Attached files

| file | filename |

|---|---|

| EX-32.1 - EXHIBIT 32.1 - GLOBAL GOLD CORP | ex32-1.htm |

| EX-31.2 - EXHIBIT 31.2 - GLOBAL GOLD CORP | ex31-2.htm |

| EX-31.1 - EXHIBIT 31.1 - GLOBAL GOLD CORP | ex31-1.htm |

| EX-21 - EXHIBIT 21 - GLOBAL GOLD CORP | ex21.htm |

U.S. SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

(Mark One)

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT

OF 1934 FOR THE FISCAL YEAR ENDED DECEMBER 31, 2016

☐ TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES

EXCHANGE ACT OF 1934

For the transition period from ______ to _______

Commission file number: 002-69494

GLOBAL GOLD CORPORATION

(Exact name of Registrant as Specified in Its Charter)

|

Delaware |

13-3025550 |

|

(State or other jurisdiction of |

(IRS Employer |

|

incorporation or organization) |

Identification No.) |

555 Theodore Fremd Avenue, Suite C305, Rye, NY 10580

(Address of principal executive offices) (Zip Code)

Registrant's telephone number (914) 925-0020

Securities registered under Section 12(b) of the Exchange Act: None

Securities registered under Section 12(g) of the Exchange Act: Common Stock

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act: Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Exchange Act: Yes ☐ No ☒

Indicate by check mark whether the registrant (l) has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the past 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No ☐

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☒

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer [ ] |

Accelerated filer [ ] |

|

|

|

|

Non-accelerated filer [ ] (Do not check if smaller reporting company) |

Smaller reporting company [X] |

| Emerging growth company [ ] |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

The aggregate market value of the voting stock held by non-affiliates of the Company computed by reference to the price at which the stock was sold, or the average bid and asked prices of such stock, as of June 30, 2016, was $598,672.

As of May 12, 2017 there were 92,507,559 shares of the registrant's Common Stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant's Proxy Statement relating to the Annual Meeting of Stockholders scheduled to be held on or around June 16, 2017 are incorporated by reference into Part III (Items 10 through 14) of this Report

Cautionary Note Regarding Forward-Looking Statements

This Annual Report includes statements of our expectations, intentions, plans and beliefs that constitute "forward-looking statements" within the meaning of Section 27A of the Securities Act of 1933, as amended, Section 21E of the Securities Exchange Act of 1934, as amended and are intended to come within the safe harbor protection provided by those sections. These statements, which involve risks and uncertainties, relate to the discussion of business strategies of Global Gold Corporation (the “Company" or "Global Gold") and our expectations concerning future operations, margins, profitability, liquidity and capital resources and to analyses and other information that are based on forecasts of future results and estimates of amounts not yet determinable. We have used words such as "may," "will," "should," "expects," "intends," "plans," "anticipates," "believes," "thinks," "estimates," "seeks," "expects," "predicts," "could," "projects," "potential" and other similar terms and phrases, including references to assumptions, in this report to identify forward-looking statements. These forward-looking statements are made based on expectations and beliefs concerning future events affecting the Company and are subject to uncertainties, risks and factors relating to our operations and business environments, all of which are difficult to predict and many of which are beyond the Company's control, that could cause our actual results to differ materially from those matters expressed or implied by these forward-looking statements. These risks and other factors include those listed under "Risk Factors" and elsewhere in this report. The following factors, among others, could cause our actual results and performance to differ materially from the results and performance projected in, or implied by the forward-looking statements:

|

o |

the Company's history of losses and expectation of further losses; |

|

o |

the effect of poor operating results on the Company; |

|

o |

the Company's ability to expand its operations in both new and existing locations and the Company's ability to develop and mine its current and new sites; |

|

o |

the Company's ability to raise capital; |

|

o |

the Company's ability to fully utilize and retain executives; |

|

o |

the impact of litigation, including international arbitrations and litigation in Armenia; |

|

o |

the impact of federal, state, local or foreign government regulations; |

|

o |

the effect of competition in the mining industry; and |

|

o |

economic and political conditions generally. |

The Company assumes no obligation to publicly update or revise these forward-looking statements for any reason, or to update the reasons actual results could differ materially from those anticipated in, or implied by, these forward-looking statements, even if new information becomes available in the future.

Cautionary Note to U.S. Investors

The United States Securities and Exchange Commission (the “SEC”) limits disclosure for U.S. reporting purposes to mineral deposits that a company can economically and legally extract or produce. We use terms such as “reserves,” “resources,” “geologic resources,” “proven,” “probable,” “measured,” “indicated,” or “inferred,” which may not be consistent with the reserve definitions established by the SEC Industry Guide 7. Laws of foreign countries including Armenia and Chile are not consistent with SEC Industry Guide 7 regarding use of such terms. We are required to adhere to the mining laws and requirements of the countries we operate in which include developing reserves as well as exploration and mining activities pursuant to laws in the countries where we operate and to be in compliance with license requirements. We acknowledge that due to the differences in laws of the countries in which we operate and SEC Industry Guide 7, our mining activities are being reported for informational and disclosure purposes based on foreign country requirements but also that the SEC does not recognize any of our properties as having proven or probable reserves established under SEC Industry Guide 7. Under SEC Industry Guide 7, we can only state that we are in the exploration stage and have found consistencies in mineralization amongst our drilling results, even though we have foreign country approved reserves, resources, mining licenses, and sales of concentrate.

ITEM 1. DESCRIPTION OF BUSINESS

(1) GENERAL OVERVIEW

The Company is engaged in exploration for, as well as development and mining of, gold, silver, and other minerals in Armenia, Canada and Chile. Until March 31, 2011, the Company's headquarters were located in Greenwich, Connecticut and as of April 1, 2011 the Company’s headquarters are in Rye, NY. Its subsidiaries and staff maintain offices in Yerevan, Armenia, and Santiago, Chile. The Company was incorporated as Triad Energy Corporation in the State of Delaware on February 21, 1980 and conducted other business prior to January 1, 1995. During 1995, the Company changed its name from Triad Energy Corporation to Global Gold Corporation to pursue certain gold and copper mining rights in the former Soviet Republics of Armenia and Georgia. The Company has not established proven and probable reserves in accordance with SEC Industry Guide 7 at any of its properties. The Company's stock is publicly traded. The Company employs approximately 25 people globally on a year-round basis. In the past, the Company has employed up to an additional 200 people on a seasonal basis, but the Company’s engagement of a mine contractor to run mining operations and non-operating status based on financial, legal, and other considerations has reduced the number of employees directly employed by the Company on a seasonal basis.

Although the Company competes with multi-national mining companies which have substantially greater resources and numbers of employees, the Company’s long term presence and the expertise and knowledge of its personnel in Armenia and in Chile allow it to compete with companies with greater resources.

In Armenia, the Company’s focus is on the exploration, development and production of gold at the Toukhmanuk property in the North Central Armenian Belt and the Marjan and an expanded Marjan North property. In addition, the Company was exploring and developing other sites in Armenia. In 2016, however, the Company stopped working at the Getik property.

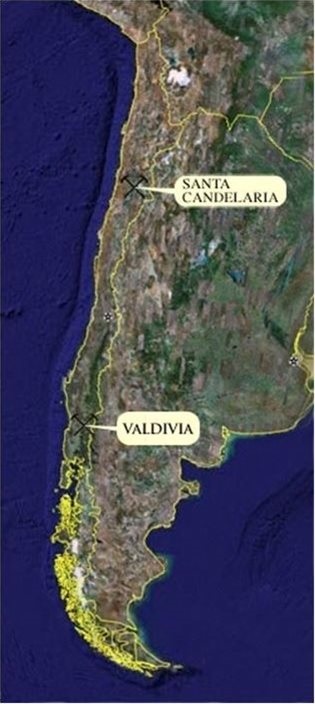

In Chile, the Company is engaged in identifying gold exploration and production opportunities and the Company’s Vice President maintains an office in Santiago.

In Canada, the Company had engaged in uranium exploration activities in the provinces of Newfoundland and Labrador, but has phased out this activity, retaining a royalty interest in the Cochrane Pond property in Newfoundland.

The Company also assesses exploration and production opportunities in other countries.

