Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - QUANTENNA COMMUNICATIONS INC | q12017-exhibit991newsrelea.htm |

| EX-99.3 - EXHIBIT 99.3 - QUANTENNA COMMUNICATIONS INC | ex993earningspresentation.htm |

| 8-K - 8-K - QUANTENNA COMMUNICATIONS INC | qtnaq120178k.htm |

Financial Commentary

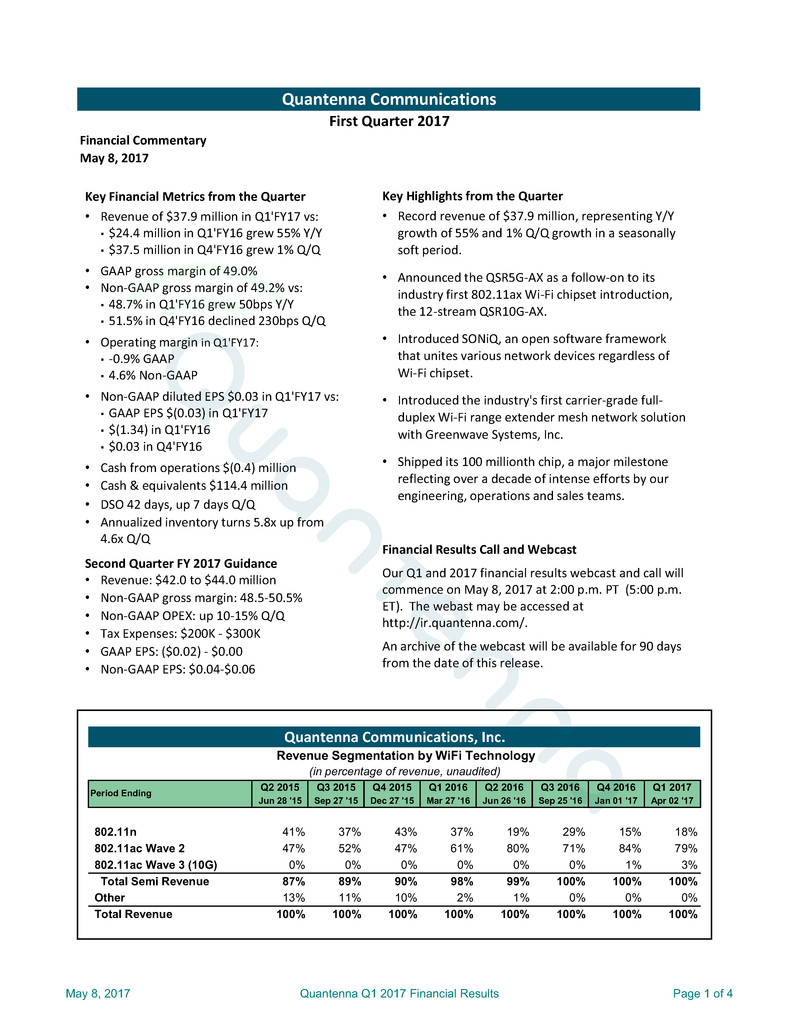

Q2 2015 Q3 2015 Q4 2015 Q1 2016 Q2 2016 Q3 2016 Q4 2016 Q1 2017

Jun 28 '15 Sep 27 '15 Dec 27 '15 Mar 27 '16 Jun 26 '16 Sep 25 '16 Jan 01 '17 Apr 02 '17

802.11n 41% 37% 43% 37% 19% 29% 15% 18%

802.11ac Wave 2 47% 52% 47% 61% 80% 71% 84% 79%

802.11ac Wave 3 (10G) 0% 0% 0% 0% 0% 0% 1% 3%

Total Semi Revenue 87% 89% 90% 98% 99% 100% 100% 100%

Other 13% 11% 10% 2% 1% 0% 0% 0%

Total Revenue 100% 100% 100% 100% 100% 100% 100% 100%

Period Ending

Quantenna Communications

First Quarter 2017

May 8, 2017

Revenue Segmentation by WiFi Technology

(in percentage of revenue, unaudited)

Quantenna Communications, Inc.

