Attached files

| file | filename |

|---|---|

| 8-K - 8-K - WHITE MOUNTAINS INSURANCE GROUP LTD | wtm8-k2017investorpresenta.htm |

White Mountains Insurance Group, Ltd.

Investor Presentation – May 2017

Exhibit 99.1

1

Forward-Looking Statements

Forward-Looking Statements

This presentation may contain, and management may make, “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933 and

Section 21E of the Securities Exchange Act of 1934. All statements, other than statements of historical facts, included or referenced in this presentation which

address activities, events or developments which White Mountains expects or anticipates will or may occur in the future are forward-looking statements. The

words "will", "believe," "intend," "expect," "anticipate," "project," "estimate," "predict," “plan,” “envision,” “imply,” “seek,” “future” and similar expressions are

also intended to identify forward-looking statements. These forward-looking statements include, among others, statements with respect to White Mountains’s:

(i) change in adjusted book value per share or return on equity; (ii) business strategy; (iii) financial and operating targets or plans; (iv) incurred loss and loss

adjustment expenses and the adequacy of its loss and loss adjustment expense reserves and related reinsurance; (v) projections of revenues, income (or loss),

earnings (or loss) per share, dividends, market share or other financial forecasts; (vi) expansion and growth of its business and operations; and (vii) future

capital expenditures.

These statements are based on certain assumptions and analyses made by White Mountains in light of its experience and perception of historical trends,

current conditions and expected future developments, as well as other factors believed to be appropriate in the circumstances. However, whether actual

results and developments will conform to its expectations and predictions is subject to a number of risks and uncertainties that could cause actual results to

differ materially from expectations, including: (i) the risk that the acquisition of OneBeacon Insurance Group, Ltd. (“OneBeacon”) by Intact Financial

Corporation (the “Transaction”) may not be completed on the currently contemplated timeline; (ii) the possibility that any or all of the various conditions to the

consummation of the Transaction may not be satisfied or waived, including the failure to receive any required regulatory approvals from any applicable

governmental entities (or any conditions, limitations or restrictions placed on such approvals); (iii) the occurrence of any event, change or other circumstance

that could give rise to the termination of the merger agreement dated May 2, 2017, among OneBeacon, Intact Financial Corporation and the other parties

thereto (the “Merger Agreement”), including in circumstances which would require OneBeacon to pay a termination fee or other expenses; (iv) the risks related

to diverting management’s attention from White Mountains’s or OneBeacon’s ongoing business operations and other risks related to the announcement or

pendency of the Transaction, including on White Mountains’s or OneBeacon’s ability to retain and hire key personnel, their ability to maintain relationships

with customers, policyholders, brokers, service providers and others with whom they do business and their operating results and business generally; (v) the

risk that shareholder litigation in connection with the Transactions may result in significant costs of defense, indemnification and liability; (vi) the risks that are

described from time to time in White Mountains's filings with the Securities and Exchange Commission , including but not limited to White Mountains's

Annual Report on Form 10-K for the fiscal year ended December 31, 2016 filed February 27, 2017 ;(vii) claims arising from catastrophic events, such as

hurricanes, earthquakes, floods, fires, terrorist attacks or severe winter weather; (viii) the continued availability of capital and financing; (ix) general economic,

market or business conditions; (x) business opportunities (or lack thereof) that may be presented and pursued; (xi) competitive forces, including the conduct of

other property and casualty insurers and reinsurers; (xii) changes in domestic or foreign laws or regulations, or their interpretation, applicable to White

Mountains, its competitors or its customers; (xiii) an economic downturn or other economic conditions adversely affecting White Mountains’s financial

position; (xiv) recorded loss reserves subsequently proving to have been inadequate; (xv) actions taken by ratings agencies from time to time, such as financial

strength or credit ratings downgrades or placing ratings on negative watch; and (xvi) other factors, most of which are beyond White Mountains's control.

Consequently, all of the forward-looking statements made in this presentation are qualified by these cautionary statements, and there can be no assurance that

the actual results or developments anticipated by White Mountains will be realized or, even if substantially realized, that they will have the expected

consequences to, or effects on, White Mountains or its business or operations. White Mountains assumes no obligation to publicly update any such forward-

looking statements, whether as a result of new information, future events or otherwise.

2

Non-GAAP Financial Measures

Figures designated as “pro forma” or “PF” are adjusted as if the OneBeacon transaction occurred on 3/31/17.

