Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - KEMET CORP | fy2017_q4x8kxex99d1.htm |

| 8-K - 8-K - KEMET CORP | fy2017_q4x8kearningsreleas.htm |

Earnings Conference Call

May 10, 2017

Quarter Ended March 31, 2017

Cautionary Statement

Certain statements included herein contain forward-looking statements within the meaning of federal securities laws about KEMET

Corporation's (the "Company") financial condition and results of operations that are based on management's current expectations,

estimates and projections about the markets in which the Company operates, as well as management's beliefs and assumptions. Words

such as "expects," "anticipates," "believes," "estimates," variations of such words and other similar expressions are intended to identify

such forward-looking statements. These statements are not guarantees of future performance and involve certain risks, uncertainties

and assumptions, which are difficult to predict. Therefore, actual outcomes and results may differ materially from what is expressed or

forecasted in, or implied by, such forward-looking statements. Readers are cautioned not to place undue reliance on these forward-

looking statements, which reflect management's judgment only as of the date hereof. The Company undertakes no obligation to update

publicly any of these forward-looking statements to reflect new information, future events or otherwise.

Factors that may cause actual outcomes and results to differ materially from those expressed in, or implied by, these forward-looking

statements include, but are not necessarily limited to, the following: (i) adverse economic conditions could impact our ability to realize

operating plans if the demand for our products declines, and such conditions could adversely affect our liquidity and ability to continue

to operate and cause a write down of long-lived assets or goodwill; (ii) an increase in the cost or a decrease in the availability of our

principal or single-sourced purchased raw materials; (iii) changes in the competitive environment; (iv) uncertainty of the timing of customer

product qualifications in heavily regulated industries; (v) economic, political, or regulatory changes in the countries in which we operate;

(vi) difficulties, delays or unexpected costs in completing the restructuring plans; (vii) acquisitions and other strategic transactions expose

us to a variety of risks; (viii) acquisition of TOKIN may not achieve all of the anticipated results; (ix) our business could be negatively

impacted by increased regulatory scrutiny and litigation; (x) difficulties associated with retaining, attracting and training effective

employees and management; (xi) the need to develop innovative products to maintain customer relationships and offset potential price

erosion in older products; (xii) exposure to claims alleging product defects; (xiii) the impact of laws and regulations that apply to our

business, including those relating to environmental matters; (xiv) the impact of international laws relating to trade, export controls and

foreign corrupt practices; (xv) changes impacting international trade and corporate tax provisions related to the global manufacturing

and sales of our products may have an adverse effect on our financial condition and results of operations; (xvi) volatility of financial and

credit markets affecting our access to capital; (xvii) the need to reduce the total costs of our products to remain competitive; (xviii) potential

limitation on the use of net operating losses to offset possible future taxable income; (xix) restrictions in our debt agreements that limit

our flexibility in operating our business; (xx) disruption to our information technology systems to function properly or control unauthorized

access to our systems may cause business disruptions; (xxi) additional exercise of the warrant by K Equity, LLC which could potentially

result in the existence of a significant stockholder who could seek to influence our corporate decisions; and (xxii) fluctuation in distributor

sales could adversely affect our results of operations.

2

Income Statement Highlights

U.S. GAAP (Unaudited)

3

For the Quarters Ended

(Amounts in thousands, except percentages and per share data) Mar 2017 Dec 2016 Mar 2016

Net sales $ 197,519 $ 188,029 $ 183,926

Gross margin $ 49,839 $ 47,337 $ 42,013

Gross margin as a percentage of net sales 25.2% 25.2% 22.8%

Selling, general and administrative $ 29,317 $ 26,665 $ 25,790

SG&A as a percentage of net sales 14.8% 14.2% 14.0%

Operating income (loss) $ 8,742 $ 13,850 $ 8,603

Net income (loss) $ 52,914 $ 12,278 $ (15,173)

Per share data:

Net income (loss) per basic share $ 1.13 $ 0.26 $ (0.33)

Net income (loss) per diluted share $ 0.93 $ 0.22 $ (0.33)

Weighted avg. shares - basic 46,803 46,606 46,160

Weighted avg. shares - diluted 57,130 55,296 46,160

Income Statement Highlights

Non-GAAP (Unaudited)

4

For the Quarters Ended

(Amounts in thousands, except percentages and per share data) Mar 2017 Dec 2016 Mar 2016

Net sales $ 197,519 $ 188,029 $ 183,926

Adjusted gross margin $ 50,230 $ 47,645 $ 42,751

Gross margin as a percentage of net sales 25.4% 25.3% 23.2%

Adjusted selling, general and administrative $ 25,848 $ 23,649 $ 23,499

Adjusted SG&A as a percentage of net sales 13.1% 12.6% 12.8%

Adjusted operating income (loss) $ 17,912 $ 16,983 $ 12,907

Adjusted net income (loss) $ 7,845 $ 5,810 $ 1,812

Adjusted EBITDA $ 27,230 $ 26,841 $ 23,042

Per share data:

Adjusted net income (loss) - basic $ 0.17 $ 0.13 $ 0.04

Adjusted net income (loss) - diluted $ 0.14 $ 0.11 $ 0.04

Weighted avg. shares - basic 46,803 46,606 46,160

Weighted avg. shares - diluted 57,130 55,296 50,056

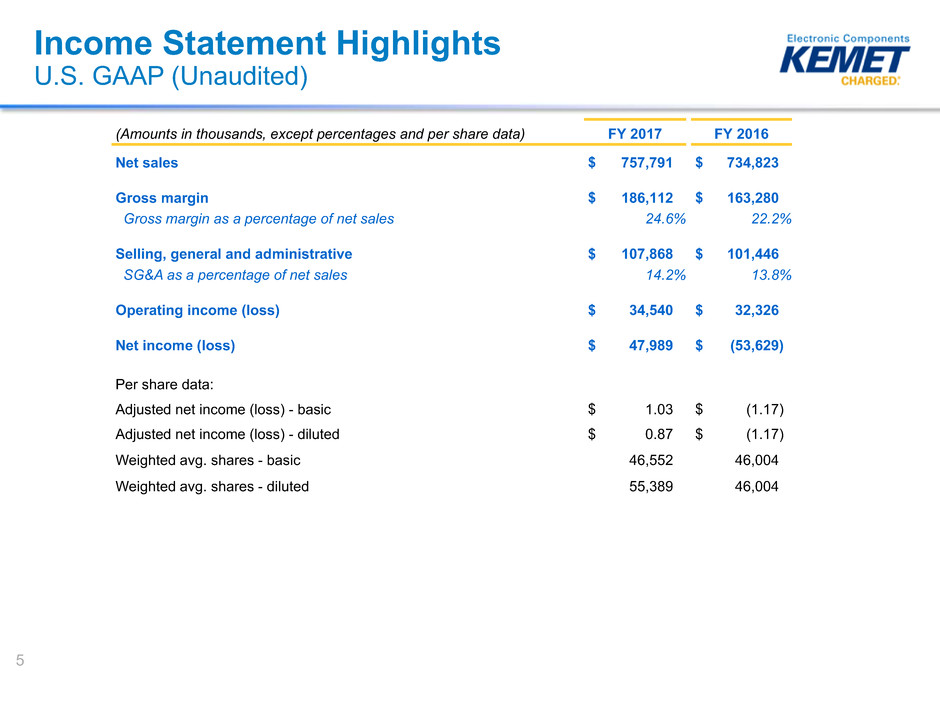

Income Statement Highlights

U.S. GAAP (Unaudited)

5

(Amounts in thousands, except percentages and per share data) FY 2017 FY 2016

Net sales $ 757,791 $ 734,823

Gross margin $ 186,112 $ 163,280

Gross margin as a percentage of net sales 24.6% 22.2%

Selling, general and administrative $ 107,868 $ 101,446

SG&A as a percentage of net sales 14.2% 13.8%

Operating income (loss) $ 34,540 $ 32,326

Net income (loss) $ 47,989 $ (53,629)

