liquidators was chosen as the winning bidder to be retained as the agent for Gander Mountain to conduct liquidation sales at substantially all of Gander Mountain's existing stores. On May 4, 2017, the transaction was approved by the United States Bankruptcy Court for the District of Minnesota (the "Bankruptcy Court").

Pursuant to the Asset Purchase Agreement, CWI will purchase Overton's inventory for an amount equal to cost, which as of April 28, 2017 was approximately $15.6 million (based on estimates available as of April 28, 2017), plus $22.2 million for certain other assets, such as the right to designate any real estate leases for assignment to CWI or other third parties, other agreements CWI elects to assume, intellectual property rights, operating systems and platforms, certain distribution center equipment, the Gander Mountain and Overton's ecommerce businesses and fixtures and equipment for Overton's retail and corporate operations. Furthermore, CWI has committed to assume no fewer than 17 of Gander Mountain's real estate leases (two of which can be Overton's real estate leases) and CWI has until October 6, 2017 to determine which additional real estate leases CWI wants to assume and which real estate leases CWI wants to assign to third parties. CWI will also assume certain liabilities, such as cure costs for real property leases and other agreements it elects to assume, accrued time off for employees retained by CWI and retention bonuses payable to certain key Gander Mountain employees retained by CWI. Our current goal is to operate 70 or more locations subject to, among other things, our ability to negotiate lease terms with landlords on terms acceptable to us and approval of the Bankruptcy Court. We believe Gander Mountain's and Overton's consumers' affinity to the outdoor lifestyle complement our businesses with significant potential opportunity to build on our Good Sam strategy of selling clubs, warranties, insurance and other related products.

CWI and Gander Mountain have made customary representations, warranties and covenants in the Asset Purchase Agreement, which is subject to termination by either CWI or Gander Mountain upon the occurrence of specified events. The transaction is expected to close on or before May 26, 2017, subject to the satisfaction or waiver of various conditions.

We plan to finance the Gander Mountain Acquisition, including the re-opening and initial working capital needs of our current goal to operate 70 or more retail locations and certain liabilities that we will assume in connection therewith, as described above, with available cash on hand, which may include proceeds from the sale of Class A common stock by us in this offering, along with additional capital from future equity or debt financings. See "Use of Proceeds." This offering is not condition on the closing of the Gander Mountain Acquisition and we cannot assure you that the Gander Mountain Acquisition will be completed on the terms described herein or at all. See "Risk Factors—Risks Related to the Gander Mountain Acquisition."

6

The foregoing description of the terms of the Asset Purchase Agreement is qualified in its entirety by reference to such Asset Purchase Agreement, which is included as an exhibit to our Current Report on Form 8-K filed with the SEC on May 8, 2017, which is incorporated by reference herein. The Asset Purchase Agreement has been incorporated by reference herein to provide investors and security holders with information regarding its terms. It is not intended to provide any other factual information about us or Gander Mountain. The representations, warranties and covenants contained in the Asset Purchase Agreement were made only for purposes of such agreement and as of specific dates, were solely for the benefit of the parties to such Asset Purchase Agreement, and may be subject to important limitations agreed upon by the contracting parties, including being qualified by confidential disclosures exchanged between the parties in connection with the execution of the Asset Purchase Agreement. The representations and warranties may have been made for the purposes of allocating contractual risk between the parties to the agreement instead of establishing these matters as facts, and may be subject to standards of materiality applicable to the contracting parties that differ from those applicable to investors. As to factual matters concerning Camping World and Gander Mountain, you should not rely upon the representations and warranties in the Asset Purchase Agreement.

Summary Risk Factors

Participating in this offering involves substantial risk. Our ability to execute our strategy is also subject to certain risks. The risks described under the heading "Risk Factors" included elsewhere in this prospectus and in our 2016 10-K, which is incorporated by reference herein, may cause us not to realize the full benefits of our strengths or may cause us to be unable to successfully execute all or part of our strategy. Some of the most significant challenges and risks include the following:

- •

- our business is affected by the availability of financing to us and our customers;

- •

- shortages of gasoline and diesel fuel have had a material adverse effect on the RV industry as a whole in the past and could have a material

adverse effect on our business, financial condition or results of operations;

- •

- the interruption or discontinuance of the operations of our suppliers and manufacturers could cause us to experience shortfalls, disruptions,

or delays with respect to needed inventory;

- •

- our business model is impacted by general economic conditions in our markets, and ongoing economic and financial uncertainties may cause a

decline in consumer spending;

