Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Argo Group International Holdings, Ltd. | d400642d8k.htm |

Exhibit 99.1

Forward-Looking Statements .

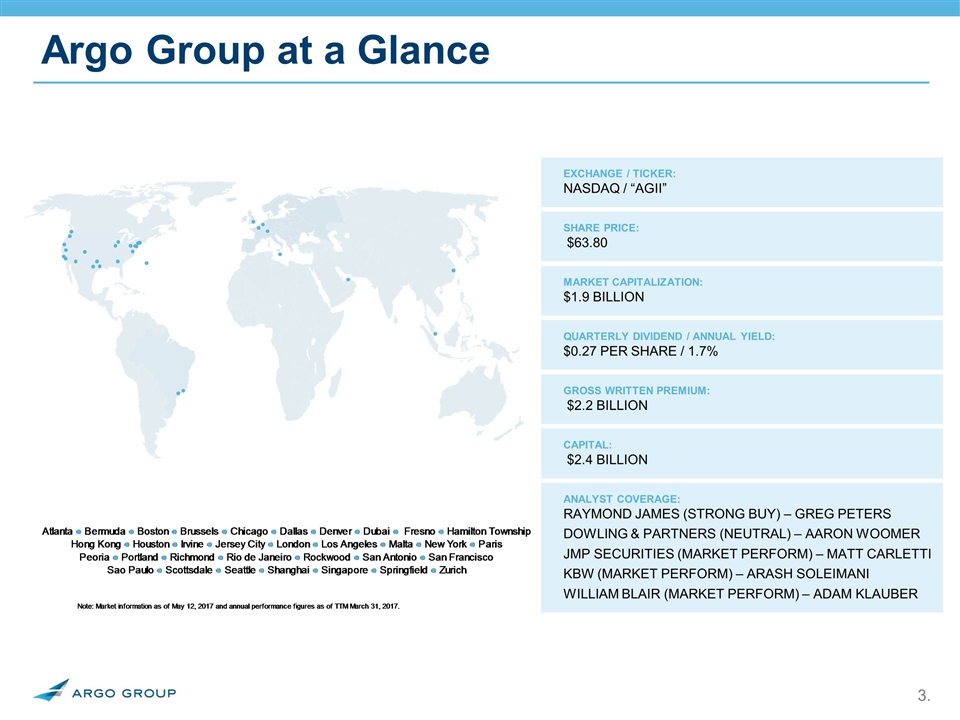

Argo Group at a Glance EXCHANGE / TICKER: NASDAQ / “AGII” SHARE PRICE: $63.80 MARKET CAPITALIZATION: $1.9 BILLION QUARTERLY DIVIDEND / ANNUAL YIELD: $0.27 PER SHARE / 1.7% GROSS WRITTEN PREMIUM: $2.2 BILLION CAPITAL: $2.4 BILLION ANALYST COVERAGE: RAYMOND JAMES (STRONG BUY) ‒ GREG PETERS DOWLING & PARTNERS (NEUTRAL) ‒ AARON WOOMER JMP SECURITIES (MARKET PERFORM) – MATT CARLETTI KBW (MARKET PERFORM) ‒ ARASH SOLEIMANI WILLIAM BLAIR (MARKET PERFORM) ‒ ADAM KLAUBER

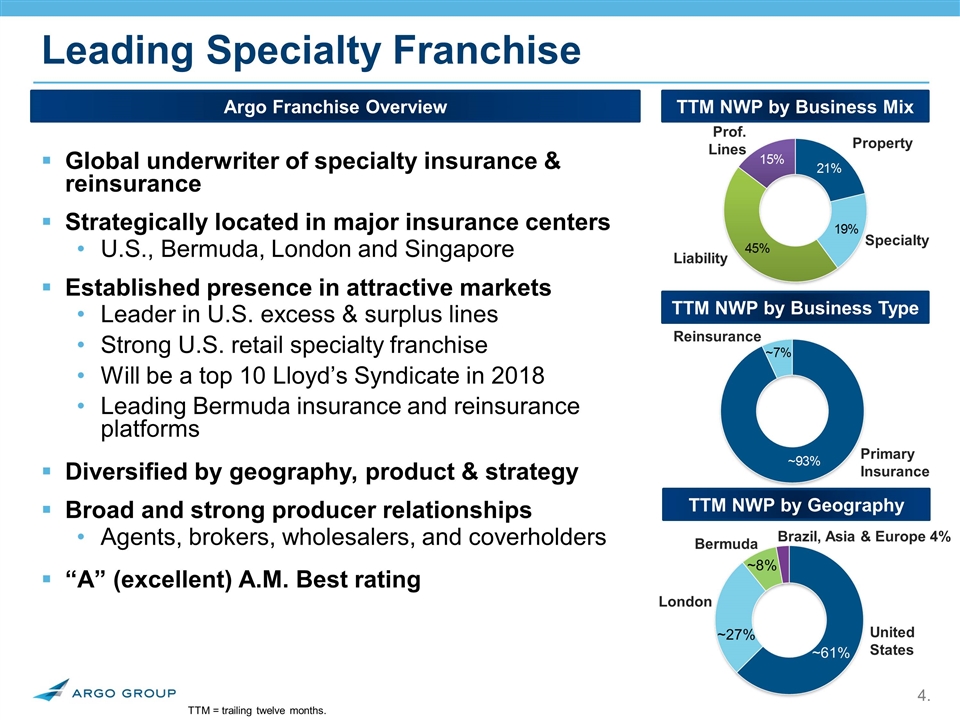

Reinsurance Leading Specialty Franchise Global underwriter of specialty insurance & reinsurance Strategically located in major insurance centers U.S., Bermuda, London and Singapore Established presence in attractive markets Leader in U.S. excess & surplus lines Strong U.S. retail specialty franchise Will be a top 10 Lloyd’s Syndicate in 2018 Leading Bermuda insurance and reinsurance platforms Diversified by geography, product & strategy Broad and strong producer relationships Agents, brokers, wholesalers, and coverholders “A” (excellent) A.M. Best rating Primary Insurance Property Liability TTM NWP by Business Type TTM NWP by Business Mix Argo Franchise Overview Specialty Prof. Lines TTM = trailing twelve months. TTM NWP by Geography Brazil, Asia & Europe 4% Bermuda ~8% London ~27% United States ~61%

