Attached files

| file | filename |

|---|---|

| EX-23.1 - EX-23.1 - WideOpenWest, Inc. | a2232183zex-23_1.htm |

| EX-10.20 - EX-10.20 - WideOpenWest, Inc. | a2232183zex-10_20.htm |

| EX-10.15 - EX-10.15 - WideOpenWest, Inc. | a2232183zex-10_15.htm |

| EX-5.1 - EX-5.1 - WideOpenWest, Inc. | a2232183zex-5_1.htm |

| EX-1.1 - EX-1.1 - WideOpenWest, Inc. | a2232183zex-1_1.htm |

Use these links to rapidly review the document

TABLE OF CONTENTS

INDEX TO CONSOLIDATED FINANCIAL STATEMENTS

As filed with the Securities and Exchange Commission on May 19, 2017

No. 333-216894

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 4

to

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

WideOpenWest, Inc.

(Exact name of registrant as specified in its charter)

| Delaware (State or other jurisdiction of incorporation or organization) |

4841 (Primary Standard Industrial Classification Code Number) |

46-0552948 (I.R.S. Employer Identification No.) |

7887 East Belleview Avenue, Suite 1000

Englewood, Colorado 80111

(720) 479-3500

(Address, including zip code, and telephone number, including area code, of registrant's principal executive offices)

Craig Martin

General Counsel

7887 East Belleview Avenue, Suite 1000

Englewood, Colorado 80111

(720) 479-3500

(Name, address, including zip code, and telephone number, including area code, of agent for service)

| With copies to: | ||

Joshua N. Korff, P.C. Brian Hecht Kirkland & Ellis LLP 601 Lexington Avenue New York, New York 10022 (212) 446-4800 |

Richard D. Truesdell, Jr. Shane Tintle Davis Polk & Wardwell LLP 450 Lexington Avenue New York, New York 10017 (212) 450-4000 |

|

Approximate date of commencement of proposed sale to the public:

As soon as practicable after this Registration Statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box: o

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of "large accelerated filer," "accelerated filer," "smaller reporting company," and "emerging growth company" in Rule 12b-2 of the Exchange Act.

Large accelerated filer o |

Accelerated filer o |

Non-accelerated filer ý (Do not check if a smaller reporting company) |

Smaller reporting company o Emerging growth company o |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. o

CALCULATION OF REGISTRATION FEE

|

||||||||

| Title of Each Class of Securities to be Registered |

Amount to be Registered |

Estimated Maximum Offering Price Per Share |

Proposed Maximum Aggregate Offering Price(1)(2) |

Amount of Registration Fee |

||||

|---|---|---|---|---|---|---|---|---|

Common Stock, $0.01 par value per share |

21,904,761(1) | $22.00(2) | $481,904,742 | $55,852(3) | ||||

|

||||||||

- (1)

- Includes

the offering price of any additional shares of common stock that the underwriters have the option to purchase.

- (2)

- Estimated

solely for the purpose of calculating the registration fee pursuant to Rule 457(a) under the Securities Act of 1933, as amended.

- (3)

- $55,852 previously paid.

The registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until this Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities nor a solicitation of an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

Subject to Completion, dated May 19, 2017

PRELIMINARY PROSPECTUS

19,047,619 Shares

WideOpenWest, Inc.

Common Stock

This is the initial public offering of shares of common stock of WideOpenWest, Inc. We are offering 19,047,619 shares of our common stock.

Prior to this offering, there has been no public market for our common stock. The initial public offering price per share of our common stock is expected to be between $20.00 and $22.00. We have received approval to list our common stock on the New York Stock Exchange under the symbol "WOW." Upon completion of this offering, we expect to be a "controlled company" as defined under the corporate governance rules of the New York Stock Exchange.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

Investing in our common stock involves risks. See "Risk Factors" beginning on page 16.

|

||||

| |

Per Share |

Total |

||

|---|---|---|---|---|

Price to public |

$ | $ | ||

Underwriting discounts and commissions(1) |

$ | $ | ||

Proceeds, before expenses, to us |

$ | $ | ||

|

||||

- (1)

- See also "Underwriting" for a description of underwriting compensation in connection with this offering.

The underwriters have an option to purchase up to 2,857,142 additional shares from the selling stockholders named in this prospectus at the initial public offering price, less the underwriting discount. The underwriters can exercise this option at any time and from time to time within 30 days from the date of this prospectus.

Delivery of the shares of common stock will be made on or about , 2017.

Joint Book-Running Managers

| UBS Investment Bank | Credit Suisse |

| RBC Capital Markets | SunTrust Robinson Humphrey | Evercore ISI | Macquarie Capital |

Co-Managers

| LionTree | Raymond James |

The date of this prospectus is , 2017.

We have not and the selling stockholders and the underwriters have not authorized anyone to provide you with any information other than that contained in this prospectus or in any free writing prospectus prepared by or on behalf of us or to which we have referred you. We, the selling stockholders and the underwriters take no responsibility for, and can provide no assurance as to the reliability of, any information that others may give you. We and the selling stockholders are offering to sell, and seeking offers to buy, shares of our common stock only in jurisdictions where such offers and sales are permitted. The information in this prospectus or any free writing prospectus is accurate only as of its date, regardless of its time of delivery or the time of any sale of shares of our common stock. Our business, financial condition, results of operations and prospects may have changed since that date.

MARKET, RANKING AND OTHER INDUSTRY DATA

In this prospectus, we refer to information regarding market data obtained from internal sources, market research, publicly available information and industry publications. Estimates are inherently uncertain, involve risks and uncertainties and are subject to change based on various factors, including those discussed under the heading "Risk Factors" in this prospectus. We believe that these sources and estimates are reliable as of the date of this prospectus but have not independently verified them and cannot guarantee their accuracy or completeness.

i

TRADEMARKS, SERVICE MARKS, TRADE NAMES AND COPYRIGHTS

We do not own, either legally or beneficially, any trademarks, service marks or trade names in connection with the operation of our business. We own or have rights to copyrights that protect the content of our products. This prospectus may also contain trademarks, service marks, trade names and copyrights of other companies, which are the property of their respective owners. Solely for convenience, the trademarks, service marks, trade names and copyrights referred to in this prospectus may be listed without the TM, SM, © and ® symbols, but we will assert, to the fullest extent under applicable law, our rights or the rights of the applicable licensors, if any, to these trademarks, service marks, trade names and copyrights.

We use certain financial measures in this prospectus such as Revenue Including Acquisitions and Dispositions, Adjusted EBITDA, Transaction Adjusted EBITDA, Transaction Adjusted Capital Expenditures and incremental contribution, which are not recognized under generally accepted accounting principles or "GAAP."

Revenue Including Acquisitions and Dispositions is included in this prospectus because it is a key metric used by management and our Board of Directors to assess our financial performance. We define Revenue Including Acquisitions and Dispositions as revenue after giving effect to certain acquisitions and divestitures made by the Company. We believe that Revenue Including Acquisitions and Dispositions is an appropriate measure of operating performance because it is meaningful to investors by showing how certain acquisitions and divestitures might have affected the Company's historical financial statements.

The presentation of Revenue Including Acquisitions and Dispositions is not made in accordance with GAAP and our use of the term Revenue Including Acquisitions and Dispositions in this prospectus varies from the use of similar terms by other companies in our industry due to different methods of calculation and is not necessarily comparable. Revenue Including Acquisitions and Dispositions should not be considered as an alternative to revenue or any other performance measures derived in accordance with GAAP as measures of operating performance.

For a reconciliation of revenue to Revenue Including Acquisitions and Dispositions, see "Prospectus Summary—Summary Historical Combined Consolidated Financial Data."

Adjusted EBITDA is included in this prospectus because it is a key metric used by management and our Board of Directors to assess our financial performance. We believe that Adjusted EBITDA is an appropriate measure of operating performance because it eliminates the impact of expenses that do not relate to business performance, and that the presentation of this measure enhances an investor's understanding of our financial performance. Transaction Adjusted EBITDA makes certain additional adjustments to the historical financial information that the Company believes is meaningful to investors by showing how certain acquisitions and divestitures might have affected the Company's historical financial statements.

