Attached files

| file | filename |

|---|---|

| 8-K - 8-K - SUNTRUST BANKS INC | a05162017barclays8-kdocume.htm |

BARCLAYS AMERICAS

SELECT FRANCHISE

CONFERENCE

Aleem Gillani, Chief Financial Officer, SunTrust Banks, Inc.

May 16, 2017

© 2017 SunTrust Banks, Inc. SunTrust is a federally registered trademark of SunTrust Banks, Inc.

2

The following should be read in conjunction with the financial statements, notes and other information contained in the Company’s 2016 Annual Report on Form 10-K, Quarterly Reports on

Form 10-Q, and Current Reports on Form 8-K.

This presentation includes non-GAAP financial measures to describe SunTrust’s performance. We reconcile those measures to GAAP measures within the presentation or in the appendix. In this

presentation, we present net interest income and net interest margin on a fully taxable-equivalent (“FTE”) basis, and ratios on an annualized basis. The FTE basis adjusts for the tax-favored

status of income from certain loans and investments. We believe this measure to be the preferred industry measurement of net interest income and provides relevant comparison between

taxable and non-taxable amounts.

This presentation contains forward-looking statements. Statements regarding future levels of the efficiency ratio, future number of branches, and capital return are forward-looking

statements. Also, any statement that does not describe historical or current facts is a forward-looking statement. These statements often include the words “believes,” “expects,”

“anticipates,” “estimates,” “intends,” “plans,” “targets,” “strategies,” “goals,” “initiatives,” “opportunity,” “potentially,” “probably,” “projects,” “outlook,” or similar expressions or future

conditional verbs such as “may,” “will,” “should,” “would,” and “could.” Such statements are based upon the current beliefs and expectations of management and on information currently

available to management. They speak as of the date hereof, and we do not assume any obligation to update the statements made herein or to update the reasons why actual results could

differ from those contained in such statements in light of new information or future events.

Forward-looking statements are subject to significant risks and uncertainties. Investors are cautioned against placing undue reliance on such statements. Actual results may differ materially

from those set forth in the forward-looking statements. Factors that could cause actual results to differ materially from those described in the forward-looking statements can be found in Part

I, Item 1A., “Risk Factors,” in our Annual Report on Form 10-K for the year ended December 31, 2016 and in other periodic reports that we file with the SEC. Those factors include: current and

future legislation and regulation could require us to change our business practices, reduce revenue, impose additional costs, or otherwise adversely affect business operations or

competitiveness; we are subject to stringent capital adequacy and liquidity requirements and our failure to meet these would adversely affect our financial condition; the monetary and fiscal

policies of the federal government and its agencies could have a material adverse effect on our earnings; our financial results have been, and may continue to be, materially affected by

general economic conditions, and a deterioration of economic conditions or of the financial markets may materially adversely affect our lending and other businesses and our financial results

and condition; changes in market interest rates or capital markets could adversely affect our revenue and expenses, the value of assets and obligations, and the availability and cost of capital

and liquidity; our earnings may be affected by volatility in mortgage production and servicing revenues, and by changes in carrying values of our servicing assets and mortgages held for sale

due to changes in interest rates; disruptions in our ability to access global capital markets may adversely affect our capital resources and liquidity; we are subject to credit risk; we may have

more credit risk and higher credit losses to the extent that our loans are concentrated by loan type, industry segment, borrower type, or location of the borrower or collateral; we rely on the

mortgage secondary market and GSEs for some of our liquidity; loss of customer deposits could increase our funding costs; any reduction in our credit rating could increase the cost of our

funding from the capital markets; we are subject to litigation, and our expenses related to this litigation may adversely affect our results; we may incur fines, penalties and other negative

consequences from regulatory violations, possibly even inadvertent or unintentional violations; we are subject to certain risks related to originating and selling mortgages, and may be required

to repurchase mortgage loans or indemnify mortgage loan purchasers as a result of breaches of representations and warranties, or borrower fraud, and this could harm our liquidity, results of

operations, and financial condition; we face risks as a servicer of loans; we are subject to risks related to delays in the foreclosure process; consumers and small businesses may decide not to

use banks to complete their financial transactions, which could affect net income; we have businesses other than banking which subject us to a variety of risks; negative public opinion could

damage our reputation and adversely impact business and revenues; we may face more intense scrutiny of our sales, training, and incentive compensation practices; we rely on other

companies to provide key components of our business infrastructure; competition in the financial services industry is intense and we could lose business or suffer margin declines as a result;

we continually encounter technological change and must effectively develop and implement new technology; maintaining or increasing market share depends on market acceptance and

regulatory approval of new products and services; we have in the past and may in the future pursue acquisitions, which could affect costs and from which we may not be able to realize

anticipated benefits; we depend on the expertise of key personnel, and if these individuals leave or change their roles without effective replacements, operations may suffer; we may not be

able to hire or retain additional qualified personnel and recruiting and compensation costs may increase as a result of turnover, both of which may increase costs and reduce profitability and

may adversely impact our ability to implement our business strategies; our framework for managing risks may not be effective in mitigating risk and loss to us; our controls and procedures may

not prevent or detect all errors or acts of fraud; we are at risk of increased losses from fraud; a failure in, or breach of, our operational or security systems or infrastructure, or those of our

third party vendors and other service providers, including as a result of cyber-attacks, could disrupt our businesses, result in the disclosure or misuse of confidential or proprietary information,

damage our reputation, increase our costs and cause losses; the soundness of other financial institutions could adversely affect us; we depend on the accuracy and completeness of information

about clients and counterparties; our accounting policies and processes are critical to how we report our financial condition and results of operation, and they require management to make

estimates about matters that are uncertain; depressed market values for our stock and adverse economic conditions sustained over a period of time may require us to write down some portion

of our goodwill; our financial instruments measured at fair value expose us to certain market risks; our stock price can be volatile; we might not pay dividends on our stock; our ability to

receive dividends from our subsidiaries or other investments could affect our liquidity and ability to pay dividends; and certain banking laws and certain provisions of our articles of

incorporation may have an anti-takeover effect.

IMPORTANT CAUTIONARY STATEMENT

3

Deposit Market Share

in Respective Top 10

MSAs4

14%

6%

SunTrust Peer Median

SUNTRUST OVERVIEW

SunTrust is a leading financial institution focused on meeting clients’ needs and improving

their financial well-being. Our Company is differentiated by:

Size

Large enough to

compete with the

largest banks while still

being able to serve our

clients as “One Team”

Diversity

Strong regional bank

with key national

businesses, full product

capabilities, and a

diverse revenue mix

Footprint

Leading market shares

in high growth markets

(Southeast & Mid-

Atlantic); supplemented

by growing presence

nationally

Culture

“Client First” culture

centered on our

purpose of Lighting the

Way to Financial

Well-Being

Key Statistics (Rank)1,2

$28.0B

Market Cap

~5.6MM

Clients

$206B (11th)

Assets

$163B (10th)

Deposits

$144B (10th)

