Attached files

| file | filename |

|---|---|

| EX-99.2 - EXHIBIT 99.2 - UNITED FIRE GROUP INC | pressrelease170519.htm |

| 8-K - 8-K - UNITED FIRE GROUP INC | a8kmeetingresults170519.htm |

Exhibit 99.1

Shareholder Presentation from the Annual Meeting of Shareholders on May 17, 2017

| • Our theme is “The Business of Promises,” which is how we view the insurance business at UFG. • In simple terms, consumers promise to pay a premium now and insurance carriers promise to pay money in the future if a loss occurs. • These promises—and our commitment to delivering on them for our policyholders and insurance agents—carry over to you, our shareholders, to whom we also make an important promise, and that is: to make strong financial decisions for our long-term success. • Let’s talk about our year past and our year ahead at UFG. |

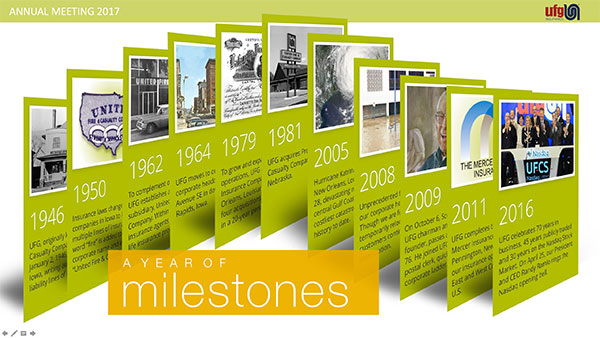

| • 2016 marked our 70th year in business, 45th year as a publicly held company and 30th year of being listed on the Nasdaq. • As mentioned in video, we also achieved $1 billion in property and casualty direct written premiums for the first time in our history. • Another milestone of sorts happened on January 1 of this year, when we finally stopped publishing our daily claim reports related to Hurricane Katrina, which remains the largest loss in our history. Although Katrina hasn’t had any financial materiality for years, we’re thankful to have 99.9 percent of the claims from this storm behind us. • That brings me to my next topic: analytics, which is something we definitely would have benefited from during Katrina. |

Exhibit 99.1

| • UFG is getting analytical and taking a more sophisticated approach to gathering and analyzing our data. • Started off 2017 with a new enterprise analytics department on board and are excited about the positive impact analytics could have on our financial performance. • Specifically, analytics can help us make more accurate decisions related to pricing and selecting risks and settling claims. |

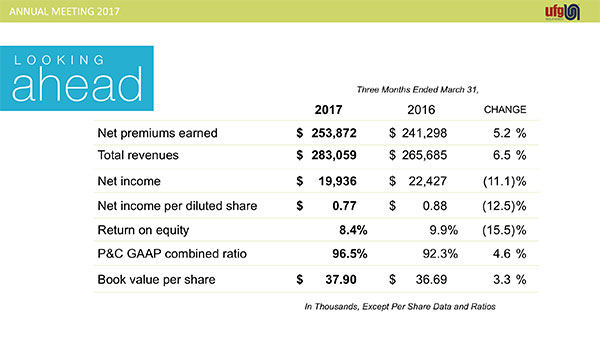

| • Earlier this month, we released our first quarter financial results. Similar to the last half of 2016, our results were impacted by a deterioration in our core loss ratio, primarily from our commercial auto and personal auto lines of business. Also impacting our first quarter results was an increase in catastrophe losses, which were above our 10-year historical average. • Last year, we put initiatives in place to improve profitability in our commercial auto and personal auto lines of business—including pricing increases, stricter underwriting guidelines, new analytical tools and more rigorous loss control requirements—and we expect to start seeing the results of our efforts later this year. • We are also launching a UFG-branded Distracted Driving campaign to raise awareness about this dangerous and growing epidemic among our customers, as well as within our communities. |

Exhibit 99.1

| • As you could see when walking in today, the expansion of our corporate headquarters is well underway. • Currently, we have over 1,125 employees across the country, with 550 here in Cedar Rapids. Our workforce has grown at an average rate of 5% over the past four years—with a 23 percent increase in our headcount since the end of 2012. • Once complete, our expansion project will add 110,000 square feet of new office space to accommodate our future growth. |

| • Finally, I have some news that was even too new to make it into our video this year. • For the fourth year in a row, UFG has made Forbes’® distinguished list of “America’s 50 Most Trustworthy Financial Companies”—recognizing us for our financial transparency. • This year, UFG was one of only 10 companies on the list honored for displaying “consistent trustworthiness.” • We’re very pleased to receive this recognition from Forbes, because we know how important trust is in our business and we believe this award is a true reflection of our financial integrity. |