Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - DigitalBridge Group, Inc. | exhibit9912017q1pressrelea.htm |

| 8-K - 8-K - DigitalBridge Group, Inc. | form8-kearningsrelease33117.htm |

Supplemental Financial Report

First Quarter 2017

May 9, 2017

NYSE:CLNS | A Diversified Equity REIT

Colony NorthStar, Inc. | Supplemental Financial Report

Cautionary Statement Regarding Forward-Looking Statements

This presentation may contain forward-looking statements within the meaning of the federal securities laws. Forward-looking statements relate to expectations, beliefs, projections, future plans and

strategies, anticipated events or trends and similar expressions concerning matters that are not historical facts. In some cases, you can identify forward-looking statements by the use of forward-looking

terminology such as “may,” “will,” “should,” “expects,” “intends,” “plans,” “anticipates,” “believes,” “estimates,” “predicts,” or “potential” or the negative of these words and phrases or similar words or phrases

which are predictions of or indicate future events or trends and which do not relate solely to historical matters. You can also identify forward-looking statements by discussions of strategy, plans or intentions.

Forward-looking statements involve known and unknown risks, uncertainties, assumptions and contingencies, many of which are beyond the Company’s control, and may cause the Company’s actual results

to differ significantly from those expressed in any forward-looking statement.

Factors that might cause such a difference include, without limitation, our failure to achieve anticipated synergies in and benefits of the completed merger among NorthStar Asset Management Group Inc.,

Colony Capital, Inc. and NorthStar Realty Finance Corp., Colony NorthStar’s liquidity, including its ability to complete identified monetization transactions and other potential sales of non-core investments,

whether Colony NorthStar will be able to maintain its qualification as a real estate investment trust, or REIT, for U.S. federal income tax purposes, the timing of and ability to deploy available capital, the

timing of and ability to complete repurchases of Colony NorthStar’s stock, Colony NorthStar’s ability maintain inclusion and relative performance on the RMZ, Colony NorthStar’s leverage, including the timing

and amount of borrowings under its credit facility, increased interest rates and operating costs, adverse economic or real estate developments in Colony NorthStar’s markets, Colony NorthStar’s failure to

successfully operate or lease acquired properties, decreased rental rates, increased vacancy rates or failure to renew or replace expiring leases, defaults on or non-renewal of leases by tenants, the impact

of economic conditions on the borrowers of Colony NorthStar’s commercial real estate debt investments and the commercial mortgage loans underlying its commercial mortgage backed securities, adverse

general and local economic conditions, an unfavorable capital market environment, decreased leasing activity or lease renewals, and other risks and uncertainties detailed in our filings with the U.S.

Securities and Exchange Commission (“SEC”). All forward-looking statements reflect the Company’s good faith beliefs, assumptions and expectations, but they are not guarantees of future performance.

Additional information about these and other factors can be found in Colony NorthStar’s reports filed from time to time with the SEC.

Statements regarding the following subjects, among others, may constitute forward-looking: the market, economic and environmental conditions in the Company’s real estate investment sectors; the

Company’s business and investment strategy; the Company’s ability to dispose of its real estate investments; the performance of the real estate in which the Company owns an interest; market trends in the

Company’s industry, interest rates, real estate values, the debt securities markets or the general economy; actions, initiatives and policies of the U.S. government and changes to U.S. government policies

and the execution and impact of these actions, initiatives and policies; the state of the U.S. and global economy generally or in specific geographic regions; the Company’s ability to obtain and maintain

financing arrangements, including securitizations; the amount and value of commercial mortgage loans requiring refinancing in future periods; the availability of attractive investment opportunities; the general

volatility of the securities markets in which the Company participates; changes in the value of the Company’s assets; the impact of and changes in governmental regulations, tax law and rates, accounting

guidance and similar matters; the Company’s ability to maintain its qualification as a real estate investment trust, or REIT, for U.S. federal income tax purposes; the Company’s ability to maintain its

exemption from registration as an investment company under the Investment Company Act of 1940, as amended (the “1940 Act”); and the availability of qualified personnel.

All forward-looking statements reflect the Colony NorthStar’s good faith beliefs, assumptions and expectations, but they are not guarantees of future performance. Additional information about these and

other factors can be found in Colony NorthStar’s reports filed from time to time with the SEC. Colony NorthStar cautions investors not to unduly rely on any forward-looking statements. The forward-looking

statements speak only as of the date of this presentation. Colony NorthStar is under no duty to update any of these forward-looking statements after the date of this presentation, nor to conform prior

statements to actual results or revised expectations, and Colony NorthStar does not intend to do so.

This presentation may contain statistics and other data that has been obtained or compiled from information made available by third-party service providers. Colony NorthStar has not independently verified

such statistics or data.

This presentation is for informational purposes only and does not constitute an offer to sell or a solicitation of an offer to buy any securities of the Colony NorthStar. This information is not

intended to be indicative of future results. Actual performance of Colony NorthStar may vary materially.

The appendices herein contain important information that is material to an understanding of this presentation and you should read this presentation only with and in context of the

appendices.

Colony NorthStar, Inc. | Supplemental Financial Report

Important Note Regarding Non-GAAP Financial Measures

This supplemental package includes certain “non-GAAP” supplemental measures that are not defined by generally accepted accounting principles, or GAAP, including; funds from operations, or FFO; core

funds from operations, or Core FFO; net operating income (“NOI”); earnings before interest, tax, depreciation and amortization (“EBITDA”); and pro rata financial information.

The Company calculates funds from operations ("FFO") in accordance with standards established by the Board of Governors of the National Association of Real Estate Investment Trusts, which defines FFO

as net income or loss calculated in accordance with GAAP, excluding extraordinary items, as defined by GAAP, gains and losses from sales of depreciable real estate and impairment write-downs associated

with depreciable real estate, plus real estate-related depreciation and amortization, and after similar adjustments for unconsolidated partnerships and joint ventures. Included in FFO are gains and losses

from sales of assets which are not depreciable real estate such as loans receivable, investments in unconsolidated joint ventures as well as investments in debt and other equity securities, as applicable.

The Company computes core funds from operations ("Core FFO") by adjusting FFO for the following items, including the Company’s share of these items recognized by its unconsolidated partnerships and

joint ventures: (i) gains and losses from sales of depreciable real estate within the Other Equity and Debt segment, net of depreciation, amortization and impairment previously adjusted for FFO; (ii) equity-

based compensation expense; (iii) effects of straight-line rent revenue and straight-line rent expense on ground leases; (iv) amortization of acquired above- and below-market lease values; (v) amortization of

deferred financing costs and debt premiums and discounts; (vi) unrealized fair value gains or losses and foreign currency remeasurements; (vii) acquisition-related expenses, merger and integration costs;

(viii) amortization and impairment of finite-lived intangibles related to investment management contracts and customer relationships; (ix) gain on remeasurement of consolidated investment entities and the

effect of amortization thereof; (x) non-real estate depreciation and amortization; (xi) change in fair value of contingent consideration; and (xii) deferred tax effect on certain of the foregoing adjustments. Also,

beginning with the first quarter of 2016, the Company’s share of Core FFO from its interest in Colony Starwood Homes (NYSE: SFR) represented its percentage interest multiplied by SFR's reported Core

FFO, which may differ from the Company’s calculation of Core FFO. Refer to SFR's filings for its definition and calculation of Core FFO.

FFO and Core FFO should not be considered alternatives to GAAP net income as indications of operating performance, or to cash flows from operating activities as measures of liquidity, nor as indications of

the availability of funds for our cash needs, including funds available to make distributions. FFO and Core FFO should not be used as supplements to or substitutes for cash flow from operating activities

computed in accordance with GAAP. The Company’s calculations of FFO and Core FFO may differ from methodologies utilized by other REITs for similar performance measurements, and, accordingly, may

not be comparable to those of other REITs.

The Company uses FFO and Core FFO as supplemental performance measures because, in excluding real estate depreciation and amortization and gains and losses from property dispositions, it provides

a performance measure that captures trends in occupancy rates, rental rates, and operating costs. The Company also believes that, as widely recognized measures of the performance of REITs, FFO and

Core FFO will be used by investors as a basis to compare its operating performance with that of other REITs. However, because FFO and Core FFO excludes depreciation and amortization and captures

neither the changes in the value of the Company’s properties that resulted from use or market conditions nor the level of capital expenditures and leasing commissions necessary to maintain the operating

performance of its properties, all of which have real economic effect and could materially impact the Company’s results from operations, the utility of FFO and Core FFO as measures of the Company’s

performance is limited. FFO and Core FFO should be considered only as supplements to net income as a measure of the Company’s performance.

The Company believes that NOI and EBITDA are useful measures of operating performance of its respective real estate portfolios as they are more closely linked to the direct results of operations at the

property level. NOI also reflects actual rents received during the period after adjusting for the effects of straight-line rents and amortization of above- and below- market leases; therefore, a comparison of

NOI across periods better reflects the trend in occupancy rates and rental rates at the Company’s properties.

NOI and EBITDA exclude historical cost depreciation and amortization, which are based on different useful life estimates depending on the age of the properties, as well as adjust for the effects of real estate

impairment and gains or losses on sales of depreciated properties, which eliminate differences arising from investment and disposition decisions. This allows for comparability of operating performance of the

Company’s properties period over period and also against the results of other equity REITs in the same sectors. Additionally, by excluding corporate level expenses or benefits such as interest expense, any

gain or loss on early extinguishment of debt and income taxes, which are incurred by the parent entity and are not directly linked to the operating performance of the Company’s properties, NOI and EBITDA

provide a measure of operating performance independent of the Company’s capital structure and indebtedness.

However, the exclusion of these items as well as others, such as capital expenditures and leasing costs, which are necessary to maintain the operating performance of the Company’s properties, and

transaction costs and administrative costs, may limit the usefulness of NOI and EBITDA. NOI may fail to capture significant trends in these components of U.S. GAAP net income (loss) which further limits its

usefulness.

NOI should not be considered as an alternative to net income (loss), determined in accordance with U.S. GAAP, as an indicator of operating performance. In addition, the Company’s methodology for

calculating NOI involved subjective judgment and discretion and may differ from the methodologies used by other comparable companies, including other REITs, when calculating the same or similar

supplemental financial measures and may not be comparable with other companies.

The Company presents pro rata financial information, which is not, and is not intended to be, a presentation in accordance with GAAP. The Company computes pro rata financial information by applying its

economic interest to each financial statement line item on an investment-by-investment basis. Similarly, noncontrolling interests’ share of assets, liabilities, profits and losses was computed by applying

noncontrolling interests’ economic interest to each financial statement line item. The Company provides pro rata financial information because it may assist investors and analysts in estimating the

Company’s economic interest in its investments. However, pro rata financial information as an analytical tool has limitations. Other equity REITs may not calculate their pro rata information in the same

methodology, and accordingly, the Company’s pro rata information may not be comparable to such other REITs' pro rata information. As such, the pro rata financial information should not be considered in

isolation or as a substitute for our financial statements as reported under GAAP, but may be used as a supplement to financial information as reported under GAAP.

Colony NorthStar, Inc. | Supplemental Financial Report

Note Regarding CLNS Reportable Segments / Consolidated

and OP Share of Consolidated Amounts

Colony NorthStar holds investment interests in five reportable segments: Healthcare Real Estate; Industrial Real Estate; Hospitality Real Estate; Other Equity and Debt; and Investment Management.

Healthcare Real Estate

As of March 31, 2017, the consolidated healthcare portfolio consisted of 425 properties: 113 medical office properties, 191 senior housing properties, 107 skilled nursing facilities and 14 hospitals. The

Company’s equity interest in the consolidated Healthcare Real Estate segment was approximately 71.3% as of March 31, 2017. The healthcare portfolio earns rental and escalation income from leasing of

space to various healthcare tenants and operators. The leases are for fixed terms of varying length and generally provide for rent and expense reimbursements to be paid in monthly installments. The

healthcare portfolio also generates operating income from healthcare properties operated through management agreements with independent third-party operators, predominantly through structures

permitted by the REIT Investment Diversification and Empowerment Act of 2007, or RIDEA.

Industrial Real Estate

As of March 31, 2017, the consolidated industrial portfolio consisted of 353 primarily light industrial buildings totaling 39.0 million rentable square feet across 15 major U.S. markets and was 96% leased.

The Company’s equity interest in the consolidated Industrial Real Estate segment was approximately 43.0% as of March 31, 2017, which decreased from the prior quarter due to increased third-party

capital commitments during the first quarter of 2017. Total third-party capital commitments were in excess of $1 billion compared to cumulative balance sheet contributions of $684 million as of March 31,

2017. The Company continues to own a 100% interest in the related operating platform. The Industrial Real Estate segment is comprised of and primarily invests in light industrial properties in infill

locations in major U.S. metropolitan markets targeting multi-tenant buildings of up to 500,000 square feet and single tenant buildings of up to 250,000 square feet with an office buildout of less than 20%.

