Attached files

| file | filename |

|---|---|

| EX-32 - EXHIBIT 32 OFFICER CERTIFICATIONS - WOLVERINE WORLD WIDE INC /DE/ | a2017-q1exhibit32.htm |

| 10-Q - FORM 10-Q - WOLVERINE WORLD WIDE INC /DE/ | wolverineform10-q2017xq1.htm |

| EX-31.2 - EXHIBIT 31.2 CFO CERTIFICATION - WOLVERINE WORLD WIDE INC /DE/ | a2017-q1exhibit312.htm |

| EX-31.1 - EXHIBIT 31.1 CEO CERTIFICATION - WOLVERINE WORLD WIDE INC /DE/ | a2017-q1exhibit311.htm |

| EX-10.4 - EXHIBIT 10.4 SERP - WOLVERINE WORLD WIDE INC /DE/ | a2017-q1exhibit104serp.htm |

| EX-10.3 - EXHIBIT 10.3 PENSION PLAN - WOLVERINE WORLD WIDE INC /DE/ | a2017-q1exhibit103pension.htm |

| EX-10.1 - EXHIBIT 10.1 FORM OF AWARD - WOLVERINE WORLD WIDE INC /DE/ | a2017-q1exhibit101rsuaward.htm |

Exhibit 10.2

FORM OF PERFORMANCE RESTRICTED STOCK UNIT AWARD AGREEMENT

Performance Restricted Stock Unit Agreement # |

PERFORMANCE RESTRICTED STOCK UNIT AWARD AGREEMENT

This Performance Restricted Stock Unit Award Agreement (together with Attachment 1 hereto, the “Agreement”) is made as of the award date set forth in the grant (the “Grant Date”), by and between WOLVERINE WORLD WIDE, INC., a Delaware corporation (“Wolverine” or the “Company”), and the employee identified in the grant (“Employee”).

Wolverine maintains a Stock Incentive Plan of 2016 (as amended from time to time, the “Plan”) that is administered by the Compensation Committee of Wolverine’s Board of Directors (the “Committee”), under which the Committee may award restricted stock units as all or part of a long-term incentive award. The Plan has been approved by the Company’s shareholders.

The Committee has determined (i) that Employee is eligible to participate in the Plan and receive a long-term incentive award, (ii) Employee’s participation level, and (iii) the performance criteria for the award. The Committee has awarded to Employee restricted stock units of Wolverine subject to the terms, conditions and restrictions contained in this Agreement and in the Plan (the “Restricted Stock Unit Award”). Employee acknowledges receipt of a copy of the Plan and accepts this Restricted Stock Unit Award subject to all such terms, conditions and restrictions.

1.Award. Wolverine hereby awards to Employee the Restricted Stock Unit Award consisting of a target number of restricted stock units as set forth in the grant (the “Restricted Stock Units”), which shall be eligible to vest in accordance with the terms of this Agreement and the Plan. The ultimate “Incentive Award” received by Employee will be the number of Restricted Stock Units that vest hereunder as determined by the Committee. Each Restricted Stock Unit represents the conditional right to receive, without payment but subject to the terms, conditions and limitations set forth in this Agreement and in the Plan, one share of common stock of the Company (“Common Stock”) in accordance with this Agreement. On the Payout Date, the Company shall deliver to Employee a number of shares of Common Stock in respect of the Restricted Stock Units that vest hereunder, together with any Dividend Equivalents (as defined below) thereon, or, at the option of the Company, a cash payment in an amount equal to the Fair Market Value on the Payout Date multiplied by the number of shares of Common Stock in respect of the Restricted Stock Units that vest hereunder, together with any Dividend Equivalents thereon, subject to any applicable withholdings required by applicable law.

2. Consideration. Employee acknowledges that the Award referenced in Section 1 as well as any discretionary cash bonus that Employee receives in February 2017 constitute adequate consideration for the execution of the Employee Confidentiality, Intellectual Property Protection, Non-Solicitation and Non-Competition Agreement.

3. Transferability. Until the Restricted Stock Units vest as set forth in Section 4 below and Attachment 1, the Plan provides that Restricted Stock Units are generally not transferable by Employee except by will or according to the laws of descent and distribution. The Plan further provides that all rights with respect to the Restricted Stock Units are exercisable during Employee’s lifetime only by Employee, Employee’s guardian or legal representative.

4. Vesting. Except as otherwise provided in this Agreement or by action of the Committee to reduce the number of Restricted Stock Units that would otherwise vest hereunder, the Restricted Stock Units shall vest as set forth in Attachment 1.