- •

- we depend on our ability to attract and retain customers;

- •

- we operate in a highly fragmented and competitive industry and may face increased competition;

- •

- we may not be successful in opening, acquiring or operating new retail locations in any existing or new markets into which we expand;

- •

- we depend on the value and strength of our brands;

- •

- we have incurred, and will continue to incur, increased costs and obligations as a result of being a public company;

- •

- whether we are able to realize any tax benefits that may arise from our organizational structure and any redemptions or exchanges of

CWGS, LLC common units for cash or stock, including in connection with our IPO and this offering;

- •

- Marcus Lemonis, through his beneficial ownership of our shares directly or indirectly held by ML Acquisition and ML RV Group, has substantial control over us and may approve or

7

- •

- we are a "controlled company" within the meaning of the New York Stock Exchange (the "NYSE") listing requirements and, as a result, qualify for, and intend to continue to rely on, exemptions from certain corporate governance requirements.

disapprove substantially all transactions and other matters requiring approval by our stockholders, including, but not limited to, the election of directors; and

Before you invest in our Class A common stock, you should carefully consider all the information contained, or incorporated by reference, in this prospectus, including matters set forth under the heading "Risk Factors" in this prospectus and in the section entitled "Risk Factors" in our 2016 10-K, which is incorporated by reference herein.

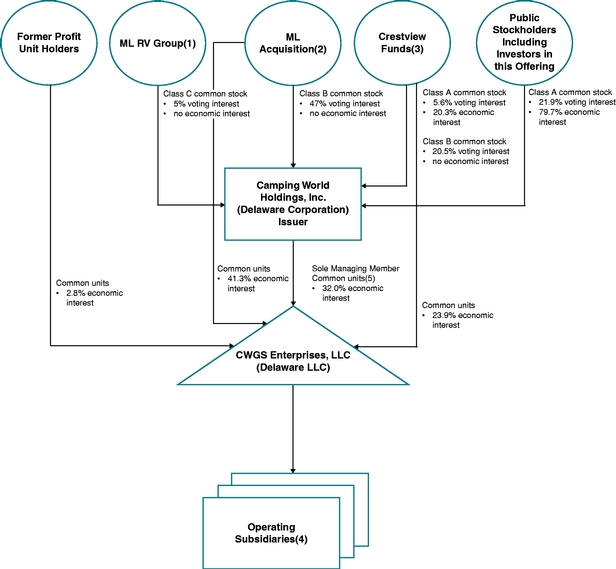

Ownership Structure

The diagram below depicts our organizational structure immediately following this offering, assuming no exercise by the underwriters of their option to purchase additional shares of Class A common stock.

- (1)

- ML RV Group is wholly-owned by our Chairman and Chief Executive Officer, Marcus Lemonis.

8

- (2)

- ML Acquisition holds its shares of Class B common stock in Camping World Holdings, Inc. and its

common units in CWGS, LLC through CWGS Holding, LLC, a wholly owned subsidiary of ML Acquisition. ML Acquisition is currently indirectly owned by each of Stephen Adams and our Chairman

and Chief Executive Officer, Marcus Lemonis.

- (3)

- Certain funds controlled by Crestview Partners II GP, L.P., as Continuing Equity Owners, hold

their common units in CWGS, LLC through CVRV Acquisition LLC, which is wholly owned by such funds. Certain other funds controlled by Crestview Partners II GP, L.P., as

Former Equity Owners, hold their Class A common stock in Camping World Holdings, Inc. through CVRV Acquisition II LLC, which is wholly owned by such funds.

- (4)

- CWGS Group, LLC, a direct wholly-owned subsidiary of CWGS, LLC, is the borrower under our Senior

Secured Credit Facilities. FreedomRoads, LLC, an indirect wholly-owned subsidiary of CWGS, LLC, is the borrower under our Floor Plan Facility (as defined herein).

- (5)

- A portion of these common units are held through a wholly-owned subsidiary of Camping World Holdings, Inc. as a result of the Former Equity Owners exchanging their indirect ownership interests in common units of CWGS, LLC for shares of Class A common stock on a one-to-one basis in connection with our IPO.

