Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - MEDICAL PROPERTIES TRUST INC | d391054dex991.htm |

| 8-K - FORM 8-K - MEDICAL PROPERTIES TRUST INC | d391054d8k.htm |

MEDICAL PROPERTIES TRUST $1.4 BILLION HOSPITAL REAL ESTATE INVESTMENT AND LONG-TERM LEASE/LOAN TO STEWARD HEALTHCARE MAY 19, 2017 Exhibit 99.2

At the Very Heart of Healthcare

FORWARD-LOOKING STATEMENTS This presentation includes “forward-looking statements” within the meaning of securities laws of applicable jurisdictions. Forward-looking statements can generally be identified by the use of forward-looking words such as “may”, “will”, “would”, “could”, “expect”, “intend”, “plan”, “aim”, “estimate”, “target”, “anticipate”, “believe”, “continue”, “objectives”, “outlook”, “guidance” or other similar words, and include statements regarding MPT’s plans, strategies, objectives, targets, future expansion and development activities and expected financial performance. These forward-looking statements involve known and unknown risks, uncertainties and other factors, many of which are outside the control of MPT, and its officers, employees, agents or associates, such as: our ability to successfully consummate the Steward/IASIS transaction discussed in this presentation; national and local and foreign business, real estate, and other market conditions, the competitive environment in which we operate, the execution of our business plan, financing risks, acquisition and development risks, including risks around the closing and/or timing of the close of Steward/IASIS transaction, potential environmental contingencies, and other liabilities, other factors affecting the real estate industry generally or the healthcare real estate industry in particular, our ability to maintain our status as a REIT for federal and state income tax purposes, our ability to attract and retain qualified personnel, federal and state healthcare and other regulatory requirements, U.S. national and local economic conditions, as well as conditions in foreign jurisdictions where we own healthcare facilities which may have a negative effect on the following, among other things: the financial condition of our tenants, our lenders, and institutions that hold our cash balances, which may expose us to increased risks of default by these parties; our ability to obtain debt financing on attractive terms or at all, which may adversely impact our ability to pursue acquisition and development opportunities and refinance existing debt and our future interest expense; and the value of our real estate assets, which may limit our ability to dispose of assets at attractive prices or obtain or maintain equity or debt financing secured by our properties or on an unsecured basis, and the factors referenced under the section captioned “Item 1.A Risk Factors” in our annual report on Form 10-K for the year ended December 31, 2016 and in our Form 10-Q for the quarter ended March 31, 2017. Actual results, performance or achievements may vary materially from any projections and forward looking statements and the assumptions on which those statements are based. Readers are cautioned not to place undue reliance on forward-looking statements, and MPT disclaims any responsibility to update such information.

