Attached files

| file | filename |

|---|---|

| EX-32.2 - EXHIBIT 32.2 - Drive Shack Inc. | ds-2017331xexhibit32x2.htm |

| EX-32.1 - EXHIBIT 32.1 - Drive Shack Inc. | ds-2017331xexhibit32x1.htm |

| EX-31.2 - EXHIBIT 31.2 - Drive Shack Inc. | ds-2017331xexhibit31x2.htm |

| EX-31.1 - EXHIBIT 31.1 - Drive Shack Inc. | ds-2017331xexhibit31x1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

x | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended March 31, 2017

or

o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from _______________ to _______________

Commission File Number: 001-31458

Drive Shack Inc. |

(Exact name of registrant as specified in its charter)

Maryland | 81-0559116 | |

(State or other jurisdiction of incorporation | (I.R.S. Employer Identification No.) | |

or organization) | ||

1345 Avenue of the Americas, New York, NY | 10105 | |

(Address of principal executive offices) | (Zip Code) | |

(212) 798-6100 |

(Registrant’s telephone number, including area code)

(Former name, former address and former fiscal year, if changed since last report) |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes S No £

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulations S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

S Yes No £

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer £ Accelerated filer S Non-accelerated filer £ (Do not check if a smaller reporting company)

Smaller reporting company £ Emerging growth company £

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. £

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes £ No S

Indicate the number of shares outstanding of each of the issuer’s classes of common stock, as of the last practicable date.

Common stock, $0.01 par value per share: 66,842,378 shares outstanding as of April 26, 2017.

CAUTIONARY NOTE REGARDING FORWARD LOOKING STATEMENTS

This report contains certain “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Such forward-looking statements relate to, among other things, the operating performance of our investments, the stability of our earnings, and our financing needs. Forward-looking statements are generally identifiable by use of forward-looking terminology such as “may,” “will,” “should,” “potential,” “intend,” “expect,” “endeavor,” “seek,” “anticipate,” “estimate,” “overestimate,” “underestimate,” “believe,” “could,” “project,” “predict,” “continue” or other similar words or expressions. Forward-looking statements are based on certain assumptions, discuss future expectations, describe future plans and strategies, contain projections of results of operations or of financial condition or state other forward-looking information. Our ability to predict results or the actual outcome of future plans or strategies is inherently uncertain. Although we believe that the expectations reflected in such forward-looking statements are based on reasonable assumptions, our actual results and performance could differ materially from those set forth in the forward-looking statements. These forward-looking statements involve risks, uncertainties and other factors that may cause our actual results in future periods to differ materially from forecasted results. Factors which could have a material adverse effect on our operations and future prospects include, but are not limited to:

• | the ability to retain and attract members to our golf properties; |

• | changes in global, national and local economic conditions, including, but not limited to, changes in consumer spending patterns, a prolonged economic slowdown and a downturn in the real estate market; |

• | effects of unusual weather patterns and extreme weather events, geographical concentrations with respect to our operations and seasonality of our business; |

• | competition within the industries in which we operate or may pursue additional investments; |

• | material increases in our expenses, including but not limited to unanticipated labor issues or costs with respect to our workforce, and costs of goods, utilities and supplies; |

• | our inability to sell or exit certain properties, and unforeseen changes to our ability to develop, redevelop or renovate certain properties; |

• | difficulty monetizing our real estate debt investments; |

• | liabilities with respect to inadequate insurance coverage, accidents or injuries on our properties, adverse litigation judgments or settlements, or membership deposits; |

• | changes to and failure to comply with relevant regulations and legislation, including in order to maintain certain licenses and permits, and environmental regulations in connection with our operations; |

• | inability to execute on our growth and development strategy by successfully developing, opening and operating new venues; |

• | impacts of failures of our information technology and cybersecurity systems; |

• | the impact of any current or further legal proceedings and regulatory investigations and inquiries; |

• | the impact of any material transactions with FIG LLC (the “Manager”) or one of its affiliates, including the impact of any actual, potential or predicted conflicts of interest; |

• | effects of the pending merger of Fortress Investment Group LLC with affiliates of SoftBank Group Corp.; and |

• | other risks detailed from time to time below, particularly under the heading “Risk Factors,” and in our other reports filed with or furnished to the Securities and Exchange Commission (the “SEC”). |

Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance or achievements. The factors noted above could cause our actual results to differ significantly from those contained in any forward-looking statement.

Readers are cautioned not to place undue reliance on any of these forward-looking statements, which reflect our management’s views only as of the date of this report. We are under no duty to update any of the forward-looking statements after the date of this report to conform these statements to actual results.

SPECIAL NOTE REGARDING EXHIBITS

In reviewing the agreements included as exhibits to this Quarterly Report on Form 10-Q, please remember they are included to provide you with information regarding their terms and are not intended to provide any other factual or disclosure information about Drive Shack Inc. (the “Company”) or the other parties to the agreements. The agreements contain representations and warranties by each of the parties to the applicable agreement. These representations and warranties have been made solely for the benefit of the other parties to the applicable agreement and:

• | should not in all instances be treated as categorical statements of fact, but rather as a way of allocating the risk to one of the parties if those statements prove to be inaccurate; |

• | have been qualified by disclosures that were made to the other party in connection with the negotiation of the applicable agreement, which disclosures are not necessarily reflected in the agreement; |

• | may apply standards of materiality in a way that is different from what may be viewed as material to you or other investors; and |

• | were made only as of the date of the applicable agreement or such other date or dates as may be specified in the agreement and are subject to more recent developments. |

Accordingly, these representations and warranties may not describe the actual state of affairs as of the date they were made or at any other time. Additional information about the Company may be found elsewhere in this Quarterly Report on Form 10-Q and the Company’s other public filings, which are available without charge through the SEC’s website at http://www.sec.gov.

The Company acknowledges that, notwithstanding the inclusion of the foregoing cautionary statements, it is responsible for considering whether additional specific disclosures of material information regarding material contractual provisions are required to make the statements in this report not misleading.

DRIVE SHACK INC.

FORM 10-Q

INDEX

PAGE | |||

PART I. FINANCIAL INFORMATION | |||

Item 1. | Financial Statements | ||

DRIVE SHACK INC. AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS

(dollars in thousands, except share data)

March 31, 2017 | December 31, 2016 | ||||||

(Unaudited) | |||||||

Assets | |||||||

Real estate securities, available-for-sale | $ | 2,032 | $ | 1,950 | |||

Real estate securities, available-for-sale - pledged as collateral | 326,878 | 627,304 | |||||

Real estate related and other loans, held-for-sale, net | 59,043 | 55,612 | |||||

Investments in real estate, net of accumulated depreciation | 216,452 | 217,611 | |||||

Intangibles, net of accumulated amortization | 63,366 | 65,112 | |||||

Other investments | 19,636 | 19,256 | |||||

Cash and cash equivalents | 126,970 | 140,140 | |||||

Restricted cash | 7,213 | 6,404 | |||||

Receivables from brokers, dealers and clearing organizations | — | 552 | |||||

Receivables and other assets | 38,165 | 38,017 | |||||

Total Assets | $ | 859,755 | $ | 1,171,958 | |||

Liabilities and Equity | |||||||

Liabilities | |||||||

Repurchase agreements | 310,630 | 600,964 | |||||

Credit facilities and obligations under capital leases | 114,851 | 115,284 | |||||

Junior subordinated notes payable | 51,214 | 51,217 | |||||

Dividends payable | 930 | 8,949 | |||||

Membership deposit liabilities | 90,570 | 89,040 | |||||

Accounts payable, accrued expenses and other liabilities | 87,720 | 88,437 | |||||

Total Liabilities | $ | 655,915 | $ | 953,891 | |||

Commitments and contingencies | |||||||

Equity | |||||||

Preferred stock, $0.01 par value, 100,000,000 shares authorized, 1,347,321 shares of 9.75% Series B Cumulative Redeemable Preferred Stock, 496,000 shares of 8.05% Series C Cumulative Redeemable Preferred Stock, and 620,000 shares of 8.375% Series D Cumulative Redeemable Preferred Stock, liquidation preference $25.00 per share, issued and outstanding as of March 31, 2017 and December 31, 2016 | $ | 61,583 | $ | 61,583 | |||

Common stock, $0.01 par value, 1,000,000,000 shares authorized, 66,842,378 and 66,824,304 shares issued and outstanding at March 31, 2017 and December 31, 2016, respectively | 668 | 668 | |||||

Additional paid-in capital | 3,172,795 | 3,172,720 | |||||

Accumulated deficit | (3,032,421 | ) | (3,018,072 | ) | |||

Accumulated other comprehensive income | 1,215 | 1,168 | |||||

Total Drive Shack Inc. Stockholders’ Equity | 203,840 | 218,067 | |||||

Noncontrolling interest | — | — | |||||

Total Equity | $ | 203,840 | $ | 218,067 | |||

Total Liabilities and Equity | $ | 859,755 | $ | 1,171,958 | |||

See notes to Consolidated Financial Statements.

