Attached files

| file | filename |

|---|---|

| EX-32.1 - CERTIFICATION - China Green Agriculture, Inc. | f10q0317ex32i_chinagreen.htm |

| EX-31.2 - CERTIFICATION - China Green Agriculture, Inc. | f10q0317ex31ii_chinagreen.htm |

| EX-31.1 - CERTIFICATION - China Green Agriculture, Inc. | f10q0317ex31i_chinagreen.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-Q

(Mark One)

☒ QUARTERLY REPORT PURSUANT TO SECTION 13 or 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934.

For the quarterly period ended March 31, 2017

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934.

For the transition period from ____________ to ____________

Commission File Number 001-34260

CHINA GREEN AGRICULTURE, INC.

(Exact name of registrant as specified in its charter)

| Nevada | 36-3526027 | |

| (State or other jurisdiction of | (IRS Employer | |

| incorporation or organization) | Identification No.) |

| 3rd floor, Borough A, Block A. No. 181, South Taibai Road,Xi’an, Shaanxi province, PRC 710065 | ||

| (Address of principal executive offices) (Zip Code) |

| +86-29-88266368 | ||

| (Issuer's telephone number, including area code) |

Indicate by check mark whether the issuer (1) filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ |

| Non-accelerated filer | ☐ (Do not check if a smaller reporting company) | Smaller reporting company | ☒ |

| Emerging growth company | ☐ | ||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

APPLICABLE ONLY TO CORPORATE ISSUERS:

Indicate the number of shares outstanding of each of the issuer's classes of common stock, as of the latest practicable date: 38,551,265 shares of common stock, $.001 par value, as of May 8, 2017.

TABLE OF CONTENTS

PART I – FINANCIAL INFORMATION

| CHINA GREEN AGRICULTURE INC. AND SUBSIDIARIES | ||||||||

| CONSOLIDATED BALANCE SHEETS | ||||||||

| March 31, 2017 | June 30, 2016 | |||||||

| (unaudited) | ||||||||

| ASSETS | ||||||||

| Current Assets | ||||||||

| Cash and cash equivalents | $ | 118,259,995 | $ | 102,896,486 | ||||

| Accounts receivable, net | 154,950,404 | 117,055,376 | ||||||

| Inventories | 46,418,945 | 87,436,315 | ||||||

| Prepaid expenses and other current assets | 1,801,665 | 1,329,098 | ||||||

| Advances to suppliers, net | 28,540,308 | 26,863,959 | ||||||

| Total Current Assets | 349,971,317 | 335,581,234 | ||||||

| Plant, Property and Equipment, Net | 33,909,365 | 37,569,739 | ||||||

| Deferred Asset, Net | 1,967,215 | 13,431,621 | ||||||

| Other Assets | 262,881 | 379,047 | ||||||

| Other Non-current Assets | 9,920,596 | - | ||||||

| Intangible Assets, Net | 22,589,546 | 23,840,048 | ||||||

| Goodwill | 8,356,291 | 7,980,838 | ||||||

| Total Assets | $ | 426,977,211 | $ | 418,782,527 | ||||

| LIABILITIES AND STOCKHOLDERS' EQUITY | ||||||||

| Current Liabilities | ||||||||

| Accounts payable | $ | 11,783,861 | $ | 5,246,153 | ||||

| Customer deposits | 6,555,693 | 8,578,341 | ||||||

| Accrued expenses and other payables | 8,451,805 | 16,414,392 | ||||||

| Amount due to related parties | 3,034,201 | 2,473,004 | ||||||

| Taxes payable | 3,379,961 | 4,104,218 | ||||||

| Short term loans | 5,965,201 | 4,665,500 | ||||||

| Interest payable | 297,121 | - | ||||||

| Derivative liability | 52,768 | 144,818 | ||||||

| Total Current Liabilities | 39,520,611 | 41,626,426 | ||||||

| Long-term Liabilities | ||||||||

| Long-term loan | 3,428 | - | ||||||

| Convertible notes payable, Net | 8,167,929 | 6,671,769 | ||||||

| Total Liabilities | 8,171,357 | 6,671,769 | ||||||

| Stockholders' Equity | ||||||||

| Preferred Stock, $.001 par value, 20,000,000 shares authorized, zero shares issued and outstanding | - | - | ||||||

| Common stock, $.001 par value, 115,197,165 shares authorized, 38,535,161 and 36,978,605 shares issued and outstanding as of March 31, 2017 and June 30, 2016, respectively | 38,535 | 37,648 | ||||||

| Additional paid-in capital | 128,896,690 | 127,593,932 | ||||||

| Statutory reserve | 28,872,126 | 27,203,861 | ||||||

| Retained earnings | 240,726,280 | 221,345,279 | ||||||

| Accumulated other comprehensive income | (19,248,388 | ) | (5,696,388 | ) | ||||

| Total Stockholders' Equity | 379,285,243 | 370,484,332 | ||||||

| Total Liabilities and Stockholders' Equity | $ | 426,977,211 | $ | 418,782,527 | ||||

The accompanying notes are an integral part of these consolidated financial statements.

| 1 |

| CHINA GREEN AGRICULTURE INC. AND SUBSIDIARIES | ||||||||||||||||

| CONSOLIDATED STATEMENTS OF INCOME AND COMPREHENSIVE INCOME (LOSS) | ||||||||||||||||

| (UNAUDITED) | ||||||||||||||||

| Three Months Ended March 31, | Nine Months Ended March 31, | |||||||||||||||

| 2017 | 2016 | 2017 | 2016 | |||||||||||||

| Sales | ||||||||||||||||

| Jinong | $ | 26,316,821 | $ | 31,602,239 | $ | 84,570,215 | $ | 97,612,604 | ||||||||

| Gufeng | 30,858,499 | 43,762,058 | 67,734,572 | 85,576,564 | ||||||||||||

| Yuxing | 2,781,003 | 3,274,177 | 6,590,728 | 6,599,577 | ||||||||||||

| VIEs | 21,349,305 | - | 43,039,748 | - | ||||||||||||

| Net sales | 81,305,628 | 78,638,474 | 201,935,263 | 189,788,745 | ||||||||||||

| Cost of goods sold | ||||||||||||||||

| Jinong | 12,143,167 | 13,353,222 | 37,744,757 | 41,328,293 | ||||||||||||

| Gufeng | 26,319,435 | 38,109,311 | 57,843,171 | 72,567,833 | ||||||||||||

| Yuxing | 2,230,319 | 2,441,652 | 5,209,973 | 4,334,600 | ||||||||||||

| VIEs | 19,260,074 | - | 37,173,460 | - | ||||||||||||

| Cost of goods sold | 59,952,995 | 53,904,185 | 137,971,361 | 118,230,726 | ||||||||||||

| Gross profit | 21,352,633 | 24,734,289 | 63,963,902 | 71,558,019 | ||||||||||||

| Operating expenses | ||||||||||||||||

| Selling expenses | 6,130,825 | 3,441,511 | 15,108,275 | 11,070,369 | ||||||||||||

| Selling expenses - amortization of deferred asset | 1,556,031 | 8,780,893 | 11,140,251 | 27,158,360 | ||||||||||||

| General and administrative expenses | 3,971,890 | 2,204,771 | 11,837,282 | 7,864,395 | ||||||||||||

| Total operating expenses | 11,658,746 | 14,427,175 | 38,085,808 | 46,093,124 | ||||||||||||

| Income from operations | 9,693,887 | 10,307,114 | 25,878,094 | 25,464,895 | ||||||||||||

| Other income (expense) | ||||||||||||||||

| Other income (expense) | 330,538 | (2,473 | ) | 175,366 | (6,307 | ) | ||||||||||

| Interest income | 79,280 | 263,768 | 232,396 | 416,700 | ||||||||||||

| Interest expense | (232,639 | ) | (211,734 | ) | (464,430 | ) | (943,413 | ) | ||||||||

| Total other income (expense) | 177,179 | 49,561 | (56,668 | ) | (533,020 | ) | ||||||||||

| Income before income taxes | 9,871,066 | 10,356,675 | 25,821,426 | 24,931,875 | ||||||||||||

| Provision for income taxes | 1,679,391 | 2,104,904 | 4,772,160 | 5,166,897 | ||||||||||||

| Net income | 8,191,675 | 8,251,771 | 21,049,266 | 19,764,978 | ||||||||||||

| Other comprehensive income (loss) | ||||||||||||||||

| Foreign currency translation gain (loss) | (2,801,325 | ) | 2,722,073 | (19,248,388 | ) | (20,006,295 | ) | |||||||||

| Comprehensive income (loss) | $ | 5,390,350 | $ | 10,973,844 | $ | 1,800,878 | $ | (241,317 | ) | |||||||

| Basic weighted average shares outstanding | 38,532,033 | 36,962,166 | 37,941,957 | 36,610,131 | ||||||||||||

| Basic net earnings per share | $ | 0.21 | $ | 0.22 | $ | 0.55 | $ | 0.54 | ||||||||

| Diluted weighted average shares outstanding | 38,532,033 | 36,962,166 | 37,941,957 | 36,610,131 | ||||||||||||

| Diluted net earnings per share | 0.21 | 0.22 | 0.55 | 0.54 | ||||||||||||

The accompanying notes are an integral part of these consolidated financial statements.

