Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - Lument Finance Trust, Inc. | v466611_ex99-1.htm |

| 8-K - FORM 8-K - Lument Finance Trust, Inc. | v466611_8k.htm |

Exhibit 99.2

Invest m ent Corp. Fi r s t Q u ar t e r 2 0 17 E arnin g s and P e r f orman c e Hi ghl i g h ts P r e se nt a t i on M a y 1 0 , 2 0 17

S a f e H a rbo r S t a t e m e n t 2 This p r e s e nta t ion i n c l u d e s " f o r w a r d - loo k i n g sta t e m e nts" w ithin the m e ani n g of the U .S. s ec u r ities la w s that a r e subj e c t t o r is k s and un cer tainties. T h e se f o r w a r d - loo k i n g sta t e m e nts i n c l u de i nf o r m a t ion about possible or ass u m e d f utu r e r e sults of t he Co m pany's busi n e ss, f i n an c ial c ondition, liqui d it y , r e sults of op er a t io n s, pla n s and obj e c tiv e s. Y ou c an i d e nti f y f o r w a r d - loo k i n g s t a te m e nts by use of w o r ds su c h as "b e liev e ," " e xpe c t ," "anti c ipa te ," " e s t i m a te ," "plan," " c ontinu e ," "in t e n d ," "shoul d ," " m ay" or si m ilar e xp r e ssions or o t h e r c o m pa r able t e r m s, or by discussio n s of st r a te g y , pla n s or i n t e ntions. Sta t e m e nts r e ga r d i n g the follo w i n g subj e c ts, a m ong othe r s, m ay be f o r w a r d - loo k i n g: the r e turn on e quity; t he yield on i n v e st m e nts; the a bility t o bo r r ow t o f i n an c e asse t s; and r is k s associa te d w ith i n v e sting in r e al e sta t e asse t s, i n c l u di n g c hang e s in busi n e ss c ondition s , i n t e r e st r a te s, the ge n er al ec ono m y and politi c al c onditions and r e lat e d m a t t e r s. F o r w a r d - loo k i n g sta t e m e nts a r e based on the Co m pany's b e li e f s, assu m ptions and e xp ec ta t io n s of its f utu r e p er f o r m an ce , taking i n to a c c ount all in f o r m a t ion c u r r e ntly available t o the C o m pan y . A c tual r e sults m ay di ff e r f r om e xp ec ta t io n s, e sti m a te s and p r o jec tions and, c ons e qu e ntl y , you shou l d not r e ly on t h e se f o r w a r d loo k i n g sta t e m e nts as p r e dic t io n s of f utu r e e v e nts. F o r w a r d - loo k i n g sta t e m e nts a r e subj e c t t o substantial r is k s and un cer tainties, m any of w hich a r e di ff icult to p r e dict and a r e g e n er ally b e yond the Co m pany's c ont r ol. Ad d itional i nf o r m a t ion c on cer ni n g these and o t h e r r isk f a c to r s a r e c ontained in the Co m pany's m ost r ece nt f ili n gs w ith the S ec u r ities and Ex c hange Co mm issio n , w hich a r e available on the S ec u r ities and Ex c hange Co mm issio n 's w e bsite at ww w .se c .go v . All s u bs e qu e nt w r it te n and o r al f o r w a r d - loo k i n g sta t e m e nts that t he Co m pany m ak e s, or that a r e a t t r i b utable t o the Co m pan y , a r e e xp r e ssly quali f ied in their e nti r e ty by this c autiona r y no t ic e . Any f o r w a r d - loo k i n g sta t e m e nt sp e aks only as of the da t e on w hich it is m ad e . Ex ce pt as r e qui r e d by la w , the C o m pany is n ot obligat e d t o, and do e s not i n t e nd to, upda t e or r e vise any f o r w a r d - loo k i n g sta t e m e nts, w h e ther as a r e sult of n e w i nf o r m a t io n , f utu r e e v e nts or o t h er w ise.

