Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Conifer Holdings, Inc. | a8-k2017annualmeetingslide.htm |

CNFR ANNUAL SHAREHOLDER MEETING

MAY 17, 2017

1

SAFE HARBOR STATEMENT

This presentation contains “forward-looking” statements within the meaning of Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of 1934, as amended, that are based on our management’s beliefs

and assumptions and on information currently available to management. These forward-looking statements include, without

limitation, statements regarding our industry, business strategy, plans, goals and expectations concerning our market position,

product expansion, future operations, margins, profitability, future efficiencies, and other financial and operating information.

When used in this discussion, the words “may,” “believes,” “intends,” “seeks,” “anticipates,” “plans,” “estimates,” “expects,”

“should,” “assumes,” “continues,” “potential,” “could,” “will,” “future” and the negative of these or similar terms and

phrases are intended to identify forward-looking statements.

Forward-looking statements involve known and unknown risks, uncertainties, inherent risks and other factors that may cause

our actual results, performance or achievements to be materially different from any future results, performance or

achievements expressed or implied by the forward-looking statements. Forward-looking statements represent our

management’s beliefs and assumptions only as of the date of this presentation. Our actual future results may be materially

different from what we expect due to factors largely outside our control, including the occurrence of severe weather

conditions and other catastrophes, the cyclical nature of the insurance industry, future actions by regulators, our ability to

obtain reinsurance coverage at reasonable rates and the effects of competition. These and other risks and uncertainties

associated with our business are described under the heading “Risk Factors” in our Annual Report on Form 10-K, filed on

March 15, 2017, which should be read in conjunction with this presentation. The company and subsidiaries operate in a

dynamic business environment, and therefore the risks identified are not meant to be exhaustive. Risk factors change and new

risks emerge frequently. Except as required by law, we assume no obligation to update these forward-looking statements

publicly, or to update the reasons actual results could differ materially from those anticipated in the forward-looking

statements, even if new information becomes available in the future.

CONIFER: AT A GLANCE

2

Exchange / Ticker Nasdaq: CNFR

Share Price (at 5/1/2017): $7.95

Shares Outstanding*: 7.6M

Market Capitalization: $60M

GAAP Equity*: $68M

Book Value per Share*: $8.88

Conifer Holdings, Inc.

Conifer

Insurance Company

MI Domicile

A.M. Best: B++

Demotech: A

White Pine

Insurance Company

MI Domicile

A.M. Best: B+

Demotech: A

Sycamore

Insurance Agency

MI Domicile

A.M. Best: NR

Demotech: NR

* as of 12/31/2016

COMPANY HISTORY

2008

North Pointe

(founded by

Conifer founder

Jim Petcoff)

sold to QBE for

$146 million, or

approximately

1.7X book value

2012

Non-compete

agreements expire

and Conifer is

founded, bringing

together successful

executives with

new, state-of-the-

art processing

systems

August 2015

Conifer completes

IPO on Nasdaq,

further expands

as a specialty

niche writer of

P&C products

2015

Company makes

strategic decision to

slow growth in

homeowners

product in Florida;

Commences new

specialty products

in security guards

and low-value

dwelling with

historically strong

loss ratios

2016

Conifer continues to

lessen exposure to

Florida market;

Ramps up new lines;

reports favorable

underwriting trends

in new lines; grows

GWP by 22.6%

2017

Lower expense ratio

as GWP continues

to grow; focus on

enhancing

underwriting profit

in core specialty

commercial lines

3

CNFR 2016: YEAR IN REVIEW

Maintained Focus on Writing Core Lines of Business

Shifted Business Mix to Improve Profitability

Achieved Additional Expense Efficiencies across Organization

Balance Sheet Remains Well-Positioned to Support Companies

2017: Drive Positive Bottom Line

4

BUSINESS MIX – GROSS WRITTEN PREMIUM 2015 & 2016

2015 2016

5

CHI CONSOLIDATED: GROSS WRITTEN PREMIUM

• CHI has consistently grown and retained over 93% of its core lines of business, demonstrating success in

finding and keeping profitable business within its main competencies

• Retained renewal business provides opportunities to improve risk profile

• Management has moved quickly and effectively to reduce exposure in the few lines that underperformed