Per share data:

Adjusted net income (loss) - basic $ 1.03 $ (1.17)

Adjusted net income (loss) - diluted $ 0.87 $ (1.17)

Weighted avg. shares - basic 46,552 46,004

Weighted avg. shares - diluted 55,389 46,004

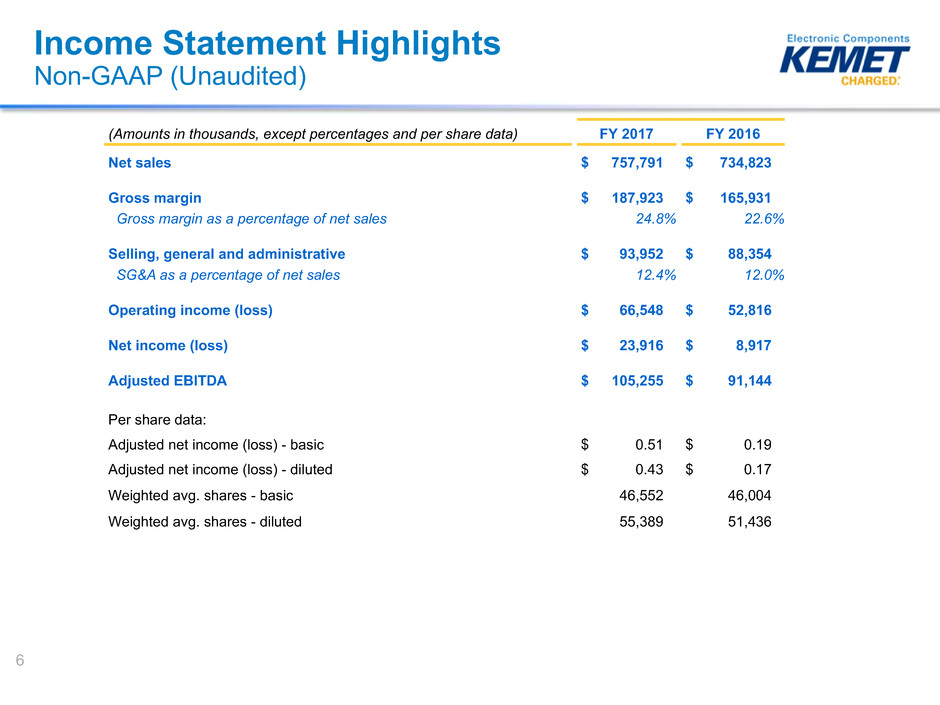

Income Statement Highlights

Non-GAAP (Unaudited)

6

(Amounts in thousands, except percentages and per share data) FY 2017 FY 2016

Net sales $ 757,791 $ 734,823

Gross margin $ 187,923 $ 165,931

Gross margin as a percentage of net sales 24.8% 22.6%

Selling, general and administrative $ 93,952 $ 88,354

SG&A as a percentage of net sales 12.4% 12.0%

Operating income (loss) $ 66,548 $ 52,816

Net income (loss) $ 23,916 $ 8,917

Adjusted EBITDA $ 105,255 $ 91,144

Per share data:

Adjusted net income (loss) - basic $ 0.51 $ 0.19

Adjusted net income (loss) - diluted $ 0.43 $ 0.17

Weighted avg. shares - basic 46,552 46,004

Weighted avg. shares - diluted 55,389 51,436

Financial Highlights

(Unaudited)

(1) Calculated as accounts receivable, net, plus inventories, net, less accounts payable

(2) Current quarter's accounts receivable divided by annualized current quarter's net sales multiplied by 365

(3) Current quarter's accounts payable divided by annualized current quarter's cost of goods sold multiplied

by 3657

(Amounts in millions, except DSO and DPO) Mar 2017 Dec 2016 FX Impact

Cash, cash equivalents $ 109.8 $ 87.4 $ 0.2

Capital expenditures $ 10.6 $ 4.7

Short-term debt $ 2.0 $ —

Long-term debt 387.3 386.9

Debt premium (1.1) (0.7)

Total debt $ 388.2 $ 386.2 $ —

Equity $ 154.7 $ 90.4 $ (2.7)

Net working capital (1) $ 170.8 $ 174.7 $ 0.4

Days in receivables (DSO)(2) 43 40

Days in payables (DPO)(3) 43 40

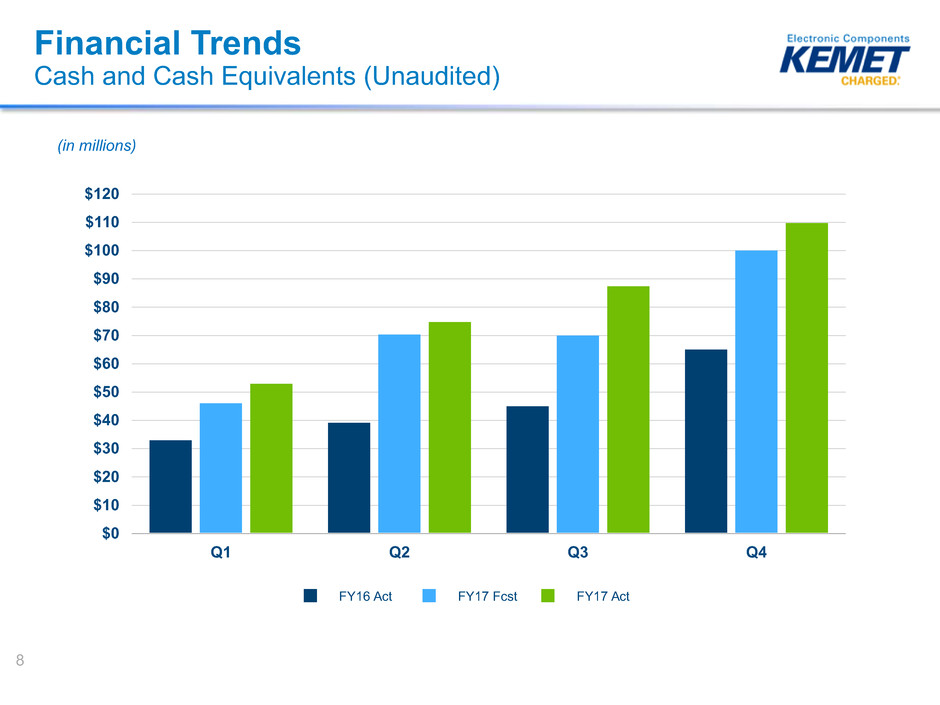

Financial Trends

Cash and Cash Equivalents (Unaudited)

FY16 Act FY17 Fcst FY17 Act

$120

$110

$100

$90

$80

$70

$60

$50

$40

$30

$20

$10

$0

Q1 Q2 Q3 Q4

8

(in millions)