We define Adjusted EBITDA as net income (loss) before net interest expense, income taxes, depreciation and amortization (including impairments), gains (losses) realized and unrealized on derivative instruments, management fees to related parties, the write up or write off of any asset, debt modification expenses, loss on extinguishment of debt, integration and restructuring expenses, all non-cash charges and expenses (including equity-based compensation expense) and certain other income and expenses, as further defined in our Senior Secured Credit Facilities (as defined herein). Transaction Adjusted EBITDA represents Adjusted EBITDA after giving effect to the impact of acquisitions and dispositions that were completed during the relevant periods as if they occurred at the beginning of the period presented.

ii

The presentation of Adjusted EBITDA and Transaction Adjusted EBITDA is not made in accordance with GAAP and our use of the terms Adjusted EBITDA and Transaction Adjusted EBITDA in this prospectus varies from the use of similar terms by other companies in our industry due to different methods of calculation and are not necessarily comparable. Adjusted EBITDA and Transaction Adjusted EBITDA should not be considered as alternatives to net income, operating income or any other performance measures derived in accordance with GAAP as measures of operating performance.

Adjusted EBITDA and Transaction Adjusted EBITDA have important limitations as analytical tools and you should not consider them in isolation or as substitutes for the analysis of our results as reported under GAAP. For example, Adjusted EBITDA and Transaction Adjusted EBITDA:

- •

- do not reflect any cash capital expenditure requirements for the assets being depreciated and amortized that may have to be replaced in the

future;

- •

- do not reflect changes in, or cash requirements for, our working capital needs;

- •

- do not reflect the impact of certain cash charges resulting from matters we consider not to be indicative of our ongoing operations;

- •

- do not reflect the significant interest expense or the cash requirements necessary to service interest or principal payments on our debt;

- •

- do not reflect stock-based compensation expense and other non-cash charges; and

- •

- exclude certain tax payments that may represent a reduction in cash available to us.

For a reconciliation of net income (loss) to Adjusted EBITDA and Transaction Adjusted EBITDA, see "Prospectus Summary—Summary Historical Combined Consolidated Financial Data."

Transaction Adjusted Capital Expenditures is included in this prospectus because it is a key metric used by management and our Board of Directors to assess our financial performance. We define Transaction Adjusted Capital Expenditures as capital expenditures after giving effect to certain acquisitions and divestitures made by the Company. We believe that Transaction Adjusted Capital Expenditures is an appropriate measure of operating performance because it is meaningful to investors by showing how certain acquisitions and divestitures might have affected the Company's historical financial statements.

The presentation of Transaction Adjusted Capital Expenditures is not made in accordance with GAAP and our use of the term Transaction Adjusted Capital Expenditures in this prospectus varies from the use of similar terms by other companies in our industry due to different methods of calculation and is not necessarily comparable. Transaction Adjusted Capital Expenditures should not be considered as an alternative to capital expenditures or any other performance measures derived in accordance with GAAP as measures of operating performance.

For a reconciliation of capital expenditures to Transaction Adjusted Capital Expenditures, see "Prospectus Summary—Summary Historical Combined Consolidated Financial Data."

Incremental contribution is included herein because we believe that it is a key metric used by our management to assess the financial performance of the business by showing how the relative relationship of the various components of subscription services contributes to our overall consolidated historical results. Our management further believes that it provides useful information to investors in evaluating our financial condition and results of operations because the additional detail illustrates how an incremental dollar of revenue, by particular service type, generates cash, before any unallocated costs are considered, which we believe is a key component of our overall strategy and important for understanding what drives our cash flow position relative to our historical results. We believe that when evaluating our business, investors apply varying degrees of importance to the different types of

iii

subscription revenue we generate and providing supplemental detail on these services, as well as third party costs associated with each service, is useful to investors because it allows investors to better evaluate these aspects of our performance. Incremental contribution is defined by WOW! as the components of subscription revenue, less costs directly incurred from third parties in connection with the provision of such services to our customers.

Incremental contribution is not made in accordance with GAAP and our use of the term incremental contribution varies from others in our industry. Incremental contribution has important limitations as an analytical tool and you should not consider it in isolation or as a substitute for analysis of our results as reported under GAAP as it does not identify or allocate any other operating costs and expenses that are components of our Income from Operations to specific subscription revenues as we do not measure or record such costs and expenses in a manner that would allow attribution to a specific component of subscription revenue. Accordingly, incremental contribution should not be considered as an alternative to operating income or any other performance measures derived in accordance with GAAP as measures of operating performance or operating cash flows, or as measures of liquidity.

For a reconciliation of incremental contribution to Income from Operations, see "Management's Discussion and Analysis of Financial Condition and Results of Operations."

iv

The following summary highlights information appearing elsewhere in this prospectus. This summary does not contain all of the information you should consider before investing in our common stock. You should read this entire prospectus carefully. In particular, you should read the sections entitled "Risk Factors" and "Management's Discussion and Analysis of Financial Condition and Results of Operations" and the consolidated financial statements and the notes relating to those statements included elsewhere in this prospectus. Some of the statements in this prospectus constitute forward-looking statements. See "Forward-Looking Statements."

In this prospectus, unless the context requires otherwise, "we," "us," "our," "WOW!" and the "Company" refer to WideOpenWest, Inc. and its consolidated subsidiaries. "Parent" refers to WideOpenWest Holdings, LLC, our indirect parent company.

All statistical and operating information in this section gives effect to the acquisitions of Bluemile, Anne Arundel Broadband and NuLink and the divestitures of the South Dakota systems and Lawrence, Kansas system, except as otherwise noted. For additional detail on these transactions, see "—Summary Historical Combined Consolidated Financial Data."

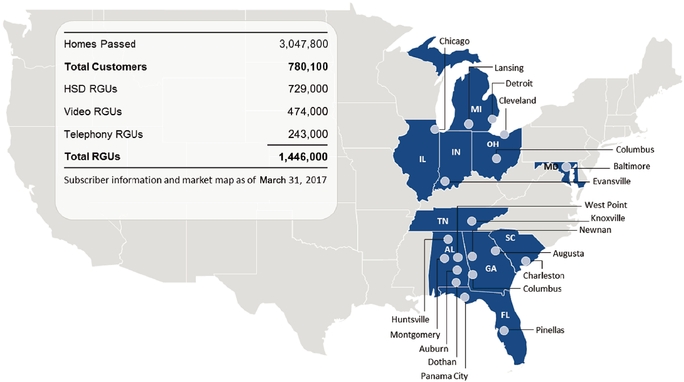

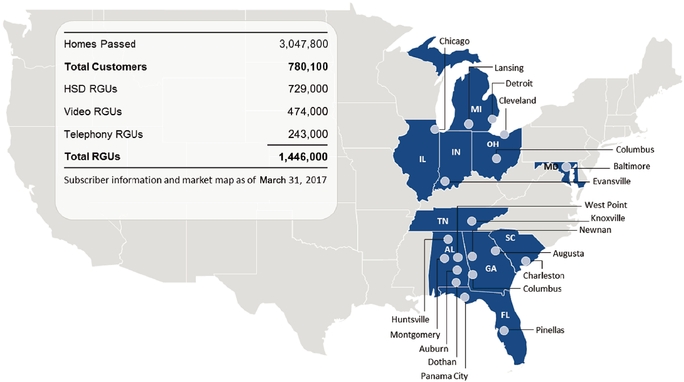

Overview

We are the sixth largest cable operator in the United States ranked by number of customers as of December 31, 2016. We provide high-speed data ("HSD"), cable television ("Video"), Voice over IP-based telephony ("Telephony") and business-class services to a service area that includes approximately 3.0 million homes and businesses. Our services are delivered across 19 markets via our advanced hybrid fiber-coaxial ("HFC") cable network. Our footprint covers over 300 communities in the states of Alabama, Florida, Georgia, Illinois, Indiana, Maryland, Michigan, Ohio, South Carolina and Tennessee. Led by our robust HSD offering, our products are available either as a bundle or as an individual service to residential and business services customers. As of March 31, 2017, 780,100 customers subscribed to our services.