Hospitality Real Estate

As of March 31, 2017, the consolidated hospitality portfolio consisted of 167 properties: 97 select service properties, 66 extended stay properties and 4 full service properties. The Company’s equity interest

in the consolidated Hospitality Real Estate segment was approximately 94.3% as of March 31, 2017. The hospitality portfolio is geographically diverse, consisting primarily of extended stay hotels and

premium branded select service hotels located mostly in major metropolitan markets, of which a majority are affiliated with top hotel brands.

Other Equity and Debt

In addition to the Company’s aforementioned real estate equity segments, the Company also holds investments in other real estate equity and debt. These other investments include direct interests and

interests held through unconsolidated joint ventures in net lease real estate assets; other real estate equity & debt investments; limited partnership interests in third-party sponsored real estate private

equity funds; multiple classes of commercial real estate (“CRE”) securities; and an interest in Colony Starwood Homes (NYSE: SFR).

Investment Management

The Company’s Investment Management segment includes the business and operations of managing capital on behalf of third-party investors through closed and open-end funds, non-traded and traded

real estate investment trusts and registered investment companies.

Throughout this presentation, consolidated figures represent the interest of both the Company (and its subsidiary Colony Capital Operating Company or the “CLNS OP”) and non-controlling interests.

Figures labeled as CLNS OP share represent the Company’s pro rata share.

Colony NorthStar, Inc. | Supplemental Financial Report 5

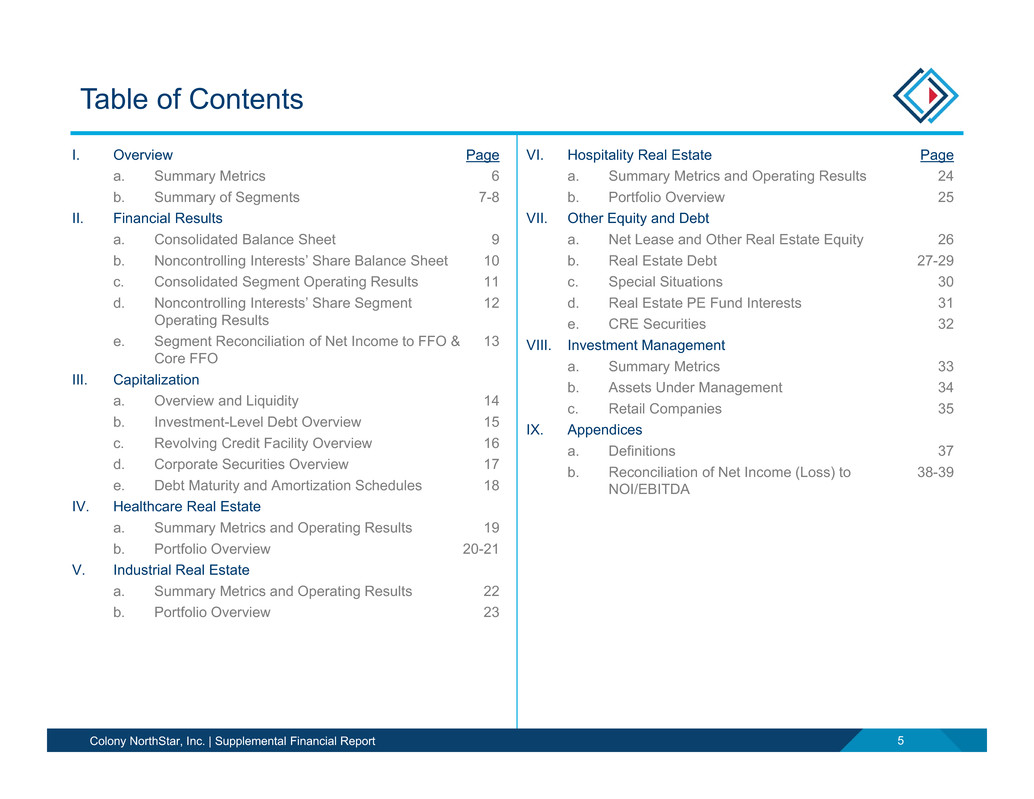

Table of Contents

I. Overview

a. Summary Metrics

b. Summary of Segments

II. Financial Results

a. Consolidated Balance Sheet

b. Noncontrolling Interests’ Share Balance Sheet

c. Consolidated Segment Operating Results

d. Noncontrolling Interests’ Share Segment

Operating Results

e. Segment Reconciliation of Net Income to FFO &

Core FFO

III. Capitalization

a. Overview and Liquidity

b. Investment-Level Debt Overview

c. Revolving Credit Facility Overview

d. Corporate Securities Overview

e. Debt Maturity and Amortization Schedules

IV. Healthcare Real Estate

a. Summary Metrics and Operating Results

b. Portfolio Overview

V. Industrial Real Estate

a. Summary Metrics and Operating Results

b. Portfolio Overview

VI. Hospitality Real Estate

a. Summary Metrics and Operating Results

b. Portfolio Overview

VII. Other Equity and Debt

a. Net Lease and Other Real Estate Equity

b. Real Estate Debt

c. Special Situations

d. Real Estate PE Fund Interests

e. CRE Securities

VIII. Investment Management

a. Summary Metrics

b. Assets Under Management

c. Retail Companies

IX. Appendices

a. Definitions

b. Reconciliation of Net Income (Loss) to

NOI/EBITDA

Page

6

7-8

9

10

11

12

13

14

15

16

17

18

19

20-21

22

23

Page

24

25

26

27-29

30

31

32

33

34

35

37

38-39

Colony NorthStar, Inc. | Supplemental Financial Report 6

($ and shares in thousands, except per share data; as of or for the three months ended March 31, 2017, unless otherwise noted)

Financial Data

Net income (loss) attributable to common stockholders(1) (5,216)$

Net income (loss) attributable to common stockholders per basic share(1) (0.01)

FFO(1) 91,071

FFO per basic share(1) 0.17

Core FFO(1) 173,124

Core FFO per basic share(1) 0.31

Q2 2017 dividend per share 0.27

Annualized Q2 2017 dividend per share 1.08

Balance Sheet, Capitalization and Trading Statistics

Total consolidated assets 24,909,731

CLNS OP share of consolidated assets 18,942,399

Total consolidated debt(2) 10,239,832

CLNS OP share of consolidated debt(2) 8,016,958

Shares and OP units outstanding as of May 5, 2017 585,019

Share price as of May 5, 2017 13.15

Market value of common equity & OP units 7,692,993

Liquidation preference of perpetual preferred equity 1,612,390

Insider ownership of shares and OP units 7.1%

AUM 55.6 billion

Ia. Overview - Summary Metrics

Notes:

See Appendix of this presentation for definitions.

(1) Colony NorthStar, Inc. was formed through a tri-party merger among Colony Capital, Inc. (“Colony”); NorthStar Asset Management Group Inc.; and NorthStar Realty Finance Corp., which closed on January 10, 2017. These earnings

metrics represents the pre-merger financial information of Colony, as the accounting acquirer, on a stand-alone basis prior to, and including, January 10, 2017 and following January 10, 2017, results of operations of Colony NorthStar, Inc.

(2) Represents principal balance and excludes debt issuance costs, discounts and premiums. Excludes $336 million principal balance of non-recourse CDO securitization debt.

Colony NorthStar, Inc. | Supplemental Financial Report 7

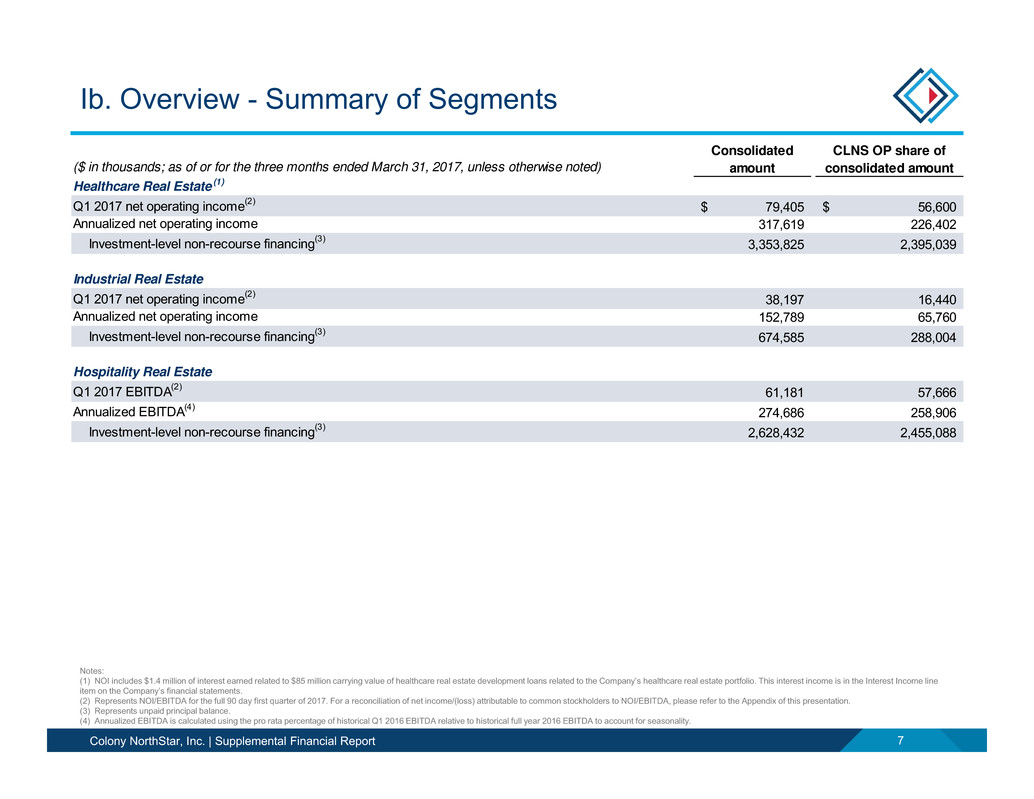

Ib. Overview - Summary of Segments

($ in thousands; as of or for the three months ended March 31, 2017, unless otherwise noted)

Consolidated

amount

CLNS OP share of

consolidated amount

Healthcare Real Estate (1)

Q1 2017 net operating income(2) 79,405$ 56,600$

Annualized net operating income 317,619 226,402

Investment-level non-recourse financing(3) 3,353,825 2,395,039

Industrial Real Estate

Q1 2017 net operating income(2) 38,197 16,440

Annualized net operating income 152,789 65,760

Investment-level non-recourse financing(3) 674,585 288,004

Hospitality Real Estate

Q1 2017 EBITDA(2) 61,181 57,666

Annualized EBITDA(4) 274,686 258,906

Investment-level non-recourse financing(3) 2,628,432 2,455,088

Notes:

(1) NOI includes $1.4 million of interest earned related to $85 million carrying value of healthcare real estate development loans related to the Company’s healthcare real estate portfolio. This interest income is in the Interest Income line

item on the Company’s financial statements.

(2) Represents NOI/EBITDA for the full 90 day first quarter of 2017. For a reconciliation of net income/(loss) attributable to common stockholders to NOI/EBITDA, please refer to the Appendix of this presentation.

(3) Represents unpaid principal balance.

(4) Annualized EBITDA is calculated using the pro rata percentage of historical Q1 2016 EBITDA relative to historical full year 2016 EBITDA to account for seasonality.