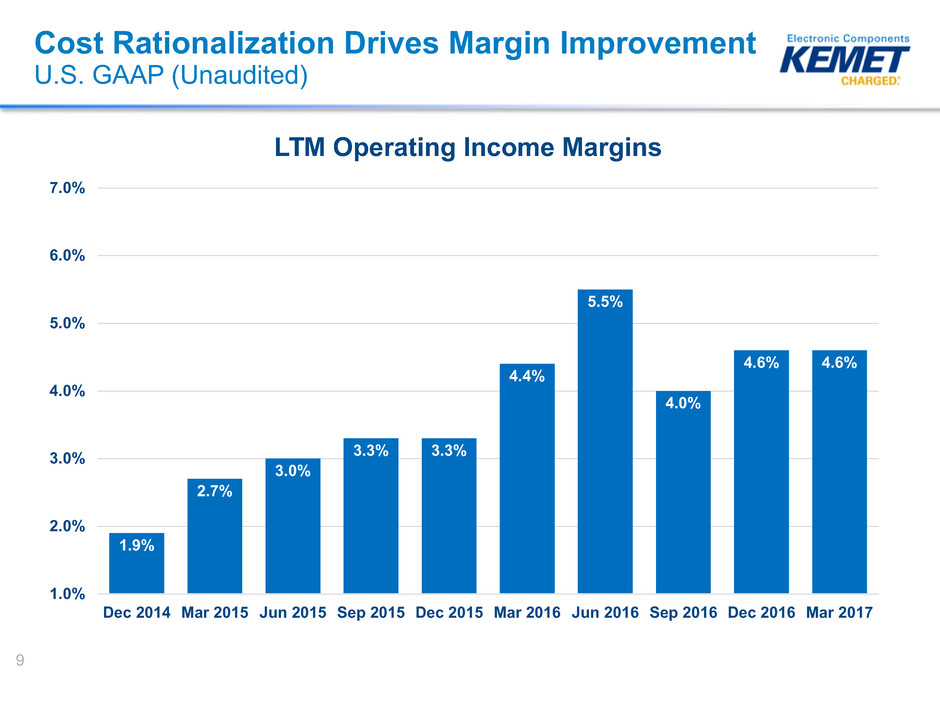

Cost Rationalization Drives Margin Improvement

U.S. GAAP (Unaudited)

LTM Operating Income Margins

7.0%

6.0%

5.0%

4.0%

3.0%

2.0%

1.0%

Dec 2014 Mar 2015 Jun 2015 Sep 2015 Dec 2015 Mar 2016 Jun 2016 Sep 2016 Dec 2016 Mar 2017

1.9%

2.7%

3.0%

3.3% 3.3%

4.4%

5.5%

4.0%

4.6% 4.6%

9

Cost Rationalization Drives Margin Improvement

Non-GAAP (Unaudited)

LTM Adjusted EBITDA Margins

14.5%

14.0%

13.5%

13.0%

12.5%

12.0%

11.5%

11.0%

10.5%

Dec 2014 Mar 2015 Jun 2015 Sep 2015 Dec 2015 Mar 2016 Jun 2016 Sep 2016 Dec 2016 Mar 2017

11.2% 11.1%

11.5%

11.8%

11.6%

12.4%

13.0%

13.3%

13.6%

13.9%

10

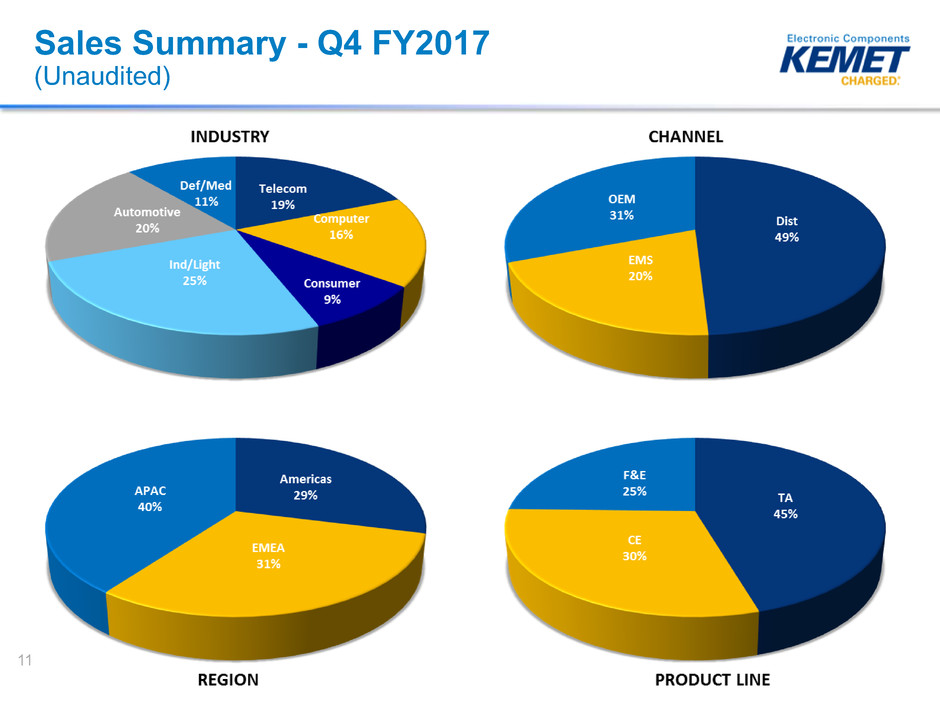

Sales Summary - Q4 FY2017

(Unaudited)

11

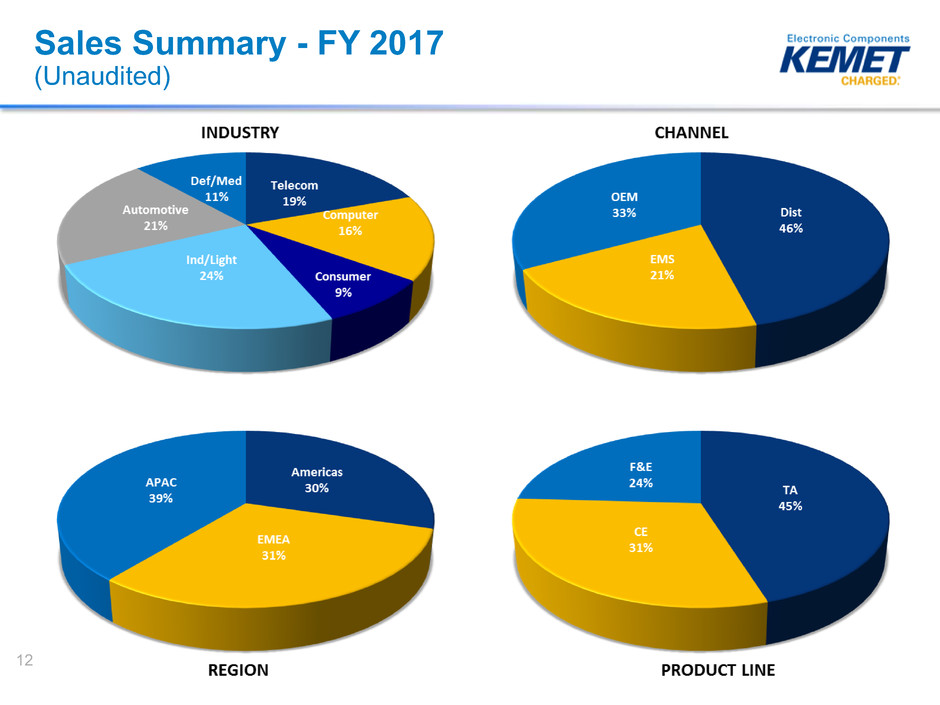

Sales Summary - FY 2017

(Unaudited)

12

Appendix

Adjusted Gross Margin

Non-GAAP (Unaudited)

14

For the Quarters Ended Fiscal Year

(Amounts in thousands, except percentages) Mar 2017 Dec 2016 Mar 2016 2017 2016

Net sales $ 197,519 $ 188,029 $ 183,926 $ 757,791 $ 734,823

Cost of sales $ 147,680 $ 140,692 $ 141,913 $ 571,679 $ 571,543

Gross margin (U.S. GAAP) $ 49,839 $ 47,337 $ 42,013 $ 186,112 $ 163,280

Gross margin as a percentage of net sales 25.2% 25.2% 22.8% 24.6% 22.2%

Adjustments:

Stock-based compensation expense 391 308 278 1,384 1,418

Plant start-up costs — — 319 427 861

Plant shut-down costs — — 141 — 372

Adjusted gross margin (non-GAAP) $ 50,230 $ 47,645 $ 42,751 $ 187,923 $ 165,931

Adjusted gross margin as a percentage of net sales 25.4% 25.3% 23.2% 24.8% 22.6%

Adjusted Selling, General & Administrative

Expenses

Non-GAAP (Unaudited)

15

For the Quarters Ended Fiscal Year

(Amounts in thousands, except percentages) Mar 2017 Dec 2016 Mar 2016 2017 2016

Net sales $ 197,519 $ 188,029 $ 183,926 $ 757,791 $ 734,823

Selling, general and administrative expenses (U.S.