Non-GAAP Financial Measures

Management believes the non-GAAP measures included in this presentation to be useful in evaluating the Company’s financial

position and performance. The following non-GAAP financial measures are presented: (i) Adjusted Book Value Per Share (ABVPS);

(ii) Adjusted Book Value; (iii) ABVPS Denominator, and (iv) Growth in ABVPS. Please see the appendix at the end of the

presentation for an explanation of each such non-GAAP financial measure and a reconciliation of the measure to its most closely

comparable GAAP financial measure.

An electronic copy of this presentation can be found at our website: www.whitemountains.com

Two Years of Transformative Activity

4

OneBeacon Transaction

Announced all-cash transaction with Intact Financial on May 2; expected to close by year-end

Purchase price of $18.10 per share, or $1.7 billion in total consideration

1.65x price-to-tangible book multiple;

$0.7 billion premium over 3/31/17 tangible book value

Economics to WTM (76% owner):

Pro forma increase in ABVPS of $107

Net cash proceeds of $1.3 billion

WTM returns over 16-year holding period:

2.5x multiple of invested capital

14% after-tax IRR (vs. S&P 500 total return of 6%)

5

Operating Asset Sales

Closing

Date

Price

/TBV

WTM Gain

(per share)

WTM

Proceeds

($ billions) IRR

Symetra 1Q16 1.6x [1] $43 $0.7 15%

Sirius Group 2Q16 1.3x $90 $2.6 11%

Tranzact 3Q16 n/a $16 $0.2 35%

OneBeacon PF exp 4Q17 1.7x $107 $1.3 14%

Total $256 $4.2 [2]

[1] Reflects deal multiple on Symetra’s book value excluding accumulated other comprehensive income

[2] Total is adjusted to avoid double counting of $0.6 billion of proceeds from the sale of Symetra shares held by Sirius Group

6

Capital Management

Returned $887 million to shareholders through share repurchases in 2016

Repurchased 1.1 million shares, roughly 20% of the company, at an average price of $802

Share repurchases slowed since 4Q16 as our share price steadily climbed

Share repurchase activity since 2010:

shares repurchased $ millions per share

2010 687,871 226$ 328$

2011 646,502 253 391

2012 1,329,640 669 503

2013 141,535 80 564

2014 217,879 134 617

20 5 387,495 284 733

2016 1,106,145 887 802

total 4,517,067 2,534$ 561$

7

Management Team Changes

Chairman: Morgan Davis (31 years with White Mountains)

CEO: Manning Rountree (13 years with White Mountains)

CFO: Reid Campbell (23 years with White Mountains)

8

A Picture Says 1,000 Words

9/30/2015

(Actual)

3/31/17

(PF for OB Transaction)

Operating Assets

ABVPS $655 $906

Run Rate GABVPS mid/high single digits low single digits

Undeployed Capital $0.6 billion $3.1 billion

CAPITAL

C PITAL

White Mountains after OneBeacon

10

WTM Pro Forma for OneBeacon Transaction

Total capital of $4.2 billion, substantially all in common shareholders’ equity

Parent undeployed capital of roughly $3.1 billion, or 75% of total capital

No parent company financial leverage

Two principal operating assets:

HG Global / BAM

WMC portfolio companies

Low single-digit GAAP returns, reflecting:

GAAP “unfriendly” return profile of both HG Global/BAM and WMC; and

Muted investment return outlook for substantial undeployed capital position

11

WTM Pro Forma Financial Position

3/31/17

($ millions, except where noted otherwise) Actual

OneBeacon

Transaction

Pro Forma

Common equity $ 3,625 $ 486 $ 4,111

Non-controlling interest – OneBeacon 251 (251) 0

Non-controlling interest – Other (excluding BAM) 35 (4) 31

Total debt (at subsidiaries) 285 (273) 12

Total capital $ 4,195 $ (38) $ 4,153

Debt to total capital 7% 0%

Parent undeployed capital $ 1.8 B $ 3.1 B

12

WTM Pro Forma Allocation of Capital

($ billions, except per share) carrying value abvps

onebeacon 0.8$ 173$

hgg / bam 0.7 156

white mountains capital 0.2 34

parent udc / other 2.0 437

total 3.6$ 800$

3/31/17 (Actual)

($ billions, except per share) carrying value abvps

onebeacon -$ -$

hgg / bam 0.7 156

white mountains capital 0.2 34

parent udc / other 3.2 716

total 4.1$ 906$

3/31/17 (PF for OneBeacon Sale)

Where Do We Go From Here?

