Attached files

| file | filename |

|---|---|

| EX-32.2 - EXHIBIT 32.2 - AMERICAN EDUCATION CENTER, INC. | v466923_ex32-2.htm |

| EX-32.1 - EXHIBIT 32.1 - AMERICAN EDUCATION CENTER, INC. | v466923_ex32-1.htm |

| EX-31.2 - EXHIBIT 31.2 - AMERICAN EDUCATION CENTER, INC. | v466923_ex31-2.htm |

| EX-31.1 - EXHIBIT 31.1 - AMERICAN EDUCATION CENTER, INC. | v466923_ex31-1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

| x |

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended March 31, 2017, or | |

| ¨ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to |

Commission File Number: 333-201029

AMERICAN EDUCATION CENTER, INC.

(Exact Name of Registrant as Specified in Its Charter)

|

Nevada (State of Other Jurisdiction of Incorporation

or |

38-3941544 (I.R.S. Employer Identification No.) |

|

2 Wall Street, 8th Floor, New York, NY (Address of Principal Executive Offices) |

10004 (ZIP Code) |

(212) 825-0437

(Registrant’s Telephone Number, Including Area Code)

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Sections 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

| Yes x | No ¨ |

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

| Yes x | No ¨ |

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer ¨ | Accelerated filer ¨ |

| Non-accelerated filer ¨ |

Smaller reporting company x |

Emerging growth company x

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised accounting standard provided pursuant to Section 13(a) of the Exchanger Act.¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

| Yes ¨ | No x |

As of May 15th, 2017, the registrant had 38,350,000 shares of common stock issued and outstanding.

TABLE OF CONTENTS

Index to Form 10-Q

| Page | ||

| Part I | ||

| FINANCIAL INFORMATION | ||

| Item 1. | Financial Statements | 1 |

| Condensed Statements of Financial Condition | 1 | |

| Condensed Statements of Income | 2 | |

| Condensed Statements of Comprehensive Income | 3 | |

| Condensed Statements of Cash Flows | 4 | |

| Notes to Condensed Financial Statements | 5 | |

| Item 2. | Management’s Discussion and Analysis of Financial Condition and Results of Operations | 25 |

| Item 3. | Quantitative and Qualitative Disclosures About Market Risk | 37 |

| Item 4. | Controls and Procedures | 37 |

| Part II | ||

| OTHER INFORMATION | ||

| Item 1. | Legal Proceedings | 38 |

| Item 1A. | Risk Factors | 38 |

| Item 2. | Unregistered Sales of Equity Securities and Use of Proceeds | 38 |

| Item 3. | Defaults Upon Senior Securities | 38 |

| Item 4. | Mine Safety Disclosures | 38 |

| Item 5. | Other Information | 38 |

| Item 6. | Exhibits | 38 |

| SIGNATURE | 39 | |

Throughout this Quarterly Report on Form 10-Q, the “Company”, “we,” “us,” and “our,” refer to (i) American Education Center, Inc., a Nevada corporation (“AEC Nevada”); (ii) American Education Center, Inc., a New York corporation ("AEC New York"); and (iii) AEC Southern Management Co., LTD, a company formed pursuant to the laws of England and Wales (the “AEC Southern UK”) and the subsidiaries of AEC Southern UK unless otherwise indicated or the context otherwise requires.

FORWARD-LOOKING STATEMENTS

This Quarterly Report on Form 10-Q contains certain forward-looking statements (as such term is defined in Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934). The statements herein which are not historical reflect our current expectations and projections about the Company’s future results, performance, liquidity, financial condition, prospects and opportunities and are based upon information currently available to us and our management and our interpretation of what we believe to be significant factors affecting our business, including many assumptions about future events. Such forward-looking statements include statements regarding, among other things:

| · | our ability to produce, market and generate sales of our products and services; |

| · | our ability to develop and/or introduce new products and services; |

| · | our projected future sales, profitability and other financial metrics; |

| · | our future financing plans; |

| · | our anticipated needs for working capital; |

| · | the anticipated trends in our industry; |

| · | our ability to expand our sales and marketing capability; |

| · | acquisitions of other companies or assets that we might undertake in the future; |

| · | competition existing today or that will likely arise in the future; and |

| · | other factors discussed elsewhere herein. |

Forward-looking statements, which involve assumptions and describe our future plans, strategies, and expectations, are generally identifiable by use of the words “may,” “should,” “will,” “plan,” “could,” “target,” “contemplate,” “predict,” “potential,” “continue,” “expect,” “anticipate,” “estimate,” “believe,” “intend,” “seek,” or “project” or the negative of these words or other variations on these or similar words. Actual results, performance, liquidity, financial condition and results of operations, prospects and opportunities could differ materially from those expressed in, or implied by, these forward-looking statements as a result of various risks, uncertainties and other factors, including the ability to raise sufficient capital to continue the Company’s operations. These statements may be found under Part I, Item 2—“Management’s Discussion and Analysis of Financial Condition and Results of Operations,” as well as elsewhere in this Quarterly Report on Form 10-Q generally. Actual events or results may differ materially from those discussed in forward-looking statements as a result of various factors, including, without limitation, matters described in this Quarterly Report on Form 10-Q.

In light of these risks and uncertainties, there can be no assurance that the forward-looking statements contained in this Quarterly Report on Form 10-Q will in fact occur.

Potential investors should not place undue reliance on any forward-looking statements. Except as expressly required by the federal securities laws, there is no undertaking to publicly update or revise any forward-looking statements, whether as a result of new information, future events, changed circumstances or any other reason.

The forward-looking statements in this Quarterly Report on Form 10-Q represent our views as of the date of this Quarterly Report on Form 10-Q. Such statements are presented only as a guide about future possibilities and do not represent assured events, and we anticipate that subsequent events and developments will cause our views to change. You should, therefore, not rely on these forward-looking statements as representing our views as of any date after the date of this Quarterly Report on Form 10-Q.

This Quarterly Report on Form 10-Q also contains estimates and other statistical data prepared by independent parties and by us relating to market size and growth and other data about our industry. These estimates and data involve a number of assumptions and limitations, and potential investors are cautioned not to give undue weight to these estimates and data. We have not independently verified the statistical and other industry data generated by independent parties and contained in this Quarterly Report on Form 10-Q. In addition, projections, assumptions and estimates of our future performance and the future performance of the industries in which we operate are necessarily subject to a high degree of uncertainty and risk.

Potential investors should not make an investment decision based solely on our projections, estimates or expectations.

PART I.

FINANCIAL INFORMATION

| AMERICAN EDUCATION CENTER, INC. AND SUBSIDIARIES |

| CONSOLIDATED BALANCE SHEETS |

| March 31, | December 31, | |||||||

| 2017 | 2016 | |||||||

| (Unaudited) | ||||||||

| ASSETS | ||||||||

| Current assets: | ||||||||

| Cash (Note2) | $ | 1,867,310 | $ | 2,290,429 | ||||

| Accounts receivable, net of allowance for doubtful accounts of $63,000 at March 31, 2017 and December 31, 2016 (Note 2) | 6,510,883 | 2,887,837 | ||||||

| Prepaid expenses | 84,846 | 61,600 | ||||||

| Total current assets | 8,463,039 | 5,239,866 | ||||||

| Noncurrent assets: | ||||||||

| Deferred compensation (Note 6) | 3,022,501 | 3,315,001 | ||||||

| Deferred income taxes (Notes 2 and 13) | 36,267 | 97,936 | ||||||

| Intangible asset, net (Note 8) | 544,724 | 578,769 | ||||||

| Security deposits (Note 7) | 266,021 | 266,021 | ||||||

| Total noncurrent assets | 3,869,513 | 4,257,727 | ||||||

| TOTAL ASSETS | $ | 12,332,552 | $ | 9,497,593 | ||||

| LIABILITIES AND STOCKHOLDERS' EQUITY | ||||||||

| Current liabilities: | ||||||||

| Accounts payable and accrued expenses | $ | 4,386,306 | $ | 3,452,231 | ||||

| Taxes payable | 793,031 | 511,355 | ||||||

| Deferred revenue (Note 9) | 551,035 | 177,132 | ||||||

| Loan from stockholders (Note 10) | 113,906 | 113,906 | ||||||

| Total current liabilities | 5,844,278 | 4,254,624 | ||||||

| Noncurrent liabilities: | ||||||||

| Deferred rent | 171,215 | 155,707 | ||||||

| Long-term loan (Note 11) | 295,579 | 295,579 | ||||||

| Total liabilities | 6,311,072 | 4,705,910 | ||||||

| Stockholders’ equity: | ||||||||

| Preferred stock, $0.001 par value; 20,000,000 shares authorized; none issued | - | - | ||||||

| Common stock, $0.001 par value; 180,000,000 shares authorized; 41,350,000 shares issued and outstanding, at March 31, 2017 and December 31, 2016 (Note 14) | 41,350 | 41,350 | ||||||

| Additional paid-in capital | 4,021,626 | 4,021,626 | ||||||

| Retained earnings | 1,958,504 | 728,707 | ||||||

| Total stockholders' equity | 6,021,480 | 4,791,683 | ||||||

| TOTAL LIABILITIES AND STOCKHOLDERS’ EQUITY | $ | 12,332,552 | $ | 9,497,593 | ||||

See accompanying notes to consolidated financial statements.