GAAP) $ 29,317 $ 26,665 $ 25,790 $ 107,868 $ 101,446

Selling, general, and administrative as a percentage of net sales 14.8% 14.2% 14.0% 14.2% 13.8%

Less adjustments:

ERP integration costs/IT transition costs 1,760 1,734 859 7,045 5,677

Stock-based compensation expense 806 785 685 3,130 3,162

Legal expenses related to antitrust class actions 406 293 482 2,640 3,041

NEC TOKIN investment related expenses 497 204 265 1,101 900

Pension plan adjustment — — — — 312

Adjusted selling, general and administrative

expenses (non-GAAP) $ 25,848 $ 23,649 $ 23,499 $ 93,952 $ 88,354

Adjusted selling, general, and administrative as a percentage of net sales 13.1% 12.6% 12.8% 12.4% 12.0%

Adjusted Operating Income

Non-GAAP (Unaudited)

16

For the Quarters Ended Fiscal Year

(Amounts in thousands) Mar 2017 Dec 2016 Mar 2016 2017 2016

Operating income (loss) (U.S. GAAP) $ 8,742 $ 13,850 $ 8,603 $ 34,540 $ 32,326

Adjustments:

ERP integration costs/IT transition costs 1,760 1,734 859 7,045 5,677

Stock-based compensation expense 1,249 1,139 1,013 4,720 4,774

Restructuring charges 1,087 (369) 617 5,404 4,178

Legal expenses related to antitrust class actions 406 293 482 2,640 3,041

NEC TOKIN investment related expenses 497 204 265 1,101 900

Net (gain) loss on sales and disposals of assets 85 132 608 392 375

Plant start-up costs — — 319 427 861

Plant shut-down costs — — 141 — 372

Pension plan adjustment — — — — 312

Write down of long-lived assets 4,086 — — 10,279 —

Adjusted operating income (loss) (non-GAAP) $ 17,912 $ 16,983 $ 12,907 $ 66,548 $ 52,816

Adjusted Net Income (Loss) and Adjusted

EBITDA

Non-GAAP (Unaudited)

17

For the Quarters Ended Fiscal Year

(Amounts in thousands) Mar 2017 Dec 2016 Mar 2016 2017 2016

Net income (loss) (U.S. GAAP) $ 52,914 $ 12,278 $ (15,173) $ 47,989 $ (53,629)

Adjustments:

Change in value of NEC TOKIN options (14,200) (6,900) — (10,700) 26,300

Net foreign exchange (gain) loss 1,507 (2,621) 122 (3,758) (3,036)

ERP integration costs/IT transition costs 1,760 1,734 859 7,045 5,677

Stock-based compensation 1,249 1,139 1,013 4,720 4,774

Income tax effect of non-GAAP adjustments (374) (396) 546 (741) 652

Restructuring charges 1,087 (369) 617 5,404 4,178

Legal expenses related to antitrust class actions 406 293 482 2,640 3,041

NEC TOKIN investment related expenses 497 204 265 1,101 900

Amortization included in interest expense 200 183 210 761 859

Equity (gain) loss from NEC TOKIN (41,372) 133 11,648 (41,643) 16,406

Net (gain) loss on sales and disposals of assets 85 132 608 392 375

Write down of long-lived assets 4,086 — — 10,279 —

Income tax effect of pension curtailment — — 155 — 875

Plant start-up costs — — 319 427 861

Plant shut-down costs — — 141 — 372

Pension plan adjustment — — — — 312

Adjusted net income (loss) (non-GAAP) $ 7,845 $ 5,810 $ 1,812 $ 23,916 $ 8,917

Adjusted net income (loss) per share - basic $ 0.17 $ 0.13 $ 0.04 $ 0.51 $ 0.19

Adjusted net income (loss) per share - diluted $ 0.14 $ 0.11 $ 0.04 $ 0.43 $ 0.17

Adjusted EBITDA (non-GAAP) $ 27,230 $ 26,841 $ 23,042 $ 105,255 $ 91,144

Weighted avg. shares - basic 46,803 46,606 46,160 46,552 46,004

Weighted avg. shares - diluted 57,130 55,296 50,056 55,389 51,436

Adjusted EBITDA Reconciliation

Non-GAAP (Unaudited)

18

For the Quarters Ended Fiscal Year

(Amounts in thousands) Mar 2017 Dec 2016 Mar 2016 2017 2016

Net income (loss) (U.S. GAAP) $ 52,914 $ 12,278 $ (15,173) $ 47,989 $ (53,629)

Interest expense, net 9,994 9,913 9,925 39,731 39,591

Income tax expense (benefit) (150) 1,810 2,056 4,290 6,006

Depreciation and amortization 9,367 9,095 10,160 37,338 39,016

EBITDA (non-GAAP) 72,125 33,096 6,968 129,348 30,984

Excluding the following items

Change in value of NEC TOKIN options (14,200) (6,900) — (10,700) 26,300

Net foreign exchange (gain) loss 1,507 (2,621) 122 (3,758) (3,036)

ERP integration costs/IT transition costs 1,760 1,734 859 7,045 5,677

Stock-based compensation 1,249 1,139 1,013 4,720 4,774

Restructuring charges 1,087 (369) 617 5,404 4,178

Legal expenses related to antitrust class actions 406 293 482 2,640 3,041

NEC TOKIN investment related expenses 497 204 265 1,101 900

Equity (gain) loss from NEC TOKIN (41,372) 133 11,648 (41,643) 16,406

Net (gain) loss on sales and disposals of assets 85 132 608 392 375

Write down of long-lived assets 4,086 — — 10,279 —

Plant start-up costs — — 319 427 861

Plant shut-down costs — — 141 — 372

Pension plan adjustment — — — — 312

Adjusted EBITDA (non-GAAP) $ 27,230 $ 26,841 $ 23,042 $ 105,255 $ 91,144

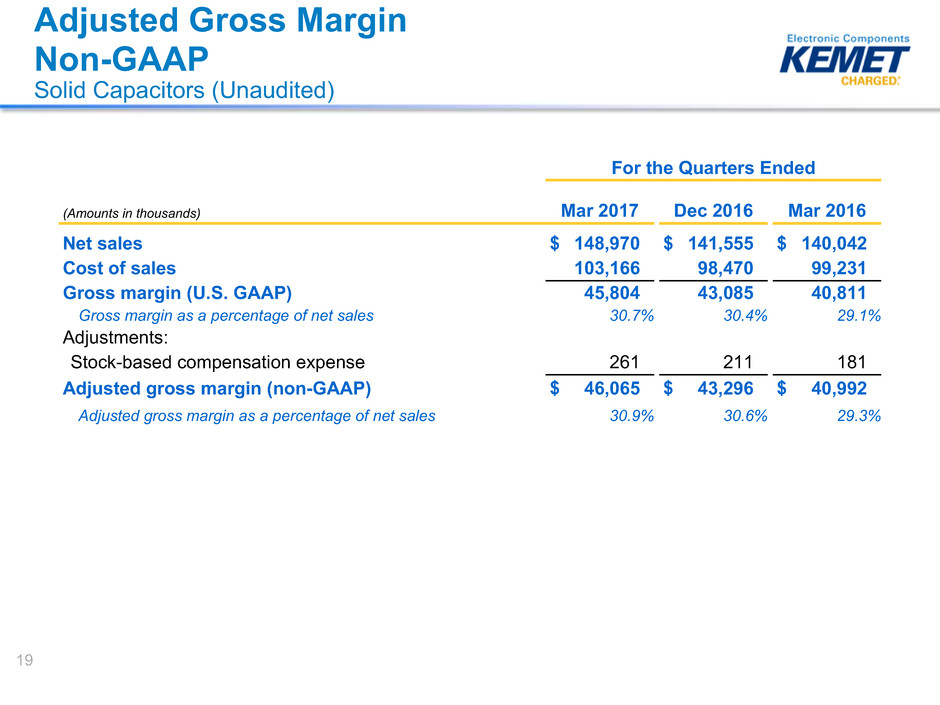

Adjusted Gross Margin

Non-GAAP

Solid Capacitors (Unaudited)