We believe we have one of the most technologically advanced, fiber-rich networks in our service areas, with approximately 11,500 route miles of intra- and inter-market fiber and approximately 33,500 miles of coaxial cable. We have designed our network with the goal of maximizing Internet speeds and accommodating future broadband demand. Our all-digital HFC infrastructure operates with a bandwidth capacity of 750 Mhz or higher in 97% of our footprint and is upgradeable to 1.2 Ghz throughout. All of our new communities are built with a capacity of 1.2 Ghz. Our HFC network is fully upgraded with Data Over Cable Service Interface Specification ("DOCSIS") 3.0 and is capable of being upgraded to DOCSIS 3.1 in all of our markets. According to CableLabs, a non-profit innovation and research and development lab founded by members of the cable industry, DOCSIS 3.1 technology has the capacity to support network speeds up to 10 Gbps downstream and up to 1 Gbps upstream. We serve an average of 310 homes per distribution point, which are also referred to as nodes, enabling us to deliver quality HSD service and the capability to provide broadband speeds of 1 Gbps and higher. Our HFC network consists of a high-bandwidth, multi-use service provider backbone, which allows us to centrally source data, voice and video services for both residential and business traffic. We believe the quality and uniform architecture of our next-generation network is a competitive advantage that enables us to offer high-quality broadband services that meet our current and future customers' needs without incurring significant upgrade capital expenditures.

We operate primarily in economically stable suburbs that are adjacent to large metropolitan areas as well as secondary and tertiary markets, which we believe have favorable competitive and demographic profiles and include businesses operating across a range of industries. We benefit from the ability to augment our footprint by pursuing value-accretive network extensions ("edge-outs") to

1

increase our addressable market and grow our customer base. We have historically made selective capital investments in edge-outs to facilitate growth in residential and business services. Additionally, we provide a range of services to small, medium and large businesses within our footprint, and we believe we have the opportunity to grow our business services market share with our robust product suite.

Attractive Markets with Favorable Competitive Dynamics

Note: "RGUs" represent Revenue Generating Units.

We are focused on efficient capital spending and maximizing Adjusted EBITDA through an Internet-centric growth strategy while maintaining a profitable video subscriber base. Based on its per subscriber economics, we believe that HSD represents the greatest opportunity to drive increased profitability across our residential and business markets. According to Cisco, North America has experienced significant growth in bandwidth usage in recent years, driven primarily by (i) over-the-top video ("OTT") viewership trends, (ii) a proliferation of connected devices, and (iii) increased customer demand for high-bandwidth business applications, including cloud computing. We believe our superior network infrastructure provides an efficient, scalable platform to meet our current and future customers' needs and deliver services as demand for bandwidth continues to increase. Data compiled by Kagan demonstrates that cable operators have enjoyed an increasing share of new broadband subscribers since 2010, while telephone companies have seen their share of these customers decline year over year. Also based on data compiled by Kagan, from the quarter ended June 30, 2015 through the quarter ended September 30, 2016, the cable industry has captured in excess of a 95% share of wired broadband net subscriber growth in each quarter. We believe the cable industry's net broadband share growth is indicative of a superior product offering relative to other HSD technologies, such as the digital subscriber line ("DSL") network architecture often utilized in whole or in part by telephone companies.

2

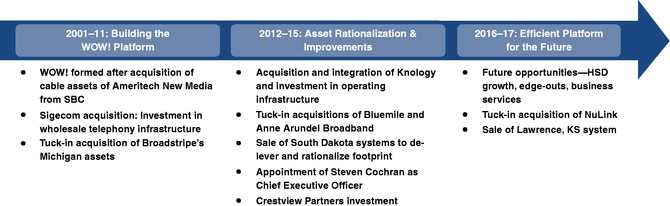

Our History

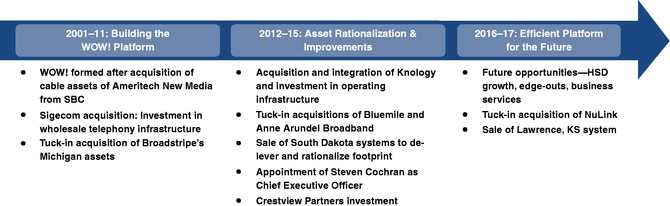

Since commencing operations in 2001, our focus has been to offer a competitive alternative cable service and establish a brand with a strong market position. We have scaled our business through (i) organic subscriber growth and increased penetration within our existing markets and footprint, (ii) edge-outs to grow our footprint, (iii) upgrades to introduce enhanced broadband services to networks we have acquired, (iv) entry into business services, with a broad range of HSD, Video and Telephony products, and (v) acquisitions and integration of cable systems.

WOW!'s Evolution Over Time

After a period of strong growth from 2001 through 2011, we shifted our focus to integrating our acquisitions and strengthening our product offering. Debt service costs associated with the Knology acquisition and capital expenditures necessary for network priorities and integration limited further investment in edge-outs and other growth opportunities through 2015. Through organic growth, normalization of capital expenditures, de-levering and interest cost reduction, we have increased free cash flow generation and renewed our focus on edge-outs and business services. As a result of a stronger balance sheet, we believe we are better positioned to accelerate our growth investments in a meaningful way going forward. The investments we have made in our platform have resulted in overall customer and HSD subscriber growth for the year ended December 31, 2016.

Our Strengths

We believe the following core competitive strengths enable us to differentiate ourselves:

Technologically Advanced Platform that Underpins our Competitive Advantage

Our all-digital, fiber-rich HFC network has a bandwidth capacity of 750 Mhz or higher in 97% of our footprint and is upgradeable throughout the network to 1.2 Ghz to accommodate future broadband demand. The infrastructure is currently operating on DOCSIS 3.0, is capable of being upgraded to DOCSIS 3.1 and serves approximately 310 homes per node. We offer HSD speeds up to 500 Mbps in 94% of our footprint with the capability to offer 1 Gbps or more in all of our markets. In the fourth quarter of 2016, we launched a 1 Gbps offering in four of our markets, with additional market launches planned for 2017 in our edge-out communities. Over the twelve months ended February 28, 2017, our average monthly Internet speed ranking was second out of 62 cable, fiber, DSL, wireless and satellite Internet service providers, or ISPs, according to Netflix's USA ISP Speed Index.

We offer a full suite of digital video services, including video-on-demand ("VOD"), high-definition video and digital video recording ("DVR"). In approximately 79% of our footprint, we also offer our "Ultra" video product, which is a technologically advanced, Internet protocol ("IP") enabled, whole-home DVR solution that integrates traditional linear video, an advanced user interface and direct access to OTT content, such as Netflix and other applications.

3

Our technologically advanced network enables us to provide business services customers with a broad portfolio of carrier-class data and voice services, including Direct Internet Access, Ethernet over fiber and HFC, virtual private networks, Hosted Voice over Internet Protocol ("VoIP") solutions, wholesale fiber connectivity, cell backhaul solutions, disaster recovery, cloud back-up and Session Initiated Protocol ("SIP") and Primary Rate Interface ("PRI") trunking services. Our advanced business services product offering continues to evolve, as we leverage our investment in next generation software enabled infrastructure to launch new services such as a full suite of managed and other virtual services.

We expect future network-related capital expenditures to be generally stable. We believe that our flexible network architecture will allow us to meet our current and future customers' needs without incurring significant upgrade capital expenditures.

Value-Accretive Edge-Outs

We have a proven track record of successful edge-outs. Through network extensions to adjacent communities and increased customer penetration levels over time within these communities, we have increased the number of residential and business services customers that we serve. For the year ended December 31, 2016, we added approximately 8,900 customers from our edge-outs activated in 2016. We have experienced success in this strategy by targeting communities that we believe possess attractive demographic and competitive profiles, making capital-efficient decisions and leveraging our existing operating infrastructure. We have identified a large number of communities near our footprint for edge-out expansion, and believe edge-out expansion has a self-perpetuating effect as each community adjacent to a new edge-out investment presents further expansion opportunities.