1

DRIVE SHACK INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF OPERATIONS (Unaudited)

(dollars in thousands, except share data)

Three Months Ended March 31, | |||||||

2017 | 2016 | ||||||

Revenues | |||||||

Golf course operations | $ | 46,296 | $ | 48,597 | |||

Sales of food and beverages | 12,845 | 13,561 | |||||

Total revenues | 59,141 | 62,158 | |||||

Operating costs | |||||||

Operating expenses | 54,431 | 58,219 | |||||

Cost of sales - food and beverages | 4,032 | 4,597 | |||||

General and administrative expense | 3,565 | 2,937 | |||||

Management fee to affiliate | 2,677 | 2,675 | |||||

Depreciation and amortization | 5,793 | 6,031 | |||||

Impairment | — | 2,308 | |||||

Realized/unrealized loss on investments | 3,389 | 2,007 | |||||

Total operating costs | 73,887 | 78,774 | |||||

Operating loss | (14,746 | ) | (16,616 | ) | |||

Other income (expenses) | |||||||

Interest and investment income | 7,888 | 21,039 | |||||

Interest expense | (5,434 | ) | (13,534 | ) | |||

Gain on deconsolidation | — | 82,130 | |||||

Other income (loss), net | (123 | ) | 320 | ||||

Total other income (expenses) | 2,331 | 89,955 | |||||

(Loss) Income before income tax | (12,415 | ) | 73,339 | ||||

Income tax expense | 539 | 44 | |||||

Net (Loss) Income | (12,954 | ) | 73,295 | ||||

Preferred dividends | (1,395 | ) | (1,395 | ) | |||

Net loss attributable to noncontrolling interest | — | 124 | |||||

(Loss) Income Applicable to Common Stockholders | $ | (14,349 | ) | $ | 72,024 | ||

(Loss) Income Applicable to Common Stock, per share | |||||||

Basic | $ | (0.21 | ) | $ | 1.08 | ||

Diluted | $ | (0.21 | ) | $ | 1.05 | ||

Weighted Average Number of Shares of Common Stock Outstanding | |||||||

Basic | 66,841,977 | 66,654,598 | |||||

Diluted | 66,841,977 | 68,284,898 | |||||

Dividends Declared per Share of Common Stock | $ | — | $ | 0.12 | |||

See notes to Consolidated Financial Statements.

2

DRIVE SHACK INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (LOSS) (Unaudited)

(dollars in thousands, except share data)

Three Months Ended March 31, | |||||||

2017 | 2016 | ||||||

Net (loss) income | $ | (12,954 | ) | $ | 73,295 | ||

Other comprehensive income (loss): | |||||||

Net unrealized (loss) gain on available-for-sale securities | 47 | 5,301 | |||||

Reclassification of net realized loss (gain) on securities into earnings | — | (5,863 | ) | ||||

Reclassification of net realized gain on deconsolidation of CDO VI | — | (20,682 | ) | ||||

Reclassification of net realized gain on derivatives designated as cash flow hedges into earnings | — | (20 | ) | ||||

Other comprehensive income (loss) | 47 | (21,264 | ) | ||||

Total comprehensive (loss) income | $ | (12,907 | ) | $ | 52,031 | ||

Comprehensive (loss) income attributable to Drive Shack Inc. stockholders’ equity | $ | (12,907 | ) | $ | 52,155 | ||

Comprehensive loss attributable to noncontrolling interest | $ | — | $ | (124 | ) | ||

See notes to Consolidated Financial Statements.

3

DRIVE SHACK INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENT OF EQUITY (Unaudited)

FOR THE THREE MONTHS ENDED MARCH 31, 2017

(dollars in thousands, except share data)

Drive Shack Inc. Stockholders | |||||||||||||||||||||||||||||||||||||

Preferred Stock | Common Stock | ||||||||||||||||||||||||||||||||||||

Shares | Amount | Shares | Amount | Additional Paid- in Capital | Accumulated Deficit | Accumulated Other Comp. Income (Loss) | Total Drive Shack Inc. Stockholders’ Equity | Noncontrolling Interest | Total Equity (Deficit) | ||||||||||||||||||||||||||||

Equity (deficit) - December 31, 2016 | 2,463,321 | $ | 61,583 | 66,824,304 | $ | 668 | $ | 3,172,720 | $ | (3,018,072 | ) | $ | 1,168 | $ | 218,067 | $ | — | $ | 218,067 | ||||||||||||||||||

Dividends declared | — | — | — | — | — | (1,395 | ) | — | (1,395 | ) | — | (1,395 | ) | ||||||||||||||||||||||||

Issuance of common stock (directors) | — | — | 18,074 | — | 75 | — | — | 75 | — | 75 | |||||||||||||||||||||||||||

Comprehensive income (loss) | |||||||||||||||||||||||||||||||||||||

Net loss | — | — | — | — | — | (12,954 | ) | — | (12,954 | ) | — | (12,954 | ) | ||||||||||||||||||||||||

Other comprehensive income | — | — | — | — | — | — | 47 | 47 | — | 47 | |||||||||||||||||||||||||||

Total comprehensive loss | (12,907 | ) | — | (12,907 | ) | ||||||||||||||||||||||||||||||||

Equity (deficit) - March 31, 2017 | 2,463,321 | $ | 61,583 | 66,842,378 | $ | 668 | $ | 3,172,795 | $ | (3,032,421 | ) | $ | 1,215 | $ | 203,840 | $ | — | $ | 203,840 | ||||||||||||||||||

See notes to Consolidated Financial Statements.

4

DRIVE SHACK INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS (Unaudited)

(dollars in thousands, except share data)

Three Months Ended March 31, | |||||||

2017 | 2016 | ||||||

Cash Flows From Operating Activities | |||||||

Net (loss) income | $ | (12,954 | ) | $ | 73,295 | ||

Adjustments to reconcile net (loss) income to net cash used in operating activities: | |||||||

Depreciation and amortization | 5,793 | 6,031 | |||||

Amortization of discount and premium | 620 | 463 | |||||

Other amortization | 2,614 | 2,635 | |||||

Net interest income on investments accrued to principal balance | (3,431 | ) | (7,931 | ) | |||

Amortization of revenue on golf membership deposit liabilities | (305 | ) | (185 | ) | |||

Amortization of prepaid golf membership dues | (6,283 | ) | (6,222 | ) | |||

Non-cash directors’ compensation | 75 | — | |||||

Valuation allowance on loans | — | 2,198 | |||||

Other-than-temporary impairment on securities | — | 110 | |||||

Equity in earnings from equity method investments, net of distributions | (379 | ) | (371 | ) | |||

Gain on deconsolidation | — | (82,130 | ) | ||||

Loss on settlement of investments, net | 473 | 1,725 | |||||

Unrealized loss on securities, intent-to-sell | 558 | — | |||||

Unrealized loss on non-hedge derivatives | 2,502 | 341 | |||||

Loss on extinguishment of debt, net | 146 | 232 | |||||

Change in: | |||||||

Restricted cash | 330 | (482 | ) | ||||

Receivables and other assets | (645 | ) | (1,313 | ) | |||

Accounts payable, accrued expenses and other liabilities | 1,474 | 2,250 | |||||

Net cash used in operating activities | (9,412 | ) | (9,354 | ) | |||

Cash Flows From Investing Activities | |||||||

Principal repayments from investments | 10,707 | 5,444 | |||||

Purchase of real estate securities | — | (364,072 | ) | ||||

Proceeds from sale of investments | 286,639 | 361,341 | |||||

Net proceeds from (payments for) settlement of TBAs | 2,474 | (7,536 | ) | ||||

Acquisition and additions of investments in real estate | (3,971 | ) | (1,972 | ) | |||

Deposits paid on investments | (80 | ) | — | ||||

Net cash provided by (used in) investing activities | 295,769 | (6,795 | ) | ||||

Cash Flows From Financing Activities | |||||||

Borrowings under debt obligations | 1,007 | 363,741 | |||||

Repayments of debt obligations | (292,237 | ) | (352,211 | ) | |||

Margin deposits under repurchase agreements and derivatives | (49,545 | ) | (9,406 | ) | |||

Return of margin deposits under repurchase agreements and derivatives | 50,156 | 9,636 | |||||

Golf membership deposits received | 695 | 679 | |||||

Common stock dividends paid | (8,019 | ) | (7,999 | ) | |||

Preferred stock dividends paid | (1,395 | ) | (1,395 | ) | |||

Payment of deferred financing costs | (22 | ) | (263 | ) | |||

Other financing activities | (167 | ) | (158 | ) | |||

Net cash (used in) provided by financing activities | (299,527 | ) | 2,624 | ||||

Net Decrease in Cash and Cash Equivalents | (13,170 | ) | (13,525 | ) | |||

Cash and Cash Equivalents, Beginning of Period | 140,140 | 45,651 | |||||

Cash and Cash Equivalents, End of Period | $ | 126,970 | $ | 32,126 | |||

Supplemental Schedule of Non-Cash Investing and Financing Activities | |||||||

Preferred stock dividends declared but not paid | $ | 930 | $ | 930 | |||

Common stock dividends declared but not paid | $ | — | $ | 7,999 | |||

Additions to capital lease assets and liabilities | $ | 254 | $ | 718 | |||

See notes to Consolidated Financial Statements.