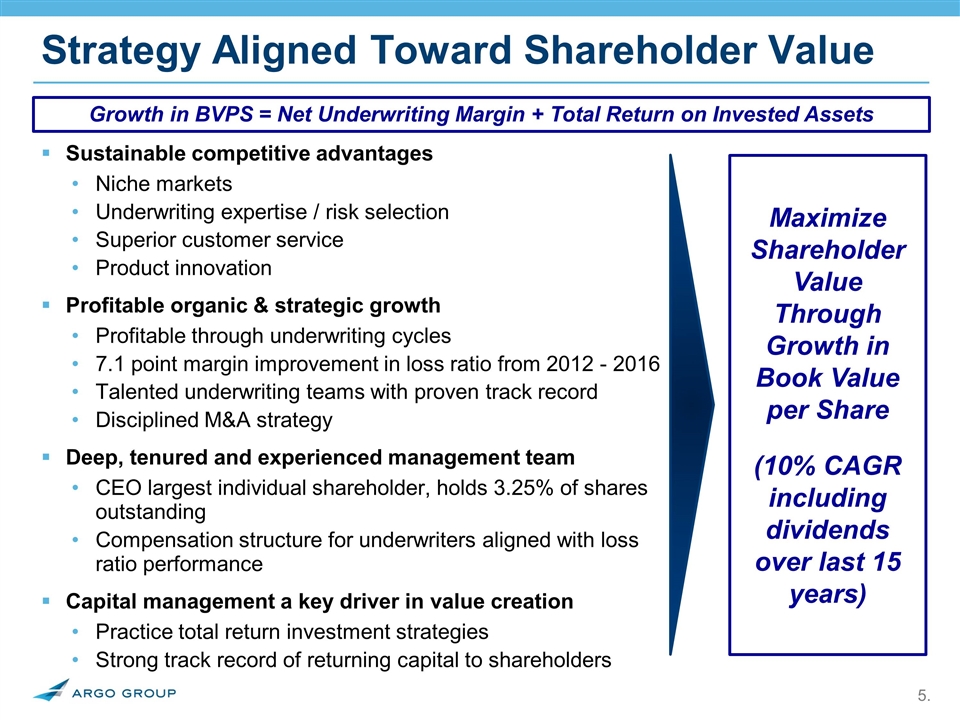

Maximize Shareholder Value Through Growth in Book Value per Share (10% CAGR including dividends over last 15 years) Sustainable competitive advantages Niche markets Underwriting expertise / risk selection Superior customer service Product innovation Profitable organic & strategic growth Profitable through underwriting cycles 7.1 point margin improvement in loss ratio from 2012 - 2016 Talented underwriting teams with proven track record Disciplined M&A strategy Deep, tenured and experienced management team CEO largest individual shareholder, holds 3.25% of shares outstanding Compensation structure for underwriters aligned with loss ratio performance Capital management a key driver in value creation Practice total return investment strategies Strong track record of returning capital to shareholders Strategy Aligned Toward Shareholder Value Growth in BVPS = Net Underwriting Margin + Total Return on Invested Assets