The subsidiaries of the Company are as follows:

On August 18, 2003, the Company formed Global Gold Armenia LLC ("GGA"), as a wholly owned subsidiary, which in turn formed Global Gold Mining, LLC ("GGM"), as a wholly owned subsidiary, both in the State of Delaware. GGM was qualified to do business as a branch operation in Armenia and owns assets, royalty and participation interests, as well as shares of operating companies in Armenia.

On December 21, 2003, GGM acquired 100% of the Armenian limited liability company SHA, LLC (renamed Global Gold Hankavan, LLC ("GGH") as of July 21, 2006), which held the license to the Hankavan and Marjan properties in Armenia. On December 18, 2009, the Company entered into an agreement with Caldera Resources Inc. (“Caldera”) outlining the terms of a joint venture on the Company’s Marjan property in Armenia (“Marjan JV”). On March 12, 2010, GGH transferred the rights, title and interest for the Marjan property to Marjan Mining Company LLC, a limited liability company incorporated under the laws of the Republic of Armenia (“Marjan RA”) which is a wholly owned subsidiary of GGM. On October 7, 2010, the Company terminated the Marjan JV. The Armenian Court of Cassation in a final, non-appealable decision, issued and effective February 8, 2012, ruled that the registration and assumption of control by Caldera through unilateral charter changes of the Marjan Mine and Marjan RA were illegal and that 100% ownership rests fully with GGM. On March 29, 2012, Justice Herman Cahn, who was appointed by United States District Court Judge Hellerstein as the sole arbitrator in an American Arbitration Association arbitration between the Company and Caldera, ruled in the Company’s favor on the issue of the JV’s termination ordering that the Marjan property be 100% owned by the Company effective April 29, 2012. Judge Karas of the United States Federal District Court confirmed Judge Cahn’s decision. On November 10, 2014, a Final Award in the Company’s favor ruled that Caldera had no interest whatsoever in Marjan RA or the Marjan Property. See Legal Proceedings for more information on the Marjan JV.

On August 1, 2005, GGM acquired 51% of the Armenian limited liability company Mego-Gold, LLC ("Mego"), which is the licensee for the Toukhmanuk mining property and seven surrounding exploration sites. On August 2, 2006, GGM acquired the remaining 49% interest of Mego-Gold, LLC, leaving GGM as the owner of 100% of Mego-Gold, LLC. See Agreements for more information on Mego-Gold, LLC.

On January 31, 2006, GGM closed a transaction to acquire 80% of the Armenian company, Athelea Investments, CJSC (renamed "Getik Mining Company, LLC") and its approximately 27 square kilometer Getik gold/uranium exploration license area in the northeast Geghargunik province of Armenia. As of May 30, 2007, GGM acquired the remaining 20% interest in Getik Mining Company, LLC, leaving GGM as the owner of 100% of Getik Mining Company, LLC. See Agreements for more information on Getik Mining Company, LLC.

On January 5, 2007, the Company formed Global Gold Uranium, LLC ("Global Gold Uranium"), as a wholly owned subsidiary, in the State of Delaware, to operate the Company's uranium exploration activities in Canada.

On September 23, 2011, Global Gold Consolidated Resources Limited (“GGCRL”) was incorporated in Jersey as a 51% subsidiary of the Company pursuant to the April 27, 2011 Joint Venture Agreement with Consolidated Resources. On December 1, 2016, the Viscounts Department of the Island of Jersey arrested all of the Consolidated Resources Armenia (“CRA”) shares in GGCRL in favor of the Company pursuant to a Royal Court judgement in the Company’s favor. See Agreements Section for more information on Consolidated Resources agreements.

On November 8, 2011, GGCR Mining, LLC (“GGCR Mining”) was formed in Delaware as a 100%, wholly owned, subsidiary of GGCRL. On September 26, 2012, the Company conditionally transferred 100% of the shares of Mego and Getik Mining Company, LLC to GGCR Mining. See Agreements section.

The Company is a reporting company and is therefore subject to the requirements of the Securities and Exchange Act of 1934, as amended (the "Exchange Act"), and accordingly files its Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Definitive Proxy Statements, Current Reports on Form 8-K, and other information with the Securities and Exchange Commission (the "SEC"). The public may read and copy any materials filed with the SEC at the SEC's Public Reference Room at 100 F Street, NW, Washington, DC 20549. Please call the SEC at (800) SEC-0330 for further information on the Public Reference Room. As an electronic filer, the Company's public filings are maintained on the SEC's Internet site that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC. The address of that website is http://www.sec.gov.

The Company’s Annual and Quarterly filings are also accessible free of charge through the Company's Internet site after the Company has electronically filed such material with, or furnished it to, the SEC. The address of that website is http:// www.globalgoldcorp.com. However, such reports may not be accessible through the Company's website as promptly as they are accessible on the SEC's website.

(2) INITIAL ARMENIAN MINING PROJECT

In 1996, the Company acquired rights under a Joint Venture Agreement with the Ministry of Industry of Armenia and Armgold, S.E., the Armenian state enterprise, formed to provide capital and multistage financing of the Armenian gold industry, which rights were finalized under the Second Armenian Gold Recovery Company Joint Venture Agreement, dated as of September 30, 1997.

As of January 31, 1997, the Company and Global Gold Armenia Limited, the Company's then wholly-owned Cayman Islands subsidiary ("GGA Cayman"), reached an initial agreement with First Dynasty Mines, Ltd., whose name changed to Sterlite Gold Ltd. ("Sterlite") on July 5, 2002, a Canadian public company and whose shares were traded on the Toronto Stock Exchange with respect to the initial Armenian project. The Company, GGA Cayman and Sterlite entered into a definitive agreement, dated May 13, 1997. Under such agreement, Sterlite acquired all of the stock of GGA Cayman, subject to certain conditions, by advancing funds in stages necessary for the implementation of the tailings reprocessing project and the preparation of engineering and business plan materials for the Armenian Joint Venture and delivering 4,000,000 shares of First Dynasty (later Sterlite) Common Stock to the Company (the "FDM Agreement"). The parties thereafter amended the FDM Agreement on July 24, 1998. Pursuant to the FDM Agreement, the Company retained the right until December 31, 2009 to elect to participate at a level of up to 20% with Sterlite, or any of its affiliates or successors in interest, in any exploration project undertaken by them in Armenia. As of December 31, 2004, the Company did not own any shares of Sterlite common stock. In 2006, Vedanta Resources plc ("Vedanta") acquired control of Sterlite through Twin Star International Limited ("TSI"), an indirect wholly-owned subsidiary of Vedanta. In September 2007, Vedanta (and Sterlite) announced that they had closed a stock sale transaction with GeoProMining Ltd., which made GeoProMining Ltd. and its affiliates the successors to the 20% obligation.

(3) ARMENIA PROPERTIES

The Company operates an office in Yerevan, Armenia where it manages its exploration and mining activities as well as reviews potential acquisitions. A map showing the location of the properties in Armenia (below) and other information on the properties are located on the Company's website.

|

Hankavan

Hankavan is located in central Armenia in the Kotayk province between Vanadzor and Meghradzor north of the Marmarik River.

GGH acquired Hankavan licenses in December of 2003 through the acquisition of the Armenian company, SHA, LLC (since renamed Global Gold Hankavan, LLC ("GGH")), and conducted a drilling program along with other exploration activities to confirm the historical feasibility work done on the copper, molybdenum and gold mineralization in the Soviet era. GGH also expanded its exploration activities to six other, smaller license areas in and around Hankavan. In addition, GGH conducted exploration and planned to determine the feasibility of a quick start mining operation for copper oxide in this area. These activities have not been actively pursued pending performance of a conditional, confidential settlement agreement with the Armenian Government entered as of February 25, 2008.

See Item 1A “Risk Factors” and Item 3 “Legal Proceedings”, below.

