Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 GREEN BRICK PARTNERS, INC. EARNINGS RELEASE 3.31.2017 - Green Brick Partners, Inc. | exhibit991grbkearningsrele.htm |

| 8-K - FORM 8-K 3.31.2017 - Green Brick Partners, Inc. | a3312017grbkform8-k.htm |

Green Brick Partners

First Quarter 2017 Investor Call Presentation

May 8, 2017

Exhibit 99.2

1

Forward-looking statements

This presentation and the oral statements made by representatives of the Company during the course of this presentation that are not historical facts are

forward-looking statements. These statements are often, but not always, made through the use of words or phrases such as “may,” “will,” “should,” “could,”

“would,” “predicts,” “potential,” “continue,” “expects,” “anticipates,” “future,” “outlook,” “strategy,” “positioned,” “intends,” “plans,” “believes,” “projects,”

“estimates” and similar expressions, as well as statements in the future tense. Although the Company believes that the assumptions underlying these

statements are reasonable, individuals considering such statements for any purpose are cautioned that such forward-looking statements are inherently

uncertain and necessarily involve risks that may affect the Company’s business prospects and performance, causing actual results to differ from those discussed

during the presentation, and any such difference may be material. Factors that could cause actual results to differ from those anticipated are discussed in the

Company’s annual and quarterly reports filed with the SEC.

Any forward-looking statements made are subject to risks and uncertainties, many of which are beyond management’s control. These risks include the risks

described in the Company’s filings with the SEC. Should one or more of these risks or uncertainties occur, or should underlying assumptions prove incorrect, the

Company’s actual results and plans could differ materially from those expressed in any forward-looking statements.

Given these risks and uncertainties, you are cautioned not to place undue reliance on such forward-looking statements. These forward-looking statements are

made only as of the date hereof. The Company undertakes no obligation to publicly update any forward-looking statements, whether as a result of new

information or future events.

The Company presents Basic Adjusted EPS and Diluted Adjusted EPS and Basic and Diluted Adjusted weighted-average number of shares outstanding, Income

before taxes attributable to GRBK and Adjusted Homebuilding Gross Margin. The Company believes these and similar measures are useful to management and

investors in evaluating its operating performance and financing structure. The Company also believes these measures facilitate the comparison of their

operating performance and financing structure with other companies in the industry. Because these measures are not calculated in accordance with Generally

Accepted Accounting Principles (“GAAP”), they may not be comparable to other similarly titled measures of other companies and should not be considered in

isolation or as a substitute for, or superior to, financial measures prepared in accordance with GAAP.

Jim Brickman

− Chief Executive Officer

− Over 35 years in real estate development and homebuilding

− Co-founded JBGL with Greenlight Capital in 2008. JBGL was merged into Green Brick

in 2014

− Previously served as Chairman and CEO of Princeton Homes and Princeton Realty Corp.

Rick Costello

− Chief Financial Officer

− Over 25 years of financial and operating experience in all aspects of real estate

management

− Previously served as CFO and COO of GL Homes, as AVP of finance of Paragon Group and

as an auditor for KPMG

Management presenters

2

First quarter 2017 highlights

3

First quarter pre-tax income attributable to Green

Brick of $10.1 million was up 123% from the same

period in 2016

Home closing revenues of $93.4 million in Q1 2017

were up 40% from Q1 2016 on a 40% increase in new

homes delivered

Net new orders of 287 homes in the first quarter of

2017 increased 20% compared to the first quarter of

2016

Last 12 month adjusted homebuilding gross margins

remained at 23.1% through Q1 2017 versus Q4 2016

Homes under construction now stand at 625 homes,

up 16% over Q1 2016

Active selling communities total 52 at March 31, 2017,

up 18% year-over-year

Backlog at March 31, 2017 is now at approximately

$145 million, up 12% from the prior year period

4

Housing starts are highly correlated to jobs and we build in

two of the highest job growth markets.

We are less than 1.5% of the starts in two of the largest housing

markets, giving us significant opportunity for growth.