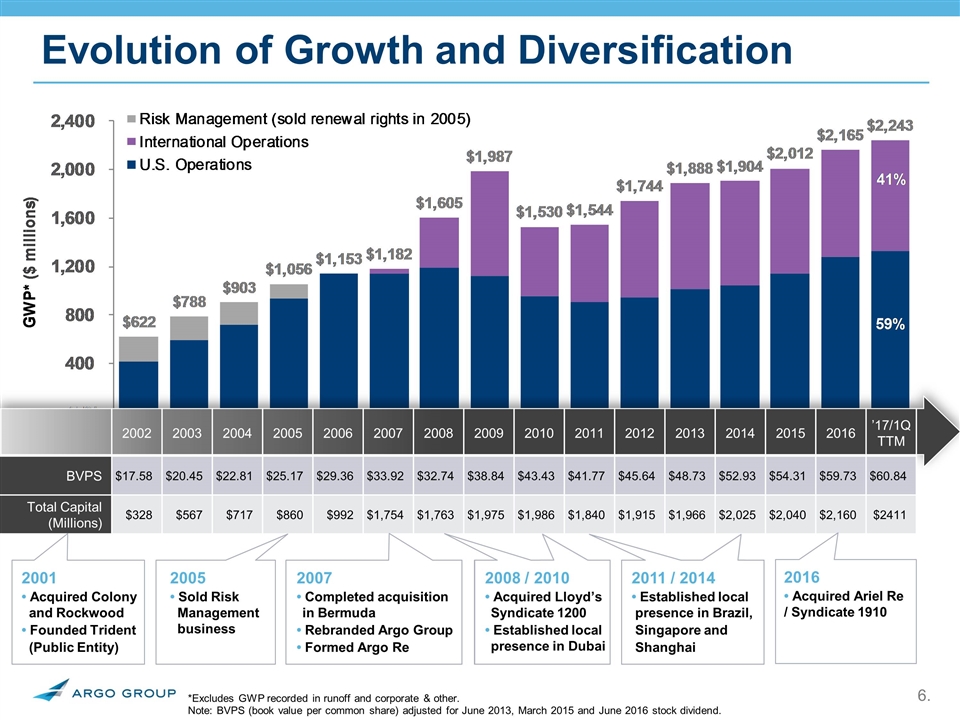

*Excludes GWP recorded in runoff and corporate & other. Note: BVPS (book value per common share) adjusted for June 2013, March 2015 and June 2016 stock dividend. Evolution of Growth and Diversification 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 ’17/1Q TTM BVPS $17.58 $20.45 $22.81 $25.17 $29.36 $33.92 $32.74 $38.84 $43.43 $41.77 $45.64 $48.73 $52.93 $54.31 $59.73 $60.84 Total Capital (Millions) $328 $567 $717 $860 $992 $1,754 $1,763 $1,975 $1,986 $1,840 $1,915 $1,966 $2,025 $2,040 $2,160 $2411 2001 • Acquired Colony and Rockwood • Founded Trident (Public Entity) 2005 • Sold Risk Management business 2007 • Completed acquisition in Bermuda • Rebranded Argo Group • Formed Argo Re 2008 / 2010 • Acquired Lloyd’s Syndicate 1200 • Established local presence in Dubai 2011 / 2014 • Established local presence in Brazil, Singapore and Shanghai 2016 • Acquired Ariel Re / Syndicate 1910

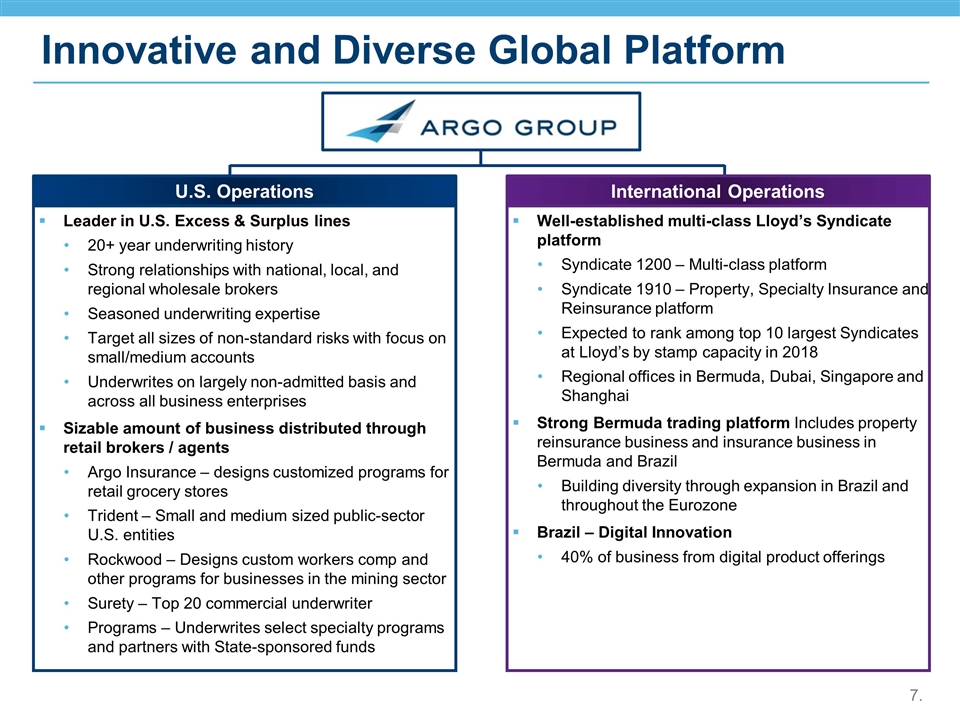

Well-established multi-class Lloyd’s Syndicate platform Syndicate 1200 – Multi-class platform Syndicate 1910 – Property, Specialty Insurance and Reinsurance platform Expected to rank among top 10 largest Syndicates at Lloyd’s by stamp capacity in 2018 Regional offices in Bermuda, Dubai, Singapore and Shanghai Strong Bermuda trading platform Includes property reinsurance business and insurance business in Bermuda and Brazil Building diversity through expansion in Brazil and throughout the Eurozone Brazil – Digital Innovation 40% of business from digital product offerings Leader in U.S. Excess & Surplus lines 20+ year underwriting history Strong relationships with national, local, and regional wholesale brokers Seasoned underwriting expertise Target all sizes of non-standard risks with focus on small/medium accounts Underwrites on largely non-admitted basis and across all business enterprises Sizable amount of business distributed through retail brokers / agents Argo Insurance – designs customized programs for retail grocery stores Trident – Small and medium sized public-sector U.S. entities Rockwood – Designs custom workers comp and other programs for businesses in the mining sector Surety – Top 20 commercial underwriter Programs – Underwrites select specialty programs and partners with State-sponsored funds Innovative and Diverse Global Platform 7. U.S. Operations International Operations