19

For the Quarters Ended

(Amounts in thousands) Mar 2017 Dec 2016 Mar 2016

Net sales $ 148,970 $ 141,555 $ 140,042

Cost of sales 103,166 98,470 99,231

Gross margin (U.S. GAAP) 45,804 43,085 40,811

Gross margin as a percentage of net sales 30.7% 30.4% 29.1%

Adjustments:

Stock-based compensation expense 261 211 181

Adjusted gross margin (non-GAAP) $ 46,065 $ 43,296 $ 40,992

Adjusted gross margin as a percentage of net sales 30.9% 30.6% 29.3%

Adjusted Gross Margin

Non-GAAP

Film & Electrolytics (Unaudited)

20

For the Quarters Ended

(Amounts in thousands) Mar 2017 Dec 2016 Mar 2016

Net sales $ 48,549 $ 46,474 $ 43,884

Cost of sales 44,514 42,222 42,682

Gross margin (U.S. GAAP) 4,035 4,252 1,202

Gross margin as a percentage of net sales 8.3% 9.1 % 2.7%

Adjustments:

Stock-based compensation expense 130 97 97

Plant start-up costs — — 319

Plant shut-down costs — — 141

Adjusted gross margin (non-GAAP) $ 4,165 $ 4,349 $ 1,759

Adjusted gross margin as a percentage of net sales 8.6% 9.4 % 4.0%

Adjusted Operating Income (Loss)

Non-GAAP

Solid Capacitors (Unaudited)

21

For the Quarters Ended

(Amounts in thousands) Mar 2017 Dec 2016 Mar 2016

Net sales $ 148,970 $ 141,555 $ 140,042

Operating income (loss) (U.S. GAAP) 38,941 37,264 34,538

Adjustments:

Stock-based compensation expense 261 211 181

Restructuring charges 767 (128) 360

Gain on sales and disposals of assets 76 67 507

Adjusted operating income (loss) (non-GAAP) $ 40,045 $ 37,414 $ 35,586

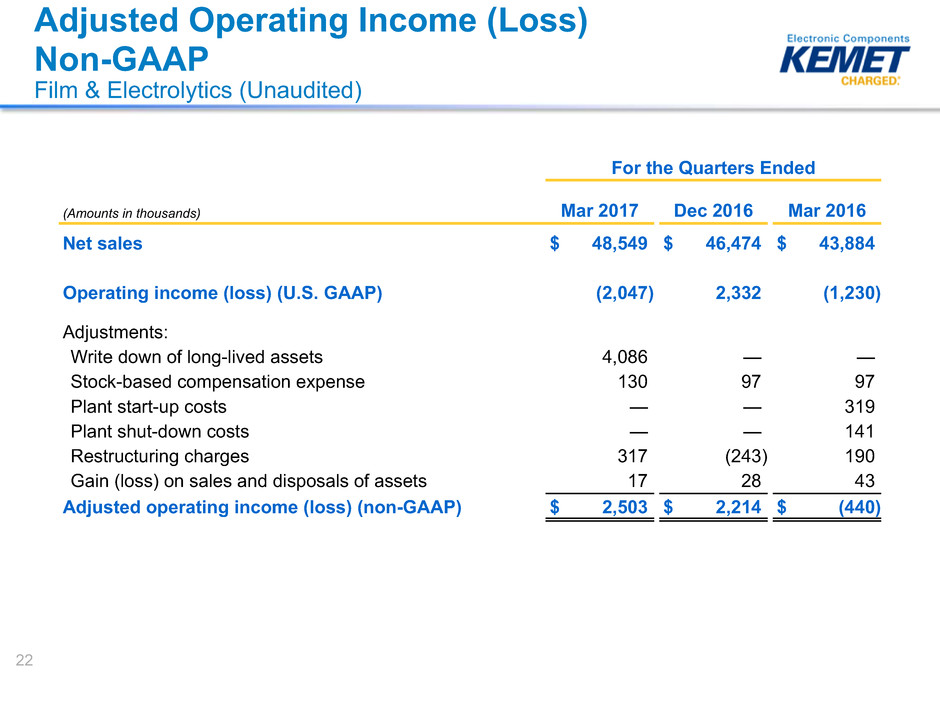

Adjusted Operating Income (Loss)

Non-GAAP

Film & Electrolytics (Unaudited)

22

For the Quarters Ended

(Amounts in thousands) Mar 2017 Dec 2016 Mar 2016

Net sales $ 48,549 $ 46,474 $ 43,884

Operating income (loss) (U.S. GAAP) (2,047) 2,332 (1,230)

Adjustments:

Write down of long-lived assets 4,086 — —

Stock-based compensation expense 130 97 97

Plant start-up costs — — 319

Plant shut-down costs — — 141

Restructuring charges 317 (243) 190

Gain (loss) on sales and disposals of assets 17 28 43

Adjusted operating income (loss) (non-GAAP) $ 2,503 $ 2,214 $ (440)

23

Adjusted EBITDA Reconciliation

Non-GAAP (Unaudited)

Quarter Ended LTM

(Amounts in thousands, except percentages) Mar 2014 Jun 2014 Sep 2014 Dec 2014 Dec 2014

Net Sales $ 215,821 $ 212,881 $ 215,293 $ 201,310 $ 845,305

Net income (loss) (U.S. GAAP) (14,447) (3,540) 6,330 2,914 (8,743)

Income tax expense (benefit) (2,811) 1,282 2,583 1,359 2,413

Interest expense, net 10,658 10,453 10,284 9,933 41,328

Depreciation and amortization 12,175 10,797 10,177 9,720 42,869

EBITDA (non-GAAP) 5,575 18,992 29,374 23,926 77,867

Excluding the following items (non-GAAP):

Change in value of NEC TOKIN options (1,777) (4,100) (6,600) (2,500) (14,977)

Equity (gain) loss from NEC TOKIN 4,127 1,675 (232) (1,367) 4,203

Restructuring charges 5,954 1,830 1,687 6,063 15,534

ERP integration costs / IT transition costs 837 895 409 671 2,812

Stock-based compensation expense 579 994 958 1,232 3,763

Legal expenses related to antitrust class actions — — — 409 409

Net foreign exchange (gain) loss (449) 527 (1,351) (1,257) (2,530)

NEC TOKIN investment-related expenses 618 580 487 485 2,170

Plant start-up costs 669 1,647 1,114 1,144 4,574

Plant shut-down costs 2,668 889 — — 3,557

Net (gain) loss on sales and disposals of assets (39) 365 (550) (574) (798)

(Income) loss from discontinued operations (103) (6,943) 1,400 164 (5,482)

(Gain) loss on early extinguishment of debt — — — (1,003) (1,003)

Professional fees related to financing activities — — — 1,142 1,142

Inventory revaluation — 2,676 (821) (927) 928

Write down of long-lived assets 1,118 — — — 1,118

Infrastructure tax 1,079 — — — 1,079

Adjusted EBITDA (non-GAAP) $ 20,856 $ 20,027 $ 25,875 $ 27,608 $ 94,366

Adjusted EBITDA Margin 9.7% 9.4% 12.0% 13.7% 11.2%

24

Adjusted EBITDA Reconciliation

Non-GAAP (Unaudited)