14

Challenging Market Environment Persists

Soft insurance markets

Pressure on accident year pricing / reserve releases slowing to a trickle

Carriers sowing the seeds for future distress, but will take years to blossom

Over-abundant supply of (low hurdle-rate) capital / no obvious catalyst for near-term market turn

Low interest rates / elevated equity markets / muted investment outlook

Elevated asset prices

On most deals we see, we would rather be a seller than a buyer

Middle innings on “insuretech” phenomenon; getting frothy

Implications for WTM:

We have been a net seller of insurance operating assets for a reason!

Conditions have not magically reversed now that we have money in our pocket

15

What to Expect from Us?

We expect to shrink, likely significantly, before we grow again

We have been here before (following 1991 sale of Fireman’s Fund)

Reflects willingness to “walk the walk” on capital rotation and shareholder value creation

We envision resizing as a $2.0 - $2.5B company

~$1.0B deployed to current operating assets (HG Global/BAM & WMC)

~$1.0 - $1.5B “war chest” for deployment into new operating assets

This implies distributing $1.5 – $2.0B of currently undeployed capital

Plan to pursue in a flexible and disciplined manner over the medium term

Will aim to create value for continuing shareholders

We are reducing our expense base and shifting our human capital accordingly

16

Capital Redeployment Approach

Fundamental philosophy and approach is unchanged

Will remain focused on economics and shareholder value creation (not accounting or empire building)

Will stick to our knitting: primarily insurance, broader financial services, and adjacent sectors

Will remain value-oriented, opportunistic and highly flexible

Focus will be on “chunkier deployments”

Bogey of $200 million of annual deployments; will be lumpy, not smooth

Targeting deals of $50 million and higher, preferably much higher

Preference for majority stakes in operating businesses that we understand and can enhance

Working through traditional channels and also developing “special situations”

Core belief that deals will come, but patience is required

Strong deal team with relevant expertise

Circumstances will naturally change over time, and opportunities will emerge (and we will be there)

Expect run rate returns to increase as we normalize our undeployed capital position