Loans

24,215

Teammates3

See appendix slide #22 for footnotes

#2 of 12

4

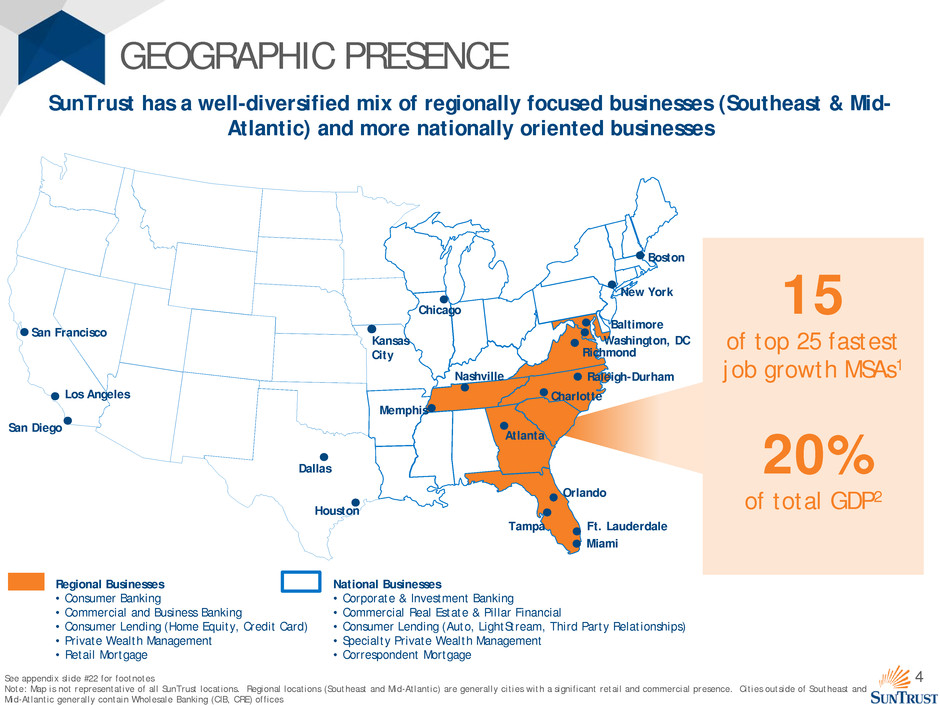

GEOGRAPHIC PRESENCE

Regional Businesses

• Consumer Banking

• Commercial and Business Banking

• Consumer Lending (Home Equity, Credit Card)

• Private Wealth Management

• Retail Mortgage

National Businesses

• Corporate & Investment Banking

• Commercial Real Estate & Pillar Financial

• Consumer Lending (Auto, LightStream, Third Party Relationships)

• Specialty Private Wealth Management

• Correspondent Mortgage

SunTrust has a well-diversified mix of regionally focused businesses (Southeast & Mid-

Atlantic) and more nationally oriented businesses

See appendix slide #22 for footnotes

Note: Map is not representative of all SunTrust locations. Regional locations (Southeast and Mid-Atlantic) are generally cities with a significant retail and commercial presence. Cities outside of Southeast and

Mid-Atlantic generally contain Wholesale Banking (CIB, CRE) offices

Los Angeles

San Francisco

Dallas

Houston

Atlanta

Orlando

Miami

Tampa

Chicago

Nashville

Memphis

Charlotte

Richmond

Baltimore

New York

Boston

Ft. Lauderdale

Raleigh-Durham

Washington, DC

San Diego

Kansas

City

15

of top 25 fastest

job growth MSAs1

20%

of total GDP2

5

8% 11%

26%

48%

62%

73%

2011 2012 2013 2014 2015 2016

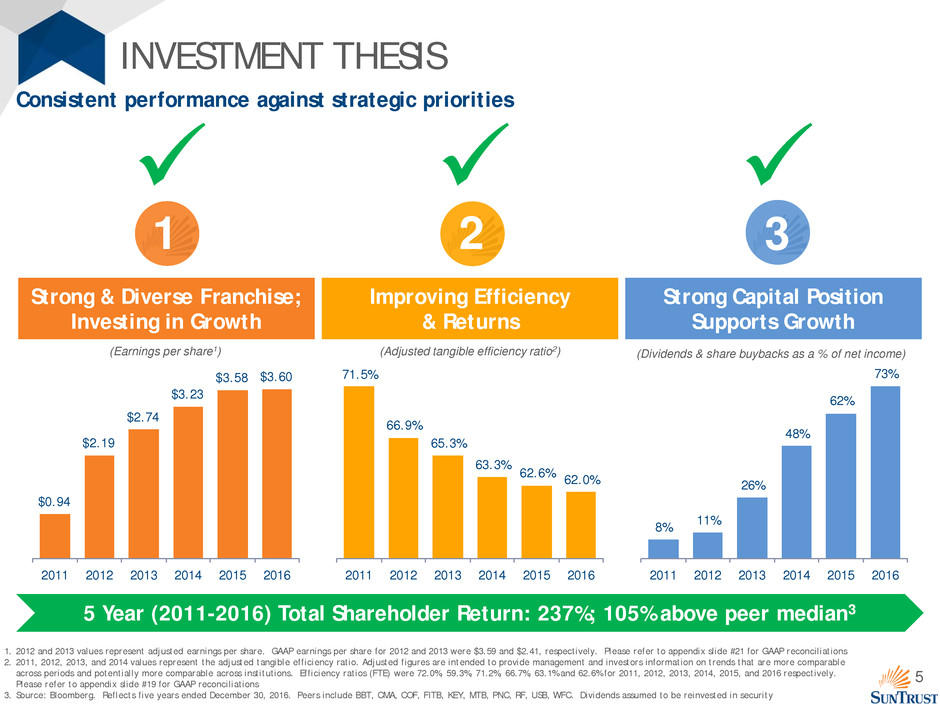

INVESTMENT THESIS

Consistent performance against strategic priorities

Strong & Diverse Franchise;

Investing in Growth

Improving Efficiency

& Returns

Strong Capital Position

Supports Growth

(Dividends & share buybacks as a % of net income)

1 3 2

$0.94

$2.19

$2.74

$3.23

$3.58 $3.60

2011 2012 2013 2014 2015 2016

71.5%

66.9%

65.3%

63.3%

62.6% 62.0%

2011 2012 2013 2014 2015 2016

(Adjusted tangible efficiency ratio2) (Earnings per share1)

1. 2012 and 2013 values represent adjusted earnings per share. GAAP earnings per share for 2012 and 2013 were $3.59 and $2.41, respectively. Please refer to appendix slide #21 for GAAP reconciliations

2. 2011, 2012, 2013, and 2014 values represent the adjusted tangible efficiency ratio. Adjusted figures are intended to provide management and investors information on trends that are more comparable

across periods and potentially more comparable across institutions. Efficiency ratios (FTE) were 72.0%, 59.3%, 71.2%, 66.7%, 63.1% and 62.6% for 2011, 2012, 2013, 2014, 2015, and 2016 respectively.