| 1 |

| AMERICAN EDUCATION CENTER, INC. AND SUBSIDIARIES |

| CONSOLIDATED STATEMENTS OF OPERATIONS (UNAUDITED) |

| Three Months Ended March 31, | ||||||||

| 2017 | 2016 | |||||||

| Revenues (Note 2) | $ | 9,458,706 | $ | 2,683,804 | ||||

| Costs and expenses: | ||||||||

| Consulting services | 6,195,252 | 1,973,517 | ||||||

| Application fees | - | 44,772 | ||||||

| General and administrative | 1,683,372 | 467,480 | ||||||

| Total costs and expenses | 7,878,624 | 2,485,769 | ||||||

| Income from operations | 1,580,082 | 198,035 | ||||||

| Other income | - | 4,392 | ||||||

| Income before provision for income taxes | 1,580,082 | 202,427 | ||||||

| Provision for income taxes | 350,285 | 93,058 | ||||||

| Net income | $ | 1,229,797 | $ | 109,369 | ||||

| Earnings per share - basic and diluted | $ | 0.03 | $ | 0.00 | ||||

| Weighted average shares outstanding, basic and diluted | 41,350,000 | 30,000,000 | ||||||

See accompanying notes to consolidated financial statements.

| 2 |

| AMERICAN EDUCATION CENTER, INC. AND SUBSIDIARIES |

| CONSOLIDATED STATEMENTS OF STOCKHOLDERS' EQUITY (UNAUDITED) |

| FOR THE THREE MONTHS ENDED MARCH 31, 2017 |

| Additional | ||||||||||||||||||||

| Common stock | paid-in | Retained | ||||||||||||||||||

| Shares | Amount | capital | earnings | Total | ||||||||||||||||

| Balance-December 31, 2016 | 41,350,000 | $ | 41,350 | $ | 4,021,626 | $ | 728,707 | $ | 4,791,683 | |||||||||||

| Net income | - | - | - | 1,229,797 | 1,229,797 | |||||||||||||||

| Balance-March 31, 2017-unaudited | 41,350,000 | $ | 41,350 | $ | 4,021,626 | $ | 1,958,504 | $ | 6,021,480 | |||||||||||

See accompanying notes to consolidated financial statements.

| 3 |

| AMERICAN EDUCATION CENTER, INC. AND SUBSIDIARIES |

| CONSOLIDATED STATEMENTS OF CASH FLOWS (UNAUDITED) |

| Three Months Ended March 31, | ||||||||

| 2017 | 2016 | |||||||

| Cash flows from operating activities: | ||||||||

| Net income | $ | 1,229,797 | $ | 109,369 | ||||

| Adjustments to reconcile net income to net cash provided by (used in) operating activities: | ||||||||

| Deferred income taxes | 61,669 | - | ||||||

| Deferred rent expense | 15,508 | 13,524 | ||||||

| Deferred compensation (Note 6) | 292,500 | - | ||||||

| Amortization expense (Note 8) | 34,045 | - | ||||||

| Change in operating assets and liabilities: | ||||||||

| (Increase) in accounts receivable | (3,623,046 | ) | (62,041 | ) | ||||

| (Increase) decrease in prepaid expenses | (23,246 | ) | 24,000 | |||||

| (Increase) in security deposits | - | (471,653 | ) | |||||

| Increase in accounts payable and accrued expenses | 934,075 | 81,833 | ||||||

| Increase in taxes payable | 281,676 | - | ||||||

| Increase (decrease) in deferred revenue | 373,903 | (480,829 | ) | |||||

| Increase in advances from clients | - | 112,340 | ||||||

| Net cash (used in) operating activities | (423,119 | ) | (673,457 | ) | ||||

| Net change in cash | (423,119 | ) | (673,457 | ) | ||||

| Cash, beginning of period | 2,290,429 | 1,093,755 | ||||||

| Cash, end of period | $ | 1,867,310 | $ | 420,298 | ||||

| Supplemental disclosure of cash flow information | ||||||||

| Cash paid for income taxes | $ | 6,940 | $ | 11,225 | ||||

| Cash paid for interest | $ | - | $ | - | ||||

See accompanying notes to consolidated financial statements.

| 4 |

AMERICAN EDUCATION CENTER, Inc.AND SUBSIDIARies

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

FOr the THREE MONTHS ended MARCH 31, 2017 and 2016

| 1. | ORGANIZATION AND BUSINESS |

American Education Center, Inc. (“AEC New York”) is a New York Corporation organized on November 8, 1999 and is licensed by the Education Department of the State of New York to engage in education related consulting services between the United States and China.

On May 7, 2014, the President/sole shareholder of AEC New York formed a new company (“AEC Nevada”) in the State of Nevada with the same name. On May 31, 2014, the President/sole shareholder of AEC New York exchanged his 200 shares for 10,563,000 shares of AEC Nevada. This exchange made AEC New York a wholly owned subsidiary of AEC Nevada.

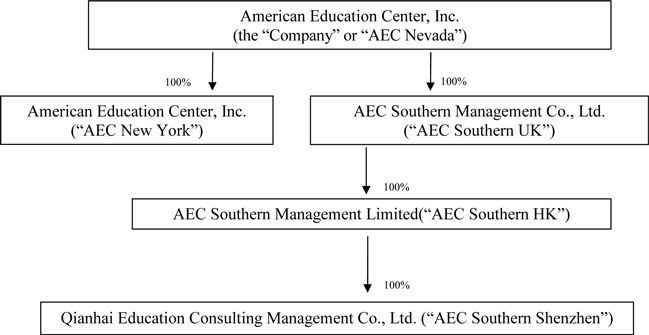

On October 31, 2016, AEC Nevada completed an acquisition transaction through a share exchange with the stockholders of AEC Southern Management Co., Ltd. (“AEC Southern UK”), a company incorporated in December 2015 with registered capital of 10,000 British Pounds (approximately US$ 15,000) pursuant to the laws of England and Wales. The Company acquired 100% of the outstanding shares of AEC Southern UK in exchange for 1,500,000 shares of its common stock valued at $210,000, representing 4.63% of the issued and outstanding shares of common stock. Before October 31, 2016, AEC Southern UK was owned by the following persons, Ye Tian owned51.00% and Rongxia Wang owned 49%. AEC Southern UK holds 100% equity in AEC Southern Management Limited (“AEC Southern HK”), an entity organized pursuant to Hong Kong laws on December 29, 2015, with registered capital of HK Dollars 10,000 (approximately US$ 1,300). AEC Southern HK holds 100% equity in Qianhai Education Consulting Management Co., Ltd. (“AEC Southern Shenzhen”) organized pursuant to PRC laws, with registered capital of RMB 5,000,000 (approximately US$ 768,000).

As a result of the acquisition by AEC Nevada, AEC Southern UK and its wholly owned subsidiaries became AEC Nevada’s wholly-owned subsidiary.AEC Nevada, AEC NY, and AEC Southern UK and its wholly owned subsidiaries are referenced collectively as the “Company.”

| 5 |

AMERICAN EDUCATION CENTER, Inc. AND SUBSIDIARies

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

FOR THE THREE MONTHS ENDED MARCH 31, 2017 AND 2016

| 1. | ORGANIZATION AND BUSINESS (continued) |

The Company has a corporate structure, which is set forth as follows:

The Company’s primary goal is to build upon the concept of “one-stop comprehensive services” for international students, educators, executives, and institutions.

