Attached files

| file | filename |

|---|---|

| 8-K - 8-K - MUFG Americas Holdings Corp | investorpresentation8-k_co.htm |

MUFG Americas Holdings

Corporation

MUFG Americas Holdings Corporation

Investor Presentation for the Quarter Ended

March 31, 2017

MUFG Americas Holdings Corporation Investor Presentation, 1Q17

This presentation describes activities of MUFG Americas Holdings Corporation and its consolidated subsidiaries (the Company) unless otherwise

specified. This presentation should be read in conjunction with the financial statements, notes and other information contained in the Company’s

most recent annual report on Form 10-K and Quarterly Reports on Forms 10-Q and in any subsequent filings with the Securities and Exchange

Commission (SEC).

The following appears in accordance with the Private Securities Litigation Reform Act. This presentation includes forward-looking statements that

involve risks and uncertainties. Forward-looking statements can be identified by the fact that they do not relate strictly to historical or current facts.

Often, they include the words “believe,” “continue,” “expect,” “target,” “anticipate,” “intend,” “plan,” “estimate,” “potential,” “ project,” or words of

similar meaning, or future or conditional verbs such as “will,” “would,” “should,” “could,” or “may.” They may also consist of annualized amounts

based on historical interim period results. There are numerous risks and uncertainties that could and will cause actual results to differ materially

from those discussed in the Company’s forward-looking statements. Many of these factors are beyond the Company’s ability to control or predict

and could have a material adverse effect on the Company’s financial condition, and results of operations or prospects. For more information about

factors that could cause actual results to differ materially from our expectations, refer to our reports filed with the SEC, including the discussions

under “Management’s Discussion & Analysis of Financial Condition and Results of Operations” and “Risk Factors” in the Company’s most recent

Annual Report on Form 10-K and Quarterly Reports on Forms 10-Q and in any subsequent filings with the SEC and available on the SEC’s

website at www.sec.gov. Any factor described above or in our SEC reports could, by itself or together with one or more other factors, adversely

affect our financial results and condition. All forward-looking statements contained herein are based on information available at the time of this

presentation, and the Company assumes no obligation to update any forward-looking statements.

This investor presentation includes additional capital ratios (tangible common equity and Common Equity Tier 1 capital (calculated under the Basel

III standardized approach on a fully phased-in basis)) to facilitate the understanding of the Company’s capital structure and for use in assessing

and comparing the quality and composition of the Company's capital structure to other financial institutions. These presentations should not be

viewed as a substitute for results determined in accordance with GAAP, nor are they necessarily comparable to non-GAAP financial measures

presented by other companies. Please refer to our separate reconciliation of non-GAAP financial measures in our earnings release dated April 24,

2017 and our 10-Q for the quarter ended March 31, 2017.

Forward-Looking Statements and Non-GAAP Financial Measures

MUFG Americas Holdings Corporation Investor Presentation, 1Q17

One of the Largest Regional Bank Holding Companies in the United States

Headquarters New York

Main Banking Office San Francisco

U.S. Branches4 365

Employees5 Approx. 12,500

Total Assets $149.7 billion

Total Loans Held for Investment $78.4 billion

Total Deposits $86.5 billion

Tangible Common Equity6 $14.1 billion

4. In addition, MUB had two international offices and 13 PurePoint Financial Centers

5. Full-time equivalent staff

6. Tangible common equity is a non-GAAP measure. Refer to MUAH’s earnings release dated April 24, 2017 and

our 10-Q for the quarter ended March 31, 2017 for a reconciliation between certain GAAP amounts and this non-

GAAP measure

MUAH Company Profile as of March 31, 2017 Reference Banks’ Period-End Assets ($bn) 2,3

MUFG Americas Holdings Corporation (MUAH) (A3 / A / A)1 and its principal subsidiaries MUFG

Union Bank, N.A. (MUB) (A2 / A+ / A)1 and MUFG Securities Americas Inc. (MUSA) (NR / A+ / A)1

are owned by The Bank of Tokyo-Mitsubishi UFJ, Ltd. (BTMU) and Mitsubishi UFJ Financial

Group, Inc. (MUFG). BTMU is a wholly-owned subsidiary of MUFG.

• Solid balance sheet with high-quality capital base and strong liquidity

• Conservative risk culture resulting in a high quality loan portfolio with strong credit performance

• Network of 365 U.S. retail and commercial branches and two international offices

• Prominent market share in demographically attractive West Coast markets

• Both MUB and MUAH have currently outstanding, publicly issued debt securities

MUB Branch Network

1. Credit ratings represent long-term issuer ratings from Moody’s, S&P, and Fitch Ratings, respectively

2. Source: SNL Financial as of May 5, 2017

3. ‘Reference Banks’, referred to throughout this presentation unless otherwise noted, consist of these 13 CCAR-filing public regional

banks, plus the four largest U.S. money center banks (BAC, C, JPM and WFC) not shown here

USB PNC COF BBT STI CFG MUAH FITB KEY RF MTB HBAN CMA ZION

$450

$371 $349

$221 $206

$150 $150 $140 $134 $125 $123 $100 $73 $65

MUFG Americas Holdings Corporation Investor Presentation, 1Q17

Core Strategic Subsidiary of Mitsubishi UFJ Financial Group (MUFG)

As of March 31, 2017

Employees3 Approx. 12,500

Total assets $149.7 billion

Total loans held for

investment $78.4 billion

Total deposits $86.5 billion

Common Equity Tier 1

risk-based capital ratio

(fully phased-in)4

15.15%

As of December 31, 2016

Employees Approx. 140,000

Total assets $2,593 billion 1

Total loans $930 billion 1

Total deposits $1,429 billion 1

Common Equity Tier 1

risk-based capital ratio

(fully phased-in)2

11.40%

1. JPY denominated amounts converted to USD based on an exchange rate of 116.49 JPY/USD as of December 31, 2016; refer to MUFG’s Investor Relations website (http://www.mufg.jp/english/ir/) for additional information

2. Calculated in accordance with Japanese banking regulations based on information derived from MUFG’s consolidated financial statements prepared in accordance with Japanese GAAP, as required by the Japanese Financial Services Agency

3. Full-time equivalent staff

4. Common Equity Tier 1 risk-based capital ratio (standardized, fully phased-in basis) is a non-GAAP financial measure that is used to assess a bank holding company's capital position as if the transition provisions of the U.S. Basel III rules were

fully phased in for the periods in which the ratio is disclosed. Please refer to our separate reconciliation of non-GAAP financial measures in our earnings release dated April 24, 2017 and our 10-Q for the quarter ended March 31, 2017

Mitsubishi UFJ

Financial

Group, Inc.

MUFG Americas

(includes Latin America and Canada)

Combined U.S. Operations

(includes BTMU & MUTB U.S. Branches)

MUFG Americas

Holdings Corporation

MUFG Americas Holdings Corporation Investor Presentation, 1Q17

The enhanced prudential standards require that all foreign banking organizations with at least $50bn in assets hold

ownership of controlled U.S. subsidiaries through an Intermediate Holding Company (IHC).

MUAH is MUFG's Intermediate Holding Company

3/31/17 assets: $116.1bn 3/31/17 assets: $30.5bn 3/31/17 assets: $3.1bn1

1. Net of intercompany eliminations

MUFG Americas Holdings Corporation Investor Presentation, 1Q17

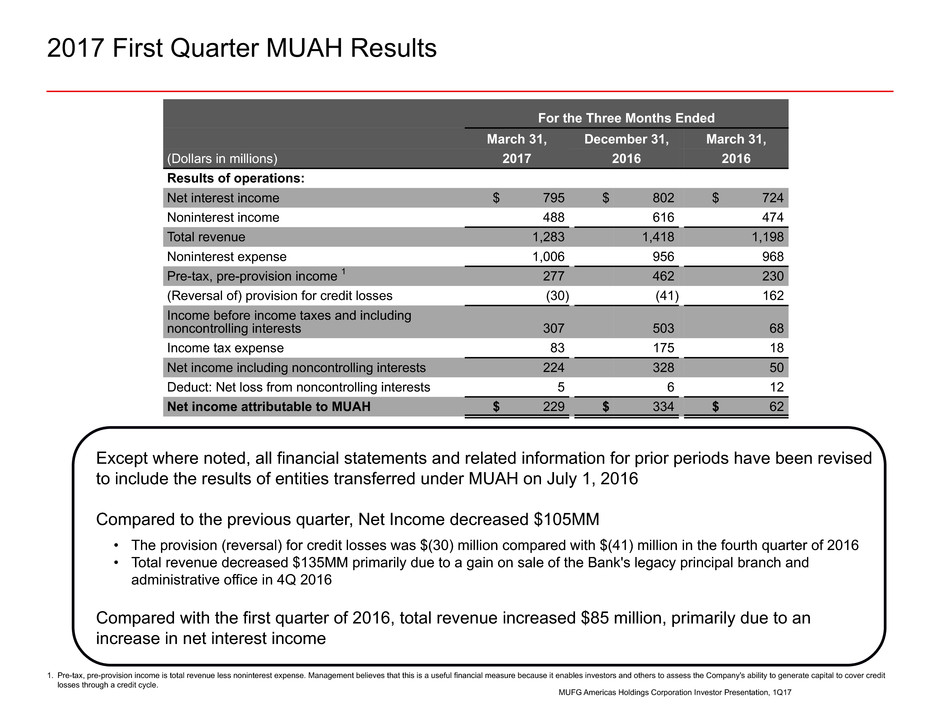

2017 First Quarter MUAH Results

Except where noted, all financial statements and related information for prior periods have been revised

to include the results of entities transferred under MUAH on July 1, 2016

Compared to the previous quarter, Net Income decreased $105MM

• The provision (reversal) for credit losses was $(30) million compared with $(41) million in the fourth quarter of 2016

• Total revenue decreased $135MM primarily due to a gain on sale of the Bank's legacy principal branch and

administrative office in 4Q 2016

Compared with the first quarter of 2016, total revenue increased $85 million, primarily due to an

increase in net interest income

1. Pre-tax, pre-provision income is total revenue less noninterest expense. Management believes that this is a useful financial measure because it enables investors and others to assess the Company's ability to generate capital to cover credit

losses through a credit cycle.

For the Three Months Ended

March 31, December 31, March 31,

(Dollars in millions) 2017 2016 2016

Results of operations:

Net interest income $ 795 $ 802 $ 724

Noninterest income 488 616 474

Total revenue 1,283 1,418 1,198

Noninterest expense 1,006 956 968

Pre-tax, pre-provision income 1 277 462 230

(Reversal of) provision for credit losses (30) (41) 162

Income before income taxes and including

noncontrolling interests 307 503 68

Income tax expense 83 175 18

Net income including noncontrolling interests 224 328 50

Deduct: Net loss from noncontrolling interests 5 6 12

Net income attributable to MUAH $ 229 $ 334 $ 62

MUFG Americas Holdings Corporation Investor Presentation, 1Q17

MUAH Balance Sheet and Profitability Highlights

1. Core deposits exclude brokered deposits, foreign time deposits, domestic time deposits greater than $250,000 and certain other deposits not considered to be core customer relationships

2. Annualized

3. Net interest margin is presented on a taxable-equivalent basis using the federal statutory tax rate of 35 percent.

4. The efficiency ratio is total noninterest expense as a percentage of total revenue (net interest income and noninterest income)

5. Adjusted efficiency ratio is a non-GAAP financial measure. Refer to our separate reconciliation of non-GAAP financial measures in our earnings release dated April 24, 2017 and our 10-Q for the quarter ended March 31, 2017

Except where noted, all financial

statements and related information for

prior periods have been revised to

include the results of entities transferred

under MUAH on July 1, 2016

Compared to the previous quarter:

• Total assets were up largely due to an

increase in loans held for investment and

securities available for sale

• Total deposits decreased $0.4 billion due to

a decrease in demand deposits and money

market deposits, partially offset by an

increase in interest bearing savings deposits

related to the launch of PurePoint Financial,

a new online division of the Bank, and

interest bearing checking deposits.

Compared to a year ago:

• Total assets are down primarily due to a

decrease in securities borrowed or

purchased under repurchase agreements,

partially offset by an increase in total

securities

As of and For the Three Months Ended

March 31, December 31, March 31,

(Dollars in millions) 2017 2016 2016

Balance sheet (end of period)

Total assets $ 149,678 $ 148,144 $ 156,554

Total loans held for investment 78,434 77,551 80,906

Total securities 25,299 24,478 23,699

Securities borrowed or purchased under repo 19,992 19,747 28,110

Trading account assets 8,926 8,942 5,629

Core deposits 1 80,717 80,482 74,882

Total deposits 86,533 86,947 89,460

Securities loaned or sold under repo 25,079 24,616 27,211

Long-term debt 11,333 11,410 13,068

Trading account liabilities 3,233 2,905 4,375

MUAH stockholders' equity 17,484 17,233 16,684

Performance ratios

Net interest margin 2,3 2.37% 2.35% 2.06%

Return on average assets 2 0.62 0.89 0.16

Return on MUAH stockholders' equity 2 5.27 7.69 1.45

Return on tangible common equity 2 6.64 9.71 1.94

Efficiency ratio 4 78.39 67.35 80.90

Adjusted efficiency ratio 5 73.42 64.62 73.72

MUFG Americas Holdings Corporation Investor Presentation, 1Q17

Business Model for Five Key Segments

Five main divisions: Consumer Banking, Wealth Markets, Commercial Banking, Real Estate Industries and

PurePoint Financial

Two customer segments:

Consumer: West Coast individuals, including high net worth

• Products and services include checking and deposit accounts, mortgages, home equity loans,

consumer loans, credit cards, bill and loan payment services, wealth planning, trust and estate

services, investment management, brokerage and private wealth management

• PurePoint serves consumers, offering savings accounts and CD products online with services

provided through a call center and a network of financial centers in Florida, Illinois and Texas

Commercial: Institutional clients and businesses generally with annual revenues up to $1 billion

• Commercial credit products and services include commercial and asset-based loans, accounts

receivable, inventory, and trade financing primarily to West Coast corporate customers, and real

estate financing to professional real estate investors and developers nationwide

• Non-credit products and services include global treasury management, capital market solutions,

foreign exchange, interest rate risk and commodity risk management products and services

• Provides commercial lending products, including commercial loans, lines of credit and project

financing to corporate customers with annual revenues generally greater than $1 billion

• Employs an industry-focused strategy including dedicated coverage teams in:

• General Industries

• Power and Utilities

• Oil and Gas

• Telecom and Media

• Technology

• Healthcare and Nonprofit

• Public Finance, and

• Financial Institutions (predominantly Insurance and Asset Managers)

• Non-credit products and services include global treasury management, capital market solutions,

foreign exchange, interest rate risk and commodity risk management products

Regional Bank U.S. Wholesale Banking

Investment Banking & Markets

Transaction Banking

• Automated Clearing House

• Cash Management

• Commercial Card

MUFG Securities Americas Inc.

• Capital Markets

• Collateralized Financings

• Domestic and Foreign Debt

and Equity Securities Transactions

Coverag

e

Product

s

• Commercial Finance

• Corporate Advisory

• Foreign Exchange

• Funds Finance

• Global Financial Solutions

• Interest Rate Derivatives

• Leasing and Equipment Finance

• Project Finance

• Securitization

• Structured Trade Finance

• Supply Chain Finance

• Syndications

• Demand Deposit Account

• Institutional Trust and Global Custody

• Money Market Demand Account

Brandin

g

• Payables / Receivables

• Treasury Management

• Trade Finance

• Private Placements

• Sales & Trading

• Securities Borrow and Loan

• Securitization

MUFG Americas Holdings Corporation Investor Presentation, 1Q17

Strong and High Quality Capital Base

1. Reference Banks consist of 13 CCAR-filing public regional banks depicted on slide 3 plus the four largest U.S. money center banks. Reference Banks’ average based on reporting through May 5, 2017 (Source: SNL Financial)

2. Non-GAAP financial measures. Refer to our separate reconciliation of non-GAAP financial measures in our earnings release dated April 24, 2017 and our 10-Q for the quarter ended March 31, 2017

MUAH's capital ratios exceed the average of the Reference Banks1

MUAH reports its regulatory capital ratios under the standardized approach of the U.S. Basel III rules, with certain

provisions subject to phase-in periods

• MUB is subject to both the standardized and advanced approaches rules, however, MUB is in discussions with the OCC to opt-out

of the U.S. Basel III advanced approaches rules

Capital ratios:

Reference

Banks'

Average1

MUAH Capital Ratios

March 31,

2017

March 31,

2017

December

31, 2016

Regulatory:

Common Equity Tier 1 risk-based capital ratio 11.02% 15.17% 14.77%

Tier 1 risk-based capital ratio 12.10 15.17 14.77

Total risk-based capital ratio 14.30 16.72 16.45

Tier 1 leverage ratio 9.68 10.16 9.92

Other:

Tangible common equity ratio2 8.67 9.65 9.58

Common Equity Tier 1 risk-based capital ratio

(U.S. Basel III standardized approach; fully

phased-in)2

N/A 15.15 14.73

MUFG Americas Holdings Corporation Investor Presentation, 1Q17

Core Deposits: $80.7

Brokered Deposits: $4.4

Other Deposits: $1.4

Medium- and

Long-term

Debt: $11.3

Commercial Paper and

Other Short-term

Borrowings: $3.5

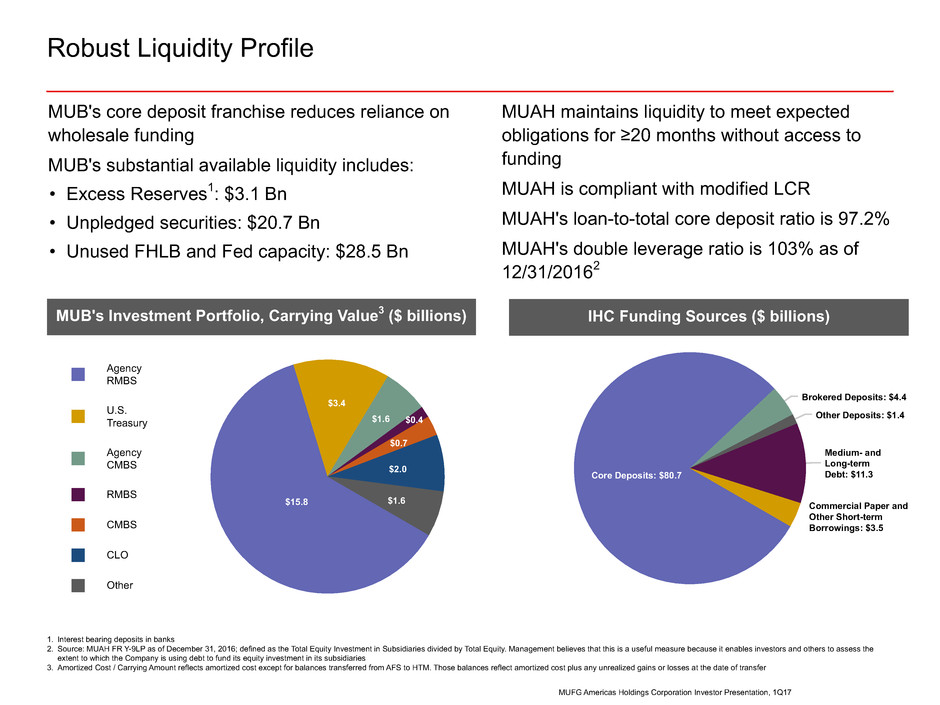

Robust Liquidity Profile

MUB's core deposit franchise reduces reliance on

wholesale funding

MUB's substantial available liquidity includes:

• Excess Reserves1: $3.1 Bn

• Unpledged securities: $20.7 Bn

• Unused FHLB and Fed capacity: $28.5 Bn

1. Interest bearing deposits in banks

2. Source: MUAH FR Y-9LP as of December 31, 2016; defined as the Total Equity Investment in Subsidiaries divided by Total Equity. Management believes that this is a useful measure because it enables investors and others to assess the

extent to which the Company is using debt to fund its equity investment in its subsidiaries

3. Amortized Cost / Carrying Amount reflects amortized cost except for balances transferred from AFS to HTM. Those balances reflect amortized cost plus any unrealized gains or losses at the date of transfer

IHC Funding Sources ($ billions)

MUAH maintains liquidity to meet expected

obligations for ≥20 months without access to

funding

MUAH is compliant with modified LCR

MUAH's loan-to-total core deposit ratio is 97.2%

MUAH's double leverage ratio is 103% as of

12/31/20162

Agency

RMBS

U.S.

Treasury

Agency

CMBS

RMBS

CMBS

CLO

Other

$15.8

$3.4

$1.6 $0.4

$0.7

$2.0

$1.6

MUB's Investment Portfolio, Carrying Value3 ($ billions)

MUFG Americas Holdings Corporation Investor Presentation, 1Q17

Securities Financing Maturity Profile

Securities Financing Portfolio

Assets Liabilities

25,000

20,000

15,000

10,000

5,000

0

$

(M

illi

on

s)

O/N and Continuous 2-30 days 31-90 days > 90 days

$12,013 $12,614

$4,598

$1,922

$21,977

$6,613

$7,549

$96

59.1%28.7%

5.8%

1.5%

4.8%

37.6%

51.1%

6.2%

1.0%

4.0%

Assets

Liabilities

Securities financing portfolio is substantially all collateralized by

high quality, liquid assets

• Approximately 88% is collateralized by U.S. Treasuries

and Agency MBS and 12% is backed by equities, credit

and other

Robust risk management framework governs secured financing

profile including guidelines and limits for tenor gaps,

counterparty concentration and stressed liquidity outflows

Securities financing activity, largely conducted through MUSA, is supported by high quality collateral

1. Includes continuous maturities which include open trades and term evergreen transactions that are primarily used to fund inventory

1

MUFG Americas Holdings Corporation Investor Presentation, 1Q17

Internal TLAC1 Requirement to be Effective January 1, 2019

TLAC-related implications to MUAH due to MUFG's

status as a single point of entry G-SIB are:

• 18.5% overall Internal TLAC requirement; minimum

6% must be issued as eligible long-term debt

• Internal TLAC must be issued by MUAH to a

foreign affiliate; Internal TLAC instruments may not

be issued to third party investors

• TLAC-eligible long-term debt will contain a

contractual conversion ("bail-in") trigger while

remaining external debt will not

• Clean Holding Company requirements limit

MUAH's external liabilities including debt,

derivatives and guarantees

• Compliance mandatory by Jan 1, 2019

MUFG is expected to be the external TLAC issuing

entity for the global organization

MUAH has sufficient aggregate capital and debt to achieve quantitative TLAC requirements; some modifications are required

1. "Total Loss-Absorbing Capacity, Long-Term Debt, and Clean Holding Company Requirements for Systemically Important U.S. Bank Holding Companies and Intermediate Holding Companies of Systemically Important

Foreign Banking Organizations," Federal Register Vol. 82, No. 14, January 24, 2017

MUFG Americas Holdings Corporation Investor Presentation, 1Q17

MUAH Long-Term Debt Outstanding and Maturity Schedule1

As of March 31, 2017

Long-Term Debt Redemption Schedule - Next 10 Years

1. Excludes nonrecourse debt, junior subordinated debt and capital leases

MUFG Americas Holdings Corporation Investor Presentation, 1Q17

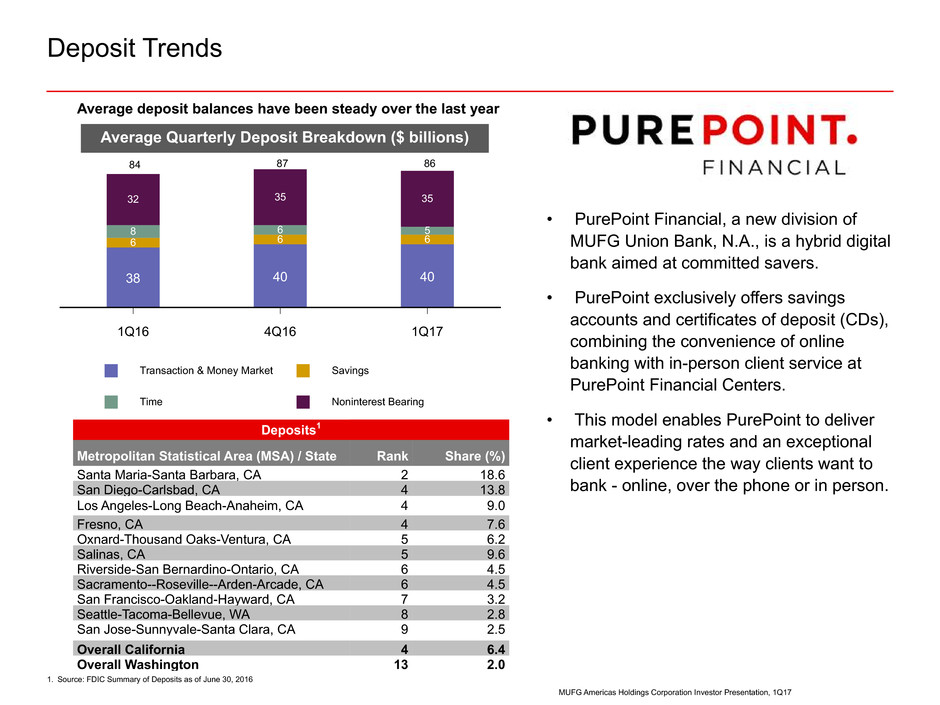

Average Quarterly Deposit Breakdown ($ billions)

Deposit Trends

1. Source: FDIC Summary of Deposits as of June 30, 2016

Average deposit balances have been steady over the last year

Transaction & Money Market Savings

Time Noninterest Bearing

1Q16 4Q16 1Q17

38 40 40

6 6 6

8 6 5

32 35 35

Deposits1

Metropolitan Statistical Area (MSA) / State Rank Share (%)

Santa Maria-Santa Barbara, CA 2 18.6

San Diego-Carlsbad, CA 4 13.8

Los Angeles-Long Beach-Anaheim, CA 4 9.0

Fresno, CA 4 7.6

Oxnard-Thousand Oaks-Ventura, CA 5 6.2

Salinas, CA 5 9.6

Riverside-San Bernardino-Ontario, CA 6 4.5

Sacramento--Roseville--Arden-Arcade, CA 6 4.5

San Francisco-Oakland-Hayward, CA 7 3.2

Seattle-Tacoma-Bellevue, WA 8 2.8

San Jose-Sunnyvale-Santa Clara, CA 9 2.5

Overall California 4 6.4

Overall Washington 13 2.0

868784

• PurePoint Financial, a new division of

MUFG Union Bank, N.A., is a hybrid digital

bank aimed at committed savers.

• PurePoint exclusively offers savings

accounts and certificates of deposit (CDs),

combining the convenience of online

banking with in-person client service at

PurePoint Financial Centers.

• This model enables PurePoint to deliver

market-leading rates and an exceptional

client experience the way clients want to

bank - online, over the phone or in person.

MUFG Americas Holdings Corporation Investor Presentation, 1Q17

Earning Asset Mix 1Q 2017

MUB's loan portfolio is primarily residential mortgage and commercial; MUSA contributes trading and securities financing

assets

1. Average balance for the quarter ended March 31, 2017. May not total 100% due to rounding.

2. Period-end total loans held for investment, including all nonperforming loans and purchased credit-impaired loans.

Loan Portfolio Composition 2Earning Asset Mix 1

Securities: 18.2%

Cash and

equivalents:

2.5%

Securities Purchased

under Repo and

Securities Borrowed:

15.0%

Trading Assets &

Other: 7.1%

Commercial &

Industrial: 32.6%

Commercial

Mortgage: 18.4%

Construction: 2.6%

Lease Financing:

2.3%

Residential Mortgage:

39.7%

Home Equity & Other

Consumer: 4.3%

Loans2: 57.1%

MUFG Americas Holdings Corporation Investor Presentation, 1Q17

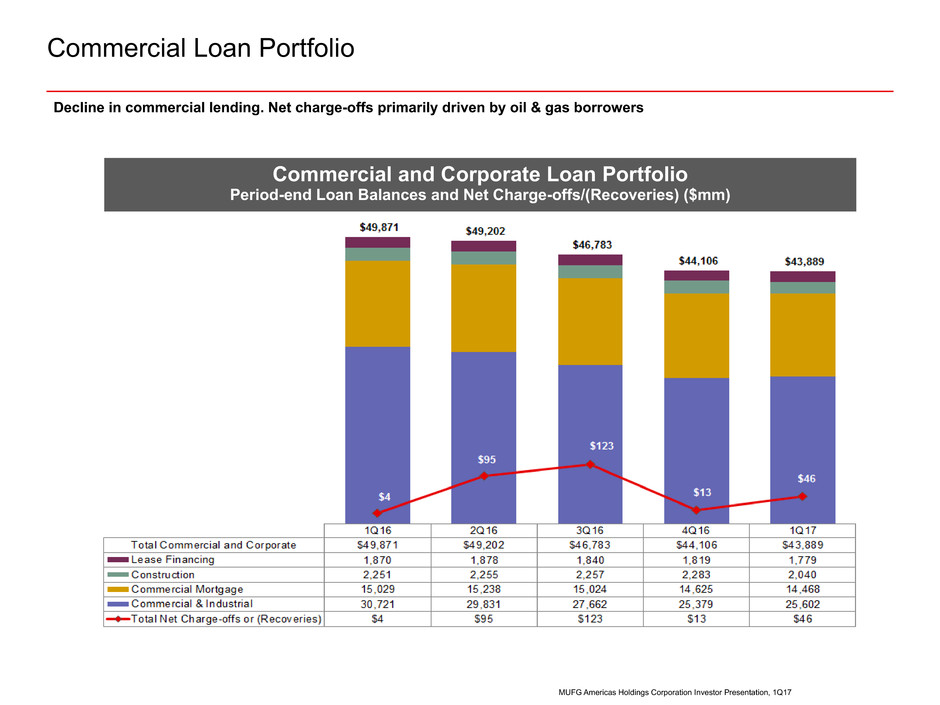

Commercial Loan Portfolio

Decline in commercial lending. Net charge-offs primarily driven by oil & gas borrowers

Commercial and Corporate Loan Portfolio

Period-end Loan Balances and Net Charge-offs/(Recoveries) ($mm)

MUFG Americas Holdings Corporation Investor Presentation, 1Q17

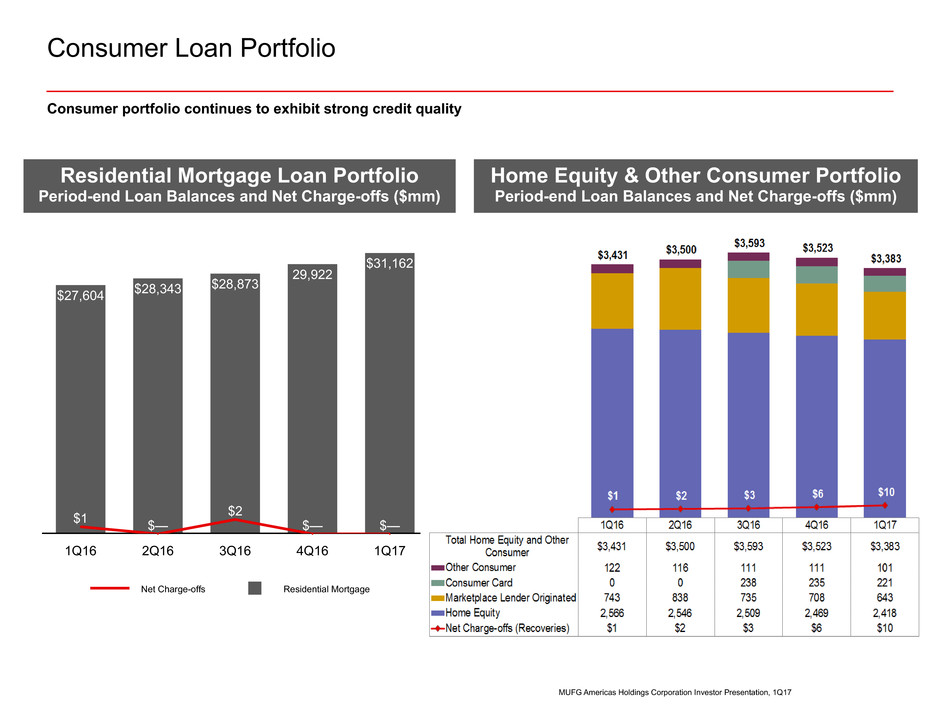

Consumer Loan Portfolio

Consumer portfolio continues to exhibit strong credit quality

Home Equity & Other Consumer Portfolio

Period-end Loan Balances and Net Charge-offs ($mm)

Residential Mortgage Loan Portfolio

Period-end Loan Balances and Net Charge-offs ($mm)

Net Charge-offs Residential Mortgage

1Q16 2Q16 3Q16 4Q16 1Q17

$1 $—

$2

$— $—

$27,604 $28,343

$28,873

29,922

$31,162

MUFG Americas Holdings Corporation Investor Presentation, 1Q17

Loans Securities

Securities Purchased under Repo and Borrowed Trading Assets & Other

Cash and Equiv.

1Q16 2Q16 3Q16 4Q16 1Q17

$80 $82 $80 $79 $78

$24 $23 $24 $24 $25

$32 $24 $21 $22 $20

$4

$7 $8 $9 $10

Net Interest Margin Impacted by Low Rate Environment

Expansion in net interest margin in recent quarters as rates have begun to rise

1. Net interest margin is annualized and presented on a taxable-equivalent basis using the federal statutory tax rate of 35 percent

2. Total loans held for investment

Average Earning Assets ($bn)Net Interest Income & Margin ($mm)

2

1

Net Interest Margin Net Interest Income

1Q16 2Q16 3Q16 4Q16 1Q17

2.06%

2.23% 2.29%

2.35% 2.37%$724

$754 $773

$802 $795

1

$3$4$4

$2$2

MUFG Americas Holdings Corporation Investor Presentation, 1Q17

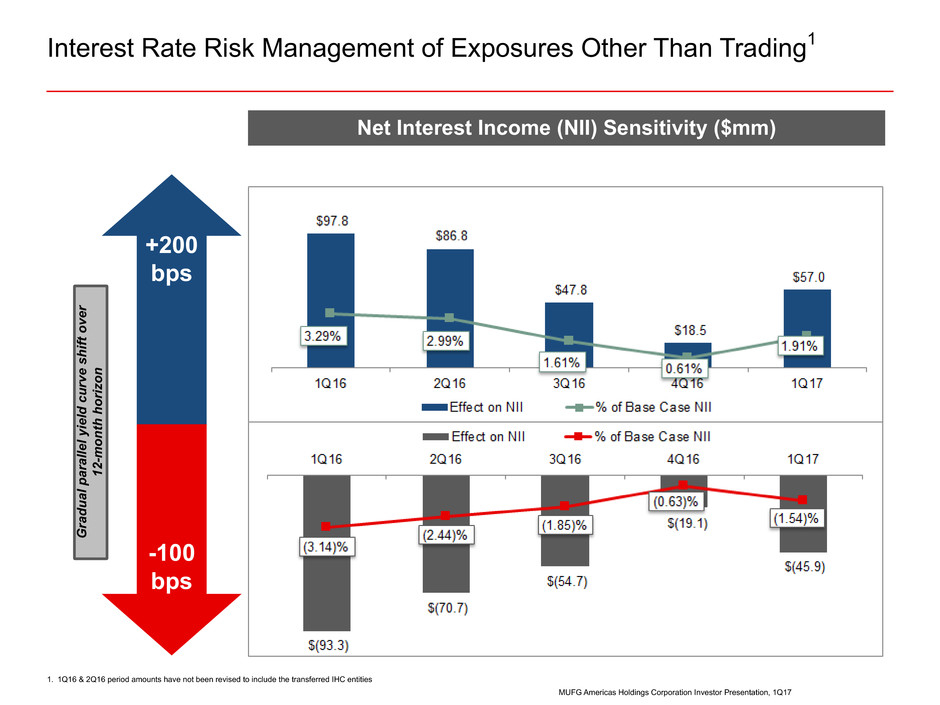

Interest Rate Risk Management of Exposures Other Than Trading1

Net Interest Income (NII) Sensitivity ($mm)

+200

bps

-100

bps

Gradual parallel yield curve shift ove

r

12-month horizo

n

1. 1Q16 & 2Q16 period amounts have not been revised to include the transferred IHC entities

MUFG Americas Holdings Corporation Investor Presentation, 1Q17

MUAH Reference Banks' Average

2.0%

1.0%

0.0%

1Q2016 2Q2016 3Q2016 4Q2016 1Q2017

1.18%

0.78%

0.91% 0.89%

0.73%

1.87% 1.79% 1.70% 1.63% 1.53%

Asset Quality Trends

Nonperforming Assets by Loan Type ($mm)

Net Charge-offs (Recoveries) / Average Loans1,3Nonperforming Loans / Total Loans1

Criticized4 & Nonaccrual Loans / Total Loans

1. Source: SNL Financial and company reports

2. Reference Banks consist of 13 CCAR-filing public regional banks depicted on slide 3 plus the four largest U.S. money center banks. Reference Banks’ average based on reporting through May 5, 2017 (Source: SNL Financial)

3. Annualized ratio

4. Criticized loans held for investment reflect loans in the commercial portfolio segment that are monitored for credit quality based on internal ratings. Amounts exclude small business loans, which are monitored by business credit score and

delinquency status

MUAH Reference Banks' Average

1.0%

0.5%

0.0%

-0.5%

1Q16 2Q16 3Q16 4Q16 1Q17

0.02%

0.48%

0.61%

0.09%

0.29%

0.49%

0.47% 0.46%

0.52% 0.52%

Criticized Percent of Total Loans Held For Investment

Nonaccrual Loans % Of Total Loans Held For Investment

5.00%

4.00%

3.00%

2.00%

1.00%

0.00%

1Q16 2Q16 3Q16 4Q16 1Q17

3.89%

3.60%

3.03% 3.13%

2.74%

1.18%

0.78% 0.91% 0.89% 0.73%

Commercial &

Industrial

Commercial

Mortgage

Residential

Mortgage

Home Equity and

Other Consumer

Other (OREO)

NPA / Total Assets

$1,000

$900

$800

$700

$600

$500

$400

$300

$200

$100

$0

1Q16 2Q16 3Q16 4Q16 1Q17

702

397

487 458

400

30

26

31

31

33

186

177

172

171

110

38

32

29

29

26

2 2

0.47

%0.48

%

0.44

%0.62

%

0.38

%

MUFG Americas Holdings Corporation Investor Presentation, 1Q17

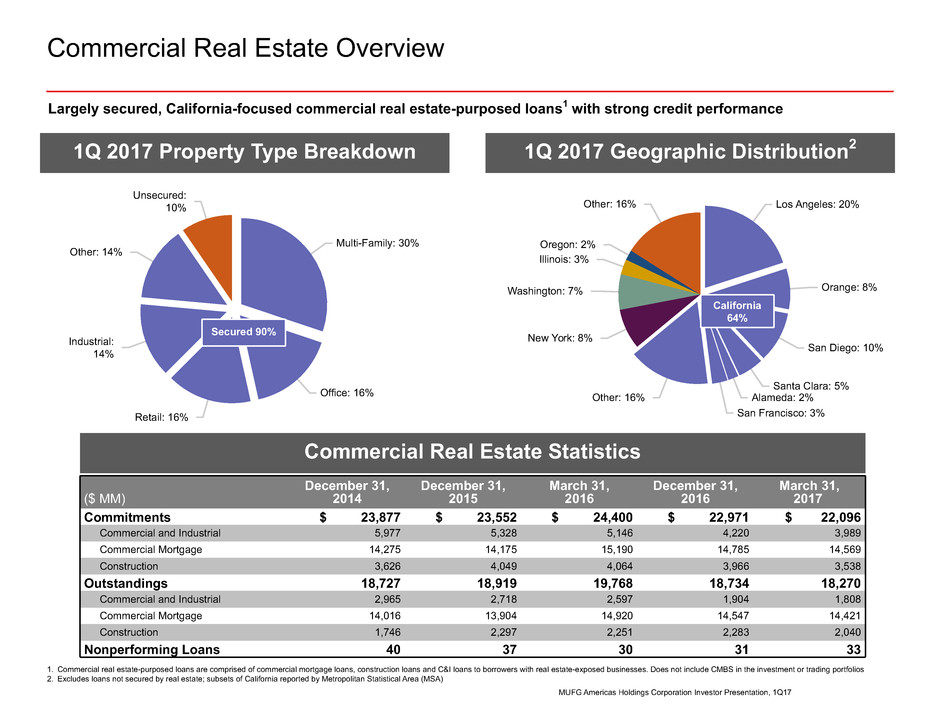

Commercial Real Estate Overview

1Q 2017 Geographic Distribution21Q 2017 Property Type Breakdown

Multi-Family: 30%

Office: 16%

Retail: 16%

Industrial:

14%

Other: 14%

Unsecured:

10%

Secured 90%

Los Angeles: 20%

Orange: 8%

San Diego: 10%

Santa Clara: 5%

Alameda: 2%

San Francisco: 3%

Other: 16%

New York: 8%

Washington: 7%

Illinois: 3%

Oregon: 2%

Other: 16%

Commercial Real Estate Statistics

($ MM)

December 31,

2014

December 31,

2015

March 31,

2016

December 31,

2016

March 31,

2017'

Commitments $ 23,877 $ 23,552 $ 24,400 $ 22,971 $ 22,096

Commercial and Industrial 5,977 5,328 5,146 4,220 3,989

Commercial Mortgage 14,275 14,175 15,190 14,785 14,569

Construction 3,626 4,049 4,064 3,966 3,538

Outstandings 18,727 18,919 19,768 18,734 18,270

Commercial and Industrial 2,965 2,718 2,597 1,904 1,808

Commercial Mortgage 14,016 13,904 14,920 14,547 14,421

Construction 1,746 2,297 2,251 2,283 2,040

Nonperforming Loans 40 37 30 31 33

California

64%

Largely secured, California-focused commercial real estate-purposed loans1 with strong credit performance

1. Commercial real estate-purposed loans are comprised of commercial mortgage loans, construction loans and C&I loans to borrowers with real estate-exposed businesses. Does not include CMBS in the investment or trading portfolios

2. Excludes loans not secured by real estate; subsets of California reported by Metropolitan Statistical Area (MSA)

MUFG Americas Holdings Corporation Investor Presentation, 1Q17

Consumer Loans Performed Well Through the Crisis

1. At origination

2. Excluding loans serviced by third-party service providers and loans covered by FDIC loss share agreements, includes PCI loans

3. Data Source: Consumer Lending Monthly Summary and Key Statistics; Source: Residential – Mortgage Bankers Association, Home Equity-American Bankers Association

4. National (SA) is seasonally adjusted American Bankers Association data; Benchmark metrics are reported on a one quarter lag

Residential Mortgage Performance Trends

(30 days Past Due + in Foreclosure) 3

Home Equity and Other Consumer

Total Delinquency (30 Days + Past Due) 3

Residential Mortgage Portfolio as of March 31, 2017:

• 39% interest-only (non-amortizing)

• 65% weighted average LTV1 for the I/O portfolio

• No subprime programs or option ARM loans

• Low delinquency rate due to focus on prime loans, high FICO scores, and low LTVs

• 79% of the consumer portfolio has a refreshed FICO score of 720 and above2

• 96% has an LTV less than or equal to 80%

MUAH MBA-CA Prime National Prime

MBA-CA Prime ARM

30.0%

25.0%

20.0%

15.0%

10.0%

5.0%

0.0%

2009 2010 2011 2012 2013 2014 2015 2016 2017

MUAH CA HE 30+ (NSA) National (SA)

4.5%

4.0%

3.5%

3.0%

2.5%

2.0%

1.5%

1.0%

0.5%

2009 2010 2011 2012 2013 2014 2015 2016 2017

4

MUFG Americas Holdings Corporation Investor Presentation, 1Q17

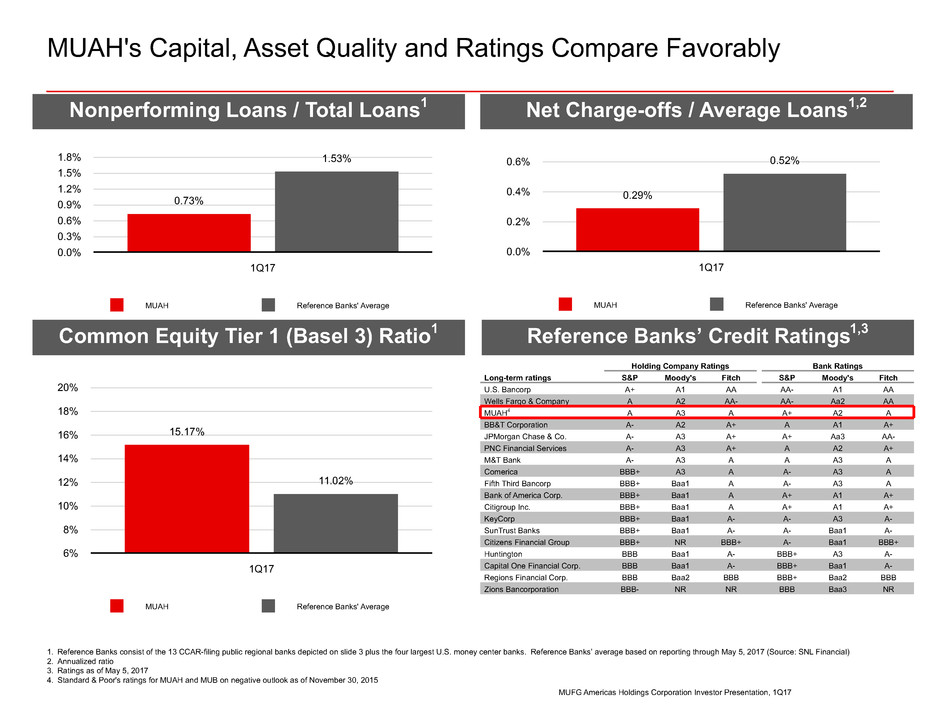

MUAH's Capital, Asset Quality and Ratings Compare Favorably

1. Reference Banks consist of the 13 CCAR-filing public regional banks depicted on slide 3 plus the four largest U.S. money center banks. Reference Banks’ average based on reporting through May 5, 2017 (Source: SNL Financial)

2. Annualized ratio

3. Ratings as of May 5, 2017

4. Standard & Poor's ratings for MUAH and MUB on negative outlook as of November 30, 2015

Net Charge-offs / Average Loans1,2Nonperforming Loans / Total Loans1

Common Equity Tier 1 (Basel 3) Ratio1 Reference Banks’ Credit Ratings1,3

MUAH Reference Banks' Average

1.8%

1.5%

1.2%

0.9%

0.6%

0.3%

0.0%

1Q17

0.73%

1.53%

MUAH Reference Banks' Average

20%

18%

16%

14%

12%

10%

8%

6%

1Q17

15.17%

11.02%

Holding Company Ratings Bank Ratings

Long-term ratings S&P Moody's Fitch S&P Moody's Fitch

U.S. Bancorp A+ A1 AA AA- A1 AA

Wells Fargo & Company A A2 AA- AA- Aa2 AA

MUAH4 A A3 A A+ A2 A

BB&T Corporation A- A2 A+ A A1 A+

JPMorgan Chase & Co. A- A3 A+ A+ Aa3 AA-

PNC Financial Services A- A3 A+ A A2 A+

M&T Bank A- A3 A A A3 A

Comerica BBB+ A3 A A- A3 A

Fifth Third Bancorp BBB+ Baa1 A A- A3 A

Bank of America Corp. BBB+ Baa1 A A+ A1 A+

Citigroup Inc. BBB+ Baa1 A A+ A1 A+

KeyCorp BBB+ Baa1 A- A- A3 A-

SunTrust Banks BBB+ Baa1 A- A- Baa1 A-

Citizens Financial Group BBB+ NR BBB+ A- Baa1 BBB+

Huntington BBB Baa1 A- BBB+ A3 A-

Capital One Financial Corp. BBB Baa1 A- BBB+ Baa1 A-

Regions Financial Corp. BBB Baa2 BBB BBB+ Baa2 BBB

Zions Bancorporation BBB- NR NR BBB Baa3 NR

MUAH Reference Banks' Average

0.6%

0.4%

0.2%

0.0%

1Q17

0.29%

0.52%

MUFG Americas Holdings Corporation Investor Presentation, 1Q17

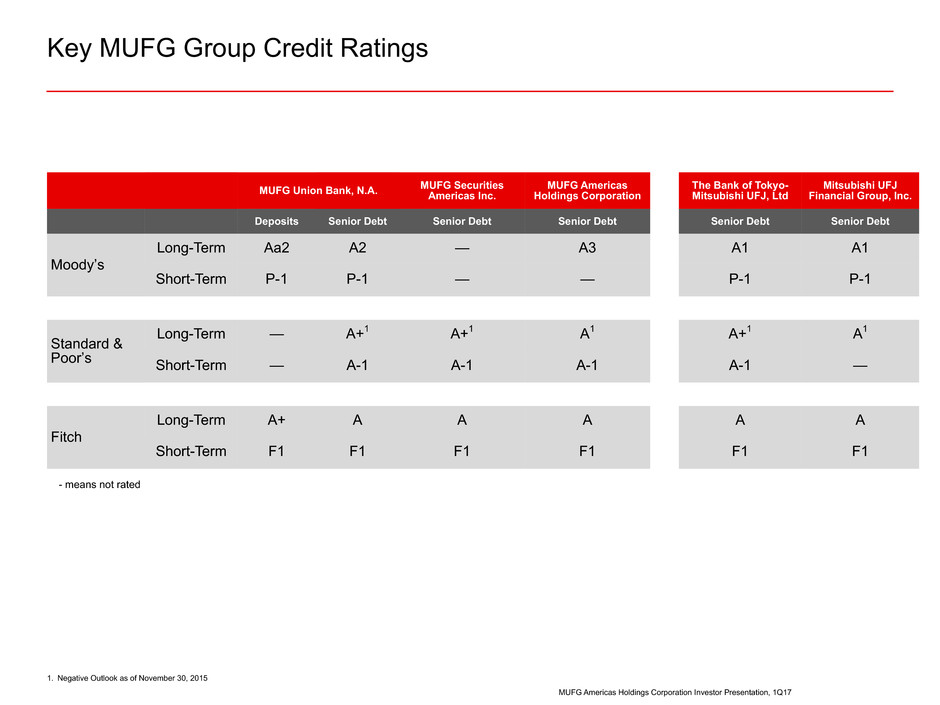

Key MUFG Group Credit Ratings

- means not rated

1. Negative Outlook as of November 30, 2015

MUFG Union Bank, N.A. MUFG SecuritiesAmericas Inc.

MUFG Americas

Holdings Corporation

The Bank of Tokyo-

Mitsubishi UFJ, Ltd

Mitsubishi UFJ

Financial Group, Inc.

Deposits Senior Debt Senior Debt Senior Debt Senior Debt Senior Debt

Moody’s

Long-Term Aa2 A2 — A3 A1 A1

Short-Term P-1 P-1 — — P-1 P-1

Standard &

Poor’s

Long-Term — A+1 A+1 A1 A+1 A1

Short-Term — A-1 A-1 A-1 A-1 —

Fitch

Long-Term A+ A A A A A

Short-Term F1 F1 F1 F1 F1 F1

MUFG Americas Holdings Corporation Investor Presentation, 1Q17

2016 CCAR and 2016 Mid-Cycle DFAST Results

The Federal Reserve did not object to MUAH's 2016 capital plan/CCAR submission

In April 2017, MUAH timely filed its annual capital plan under the Federal Reserve's CCAR program

2016 Mid-Cycle Severely Adverse Scenario Results

Mid-Cycle DFAST stress test results demonstrate MUAH's capital cushion in excess of regulatory

minimums

• Severely Adverse scenario included a severe global recession, negative short-term interest rates and low long-term

Treasury rates in the U.S., a multi-family commercial real estate (CRE) price shock and a European bank failure

Note: MUAH is a standardized BHC for purposes of calculating capital levels and ratios. MUB is subject to both standardized and advanced approaches rules.

1. Represents minimum projected capital ratios from July 1, 2016 through September 30, 2018.

2. Minimum post-stress regulatory ratios as defined in the Comprehensive Capital Analysis and Review 2016 Summary Instructions, January 2016.

MUFG Americas Holdings Corporation Investor Presentation, 1Q17

Conclusion

MUAH, MUB and MUSA carry solid credit ratings and benefit from ownership by MUFG, one of the

world’s largest financial organizations

Strong local management team with a majority of independent board members

Solid balance sheet with high-quality capital base and strong liquidity

Conservative risk culture resulting in a high quality loan portfolio with historically strong credit

performance

There are many risks facing the banking industry and MUAH; please refer to the Risk Factors on pages

18-33 of our Form 10-K for the year ended December 31, 2016

Contacts

Mimi Mengis Doug Lambert

Managing Director Director

415-765-3182 415-765-3180

mimi.mengis@unionbank.com doug.lambert@unionbank.com