5

DRIVE SHACK INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Unaudited)

MARCH 31, 2017

(dollars in tables in thousands, except share data)

1. ORGANIZATION

Drive Shack Inc. (and with its subsidiaries, “Drive Shack Inc.” or the “Company”), is a leading owner and operator of golf-related leisure and entertainment businesses. On December 28, 2016, the Company changed its name from Newcastle Investment Corp. to Drive Shack Inc. in connection with its transformation to a leisure and entertainment company. The Company, a Maryland corporation, was formed in 2002, and its common stock is traded on the NYSE under the symbol “DS.”

The Company conducts its business through the following segments: (i) Traditional Golf properties, (ii) Entertainment Golf venues, (iii) Debt Investments and (iv) corporate. For a further discussion of the reportable segments, see Note 3.

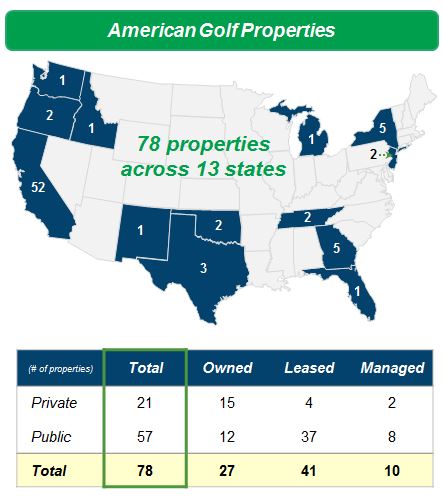

The Company’s Traditional Golf business is one of the largest owners and operators of golf properties in the United States. As of March 31, 2017, the Company owned, leased or managed 78 properties across 13 states. Additionally, the Company plans to open a chain of next-generation Entertainment Golf venues across the United States and internationally which combine golf, competition, dining and fun. The Company plans to monetize the remaining loans and securities in its Debt Investments segment as part of the transformation to a leisure and entertainment company.

On February 23, 2017, the Company revoked its election to be treated as a real estate investment trust (“REIT”), effective January 1, 2017. The Company operated in a manner intended to qualify as a REIT for federal income tax purposes through December 31, 2016.

2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Basis of Presentation — The accompanying Consolidated Financial Statements and related notes of the Company have been prepared in accordance with accounting principles generally accepted in the United States for interim financial reporting and the instructions to Form 10-Q and Rule 10-01 of Regulation S-X. Accordingly, certain information and footnote disclosures normally included in financial statements prepared under U.S. generally accepted accounting principles (“GAAP”) have been condensed or omitted. In the opinion of management, all adjustments considered necessary for a fair presentation of the Company’s financial position, results of operations and cash flows have been included and are of a normal and recurring nature. The operating results presented for interim periods are not necessarily indicative of the results that may be expected for any other interim period or for the entire year. These financial statements should be read in conjunction with the Company’s Consolidated Financial Statements for the year ended December 31, 2016 and notes thereto included in the Company’s Annual Report on Form 10-K filed with the SEC on March 2, 2017. Capitalized terms used herein, and not otherwise defined, are defined in the Company’s Consolidated Financial Statements for the year ended December 31, 2016.

Certain prior period amounts have been reclassified to conform to the current period’s presentation. In connection with the Company’s continued transformation from a financial services company to a leisure and entertainment company, including the announcement of the new management team in September 2016, the revocation of its REIT election effective January 1, 2017, as well as the monetization and planned exit of our real estate related debt positions, the Company’s Consolidated Statements of Operations have been changed to reflect an operating company presentation. We have reclassified driving range revenue, including the monthly membership program offered at most of our public properties (“The Players Club’’) and miscellaneous revenue associated with operations from “Other revenue” to “Golf course operations”. We have reclassified expenses associated with the cost of merchandise sold from “Cost of sales - golf” to “Operating expenses.” We have added “Loan and security servicing expense” to “General and administrative expense.” The gains and losses associated with derivative instruments have been reclassified from “Other income (loss), net” to “Realized/unrealized (gain) loss on investments” to include balances as part of our operating income (loss). The Company did not make changes to its Consolidated Balance Sheets given the carrying value of the real estate related investments, including agency FNMA/FHLMC securities, held by the Company still represents a significant amount on the Company's Consolidated Balance Sheets at March 31, 2017.

As of March 31, 2017, the Company’s significant accounting policies for these financial statements are summarized below and should be read in conjunction with the Summary of Significant Accounting Policies detailed in the Company’s Annual Report on Form 10-K for the year ended December 31, 2016.

6

DRIVE SHACK INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Unaudited)

MARCH 31, 2017

(dollars in tables in thousands, except share data)

REVENUE RECOGNITION

Golf Course Operations — Revenue from green fees, cart rentals, merchandise sales and other operating activities (consisting primarily of range income, banquets and club amenities) are generally recognized at the time of sale, when services are rendered and collection is reasonably assured.

Revenue from membership dues is recognized in the month earned. Membership dues received in advance are included in deferred revenues and recognized as revenue ratably over the appropriate period, which is generally twelve months or less. The membership dues are generally structured to cover the club operating costs and membership services.

Private country club members generally pay an advance initiation fee deposit upon their acceptance as a member to the respective country club. Initiation fee deposits are refundable 30 years after the date of acceptance as a member. The difference between the initiation fee deposit paid by the member and the present value of the refund obligation is deferred and recognized into revenue in the Consolidated Statements of Operations on a straight-line basis over the expected life of an active membership, which is estimated to be seven years. The present value of the refund obligation is recorded as a membership deposit liability in the Consolidated Balance Sheets and accretes over a 30-year nonrefundable term using the effective interest method. This accretion is recorded as interest expense in the Consolidated Statements of Operations.

Realized/Unrealized Loss on Investments and Other Income (Loss), Net — These items are comprised of the following:

Three Months Ended March 31, | ||||||||

2017 | 2016 | |||||||

(Gain) on settlement of real estate securities | $ | — | $ | (5,917 | ) | |||

Loss on settlement of real estate securities | 2,803 | — | ||||||

Unrealized loss on securities, intent-to-sell | 558 | — | ||||||

Loss on repayment/disposition of loans held-for-sale | — | 47 | ||||||

Realized (gain) loss on settlement of TBAs, net | (2,474 | ) | 7,536 | |||||

Unrealized loss on non-hedge derivative instruments | 2,502 | 341 | ||||||

Realized/unrealized loss on investments | $ | 3,389 | $ | 2,007 | ||||

Loss on lease modifications and terminations | $ | (158 | ) | $ | (60 | ) | ||

Loss on extinguishment of debt, net | (146 | ) | (232 | ) | ||||

Collateral management fee income, net | 122 | 232 | ||||||

Equity in earnings of equity method investees | 379 | 371 | ||||||

Gain (loss) on disposal of long-lived assets | 26 | (6 | ) | |||||

Other (loss) income | (346 | ) | 15 | |||||

Other (loss) income, net | $ | (123 | ) | $ | 320 | |||

7

DRIVE SHACK INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Unaudited)

MARCH 31, 2017

(dollars in tables in thousands, except share data)

Reclassification From Accumulated Other Comprehensive Income Into Net (Loss) Income — The following table summarizes the amounts reclassified out of accumulated other comprehensive income into net (loss) income:

Three Months Ended March 31, | ||||||||||

Accumulated Other Comprehensive Income ("AOCI") Components | Income Statement Location | 2017 | 2016 | |||||||

Net realized (gain) loss on securities | ||||||||||

Impairment | Impairment | $ | — | $ | 54 | |||||

(Gain) on settlement of real estate securities | Realized/unrealized (gain) loss on investments | — | (5,917 | ) | ||||||

Realized (gain) on deconsolidation of CDO VI | Gain on deconsolidation | — | (20,682 | ) | ||||||

$ | — | $ | (26,545 | ) | ||||||

Net realized (gain) loss on derivatives designated as cash flow hedges | ||||||||||

Amortization of deferred hedge (gain) | Interest expense | $ | — | $ | (20 | ) | ||||

$ | — | $ | (20 | ) | ||||||

Total reclassifications | $ | — | $ | (26,565 | ) | |||||

EXPENSE RECOGNITION

Operating Expenses — Operating expenses for Traditional Golf consist primarily of payroll, equipment and cart leases, utilities, repairs and maintenance, supplies, seed, soil and fertilizer, marketing and operating lease rent expense. Many of the Traditional Golf properties and related facilities are leased under long-term operating leases. In addition to minimum payments, certain leases require payment of the excess of various percentages of gross revenue or net operating income over the minimum rental payments. The leases generally require the payment of taxes assessed against the leased property and the cost of insurance and maintenance. The majority of lease terms range from 10 to 20 years, and typically, the leases contain renewal options. Certain leases include scheduled increases or decreases in minimum rental payments at various times during the term of the lease. These scheduled rent increases or decreases are recognized on a straight-line basis over the term of the lease. Increases result in an accrual, which is included in accounts payable, accrued expenses and other liabilities, and decreases result in a receivable, which is included in receivables and other assets, for the amount by which the cumulative straight-line rent differs from the contractual cash rent.