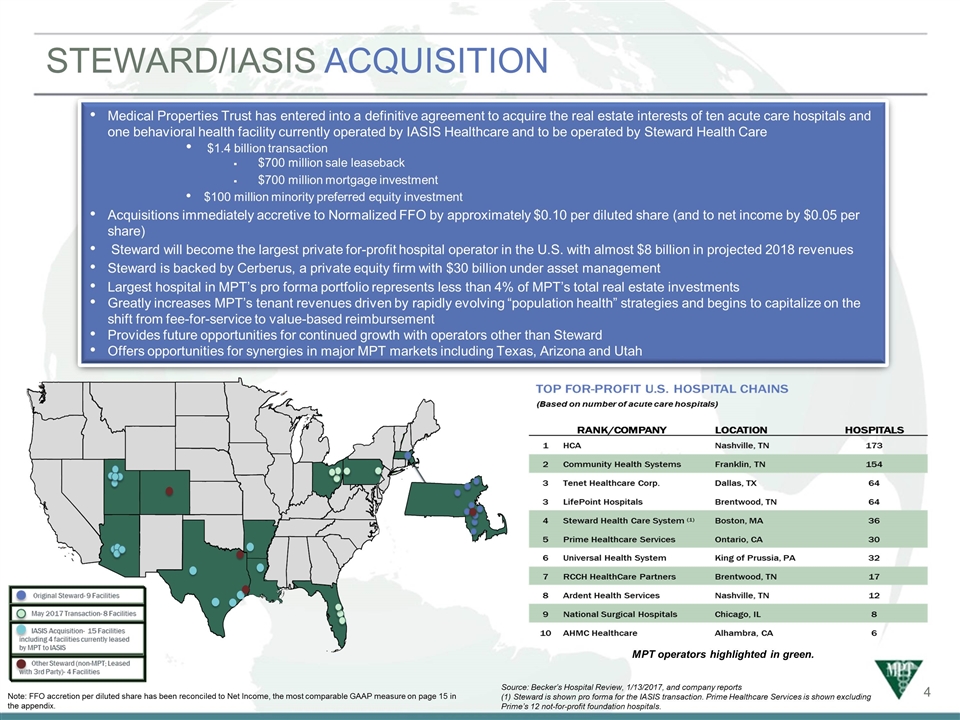

STEWARD/IASIS ACQUISITION Medical Properties Trust has entered into a definitive agreement to acquire the real estate interests of ten acute care hospitals and one behavioral health facility currently operated by IASIS Healthcare and to be operated by Steward Health Care $1.4 billion transaction $700 million sale leaseback $700 million mortgage investment $100 million minority preferred equity investment Acquisitions immediately accretive to Normalized FFO by approximately $0.10 per diluted share (and to net income by $0.05 per share) Steward will become the largest private for-profit hospital operator in the U.S. with almost $8 billion in projected 2018 revenues Steward is backed by Cerberus, a private equity firm with $30 billion under asset management Largest hospital in MPT’s pro forma portfolio represents less than 4% of MPT’s total real estate investments Greatly increases MPT’s tenant revenues driven by rapidly evolving “population health” strategies and begins to capitalize on the shift from fee-for-service to value-based reimbursement Provides future opportunities for continued growth with operators other than Steward Offers opportunities for synergies in major MPT markets including Texas, Arizona and Utah MPT operators highlighted in green. (1) Steward is shown pro forma for the IASIS transaction. Prime Healthcare Services is shown excluding Prime’s 12 not-for-profit foundation hospitals. Note: FFO accretion per diluted share has been reconciled to Net Income, the most comparable GAAP measure on page 15 in the appendix. Source: Becker’s Hospital Review, 1/13/2017, and company reports

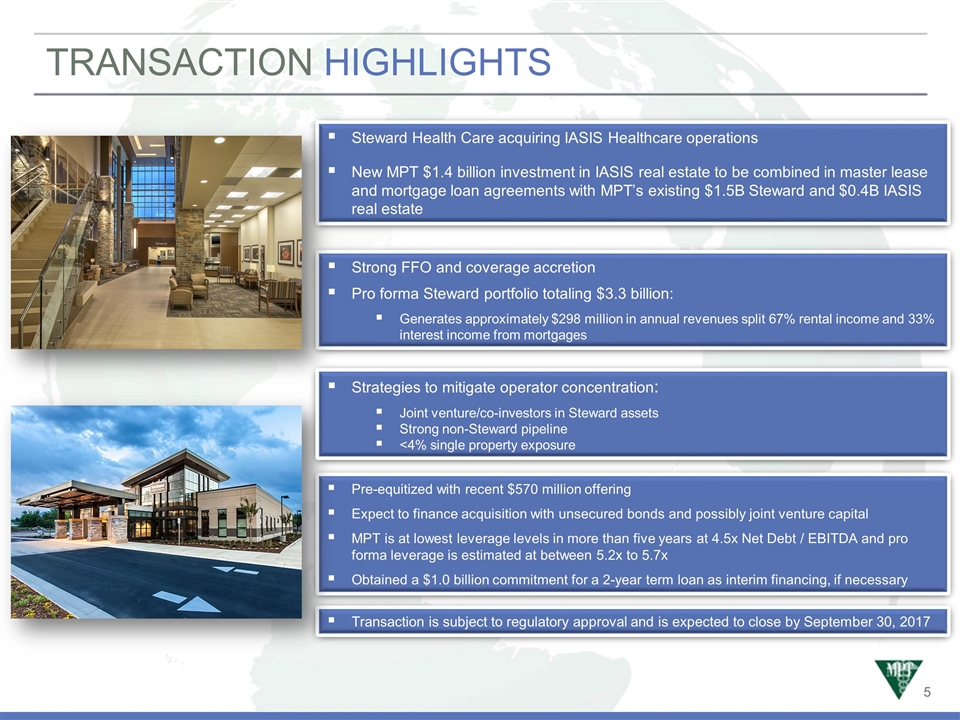

TRANSACTION HIGHLIGHTS Strong FFO and coverage accretion Pro forma Steward portfolio totaling $3.3 billion: Generates approximately $298 million in annual revenues split 67% rental income and 33% interest income from mortgages Steward Health Care acquiring IASIS Healthcare operations New MPT $1.4 billion investment in IASIS real estate to be combined in master lease and mortgage loan agreements with MPT’s existing $1.5B Steward and $0.4B IASIS real estate Pre-equitized with recent $570 million offering Expect to finance acquisition with unsecured bonds and possibly joint venture capital MPT is at lowest leverage levels in more than five years at 4.5x Net Debt / EBITDA and pro forma leverage is estimated at between 5.2x to 5.7x Obtained a $1.0 billion commitment for a 2-year term loan as interim financing, if necessary Transaction is subject to regulatory approval and is expected to close by September 30, 2017 Strategies to mitigate operator concentration: Joint venture/co-investors in Steward assets Strong non-Steward pipeline <4% single property exposure

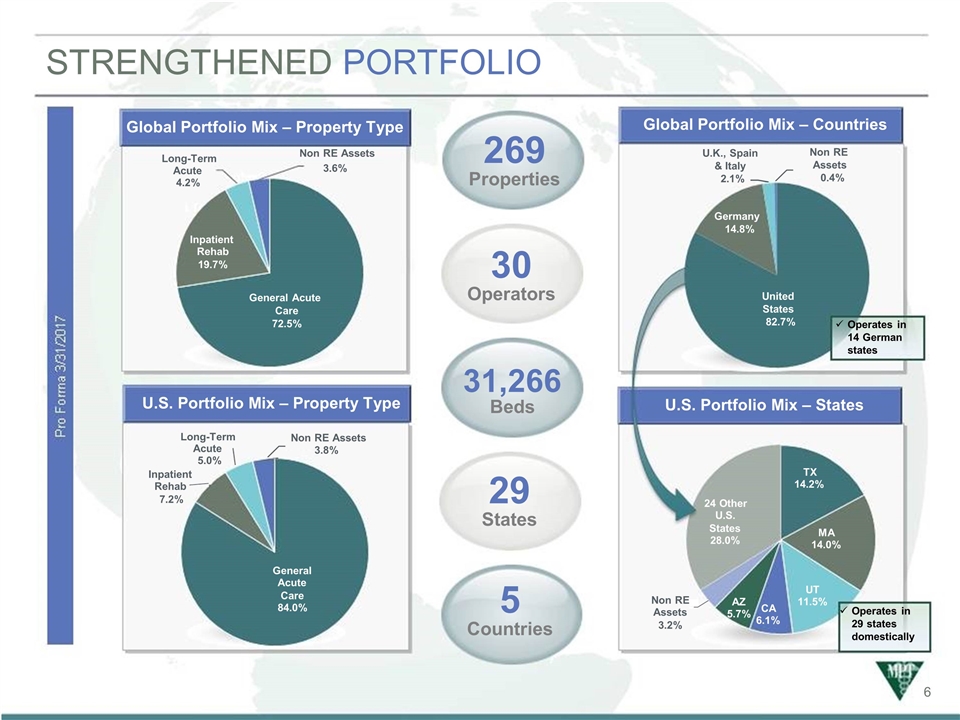

269 Properties 30 Operators 31,266 Beds 29 States Global Portfolio Mix – Countries U.S. Portfolio Mix – Property Type U.S. Portfolio Mix – States Operates in 14 German states Operates in 29 states domestically 5 Countries STRENGTHENED PORTFOLIO TX 14.2% MA 14.0% UT 11.5% CA 6.1% AZ 5.7% Non RE Assets 3.2% 24 Other U.S. States 28.0% General Acute Care 72.5% Inpatient Rehab 19.7% Long-Term Acute 4.2% Non RE Assets 3.6% General Acute Care 84.0% Inpatient Rehab 7.2% Long-Term Acute 5.0% Non RE Assets 3.8% Global Portfolio Mix – Property Type Non RE Assets 0.4% U.K., Spain & Italy 2.1% United States 82.7% Germany 14.8%

MPT TO MANAGE OPERATOR CONCENTRATION Continued non-Steward acquisitions ü Potential joint venture of existing Steward assets ü Joint venture of additional Steward investments ü Goal is to reduce to <25% ü MPT has a number of alternatives to manage the overall Steward concentration:

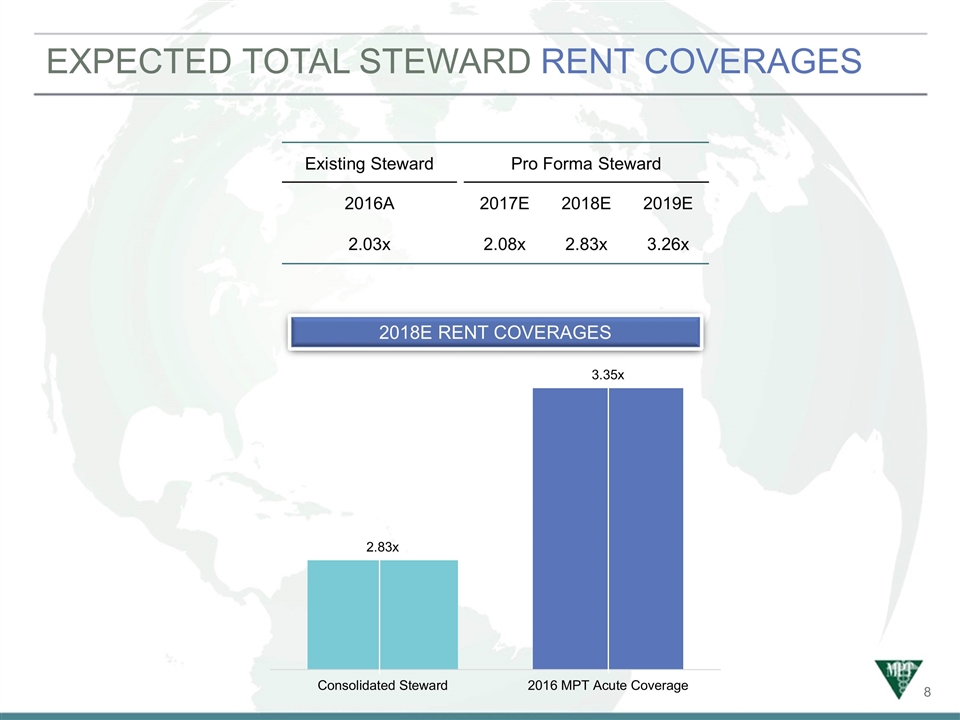

EXPECTED TOTAL STEWARD RENT COVERAGES 2018E RENT COVERAGES Existing Steward Pro Forma Steward 2016A 2017E 2018E 2019E 2.03x 2.08x 2.83x 3.26x

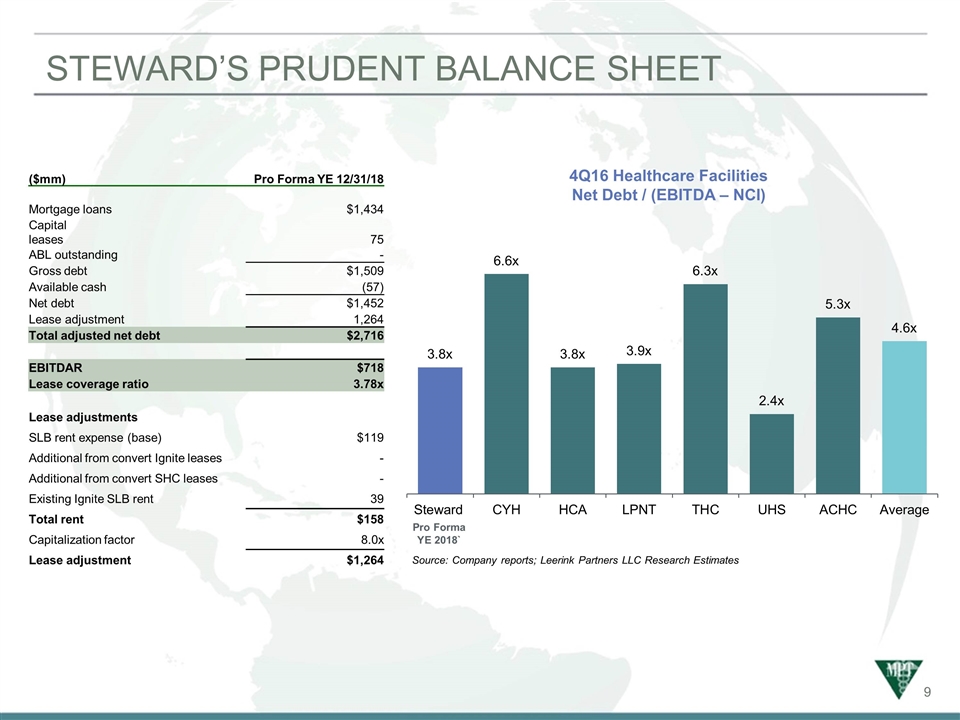

4Q16 Healthcare Facilities Net Debt / (EBITDA – NCI) STEWARD’S PRUDENT BALANCE SHEET Source: Company reports; Leerink Partners LLC Research Estimates Pro Forma YE 2018` ($mm) Pro Forma YE 12/31/18 Mortgage loans $1,434 Capital leases 75 ABL outstanding - Gross debt $1,509 Available cash (57) Net debt $1,452 Lease adjustment 1,264 Total adjusted net debt $2,716 EBITDAR $718 Lease coverage ratio 3.78x Lease adjustments SLB rent expense (base) $119 Additional from convert Ignite leases - Additional from convert SHC leases - Existing Ignite SLB rent 39 Total rent $158 Capitalization factor 8.0x Lease adjustment $1,264

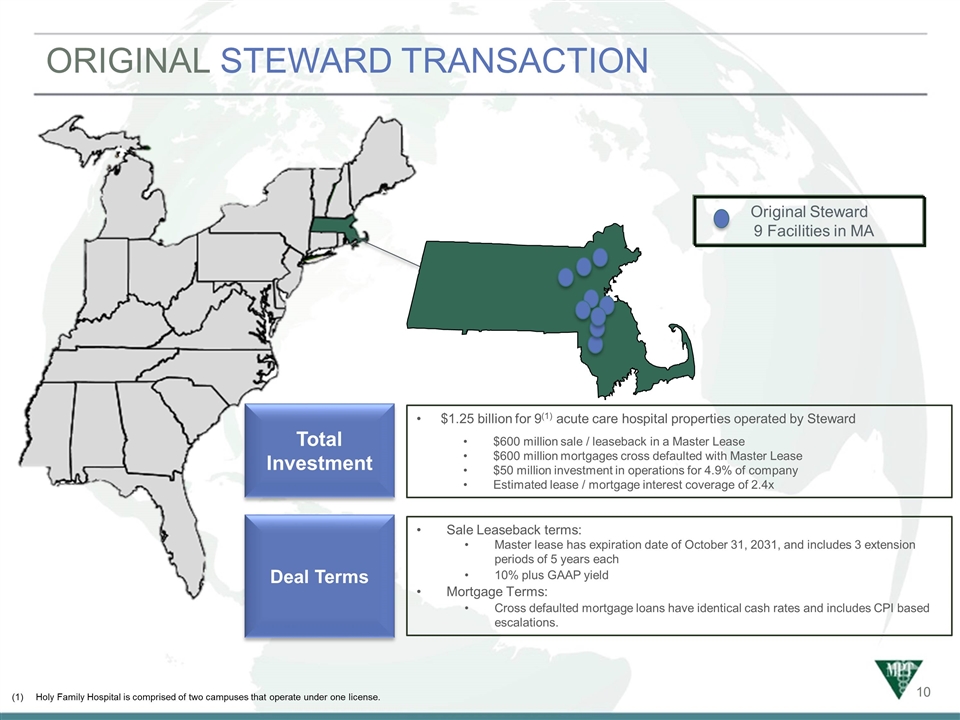

ORIGINAL STEWARD TRANSACTION Total Investment $1.25 billion for 9(1) acute care hospital properties operated by Steward $600 million sale / leaseback in a Master Lease $600 million mortgages cross defaulted with Master Lease $50 million investment in operations for 4.9% of company Estimated lease / mortgage interest coverage of 2.4x Holy Family Hospital is comprised of two campuses that operate under one license. Original Steward 9 Facilities in MA Sale Leaseback terms: Master lease has expiration date of October 31, 2031, and includes 3 extension periods of 5 years each 10% plus GAAP yield Mortgage Terms: Cross defaulted mortgage loans have identical cash rates and includes CPI based escalations. Deal Terms

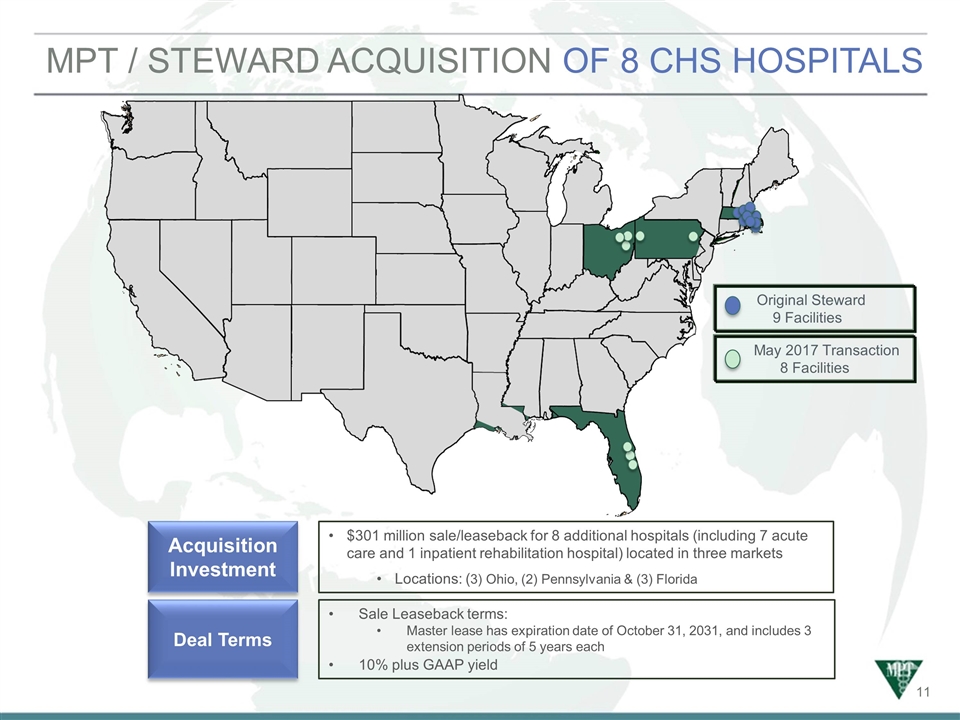

MPT / STEWARD ACQUISITION OF 8 CHS HOSPITALS Acquisition Investment $301 million sale/leaseback for 8 additional hospitals (including 7 acute care and 1 inpatient rehabilitation hospital) located in three markets Locations: (3) Ohio, (2) Pennsylvania & (3) Florida Original Steward 9 Facilities May 2017 Transaction 8 Facilities Sale Leaseback terms: Master lease has expiration date of October 31, 2031, and includes 3 extension periods of 5 years each 10% plus GAAP yield Deal Terms

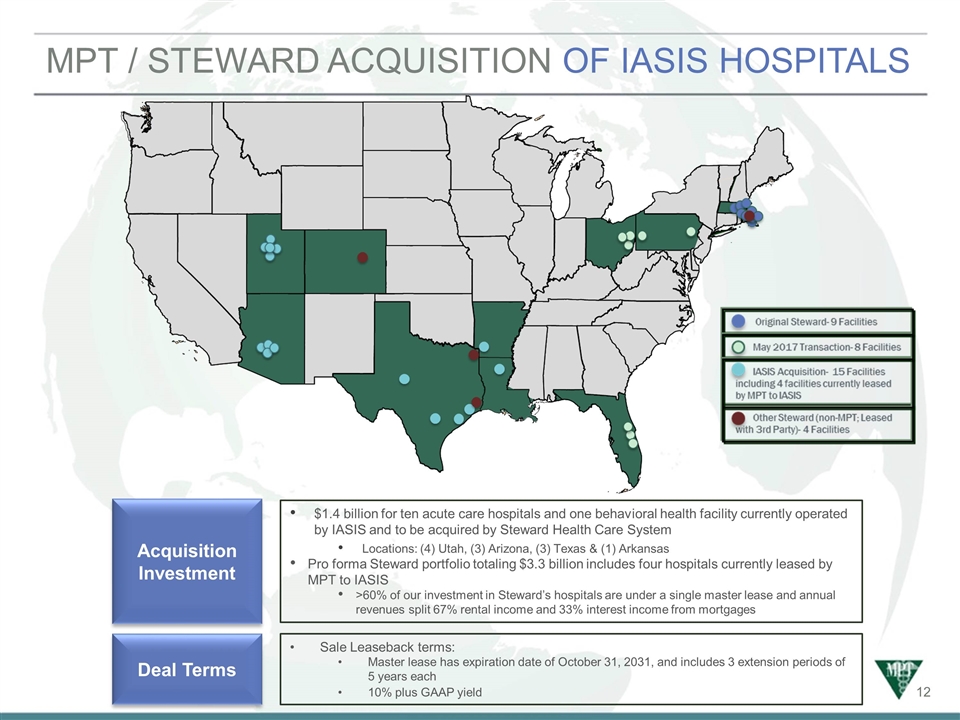

MPT / STEWARD ACQUISITION OF IASIS HOSPITALS Acquisition Investment $1.4 billion for ten acute care hospitals and one behavioral health facility currently operated by IASIS and to be acquired by Steward Health Care System Locations: (4) Utah, (3) Arizona, (3) Texas & (1) Arkansas Pro forma Steward portfolio totaling $3.3 billion includes four hospitals currently leased by MPT to IASIS >60% of our investment in Steward’s hospitals are under a single master lease and annual revenues split 67% rental income and 33% interest income from mortgages Sale Leaseback terms: Master lease has expiration date of October 31, 2031, and includes 3 extension periods of 5 years each 10% plus GAAP yield Deal Terms

Appendix

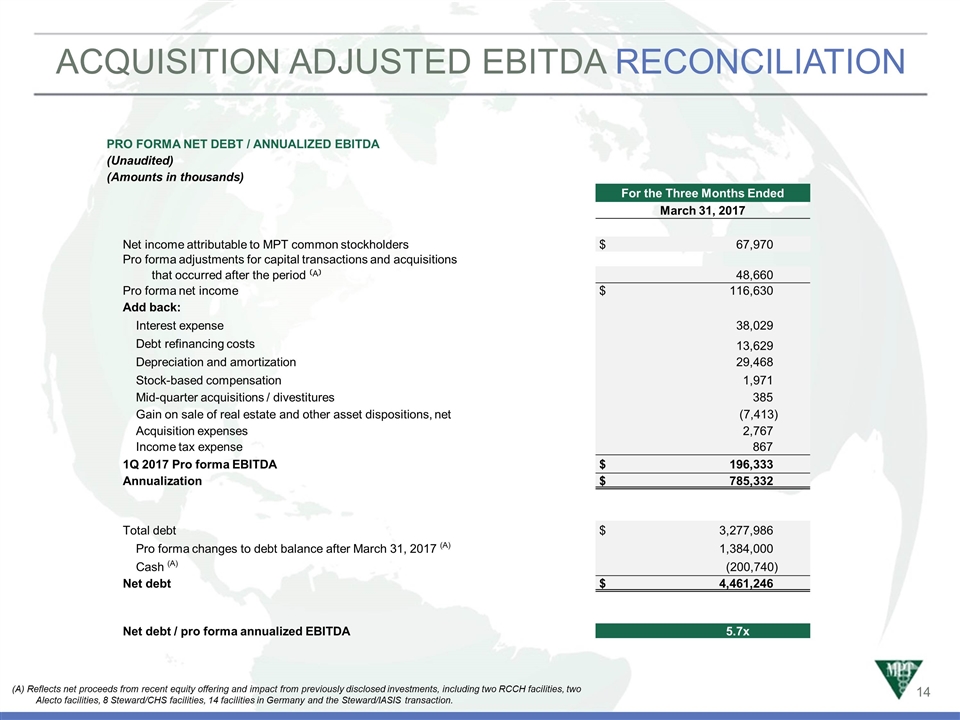

ACQUISITION ADJUSTED EBITDA RECONCILIATION PRO FORMA NET DEBT / ANNUALIZED EBITDA (Unaudited) (Amounts in thousands) For the Three Months Ended March 31, 2017 Net income attributable to MPT common stockholders $ 67,970 Pro forma adjustments for capital transactions and acquisitions that occurred after the period ⁽ᴬ⁾ 48,660 Pro forma net income $ 116,630 Add back: Interest expense 38,029 Debt refinancing costs 13,629 Depreciation and amortization 29,468 Stock-based compensation 1,971 Mid-quarter acquisitions / divestitures 385 Gain on sale of real estate and other asset dispositions, net (7,413) Acquisition expenses 2,767 Income tax expense 867 1Q 2017 Pro forma EBITDA $ 196,333 Annualization $ 785,332 Total debt $ 3,277,986 Pro forma changes to debt balance after March 31, 2017 (A) 1,384,000 Cash (A) (200,740) Net debt $ 4,461,246 Net debt / pro forma annualized EBITDA 5.7x (A) Reflects net proceeds from recent equity offering and impact from previously disclosed investments, including two RCCH facilities, two Alecto facilities, 8 Steward/CHS facilities, 14 facilities in Germany and the Steward/IASIS transaction.

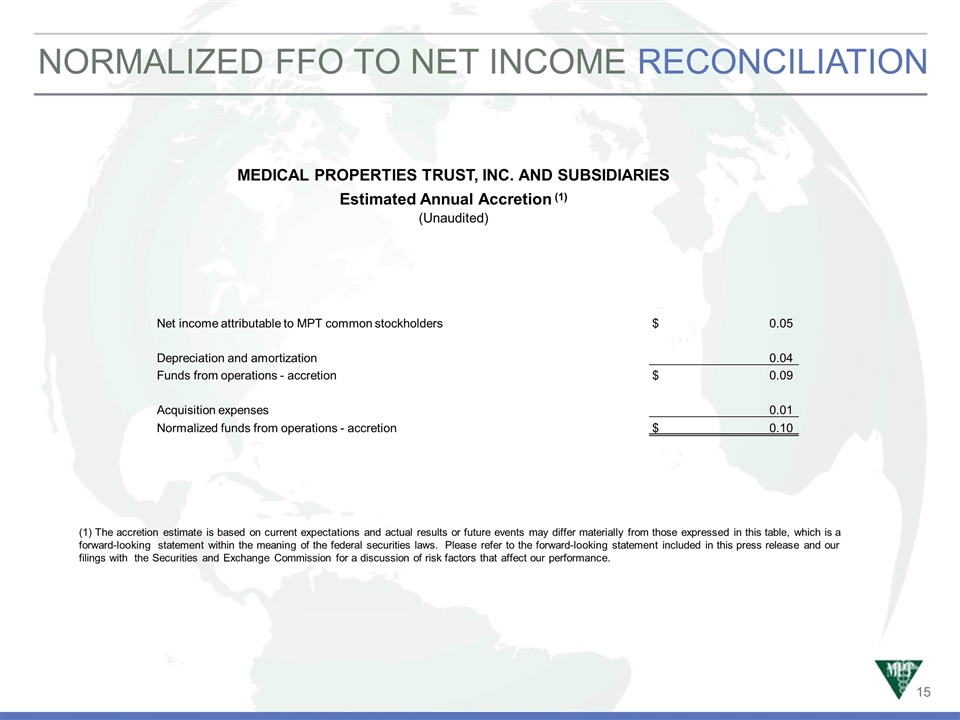

NORMALIZED FFO TO NET INCOME RECONCILIATION MEDICAL PROPERTIES TRUST, INC. AND SUBSIDIARIES Estimated Annual Accretion (1) (Unaudited) Net income attributable to MPT common stockholders $ 0.05 Depreciation and amortization 0.04 Funds from operations - accretion $ 0.09 Acquisition expenses 0.01 Normalized funds from operations - accretion $ 0.10 (1) The accretion estimate is based on current expectations and actual results or future events may differ materially from those expressed in this table, which is a forward-looking statement within the meaning of the federal securities laws. Please refer to the forward-looking statement included in this press release and our filings with the Securities and Exchange Commission for a discussion of risk factors that affect our performance.

At the Very Heart of Healthcare