| 2 |

| CHINA GREEN AGRICULTURE INC. AND SUBSIDIARIES |

| CONSOLIDATED STATEMENTS OF CASH FLOWS |

| (UNAUDITED) |

| Nine Months Ended March 31, | ||||||||

| 2017 | 2016 | |||||||

| Cash flows from operating activities | ||||||||

| Net income | $ | 21,049,266 | $ | 19,764,978 | ||||

| Adjustments to reconcile net income to net cash provided by operating activities | ||||||||

| Issuance of common stock and stock options for compensation | 1,303,645 | 3,014,153 | ||||||

| Depreciation and amortization | 14,921,548 | 31,245,614 | ||||||

| Loss on disposal of property, plant and equipment | 115,933 | 1,375 | ||||||

| Amortization of debt discount | 231,998 | - | ||||||

| Change in fair value of derivative liability | (88,106 | ) | - | |||||

| Allowance for bad debts | 5,624,394 | 218,244 | ||||||

| Changes in operating assets | ||||||||

| Accounts receivable | (47,292,468 | ) | (10,096,055 | ) | ||||

| Amount due from related parties | - | (618,198 | ) | |||||

| Other current assets | (509,573 | ) | (52,579 | ) | ||||

| Inventories | 39,403,840 | (12,622,730 | ) | |||||

| Advances to suppliers | (2,675,330 | ) | 1,440,660 | |||||

| Other assets | (9,753,250 | ) | 53,797 | |||||

| Changes in operating liabilities | ||||||||

| Accounts payable | 6,094,687 | 343,579 | ||||||

| Customer deposits | (2,181,648 | ) | (12,842,647 | ) | ||||

| Tax payables | (8,461,337 | ) | (420,814 | ) | ||||

| Accrued expenses and other payables | (585,606 | ) | 456,970 | |||||

| Interest payable | 301,355 | - | ||||||

| Net cash provided by operating activities | 17,499,348 | 19,886,347 | ||||||

| Cash flows from investing activities | ||||||||

| Purchase of plant, property, and equipment | (30,756 | ) | (16,608 | ) | ||||

| Cash paid for acquisition, net | (123,614 | ) | - | |||||

| Change in construction in process | (204,660 | ) | - | |||||

| Net cash used in investing activities | (359,030 | ) | (16,608 | ) | ||||

| Cash flows from financing activities | ||||||||

| Proceeds from loans | 5,890,757 | 5,626,800 | ||||||

| Repayment of loans | (4,562,642 | ) | (23,319,960 | ) | ||||

| Advance from related party | 600,000 | 200,000 | ||||||

| Net cash provided by financing activities | 1,928,115 | (17,493,160 | ) | |||||

| Effect of exchange rate change on cash and cash equivalents | (3,704,924 | ) | (4,888,986 | ) | ||||

| Net increase in cash and cash equivalents | 15,363,509 | (2,512,407 | ) | |||||

| Cash and cash equivalents, beginning balance | 102,896,486 | 92,982,564 | ||||||

| Cash and cash equivalents, ending balance | $ | 118,259,995 | $ | 90,470,157 | ||||

| Supplement disclosure of cash flow information | ||||||||

| Interest expense paid | $ | 464,430 | $ | 943,413 | ||||

| Income taxes paid | $ | 6,071,366 | $ | 583,304 | ||||

The accompanying notes are an integral part of these consolidated financial statements.

| 3 |

NOTE 1 – ORGANIZATION AND DESCRIPTION OF BUSINESS

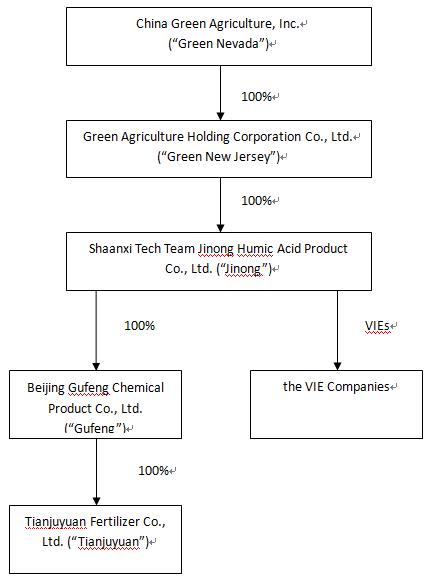

China Green Agriculture, Inc. (the “Company”, “Parent Company” or “Green Nevada”), through its subsidiaries, is engaged in the research, development, production, distribution and sale of humic acid-based compound fertilizer, compound fertilizer, blended fertilizer, organic compound fertilizer, slow-release fertilizers, highly-concentrated water-soluble fertilizers and mixed organic-inorganic compound fertilizer and the development, production and distribution of agricultural products.

Unless the context indicates otherwise, as used in the notes to the financial statements of the Company, the following are the references herein of all the subsidiaries of the Company (i) Green Agriculture Holding Corporation (“Green New Jersey”), a wholly-owned subsidiary of Green Nevada, incorporated in the State of New Jersey; (ii) Shaanxi TechTeam Jinong Humic Acid Product Co., Ltd. (“Jinong”), a wholly-owned subsidiary of Green New Jersey organized under the laws of the PRC; (iii) Xi’an Hu County Yuxing Agriculture Technology Development Co., Ltd. (“Yuxing”), a Variable Interest Entity (“VIE”) in the in the People’s Republic of China (the “PRC”) controlled by Jinong through a series of contractual agreements; (iv) Beijing Gufeng Chemical Products Co., Ltd., a wholly-owned subsidiary of Jinong in the PRC (“Gufeng”), and (v) Beijing Tianjuyuan Fertilizer Co., Ltd., Gufeng’s wholly-owned subsidiary in the PRC (“Tianjuyuan”).

On June 30, 2016 the Company, through its wholly-owned subsidiary Jinong, entered into strategic acquisition agreements and a series of contractual agreements with the shareholders of the following six companies that are organized under the laws of the PRC and would be deemed VIEs: Shaanxi Lishijie Agrochemical Co., Ltd. (“Lishijie”), Songyuan Jinyangguang Sannong Service Co., Ltd. (“Jinyangguang”), Shenqiu County Zhenbai Agriculture Co., Ltd. (“Zhenbai”), Weinan City Linwei District Wangtian Agricultural Materials Co., Ltd. (“Wangtian”), Aksu Xindeguo Agricultural Materials Co., Ltd. (“Xindeguo”), and Xinjiang Xinyulei Eco-agriculture Science and Technology co., Ltd. (“Xinyulei”). On January 1, 2017, the Company, through its wholly-owned subsidiary Jinong, entered into strategic acquisition agreements and a series of contractual agreements with the shareholders of the following two companies that are organized under the laws of the PRC and would be deemed VIEs, Sunwu County Xiangrong Agricultural Materials Co., Ltd. (“Xiangrong”), and Anhui Fengnong Seed Co., Ltd. (“Fengnong”).

Yuxing, Lishijie, Jinyangguang, Zhenbai, Wangtian, Xindeguo, Xinyulei, Xiangrong and Fengnong may also collectively be referred to as the “the VIE Companies”

| 4 |

The Company’s current corporate structure as of is set forth in the diagram below:

| 5 |

NOTE 2 – BASIS OF PRESENTATION AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Principle of consolidation

The accompanying consolidated financial statements include the accounts of the Company and its wholly-owned subsidiaries, Green New Jersey, Jinong, Gufeng, Tianjuyuan, Yuxing and the VIE Companies. All significant inter-company accounts and transactions have been eliminated in consolidation.

VIE assessment

A VIE is an entity (1) that has total equity at risk that is not sufficient to finance its activities without additional subordinated financial support from other entities, (2) where the group of equity holders does not have the power to direct the activities of the entity that most significantly impact the entity’s economic performance, or the obligation to absorb the entity’s expected losses or the right to receive the entity’s expected residual returns, or both, or (3) where the voting rights of some investors are not proportional to their obligations to absorb the expected losses of the entity, their rights to receive the expected residual returns of the entity, or both, and substantially all of the entity’s activities either involve or are conducted on behalf of an investor that has disproportionately few voting rights. In order to determine if an entity is considered a VIE, the Company first performs a qualitative analysis, which requires certain subjective decisions regarding its assessments, including, but not limited to, the design of the entity, the variability that the entity was designed to create and pass along to its interest holders, the rights of the parties, and the purpose of the arrangement. If the Company cannot conclude after a qualitative analysis whether an entity is a VIE, it performs a quantitative analysis. The qualitative analysis considered the design of the entity, the risks that cause variability, the purpose for which the entity was created, and the variability that the entity was designed to pass along to its variable interest holders. When the primary beneficiary could not be identified through a qualitative analysis, we used internal cash flow models to compute and allocate expected losses or expected residual returns to each variable interest holder based upon the relative contractual rights and preferences of each interest holder in the VIE’s capital structure.

Use of estimates

The preparation of consolidated financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the consolidated financial statements and the amount of revenues and expenses during the reporting periods. Management makes these estimates using the best information available at the time the estimates are made. However, actual results could differ materially from those results.