5. Termination of Employment Status.

(a) | Except as set forth in subsection (b) or Section 6 below, Employee: |

(i) must be an employee of the Company or one of its subsidiaries at the time the Committee certifies the achievement of the Performance Period performance criteria for the vesting of any portion of the Restricted Stock Unit Award (the performance criteria being Cumulative BVA, Cumulative EPS, and TSR Percentile Ranking, as defined in Attachment 1); and

(ii) shall forfeit the entire unvested Restricted Stock Unit Award if, before such certification, Employee’s employment with Wolverine or its subsidiaries terminates (the “Employment Termination”) or the Committee terminates the Restricted Stock Unit Award (an “Award Termination”).

(b) If the Employment Termination is:

(i) due to Employee’s:

(1) disability (as defined in Wolverine’s long-term disability plan);

(2) death;

(3) Retirement, absent a determination to the contrary by the Compensation Committee (after taking into consideration the Factors, as defined below) within fourteen days following such termination of employment (the “Determination Period”); or

(ii) to such other circumstances as the Committee in its discretion allows;

then the number of Restricted Stock Units which shall vest at the end of the Performance Period shall be calculated as set forth in subsection (c), subject to reduction by the Committee in its discretion. If there is an Award Termination, the Committee may in its discretion allow some or all of the Restricted Stock Units to vest, calculated as set forth in subsection (c), subject to reduction by the Committee in its discretion.

“Factors” that would result in a determination to the contrary by the Compensation Committee shall include Employee’s: (i) inadequate job performance; (ii) inadequate notice of resignation; (iii) intention for comparable future employment at a third party organization; (iv) intention for future employment or other service or advisory relationship with a competitor of the Company; or (v) any other similar consideration.

(c) As soon as reasonably practicable following the end of the Performance Period, the Committee shall calculate, as set forth in Attachment 1, the number of Restricted Stock Units that would have vested based on the attainment of the performance criteria if Employee’s employment or Restricted Stock Units had not been terminated prior to the certification. The remainder of the Restricted Stock Units shall be automatically forfeited.

6. Change in Control.

(a) If, prior to the Performance Period End Date (as defined in Attachment 1), a Change in Control occurs, to the extent the Restricted Stock Units are outstanding immediately prior to such Change in Control, they shall be converted into Restricted Stock Units that vest solely based on time, with the number of Restricted Stock Units that are so converted equal to the target number of Restricted Stock Units. The Restricted Stock Units shall continue to vest solely based on time and shall vest on the Performance Period End Date, subject to the Participant remaining an employee through such date, except as otherwise provided in Section 5(b)(i)(1) or (2) above (related to termination due to death or disability) or as provided below.

(b) If Employee’s employment is terminated by Wolverine without Cause or by Employee for Good Reason, in each case, within the twenty-four (24) month period following the Change in Control, the Restricted Stock Units, to the extent then outstanding and not vested, shall immediately vest and become payable. If Employee is party to an employment or other severance-benefit agreement that contains a definition of “Good Reason,” the definition set forth in such agreement will apply under hereunder for long as such agreement is in effect; if Employee is party to multiple such agreements, “Good Reason” under any such agreement shall count as “Good Reason” for purposes of this Agreement.

If Employee is not party to any such agreement, “Good Reason” shall mean any of the following and the below notice provision shall apply: (i) a reduction in Employee’s base salary, annual bonus opportunity, or long-term incentive opportunity; (ii) failure to pay amounts owed to Employee as salary, bonus, deferred compensation or other compensation; (iii) any material adverse change to Employee’s position, duties, responsibilities, reporting responsibilities or title; or (iv) any requirement Employee be based at a location that is more than 25 miles from his or her regular place of employment immediately before the Change in Control unless such change results in a shorter commute for Employee. Notwithstanding the foregoing, no termination of Employee’s employment shall be for Good Reason unless (i) termination of Employee’s employment (or notice of Employee’s intent to terminate employment) occurs during the 24-month period following the Change in Control, and (ii) Employee gives the Company written notice within 90 days of Employee obtaining knowledge of circumstances giving rise to Good Reason (describing in reasonable detail the circumstances and the Good Reason event that has occurred) and the Company does not remedy these circumstances within 30 days of receipt of such notice.

Employee’s rights under this subsection (b) are in addition to any other rights Employee has under this Section 6.

(c) Notwithstanding Section 5(b)(3) above or this Section 6, if, at any time during the Performance Period, Employee is or becomes eligible to terminate his or her employment with Wolverine or its subsidiaries due to Retirement (without regard to the application of any Factors or any Determination Period), in the event of a Change in Control that occurs prior to the Performance Period End Date, to the extent then outstanding, the target number of Restricted Stock Units shall immediately vest in full upon the Change in Control.