Quarter Ended LTM

(Amounts in thousands, except percentages) Sep 2014 Dec 2014 Mar 2015 Jun 2015 Jun 2015

Net Sales $ 215,293 $ 201,310 $ 193,708 $ 187,590 $ 797,901

Net income (loss) (U.S. GAAP) 6,330 2,914 (19,847) (37,050) (47,653)

Income tax expense (benefit) 2,583 1,359 3 (248) 3,697

Interest expense, net 10,284 9,933 10,016 10,010 40,243

Depreciation and amortization 10,177 9,720 10,074 9,917 39,888

EBITDA (non-GAAP) 29,374 23,926 246 (17,371) 36,175

Excluding the following items (non-GAAP):

Change in value of NEC TOKIN options (6,600) (2,500) 11,100 29,200 31,200

Equity (gain) loss from NEC TOKIN (232) (1,367) 2,093 (1,585) (1,091)

Restructuring charges 1,687 6,063 3,437 1,824 13,011

ERP integration costs / IT transition costs 409 671 1,273 4,369 6,722

Stock-based compensation expense 958 1,232 1,328 1,279 4,797

Legal expenses related to antitrust class actions — 409 435 718 1,562

Net foreign exchange (gain) loss (1,351) (1,257) (2,168) 1,049 (3,727)

NEC TOKIN investment-related expenses 487 485 226 224 1,422

Plant start-up costs 1,114 1,144 651 195 3,104

Net (gain) loss on sales and disposals of assets (550) (574) 538 (58) (644)

Pension plan adjustment — — — 312 312

(Income) loss from discontinued operations 1,400 164 — — 1,564

(Gain) loss on early extinguishment of debt — (1,003) — — (1,003)

Professional fees related to financing activities — 1,142 — — 1,142

Inventory revaluation (821) (927) (928) — (2,676)

Adjusted EBITDA (non-GAAP) $ 25,875 $ 27,608 $ 18,231 $ 20,156 $ 91,870

Adjusted EBITDA Margin 12.0% 13.7% 9.4% 10.7% 11.5%

25

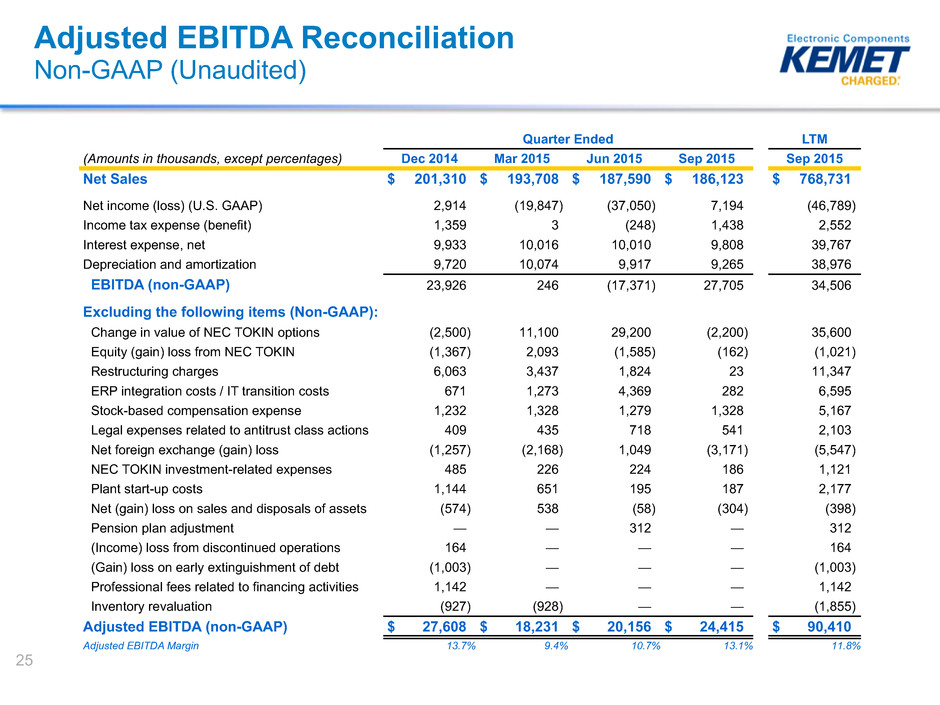

Adjusted EBITDA Reconciliation

Non-GAAP (Unaudited)

Quarter Ended LTM

(Amounts in thousands, except percentages) Dec 2014 Mar 2015 Jun 2015 Sep 2015 Sep 2015

Net Sales $ 201,310 $ 193,708 $ 187,590 $ 186,123 $ 768,731

Net income (loss) (U.S. GAAP) 2,914 (19,847) (37,050) 7,194 (46,789)

Income tax expense (benefit) 1,359 3 (248) 1,438 2,552

Interest expense, net 9,933 10,016 10,010 9,808 39,767

Depreciation and amortization 9,720 10,074 9,917 9,265 38,976

EBITDA (non-GAAP) 23,926 246 (17,371) 27,705 34,506

Excluding the following items (Non-GAAP):

Change in value of NEC TOKIN options (2,500) 11,100 29,200 (2,200) 35,600

Equity (gain) loss from NEC TOKIN (1,367) 2,093 (1,585) (162) (1,021)

Restructuring charges 6,063 3,437 1,824 23 11,347

ERP integration costs / IT transition costs 671 1,273 4,369 282 6,595

Stock-based compensation expense 1,232 1,328 1,279 1,328 5,167

Legal expenses related to antitrust class actions 409 435 718 541 2,103

Net foreign exchange (gain) loss (1,257) (2,168) 1,049 (3,171) (5,547)

NEC TOKIN investment-related expenses 485 226 224 186 1,121

Plant start-up costs 1,144 651 195 187 2,177

Net (gain) loss on sales and disposals of assets (574) 538 (58) (304) (398)

Pension plan adjustment — — 312 — 312

(Income) loss from discontinued operations 164 — — — 164

(Gain) loss on early extinguishment of debt (1,003) — — — (1,003)

Professional fees related to financing activities 1,142 — — — 1,142

Inventory revaluation (927) (928) — — (1,855)

Adjusted EBITDA (non-GAAP) $ 27,608 $ 18,231 $ 20,156 $ 24,415 $ 90,410

Adjusted EBITDA Margin 13.7% 9.4% 10.7% 13.1% 11.8%

26

Adjusted EBITDA Reconciliation

Non-GAAP (Unaudited)

Quarter Ended LTM

(Amounts in thousands, except percentages) Mar 2015 Jun 2015 Sep 2015 Dec 2015 Dec 2015

Net Sales $ 193,708 $ 187,590 $ 186,123 $ 177,184 $ 744,605

Net income (loss) (U.S. GAAP) (19,847) (37,050) 7,194 (8,600) (58,303)

Income tax expense (benefit) 3 (248) 1,438 2,760 3,953

Interest expense, net 10,016 10,010 9,808 9,848 39,682

Depreciation and amortization 10,074 9,917 9,265 9,674 38,930

EBITDA (non-GAAP) 246 (17,371) 27,705 13,682 24,262

Excluding the following items (Non-GAAP):

Change in value of NEC TOKIN options 11,100 29,200 (2,200) (700) 37,400

Equity (gain) loss from NEC TOKIN 2,093 (1,585) (162) 6,505 6,851

Restructuring charges 3,437 1,824 23 1,714 6,998

ERP integration costs / IT transition costs 1,273 4,369 282 167 6,091

Stock-based compensation expense 1,328 1,279 1,328 1,154 5,089

Legal expenses related to antitrust class actions 435 718 541 1,300 2,994

Net foreign exchange (gain) loss (2,168) 1,049 (3,171) (1,036) (5,326)