Cash and cash equivalents and concentration of cash

For statement of cash flows purposes, the Company considers all cash on hand and in banks, certificates of deposit with state owned banks in the Peoples Republic of China (“PRC”) and banks in the United States, and other highly-liquid investments with maturities of nine months or less, when purchased, to be cash and cash equivalents. The Company maintains large sums of cash in three major banks in China. The aggregate cash in such accounts and on hand as of March 31, 2017 and June 30, 2016 were $118,259,995 and $102,896,486, respectively. In addition, the Company also had $221,024 and $167,495 in cash in two banks in the United States as of March 31, 2017 and June 30, 2016, respectively. Cash overdraft as of balance sheet date will be reflected as liabilities in the balance sheet. The Company has not experienced any losses in such accounts and believes it is not exposed to any significant risks on its cash in bank accounts.

Accounts receivable

The Company's policy is to maintain reserves for potential credit losses on accounts receivable. Management regularly reviews the composition of accounts receivable and analyzes customer creditworthiness, current economic trends and changes in customer payment patterns to evaluate the adequacy of these reserves at each year-end. Accounts considered uncollectible are written off through a charge to the valuation allowance. As of March 31, 2017 and June 30, 2016, the Company had accounts receivable of $154,950,404 and $117,055,376, net of allowance for doubtful accounts of $6,859,447 and $1,362,852, respectively.

Inventories

Inventory is valued at the lower of cost (determined on a weighted average basis) or market. Inventories consist of raw materials, work in process, finished goods and packaging materials. The Company reviews its inventories regularly for possible obsolete goods and establishes reserves when determined necessary.

| 6 |

Deferred assets

Deferred assets represent amounts that the distributors owed to the Company in their marketing efforts and developing standard stores to expand the Company’s products’ competitiveness and market shares. The amount owed to the Company to assist its distributors will be expensed over three years, which is the term as stated in the cooperation agreement, as long as the distributors are actively selling the Company’s products. For the nine months ended March 31, 2017 and 2016, the Company amortized $13,735,614 and $21,430,699, respectively, of the deferred assets. If a distributor breaches, defaults, or terminates the agreement with the Company within the three-year period, the outstanding unamortized portion of the amount owed will become payable to the Company immediately. The Company’s Chairman, Mr. Li, has guaranteed repayment of any amounts due to the Company remaining unpaid from distributors.

The deferred assets consist of items inside the distributors’ stores such as furniture, racks, cabinets, and display units, and items outside or attached to the distributors’ stores, such as signage and billboards. These types of assets would be capitalized as fixed assets if the Company actually owned the stores or utilized the assets for its own operations. These assets would also be capitalized as leasehold improvements if the Company leased these stores from the distributors. Therefore, the Company believes that under U.S. generally accepted accounting principles, these types of asset purchases are properly capitalized. In addition, the Company believes that these assets are properly classified as deferred assets because if a distributor breaches, defaults, or terminates the agreement with the Company within a three-year period, a proportionate amount expended by the Company is to be repaid by the distributor. The Company’s Chairman, Mr. Li, has guaranteed repayment of any amounts due to the Company remaining unpaid from distributors.

The assets inside the distributors’ stores are custom made to fit the layout of each individual store and the signage and billboards are also custom designed to fit the specific location. The assets were purchased by the Company directly from the manufacturers and installed in the distributors’ stores. The Company wants to maintain control over the quality of the items being purchased as well as making them uniform among all the distributor locations.

Intangible Assets

The Company records intangible assets acquired individually or as part of a group at fair value. Intangible assets with definite lives are amortized over the useful life of the intangible asset, which is the period over which the asset is expected to contribute directly or indirectly to the entity’s future cash flows. The Company evaluates intangible assets for impairment at least annually and more often whenever events or changes in circumstances indicate that the carrying value may not be recoverable. Whenever any such impairment exists, an impairment loss will be recognized for the amount by which the carrying value exceeds the fair value.

Goodwill

Goodwill represents the excess of purchase price over the underlying net assets of businesses acquired. Goodwill is reviewed for impairment on an annual basis, or more frequently if events or changes in circumstances indicate that the carrying amount of goodwill may be impaired. The goodwill impairment test is a two-step test. Under the first step, the fair value of the reporting unit is compared with its carrying value including goodwill. If the fair value of the reporting unit exceeds its carrying value, step two does not need to be performed. If the fair value of the reporting unit is less than its carrying value, an indication of goodwill impairment exists for the reporting unit and the enterprise must perform step two of the impairment test. Under step two, an impairment loss is recognized for any excess of the carrying amount of the reporting unit’s goodwill over the implied fair value of that goodwill. The implied fair value of goodwill is determined by allocating the fair value of the reporting unit in a manner similar to a purchase price allocation. The residual fair value after this allocation is the implied fair value of the reporting unit goodwill. As of June 30, 2016, the Company performed the required impairment review which resulted in no impairment adjustment.

Summary of changes in goodwill by reporting segments is as follows:

| Balance at | Foreign | Balance at | ||||||||||||||

| June 30, | Currency | March 31, | ||||||||||||||

| Segment | 2016 | Additions | Adjustment | 2017 | ||||||||||||

| Gufeng | $ | 4,822,659 | - | $ | (172,590 | ) | 4,650,069 | |||||||||

| Acquisition of VIE Companies | 3,158,179 | 661,066 | (113,023 | ) | 3,706,222 | |||||||||||

| $ | 7,930,838 | $ | 661,066 | $ | (422,984 | ) | $ | 8,356,291 | ||||||||

The goodwill addition in the above table is due to the acquisition of two new VIE Companies in January 2017. Such addition amount will be subject to the year-end audit as of June 30, 2017 for adjustments if needed.

| 7 |

Fair Value Measurement and Disclosures

Our accounting for Fair Value Measurement and Disclosures, defines fair value as the exchange price that would be received for an asset or paid to transfer a liability (an exit price) in the principal or most advantageous market for the asset or liability in an orderly transaction between market participants on the measurement date. This topic also establishes a fair value hierarchy which requires classification based on observable and unobservable inputs when measuring fair value. The fair value hierarchy distinguishes between assumptions based on market data (observable inputs) and an entity’s own assumptions (unobservable inputs). The hierarchy consists of three levels:

Level one — Quoted market prices in active markets for identical assets or liabilities;

Level two — Inputs other than level one inputs that are either directly or indirectly observable; and

Level three — Unobservable inputs developed using estimates and assumptions, which are developed by the reporting entity and reflect those assumptions that a market participant would use.

Determining which category an asset or liability falls within the hierarchy requires significant judgment. The Company evaluates its hierarchy disclosures each quarter.

The following table presents the Company’s assets and liabilities required to be reflected within the fair value hierarchy as of March 31, 2017.

| Fair Value | Fair Value Measurements at | |||||||||||||||

| As

of March 31, | June

30, 2016 | |||||||||||||||

| Description | 2017 | Using Fair Value Hierarchy | ||||||||||||||

| Level 1 | Level 2 | Level 3 | ||||||||||||||

| Derivative liability | $ | 52,768 | $ | - | $ | 144,818 | $ | - | ||||||||

The carrying values of cash and cash equivalents, trade and other receivables, trade and other payables approximate their fair values due to the short maturities of these instruments.

Derivative financial instruments

The Company evaluates its financial instruments to determine if such instruments are derivatives or contain features that qualify as embedded derivatives. For derivative financial instruments that are accounted for as liabilities, the derivative instrument is initially recorded at its fair value and is then re-valued at each reporting date, with changes in the fair value reported in the statements of operations. The Company uses a binomial option pricing model to value the derivative instruments. The classification of derivative instruments, including whether such instruments should be recorded as liabilities or as equity, is evaluated at the end of each reporting period.

At March 31, 2017, the only derivative financial instrument is the variable conversion feature embedded in the convertible notes payable (See Note 9). The fair value of the embedded conversion of $52,768 is recorded as a derivative liability at March 31, 2017. The fair value was determined using a binomial option pricing model with the following assumptions:

| Risk-free rate | 2.96 | % | ||

| Volatility | 51.4 | % | ||

| Dividend yield | 0.0 | % | ||

| Country risk premium | 90.0 | % | ||

| Liquidity risk premium | 3.0 | % |

Customer deposits

Payments received before all of the relevant criteria for revenue recognition are satisfied are recorded as customer deposits. When all revenue recognition criteria are met, the customer deposits are recognized as revenue. As of March 31, 2017 and June 30, 2016, the Company had customer deposits of $6,555,693 and $8,578,341, respectively.

| 8 |

Earnings per share

Basic earnings per share is computed based on the weighted average number of shares of common stock outstanding during the period. Diluted earnings per share is computed based on the weighted average number of shares of common stock plus the effect of dilutive potential common shares outstanding during the period using the treasury stock method. Dilutive potential common shares include outstanding stock options and stock awards.