5

6

Dallas market continues 6-year expansion but

is still well below the prior peak

Dallas/Fort Worth Market

SFD-TH – Starts and Closings

Source: Metrostudy - MetroUSA

7

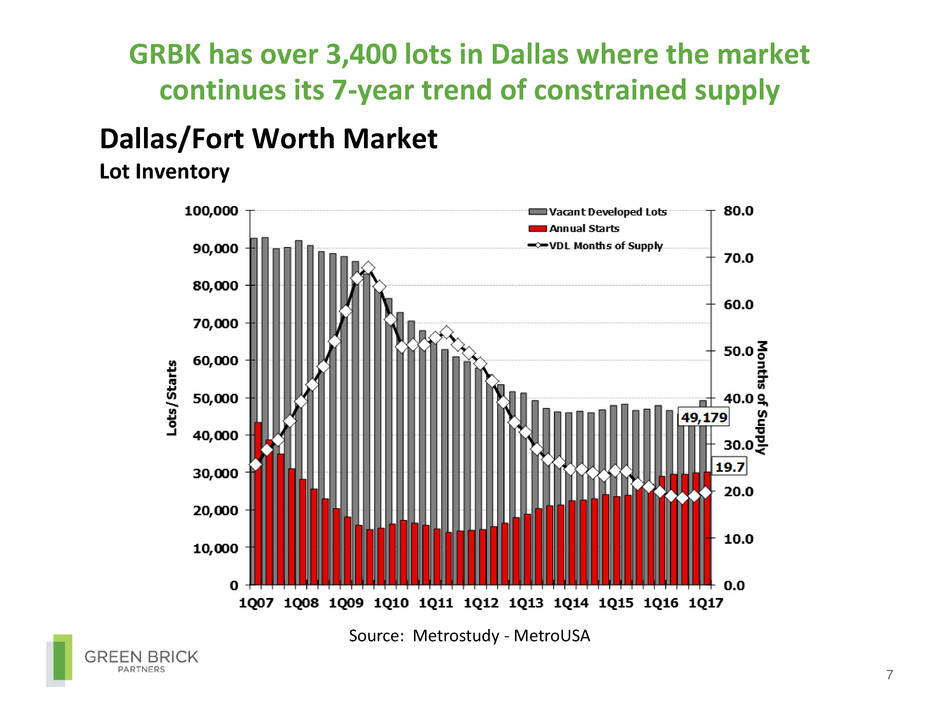

GRBK has over 3,400 lots in Dallas where the market

continues its 7-year trend of constrained supply

Dallas/Fort Worth Market

Lot Inventory

Source: Metrostudy - MetroUSA

21,616

+14%

20,337

+15%

8

Atlanta market also continues to expand

but is still well below the prior peak

Source: Metrostudy - MetroUSA

73% of activity is in North Atlanta.

GRBK has one of the lowest debt-to-capital

ratios amongst public builders

GRBK net debt to capital is under 10% versus an average 40% for covered public builders

GRBK’s has no off-balance sheet debt embedded in unconsolidated JV’s, unlike many peers

GRBK’s eventual target is approximately 35%

9

Citi Research data for comparative companies is as of December 31, 2016;

“Net Debt” equals Total Debt minus Cash

First quarter 2017 financial highlights

Q1 2017 versus Q1 2016:

- Net new orders increased by 20%

- Home sales revenues increased by 40%

- Home deliveries also increased by 40%

- Dollar value of units in backlog increased by 12%

10

TX

G

Green Brick at a glance

Uniquely structured residential land development and

homebuilding company

− We build and deliver homes through our current

builders in which we own a 50% controlling interest

− We sell lots and provide lot acquisition and vertical

construction financing to our controlled builders

Currently focused on the high growth metropolitan

areas of Dallas and Atlanta

Attractive land position of almost 5,000 well-located

residential lots as of March 31, 2017

− About 81% of our residential lots are owned

− Virtually all of our owned lots are owned at

corporate level vs. at the controlled builder level

Products offered

Townhomes, single family

Single family

Luxury homes

Townhomes,

contractor on luxury homes

Townhomes, single family,

luxury homes

11

Dallas

CB JENI

Normandy Homes

Southgate Homes

Centre Living Homes

Atlanta

The Providence Group

Controlled builders

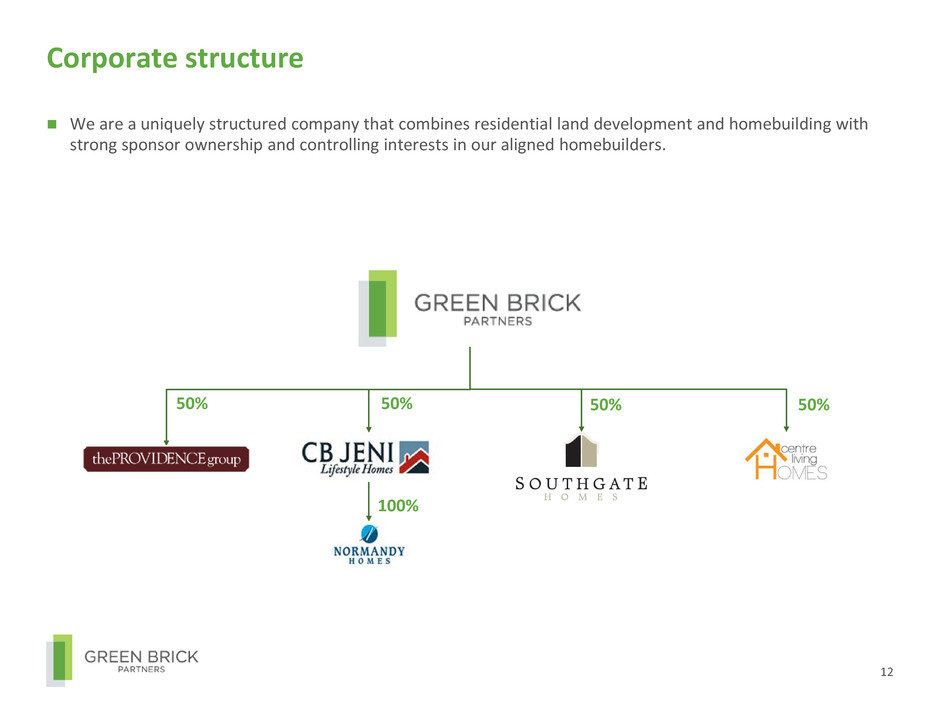

We are a uniquely structured company that combines residential land development and homebuilding with

strong sponsor ownership and controlling interests in our aligned homebuilders.

Corporate structure

12

50%50%50%50%

100%

Key takeaways

Significant growth opportunities exist in Dallas and

Atlanta ̶ two of the most attractive homebuilder

markets in the U.S.

We have the balance sheet and management team to

support significant growth

Proven success in executing our growth strategy with

our controlled and aligned builders

Our operating model and low leverage results in

superior risk adjusted returns.

13

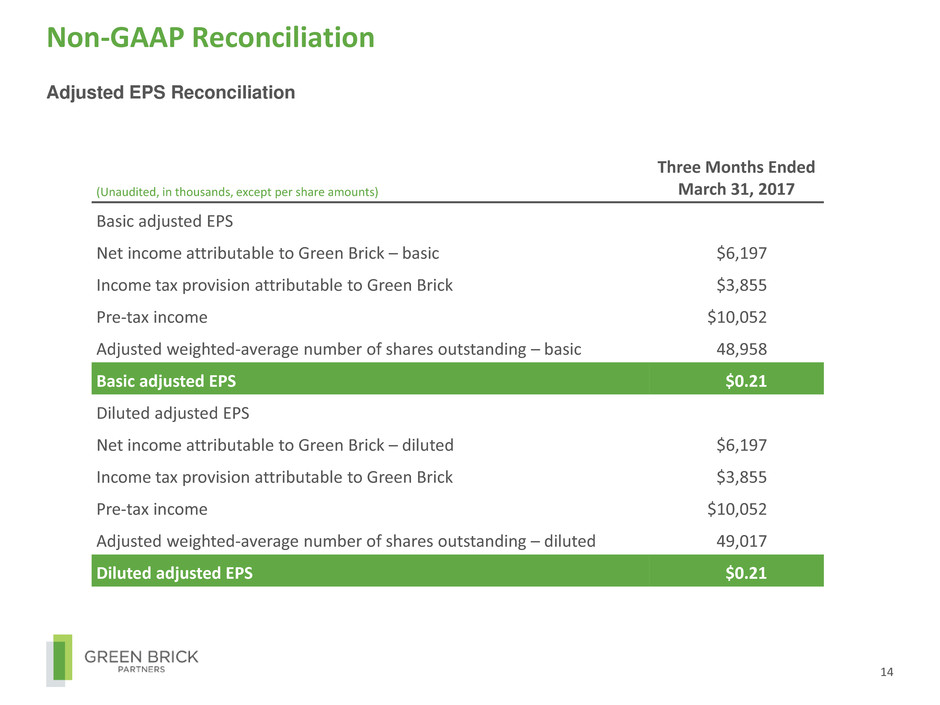

Non-GAAP Reconciliation

14

Adjusted EPS Reconciliation

(Unaudited, in thousands, except per share amounts)