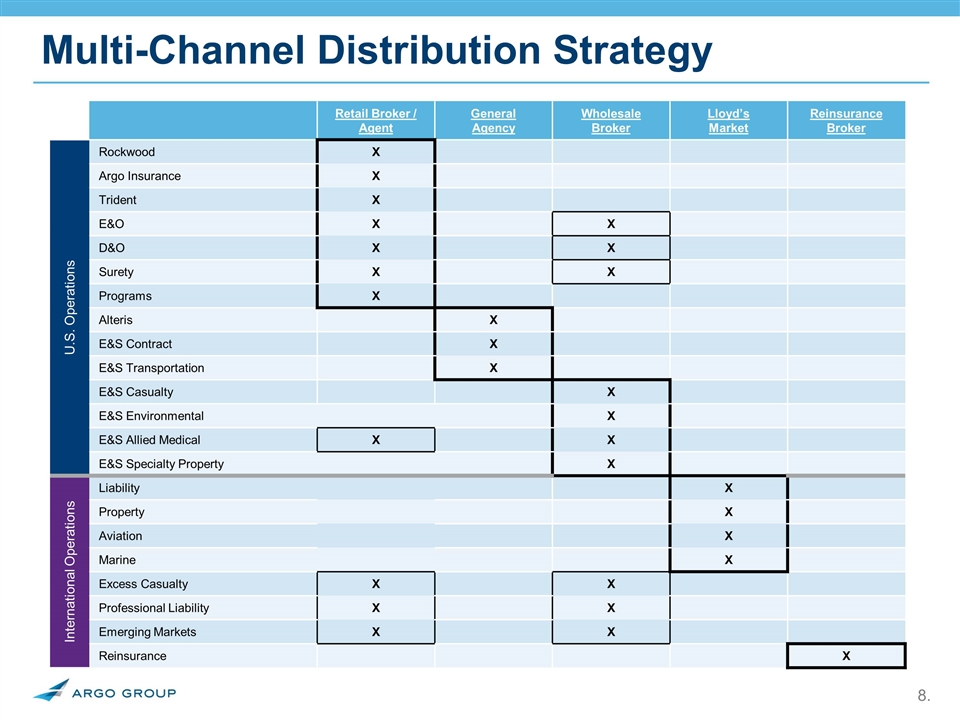

Multi-Channel Distribution Strategy Retail Broker / Agent General Agency Wholesale Broker Lloyd’s Market Reinsurance Broker U.S. Operations Rockwood X Argo Insurance X Trident X E&O X X D&O X X Surety X X Programs X Alteris X E&S Contract X E&S Transportation X E&S Casualty X E&S Environmental X E&S Allied Medical X X E&S Specialty Property X International Operations Liability X Property X Aviation X Marine X Excess Casualty X X Professional Liability X X Emerging Markets X X Reinsurance X

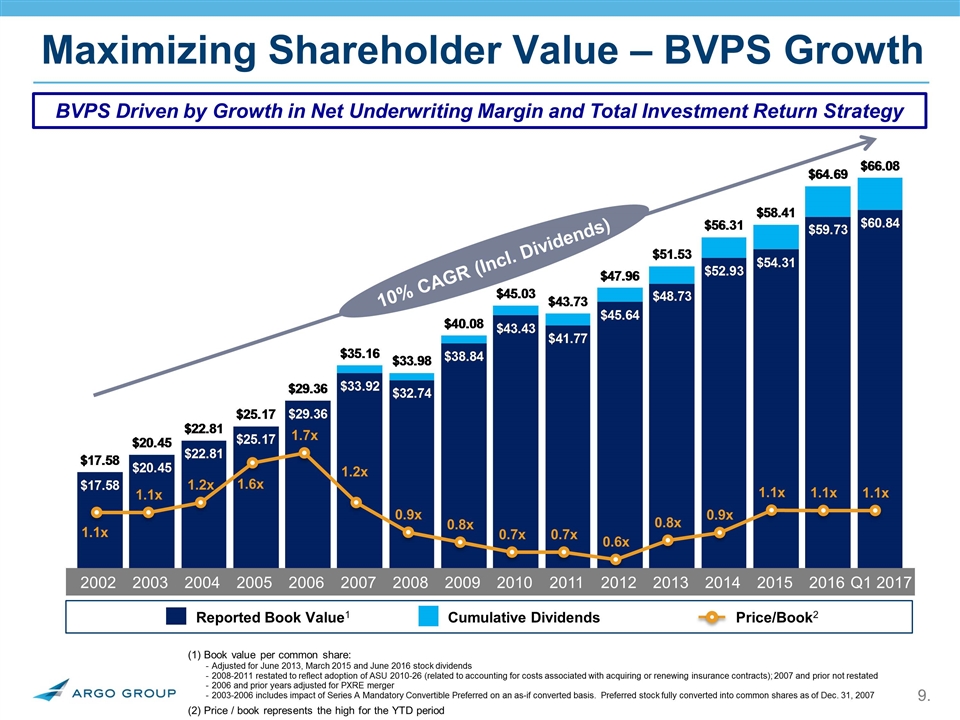

(1) Book value per common share: Adjusted for June 2013, March 2015 and June 2016 stock dividends 2008-2011 restated to reflect adoption of ASU 2010-26 (related to accounting for costs associated with acquiring or renewing insurance contracts); 2007 and prior not restated 2006 and prior years adjusted for PXRE merger 2003-2006 includes impact of Series A Mandatory Convertible Preferred on an as-if converted basis. Preferred stock fully converted into common shares as of Dec. 31, 2007 (2) Price / book represents the high for the YTD period Maximizing Shareholder Value – BVPS Growth 10% CAGR (Incl. Dividends) 2002 Reported Book Value1Cumulative Dividends Price/Book2 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2015 2014 2016 Q1 2017 BVPS Driven by Growth in Net Underwriting Margin and Total Investment Return Strategy