AEC New York has been devoted to international education exchanges, by providing educational and career enrichment opportunities for students, teachers, and educational institutions between China and the United States. It currently provides admission, visa application consulting, housing and other consulting services to Chinese students wishing to study in the United States. It also provides exchange and placement services for qualified United States educators to teach in China. AEC New York also provides localization consulting services to multi-national companies with employees coming to the United States to work.

AEC Southern UK provides targeted and tailored executive training services. AEC Southern UK currently has two major clients from the food industry. The training focuses on food industry regulation compliance in various geographical regions, International Organization for Standardization (“ISO”) 9001 compliance, human resources management and organizational management. AEC Southern UK is looking to expand its clientele to companies in other industries.

| 6 |

AMERICAN EDUCATION CENTER, Inc. AND SUBSIDIARies

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

FOR THE THREE MONTHS ENDED MARCH 31, 2017 AND 2016

| 2. | SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES |

Basis of Accounting and Presentation

The accompanying consolidated financial statements have been prepared on the accrual basis of accounting in accordance with accounting principles generally accepted in the United States of America (“GAAP”). The consolidated financial statements are comprised of AEC Nevada and its wholly owned subsidiaries, AEC New York, AEC Southern UK, AEC Southern HK and AEC Southern Shenzhen. All significant intercompany accounts and transactions have been eliminated in consolidation

The unaudited interim financial statements of the Company as of March 31, 2017 and for the three months ended March 31, 2017 and 2016, have been prepared in accordance with GAAP and the rules and regulations of the Securities and Exchange Commission (the “SEC”) which apply to interim financial statements. Accordingly, they do not include all of the information and footnotes normally required by accounting principles generally accepted in the United States of America for annual financial statements. In the opinion of management, such information contains all adjustments, consisting only of normal recurring adjustments, necessary for a fair presentation of the results for the periods presented. The results of operations for the three months ended March 31, 2017 are not necessarily indicative of the results to be expected for future quarters or for the year ending December 31, 2017 .

Cash and Cash Equivalents

The Company considers all liquid investments with an original maturity of three months or less to be cash equivalents.

Accounts Receivable

The Company carries its accounts receivable at cost less an allowance for doubtful accounts if required. On a periodic basis, management evaluates accounts receivable balances and establishes an allowance for doubtful accounts, based on the history of past write-offs and collections, when necessary. As of March 31, 2017 and December 31, 2016, the allowance for doubtful accounts was $63,000.

| 7 |

AMERICAN EDUCATION CENTER, Inc. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

FOR THE THREE MONTHS ENDED MARCH 31, 2017 AND 2016

| 2. | SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (continued) |

Revenue Recognition

Revenue is recorded pursuant to Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) 605, “Revenue Recognition,” when persuasive evidence of an arrangement exists, delivery of the services has occurred, the fee is fixed or determinable and collectability is reasonably assured.

AEC New York provides localization consulting services to multi-national companies and educational and career enrichment services to students. Consulting services to multi-national companies are recognized when all services are rendered. Services provided to students are generally paid in advance and are recognized proportionally as services are completed. The unearned advances of students services are reflected as “deferred revenue” in the consolidated balance sheets. No refund terms are offered for both types of services provided.

AEC Southern UK provides consulting services regarding ISO and the U.S. Food and Drug Administration (“FDA”) standards and related staff training consulting and other services such as marketing and distribution consulting. AEC Southern UK recognizes monthly non-refundable retainer payments and recognizes revenue for its consulting services when provided.

Intangible Assets

Finite-lived intangible assets that are acquired from a third party are recorded at cost on their acquisition dates and are amortized on a straight-line basis over the economic useful life of the asset. The finite-lived intangible asset consists of a customized computer system, comprised of an email platform, student information management portal, online studying and conferencing portals.

The Company reviews its finite-lived intangible assets for impairment whenever events or changes in circumstances indicate that the carrying amount of an asset may not be recoverable. Recoverability of assets to be held and used is measured by a comparison of the carrying amount of an asset to undiscounted future net cash flows expected to be generated by the asset. If such assets are not recoverable, a potential impairment loss is recognized to the extent the carrying amount of the assets exceeds the fair value of the assets. Fair value is generally determined using a discounted cash flow approach.

| 8 |

AMERICAN EDUCATION CENTER, Inc. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

FOR THE THREE MONTHS ENDED MARCH 31, 2017 AND 2016

| 2. | SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (continued) |

Stock-Based Compensation

The Company uses the fair value-based method for stock issued for services rendered and therefore all awards to employees and non-employees will be recorded at the market price on the date of the grant and expensed over the required period of services rendered.

The fair value of stock options issued to third party consultants and to employees, officers and directors are recorded in accordance with the measurement and recognition criteria of FASB ASC 505-50, “Equity-Based Payments to Non-Employees” and FASB ASC 718, “Compensation – Stock Based Compensation,” respectively.

The options are valued using the Black-Scholes valuation model. This model is affected by the Company’s stock price as well as assumptions regarding a number of subjective variables. These subjective variables include, but are not limited to the Company’s expected stock price volatility over the expected term of the awards, and actual and projected stock option and warrant exercise behaviors and forfeitures.

Income Taxes

The Company accounts for income taxes in accordance with FASB ASC 740, “Income Taxes,” which requires the recognition of deferred income taxes for differences between the basis of assets and liabilities for financial statement and income tax purposes. Deferred tax assets and liabilities represent the future tax consequences for those differences, which will either be taxable or deductible when the assets and liabilities are recovered or settled. Deferred taxes are also recognized for operating losses that are available to offset future taxable income. A valuation allowance is established when necessary to reduce deferred tax assets to the amount expected to be realized.

| 9 |

AMERICAN EDUCATION CENTER, Inc. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

FOR THE THREE MONTHS ENDED MARCH 31, 2017 AND 2016

| 2. | SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (continued) |

Income Taxes (continued)

ASC 740 also addresses the determination of whether tax benefits claimed or expected to be claimed on a tax return should be recorded in the financial statements. Under ASC 740, the Company may recognize the tax benefit from an uncertain tax position only if it is “more likely than not” that the tax position will be sustained on examination by the taxing authorities, based on the technical merits of the position. The tax benefits recognized in the financial statements from such a position would be measured based on the largest benefit that has a greater than 50% likelihood of being realized upon ultimate settlement. ASC 740 also provides guidance on derecognition of income tax assets and liabilities, classification of current and deferred income tax assets and liabilities, and accounting for interest and penalties associated with tax positions. As of March31, 2017 and December 31, 2016, the Company does not have a liability for any unrecognized tax benefits.

The income tax laws of various jurisdictions in which the Company and its subsidiaries operate are summarized as follows:

United States (“US”)

The Company is subject to United States tax at 34%. Provisions for income taxes in the United States have been made for taxable income the Company had in the US for the three months ended March 31, 2017 and 2016.

United Kingdom (“UK”)

AEC Southern UK was incorporated in the United Kingdom and is governed by the income tax laws of England and Wales. According to current England and Wales income tax law, the applicable income tax rate for the Company is 20%.

Hong Kong

AEC Southern HK was formed in Hong Kong. Pursuant to the income tax laws of Hong Kong, the Company is not subject to tax on non-Hong Kong source income.

The People's Republic of China (“PRC”)

AEC Southern Shenzhen was incorporated in the PRC. Pursuant to the income tax laws of China, the Company is not subject to tax on non-China source income.

| 10 |

AMERICAN EDUCATION CENTER, Inc. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

FOR THE THREE MONTHS ENDED MARCH 31, 2017 AND 2016

| 2. | SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (continued) |

Fair Value Measurements

FASB ASC 820, “Fair Value Measurement,” specifies a hierarchy of valuation techniques based upon whether the inputs to those valuation techniques reflect assumptions other market participants would use based upon market data obtained from independent sources (observable inputs). In accordance with ASC 820, the following summarizes the fair value hierarchy:

| Level 1 Inputs – | Unadjusted quoted market prices for identical assets and liabilities in an active market that the Company has the ability to access. |

| Level 2 Inputs – | Inputs other than the quoted prices in active markets that are observable either directly or indirectly. |

| Level 3 Inputs – | Inputs based on prices or valuation techniques that are both unobservable and significant to the overall fair value measurements. |

FASB ASC 820 requires the use of observable market data, when available, in making fair value measurements. When inputs used to measure fair value fall within different levels of the hierarchy, the level within which the fair value measurement is categorized is based on the lowest level input that is significant to the fair value measurement. Valuation techniques used need to maximize the use of observable inputs and minimize the use of unobservable inputs.