NEC TOKIN investment-related expenses 226 224 186 225 861

Plant start-up costs 651 195 187 160 1,193

Plant shut-down costs — — — 231 231

Net (gain) loss on sales and disposals of assets 538 (58) (304) 129 305

Pension plan adjustment — 312 — — 312

Inventory revaluation (928) — — — (928)

Adjusted EBITDA (non-GAAP) $ 18,231 $ 20,156 $ 24,415 $ 23,531 $ 86,333

Adjusted EBITDA Margin 9.4% 10.7% 13.1% 13.3% 11.6%

27

Adjusted EBITDA Reconciliation

Non-GAAP (Unaudited)

Quarter Ended LTM

(Amounts in thousands, except percentages) Sep 2015 Dec 2015 Mar 2016 Jun 2016 Jun 2016

Net Sales $ 186,123 $ 177,184 $ 183,926 $ 184,935 $ 732,168

Net income (loss) (U.S. GAAP) 7,194 (8,600) (15,173) (12,205) (28,784)

Income tax expense (benefit) 1,438 2,760 2,056 1,800 8,054

Interest expense, net 9,808 9,848 9,925 9,920 39,501

Depreciation and amortization 9,265 9,674 10,160 9,436 38,535

EBITDA (non-GAAP) 27,705 13,682 6,968 8,951 57,306

Excluding the following items (Non-GAAP):

Change in value of NEC TOKIN options (2,200) (700) — 12,000 9,100

Equity (gain) loss from NEC TOKIN (162) 6,505 11,648 (223) 17,768

Restructuring charges 23 1,714 617 688 3,042

ERP integration costs / IT transition costs 282 167 859 1,768 3,076

Stock-based compensation expense 1,328 1,154 1,013 1,228 4,723

Legal expenses related to antitrust class actions 541 1,300 482 1,175 3,498

Net foreign exchange (gain) loss (3,171) (1,036) 122 (1,920) (6,005)

NEC TOKIN investment-related expenses 186 225 265 206 882

Plant start-up costs 187 160 319 308 974

Plant shut-down costs — 231 141 — 372

Net (gain) loss on sales and disposals of assets (304) 129 608 91 524

Adjusted EBITDA (non-GAAP) $ 24,415 $ 23,531 $ 23,042 $ 24,272 $ 95,260

Adjusted EBITDA Margin 13.1% 13.3% 12.5% 13.1% 13.0%

28

Adjusted EBITDA Reconciliation

Non-GAAP (Unaudited)

Quarter Ended LTM

(Amounts in thousands, except percentages) Dec 2015 Mar 2016 Jun 2016 Sep 2016 Sep 2016

Net Sales $ 177,184 $ 183,926 $ 184,935 $ 187,308 $ 733,353

Net income (loss) (U.S. GAAP) (8,600) (15,173) (12,205) (4,998) (40,976)

Income tax expense (benefit) 2,760 2,056 1,800 830 7,446

Interest expense, net 9,848 9,925 9,920 9,904 39,597

Depreciation and amortization 9,674 10,160 9,436 9,440 38,710

EBITDA (non-GAAP) 13,682 6,968 8,951 15,176 44,777

Excluding the following items (non-GAAP):

Change in value of NEC TOKIN options (700) — 12,000 (1,600) 9,700

Equity (gain) loss from NEC TOKIN 6,505 11,648 (223) (181) 17,749

Restructuring charges 1,714 617 688 3,998 7,017

ERP integration costs / IT transition costs 167 859 1,768 1,783 4,577

Stock-based compensation expense 1,154 1,013 1,228 1,104 4,499

Legal expenses related to antitrust class actions 1,300 482 1,175 766 3,723

Net foreign exchange (gain) loss (1,036) 122 (1,920) (724) (3,558)

NEC TOKIN investment-related expenses 225 265 206 194 890

Plant start-up costs 160 319 308 119 906

Plant shut-down costs 231 141 — — 372

Net (gain) loss on sales and disposals of assets 129 608 91 84 912

Write down of long-lived assets — — — 6,193 6,193

Adjusted EBITDA (non-GAAP) $ 23,531 $ 23,042 $ 24,272 $ 26,912 $ 97,757

Adjusted EBITDA Margin 13.3% 12.5% 13.1% 14.4% 13.3%

29

Adjusted EBITDA Reconciliation

Non-GAAP (Unaudited)

Quarter Ended LTM

(Amounts in thousands, except percentages) Mar 2016 Jun 2016 Sep 2016 Dec 2016 Dec 2016

Net Sales $ 183,926 $ 184,935 $ 187,308 $ 188,029 $ 744,198

Net income (loss) (U.S. GAAP) (15,173) (12,205) (4,998) 12,278 (20,098)

Income tax expense (benefit) 2,056 1,800 830 1,810 6,496

Interest expense, net 9,925 9,920 9,904 9,913 39,662

Depreciation and amortization 10,160 9,436 9,440 9,095 38,131

EBITDA (non-GAAP) 6,968 8,951 15,176 33,096 64,191

Excluding the following items (non-GAAP):

Change in value of NEC TOKIN options — 12,000 (1,600) (6,900) 3,500

Equity (gain) loss from NEC TOKIN 11,648 (223) (181) 133 11,377

Restructuring charges 617 688 3,998 (369) 4,934

ERP integration costs / IT transition costs 859 1,768 1,783 1,734 6,144

Stock-based compensation expense 1,013 1,228 1,104 1,139 4,484

Legal expenses related to antitrust class actions 482 1,175 766 293 2,716

Net foreign exchange (gain) loss 122 (1,920) (724) (2,621) (5,143)

NEC TOKIN investment-related expenses 265 206 194 204 869

Plant start-up costs 319 308 119 — 746

Plant shut-down costs 141 — — — 141

Net (gain) loss on sales and disposals of assets 608 91 84 132 915

Write down of long-lived assets — — 6,193 — 6,193

Adjusted EBITDA (non-GAAP) $ 23,042 $ 24,272 $ 26,912 $ 26,841 $ 101,067

Adjusted EBITDA Margin 12.5% 13.1% 14.4% 14.3% 13.6%

30

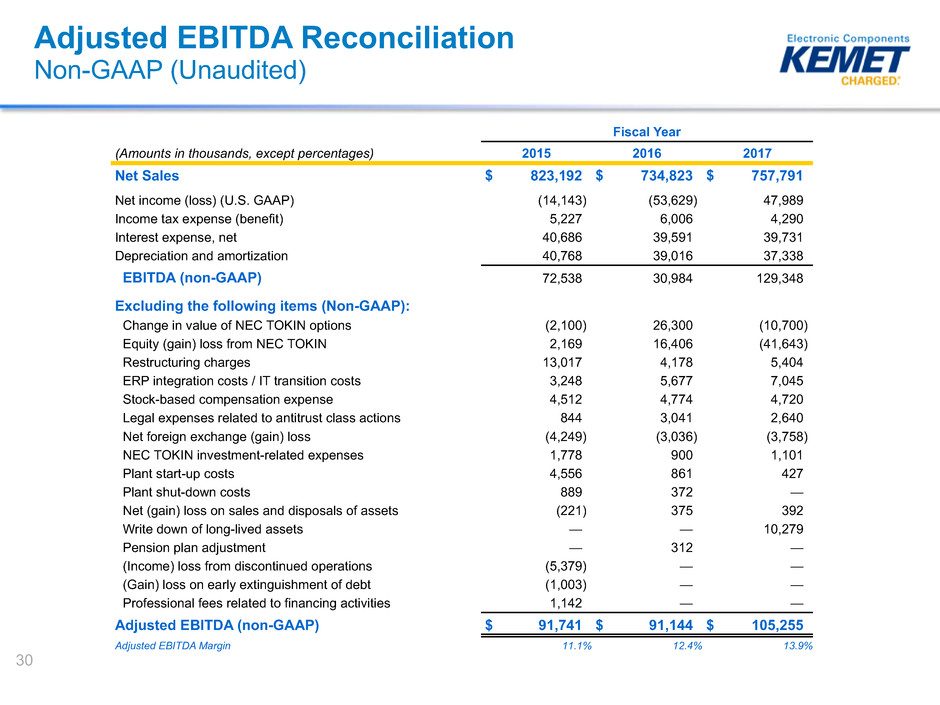

Adjusted EBITDA Reconciliation

Non-GAAP (Unaudited)

