Attached files

| file | filename |

|---|---|

| EX-32 - EX-32 - Stemcell Holdings, Inc. | ex32.htm |

| EX-31 - EX-31 - Stemcell Holdings, Inc. | ex31.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

| [X] ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934. |

FOR THE FISCAL YEAR ENDED December 31, 2016

OR

| [ ] ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

COMMISSION FILE NUMBER: 000-55583

Stemcell Holdings, Inc.

(Exact name of registrant as specified in its charter)

| Delaware | 36-4827622 | ||

(State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) | ||

5-9-15-3F, Minamiaoyama Minato-ku, Tokyo, Japan |

107-0062 | ||

| (Address of Principal Executive Offices) | (Zip Code) |

Securities to be registered under Section 12(b) of the Act: None

Securities to be registered under Section 12(g) of the Exchange Act:

| Title of each class | Name of each exchange on which registered |

|||

| Common Stock, $.0001 | N/A |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

[ ] Yes [X] No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

[ ] Yes [X] No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

[X] Yes [ ] No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

[X] Yes [ ] No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K.

[ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer or a small reporting company. See definition of large accelerated filer, accelerated filer and small reporting company in Rule 12b-2 of the Securities Exchange Act of 1934.

Large accelerated filer [ ] Accelerated filer [ ] Non-accelerated filer [ ] Smaller reporting company [X]

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

[ ] Yes [X] No

As of June 30, 2016, the aggregate market value of the voting common stock held by non-affiliates of the Registrant (without admitting that any person whose shares are not included in such calculation is an affiliate) was approximately $200. This value was determined with each share of common stock valued at par value ($0.0001).

As of May 15, 2017, there were 27,596,000 shares of the Registrant’s common stock, par value $0.0001 per share, issued and outstanding.

TABLE OF CONTENTS

PART I

Corporate History

The Company was originally incorporated with the name Perfect Acquisition, Inc., under the laws of the State of Delaware on December 31, 2015, with an objective to acquire, or merge with, an operating business.

On December 31, 2015 Jeffrey DeNunzio was appointed as Director, Chief Executive Officer, Chief Financial Officer, President, Secretary, and Treasurer.

On December 31, 2015 the Company issued 40,000,000,000 shares of restricted common stock to Jeffrey DeNunzio in return for his services developing the Company’s business concept.

On January 27, 2016, Jeffrey DeNunzio of 780 Reservoir Avenue, #123, Cranston, RI 02910, the sole shareholder of the Company, entered into a Share Purchase Agreement with Takaaki Matsuoka with an address at 3-18-17-6F, Minamiaoyama, Minato-ku, Tokyo, 107-0062, Japan. Pursuant to the Agreement, Mr. DeNunzio transferred to Takaaki Matsuoka, 40,000,000,000 shares of our common stock which represents all of our issued and outstanding shares.

Following the closing of the share purchase transaction, Takaaki Matsuoka gained a 100% interest in the issued and outstanding shares of our common stock and became the controlling shareholder of the Company.

The sale of shares between Jeffrey DeNunzio and Takaaki Matsuoka was made pursuant to Regulation S of the Securities Act of 1933, as amended ("Regulation S"). No directed selling efforts were made in the United States. Takaaki Matsuoka is a Japanese Citizen.

On January 27, 2016, the Company changed its name to Stemcell Holdings, Inc. and filed with the Delaware Secretary of State, a Certificate of Amendment.

On January 27, 2016, Jeffrey DeNunzio resigned as our Chief Executive Officer, Chief Financial Officer, President, Director, Secretary, and Treasurer. The resignation was not the result of any disagreement with us on any matter relating to our operations, policies or practices.

On January 27, 2016, Mr. Takaaki Matsuoka was appointed as our Chief Executive Officer, Chief Financial Officer, President, Director, Secretary, and Treasurer.

On March 23, 2016, Stemcell Holdings, Inc., a Delaware corporation, entered into a Stock Purchase Agreement (the “Stock Purchase Agreement”) with Takaaki Matsuoka, our President, CEO and Director. Pursuant to this Agreement, on March 24, 2016 Takaaki Matsuoka transferred to Stemcell Holdings, Inc., 500 shares of the common stock of Stemcell Co., Ltd., a Japan corporation (“Stemcell”), which represents all of its issued and outstanding shares, in consideration of JPY 5,000,000 ($44,476). Following the effective date of the share purchase transaction above on March 24, 2016, Stemcell Holdings, Inc. gained a 100% interest in the issued and outstanding shares of Stemcell’s common stock and Stemcell became a wholly owned subsidiary of Stemcell Holdings, Inc.

On May 2, 2016, Takaaki Matsuoka entered into a Stock Purchase Agreement with Primavera Singa Pte Ltd, a Singapore corporation (“Primavera Singa”) with an address at 60 Paya Lebar Rd #09-25, Paya Lebar Square 409051, Singapore. Pursuant to the Agreement, Takaaki Matsuoka transferred to Primavera Singa, 34,599,066,000 shares of our common stock in consideration of JPY 3,000,000 (approximately $28,145) which represents 86.5% of our issued and outstanding shares.

Shiho Matsuoka, the wife of our sole officer and director Takaaki Matsuoka, owns and controls 100% of Primavera Singa Pte., Ltd.

Following the closing of the share purchase transaction, Primavera Singa Pte., Ltd. became the controlling shareholder of the Company.

The sale of shares between Takaaki Matsuoka and Primavera Singa was made pursuant to Regulation S of the Securities Act of 1933, as amended ("Regulation S"). No directed selling efforts were made in the United States. Takaaki Matsuoka is a Japanese Citizen.

On September 10, 2016, the Company changed its principal executive offices to 5-9-15-3F, Minamiaoyama, Minato-ku, Tokyo, 107-0062, Japan.

On October 26, 2016, the Board and major shareholders approved to cancel 39,972,404,000 shares owned by 7 shareholders (the “Stock cancellation”). The 7 shareholders were the “major shareholders.”

On October 29, 2016, the Company performed the forward stock split, whereby every one (1) share of the common stock was automatically reclassified and changed into two thousand (2000) shares (the “2000-for-1 Forward Stock Split”). The authorized number of shares and par value per share were not be affected by the 2000-for-1 Forward Stock Split. The 2000-for-1 Forward Stock Split was executed subsequent to the Stock Cancellation. On October 29, 2016, we filed a Certificate of Amendment with the Delaware Secretary of State.

Currently, we operate through our wholly owned subsidiary, Stemcell Co., Ltd., which is primarily engaged in the regenerative medicine-related business which includes but is not limited to the culturing, storing and delivery of stem cells.

Our principal executive offices are located at 5-9-15-3F, Minamiaoyama, Minato-ku, Tokyo, 107-0062, Japan. Our phone number is +81-3-6432-9977.

- 1 -

Our Stem Cell Culturing Business

We currently employ two different options for stem cell regenerative treatments: autologous stem cell culturing and umbilical cord stem cell culturing. For autologous cell culturing, we take some of a patient’s own skin cells (provided to us by the patient or cooperative clinics) and subsequently culture the stem cells at our culturing center. For umbilical cord stem cells, the HLA test is performed in order to find the right stem cells that suit a particular patient’s body. HLA testing, also known as human leukocyte antigen testing, matches the major HLA genes a person has inherited and the corresponding antigens that are present on the surface of their cells. Antigens help the body identify which cells are “self” and which are “foreign” or “non-self”. The purpose of this testing is to match organ and tissue transplant recipients with compatible donors.

The cultured stem cells can be inserted back into a patient’s body through either muscle or IV injection at a hospital or clinic. Stemcell Co., Ltd does not operate on any individuals in any way, and does not inject any individuals with the stem cells. The role of the Company is strictly to culture the stem cells for individuals and health clinics to then use for medical purposes.

In order to increase awareness of our business we advertise and promote our stem cell culturing services in a variety of ways. A large portion of our business is generated through referrals made by clinics and hospitals that we have worked with, including Omotesando Helene Clinic. We have also received referrals from a number of agencies that we work with, and through professional relationships that have been forged over the course of our employees’ careers. Additionally, we have an online presence through the websites http://stemcells.jp/ and https://www.stemcoordinate.com/.