Please refer to appendix slide #19 for GAAP reconciliations

3. Source: Bloomberg. Reflects five years ended December 30, 2016. Peers include BBT, CMA, COF, FITB, KEY, MTB, PNC, RF, USB, WFC. Dividends assumed to be reinvested in security

5 Year (2011-2016) Total Shareholder Return: 237%; 105% above peer median3

STRONG & DIVERSE

FRANCHISE

Investing in Growth

1

7

MAKING INVESTMENTS IN GROWTH

Consumer

Omni-Channel Strategy

→ Enhance and expand mobile, digital, & online platforms /

capabilities (for clients and teammates)

→ Train and hire advisory personnel within branches

→ Expand ATM and Teller Connect network

→ Refurbish existing branches

→ Targeted new branch openings

Consumer Lending

→ LightStream: increase investments to allow for scale

(talent, marketing, technology)

→ Credit Card: improve product offerings

Private Wealth Management

→ Train and hire new wealth advisors

→ Grow retail asset management capabilities

→ Enhance and expand online & digital capabilities of

SummitView

Mortgage

→ Production: meet clients’ increased purchase needs

→ Servicing: targeted growth to leverage scale of servicing

business

Wholesale

Continued growth of corporate and investment banking

(CIB)

→ Expand sub-industry verticals

→ Grow and invest further in advisory businesses (M&A /

equity)

→ Expand product capabilities

Expand industry expertise outside of CIB into Commercial &

Business Banking (CBB) and CRE

→ Further build out of industry verticals

→ Acquire and develop top talent in order to move up

market (relationship managers, corporate finance

specialists, industry specialists)

Technology

→ Ongoing investments in integrated ecosystem

→ Ongoing investments in a more efficient, user-friendly

T&PS platform and overall product offerings

Integration of Pillar & Cohen Financial

Strategic investments will drive future growth & improve profitability

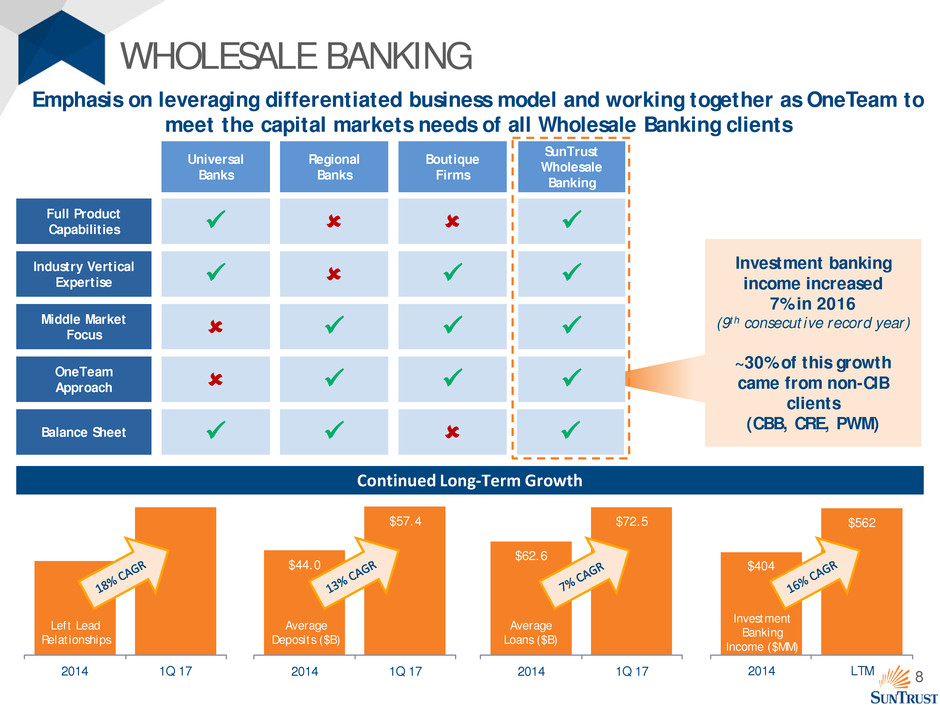

8 2014 1Q 17

$44.0

$57.4

2014 1Q 17

$62.6

$72.5

2014 1Q 17

$404

$562

2014 LTM

WHOLESALE BANKING

Full Product

Capabilities

Industry Vertical

Expertise

Middle Market

Focus

OneTeam

Approach

Balance Sheet

Universal

Banks

Regional

Banks

Boutique

Firms

SunTrust

Wholesale

Banking

Investment banking

income increased

7% in 2016

(9th consecutive record year)

~30% of this growth

came from non-CIB

clients

(CBB, CRE, PWM)

Continued Long-Term Growth

Left Lead

Relationships

Average

Loans ($B)

Average

Deposits ($B)

Investment

Banking

Income ($MM)

Emphasis on leveraging differentiated business model and working together as OneTeam to

meet the capital markets needs of all Wholesale Banking clients

9

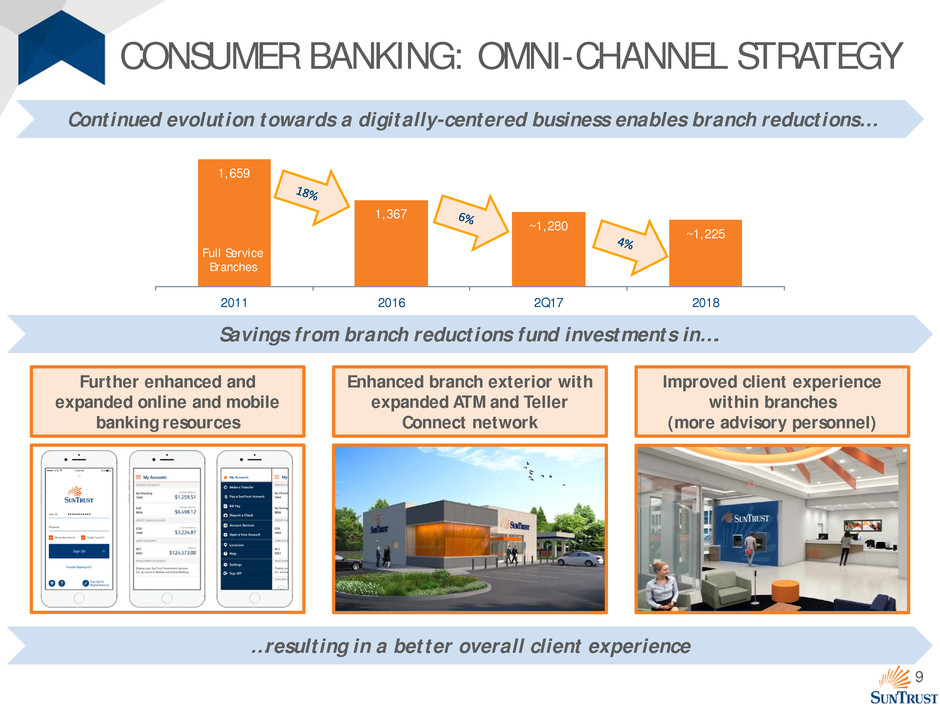

1,659

1,367

~1,280 ~1,225

2011 2016 2Q17 2018

Savings from branch reductions fund investments in….

