Attached files

| file | filename |

|---|---|

| 8-K - 8-K - STATE BANK FINANCIAL CORP | stbz-20170508x8k.htm |

State Bank Financial Corporation

May 8, 2017

2017 Gulf South Bank Conference

2

Cautionary Note Regarding Forward-Looking

Statements

This presentation contains forward-looking statements within the meaning of the federal securities laws. These forward-looking statements, which are based on

certain assumptions and describe our future plans, strategies, and expectations, can generally be identified by the use of the words “will,” “expect,” “should,”

“anticipate,” “may,” and “project,” as well as similar expressions. These forward-looking statements include, but are not limited to, statements regarding our

significant opportunity for deposit growth in the Atlanta and Savannah markets, statements regarding our ability to leverage our existing treasury and payroll

capabilities in certain markets, statements regarding our strategic outlook on Slide 7, including our forward vision, our focus on improving efficiency, including that

our noninterest expense is expected to decline, and other statements about expected developments or events, our future financial performance, and the execution

of our strategic goals. Forward-looking statements are not guarantees of future performance and are subject to risks, uncertainties and assumptions (“risk factor”)

that are difficult to predict with regard to timing, extent, likelihood and degree. Therefore, actual results and outcomes may materially differ from what may be

expressed or forecasted in such forward-looking statements. We undertake no obligation to update, amend or clarify forward-looking statements, whether as a

result of new information, future events or otherwise. Risk factors including, without limitation, the following:

• negative reactions to our recent or future acquisitions of each bank’s customers, employees, and counterparties or difficulties related to the transition of services;

• our ability to achieve anticipated results from the transactions with NBG Bancorp and S Bankshares will depend on the state of the economic and financial

markets going forward;

• economic conditions (both generally and in our markets) may be less favorable than expected, which could result in, among other things, a deterioration in credit

quality, a reduction in demand for credit and a decline in real estate values;

• a general decline in the real estate and lending markets, particularly in our market areas, could negatively affect our financial results;

• risk associated with income taxes including the potential for adverse adjustments and the inability to fully realize deferred tax benefits;

• increased cybersecurity risk, including potential network breaches, business disruptions, or financial losses;

• restrictions or conditions imposed by our regulators on our operations may make it more difficult for us to achieve our goals;

• legislative or regulatory changes, including changes in accounting standards and compliance requirements, may adversely affect us;

• competitive pressures among depository and other financial institutions may increase significantly;

• changes in the interest rate environment may reduce margins or the volumes or values of the loans we make or have acquired;

• other financial institutions have greater financial resources and may be able to develop or acquire products that enable them to compete more successfully than

we can;

• our ability to attract and retain key personnel can be affected by the increased competition for experienced employees in the banking industry;

• adverse changes may occur in the bond and equity markets;

• war or terrorist activities may cause deterioration in the economy or cause instability in credit markets; and

• economic, governmental, or other factors may prevent the projected population, residential, and commercial growth in the markets in which we operate.

In addition, risk factors include, but are not limited to, the risk factors described in Item 1A, Risk Factors, in our Annual Report on Form 10-K for the most recently

ended fiscal year. These and other risk factors are representative of the risk factors that may emerge and could cause a difference between an ultimate actual

outcome and a forward-looking statement.

3

Headquartered in Atlanta, Georgia

State Bank operates 31 full-service banking

offices and 8 mortgage origination offices in 7 of

the 8 largest MSAs in Georgia

Completed mergers with The National Bank of

Georgia and S Bank on December 31, 2016

These acquisitions expanded our statewide

footprint and provided entry into the attractive

markets of Athens, Gainesville, and Savannah

Atlanta

Macon

Warner

Robins

Augusta

Savannah

Athens

Gainesville

State Bank Financial Corporation Profile

Source: SNL Financial

Note: Financial metrics as of 3/31/17; dividend yield and market cap as of 5/3/17