Update on Current Businesses

18

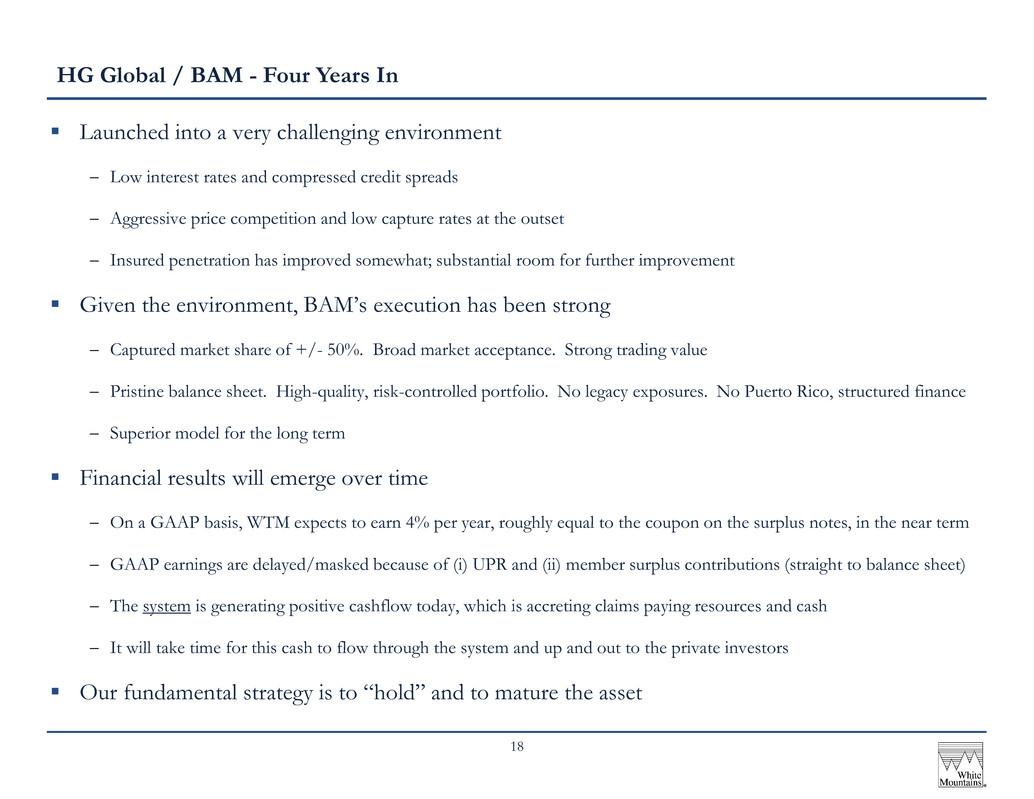

Launched into a very challenging environment

Low interest rates and compressed credit spreads

Aggressive price competition and low capture rates at the outset

Insured penetration has improved somewhat; substantial room for further improvement

Given the environment, BAM’s execution has been strong

Captured market share of +/- 50%. Broad market acceptance. Strong trading value

Pristine balance sheet. High-quality, risk-controlled portfolio. No legacy exposures. No Puerto Rico, structured finance

Superior model for the long term

Financial results will emerge over time

On a GAAP basis, WTM expects to earn 4% per year, roughly equal to the coupon on the surplus notes, in the near term

GAAP earnings are delayed/masked because of (i) UPR and (ii) member surplus contributions (straight to balance sheet)

The system is generating positive cashflow today, which is accreting claims paying resources and cash

It will take time for this cash to flow through the system and up and out to the private investors

Our fundamental strategy is to “hold” and to mature the asset

HG Global / BAM - Four Years In

19

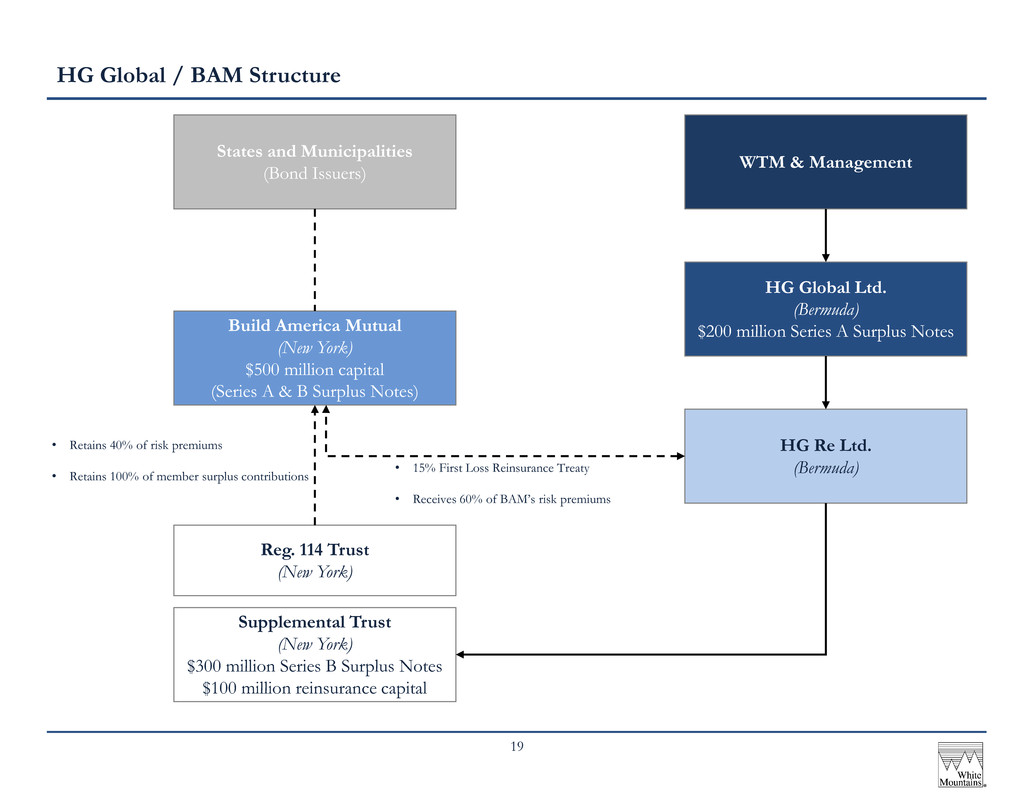

Build America Mutual

(New York)

$500 million capital

(Series A & B Surplus Notes)

HG Global Ltd.

(Bermuda)

$200 million Series A Surplus Notes

WTM & Management

States and Municipalities

(Bond Issuers)

HG Re Ltd.