Colony NorthStar, Inc. | Supplemental Financial Report 8

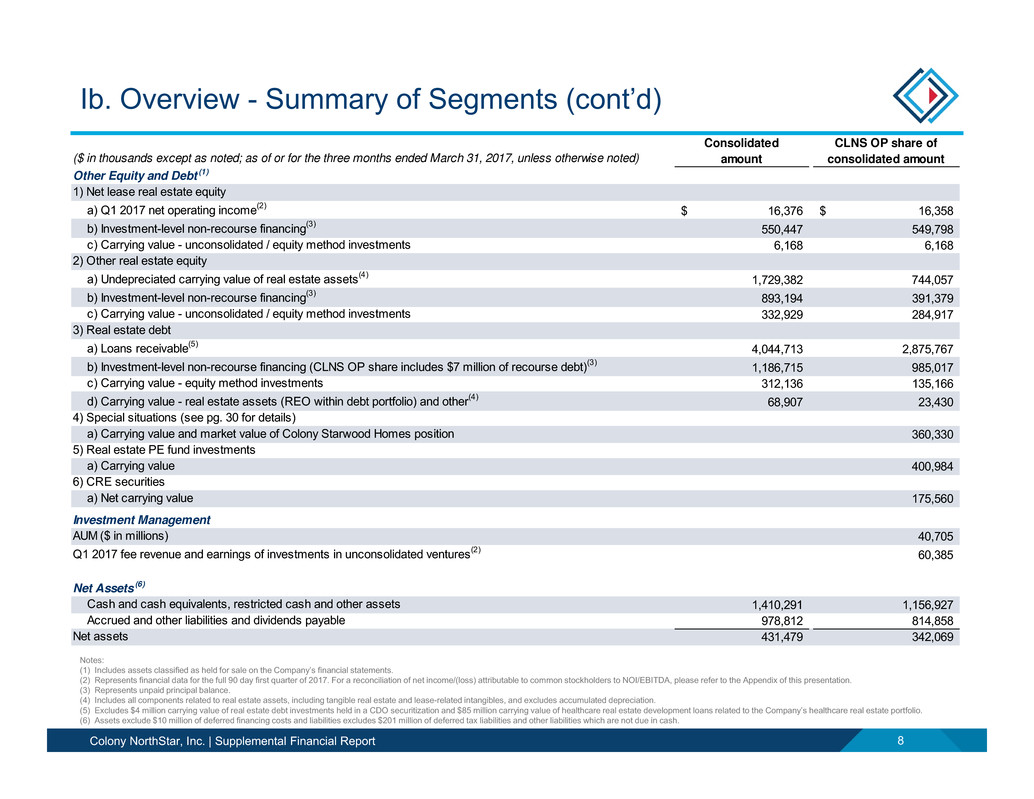

($ in thousands except as noted; as of or for the three months ended March 31, 2017, unless otherwise noted)

Consolidated

amount

CLNS OP share of

consolidated amount

Other Equity and Debt (1)

1) Net lease real estate equity

a) Q1 2017 net operating income(2) 16,376$ 16,358$

b) Investment-level non-recourse financing(3) 550,447 549,798

c) Carrying value - unconsolidated / equity method investments 6,168 6,168

2) Other real estate equity

a) Undepreciated carrying value of real estate assets(4) 1,729,382 744,057

b) Investment-level non-recourse financing(3) 893,194 391,379

c) Carrying value - unconsolidated / equity method investments 332,929 284,917

3) Real estate debt

a) Loans receivable(5) 4,044,713 2,875,767

b) Investment-level non-recourse financing (CLNS OP share includes $7 million of recourse debt)(3) 1,186,715 985,017

c) Carrying value - equity method investments 312,136 135,166

d) Carrying value - real estate assets (REO within debt portfolio) and other(4) 68,907 23,430

4) Special situations (see pg. 30 for details)

a) Carrying value and market value of Colony Starwood Homes position 360,330

5) Real estate PE fund investments

a) Carrying value 400,984

6) CRE securities

a) Net carrying value 175,560

Investment Management

AUM ($ in millions) 40,705

Q1 2017 fee revenue and earnings of investments in unconsolidated ventures(2) 60,385

Net Assets(6)

Cash and cash equivalents, restricted cash and other assets 1,410,291 1,156,927

Accrued and other liabilities and dividends payable 978,812 814,858

Net assets 431,479 342,069

Ib. Overview - Summary of Segments (cont’d)

Notes:

(1) Includes assets classified as held for sale on the Company’s financial statements.

(2) Represents financial data for the full 90 day first quarter of 2017. For a reconciliation of net income/(loss) attributable to common stockholders to NOI/EBITDA, please refer to the Appendix of this presentation.

(3) Represents unpaid principal balance.

(4) Includes all components related to real estate assets, including tangible real estate and lease-related intangibles, and excludes accumulated depreciation.

(5) Excludes $4 million carrying value of real estate debt investments held in a CDO securitization and $85 million carrying value of healthcare real estate development loans related to the Company’s healthcare real estate portfolio.

(6) Assets exclude $10 million of deferred financing costs and liabilities excludes $201 million of deferred tax liabilities and other liabilities which are not due in cash.

Colony NorthStar, Inc. | Supplemental Financial Report 9

($ in thousands, except per share data) (Unaudited) As of March 31, 2017

Assets

Cash and cash equivalents 633,210

Restricted cash 316,288

Real estate assets, net 13,460,872

Loans receivable, net 4,039,995

Investments in unconsolidated ventures 1,561,640

Securities available for sale, at fair value 413,570

Goodwill 1,717,365

Deferred leasing costs and intangible assets, net 1,019,204

Assets held for sale 1,276,695

Other assets 420,143

Due from affiliates 50,749

Total assets 24,909,731$

Liabilities

Debt, net 10,249,548

Accrued and other liabilities 964,027

Intangible liabilities, net 228,623

Liabilities related to assets held for sale 77,141

Due to affiliates 39,878

Dividends payable 175,498

Total liabilities 11,734,715

Commitments and contingencies

Redeemable noncontrolling interests 79,472

Equity

Stockholders’ equity:

Preferred stock, $0.01 par value per share; $1,612,400 liquidation preference; 250,000 shares authorized;

64,496 shares issued and outstanding 1,604,651

Common stock, $0.01 par value per share

Class A, 949,000 shares authorized; 557,404 shares issued and outstanding 5,574

Class B, 1,000 shares authorized; 770 shares issued and outstanding 8

Additional paid-in capital 7,994,460

Distributions in excess of earnings (401,069)

Accumulated other comprehensive loss (23,750)

Total stockholders’ equity 9,179,874

Noncontrolling interests in investment entities 3,450,385

Noncontrolling interests in Operating Company 465,285

Total equity 13,095,544

Total liabilities, redeemable non-controlling interests and equity 24,909,731$

IIa. Financial Results - Consolidated Balance Sheet

Colony NorthStar, Inc. | Supplemental Financial Report 10

($ in thousands, except per share data) (Unaudited) As of March 31, 2017

Assets

Cash and cash equivalents 116,731$

Restricted cash 70,050

Real estate assets, net 3,777,337

Loans receivable, net 1,194,502

Investments in unconsolidated ventures 275,363

Securities available for sale, at fair value -

Goodwill 1,530

Deferred leasing costs and intangible assets, net 184,189

Assets held for sale 281,060

Other assets 66,828

Due from affiliates (258)

Total assets 5,967,332$

Liabilities

Debt, net 2,186,178

Accrued and other liabilities 161,433

Intangible liabilities, net 71,390

Liabilities related to assets held for sale 15,953

Due to affiliates 2,521

Dividends payable -

Total liabilities 2,437,475

Commitments and contingencies -

Redeemable noncontrolling interests 79,472

Equity

Stockholders’ equity:

Preferred stock, $0.01 par value per share; $1,612,400 liquidation preference; 250,000 shares authorized;

64,496 shares issued and outstanding

-

Common stock, $0.01 par value per share

Class A, 949,000 shares authorized; 557,404 shares issued and outstanding -

Class B, 1,000 shares authorized; 770 shares issued and outstanding -

Additional paid-in capital -

Distributions in excess of earnings -

Accumulated other comprehensive loss -

Total stockholders’ equity -

Noncontrolling interests in investment entities 3,450,385

Noncontrolling interests in Operating Company -

Total equity 3,529,857

Total liabilities, redeemable non-controlling interests and equity 5,967,332$

IIb. Financial Results - Noncontrolling Interests’ Share Balance

Sheet

Colony NorthStar, Inc. | Supplemental Financial Report 11

($ in thousands) (Unaudited) Healthcare Industrial Hospitality

Other

Equity and

Debt

Investment

Management

Amounts not

allocated to

segments Total

Revenues

Property operating income 137,431$ 56,679$ 175,670$ 57,074$ —$ —$ 426,854$

Interest income 1,231 — — 114,181 — 132 115,544

Fee income — — — 40 53,210 — 53,250

Other income 151 363 43 3,791 6,430 739 11,517

Total revenues 138,813 57,042 175,713 175,086 59,640 871 607,165

Expenses

Property operating expense 60,686 16,497 118,491 20,675 — — 216,349

Interest expense 41,092 12,426 27,249 30,819 — 14,692 126,278

Investment, servicing and commission expense 2,820 101 1,737 4,306 2,247 596 11,807

Transaction costs 35 — — 3,638 — 83,667 87,340

Depreciation and amortization 40,881 24,639 30,041 28,218 12,483 1,158 137,420

Provision for loan loss — — — 6,724 — — 6,724

Impairment loss — — — 8,519 — — 8,519

Compensation expense 1,450 2,237 1,303 3,708 24,142 58,978 91,818

Administrative expenses 337 1,221 394 3,404 3,415 17,143 25,914

Total expenses 147,301 57,121 179,215 110,011 42,287 176,234 712,169

Other income (loss)

Gain on sale of real estate assets — — — 8,970 — — 8,970

Other gain (loss), net 1,464 — (76) (1,641) (450) 26,084 25,381

Earnings of investments in unconsolidated ventures — — — 108,837 5,155 — 113,992

Income (loss) before income taxes (7,024) (79) (3,578) 181,241 22,058 (149,279) 43,339

Income tax benefit (expense) (2,242) 598 (38) (1,333) (2,069) 1,375 (3,709)

Net income (loss) from continuing operations (9,266) 519 (3,616) 179,908 19,989 (147,904) 39,630

Income (loss) from discontinued operations — — — — — 12,560 12,560

Net income (loss) (9,266) 519 (3,616) 179,908 19,989 (135,344) 52,190

Net income (loss) attributable to noncontrolling interests:

Redeemable noncontrolling interests —$ —$ —$ —$ 617$ —$ 617$

Investment entities (314)$ 585$ (441)$ 27,229$ —$ —$ 27,059$

Operating Company (514)$ (4)$ (182)$ 8,767$ 1,112$ (10,262)$ (1,083)$

Net income (loss) attributable to Colony NorthStar, Inc. (8,438) (62) (2,993) 143,912 18,260 (125,082) 25,597

Preferred stock dividends — — — — — 30,813 30,813

Net income (loss) attributable to common stockholders (8,438)$ (62)$ (2,993)$ 143,912$ 18,260$ (155,895)$ (5,216)$

Three Months Ended March 31, 2017

IIc. Financial Results - Consolidated Segment Operating

Results

Colony NorthStar, Inc. | Supplemental Financial Report 12

($ in thousands) (Unaudited) Healthcare Industrial Hospitality

Other Equity

and Debt

Investment

Management

Amounts not

allocated to

segments Total

Revenues

Property operating income 16,371$ 28,931$ 13,853$ 20,716$ -$ -$ 79,871$

Interest income 182 - - 35,709 - - 35,891

Fee income - - - - 2,036 - 2,036

Other income 22 (357) 2 2,400 109 - 2,176

Total revenues 16,575 28,574 13,855 58,825 2,145 - 119,974

Expenses

Property operating expense 6,740 8,405 9,433 9,683 - - 34,261

Interest expense 5,184 6,302 2,287 7,346 - - 21,119

Investment, servicing and commission expense 274 49 161 2,213 135 - 2,832

Transaction costs - - - 1,109 - - 1,109

Depreciation and amortization 4,806 12,478 2,495 8,740 340 - 28,859

Provision for loan loss - - - 3,289 - - 3,289

Impairment loss - - - 5,683 - - 5,683

Compensation expense (1) 606 (1) 531 870 - 2,005

Administrative expenses 44 454 30 1,756 214 - 2,498

Total expenses 17,047 28,294 14,405 40,350 1,559 - 101,655

Other income (loss)

Gain on sale of real estate assets - - - 5,574 - - 5,574

Other gain (loss), net 217 - (12) (750) (1) - (546)

Earnings of investments in unconsolidated ventures - - - 4,974 42 - 5,016

Income (loss) before income taxes (255) 280 (562) 28,273 627 - 28,363

Income tax benefit (expense) (59) 305 121 (1,044) (10) - (687)

Net income (loss) from continuing operations (314) 585 (441) 27,229 617 - 27,676

Income (loss) from discontinued operations - - - - - - -

Net income (loss) attributable to noncontrolling interests (314)$ 585$ (441)$ 27,229$ 617$ -$ 27,676$

Three Months Ended March 31, 2017

IId. Financial Results - Noncontrolling Interests’ Share

Segment Operating Results

Colony NorthStar, Inc. | Supplemental Financial Report 13

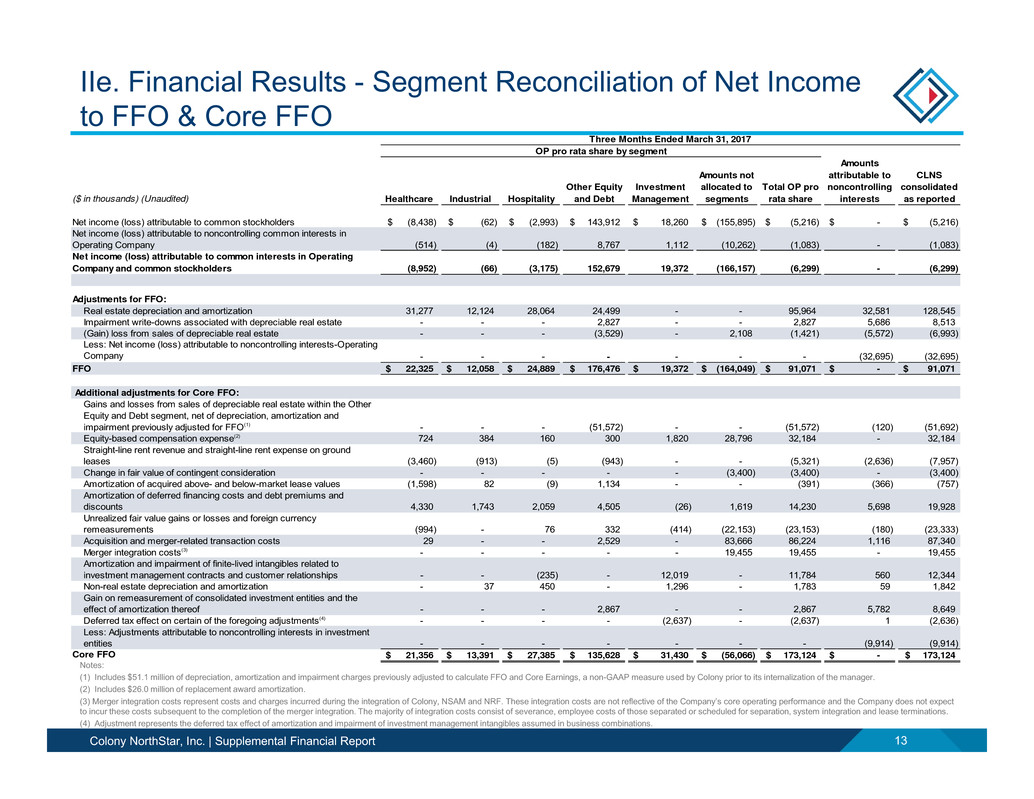

IIe. Financial Results - Segment Reconciliation of Net Income

to FFO & Core FFO

Notes:

(1) Includes $51.1 million of depreciation, amortization and impairment charges previously adjusted to calculate FFO and Core Earnings, a non-GAAP measure used by Colony prior to its internalization of the manager.

