Attached files

| file | filename |

|---|---|

| 8-K - Sonnet BioTherapeutics Holdings, Inc. | form8-k.htm |

Chanticleer Holdings Reports Operating Results for

First Quarter Ended March 31, 2017

CHARLOTTE, NC – May 15, 2017 — Chanticleer Holdings, Inc. (NASDAQ: HOTR) (“Chanticleer,” or the “Company”), owner, operator and franchisor of multiple branded restaurants in the U.S. and abroad, today announced financial results for the first quarter ended March 31, 2017.

First Quarter Financial Highlights

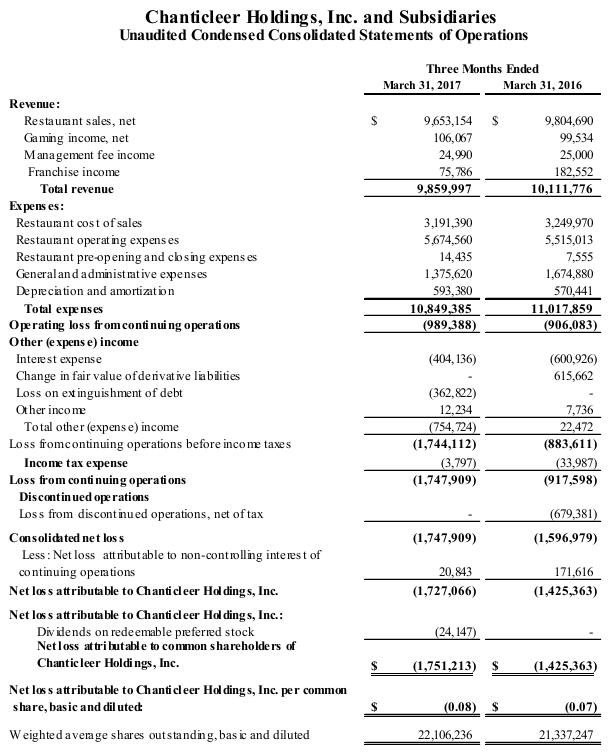

| ● | Total revenue for the first quarter decreased 2.5% to $9.9 million from $10.1 million in the prior year, primarily due to unusually inclement weather in Oregon and Washington state which caused store closures and decreased traffic during January and February. The prior year also benefited approximately $0.1 million from BGR franchise deals that did not recur in the current quarter. | |

| ● | Cost of sales as a percentage of restaurant sales was 33.1%, consistent with the comparable quarter last year. | |

| ● | General and administrative expenses as a percentage of total revenue improved to 14.0% from 16.6% in the comparable quarter last year. | |

| ● | Operating loss from continuing operations was $1.0 million compared to $0.9 million in the comparable quarter last year. | |

| ● | Net loss attributable to Common Shareholders was $1.8 million, ($0.8) per share, compared to $1.4 million, $(0.7) per share in the comparable quarter last year. | |

| ● | Restaurant EBITDA was $0.9 million compared to $1.1 million for the comparable quarter of last year. | |

| ● | Adjusted EBITDA was a loss of $288 thousand compared to a loss of $230 thousand in the comparable quarter last year. | |

| ● | During the quarter, the Company opened one new Little Big Burger in Portland, and expects to open 8 to 12 new stores during 2017. |

Subsequent to the close of the quarter, Chanticleer announced the completion of a $6 million financing with certain strategic investors, two of whom are partnering with the Company for the continued roll out of Little Big Burger restaurants via joint ventures and franchising. $5 million of proceeds was used to pay off, in full, the Florida Mezzanine note payable.

Mike Pruitt, Chairman and CEO of Chanticleer commented, “We are beginning to accelerate growth of company stores and are also receiving substantial interest in Little Big Burger franchising opportunities. Store revenues were impacted in January and February by inclement weather that hampered customer traffic in our Pacific Northwest locations. We saw improved store performance in March, which continued during April. The financing we announced last week strengthens our balance sheet providing a stronger foundation to drive growth in our high performing brands as we shift our focus from internal integration projects to organic growth and franchising initiatives.”

Mr. Pruitt continued, “Last month, we opened our 10th Little Big Burger in the Hillsboro neighborhood in Portland, Oregon with a record setting grand opening crowd and we will continue to open additional LBB stores throughout the year. Additionally, we announced a multi-unit franchise deal with a restauranteur, who is also a recent large investor in Chanticleer, to bring a minimum of eight LBB locations to Southern California by 2021. Our better burger brands, led by Little Big Burger, are our growth engine and we are executing on our strategy to drive expansion, build scale and drive efficiencies throughout our restaurant network. We remain on track to open 8-12 new company and franchise stores and continue to expect to achieve positive EBITDA for 2017. Additionally, we continue to focus our efforts toward our strategic goal of doubling our store count by 2020.”

Conference Call

The Company will hold a conference call on Monday, May 15, 2017 at 4:30 pm. Eastern Time.