STBZ Profile

Total Assets $4.2 billion TCE Ratio 12.9%

Total Loans $2.9 billion Cost of Funds .37%

Total Deposits $3.4 billion Dividend Yield 2.11%

Total Equity $620 million Market Cap $1.0 billion

Key Metrics

4

Investment Thesis

Executive management team with a 30+ year track record in Georgia of

successful acquisitions / integrations and building long-term shareholder value

Strong historical growth in core deposits and organic loans

Excellent credit metrics with minimal levels of NPAs, NCOs, and past due loans

Asset-sensitive balance sheet

Robust capital levels to support growth and opportunistic transactions

Attractive dividend yield and payout ratio

Concentrated branch footprint in high-quality metro markets

Well-positioned acquirer as one of only three publicly traded banks

headquartered in Georgia with $2 billion to $5 billion in assets

5

Acquisition History

July 2009 – October 2011

12 FDIC-assisted acquisitions

Total Assets: $3.9 billion

Total Deposits: $3.6 billion

January 2015

First Bank of Georgia

Assets: $527 million

Deposits: $418 million

December 2016

National Bank of Georgia

Assets: $378 million

Deposits: $288 million

February 2015

Boyett Insurance

Agency

October 2012

Altera Payroll

Services

October 2014

Bank of Atlanta

Assets: $186 million

Deposits: $149 million

October 2015

Patriot Capital

Equipment Finance

December 2016

S Bank

Assets: $106 million

Deposits: $94 million

$4.2 billion in

assets as of 1Q17

Prior to July 2009 Change of Control

$35 million in assets

2 Branches in Middle Georgia

2009 - 2011 2012 - 2014 2015 2016

6

Strong Core Deposit Base with

Significant Opportunity for Growth

1 Region represents individual or combined MSAs; Savannah region includes Savannah and Hinesville MSAs and Tattnall County, GA

Source: SNL Financial; FDIC deposit data as of 6/30/16

Atlanta – less than 1% market share of $153 billion in deposits; over 75% of the market is

dominated by large regional and national competitors

Savannah – new market where State Bank executive management has significant in-market

experience

Significant

Growth

Opportunities

Leading

Market Share

Top 10

Market Share

Augusta – remain well-positioned to take advantage of recent market disruption

Athens / Gainesville – strong local leadership team; opportunity to leverage State Bank’s

existing treasury and payroll capabilities in these new markets

Macon / Warner Robins – mature franchise with #1 market share since 2005 (including

predecessor bank)

($ in 000)