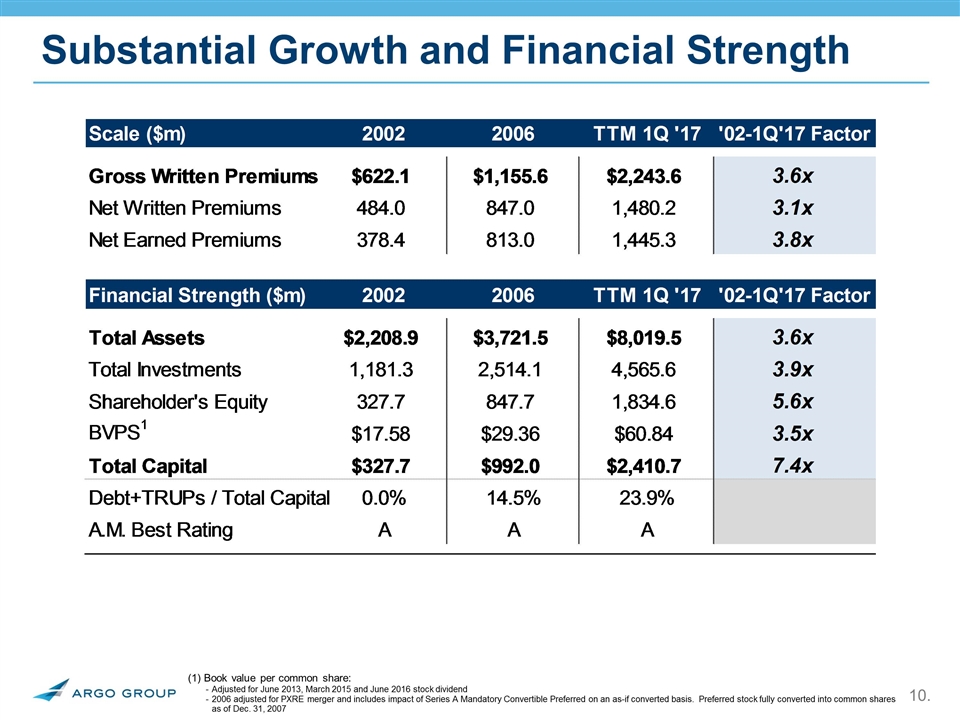

Substantial Growth and Financial Strength (1) Book value per common share: Adjusted for June 2013, March 2015 and June 2016 stock dividend 2006 adjusted for PXRE merger and includes impact of Series A Mandatory Convertible Preferred on an as-if converted basis. Preferred stock fully converted into common shares as of Dec. 31, 2007

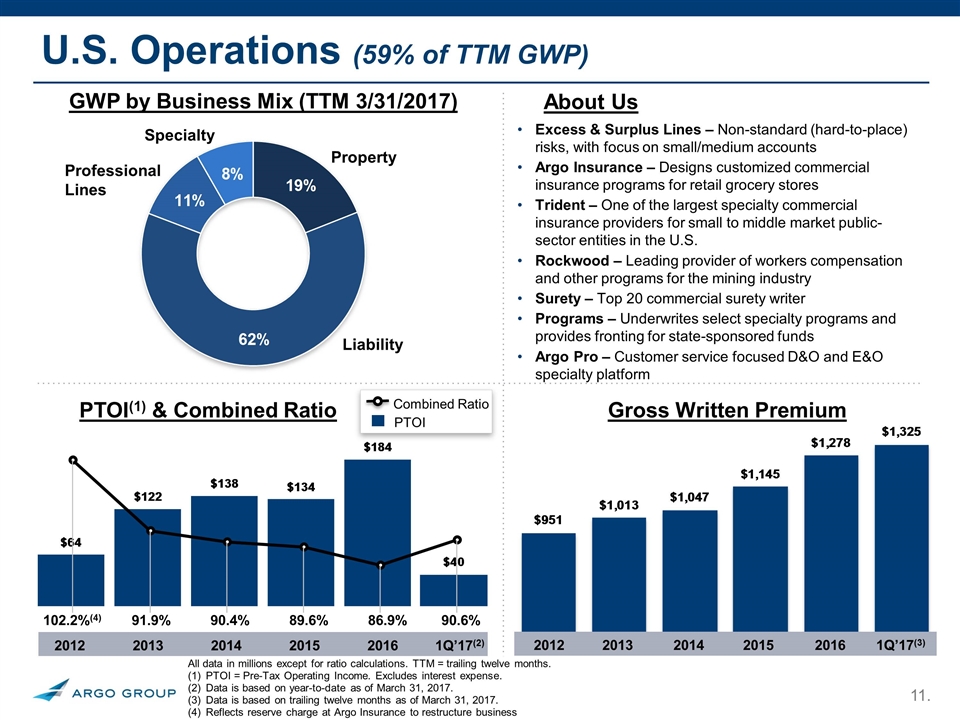

U.S. Operations (59% of TTM GWP) About Us Excess & Surplus Lines – Non-standard (hard-to-place) risks, with focus on small/medium accounts Argo Insurance – Designs customized commercial insurance programs for retail grocery stores Trident – One of the largest specialty commercial insurance providers for small to middle market public-sector entities in the U.S. Rockwood – Leading provider of workers compensation and other programs for the mining industry Surety – Top 20 commercial surety writer Programs – Underwrites select specialty programs and provides fronting for state-sponsored funds Argo Pro – Customer service focused D&O and E&O specialty platform GWP by Business Mix (TTM 3/31/2017) Gross Written Premium All data in millions except for ratio calculations. TTM = trailing twelve months. PTOI = Pre-Tax Operating Income. Excludes interest expense. Data is based on year-to-date as of March 31, 2017. Data is based on trailing twelve months as of March 31, 2017. Reflects reserve charge at Argo Insurance to restructure business 102.2%(4) 91.9% 89.6% 90.4% Combined Ratio PTOI PTOI(1) & Combined Ratio 2012 2013 2014 86.9% 90.6% 2015 2016 1Q’17(2) Property Liability Specialty Professional Lines 2012 2013 2014 2015 2016 1Q’17(3)