Derivatives and Hedging Activities — All derivatives are recognized as either assets or liabilities on the balance sheet and measured at fair value. The Company reports the fair value of derivative instruments gross of cash paid or received pursuant to credit support agreements and fair value is reflected on a net counterparty basis when the Company believes a legal right of offset exists under an enforceable netting agreement. Fair value adjustments affect either equity or net income depending on whether the derivative instrument qualifies as a hedge for accounting purposes and, if so, the nature of the hedging activity. For those derivative instruments that are designated and qualify as hedging instruments, the Company designates the hedging instrument, based upon the exposure being hedged, as a cash flow hedge or a fair value hedge.

Derivative transactions are entered into by the Company solely for risk management purposes in the ordinary course of business. In determining whether to hedge a risk, the Company may consider whether other assets, liabilities, firm commitments and anticipated transactions already offset or reduce the risk. All transactions undertaken as hedges are entered into with a view towards minimizing the potential for economic losses that could be incurred by the Company. As of March 31, 2017, the Company has no derivative instruments that qualify and are designated as hedging instruments, but has one interest rate cap with a fair value of $0.4 million which is not designated as a hedge.

The Company transacts in the To Be Announced mortgage backed securities (“TBA”) market. TBA contracts are forward contracts to purchase mortgage-backed securities that will be issued by a U.S. government sponsored enterprise in the future. The Company

8

DRIVE SHACK INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Unaudited)

MARCH 31, 2017

(dollars in tables in thousands, except share data)

primarily engages in TBA transactions for purposes of managing interest rate risk and market risk associated with our Agency residential mortgage backed securities (“RMBS”) investments for which we have exposure to interest rate and market risk volatility.

The Company typically does not take delivery of TBAs, but rather settles the associated receivable and payable with its trading counterparties on a net basis. As part of its TBA activities, the Company may “roll” its TBA positions, whereby it may sell (buy) securities for delivery (receipt) in an earlier month and simultaneously contract to repurchase (sell) similar securities at an agreed-upon price on a fixed date in a later month. The Company accounts for its TBA transactions as non-hedge instruments, with changes in market value recorded in the Statement of Operations. As of March 31, 2017, the Company held two short TBA contracts totaling $319.0 million in notional amount of Agency RMBS. As of March 31, 2017 and December 31, 2016, the Company funded approximately $1.1 million and zero, respectively, for margin calls related to TBA contracts.

The Company’s derivative financial instruments contain credit risk to the extent that its bank counterparties may be unable to meet the terms of the agreements. The Company seeks to reduce such risk by limiting its counterparties to major financial institutions. In addition, the potential risk of loss with any one party resulting from this type of credit risk is monitored. Management does not expect any material losses as a result of default by other parties.

BALANCE SHEET MEASUREMENT

Investments in Real Estate, Net — Real estate and related improvements are recorded at cost less accumulated depreciation. Costs that both materially add value to an asset and extend the useful life of an asset by more than a year are capitalized. With respect to golf course improvements (included in buildings and improvements), costs associated with original construction, significant replacements, permanent landscaping, sand traps, fairways, tee boxes or greens are capitalized. All other asset-related costs that do not meet these criteria, such as minor repairs and routine maintenance, are expensed as incurred.

Long-lived assets to be disposed of by sale, which meet certain criteria, are reclassified to real estate held-for-sale and measured at the lower of their carrying amount or fair value less costs of sale. A disposal of a component of an entity or a group of components of an entity are reported in discontinued operations if the disposal represents a strategic shift that has or will have a major effect on the Company’s operations and financial results. Discontinued operations are retroactively reclassified to income (loss) from discontinued operations for all periods presented.

Traditional Golf leases certain golf carts and other equipment that are classified as capital leases. The value of capital leases is recorded as an asset on the balance sheet, along with a liability related to the associated payments. Depreciation of capital lease assets is calculated using the straight-line method over the shorter of the estimated useful lives and the expected lease terms. The cost of equipment under capital leases is included in investments in real estate in the Consolidated Balance Sheets. Payments under the leases are treated as reductions of the liability, with a portion being recorded as interest expense under the effective interest method.

Depreciation is calculated using the straight-line method based on the following estimated useful lives:

Buildings and improvements | 10-30 years |

Capital leases - equipment | 3-7 years |

Furniture, fixtures and equipment | 3-7 years |

Intangibles — Intangible assets and liabilities relating to Traditional Golf consist primarily of leasehold advantages (disadvantages), management contracts and membership base. A leasehold advantage (disadvantage) exists to the Company when it pays a contracted rent that is below (above) market rents at the date of the transaction. The value of a leasehold advantage (disadvantage) is calculated based on the differential between market and contracted rent, which is tax effected and discounted to present value based on an after-tax discount rate corresponding to each golf property and is amortized over the term of the underlying lease agreement. The management contract intangible represents the Company’s golf course management contracts for both leased and managed properties. The management contract intangible for leased and managed properties is valued utilizing a discounted cash flow methodology under the income approach and is amortized over the term of the underlying lease or management agreements, respectively. The membership base intangible represents the Company’s relationship with its private country club members. The membership base intangible is valued using the multi-period excess earnings method under the income approach, and is amortized over the expected life of an active membership.

9

DRIVE SHACK INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Unaudited)

MARCH 31, 2017

(dollars in tables in thousands, except share data)

Amortization of leasehold intangible assets and liabilities is included within operating expenses and amortization of all other intangible assets is included within depreciation and amortization in the Consolidated Statements of Operations. Amortization of all intangible assets is calculated using the straight-line method based on the following estimated useful lives:

Trade name | 30 years |

Leasehold intangibles | 1 -26 years |

Management contracts | 1 -26 years |

Internally-developed software | 5 years |

Membership base | 7 years |

Membership Deposit Liabilities — Private country club members generally pay an advance initiation fee deposit upon their acceptance as a member to the respective country club. Initiation fee deposits are refundable 30 years after the date of acceptance as a member. The difference between the initiation fee deposit paid by the member and the present value of the refund obligation is deferred and recognized into Golf course operations revenue in the Consolidated Statements of Operations on a straight-line basis over the expected life of an active membership, which is estimated to be seven years. The present value of the refund obligation is recorded as a membership deposit liability in the Consolidated Balance Sheets and accretes over a 30-year nonrefundable term using the effective interest method. This accretion is recorded as interest expense in the Consolidated Statements of Operations.

Other Investment — The Company owns a 23% economic interest in a limited liability company which owns preferred equity secured by a commercial real estate project. The Company accounts for this investment as an equity method investment. As of March 31, 2017 and December 31, 2016, the carrying value of this investment was $19.6 million and $19.3 million, respectively. The Company evaluates its equity method investment for other than temporary impairment whenever events or changes in circumstances indicate that the carrying amount of the investment might not be recoverable. The evaluation of recoverability is based on management’s assessment of the financial condition and near term prospects of the commercial real estate project, the length of time and the extent to which the market value of the investment has been less than cost, availability and cost of financing, demand for space, competition for tenants, changes in market rental rates, and operating costs. As these factors are difficult to predict and are subject to future events that may alter management’s assumptions, the values estimated by management in its recoverability analyses may not be realized, and actual losses or impairment may be realized in the future.