(d) Notwithstanding this Section 6, in the event a Change in Control occurs following an Employment Termination described in Section 5(b)(i) above and prior to the Performance Period End Date, the target number of Restricted Stock Units will automatically vest in full upon the occurrence of such Change in Control.

(e) If, in connection with a Change in Control, the Restricted Stock Units are not assumed or continued, or a new award is not substituted for the Restricted Stock Units by the acquirer or survivor (or an affiliate of the acquirer or survivor) in accordance with the provisions of Section 13(b) of the Plan having an equivalent value at the time of such substitution or assumption, as applicable, the target number of Restricted Stock Units will automatically vest in full upon the occurrence of such Change in Control.

7. Employment by Wolverine. The Agreement and the Restricted Stock Unit Award shall not impose upon Wolverine or any of its Subsidiaries any obligation to retain Employee in its employ for any given period or upon any specific terms of employment. Wolverine or any of its Subsidiaries may at any time dismiss Employee from employment, free from any liability or claim under the Plan or this Agreement, unless otherwise expressly provided in any written agreement with Employee.

8. Stockholder Rights. Employee (or Employee’s permitted transferees) shall not have any voting and liquidation rights with respect to the Restricted Stock Units or the underlying Common Stock represented thereby unless and until shares of Common Stock are actually issued to Employee upon vesting of the Restricted Stock Units in accordance with the terms of this Agreement. Employee shall be entitled to receive a dividend equivalent (“Dividend Equivalent”) in the form of cash, with respect to any cash dividend that is declared and paid on the Common Stock underlying the Restricted Stock Units prior to the Payout Date, with the amount that is paid to Employee in respect of the Dividend Equivalents equal to the aggregate cash dividends declared and paid per share of Common Stock during the period beginning on the Grant Date and ending immediately prior to the Payout Date multiplied by the number of Restricted Stock Units that vest hereunder in accordance with Appendix 1. For greater certainty, no Dividend Equivalent shall be payable to Employee in respect of any unvested Restricted Stock Units that are forfeited. Upon vesting of the Restricted Stock Units and issuance to Employee of underlying Common Stock, if applicable, Employee shall have all stockholder rights, including the right to transfer the underlying Common Stock, subject to such conditions as Wolverine may reasonably specify to ensure compliance with applicable federal and state securities laws.

9. Withholding. Wolverine and any of its Subsidiaries shall be entitled to (a) withhold and deduct from Employee’s future wages (or from other amounts that may be due and owing to Employee from Wolverine or a Subsidiary, including amounts under this Agreement), or make other arrangements for the collection of, all legally required amounts necessary to satisfy any and all applicable federal, state and local withholding and employment-related tax requirements attributable to the Restricted Stock Units Award under this Agreement, including, without limitation, the award, vesting or settlement of Restricted Stock Units and any Dividend Equivalents; or (b) require Employee promptly to remit the amount of such withholding to Wolverine or a Subsidiary before taking any action with respect to the Restricted Stock Units. Unless the Committee provides otherwise, withholding may be satisfied by withholding shares of Common Stock to be received by Employee pursuant to this Agreement or by delivery to Wolverine or a Subsidiary of previously owned Common Stock of Wolverine.

10. Effective Date. This grant of Restricted Stock Units shall be effective as of the Grant Date set forth in the grant.

11. Agreement Controls. The Plan is hereby incorporated in this Agreement by reference. Capitalized terms not defined in this Agreement shall have those meanings provided in the Plan. In the event of any conflict between the terms of this Agreement and the terms of the Plan, the provisions of the Agreement shall control.

WOLVERINE WORLD WIDE, INC.

COMPENSATION COMMITTEE

ATTACHMENT 1 TO RESTRICTED STOCK UNITS AWARD AGREEMENT

To the extent that either Threshold BVA or Threshold EPS is satisfied, as determined by the Committee, 600% of the target number of Restricted Stock Units (“the Maximum RSU Amount”) shall be deemed earned hereunder. The actual number of Restricted Stock Units that will vest is equal to the number resulting from the formula set forth immediately below, but not in excess of the Maximum RSU Amount. Restricted Stock Units are intended to qualify as performance-based compensation under Section 162(m) of the Internal Revenue Code because of the requirement to achieve the pre-set Threshold BVA goal or Threshold EPS goal to earn the Maximum RSU Amount, with any reduction from such maximum based on the level of achievement under the formula immediately below (in an amount no greater than the Maximum RSU Amount) or as a result of any exercise of negative discretion of the Committee.