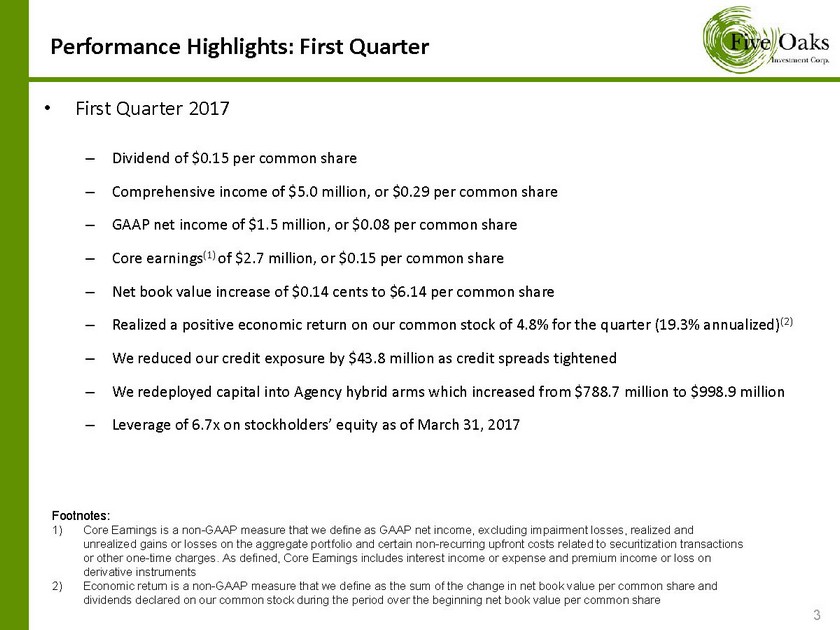

P er f or m a nce H ighlig h ts: Fi r s t Qu a r t er 3 • Fi r s t Qua r t er 2017 – Divide n d o f $ 0 .15 p er c om m o n sha r e – Com p r e h e n si v e in c om e o f $ 5 .0 m illi on , o r $ 0 .29 p er c om m o n sha r e – GAAP n e t in c om e o f $ 1 .5 m illi on , o r $ 0 .08 p er c om m o n sha r e – Co r e ear n in g s ( 1 ) o f $ 2 .7 m illi on , o r $ 0 .15 p er c om m o n sha r e – N e t b o ok v al u e i nc r e ase o f $0 . 1 4 c e n ts t o $6 . 1 4 p e r c om m o n sh a r e – R eali z ed a p o s iti v e e c onomi c r e t u rn o n ou r c om m o n s t oc k o f 4. 8 % f o r t h e qu ar t er ( 1 9 .3% a nnu ali z e d ) (2) – W e r e duc ed ou r c r e d it e xpo s u r e b y $ 4 3.8 m illi o n as c r e d it sp r ea d s tig h t e n ed – W e r e d e p l o y ed c a p i t al i n t o A g e nc y h y b rid ar m s whi c h in c r eased f r o m $ 7 8 8 .7 m illi o n t o $ 9 9 8.9 m illi on – L e v e r a g e o f 6.7x o n s t oc k h ol d e r s’ e qu ity as o f Ma r c h 3 1 , 20 1 7 Foo t no t es: 1) Core E arn in g s i s a n o n - G AA P m e a s ure th a t w e d e f ine as G AA P n e t inco m e, ex c luding i m pai r m e n t los s es, re ali z ed a n d u n re ali z ed gains or los s es on t h e a g gregate p o rt f o l io a nd c erta in n o n - recur r ing u p f ro n t c osts re l at e d to s ecuri ti z at i on tra n s ac t io n s or oth e r o n e - t i m e c h a rg e s . A s d e f in e d, Core E arn in g s i nclu d es i nt e rest i nco m e or e x p e nse a n d p re m ium inco m e or loss on d e r i v at iv e i nstru m e n ts E c o n o m i c ret u rn i s a n o n - G AA P m e a s ure th a t w e d e f ine as t h e s um of the ch a n g e in n e t b o ok v a l ue p e r co mm on s h a re a n d d iv id e n d s d e c l ared o n o u r co mm on s tock d u r ing t h e p eri o d ov er the b e g i nning n e t b o o k v a l ue p e r co mm on s h a re 2)