(2) Includes $26.0 million of replacement award amortization.

(3) Merger integration costs represent costs and charges incurred during the integration of Colony, NSAM and NRF. These integration costs are not reflective of the Company’s core operating performance and the Company does not expect

to incur these costs subsequent to the completion of the merger integration. The majority of integration costs consist of severance, employee costs of those separated or scheduled for separation, system integration and lease terminations.

(4) Adjustment represents the deferred tax effect of amortization and impairment of investment management intangibles assumed in business combinations.

OP pro rata share by segment

($ in thousands) (Unaudited) Healthcare Industrial Hospitality

Other Equity

and Debt

Investment

Management

Amounts not

allocated to

segments

Total OP pro

rata share

Amounts

attributable to

noncontrolling

interests

CLNS

consolidated

as reported

Net income (loss) attributable to common stockholders (8,438)$ (62)$ (2,993)$ 143,912$ 18,260$ (155,895)$ (5,216)$ -$ (5,216)$

Net income (loss) attributable to noncontrolling common interests in

Operating Company (514) (4) (182) 8,767 1,112 (10,262) (1,083) - (1,083)

Net income (loss) attributable to common interests in Operating

Company and common stockholders (8,952) (66) (3,175) 152,679 19,372 (166,157) (6,299) - (6,299)

Adjustments for FFO:

Real estate depreciation and amortization 31,277 12,124 28,064 24,499 - - 95,964 32,581 128,545

Impairment write-downs associated with depreciable real estate - - - 2,827 - - 2,827 5,686 8,513

(Gain) loss from sales of depreciable real estate - - - (3,529) - 2,108 (1,421) (5,572) (6,993)

Less: Net income (loss) attributable to noncontrolling interests-Operating

Company - - - - - - - (32,695) (32,695)

FFO 22,325$ 12,058$ 24,889$ 176,476$ 19,372$ (164,049)$ 91,071$ -$ 91,071$

Additional adjustments for Core FFO:

Gains and losses from sales of depreciable real estate within the Other

Equity and Debt segment, net of depreciation, amortization and

impairment previously adjusted for FFO(1) - - - (51,572) - - (51,572) (120) (51,692)

Equity-based compensation expense(2) 724 384 160 300 1,820 28,796 32,184 - 32,184

Straight-line rent revenue and straight-line rent expense on ground

leases (3,460) (913) (5) (943) - - (5,321) (2,636) (7,957)

Change in fair value of contingent consideration - - - - - (3,400) (3,400) - (3,400)

Amortization of acquired above- and below-market lease values (1,598) 82 (9) 1,134 - - (391) (366) (757)

Amortization of deferred financing costs and debt premiums and

discounts 4,330 1,743 2,059 4,505 (26) 1,619 14,230 5,698 19,928

Unrealized fair value gains or losses and foreign currency

remeasurements (994) - 76 332 (414) (22,153) (23,153) (180) (23,333)

Acquisition and merger-related transaction costs 29 - - 2,529 - 83,666 86,224 1,116 87,340

Merger integration costs(3) - - - - - 19,455 19,455 - 19,455

Amortization and impairment of finite-lived intangibles related to

investment management contracts and customer relationships - - (235) - 12,019 - 11,784 560 12,344

Non-real estate depreciation and amortization - 37 450 - 1,296 - 1,783 59 1,842

Gain on remeasurement of consolidated investment entities and the

effect of amortization thereof - - - 2,867 - - 2,867 5,782 8,649

Deferred tax effect on certain of the foregoing adjustments(4) - - - - (2,637) - (2,637) 1 (2,636)

Less: Adjustments attributable to noncontrolling interests in investment

entities - - - - - - - (9,914) (9,914)

Core FFO 21,356$ 13,391$ 27,385$ 135,628$ 31,430$ (56,066)$ 173,124$ -$ 173,124$

Three Months Ended March 31, 2017

Colony NorthStar, Inc. | Supplemental Financial Report 14

($ in thousands, except per share data; as of March 31, 2017, unless otherwise noted)

Consolidated

amount

CLNS OP share of

consolidated amount

Debt (UPB)

$1,000,000 Revolving credit facility -$ -$

Convertible/exchangeable senior notes 631,860 631,860

Corporate aircraft promissory note 40,656 40,656

Trust Preferred Securities ("TruPS") 280,117 280,117

Investment-level debt:

Healthcare 3,353,825 2,395,039

Industrial 674,585 288,004

Hospitality 2,628,432 2,455,088

Other Equity and Debt(1) 2,630,356 1,926,194

Total investment-level debt 9,287,198 7,064,325

Total debt 10,239,832 8,016,958

Perpetual preferred equity, redemption value

Total perpetual preferred equity 1,612,390

Common equity as of May 5, 2017 Price per share Shares / Units

Class A and B common stock and restricted stock units 13.15$ 552,151 7,260,779

OP units 13.15 32,868 432,214

Total market value of common equity 7,692,993

Total capitalization 17,322,341$

Liquidity as of May 5, 2017

Unrestricted cash 271,872$

Undrawn revolving credit facility 924,000

Total potential liquidity 1,195,872$

IIIa. Capitalization - Overview and Liquidity

Notes:

(1) Excludes $336 million principal balance of non-recourse CDO securitization debt.

Colony NorthStar, Inc. | Supplemental Financial Report 15

($ in thousands; as of or for the three months ended March 31, 2017, unless otherwise noted)

Investment-level debt overview

Consolidated CLNS OP share of consolidated amount

Type

Unpaid principal

balance

Unpaid principal

balance

Wtd. avg. years

remaining to maturity Wtd. avg. interest rate

Healthcare Non-recourse 3,353,825$ 2,395,039$ 3.7 4.8%

Industrial Non-recourse 674,585 288,004 11.0 3.7%

Hospitality Non-recourse 2,628,432 2,455,088 2.6 4.1%

Other Equity and Debt

Net lease real estate equity Non-recourse 550,447 549,798 8.0 4.0%

Other real estate equity Non-recourse 893,194 391,379 3.0 3.3%

Real estate debt(1) Non-recourse(2) 1,186,715 985,017 9.8 3.3%

Total investment-level debt 9,287,198$ 7,064,325$ 4.8 4.2%

IIIb. Capitalization - Investment-Level Debt Overview

Notes:

(1) Excludes $336 million principal balance of non-recourse CDO securitization debt.

(2) $7 million is recourse debt.

Colony NorthStar, Inc. | Supplemental Financial Report 16

($ in thousands, except as noted; as of March 31, 2017)

Revolving credit facility

Maximum principal amount 1,000,000$

Amount outstanding -

Initial maturity January 11, 2021

Fully-extended maturity January 10, 2022

Interest rate LIBOR + 2.25%

Financial covenants as defined in the Credit Agreement: Covenant level

Consolidated Tangible Net Worth Minimum $4,550 million

Consolidated Fixed Charge Coverage Ratio Minimum 1.50 to 1.00

Consolidated Interest Coverage Ratio Minimum 3.00 to 1.00

Consolidated Leverage Ratio Maximum 0.65 to 1.00

Company status: As of March 31, 2017, CLNS is meeting all required covenant threshold levels

IIIc. Capitalization - Revolving Credit Facility Overview

Colony NorthStar, Inc. | Supplemental Financial Report 17

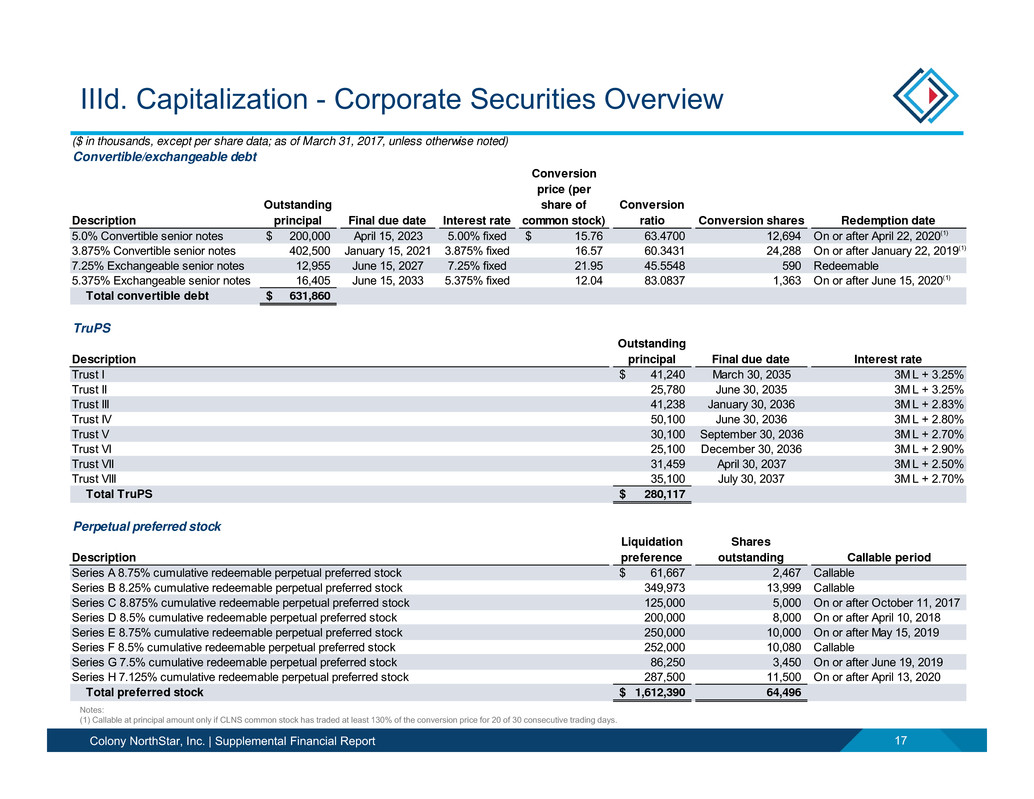

($ in thousands, except per share data; as of March 31, 2017, unless otherwise noted)

Convertible/exchangeable debt

Description

Outstanding

principal Final due date Interest rate

Conversion

price (per

share of

common stock)

Conversion

ratio Conversion shares Redemption date

5.0% Convertible senior notes 200,000$ April 15, 2023 5.00% fixed 15.76$ 63.4700 12,694 On or after April 22, 2020(1)

3.875% Convertible senior notes 402,500 January 15, 2021 3.875% fixed 16.57 60.3431 24,288 On or after January 22, 2019(1)

7.25% Exchangeable senior notes 12,955 June 15, 2027 7.25% fixed 21.95 45.5548 590 Redeemable

5.375% Exchangeable senior notes 16,405 June 15, 2033 5.375% fixed 12.04 83.0837 1,363 On or after June 15, 2020(1)

Total convertible debt 631,860$

TruPS

Description

Outstanding

principal Final due date Interest rate

Trust I 41,240$ March 30, 2035 3M L + 3.25%

Trust II 25,780 June 30, 2035 3M L + 3.25%

Trust III 41,238 January 30, 2036 3M L + 2.83%

Trust IV 50,100 June 30, 2036 3M L + 2.80%

Trust V 30,100 September 30, 2036 3M L + 2.70%

Trust VI 25,100 December 30, 2036 3M L + 2.90%

Trust VII 31,459 April 30, 2037 3M L + 2.50%

Trust VIII 35,100 July 30, 2037 3M L + 2.70%

Total TruPS 280,117$

Perpetual preferred stock

Description

Liquidation

preference

Shares

outstanding Callable period

Series A 8.75% cumulative redeemable perpetual preferred stock 61,667$ 2,467 Callable

Series B 8.25% cumulative redeemable perpetual preferred stock 349,973 13,999 Callable

Series C 8.875% cumulative redeemable perpetual preferred stock 125,000 5,000 On or after October 11, 2017

Series D 8.5% cumulative redeemable perpetual preferred stock 200,000 8,000 On or after April 10, 2018

Series E 8.75% cumulative redeemable perpetual preferred stock 250,000 10,000 On or after May 15, 2019

Series F 8.5% cumulative redeemable perpetual preferred stock 252,000 10,080 Callable

Series G 7.5% cumulative redeemable perpetual preferred stock 86,250 3,450 On or after June 19, 2019

Series H 7.125% cumulative redeemable perpetual preferred stock 287,500 11,500 On or after April 13, 2020

Total preferred stock 1,612,390$ 64,496

IIId. Capitalization - Corporate Securities Overview

Notes:

(1) Callable at principal amount only if CLNS common stock has traded at least 130% of the conversion price for 20 of 30 consecutive trading days.

