Attached files

| file | filename |

|---|---|

| 8-K - 8-K - S&T BANCORP INC | form8-k1q17annualpres.htm |

MEMBER FDIC

Charles G. Urtin

Chairman of the Board

MEMBER FDIC

Todd D. Brice

President and Chief Executive Officer

3

Forward Looking Statement

and Risk Factors

This presentation contains or incorporates statements that we believe are forward-looking statements within the meaning of the Private

Securities Litigation Reform Act of 1995. Forward-looking statements generally relate to our financial condition, results of operations, plans,

objectives, outlook for earnings, revenues, expenses, capital and liquidity levels and ratios, asset levels, asset quality, financial position, and

other matters regarding or affecting S&T and its future business and operations. Forward looking statements are typically identified by words

or phrases such as “will likely result,” “expect”, “anticipate,” “estimate,” “forecast,” “project,” “intend”, “ believe”, “assume”, “strategy”, “trend”,

“plan”, “outlook”, “outcome”, “continue”, “remain”, “potential,” “opportunity”, “believe”, “comfortable”, “current”, “position”, “maintain”, “sustain”,

“seek”, “achieve” and variations of such words and similar expressions, or future or conditional verbs such as will, would, should, could or

may. Although we believe the assumptions upon which these forward-looking statements are based are reasonable, any of these

assumptions could prove to be inaccurate and the forward-looking statements based on these assumptions could be incorrect. The matters

discussed in these forward-looking statements are subject to various risks, uncertainties and other factors that could cause actual results and

trends to differ materially from those made, projected, or implied in or by the forward-looking statements depending on a variety of

uncertainties or other factors including, but not limited to: credit losses; cyber-security concerns; rapid technological developments and

changes; sensitivity to the interest rate environment including a prolonged period of low interest rates, a rapid increase in interest rates or a

change in the shape of the yield curve; a change in spreads on interest-earning assets and interest-bearing liabilities; regulatory supervision

and oversight; legislation affecting the financial services industry as a whole, and S&T, in particular; the outcome of pending and future

litigation and governmental proceedings; increasing price and product/service competition; the ability to continue to introduce competitive

new products and services on a timely, cost-effective basis; managing our internal growth and acquisitions; the possibility that the anticipated

benefits from acquisitions cannot be fully realized in a timely manner or at all, or that integrating the acquired operations will be more difficult,

disruptive or costly than anticipated; containing costs and expenses; reliance on significant customer relationships; general economic or

business conditions; deterioration of the housing market and reduced demand for mortgages; deterioration in the overall macroeconomic

conditions or the state of the banking industry that could warrant further analysis of the carrying value of goodwill and could result in an

adjustment to its carrying value resulting in a non-cash charge to net income; re-emergence of turbulence in significant portions of the global

financial and real estate markets that could impact our performance, both directly, by affecting our revenues and the value of our assets and

liabilities, and indirectly, by affecting the economy generally and access to capital in the amounts, at the times and on the terms required to

support our future businesses. Many of these factors, as well as other factors, are described in our filings with the SEC. Forward-looking

statements are based on beliefs and assumptions using information available at the time the statements are made. We caution you not to

unduly rely on forward-looking statements because the assumptions, beliefs, expectations and projections about future events may, and often

do, differ materially from actual results. Any forward-looking statement speaks only as to the date on which it is made, and we undertake no

obligation to update any forward-looking statement to reflect developments occurring after the statement is made.