Key Financial Metrics from the Quarter

• Revenue of $37.9 million in Q1'FY17 vs:

▪ $24.4 million in Q1'FY16 grew 55% Y/Y

▪ $37.5 million in Q4'FY16 grew 1% Q/Q

• GAAP gross margin of 49.0%

• Non-GAAP gross margin of 49.2% vs:

▪ 48.7% in Q1'FY16 grew 50bps Y/Y

▪ 51.5% in Q4'FY16 declined 230bps Q/Q

• Operating margin in Q1'FY17:

▪ -0.9% GAAP

▪ 4.6% Non-GAAP

• Non-GAAP diluted EPS $0.03 in Q1'FY17 vs:

▪ GAAP EPS $(0.03) in Q1'FY17

▪ $(1.34) in Q1'FY16

▪ $0.03 in Q4'FY16

• Cash from operations $(0.4) million

• Cash & equivalents $114.4 million

• DSO 42 days, up 7 days Q/Q

• Annualized inventory turns 5.8x up from

4.6x Q/Q

Second Quarter FY 2017 Guidance

• Revenue: $42.0 to $44.0 million

• Non-GAAP gross margin: 48.5-50.5%

• Non-GAAP OPEX: up 10-15% Q/Q

• Tax Expenses: $200K - $300K

• GAAP EPS: ($0.02) - $0.00

• Non-GAAP EPS: $0.04-$0.06

Key Highlights from the Quarter

• Record revenue of $37.9 million, representing Y/Y

growth of 55% and 1% Q/Q growth in a seasonally

soft period.

• Announced the QSR5G-AX as a follow-on to its

industry first 802.11ax Wi-Fi chipset introduction,

the 12-stream QSR10G-AX.

• Introduced SONiQ, an open software framework

that unites various network devices regardless of

Wi-Fi chipset.

• Introduced the industry's first carrier-grade full-

duplex Wi-Fi range extender mesh network solution

with Greenwave Systems, Inc.

• Shipped its 100 millionth chip, a major milestone

reflecting over a decade of intense efforts by our

engineering, operations and sales teams.

Financial Results Call and Webcast

Our Q1 and 2017 financial results webcast and call will

commence on May 8, 2017 at 2:00 p.m. PT (5:00 p.m.

ET). The webast may be accessed at

http://ir.quantenna.com/.

An archive of the webcast will be available for 90 days

from the date of this release.

May 8, 2017 Quantenna Q1 2017 Financial Results Page 1 of 4

Q2 2015 Q3 2015 Q4 2015 Q1 2016 Q2 2016 Q3 2016 Q4 2016 Q1 2017

Jun 28 '15 Sep 27 '15 Dec 27 '15 Mar 27 '16 Jun 26 '16 Sep 25 '16 Jan 01 '17 Apr 02 '17

Revenue 18,171$ 21,806$ 25,412$ 24,437$ 33,035$ 34,105$ 37,492$ 37,891$

COGS 8,903 11,395 12,425 12,534 16,671 17,247 18,188 19,307

Gross Margin 9,268 10,411 12,987 11,903 16,364 16,858 19,304 18,584

GM % of revenue 51.0% 47.7% 51.1% 48.7% 49.5% 49.4% 51.5% 49.0%

R&D 8,681 7,587 9,545 10,227 11,524 11,162 13,691 12,633

S&M 1,681 1,490 1,625 1,630 1,769 2,172 2,520 2,914

G&A 1,305 1,178 1,302 1,562 2,993 3,248 2,757 3,389

OPEX 11,667 10,255 12,472 13,419 16,286 16,582 18,968 18,936

OPEX % of revenue 64.2% 47.0% 49.1% 54.9% 49.3% 48.6% 50.6% 50.0%

Operating Income (loss) (2,399)$ 156$ 515$ (1,516)$ 78$ 276$ 336$ (352)$

OpInc % of revenue -13.2% 0.7% 2.0% -6.2% 0.2% 0.8% 0.9% -0.9%

Interest & Other Income (loss) (221) (188) (50) (182) (291) (241) 10 3

Pretax Income (loss) (2,620) (32) 465 (1,698) (213) 35 346 (349)