Colony NorthStar, Inc. | Supplemental Financial Report 18

($ in thousands; as of March 31, 2017)

Consolidated debt maturity and amortization schedule

Payments due by period(1)

Q2-Q4 2017 2018 2019(2) 2020 2021 and after Total

$1,000,000 Revolving credit facility -$ -$ -$ -$ -$ -$

Convertible/exchangeable senior notes - - - - 631,860 631,860

Corporate aircraft promissory note 1,449 2,029 2,134 2,244 32,800 40,656

TruPS - - - - 280,117 280,117

Investment-level debt:

Healthcare 280,871 10,074 2,236,752 61,550 764,577 3,353,825

Industrial 583 806 78,113 875 594,209 674,585

Hospitality 211,682 - 2,169,000 247,750 - 2,628,432

Other Equity and Debt(3) 441,539 386,035 145,887 70,033 1,586,862 2,630,356

Total debt 936,125$ 398,944$ 4,631,886$ 382,452$ 3,890,425$ 10,239,832$

Pro rata debt maturity and amortization schedule

Payments due by period(1)

Q2-Q4 2017 2018 2019(2) 2020 2021 and after Total

$1,000,000 Revolving credit facility -$ -$ -$ -$ -$ -$

Convertible/exchangeable senior notes - - - - 631,860 631,860

Corporate aircraft promissory note 1,449 2,029 2,134 2,244 32,800 40,656

TruPS - - - - 280,117 280,117

Investment-level debt:

Healthcare 196,041 7,525 1,574,471 46,005 570,997 2,395,039

Industrial 249 344 33,349 373 253,689 288,004

Hospitality 206,390 - 2,000,948 247,750 - 2,455,088

Other Equity and Debt(3) 281,019 142,964 35,716 38,364 1,428,131 1,926,194

Total debt 685,148$ 152,862$ 3,646,618$ 334,737$ 3,197,594$ 8,016,958$

IIIe. Capitalization - Debt Maturity and Amortization Schedules

Notes:

(1) Based on initial maturity dates or extended maturity dates to the extent criteria are met and the extension option is at the borrower’s discretion.

(2) Subsequent to the first quarter 2017, the Company executed commitment letters to refinance approximately $1.6 billion of consolidated mortgage debt in the Hospitality Real Estate segment, extending the fully extended maturity dates

from 2019 to 2022 at a moderately reduced interest rates.

(3) Excludes $336 million principal balance of non-recourse CDO securitization debt.

Colony NorthStar, Inc. | Supplemental Financial Report 19

($ in thousands; as of or for the three months ended March 31, 2017, unless otherwise noted)

Net operating income

Consolidated

amount(1)

Net operating income(2):

MOB's 13,700$ 9,766$

Senior Housing - Operating 18,333 13,068

Triple-Net Lease:

Senior Housing 13,503 9,625

Skilled Nursing Facilities 28,451 20,280

Hospitals 5,418 3,862

Total net operating income 79,405$ 56,601$

Annualized net operating income 317,620$ 226,404$

Portfolio overview

Total number

of buildings Capacity % Occupied

TTM Lease

Coverage

WA Remaining

Lease Term

MOB's 113 4.0 million sq. ft. 85.1% N/A 5.1

Senior Housing - Operating 109 6,436 units 86.8% N/A N/A

Triple-Net Lease:

Senior Housing 82 4,065 units 85.7% 1.5x 11.5

Skilled Nursing Facilities 107 12,794 beds 84.2% 1.4x 7.6

Hospitals 14 817 beds 60.9% 3.7x 12.0

Total/W.A healthcare 425 83.6% 1.7x 9.5

Same store financial/operating results related to the segment

Q1 2017 Q4 2016 12/31/2016 9/30/2016 Q1 2017 Q4 2016 % Change

MOB's 85.1% 85.8% n/a n/a 13,593$ 14,806$ -8.2%

Senior Housing - Operating 86.8% 88.1% n/a n/a 18,333 18,291 0.2%

Triple-Net Lease:

Senior Housing 85.7% 86.6% 1.5x 1.6x 13,503 14,034 -3.8%

Skilled Nursing Facilities 84.2% 84.2% 1.4x 1.4x 28,451 28,162 1.0%

Hospitals 60.9% 62.8% 3.7x 3.3x 5,418 5,125 5.7%

Total/W.A healthcare 83.6% 84.5% 1.7x 1.7x 79,298$ 80,418$ -1.4%

NOI% Occupied(3) TTM Lease Coverage(4)

CLNS OP share

of consolidated

amount(1)

IVa. Healthcare Real Estate - Summary Metrics and Operating

Results

Notes:

(1) Represents NOI for the full 90 day first quarter of 2017. CLNS OP Share represents Consolidated NOI multiplied by the Company’s interest as of March 31, 2017. For a reconciliation of net income/(loss) attributable to common

stockholders to NOI, please refer to the Appendix of this presentation.

(2) Consolidated NOI includes $1.4 million of interest earned related to $85 million of healthcare real estate development loans related to the Company’s healthcare real estate portfolio. This interest income is in the Interest Income line item

on the Company’s financial statements.

(3) Occupancy % for Senior Housing - Operating represents average of the presented quarter, MOB’s is as of last day in the quarter and for Triple-Net Lease represents average of the prior quarter. Occupancy represents real estate

property operator’s patient occupancy for all types except MOB.

(4) Represents the ratio of EBITDAR to cash rent on a trailing twelve month basis.

Colony NorthStar, Inc. | Supplemental Financial Report 20

(As of or for the three months ended March 31, 2017, unless otherwise noted)

Triple-Net Lease Coverage (1)

December 31, 2016 TTM Lease Coverage # of Leases Senior Housing

Skilled Nursing

Facilities &

Hospitals % Total NOI

WA Remaining

Lease Term

Less than 0.99x 3 2% 6% 8% 5 yrs

1.00x - 1.09x 2 1% 2% 3% 11 yrs

1.10x - 1.19x 2 0% 6% 6% 9 yrs

1.20x - 1.29x 2 2% 3% 5% 8 yrs

1.30x - 1.39x 1 0% 5% 5% 12 yrs

1.40x - 1.49x 2 0% 4% 4% 10 yrs

1.50x and greater 6 8% 11% 19% 10 yrs

Total / W.A. 18 13% 37% 50% 9 yrs

Revenue Mix (2)

Private Pay Medicare Medicaid

MOB's 100% 0% 0%

Senior Housing - Operating 85% 4% 11%

Triple-Net Lease:

Senior Housing 64% 0% 36%

Skilled Nursing Facilities 21% 20% 58%

Hospitals 12% 37% 51%

W.A. 56% 11% 33%

December 31, 2016 TTM

% of Total Portfolio December 31, 2016 TTM NOI

IVb. Healthcare Real Estate - Portfolio Overview

Notes:

(1) Represents the ratio of EBITDAR to cash rent on a trailing twelve month basis. Represents leases with EBITDAR coverage in each listed range. Excludes interest income associated with triple-net lease senior housing and hospital

types. Caring Homes (U.K.) lease (EBITDAR) coverage includes additional collateral provided by the operator.

(2) Revenue mix represents percentage of revenues derived from private, Medicare and Medicaid payor sources. The payor source percentages for the hospital category excludes two operating partners, whom do not track or report payor

source data and totals approximately one-third of NOI in the hospital category. Overall percentages are weighted by NOI exposure in each category.

Colony NorthStar, Inc. | Supplemental Financial Report 21

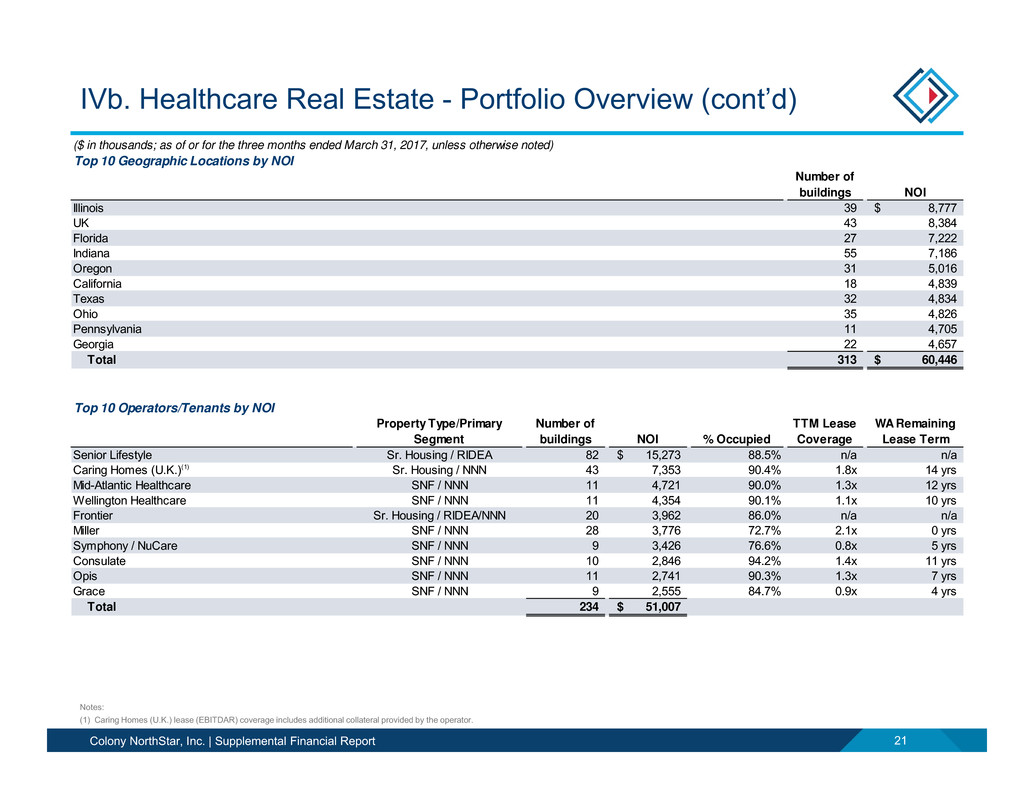

($ in thousands; as of or for the three months ended March 31, 2017, unless otherwise noted)

Top 10 Geographic Locations by NOI

Number of

buildings NOI

Illinois 39 8,777$

UK 43 8,384

Florida 27 7,222

Indiana 55 7,186

Oregon 31 5,016

California 18 4,839

Texas 32 4,834

Ohio 35 4,826

Pennsylvania 11 4,705

Georgia 22 4,657

Total 313 60,446$

Top 10 Operators/Tenants by NOI

Property Type/Primary

Segment

Number of

buildings NOI % Occupied

TTM Lease

Coverage

WA Remaining

Lease Term

Senior Lifestyle Sr. Housing / RIDEA 82 15,273$ 88.5% n/a n/a

Caring Homes (U.K.)(1) Sr. Housing / NNN 43 7,353 90.4% 1.8x 14 yrs

Mid-Atlantic Healthcare SNF / NNN 11 4,721 90.0% 1.3x 12 yrs

Wellington Healthcare SNF / NNN 11 4,354 90.1% 1.1x 10 yrs

Frontier Sr. Housing / RIDEA/NNN 20 3,962 86.0% n/a n/a

Miller SNF / NNN 28 3,776 72.7% 2.1x 0 yrs

Symphony / NuCare SNF / NNN 9 3,426 76.6% 0.8x 5 yrs

Consulate SNF / NNN 10 2,846 94.2% 1.4x 11 yrs

Opis SNF / NNN 11 2,741 90.3% 1.3x 7 yrs

Grace SNF / NNN 9 2,555 84.7% 0.9x 4 yrs

Total 234 51,007$

IVb. Healthcare Real Estate - Portfolio Overview (cont’d)

Notes:

(1) Caring Homes (U.K.) lease (EBITDAR) coverage includes additional collateral provided by the operator.