1. The number of Restricted Stock Units that will vest under this Attachment 1 and this Agreement, as determined by the Committee, is equal to:

[(Overall Award Percentage x Applicable Earnings)/Market Price] x the Adjustment Factor

rounded up to the nearest whole number (but not in excess of the Maximum RSU Amount) where:

Overall Award Percentage will be the sum of (i) the BVA Award Percentage multiplied by the BVA Factor, and (ii) the EPS Award Percentage multiplied by the EPS Factor.

(a) BVA Award Percentage will be calculated as follows:

If the Cumulative BVA is < Threshold BVA, BVA Award Percentage = 0%

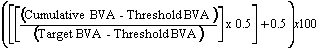

If the Cumulative BVA is ≥ Threshold BVA and < Target BVA, BVA Award Percentage =

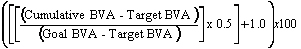

If the Cumulative BVA is ≥ Target BVA and < Goal BVA, BVA Award Percentage =

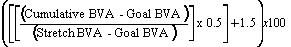

If the Cumulative BVA is ≥ Goal BVA and < Stretch BVA, BVA Award Percentage =

If the Cumulative BVA is ≥ Stretch BVA, BVA Award Percentage = Award Cap

(b) EPS Award Percentage will be calculated as follows:

If the Cumulative EPS is < Threshold EPS, EPS Award Percentage = 0%

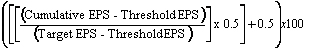

If the Cumulative EPS is ≥ Threshold EPS and < Target EPS, EPS Award Percentage =

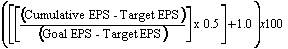

If the Cumulative EPS is ≥ Target EPS and < Goal EPS, EPS Award Percentage =

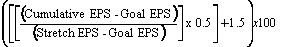

If the Cumulative EPS is ≥ Goal EPS and < Stretch EPS, EPS Award Percentage =

If the Cumulative EPS is ≥ Stretch EPS, EPS Award Percentage = Award Cap

2. The number of Restricted Stock Units that vest based on performance as determined under Section 1 above will be adjusted by the following “Adjustment Factor”:

a. | If the TSR Percentile Rank is greater than or equal to the 75.00, then the number of Restricted Stock Units that vest will be a number equal to the number of Restricted Stock Units that would vest based on performance as determined under Section 1 above, multiplied by an Adjustment Factor of 1.25 (e.g., if 100 Restricted Stock Units would vest under Section 1 prior to applying the Adjustment Factor, 125 would vest), subject to the Maximum RSU Amount. |

b. | If the TSR Percentile Rank is greater than the 25.01 and less than the 74.99 , the Adjustment Factor is 1.0 (e.g., there shall be no adjustment to the number of Restricted Stock Units that vest based on performance as determined under Section 1 above). |

c. | If the TSR Percentile Rank is less than or equal to 25.00, then the number of Restricted Stock Units that vest based on performance as determined under Section 1 above will be a number equal to the number of Restricted Stock Units that would vest based on performance as determined under Section 1 above, multiplied by an Adjustment Factor of 0.75 (e.g., if 100 Restricted Stock Units would vest under Section 1 prior to applying the Adjustment Factor, 75 would vest). |

The other defined terms shall have the following meanings for the purpose of this Agreement:

Applicable Earnings | The sum of the annualized base salaries at the end of each year of the Performance Period, multiplied by the target incentive award percentage as of the end of each of the year of the Performance Period, divided by three. For any year during the Performance Period where Employee is either not designated as a three-year plan participant for the full year or is not employed for the full year, annualized base salary shall be multiplied by a fraction, the numerator of which is months employed/participating during such year and the denominator of which is 12. Partial months employed/participating shall only be included in the numerator, above, if Employee is employed/participating for the majority of days in such month. |

Award Cap | 200% |

Award Recipient | An employee of the Company to whom the Compensation Committee of the Board of Directors or the Board of Directors grants a Performance Restricted Unit Award, for such portion of the Performance Period as the Committee determines. |

BVA | An economic value added measurement that equals the operating income for a Fiscal Year reduced by (i) a provision for income taxes equal to the operating income multiplied by the Company’s total effective tax rate for the same Fiscal Year; and (ii) a capital charge equal to a 13-point average of “net operating assets” at the beginning and end of a Fiscal Year (with “net operating assets” defined as the net of trade receivables (net of reserves), inventory (net of reserves), other current assets, property, plant and equipment, trade payables and accrued liabilities) multiplied by 10%, as adjusted by resolution of the Compensation Committee within the first 90 days of the Performance Period. |