…resulting in a better overall client experience

Enhanced branch exterior with

expanded ATM and Teller

Connect network

Improved client experience

within branches

(more advisory personnel)

Further enhanced and

expanded online and mobile

banking resources

CONSUMER BANKING: OMNI-CHANNEL STRATEGY

Full Service

Branches

Continued evolution towards a digitally-centered business enables branch reductions…

10

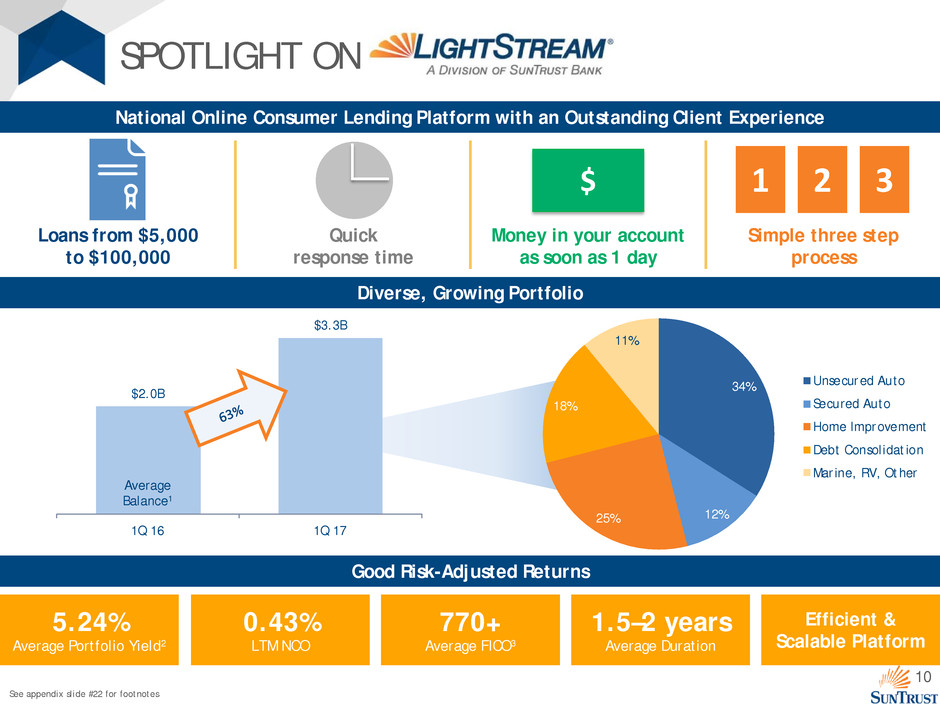

$2.0B

$3.3B

1Q 16 1Q 17

SPOTLIGHT ON

Good Risk-Adjusted Returns

5.24%

Average Portfolio Yield2

0.43%

LTM NCO

770+

Average FICO3

1.5–2 years

Average Duration

Loans from $5,000

to $100,000

Quick

response time

$

Money in your account

as soon as 1 day

1 2 3

Simple three step

process

National Online Consumer Lending Platform with an Outstanding Client Experience

Diverse, Growing Portfolio

Average

Balance1

Efficient &

Scalable Platform

See appendix slide #22 for footnotes

34%

12%25%

18%

11%

Unsecured Auto

Secured Auto

Home Improvement

Debt Consolidation

Marine, RV, Other

IMPROVING

EFFICIENCY &

RETURNS

2

12

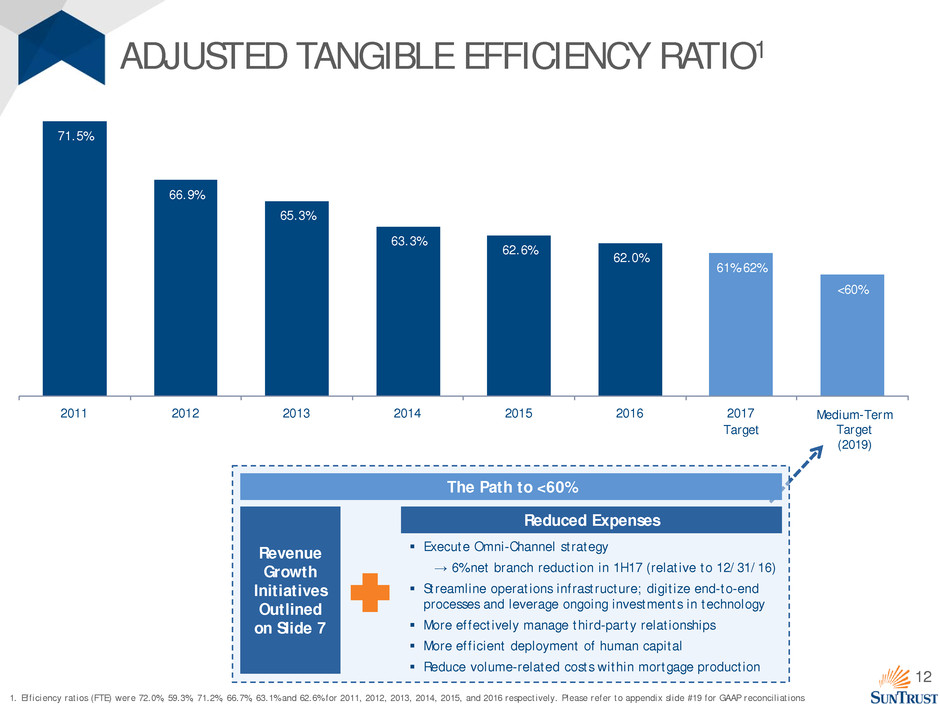

ADJUSTED TANGIBLE EFFICIENCY RATIO1

Revenue

Growth

Initiatives

Outlined

on Slide 7

Execute Omni-Channel strategy

→ 6% net branch reduction in 1H17 (relative to 12/31/16)

Streamline operations infrastructure; digitize end-to-end

processes and leverage ongoing investments in technology

More effectively manage third-party relationships

More efficient deployment of human capital

Reduce volume-related costs within mortgage production

The Path to <60%

Reduced Expenses

71.5%

66.9%

65.3%

63.3%

62.6% 62.0%

61%-62%

<60%

2011 2012 2013 2014 2015 2016 2017 Medium-Term

Target

(2019)

1. Efficiency ratios (FTE) were 72.0%, 59.3%, 71.2%, 66.7%, 63.1% and 62.6% for 2011, 2012, 2013, 2014, 2015, and 2016 respectively. Please refer to appendix slide #19 for GAAP reconciliations

Target

13

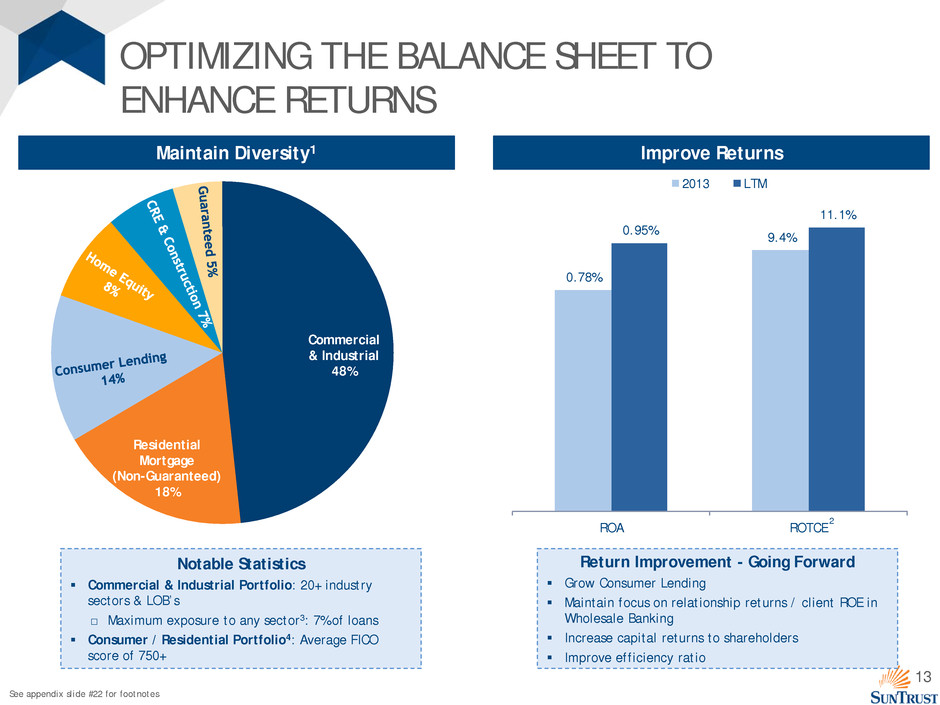

0.78%

9.4%0.95%

11.1%

ROA ROTCE

2013 LTM

OPTIMIZING THE BALANCE SHEET TO

ENHANCE RETURNS

Notable Statistics

Commercial & Industrial Portfolio: 20+ industry

sectors & LOB’s

□ Maximum exposure to any sector3: 7% of loans

Consumer / Residential Portfolio4: Average FICO

score of 750+

Return Improvement - Going Forward

Grow Consumer Lending

Maintain focus on relationship returns / client ROE in

Wholesale Banking

Increase capital returns to shareholders

Improve efficiency ratio

See appendix slide #22 for footnotes

Commercial

& Industrial

48%

Residential

Mortgage

(Non-Guaranteed)