The Company did not identify any assets or liabilities that are required to be presented at fair value on a recurring basis. Non-derivative financial instruments include cash, accounts receivable, prepaid expenses, accounts payable and accrued expenses, corporate taxes payable, and loan from stockholders. As of March 31, 2017 and December31, 2016, the carrying values of these financial instruments approximated their fair values due to their short term nature.

Use of Estimates

The preparation of consolidated financial statements in accordance with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect certain reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting periods. Actual results could differ from those estimates.

| 11 |

AMERICAN EDUCATION CENTER, Inc.AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

FOR THE THREE MONTHS ENDED MARCH 31, 2017 AND 2016

| 2. | SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (continued) |

Earnings (Loss) per Share

Earnings (loss) per share is calculated in accordance with FASB ASC 260, “Earnings Per Share.” Basic earnings (loss) per share is based upon the weighted average number of common shares outstanding during the period. Diluted earnings per share is based on the assumption that all dilutive convertible shares and stock options are converted or exercised. Dilution is computed by applying the treasury stock method. Under this method, options and warrants are assumed to be exercised at the beginning of the period (or at the time of issuance, if later), and as if funds obtained thereby were used to purchase common stock at the average market price during the period. Options and warrants are only dilutive when the average market price of the underlying common stock exceeds the exercise price of the options or warrants because it is unlikely they would be exercised if the exercise price were higher than the market price. Therefore, basic and diluted shares outstanding are the same for the three months ended March 31, 2017 and 2016.

| 12 |

AMERICAN EDUCATION CENTER, Inc. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

FOR THE THREE MONTHS ENDED MARCH 31, 2017 AND 2016

| 3. | RECENTLY ISSUED ACCOUNTING STANDARDS |

In May 2014, the FASB issued Accounting Standards Update (the “ASU”) No. 2014-09, "Revenue from Contracts with Customers (Topic 606).'' This guidance supersedes current guidance on revenue recognition in Topic 605, "Revenue Recognition.'' In addition, there are disclosure requirements related to the nature, amount, timing, and uncertainty of revenue recognition. In August 2015, the FASB issued ASU No.2015-14 to defer the effective date of ASU No. 2014-09 for all entities by one year. For public business entities that follow U.S. GAAP, the deferral results in the new revenue standard being effective for fiscal years, and interim periods within those fiscal years, beginning after December 15, 2017, with early adoption permitted for interim and annual periods beginning after December 15, 2016. In March 2016, the FASB issued ASU No. 2016-12, “Revenue from Contracts with Customers,” with respect to Principal versus Agent Considerations. In April 2016, the FASB issued ASU No. 2016-12, “Revenue from Contracts with Customers,” with respect to Identifying Performance Obligations and Licensing. In April 2016, the FASB additionally issued ASU No. 2016-12, “Revenue from Contracts with Customers,” with respect to Narrow-Scope Improvements and Practical Expedients. In December 2016, the FASB issued ASU No. 2016-20, “Revenue from Contracts with Customers,” with respect to Technical Corrections and Improvements. We do not believe the adoption will have a material impact on our consolidated financial statements.

In February 2016, the FASB issued ASU 2016-02, “Leases.” The new standard establishes a right-of-use (“ROU”) model that requires a lessee to record a ROU asset and a lease liability on the balance sheet for all leases with terms longer than 12 months. Leases will be classified as either finance or operating, with classification affecting the pattern of expense recognition in the income statement. The new standard is effective for fiscal years beginning after December 15, 2018, including interim periods within those fiscal years. A modified retrospective transition approach is required for lessees for capital and operating leases existing at, or entered into after, the beginning of the earliest comparative period presented in the financial statements, with certain practical expedients available. We are currently evaluating the impact of our pending adoption of the new standard on our financial statements.

| 13 |

AMERICAN EDUCATION CENTER, Inc. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

FOR THE THREE MONTHS ENDED MARCH 31, 2017 AND 2016

| 4. | CONCENTRATION OF CREDIT AND BUSINESS RISK |

The Company maintains its cash accounts at three commercial banks located in United States and one commercial bank in Hong Kong. The Company uses a commercial bank located in Hong Kong which is not covered by protection similar to that provided by the Federal Deposit Insurance Corporation (“FDIC”) on funds held in United States banks. The FDIC insures $250,000 per bank for the total of all depository accounts. At March 31, 2017, the Company’s US bank accounts had cash balances in excess of Federally insured limits of approximately $688,000. The Company performs ongoing evaluation of its financial institutions to limit its concentration of risk exposure. Management believes this risk is not significant due to the financial strength of the financial institution utilized by the Company.

The following table represents major customers which individually accounted for more than 10% of the Company’s gross revenue in the following periods:

| the three months ended March 31, 2017 | ||||||||||||||||

| Gross Revenue | Percentage | Accounts Receivable | Percentage | |||||||||||||

| Customer 1 | $ | 1,768,000 | 18.7 | % | $ | 215,000 | 3.0 | % | ||||||||

| Customer 2 | 5,609,000 | 59.3 | % | 5,504,000 | 84.2 | % | ||||||||||

| the three months ended March 31, 2016 | ||||||||||||||||

| Gross Revenue | Percentage | Accounts Receivable | Percentage | |||||||||||||

| Customer 1 | $ | 562,000 | 19.4 | % | $ | 376,000 | 31.8 | % | ||||||||

| Customer 2 | 317,000 | 11.8 | % | 105,000 | 8.9 | % | ||||||||||

| Customer 3 | 600,000 | 22.4 | % | 100,000 | 8.5 | % | ||||||||||

| 14 |

AMERICAN EDUCATION CENTER, Inc. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

FOR THE THREE MONTHS ENDED MARCH 31, 2017 AND 2016

| 5. | SEGMENT REPORTING |

Operating segments have been determined on the basis of reports reviewed by the president who is the chief operating decision maker of the group. The president considers the business from a geographic perspective and assesses performance and allocates resources on this basis. The reportable segments are as follows:

The Company has two operating segments, which are AEC New York and AEC Southern UK businesses.

AEC New York

Thebusiness is principally business consulting services, and student VIP services regarding language training, job placements, and academic tutorials.

AEC Southern UK

The business currently focuses on tailored executive and staff training and consulting to assist businesses in the food industry in meeting the ISO and the FDA standards.

Entity-Wide Disclosures

Revenues from external customers, gross profit, segment assets and liabilities for each business are as follows:

| For three months ended March 31,2017 | ||||||||||||

| AEC New York | AEC Southern UK | Total | ||||||||||

| Segment revenue: | ||||||||||||

| Business consulting services | $ | 2,022,055 | $ | 7,377,213 | $ | 9,399,268 | ||||||

| Student VIP services | 59,438 | - | 59,438 | |||||||||

| Total revenues | $ | 2,081,493 | $ | 7,377,213 | $ | 9,458,706 | ||||||

| Gross profit | $ | 460,164 | $ | 2,803,290 | $ | 3,263,454 | ||||||

| March 31, 2017 | ||||||||||||

| AEC New York | AEC Southern UK | Total | ||||||||||

| Segment assets and liabilities: | ||||||||||||

| Segment assets | $ | 2,681,058 | $ | 9,651,494 | $ | 12,332,552 | ||||||

| Segment liabilities | $ | 2,652,790 | $ | 3,658,282 | $ | 6,311,072 | ||||||

The Company didn’t have operating segments as it only has one subsidiary, AEC New York, during three months ended March 31, 2016.

| 15 |

AMERICAN EDUCATION CENTER, Inc. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

FOR THE THREE MONTHS ENDED MARCH 31, 2017 AND 2016

| 6. | DEFERRED COMPENSATION |

On October 31, 2016, a total of 1,500,000 shares were granted to AEC Southern UK’s CEO and vest over a three-year period commencing November 1, 2016. The shares were valued using the market price of the Company’s common stock on the grant date of $0.14 per share. On the grant date, $210,000 was recognized as deferred compensation, which will be expensed over the three year vesting period using the straight line method. As of March 31, 2017, the remaining deferred compensation was $180,834.