Cumulative BVA | The sum of the BVA for each of the Fiscal Years in the Performance Period. |

Cumulative EPS | The sum of the EPS for each of the Fiscal Years in the Performance Period. |

EPS | The total after-tax profits for a Fiscal Year divided by the fully-diluted weighted average shares outstanding during the Fiscal Year, as adjusted by resolution of the Compensation Committee within the first 90 days of the Performance Period. |

Fiscal Year | The fiscal year of the Company for financial reporting purposes as the Company may adopt from time to time. |

Market Price | The Fair Market Value on the Grant Date. |

Payout Date | The date determined by the Committee upon the vesting of Restricted Stock Units for the issuance and delivery of Common Stock and, if applicable, any cash payment, to which such Payout Date relates, which date shall be as soon as practicable following the date of vesting, but not later than March 15, 2020 (or, if earlier, within 30 days following the date of a Change in Control or termination of employment, to the extent provided in Section 6 of this Agreement). |

Performance Period | The three year period beginning on the first day of the Company’s 2017 Fiscal Year and ending on the last day of the Company’s 2019 Fiscal Year. |

Performance Period End Date | The last day of the Company’s 2019 Fiscal Year. |

Russell 3000 Companies | The companies making up the Russell 3000 Consumer Discretionary Index as of the first day of the Performance Period. |

Total Shareholder Return | The change in value expressed as a percentage of a given dollar amount invested in a company’s most widely publicly traded stock over the Performance Period, taking into account both stock price appreciation (or depreciation) and the reinvestment of dividends (including the cash value of non-cash dividends) in such stock of the company. The thirty (30) calendar-day average closing price of shares of Common Stock and the stock of the Russell 3000 Companies (i.e., the average closing prices over the period of trading days occurring in the thirty (30) calendar days prior to the first day of the Performance Period and ending on the first day of the Performance Period and the average closing prices over the period of trading days occurring in the final thirty (30) calendar days ending on the Performance Period End Date) will be used to value shares of Common Stock and the stock of the Russell 3000 Companies. Dividend reinvestment will be calculated using the closing price of a share of Common Stock or the stock of the applicable Russell 3000 Company on the ex-dividend date or, if no trades were reported on such date, the latest preceding date for which a trade was reported. If a company that is included in the Russell 3000 Consumer Discretionary Index as of the first day of the Performance Period ceases to be publicly traded (other than through bankruptcy) during the Performance Period, or if it publicly announced that any such company will be acquired, whether or not such acquisition occurs during the Performance Period, such company shall not be treated as Russell 3000 Company for purposes of the determinations herein and such company’s Total Shareholder Return shall not be included for purposes of the calculations herein. Companies that were in the Russell 3000 Consumer Discretionary Index on the first day of the Performance Period but that exit due to bankruptcy before the end of the Performance Period remain Russell 3000 Companies and are assigned a Total Shareholder Return value of -100%. Companies that exit the Russell 3000 Consumer Discretionary Index before the end of the Performance Period but remain publicly-traded throughout the Performance Period remain Russell 3000 Companies. |

TSR Percentile Rank | The percentage of Total Shareholder Return values among the Russell 3000 Companies at the Performance Period End Date that are equal to or lower than the Company’s Total Shareholder Return at the Performance Period End Date, provided that if the Company’s Total Shareholder Return falls between the Total Shareholder Return of two of the Russell 3000 Companies the TSR Percentile Rank shall be adjusted by interpolating the Company’s Total Shareholder Return on a straight line basis between the Total Shareholder Return of the two Russell 3000 Companies that are closest to the Company’s. For purposes of the TSR Percentile Rank calculation, the Company will be excluded from the group of Russell 3000 Companies. |

BVA Factor | As set by the Compensation Committee within the first 90 days of the Performance Period. |

Threshold BVA | As set by the Compensation Committee within the first 90 days of the Performance Period. |

Target BVA | As set by the Compensation Committee within the first 90 days of the Performance Period. |

Goal BVA | As set by the Compensation Committee within the first 90 days of the Performance Period. |

Stretch BVA | As set by the Compensation Committee within the first 90 days of the Performance Period. |

EPS Factor | As set by the Compensation Committee within the first 90 days of the Performance Period. |

Threshold EPS | As set by the Compensation Committee within the first 90 days of the Performance Period. |

Target EPS | As set by the Compensation Committee within the first 90 days of the Performance Period. |

Goal EPS | As set by the Compensation Committee within the first 90 days of the Performance Period. |

Stretch EPS | As set by the Compensation Committee within the first 90 days of the Performance Period. |