4

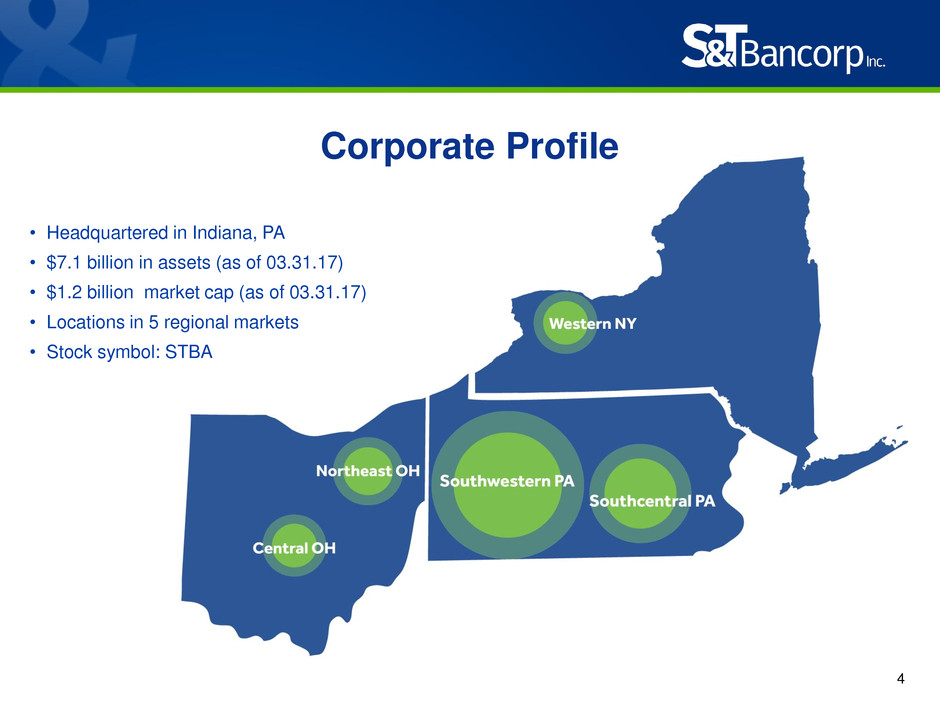

Corporate Profile

4

• Headquartered in Indiana, PA

• $7.1 billion in assets (as of 03.31.17)

• $1.2 billion market cap (as of 03.31.17)

• Locations in 5 regional markets

• Stock symbol: STBA

5

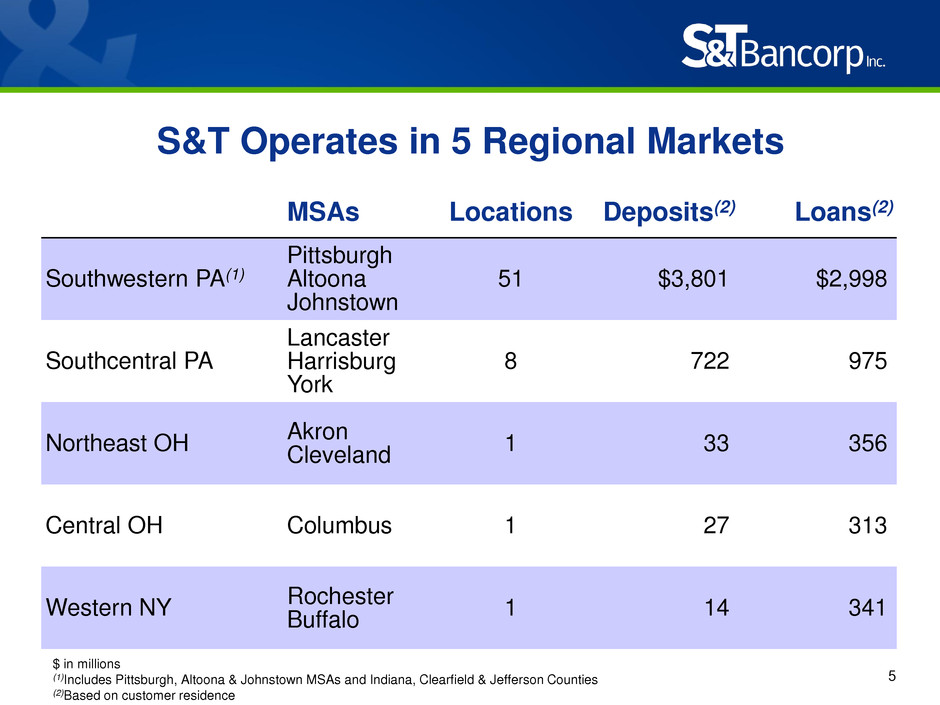

$ in millions

(1)Includes Pittsburgh, Altoona & Johnstown MSAs and Indiana, Clearfield & Jefferson Counties