The components of basic and diluted earnings per share consist of the following:

| Three Months Ended March 31, | ||||||||

| 2017 | 2016 | |||||||

| Net Income for Basic Earnings Per Share | $ | 8,191,675 | $ | 8,251,771 | ||||

| Basic Weighted Average Number of Shares | 38,532,033 | 36,962,166 | ||||||

| Net Income Per Share – Basic | $ | 0.21 | $ | 0.22 | ||||

| Net Income for Diluted Earnings Per Share | $ | 8,191,675 | $ | 8,251,771 | ||||

| Diluted Weighted Average Number of Shares | 38,532,033 | 36,962,166 | ||||||

| Net Income Per Share – Diluted | $ | 0.21 | $ | 0.22 | ||||

| Nine Months Ended March 31, | ||||||||

| 2017 | 2016 | |||||||

| Net Income for Basic Earnings Per Share | $ | 21,049,266 | $ | 19,764,978 | ||||

| Basic Weighted Average Number of Shares | 37,941,957 | 36,610,131 | ||||||

| Net Income Per Share – Basic | $ | 0.55 | $ | 0.54 | ||||

| Net Income for Diluted Earnings Per Share | $ | 21,049,266 | $ | 19,764,978 | ||||

| Diluted Weighted Average Number of Shares | 37,941,957 | 36,610,131 | ||||||

| Net Income Per Share – Diluted | $ | 0.55 | $ | 0.54 | ||||

Recent accounting pronouncements

In May 2014, the FASB issued ASU 2014-09, Revenue from Contracts with Customers, which supersedes nearly all existing revenue recognition guidance under U.S. GAAP. The core principle of ASU 2014-09 is to recognize revenues when promised goods or services are transferred to customers in an amount that reflects the consideration to which an entity expects to be entitled for those goods or services. ASU 2014-09 defines a five step process to achieve this core principle and, in doing so, more judgment and estimates may be required within the revenue recognition process than are required under existing U.S. GAAP. This pronouncement is effective for annual reporting periods beginning after December 15, 2016, and is to be applied using one of two retrospective application methods, with early application not permitted. The Company is currently assessing the materiality of the impact to our consolidated financial statements, and have not yet selected a transition approach.

In January 2015, the FASB issued Accounting Standards Update (ASU) No. 2015-01 (Subtopic 225-20) - Income Statement - Extraordinary and Unusual Items. ASU 2015-01 eliminates the concept of an extraordinary item from GAAP. As a result, an entity will no longer be required to segregate extraordinary items from the results of ordinary operations, to separately present an extraordinary item on its income statement, net of tax, after income from continuing operations or to disclose income taxes and earnings-per-share data applicable to an extraordinary item. However, ASU 2015-01 will still retain the presentation and disclosure guidance for items that are unusual in nature and occur infrequently. ASU 2015-01 is effective for periods beginning after December 15, 2015. The adoption of ASU 2015-01 is not expected to have a material effect on the Company’s consolidated financial statements. Early adoption is permitted.

In February, 2015, the FASB issued Accounting Standards Update (ASU) No. 2015-02, Consolidation (Topic 810): Amendments to the Consolidation Analysis. ASU 2015-02 provides guidance on the consolidation evaluation for reporting organizations that are required to evaluate whether they should consolidate certain legal entities such as limited partnerships, limited liability corporations, and securitization structures (collateralized debt obligations, collateralized loan obligations, and mortgage-backed security transactions). ASU 2015-02 is effective for periods beginning after December 15, 2015. The adoption of ASU 2015-02 is not expected to have a material effect on the Company’s consolidated financial statements. Early adoption is permitted.

| 9 |

In September, 2015, the FASB issued ASU No. 2015-16, Business Combinations (Topic 805). Topic 805 requires that an acquirer retrospectively adjust provisional amounts recognized in a business combination, during the measurement period. To simplify the accounting for adjustments made to provisional amounts, the amendments in the Update require that the acquirer recognize adjustments to provisional amounts that are identified during the measurement period in the reporting period in which the adjustment amount is determined. The acquirer is required to also record, in the same period’s financial statements, the effect on earnings of changes in depreciation, amortization, or other income effects, if any, as a result of the change to the provisional amounts, calculated as if the accounting had been completed at the acquisition date. In addition an entity is required to present separately on the face of the income statement or disclose in the notes to the financial statements the portion of the amount recorded in current-period earnings by line item that would have been recorded in previous reporting periods if the adjustment to the provisional amounts had been recognized as of the acquisition date. ASU 2015-16 is effective for fiscal years beginning December 15, 2015. The adoption of ASU 2015-016 is not expected to have a material effect on the Company’s consolidated financial statements.

In November 2015, the FASB issued ASU No. 2015-17, Balance Sheet Classification of Deferred Taxes. The new guidance requires that all deferred tax assets and liabilities, along with any related valuation allowance, be classified as noncurrent on the balance sheet. This update is effective for annual periods beginning after December 15, 2016 and interim periods within those annual periods. The Company does not anticipate the adoption of this ASU will have a significant impact on its consolidated financial position, results of operations, or cash flows.

In February 2016, the FASB issued ASU No. 2016-02, Leases (Topic 842). The guidance in ASU No. 2016-02 supersedes the lease recognition requirements in ASC Topic 840, Leases (FAS 13). ASU 2016-02 requires an entity to recognize assets and liabilities arising from a lease for both financing and operating leases, along with additional qualitative and quantitative disclosures. ASU 2016-02 is effective for fiscal years beginning after December 15, 2018, with early adoption permitted. The Company is currently evaluating the effect this standard will have on its consolidated financial statements.

In March 2016, the FASB issued ASU 2016-09, Improvements to Employee Share Based Payment Accounting, to simplify several aspects of the accounting for share-based payment transactions, including the income tax consequences, classification of awards as either equity or liabilities, and classification on the statement of cash flows. The guidance will be effective for annual periods beginning after December 15, 2016 and interim periods within those annual periods. Early adoption is permitted, including adoption in an interim period. The Company is currently evaluating the impact of the adoption of this newly issued guidance to its consolidated financial statements.

Other recent accounting pronouncements issued by the FASB, including its Emerging Issues Task Force, the American Institute of Certified Public Accountants, and the Securities and Exchange Commission did not or are not believed by management to have a material impact on the Company's present or future financial statements.

NOTE 3 – INVENTORIES

Inventories consisted of the following:

| March 31, | June 30, | |||||||

| 2017 | 2016 | |||||||

| Raw materials | $ | 6,964,106 | $ | 29,926,762 | ||||

| Supplies and packing materials | $ | 514,822 | $ | 444,373 | ||||

| Work in progress | $ | 362,137 | $ | 408,820 | ||||

| Finished goods | $ | 38,577,880 | $ | 56,656,360 | ||||

| Total | $ | 46,418,945 | $ | 87,436,315 | ||||

| 10 |

NOTE 4 – PROPERTY, PLANT AND EQUIPMENT

Property, plant and equipment consisted of the following:

| March 31, | June 30, | |||||||

| 2017 | 2016 | |||||||

| Building and improvements | $ | 40,930,618 | $ | 42,489,975 | ||||

| Auto | 1,134,845 | 937,642 | ||||||

| Machinery and equipment | 18,136,674 | 19,015,420 | ||||||

| Agriculture assets | 738,571 | 765,983 | ||||||

| Total property, plant and equipment | 60,940,708 | 63,209,020 | ||||||

| Less: accumulated depreciation | (27,031,343 | ) | (25,639,281 | ) | ||||

| Total | $ | 33,909,365 | $ | 37,569,739 | ||||

NOTE 5 – INTANGIBLE ASSETS

Intangible assets consisted of the following:

| March 31, | June 30, | |||||||

| 2017 | 2016 | |||||||

| Land use rights, net | $ | 9,834,810 | $ | 10,381,215 | ||||

| Technology patent, net | 3,976 | 4,462 | ||||||

| Customer relationships, net | 5,725,467 | 6,403,343 | ||||||

| Non-compete agreement | 1,119,153 | 925,678 | ||||||

| Trademarks | 5,906,140 | 6,125,350 | ||||||

| Total | $ | 22,589,546 | $ | 23,840,048 | ||||

LAND USE RIGHT

On September 25, 2009, Yuxing was granted a land use right for approximately 88 acres (353,000 square meters or 3.8 million square feet) by the People’s Government and Land & Resources Bureau of Hu County, Xi’an, Shaanxi Province. The fair value of the related intangible asset was determined to be the respective cost of RMB73,184,895 (or $10,620,153). The intangible asset is being amortized over the grant period of 50 years using the straight line method.

On August 13, 2003, Tianjuyuan was granted a certificate of Land Use Right for a parcel of land of approximately 11 acres (42,726 square meters or 459,898 square feet) at Ping Gu District, Beijing. The purchase cost was recorded at RMB1,045,950 (or $151,782). The intangible asset is being amortized over the grant period of 50 years.

On August 16, 2001, Jinong received a land use right as a contribution from a shareholder, which was granted by the People’s Government and Land & Resources Bureau of Yangling District, Shaanxi Province. The fair value of the related intangible asset at the time of the contribution was determined to be RMB7,285,099 (or $1,057,170). The intangible asset is being amortized over the grant period of 50 years.

| 11 |

The Land Use Rights consisted of the following:

| March 31, | June 30, | |||||||

| 2017 | 2016 | |||||||

| Land use rights | $ | 11,829,105 | $ | 12,268,150 | ||||

| Less: accumulated amortization | (1,994,295 | ) | (1,886,935 | ) | ||||

| Total land use rights, net | $ | 9,834,810 | $ | 10,381,215 | ||||

TECHNOLOGY PATENT

On August 16, 2001, Jinong was issued a technology patent related to a proprietary formula used in the production of humic acid. The fair value of the related intangible asset was determined to be the respective cost of RMB5,875,068 (or $852,555) and is being amortized over the patent period of 10 years using the straight line method. This technology patent has been fully amortized.

On July 2, 2010, the Company acquired Gufeng and its wholly-owned subsidiary Tianjuyuan. The fair value on the acquired technology patent was estimated to be RMB9,200,000 (or $1,335,049) and is amortized over the remaining useful life of six years using the straight line method.