On December 31, 2016, a total of 6,000,000 shares were granted to the AEC Southern UK’s Chairman and vest over a three-year period commencing November 1, 2016. The shares were valued using the market price of the Company’s common stock on the grant date of $0.55 per share. As of March 31, 2017, $2,841,667 was recognized as deferred compensation, which will be expensed over the remaining two year and seven months using the straight line method.

Future amortization of the deferred compensation is as follows:

| Year Ending December 31, | ||||

| 2017 | $ | 877,500 | ||

| 2018 | 1,170,000 | |||

| 2019 | 975,001 | |||

| Total | $ | 3,022,501 | ||

Stock compensation expense was $292,500 and $0 for the three months ended March 31, 2017 and 2016, respectively.

| 7. | SECURITY DEPOSITS |

The Company has security deposits with the landlords of $266,021as of March 31, 2017 and December 31, 2016.

| 16 |

AMERICAN EDUCATION CENTER, Inc. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

FOR THE THREE MONTHS ENDED MARCH 31, 2017 AND 2016

| 8. | INTANGIBLE ASSET |

The customized computer system acquired is being amortized on a straight line basis over four and a half years. The gross carrying amount and accumulated amortization of this assets as of March 31, 2017 and December 31, 2016 are as follows:

| March 31, 2017 | December 31, 2016 | |||||||

| Intangible asset | $ | 612,814 | $ | 612,814 | ||||

| Less: accumulated amortization | (68,090 | ) | (34,045 | ) | ||||

| Intangible asset - net | $ | 544,724 | $ | 578,769 | ||||

For the three months ended March 31, 2017 and 2016, amortization expense was $34,045 and $0, respectively.

The following table is the future amortization expense to be recognized:

| Year Ending December 31, | ||||

| 2017 | $ | 102,136 | ||

| 2018 | 136,181 | |||

| 2019 | 136,181 | |||

| 2020 | 136,181 | |||

| 2021 | 34,045 | |||

| Total | $ | 544,724 | ||

| 17 |

AMERICAN EDUCATION CENTER, Inc.AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

FOR THE THREE MONTHS ENDED MARCH 31, 2017 AND 2016

| 9. | DEFERRED REVENUE |

The Company receives advance payments for services to be performed and recognizes revenue when the services have been rendered. The deferred revenue at March 31, 2017 and December 31, 2016 was $551,035 and $177,132, respectively.

| 10. | RELATED-PARTY TRANSACTIONS |

The loan from stockholders of $113,906 as of March 31, 2017 and December 31, 2016, respectively, represents an unsecured non-interest bearing loan, arising from expenses paid on behalf of the Company. The loan is due on demand.

The Company’s President/Chairman/Chief Financial Officer/Secretary has a 34% interest in Columbia International College, Inc. (“CIC”). In the normal course of business, the Company conducts certain transactions with CIC. Included in accounts receivable is an amount due from CIC of $21,500 as of March 31, 2017 and December 31, 2016. The Company paid $0and $175,000 for consulting services to CIC for the three months ended March 31, 2017 and 2016, respectively.

AEC New York’s Chief Operating Officer also serves as Chief Executive Officer of Wall Street Innovation Center, Inc. (“WSIC”). The Company entered into a sublease agreement with WSIC in March 2016, which expires in February 2021. WSIC paid the annual rent of $250,000 in advance. In the normal course of business, the Company conducts certain transactions with WSIC. Included in accounts payable is an amount due to WSIC of $110,000 as of March 31, 2017 and December 31, 2016.

| 18 |

AMERICAN EDUCATION CENTER, Inc.AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

FOR THE THREE MONTHS ENDED MARCH 31, 2017 AND 2016

| 11. | LONG-TERM LOAN |

On December 1, 2014, an unrelated third party loaned the Company $295,579, with interest at 10%. The loan is to be repaid on December 13, 2019. Interest will be paid on the last day of each quarter from 2015 to 2019, except for the last payment, which will be made on December 12, 2019.Interest expense for each of three months ended March 31, 2017 and 2016 was $7,389.

| 12. | LEASE COMMITMENTS |

In December 2014, the Company entered into a lease for office space with an unrelated party, expiring on July 31, 2025. The lease was to commence on December 11, 2014, however, due to renovation issues, the lease was amended and commenced on March 1, 2015 and the Company received two months of free rent. Due to free rent and escalating monthly rental payments, utilities, real estate taxes, insurance and other operating expenses, the lease is being recognized on a straight-line basis of $34,066 per month for financial statement purposes which creates deferred rent as shown on the balance sheets. In February 2016, the Company entered into a sublease agreement to lease space to WSIC for an annual rental of $250,000. The sublease commenced on March 1, 2016 and expires on February 28, 2021. The sublease income will be netted against the Company’s rent expense. Rent expense, net of sublease income, was approximately $39,698 and $95,938 for three months ended March 31, 2017 and 2016, respectively.

Future minimum lease commitments are as follows:

| Year Ending December 31, | Gross Lease Payment | Sublease Income | Net Amount | |||||||||

| 2017 | $ | 369,621 | $ | 250,000 | $ | 119,621 | ||||||

| 2018 | 378,862 | 250,000 | 128,862 | |||||||||

| 2019 | 388,333 | 250,000 | 138,333 | |||||||||

| 2020 | 418,604 | 250,000 | 168,604 | |||||||||

| 2021 | 439,350 | 41,666 | 397,684 | |||||||||

| 2022 and thereafter | 1,666,383 | - | 1,666,383 | |||||||||

| Total | $ | 3,661,153 | $ | 1,041,666 | $ | 2,619,487 | ||||||

| 19 |

AMERICAN EDUCATION CENTER, Inc. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

FOR THE THREE MONTHS ENDED MARCH 31, 2017 AND 2016

| 13. | Income taxes |

The component of deferred tax assets at March 31, 2017 and December31, 2016is as follows:

| 2017 | 2016 | |||||||

| Net operating loss carryforwards | $ | 36,267 | $ | 97,936 | ||||

The provision for income taxes for the three months ended March 31consists of the following:

| 2017 | 2016 | |||||||

| Current: | ||||||||

| Federal | $ | - | $ | 58,976 | ||||

| State | - | 34,082 | ||||||

| Foreign | 288,616 | - | ||||||

| Total current | 288,616 | 93,058 | ||||||

| Deferred: | ||||||||

| Federal | 39,083 | - | ||||||

| State | 22,586 | - | ||||||

| Foreign | - | - | ||||||

| Total deferred | 61,669 | - | ||||||

| Total | $ | 350,285 | $ | 93,058 | ||||

The Company conducts business globally and, as a result, files income tax returns in the US federal jurisdiction, state and city, and foreign jurisdictions. In the normal course of business, the Company is subject to examination by taxing authorities throughout the world, including jurisdictions in the US and UK. The Company is subject to income tax examinations of US federal, state, and city for 2015, 2014 and 2013 tax years and of UK for 2016.The Company is not currently under examination nor have they been notified by the authorities.

| 20 |

AMERICAN EDUCATION CENTER, Inc. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

FOR THE THREE MONTHS ENDED MARCH 31, 2017 AND 2016

13. Income taxes (continued)

A reconciliation of the provision for income taxes, with the amount computed by applying the statutory federal income tax rate for the three months ended March 31is as follows:

| 2017 | 2016 | |||||||

| Tax at federal statutory rate | 34.0 | % | 34.0 | % | ||||

| State and local taxes, net of federal benefit | 10.8 | 10.8 | ||||||

| Tax impact of foreign operations | (20.0 | ) | - | |||||

| Non-deductible/ non-taxable items | (0.1 | ) | - | |||||

| Changes in tax reserves | - | 1.2 | ||||||

| Other | (2.6 | ) | - | |||||

| Total | 22.1 | % | 46.0 | % | ||||

| 21 |

AMERICAN EDUCATION CENTER, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

FOR THE THREE MONTHS ENDED MARCH 31, 2017 AND 2016

| 14. | ISSUANCE OF COMMON STOCK |

On October 31, 2016, the Company issued 1,500,000 shares of common stock at the market price of $0.14 per share for deferred compensation of AEC Southern UK’s CEO to be earned over three years commencing November 1, 2016.Amortization of deferred compensation was $17,500and $0 for the three months ended March 31, 2017 and 2016, respectively.