Taxes 21 40 38 17 21 14 314 535

Tax Rate -1% -125% 8% -1% -10% 40% 91% -153%

Net Income (loss) (2,641)$ (72)$ 427$ (1,715)$ (234)$ 21$ 32$ (884)$

Q2 2015 Q3 2015 Q4 2015 Q1 2016 Q2 2016 Q3 2016 Q4 2016 Q1 2017

Jun 28 '15 Sep 27 '15 Dec 27 '15 Mar 27 '16 Jun 26 '16 Sep 25 '16 Jan 01 '17 Apr 02 '17

Revenue 18,171$ 21,806$ 25,412$ 24,437$ 33,035$ 34,105$ 37,492$ 37,891$

COGS 8,901 11,393 12,422 12,531 16,668 17,238 18,170 19,264

Gross Margin 9,270 10,413 12,990 11,906 16,367 16,867 19,322 18,627

GM % of revenue 51.0% 47.8% 51.1% 48.7% 49.5% 49.5% 51.5% 49.2%

R&D 8,611 7,515 9,468 10,126 11,402 10,931 13,234 11,428

S&M 1,485 1,464 1,599 1,600 1,739 2,112 2,392 2,561

G&A 1,203 1,065 1,163 1,392 2,262 2,514 2,494 2,886

OPEX 11,299 10,044 12,230 13,118 15,403 15,557 18,120 16,875

OPEX % of revenue 62.2% 46.1% 48.1% 53.7% 46.6% 45.6% 48.3% 44.5%

Operating Income (loss) (2,029)$ 369$ 760$ (1,212)$ 964$ 1,310$ 1,202$ 1,752$

OpInc % of revenue -11.2% 1.7% 3.0% -5.0% 2.9% 3.8% 3.2% 4.6%

Interest & Other Income (loss) (221) (188) (50) (182) (291) (241) 10 3

Pretax Income (loss) (2,250) 181 710 (1,394) 673 1,069 1,212 1,755

Taxes 21 40 38 17 21 14 314 535

Tax Rate -1% 22% 5% -1% 3% 1% 26% 30%

Net Income (loss) (2,271)$ 141$ 672$ (1,411)$ 652$ 1,055$ 898$ 1,220$

Q2 2015 Q3 2015 Q4 2015 Q1 2016 Q2 2016 Q3 2016 Q4 2016 Q1 2017

Jun 28 '15 Sep 27 '15 Dec 27 '15 Mar 27 '16 Jun 26 '16 Sep 25 '16 Jan 01 '17 Apr 02 '17

Stock Based Compensation

COGS 2$ 2$ 3$ 3$ 3$ 9$ 18$ 43$

R&D 70 72 77 101 122 231 457 1,205

S&M 196 26 26 30 30 60 128 353

G&A 102 113 139 170 731 734 263 503

Total 370$ 213$ 245$ 304$ 886$ 1,034$ 866$ 2,104$

Period Ending

(in thousands, unaudited)

Quantenna Communications, Inc.

Consolidated Statements of Operations (GAAP)

(in thousands, unaudited)

Consolidated Statements of Operations (Non-GAAP )

GAAP to Non-GAAP Reconciling Items

(in thousands, unaudited)