Marjan

The Marjan mining property is located in Southwestern Armenia, along the Nakichevan border in the Syunik province. The property is accessible by car or truck through existing paved and dirt roads. The property includes two parts; Marjan Central, where early drilling and underground exploration has been carried out and Marjan North (Mazmazak), which is situated some 1.5 km north of Marjan Central. The whole property is roughly rectangular in shape, 3.2 km wide by 6.1 km long. The approximate geographic coordinates of the property are, 39° 24’ 00” Latitude and 45° 51’ 00” Longitude. Electric power is proximate to the property. There is also a river which passes in the immediate proximity to the property. The Company does not have any facilities or material equipment at the property. The Company has an Armenian government approved and licensed mining plan and has done exploration work at the property but has not developed any significant surface or underground works or infrastructure with the exception of approximately 62 kilometers of roads built. Approximately 60,000 tonnes of mineralized rock has been mined and stockpiled. All equipment needed is brought to the site on an as needed basis from the Company’s other properties or from contractors.

The area of the Marjan Property is underlain by Tertiary volcanic rocks, which have been intruded by north-northwest trending dioritic dykes. The bulk of the gold and silver mineralization is contained within polymetallic sulphide veins, which are associated with north-northwest trending hydrothermal alteration zones. These alteration zones are readily observed on the surface as rusty to grey zones on outcrops. Two types of gold mineralization have been observed. These are gold mineralization associated with sulphide veins in volcanic rocks, and gold mineralization adjacent to dioritic dykes, which intrude the volcanic rocks.

Effective September 7, 2016, the Company through its Marjan Mining Company subsidiary and the Armenian Government through its Ministry of Energy and Natural Resources concluded amendments to the Marjan mining agreement which among other things provides that the Company: (1) has 3 years from September 1, 2016 to build the approved tailings dam and plant; (2) has 3.4 years following the completion of the tailings dam and plant to mine 160,000 tonnes of ore from the Marjan mine, pursuant to the approved mining plan; (3) has 12 months to prepare and file for a report for recalculation of existing Marjan numbers, based on exploration results; and (4) has 12 months following the approval by the State Committee on Natural Resources’ approval (which must be issued within 12 months of the Company’s recalculation) to prepare and file an updated and mining plan, all as more particularly described in Exhibit 10.78. Any delays the government takes that shall extend the relevant terms. This amendment also resolves the overlapping license issue caused by Caldera Resources and its Biomine subsidiary which was determined in the Company’s favor by the New York ICDR arbitral award. Please see our “Cautionary Note to U.S. Investors” on our website and Form 10-K with regard to the SEC and other standards for the term “reserve.”

The Company does not currently have established reserves at the Marjan Property, except as reported by the Republic of Armenia State Committee on Reserves (“GKZ”) which is available on the Company’s website and is focusing on exploration work based on Armenian historical GKZ records (please refer to the “Cautionary Note to U.S. Investors” on page 3 of this report). The Company has done geological mapping, ground geophysical surveys, trenching and diamond drill testing at Marjan and continues its exploration work there based on the Armenian historical GKZ records in conjunction with the exploration work and results done so far. Additional exploration and mining work will need to be funded with additional funds raised through joint ventures, debt, equity or a combination thereof.

The Marjan property is a lode deposit which will be mined using open pits and underground adits. The Company has one national special mining license #HA-L-14/526, since replaced under the new 2012 Armenian Mining Code with License #29/398 (available on the Company’s website), covers surface rights for mining, exploration and related purposes for gold and non-ferrous metals (please refer to the “Cautionary Note to U.S. Investors” on page 3 of this report). The license area is defined by the following coordinates:

|

1. |

X = 4365000 |

3. |

X = 4363770 |

5. |

X = 4360000 |

|

|

Y = 8570000 |

|

Y = 8574530 |

|

Y = 8572700 |

|

2. |

X = 4366800 |

4. |

X = 4360400 |

|

|

|

|

Y = 8572000 |

|

Y = 8575250 |

|

|

In 2012, the Company re-established possession and license rights over the Marjan property after Caldera’s illegal possession. In 2014, the Company received the Final Arbitration Award terminating all of Caldera’s asserted rights and interests in Marjan, as well as awarding damages to the Company. The Company also began a review and update of the previously approved mining plan (available on the Company’s website) for the property, selected a mine contractor to implement the mining, and outlined four open pits to begin mining. The Company also updated prior exploration results to select new drilling targets. As of December 31, 2016, the Company has not generated any revenue from sales of any concentrate or other mineralized material at the property. As of December 31, 2016, the Company has spent approximately $3,516,500 on mining and exploration activities at this property, excluding acquisition and capital costs.

This property was previously explored during the Soviet era. SHA, LLC applied for an original license from the Armenian Government. GGM acquired 100% of SHA, LLC, the Armenian company which held the license to the property in December 2003. On April 28, 2008, the Company was issued a twenty-five year “special mining license” for the Marjan property effective April 22, 2008 and expiring April 22, 2033 which expands the prior license term and substantially increases the license area from approximately 1,400 acres to approximately 4,800 acres. The Company is required to pay annual governmental fees of approximately $21,000. The Company is also required to perform work at the property as submitted and approved in its mining plan which includes mining of 200,000 tonnes of mineralized rock annually starting in 2013 under Armenian Law in order to maintain the licenses in good standing (please refer to the “Cautionary Note to U.S. Investors” on page 3 of this report). On March 12, 2010, GGH transferred the rights, title and interest for the Marjan property to Marjan Mining Company, LLC, a limited liability company incorporated under the laws of the Republic of Armenia (“Marjan RA”). Marjan RA is the licensee of the Marjan Property and is a wholly owned subsidiary of the Company. Due to the Company's litigation with Caldera in 2014, the annual requirements have been tolled. For the exploration licenses, under Article 36 of Armenia Mineral Code, all time terms mentioned in the exploration license agreement (which is the document providing times for completion of different works) are contemplated, which means that the Company can cure the work requirements under the license, or any “material non - compliance” in subsequent years.

The Company is required to pay annual government fees and perform work at the property, both as described above, to keep the license in good standing. In various circumstances, Armenian law allows for annual work requirements to be cured in subsequent years and by other means without losing good standing status. Failure to maintain good license status could result in the license being suspended or terminated under Armenian Law. The Company has not received any suspension or termination notices, but could based on the Company’s performance and other factors. See Item 1A “Risk Factors,” below.

On December 18, 2009, the Company entered into an agreement with Caldera outlining the terms of a joint venture on the Company’s Marjan property in Armenia (“Marjan JV”). On March 24, 2010, the Company signed an agreement with Caldera establishing the terms for a joint venture on the Company’s Marjan property in Armenia (“Marjan JV”) which amended the December 18, 2009 agreement.

The agreement was subject to approval by the TSX Venture Exchange and the Board of Directors of the respective companies. As of April 30, 2010, Caldera paid the Company $100,000. Caldera further informed the Company that it received TSX Venture Exchange approval on the transaction, which subsequently proved to be untrue. On October 7, 2010, the Company terminated the Marjan JV for Caldera’s non-payment and non-performance as well as Caldera’s illegal registrations in Armenia and other actions. In October 2010, Caldera filed for arbitration in New York City. In September 2010, at Caldera’s invitation, the Company filed to reverse the illegal registration in Armenia. That litigation and the New York arbitration were subsequently resolved in favor of the Company, restoring the Company’s 100% ownership of Marjan. On November 10, 2014, the International Center for Dispute Resolution awarded the Company over $10.8 million in damages and other relief for Caldera’s actions, including that a partially overlapping license held by a Caldera affiliate, Biomine, LLC, identified as “Marjan West” should be relinquished which reportedly occurred as of December 31, 2015. The Armenian Government issued a new mining license to the Company’s wholly owned subsidiary Marjan RA on March 5, 2013 and is available on the Company’s website www.globalgoldcorp.com .

Because the Company’s arbitration with Caldera was not resolved until November 2014, the overlapping license issue reported here was not resolved in 2015, and resolution of the Company’s liability for approximately $577,000 in Caldera related debt in Armenia was not resolved until February 20, 2017. The Company did not make mining or exploration expenditures at Marjan during 2014, 2015 and 2016. The Company is finalizing a three year exploration program which will include drilling approximately 15,000 additional meters in the Saddle Area between the Central and North Sections as well as performing some surface sampling and trench sampling. The exploration program will cost approximately $5 million dollars and will build toward a full feasibility study. The cost for each exploration activity is not defined at this time since our mining license does not require further exploration. Beyond the Company’s geological professionals, the Company has not identified who will conduct any of the exploration work. The Company is working with various companies to raise funding for this project but did not raise necessary funds in 2016.