(2)Based on customer residence

S&T Operates in 5 Regional Markets

MSAs Locations Deposits(2) Loans(2)

Southwestern PA(1)

Pittsburgh

Altoona

Johnstown

51 $3,801 $2,998

Southcentral PA

Lancaster

Harrisburg

York

8 722 975

Northeast OH

Akron

Cleveland

1 33 356

Central OH Columbus 1 27 313

Western NY

Rochester

Buffalo

1 14 341

6

7

8

Total Annualized Shareholder Return

Includes reinvested dividends (Data as of

3.31.17)

Source: Bloomberg

Stock Performance

1 YR 3 YR 5 YR 10 YR

STBA 38.00 % 16.39 % 12.88 % 3.64 %

NASDAQ Bank 42.87 % 14.16 % 17.68 % 3.73 %

KRX-Dow Jones KBW Regional

Bank 40.76 % 12.77 % 16.06 % 3.55 %

S&P 500 17.16 % 10.34 % 13.26 % 7.49 %

9

STBA Investment Thesis

• Above peer performance

• Undervalued compared to peer

• Strategic and effective mergers and expansion

• Demonstrated expense discipline and efficiency

• Organic growth

• Stable regional markets with long-term

• oil and gas benefit

• Sound asset quality

10

The Right Size

• Big enough to:

• Provide full complement of products and services

• Access technology

• Access capital markets

• Attract talent

• Expand – mergers and acquisitions/de novo

• Small enough to:

• Stay close to our customers

• Understand our markets

• Be responsive

MEMBER FDIC

Mark Kochvar

Chief Financial Officer

12

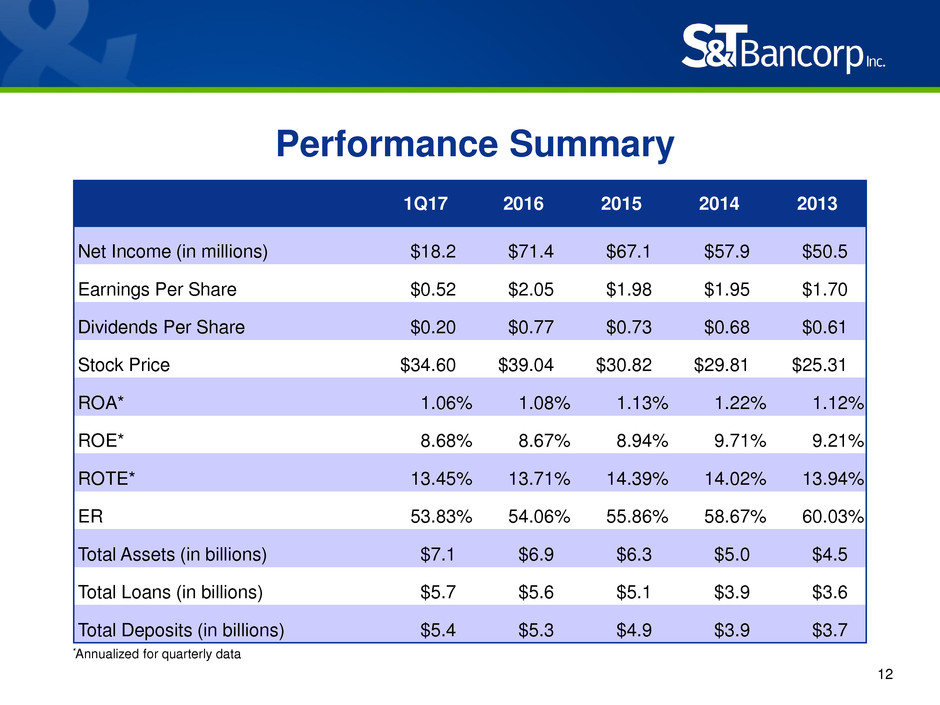

Performance Summary

*Annualized for quarterly data

1Q17 2016 2015 2014 2013

Net Income (in millions) $18.2 $71.4 $67.1 $57.9 $50.5

Earnings Per Share $0.52 $2.05 $1.98 $1.95 $1.70

Dividends Per Share $0.20 $0.77 $0.73 $0.68 $0.61

Stock Price $34.60 $39.04 $30.82 $29.81 $25.31

ROA* 1.06 % 1.08 % 1.13 % 1.22 % 1.12 %

ROE* 8.68 % 8.67 % 8.94 % 9.71 % 9.21 %

ROTE* 13.45 % 13.71 % 14.39 % 14.02 % 13.94 %

ER 53.83 % 54.06 % 55.86 % 58.67 % 60.03 %

Total Assets (in billions) $7.1 $6.9 $6.3 $5.0 $4.5

Total Loans (in billions) $5.7 $5.6 $5.1 $3.9 $3.6

Total Deposits (in billions) $5.4 $5.3 $4.9 $3.9 $3.7

13

Peer(1)

(1) BHCPR Peer Group 2: Bank Holding Companies with $3-10 Billion of Assets

(2)Annualized

(2)

14

Peer(1)

(1) BHCPR Peer Group 2: Bank Holding Companies with $3-10 Billion of Assets

(2)Annualized

(2)

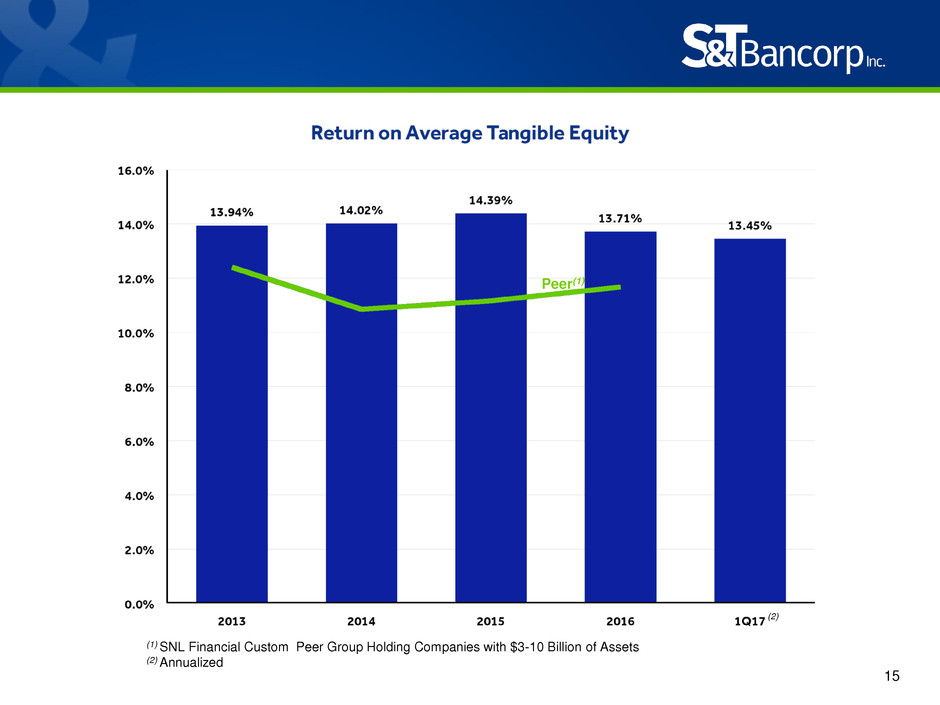

15

Peer(1)

(1) SNL Financial Custom Peer Group Holding Companies with $3-10 Billion of Assets

(2) Annualized

(2)

16

Peer(1)

(1) BHCPR Peer Group 2: Bank Holding Companies with $3-10 Billion of Assets

MEMBER FDIC

2017 Annual Meeting