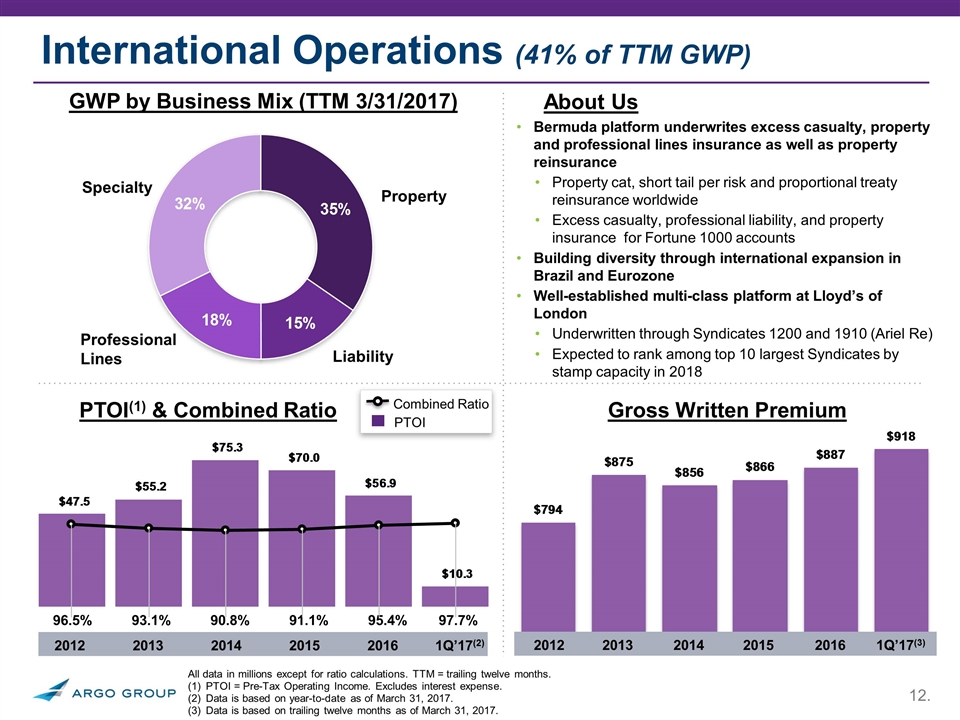

International Operations (41% of TTM GWP) Bermuda platform underwrites excess casualty, property and professional lines insurance as well as property reinsurance Property cat, short tail per risk and proportional treaty reinsurance worldwide Excess casualty, professional liability, and property insurance for Fortune 1000 accounts Building diversity through international expansion in Brazil and Eurozone Well-established multi-class platform at Lloyd’s of London Underwritten through Syndicates 1200 and 1910 (Ariel Re) Expected to rank among top 10 largest Syndicates by stamp capacity in 2018 All data in millions except for ratio calculations. TTM = trailing twelve months. PTOI = Pre-Tax Operating Income. Excludes interest expense. Data is based on year-to-date as of March 31, 2017. Data is based on trailing twelve months as of March 31, 2017. About Us Gross Written Premium PTOI(1) & Combined Ratio Combined Ratio PTOI GWP by Business Mix (TTM 3/31/2017) Property Liability Specialty Professional Lines 2012 2013 2014 2015 2016 1Q’17(2) 2012 2013 2014 2015 2016 1Q’17(3) 96.5% 93.1% 91.1% 90.8% 95.4% 97.7%

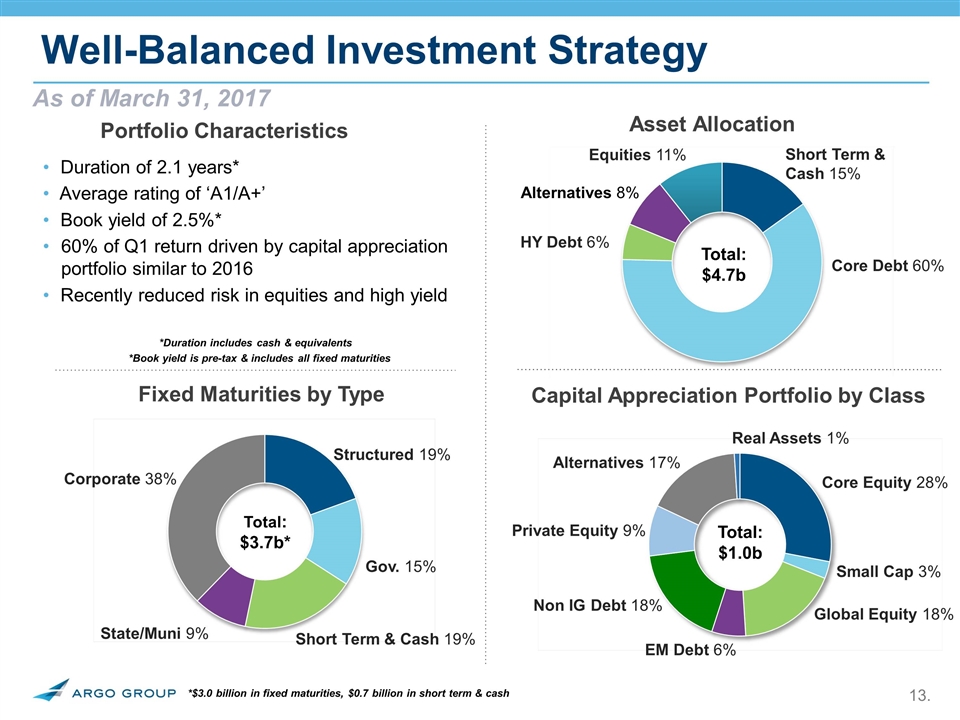

As of March 31, 2017 Well-Balanced Investment Strategy 17% Duration of 2.1 years* Average rating of ‘A1/A+’ Book yield of 2.5%* 60% of Q1 return driven by capital appreciation portfolio similar to 2016 Recently reduced risk in equities and high yield Portfolio Characteristics *Book yield is pre-tax & includes all fixed maturities *Duration includes cash & equivalents . Capital Appreciation Portfolio by Class Non IG Debt 18% Small Cap 3% Private Equity 9% Alternatives 17% Global Equity 18% EM Debt 6% Core Equity 28% Total: $1.0b Fixed Maturities by Type Short Term & Cash 19% Corporate 38%. Gov. 15% Structured 19% State/Muni 9%. Total: $3.7b* *$3.0 billion in fixed maturities, $0.7 billion in short term & cash Real Assets 1% Asset Allocation Core Debt 60% Alternatives 8% HY Debt 6% Short Term & Cash 15% Total: $4.7b Equities 11%