See Legal Matters for an update on the terminated Marjan JV.

See Item 1A “Risk Factors” and Item 3 “Legal Proceedings”, below.

Toukhmanuk

The Toukhmanuk property is adjacent to the Hankavan property in central Armenia, between the Aragatsotn and Kotayk provinces. The property includes seven surrounding exploration sites as well as other assets. The property is located approximately 60 km (72 km by road) north of Yerevan, close to the Town of Aparan and some 75 km (by road) from the Alaverdi copper smelter in northern Armenia. Access to the Toukhmanuk Property is by paved road (about 57 km from Yerevan to the turn-off of the road north of Aparan and about 15 km by dirt road from Aparan to Melikkyugh, the nearby village to the site). Local infrastructure is available at the site and at nearby towns. Infrastructure at the site includes electrical power, cell phone network and road building equipment. Logistical support, in terms of power, is available at the Toukhmanuk site, and at Melikkyugh, which is linked by a 10 Kv line to the Armenian Power grid. Water is available from natural sources within the property, independent of community sources. In addition to the central property, the acquisition included a 200,000 tonne per year capacity plant. The Company has maintained the plant’s crushers, mills, and gravitation circuits in good condition while also adding a hydro cyclone and flotation cells, as well as building a new tailings dam. Other major assets at the property include several bulldozers, excavators and a track trencher which are all in good condition. The property also includes some temporary housing units, and hangers which are used to store core samples, a gold room, and a new ISO certified laboratory.

The area of the Toukhmanuk Property is underlain predominantly by Jurassic volcanic rocks and Cretaceous intrusive rocks. The volcanic rocks comprise andesites and dacites, and the intrusive rocks are dominantly granitic with minor granitic gneiss and amphibolites. Parts of the area are also covered by Tertiary volcanic rocks including obsidian and perlites. Gold mineralization in the Toukhmanuk area is hosted by both volcanic and intrusive rocks.

On October 27, 2009, the Company issued a press release announcing the approval of the first stage. The Republic of Armenia’s State Natural Resources Agency (the "Agency") issued its certificate based on the proposal of the Agency’s State Geological Expert Commission made during its October 23, 2009 session, all as further disclosed on our website.

On November 18, 2009, the Company issued a press release announcing that following up on the issuance of the approving a first stage, the Republic of Armenia’s State Natural Resources Agency (the “Agency”) has delivered its full decision with backup calculations on November 13, 2009. The Agency issued its decision based on the proposal of the Agency’s State Geological Expert Commission made during its October 23, 2009 session. A copy of the official approval and a partial unofficial translation are available on the company’s website www.globalgoldcorp.com (please refer to the “Cautionary Note to U.S. Investors” on page 3 of this report).

The Company has done geological mapping, ground geophysical surveys, trenching and diamond drill testing at Toukhmanuk and continues its exploration work there based on the Armenian historical GKZ records in conjunction with the exploration work and results done so far (please refer to the “Cautionary Note to U.S. Investors” on page 3 of this report). Additional exploration work will need to be funded with additional funds raised through joint ventures, debt, equity or a combination thereof.

On November 4, 2016, the Armenian State Committee on Reserves approved additional amounts in three areas outside the Toukhmanuk central mining license area, i.e. in the exploration license area which is reproduced on the Company’s website. This approval triggers a one year period for the Company to prepare a mining plan for the previously exploration licensed areas, obtain new mine and territory allocations, and convert exploration license area to long term mining license territory. (Note, please refer to our “Cautionary Note to U.S. Investors” on our website and Form 10-K with regard to the SEC and other standards for the term “reserve.”)

On June 17, 2015, the Company received the Armenian Government’s reconfirmation of its Armenian standard findings confirmed by Ministry of Energy and Natural Resources order F-119/15, which is available on the Company’s website. The Toukhmanuk property is a lode deposit which is being mined using an open pit method. The Company has one national exploration license #15, as extended on July 2, 2013 until July 2, 2016 (available on the Company’s website), covering approximately 10,915 acres for sub-surface exploitation of gold. The Company also has one national mining license #HA-L-14/356, which was replaced under the new 2012 Armenian Mining Code with License #29/184 (available on the Company’s website), which covers the central section of the property and is approximately 446 acres for mining gold and silver. On December 28, 2012, the Company also received a renewable mining license #29/184 through August 5, 2017. On August 24, 2015, the Company’s Mego Gold subsidiary received the following from the Armenian government for the Toukhmanuk property: a new “Mining Agreement and Extension,” a new “Mining Act Allocation,” a new “Mining Permit and Extension” (license) amending #29/184, and a new “Order on Mining Rights” all of which are posted on the Company’s website and which expand the relevant mining license area from approximately 2.2 square kilometers to 3.2 square kilometers (approximately 791 acres) as well as extend the right to mine until July 21, 2040 all as more particularly stated in Exhibit 10.77, below. The mining license will be expanded to cover portions of the former exploration license territory, pursuant to the November 4, 2016 Armenian State Committee on Reserves approval.

The Company is required to pay annual governmental fees of approximately $22,000. The Company is also required to mine annually 168,500 tonnes of mineralized rock at the property as submitted and approved in its mining plan in order to maintain the licenses in good standing (please refer to the “Cautionary Note to U.S. Investors” on page 3 of this report). The former exploration license area is defined by the following coordinates:

Toukhmanuk Property, Armenia

|

Corner |

Easting (X) |

Northing (Y) |

|

1 |

4501580 |

8444500 |

|

2 |

4504350 |

8447800 |

|

3 |

4502700 |

8450000 |

|

4 |

4504050 |

8451850 |

|

5 |

4503250 |

8452250 |

|

6 |

4503300 |

8453950 |

|

7 |

4502500 |

8453900 |

|

8 |

4502400 |

8450850 |

|

9 |

4501950 |

8451350 |

|

10 |

4501680 |

8452550 |

|

11 |

4500525 |

8453380 |

|

12 |

4499730 |

8453950 |

|

13 |

4499800 |

8451600 |

|

14 |

4500650 |

8451550 |

|

15 |

4500700 |

8450600 |

|

16 |

4500000 |

8449870 |

|

17 |

4498550 |

8450700 |

|

18 |

4497000 |

8450650 |

|

19 |

4497000 |

8448370 |

|

20 |

4497900 |

8448700 |

|

21 |

4498200 |

8447550 |

|

22 |

4497000 |

8446100 |

|

23 |

4497000 |

8444400 |

|

24 |

4499000 |

8444400 |

|

25 |

4491750 |

8445650 |

The expanded 2015 mining license area coordinates are within the coordinates above, as set out in Exhibit 10.77, and are also available on the Company’s website.

The Company is required to pay annual government fees and perform work at the property, both as described above, to keep the license in good standing. In various circumstances, Armenian law allows for annual work requirements to be cured in subsequent years and by other means without losing good standing status. Failure to maintain good license status could result in the license being suspended or terminated under Armenian Law. The Company has not received any suspension or termination notices, but could based on the Company’s performance and other factors. See Item 1A “Risk Factors,” below.

In 2008, GGM upgraded the plant and lab, installed a new gold room, recommenced mining and production of concentrate, and continued its analysis of the prior year’s drill results. Also, the Company compiled its report and submitted it to the State Committee on Reserves of Armenia in March 2009 (please refer to the “Cautionary Note to U.S. Investors” on page 3 of this report). The Company has generated minimal sales from gold and silver concentrate from the property. Sales were approximately $6,000 in 2006 based on unmeasured old concentrate with waste concentrate, $10,400 in 2007 based on approximately 53 tonnes of concentrate with gold content of approximately 20.8 g/t gold, nothing in 2008, $136,600 in 2009 based on approximately 121 tonnes of concentrate with gold content of approximately 52.6 g/t gold, $358,400 in 2010 based on approximately 222 tonnes of concentrate with gold content of approximately 52.7 g/t gold, $81,702 in 2011 based on approximately 60 tonnes of concentrate with gold content of approximately 38.8 g/t gold, and none in 2012, 2013, 2014, 2015 and 2016. The Company has mined mineralized rock of approximately 52,000 tonnes in 2006 with content of approximately 1.27 g/t gold and 6.37 g/t silver, no mining in 2007, approximately 82,000 tonnes in 2008 with content of approximately 1.85 g/t gold and 5.21 g/t silver, no mining in 2009, approximately 21,000 tonnes in 2010 with content of approximately 2.08 g/t gold and 5.68 g/t silver, approximately 21,400 tonnes in 2011 with content of approximately 0.92 g/t gold and 3.32 g/t silver, and no mining in 2012, 2013, 2014, 2015 and 2016. As of December 31, 2016, the Company has spent approximately $12,580,000 on mining and exploration activities at this property, excluding acquisition and capital costs. In 2012, the Company installed two new mills at the plant to increase capacity and efficiency, but in 2012, 2013, 2014, 2015 and 2016 did not process any ore pending approval and construction of a new tailings dam and resolution of joint venture issues.