As humans, the older we get the fewer stem cells we have and this results in a slower metabolism among other physiological changes. Autologous stem cell, as well as umbilical cord stem cell therapy, will both assist in preventing cell loss and can assist in regenerative therapy. The following are diseases and ailments that stem cell therapy could be used for treating/improving the condition of patients, and other medical applications of the stem cells that we culture:

Chronic fatigue syndrome, Facial rejuvenation, Type II diabetes mellitus, Ovarian function Cerebral infarction, Alzheimer disease, Parkinson disease, Spinocerebellar degeneration, Multiple sclerosis (MS), Amyotrophic lateral sclerosis (ALS), Inflammatory colitis, Knee joint pain, cosmetic improvements. Please note that these are not all of the potential uses for stem cell therapy, and only a list of the more common ailments that stem cell therapy has been shown to treat.

Coordination Services

We provide coordination services to facilitate our stem cell culturing business. Currently, our coordination services primarily include the introduction of patients to clinics, arranging patients’ schedules, and translating between patients and clinics due to language barriers that may be present.

Marketing Services and Rental Services

We provide internet marketing services by providing search engine optimization for health clinics. We also provide rental services to parties so they can utilize our idle properties and equipment when it is not being used.

Team

Our team consists of a total of five members as of December 31, 2016. Most notably is our sole Officer and Director Takaaki Matsuoka who studied at the Keio University School of Medicine, specializing in anesthesiology, thereafter gaining extensive clinical and surgical experience in various hospitals and clinics prior to establishing his own surgical and stem cell businesses. We also have two highly experienced and dedicated cell culturists with extensive medical backgrounds and graduate degrees in cell tissue engineering. Coordination and marketing services are provided by two other members of our team. These members are proficient in multiple languages such as Japanese, English and Mandarin. They also have experience with SEO and marketing.

Our Facilities

We share the same address as our wholly owned subsidiary Stemcell Co., Ltd.

Our facility is located at 5-9-15-3F, Minamiaoyama, Minato-ku, Tokyo, 107-0062, Japan. The space is currently being provided to the Company rent-free by Omotesando Helene Clinic, which is controlled by our sole officer and director Takaaki Matsuoka.

Equipment

As of December 31, 2016 we, Stemcell Holdings, Inc., through our subsidiary Stemcell Co., Ltd. own the following equipment valued at $529,747:

| Property, Plant and Equipment | Acquisition cost | Book value | |

| December 31, 2016 | |||

| USD | USD | ||

| Equipment | Cell culturing equipment | 21,317 | 17,764 |

| Accessory equipment | Clean room | 64,225 | 62,084 |

| Accessory equipment | Air conditioning Unit | 51,750 | 50,025 |

| Accessory equipment | Electric equipment | 50,826 | 49,132 |

| Accessory equipment | Interior Accessories | 240,353 | 232,341 |

| Accessory equipment | Pass box | 3,234 | 3,154 |

| Accessory equipment | Shutters | 3,974 | 3,874 |

| Equipment | Currency Counter and Sorter | 16,079 | 15,677 |

| Equipment | Particle counter | 1,420 | 1,373 |

| Equipment | CO2 incubator | 28,226 | 27,285 |

| Equipment | Mini & MidiMACS Starting Kit | 2,578 | 2,535 |

| Equipment | Ikeda Rika machine set | 29,399 | 28,909 |

| Equipment | Medical analizer | 22,068 | 21,700 |

| Equipment | Ikeda Rika machine set-2 | 8,400 | 8,260 |

| Software | Customer management system | 5,729 | 5,634 |

| Total | 549,578 | 529,747 | |

Outline of the Structure of Our Stem Cell Culturing Business

We operate through our wholly owned subsidiary Stemcell Co., Ltd. Stemcell Co. Ltd. is responsible for the culturing, storing and delivering stem cells to clientele.

Process

We culture stem cells for health clinics, hospitals, and medical facilities. All of the stem cell culturing that we carry out is conducted at our facility. After we culture a batch of stem cells we supply them directly to the clinic, hospital, medical center, etc. whereupon that party then uses the collected stem cells to inject back into their patients for stem cell therapy. It is important to note that we do not conduct any medical operations, operate, or directly treat any patients. We only culture the stem cells.

Government Regulations

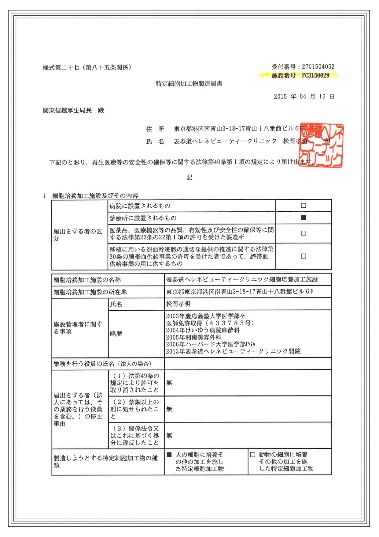

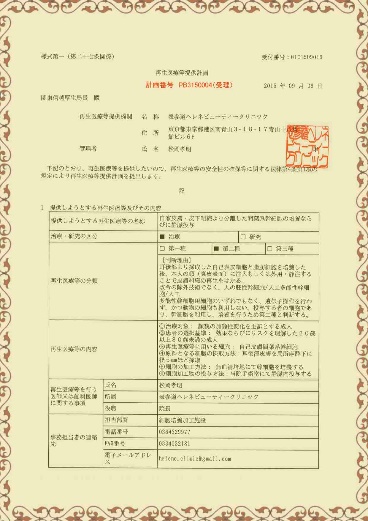

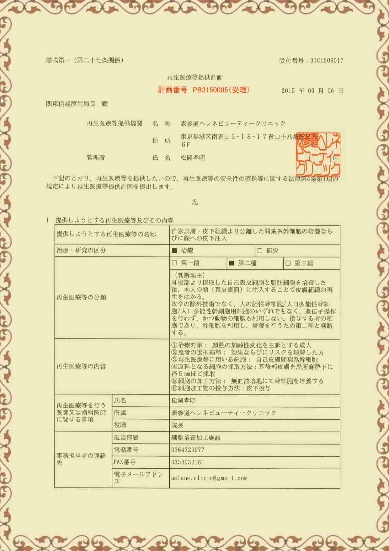

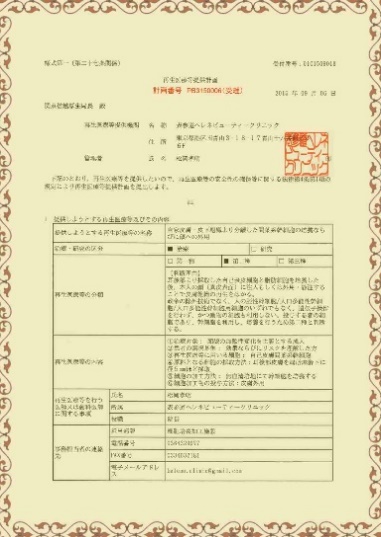

In 2015 our Chief Executive Officer, Takaaki Matsuoka, filed a notification and a plan of operations to the MHLW (Minister of Health, Labor and Welfare in Japan) in accordance with the Regenerative Medicine Safety Assurance Law of Japan. The notification and plan was sent to the MHLW so that the Company could engage in activities relating to regenerative medicine. The following pictures are copies of the certificates of notification and approvals. It is important to note the Company only conducts operations in Japan and is not licensed to conduct services in any other countries.

|

| |

|

Notification for Cell Culturing Facilities.

|

Approval of the Regenerative Medicine Provision Plan - Intravenous injection of stem cells.

| |

|

| |

|

Approval of the Regenerative Medicine Provision Plan - Subcutaneous injection of stem cells |

Approval of the Regenerative Medicine Provision Plan - External administration of stem cells |

- 2 -

Risks Relating to Our Company and Our Industry

Our limited operating history makes it difficult for us to accurately forecast net sales and appropriately plan our expenses.

We have a very limited operating history. As a result, it is difficult to accurately forecast our net sales and plan our operating expenses. Certain factors that could influence our net sales or operating expenses may include, but are not limited to, demand for our stem cell culturing services, negative or positive public perceptions regarding stem cells and stem cell therapy, general economic conditions, and disposable consumer income.

We operate in a competitive environment, and if we are unable to compete with our competitors, our business, financial condition, results of operations, cash flows and prospects could be materially adversely affected.