M a r k e t O b se r va tions: Fi r s t Qu a r t e r 2017 4 • R at es s t a b ili z ed in t h e f i r s t qu ar t er w i th t h e 10 y r . U S T t r a d ing in a r a n g e o f 2.3 1 % t o 2.6 3 % • I n v e st o r s h a v e g r o w n m o r e c a u tious of t h e n e w a dm ini s t r a tion ’ s a b ility t o qu i c kly i m p le m e n t its r e f l a tiona r y a g e nd a • Th e mar k e t e xpe c ts t w o m o r e F ed tig h t e n ing m o v es t h is y ear • I t a pp ea r s t h e F ed w i ll b e g in shrin k ing its b ala nc e sh e e t b y y ear e n d 2 0 17 • T h e yield cu r v e f l a t t e n ed with t h e 2/ 1 0 ’ s t r eas u r y sp r ead d e c lini n g f r om 1 2 5 b p s t o 1 1 3 b p s. • C r e d it sp r ea d s g e n e r ally tig h t e n ed • A g e nc y r e p o r at e a v e r a g ed a pp ro x i m at ely 1 0 2 b p s in t h e q u ar t er • Inc r e asi n g su pp ly o f A g e nc y MBS a n d wid e r sp r e a d s is p o siti v e f o r i n v e s t m e n ts in A g e nc y MBS

I nv e s tme n t St r a t egy 5 • As w e c om mun i c at ed p r e vi o u sl y , w e i n t e n d t o f oc u s o n a bu sines s s t r at e g y t h a t is sim p ler t o und e r s t a n d a n d m o r e c os t e f f i c ie n t • Ou r f oc u s is n o w p ri m arily up o n A g e nc y h y b rid fl o a ti n g - r a t e se cu riti e s a n d F r e dd ie Mac K - serie s M u lti f a m ily c r e d it e xpo s u r e • Exitin g ou r p rime ju mb o se cu riti z a tion p l a t f o rm h as allo w ed u s t o m ea n in g full y r e duc e o u r fi x ed e xpe n se s g o i n g f o r w a r d ( i . e. a f t er Q1 2 0 1 7 ) • I n v e s ti n g in i nt er m e d i at e f l o a ti n g r at e A g e nc y h y b rid sec u rities shoul d all o w u s t o c a p t u r e yield alo n g t h e cu r v e while m ini m izi n g e x t e n si o n risk • A g e nc y i n t er m e d i at e t erm h y b rid sec u rities shoul d b e n e f it f r o m r o l ling d o w n t h e yield cu r v e • T h e F e d ’ s i n t e n tion t o r e duc e its b ala nc e s h e e t w e b eli e v e is a n e t p o s iti v e f or our A g e nc y r ei n v e s t m e n t a n d is e xpe c t ed t o a d d a s t r on g t ail wind t o MBS sp r ead i n v e s t m e n ts f o r y ea r s t o c ome • W e h a v e r e duc ed ou r r e p o - fu nd ed F r e dd ie Mac K - serie s i n v e s t m e n ts as sp r ea d s h a v e tig ht e n ed • W e h a v e e mp l o y ed an a c ti v e he d gi n g s t r at e g y in an a t t e mp t t o m ini m i z e la r g e pric e c h a n g es r es u lti n g f r o m m o v e m e n ts in r at es a n d ch a n g es in t h e sha p e o f t h e yield cu r v e • Ap p ro x i m at ely 6 0 % o f ou r h e d g es m a t u r e in t w o y ea r s o r less • W e h a v e bo o k ed $ 4 9 2m illi o n in g r o s s loan v o l um e as a limi t ed r ep a n d w ar r a n ty risk b a c k s t op g u a r a n t ee p r ovid e r on p rime j u mb o loans sold t h r ough MAXE X ’ s LNEX E x ch a n g e