The technology know-how consisted of the following:

| March 31, | June 30, | |||||||

| 2017 | 2016 | |||||||

| Technology know-how | $ | 2,191,906 | $ | 2,273,260 | ||||

| Less: accumulated amortization | (2,187,930 | ) | (2,268,798 | ) | ||||

| Total technology know-how, net | $ | 3,976 | $ | 4,462 | ||||

CUSTOMER RELATIONSHIPS

On July 2, 2010, the Company acquired Gufeng and its wholly-owned subsidiary Tianjuyuan. The fair value of the acquired customer relationships was estimated to be RMB65,000,000 (or $9,432,410) and is amortized over the remaining useful life of ten years. On June 30, 2016, and January 1, 2017 the Company acquired the VIE Companies. The fair value of the acquired customer relationships was estimated to be RMB19,917,253 (or $2,890,272) and is amortized over the remaining useful life of seven to ten years.

| March 31, | June 30, | |||||||

| 2017 | 2016 | |||||||

| Customer relationships | $ | 12,322,682 | $ | 12,257,100 | ||||

| Less: accumulated amortization | (6,597,215 | ) | (5,853,757 | ) | ||||

| Total customer relationships, net | $ | 5,725,467 | $ | 6,403,343 | ||||

NON-COMPETE AGREEMENT

On July 2, 2010, the Company acquired Gufeng and its wholly-owned subsidiary Tianjuyuan. The fair value of the acquired non-compete agreement was estimated to be RMB1,320,000 (or $191,550) and is amortized over the remaining useful life of five years using the straight line method. On June 30, 2016, and January 1, 2017 the Company acquired the VIE Companies. The fair value of the acquired non-compete agreements was estimated to be RMB8,765,582 (or $1,272,009) and is amortized over the remaining useful life of five years using the straight line method.

| March 31, | June 30, | |||||||

| 2017 | 2016 | |||||||

| Non-compete agreement | $ | 1,463,559 | $ | 1,124,338 | ||||

| Less: accumulated amortization | (344,406 | ) | (198,660 | ) | ||||

| Total non-compete agreement, net | $ | 1,119,153 | $ | 925,678 | ||||

| 12 |

TRADEMARKS

On July 2, 2010, the Company acquired Gufeng and its wholly-owned subsidiary Tianjuyuan. The preliminary fair value of the acquired trademarks was estimated to be RMB40,700,000 (or $5,906,140) and is subject to an annual impairment test.

AMORTIZATION EXPENSE

Estimated amortization expenses of intangible assets for the next five twelve months periods ending March 31, are as follows:

| Twelve Months Ending March 31, | Expense ($) | |||

| 2018 | 1,647,388 | |||

| 2019 | 1,647,388 | |||

| 2020 | 1,628,631 | |||

| 2021 | 864,932 | |||

| 2022 | 552,158 | |||

NOTE 6 – ACCRUED EXPENSES AND OTHER PAYABLES

Accrued expenses and other payables consisted of the following:

| March 31, | June 30, | |||||||

| 2017 | 2016 | |||||||

| Payroll payable | $ | 103,915 | $ | 58,704 | ||||

| Welfare payable | 148,980 | 154,510 | ||||||

| Accrued expenses | 4,666,446 | 4,450,306 | ||||||

| Other payables | 3,410,762 | 11,624,653 | ||||||

| Other levy payable | 121,702 | 126,219 | ||||||

| Total | $ | 8,451,805 | $ | 16,414,392 | ||||

| 13 |

NOTE 7 – AMOUNT DUE TO RELATED PARTIES

As of March 31, 2017 and June 30, 2016, the amount due to related parties was $3,034,201 and $2,473,004, respectively. As of March 31, 2017 and June 30, 2016, $1,015,798 and $1,092,243, respectively were amounts that Gufeng borrowed from a related party, Xi’an Techteam Science & Technology Industry (Group) Co. Ltd., a company controlled by Mr. Tao Li, Chairman and CEO of the Company, representing unsecured, non-interest bearing loans that are due on demand. These loans are not subject to written agreements.

At the end of December 2015, Yuxing entered into a sales agreement with the Company’s affiliate, 900LH.com Food Co., Ltd. ("900LH.com", previously announced as Xi'an Gem Grain Co., Ltd) pursuant to which Yuxing is to supply various vegetables to 900LH.com for its incoming seasonal sales at the holidays and year ends (the “Sales Agreement”). The contingent contracted value of the Sales Agreement is RMB25,500,000 (approximately $3,700,407). For the nine months ended March 31, 2017, Yuxing has sold approximately $2,552,963 products to 900LH.com.

On June 29, 2016, Jinong signed an office lease with Kingtone Information Technology Co., Ltd. (“Kingtone Information”), of which Mr. Tao Li, Chairman and CEO of the Company, serves as Chairman. Pursuant to the lease, Jinong rented 612 square meters (approximately 6,588 square feet) of office space from Kingtone Information. The lease provides for a two-year term effective as of July 1, 2016 with monthly rent of RMB24,480 (approximately $3,552).

NOTE 8 – LOAN PAYABLES

As of March 31, 2017, the short-term loan payables consisted of three loans which mature on dates ranging from July 28, 2016 through March 5, 2018 with interest rates ranging from 5.22% to 6.3075%. Loan No. 1 below is collateralized by Tianjuyan’s real estate, and guaranteed by Jinong’s credit and Loan No. 2 below is guaranteed by Jinong’s credit.

| No. | Payee | Loan period per agreement | Interest Rate | March 31, 2017 |

||||||||

| 1 | Postal Savings Bank of China-Pinggu Branch | March 24, 2017 - March 5, 2018 | 6.3075 | % | 1,886,482 | |||||||

| 2 | Beijing Bank- Pinggu Branch | July 28, 2016 – July 28, 2017 | 5.22 | % | 1,451,140 | |||||||

| Total | $ | 3,337,622 | ||||||||||

As of June 30, 2016, the short-term loan payables consisted of three loans which mature on dates ranging from May 18, 2016 through March 17, 2017 with interest rates ranging from 4.87% to 5.82%. Loans No. 1 and 3 below are collateralized by Tianjuyan’s land use right and building ownership right. Loan No. 2 below is guaranteed by Jinong’s credit.

| No. | Payee | Loan period per agreement | Interest Rate | June 30, 2016 | ||||||||

| 1 | Agriculture Bank of China-Pinggu Branch | May. 18, 2016 – Mar. 17, 2017 | 4.87 | % | $ | 1,956,500 | ||||||

| 2 | Beijing Bank - Pinggu Branch | Aug. 11, 2015 – Aug. 2, 2016 | 5.82 | % | 1,505,000 | |||||||

| 3 | Agriculture Bank of China-Pinggu Branch | Jan. 19, 2016 – Jan. 17, 2017 | 5.00 | % | 1,204,000 | |||||||

| Total | $ | 4,665,500 | ||||||||||

The interest expense from short-term loans was $464,430 and $943,413 for the nine months ended March 31, 2017 and 2016, respectively.

| 14 |

NOTE 9 – CONVERTIBLE NOTES PAYABLE

In connection with the acquisition of the VIE Companies, the Company’s subsidiary, Jinong, issued to the VIE Companies’ shareholders convertible notes payable in the aggregate amount of RMB63,000,000 ($9,142,182), with a term of three years and an annual interest rate of 3%. The convertible notes take priority over the preferred stock and common stock of Jinong, and any other class or series of capital stock Jinong issues in the future in terms of interests and payments in the event of any liquidation, dissolution or winding up of Jinong. On or after the third anniversary of the issuance date of the notes, noteholders may request Jinong to process the note conversion to convert the note into shares of the Company’s common stock. The notes cannot be converted prior to the maturity date. The per share conversion price of the notes is the higher of the following: (i) $5.00 per share or (ii) 75% of the closing price of the Company’s common stock on the date the noteholder delivers the conversion notice.

The Company determined that the fair value of the convertible notes payable was RMB56,286,294 ($8,167,929) and RMB44,330,692 ($6,383,620) as of March 31, 2017 and June 30, 2016, respectively, which was due to the lower than market interest rate and the conversion feature. The difference between the fair value of the notes and the face amount of the notes will be amortized to interest expense over the three year life of the notes. As of March 31, 2017, the amortization of this discount into interest expense was $249,125.

NOTE 10 – TAXES PAYABLE

Enterprise Income Tax

Effective January 1, 2008, the Enterprise Income Tax (“EIT”) law of the PRC replaced the tax laws for Domestic Enterprises (“DEs”) and Foreign Invested Enterprises (“FIEs”). The EIT rate of 25% replaced the 33% rate that was applicable to both DEs and FIEs. The two year tax exemption and three year 50% tax reduction tax holiday for production-oriented FIEs was eliminated. Since January 1, 2008, Jinong became subject to income tax in China at a rate of 15% as a high-tech company, as a result of the expiration of its tax exemption on December 31, 2007. Accordingly, it made provision for income taxes for the nine months ended March 31, 2017 and 2016 of $2,814,503 and $1,805,667, respectively, which is mainly due to the operating income from Jinong. Gufeng is subject to 25% EIT rate and thus it made provision for income taxes of $1,428,284 and $1,256,325 for the nine months ended March 31, 2017 and 2016, respectively.