On December 31, 2016, the Company entered into an agreement to issue 6,000,000 shares of common stock at the market price of $0.55 per share for deferred compensation of AEC Southern UK’s chairman to be earned over three years commencing November 1, 2016.Amortization of deferred compensation was $275,000, and $0 for the three months ended March 31, 2017 and 2016.The agreement also agrees to issue up to 4,000,000 shares of common stock to AEC Southern UK’s chairman of which 2,000,000 shares (“Tranche 1”) shall be issued if AEC Southern UK’s revenue reaches at least $20,000,000 for any calendar years ending after December 31, 2016, and the remaining 2,000,000 shares (“Tranche 2”) shall be issued if revenue reaches at least $20,000,000 for any years ending December 31 after Tranche 1 has been achieved. As of March 31, 2017, no incentive shares of common stock were earned.

| 22 |

AMERICAN EDUCATION CENTER, Inc. AND SUBSIDIARies

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

FOR THE THREE MONTHS ENDED MARCH 31, 2017 AND 2016

| 15. | STOCK OPTIONS |

The Company didn’t grant or exercise any options during the three months ended March 31, 2017.

The following is a summary of stock option activity:

| Shares | Weighted Average Exercise Price | Weighted- Average Remaining Contractual Life | Aggregate Intrinsic Value | |||||||||||||

| Outstanding at December 31, 2016 | 3,200,000 | $ | 2.45 | 6.87 years | $ | - | ||||||||||

| Granted | - | - | - | - | ||||||||||||

| Exercised | - | - | - | - | ||||||||||||

| Cancelled and expired | - | - | - | - | ||||||||||||

| Forfeited | - | - | - | - | ||||||||||||

| Outstanding at March 31, 2017 | 3,200,000 | $ | 2.45 | 6.62 years | $ | - | ||||||||||

| Vested and expected to vest at December March 31, 2017 | 140,000 | $ | 1.00 | 4.50 years | $ | - | ||||||||||

| Exercisable at March, 2017 | 140,000 | $ | 1.00 | 4.50 years | $ | - | ||||||||||

The aggregate intrinsic value is calculated as the difference between the exercise price of the underlying awards and the quoted price of the Company’s common stock. There were no options exercised during the three months ended March 31, 2017 and 2016.

Total recognized compensation expense related to all the above options was $0 and $0 for the three months ended March 31, 2017 and 2016, respectively.

| 23 |

AMERICAN EDUCATION CENTER, Inc. AND SUBSIDIARies

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

FOR THE THREE MONTHS ENDED MARCH 31, 2017 AND 2016

| 16. | SUBSEQUENT EVENTS |

The Company’s management has performed subsequent events procedures through May 15, 2017, which is the date the consolidated financial statements were available to be issued. There were no subsequent events requiring adjustment to or disclosure in the consolidated financial statements.

| 24 |

ITEM 2. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

The following discussion and analysis of financial condition and results of operations relates to the operations and financial condition reported in the unaudited condensed consolidated financial statements of the Company for the three months ended March 31, 2017 and 2016, and should be read in conjunction with such financial statements and related notes included in this report. Except for the historical information contained herein, the following discussion, as well as other information in this report, contain “forward-looking statements,” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, and are subject to the “safe harbor” created by those sections. Actual results and the timing of the events may differ materially from those contained in these forward looking statements due to a number of factors, including those discussed in the “Forward-Looking Statements” set forth elsewhere in this Quarterly Report on Form 10-Q.

Overview

AEC Nevada was incorporated in May 2014 as a holding company, and operates in the U.S. through its wholly owned subsidiary, AEC New York, operates in China through its wholly owned subsidiaries, AEC Southern UK and the AEC Southern Subsidiaries. Through our AEC New York operation, we are devoted to international education exchanges and provide education-related consulting services such as educational and career enrichment opportunities to students, educators and educational institutions in both the PRC and the United States. Our mission is to provide “one-stop comprehensive services” to international students, educators, educational institutions and corporate entities. Our services include admission applications, visa applications, living accommodations and other consulting services to Chinese students who wish to study in the United States, placement services to qualified American educators to teach and live in China, as well as U.S. relocation services to employees of multi-national companies with U.S. operations.

AEC Southern UK and AEC Southern Subsidiaries currently focus on providing executives services, specifically, tailored executive and staff training and consulting. Since AEC Nevada’s acquisition of AEC Southern UK and AEC Southern Subsidiaries in October 2016, the Company has provided tailored executive services to assist executives in the food industry businesses in meeting the ISO (“ISO 9001 Quality Management”) and FSA (“Food Standards Agency”) standards.

There are two separate operating groups within AEC. In combination, they provide five types of consulting services.

| · | Student & Family Services, |

| · | Institutional Services, |

| · | Student Exchange Programs, |

| · | Executive Services, and |

| · | Educator Placements. |

Our Student & Family Servicesprovide guidance and consulting services to help our client students and their families throughout the school application and admission process, and continuing with their studying and living needs while they complete their degrees. Beyond graduation, we can continue to help them secure suitable internships and other career development opportunities in the United States.

Our Student & Family Services fall into three sub-categories: Academic, Life and Career.

The Academic offering focuses on providing admission services for Chinese students to study in the U.S., English as a Second Language (ESL) training program, and the Elite 100 program. For middle school students, we assist in providing information on U.S. high schools. We also help high school graduates with admissions applications to U.S. colleges and universities.

We place ESL teachers in our representative office in China to conduct ESL programs. Students who enroll in this program receive preparation in taking ESL tests and will obtain certificates upon successfully passing these tests.

| 25 |

AEC’s Elite 100 Program provides consulting services to talented Chinese students to enable them to reach a comprehensive understanding of American politics, business, science, education, culture and other areas. We offer academic consulting services to these top Chinese students to apply to prestigious colleges and universities in the United States. In connection with our admission services, we assist these students in arranging campus tours, writing programs, tailored ESL language programs and interview guidance. After the students are admitted into U.S. colleges/universities, we provide consulting services in connection with applications for a second major, transfers, housing accommodations, accelerated degree applications and other services. We enroll the students in seminars and events in which we partner with other business organizations, governments, non-government organizations (“NGOs”), scholars and universities to help these students build social networks and cultivate their leadership skills. We also help arrange extracurricular activities tailored for each student, such as organized artistic endeavors including dance, music, painting, photography and other performance events to enrich their cultural experience.

Our Life program offers consulting services, including personalized VIP services, to assist our Chinese customers to settle in the U.S. so they can focus effectively on their studies, as well as VIP services for the families of our students to visit and/or settle in the U.S. The Company refers its customers to its business partners in the U.S. to assist the customers with purchasing real estate properties, organizing their personal financial management and investment needs, buying insurance and starting businesses. These VIP services provide “concierge services” personally tailored for our clients to meet almost all aspects of their needs during their stay in the U.S. Every VIP client has an exclusive consultant to help meet his or her needs and monitors their progress along the way, so that a customized career plan can be developed taking into consideration changing conditions. VIP services include high school enrollment, college applications, medical insurance, parental travel support, housing, legal and immigration status, internship, job application and referrals to financial and real estate investment advisory firms and other related services.

Our Career program focuses on clients’ career development by identifying internship and work opportunities that are suitable to their educational background and experience level. Through this program we strive to provide clients with potential career paths, assist them in every step of the way from academic improvement to career assistance. In addition, we introduce our student customers to companies and prospective employers that may potentially provide internships and part-time or full-time work opportunities to our student customers.

Our Institutional Services assist U.S. institutions such as middle schools, high schools, and universities and colleges, to enroll students from China by establishing alliances and strategic business partnerships with colleges and universities in China. Educational institutions in the U.S. retain us to reach, market to and recruit a broad population of prospective students. Although many U.S. educational institutions are interested in attracting more students from China to diversify their student bodies, they often have a difficult time marketing to and enrolling students from China often due to lack of understanding Chinese culture and access to qualified students. We serve as an international liaison to provide marketing services to students in China. We enter into agreements with U.S. schools to market their institutions, academic programs, local environment and their students’ lifestyle on their behalf

Pursuant to our Student Exchange Programs, we recruit and enroll Chinese students in U.S. educational institutions for Exchange Programs, whereby students will finish the remainder of their education and receive their diplomas in China.