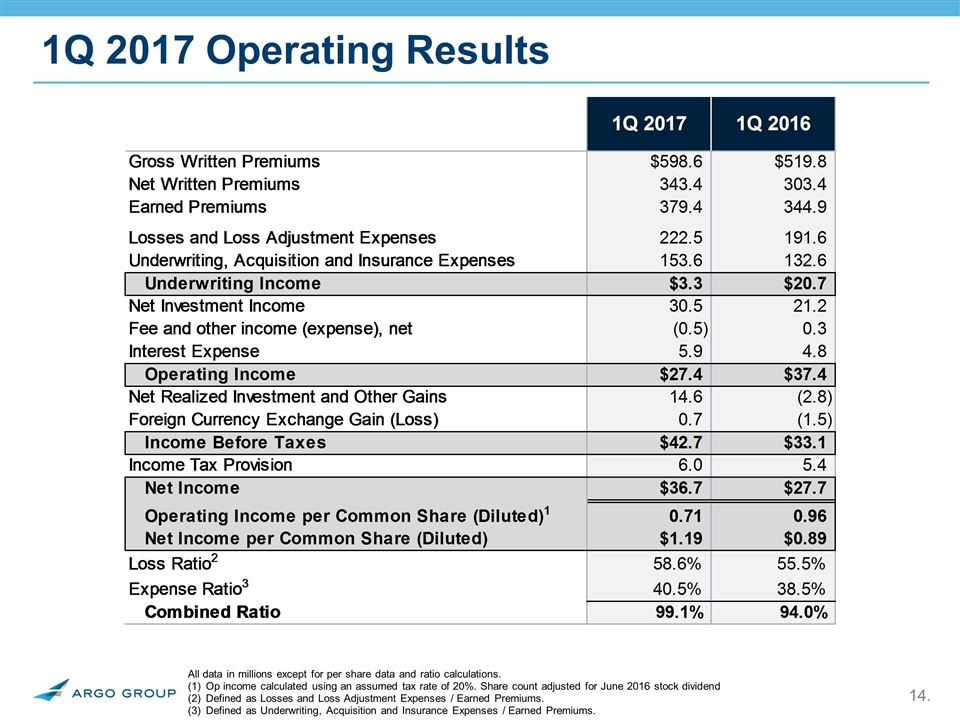

All data in millions except for per share data and ratio calculations. Op income calculated using an assumed tax rate of 20%. Share count adjusted for June 2016 stock dividend Defined as Losses and Loss Adjustment Expenses / Earned Premiums. Defined as Underwriting, Acquisition and Insurance Expenses / Earned Premiums. 1Q 2017 Operating Results

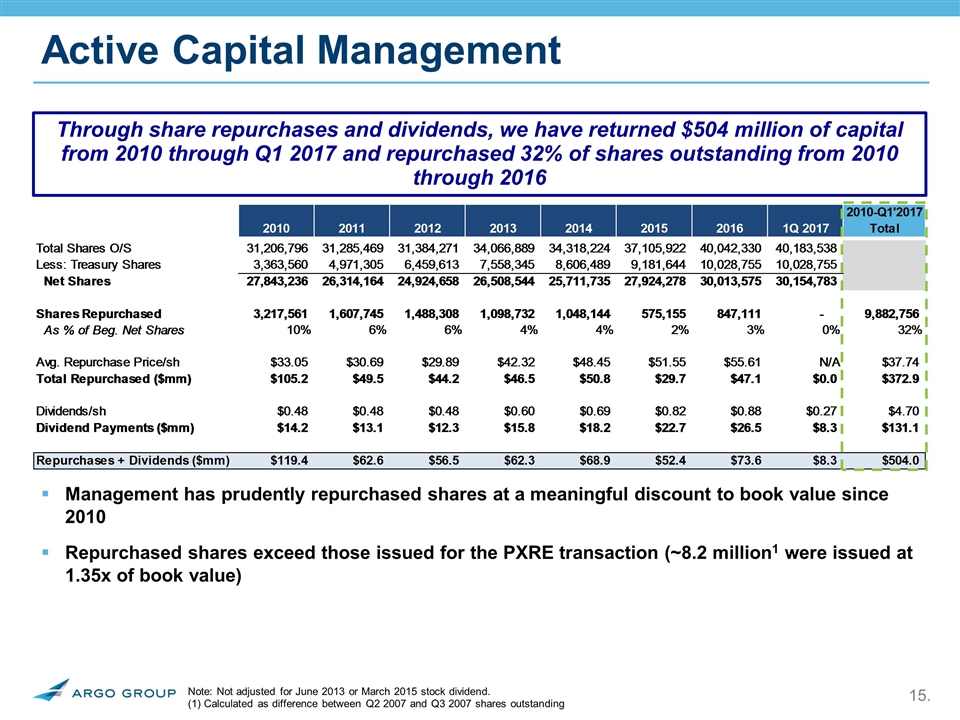

Note: Not adjusted for June 2013 or March 2015 stock dividend. (1) Calculated as difference between Q2 2007 and Q3 2007 shares outstanding Active Capital Management Through share repurchases and dividends, we have returned $504 million of capital from 2010 through Q1 2017 and repurchased 32% of shares outstanding from 2010 through 2016 Management has prudently repurchased shares at a meaningful discount to book value since 2010 Repurchased shares exceed those issued for the PXRE transaction (~8.2 million1 were issued at 1.35x of book value)