We operate in a competitive environment. Our competition includes all other companies that are in the business of stem cell culturing. While stem cell culturing is illegal in many countries, it is legal within Japan and we face competition from other facilities on a national level, as well as from companies which operate in countries where such operations are legal. A competitive environment could materially adversely affect our business, financial condition, results of operations, cash flows and prospects.

We expect our quarterly financial results to fluctuate.

We expect our net sales and operating results to vary significantly from quarter to quarter due to a number of factors, including but not limited to changes in:

• Demand for our stem cell culturing services;

• Our ability to obtain and retain existing customers or encourage repeat purchases from clinics and hospitals;

• Our ability to manage our services;

• General economic conditions;

• Advertising and other marketing costs.

As a result of the variability of these and other factors, our operating results in future quarters may be below the expectations of public market analysts and investors.

The negative stigma attached to stem cell therapy may limit our appeal.

In some countries, including the United States, stem cell therapy is not available for legal reasons. In these countries, and indeed even in countries where stem cell therapy is legal, there could be a stigma associated with the industry in general that may limit the growth of our client base. If there are not as many individuals seeking stem cell therapy for any reason whatsoever the results of our operations may not meet our expectations and we may not see the growth we anticipate. In the event that our business becomes unsustainable we may be forced to cease operations entirely and investors may lose part or all of their investment.

Because the Company’s headquarters and assets are located outside the United States in Japan, investors may experience difficulties in attempting to effect service of process and to enforce judgments based upon US Federal Securities Laws against the Company and its non-US resident officers and directors.

While we are organized under the laws of State of Delaware, our officers and Directors are non-US residents and our headquarters and assets are located outside the United States in Japan. Consequently, it may be difficult for investors to affect service of process on them in the United States and to enforce in the United States judgments obtained in United States courts against them based on the civil liability provisions of the United States securities laws. Since all our assets will be located outside U.S. it may be difficult or impossible for U.S. investors to collect a judgment against us.

Our future success is dependent, in part, on the performance and continued services of Takaaki Matsuoka, our sole Officer and Director. Without his continued service, we may be forced to interrupt or eventually cease our operations.

We are presently dependent to a great extent upon the experience, abilities and continued services of Takaaki Matsuoka, our sole Officer and Director. The loss of his services would delay our business operations substantially.

- 3 -

The recently enacted JOBS Act will allow the Company to postpone the date by which it must comply with certain laws and regulations intended to protect investors and to reduce the amount of information provided in reports filed with the SEC.

The recently enacted JOBS Act is intended to reduce the regulatory burden on “emerging growth companies”. The Company meets the definition of an “emerging growth company” and so long as it qualifies as an “emerging growth company,” it will, among other things:

-be exempt from the provisions of Section 404(b) of the Sarbanes-Oxley Act requiring that its independent registered public accounting firm provide an attestation report on the effectiveness of its internal control over financial reporting;

-be exempt from the "say on pay” provisions (requiring a non-binding shareholder vote to approve compensation of certain executive officers) and the "say on golden parachute” provisions (requiring a non-binding shareholder vote to approve golden parachute arrangements for certain executive officers in connection with mergers and certain other business combinations) of The Dodd-Frank Wall Street Reform and Consumer Protection Act (the “Dodd-Frank Act”) and certain disclosure requirements of the Dodd-Frank Act relating to compensation of Chief Executive Officers;

-be permitted to omit the detailed compensation discussion and analysis from proxy statements and reports filed under the Securities Exchange Act of 1934, as amended (the “Exchange Act”) and instead provide a reduced level of disclosure concerning executive compensation; and

-be exempt from any rules that may be adopted by the Public Company Accounting Oversight Board (the “PCAOB”) requiring mandatory audit firm rotation or a supplement to the auditor’s report on the financial statements.

Although the Company is still evaluating the JOBS Act, it currently intends to take advantage of all of the reduced regulatory and reporting requirements that will be available to it so long as it qualifies as an “emerging growth company”. The Company has elected not to opt out of the extension of time to comply with new or revised financial accounting standards available under Section 102(b)(1) of the JOBS Act. Among other things, this means that the Company's independent registered public accounting firm will not be required to provide an attestation report on the effectiveness of the Company's internal control over financial reporting so long as it qualifies as an “emerging growth company”, which may increase the risk that weaknesses or deficiencies in the internal control over financial reporting go undetected. Likewise, so long as it qualifies as an “emerging growth company”, the Company may elect not to provide certain information, including certain financial information and certain information regarding compensation of executive officers, which would otherwise have been required to provide in filings with the SEC, which may make it more difficult for investors and securities analysts to evaluate the Company. As a result, investor confidence in the Company and the market price of its common stock may be adversely affected.

Notwithstanding the above, we are also currently a “smaller reporting company”, meaning that we are not an investment company, an asset-backed issuer, or a majority-owned subsidiary of a parent company that is not a smaller reporting company and have a public float of less than $75 million and annual revenues of less than $50 million during the most recently completed fiscal year. In the event that we are still considered a “smaller reporting company”, at such time are we cease being an “emerging growth company”, the disclosure we will be required to provide in our SEC filings will increase, but will still be less than it would be if we were not considered either an “emerging growth company” or a “smaller reporting company”. Specifically, similar to “emerging growth companies”, “smaller reporting companies” are able to provide simplified executive compensation disclosures in their filings; are exempt from the provisions of Section 404(b) of the Sarbanes-Oxley Act requiring that independent registered public accounting firms provide an attestation report on the effectiveness of internal control over financial reporting; and have certain other decreased disclosure obligations in their SEC filings, including, among other things, being required to provide only two years of audited financial statements in annual reports. Decreased disclosures in our SEC filings due to our status as an “emerging growth company” or “smaller reporting company” may make it harder for investors to analyze the Company’s results of operations and financial prospects.

We are an “emerging growth company” under the JOBS Act of 2012, and we cannot be certain if the reduced disclosure requirements applicable to emerging growth companies will make our common stock less attractive to investors.

We are an “emerging growth company,” as defined in the JOBS Act, and we may take advantage of certain exemptions from various reporting requirements that are applicable to other public companies that are not “emerging growth companies” including, but not limited to, not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act, reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements, and exemptions from the requirements of holding a nonbinding advisory vote on executive compensation and shareholder approval of any golden parachute payments not previously approved. We cannot predict if investors will find our common stock less attractive because we may rely on these exemptions. If some investors find our common stock less attractive as a result, there may be a less active trading market for our common stock and our stock price may be more volatile.

In addition, Section 107 of the JOBS Act also provides that an “emerging growth company” can take advantage of the extended transition period provided in Section 7(a)(2)(B) of the Securities Act for complying with new or revised accounting standards. In other words, an “emerging growth company” can delay the adoption of certain accounting standards until those standards would otherwise apply to private companies. We are choosing to take advantage of the extended transition period for complying with new or revised accounting standards. As a result, our financial statements may not be comparable to those of companies that comply with public company effective dates.

We will remain an “emerging growth company” for up to five years, although we will lose that status sooner if our revenues exceed $1 billion, if we issue more than $1 billion in non-convertible debt in a three year period, or if the market value of our common stock that is held by non-affiliates exceeds $700 million.

- 4 -

Risks Relating to the Company’s Securities

We may never have a public market for our common stock or may never trade on a recognized exchange. Therefore, you may be unable to liquidate your investment in our stock.

There is no established public trading market for our securities. Our shares are not and have not been listed or quoted on any exchange or quotation system.

In order for our shares to be quoted, a market maker must agree to file the necessary documents with FINRA, which operates the OTCBB. In addition, it is possible that such application for quotation may not be approved and even if approved it is possible that a regular trading market will not develop or that if it did develop, will be sustained. In the absence of a trading market, an investor may be unable to liquidate their investment.

We may, in the future, issue additional shares of our common stock, which may have a dilutive effect on our stockholders.

Our Certificate of Incorporation authorizes the issuance of 500,000,000 shares of common stock, of which 27,596,000 shares are issued and outstanding as of December 31, 2016 and the date of this report. The future issuance of our common shares may result in substantial dilution in the percentage of our common shares held by our then existing stockholders. We may value any common stock issued in the future on an arbitrary basis. The issuance of common stock for future services or acquisitions or other corporate actions may have the effect of diluting the value of the shares held by our investors, and might have an adverse effect on any trading market for our common stock.