Our History and Corporate Information

Founded in 1966, our Good Sam and Camping World brands have delivered superior specialty services and protection plans, expert advice and high-quality products to the growing community of RV owners and outdoor enthusiasts for over 50 years. Good Sam combined with Camping World in 1997, when the Good Sam Club had approximately 911,000 members and Camping World had 26 retail locations. In 2011, Camping World Good Sam combined with FreedomRoads, a successful RV dealership business founded in 2003, to form the largest provider of products and services for RVs in North America. Since 2011, we have continued to invest in our growth, driving an increase in our Active Customer base from approximately 2.6 million as of December 31, 2011 to approximately 3.4 million as of March 31, 2017.

Camping World Holdings, Inc. was incorporated as a Delaware corporation on March 8, 2016. On June 8, 2016, we effected a name change from CWGS, Inc. to Camping World Holdings, Inc. Our corporate headquarters are located at 250 Parkway Drive, Suite 270, Lincolnshire, IL 60069. Our telephone number is (847) 808-3000. Our principal website address is www.campingworld.com. The information on any of our websites is deemed not to be incorporated by reference in this prospectus or to be part of this prospectus.

Camping World Holdings, Inc. is a holding company, and upon the consummation of this offering, its principal asset will be its 27,960,703 common units of CWGS, LLC, representing an aggregate 32.0% economic interest in CWGS, LLC (or 29,252,068 common units of CWGS, LLC, representing an aggregate 33.3% economic interest in CWGS, LLC, if the underwriters exercise their option to purchase additional shares in full).

Crestview

Founded in 2004, Crestview is a value-oriented private equity firm focused on the middle market. The firm is based in New York and manages funds with over $7 billion of aggregate capital commitments. The firm is led by a group of partners who have complementary experience and distinguished backgrounds in private equity, finance, operations and management. Crestview's senior investment professionals primarily focus on sourcing and managing investments in each of the specialty areas of the firm: media, energy, financial services and industrials. For additional information regarding Crestview's ownership in us after this offering see "Risk Factors — Risks Related to Our Organizational Structure — Marcus Lemonis, through his beneficial ownership of our shares directly or indirectly held by ML Acquisition and ML RV Group, has substantial control over us, including over decisions that require the approval of stockholders, and his interests, along with the interests of our other Continuing Equity Owners, in our business may conflict with yours" and "Principal and Selling Stockholders."

9

Shares of Class A common stock offered by us |

3,500,000 shares. | |

Shares of Class A common stock offered by the Selling Stockholders |

6,500,000 shares offered by (i) certain of the Continuing Equity Owners, following the redemption or exchange of their common units of CWGS, LLC in exchange for such shares of Class A common stock, and (ii) the Former Equity Owners. See "— Redemption rights of holders of common units" and "Principal and Selling Stockholders." |

|

Underwriters' option to purchase additional shares of Class A common stock from us |

525,000 shares. |

|

Underwriters' option to purchase additional shares of Class A common stock from the Selling Stockholders |

975,000 shares. |

|

Shares of Class A common stock to be outstanding immediately after this offering |

27,960,703 shares, representing 27.5% of the voting power and 100% of the economic interest in Camping World Holdings, Inc. (or 29,252,068 shares, representing 28.5% of the voting power and 100% of the economic interest in Camping World Holdings, Inc., if the underwriters exercise in full their option to purchase additional shares of Class A common stock). |

|

Shares of Class B common stock to be outstanding immediately after this offering |

56,893,631 shares, representing 67.5% of the voting power and no economic interest in Camping World Holdings, Inc. (or 56,127,266 shares, representing 66.5% of the voting power and no economic interest in Camping World Holdings, Inc., if the underwriters exercise in full their option to purchase additional shares of Class A common stock). All of the shares of Class B common stock to be outstanding immediately after this offering will continue to be owned by the Continuing Equity Owners (other than the Former Profit Unit Holders). |

|

Shares of Class C common stock to be outstanding immediately after this offering |

One share, representing 5% of the voting power and no economic interest in Camping World Holdings, Inc. |

|

Common units of CWGS, LLC to be held by us immediately after this offering |

27,960,703 common units, representing a 32.0% economic interest in the business of CWGS, LLC (or 29,252,068 common |

|

|

10

|

units, representing a 33.3% economic interest in the business of CWGS, LLC if the underwriters exercise in full their option to purchase additional shares of Class A common stock). |

|

Common units of CWGS, LLC to be held by the Continuing Equity Owners after this offering |