Value-Added Tax

All of the Company’s fertilizer products that are produced and sold in the PRC were subject to a Chinese Value-Added Tax (VAT) of 13% of the gross sales price. On April 29, 2008, the PRC State of Administration of Taxation (SAT) released Notice #56, “Exemption of VAT for Organic Fertilizer Products”, which allows certain fertilizer products to be exempt from VAT beginning June 1, 2008. The Company submitted the application for exemption in May 2009, which was granted effective September 1, 2009, continuing through March 31, 2016.

Income Taxes and Related Payables

Taxes payable consisted of the following:

| March 31, | June 30, | |||||||

| 2017 | 2016 | |||||||

| VAT provision | $ | (423,349 | ) | $ | 2,218 | |||

| Income tax payable | 3,803,310 | 3,445,480 | ||||||

| Other levies | 121,702 | 656,520 | ||||||

| Total | $ | 3,501,663 | $ | 4,104,218 | ||||

| 15 |

The provision for income taxes consists of the following:

| March 31, 2017 | June 30, 2016 | |||||||

| Current tax - foreign | $ | 4,772,160 | $ | 7,371,967 | ||||

| Deferred tax | - | - | ||||||

| $ | 4,772,160 | $ | 7,371,967 | |||||

Tax Rate Reconciliation

Our effective tax rates were approximately 20.1% and 24.7% for the nine months ended March 31, 2017 and 2016, respectively. Substantially all of the Company’s income before income taxes and related tax expense are from PRC sources. Actual income tax benefit reported in the consolidated statements of income and comprehensive income differ from the amounts computed by applying the US statutory income tax rate of 34% to income before income taxes for the nine months ended March 31, 2017 and 2016 for the following reasons:

| March 31, 2017 | ||||||||||||||||||||||||||||

| China | United States | |||||||||||||||||||||||||||

| 15% - 25% | 34% | Total | ||||||||||||||||||||||||||

| Pretax income (loss) | $ | 25,831,101 | - | (2,067,988 | ) | - | $ | 23,763,113 | ||||||||||||||||||||

| Expected income tax expense (benefit) | 6,457,775 | 25.0 | % | (703,116 | ) | 34.0 | % | 5,754,659 | ||||||||||||||||||||

| High-tech income benefits on Jinong | (1,653,707 | ) | (6 | )% | - | (1,653,707 | ) | |||||||||||||||||||||

| Losses from subsidiaries in which no benefit is recognized | (31,908 | ) | (0.1 | )% | - | (31,908 | ) | |||||||||||||||||||||

| Change in valuation allowance on deferred tax asset from US tax benefit | 0 | - | 703,116 | 703,116 | (34.0 | )% | 703,116 | |||||||||||||||||||||

| Actual tax expense | $ | 4,772,160 | 18 | % | $ | - | - | % | $ | 4,772,160 | 20.1 | % | ||||||||||||||||

| March 31, 2016 | ||||||||||||||||||||||||

| China | United States | |||||||||||||||||||||||

| 15% - 25% | 34% | Total | ||||||||||||||||||||||

| Pretax income (loss) | $ | 24,931,875 | - | 3,973 | - | $ | 20,957,987 | |||||||||||||||||

| Expected income tax expense (benefit) | 6,232,969 | 25.0 | % | (1,351,122 | ) | 34.0 | % | 4,881,847 | ||||||||||||||||

| High-tech income benefits on Jinong | (1,729,430 | ) | (6.94 | )% | - | - | (1,729,430 | ) | ||||||||||||||||

| Losses from subsidiaries in which no benefit is recognized | 663,358 | 2.66 | % | - | - | 663,358 | ||||||||||||||||||

| Change in valuation allowance on deferred tax asset from US tax benefit | - | - | 1,351,122 | (34.0 | )% | 1,351,122 | ||||||||||||||||||

| Actual tax expense | $ | 5,166,897 | 21 | % | $ | - | - | % | $ | 5,166,897 | 24.7 | % | ||||||||||||

| 16 |

NOTE 11 – STOCKHOLDERS’ EQUITY

Common Stock

On September 30, 2014, the Company granted an aggregate of 1,750,000 shares of restricted stock under the 2009 Plan to certain executive officers, directors and employees, among which were (i) 240,000 shares of restricted stock to Mr. Tao Li, the CEO; (ii) 100,000 shares of restricted stock to Mr. Ken Ren, the CFO, (iii) 40,000 shares of restricted stock to Mr. Yizhao Zhang, (iv) 30,000 shares of restricted stock to Ms. Yiru Shi, and (v) 20,000 shares of restricted stock to Mr. Lianfu Liu, each an independent director of the Company; and (vi) 1,320,000 shares of restricted stock to key employees. The stock grants are subject to time-based vesting schedules, vesting in various installments until March 31, 2015 for the CFO and the three independent directors, until June 30, 2015 for the CEO and until March 31, 2017 for the employees. The value of the restricted stock awards was $3,675,000 and is based on the fair value of the Company’s common stock on the grant date. This amount is being amortized to compensation expense over the vesting periods for the various awards. As of June 30, 2016 the unamortized portion of the compensation expense was $235,264 which will be amortized to expense through December 15, 2016.

On September 28, 2015, the Company granted an aggregate of 1,000,000 shares of restricted stock under the 2009 Plan to certain key employees. The stock grants are subject to time-based vesting schedules, vesting in various installments until June 30, 2016. The value of the restricted stock awards was $1,660,000 and is based on the fair value of the Company’s common stock on the grant date. This amount is being amortized to compensation expense over the vesting periods for the various awards.

On June 26, 2016, the Company granted an aggregate of 670,000 shares of restricted stock under the 2009 Plan to certain key employees. The stock grants vest immediately. The value of the restricted stock awards was $897,800 and is based on the fair value of the Company’s common stock on the grant date.

On December 30, 2016, the Company granted an aggregate of 870,000 shares of restricted stock under the 2009 Plan to certain key employees. The stock grants vest immediately. The value of the restricted stock awards was $1,044,000 and is based on the fair value of the Company’s common stock on the grant date.

The following table sets forth changes in compensation-related restricted stock awards during the twelve-month periods ended March 31, 2017 and 2016:

| Fair | Grant Date | |||||||||||

| Number of | Value of | Fair Value | ||||||||||

| Shares | Shares | Per share | ||||||||||

| Outstanding (unvested) at June 30, 2016 | - | $ | - | |||||||||

| Granted | - | - | $ | - | ||||||||

| Forfeited | - | |||||||||||

| Vested | - | - | ||||||||||

| Outstanding (unvested) at March 31, 2017 | - | $ | - | |||||||||

As of March 31, 2017, the unamortized expense related to the grant of restricted shares of common stock was nil. The fair value of the restricted common stock awards was based on the closing price of the Company’s common stock on the grant date. The fair value of the common stock awarded is amortized over the various vesting terms of each grant.

| 17 |

Dividend

On October 1, 2014, the Company's Board of Directors declared a cash dividend of $0.10 per share to the Company's stockholders of common stock. The dividend payable represents a total payment to the stockholders of $3,296,156. The cash dividend of $2,161,904 was paid on January 30, 2015 to stockholders of record as of the close of business on the record date of October 31, 2014. Certain stockholders, including the Company’s Chairman, Mr. Li, elected to waive the dividend payment due to them and directed the Company to retain the funds for working capital purposes.

Preferred Stock

Under the Company’s Articles of Incorporation, the Board has the authority, without further action by stockholders, to designate up to 20,000,000 shares of preferred stock in one or more series and to fix the rights, preferences, privileges, qualifications and restrictions granted to or imposed upon the preferred stock, including dividend rights, conversion rights, voting rights, rights and terms of redemption, liquidation preference and sinking fund terms, any or all of which may be greater than the rights of the common stock. If the Company sells preferred stock under its registration statement on Form S-3, it will fix the rights, preferences, privileges, qualifications and restrictions of the preferred stock of each series in the certificate of designation relating to that series and will file the certificate of designation that describes the terms of the series of preferred stock the Company offers before the issuance of the related series of preferred stock.

As of March 31, 2017, the Company has 20,000,000 shares of preferred stock authorized, with a par value of $.001 per share, of which no shares are issued or outstanding.

NOTE 12 – CONCENTRATIONS

Cash and cash equivalents concentration

The Company maintains large sums of cash in three major banks in China. The aggregate cash in such accounts and on hand as of March 31, 2017 and June 30, 2016 were $118,259,995 and $102,896,486, respectively. Financial instruments that potentially subject the Company to concentration of credit risk consist principally of cash deposits.

Market Concentration

All of the Company's revenue-generating operations are conducted in the PRC. Accordingly, the Company's business, financial condition and results of operations may be influenced by the political, economic and legal environments in the PRC, and by the general state of the PRC's economy.

The Company's operations in the PRC are subject to specific considerations and significant risks not typically associated with companies in North America and Western Europe. These include risks associated with, among other things, the political, economic and legal environment and foreign currency exchange. The Company’s results may be adversely affected by, among other things, changes in governmental policies with respect to laws and regulations, anti-inflationary measures, currency conversion and remittance abroad, and rates and methods of taxation.

Vendor and Customer Concentration

There is one vendor from which the Company purchased 15.4% of its raw materials for the three month ended March 31, 2017. Total purchases from this vendor amounted to $8,670,903 as of March 31, 2017.