Region1 Deposits

% of

Deposits

Deposits /

Branch

# of

Branches

Market

Share Deposits

Deposits /

Branch

Atlanta $1,232,279 37% $205,380 6 0.8% $152,829,823 $122,069

Macon / Warner Robins 1,281,920 38% 106,827 12 25.1% 5,114,867 55,596

Augusta 424,956 13% 60,708 7 5.3% 7,995,226 62,955

Athens / Gainesville 323,661 10% 161,831 2 4.5% 7,154,932 73,762

Savannah 91,379 3% 22,845 4 1.2% 7,815,113 66,796

STBZ Total Region

7

Grow Commercial

Relationships by

Targeting Net

Funding Segments

Scale Efficient

Asset-Generating

Lines of Business

Foster a Culture

of Efficiency

Maintain Focus on

Noninterest Income

Strategic Outlook

Management Depth

Disciplined and

Experienced Acquirer

Balance Sheet Strength

Strong Credit Quality

Metrics

Shareholder Focused

Management Team with

Significant Insider

Ownership

Solid Foundation Built on

Proven Performance

Forward Vision

8

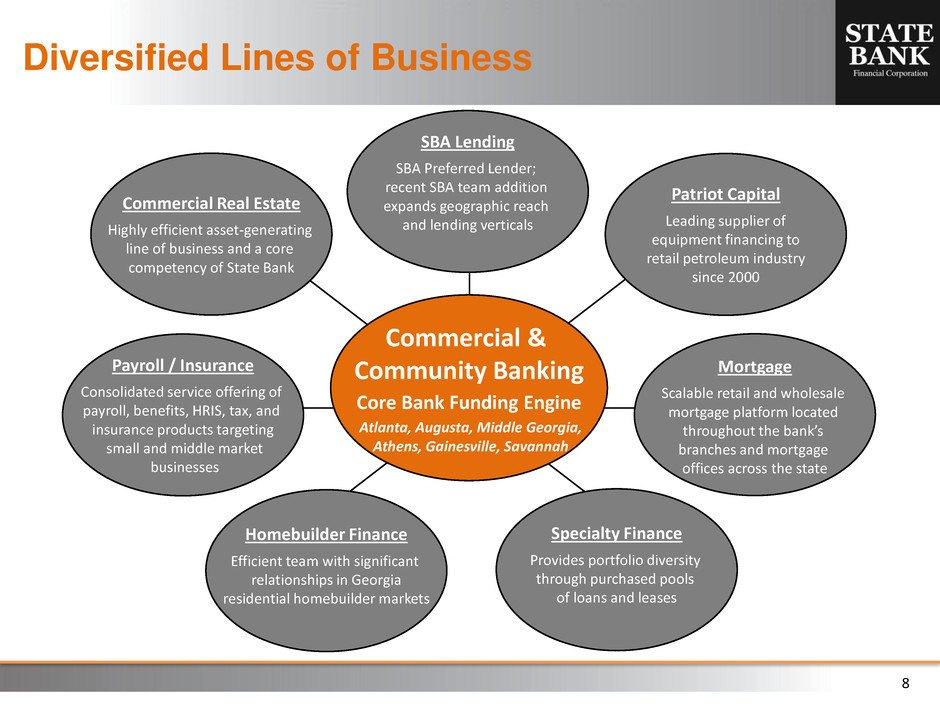

Diversified Lines of Business

Commercial &

Community Banking

Core Bank Funding Engine

Atlanta, Augusta, Middle Georgia,

Athens, Gainesville, Savannah

Mortgage

Scalable retail and wholesale

mortgage platform located

throughout the bank’s

branches and mortgage

offices across the state

Patriot Capital

Leading supplier of

equipment financing to

retail petroleum industry

since 2000

SBA Lending

SBA Preferred Lender;

recent SBA team addition

expands geographic reach

and lending verticals

Specialty Finance

Provides portfolio diversity

through purchased pools

of loans and leases

Payroll / Insurance

Consolidated service offering of

payroll, benefits, HRIS, tax, and

insurance products targeting

small and middle market

businesses

Commercial Real Estate

Highly efficient asset-generating

line of business and a core

competency of State Bank

Homebuilder Finance

Efficient team with significant

relationships in Georgia

residential homebuilder markets

9

1Q 2017 Financial Results

10

Income Statement Highlights

($ in 000s, except per share data) 1Q17 4Q16 1Q16

Interest income on loans $34,060 $26,696 $24,342

Accretion income on loans 7,677 10,271 9,743

Interest income on invested funds 5,460 4,810 4,673

Total interest income 47,197 41,777 38,758

Interest expense 3,239 2,631 2,113

Net interest income 43,958 39,146 36,645

Provision for loan and lease losses 1,002 277 (134)

Net interest income after provision for loan losses 42,956 38,869 36,779

Total noninterest income 9,459 9,911 9,391

Total noninterest expense 34,565 32,875 28,898

Income before income taxes 17,850 15,905 17,272

Income tax expense 6,292 5,578 6,434

Net income $11,558 $10,327 $10,838

Diluted earnings per share .30 .28 .29

Dividends per share .14 .14 .14

Tangible book value per share 13.66 13.48 13.49

Balance Sheet Highlights (period-end)

Total loans $2,854,780 $2,814,572 $2,258,533

Organic 2,172,555 2,090,564 1,895,340

Purchased non-credit impaired 528,065 563,362 223,398

Purchased credit impaired 154,160 160,646 139,795

Total assets 4,202,681 4,225,265 3,533,213

Noninterest-bearing deposits 944,838 984,419 891,511

Total deposits 3,409,775 3,431,165 2,905,598

Shareholders’ equity 620,283 613,633 545,855

1Q 2017 Results Summary

1 Denotes a non-GAAP financial measure; for more information, refer to Table 7 of the 1Q17 earnings press release

Note: Consolidated financial results contained throughout this presentation are unaudited; numbers may not add due to rounding