Colony NorthStar, Inc. | Supplemental Financial Report 22

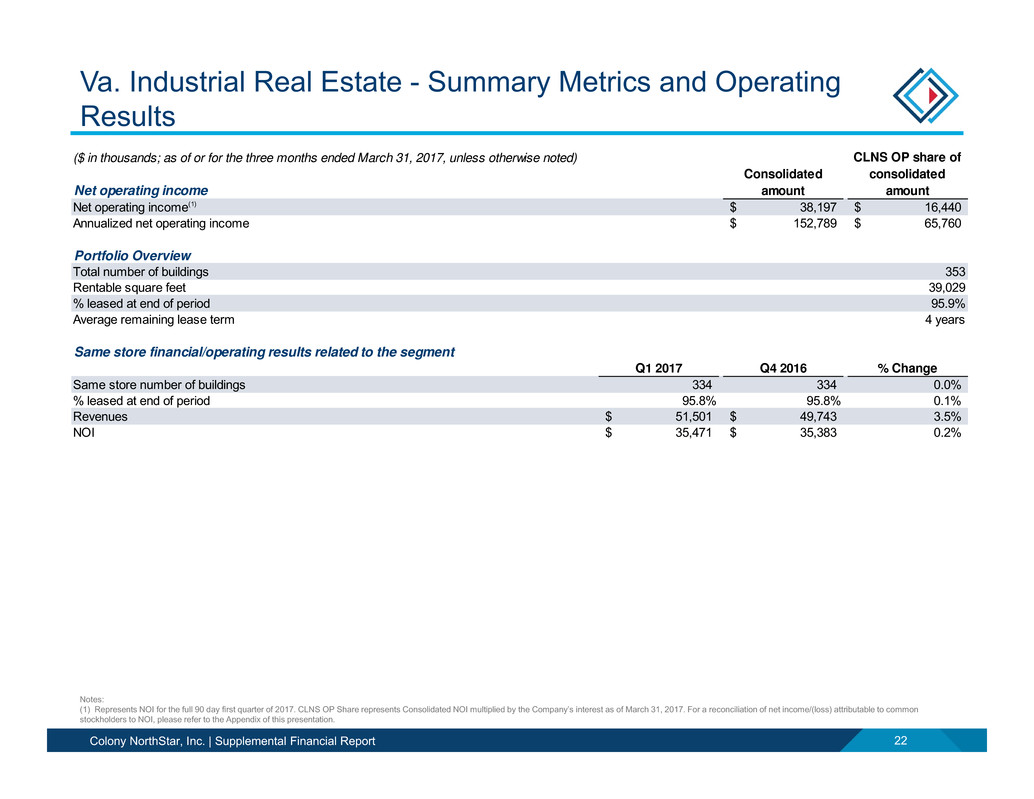

($ in thousands; as of or for the three months ended March 31, 2017, unless otherwise noted)

Net operating income

Consolidated

amount

Net operating income(1) 38,197$ 16,440$

Annualized net operating income 152,789$ 65,760$

Portfolio Overview

Total number of buildings 353

Rentable square feet 39,029

% leased at end of period 95.9%

Average remaining lease term 4 years

Same store financial/operating results related to the segment

Q1 2017 Q4 2016 % Change

Same store number of buildings 334 334 0.0%

% leased at end of period 95.8% 95.8% 0.1%

Revenues 51,501$ 49,743$ 3.5%

NOI 35,471$ 35,383$ 0.2%

CLNS OP share of

consolidated

amount

Va. Industrial Real Estate - Summary Metrics and Operating

Results

Notes:

(1) Represents NOI for the full 90 day first quarter of 2017. CLNS OP Share represents Consolidated NOI multiplied by the Company’s interest as of March 31, 2017. For a reconciliation of net income/(loss) attributable to common

stockholders to NOI, please refer to the Appendix of this presentation.

Colony NorthStar, Inc. | Supplemental Financial Report 23

($ in thousands; as of or for the three months ended March 31, 2017, unless otherwise noted)

Top 10 Geographic Locations by NOI

Number of

buildings

Rentable square

feet (in thousands) NOI

% leased at end

of period

Atlanta 82 8,105 7,616$ 96.4%

Dallas 70 7,191 7,093 98.2%

Chicago 34 3,972 3,534 93.9%

New Jersey, South / Philadelphia 30 3,328 3,108 93.8%

Orlando 18 3,032 2,924 97.0%

Minneapolis 18 2,814 2,883 95.6%

Phoenix 18 1,705 1,964 97.6%

Houston 21 1,713 1,642 90.7%

Kansas City 9 1,664 1,423 97.9%

Salt Lake City 16 1,269 1,369 99.8%

Total / W.A. 316 34,793 33,556$ 96.2%

Top 10 Tenant Base by Industry

Industry

Total Leased Square

Feet (in thousands) % of total

Warehousing & Transportation 14,217 38.0%

Manufacturing 6,340 16.9%

Wholesale Trade 4,486 12.0%

Professional, Scientific, and Technical Services 3,979 10.6%

Health & Science 2,796 7.5%

Construction & Contractors 2,512 6.7%

Retail Trade 1,261 3.4%

Entertainment & Recreation 1,058 2.8%

Media & Information 665 1.8%

Public Administration & Government 113 0.3%

Total 37,427 100.0%

Vb. Industrial Real Estate - Portfolio Overview

Colony NorthStar, Inc. | Supplemental Financial Report 24

($ in thousands; as of or for the three months ended March 31, 2017, unless otherwise noted)

EBITDA

Consolidated

amount(1)

EBITDA(2):

Select Service 34,219$ 32,253$

Extended Stay 24,146 22,759

Full Service 2,816 2,654

Total EBITDA 61,181$ 57,666$

Annualized EBITDA(3) 274,686$ 258,906$

Portfolio overview by type

Number

of hotels

Number

of rooms

Avg. qtr. %

occupancy

Avg. daily

rate (ADR) RevPAR

Q1 2017

EBITDA(1)(2) EBITDA margin

Select Service 97 13,193 67.6% 123$ 83$ 34,219$ 32.0%

Extended Stay 66 7,936 73.4% 130 96 24,146 35.0%

Full Service 4 962 67.3% 167 112 2,816 18.0%

Total / W.A. 167 22,091 69.7% 128$ 89$ 61,181$ 32.1%

Same store financial/operating results related to the segment by brand

Brand Q1 2017 Q1 2016 Q1 2017 Q1 2016 Q1 2017 Q1 2016 Q1 2017 Q1 2016 % Change

Marriott 68.8% 69.3% 129$ 128$ 89$ 89$ 48,229$ 50,644$ -4.8%

Hilton 72.8% 70.9% 123 120 90 85 9,679 8,863 9.2%

Other 72.5% 72.5% 129 131 93 95 3,273 3,798 -13.8%

Total / W.A. 69.7% 69.7% 128$ 127$ 89$ 89$ 61,181$ 63,305$ -3.4%

CLNS OP share

of consolidated

amount(1)

Avg. qtr. % occupancy Avg. daily rate (ADR) RevPAR Q1 2017 EBITDA(1)(2)

VIa. Hospitality Real Estate - Summary Metrics and Operating

Results

Notes:

(1) Represents EBITDA for the full 90 day first quarter of 2017. CLNS OP Share represents Consolidated EBITDA multiplied by the Company’s interest as of March 31, 2017. For a reconciliation of net income/(loss) attributable to common

stockholders to EBITDA please refer to the Appendix of this presentation.

(2) Q1 2017 Consolidated EBITDA excludes FF&E reserve amounts of $8.5 million.

(3) Annualized EBITDA is calculated using the pro rata percentage of historical Q1 2016 EBITDA relative to historical full year 2016 EBITDA to account for seasonality.

Colony NorthStar, Inc. | Supplemental Financial Report 25

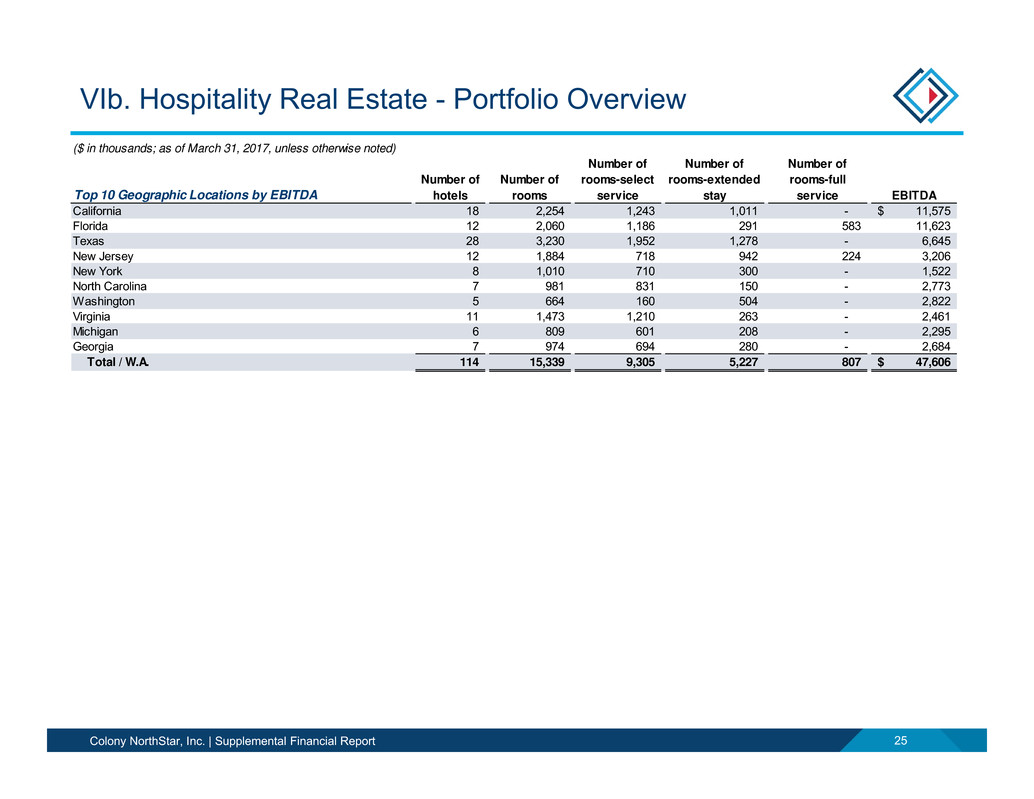

($ in thousands; as of March 31, 2017, unless otherwise noted)

Top 10 Geographic Locations by EBITDA

Number of

hotels

Number of

rooms

Number of

rooms-select

service

Number of

rooms-extended

stay

Number of

rooms-full

service EBITDA

California 18 2,254 1,243 1,011 - 11,575$

Florida 12 2,060 1,186 291 583 11,623

Texas 28 3,230 1,952 1,278 - 6,645

New Jersey 12 1,884 718 942 224 3,206

New York 8 1,010 710 300 - 1,522

North Carolina 7 981 831 150 - 2,773

Washington 5 664 160 504 - 2,822

Virginia 11 1,473 1,210 263 - 2,461

Michigan 6 809 601 208 - 2,295

Georgia 7 974 694 280 - 2,684

Total / W.A. 114 15,339 9,305 5,227 807 47,606$

VIb. Hospitality Real Estate - Portfolio Overview

Colony NorthStar, Inc. | Supplemental Financial Report 26

($ in thousands; as of March 31, 2017, unless otherwise noted)

Net Lease Real Estate Equity

Consolidated

amount

CLNS OP share of

consolidated amount

Number of

buildings

Rentable

square feet

(thousands) NOI NOI

% leased at

end of period

Weighted average

remaining lease term

U.S.:

Office 8 1,716 6,094$ 6,076$ 94.7% 4.3

Retail 10 468 1,205 1,205 100.0% 6.8

Industrial 3 1,140 587 587 100.0% 12.3

Education 1 82 382 382 100.0% 10.2

Europe:

Office 29 1,478 5,153 5,153 100.0% 12.8

Education 20 304 2,954 2,954 100.0% 17.8

Total / weighted average 71 5,188 16,376$ 16,358$ 98.3% 9.6

Other Real Estate Equity

Consolidated

amount

CLNS OP share of

consolidated amount

Number of

buildings

Rentable

square feet

(thousands)

Undepreciated

carrying value

Undepreciated

carrying value

% leased at

end of period

Weighted average

remaining lease term

U.S.:

Office 14 1,480 262,337$ 228,034$ 78.5% 3.5

Multifamily 1 N/A 59,752 53,822 96.7% N/A

Hotel 5 N/A 29,801 9,805 59.4% N/A

Europe:

Industrial 38 2,795 151,833 68,832 100.0% 7.0

Office 37 973 141,668 65,464 73.0% 10.1

Mixed / Retail 274 8,620 1,083,991 318,101 70.9% 7.4

Total / weighted average 369 13,867 1,729,382$ 744,057$ 77.7% 7.1

Unconsolidated joint ventures (Net Lease & Other RE Equity) 339,097 291,085

VIIa. Other Equity and Debt - Net Lease and Other Real Estate

Equity

Colony NorthStar, Inc. | Supplemental Financial Report 27

($ in thousands; as of or for the three months ended March 31, 2017, unless otherwise noted)

Portfolio Overview (1)

Consolidated

amount

CLNS OP share of

consolidated amount

Non-PCI loans

Loans receivables held for investment, net 3,277,168$ 2,386,913$

Loans receivables held for sale, net 93,270 93,270

Non-recourse investment-level financing (UPB) 970,714 912,574

Carrying value - equity method investments 308,787 131,818

PCI loans

Loans receivables held for investment, net 674,275 395,584

Non-recourse investment-level financing (UPB) 63,807 22,200

Carrying value - equity method investments 3,349 3,349

Other

Carrying value - real estate assets (REO) 68,907 23,430

Warehouse facility (UPB) 27,860 27,860

Subscription line (UPB) 124,334 22,384

Total Portfolio

Loans receivables held for investment, net 3,951,443 2,782,497

Loans receivables held for sale, net 93,270 93,270

Carrying value - equity method investments 312,136 135,166

Carrying value - real estate assets (REO) 68,907 23,430

Non-recourse investment-level financing (UPB) 1,034,521 934,774

Warehouse facility (UPB) 27,860 27,860

Subscription Line (UPB) 124,334 22,384

Total debt (UPB) 1,186,715 985,017

VIIb. Other Equity and Debt - Real Estate Debt

Notes:

(1) Excludes $4 million carrying value of real estate debt investments held in a CDO securitization and $85 million carrying value of healthcare real estate development loans related to the Company’s healthcare real estate portfolio.