18%

Maintain Diversity1 Improve Returns

2

14

4.6%

5.5%

STI Peer Median

4.5%

5.1%

STI Peer Median

4.5%

5.4%

STI Peer Median

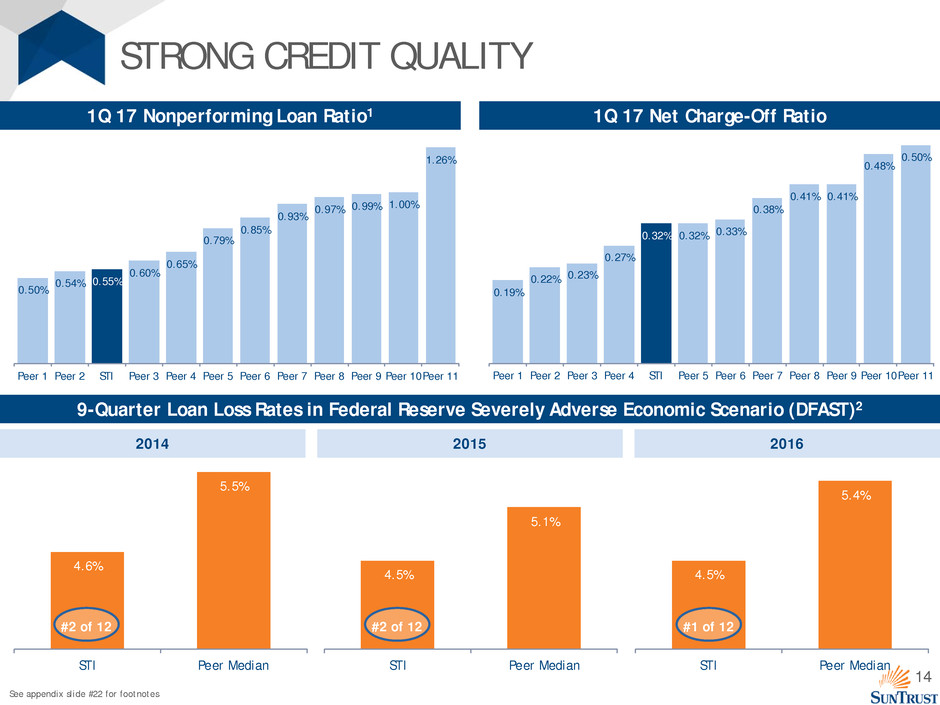

STRONG CREDIT QUALITY

#2 of 12

1Q 17 Nonperforming Loan Ratio1 1Q 17 Net Charge-Off Ratio

9-Quarter Loan Loss Rates in Federal Reserve Severely Adverse Economic Scenario (DFAST)2

#2 of 12 #1 of 12

See appendix slide #22 for footnotes

0.19%

0.22% 0.23%

0.27%

0.32% 0.32% 0.33%

0.38%

0.41% 0.41%

0.48%

0.50%

Peer 1 Peer 2 Peer 3 Peer 4 STI Peer 5 Peer 6 Peer 7 Peer 8 Peer 9 Peer 10Peer 11

2014 2015 2016

0.50%

0.54% 0.55%

0.60%

0.65%

0.79%

0.85%

0.93%

0.97% 0.99% 1.00%

1.26%

Peer 1 Peer 2 STI Peer 3 Peer 4 Peer 5 Peer 6 Peer 7 Peer 8 Peer 9 Peer 10Peer 11

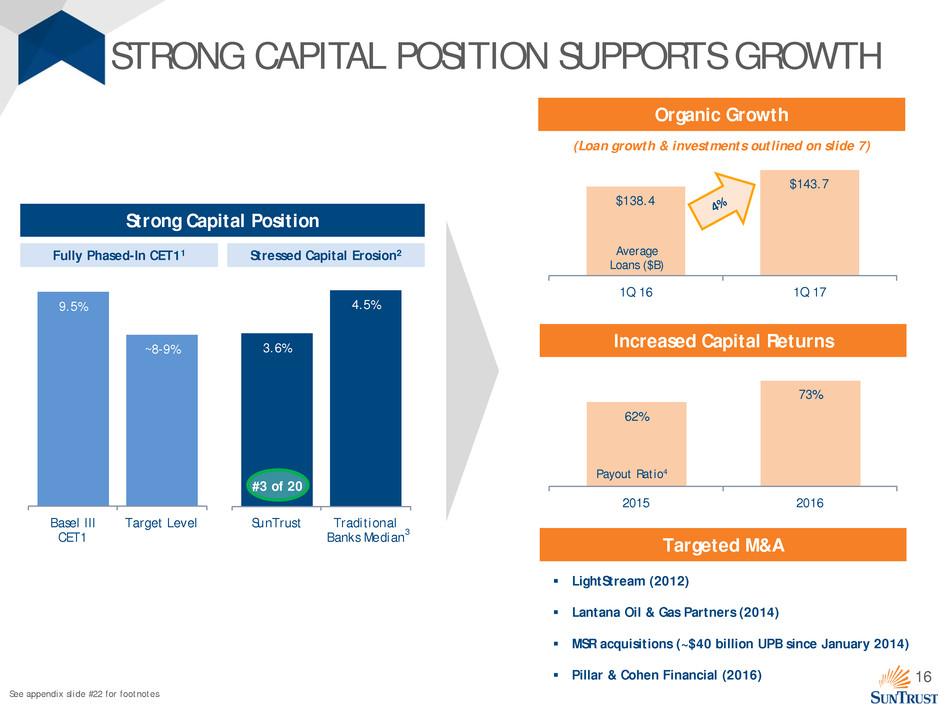

3

STRONG CAPITAL

POSITION

SUPPORTS GROWTH

16

$138.4

$143.7

1Q 16 1Q 17

3.6%

4.5%

SunTrust Traditional

Banks Median

STRONG CAPITAL POSITION SUPPORTS GROWTH

Strong Capital Position

62%

73%

2015 2016

Increased Capital Returns

Targeted M&A

LightStream (2012)

Lantana Oil & Gas Partners (2014)

MSR acquisitions (~$40 billion UPB since January 2014)

Pillar & Cohen Financial (2016)

Organic Growth

(Loan growth & investments outlined on slide 7)

Average

Loans ($B)