(Bermuda)

Reg. 114 Trust

(New York)

Supplemental Trust

(New York)

$300 million Series B Surplus Notes

$100 million reinsurance capital

• 15% First Loss Reinsurance Treaty

• Receives 60% of BAM’s risk premiums

• Retains 40% of risk premiums

• Retains 100% of member surplus contributions

HG Global / BAM Structure

20

BAM Key Metrics

2013A 2014A 2015A 2016A 1Q16A 1Q17A

par insured (closed) 4,708$ 7,830$ 10,606$ 11,303$ 2,179$ 2,379$

total premiums (%) 0.65% 0.43% 0.52% 0.68% 0.62% 1.19%

total premiums ($) 31$ 33$ 56$ 77$ 14$ 28$

gross expenses (BAM & HG Re) 36$ 40$ 41$ 45$ 11$ 13$

s&p RAP 3.21% 2.26% 2.35% 3.53% 3.04% 4.61%

qualified statutory capital 470$ 454$ 450$ 454$ 448$ 455$

claims paying resources 579$ 581$ 601$ 644$ 607$ 662$

year ended quarter ended

21

Pivot from “traditional” insurance balance sheet transactions in late 2012

Frustrated by the M&A market in core sector; deals not available at attractive prices

Sought alternative ways to leverage our unique capabilities; typically looking for an “insurance angle”

Different type of investment / financial profile

Generally cash flow (or path to cash flow) businesses, rather than book value businesses

Lower required capital; higher risk / higher return propositions

The WMC portfolio has performed well to-date

4 exits generating 1.3x multiple of invested capital and $230 million of p/t proceeds

Excited about the prospects of a number of the remaining WMC businesses

But the WMC portfolio does not move the needle today

Only $150 million of deployed capital currently

Smaller, option-like deals make less sense today, given undeployed capital levels