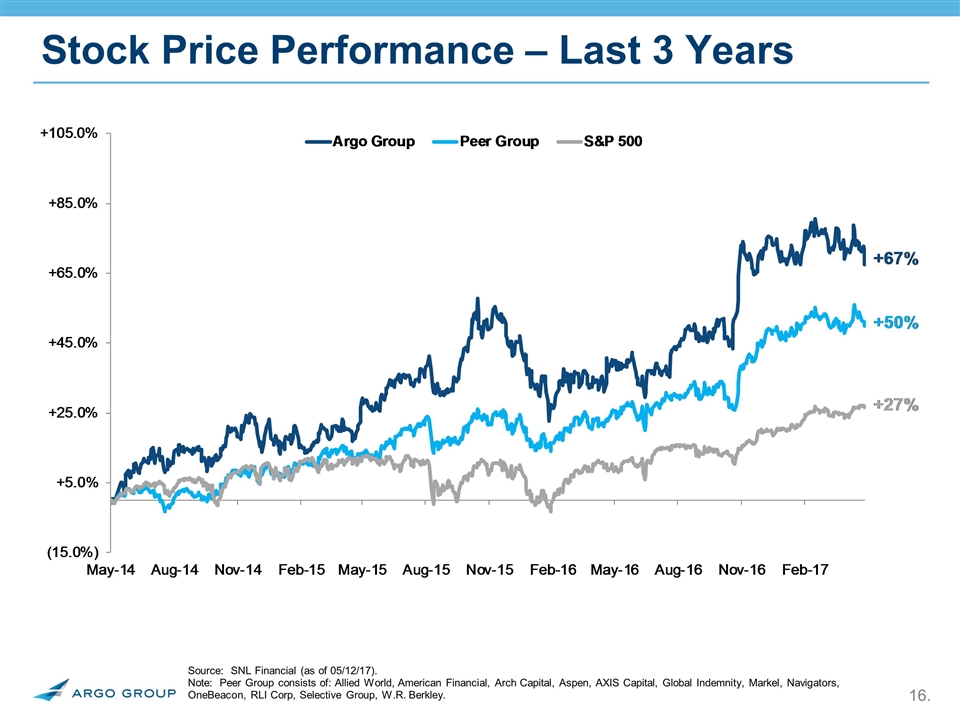

Stock Price Performance – Last 3 Years Source: SNL Financial (as of 05/12/17). Note: Peer Group consists of: Allied World, American Financial, Arch Capital, Aspen, AXIS Capital, Global Indemnity, Markel, Navigators, OneBeacon, RLI Corp, Selective Group, W.R. Berkley.

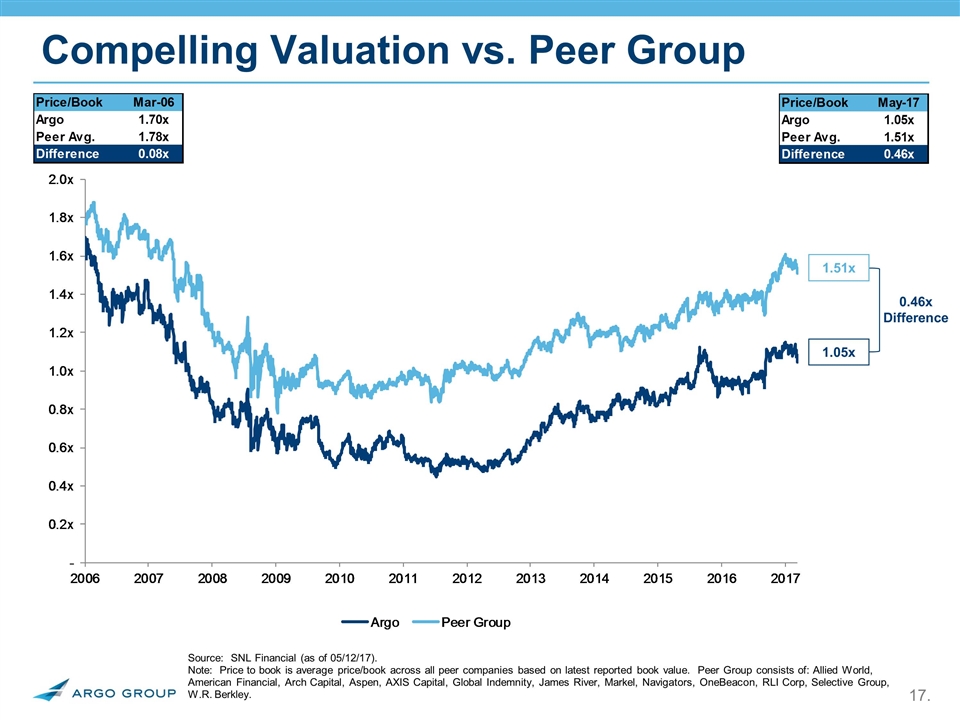

Compelling Valuation vs. Peer Group Source: SNL Financial (as of 05/12/17). Note: Price to book is average price/book across all peer companies based on latest reported book value. Peer Group consists of: Allied World, American Financial, Arch Capital, Aspen, AXIS Capital, Global Indemnity, James River, Markel, Navigators, OneBeacon, RLI Corp, Selective Group, W.R. Berkley. 1.05x 1.51x 0.46x Difference

We believe that Argo Group continues to have the potential to generate substantial value for new and existing investors Operations Well Positioned for Value Creation in 2017 and Beyond Moderate financial leverage Strong balance sheet with 15 years of overall redundant loss reserves Capital Significant changes to the underwriting portfolio composition completed Results of underwriting initiatives evident in financial results Best in class loss ratios, improved to 57.4% in 2016 from 64.5% in 2012 Incremental underwriting margin and yield improvements as well as a well balanced investment portfolio should favorably impact ROE going forward Continues to employ and attract some of the best talent both in the insurance and technology industries Valuation Compelling investment case, trading at a price/book of 1.1x versus peers at 1.5x Stock trading at a discount to peers notwithstanding similar returns to peer Argo’s four year average ROE is 9.7% versus peer average of 9.4x