Between 2008 and 2012, we extended our network to over 100,000 new homes passed through edge-outs. During 2016, we expanded our network footprint by approximately 38,000 homes passed in five markets and achieved average customer penetration levels of 23% over an average activation period of 157 days as of December 31, 2016. The edge-outs that we activated in 2016 are continuing to experience net additions, and we expect an increase in penetration levels as they reach full maturity. We continue to selectively evaluate and invest in edge-out opportunities within our markets and believe we are well-positioned based on our historical track record of success in edge-out expansion.

Business Services Capabilities

We offer integrated solutions for businesses, including Direct Internet Access, Ethernet over fiber and HFC, hosted and on-premise VoIP solutions, metro Ethernet services, wholesale fiber connectivity, cell backhaul solutions and SIP and PRI trunking services. Recognizing the opportunity in our markets, we have built the necessary infrastructure, processes and sales and support organizations to scale our business services offering. Supported by our robust network, we have developed a full suite of products for small, medium and large businesses within our footprint, including enhanced telephony services and data speeds of up to 10 Gbps. We have built a consistent sales practice across our business services organization while ensuring product competitiveness and local knowledge to drive market share gain. We utilize multiple distribution channels, including direct sales, wholesale and indirect sales to capture opportunities across a variety of customer segments. Additional products within our portfolio include virtual private networks, a complete line of colocation infrastructure, cloud computing, managed backup and disaster recovery services.

We have also made significant investments in our fiber network in the Chicago area. Since 2014, we have constructed approximately 1,200 miles of fiber in this market, providing connectivity to more than 500 macro and small cell sites as part of a fiber construction project for a leading wireless carrier. While a meaningful portion of the fiber network in this area is under a long-term contract to this carrier, there is significant capacity on the network that we expect will support future growth. As a result, we believe there is considerable embedded value in this asset.

4

Strong execution has supported our business services expansion to date and will enable us to execute on our growth strategy. We have built substantial scale within our platform, with business services revenues of $154.7 million and $123.7 million for the years ended December 31, 2016 and December 31, 2015, respectively. Excluding pass-through revenues related to our Chicago fiber construction project of $13.7 million and $0.3 million in 2016 and 2015, respectively, for the year ended December 31, 2016 business services revenues grew 14.3% from the year ended December 31, 2015.

Attractive Geographic Footprint and Favorable Competitive Dynamics

Our customers are located primarily in economically stable suburbs adjacent to large metropolitan areas, as well as secondary and tertiary markets, in the Midwest and Southeast United States. Our typical market possesses what we believe to be an advantageous mix of size and geographical position with favorable competitive dynamics and demographics, and includes a number of businesses operating across a range of industries. We believe our network footprint insulates us from heightened competition typical of major metropolitan centers. In addition, the diversity of WOW!'s geographic footprint enables us to mitigate the impact of economic downturns our business could face in a particular region.

Within our geographical areas, we believe we are typically one of the top two providers of HSD and Video services. We have a proven track record of winning customers from other operators by providing superior HSD product offerings, focusing on local marketing efforts, offering competitive pricing and delivering strong customer service while leveraging our advanced network.

Based on homes passed, we estimate approximately 53% and 39% of our footprint overlaps with Comcast Corp. and Charter, respectively. We estimate systems formerly owned by Time Warner Cable and Bright House Networks (recently acquired by Charter) overlap with approximately 33% of our homes passed. We believe competitive dynamics with telephone companies are favorable in our markets. We estimate that AT&T Corp's U-verse offering is available in approximately 63% of our footprint based on homes passed. We believe competitive dynamics with AT&T U-verse are favorable for WOW!, as AT&T U-verse's network architecture is a mix of fiber and DSL in several markets. Competition from Verizon FiOS and Frontier Communications is estimated to be 3.5% and 2.7% of our overall footprint, respectively.

Strong Financial Performance Benefiting from the Mix Shift to HSD

Our margin profile is driven by an increase in HSD revenues, which benefit from higher margins and our focus on preserving the profitability of our Video customers, which has resulted in increases in Video average revenue per user ("ARPU"). For the year ended December 31, 2016, HSD revenues represented approximately 30.2% of our total revenues and 45.4% of our incremental contribution. In comparison, Video represented 44.2% of our total revenues and 23.9% of our incremental contribution over the same period. High content costs associated with the distribution of Video services are the key driver of the increasing divergence in profitability of HSD and Video. As a result of our continued customer mix shifting to HSD, we believe we will benefit from higher free cash flow conversion and margin expansion because HSD requires lower capital expenditures and operating expenses relative to Video.

For the year ended December 31, 2016, we generated Revenue of $1,237.0 million, which represented a reduction of $27.3 million over the year ended December 31, 2014. The Company completed certain key acquisitions and divestitures during the two-year period ended December 31, 2016 which impacted reported Revenues. For the year ended December 31, 2016, we generated approximately $1,208.4 million of Revenue Including Acquisitions and Dispositions, which represented an increase of $22.1 million, or 0.9%, on an annualized basis over the year ended December 31, 2014. See "—Summary Historical Combined Consolidated Financial Data" for a reconciliation of Revenue to Revenue Including Acquisitions and Dispositions.

5

For the year ended December 31, 2016, we generated net income of $26.3 million, which represented a $53.6 million improvement over the year ended December 31, 2014, and approximately $445.7 million of Transaction Adjusted EBITDA, which represented an increase of $47.2 million, or 5.8%, on an annualized basis over the year ended December 31, 2014. See "—Summary Historical Combined Consolidated Financial Data" for a reconciliation of net income (loss) to Transaction Adjusted EBITDA.

Operating Philosophy Founded on a Superior Customer Experience

We compete strategically by adhering to our operating philosophy, which is: "To deliver an employee and customer experience that lives up to our name." The ongoing pursuit of this philosophy has a strong foundation in the WOW! culture that has been cultivated over time and focuses our organization on four core values: (i) respect: treat others as you wish to be treated; (ii) integrity: choose to do what is right; (iii) servanthood: embracing the attitude and honor of serving others rather than being served; and (iv) ownership: act with thought and a focus on the collective good.

We believe that servanthood in particular is unique to WOW! and exemplifies our commitment to the customer experience—that "how" we treat our customers is just as important as "what" we provide them and ultimately is how we earn customer loyalty. This mindset is what drives our operating philosophy and we believe compels employees and customers alike to choose WOW!.

Strong and Experienced Management Team

Our management team is comprised of senior executives who have significant experience in the telecommunications industry, with an average tenure of seven years with the Company and approximately 24 years of relevant industry experience. Our management team has collaborated to establish WOW!'s unique culture and execute on the Company's operating philosophy and commitment to the customer experience. The team's track record of success has translated into numerous independent awards and recognitions. We have been (i) ranked highest in customer satisfaction by J.D. Power and Associates 21 times in the last twelve years, (ii) rated highest by Consumer Reports fifteen times in the last eight years, and (iii) recognized by PC Magazine with the Reader's Choice Award five times in the last six years. Our management team has substantial experience in deploying new products and services and has successfully guided WOW! through various business cycles. In addition, our management team has considerable experience in successfully identifying and completing edge-outs and acquiring and integrating cable assets.

Our Strategy

The key components of our strategy are as follows:

Focus on Highly Profitable Internet-Centric Products

Driven by the increased Internet needs of our customers, we believe we will continue to experience strong demand for HSD services within our markets. The growth of bandwidth-intensive applications, such as mobile and social media applications, OTT video and cloud-based computing, and the proliferation of connected devices, are expected to continue to drive rapidly-increasing consumption of data. We intend to capitalize on these favorable industry trends by continuing to focus on HSD customer growth via increased penetration, driving a greater mix shift toward higher-margin HSD and business services products and transitioning customers to higher-priced HSD speed tiers. While we will continue to provide a robust Video product to satisfy the needs of our bundled customers, our strategy is to maintain profitability by increasing Video pricing in the face of rising content costs. For customers who value the Video product, our marketing approach is to drive adoption of HSD-centric bundles.

The growth of our HSD business is driven by our ability to offer a range of speeds, packaged and bundled at a competitive value and provisioned to deliver a consistent and high-quality experience. We

6

provide market-leading speed tiers of 10 Mbps, 100 Mbps, 500 Mbps and 1 Gbps. This "good, better, best" approach provides competitive speed and price-value differentiation while simplifying the overall customer value proposition. Our fiber-rich HFC network is fully DOCSIS 3.1-capable, allowing us to remain highly competitive as our customers' bandwidth needs evolve. In addition, we believe that new product development of HSD-adjacent services provides an opportunity for additional growth. Our existing infrastructure enables us to drive new product development initiatives, which could include home security, home automation and other Internet of Things services in the future.