White Mountains Capital

22

WMC Portfolio Overview

current wtm value ($ millions) - 3/31/17

operating ownership, gross invested net invested carrying

location fd/fc capital, a/t capital, a/t value

A. cashflow businesses

mediaalpha US 56% 36$ 22$ 17$

wobi Israel 94% 46 46 19

passportcard Israel/Intl 50% 21 21 21

B. venture businesses

compare US 22% 34$ 34$ 22$

captricity US 22% 29 29 29

durchblicker Austria 45% 12 12 9

buzzmove UK 66% 8 8 7

C. insurance businesses

onetitle US 20% 3$ 3$ 3$

D. other investments

enlightenment capital US 30$ 14$ 24$

nyca partners US 1 1 2

total 220$ 190$ 153$

Appendices

1. Track Record vs S&P 500 (p.24)

2. Non-GAAP Financial Measures (p. 25-27)

24

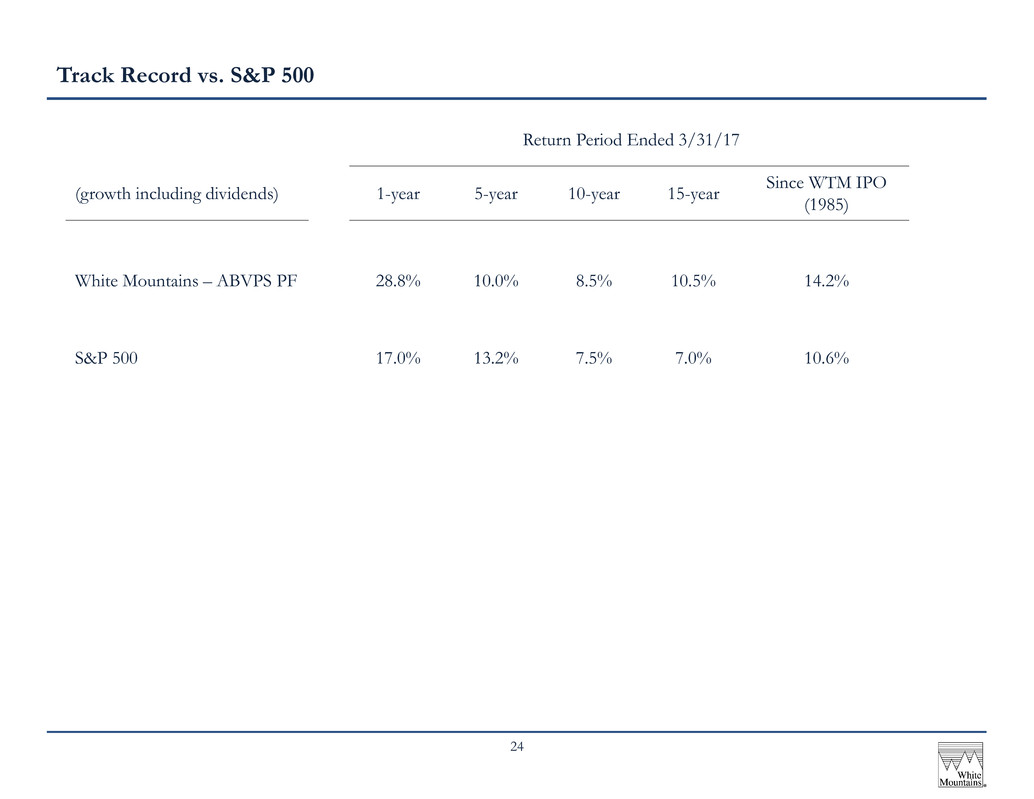

Track Record vs. S&P 500

Return Period Ended 3/31/17

(growth including dividends) 1-year 5-year 10-year 15-year

Since WTM IPO

(1985)

White Mountains – ABVPS PF 28.8% 10.0% 8.5% 10.5% 14.2%

S&P 500 17.0% 13.2% 7.5% 7.0% 10.6%

25

Adjusted Book Value, ABVPS Denominator and Adjusted Book Value Per Share

Adjusted Book Value, ABVPS Denominator and Adjusted Book Value Per Share

Adjusted Book Value is a non-GAAP financial measure that is derived by excluding from GAAP shareholders' equity the equity in unrealized

gains from Symetra's fixed maturity portfolio. ABVPS Denominator excludes from GAAP common shares outstanding unearned shares of

of restricted stock, the compensation cost of which, at the date of calculation, has yet to be amortized.

Adjusted Book Value Per Share (ABVPS) is the result of dividing Adjusted Book Value by ABVPS Denominator.

Sept. 30,

2015 2017A 2017PF

Book value per share numerators ($ in millions):

GAAP common shareholders' equity 3,746$ 3,625$ 4,111$

less: equity in net unrealized gains from Symetra's fixed maturity portfolio (6) - -

Adjusted Book Value (ABVPS numerator) 3,740$ 3,625$ 4,111$

Book value per share denominators (in 000's):

GAAP common shares outstanding 5,745 4,573 4,573

Unearned restricted shares (31) (35) (35)

ABVPS Denominator 5,714 4,538 4,538

GAAP book value per share 652$ 793$ 900$

Adjusted Book Value Per Share 655$ 799$ 906$

March 31

26

Growth in Adjusted Book Value Per Share

Growth in Adjusted Book Value Per Share

The Company calculates its annual growth in values per share on an IRR basis, which includes the value per share at the beginning of the year,

the dividends received each year and the value per share at the end of the year. See the table below for comparison of growth in GAAP book

value per share and growth in ABVPS over a range of return periods:

Annualized Growth: 1-year 5-year 10-year 15-year Since IPO

GAAP book value per share PF 28.7% 10.1% 8.4% 10.5% 14.8%

Adjusted Book Value Per Share PF 28.8% 10.0% 8.5% 10.5% 14.2%

Return Period Ended December 31, 2016

27

Adjusted Book Value Per Share - Allocation of Capital

Adjusted Book Value Per Share - Allocation of Capital

Adjusted Book Value Per Share (ABVPS) is the result of dividing Adjusted Book Value by ABVPS Denominator. ABVPS Denominator

excludes from GAAP common shares outstanding unearned shares of restricted stock, the compensation cost of which, at the date of

calculation, has yet to be amortized.

GAAP

3/31/17 A per share ABVPS

OneBeacon 0.8$ 172$ 173$

HG Global / BAM 0.7 155 156

White Mountains Capital 0.2 33 34

Parent undeployed capital / other 2.0 433 436

3.6$ 793$ 799$

GAAP

3/31/17 PF per share ABVPS

OneBeacon -$ -$ -$

HG Global / BAM 0.7 155 156

White Mountains Capital 0.2 33 34

Parent undeployed capital / other 3.2 712 716

4.1$ 900$ 906$

Book value per share denominators (in 000's): 3/31/17 A

GAAP common shares outstanding 4,573

Unearned restricted shares (35)

ABVPS denominator 4,538