Fully Phased-In CET11 Stressed Capital Erosion2

#3 of 20

Payout Ratio4

3

See appendix slide #22 for footnotes

9.5%

~8-9%

Basel III

CET1

Target Level

17

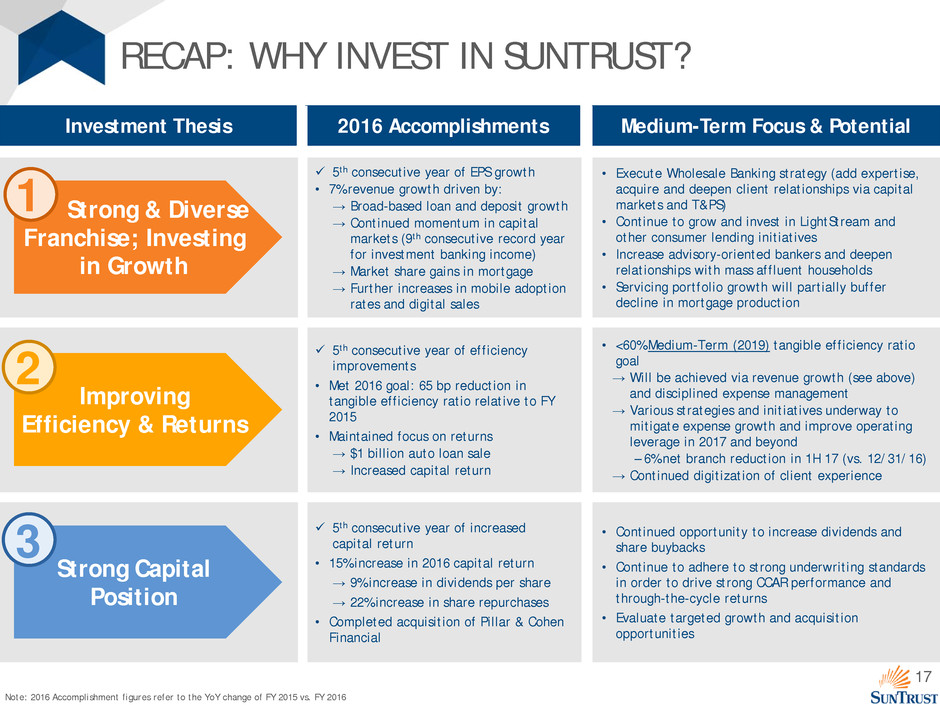

Note: 2016 Accomplishment figures refer to the YoY change of FY 2015 vs. FY 2016

RECAP: WHY INVEST IN SUNTRUST?

• <60% Medium-Term (2019) tangible efficiency ratio

goal

→ Will be achieved via revenue growth (see above)

and disciplined expense management

→ Various strategies and initiatives underway to

mitigate expense growth and improve operating

leverage in 2017 and beyond

– 6% net branch reduction in 1H 17 (vs. 12/31/16)

→ Continued digitization of client experience

5th consecutive year of efficiency

improvements

• Met 2016 goal: 65 bp reduction in

tangible efficiency ratio relative to FY

2015

• Maintained focus on returns

→ $1 billion auto loan sale

→ Increased capital return

Improving

Efficiency & Returns

• Continued opportunity to increase dividends and

share buybacks

• Continue to adhere to strong underwriting standards

in order to drive strong CCAR performance and

through-the-cycle returns

• Evaluate targeted growth and acquisition

opportunities

5th consecutive year of increased

capital return

• 15% increase in 2016 capital return

→ 9% increase in dividends per share

→ 22% increase in share repurchases

• Completed acquisition of Pillar & Cohen

Financial

Strong Capital

Position

Investment Thesis Medium-Term Focus & Potential

Strong & Diverse

Franchise; Investing

in Growth

• Execute Wholesale Banking strategy (add expertise,

acquire and deepen client relationships via capital

markets and T&PS)

• Continue to grow and invest in LightStream and

other consumer lending initiatives

• Increase advisory-oriented bankers and deepen

relationships with mass affluent households

• Servicing portfolio growth will partially buffer

decline in mortgage production

5th consecutive year of EPS growth

• 7% revenue growth driven by:

→ Broad-based loan and deposit growth

→ Continued momentum in capital

markets (9th consecutive record year

for investment banking income)

→ Market share gains in mortgage

→ Further increases in mobile adoption

rates and digital sales

2016 Accomplishments

1

2

3

APPENDIX

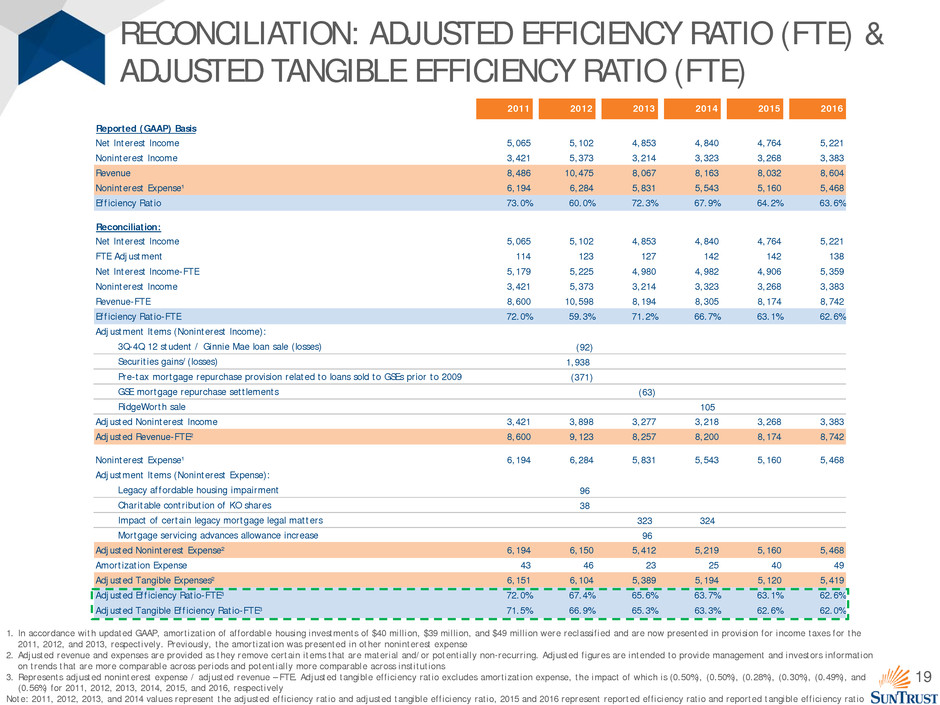

19

2011 2012 2013 2014 2015 2016

Reported (GAAP) Basis

Net Interest Income 5,065 5,102 4,853 4,840 4,764 5,221

Noninterest Income 3,421 5,373 3,214 3,323 3,268 3,383

Revenue 8,486 10,475 8,067 8,163 8,032 8,604

Noninterest Expense¹ 6,194 6,284 5,831 5,543 5,160 5,468

Efficiency Ratio 73.0% 60.0% 72.3% 67.9% 64.2% 63.6%

Reconciliation:

Net Interest Income 5,065 5,102 4,853 4,840 4,764 5,221

FTE Adjustment 114 123 127 142 142 138

Net Interest Income-FTE 5,179 5,225 4,980 4,982 4,906 5,359

Noninterest Income 3,421 5,373 3,214 3,323 3,268 3,383

Revenue-FTE 8,600 10,598 8,194 8,305 8,174 8,742

Efficiency Ratio-FTE 72.0% 59.3% 71.2% 66.7% 63.1% 62.6%

Adjustment Items (Noninterest Income):