Impairment of Real Estate and Finite-lived Intangible Assets — The Company periodically reviews the carrying amounts of its long-lived assets, including real estate and finite-lived intangible assets, to determine whether current events or circumstances indicate that such carrying amounts may not be recoverable. The assessment of recoverability is based on management’s estimates by comparing the sum of the estimated undiscounted cash flows generated by the underlying asset, or other appropriate grouping of assets, to its carrying value to determine whether an impairment existed at its lowest level of identifiable cash flows. If the carrying amount of the asset is greater than the expected undiscounted cash flows to be generated by such asset, an impairment is recognized to the extent the carrying value of such asset exceeds its fair value. The Company generally measures fair value by considering sale prices for similar assets or by discounting estimated future cash flows using an appropriate discount rate. Assets to be disposed of are carried at the lower of their financial statement carrying amount or fair value less costs to sell.

Investments in CDO Servicing Rights — In February 2011, the Company, through one of its subsidiaries, purchased the management rights with respect to certain C-BASS Investment Management LLC (“C-BASS”) Collateralized Debt Obligations (“CDOs”) for $2.2 million pursuant to a bankruptcy proceeding. The Company initially recorded the cost of acquiring the collateral management rights as a servicing asset and subsequently amortizes this asset in proportion to, and over the period of, estimated net servicing income. Servicing assets are assessed for impairment on a quarterly basis, with impairment recognized as a valuation allowance. Key economic assumptions used in measuring any potential impairment of the servicing assets include the prepayment speeds of the underlying collateral, default rates, loss severities and discount rates. During both the three months ended March 31, 2017 and 2016, the Company recorded $0.1 million of servicing rights amortization and no servicing rights impairment. As of March 31, 2017 and December 31, 2016, the Company’s servicing assets had a carrying value of $0.3 million and $0.4 million, respectively, recorded in receivables and other assets.

Variable Interest Entities (“VIEs”) - There are no assets or liabilities of consolidated VIEs included in the Consolidated Balance Sheets as of March 31, 2017 and December 31, 2016. The Company sold its remaining variable interests in Newcastle CDO V and Newcastle CDO VI during 2016 but continue to receive servicing fees as collateral manager, which are not considered variable interests.

10

DRIVE SHACK INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Unaudited)

MARCH 31, 2017

(dollars in tables in thousands, except share data)

Supplemental Non-Cash Investing and Financing Activities Related to CDOs - The Company considers all activity in its CDOs’ restricted cash accounts to be non-cash activity for purposes of its Consolidated Statement of Cash Flows since transactions conducted with restricted cash have no effect on its cash and cash equivalents. Supplemental non-cash investing and financing activities relating to CDOs for the three months ended March 31, 2016 are disclosed below. There were no non-cash investing and financing activities relating to CDOs for the three months ended March 31, 2017.

Three Months Ended March 31, 2016 | |||

Restricted cash generated from pay downs on securities and loans | 2,310 | ||

Restricted cash used for repayments of CDO and other bonds payable | 2,748 | ||

CDO VI deconsolidation: | |||

Real estate securities | 43,889 | ||

Restricted cash | 67 | ||

CDO and other bonds payable | 105,423 | ||

Receivables and Other Assets

The following table summarizes the Company's receivables and other assets:

March 31, 2017 | December 31, 2016 | |||||||

Accounts receivable, net | $ | 7,657 | $ | 8,047 | ||||

Prepaid expenses | 4,243 | 3,654 | ||||||

Interest receivable | 932 | 1,697 | ||||||

Deposits | 4,833 | 4,105 | ||||||

Inventory | 5,010 | 4,496 | ||||||

Derivative assets | 364 | 856 | ||||||

Residential mortgage loans, held-for-sale, net | 228 | 231 | ||||||

Miscellaneous assets, net (A) | 14,898 | 14,931 | ||||||

$ | 38,165 | $ | 38,017 | |||||

(A) | Includes one owned property in Annandale, New Jersey in the Traditional Golf segment classified as held-for-sale as of December 31, 2016. We expect to close on this property during 2017. |

Accounts Payable, Accrued Expenses and Other Liabilities

The following table summarizes the Company's accounts payable, accrued expenses and other liabilities:

March 31, 2017 | December 31, 2016 | |||||||

Accounts payable and accrued expenses | $ | 24,849 | $ | 26,249 | ||||

Deferred revenue | 30,255 | 36,107 | ||||||

Security deposits payable | 9,392 | 6,073 | ||||||

Unfavorable leasehold interests | 4,012 | 4,225 | ||||||

Derivative liabilities | 2,010 | — | ||||||

Accrued rent | 2,031 | 2,613 | ||||||

Due to affiliates | 892 | 892 | ||||||

Miscellaneous liabilities | 14,279 | 12,278 | ||||||

$ | 87,720 | $ | 88,437 | |||||

11

DRIVE SHACK INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Unaudited)

MARCH 31, 2017

(dollars in tables in thousands, except share data)

Recent Accounting Pronouncements

In May 2014, the Financial Accounting Standards Board (“FASB”) issued Accounting Standards Update (“ASU”) 2014-09 Revenue from Contracts with Customers (Topic 606). The standard’s core principle is that a company will recognize revenue when it transfers promised goods or services to customers in an amount that reflects the consideration to which the company expects to be entitled in exchange for those goods or services. In doing so, companies will need to use more judgment and make more estimates than under today’s guidance. These may include identifying performance obligations in the contract, estimating the amount of variable consideration to include in the transaction price and allocating the transaction price to each separate performance obligation. In August 2015, the FASB issued ASU 2015-14 Revenue from Contracts with Customers (Topic 606): Deferral of the Effective Date, which defers the effective date by one year. The standard will be effective for annual and interim periods beginning after December 15, 2017; however, all entities are allowed to adopt the standard as early as the original effective date (annual periods beginning after December 15, 2016). Entities have the option of using either a full retrospective or a modified approach to adopt the guidance. In March 2016, the FASB issued ASU 2016-08 Revenue from Contracts with Customers (Topic 606): Principal versus Agent Considerations which clarifies how an entity should identify the unit of accounting for the principal versus agent evaluation and how to apply the control principle to certain types of arrangements. In April 2016, the FASB issued ASU 2016-10 Revenue from Contracts with Customers (Topic 606): Identifying Performance Obligations and Licensing, which clarifies when a promised good or service is separately identifiable. In May 2016, the FASB issued ASU 2016-12 Revenue from Contracts with Customers (Topic 606): Narrow-Scope Improvements and Practical Expedients which amends the new revenue recognition guidance on transition, collectibility, noncash consideration and the presentation of sales and other similar taxes. In December 2016, the FASB issued ASU 2016-20 Technical Corrections and Improvements to Topic 606, Revenue from Contracts with Customers which amends the new revenue recognition guidance on performance obligations and 12 additional technical corrections and improvements. The Company is evaluating potential impacts of adopting this standard, and is in the process of reviewing customer contracts and revenue streams, identifying contractual provisions that may result in a change in the timing or the amount of revenue recognized. The Company expects to adopt the requirements of the new standard in the first quarter of 2018, and anticipates using the modified retrospective transition method.

In January 2016, the FASB issued ASU 2016-01 Financial Instruments - Overall (Subtopic 825-10): Recognition and Measurement of Financial Assets and Financial Liabilities. The standard addresses certain aspects of recognition, measurement, presentation and disclosure of financial instruments. The effective date of the standard will be for fiscal years, and interim periods within those fiscal years, beginning after December 15, 2017. The Company is currently evaluating the new guidance to determine the impact it may have on its Consolidated Financial Statements.

In February 2016, the FASB issued ASU 2016-02 Leases (Topic 842). The standard requires lessees to recognize most leases on the balance sheet and addresses certain aspects of lessor accounting. The effective date of the standard will be for fiscal years, and interim periods within those fiscal years, beginning after December 15, 2018 and early adoption is permitted. Entities are required to use a modified retrospective approach for leases that exist or are entered into after the beginning of the earliest comparative period in the financial statements, with an option to use certain relief. The Company is currently evaluating the new guidance to determine the impact it may have on its Consolidated Financial Statements.

In June 2016, the FASB issued ASU 2016-13 Financial Instruments - Credit Losses (Topic 326), Measurement of Credit Losses on Financial Instruments. The standard changes how entities will measure credit losses for most financial assets and certain other instruments that are not measured at fair value through net income. For available-for-sale debt securities, entities will be required to record allowances rather than reduce the carrying amount under the other-than-temporary impairment model. The effective date of the standard will be for fiscal years, and interim periods within those fiscal years, beginning after December 15, 2019 and early adoption is permitted for annual periods beginning after December 15, 2018. Entities will apply the standard's provisions as a cumulative-effect adjustment to retained earnings as of the beginning of the first reporting period in which the guidance is effective. The Company is currently evaluating the new guidance to determine the impact it may have on its Consolidated Financial Statements.