Three Months Ended

March 31, 2017

Basic adjusted EPS

Net income attributable to Green Brick – basic $6,197

Income tax provision attributable to Green Brick $3,855

Pre-tax income $10,052

Adjusted weighted-average number of shares outstanding – basic 48,958

Basic adjusted EPS $0.21

Diluted adjusted EPS

Net income attributable to Green Brick – diluted $6,197

Income tax provision attributable to Green Brick $3,855

Pre-tax income $10,052

Adjusted weighted-average number of shares outstanding – diluted 49,017

Diluted adjusted EPS $0.21

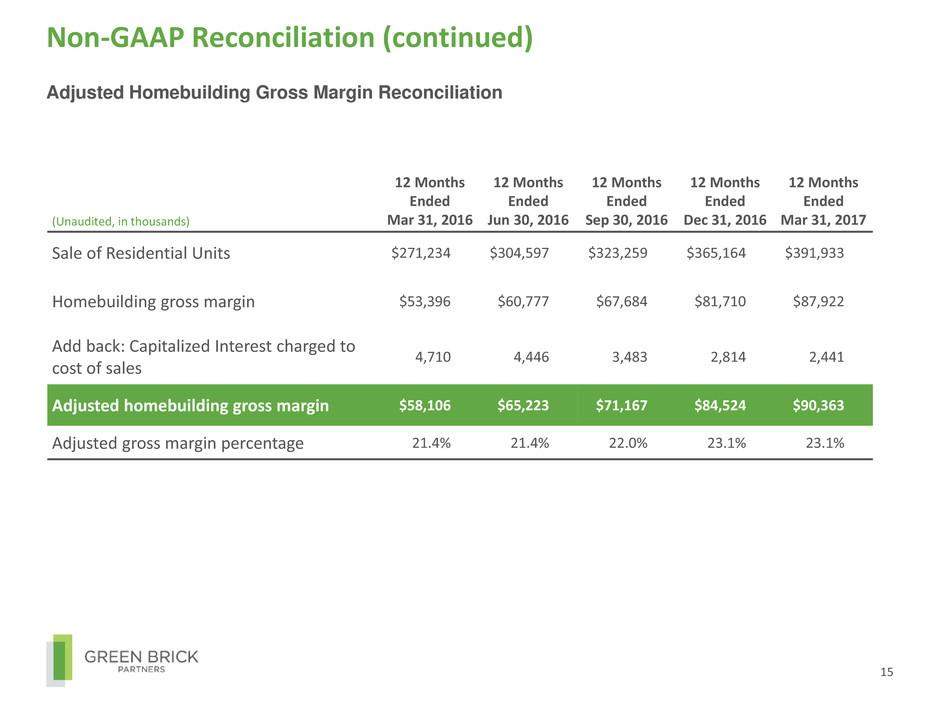

Non-GAAP Reconciliation (continued)

15

Adjusted Homebuilding Gross Margin Reconciliation

(Unaudited, in thousands)

12 Months

Ended

Mar 31, 2016

12 Months

Ended

Jun 30, 2016

12 Months

Ended

Sep 30, 2016

12 Months

Ended

Dec 31, 2016

12 Months

Ended

Mar 31, 2017

Sale of Residential Units $271,234 $304,597 $323,259 $365,164 $391,933

Homebuilding gross margin $53,396 $60,777 $67,684 $81,710 $87,922

Add back: Capitalized Interest charged to

cost of sales

4,710 4,446 3,483 2,814 2,441

Adjusted homebuilding gross margin $58,106 $65,223 $71,167 $84,524 $90,363

Adjusted gross margin percentage 21.4% 21.4% 22.0% 23.1% 23.1%