Colony NorthStar, Inc. | Supplemental Financial Report 28

($ in thousands; as of or for the three months ended March 31, 2017, unless otherwise noted)

Loans receivable held for investment by loan type (1)

Consolidated

amount CLNS OP share of consolidated amount

Net carrying

amount

Net carrying

amount

Weighted average

yield

Weighted average

maturity in years

Non-PCI loans

Fixed rate

First mortgage loans 830,086$ 475,943$ 5.4% 2.2

Securitzed mortgage loans 65,881 65,881 5.8% 13.4

Second mortgage loans / B-notes 282,679 193,837 10.4% 4.6

Mezzanine loans 319,756 158,452 11.3% 2.4

Corporate 60,155 60,155 12.4% 10.0

Total fixed rate non-PCI loans 1,558,555 954,267 7.9% 4.0

Variable rate

First mortgage loans 520,722 421,406 9.0% 0.9

Securitized mortgage loans 706,869 694,812 6.3% 3.1

Second mortgage loans / B-notes 146,855 126,728 6.5% 5.3

Mezzanine loans 347,698 192,688 11.5% 0.4

Total variable rate non-PCI loans 1,722,143 1,435,635 7.8% 2.3

Total non-PCI loans 3,280,698 2,389,903

Allowance for loan losses (3,531) (2,989)

Total non-PCI loans, net of allowance for loan losses 3,277,168 2,386,913

PCI loans

First mortgage loans 730,807 404,688

Securitized mortgage loans 5,739 5,739

Mezzanine loans 3,671 3,671

Total PCI loans 740,217 414,098

Allowance for loan losses (65,943) (18,515)

Total PCI loans, net of allowance for loan losses 674,275 395,584

Total loans receivable, net of allowance for loan losses 3,951,443$ 2,782,497$

VIIb. Other Equity and Debt - Real Estate Debt (cont’d)

Notes:

(1) Excludes $4 million carrying value of real estate debt investments held in a CDO securitization and $85 million carrying value of healthcare real estate development loans related to the Company’s healthcare real estate portfolio.

Colony NorthStar, Inc. | Supplemental Financial Report 29

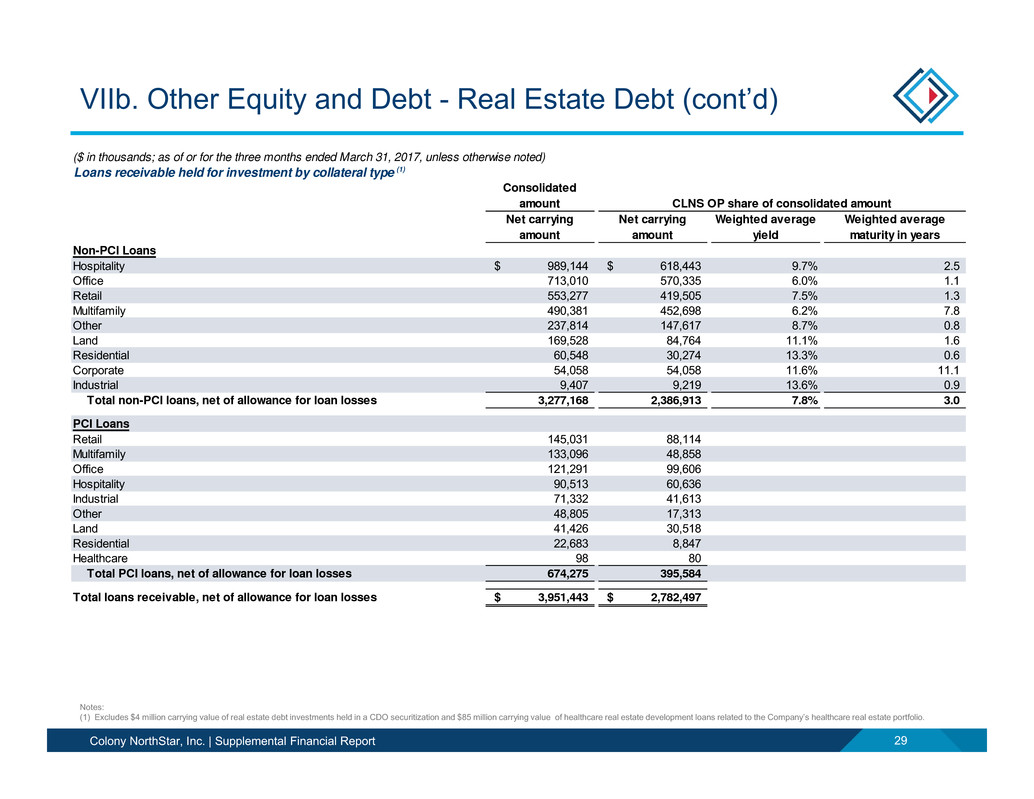

($ in thousands; as of or for the three months ended March 31, 2017, unless otherwise noted)

Loans receivable held for investment by collateral type (1)

Consolidated

amount CLNS OP share of consolidated amount

Net carrying

amount

Net carrying

amount

Weighted average

yield

Weighted average

maturity in years

Non-PCI Loans

Hospitality 989,144$ 618,443$ 9.7% 2.5

Office 713,010 570,335 6.0% 1.1

Retail 553,277 419,505 7.5% 1.3

Multifamily 490,381 452,698 6.2% 7.8

Other 237,814 147,617 8.7% 0.8

Land 169,528 84,764 11.1% 1.6

Residential 60,548 30,274 13.3% 0.6

Corporate 54,058 54,058 11.6% 11.1

Industrial 9,407 9,219 13.6% 0.9

Total non-PCI loans, net of allowance for loan losses 3,277,168 2,386,913 7.8% 3.0

PCI Loans

Retail 145,031 88,114

Multifamily 133,096 48,858

Office 121,291 99,606

Hospitality 90,513 60,636

Industrial 71,332 41,613

Other 48,805 17,313

Land 41,426 30,518

Residential 22,683 8,847

Healthcare 98 80

Total PCI loans, net of allowance for loan losses 674,275 395,584

Total loans receivable, net of allowance for loan losses 3,951,443$ 2,782,497$

VIIb. Other Equity and Debt - Real Estate Debt (cont’d)

Notes:

(1) Excludes $4 million carrying value of real estate debt investments held in a CDO securitization and $85 million carrying value of healthcare real estate development loans related to the Company’s healthcare real estate portfolio.

Colony NorthStar, Inc. | Supplemental Financial Report 30

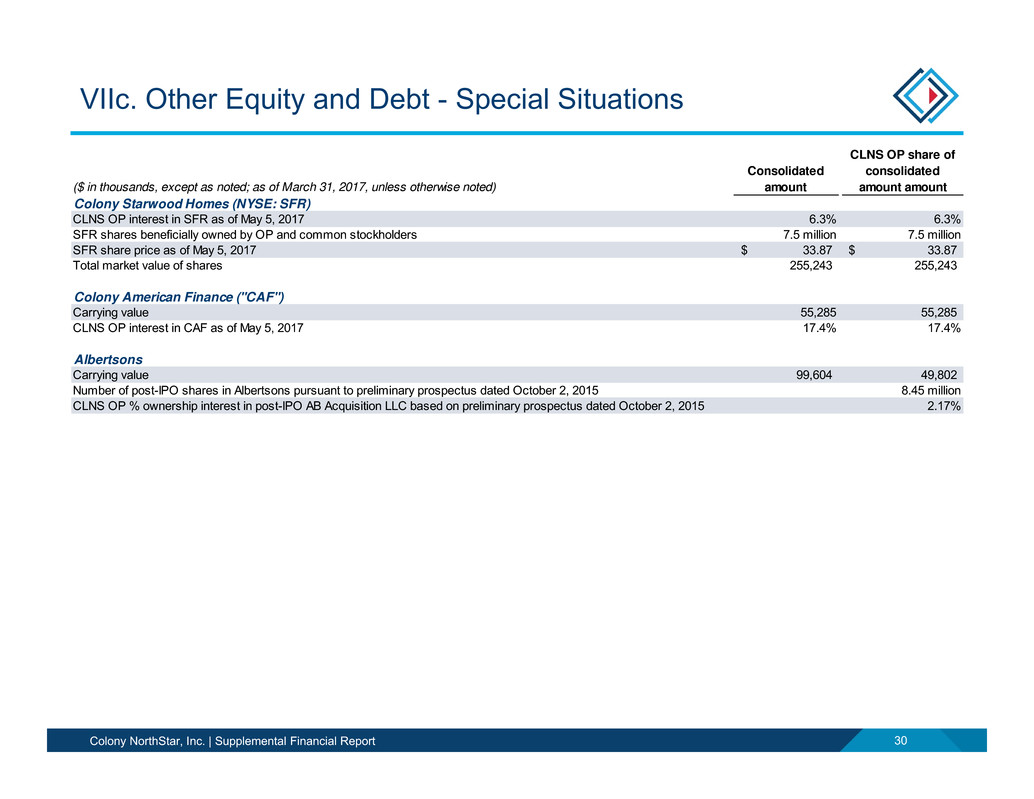

($ in thousands, except as noted; as of March 31, 2017, unless otherwise noted)

Consolidated

amount

CLNS OP share of

consolidated

amount amount

Colony Starwood Homes (NYSE: SFR)

CLNS OP interest in SFR as of May 5, 2017 6.3% 6.3%

SFR shares beneficially owned by OP and common stockholders 7.5 million 7.5 million

SFR share price as of May 5, 2017 33.87$ 33.87$

Total market value of shares 255,243 255,243

Colony American Finance ("CAF")

Carrying value 55,285 55,285

CLNS OP interest in CAF as of May 5, 2017 17.4% 17.4%

Albertsons

Carrying value 99,604 49,802

Number of post-IPO shares in Albertsons pursuant to preliminary prospectus dated October 2, 2015 8.45 million

CLNS OP % ownership interest in post-IPO AB Acquisition LLC based on preliminary prospectus dated October 2, 2015 2.17%

VIIc. Other Equity and Debt - Special Situations

Colony NorthStar, Inc. | Supplemental Financial Report 31

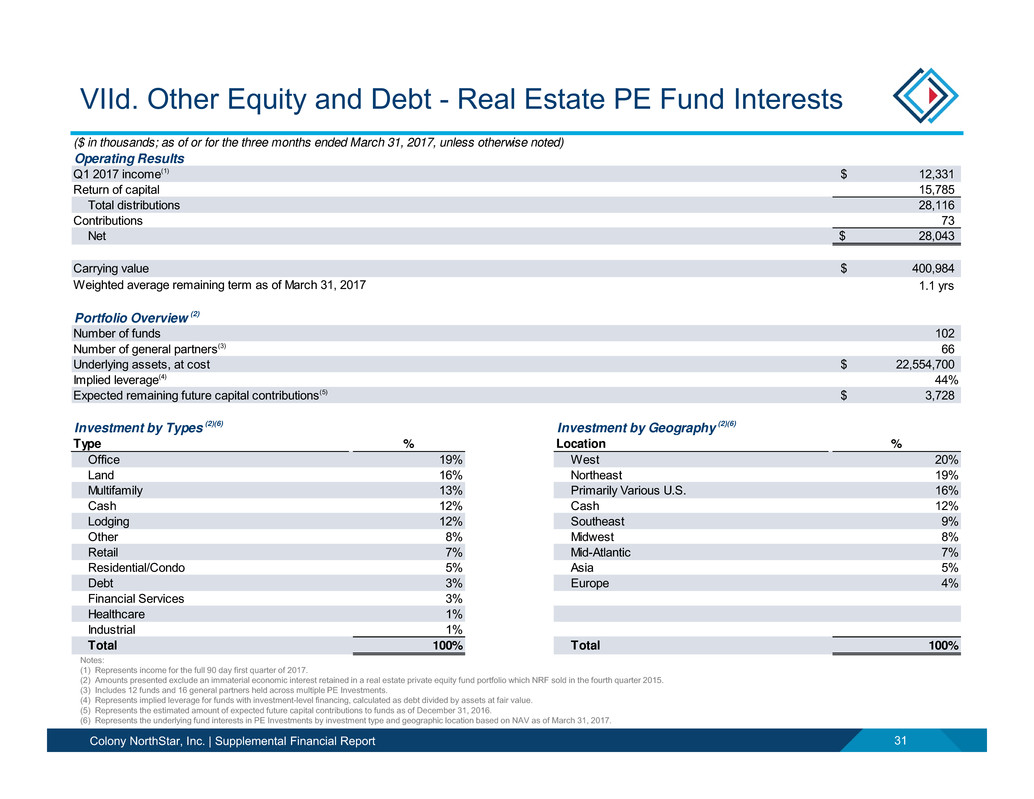

($ in thousands; as of or for the three months ended March 31, 2017, unless otherwise noted)

Operating Results

Q1 2017 income(1) 12,331$

Return of capital 15,785

Total distributions 28,116

Contributions 73

Net 28,043$

Carrying value 400,984$

Weighted average remaining term as of March 31, 2017 1.1 yrs

Portfolio Overview (2)

Number of funds 102

Number of general partners(3) 66

Underlying assets, at cost 22,554,700$

Implied leverage(4) 44%

Expected remaining future capital contributions(5) 3,728$

Investment by Types (2)(6) Investment by Geography (2)(6)

Type % Location %

Office 19% West 20%

Land 16% Northeast 19%

Multifamily 13% Primarily Various U.S. 16%

Cash 12% Cash 12%

Lodging 12% Southeast 9%

Other 8% Midwest 8%

Retail 7% Mid-Atlantic 7%

Residential/Condo 5% Asia 5%

Debt 3% Europe 4%

Financial Services 3%

Healthcare 1%

Industrial 1%

Total 100% Total 100%

VIId. Other Equity and Debt - Real Estate PE Fund Interests

Notes:

(1) Represents income for the full 90 day first quarter of 2017.