Period Ending

Period Ending

May 8, 2017 Quantenna Q1 2017 Financial Results Page 2 of 4

Q1 2016 Q2 2016 Q3 2016 Q4 2016 Q1 2017

Period Ending Mar 27 '16 Jun 26 '16 Sep 25 '16 Jan 01 '17 Apr 02 '17

Assets

Current assets

Cash and cash equivalents 20,744$ 16,943$ 17,822$ 117,045$ 114,401$

Accounts receivable 13,569 20,813 17,306 14,480 17,812

Inventory 7,259 7,449 10,268 15,820 13,361

Restricted Cash - 1,500 1,559 - -

Prepaid expenses and other current assets 1,743 1,666 1,842 2,470 3,745

Total current assets 43,315 48,371 48,797 149,815 149,319

Property and equipment, net 2,828 3,548 3,842 4,742 6,025

Other assets 178 1,311 2,443 232 743

Total assets 46,321$ 53,230$ 55,082$ 154,789$ 156,087$

Liabilities, Redeemable Convertible Preferred Stock,

and Stockholders’ Equity (Deficit)

Current liabilities

Accounts payable 5,927$ 3,778$ 6,038$ 7,776$ 1,896$

Accrued liabilities and other current liabilities 7,517 10,626 11,910 11,801 18,163

Loan obligations, current portion 3,552 2,102 2,218 2,257 2,288

Total current liabilities 16,996 16,506 20,166 21,834 22,347

Loan obligations, long term portion 1,386 7,967 4,342 3,680 3,539

Other long term liabilities 578 527 0

Convertible preferred stock warrant liability 265 300 364 - -

Total liabilities 18,647 24,773 25,450 26,041 25,886

Convertible preferred stock 184,704 184,704 184,704 - -

Stockholders’ equity (deficit)

Common stock - - - 3 3

Additional paid-in capital 4,364 5,381 6,534 290,319 292,710

Accumulated deficit (161,394) (161,628) (161,606) (161,574) (162,512)

Total stockholders’ equity (deficit) (157,030) (156,247) (155,072) 128,748 130,201

Total liabilities, conv prfrrd stock and stockholders' equity (defecit) 46,321$ 53,230$ 55,082$ 154,789$ 156,087$

Q1 2016 Q2 2016 Q3 2016 Q4 2016 Q1 2017

Period Ending Mar 27 '16 Jun 26 '16 Sep 25 '16 Jan 01 '17 Apr 02 '17

Cash flows from operating activities

Net income (loss) (1,715)$ (234)$ 22$ 32$ (884)$

Adjustments to reconcile net income (loss) to net cash

provided by (used in) operating activities

Depreciation and amortization 269 268 343 398 479

Stock-based compensation expense 304 886 1,009 866 2,104

Stock issued for services - - 25 - -

Non-cash interest expense 34 (4) 110 182 135

Remeasurement of preferred stock warrant liability 10 35 64 (22) -

Changes in assets and liabilities

Accounts receivable 2,148 (7,244) 3,507 2,826 (3,332)

Inventory 148 (190) (2,819) (5,552) 2,459

Prepaid expenses and other current assets (315) 273 (241) (618) (1,324)

Other assets 4 (59) 71 (66) (511)

Accounts payable 10 (3,599) 2,453 2,940 (5,870)

Accrued liabilities 1,900 3,109 1,127 (379) 6,309

Net cash provided by (used in) operating activities 2,797 (6,759) 5,671 607 (435)

Cash flows from investing activities

Restricted cash - (1,500) (59) 1,500 -

Purchase of property and equipment (14) (612) (995) (1,103) (1,700)

Net cash provided by (used in) investing activities (14) (2,112) (1,054) 397 (1,700)

Cash flows from financing activities

Proceeds from issuance of common stock, net of issuance cost 53 35 697 406 194

Proceeds from initial public offering, net of issuance costs - - - 97,483 -

Principal payments on debt (942) (1,769) (554) (551) (672)

Other - 6,804 (3,881) 881 (31)

Net cash provided by (used in) financing activities (889) 5,070 (3,738) 98,219 (509)

Net increase (decrease) in cash and cash equivalents 1,894 (3,801) 879 99,223 (2,644)

Cash and cash equivalents

Beginning of period 18,850 20,744 16,943 17,822 117,045

End of period 20,744 16,943 17,822 117,045 114,401

Condensed Consolidated Cash Flows

(in thousands, unaudited)

Quantenna Communications, Inc.