1Q17 net income of $11.6

million, or $.30 per diluted

share

Interest income on loans

and invested funds up 25%

from 4Q16

Successful integration and

conversion of National Bank

of Georgia and S Bank

completed in February

Noninterest expense higher

due to two recent

acquisitions, with majority

of cost savings expected to

be realized in 2Q17

Asset sensitivity contributed

to net interest margin

expansion in 1Q17

1

11

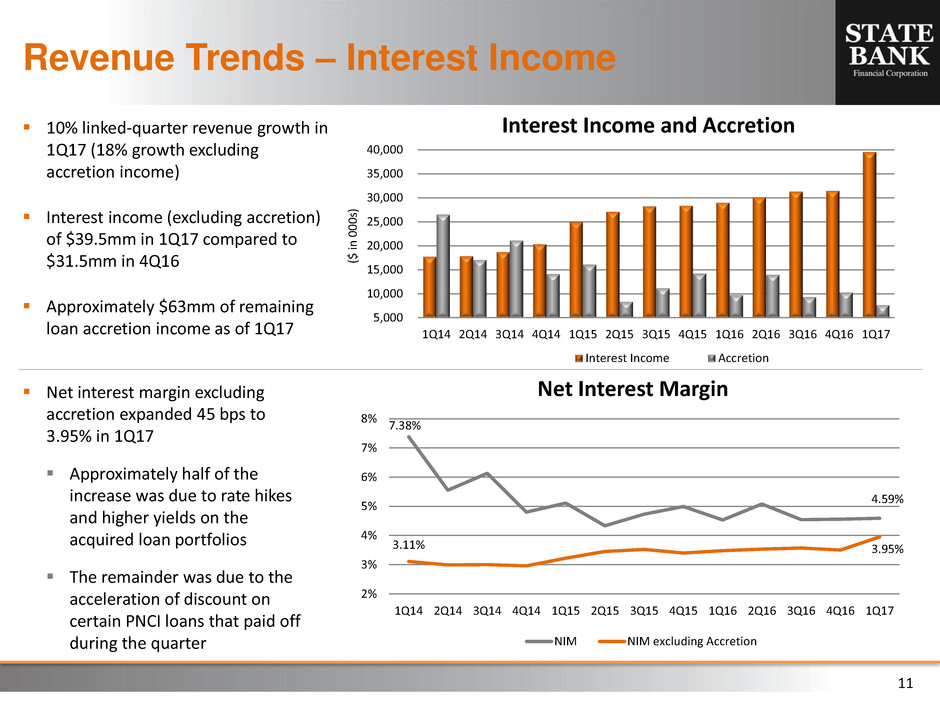

Revenue Trends – Interest Income

10% linked-quarter revenue growth in

1Q17 (18% growth excluding

accretion income)

Interest income (excluding accretion)

of $39.5mm in 1Q17 compared to

$31.5mm in 4Q16

Approximately $63mm of remaining

loan accretion income as of 1Q17

($ i

n

000

s)

Net interest margin excluding

accretion expanded 45 bps to

3.95% in 1Q17

Approximately half of the

increase was due to rate hikes

and higher yields on the

acquired loan portfolios

The remainder was due to the

acceleration of discount on

certain PNCI loans that paid off

during the quarter

7.38%

4.59%

3.11% 3.95%

2%

3%

4%

5%

6%

7%

8%

1Q14 2Q14 3Q14 4Q14 1Q15 2Q15 3Q15 4Q15 1Q16 2Q16 3Q16 4Q16 1Q17

Net Interest Margin

NIM NIM excluding Accretion

5,000

10,000

15,000

20,000

25,000

30,000

35,000

40,000

1Q14 2Q14 3Q14 4Q14 1Q15 2Q15 3Q15 4Q15 1Q16 2Q16 3Q16 4Q16 1Q17

Interest Income and Accretion

Interest Income Accretion

12

SBA income declined to $1.2mm in 1Q17; rebuilding

loan pipeline in 1Q17 after a strong 4Q16

Payroll and insurance income of $1.5mm in 1Q17;

continue to add payroll clients at relatively steady pace

Revenue Trends – Noninterest Income

Mortgage banking income increased 15% linked-quarter in

1Q17 on production of $115mm

Total 1Q17 noninterest income of $9.5mm, with

diversity across lines of business

($ i

n

000

s)

0

2,000

4,000

6,000

8,000

10,000

12,000

1Q16 2Q16 3Q16 4Q16 1Q17

Service Charge Other Mortgage Payroll SBA

0

50

100

150

200

0

1,000

2,000

3,000

4,000

1Q16 2Q16 3Q16 4Q16 1Q17

Pr

o

d

u

cti

o

n

($

in

m

m

)

N

o

n

in

ter

es

t

In

com

e

($ i

n

000

s)

Income Production

0

5

10

15

20

25

30

35

0

500

1,000

1,500

2,000

1Q16 2Q16 3Q16 4Q16 1Q17

Pr

o

d

u

cti

o

n

($

in

m

m

)

N

o

n

in

ter

es

t

In

com

e

($ i

n

000

s)

Income Production

1,100

1,125

1,150

1,175

1,200

0

500

1,000

1,500

2,000

1Q16 2Q16 3Q16 4Q16 1Q17

# o

f P

ayro

ll C

lien

ts

N

o

n

in

ter

es

t

In

com

e

($ i

n

000

s)