3Q-4Q 12 student / Ginnie Mae loan sale (losses) (92)

Securities gains/(losses) 1,938

Pre-tax mortgage repurchase provision related to loans sold to GSEs prior to 2009 (371)

GSE mortgage repurchase settlements (63)

RidgeWorth sale 105

Adjusted Noninterest Income 3,421 3,898 3,277 3,218 3,268 3,383

Adjusted Revenue-FTE² 8,600 9,123 8,257 8,200 8,174 8,742

Noninterest Expense¹ 6,194 6,284 5,831 5,543 5,160 5,468

Adjustment Items (Noninterest Expense):

Legacy affordable housing impairment 96

Charitable contribution of KO shares 38

Impact of certain legacy mortgage legal matters 323 324

Mortgage servicing advances allowance increase 96

Adjusted Noninterest Expense² 6,194 6,150 5,412 5,219 5,160 5,468

Amortization Expense 43 46 23 25 40 49

Adjusted Tangible Expenses² 6,151 6,104 5,389 5,194 5,120 5,419

Adjusted Efficiency Ratio-FTE³ 72.0% 67.4% 65.6% 63.7% 63.1% 62.6%

Adjusted Tangible Efficiency Ratio-FTE³ 71.5% 66.9% 65.3% 63.3% 62.6% 62.0%

RECONCILIATION: ADJUSTED EFFICIENCY RATIO (FTE) &

ADJUSTED TANGIBLE EFFICIENCY RATIO (FTE)

1. In accordance with updated GAAP, amortization of affordable housing investments of $40 million, $39 million, and $49 million were reclassified and are now presented in provision for income taxes for the

2011, 2012, and 2013, respectively. Previously, the amortization was presented in other noninterest expense

2. Adjusted revenue and expenses are provided as they remove certain items that are material and/or potentially non-recurring. Adjusted figures are intended to provide management and investors information

on trends that are more comparable across periods and potentially more comparable across institutions

3. Represents adjusted noninterest expense / adjusted revenue – FTE. Adjusted tangible efficiency ratio excludes amortization expense, the impact of which is (0.50%), (0.50%), (0.28%), (0.30%), (0.49%), and

(0.56%) for 2011, 2012, 2013, 2014, 2015, and 2016, respectively

Note: 2011, 2012, 2013, and 2014 values represent the adjusted efficiency ratio and adjusted tangible efficiency ratio, 2015 and 2016 represent reported efficiency ratio and reported tangible efficiency ratio

20

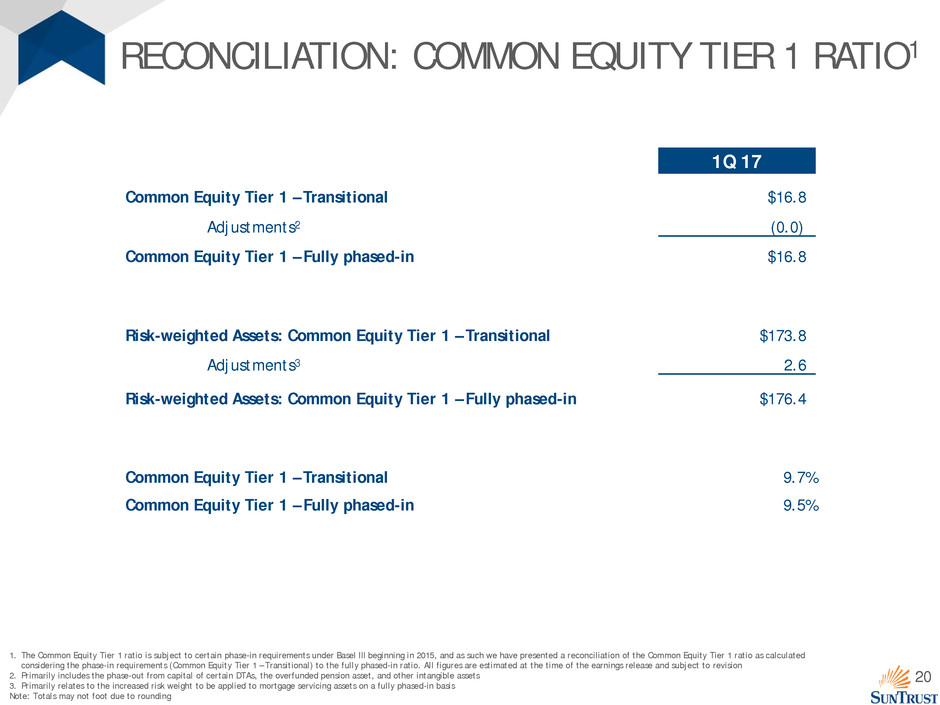

RECONCILIATION: COMMON EQUITY TIER 1 RATIO1

1. The Common Equity Tier 1 ratio is subject to certain phase-in requirements under Basel III beginning in 2015, and as such we have presented a reconciliation of the Common Equity Tier 1 ratio as calculated

considering the phase-in requirements (Common Equity Tier 1 – Transitional) to the fully phased-in ratio. All figures are estimated at the time of the earnings release and subject to revision

2. Primarily includes the phase-out from capital of certain DTAs, the overfunded pension asset, and other intangible assets

3. Primarily relates to the increased risk weight to be applied to mortgage servicing assets on a fully phased-in basis

Note: Totals may not foot due to rounding

1Q 17

Common Equity Tier 1 – Transitional $16.8

Adjustments2 (0.0)

Common Equity Tier 1 – Fully phased-in $16.8

Risk-weighted Assets: Common Equity Tier 1 – Transitional $173.8

Adjustments3 2.6

Risk-weighted Assets: Common Equity Tier 1 – Fully phased-in $176.4

Common Equity Tier 1 – Transitional 9.7%

Common Equity Tier 1 – Fully phased-in 9.5%

21

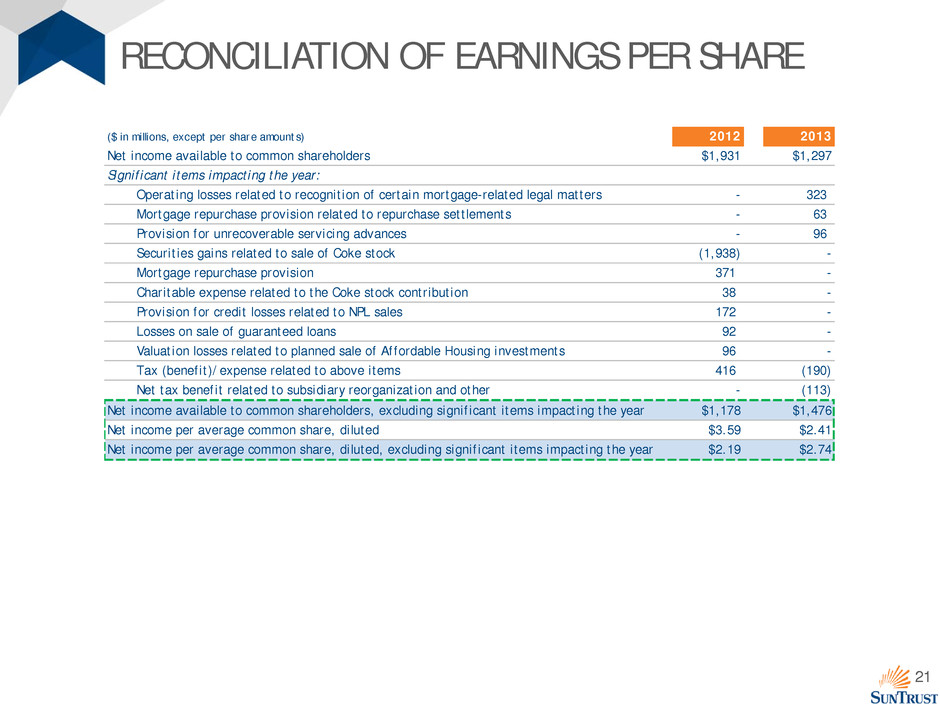

RECONCILIATION OF EARNINGS PER SHARE

($ in millions, except per share amounts) 2012 2013

Net income available to common shareholders $1,931 $1,297

Significant items impacting the year:

Operating losses related to recognition of certain mortgage-related legal matters - 323

Mortgage repurchase provision related to repurchase settlements - 63

Provision for unrecoverable servicing advances - 96

Securities gains related to sale of Coke stock (1,938) -

Mortgage repurchase provision 371 -

Charitable expense related to the Coke stock contribution 38 -

Provision for credit losses related to NPL sales 172 -

Losses on sale of guaranteed loans 92 -

Valuation losses related to planned sale of Affordable Housing investments 96 -

Tax (benefit)/expense related to above items 416 (190)

Net tax benefit related to subsidiary reorganization and other - (113)

Net income available to common shareholders, excluding significant items impacting the year $1,178 $1,476

Net income per average common share, diluted $3.59 $2.41

Net income per average common share, diluted, excluding significant items impacting the year $2.19 $2.74

22

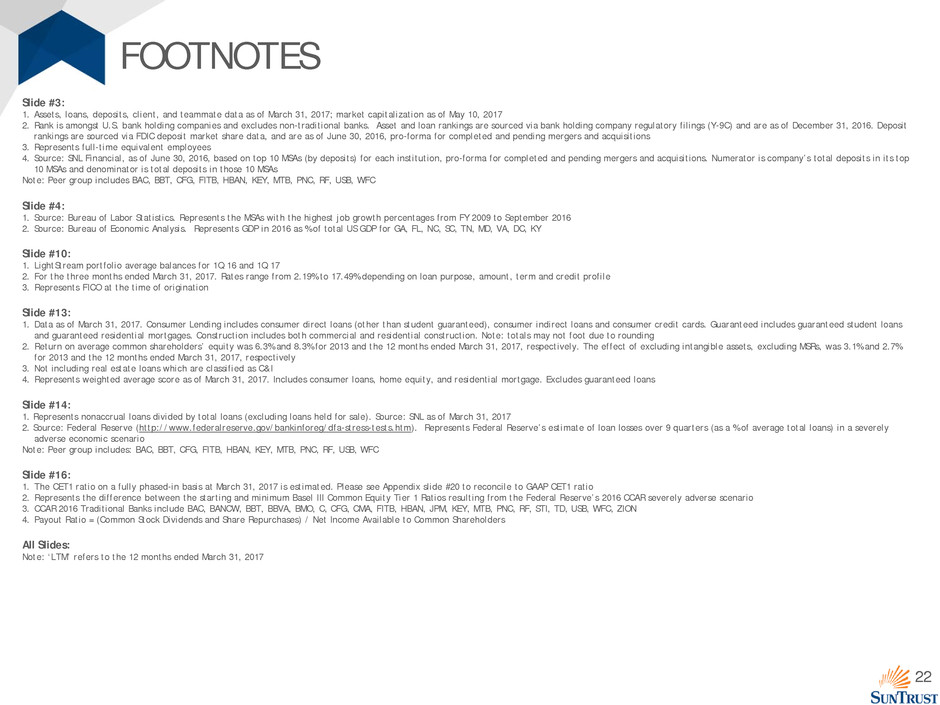

FOOTNOTES

Slide #3:

1. Assets, loans, deposits, client, and teammate data as of March 31, 2017; market capitalization as of May 10, 2017

2. Rank is amongst U.S. bank holding companies and excludes non-traditional banks. Asset and loan rankings are sourced via bank holding company regulatory filings (Y-9C) and are as of December 31, 2016. Deposit

rankings are sourced via FDIC deposit market share data, and are as of June 30, 2016, pro-forma for completed and pending mergers and acquisitions

3. Represents full-time equivalent employees

4. Source: SNL Financial, as of June 30, 2016, based on top 10 MSAs (by deposits) for each institution, pro-forma for completed and pending mergers and acquisitions. Numerator is company’s total deposits in its top

10 MSAs and denominator is total deposits in those 10 MSAs

Note: Peer group includes BAC, BBT, CFG, FITB, HBAN, KEY, MTB, PNC, RF, USB, WFC

Slide #4:

1. Source: Bureau of Labor Statistics. Represents the MSAs with the highest job growth percentages from FY 2009 to September 2016

2. Source: Bureau of Economic Analysis. Represents GDP in 2016 as % of total US GDP for GA, FL, NC, SC, TN, MD, VA, DC, KY

Slide #10:

1. LightStream portfolio average balances for 1Q 16 and 1Q 17

2. For the three months ended March 31, 2017. Rates range from 2.19% to 17.49% depending on loan purpose, amount, term and credit profile

3. Represents FICO at the time of origination

Slide #13:

1. Data as of March 31, 2017. Consumer Lending includes consumer direct loans (other than student guaranteed), consumer indirect loans and consumer credit cards. Guaranteed includes guaranteed student loans

and guaranteed residential mortgages. Construction includes both commercial and residential construction. Note: totals may not foot due to rounding

2. Return on average common shareholders’ equity was 6.3% and 8.3% for 2013 and the 12 months ended March 31, 2017, respectively. The effect of excluding intangible assets, excluding MSRs, was 3.1% and 2.7%

for 2013 and the 12 months ended March 31, 2017, respectively

3. Not including real estate loans which are classified as C&I

4. Represents weighted average score as of March 31, 2017. Includes consumer loans, home equity, and residential mortgage. Excludes guaranteed loans

Slide #16:

1. The CET1 ratio on a fully phased-in basis at March 31, 2017 is estimated. Please see Appendix slide #20 to reconcile to GAAP CET1 ratio

2. Represents the difference between the starting and minimum Basel III Common Equity Tier 1 Ratios resulting from the Federal Reserve’s 2016 CCAR severely adverse scenario

3. CCAR 2016 Traditional Banks include BAC, BANCW, BBT, BBVA, BMO, C, CFG, CMA, FITB, HBAN, JPM, KEY, MTB, PNC, RF, STI, TD, USB, WFC, ZION

4. Payout Ratio = (Common Stock Dividends and Share Repurchases) / Net Income Available to Common Shareholders

All Slides:

Note: ‘LTM’ refers to the 12 months ended March 31, 2017

Slide #14:

1. Represents nonaccrual loans divided by total loans (excluding loans held for sale). Source: SNL as of March 31, 2017

2. Source: Federal Reserve (http://www.federalreserve.gov/bankinforeg/dfa-stress-tests.htm). Represents Federal Reserve’s estimate of loan losses over 9 quarters (as a % of average total loans) in a severely

adverse economic scenario

Note: Peer group includes: BAC, BBT, CFG, FITB, HBAN, KEY, MTB, PNC, RF, USB, WFC