We may issue shares of preferred stock in the future that may adversely impact your rights as holders of our common stock.

Our Certificate of Incorporation authorizes us to issue up to 20,000,000 shares of preferred stock. Accordingly, our board of directors will have the authority to fix and determine the relative rights and preferences of preferred shares, as well as the authority to issue such shares, without further stockholder approval. Our board of directors could authorize the issuance of a series of preferred stock that would grant to holders preferred rights to our assets upon liquidation, the right to receive dividends before dividends are declared to holders of our common stock, and the right to the redemption of such preferred shares, together with a premium, prior to the redemption of the common stock. To the extent that we do issue such additional shares of preferred stock, your rights as holders of common stock could be impaired thereby, including, without limitation, dilution of your ownership interests in us. In addition, shares of preferred stock could be issued with terms calculated to delay or prevent a change in control or make removal of management more difficult, which may not be in your interest as holders of common stock.

We do not currently intend to pay dividends on our common stock and consequently, your ability to achieve a return on your investment will depend on appreciation in the price of our common stock.

We have never declared or paid any cash dividends on our common stock and do not currently intend to do so for the foreseeable future. We currently intend to invest our future earnings, if any, to fund our growth. Therefore, you are not likely to receive any dividends on your common stock for the foreseeable future and the success of an investment in shares of our common stock will depend upon any future appreciation in its value. There is no guarantee that shares of our common stock will appreciate in value or even maintain the price at which our stockholders have purchased their shares.

We may be exposed to potential risks resulting from requirements under Section 404 of the Sarbanes-Oxley Act of 2002.

As a reporting company we are required, pursuant to Section 404 of the Sarbanes-Oxley Act of 2002, to include in our annual report our assessment of the effectiveness of our internal control over financial reporting. We do not have a sufficient number of employees to segregate responsibilities and may be unable to afford increasing our staff or engaging outside consultants or professionals to overcome our lack of employees.

We do not currently have independent audit or compensation committees. As a result, our directors have the ability, among other things, to determine their own level of compensation. Until we comply with such corporate governance measures, regardless of whether such compliance is required, the absence of such standards of corporate governance may leave our stockholders without protections against interested director transactions, conflicts of interest and similar matters and investors may be reluctant to provide us with funds necessary to expand our operations.

The costs to meet our reporting and other requirements as a public company subject to the Exchange Act of 1934 is and will be substantial and may result in us having insufficient funds to expand our business or even to meet routine business obligations.

As a public entity, subject to the reporting requirements of the Exchange Act of 1934, we will continue to incur ongoing expenses associated with professional fees for accounting, legal and a host of other expenses for annual reports and proxy statements. We estimate that these costs will range up to $35,000 per year for the next few years and will be higher if our business volume and activity increases. As a result, we may not have sufficient funds to grow our operations.

State Securities Laws may limit secondary trading, which may restrict the states in which and conditions under which you can sell Shares.

Secondary trading in our common stock may not be possible in any state until the common stock is qualified for sale under the applicable securities laws of the state or there is confirmation that an exemption, such as listing in certain recognized securities manuals, is available for secondary trading in the state. If we fail to register or qualify, or to obtain or verify an exemption for the secondary trading of, the common stock in any particular state, the common stock cannot be offered or sold to, or purchased by, a resident of that state. In the event that a significant number of states refuse to permit secondary trading in our common stock, the liquidity for the common stock could be significantly impacted.

- 5 -

Item 1B. Unresolved Staff Comments.

None.

We and our wholly owned subsidiary Stemcell Co., Ltd. share the same address.

Our operating/office space is located at 5-9-15-3F, Minamiaoyama, Minato-ku, Tokyo, 107-0062, Japan. The space is currently being provided to the Company rent-free by Omotesando Helene Clinic, which is controlled by our sole officer and director Takaaki Matsuoka.

From time to time, we may become party to litigation or other legal proceedings that we consider to be a part of the ordinary course of our business. We are not currently involved in legal proceedings that could reasonably be expected to have a material adverse effect on our business, prospects, financial condition or results of operations.

Item 4. Mine Safety Disclosures.

Not applicable.

PART II

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities.

Market Information

We are not currently listed on any exchange however, in the future we intend to list on the OTC Marketplace.

Holders

As of the date of this report, there are approximately 69 shareholders of record of our common stock and 27,596,000 shares of common stock issued and outstanding.

Dividends and Share Repurchases

We have not paid any dividends to our shareholder. There are no restrictions which would limit our ability to pay dividends on common equity or that are likely to do so in the future.

Issuer Purchases of Equity Securities

None.

Equity Compensation Plan Information

Not applicable.

Recent Sales of Unregistered Securities; Uses of Proceeds from Registered Securities

The Company has had no recent sales of unregistered securities.

- 6 -

Item 6. Selected Financial Data.

Balance Sheets

| As of | As of | ||||

| December 31, 2016 | December 31, 2015 | ||||

| ASSETS | |||||

| Current Assets | |||||

| Cash and cash equivalents | $ | 2,646,855 | $ | - | |

| Prepaid expenses and other current assets | 30,452 | - | |||

| Deferred tax assets | 21,848 | - | |||

| TOTAL CURRENT ASSETS | 2,699,155 | - | |||

| Property, plant and equipment, net | 529,747 | - | |||

| TOTAL ASSETS | $ | 3,228,902 | $ | - | |

| LIABILITIES AND SHAREHOLDERS' EQUITY (DEFICIT) | |||||

| Current Liabilities | |||||

| Accrued expenses and other current liabilities | $ | 106,413 | $ | 2,998 | |

| Accounts payable to related party | 573,827 | - | |||

| Income tax payables | 1,187,722 | - | |||

| TOTAL CURRENT LIABILITIES | 1,867,962 | 2,998 | |||

| TOTAL LIABILITIES | 1,867,962 | 2,998 | |||

| Shareholders’ Equity (Deficit) | |||||

| Preferred stock ($.0001 par value, 20,000,000 shares authorized; | |||||

| none issued and outstanding as of December 31, 2016 and December 31, 2015) | - | - | |||

| Common stock ($.0001 par value, 500,000,000 shares authorized, | |||||

| 27,596,000 shares and 40,000,000,000 shares issued and outstanding as of December 31, 2016 and December 31, 2015) (*) | 2,760 | 4,000,000 | |||

| Additional paid-in capital | 65,116 | (3,998,000) | |||

| Retained earnings (deficit) | 1,397,421 | (4,998) | |||

| Accumulated other comprehensive loss | (104,357) | - | |||

| TOTAL SHAREHOLDERS’ EQUITY (DEFICIT) | 1,360,940 | (2,998) | |||

| TOTAL LIABILITIES AND SHAREHOLDERS’ EQUITY (DEFICIT) | $ | 3,228,902 | $ | - | |

(*) On October 29, 2016, the Company performed the forward stock split, whereby every one (1) share of the common stock was automatically reclassified and changed into two thousand (2,000) shares (the "Stock Split"). The authorized number of shares and par value per share were not affected by the Stock Split. The Company had 20,000,000 shares of common stock outstanding as of December 31, 2015, which was retroactively stated as 40,000,000,000 shares due to the Stock Split.

Statement of operations and comprehensive income (loss)

| Year Ended | Period From December 31, 2015 (Inception) | ||||

| December 31, 2016 | To December 31, 2015 | ||||

| Revenues from related parties | |||||

| Stem cell culturing | $ | 2,776,327 | $ | - | |

| Coordination services | 386,110 | - | |||

| Marketing services | 122,609 | - | |||

| Total revenues from related parties | 3,285,046 | - | |||

| Rental revenues | 53,660 | - | |||

| Total revenues | 3,338,706 | - | |||

| Cost of revenues | 369,195 | - | |||

| Gross profit | 2,969,511 | - | |||

| Operating expenses | |||||

| Selling, general and administrative expenses | 317,609 | 4,998 | |||

| Total operating expenses | 317,609 | 4,998 | |||

| OTHER INCOME | |||||

| Foreign currency exchange gains | 3,043 | - | |||

| Total other income | 3,043 | - | |||

| NET INCOME (LOSS) BEFORE TAXES | 2,654,945 | (4,998) | |||

| Provision for income taxes | 1,252,526 | - | |||

| NET INCOME (LOSS) | $ | 1,402,419 | $ | (4,998) | |

| Other comprehensive loss | |||||

| Foreign currency translation adjustment | (104,357) | - | |||

| TOTAL COMPREHENSIVE INCOME (LOSS) | $ | 1,298,062 | $ | (4,998) | |

| NET INCOME (LOSS) PER COMMON SHARE, BASIC AND DILUTED | $ | (0.00) | $ | (0.00) | |

| WEIGHTED AVERAGE NUMBER OF COMMON SHARES OUTSTANDING, BASIC AND DILUTED | 33,119,504,230 | 40,000,000,000 | |||

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations.