Accelerate Investment in Highly Accretive Network Edge-Out Builds

We believe edge-outs are an attractive investment opportunity available to WOW!. We have a track record of successfully identifying and expanding our network in a cost-effective manner to new communities and acquiring residential and business services customers. We believe that capital expenditures and operating costs for edge-outs are inherently lower relative to a new greenfield build because we are able to leverage our existing infrastructure and operating platforms to extend our network to communities adjacent to and near our existing footprint. Management evaluates potential edge-out opportunities based on the expected average acquired customer's annual Adjusted EBITDA contribution from such projects relative to the anticipated required capital expenditures. An edge-out project generally consists of a construction phase of twelve months or less, during which we incur capital expenditures. As the edge-out project is completed and we begin providing services to customers, we generally increase customer penetration and the average investment per acquired customer declines. Based on edge-outs activated in 2016 and customer penetration through December 31, 2016, our average capital expenditures per acquired customer represent a mid-single digit multiple of our average customer's annual Adjusted EBITDA contribution. As our edge-outs mature, penetration generally increases over time, and as a result, we expect this multiple to decrease.

We continue to evaluate new opportunities for edge-outs to increase our residential and business footprint. Edge-outs are expected to add approximately 72,000 homes passed in 2017, and we have identified additional edge-out opportunities that we expect will be prioritized and built over the next several years. We believe that the overall edge-out opportunity within our network extends beyond what we have identified and will continue to expand as we gain access to new adjacent communities.

Drive Growth in Business Services Market Opportunity

We believe that business services represent a substantial growth area for WOW! and we have made significant investments in our network and product capabilities to address these opportunities. We believe that we have a significant market penetration growth opportunity in several of our markets, including those in the Midwest and Florida, and that our advanced network positions us to capitalize on the substantial business services opportunity within our footprint. We believe we have developed the product suite and sales expertise to continue to gain share with the small, medium and large businesses we target within our footprint. We estimate there is an approximately $1.3 billion addressable revenue opportunity across our markets. We believe that a substantial part of our target customer base is served by legacy DSL technologies, creating a clear competitive advantage and market opportunity for our HFC-based cable HSD services. We have built substantial scale within our platform, with business services revenues of $154.7 million and $123.7 million for the years ended December 31, 2016 and December 31, 2015, respectively. Excluding pass-through revenues related to our Chicago fiber construction project of $13.7 million and $0.3 million in 2016 and 2015, respectively, for the year ended December 31, 2016 business services revenues grew 14.3% from the year ended December 31, 2015. We design our networks with additional capacity so that increased bandwidth can be deployed economically and efficiently, allowing us to address our current and future customers' demand. We believe that our robust, customer-centric solutions, experienced sales organization and strong product capabilities have supported our expansion in the business services market and will help us execute on our growth strategy.

7

Accelerate Free Cash Flow Generation

We believe we will achieve accelerating free cash flow generation, which will allow us to continue to pursue enhanced, disciplined levels of investment in our edge-out and business services investment opportunities. We expect growth in income from operations and Adjusted EBITDA to exceed revenue growth over time, benefiting from the mix shift to HSD, the transition of customers to higher-priced HSD speed tiers and the management of Video customer profitability. We also expect the mix shift to drive a reduction in our capital expenditures relative to our revenues over time. We expect our near-term federal corporate income tax payments to be minimal given our federal net operating loss ("NOL") balance of $833.8 million as of December 31, 2016. See "Risk Factors—Our ability to use our net operating losses to offset future taxable income may be subject to certain limitations."

Continue Identifying and Successfully Integrating Acquisitions

We expect to evaluate and pursue opportunistic tuck-in acquisitions. We have acquired six cable companies since 2006. We believe that we have consistently demonstrated an ability to acquire and integrate companies, realize cost synergies and increase the profitability of these businesses post-close. We have pursued these acquisitions for a variety of reasons including: (i) geographic diversity and increased scale; (ii) expansion of WOW!'s network through tuck-ins of smaller adjacent systems; (iii) value creation via upgrading and streamlining undermanaged systems; (iv) enhancement of our business services capabilities; and (v) cost rationalization.

For example, our acquisition of Sigecom, LLC ("Sigecom") in 2006 (i) expanded WOW!'s footprint into the Evansville, Indiana market, (ii) increased WOW!'s business services presence, and (iii) generated significant cost savings by leveraging Sigecom's infrastructure and expertise, which provided an in-house telephony switch solution throughout our network. Our acquisition of Knology, Inc. ("Knology") in 2012 provided incremental scale, geographic and competitive diversification and allowed us to consolidate a clustered footprint in the Midwest and Southeast. Most recently, our acquisition of HC Cable Opco, LLC d/b/a NuLink ("NuLink") added approximately 34,000 homes and businesses near WOW!'s existing Georgia footprint, with attractive demographics and meaningful edge-out and business services opportunities given its proximity to Atlanta.

We believe our acquisition track record provides us with an advantage in future consolidation opportunities. We will continue to evaluate and pursue future acquisition opportunities based on the quality of underlying assets, fit within our existing business, opportunity to expand our network and the ability to create value through the realization of cost efficiencies.

Operating Philosophy Driving Differentiation in Customer Experience

Our philosophy is to deliver an employee and customer experience that is consistent with the WOW! name. We are a company comprised of people who derive satisfaction from taking care of each other and our customers. As a result, there is heightened awareness and understanding among our team that it is our employees who ultimately are WOW!'s greatest strategic asset. Our approximately 3,000 employees are brand ambassadors across the communities we serve.

Our purposeful focus on creating a thriving WOW! culture is all for the benefit of our customers. We have established an enduring record of delivering award-winning customer service and satisfaction. Recognition by a variety of independent third parties, including J.D. Power and Associates, Consumer Reports and PC Magazine, has helped create a winning, competitive spirit amongst employees that drives our success.

8

Our business is subject to numerous risks described in the section entitled "Risk Factors" and elsewhere in this prospectus. You should carefully consider these risks before making an investment. Some of these risks include:

- •

- the wide range of competition we face;

- •

- the relative size and resources of our competitors;

- •

- the impact of advancing technology on the leisure and entertainment time of audiences;

- •

- whether our "edge-out" strategy will succeed;

- •

- the likelihood of prolonged economic downturns, especially any downturns in the housing market, and their effect on our ability to attract new

subscribers;

- •

- the volatility of our stock price; and

- •

- the lack of an existing market for our common stock and the uncertainty that such a market will develop.

On May 8, 2017, we entered into a Commitment Letter for a new 5-year revolving credit facility of up to $300 million (the "New Revolving Credit Facility") to replace our existing $200 million revolving credit facility. The New Revolving Credit Facility is expected to be entered into substantially concurrently with the consummation of this offering, subject to receipt by us of gross proceeds from this offering of at least $310 million and the satisfaction of other customary closing conditions. At such time, $200 million of revolving commitments under the New Revolving Credit Facility will be immediately available to us, while the remaining $100 million of revolving commitments will only become available to us upon compliance with certain other conditions. Loans under the New Revolving Credit Facility will bear interest, at our option, at a rate equal to ABR plus 2.00% or LIBOR plus 3.00%. The guarantees, collateral and covenants in the New Revolving Credit Facility will be the same as those contained in our existing revolving credit facility.