As part of our Executive Services, we provide services to Chinese and other multi-national corporate clients whose executives are moving to the U.S. for work. We assist them in all aspects of relocation as well as their preparation for visa applications, as well as offering a full range of family support services.

Additionally, our Executive Services also offer targeted and tailored executive training services provided through our AEC Southern subsidiary. Currently we have two enterprise clients who from time to time request from us customized training courses for their senior executives in specific areas such as regulatory compliance, human resources management, organizational management, business model development, and government relations. To provide this type of training we work with third-party vendors to design one-week or two-week training programs conforming to our clients' specifications. We organize and arrange the training sessions, while the instructors are provided by our vendors.

| 26 |

Finally, our Educator Placement services are designed to meet the increasing demands for foreign teachers in both the U.S. and China. Our program helps teachers in the U.S. or China who plan to gain experience in another country find the most suitable positions. We also recruit and place native English speaking teachers for our clients and business partners in China, and recruit and place Chinese-speaking teachers in U.S. educational institutions. In order to ensure that educators experience a smooth transition, we also provide local services to educators, which include settlement services, financial services, assistance with insurance coverage, tax services, living services, as well as business consulting services.

Please refer our Form 10-K for fiscal year of 2016, which was filed on April 17th 2017 for more information about our operations.

Pursuant to Accounting Standard Codification 280 “Segment Reporting” (“ASC 280”), we are required to identify reportable segments. Given the following criteria, we identify AEC has two reporting segments: AEC US and AEC Southern UK: 1. These two segments engage two sets of customers and venders to generate revenue and incur expenses; 2.Separate financial informationis generated for these two segments and; 3. Based on these financial reports and other segment specific information, the chief operating decision maker determines the resources to be allocated and evaluate the performance, of each segment.

Significant Accounting Policies

The discussion and analysis of our financial condition and results of operations is based upon our financial statements, which have been prepared in accordance with accounting principles generally accepted in the United States of America (GAAP). The preparation of these financial statements requires us to make estimates and judgments that affect the reported amounts of assets and liabilities. On an on-going basis, we evaluate our estimates including the allowance for doubtful accounts, income taxes and contingencies. We base our estimates on historical experience and on other assumptions that we believe to be reasonable under the circumstances, the results of which form our basis for making judgments about the carrying values of assets and liabilities that are not readily apparent from other sources. Actual results may differ from these estimates under different assumptions or conditions. The consolidated financial statements are comprised of AEC Nevada and its wholly owned subsidiaries, AEC New York and AEC Southern. All significant intra company accounts and transactions have been eliminated in consolidation.

As part of the process of preparing our consolidated financial statements, we are required to estimate our income taxes. This process involves estimating our current tax exposure together with assessing temporary differences resulting from differing treatment of items for tax and accounting purposes. These differences result in deferred tax assets and liabilities. As of March 31, 2017, the Company does not have a liability for any unrecognized tax benefits.

We cannot predict what future laws and regulations might be passed that could have a material effect on our results of operations. We assess the impact of significant changes in laws and regulations on a regular basis and update the assumptions and estimates used to prepare our financial statements when we deem it necessary.

We have determined the significant principles by accounting policies that involve the most complex and subjective decisions or assessments. While our significant accounting policies are more fully described in Note 2 to our financial statements, we believe that the following accounting policies are the most critical to aid you in fully understanding and evaluating this “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” Both operating groups are reported under the same accounting policies/estimations.

Revenue is recognized when the following criteria are met: (1) when persuasive evidence of an arrangement exists; (2) delivery of the services service has occurred; (3) the fee is fixed or determinable; and (4) collectability of the resulting receivable is reasonably assured. Tuition and consulting fees are generally paid in advance upon service engagement and are recognized when all services are rendered, net of refunds, if any. Tuition fees are recognized when reliable estimates of the number of students enrolled in the program are available upon the class completion. Consulting services that have refund provisions are recognized when such provisions have been fulfilled and refund provision are no longer applicable. Beginning January 1, 2014, the Company has discontinued utilizing the refund provisions in its consulting agreements and recognizes deferred revenue based on completion of the service.

| 27 |

Revenues are recognized on principal standing as AEC UK and AEC US companies meet the following criteria: a. AEC assumes primary obligation in the arrangements, b. AEC has latitude in setting price charged to customers, c. AEC has the ability to change the products delivered or service provided, d. AEC has discretion in vender selection, f. AEC determines the product and service specifications and e. AEC assumes credit risks.

Recent Accounting Pronouncements

In February 2016, the FASB issued ASU 2016-02, Leases. The new standard establishes a right-of-use (“ROU”) model that requires a lessee to record a ROU asset and a lease liability on the balance sheet for all leases with terms longer than 12 months. Leases will be classified as either finance or operating, with classification affecting the pattern of expense recognition in the income statement. The new standard is effective for fiscal years beginning after December 15, 2018, including interim periods within those fiscal years. A modified retrospective transition approach is required for lessees for capital and operating leases existing at, or entered into after, the beginning of the earliest comparative period presented in the financial statements, with certain practical expedients available. We are currently evaluating the impact of our pending adoption of the new standard on our financial statements.

In August 2014, the FASB issued ASU 2014-15, Presentation of Financial Statements—Going Concern (Subtopic 205-40): Disclosure of Uncertainties about an Entity’s Ability to Continue as a Going Concern. ASU 2014-15 provides guidance in GAAP about management’s responsibility to evaluate whether there is substantial doubt about an entity’s ability to continue as a going concern and to provide related footnote disclosures. In doing so, the amendments should reduce diversity in the timing and content of footnote disclosures. The amendments in ASU 2014-15 are effective for the annual period ending after December 15, 2016, and for annual periods and interim periods thereafter. Early application is permitted. This accounting standard update is not expected to have a material impact on the Company’s financial statements.

In May 2014, the FASB issued ASU 2014-09, Revenue from Contracts with Customers, which supersedes the revenue recognition requirements in ASC 605, Revenue Recognition. The core principle of this updated guidance is that an entity should recognize revenue to depict the transfer of promised goods or services to customers in an amount that reflects the consideration to which the entity expects to be entitled in exchange for those goods or services. The new rule also requires additional disclosure about the nature, amount, timing and uncertainty of revenue and cash flows arising from customer contracts, including significant judgments and changes in judgments and assets recognized from costs incurred to obtain or fulfill a contract. This guidance is effective for annual reporting periods beginning after December 15, 2017, including interim periods within that reporting period. Companies are permitted to adopt this new rule following either a full or modified retrospective approach. Early adoption is not permitted. This accounting standard update is not expected to have a material impact on the Company’s financial statements.

Results of Operations

Below we have included a discussion of our operating results and material changes in our operating results during the three months ended March 31, 2017 compared to the three months ended March 31, 2016. Our revenue and operating results normally fluctuate as a result of seasonal or other variations in our enrollments and the extent of expenses required in using consulting services from third-parties. Our student population varies as a result of new enrollments and other reasons that we cannot always anticipate. We expect quarterly fluctuations in operating results to continue as a result of various enrollment patterns and services as well as changes in expenses.