In August 2016, the FASB issued ASU 2016-15 Statement of Cash Flows (Topic 230), Classification of Certain Cash Receipts and Cash Payments. The standard provides specific guidance over eight identified cash flow issues in order to reduce diversity in practice over the presentation and classification of certain types of cash receipts and cash payments. The effective date of the standard will be for fiscal years, and interim periods within those fiscal years, beginning after December 15, 2017 and early adoption is permitted. Entities should apply the standard using a retrospective transition method to each period presented. The Company is currently evaluating the new guidance to determine the impact it may have on its Consolidated Financial Statements.

12

DRIVE SHACK INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Unaudited)

MARCH 31, 2017

(dollars in tables in thousands, except share data)

In November 2016, the FASB issued ASU 2016-18 Statement of Cash Flows (Topic 230), Restricted Cash. The standard requires entities to show the changes in the total of cash, cash equivalents and restricted cash in the statement of cash flows and provide a reconciliation to the related line items in the balance sheet. The effective date of the standard will be for fiscal years, and interim periods within those fiscal years, beginning after December 15, 2017 and early adoption is permitted. Entities will be required to apply the guidance retrospectively when adopted and provide the relevant disclosures in ASC 250 in the first interim and annual periods in which the guidance is adopted. The Company is currently evaluating the new guidance to determine the impact it may have on its Consolidated Financial Statements.

In January 2017, the FASB issued ASU 2017-01 Business Combinations (Topic 805), Clarifying the Definition of a Business. The standard clarifies the definition of a business with the objective of adding guidance to assist entities with evaluating whether transactions should be accounted for as acquisitions (or disposals) of assets of businesses. The effective date of the standard will be for interim and annual periods beginning after December 15, 2017 and early adoption is permitted. Entities will be required to apply the guidance on a prospective basis. The Company is currently evaluating the impact that this update will have on its consolidated financial statements and related disclosures.

The FASB has recently issued or discussed a number of proposed standards on topics such as financial statement presentation, financial instruments and hedging. Some of the proposed changes are significant and could have a material impact on the Company’s reporting. The Company has not yet fully evaluated the potential impact of these proposals, but will make such an evaluation as the standards are finalized.

13

DRIVE SHACK INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Unaudited)

MARCH 31, 2017

(dollars in tables in thousands, except share data)

3. SEGMENT REPORTING

The Company currently has four reportable segments: (i) Traditional Golf properties, (ii) Entertainment Golf venues, (iii) Debt Investments, and (iv) corporate. The Company's Traditional Golf business is one of the largest owners and operators of golf properties in the United States. As of March 31, 2017, the Company owned, leased or managed 78 properties across 13 states. Additionally, the Company plans to open a chain of next-generation Entertainment Golf venues across the United States and internationally, which combine golf, competition, dining and fun.

The Debt Investment segment consists primarily of loans and securities which the Company plans to monetize as part of its transformation to a leisure and entertainment company. The corporate segment consists primarily of interest income on short-term investments, general and administrative expenses, interest expense on the junior subordinated notes payable (Note 8) and management fees pursuant to the Management Agreement (Note 12). Segment information for previously reported periods has been restated to reflect the change to the reportable segments in the fourth quarter of 2016.

Summary financial data on the Company’s segments is given below, together with reconciliation to the same data for the Company as a whole:

Traditional Golf | Entertainment Golf | Debt Investments (A) | Corporate | Total | |||||||||||||||

Three Months Ended March 31, 2017 | |||||||||||||||||||

Revenues | |||||||||||||||||||

Golf course operations | $ | 46,296 | $ | — | $ | — | $ | — | $ | 46,296 | |||||||||

Sales of food and beverages | 12,845 | — | — | — | 12,845 | ||||||||||||||

Total revenues | 59,141 | — | — | — | 59,141 | ||||||||||||||

Operating costs | |||||||||||||||||||

Operating expenses (B) | 54,431 | — | — | — | 54,431 | ||||||||||||||

Cost of sales - food and beverages | 4,032 | — | — | — | 4,032 | ||||||||||||||

General and administrative expense | 700 | 65 | 1 | 1,145 | 1,911 | ||||||||||||||

General and administrative expense - acquisition and transaction expenses (C) | 276 | 1,261 | — | 117 | 1,654 | ||||||||||||||

Management fee to affiliate | — | — | — | 2,677 | 2,677 | ||||||||||||||

Depreciation and amortization | 5,793 | — | — | — | 5,793 | ||||||||||||||

Realized/unrealized loss on investments | 120 | — | 3,269 | — | 3,389 | ||||||||||||||

Total operating costs | 65,352 | 1,326 | 3,270 | 3,939 | 73,887 | ||||||||||||||

Operating loss | (6,211 | ) | (1,326 | ) | (3,270 | ) | (3,939 | ) | (14,746 | ) | |||||||||

Other income (expenses) | |||||||||||||||||||

Interest and investment income | 39 | — | 7,802 | 47 | 7,888 | ||||||||||||||

Interest expense | (3,817 | ) | — | (1,206 | ) | (411 | ) | (5,434 | ) | ||||||||||

Other (loss) income, net | (624 | ) | — | 501 | — | (123 | ) | ||||||||||||

Total other income (expenses) | (4,402 | ) | — | 7,097 | (364 | ) | 2,331 | ||||||||||||

Income tax expense (D) | — | — | — | 539 | 539 | ||||||||||||||

Net (loss) income | (10,613 | ) | (1,326 | ) | 3,827 | (4,842 | ) | (12,954 | ) | ||||||||||

Preferred dividends | — | — | — | (1,395 | ) | (1,395 | ) | ||||||||||||

(Loss) income applicable to common stockholders | $ | (10,613 | ) | $ | (1,326 | ) | $ | 3,827 | $ | (6,237 | ) | $ | (14,349 | ) | |||||

14

DRIVE SHACK INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Unaudited)

MARCH 31, 2017

(dollars in tables in thousands, except share data)

Summary segment financial data (continued).

Traditional Golf | Entertainment Golf | Debt Investments (A) | Corporate | Total | |||||||||||||||

March 31, 2017 | |||||||||||||||||||

Investments | $ | 278,686 | $ | 1,132 | $ | 407,589 | $ | — | $ | 687,407 | |||||||||

Cash and restricted cash | 13,681 | 1,254 | 1,545 | 117,703 | 134,183 | ||||||||||||||

Other assets | 34,427 | 2,136 | 1,444 | 158 | 38,165 | ||||||||||||||

Total assets | 326,794 | 4,522 | 410,578 | 117,861 | 859,755 | ||||||||||||||

Debt, net | 114,851 | — | 310,630 | 51,214 | 476,695 | ||||||||||||||

Other liabilities | 167,342 | 1,578 | 5,967 | 4,333 | 179,220 | ||||||||||||||

Total liabilities | 282,193 | 1,578 | 316,597 | 55,547 | 655,915 | ||||||||||||||

Preferred stock | — | — | — | 61,583 | 61,583 | ||||||||||||||

Noncontrolling interest | — | — | — | — | — | ||||||||||||||

Equity attributable to common stockholders | $ | 44,601 | $ | 2,944 | $ | 93,981 | $ | 731 | $ | 142,257 | |||||||||

Additions to investments in real estate during the three months ended March 31, 2017 | $ | 3,496 | $ | 138 | $ | — | $ | — | $ | 3,634 | |||||||||

Traditional Golf | Entertainment Golf | Debt Investments (A) | Corporate | Total | |||||||||||||||

Three Months Ended March 31, 2016 | |||||||||||||||||||

Revenues | |||||||||||||||||||

Golf course operations | $ | 48,597 | $ | — | $ | — | $ | — | $ | 48,597 | |||||||||

Sales of food and beverages | 13,561 | — | — | — | 13,561 | ||||||||||||||

Total revenues | 62,158 | — | — | — | 62,158 | ||||||||||||||

Operating costs | |||||||||||||||||||

Operating expenses (B) | 58,219 | — | — | — | 58,219 | ||||||||||||||

Cost of sales - food and beverages | 4,597 | — | — | — | 4,597 | ||||||||||||||

General and administrative expense | 839 | 2 | 37 | 1,883 | 2,761 | ||||||||||||||

General and administrative expense - acquisition and transaction expenses (C) | 126 | 12 | — | 38 | 176 | ||||||||||||||

Management fee to affiliate | — | — | — | 2,675 | 2,675 | ||||||||||||||

Depreciation and amortization | 6,031 | — | — | — | 6,031 | ||||||||||||||

Impairment | — | — | 2,308 | — | 2,308 | ||||||||||||||

Realized/unrealized loss on investments | 1 | — | 2,006 | — | 2,007 | ||||||||||||||

Total operating costs | 69,813 | 14 | 4,351 | 4,596 | 78,774 | ||||||||||||||

Operating loss | (7,655 | ) | (14 | ) | (4,351 | ) | (4,596 | ) | (16,616 | ) | |||||||||