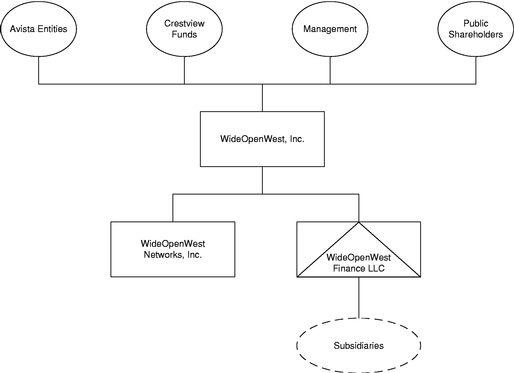

Distribution and Corporate Structure

Prior to the closing of this offering, we will effect a 67,274.092-for-1 stock split (the "Stock Split") and our indirect parent company, WideOpenWest Holdings, LLC, will distribute the shares of our common stock that it holds (indirectly through Racecar Acquisition LLC) to its equity holders based on their relative rights under its limited liability company agreement (the "Distribution"), with no issuance of additional shares by us. Each holder of units of WideOpenWest Holdings, LLC will receive shares of our common stock in the distribution, subject to the terms of any applicable grant or other agreement. For additional information regarding the treatment of outstanding units in WideOpenWest Holdings, LLC in connection with the distribution and this offering, see "Executive Compensation—Effect of the Distribution and this Offering."

9

The diagram below reflects our organizational structure following the offering.

Our business commenced operations in 2001. WideOpenWest, Inc. was founded in 2012 as WideOpenWest Kite, Inc. and is a Delaware corporation. WideOpenWest Kite, Inc. subsequently changed its name to WideOpenWest, Inc. in March 2017. WOW!'s principal executive offices are located at 7887 East Belleview Avenue, Suite 1000, Englewood, Colorado 80111. Our telephone number is (720) 479-3500. Our website can be found on the Internet at www.wowway.com.

The information contained on WOW!'s website or that can be accessed through the website is not part of this prospectus and you should not rely on that information when making a decision whether to invest in our common stock.

Avista Capital Partners ("Avista") is a leading New York-based private equity firm with approximately $5 billion under management. Founded in 2005, Avista makes control investments in growth-oriented healthcare and communications businesses. Through its team of seasoned investment professionals and industry experts, Avista seeks to partner with exceptional management teams to invest in and add value to well-positioned businesses.

Founded

in 2004, Crestview Partners ("Crestview" and together with Avista, the "Sponsors") is a value-oriented private equity firm focused on the middle market. The firm is based in New

York and manages funds with over $7 billion of aggregate capital commitments. The firm is led by a group of partners who have complementary experience and distinguished backgrounds in private

equity, finance, operations and management. Crestview's senior investment professionals primarily focus on sourcing and managing investments in each of the specialty areas of the firm: media, energy,

financial services and industrials.

10

Issuer |

WideOpenWest, Inc. | |

Common stock offered by us |

19,047,619 shares. |

|

Underwriters' option to purchase additional shares |

The selling stockholders named in this prospectus have granted the underwriters a 30-day option to purchase up to an additional 2,857,142 shares at the public offering price less underwriting discounts and commissions. |

|

Common stock to be outstanding immediately after completion of this offering |

Immediately following the consummation of this offering, we will have 86,321,711 shares of common stock outstanding. |

|

Use of proceeds |

We estimate that the net proceeds to us from this offering, after deducting estimated underwriting discounts and commissions and offering expenses payable by us, will be approximately $373.5 million, assuming the shares offered by us are sold for $21.00 per share, the midpoint of the price range set forth on the cover of this prospectus. |

|

|

We will not receive any proceeds from the sale of shares by the selling stockholders in connection with the exercise of the underwriters' option to purchase additional shares. |

|

|

We intend to use the net proceeds from this offering to redeem a portion of our 10.25% Senior Notes due 2019, for general corporate purposes and to pay fees and expenses related to this offering. For additional information, see "Use of Proceeds." |

|

Principal stockholders |

Upon completion of this offering, the Sponsors will beneficially own a controlling interest in us. We currently intend to avail ourselves of the "controlled company" exemption under the corporate governance rules of the New York Stock Exchange. |

|

Dividend policy |

We currently expect to retain all available funds and any future earnings to fund the development and growth of our business and to repay indebtedness; therefore, we do not anticipate paying any cash dividends in the foreseeable future. For additional information, see "Dividend Policy." |

|

Proposed symbol for trading on |

"WOW" |

|

Risk factors |

For a discussion of risks relating to the Company, our business and an investment in our common stock, see "Risk Factors" and all other information set forth in this prospectus before investing in our common stock. |

11

Unless otherwise indicated, all information in this prospectus relating to the number of shares of common stock to be outstanding immediately after this offering:

- •

- assumes the effectiveness of our amended and restated certificate of incorporation and amended and restated bylaws, which we will adopt prior

to the completion of this offering;

- •

- is based on the number of shares outstanding after giving effect to the Stock Split and the Distribution;

- •

- includes 122,237 shares of restricted common stock expected to be granted under our 2017 Omnibus Incentive Plan (based on the midpoint of the

price range set forth on the cover of this prospectus) in connection with this offering;

- •

- excludes additional shares of restricted common stock to be granted under our 2017 Omnibus Incentive Plan anticipated to represent between 1.0%

and 2.0% of our total common stock outstanding, expected to be issued following this offering, solely at the discretion of our board of directors;

- •

- excludes 6,474,128 shares of our common stock reserved for future grants under our 2017 Plan (as defined below); and

- •

- assumes (i) no exercise by the underwriters of their option to purchase up to 2,857,142 additional shares from the selling stockholders and (ii) an initial public offering price of $21.00 per share, the midpoint of the price range set forth on the cover of this prospectus.

12

Summary Historical Combined Consolidated Financial Data

The following tables present a summary of our historical combined consolidated financial data at the dates and for the periods indicated. We derived the following summary historical combined consolidated financial data for the years ended December 31, 2014, 2015 and 2016 and as of December 31, 2015 and 2016 from our audited combined consolidated financial statements included elsewhere in this prospectus. The balance sheet data as of December 31, 2014 is derived from our audited combined consolidated financial statements for the year ended December 31, 2014 not included in this prospectus. We derived the following summary historical combined condensed consolidated financial data for the three months ended March 31, 2016 and 2017 from our unaudited combined condensed consolidated financial statements included elsewhere in this prospectus. Operating results for the three months ended March 31, 2017 are not necessarily indicative of the results that may be expected for the entire fiscal year ending December 31, 2017. Our historical operating results are not necessarily indicative of future operating results.

You should read this data in conjunction with, and it is qualified by reference to, the sections entitled "Selected Historical Combined Consolidated Financial and Other Data" and "Management's Discussion and Analysis of Financial Condition and Results of Operations" and our combined consolidated financial statements and related notes appearing elsewhere in this prospectus.