For additional information on the potential risks associated with these initiatives and our operations, please refer to the Risk Factors sections in our annual report on Form 10-K for the period ended December 31, 2016.

| 28 |

The following table sets forth information from our statements of operations for the three months period ended March 31, 2017 and 2016:

| AMERICAN EDUCATION CENTER, INC. AND SUBSIDIARIES |

| CONSOLIDATED STATEMENTS OF OPERATIONS (UNAUDITED) |

| Three Months Ended March 31, | ||||||||

| 2017 | 2016 | |||||||

| Revenues | $ | 9,458,706 | $ | 2,683,804 | ||||

| Costs and expenses: | ||||||||

| Consulting services | 6,195,252 | 1,973,517 | ||||||

| Application fees | - | 44,772 | ||||||

| General and administrative | 1,683,372 | 467,480 | ||||||

| Total costs and expenses | 7,878,624 | 2,485,769 | ||||||

| Income from operations | 1,580,082 | 198,035 | ||||||

| Other income | - | 4,392 | ||||||

| Income before provision for income taxes | 1,580,082 | 202,427 | ||||||

| Provision for income taxes | 350,285 | 93,058 | ||||||

| Net income | $ | 1,229,797 | $ | 109,369 | ||||

| Earnings per share - basic and diluted | $ | 0.03 | $ | 0.00 | ||||

| Weighted average shares outstanding, basic and diluted | 41,350,000 | 30,000,000 | ||||||

Revenue

The Company generates revenue from two separate segments: AEC US (the business generated by AEC New York) and AEC Southern UK. Our revenues are generated from consulting services to individuals and companies including our Elite 100 services and parent services and student VIP services through AEC New York and Executive services through AEC Southern UK.

AEC US’s business is principally consulting services and student VIP services regarding language training, job placement and academic tutorials.

| 29 |

AEC Southern UK’s business currently focuses on tailored executive and staff training and consulting. These services are tailored to assist businesses in food industry in meeting the ISO (“ISO 9001 Quality Management”) and FSA (“Food Standards Agency”) standards.

Our aggregate revenue from both AEC US and AEC Southern UK, for the three months period ended March 31, 2017 were $9,458,706 representing an increase of $6,774,902, or 252% from $2,683,804 for the three months period ended March 31, 2016. The growth was mainly driven by an increase in the number of clients participating in our student services and company services, and steady performance from AEC UK’s consulting service in China.

Revenue from AEC US decreased by $602,311, or 22% from $2,683,804 for 3 month ended March 31st from prior year. This decline reflects the Chinese bureau of foreign currency administration’s new currency regulation. Through AEC Southern UK, we offer food safety compliance/consulting services. These food safety services are currently utilized by two companies in the PRC. Revenue from these services was $7,377,213 for the 3 months ended March 31, 2017.

The aggregate revenue generated from consulting services to companies increased by $7,482,693 or 390% to $9,399,268 for the 3 months ended March 31, 2017 from $1,916,575 for the same period in the prior year. The increase is primarily due to the expansion of our services, specifically the food safety compliance/consulting services in China, which contributed $7,377,213 to the overall increase.

The aggregate revenue generated from consulting services to students and parents declined by $707,791, all of which decrease came from AEC US’s business.The decline was mainly attributable to tighter foreign currency regulations promulgated by the Chinese government. To restrict foreign currency outflows, the Chinese State Administration of Foreign Exchange issued a notice in September 2015, followed up with an online monitoring system to deter and monitor so called “Ant Moving” (multiple purchases in relatively small amounts).

These regulations affected AEC US’s business as customers unfamiliar with compliance with the new regulations encountered obstacles in securing enough foreign currency to pay our bills. AEC anticipated the impact of these regulations and has been working to mitigate its effects by 1. providing more value-added services to students and parents in the US, 2. working to identify those clients in China with greater ability to work within the framework of the new regulations.

The increase in revenue in 2017 was a result of expansion in our operations related to the variety of services we provide to our clients. We have more referrals from past and current clients, and have been focusing on the development and promotion of our education-related services in our main market, the PRC, through partnering with additional marketing agents in tier-one cities and opening representative offices in our local markets in the PRC.

Generally, we have benefited from increasing demand for education-related services in the PRC in the last decade. This increase was driven by the overall economic growth, the rise in household disposable income and household spending on education, as well as the trend of welcoming Chinese students in U.S. universities and colleges.

Revenue by reporting segments are broken down as following: AEC US, total revenue $2,081,493 , consist of consulting revenue to company $2,022,055, and student VIP service $59,438; AEC Southern UK, total revenue $7,377,213, all of which was consulting revenue to company.

Total Cost and Expenses

Our overall cost and expenses increased by $5,392,855 or 217%, to $7,878,624 for the three months period ended March 31, 2017 from $2,485,769 for the same period in the prior year.

Cost and expenses for providing our services to our clients are comprised of the cost of third-party consulting services, application fees, and general and administrative expenses.

Consulting Services

Cost of consulting services for the three months period ended March 31, 2017 was $6,195,252, an increase of $4,221,735 or 214% from $1,973,517 for the three months period ended March 31, 2016, which is primarily attributable to the rapid expansion of our business operations, especially with AEC UK’s consulting services in China. We expect our consulting services to increase further in accordance with further expansion of our business operations.

Consulting services cost by reporting segment are broken down as follows: AEC US, cost of consulting services $1,621,329 ; AEC Southern UK, cost of consulting services $4,573,923.

General and Administrative Expenses

General and administrative expenses consist primarily of compensation and related costs for personnel and facilities, and include costs related to human resources, information technology and legal organizations, as well as fees for professional services and marketing and promotion expenses. Our general and administrative expenses were $1,683,372 for the three months ended March 31, 2017, and $467,480 for the three months ended March 31, 2016, indicating an increase of 260% or $1,215,892. This was mainly due to increase in marketing expense ($1,076,526) and personnel compensation ($300,033), particularly from AEC Southern UK’s operations.

| 30 |

General and administrative expenses by reporting segment are broken down as follows: AEC US, total general and administrative expenses $323,160; AEC Southern UK total general and administrative expenses $1,360,212.

Income taxes

The provision for taxes for the three months ended March 31, 2017 principally relates to federal, state, local and foreign jurisdiction income taxes. Income taxes for the three months ended March 31, 2016 relate principally to the creation of a valuation allowance for deferred tax assets principally related to the net operating loss carry forwards and the allowance for doubtful accounts due to the uncertainty of their realization.

The provision for income tax was $350,285 for the 3 months ended March 31, 2017, an increase of $257,227 or 276% from $93,058 for the 3 months ended March 31, 2016.

Income tax by reporting segment is broken down as follows: AEC US, tax expense of $61,669, AEC Southern UK, tax expense of $288,616.

| 31 |

Net Income

Net income was $1,229,797 or $0.03 per share basic and diluted, for the three months ended March 31, 2017, compared to net income of $109,369 or $0.00 per share basic and diluted for the three months ended March 31, 2016, an increase of $1,120,428 of 1024.45%.

Net income is broken down by reporting segments as follows: AEC US net income of $75,335, AEC Southern UK net income of $1,154,462.

| AMERICAN EDUCATION CENTER, INC. AND SUBSIDIARIES |

| CONSOLIDATED BALANCE SHEETS |

| March 31, | December 31, | |||||||

| 2017 | 2016 | |||||||

| (Unaudited) | ||||||||

| ASSETS | ||||||||

| Current assets: | ||||||||

| Cash | $ | 1,867,310 | $ | 2,290,429 | ||||

| Accounts receivable, net of allowance for doubtful accounts of $63,000 at March 31, 2017 and December 31, 2016 | 6,510,883 | 2,887,837 | ||||||

| Prepaid expenses | 84,846 | 61,600 | ||||||

| Total current assets | 8,463,039 | 5,239,866 | ||||||

| Noncurrent assets: | ||||||||

| Deferred compensation | 3,022,501 | 3,315,001 | ||||||

| Deferred income taxes | 36,267 | 97,936 | ||||||

| Intangible asset, net | 544,724 | 578,769 | ||||||

| Security deposits | 266,021 | 266,021 | ||||||

| Total noncurrent assets | 3,869,513 | 4,257,727 | ||||||

| TOTAL ASSETS | $ | 12,332,552 | $ | 9,497,593 | ||||

| LIABILITIES AND STOCKHOLDERS' EQUITY | ||||||||

| Current liabilities: | ||||||||

| Accounts payable and accrued expenses | $ | 4,386,306 | $ | 3,452,231 | ||||

| Taxes payable | 793,031 | 511,355 | ||||||

| Deferred revenue | 551,035 | 177,132 | ||||||

| Loan from stockholders | 113,906 | 113,906 | ||||||

| Total current liabilities | 5,844,278 | 4,254,624 | ||||||

| Noncurrent liabilities: | ||||||||

| Deferred rent | 171,215 | 155,707 | ||||||

| Long-term loan | 295,579 | 295,579 | ||||||

| Total liabilities | 6,311,072 | 4,705,910 | ||||||

| Stockholders’ equity: | ||||||||