Other income (expenses) | |||||||||||||||||||

Interest and investment income | 42 | — | 20,991 | 6 | 21,039 | ||||||||||||||

Interest expense | (2,665 | ) | — | (9,924 | ) | (945 | ) | (13,534 | ) | ||||||||||

Gain on deconsolidation | — | — | 82,130 | — | 82,130 | ||||||||||||||

Other (loss) income, net | (283 | ) | — | 603 | — | 320 | |||||||||||||

Total other income (expenses) | (2,906 | ) | — | 93,800 | (939 | ) | 89,955 | ||||||||||||

Income tax expense | 44 | — | — | — | 44 | ||||||||||||||

Net (loss) income | (10,605 | ) | (14 | ) | 89,449 | (5,535 | ) | 73,295 | |||||||||||

Preferred dividends | — | — | — | (1,395 | ) | (1,395 | ) | ||||||||||||

Net loss attributable to noncontrolling interest | 124 | — | — | — | 124 | ||||||||||||||

(Loss) income applicable to common stockholders | $ | (10,481 | ) | $ | (14 | ) | $ | 89,449 | $ | (6,930 | ) | $ | 72,024 | ||||||

15

DRIVE SHACK INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Unaudited)

MARCH 31, 2017

(dollars in tables in thousands, except share data)

(A) | The following table summarizes the investments and debt in the Debt Investments segment: |

March 31, 2017 | |||||||||||||||

Investments | Debt | ||||||||||||||

Outstanding Face Amount | Carrying Value | Outstanding Face Amount | Carrying Value | ||||||||||||

Unlevered real estate securities | $ | 4,000 | $ | 2,032 | $ | — | $ | — | |||||||

Levered real estate securities | 319,380 | 326,878 | 310,630 | 310,630 | |||||||||||

Real estate related and other loans (E) | 78,125 | 59,043 | — | — | |||||||||||

Other investments | N/A | 19,636 | — | — | |||||||||||

$ | 401,505 | $ | 407,589 | $ | 310,630 | $ | 310,630 | ||||||||

(B) | Operating expenses includes rental expenses recorded under operating leases for carts and equipment in the amount of $0.8 million and $1.0 million for the three months ended March 31, 2017 and 2016, respectively. |

(C) | Acquisition and transaction expense includes costs related to completed and potential acquisitions and transactions which may include advisory, legal, accounting, valuation and other professional or consulting fees. Transaction expense also includes personnel and other costs which do not qualify for capitalization associated with the development of new Entertainment Golf venues. |

(D) | Effective January 1, 2017, the Company revoked its election to be treated as a REIT. As a result, the Company is subject to U.S. federal corporate income tax and the provision for income taxes is recorded in the corporate segment. |

(E) | Excludes two mezzanine loans with zero carrying value, which had an aggregate face amount of $17.8 million and two corporate loans with zero carrying value, which had an aggregate face amount of $45.7 million. |

16

DRIVE SHACK INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Unaudited)

MARCH 31, 2017

(dollars in tables in thousands, except share data)

4. REAL ESTATE SECURITIES

The following is a summary of the Company’s real estate securities at March 31, 2017, all of which are classified as available-for-sale and are, therefore, reported at fair value with changes in fair value recorded in other comprehensive income, except for securities that are other-than-temporarily impaired.

Amortized Cost Basis | Gross Unrealized | Weighted Average | ||||||||||||||||||||||||||||||||||||||||||

Asset Type | Outstanding Face Amount | Before Impairment | Other-Than- Temporary Impairment (A) | After Impairment | Gains | Losses | Carrying Value (B) | Number of Securities | Rating (C) | Coupon | Yield | Life (Years) (D) | Principal Subordination (E) | |||||||||||||||||||||||||||||||

ABS - Non-Agency RMBS | $ | 4,000 | $ | 2,338 | $ | (1,521 | ) | $ | 817 | $ | 1,215 | $ | — | $ | 2,032 | 1 | C | 1.37 | % | 25.44 | % | 9.2 | 28.8 | % | ||||||||||||||||||||

Total Securities, Available-for-Sale (F) | $ | 4,000 | $ | 2,338 | $ | (1,521 | ) | $ | 817 | $ | 1,215 | $ | — | $ | 2,032 | 1 | ||||||||||||||||||||||||||||

FNMA/FHLMC (A) | 319,380 | 337,972 | (11,094 | ) | 326,878 | — | — | 326,878 | 1 | AAA | 3.50 | % | 3.13 | % | 7.7 | N/A | ||||||||||||||||||||||||||||

Total Securities, Pledged as Collateral (F) | $ | 319,380 | $ | 337,972 | $ | (11,094 | ) | $ | 326,878 | $ | — | $ | — | $ | 326,878 | 1 | ||||||||||||||||||||||||||||

(A) | As of March 31, 2017, the Company reclassified gross unrealized losses of $11.1 million from other comprehensive income into earnings on FNMA/FHLMC securities that the Company intends to sell and recorded in realized/unrealized (gain) loss on investments in the Consolidated Statements of Operations. |

(B) | See Note 10 regarding the estimation of fair value, which is equal to carrying value for all securities. |

(C) | Represents the weighted average of the ratings of all securities in each asset type, expressed as an S&P equivalent rating. For each security rated by multiple rating agencies, the lowest rating is used. The Company uses an implied AAA rating for the Fannie Mae/Freddie Mac (“FNMA/FHLMC”) securities. Ratings provided were determined by third-party rating agencies, represent the most recent credit ratings available as of the reporting date and may not be current. |

(D) | The weighted average life is based on the timing of expected cash flows on the assets. |

(E) | Percentage of the outstanding face amount of securities and residual interests that is subordinate to the Company’s investments. |

(F) | The total outstanding face amount was $319.4 million for fixed rate securities and $4.0 million for floating rate securities. |

17

DRIVE SHACK INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Unaudited)

MARCH 31, 2017

(dollars in tables in thousands, except share data)

Unrealized losses that are considered other-than-temporary are recognized currently in earnings. During the three months ended March 31, 2017, the Company recorded other-than-temporary impairment charges (“OTTI”) of $0.6 million with respect to real estate securities (gross of $0.0 million of other-than-temporary impairment recognized in other comprehensive income). Based on management’s analysis of the securities, the performance of the underlying loans and changes in market factors, the Company noted adverse changes in the expected cash flows on certain of these securities and concluded that they were other-than-temporarily impaired. Any remaining unrealized losses on the Company’s securities were primarily the result of changes in market factors, rather than issuer-specific credit impairment. The Company performed analyses in relation to such securities, using management’s best estimate of their cash flows, which support that the carrying values of such securities were fully recoverable over their expected holding period. The following table summarizes the Company's securities in an unrealized loss position as of March 31, 2017.

Amortized Cost Basis | Gross Unrealized | Weighted Average | |||||||||||||||||||||||||||||||||||||||||

Securities in an Unrealized Loss Position | Outstanding Face Amount | Before Impairment | Other-than-Temporary Impairment (A) | After Impairment | Gains | Losses | Carrying Value | Number of Securities | Rating | Coupon | Yield | Life (Years) | |||||||||||||||||||||||||||||||

Less Than Twelve Months | $ | 319,380 | $ | 337,972 | $ | (11,094 | ) | $ | 326,878 | $ | — | $ | — | $ | 326,878 | 1 | AAA | 3.50 | % | 3.13 | % | 7.7 | |||||||||||||||||||||

Twelve or More Months | — | — | — | — | — | — | — | — | — | — | % | — | % | — | |||||||||||||||||||||||||||||

Total | $ | 319,380 | $ | 337,972 | $ | (11,094 | ) | $ | 326,878 | $ | — | $ | — | $ | 326,878 | 1 | AAA | 3.50 | % | 3.13 | % | 7.7 | |||||||||||||||||||||

(A) | As of March 31, 2017, the Company reclassified gross unrealized losses of $11.1 million from other comprehensive income into earnings on FNMA/FHLMC securities that the Company intends to sell and recorded in realized/unrealized (gain) loss on investments in the Consolidated Statements of Operations. |

The Company performed an assessment of all of its debt securities that are in an unrealized loss position (unrealized loss position exists when a security’s amortized cost basis, excluding the effect of OTTI, exceeds its fair value). The securities that the Company intends to sell have a fair value of $326.9 million and amortized cost basis after impairment of $326.9 million as of March 31, 2017.

The Company has no activity related to credit losses on debt securities for the three months ended March 31, 2017.

The table below summarizes the geographic distribution of the collateral securing the asset-backed securities (“ABS”) at March 31, 2017:

ABS - Non-Agency RMBS | |||||||

Geographic Location | Outstanding Face Amount | Percentage | |||||

Western U.S. | $ | 1,295 | 32.4 | % | |||

Northeastern U.S. | 605 | 15.1 | % | ||||

Southeastern U.S. | 1,065 | 26.6 | % | ||||

Midwestern U.S. | 430 | 10.8 | % | ||||

Southwestern U.S. | 605 | 15.1 | % | ||||

$ | 4,000 | 100.0 | % | ||||

Geographic concentrations of investments expose the Company to the risk of economic downturns within the relevant regions, particularly given the current unfavorable market conditions. These market conditions may make regions more vulnerable to downturns in certain market factors. Any such downturn in a region where the Company holds significant investments could have a material, negative impact on the Company.

In March 2017, the Company sold $289.7 million face amount of agency FNMA/FHLMC fixed-rate securities at an average price of 98.8% of par for total proceeds of $286.1 million and recognized a loss on sale of securities of $2.8 million. The Company repaid $277.8 million of repurchase agreements associated with these securities.

18

DRIVE SHACK INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Unaudited)

MARCH 31, 2017

(dollars in tables in thousands, except share data)

Securities Pledged as Collateral

These government agency securities were sold under agreements to repurchase which are treated as collateralized financing transactions. Although being pledged as collateral, securities financed through a repurchase agreement remains on the Company's Consolidated Balance Sheets as an asset and cash received from the purchaser is recorded on the Company's Consolidated Balance Sheets as a liability.

5. REAL ESTATE RELATED AND OTHER LOANS, RESIDENTIAL MORTGAGE LOANS AND SUBPRIME MORTGAGE LOANS

Loans are accounted for based on management’s strategy for the loan, and on whether the loan was credit-impaired at the date of acquisition. Loans acquired with the intent to sell are classified as held-for-sale.

The following is a summary of real estate related and other loans and residential mortgage loans at March 31, 2017. The loans contain various terms, including fixed and floating rates, self-amortizing and interest only. They are generally subject to prepayment.

Loan Type | Outstanding Face Amount | Carrying Value (A) | Loan Count | Weighted Average Yield | Weighted Average Coupon | Weighted Average Life (Years) (B) | Floating Rate Loans as % of Face Amount | Delinquent Face Amount (C) | |||||||||||||||||

Mezzanine Loans | $ | 17,767 | $ | — | 2 | 0.00 | % | 8.39 | % | 0.0 | 100.0 | % | $ | 17,767 | |||||||||||

Corporate Loans | 123,812 | 59,043 | 4 | 22.49 | % | 15.40 | % | 0.5 | — | % | 59,384 | ||||||||||||||

Total Real Estate Related and other Loans Held-for-Sale, Net | $ | 141,579 | $ | 59,043 | 6 | 22.49 | % | 14.52 | % | 0.5 | 12.5 | % | $ | 77,151 | |||||||||||

Residential Mortgage Loans Held-for-Sale, Net (D) | $ | 769 | $ | 228 | 3 | 3.11 | % | 3.42 | % | 0.4 | 100.0 | % | $ | 628 | |||||||||||

(A) | Carrying value includes negligible interest receivable for the residential housing loans. |

(B) | The weighted average maturity is based on the timing of expected cash flows on the assets. |

(C) | Includes loans that are 60 days or more past due (including loans that are in foreclosure and borrowers in bankruptcy) or considered real estate owned (“REO”). As of March 31, 2017, $77.2 million face amount of real estate related and other loans was on non-accrual status. |

(D) | Loans acquired at a discount for credit quality. Residential mortgage loans held-for-sale, net is recorded in receivables and other assets on the Consolidated Balance Sheets. |

19

DRIVE SHACK INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Unaudited)

MARCH 31, 2017

(dollars in tables in thousands, except share data)

The following is a summary of real estate related and other loans by maturities at March 31, 2017:

Year of Maturity | Outstanding Face Amount | Carrying Value | Number of Loans | |||||||

Delinquent (A) | $ | 77,151 | $ | 147 | 5 | |||||

Period from April 1, 2017 to December 31, 2017 | — | — | — | |||||||

2018 | — | — | — | |||||||

2019 | 64,428 | 58,896 | 1 | |||||||

2020 | — | — | — | |||||||

2021 | — | — | — | |||||||

2022 | — | — | — | |||||||

Thereafter | — | — | — | |||||||

Total | $ | 141,579 | $ | 59,043 | 6 | |||||

(A) | Includes loans that are non-performing, in foreclosure, or under bankruptcy |

Activities relating to the carrying value of the Company’s real estate related and other loans and residential mortgage loans are as follows:

Held-for-Sale | |||||||

Real Estate Related and Other Loans | Residential Mortgage Loans (A) | ||||||

Balance at December 31, 2016 | $ | 55,612 | $ | 231 | |||

Purchases / additional fundings | — | — | |||||

Interest accrued to principal balance | 3,431 | — | |||||

Principal pay downs | — | (3 | ) | ||||

Balance at March 31, 2017 | $ | 59,043 | $ | 228 | |||

(A) | Recorded in receivables and other assets on the Consolidated Balance Sheets. |

There was no change in the loss allowance on the Company's real estate related and other loans and residential mortgage loans during the three months ended March 31, 2017.

The table below summarizes the geographic distribution of real estate related and other loans and residential mortgage loans at March 31, 2017:

Real Estate Related and Other Loans | Residential Mortgage Loans | ||||||||||||

Geographic Location | Outstanding Face Amount | Percentage | Outstanding Face Amount | Percentage | |||||||||

Northeastern U.S. | $ | — | — | % | $ | 523 | 68.0 | % | |||||

Southeastern U.S. | — | — | % | 246 | 32.0 | % | |||||||

Foreign | 63,454 | 100.0 | % | — | — | % | |||||||

$ | 63,454 | 100.0 | % | $ | 769 | 100.0 | % | ||||||

Other (A) | 78,125 | ||||||||||||

$ | 141,579 | ||||||||||||

(A) | Includes corporate loans which are not directly secured by real estate assets. |

20

DRIVE SHACK INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Unaudited)

MARCH 31, 2017

(dollars in tables in thousands, except share data)

6. INVESTMENTS IN REAL ESTATE, NET OF ACCUMULATED DEPRECIATION

The following table summarizes the Company’s investments in real estate related to its Traditional and Entertainment Golf businesses:

March 31, 2017 | December 31, 2016 | ||||||||||||||||||||||

Gross Carrying Amount | Accumulated Depreciation | Net Carrying Value | Gross Carrying Amount | Accumulated Depreciation | Net Carrying Value | ||||||||||||||||||

Land | $ | 84,319 | $ | — | $ | 84,319 | $ | 84,319 | $ | — | $ | 84,319 | |||||||||||

Buildings and improvements | 145,243 | (42,737 | ) | 102,506 | 144,690 | (39,402 | ) | 105,288 | |||||||||||||||

Furniture, fixtures and equipment | 29,900 | (21,250 | ) | 8,650 | 29,132 | (20,516 | ) | 8,616 | |||||||||||||||

Capital leases - equipment | 20,945 | (5,645 | ) | 15,300 | 20,844 | (4,818 | ) | 16,026 | |||||||||||||||

Construction in progress | 5,677 | — | 5,677 | 3,362 | — | 3,362 | |||||||||||||||||

Total Investments in Real Estate | $ | 286,084 | $ | (69,632 | ) | $ | 216,452 | $ | 282,347 | $ | (64,736 | ) | $ | 217,611 | |||||||||

7. INTANGIBLES, NET OF ACCUMULATED AMORTIZATION

The following table summarizes the Company’s intangible assets related to the Traditional and Entertainment Golf businesses:

March 31, 2017 | December 31, 2016 | ||||||||||||||||||||||

Gross Carrying Amount | Accumulated Amortization | Net Carrying Value | Gross Carrying Amount | Accumulated Amortization | Net Carrying Value | ||||||||||||||||||

Trade name | $ | 700 | $ | (76 | ) | $ | 624 | $ | 700 | $ | (70 | ) | $ | 630 | |||||||||

Leasehold intangibles (A) | 48,107 | (13,591 | ) | 34,516 | 48,107 | (12,550 | ) | 35,557 | |||||||||||||||

Management contracts | 35,207 | (11,242 | ) | 23,965 | 35,207 | (10,434 | ) | 24,773 | |||||||||||||||

Internally-developed software | 800 | (520 | ) | 280 | 800 | (480 | ) | 320 | |||||||||||||||

Membership base | 5,236 | (2,431 | ) | 2,805 | 5,236 | (2,244 | ) | 2,992 | |||||||||||||||

Nonamortizable liquor licenses | 1,176 | — | 1,176 | 840 | — | 840 | |||||||||||||||||

Total Intangibles | $ | 91,226 | $ | (27,860 | ) | $ | 63,366 | $ | 90,890 | $ | (25,778 | ) | $ | 65,112 | |||||||||