ARM and C r edi t P ort f oli o s • Ou r 1 Q17 A g e nc y A R M P o rt f o l io h as a t h r ee m o n th CP R o f 7.2% • Ou r w eig h t ed a v e r a g e c ou p o n is 2 .5 2 % • Ou r w eig h t ed a v e r a g e pu r ch ase p rice is $ 1 0 2.06 • Lo w er c ou p on a n d d ollar p rice h y b rids b e n e fit f r om “ r oll d o w n t h e c u r v e” • T o d at e, w e h a v e no t e xpe rie nc ed a n y d eli nqu e nc ies in t h e u nd erlying loan p o rt f o l ios o f ou r F r e dd ie Mac K - serie s i n v e s t m e n ts 6 AR M P o r tf o li o : 3 / 31 / 201 7 M o n t h s t o R e s e t % o f AR M P o r tf o li o C u rre n t F a c e V a l u e W e i g h t e d A v g . W e i g h t e d A v g . A m o r t i ze d P u rc h a s e C o u p o n P r i c e A m o r t i ze d C o s t W e i g h t e d A v g . M a r k e t P r i c e M a r k e t V a l u e 0 - 3 6 0 . 7 % $ 7 , 194 , 55 7 2 . 30 % 102 . 7 8 $ 7 , 394 , 910 . 5 5 102 . 2 0 $ 7 , 352 , 958 . 2 3 37 - 6 0 7 . 4 % $ 72 , 974 , 75 3 2 . 23 % 102 . 6 6 $ 74 , 912 , 977 . 5 7 101 . 7 8 $ 74 , 272 , 478 . 9 5 61 - 7 2 17 . 0 % $ 166 , 926 , 86 4 2 . 57 % 102 . 5 5 $ 171 , 178 , 323 . 2 4 102 . 1 3 $ 170 , 485 , 809 . 4 0 73 - 8 4 74 . 8 % $ 733 , 748 , 01 7 2 . 54 % 101 . 8 8 $ 747 , 560 , 302 . 8 0 101 . 7 7 $ 746 , 748 , 575 . 5 5 T o t a l AR M s 100 . 0 % $ 980 , 844 , 19 1 2 . 52 % 102 . 0 6 $ 1 , 001 , 046 , 514 . 1 6 101 . 8 4 $ 998 , 859 , 822 . 1 2