To access the call, dial (877) 407-8133 approximately five minutes prior to the scheduled start time. International callers please dial (201) 689-8040. To access the webcast, including the quarterly slide presentation, log onto the Chanticleer website at: http://www.chanticleerholdings.com/

A replay of the teleconference will be available until June 15, 2017 and may be accessed by dialing (877) 481-4010. International callers may dial (919) 882-2331. Callers should use conference ID: 10393.

Use of Non-GAAP Measures

Chanticleer Holdings, Inc. prepares its condensed consolidated financial statements in accordance with United States generally accepted accounting principles (“GAAP”). In addition to disclosing financial results prepared in accordance with GAAP, the Company discloses information regarding Adjusted EBITDA and Restaurant EBITDA, which differ from the term EBITDA as it is commonly used. In addition to adjusting net income (loss) from continuing operations to exclude taxes, interest, and depreciation and amortization, Adjusted EBITDA also excludes pre-opening and closing costs for our restaurants, non-cash expenses, transaction and severance related expenses, change in fair value of derivative liability and other income and expenses.

In addition, Restaurant EBITDA also excludes management fee income, franchise revenue and general and administrative expenses. Adjusted EBITDA and restaurant EBITDA are not measures of performance defined in accordance with GAAP. However, adjusted EBITDA and restaurant EBITDA are used internally in planning and evaluating the company’s operating performance and by the Company’s creditors. Accordingly, management believes that disclosure of these metrics offers investors, bankers and other stakeholders an additional view of the company’s operations that, when coupled with the GAAP results, provides a more complete understanding of the Company’s financial results.

Adjusted EBITDA and Restaurant EBITDA should not be considered as alternatives to net loss or to net cash used in operating activities as a measure of operating results or of liquidity. It may not be comparable to similarly titled measures used by other companies, and it excludes financial information that some may consider important in evaluating the company’s performance. A reconciliation of GAAP net income (loss) to Adjusted EBITDA and Restaurant EBITDA is included in the accompanying financial schedules.

For further information, please refer to Chanticleer’s Quarterly Report on Form 10-K to be filed with the SEC on or about March 29, 2017 available online at www.sec.gov.

About Chanticleer Holdings, Inc.

Headquartered in Charlotte, NC, Chanticleer Holdings (HOTR), owns, operates and franchises fast casual and full service restaurant brands, including American Burger Company, BGR – Burgers Grilled Right, Little Big Burger, Just Fresh and Hooters.

Forward-Looking Statements

This press release contains forward-looking statements within the meaning of The Private Securities Litigation Reform Act of 1995. These statements include projections, predictions, expectations or statements as to beliefs or future events or results or refer to other matters that are not historical facts. Forward-looking statements are subject to known and unknown risks, uncertainties and other factors that could cause the actual results to differ materially from those contemplated by these statements. The forward-looking statements contained in this press release are based on various factors and were derived using numerous assumptions. In some cases, you can identify these forward-looking statements by the words “anticipate”, “estimate”, “plan”, “project”, “continuing”, “ongoing”, “target”, “aim”, “expect”, “believe”, “intend”, “may”, “will”, “should”, “could”, or the negative of those words and other comparable words.

Our operations involve risks and uncertainties, many of which are outside our control, and any one of which, or a combination of which, could materially affect our results of operations and whether the forward-looking statements ultimately prove to be correct. Forward-looking statements in this press release include, without limitation, statements reflecting management’s expectations for future financial performance and operating expenditures, expected growth, profitability and business outlook, increased sales and marketing expenses, and the expected results from the integration of our acquisitions.

Forward-looking statements are only current predictions and are subject to known and unknown risks, uncertainties, and other factors that may cause our actual results, levels of activity, performance, or achievements to be materially different from those anticipated by such statements. These factors include, but are not limited to, the Company’s ability to manage growth; integrate acquisitions; manage debt; meet development goals; and other important risks and uncertainties referenced and discussed under the heading titled “Risk Factors” in the Company’s filings with the Securities and Exchange Commission. Although we believe that the expectations reflected in the forward-looking statements contained in this press release are reasonable, we cannot guarantee future results, levels of activity, performance, or achievements.

The statements in this press release are made as of the date of this press release, even if subsequently made available by the Company on its website or otherwise. The Company does not assume any obligations to update the forward-looking statements provided to reflect events that occur or circumstances that exist after the date on which they were made.

Contact:

Chanticleer Holdings, Inc.

Mike Pruitt, Chairman/CEO

Phone: 704.366.5122 x 1

mp@chanticleerholdings.com

Eric Lederer, CFO

Phone: 704.366.5736

elederer@chanticleerholdings.com

Press Information:

Chanticleer Holdings, Inc.

Investor Relations

Phone: 704.366.5122

ir@chanticleerholdings.com

Investor Relations

John Nesbett/Jennifer Belodeau

Institutional Marketing Services (IMS)

Phone 203.972.9200

jnesbett@institutionalms.com