59,311,269 common units, representing a 68.0% economic interest in the business of CWGS, LLC (or 58,544,904 common units, representing a 66.7% economic interest in the business of CWGS, LLC if the underwriters exercise in full their option to purchase additional shares of Class A common stock). |

|

Ratio of shares of Class A common stock to common units |

Our certificate of incorporation and the CWGS LLC Agreement each require that we and CWGS, LLC at all times maintain a one-to-one ratio between the number of shares of Class A common stock issued by us and the number of common units of CWGS, LLC owned by us. |

|

Ratio of shares of Class B common stock to common units |

Our certificate of incorporation and the CWGS LLC Agreement each require that we and CWGS, LLC at all times maintain a one-to-one ratio between the number of shares of Class B common stock owned by the Continuing Equity Owners (other than the Former Profit Unit Holders) and the number of common units of CWGS, LLC owned by the Continuing Equity Owners (other than the Former Profit Unit Holders). |

|

Permitted holders of shares of Class B common stock |

Only the Continuing Equity Holders (other than the Former Profit Unit Holders) and their permitted transferees of common units as described herein are permitted to hold shares of our Class B common stock. Shares of Class B common stock are transferable only together with an equal number of common units of CWGS, LLC. See "Certain Relationships and Related Person Transactions — CWGS LLC Agreement." |

|

Permitted holders of shares of Class C common stock |

Only ML RV Group, as described herein, is permitted to hold our Class C common stock, and upon a Class C Change of Control (as defined herein under "Description of Capital Stock"), our Class C common stock shall no longer have any voting rights, such share of our Class C common stock will be cancelled for no consideration and will be retired, and we will not reissue such share of Class C common stock. |

|

Voting rights |

Holders of shares of our Class A common stock, our Class B common stock and our Class C common stock vote together as a single class on all matters presented to stockholders for their vote or approval, except as otherwise required by law or our amended and restated certificate of incorporation. Each share of |

|

|

11

|

Class A common stock and Class B common stock entitles its holders to one vote per share on all matters presented to our stockholders generally; provided that, for as long as the ML Related Parties, directly or indirectly, beneficially own in the aggregate 27.5% or more of all of the outstanding common units of CWGS, LLC, the shares of our Class B common stock held by the ML Related Parties entitle the ML Related Parties to the number of votes necessary such that the ML Related Parties, in the aggregate, cast 47% of the total votes eligible to be cast by all of our stockholders on all matters presented to a vote of our stockholders generally. |

|

|

Additionally, our one share of Class C common stock entitles ML RV Group, its holder, to the number of votes necessary such that the holder casts 5% of the total votes eligible to be cast by all of our stockholders on all matters presented to a vote of our stockholders generally for as long as there is no Class C Change of Control. For the definition of "Class C Change of Control," please see "Description of Capital Stock." Accordingly, Marcus Lemonis, through his beneficial ownership of our shares directly or indirectly held by ML Acquisition and ML RV Group, controls, and upon the consummation of this offering will continue to control, more than 50% of the voting power of our common stock and, subject to the voting agreement (the "Voting Agreement") we entered into with ML Acquisition, ML RV Group, CVRV Acquisition LLC and CVRV Acquisition II LLC in connection with our IPO, as described herein, may approve or disapprove substantially all transactions and other matters requiring approval by our stockholders, including the election of directors. |

|

Redemption rights of holders of common units |

The Continuing Equity Owners may from time to time, at each of their options, require CWGS, LLC to redeem all or a portion of their common units (59,311,269 common units outstanding immediately after this offering (or 58,544,904 common units outstanding immediately after this offering if the underwriters exercise in full their option to purchase additional shares of Class A common stock)) in exchange for, at our election (determined solely by our independent directors (within the meaning of the rules of the NYSE) who are disinterested), newly-issued shares of our Class A common stock on a one-for-one basis or a cash payment equal to a volume weighted average market price of one share of Class A common stock for each common unit redeemed, in each case in accordance with the terms of the CWGS LLC Agreement; provided that, at our election (determined solely by our independent directors (within the meaning of the rules of the NYSE) who are disinterested), we may effect a direct exchange of such Class A common stock or such cash, as applicable, for such common units. The Continuing Equity Owners may exercise such redemption right for as long as their common units remain outstanding. See |