| |

Year Ended December 31, | Three Months Ended March 31, |

||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| (in millions) |

2014 | 2015 | 2016 | 2016 | 2017 | |||||||||||

Statement of Operations Data: |

||||||||||||||||

Revenue |

$ | 1,264.3 | $ | 1,217.1 | $ | 1,237.0 | $ | 302.3 | $ | 300.0 | ||||||

| | | | | | | | | | | | | | | | | |

Costs and expenses: |

||||||||||||||||

Operating (excluding depreciation and amortization) |

737.0 | 678.6 | 668.3 | 164.5 | 159.8 | |||||||||||

Selling, general and administrative |

135.8 | 110.6 | 116.4 | 26.0 | 30.3 | |||||||||||

Depreciation and amortization |

251.3 | 221.1 | 207.0 | 52.5 | 50.3 | |||||||||||

Management fee to related party |

1.7 | 1.9 | 1.7 | 0.4 | 0.5 | |||||||||||

| | | | | | | | | | | | | | | | | |

|

1,125.8 | 1,012.2 | 993.4 | 243.4 | 240.9 | |||||||||||

| | | | | | | | | | | | | | | | | |

Income from operations |

138.5 | 204.9 | 243.6 | 58.9 | 59.1 | |||||||||||

Other income (expense): |

||||||||||||||||

Interest expense |

(237.0 | ) | (226.0 | ) | (211.1 | ) | (54.2 | ) | (45.7 | ) | ||||||

Realized and unrealized gain on derivative instruments, net |

4.1 | 5.6 | 2.3 | 1.1 | — | |||||||||||

Gain on sale of assets |

52.9 | — | — | — | 38.7 | |||||||||||

Loss on early extinguishment of debt |

— | (22.9 | ) | (38.0 | ) | — | (5.0 | ) | ||||||||

Other income (expense), net |

3.4 | (0.4 | ) | 2.2 | — | 1.4 | ||||||||||

| | | | | | | | | | | | | | | | | |

Income (loss) before provision for income tax |

(38.1 | ) | (38.8 | ) | (1.0 | ) | 5.8 | 48.5 | ||||||||

Income tax benefit (expense), net |

10.8 | (9.9 | ) | 27.3 | (1.5 | ) | 23.9 | |||||||||

| | | | | | | | | | | | | | | | | |

Net income (loss) |

$ | (27.3 | ) | $ | (48.7 | ) | $ | 26.3 | $ | 4.3 | $ | 72.4 | ||||

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

Balance Sheet Data: |

||||||||||||||||

Total assets |

$ | 2,874.7 | $ | 2,684.7 | $ | 2,770.8 | $ | 2,672.6 | $ | 2,661.6 | ||||||

Total debt, including capital lease obligations |

$ | 3,019.3 | $ | 2,882.2 | $ | 2,871.2 | $ | 2,879.3 | $ | 2,761.5 | ||||||

Total liabilities |

$ | 3,690.9 | $ | 3,550.7 | $ | 3,488.8 | $ | 3,510.5 | $ | 3,306.8 | ||||||

Other Financial Data: |

||||||||||||||||

Revenue Including Acquisitions and Dispositions(1) |

$ | 1,186.3 | $ | 1,195.4 | $ | 1,208.4 | $ | 297.0 | $ | 298.5 | ||||||

Capital expenditures |

$ | 251.9 | $ | 231.9 | $ | 287.5 | $ | 63.6 | $ | 79.2 | ||||||

Transaction Adjusted Capital Expenditures(1) |

$ | 244.1 | $ | 229.2 | $ | 285.6 | $ | 63.5 | $ | 79.1 | ||||||

Adjusted EBITDA(1) |

$ | 438.1 | $ | 443.9 | $ | 463.6 | $ | 112.9 | $ | 112.3 | ||||||

Transaction Adjusted EBITDA(1) |

$ | 398.5 | $ | 429.1 | $ | 445.7 | $ | 109.0 | $ | 111.3 | ||||||

Other Data(2): (in thousands) |

||||||||||||||||

Homes passed |

2,985.0 | 3,003.1 | 3,094.3 | 3,010.7 | 3,047.8 | |||||||||||

Total customers(3) |

809.1 | 777.8 | 803.4 | 784.6 | 780.1 | |||||||||||

|

||||||||||||||||

HSD RGUs |

727.8 | 712.5 | 747.4 | 722.2 | 729.0 | |||||||||||

Video RGUs |

634.7 | 547.5 | 501.4 | 537.2 | 474.0 | |||||||||||

Telephony RGUs |

359.4 | 296.8 | 258.1 | 286.6 | 243.0 | |||||||||||

| | | | | | | | | | | | | | | | | |

Total RGUs |

1,721.9 | 1,556.8 | 1,506.9 | 1,546.0 | 1,446.0 | |||||||||||

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

- (1)

- Since 2014, the Company has completed certain key acquisitions and divestitures. These transactions do not constitute a significant business combination for which a balance sheet is required by Regulation S-X or a disposition of a significant portion of a business. However, the

13

Company presents certain financial data that gives effect to the impact of acquisitions and dispositions that were completed during the relevant periods as if they occurred at the beginning of the period presented.

The following table shows a reconciliation of Revenue to Revenue Including Acquisitions and Dispositions:

| |

Year Ended December 31, | Three Months Ended March 31, |

||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| (in millions) |

2014 | 2015 | 2016 | 2016 | 2017 | |||||||||||

Revenue |

$ | 1,264.3 | $ | 1,217.1 | $ | 1,237.0 | $ | 302.3 | $ | 300.0 | ||||||

Revenue related to NuLink(a) |

23.2 | 24.7 | 17.1 | 6.2 | — | |||||||||||

Revenue related to AAB(b) |

7.1 | — | — | — | — | |||||||||||

Revenue related to the South Dakota systems(c) |

(62.5 | ) | — | — | — | — | ||||||||||

Revenue related to the Lawrence system(d) |

(45.8 | ) | (46.4 | ) | (45.7 | ) | (11.5 | ) | (1.5 | ) | ||||||

| | | | | | | | | | | | | | | | | |

Revenue Including Acquisitions and Dispositions |

$ | 1,186.3 | $ | 1,195.4 | $ | 1,208.4 | $ | 297.0 | $ | 298.5 | ||||||

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

We define Adjusted EBITDA as net income (loss) before net interest expense, income taxes, depreciation and amortization (including impairments), gains (losses) realized and unrealized gain on derivative instruments, management fees to related party, the write up or write off of any asset, debt modification expenses, loss on early extinguishment of debt, integration and restructuring expenses and all non-cash charges and expenses (including equity based compensation expense) and certain other income and expenses, as further defined in our Senior Secured Credit Facilities. Transaction Adjusted EBITDA represents Adjusted EBITDA after giving effect to the impact of acquisitions and dispositions that were completed during the relevant periods as if they occurred at the beginning of the period presented. The following table shows a reconciliation of GAAP net income (loss) to Adjusted EBITDA and Transaction Adjusted EBITDA:

| |

Year Ended December 31, | Three Months Ended March 31, |

||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| (in millions) |

2014 | 2015 | 2016 | 2016 | 2017 | |||||||||||

Net income (loss) |

$ | (27.3 | ) | $ | (48.7 | ) | $ | 26.3 | $ | 4.3 | $ | 72.4 | ||||

Depreciation & amortization |

251.3 | 221.1 | 207.0 | 52.5 | 50.3 | |||||||||||

Management fee to related party |

1.7 | 1.9 | 1.7 | 0.4 | 0.5 | |||||||||||

Interest expense |

237.0 | 226.0 | 211.1 | 54.2 | 45.7 | |||||||||||

Realized and unrealized (gain) loss on derivative instruments |

(4.1 | ) | (5.6 | ) | (2.3 | ) | (1.1 | ) | — | |||||||

Loss on early extinguishment of debt |

— | 22.9 | 38.0 | — | 5.0 | |||||||||||

(Gain) on sale of assets |

(52.9 | ) | — | — | — | (38.7 | ) | |||||||||

Non-recurring professional fees, M&A integration and restructuring expense |

46.6 | 16.0 | 10.2 | 1.1 | 1.9 | |||||||||||

Non-cash compensation |

— | — | 1.1 | — | 0.5 | |||||||||||

Other (income) expense, net |

(3.4 | ) | 0.4 | (2.2 | ) | — | (1.4 | ) | ||||||||

Income tax (benefit) expense |

(10.8 | ) | 9.9 | (27.3 | ) | 1.5 | (23.9 | ) | ||||||||

| | | | | | | | | | | | | | | | | |

Adjusted EBITDA |

$ | 438.1 | $ | 443.9 | $ | 463.6 | $ | 112.9 | $ | 112.3 | ||||||

Adjusted EBITDA related to NuLink(a) |

7.8 | 8.4 | 5.8 | 2.0 | — | |||||||||||

Adjusted EBITDA related to AAB(b) |

1.0 | — | — | — | — | |||||||||||

Adjusted EBITDA related to the South Dakota systems(c) |

(26.8 | ) | — | — | — | — | ||||||||||

Adjusted EBITDA related to the Lawrence system(d) |

(21.6 | ) | (23.2 | ) | (23.7 | ) | (5.9 | ) | (1.0 | ) | ||||||

| | | | | | | | | | | | | | | | | |

Transaction Adjusted EBITDA(e) |

$ | 398.5 | $ | 429.1 | $ | 445.7 | $ | 109.0 | $ | 111.3 | ||||||

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

The following table shows a reconciliation of capital expenditures to Transaction Adjusted Capital Expenditures:

| |

Year Ended December 31, | Three months Ended March 31 |

||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| (in millions) |

2014 | 2015 | 2016 | 2016 | 2017 | |||||||||||

Capital expenditures |

$ | 251.9 | $ | 231.9 | $ | 287.5 | $ | 63.6 | $ | 79.2 | ||||||

Capital expenditures related to NuLink(a) |

3.5 | 3.7 | 3.8 | 1.2 | — | |||||||||||

Capital expenditures related to AAB(b) |

1.2 | — | — | — | — | |||||||||||

Capital expenditures related to the South Dakota systems(c) |

(8.0 | ) | — | — | — | — | ||||||||||

Capital expenditures related to the Lawrence system(d) |

(4.5 | ) | (6.4 | ) | (5.7 | ) | (1.3 | ) | (0.1 | ) | ||||||

| | | | | | | | | | | | | | | | | |

Transaction Adjusted Capital Expenditures |

$ | 244.1 | $ | 229.2 | $ | 285.6 | $ | 63.5 | $ | 79.1 | ||||||

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

- (a)