(2) Amounts presented exclude an immaterial economic interest retained in a real estate private equity fund portfolio which NRF sold in the fourth quarter 2015.

(3) Includes 12 funds and 16 general partners held across multiple PE Investments.

(4) Represents implied leverage for funds with investment-level financing, calculated as debt divided by assets at fair value.

(5) Represents the estimated amount of expected future capital contributions to funds as of December 31, 2016.

(6) Represents the underlying fund interests in PE Investments by investment type and geographic location based on NAV as of March 31, 2017.

Colony NorthStar, Inc. | Supplemental Financial Report 32

($ in thousands; as of March 31, 2017)

Portfolio Overview

Owned Bonds and Equity of Deconsolidated CDO's Principal amount Carrying Value

Total owned deconsolidated CDO bonds 367,022$ 87,560$

Total owned deconsolidated CDO equity 16,872

Consolidated CDO's Principal amount Carrying Value

Total consolidated CDO investments 715,244 287,287

Total consolidated non-recourse CDO financing 336,119 237,855

Net book value - consolidated CDOs 379,124 49,432

CMBS Principal amount Carrying Value

98,291 21,696

Income

Q1 2017 aggregate income(1) 15,975

VIIe. Other Equity and Debt - CRE Securities

Notes:

(1) Represents income for the full 90 day first quarter of 2017.

Colony NorthStar, Inc. | Supplemental Financial Report 33

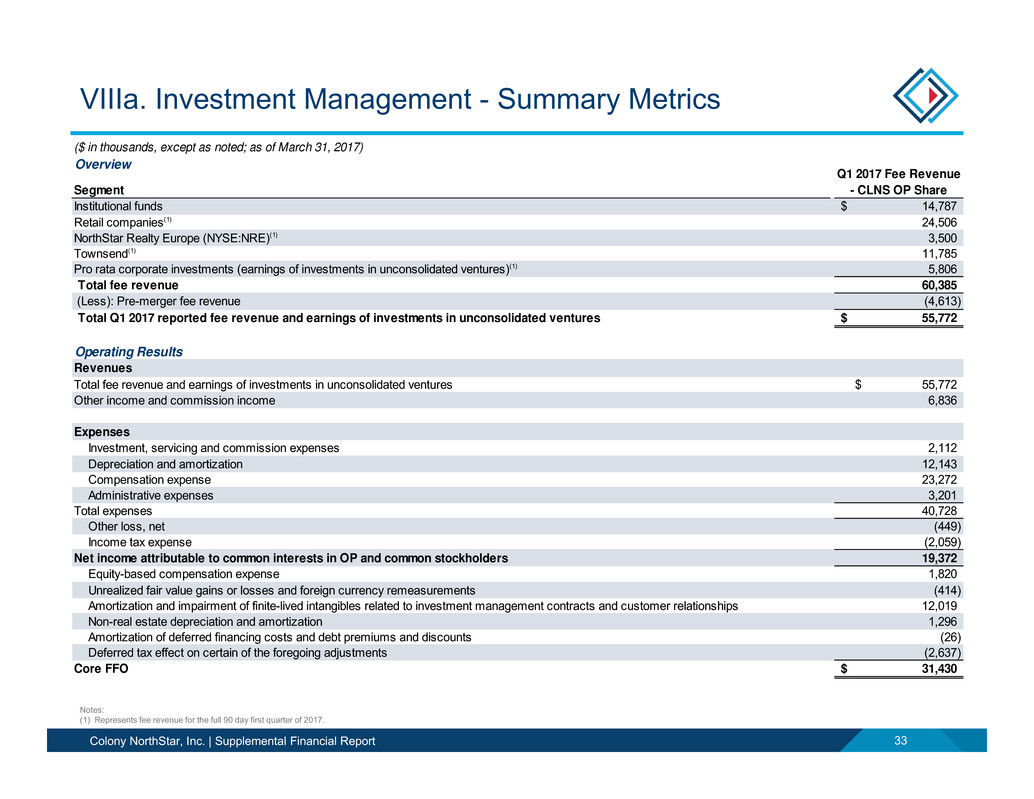

($ in thousands, except as noted; as of March 31, 2017)

Overview

Segment

Institutional funds 14,787$

Retail companies(1) 24,506

NorthStar Realty Europe (NYSE:NRE)(1) 3,500

Townsend(1) 11,785

Pro rata corporate investments (earnings of investments in unconsolidated ventures)(1) 5,806

Total fee revenue 60,385

(Less): Pre-merger fee revenue (4,613)

Total Q1 2017 reported fee revenue and earnings of investments in unconsolidated ventures 55,772$

Operating Results

Revenues

Total fee revenue and earnings of investments in unconsolidated ventures 55,772$

Other income and commission income 6,836

Expenses

Investment, servicing and commission expenses 2,112

Depreciation and amortization 12,143

Compensation expense 23,272

Administrative expenses 3,201

Total expenses 40,728

Other loss, net (449)

Income tax expense (2,059)

Net income attributable to common interests in OP and common stockholders 19,372

Equity-based compensation expense 1,820

Unrealized fair value gains or losses and foreign currency remeasurements (414)

Amortization and impairment of finite-lived intangibles related to investment management contracts and customer relationships 12,019

Non-real estate depreciation and amortization 1,296

Amortization of deferred financing costs and debt premiums and discounts (26)

Deferred tax effect on certain of the foregoing adjustments (2,637)

Core FFO 31,430$

Q1 2017 Fee Revenue

- CLNS OP Share

VIIIa. Investment Management - Summary Metrics

Notes:

(1) Represents fee revenue for the full 90 day first quarter of 2017.

Colony NorthStar, Inc. | Supplemental Financial Report 34

($ in millions, except as noted; as of March 31, 2017 unless otherwise noted)

Segment Products Description

AUM CLNS OP

Share

Institutional Funds

● Credit ($3.8 billion)

● Core plus / value-added ($1.8 billion)

● Opportunistic ($1.9 billion)

● Colony Industrial ($1.4 billion)

● Other co-investment vehicles ($1.3 billion)

● 26 years of institutional investment management experience

● Sponsorship of private equity funds and vehicles earning

asset management fees and performance fees

● More than 300 investor relationships

● $10 billion of private equity capital raised since the beginning

of 2008; $25 billion of private equity capital raised since inception

10,201$

Retail Companies

● NorthStar Income I ($1.6 billion)

● NorthStar Healthcare ($3.6 billion)

● NorthStar Income II ($1.8 billion)

● NorthStar/RXR NY Metro Real Estate

● NorthStar Real Estate Capital Income Fund

● NorthStar/Townsend Institutional Real Estate Fund (1)

● Wholly-owned broker-deal subsidiary engaged as dealer-

manager for all retail product offerings

● Over $4 billion of capital raised to date with over $5 billion

of current effective products

● Manage public non-traded vehicles earning asset

management, performance, acquisition and disposition fees

7,018

Public Company ● NorthStar Realty Europe Corp.

● Manage NYSE-listed European equity REIT

● Earns base management fee with potential for incentive fees 1,975

Townsend

● Segregrated Mandates

● Commingled Funds

● Advisory Services

● 84% investment in The Townsend Group

● Manage custom portfolios and fund-of-funds primary invested

in direct real estate funds

● Source co-investments and joint ventures alongside GPs

● Fees comprised of recurring investment management

fees, recurring advisory fees, and performance fees

14,507

Pro Rata

Corporate

Investments

● RXR Realty

● American Healthcare Investors

● Steelwave

● Hamburg Trust

● CLNS recognizes at-share earnings from underlying pro rata

corporate investments

● 27% investment in RXR Realty, a real estate owner, developer

and investment management company with over $12 billion

of AUM

● 43% investment in American Healthcare Investors, a healthcare

investment management firm and sponsor of non-traded vehicles

with $2.5 billion of AUM

7,004

Total 40,705$

VIIIb. Investment Management – Assets Under Management

Notes:

(1) NorthStar/Townsend Institutional Real Estate Fund Inc. filed a registration statement on Form N-2 to the SEC in October 2016, which as of May 5, 2017, is not yet effective.

Colony NorthStar, Inc. | Supplemental Financial Report 35

($ in thousands, except as noted; as of March 31, 2017, unless otherwise noted)

NorthStar

Income

NorthStar

Healthcare

NorthStar

Income II

NorthStar/RXR

NY Metro Real Estate(1)

NorthStar Real Estate

Capital Income Fund Total

Capital Raising Status Completed

July 2013

Completed

January 2016

Completed

November 2016

Active Active

Primary Strategy CRE Debt Healthcare Equity

and Debt

CRE Debt NY Metro Area CRE

Equity and Debt

CRE Debt

Offering Size $1.2 billion(2) $2.1 billion(2) $1.65 billion(2) $2.0 billion(2) $3.2 billion(2) $10.15 billion

Capital Raised

During Q1 2017 $ 9,354 $ 16,701 $ 8,715 $ 5,200 - $ 39,970

Year-to-date through 5-5-17 15,186 27,956 14,580 8,507 2,200 68,429

Inception to 5-5-17 1,262,555 1,897,297 1,154,041 21,916 2,200 4,338,009

Investments(3)

During Q1 2017 33,450 118,865 150,184 - - 302,499

As of 3-31-17 1,603,010 3,414,511 1,839,058 11,030 - 6,867,609

Cash as of 3-31-17 147,594 160,399 61,083 10,200 1,435 380,711

Fees earned during Q1 2017(4)

Asset management fees 4,695 8,267 5,284 15 5 18,267

Acquisition fees 120 3,188 1,446 - - 4,754

Disposition fees 776 - 709 - - 1,485

Total fees $ 5,591 $ 11,456 $ 7,439 $ 15 $ 5 $ 24,506

VIIIc. Investment Management - Retail Companies

Notes:

(1) Fees earned are split 50/50 with partner.

(2) Represents dollar amounts of shares registered to offer pursuant to each company's public offering, distribution reinvestment plan, and follow-on public offering.

(3) Based on cost for real estate equity investments, which includes net purchase price allocation related to intangibles, deferred costs and other assets, if any, committed principal amount for real estate debt and securities and carrying

value plus deferred acquisition prices for limited partnership interests in private equity funds.

(4) Represents fee revenue for the full 90 day first quarter of 2017.

Colony NorthStar, Inc. | Supplemental Financial Report 36

APPENDICES

Colony NorthStar, Inc. | Supplemental Financial Report 37

IXa. Appendices - Definitions

Assets Under Management (“AUM”)

Refers to assets which the Company and its affiliates provides investment management services, including assets for which the Company may or may not charge management fees and/or performance

allocations. AUM is generally based on reported gross undepreciated carrying value of managed investments as reported by each underlying vehicle at March 31, 2017, while retail companies and NorthStar

Realty Europe are presented as of May 5, 2017. AUM further includes a) uncalled capital commitments and b) for corporate investments in affiliates with asset and investment management functions, includes

the Company’s pro-rata share assets of each affiliate as presented and calculated by the affiliate. Affiliates include RXR Realty LLC, SteelWave, LLC, American Healthcare Investors and Hamburg Trust. The

Company's calculations of AUM may differ materially from the calculations of other asset managers, and as a result, this measure may not be comparable to similar measures presented by other asset

managers.

NOI: Net Operating Income. NOI for healthcare and industrial segments represents total property and related income less property operating expenses, adjusted for the effects of (i) straight-line rental income

adjustments; (ii) amortization of acquired above- and below-market lease adjustments to rental income; and (iii) other items such as adjustments for the Company’s share of NOI of unconsolidated ventures.