-

20,000

40,000

60,000

80,000

100,000

120,000

2011 2012 2013 2014 2015 2016

Total Commercial

Other Personal

FL HO

FL PA

ALIA

GROSS WRITTEN PREMIUMS

YEARS

Retained

Commercial Lines

Re-worked lines6.9% of GWP

Retained

Personal Lines

$27.3

$55.1

$68.2

$88.2

$21.6

$16.8

$28.8

$25.6

$26.7

$4.8

$0

$20

$40

$60

$80

$100

$120

2013 2014 2015 2016 Q1 2017

M

I

L

L

I

O

N

S

Commercial Lines Personal Lines

GROSS WRITTEN PREMIUM

• Gross written premium increased

23% for the twelve months ended

December 31, 2016

• Total gross written premium was

$115 million as of December 31, 2016

• Net Written Premium – up 25% for 2016

• Net earned premium up 34% for

same period

• Factors driving premium growth include:

Strong commercial lines experience in

hospitality & small business accounts

Particularly in commercial multi-peril

and other liability lines

Achieved growth despite planned reduction

in Personal Lines, shifting away from

wind-exposed premium (particularly

reducing Florida homeowners exposure)

6

$19.1

$21.6

$6.2

$4.8

$0

$5

$10

$15

$20

$25

$30

Q1 2016 Q1 2017

M

I

L

L

I

O

N

S

Commercial Lines Personal Lines

Q1 2017 RESULTS OVERVIEW

Significant Net Earned Premium growth:

• Total gross written premium was $26.5 million

for Q1 2017

Up 4% over the same period in 2016

Net earned premium was up 20%

for the same period

• Factors driving premium growth include:

Strong commercial lines experience in

hospitality & small business accounts,

particularly in commercial multi-peril

and other liability lines

Personal lines focus on low-value dwelling

business while reducing wind-exposed

homeowners

• Continuing Expense ratio improvement

Almost 500 basis point reduction quarter over

quarter from 49.8% in Q1 2016 to 44.9% in Q1

2017

Expect continued downward trend as earned

premiums ramp up

7

GROSS WRITTEN PREMIUM

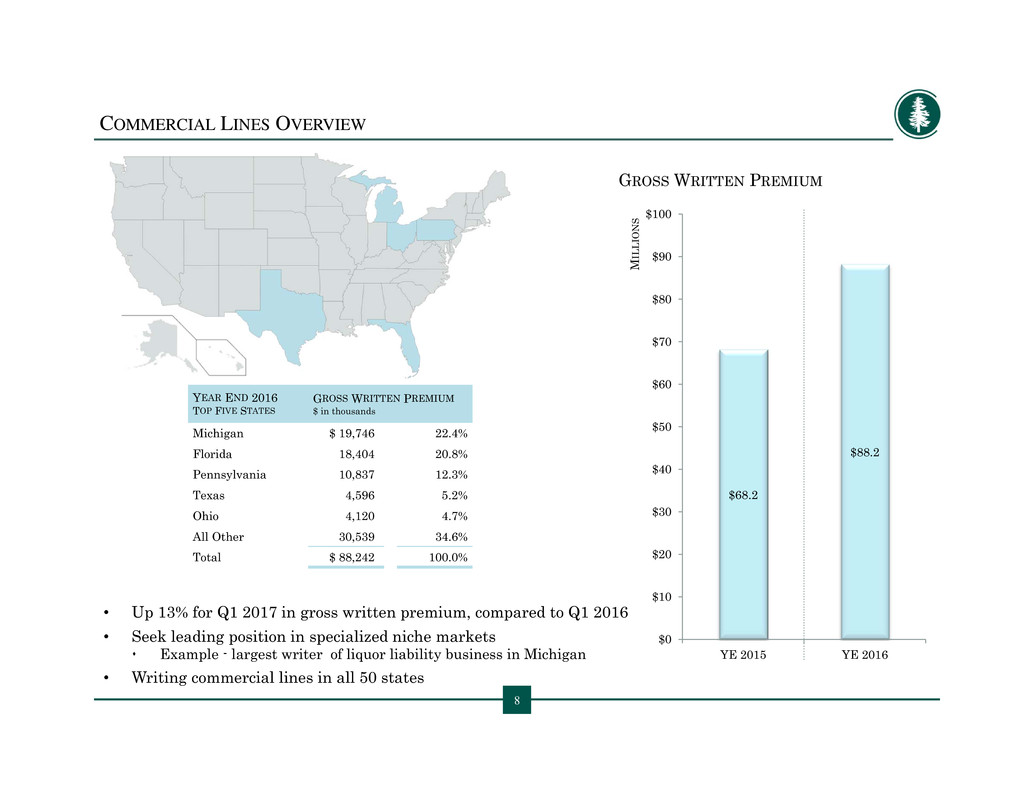

COMMERCIAL LINES OVERVIEW

• Up 13% for Q1 2017 in gross written premium, compared to Q1 2016

• Seek leading position in specialized niche markets

Example - largest writer of liquor liability business in Michigan

• Writing commercial lines in all 50 states

8

GROSS WRITTEN PREMIUM

YEAR END 2016

TOP FIVE STATES

GROSS WRITTEN PREMIUM

$ in thousands

Michigan $ 19,746 22.4%

Florida 18,404 20.8%

Pennsylvania 10,837 12.3%

Texas 4,596 5.2%

Ohio 4,120 4.7%

All Other 30,539 34.6%

Total $ 88,242 100.0%

$68.2

$88.2

$0

$10

$20

$30

$40

$50

$60

$70

$80

$90

$100

YE 2015 YE 2016

M

I

L

L

I

O

N

S

$25.6 $26.7

$0

$5

$10

$15

$20

$25

$30

YE 2015 YE 2016

M

I

L

L

I

O

N

S

• While gross written premium for Personal Lines increased 4% year over year, it was down 23%

in Q1 2017, compared to Q1 2016

• Decrease in wind-exposed homeowners - specifically Florida homeowners

• Low-value dwelling ramp-up in Texas and northern Louisiana

PERSONAL LINES: LOW-VALUE DWELLING & WIND-EXPOSED HOMEOWNERS

GROSS WRITTEN PREMIUM

$ in thousands

YTD 2016

Top Five States

Texas $ 10,425 39.1%

Florida 7,944 29.8%

Hawaii 3,885 14.6%

Indiana 3,383 12.7%

Illinois 712 2.7%

All Other 330 1.1%

Total $ 26,681 100.0%

9

GROSS WRITTEN PREMIUM

10

CHI CONSOLIDATED: LOSS RATIO IMPROVEMENT

SHIFTING BUSINESS MIX TO DRIVE STABILITY

• With planned reduction in FL HO, expect loss ratio to continue improved trend.

Shifting away from wind exposed business and focusing on low value dwelling premium

(which runs at significantly improved loss ratios).

• Each renewal period has provided additional opportunities to re-underwrite, modify pricing

and adapt claims strategies.

• Even with prior year reserve development, the accident year Loss Ratios have consistently decreased