- Represents our management's estimate of pre-acquisition Revenue, Adjusted EBITDA and Capital Expenditures of NuLink for the periods preceding our acquisition of substantially all of the operating assets of NuLink on September 9, 2016 based on the books and

14

records of NuLink, as adjusted by our management to reflect the assets actually acquired. We believe that, based on operating data, including operating data for the period following our acquisition of NuLink (from September 9, 2016 through September 30, 2016), the amounts represent a reasonable estimate of Revenue, Adjusted EBITDA and Capital Expenditures from NuLink's operations. However, there can be no assurances that such results accurately reflect the actual results of the acquired assets of NuLink for the periods preceding September 9, 2016. Such amounts are unaudited and have not been independently verified by our management.

- (b)

- Represents

our management's estimate of pre-acquisition Revenue, Adjusted EBITDA and Capital Expenditures of Anne Arundel Broadband ("AAB") for the periods preceding

our increased investment in AAB on April 30, 2014 based on the books and records of AAB, as adjusted by our management to reflect the assets actually acquired. We believe that, based on

operating data, including operating data for the period following our increased investment in AAB (from May 1, 2014 through December 31, 2014), the amounts represent a reasonable

estimate of Revenue, Adjusted EBITDA and Capital Expenditures from AAB's operations. However, there can be no assurances that such results accurately reflect the actual results of the acquired assets

of AAB for the periods preceding April 30, 2014. Such amounts are unaudited and have not been verified by our management.

- (c)

- Represents

the Revenue, Adjusted EBITDA and Capital Expenditures of the South Dakota systems for the periods preceding our divestiture of such assets on

September 30, 2014 based on the individual books and records of the South Dakota systems. Such amounts have been extracted from the consolidated financial statements for the Company which has

been audited. We believe that such amounts represent a reasonable estimate of Revenue, Adjusted EBITDA and Capital Expenditures for the South Dakota systems for the periods preceding our divestiture,

however, the individual books and records of the South Dakota systems have not been audited. As a result, there can be no assurances that such results accurately reflect the actual results of the

South Dakota systems for the periods preceding September 30, 2014.

- (d)

- Represents

the Revenue, Adjusted EBITDA and Capital Expenditures of the Lawrence system for the periods preceding our divestiture of such assets on

January 12, 2017 based on the individual books and records of the Lawrence system. Such amounts have been extracted from the consolidated financial statements for the Company which has been

audited. We believe that such amounts represent a reasonable estimate of Revenue, Adjusted EBITDA and Capital Expenditures for the Lawrence system for the periods preceding our divestiture, however,

the individual books and records of the Lawrence system have not been audited. As a result, there can be no assurances that such results accurately reflect the actual results of the Lawrence system

for the periods preceding January 12, 2017.

- (e)

- Revenue Including Acquisitions and Dispositions, Transaction Adjusted EBITDA and Transaction Adjusted Capital Expenditures give effect to events that are directly attributable to the transactions described therein, factually supportable and expected to have a continuing impact on the combined results. These metrics do not reflect non-recurring charges that have been incurred in connection with the relevant transaction and related financings, including legal fees, broker fees and accounting fees.

- (2)

- After

giving effect to the divestiture of the assets of the Lawrence system, as of December 31, 2016, homes passed was equal to approximately

3.026 million, total customers was approximately 772,300, HSD RGUs was approximately 718,900, Video RGUs was approximately 486,400, Telephony RGUs was approximately 251,100 and Total RGUs was

approximately 1,456,400. See "Management's Discussion and Analysis of Financial Condition and Results of Operations—Homes Passed and Subscribers."

- (3)

- Defined as the number of customers who receive at least one of our HSD, Video or Telephony services, without regard to which or how many services they subscribe. The period ended December 31, 2016 includes subscriber numbers from the NuLink acquisition on September 9, 2016. Due to the sale of our South Dakota systems on September 30, 2014, the South Dakota systems' homes passed and subscribers are not included in the above table for the year ended December 31, 2015.

15

Investing in our common stock involves a high degree of risk. You should carefully consider the risks and uncertainties described below, together with all of the other information in this prospectus, including our historical financial statements and the notes thereto, before making a decision to invest in our common stock. If any of the following risks actually occur, our business, financial condition, results of operations and prospects could be harmed. In that event, the trading price of our common stock could decline, and you could lose part or all of your investment in us. Some statements in this prospectus, including statements in the following risk factors, constitute forward-looking statements. See "Forward-Looking Statements."

Risks Related to Our Business

We face a wide range of competition, which could negatively affect our business and financial results.

Our industry is, and will continue to be, highly competitive. Some of our principal residential services competitors, including other cable and local telephone companies, offer services that provide features and functions comparable to the residential high-speed data, video, and/or telephony that we offer, and these competitors offer these services in bundles similar to ours. In most of our markets, cable competitors have invested in their networks and are able to offer a product suite which is comparable to ours. In addition, in some of our operating areas, AT&T, Verizon or other incumbent telephone providers have upgraded their networks to carry two-way video, high-speed data with substantial bandwidth and IP-based telephony services, which they market and sell in bundles, in some cases, along with their wireless services. These telephone incumbents may also offer satellite video as a part of their bundle, either in partnership with a satellite provider or directly as is the case with DirecTV. Consequently, there are more than two providers of "triple-play" services in some of our markets.

In addition, each of our residential services faces competition from other companies that provide residential services on a stand-alone basis. Our residential video service faces competition from other cable and direct broadcast satellite providers that seek to distinguish their services from ours by offering aggressive promotional pricing, exclusive programming, and/or assertions of superior service or offerings. Increasingly, our residential video service also faces competition from companies that deliver content to consumers over the Internet and on mobile devices, some without charging a fee for access to the content as well evolving customer preferences to receive video content online, in a trend known as "cord cutting." These trends could negatively impact customer demand for our residential video service, especially premium channels and VOD services, and could encourage content owners to seek higher license fees from us in order to subsidize their free distribution of content. Our residential high-speed data and telephony services also face competition from wireless Internet and voice providers, and our residential voice service faces competition from other cable providers, OTT phone service and other communication alternatives, including texting, social networking and email. In recent years, a trend known as "wireless substitution" has developed whereby certain customers have chosen to utilize a wireless telephone service as their sole phone provider. We expect this trend to continue in the future.

We also compete across each of our business high-speed data, networking and telephony services with incumbent local exchange carriers ("ILECs"), competitive local exchange carriers ("CLECs") and other cable companies.

Any inability to compete effectively or an increase in competition could have an adverse effect on our financial results and return on capital expenditures due to possible increases in the cost of gaining and retaining subscribers and lower per subscriber revenue could slow or cause a decline in our growth rates and could reduce our revenue. As we expand and introduce new and enhanced services, we may be subject to competition from other providers of those services. We cannot predict the extent to which this competition will affect our future business and financial results or return on capital expenditures.

16

In addition, future advances in technology, as well as changes in the marketplace, in the economy and in the regulatory and legislative environments, may also result in changes to the competitive landscape.

Many of our competitors are larger than we are and possess more resources than we do.

The industry in which we operate is highly competitive and has become more so in recent years. In some instances, we compete against companies with fewer regulatory burdens, better access to financing, greater personnel resources, greater resources for marketing, greater brand name recognition, and long-established relationships with regulatory authorities and customers. Increasing consolidation in the cable industry and the repeal of certain ownership rules have provided additional benefits to certain of our competitors, either through access to financing, resources or efficiencies of scale.