Forward-Looking Statements

Certain statements, other than purely historical information, including estimates, projections, statements relating to our business plans, objectives, and expected operating results, and the assumptions upon which those statements are based, are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. These forward-looking statements generally are identified by the words “believes,” “project,” “expects,” “anticipates,” “estimates,” “intends,” “strategy,” “plan,” “may,” “will,” “would,” “will be,” “will continue,” “will likely result,” and similar expressions. We intend such forward-looking statements to be covered by the safe-harbor provisions for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995, and are including this statement for purposes of complying with those safe-harbor provisions. Forward-looking statements are based on current expectations and assumptions that are subject to risks and uncertainties which may cause actual results to differ materially from the forward-looking statements. Our ability to predict results or the actual effect of future plans or strategies is inherently uncertain. Factors which could have a material adverse effect on our operations and future prospects on a consolidated basis include, but are not limited to: changes in economic conditions, legislative/regulatory changes, availability of capital, interest rates, competition, and generally accepted accounting principles. These risks and uncertainties should also be considered in evaluating forward-looking statements and undue reliance should not be placed on such statements.

Liquidity and Capital Resources

As of December 31, 2016, our cash and cash equivalents balance was $2,646,855. As of December 31, 2015, our cash and cash equivalents balance was $0. This variance in our cash balance over our last two fiscal years is attributed to the fact that we only began substantive operations upon the acquisition of our current wholly owned subsidiary, Stemcell Co., Ltd., which we acquired on March 24, 2016.

Our cash balance is currently sufficient to fund our operations. However, if our revenues cannot cover our operating expenses, we will need to utilize funds from Takaaki Matsuoka, our sole Officer and Director, who has informally agreed to advance funds to allow us to pay for operating expenses. Takaaki Matsuoka, however, has no formal commitment, arrangement or legal obligation to advance or loan funds to the company.

Revenue

For the year ended December 31, 2016 the Company generated revenue from related parties in the amount of $3,285,046. For the period from December 31, 2015 (inception of the Company) to December 31, 2015 the Company had generated no revenue. The variance in revenue is a result of the fact that we acquired our wholly owned subsidiary, Stemcell Co., Ltd., on March 24, 2016. Previous to that date we had no substantive operations.

The revenue that we generated for our fiscal year ended December 31, 2016 was a result of our wholly owned subsidiary’s services. These services include, but are not limited to culturing of stem cells. These services are provided to the seven clinics, related parties under common control of Takaaki Matsuoka and his wife, Shiho Matsuoka. It should be noted that the ultimate recipients of the stem cells we culture may not be Japanese citizens.

Net Income (Loss)

We recorded a net income of $1,402,419 for our fiscal year ended December 31, 2016 whereas for the period from December 31, 2015 (inception of the Company) to December 31, 2015 we recorded a net loss of $4,998. The substantial increase in net income is due to the fact that our wholly owned subsidiary, Stemcell Co., Ltd., which we acquired on March 24, 2016, is profitable and has physical operations.

Going Concern

The accompanying consolidated financial statements are prepared on a basis of accounting assuming that the Company is a going concern that contemplates realization of assets and satisfaction of liabilities in the normal course of business. The Company first generated revenues in the year ended December 31, 2016 and 98% of the revenues of the Company were from related parties for the year ended December 31, 2016. These factors raise substantial doubt about the Company’s ability to continue as a going concern. The Company will offer noncash consideration and seek equity lines as a means of financing its operations. If the Company is unable to obtain revenue-producing contracts or financing or if the revenue or financing it does obtain is insufficient to cover any operating losses it may incur, it may substantially curtail or terminate its operations or seek other business opportunities through strategic alliances, acquisitions or other arrangements that may dilute the interests of existing stockholders.

Item 7A. Quantitative and Qualitative Disclosures about Market Risk.

As a “smaller reporting company”, we are not required to provide the information required by this Item.

- 7 -

Item 8. Financial Statements and Supplementary Data.

Stemcell Holdings, Inc.

FINANCIAL STATEMENTS

INDEX TO FINANCIAL STATEMENTS

| Pages | ||

| Report of Independent Registered Public Accounting Firm | F2 | |

| Consolidated Balance Sheets | F3 | |

| Consolidated Statements of Operations and Comprehensive Income (Loss) | F4 | |

| Consolidated Statements of Shareholders’ Equity (Deficit) | F5 | |

| Consolidated Statements of Cash Flows | F6 | |

| Notes to Consolidated Financial Statements | F7-F9 |

- F1 -

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

Board of Directors and Shareholders

Stemcell Holdings, Inc. and Subsidiary

We have audited the accompanying consolidated balance sheets of Stemcell Holdings, Inc. and its subsidiary (collectively, the “Company”) as of December 31, 2016 and 2015, and the related consolidated statements of operations and comprehensive income (loss), shareholders’ equity (deficit), and cash flows for the year ended December 31, 2016 and the period from December 31, 2015 (inception) through December 31, 2015. These consolidated financial statements are the responsibility of the Company’s management. Our responsibility is to express an opinion on these consolidated financial statements based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform an audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. The Company is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. Our audits included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Company’s internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provides a reasonable basis for our opinion.

In our opinion, the consolidated financial statements referred to above present fairly, in all material respects, the financial position of Stemcell Holdings, Inc. and its subsidiary as of December 31, 2016 and 2015, and the consolidated results of their operations and their cash flows for the year ended December 31, 2016 and the period from December 31, 2015 (inception) through December 31, 2015, in conformity with accounting principles generally accepted in the United States of America.

The accompanying consolidated financial statements have been prepared assuming that the Company will continue as a going concern. As discussed in Note 5 to the consolidated financial statements, the Company first generated revenues in the year ended December 31, 2016 and 98% of the revenues were from related parties, which raises substantial doubt about its ability to continue as a going concern. The consolidated financial statements do not include any adjustments that might result from the outcome of this uncertainty.

/s/ MaloneBailey, LLP

www.malonebailey.com

Houston, Texas

May 15, 2017

- F2 -

|

STEMCELL HOLDINGS, INC. CONSOLIDATED BALANCE SHEETS | |||||

| As of December 31, 2016 | As of December 31, 2015 | ||||

| ASSETS | |||||

| Current Assets | |||||

| Cash and cash equivalents | $ | 2,646,855 | $ | - | |

| Prepaid expenses and other current assets | 30,452 | - | |||

| Deferred tax assets | 21,848 | - | |||

| TOTAL CURRENT ASSETS | 2,699,155 | - | |||

| Property, plant and equipment, net | 529,747 | - | |||

| TOTAL ASSETS | $ | 3,228,902 | $ | - | |

| LIABILITIES AND SHAREHOLDERS' EQUITY (DEFICIT) | |||||

| Current Liabilities | |||||

| Accrued expenses and other current liabilities | $ | 106,413 | $ | 2,998 | |

| Accounts payable to related party | 573,827 | - | |||

| Income tax payables | 1,187,722 | - | |||

| TOTAL CURRENT LIABILITIES | 1,867,962 | 2,998 | |||

| TOTAL LIABILITIES | 1,867,962 | 2,998 | |||

| Shareholders’ Equity (Deficit) | |||||

| Preferred stock ($.0001 par value, 20,000,000 shares authorized; | |||||

| none issued and outstanding as of December 31, 2016 and December 31, 2015) | - | - | |||

| Common stock ($.0001 par value, 500,000,000 shares authorized, | |||||

| 27,596,000 shares and 40,000,000,000 shares issued and outstanding as of December 31, 2016 and December 31, 2015) (*) | 2,760 | 4,000,000 | |||

| Additional paid-in capital | 65,116 | (3,998,000) | |||

| Retained earnings (deficit) | 1,397,421 | (4,998) | |||

| Accumulated other comprehensive loss | (104,357) | - | |||

| TOTAL SHAREHOLDERS’ EQUITY (DEFICIT) | 1,360,940 | (2,998) | |||

| TOTAL LIABILITIES AND SHAREHOLDERS’ EQUITY (DEFICIT) | $ | 3,228,902 | $ | - | |

(*) On October 29, 2016, the Company performed the forward stock split, whereby every one (1) share of the common stock was automatically reclassified and changed into two thousand (2,000) shares (the "Stock Split"). The authorized number of shares and par value per share were not affected by the Stock Split. The Company had 20,000,000 shares of common stock outstanding as of December 31, 2015, which was retroactively stated as 40,000,000,000 shares due to the Stock Split.

See Notes to Consolidated Financial Statements.

- F3 -

STEMCELL HOLDINGS, INC.

CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE INCOME (LOSS)

| Year Ended | Period From December 31, 2015 (Inception) | ||||

| December 31, 2016 | To December 31, 2015 | ||||

| Revenues from related parties | |||||

| Stem cell culturing | $ | 2,776,327 | $ | - | |

| Coordination services | 386,110 | - | |||

| Marketing services | 122,609 | - | |||

| Total revenues from related parties | 3,285,046 | - | |||

| Rental revenues | 53,660 | - | |||

| Total revenues | 3,338,706 | - | |||

| Cost of revenues | 369,195 | - | |||

| Gross profit | 2,969,511 | - | |||

| Operating expenses | |||||

| Selling, general and administrative expenses | 317,609 | 4,998 | |||

| Total operating expenses | 317,609 | 4,998 | |||

| OTHER INCOME | |||||

| Foreign currency exchange gains | 3,043 | - | |||

| Total other income | 3,043 | - | |||

| NET INCOME (LOSS) BEFORE TAXES | 2,654,945 | (4,998) | |||

| Provision for income taxes | 1,252,526 | - | |||

| NET INCOME (LOSS) | $ | 1,402,419 | $ | (4,998) | |

| Other comprehensive loss | |||||

| Foreign currency translation adjustment | (104,357) | - | |||

| TOTAL COMPREHENSIVE INCOME (LOSS) | $ | 1,298,062 | $ | (4,998) | |

| NET INCOME (LOSS) PER COMMON SHARE, BASIC AND DILUTED | $ | (0.00) | $ | (0.00) | |

| WEIGHTED AVERAGE NUMBER OF COMMON SHARES OUTSTANDING, BASIC AND DILUTED (*) | 33,119,504,230 | 40,000,000,000 | |||

(*) On October 29, 2016, the Company performed the forward stock split, whereby every one (1) share of the common stock was automatically reclassified and changed into two thousand (2,000) shares (the "Stock Split"). The authorized number of shares and par value per share were not affected by the Stock Split. The Company had 20,000,000 shares of common stock outstanding as of December 31, 2015, which was retroactively stated as 40,000,000,000 shares due to the Stock Split.

See Notes to Consolidated Financial Statements.

- F4 -

STEMCELL HOLDINGS, INC.

CONSOLIDATED STATEMENT OF CHANGES IN SHAREHOLDERS’ EQUITY (DEFICIT)

For the Period from December 31, 2015 (Inception) to December 31, 2015 and the Year Ended December 31, 2016

| COMMON STOCK (*) | ADDITIONAL PAID-IN CAPITAL | ACCUMULATED OTHER COMPREHENSIVE LOSS | RETAINED EARNINGS (DEFICIT) | TOTAL SHAREHOLDERS’ EQUITY (DEFICIT) | |||||||||||||||||

| NUMBER | AMOUNT | ||||||||||||||||||||

| Balance at December 31, 2015 (Inception) | - | $ | - | $ | - | $ | - | $ | - | $ | - | ||||||||||

| Shares issued for services rendered | 40,000,000,000 | 4,000,000 | (3,998,000) | - | - | 2,000 | |||||||||||||||

| Net loss for the period ending December 31, 2015 | - | - | - | - | (4,998) | (4,998) | |||||||||||||||

| Balance at December 31, 2015 | 40,000,000,000 | 4,000,000 | (3,998,000) | - | (4,998) | (2,998) | |||||||||||||||

| Debt assumed by former sole shareholder of the Company | - | - | 2,998 | - | - | 2,998 | |||||||||||||||

| Services contributed by sole director | - | - | 58,674 | - | - | 58,674 | |||||||||||||||

| Excess of acquisition price over carrying value of equipment purchased from entity under common control | - | - | 4,204 | - | - | 4,204 | |||||||||||||||

| Stock cancellation | (39,972,404,000) | (3,997,240) | 3,997,240 | - | - | - | |||||||||||||||

| Net income for the year ending December 31, 2016 | - | - | - | - | 1,402,419 | 1,402,419 | |||||||||||||||

| Foreign currency translation adjustment | - | - | - | (104,357) | - | (104,357) | |||||||||||||||

| Balance at December 31, 2016 | 27,596,000 | $ | 2,760 | $ | 65,116 | $ | (104,357) | $ | 1,397,421 | $ | 1,360,940 | ||||||||||

(*) On October 29, 2016, the Company performed the forward stock split, whereby every one (1) share of the common stock was automatically reclassified and changed into two thousand (2,000) shares (the "Stock Split"). The authorized number of shares and par value per share were not affected by the Stock Split. The Company’s capital accounts have been retroactively restated to reflect the Stock Split.

See Notes to Consolidated Financial Statements.

- F5 -

STEMCELL HOLDINGS, INC.

CONSOLIDATED STATEMENTS OF CASH FLOWS

| Year Ended December 31, 2016 | For the Period from December 31, 2015 (Inception) to December 31, 2015 | ||||

| CASH FLOWS FROM OPERATING ACTIVITIES | |||||

| Net income (loss) | $ | 1,402,419 | $ | (4,998) | |

| Adjustments to reconcile net income (loss) to net cash provided by operating activities: | |||||

| Depreciation expenses | 21,306 | - | |||

| Deferred income tax | (23,472) | ||||

| Service contributed by sole director | 58,674 | - | |||

| Share based compensation | - | 2,000 | |||

| Changes in operating assets and liabilities: | |||||

| Prepaid expenses and other current assets | (26,835) | - | |||

| Accrued expenses and other liabilities | 113,746 | 2,998 | |||

| Accounts payable to related party | 613,353 | - | |||

| Income tax payables | 1,275,998 | - | |||

| Net cash provided by operating activities | 3,435,189 | - | |||

| CASH FLOWS FROM INVESTING ACTIVITIES | |||||

| Purchase of property, plant and equipment | (600,800) | - | |||

| Net cash used in investing activities | (600,800) | - | |||

| Net effect of exchange rate changes on cash | (187,534) | - | |||

| Net change in cash and cash equivalents | 2,646,855 | - | |||

| Cash and cash equivalents - beginning of year | - | - | |||

| Cash and cash equivalents - end of year | $ | 2,646,855 | $ | - | |

| SUPPLEMENTAL DISCLOSURES OF CASH FLOW INFORMATION | |||||

| Interest paid | $ | - | $ | - | |

| Income taxes paid | $ | - | $ | - | |

| NON-CASH FINANCING AND INVESTING TRANSACTIONS | |||||

| Forgiveness of debt by former sole shareholder | $ | 2,998 | $ | - | |

| Excess of acquisition price over carrying value of equipment purchased from entity under common control | $ | 4,204 | $ | - | |

See Notes to Consolidated Financial Statements.

- F6 -

STEMCELL HOLDINGS, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

FOR THE PERIOD FROM DECEMBER 31, 2015 (INCEPTION) THROUGH DECEMBER 31, 2015 AND THE YEAR ENDED DECEMBER 31, 2016

NOTE 1 - ORGANIZATION, DESCRIPTION OF BUSINESS

Stemcell Holdings, Inc., formerly known as Perfect Acquisition, Inc. (the “Company”), was originally incorporated under the laws of the State of Delaware on December 31, 2015, with an objective to acquire, or merge with, an operating business.

On January 27, 2016, Jeffrey DeNunzio, the sole shareholder of the Company, entered into a Share Purchase Agreement with Takaaki Matsuoka. Pursuant to the agreement, Mr. DeNunzio transferred to Takaaki Matsuoka, 40,000,000,000 shares of the Company’s common stock for $30,000. Following the closing of the share purchase transaction, Takaaki Matsuoka gained 100% equity interest in the Company and became the controlling shareholder.

On January 27, 2016, the Company changed its name to Stemcell Holdings, Inc. and filed with the Delaware Secretary of State, a Certificate of Amendment.

On January 27, 2016, Jeffrey DeNunzio resigned as the Company’s Chief Executive Officer, Chief Financial Officer, President, Director, Secretary, and Treasurer. On the same day, Mr. Takaaki Matsuoka was appointed as the Company’s Chief Executive Officer, Chief Financial Officer, President, Director, Secretary, and Treasurer.

On March 23, 2016, the Company entered into a Stock Purchase Agreement (the “Stock Purchase Agreement”) with Takaaki Matsuoka. Pursuant to the agreement, on March 24, 2016, Takaaki Matsuoka transferred to Stemcell Holdings, Inc. 500 shares of the common stock of Stemcell Co., Ltd. (“Stemcell”), a Japanese corporation, which represents all of its issued and outstanding shares, in consideration of JPY 5,000,000 ($44,476). Neither of the registered capital of Stemcell nor the cash consideration for the acquisition was paid as of the filing date. This is a transaction between entities under common control and therefore all assets, liabilities and operations of Stemcell were accounted for at their historical carryover basis and as if they had been combined since Stemcell’s inception. Following the stock purchase transaction, Stemcell Holdings, Inc. gained 100% equity interest in Stemcell and Stemcell became a wholly owned subsidiary of the Stemcell Holdings, Inc.

On May 2, 2016, Takaaki Matsuoka entered into a Stock Purchase Agreement with Primavera Singa Pte Ltd. (“Primavera Singa”), a Singapore corporation fully owned by Shiho Matsuoka, wife of Takaaki Matsuoka. Pursuant to the agreement, Takaaki Matsuoka transferred to Primavera Singa 34,599,066,000 shares of the Company’s common stock, which represents 86.5% of the Company’s issued and outstanding shares, for JPY 3,000,000 (approximately $28,145). Following the closing of the share purchase transaction, Primavera Singa Pte., Ltd. became the controlling shareholder of the Company.

Currently, the Company operates through its wholly owned subsidiary, Stemcell Co., Ltd., which is primarily engaged in the regenerative medicine-related business which includes but is not limited to the culturing of stem cells.

NOTE 2 - SIGNIFICANT ACCOUNTING POLICIES

USE OF ESTIMATES

The presentation of financial statements in conformity with accounting principles generally accepted in the United States of America (“U.S. GAAP”) requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosures of contingent assets and liabilities as of the date of the financial statements and the reported amounts of revenues and expenses during the reporting periods. The most significant estimates and assumptions made by management include going concern and valuation allowance on deferred income tax. Operating results in the future could vary from the amounts derived from management's estimates and assumptions.

PRINCIPLES OF CONSOLIDATION

The consolidated financial statements include the accounts of the Company and its wholly-owned subsidiary, Stemcell Co., Ltd. All intercompany accounts and transactions are eliminated in the consolidation.

FAIR VALUE OF FINANCIAL INSTRUMENTS

The Company follows ASC 820, “Fair Value Measurements and Disclosures”, which defines fair value as the exchange price that would be received for an asset or paid to transfer a liability (an exit price) in the principal or most advantageous market for the asset or liability in an orderly transaction between market participants on the measurement date. ASC 820 also establishes a fair value hierarchy that distinguishes between (1) market participant assumptions developed based on market data obtained from independent sources (observable inputs) and (2) an entity’s own assumptions about market participant assumptions developed based on the best information available in the circumstances (unobservable inputs). The fair value hierarchy consists of three broad levels, which gives the highest priority to unadjusted quoted prices in active markets for identical assets or liabilities (Level 1) and the lowest priority to unobservable inputs (Level 3). The three levels of the fair value hierarchy are described:

· Level 1 - Unadjusted quoted prices in active markets that are accessible at the measurement date for identical, unrestricted assets or liabilities.

· Level 2 - Inputs other than quoted prices included within Level 1 that are observable for the asset or liability, either directly or indirectly, including quoted prices for similar assets or liabilities in active markets; quoted prices for identical or similar assets or liabilities in markets that are not active; inputs other than quoted prices that are observable for the asset or liability (e.g., interest rates); and inputs that are derived principally from or corroborated by observable market data by correlation or other means.

· Level 3 - Inputs that are both significant to the fair value measurement and unobservable.

For certain of the Company’s financial instruments, including cash and cash equivalents, prepaid expenses and other current assets, deferred tax assets, accrued expenses and other current liabilities, and income tax payables, the carrying amounts approximate fair values due to their short maturities.

Transactions involving related parties cannot be presumed to be carried out on an arm's-length basis, as the requisite conditions of competitive, free market dealings may not exist. Representations about transactions with related parties, if made, shall not imply that the related party transactions were consummated on terms equivalent to those that prevail in arm's-length transactions unless such representations can be substantiated. It is not, however, practical to determine the fair value of amounts due from/to related parties due to their related party nature.

RELATED PARTY TRANSACTION

A related party is generally defined as (i) any person that holds 10% or more of the Company’s securities and their immediate families, (ii) the Company’s management, (iii) someone that directly or indirectly controls, is controlled by or is under common control with the Company, or (iv) anyone who can significantly influence the financial and operating decisions of the Company. A transaction is considered to be a related party transaction when there is a transfer of resources or obligations between related parties. The Company conducts business with its related parties in the ordinary course of business.

Cash AND CASH equivalents

Cash and cash equivalents include cash on hand, certificates of deposit and all highly liquid investments with maturities of three months or less at the time of purchase.

PROPERTY, PLANT AND EQUIPMENT

Property, plant and equipment are stated at cost less depreciation and impairment loss. The initial cost of the assets comprises its purchase price and any directly attributable costs of bringing the asset to its working condition and location for its intended use. Depreciation is calculated using the straight-line method over the shorter of the estimated useful life of the respective assets as follows: computer software developed or acquired for internal use, 2 to 5 years; computer equipment, 2 to 5 years; buildings and improvements, 5 to 15 years; leasehold improvements, 2 to 10 years; and furniture and equipment, 1 to 5 years.

Significant improvements are capitalized when it is probable that the expenditure resulted in an increase in the future economic benefits expected to be obtained from the use of the asset beyond its originally assessed standard of performance. When improvements are made to real property and those improvements are permanently affixed to the property, the title to those improvements automatically transfers to the owner of the property. The lessee’s interest in the improvements is not a direct ownership interest but rather it is an intangible right to use and benefit from the improvements during the term of the lease. The Company uses the straight-line method over the shorter of the estimated useful life of the asset or the lease term.

In accordance with ASC Topic 360, the Company reviews long-lived assets for impairment whenever events or changes in circumstances indicate that the carrying amount of the assets may not be fully recoverable, or at least annually. The Company recognizes an impairment loss when the sum of expected undiscounted future cash flows is less than the carrying amount of the asset. The amount of impairment is measured as the difference between the asset’s estimated fair value and its book value. For year ended December 31, 2016 and period from December 31, 2015 (inception) to December 31, 2015, the Company did not record any impairment charges on long-lived assets.

Routine repairs and maintenance are expensed when incurred. Gains and losses on disposal of fixed assets are recognized in the income statement based on the net disposal proceeds less the carrying amount of the assets.

FOREIGN CURRENCY TRANSLATION

The reporting currency of the Company is the United States Dollars (“US$”) and the accompanying consolidated financial statements have been expressed in US$. Stemcell maintains its books and record in its local currency, Japanese YEN (“JPY”), which is a functional currency as being the primary currency of the economic environment in which its operation is conducted. In accordance with ASC Topic 830-30, “Translation of Financial Statement”, assets and liabilities of the Company whose functional currency is not US$ are translated into US$, using the exchange rate on the balance sheet date. Revenues and expenses are translated at average rates prevailing during the period. The gains and losses resulting from translation of financial statements are recorded as a separate component of accumulated other comprehensive income (loss) within the statements of changes in shareholders’ equity (deficit). Transaction gains and losses that arise from exchange rate fluctuations on transactions denominated in a currency other than the functional currency are included in the results of operations as incurred.