There is one vendor from which the Company purchased 15.4% of its raw materials for the three months ended March 31, 2017. Total purchases from this vendor amounted to $8,670,903 as of March 31, 2017.

No customer accounted for over 10% of the Company’s sales for the three months ended March 31, 2017.

One customer accounted for 37.8% of the Company’s sales for the three months ended March 31, 2016.

| 18 |

NOTE 13 – SEGMENT REPORTING

As of March 31, 2017, the Company was organized into three main business segments based on location and product: Jinong (fertilizer production), Gufeng (fertilizer production), and Yuxing (agricultural products production). As of June 30, 2016, with the acquisition of the VIE Companies, the Company added a new distribution segment. Each of the four operating segments referenced above has separate and distinct general ledgers. The chief operating decision maker (“CODM”) receives financial information, including revenue, gross margin, operating income and net income produced from the various general ledger systems to make decisions about allocating resources and assessing performance; however, the principal measure of segment profitability or loss used by the CODM is net income by segment.

| Three Months Ended March 31, | Nine Months Ended March 31, | |||||||||||||||

| Revenues from unaffiliated customers: | 2017 | 2016 | 2017 | 2016 | ||||||||||||

| Jinong | $ | 26,316,821 | $ | 31,602,239 | $ | 84,570,215 | $ | 97,612,604 | ||||||||

| Gufeng | 30,858,499 | 43,762,058 | 67,734,572 | 85,576,564 | ||||||||||||

| Yuxing | 2,781,003 | 3,274,177 | 6,590,728 | 6,599,577 | ||||||||||||

| VIES | 21,349,305 | - | 43,039,748 | - | ||||||||||||

| Consolidated | $ | 81,305,628 | $ | 78,638,474 | $ | 201,935,263 | $ | 189,788,745 | ||||||||

| Operating income : | ||||||||||||||||

| Jinong | $ | 5,960,846 | $ | 5,854,750 | $ | 18,080,850 | $ | 17,509,024 | ||||||||

| Gufeng | 2,457,008 | 4,805,591 | 5,448,907 | 10,468,423 | ||||||||||||

| Yuxing | 244,978 | 543,855 | 732,788 | 1,461,365 | ||||||||||||

| VIES | 1,242,773 | - | 3,683,537 | - | ||||||||||||

| Reconciling item (1) | - | - | - | - | ||||||||||||

| Reconciling item (2) | (209,917 | ) | (41,454 | ) | (209,917 | ) | (261,208 | ) | ||||||||

| Reconciling item (2)--stock compensation | (1,801 | ) | (855,628 | ) | (1,858,071 | ) | (3,712,709 | ) | ||||||||

| Consolidated | $ | 9,693,887 | $ | 10,307,114 | $ | 25,878,094 | $ | 25,464,895 | ||||||||

| Net income: | ||||||||||||||||

| Jinong | $ | 4,852,889 | $ | 5,023,016 | $ | 15,048,662 | $ | 15,023,381 | ||||||||

| Gufeng | 2,160,630 | 3,577,278 | 4,145,555 | 7,247,542 | ||||||||||||

| Yuxing | 245,239 | 548,559 | 732,828 | 1,467,943 | ||||||||||||

| VIES | 1,144,635 | - | 3,190,209 | - | ||||||||||||

| Reconciling item (1) | - | - | - | 29 | ||||||||||||

| Reconciling item (2) | (211,718 | ) | (897,082 | ) | (2,067,988 | ) | (3,973,917 | ) | ||||||||

| Consolidated | $ | 8,191,675 | $ | 8,251,771 | $ | 21,049,266 | $ | 19,764,978 | ||||||||

| Depreciation and Amortization: | ||||||||||||||||

| Jinong | $ | 1,764,443 | $ | 8,723,607 | $ | 11,752,674 | $ | 28,015,696 | ||||||||

| Gufeng | 578,525 | 747,160 | 1,836,875 | 2,221,221 | ||||||||||||

| Yuxing | 302,729 | 328,956 | 922,855 | 1,008,697 | ||||||||||||

| VIES | 159,942 | - | 409,144 | - | ||||||||||||

| Consolidated | $ | 2,805,639 | $ | 9,799,723 | $ | 14,921,548 | $ | 31,245,614 | ||||||||

| Interest expense: | ||||||||||||||||

| Jinong | 188,003 | - | 301,355 | - | ||||||||||||

| Gufeng | 44,636 | 211,734 | 163,075 | 943,413 | ||||||||||||

| Consolidated | $ | 232,639 | $ | 211,734 | $ | 464,430 | $ | 943,413 | ||||||||

| Capital Expenditure: | ||||||||||||||||

| Jinong | $ | 1,186 | $ | 616 | $ | 2,979 | $ | 7,259 | ||||||||

| Gufeng | 2,300 | 1,962 | 7,299 | 1,962 | ||||||||||||

| Yuxing | - | 938 | 6,226 | 7,387 | ||||||||||||

| VIES | 14,252 | - | 14,252 | - | ||||||||||||

| Consolidated | $ | 17,738 | $ | 3,516 | $ | 30,756 | $ | 16,608 | ||||||||

| 19 |

| As of | ||||||||

| March 31, | June 30, | |||||||

| 2017 | 2016 | |||||||

| Identifiable assets: | ||||||||

| Jinong | $ | 202,114,827 | $ | 198,599,977 | ||||

| Gufeng | 148,636,436 | 149,891,328 | ||||||

| Yuxing | 42,462,630 | 45,448,157 | ||||||

| VIES | 33,542,223 | 24,675,499 | ||||||

| Reconciling item (1) | 223,973 | 170,444 | ||||||

| Reconciling item (2) | (2,878 | ) | (2,878 | ) | ||||

| Consolidated | $ | 426,977,211 | $ | 418,782,527 | ||||

(1) Reconciling amounts refer to the unallocated assets or expenses of Green New Jersey.

(2) Reconciling amounts refer to the unallocated assets or expenses of the Parent Company.

NOTE 14 - COMMITMENTS AND CONTINGENCIES

On March 27, 2017, Jinong entered into lease agreement for 1550 mu (approximately 255 acres) paddy field, 1860 mu (approximately 306 acres) cultivated dry field, and approximately 2660 hectares uplands with the local authority at Shiquan County, Shaanxi Province, for a term of 50 years, from April 1, 2017 to March 31, 2066. The leasing fees for every ten-year period are approximately $3,338 per mu for paddy field, $1,451 per mu for cultivated dry field, $4,360 per hectare for uplands. Such ten-year fees become due prior to the beginning of every ten-year period. Jinong had paid half of the first ten-year period’s leasing fee, with an amount of RMB 67.1 million (approximately $9.7 million) by April 1, 2017, and the second half of the ten-year fee will be due by May 15, 2017.

On June 29, 2016, Jinong signed an office lease with Kingtone Information. Pursuant to the lease, Jinong rented 612 square meters (approximately 6,588 square feet) of office space from Kingtone Information. The lease provides for a two-year term effective as of July 1, 2016 with monthly rent of $3,552 (RMB24,480).

In January 2008, Jintai signed a ten-year land lease with Xi’an Jinong Hi-tech Agriculture Demonstration Zone for a monthly rent of $754 (RMB5,200).

In February 2004, Tianjuyuan signed a fifty-year lease with the village committee of Dong Gao Village and Zhen Nan Zhang Dai Village in the Beijing Ping Gu District, at a monthly rent of $429 (RMB2,958).

Accordingly, the Company recorded an aggregate of $42,626 and $16,896 as rent expenses for the nine months ended March 31, 2017 and 2016, respectively.

Lease expenses for the next five twelve month periods ending March 31, are as follows:

| Twelve Months ending March 31, | ||||

| 2018 | $ | 2,004,990 | ||

| 2019 | 2,004,990 | |||

| 2020 | 2,004,990 | |||

| 2021 | 2,004,990 | |||

| 2022 | 2,004,990 | |||

| 20 |

NOTE 15 – BUSINESS COMBINATIONS

On January 1, 2017, the Company, through its wholly-owned subsidiary Jinong, entered into strategic acquisition agreements and also into a series of contractual agreements to qualify as VIEs with the shareholders of two new VIE Companies, Sunwu County Xiangrong Agricultural Materials Co., Ltd., and Anhui Fengnong Seed Co., Ltd. (“Xiangrong and Fengnong”),.

Jinong, the two new VIE Companies, Xiangrong and Fengnong and the shareholders of the two new VIE Companies, Xiangrong and Fengnong, also entered into a series of contractual agreements for the VIE Companies to qualify as VIEs (the “VIE Agreements”). The VIE Agreements are as follows:

Entrusted Management Agreements

Pursuant to the terms of certain Entrusted Management Agreements dated January 1, 2017, between Jinong and the shareholders of the two new VIE Companies (the “Entrusted Management Agreements”), the two new VIE Companies and their shareholders agreed to entrust the operations and management of its business to Jinong. According to the Entrusted Management Agreement, Jinong possesses the full and exclusive right to manage the VIE Companies’ operations, assets and personnel, has the right to control all of the VIE Companies' cash flows through an entrusted bank account, is entitled to the VIE Companies' net profits as a management fee, is obligated to pay all of the VIE Companies’ payables and loan payments, and bears all losses of the VIE Companies. The Entrusted Management Agreements will remain in effect until (i) the parties mutually agree to terminate the agreement; (ii) the dissolution of the VIE Companies; or (iii) Jinong acquires all of the assets or equity of the VIE Companies (as more fully described below under “Exclusive Option Agreements”).