During 2014 and 2015, the Company, including through its contractor, spent $610,248 and $661,497, respectively, on exploration, assaying, modeling and design work at the Toukhmanuk Property to prepare for mining activities. The Company has requested but not received substantiation from Linne Mining for advances and amounts drawn down on the Mine Operator's Debt Facility. Equipment and assets for which title has transferred to the Company, and have been received by the Company are recorded as the Company's property, plant and equipment. Construction in process includes the Company's assets which are not yet completed and place in service, such as the new plant at the Toukhmanuk property in Armenia (Pictures of construction progress are available on the Company’s website). We have also requested a report for the full mining activity done by Linne Mining, which also has not been received. We have expensed all amount for which we have not received any support. In 2016, the Company did review of prior exploration work, mine planning, plant construction review, production projection work, and license work including submissions to the State Committee on Reserves as well as tailings dam review work, spending approximately $200,000.

On May 22, 2008, the government of Armenia issued a “special exploration license” to the Company for the Toukhmanuk mining property. The license was effective May 13, 2008 to expire on May 13, 2010 was extended for an additional two years and as a matter of right pursuant to the Armenian Mining Code is being extended until May 13, 2015. The exploration license does not affect the Company’s license over the smaller “Central Section” of the property.

On August 1, 2005, GGM entered into a share purchase agreement to acquire the Armenian limited liability company Mego-Gold, LLC which acquired the license from the government for the Toukhmanuk mining property and surrounding exploration sites as well as the owner of the related processing plant and other assets. On August 2, 2006, GGM exercised its option to acquire the remaining forty-nine percent (49%) of Mego-Gold, LLC.

As of March 17, 2011, the Company entered into an agreement (the “Formation Agreement”) with Consolidated Resources USA, LLC, a Delaware company (“CRU”) for a joint venture on the Company’s Toukhmanuk and Getik properties in Armenia (the “Properties”). Upon payment of the initial consideration as provided below, Global Gold and CRU will work together for twelve months (the “12 Month Period”) to develop the Properties and cause the Properties to be contributed to a new joint venture company, whose identity and terms will be mutually agreed, (the “JVC”). Rasia, a Dubai-based principal advisory company, acted as sole advisor on the transaction.

Key terms include CRU paying initial consideration of $5,000,000 as a working capital commitment to Global Gold payable by: a $500,000 advance immediately following the execution of the Formation Agreement (the “Advance”); $1,400,000 payable following the satisfactory completion of due diligence by CRU and the execution of definitive documents in 30 days from the date of this Agreement; and $3,100,000 according to a separate schedule in advance and payable within 5 business days of the end of every calendar month as needed.

On April 27, 2011, the Company entered into an agreement with Consolidated Resources Armenia, an exempt non-resident Cayman Islands company (“CRA”); and its affiliate CRU, (hereinafter collectively referred to as “CR”), to fund development and form a joint venture on the Properties (the “JV Agreement”). The JV Agreement was entered pursuant to the Formation Agreement.

Note, all historical CRA and related disclosures are affected by the Company’s prevailing in the Island of Jersey litigation resulting: (a) on September 13, 2016, the United Kingdom “Judicial Committee of the Privy Council” (“JCPC”) issued an order and opinion finally dismissing the action which Joseph Borkowski filed and pursued purportedly on behalf of CRA in Island of Jersey against GGCRL, the Company, and Van Krikorian. (JCPC # 2015/0075). The JCPC dismissed the Borkowski/CRA action with prejudice and like the lower courts granted the Company and Mr. Krikorian their costs and legal fees. This fully terminates the Jersey litigation in favor of the Company and Mr. Krikorian except for the calculation and collection of costs and legal fees; and (b) on December 1, 2016, the Viscounts Department of the Island of Jersey arrested all of the CRA shares in GGCRL in favor of the Company pursuant to a Royal Court judgement in the Company’s favor.

CR completed its due diligence with satisfaction, and as of the date of the JV Agreement completed the funding of the required $500,000 Advance. Upon the terms and subject to the conditions of JV Agreement, CR was to complete the funding of the remaining $4,500,000 of its $5,000,000 working capital commitment related to Toukhmanuk and Getik according to an agreed, restricted funding schedule which includes $1,400,000 payable following the execution of the Agreement and the remaining $3,100,000 payable over the next 12 months with payments occurring within 5 business days of the end of each calendar month as needed. In addition, Mr. Jeffrey Marvin of CR was elected a member of the Global Gold Board of Directors and attended the Company's annual meeting on June 10, 2011. As of December 31, 2011, the Company received the full $5,000,000 funding from CR. Mr. Marvin resigned from the Global Gold board on February 24, 2012 for personal reasons.

Pursuant to the JV Agreement, Global Gold and CR were working together for twelve months (the “12 Month Period”) from the date of the JV Agreement to develop the Properties, improve the financial performance and enhance shareholder value. The JV Agreement enables Global Gold to complete its current Toukhmanuk production expansion to 300,000 tonnes per year and advance exploration in Armenia. Global Gold and CR agree to form a new Joint Venture Company (“JVC”) to be established by CR, subject to terms and conditions mutually and reasonably agreed with Global Gold, provided that JVC shall have no liabilities, obligations, contingent or not, or commitments, except pursuant to a shareholders’ agreement. Global Gold and CR intend to integrate all of Global Gold’s Toukhmanuk and Getik mining and exploration operations into the JVC.

The JVC was to (i) own, develop and operate Toukhmanuk and Getik, (ii) be a company listed on an exchange fully admitted to trading or be in the process of being listed on such exchange and (iii) have no liabilities, obligations, contingent or not, or commitments except pursuant to the shareholders agreement. The JVC will issue new shares to the Company such that following any reverse merger or initial public offering of JVC's shares ("IPO"), Global Gold shall directly or indirectly hold the greater of (a) 51% of the equity of JVC, or (b) $40.0 million in newly issued stock of JVC, calculated based on the volume weighted average price ("VWAP") of such shares over the first 30 (thirty) days of trading following the IPO, assuming issuance of all shares issuable in the IPO, and assuming issuance of all shares issuable as management shares and conversion of the Notes issued under the Instrument (as defined) and all other convertible securities and exercise of any warrants or other securities issued in connection with the IPO, such that if following any reverse merger or IPO, the value of $40.0 million in newly issued shares based on VWAP of JVC shares is greater than the Global Gold's 51% equity ownership in JVC valued as above, new shares in JVC will be issued to the Global Gold such that the aggregate value of Global Gold's ownership in JVC is shares having a value of $40.0 million based on VWAP, and the Company shall remain in control of the JVC following the public listing.

On February 6, 2012, the Company received consent from shareholders representing a majority over 65% of its outstanding Common Stock to transfer the 100% interests in Mego and Getik Mining Company, LLC into GGCR Mining, LLC, a Delaware limited liability company, owned by a joint venture company, Global Gold Consolidated Resources Limited, a Jersey Island private limited company (“GGCR”), per the terms of the April 27, 2011 JV Agreement with Consolidated Resources Armenia, an exempt non-resident Cayman Islands company (“CRA“). The JVC was to issue new shares to the Company such that following any reverse merger or initial public offering of JVC's shares ("IPO"), Global Gold shall directly or indirectly hold the greater of (a) 51% of the equity of JVC, or (b) $40.0 million in newly issued stock of JVC, calculated based on the volume weighted average price ("VWAP") of such shares over the first 30 (thirty) days of trading following the IPO, assuming issuance of all shares issuable in the IPO, and assuming issuance of all shares issuable as management shares and conversion of the Notes issued under the Instrument (as defined) and all other convertible securities and exercise of any warrants or other securities issued in connection with the IPO, such that if following any reverse merger or IPO, the value of $40.0 million in newly issued shares based on VWAP of JVC shares is greater than the Global Gold's 51% equity ownership in JVC valued as above, new shares in JVC will be issued to the Global Gold such that the aggregate value of Global Gold's ownership in JVC is shares having a value of $40.0 million based on VWAP, and the Company shall remain in control of the JVC following the public listing, all as further described in exhibit 10.34 below. The Board of Directors of Global Gold Corporation previously approved the same transaction, discussed above, on January 5, 2012.

Based on the approval of the Board of Directors of Global Gold received on January 5, 2012 and on receiving consent from its shareholders representing over a 65% majority of its outstanding Common Stock on February 6, 2012, to transfer the 100% interest in Mego and Getik Mining Company, LLC into GGCR Mining, LLC, a Delaware limited liability company (“GGCR Mining”), owned by a joint venture company, Global Gold Consolidated Resources Limited, a Jersey Island private limited company (“GGCR”), per the terms of the April 27, 2011 Joint Venture Agreement with Consolidated Resources Armenia, an exempt non-resident Cayman Islands company (“CRA”), the Company entered into the following agreements on or about February 19, 2012 updating previous agreements, all as further described in the exhibits attached, on the following dates:

|

|

● |

Shareholders Agreement for GGCR dated February 18, 2012 (Exhibit 10.36) |

|

|

● |

Supplemental Letter dated February 19, 2012 (Exhibit 10.37) |

|

|

● |

Getik Assignment and Assumption Agreement dated February 19, 2012 (Exhibit 10.38) |

|

|

● |

MG Assignment and Assumption Agreement dated February 19, 2012 (Exhibit 10.39) |

|

|

● |

Guaranty dated February 19, 2012 (by GGC to CRA) (Exhibit 10.40) |

|

|

● |

Guaranty dated February 19, 2012 (by GGCR Mining to CRA) (Exhibit 10.41) |

|

|

● |

Security Agreement dated February 19, 2012 (by GGCR and GGCR Mining to CRA) (Exhibit 10.42) |

|

|

● |

Action by Written Consent of the Sole Member of GGCR Mining, LLC dated February 19, 2012 (Exhibit 10.43) |

|

|

● |

Certificate of Global Gold Corporation dated February 19, 2012 (Exhibit 10.44) |

|

|

● |

Global Gold Consolidated Resources Limited Registered Company No 109058 Written resolutions by all of the directors of the Company (Exhibit 10.45) |

|

|

● |

Action by Written Consent of the Board of Managers of GGCR Mining, LLC (Exhibit 10.46) |

Key terms included that Global Gold will retain 51% of the shares of GGCR, which will be a subsidiary of the Company, per the terms of the April 27, 2011 Joint Venture Agreement as approved and described above. The Board of Directors of GGCR Mining would be comprised of Van Krikorian, from GGC, Prem Premraj, from CRA, and three non-executive independent directors to be selected in the future. Pending the closing, if any, GGM was designated as the manager of the Toukhmanuk and Getik properties, with reasonable costs incurred by GGM with respect thereto being passed through to GGCRL and GGCR Mining, as applicable, for reimbursement. The April 26, 2012 deadline set in the April 2011 JV Agreement to close the transaction passed without a closing for several reasons, as previously reported, clarification and settlement efforts followed.

On September 26, 2012, GGM entered into two Share Transfer Agreements with GGCR Mining covering the transfer of all the shares of the Armenian companies Mego and the Getik Mining Company, LLC which respectively hold the Toukhmanuk and Getik mining properties in Armenia. The Share Transfer Agreements were concluded in accordance with the previously disclosed agreements with Consolidated Resources Armenia and Consolidated Resources USA, LLC, a Delaware limited liability company to fund development and form a joint venture on the Company’s Toukhmanuk and Getik properties in Armenia. GGCR Mining will (i) own, develop and operate Toukhmanuk and Getik gold mining properties, and be a (ii) be a company listed on an exchange fully admitted to trading. As of September 19, 2012, GGCRL resolved reported outstanding issues which had blocked implementation of the joint venture agreement and execution of the Share Transfer Agreements. Global Gold’s ownership in GGCRL is and shall be the greater value of either 51% or the pro forma value of $40.0 million 30 days after the stock is publicly traded. The sole officers of GGCRL as of September 19, 2012 are: Mr. Van Krikorian, Executive Chairman; Mr. Jan Dulman, Financial Controller/CFO/Treasurer; and Mr. Ashot Boghossian Armenia Managing Director, with Ogier -Corporate Services (Jersey) Limited continuing as secretary of the Company. See attached Exhibits 10.58 and 10.59.

On October 26, 2012, the shares of Mego and Getik were registered, subject to terms and conditions as stated in the transfer documents, with the State Registry of the Republic of Armenia, as being fully owned by GGCR Mining. The registration was completed after approval was given by ABB which required Global Gold to guaranty the ABB line of credit payable. The joint venture was closed in 2012. The conditions for transfer were not met and CRA breached the Agreements. On March 10, 2014, an Order of Justice was filed to commence legal action against the Company in the Isle of Jersey, purportedly on behalf of CRA. The Company successfully argued that the case should be referred to arbitration in New York. The Company has also raised fraud issues with CRA, Rasia, and Mr. Borkowski which have not been resolved; if unresolved, the fraud issues would vitiate CRA’s rights and create liabilities for the CRA parties as well as Rasia and Mr. Borkowski.

On March 26, 2015, the Court of Appeals of the Island of Jersey ruled in the Company’s favor in staying all proceedings and referring the claims initiated by Joseph Borkowski, purportedly on behalf of CRA to the contracted dispute resolution procedures in New York City. On the same day, the Court of Appeals also granted the Company its costs and fees for the entire proceedings with CRA. Approximately $65,000 has already been awarded to the Company against CRA (but not paid) with an application for an additional approximately $263,000 based on the Court of Appeals award pending. On May 27, 2015, the Court of Appeals of the Island of Jersey again ruled in the Company’s favor refusing CRA’s request for leave to appeal to the Queen’s Privy Council. CRA requested the Queen’s Privy Council for leave to appeal which was granted. At the same time, On November 18, 2015, the Royal Court of Jersey ruled in favor of GGCRL, the Company, and Mr. Krikorian in lifting all remnants of the injunction issued in 2014 which was not appealed, see exhibit 10.76 below. The Company has been awarded its costs and attorney fees, which it is pursuing. CRA has not complied with the agreed dispute resolution provisions to commence in New York, despite the Company’s initiation of the agreed mediation clause.

On July 5, 2013, GGCRL and the Company entered a financing and mine contractor agreement with Linne Mining and associated parties to mine the central section of Toukhmanuk. Equipment for a major plant expansion was purchased and delivered in 2014. Linne failed to perform and ultimately abandoned the mine operation in 2015 prior to completing the new plant or complying with its obligations to mine under the relevant agreements. While Linne procured and began assembling a new processing plant at Toukhmanuk, it abandoned completing the work as well as mining in accordance with relevant agreements and approved plans. Linne asked to be relieved of its responsibilities but terms for accommodating that request have not been agreed to and Linne continues to be responsible. The Company’s requests for substantiation of expenses and disbursements from Linne have been refused through the end of 2016, despite repeated requests to Linne and its counsel.

In 2016, the Company engaged in substantial mine planning and review, prepared the mine site, reviewed the already commenced construction of a million tonne per year plant (pictures are available on the Company’s website), and construction of a new tailings dam, and reviewed prior drilling and exploration work in anticipation of converting the exploration license to a mining license and pursuant to the legal requirements following the November 4, 2016 decision of the Armenian State Committee on Reserves. No further drilling was performed at the site in 2016. The Company has given notice to the Mine Operator of its many breaches of obligation to mine and legal disputes.

See Item 1A “Risk Factors”, Item 3 “Legal Proceedings”, “Agreements” and “Subsequent Events” below.

Getik

The Getik property is located in the northeast Geghargunik province of Armenia north-east of Lake Sevan and approximately 110 km north-east of Yerevan. The property is accessible by car or truck through existing paved and dirt roads. Gas and electric power are available at the property. The property is located in the Alaverdi-Kapan metallogenic zone on the edge of the Sevan suture zone in an area characterized by volcanogenic sedimentary rocks of Jurassic and Eocene age. A series of granitoid intrusives varying from ganodiorite to rhyolite composition have been identified in the area associated with a regional scale east-west trending fault and locale scale north-south trending faults. The Company does not have any facilities or material equipment at the property. The Company has only done exploration work at the property and has not developed any significant surface or underground working or infrastructure. All equipment needed was brought to the site on an as needed basis from the Company’s other properties or from contractors.

The Company stopped working at Getik in 2016, and is pursuing its legal options. A competing license was issued to an Armenian company, Global Signature Gold, formed and formerly owned by Signature Gold Limited pursuant to confidential information provided by the Company and governed by a confidentiality agreement. Control of Global Signature Gold based on public records was transferred to lawyers associated with Joseph Borkowski, and the Company has put Signature Gold Limited of Australia on notice of its liabilities.

The Company does not currently have established reserves at the Getik Property and is focusing on exploration work based on Armenian historical GKZ records. The Company has done geological mapping, ground geophysical surveys, trenching and diamond drill testing at Getik and continues its exploration work there based on the Armenian historical GKZ records in conjunction with the exploration work and results done so far (please refer to the “Cautionary Note to U.S. Investors” on page 3 of this report). On October 17, 2011, the Company received an updated independent technical report prepared by Behre Dolbear International Limited for the Toukhmanuk and Getik properties in Armenia and reporting on new discoveries at Toukhmanuk which is available on the Company’s website. Additional exploration work will need to be funded with additional funds raised through joint ventures, debt, equity or a combination thereof.

The Getik property is a lode deposit which will be mined using an open pit. The Company had two National exploration licenses #85 which covers sub-surface exploitation of precious metals in the Amrots manifestation and #86 which covers sub-surface exploitation of non-ferrous metals in the Aygut manifestation, as further described below. These licenses have since been replaced under the new 2012 Armenian Mining Code with License #29/034 and #29/035, respectively, which expired on December 10, 2013. The Company filed for an extension of the term of Getik license on December 6, 2013. Under Armenia Mineral Code Article 42.7, in case the application for an extension of the term of an exploration license has not been rejected within thirty (30) days of filing, the application shall be considered as granted. The Company has applied for extensions, to which it is entitled under Armenian law although the documents have not been issued yet. The license required annual governmental fees of $1,000. The Company was also required to spend approximately $1,000,000 on exploration work in order to maintain the licenses in good standing. For the exploration licenses, under Article 36 of Armenia Mineral Code, all time terms mentioned in the exploration license agreement (which is the document providing times for completion of different works) are contemplated, which means that the Company can cure the work requirements under the license, or any “material non - compliance” in subsequent years. The exploration license area was defined by the following coordinates for the Amrots gold manifestation and Aygut copper manifestation:

|

Amrots manifestation | |||||

|

1. |

X = 4507000 |

5. |

X = 4504350 |

9. |

X = 4504000 |

|

|

Y = 8517000 |

|

Y = 8521350 |

|

Y = 8519650 |

|

2. |

X = 4507000 |

6. |

X = 4504450 |

10. |

X = 4504350 |

|

|

Y = 8525000 |

|

Y = 8520850 |

|

Y = 8519000 |

|

3. |

X = 4503000 |

7. |

X = 4504350 |

11. |

X = 4504750 |

|

|

Y = 8525000 |

|

Y = 8520350 |

|

Y = 8517000 |

|

4. |

X = 4503000 |

8. |

X = 4504125 |

|

|

|

|

Y = 8522000 |

|

Y = 8520250 |

|

|

|

|

Amrots manifestation |

|

| ||

|

1. |

X = 4507000 |

3. |

X = 4504750 |

|

|

|

|

Y = 8516000 |

|

Y = 8517000 |

|

|

|

2. |

X = 4507000 |

4. |

X = 4504950 |

|

|

|

|

Y = 8517000 |

|

Y = 8516000 |

|

|

The Company is required to pay annual government fees and perform work at the property, both as described above, to keep the license in good standing. In various circumstances, Armenian law allows for annual work requirements to be cured in subsequent years and by other means without losing good standing status. Failure to maintain good license status could result in the license being suspended or terminated under Armenian Law. The Company has not received any suspension or termination notices, but could based on the Company’s performance and other factors. See Item 1A “Risk Factors,” below.

In 2009, Getik Mining Company, LLC engaged in mapping, sampling, drill analysis and other exploration work at the Getik property. As of December 31, 2009, the Company has not generated any revenue from sales of any concentrate or other mineralized material at the property. As of December 31, 2011, the Company has spent approximately $650,000 on mining and exploration activities at this property, excluding acquisition and capital costs.

On December 10, 2008, the government of Armenia issued a new special exploration license expiring December 10, 2013. The Company will conduct further exploration activities during this period.

On January 31, 2006, GGM closed a share purchase agreement, dated as of January 23, 2006, with Athelea Investments, CJSC ("AI") to transfer 80% of the shares of AI to GGM in exchange for 100,000 of the Company’s common stock. AI was renamed the "Getik Mining Company, LLC." As of May 30, 2007, GGM acquired the remaining twenty percent interest in Getik Mining Company, LLC, leaving GGM as the owner of one hundred percent of Getik Mining Company, LLC.

All historical CRA and related disclosures are affected by the Company’s prevailing in the Island of Jersey litigation resulting: (a) on September 13, 2016, the United Kingdom “Judicial Committee of the Privy Council” (“JCPC”) issued an order and opinion finally dismissing the action which Joseph Borkowski filed and pursued purportedly on behalf of CRA in Island of Jersey against GGCRL, the Company, and Van Krikorian. (JCPC # 2015/0075). The JCPC dismissed the Borkowski/CRA action with prejudice and like the lower courts granted the Company and Mr. Krikorian their costs and legal fees. This fully terminates the Jersey litigation in favor of the Company and Mr. Krikorian except for the calculation and collection of costs and legal fees; and (b) on December 1, 2016, the Viscounts Department of the Island of Jersey arrested all of the CRA shares in GGCRL in favor of the Company pursuant to a Royal Court judgement in the Company’s favor.

As of March 17, 2011, the Company entered into an agreement (the “Formation Agreement”) with Consolidated Resources USA, LLC, a Delaware company (“CRU”) for a joint venture on the Company’s Toukhmanuk and Getik properties in Armenia (the “Properties”). Upon payment of the initial consideration as provided below, Global Gold and CRU will work together for twelve months (the “12 Month Period”) to develop the Properties and cause the Properties to be contributed to a new joint venture company, whose identity and terms will be mutually agreed, (the “JVC”). Rasia, a Dubai-based principal advisory company, acted as sole advisor on the transaction.

Key terms include CRU paying initial consideration of $5,000,000 as a working capital commitment to Global Gold payable by: a $500,000 advance immediately following the execution of the Formation Agreement (the “Advance”); $1,400,000 payable following the satisfactory completion of due diligence by CRU and the execution of definitive documents in 30 days from the date of this Agreement; and $3,100,000 according to a separate schedule in advance and payable within 5 business days of the end of every calendar month as needed.

On April 27, 2011, the Company entered into an agreement with Consolidated Resources Armenia, an exempt non-resident Cayman Islands company (“CRA”); and its affiliate CRU, (hereinafter collectively referred to as “CR”), to fund development and form a joint venture on the Properties (the “JV Agreement”). The JV Agreement was entered pursuant to the Formation Agreement. CR completed its due diligence with satisfaction, and as of the date of the JV Agreement completed the funding of the required $500,000 Advance. Upon the terms and subject to the conditions of JV Agreement, CR will complete the funding of the remaining $4,500,000 of its $5,000,000 working capital commitment related to Toukhmanuk and Getik according to an agreed, restricted funding schedule which includes $1,400,000 payable following the execution of the Agreement and the remaining $3,100,000 payable over the next 12 months with payments occurring within 5 business days of the end of each calendar month as needed. In addition, Mr. Jeffrey Marvin of CR was elected a member of the Global Gold Board of Directors and attended the Company's annual meeting on June 10, 2011. As of December 31, 2011, the Company received the full $5,000,000 funding from CR. Mr. Marvin resigned from the Global Gold board on February 24, 2012 for personal reasons.