Income Number of Payroll Clients

13

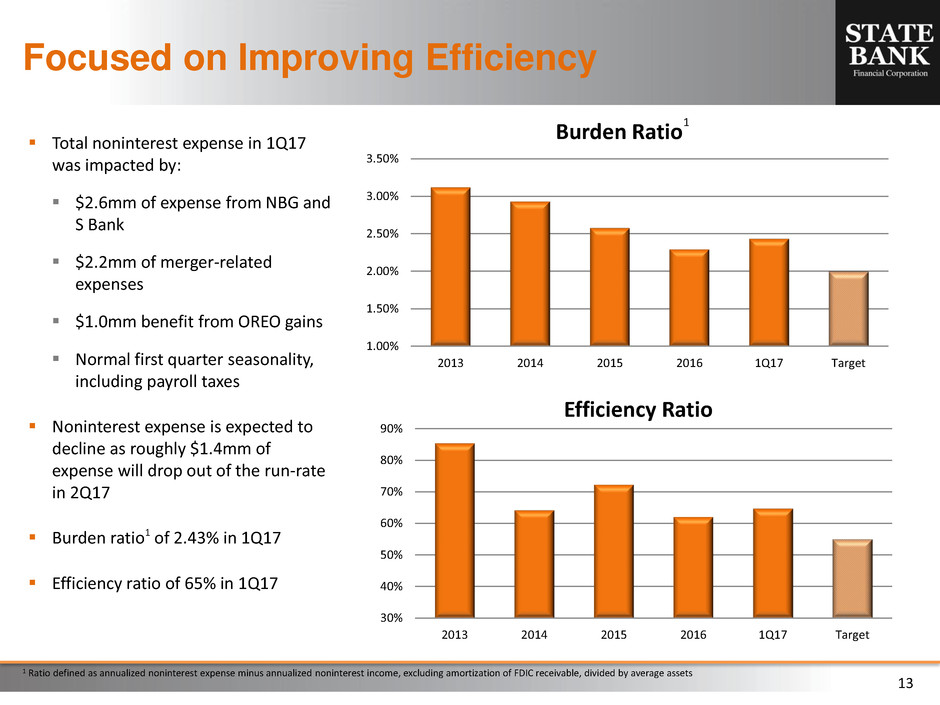

Focused on Improving Efficiency

Total noninterest expense in 1Q17

was impacted by:

$2.6mm of expense from NBG and

S Bank

$2.2mm of merger-related

expenses

$1.0mm benefit from OREO gains

Normal first quarter seasonality,

including payroll taxes

Noninterest expense is expected to

decline as roughly $1.4mm of

expense will drop out of the run-rate

in 2Q17

Burden ratio1 of 2.43% in 1Q17

Efficiency ratio of 65% in 1Q17

1 Ratio defined as annualized noninterest expense minus annualized noninterest income, excluding amortization of FDIC receivable, divided by average assets

1.00%

1.50%

2.00%

2.50%

3.00%

3.50%

2013 2014 2015 2016 1Q17 Target

Burden Ratio

1

30%

40%

50%

60%

70%

80%

90%

2013 2014 2015 2016 1Q17 Target

Efficiency Ratio

14

Core Deposit Funding

($ i

n

m

m

)

N

IB

/ Tot

al D

ep

o

sit

s

Attractive, low-cost core deposit mix focused on transaction-based funding

1

10%

15%

20%

25%

30%

35%

0

500

1,000

1,500

2,000

2,500

3,000

3,500

4,000

2013 2014 2015 2016 2017 YTD

Average Deposit Composition

NIB IB Transaction Savings & MMA CDs NIB / Total Deposits

($ in mm)

2013 % 2014 % 2015 % 2016 % 1Q17 %

Noninterest-bearing 413 20% 490 23% 758 27% 852 29% 956 28%

Interest-bearing transaction 336 16% 386 18% 519 19% 541 19% 602 18%

Savings & MMA 928 44% 911 42% 1,060 38% 1,078 37% 1,389 41%

CDs 431 20% 380 18% 437 16% 422 15% 477 14%

Total Average Deposits $2,107 $2,166 $2,773 $2,893 $3,424

15

Core Deposit Funding

Continued focus on increasing

transaction deposits, which include

noninterest-bearing demand

deposits and interest-bearing

transaction accounts

Average noninterest-bearing

deposits represent 28% of total

deposits

Maintain leading market share in

middle Georgia, with strong market

share in Augusta and Athens, and

significant opportunity for growth in

Atlanta and Savannah

($ i

n

m

m

)