Translation of amounts from the local currency of Stemcell into US$1 has been made at the following exchange rates:

| December 31, 2016 | |

| Current JPY: US$1 exchange rate | 116.87 |

| Average JPY: US$1 exchange rate | 108.78 |

REVENUE RECOGNITION

The Company applies ASC 605 for revenue recognition. The Company will recognize revenue when it is realized or realizable and earned. The Company considers revenue realized or realizable and earned when all of the following criteria are met: (i) persuasive evidence of an arrangement exists, (ii) the product has been shipped or the services have been rendered to the customer, (iii) the sales price is fixed or determinable, and (iv) collectability is reasonably assured. Revenue consists of the invoice value for the services net of discounts. The Company has four revenue streams.

Stem Cell Culturing Revenue

Stem cell culturing revenue is recognized from the sale of cultured cells to customers when persuasive evidence of an arrangement exists, the cultured cells have been delivered, title and risk of loss are transferred, the sales price is fixed and determinable, and collection of the resulting receivable is reasonably assured. Revenue is recorded net of any discounts given to the customer.

During the year ended December 31, 2016, the Company derived all of its stem cell culturing revenue from Omotesando Helene Clinic (the “Helene Clinic”), which is fully owned by Takaaki Matsuoka. Pursuant to the agreement entered into by the two parties, once the cells are delivered, the title and risk of loss are transferred and no returns are allowed.

Coordination Services Revenue

During the year ended December 31, 2016, all of the coordination services were delivered to Helene Clinic, which is fully owned by Takaaki Matsuoka. Pursuant to the agreement entered into by the Company and Helene Clinic, the Company’s performance obligations under the coordination service include introducing patients to Helene Clinic, arranging schedules, and translation. Revenue is recognized when a series of the abovementioned services are delivered to patients identified by Helene Clinic.

Marketing Services Revenue

During the year ended December 31, 2016, the Company provided internet marketing services by providing search engine optimization for seven health clinics, which are fully owned by Takaaki Matsuoka, sole director of the Company.

- F7 -

Rental Revenue

The Company leases its idle equipment and properties to medical clinics. During the year ended December 31, 2016, the rental revenue was derived to a third party clinic.

Net INCOME (loss) per common share

Net income (loss) per common share is computed pursuant to ASC 260. Basic net income (loss) per share is computed by dividing net income (loss) by the weighted average number of shares of common stock outstanding during the period. Diluted net income (loss) per share is computed by dividing net income (loss) by the weighted average number of shares of common stock and potentially outstanding shares of common stock during each period. There were no potentially dilutive shares outstanding during the year ended December 31, 2016 or the period from December 31, 2015 (inception) to December 31, 2015.

INCOME TAX

The Company follows ASC 740, which requires recognition of deferred tax assets and liabilities for the expected future tax consequences of events that have been included in the financial statements or tax returns. Under this method, deferred tax assets and liabilities are based on the differences between the financial statement and tax bases of assets and liabilities using enacted tax rates in effect for the year in which the differences are expected to reverse. Deferred tax assets are reduced by a valuation allowance to the extent management concludes it is more likely than not that the assets will not be realized. Deferred tax assets and liabilities are measured using enacted tax rates expected to apply to taxable income in the years in which those temporary differences are expected to be recovered or settled. The effect on deferred tax assets and liabilities of a change in tax rates is recognized in the Statements of Operations in the period that includes the enactment date. Under ASC 740, the Company may recognize the tax benefit from an uncertain tax position only if it is more likely than not that the tax position will be sustained on examination by the taxing authorities, based on the technical merits of the position. The tax benefits recognized in the financial statements from such a position should be measured based on the largest benefit that has a greater than fifty percent (50%) likelihood of being realized upon ultimate settlement.

CONCENTRATION OF CREDIT RISKS

Financial instruments that potentially expose the Company to concentrations of credit risk consist primarily of cash and cash equivalents. The Company places its cash and cash equivalents with financial institutions. The Company does not require collateral or other security to support financial instruments subject to credit risks.

The Company had account receivable from Helene Clinic for stem cell culturing, and account payable to Helene Clinic which represented the funds to be remitted. As of December 31, 2016, after netting the receivable of $548,884 from Helene Clinic, the Company had net payables of $573,827 due to Helene Clinic. See Note 8 for details.

Net revenues from customers accounting for 10% or more of total revenues are as follows:

| Year Ended | Period from December 31, 2015 (Inception) | ||||

| Customer | December 31, 2016 | to December 31, 2015 | |||

| % | % | ||||

| Omotesando Helene Clinic | 95 | - | |||

| Total | 95 | - | |||

RECENT ACCOUNTING PRONOUNCEMENTS

In March 2016, the FASB issued ASU 2016-08, “Revenue from Contracts with Customers (Topic 606): Principal versus Agent Considerations (Reporting Revenue Gross versus Net)”. The amendments in this ASU are intended to improve the operability and understandability of the implementation guidance on principal versus agent considerations by amending certain existing illustrative examples and adding additional illustrative examples to assist in the application of the guidance. The effective date and transition of these amendments is the same as the effective date and transition of ASU 2014-09, “Revenue from Contracts with Customers (Topic 606)”. Public entities should apply the amendments in ASU 2014-09 for annual reporting periods beginning after December 15, 2017, including interim reporting periods therein. The Company is currently in the process of evaluating the impact of the adoption on its consolidated financial statements.

In April 2016, the FASB issued ASU 2016-10, “Revenue from Contracts with Customers (Topic 606): Identifying Performance Obligations and Licensing”. The amendments in this ASU add further guidance on identifying performance obligations and also to improve the operability and understandability of the licensing implementation guidance. The amendments do not change the core principle of the guidance in Topic 606. The effective date and transition requirements for the amendments are the same as the effective date and transition requirements in Topic 606. Public entities should apply the amendments for annual reporting periods beginning after December 15, 2017, including interim reporting periods therein. Early application for public entities is permitted only as of annual reporting periods beginning after December 15, 2016, including interim reporting periods within that reporting period. The Company is currently in the process of evaluating the impact of the adoption on its consolidated financial statements.

In May 2016, the FASB issued ASU 2016-11, “Revenue Recognition (Topic 605) and Derivatives and Hedging (Topic 815): Rescission of SEC Guidance Because of Accounting Standards Updates 2014-09 and 2014-16 Pursuant to Staff Announcements at the March 3, 2016 EITF Meeting (SEC Update)”. The ASU rescinds the following SEC Staff Observer guidance: revenue and expense recognition for freight services in progress, accounting for shipping & handling fees and costs, accounting for consideration given to a vendor, and accounting for gas-balancing arrangements. The ASU’s effective date coincides with the effective date of Topic 606, specifically annual reporting periods beginning after December 15, 2017 for public companies and annual reporting periods beginning after December 15, 2018 for other entities. The Company is currently in the process of evaluating the impact of the adoption on its consolidated financial statements.

In May 2016, the FASB issued ASU 2016-12, “Revenue from Contracts with Customers (Topic 606): Narrow-Scope Improvements and Practical Expedients”. The amendments in this ASU, among other things: (1) clarify the objective of the collectability criterion for applying paragraph 606-10- 25-7; (2) permit an entity to exclude amounts collected from customers for all sales (and other similar) taxes from the transaction price; (3) specify that the measurement date for noncash consideration is contract inception; (4) provide a practical expedient that permits an entity to reflect the aggregate effect of all modifications that occur before the beginning of the earliest period presented when identifying the satisfied and unsatisfied performance obligations, determining the transaction price, and allocating the transaction price to the satisfied and unsatisfied performance obligations; (5) clarify that a completed contract for purposes of transition is a contract for which all (or substantially all) of the revenue was recognized under legacy GAAP before the date of initial application, and (6) clarify that an entity that retrospectively applies the guidance in Topic 606 to each prior reporting period is not required to disclose the effect of the accounting change for the period of adoption. The effective date of these amendments is at the same date that Topic 606 is effective. Topic 606 is effective for public entities for annual reporting periods beginning after December 15, 2017, including interim reporting periods therein. The Company is currently in the process of evaluating the impact of the adoption on its consolidated financial statements.