Pursuant to the JV Agreement, Global Gold and CR were working together for twelve months (the “12 Month Period”) from the date of the JV Agreement to develop the Properties, improve the financial performance and enhance shareholder value. The JV Agreement enables Global Gold to complete its current Toukhmanuk production expansion to 300,000 tonnes per year and advance exploration in Armenia. Global Gold and CR agree to form a new Joint Venture Company (“JVC”) to be established by CR, subject to terms and conditions mutually and reasonably agreed with Global Gold, provided that JVC shall have no liabilities, obligations, contingent or not, or commitments, except pursuant to a shareholders’ agreement. Global Gold and CR intend to integrate all of Global Gold’s Toukhmanuk and Getik mining and exploration operations into the JVC.

The JVC was to (i) own, develop and operate Toukhmanuk and Getik, (ii) be a company listed on an exchange fully admitted to trading or be in the process of being listed on such exchange and (iii) have no liabilities, obligations, contingent or not, or commitments except pursuant to the shareholders agreement. The JVC was to issue new shares to the Company such that following any reverse merger or initial public offering of JVC's shares ("IPO"), Global Gold shall directly or indirectly hold the greater of (a) 51% of the equity of JVC, or (b) $40.0 million in newly issued stock of JVC, calculated based on the volume weighted average price ("VWAP") of such shares over the first 30 (thirty) days of trading following the IPO, assuming issuance of all shares issuable in the IPO, and assuming issuance of all shares issuable as management shares and conversion of the Notes issued under the Instrument (as defined) and all other convertible securities and exercise of any warrants or other securities issued in connection with the IPO, such that if following any reverse merger or IPO, the value of $40.0 million in newly issued shares based on VWAP of JVC shares is greater than the Global Gold's 51% equity ownership in JVC valued as above, new shares in JVC will be issued to the Global Gold such that the aggregate value of Global Gold's ownership in JVC is shares having a value of $40.0 million based on VWAP, and the Company shall remain in control of the JVC following the public listing.

On February 6, 2012, the Company received consent from shareholders representing a majority over 65% of its outstanding Common Stock to transfer the 100% interests in Mego and Getik Mining Company, LLC into GGCR Mining, LLC, a Delaware limited liability company, owned by a joint venture company, Global Gold Consolidated Resources Limited, a Jersey Island private limited company (“GGCR”), per the terms of the April 27, 2011 Joint Venture Agreement with Consolidated Resources Armenia, an exempt non-resident Cayman Islands company (“CRA“). The JVC was to issue new shares to the Company such that following any reverse merger or initial public offering of JVC's shares ("IPO"), Global Gold shall directly or indirectly hold the greater of (a) 51% of the equity of JVC, or (b) $40.0 million in newly issued stock of JVC, calculated based on the volume weighted average price ("VWAP") of such shares over the first 30 (thirty) days of trading following the IPO, assuming issuance of all shares issuable in the IPO, and assuming issuance of all shares issuable as management shares and conversion of the Notes issued under the Instrument (as defined) and all other convertible securities and exercise of any warrants or other securities issued in connection with the IPO, such that if following any reverse merger or IPO, the value of $40.0 million in newly issued shares based on VWAP of JVC shares is greater than the Global Gold's 51% equity ownership in JVC valued as above, new shares in JVC will be issued to the Global Gold such that the aggregate value of Global Gold's ownership in JVC is shares having a value of $40.0 million based on VWAP, and the Company shall remain in control of the JVC following the public listing, all as further described in exhibit 10.34 below. The Board of Directors of Global Gold Corporation previously approved the same transaction, discussed above, on January 5, 2012.

Based on the approval of the Board of Directors of Global Gold received on January 5, 2012 and on receiving consent from its shareholders representing over a 65% majority of its outstanding Common Stock on February 6, 2012 to transfer the 100% interest in Mego and Getik Mining Company, LLC into GGCR Mining, LLC, a Delaware limited liability company (“GGCR Mining”), owned by a joint venture company, Global Gold Consolidated Resources Limited, a Jersey Island private limited company (“GGCR”), per the terms of the April 27, 2011 Joint Venture Agreement with Consolidated Resources Armenia, an exempt non-resident Cayman Islands company (“CRA”), the Company entered into the following agreements on or about February 19, 2012 updating previous agreements, all as further described in the exhibits attached, on the following dates:

|

|

● |

Shareholders Agreement for GGCR dated February 18, 2012 (Exhibit 10.36) |

|

|

● |

Supplemental Letter dated February 19, 2012 (Exhibit 10.37) |

|

|

● |

Getik Assignment and Assumption Agreement dated February 19, 2012 (Exhibit 10.38) |

|

|

● |

MG Assignment and Assumption Agreement dated February 19, 2012 (Exhibit 10.39) |

|

|

● |

Guaranty dated February 19, 2012 (by GGC to CRA) (Exhibit 10.40) |

|

|

● |

Guaranty dated February 19, 2012 (by GGCR Mining to CRA) (Exhibit 10.41) |

|

|

● |

Security Agreement dated February 19, 2012 (by GGCR and GGCR Mining to CRA) (Exhibit 10.42) |

|

|

● |

Action by Written Consent of the Sole Member of GGCR Mining, LLC dated February 19, 2012 (Exhibit 10.43) |

|

|

● |

Certificate of Global Gold Corporation dated February 19, 2012 (Exhibit 10.44) |

|

|

● |

Global Gold Consolidated Resources Limited Registered Company No 109058 Written resolutions by all of the directors of the Company (Exhibit 10.45) |

|

|

● |

Action by Written Consent of the Board of Managers of GGCR Mining, LLC (Exhibit 10.46) |

Key terms included that Global Gold will retain 51% of the shares of GGCR, which will be a subsidiary of the Company, per the terms of the April 27, 2011 Joint Venture Agreement as approved and described above. The Board of Directors of GGCR Mining would be comprised of Van Krikorian, from GGC, Prem Premraj, from CRA, and three non-executive independent directors to be selected in the future. Pending the closing, if any, GGM was designated as the manager of the Toukhmanuk and Getik properties, with reasonable costs incurred by GGM with respect thereto being passed through to GGCRL and GGCR Mining, as applicable, for reimbursement. The April 26, 2012 deadline set in the April 2011 JV Agreement to close the transaction passed without a closing for several reasons, as previously reported, clarification and settlement efforts followed.

On September 26, 2012, GGM entered into two Share Transfer Agreements with GGCR Mining covering the transfer of all the shares of the Armenian companies Mego and the Getik Mining Company, LLC which respectively hold the Toukhmanuk and Getik mining properties in Armenia. The Share Transfer Agreements were concluded in accordance with the previously disclosed agreements with Consolidated Resources Armenia and Consolidated Resources USA, LLC, a Delaware limited liability company to fund development and form a joint venture on the Company’s Toukhmanuk and Getik properties in Armenia. GGCR Mining will (i) own, develop and operate Toukhmanuk and Getik gold mining properties, and be a (ii) be a company listed on an exchange fully admitted to trading. As of September 19, 2012, GGCRL resolved reported outstanding issues which had blocked implementation of the joint venture agreement and execution of the Share Transfer Agreements. Global Gold’s ownership in GGCRL is and shall be the greater value of either 51% or the pro forma value of $40.0 million 30 days after the stock is publicly traded. The sole officers of GGCRL as of September 19, 2012 are: Mr. Van Krikorian, Executive Chairman; Mr. Jan Dulman, Financial Controller/CFO/Treasurer; and Mr. Ashot Boghossian Armenia Managing Director, with Ogier -Corporate Services (Jersey) Limited continuing as secretary of the Company. See attached Exhibit 10.58 and 10.59.