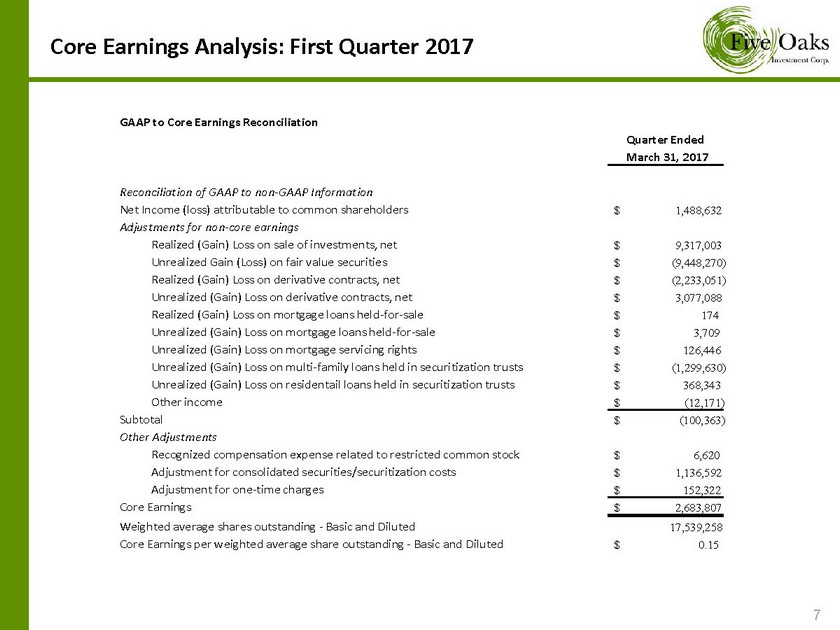

Co r e E a rning s An a l y sis: Fi r s t Q u a r t e r 2017 GAAP to C o re E a r n i n gs Rec on c ili a ti o n Q ua rter E nde d M a r c h 31, 2017 Rec on c i l ia tion o f G A AP to non - G A AP I n for m a tion N et I n c o me (l o ss ) attri b u tab l e to c o m mo n sha rehol d ers Adj u st me n ts f o r no n - co re e a r n i n g s 1 , 488 , 63 2 $ 7 Reali z ed (Gain ) L o s s o n sal e o f i n vest m en t s , n et $ 9 , 317 , 00 3 U n real iz ed Ga i n ( L o ss ) o n fai r val u e se c u rities $ ( 9 , 448 , 270 ) Reali z ed (Gain ) L o s s o n d erivative c o n trac t s , n et $ ( 2 , 233 , 051 ) U n real iz ed (Gain ) L o s s o n d erivative c o n tract s , n et $ 3 , 077 , 08 8 Reali z ed (Gain ) L o s s o n m o rtg ag e loa n s h el d - f or - sale $ 174 U n real iz ed (Gain ) L o s s o n m o rtg a g e loa n s h el d - f or - sale $ 3 , 70 9 U n real iz ed (Gain ) L o s s o n m o rtg a g e ser v ici n g ri g h ts $ 126 , 44 6 U n real iz ed (Gain ) L o s s o n m u lt i - fa m i l y loa n s h eld in s e cu r iti z ati o n trusts $ ( 1 , 299 , 630 ) U n real iz ed (Gain ) L o s s o n resi d entail loa n s h eld in s e cu r iti z ati o n trusts O t h er i n c o me $ 368 , 34 3 $ ( 12 , 171 ) S u b t o tal Oth er A d jus tments Reco g n i z ed com p e n s a t i o n expe n s e re l ated to restr i cted com mo n st ock $ ( 100 , 363 ) $ 6 , 62 0 A d just m ent f or c o ns o l id a t e d se c u rities/ s ec u riti z a t i o n c o sts $ 1 , 136 , 59 2 A d just m ent f or o n e - ti m e ch a r g es $ 152 , 32 2 C ore Earn i n g s $ 2 , 683 , 80 7 Wei g h ted avera g e sha res o u tsta nd i n g - Basic a n d D i lu ted 17 , 539 , 25 8 C ore Earn i n g s p er wei g h ted avera g e sha re o u ts t a nd i n g - Basic a n d D i lu ted $ 0 . 1 5

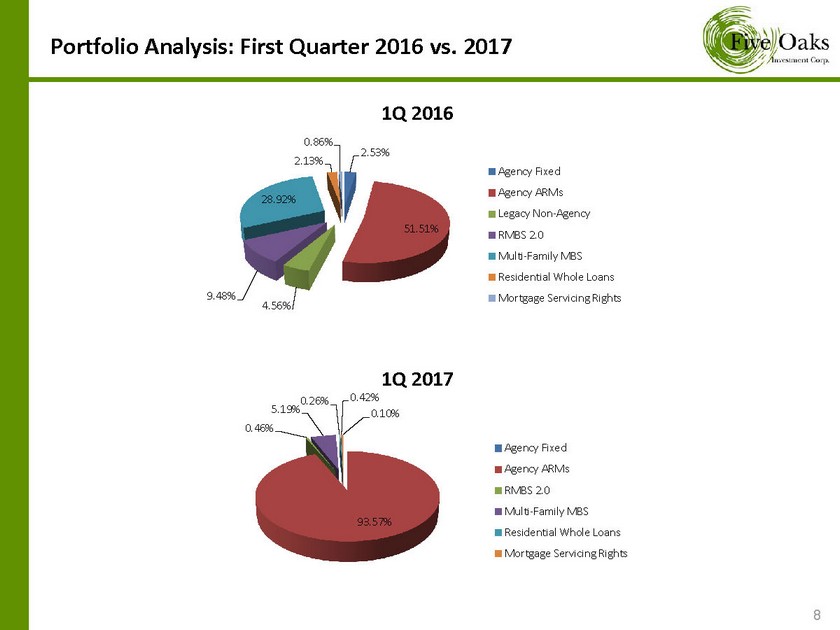

P ort f olio An a l y sis: Fi r s t Q u a r t e r 2016 vs . 2017 2.53% 51.51% 4.56% 9.48% 2 8.92% 0.86% 2.13% 1Q 20 1 6 Ag e ncy F ix ed Ag e ncy A RMs L e gacy N o n - Ag e ncy R M BS 2.0 Multi - Fa mily M BS R e s id e n t i a l W h ole Loa n s Mortga g e S e r v i c ing Rights 0. 42% 0.10% 93.57% 5.19% 0.46% 0.26% 1Q 2017 Ag e ncy F ix ed Ag e ncy A RMs R M BS 2 . 0 Multi - Fa mily M BS R e s id e n t i a l W h ole Loa n s Mortga g e S e r v i c ing Rights 8

E n d of P r ese n t a tion Inves t m ent C o rp. 9