.00%

.10%

.20%

.30%

.40%

.50%

0

200

400

600

800

1,000

1,200

1Q14 2Q14 3Q14 4Q14 1Q15 2Q15 3Q15 4Q15 1Q16 2Q16 3Q16 4Q16 1Q17

Average Transaction Deposits

Interest-bearing Noninterest-bearing Cost of Funds

Deposit Region

($ in mm)

2013 % 2014 % 2015 % 2016 % 1Q17 %

Atla ta 798 38% 869 40% 1,080 39% 1,134 39% 1,145 33%

Middle Ge rgia 1,309 62% 1,297 60% 1,271 46% 1,337 46% 1,376 40%

Augusta - - - - 422 15% 422 15% 433 13%

Athens / Gainesville - - - - - - - - 378 11%

Greater Savannah - - - - - - - - 92 3%

Total Average Deposits $2,107 $2,166 $2,773 $2,893 $3,424

16

0

125

250

375

500

500

1,000

1,500

2,000

2,500

3,000

1Q14 2Q14 3Q14 4Q14 1Q15 2Q15 3Q15 4Q15 1Q16 2Q16 3Q16 4Q16 1Q17

Total Loan Portfolio

Organic PNCI PCI New Loan Fundings

Loan Portfolio

To

ta

l L

o

an

s

($

in

m

m

)

1 New loan fundings include new loans funded and net loan advances on existing commitments

1

New loan originations in

excess of $420mm in 1Q17,

in line with prior quarters

Organic and PNCI loans

increased $46.7mm in

1Q17, as organic growth

of $82.0mm was partially

offset by a $35.3mm

decline in PNCI loans

N

ew

Lo

an

Fu

n

d

in

gs ($ i

n

m

m

)

Loan Composition (period-end)

($ in mm)

2013 2014 2015 2016 1Q17

Construction, land & land development $251 $313 $501 $551 $462

Other commercial real estate 550 636 736 964 1,074

Total commercial real estate 802 949 1,236 1,516 1,536

Residential real estate 67 135 210 289 299

Owner-occupied real estate 175 212 281 372 372

C&I and eases 71 123 267 435 433

Consumer 9 9 21 42 61

Total Organic & PNCI Loans 1,123 1,428 2,015 2,654 2,701

PCI Loans 257 206 146 161 154

Total Loans $1,381 $1,635 $2,160 $2,815 $2,855

17

Loan Portfolio and CRE Composition

1 Organic and PNCI loans as of March 31, 2017

Commercial Real Estate Composition

Significant industry, client, source of

repayment, and geographic diversity in

the CRE portfolio

Construction, land & land development

(AD&C) comprises both residential and

commercial construction, which make up

11% and 9%, respectively, of total CRE

CRE

40%

AD&C

17%

OORE

14%

C&I

14%

SFR

11%

Leases

2%

Consumer

2%

Loan Portfolio

1

($ in mm) Organic PNCI Total % of Total CRE

CRE

Retail $267 $57 $324 21%

Office 153 29 182 12%

Hospitality 135 19 154 10%

Multifamily 114 32 146 10%

Industrial 65 20 85 6%

Sr. Housing 36 10 46 3%

Farmland 26 5 31 2%

Restaurant 24 5 30 2%

Mini Storage 26 2 29 2%

C-Store 21 5 26 2%

Other 17 4 21 1%

Total $886 $189 $1,074 70%

Construction, Land & Land Development

Residential Construction $163 $10 $173 11%

Land & Development 129 26 155 10%

Commercial Construction 126 8 133 9%

Total $418 $44 $462 30%

Total Commercial Real Estate $1,304 $233 $1,536

18

Purchased credit impaired loans

declined $6.5mm to $154.2mm as

of 1Q17

Over 89% of PCI loans are current

as of 1Q17

OREO balances declined to

$3.8mm at 1Q17, down from

$10.9mm in the previous quarter

Asset Quality

($ i

n

m

m

)

Total organic NPAs of $6.3mm,

representing .29% of organic loans

and OREO

Past due organic loans of just .08% at

1Q17

Average net charge-offs were .09%

in 1Q17

Allowance for organic loans is 1.01%

and covers NPAs by 3.4 times

0.00%

0.50%

1.00%

1.50%

2.00%

0

5

10

15

20

2013 2014 2015 2016 1Q17

Nonperforming Loans

Organic PNCI NPLs / Organic Loans

0

10

20

30

40

50

0

100

200

300

2013 2014 2015 2016 1Q17

OR

EO

($ i

n

m

m

)

PCI

Lo

an

s ($

in

m

m

)

PCI Loans & OREO

PCI Loans OREO