Fiscal Year

(Amounts in thousands, except percentages) 2015 2016 2017

Net Sales $ 823,192 $ 734,823 $ 757,791

Net income (loss) (U.S. GAAP) (14,143) (53,629) 47,989

Income tax expense (benefit) 5,227 6,006 4,290

Interest expense, net 40,686 39,591 39,731

Depreciation and amortization 40,768 39,016 37,338

EBITDA (non-GAAP) 72,538 30,984 129,348

Excluding the following items (Non-GAAP):

Change in value of NEC TOKIN options (2,100) 26,300 (10,700)

Equity (gain) loss from NEC TOKIN 2,169 16,406 (41,643)

Restructuring charges 13,017 4,178 5,404

ERP integration costs / IT transition costs 3,248 5,677 7,045

Stock-based compensation expense 4,512 4,774 4,720

Legal expenses related to antitrust class actions 844 3,041 2,640

Net foreign exchange (gain) loss (4,249) (3,036) (3,758)

NEC TOKIN investment-related expenses 1,778 900 1,101

Plant start-up costs 4,556 861 427

Plant shut-down costs 889 372 —

Net (gain) loss on sales and disposals of assets (221) 375 392

Write down of long-lived assets — — 10,279

Pension plan adjustment — 312 —

(Income) loss from discontinued operations (5,379) — —

(Gain) loss on early extinguishment of debt (1,003) — —

Professional fees related to financing activities 1,142 — —

Adjusted EBITDA (non-GAAP) $ 91,741 $ 91,144 $ 105,255

Adjusted EBITDA Margin 11.1% 12.4% 13.9%

Non-GAAP Financial Measures

Non-GAAP Financial Measures

Included in this presentation are certain non-GAAP financial measures designed to complement the financial information presented in

accordance with generally accepted accounting principles in the United States of America because management believes such measures

are useful to investors.

Adjusted gross margin

Adjusted gross margin represents net sales less cost of sales excluding adjustments which are outlined in the quantitative reconciliation

provided earlier in this presentation. Management uses Adjusted gross margin to facilitate our analysis and understanding of our business

operations by excluding the items outlined in the quantitative reconciliation provided below which might otherwise make comparisons of our

ongoing business with prior periods more difficult and obscure trends in ongoing operations. The Company believes that Adjusted gross

margin is useful to investors because it provides a supplemental way to understand the underlying operating performance of the Company.

Adjusted gross margin should not be considered as an alternative to gross margin or any other performance measure derived in accordance

with GAAP.

Adjusted selling, general and administrative expenses

Adjusted selling, general and administrative expenses represents selling, general and administrative expenses excluding adjustments which

are outlined in the quantitative reconciliation provided earlier in this presentation. Management uses Adjusted selling, general and

administrative expenses to facilitate our analysis and understanding of our business operations and believes that Adjusted selling, general

and administrative expenses is useful to investors because it provides a supplemental way to understand the underlying operating performance

of the Company. Adjusted selling, general and administrative expenses should not be considered as an alternative to selling, general and

administrative expenses or any other performance measure derived in accordance with GAAP.

Adjusted operating income (loss)

Adjusted operating income represents operating income (loss), excluding adjustments which are outlined in the quantitative reconciliation

provided earlier in this presentation. Management uses Adjusted operating income to facilitate our analysis and understanding of our business

operations by excluding the items outlined in the quantitative reconciliation provided below which might otherwise make comparisons of our

ongoing business with prior periods more difficult and obscure trends in ongoing operations. The Company believes that Adjusted operating

income is useful to investors because it provides a supplemental way to understand the underlying operating performance of the Company

and allows investors to monitor and understand changes in our ability to generate income from ongoing business operations. Adjusted

operating income should not be considered as an alternative to operating loss or any other performance measure derived in accordance

with GAAP.

31

Non-GAAP Financial Measures

Continued

Adjusted net income (loss) and Adjusted EPS

Adjusted net income (loss) and Adjusted EPS represent net income (loss) and EPS, excluding adjustments which are more specifically

outlined in the quantitative reconciliation provided earlier in this presentation. Management uses Adjusted net income and Adjusted

EPS to evaluate the Company's operating performance by excluding the items outlined in the quantitative reconciliation provided below

which might otherwise make comparisons of our ongoing business with prior periods more difficult and obscure trends in ongoing

operations. The Company believes that Adjusted net income (loss) and Adjusted EPS are useful to investors because they provide a

supplemental way to possibly better understand the underlying operating performance of the Company and allows investors to monitor

and understand changes in our ability to generate income from ongoing business operations. Adjusted net income (loss) and Adjusted

EPS should not be considered as alternatives to net income, operating income or any other performance measures derived in

accordance with GAAP.

Adjusted EBITDA

Adjusted EBITDA represents net loss before income tax expense (benefit), interest expense, net, and depreciation and amortization

expense, excluding adjustments which are more specifically outlined in the quantitative reconciliation provided earlier in this

presentation. We present Adjusted EBITDA as a supplemental measure of our performance and ability to service debt. We also

present Adjusted EBITDA because we believe such measure is frequently used by securities analysts, investors and other interested

parties in the evaluation of companies in our industry.

We believe Adjusted EBITDA is an appropriate supplemental measure of debt service capacity, because cash expenditures on interest

are, by definition, available to pay interest, and tax expense is inversely correlated to interest expense because tax expense goes

down as deductible interest expense goes up; depreciation and amortization are non-cash charges. The other items excluded from

Adjusted EBITDA are excluded in order to better reflect our continuing operations.

In evaluating Adjusted EBITDA, you should be aware that in the future we may incur expenses similar to the adjustments in this

presentation. Our presentation of Adjusted EBITDA should not be construed as an inference that our future results will be unaffected

by these types of adjustments. Adjusted EBITDA is not a measurement of our financial performance under GAAP and should not be

considered as an alternative to net income, operating income or any other performance measures derived in accordance with GAAP

or as an alternative to cash flow from operating activities as a measure of our liquidity.

32

Non-GAAP Financial Measures

Continued

Our Adjusted EBITDA measure has limitations as an analytical tool, and you should not consider it in isolation or as a

substitute for analysis of our results as reported under GAAP. Some of these limitations are:

• it does not reflect our cash expenditures, future requirements for capital expenditures or contractual commitments;

• it does not reflect changes in, or cash requirements for, our working capital needs;

• it does not reflect the significant interest expense or the cash requirements necessary to service interest or principal

payment on our debt;

• although depreciation and amortization are non-cash charges, the assets being depreciated and amortized will often

have to be replaced in the future, and our Adjusted EBITDA measure does not reflect any cash requirements for such

replacements;

• it is not adjusted for all non-cash income or expense items that are reflected in our statements of cash flows;

• it does not reflect the impact of earnings or charges resulting from matters we consider not to be indicative of our

ongoing operations;

• it does not reflect limitations on or costs related to transferring earnings from our subsidiaries to us; and

• other companies in our industry may calculate this measure differently than we do, limiting its usefulness as a

comparative measure.

Because of these limitations, Adjusted EBITDA should not be considered as a measure of discretionary cash available

to us to invest in the growth of our business or as a measure of cash that will be available to us to meet our obligations.

You should compensate for these limitations by relying primarily on our GAAP results and using Adjusted EBITDA only

supplementally.

33