|

|

12

|

under "Certain Relationships and Related Person Transactions — CWGS LLC Agreement — Common unit redemption right." Simultaneously with the payment of cash or shares of Class A common stock, as applicable, in connection with a redemption or exchange of common units pursuant to the terms of the CWGS LLC Agreement, a number of shares of our Class B common stock registered in the name of the redeeming or exchanging Continuing Equity Owner (other than Former Profit Unit Holders) will be cancelled for no consideration on a one-for-one basis with the number of common units so redeemed or exchanged. In order for a Continuing Equity Owner to participate in this offering as a Selling Stockholder, such Continuing Equity Owner will redeem a portion of its common units in accordance with the exchange procedures set forth in the CWGS LLC Agreement. In response to a redemption notice received from certain of the Selling Stockholders in connection with this offering, the Company has irrevocably elected to consummate the exchange through a direct exchange of such Selling Stockholder's common units for Class A common stock on a one-for-one basis, subject only to the Selling Stockholders entering into an underwriting agreement with the underwriters in connection with the offering, but not contingent on any specific purchase price. The Company expects that the exchange of common units for Class A common stock will occur after the pricing of this offering, but prior to the closing of this offering, and such Selling Stockholder's shares of Class B common stock will be cancelled on a one-for-one basis upon such issuance. As a result of the anticipated direct exchange of common units for shares of Class A common stock, the number of common units owned by Camping World Holdings, Inc. will correspondingly increase. See under "Certain Relationships and Related Person Transactions — CWGS LLC Agreement — Common unit redemption right." |

|

Use of proceeds |

We estimate, based upon an assumed public offering price of $29.37 per share (the last reported sale price of our Class A common stock on the NYSE on May 19, 2017), that we will receive net proceeds from this offering of approximately $97.8 million (or $112.6 million if the underwriters exercise their option in full to purchase additional shares of Class A common stock), after deducting estimated underwriting discounts and commissions and estimated offering expenses payable by us. We intend to use the net proceeds from this offering to purchase 3,500,000 common units (or 4,025,000 common units if the underwriters exercise their option in full to purchase additional shares of Class A common stock) directly from CWGS, LLC at a price per unit equal to the public offering price per share of Class A common stock in this offering, less the underwriting discounts and commissions. CWGS, LLC intends to use the net proceeds from the sale of common units to Camping World |

|

|

13

|

Holdings, Inc. for general corporate purposes, including the funding of the Gander Mountain Acquisition, including the related re-opening and initial working capital needs of our current goal to operate 70 or more retail locations and certain liabilities that we will assume in connection therewith, as described under "— Recent Developments — Gander Mountain Acquisition," and the acquisition of RV dealerships. This offering is not conditioned on the closing of the Gander Mountain Acquisition and we cannot assure you that the Gander Mountain Acquisition will be completed on the terms described herein or at all. See "Risk Factors — Risks Related to the Gander Mountain Acquisition." |

|

|

We will not receive any of the proceeds from the sale of shares of Class A common stock offered by the Selling Stockholders. See "Use of Proceeds." |

|

Dividend policy |

CWGS, LLC has made a regular quarterly cash distribution to its common unit holders of approximately $0.08 per common unit, and CWGS, LLC intends to continue to make such quarterly cash distributions, and we intend to use all of the proceeds from such distribution on our common units to pay a regular quarterly cash dividend of approximately $0.08 per share on our Class A common stock, subject to our discretion as the sole managing member of CWGS, LLC and the discretion of our board of directors. In addition, we have paid, and currently intend to continue to pay, a special cash dividend of all or a portion of the Excess Tax Distribution (as defined under "Dividend Policy") to the holders of our Class A common stock from time to time subject to the discretion of our board of directors as described under "Dividend Policy." For additional information on our payments of dividends, see "Dividend Policy." |

|

|

Our ability to pay cash dividends on our Class A common stock depends on, among other things, our results of operations, financial condition, level of indebtedness, capital requirements, contractual restrictions, restrictions in our debt agreements and in any preferred stock, our business prospects and other factors that our board of directors may deem relevant. Additionally, our ability to distribute any Excess Tax Distribution will also be subject to no early termination or amendment of the tax receivable agreement (the "Tax Receivable Agreement") that we entered into with CWGS, LLC, each of the Continuing Equity Owners and Crestview Partners II GP, L.P. in connection with our IPO, as well as the amount of tax distributions actually paid to us and our actual tax liability. Furthermore, because we are a holding company, our ability to pay cash dividends on our Class A common stock depends on our receipt of cash distributions from CWGS, LLC and, through CWGS, LLC, cash distributions and dividends from its operating subsidiaries, which may further restrict our ability to pay dividends as a result of the laws of their jurisdiction of organization, agreements of our subsidiaries or covenants under any existing and future |

|

|

14

|