over 4 years – with 2016 AY Loss Ratio: 54%

NET EARNED PREMIUMS ACCIDENT YEAR NET LOSS RATIOS

Commercial Lines Personal Lines Consolidated

30.0%

40.0%

50.0%

60.0%

70.0%

80.0%

90.0%

2013 2014 2015 2016

-

10,000

20,000

30,000

40,000

50,000

60,000

70,000

2013 2014 2015 2016

11

CHI CONSOLIDATED: EXPENSE RATIO TRENDING DOWNWARD

• Total expense ratio of 44.9% in Q1 2017

• Sequential expense ratio improvement quarter to quarter

Versus 49.8% in Q1 2016

Versus 48.0% in Q2 2016

Versus 46.3% in Q3 2016

Versus 45.3% in Q4 2016

• 920 basis point improvement overall since Q4 2015

• Expect continuing downward trend in 2017

Near-term

Expense Ratio

Target: 37%

54.1%

49.8%

48.0%

46.3%

45.3%

44.9%

Q4 2015 Q1 2016 Q2 2016 Q3 2016 Q4 2016 Q1 2017

12

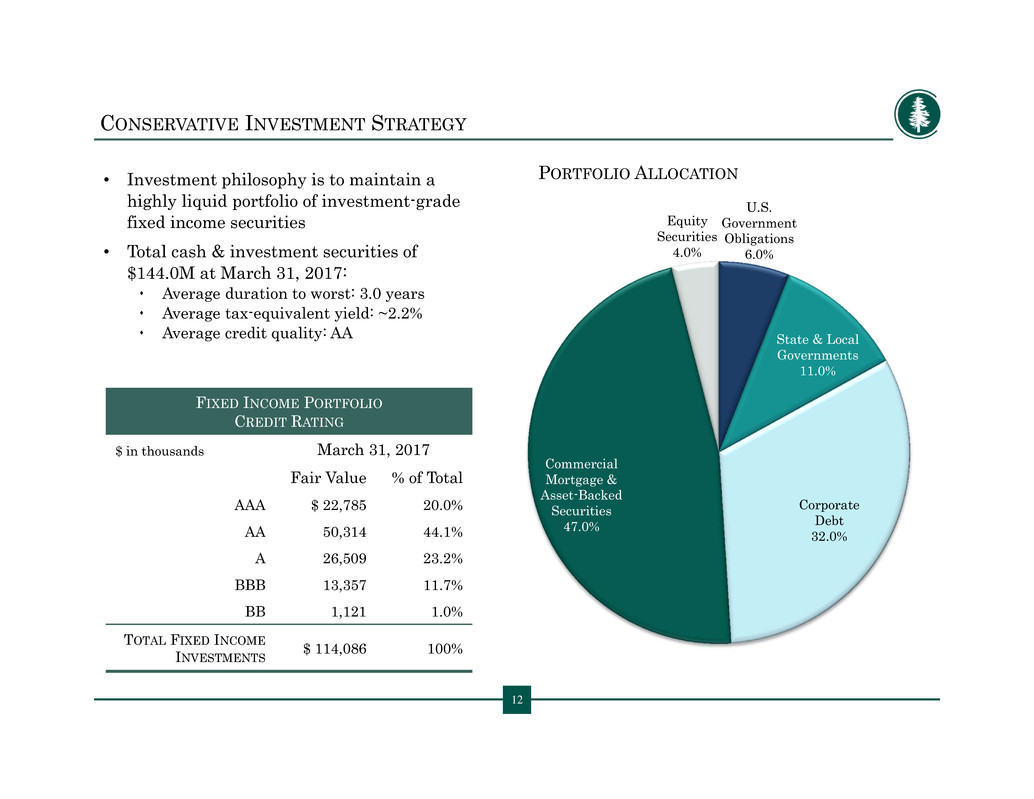

CONSERVATIVE INVESTMENT STRATEGY

• Investment philosophy is to maintain a

highly liquid portfolio of investment-grade

fixed income securities

• Total cash & investment securities of

$144.0M at March 31, 2017:

Average duration to worst: 3.0 years

Average tax-equivalent yield: ~2.2%

Average credit quality: AA

FIXED INCOME PORTFOLIO

CREDIT RATING

$ in thousands March 31, 2017

Fair Value % of Total

AAA $ 22,785 20.0%

AA 50,314 44.1%

A 26,509 23.2%

BBB 13,357 11.7%

BB 1,121 1.0%

TOTAL FIXED INCOME

INVESTMENTS

$ 114,086 100%

PORTFOLIO ALLOCATION

U.S.

Government

Obligations

6.0%

State & Local

Governments

11.0%

Corporate

Debt

32.0%

Commercial

Mortgage &

Asset-Backed

Securities

47.0%

Equity

Securities

4.0%

13

CONIFER: FOCUSED ON BOTTOM LINE RESULTS

13

Business Mix in 2016:

Commercial Lines

Represented 77% of overall

Business Mix

93% of Premiums Written

were in continuing

Core Lines

Expense Reduction:

Expense Ratio fell by

920 basis points

from Q4 2015 to Q1 2017

Expect continued

improvement over time

Strong Balance Sheet:

Total Assets Topped $200M

in 2016 with Conservative

Investment Portfolio

FOCUS: DRIVE BOTTOM LINE RESULTS IN 2017 AND BEYOND