Consolidated Balance Sheet

(in thousands, unaudited)

May 8, 2017 Quantenna Q1 2017 Financial Results Page 3 of 4

Quantenna Communications, Inc.

Non-GAAP Financial Measures

In addition to GAAP reporting, Quantenna provides information regarding income, gross margin and operating expenses on a non-

GAAP basis. This non-GAAP information excludes stock-based compensation expense, which the Company’s management believes is

not reflective of the Company’s underlying performance. These non-GAAP measures are used by the Company’s management for

purposes of evaluating the underlying operating performance of the Company, establishing internal budgets, comparing performance

with internal forecasts and goals, strategic planning, benchmarking against other companies, and to provide a more consistent basis

of comparison and to enable more meaningful period to period comparisons. These non-GAAP measures are provided in addition to,

and not as a substitute for, measures of financial performance prepared in accordance with GAAP. A reconciliation between GAAP

and non-GAAP financial data is included in the supplemental financial tables included in this press release.

Forward-Looking Statements

This press release contains forward-looking statements based on Quantenna’s current expectations, including statements regarding

Quantenna’s financial results for the first quarter ended April 2, 2017, expected future business and financial performance, growth

opportunities, product technologies and customer relationships. The words "believe," "estimate," "expect," "intend," "anticipate,"

"plan," "project," "will" and similar phrases as they relate to Quantenna are intended to identify such forward-looking statements.

These forward-looking statements reflect the current views and assumptions of Quantenna and are subject to various risks and

uncertainties that could cause actual results to differ materially from expectations. Among the factors that could cause actual results

to differ materially from those in the forward-looking statements are the following: risks that Quantenna may not be able to maintain

its historical growth; quarterly fluctuations in revenues and operating results; ability to accurately predict future revenue and

expenses; challenges developing new and leading edge products on a timely basis that achieve market acceptance; ability to attract

and retain customers and service providers; dependence on a limited number of products and customers; intense market

competition; intellectual property litigation risks; political uncertainty; potential changes in tax and other laws affecting Quantenna’s

business; risks associated with acquisitions, divestitures and strategic partnerships; product liability risks; potential cancellation of

customer orders; difficulties managing international operations; risks that Quantenna may not be able to manage strains associated

with its growth; dependence on key personnel; stock price volatility; dependence on, and geographic concentration of, contract

manufacturers, assembly and test providers, and other vendors that subject Quantenna's business and results of operations to risks

of natural disasters, epidemics, war and political unrest; the cyclical nature of the semiconductor industry, adjustments to the

preliminary financial results reported in this press release and related earnings call announcement and materials for the first quarter

2017 in connection with completion of the final closing process and procedures and preparation of our Quarterly Report on Form 10-

Q, and other factors that are detailed in the Securities and Exchange (“SEC”) filings of Quantenna Communications, Inc., which you

may obtain for free at the SEC’s website at http://www.sec.gov. Quantenna disclaims any intention or obligation to update or revise

any forward-looking statements, whether as a result of new information, future events or otherwise.

About Quantenna Communications

Quantenna is a global leader and innovator of leading-edge performance Wi-Fi solutions. Quantenna introduced the world's first 10G

Wi-Fi technology for a new generation of access points in home, enterprise and public spaces and continues to innovate. Quantenna's

Wi-Fi solutions offer superior performance, and establish benchmarks for speed, range, efficiency and reliability. With MAUI,

Quantenna's cloud-based Wi-Fi analytics platform that complement its chipset solutions, service providers can deliver real-time,

automated Wi-Fi monitoring, optimization, and self-healing to their customers around the clock to help achieve the best Wi-Fi

experience. Quantenna is Wi-Fi perfected. For more information, visit www.quantenna.com. Follow us on Facebook, LinkedIn and

Twitter.

May 8, 2017 Quantenna Q1 2017 Financial Results Page 4 of 4