Exclusive Technology Supply Agreements

Pursuant to the terms of certain Exclusive Technology Supply Agreements dated January 1, 2017, between Jinong and the VIE Companies (the “Exclusive Technology Supply Agreements”), Jinong is the exclusive technology provider to the VIE Companies. The VIE Companies agreed to pay Jinong all fees payable for technology supply prior to making any payments under the Entrusted Management Agreement. The Exclusive Technology Supply Agreements shall remain in effect until (i) the parties mutually agree to terminate the agreement; (ii) the dissolution of the VIE Companies; or (iii) Jinong acquires the VIE Companies (as more fully described below under “Exclusive Option Agreements”).

Shareholder’s Voting Proxy Agreements

Pursuant to the terms of certain Shareholder’s Voting Proxy Agreements dated January 1, 2017, among Jinong and the shareholders of the VIE Companies (the “Shareholder’s Voting Proxy Agreements”), the shareholders of the VIE Companies irrevocably appointed Jinong as their proxy to exercise on such shareholders’ behalf all of their voting rights as shareholders pursuant to PRC law and the Articles of Association of the VIE Companies, including the appointment and election of directors of the VIE Companies. Jinong agreed that it shall maintain a board of directors, the composition and appointment of which shall be approved by the Board of the Company. The Shareholder’s Voting Proxy Agreements will remain in effect until Jinong acquires all of the assets or equity of the VIE Companies.

Exclusive Option Agreements

Pursuant to the terms of certain Exclusive Option Agreements dated January 1, 2017, among Jinong, the VIE Companies, and the shareholders of the VIE Companies (the “Exclusive Option Agreements”), the shareholders of the VIE Companies granted Jinong an irrevocable and exclusive purchase option (the “Option”) to acquire the VIE Companies’ equity interests and/or remaining assets, but only to the extent that the acquisition does not violate limitations imposed by PRC law on such transactions. The Option is exercisable at any time at Jinong’s discretion so long as such exercise and subsequent acquisition of the VIE Companies does not violate PRC law. The consideration for the exercise of the Option is to be determined by the parties and memorialized in the future by definitive agreements setting forth the kind and value of such consideration. Jinong may transfer all rights and obligations under the Exclusive Option Agreements to any third parties without the approval of the shareholders of the VIE Companies so long as a written notice is provided. The Exclusive Option Agreements may be terminated by mutual agreements or by 30 days written notice by Jinong.

Equity Pledge Agreements

Pursuant to the terms of certain Equity Pledge Agreements dated January 1, 2017, among Jinong and the shareholders of the VIE Companies (the “Pledge Agreements”), the shareholders of the VIE Companies pledged all of their equity interests in the VIE Companies to Jinong, including the proceeds thereof, to guarantee all of Jinong's rights and benefits under the Entrusted Management Agreements, the Exclusive Technology Supply Agreements, the Shareholder’ Voting Proxy Agreements and the Exclusive Option Agreements. Prior to termination of the Pledge Agreements, the pledged equity interests cannot be transferred without Jinong's prior written consent. The Pledge Agreements may be terminated only upon the written agreement of the parties.

| 21 |

Non-Compete Agreements

Pursuant to the terms of certain Non-Compete Agreements dated January 1, 2017, among Jinong and the shareholders of the VIE Companies (the “Non-Compete Agreements”), the shareholders of the VIE Companies agreed that during the period beginning on the initial date of their services with Jinong, and ending five (5) years after termination of their services with Jinong, without Jinong’s prior written consent, they will not provide services or accept positions including but not limited to partners, directors, shareholders, managers, proxies or consultants, provided by any profit making organizations with businesses that may compete with Jinong. They will not solicit or interfere with any of the Jinong’s customers, or solicit, induce, recruit or encourage any person engaged or employed by Jinong to terminate his or her service or engagement. In the event that the shareholders of the VIE Companies breach the non-compete obligations contained therein, Jinong is entitled to all loss and damages; in the event that the damages are difficult to determine, remedies bore the shareholders of the VIE Companies shall be no less than 50% of the salaries and other expenses Jinong provided in the past.

The Company entered into these VIE Agreements as a way for the Company to have more control over the distribution of its products. The transactions are accounted for as business combinations in accordance with ASC 805. A summary of the purchase price allocations at fair value is below:

| Cash | $ | 1,037,297 | ||

| Accounts receivable | 1,001,521 | |||

| Prepaid expenses and other current assets | 17,716 | |||

| Inventories | 961,936 | |||

| Machinery and equipment | 215,277 | |||

| Intangible assets | 883,689 | |||

| Goodwill | 661,066 | |||

| Accounts payable | (708,724 | ) | ||

| Customer deposits | (435,342 | ) | ||

| Accrued expenses and other payables | (806,697 | ) | ||

| Short-term loan | (160,641 | ) | ||

| Purchase price | $ | 2,667,098 |

A summary of the purchase consideration paid for the VIE Companies is below:

| Cash | $ | 1,160,912 | ||

| Convertible notes | 1,485,800 | |||

| Derivative liability | 20,386 | |||

| $ | 2,667,098 |

The cash component of the purchase price for these acquisitions was paid during March 2017.

NOTE 16 - VARIABLE INTEREST ENTITIES

In accordance with accounting standards regarding consolidation of variable interest entities, VIEs are generally entities that lack sufficient equity to finance their activities without additional financial support from other parties or whose equity holders lack adequate decision making ability. All VIEs with which a company is involved must be evaluated to determine the primary beneficiary of the risks and rewards of the VIE. The primary beneficiary is required to consolidate the VIE for financial reporting purposes.

Green Nevada through one of its subsidiaries, Jinong, entered into a series of agreements (the “VIE Agreements”) with Yuxing for it to qualify as a VIE, effective June 16, 2013.

The Company has concluded, based on the contractual arrangements, that Yuxing is a VIE and that the Company’s wholly-owned subsidiary, Jinong, absorbs a majority of the risk of loss from the activities of Yuxing, thereby enabling the Company, through Jinong, to receive a majority of Yuxing’s expected residual returns.

On June 30, 2016, and January 1, 2017, the Company, through its wholly-owned subsidiary Jinong, entered into strategic acquisition agreements and also into a series of contractual agreements to qualify as VIEs with the shareholders of the VIE Companies.

Jinong, the VIE Companies, and the shareholders of the VIE Companies also entered into a series of contractual agreements for the VIE Companies to qualify as VIEs (the “VIE Agreements”).

| 22 |

As a result of these contractual arrangements with Yuxing and the VIE Companies, the Company is entitled to substantially all of the economic benefits of Yuxing and the VIE Companies. The following financial statement amounts and balances of the VIEs are included in the accompanying consolidated financial statements as of March 31, 2017 and June 30, 2016:

| March 31, | June 30, | ||||||||

| 2017 | 2016 | ||||||||

| ASSETS | |||||||||

| Current Assets | |||||||||

| Cash and cash equivalents | $ | 841,855 | $ | 1,017,841 | |||||

| Accounts receivable, net | 17,821,871 | 7,050,201 | |||||||

| Inventories | 25,470,980 | 26,370,202 | |||||||

| Other current assets | 1,635,899 | 1,875,912 | |||||||

| Advances to suppliers | 1,566,273 | 4,900,524 | |||||||

| Total Current Assets | 47,336,878 | 41,214,680 | |||||||

| Plant, Property and Equipment, Net | 12,361,600 | 13,377,817 | |||||||

| Other assets | 217,819 | 334,264 | |||||||

| Intangible Assets, Net | 12,777,313 | 12,913,776 | |||||||

| Goodwill | 3,706,222 | 3,158,179 | |||||||

| Total Assets | $ | 76,399,832 | $ | 70,998,716 | |||||

| LIABILITIES AND STOCKHOLDERS' EQUITY | |||||||||

| Current Liabilities | |||||||||

| Accounts payable | $ | 9,839,580 | $ | 3,840,052 | |||||

| Customer deposits | 2,186,165 | 3,486,150 | |||||||

| Accrued expenses and other payables | 2,947,891 | 5,580,642 | |||||||

| Amount due to related parties | 40,636,386 | 43,478,158 | |||||||

| Short-term Loan | 160,641 | - | |||||||

| Total Current Liabilities | 55,770,663 | 56,385,002 | |||||||

| Long-term Liabilities | |||||||||

| Long-term Loan | 3,428 | - | |||||||

| Stockholders' equity | 20,625,741 | 14,613,714 | |||||||

| Total Liabilities and Stockholders' Equity | $ | 76,399,832 | $ | 70,998,716 | |||||

| Three months ended March 31, | Nine months ended March 31, | |||||||||||||||

| 2017 | 2016 | 2017 | 2016 | |||||||||||||

| Revenue | $ | 24,130,308 | $ | 3,274,177 | $ | 49,630,476 | $ | 6,599,577 | ||||||||

| Expenses | 22,740,434 | 2,725,619 | 45,707,439 | 5,131,634 | ||||||||||||

| Net income (loss) | $ | 1,389,874 | $ | 548,558 | $ | 3,923,037 | $ | 1,467,943 | ||||||||

| 23 |

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations