Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Citizens Community Bancorp Inc. | a8kdadavidsoninvconfpresen.htm |

M a y 9 t h – 11 t h , 2 0 1 7

NASDAQ: CZWI

1

D.A. Davidson 19th Annual

Financial Institutions

Conference

Exhibit 99.1

This presentation includes forward-looking statements about the financial condition, results of operations and business of Citizens Community Bancorp,

Inc. (“Citizens”) and its wholly owned subsidiary, Citizens Community Federal N.A. (“CCFBank”) Forward-looking statements can be identified by the fact

that they do not relate strictly to historical or current facts. These statements may be identified by the use of forward-looking words or phrases such as

“anticipate,” “believe,” “could,” “expect,” “intend,” “may,” “planned,” “potential,” “should,” “will,” “would” or the negative of those terms or other

words of similar meaning. These forward-looking statements are intended to be covered by the safe-harbor provisions of the Private Securities Litigation

Reform Act of 1995. Such forward-looking statements in this presentation are inherently subject to many uncertainties arising in CCFBank’s operations

and business environment. These uncertainties include the timing to consummate the proposed merger with Wells Financial Corp.; the risk that a

condition to closing of the merger may not be satisfied and the transaction may not close; the risk that a regulatory approval that may be required for

the merger is delayed, is not obtained or is obtained subject to conditions that are not anticipated; the combined company’s ability to achieve the

synergies and value creation contemplated by the merger; management’s ability to promptly and effectively integrate the businesses of the two

companies; the diversion of management time on transaction-related issues; the effects of governmental regulation of the financial services industry;

industry consolidation; technological developments and major world news events; general economic conditions, in particular, relating to consumer

demand for CCFBank’s products and services; CCFBank’s ability to maintain current deposit and loan levels at current interest rates; competitive and

technological developments; deteriorating credit quality, including changes in the interest rate environment reducing interest margins; prepayment

speeds, loan origination and sale volumes, charge-offs and loan loss provisions; CCFBank’s ability to maintain required capital levels and adequate

sources of funding and liquidity; maintaining capital requirements may limit CCFBank’s operations and potential growth; changes and trends in capital

markets; competitive pressures among depository institutions; effects of critical accounting estimates and judgments; changes in accounting policies or

procedures as may be required by the Financial Accounting Standards Board (FASB) or other regulatory agencies overseeing CCFBank; CCFBank’s ability

to implement its cost-savings and revenue enhancement initiatives, including costs associated with its branch consolidation and new market branch

growth initiatives; legislative or regulatory changes or actions or significant litigation adversely affecting CCFBank; fluctuation of Citizens’ stock price;

CCFBank's ability to attract and retain key personnel; CCFBank's ability to secure confidential information through the use of computer systems and

telecommunications networks; and the impact of reputational risk created by these developments on such matters as business generation and retention,

funding and liquidity. Shareholders, potential investors and other readers are urged to consider these factors carefully in evaluating the forward-looking

statements and are cautioned not to place undue reliance on such forward-looking statements. Such uncertainties and other risks that may affect

Citizens’ performance are discussed further in Part I, Item 1A, “Risk Factors,” in Citizens’ Form 10-K, for the year ended September 30, 2016 filed with the

Securities and Exchange Commission on December 29, 2016. Citizens undertakes no obligation to make any revisions to the forward-looking statements

contained in this presentation or to update them to reflect events or circumstances occurring after the date hereof.

Cautionary Note Regarding Forward Looking

Statements

2

Executive Management

Stephen M. Bianchi is President and CEO of Citizens Community Bancorp, Inc.

Prior to joining the Bank, he was President and CEO of HF Financial Corp in

Sioux Falls, SD. Prior experience includes Senior Vice President at Associated

Bank, where he served as Minnesota Regional President and Minnesota

Regional Commercial Banking Manager from July 2006 to April 2010. Before

that, he was Twin Cities Business Banking Manager for Wells Fargo Bank,

where he held several other management positions over 21 years. Mr. Bianchi

received his B.S. degree in Finance and M.B.A. from Providence College.

Mark C. Oldenberg is Executive Vice President and CFO of Citizens Community

Bancorp, Inc. Mr. Oldenberg has worked in the financial services industry for

over twenty years, previously as Chief Financial Officer for Security Financial

Bank in Durand, WI and Fidelity National Bank in Medford, WI. He also was a

Commercial and Consumer lender for eight years at Heritage Bank in Spencer,

WI. A graduate of University of Wisconsin Eau Claire with a B.S. in Finance and

Accounting, he is also a Certified Public Accountant who is a member of the

Wisconsin Institute of Certified Public Accountants and Treasurer of the Boys &

Girls Club of the Greater Chippewa Valley.

3

Overview

• Based in Eau Claire County, Wisconsin, Citizens Community

Federal N.A. serves more than 50,000 customers.

• Key markets include:

Northwest Wisconsin MSA

Southern, Minnesota MSA

Minneapolis/St. Paul, Metro MSA

Oakland County, Michigan MSA

• Full-service commercial, ag, mortgage and consumer banking.

• Subsequent to branch closures in June 2017, the Company will

operate 14 branch locations.

4

Current Branch Locations

5

• Remix loan and deposit composition, focused on commercial,

ag and municipal relationships.

• Improve efficiencies and control expenses by leveraging

technology and personnel.

• Generate organic growth in core markets.

• Attract new Commercial/Ag bankers and reposition existing

banker marketing efforts.

• Enhance non-interest income through higher loan origination,

servicing income and new lines of business.

Enhancing Performance and Franchise Value

6

• New CEO, hired in June 2016, with history of maximizing

commercial and ag market growth and operational efficiencies.

• Shareholder focused management recently increased its dividend

33% to $.16/share.

• Acquired assets have accelerated earnings growth.

• Recent focus on branch efficiency is expected to enhance earnings.

• NPAs/Total Assets of 1.05% at March 31, 2017, including recently

acquired CBN assets.

• Proven history of accretive transactions.

Investment Considerations

7

0.95%

0.66%

0.46%

0.37%

0.62%(1)

0.29%

0.67%

0.00%

0.20%

0.40%

0.60%

0.80%

1.00%

1.20%

FY2012 FY2013 FY2014 FY2015 FY2016 FY 2017 Q2

1.05%(2)

NPAs / Total Assets Ratio Remain Low

8

(1) Total nonperforming assets increased due to the CBN acquisition in Fiscal 2016: NPLs = $1,778;REO = $212;NPAs = $1,990 or 0.29% of assets

(2) Total nonperforming assets increased due to the CBN acquisition in Fiscal 2017: NPLs = $4,322;REO = $143;NPAS = $4,465 or 0.67% of assets

$206

$1,047

$2,510

$2,806

$2,573 (1)

$1,874

$0

$500

$1,000

$1,500

$2,000

$2,500

$3,000

FY2012 FY2013 FY2014 FY2015 FY2016 FTD 2017 Q2

(In $000)

Net Income Growth

9

(As Restated) (As Restated)

(1) Fiscal 2016 Net Income includes acquisition costs of $701

Citizens Community Bancorp, Inc. and

Wells Financial Corp. to Merge

10

Transactions Highlights

11

Wells Financial Corporation

Transaction Value1 $39.8 million

Consideration 81% Cash, 19% Stock

Price/TBV 124.6%

Price/LTM EPS2 16.7x

Required Approvals Customary regulatory and shareholder approval

Expected Closing Q3 2017

Total Assets (3/31/17 Call Report) $268.5 million

Total Loans (3/31/17 Call Report) $201 million

Total Deposits (3/31/17 Call Report) $240 million

Transactions Rationale

12

Strategic

Rationale

Financially

Attractive

Low Risk

Integration

Acquisition helps CZWI bridge “valuation gap” as its pro forma franchise

will be nearly $1.0 billion in assets

Consistent with CZWI’s strategy of “re-formulating” its deposit base – core

deposits vs. super market branches

Continued loan portfolio diversification

Intention to drive shareholder value through improved earnings and

enhanced future EPS

Immediately accretive to EPS1 as the transaction is expected to generate

earnings accretion of over 50% in the first full year after closing

Attractive EPS accretion in subsequent years

TBV Dilution Payback Period of approximately 3 years

Operating synergies result in appreciable cost savings

Conservative credit mark – coverage of NPAs excluding restructured loans

within market norms

CZWI is familiar with market, and has completed past acquisition

Tangible improvement in interest rate risk position

Branch Locations – ProForma Update

13

Source: SNL Financial

Note: CZWI’s MI Branches are not shown

14

Pro Forma Loans Forma Loans

CZWI WEFP Combined

Note: Financial Data as of 3/31/17, Regulatory data shown, does not include purchase

accounting adjustments

Source: SNL Financial

Composition Composition Composition

Loan Type ($000) % of Total Loan Type ($000) % of Total Loan Type ($000) % of Total

Constr & Dev 15,736 2.9% Constr & Dev 6,193 3.1% Constr & Dev 21,929 3.0%

1-4 Family Residential 199,195 37.2% 1-4 Family Residential 62,425 31.0% 1-4 Family Residential 261,620 35.5%

Home Equity 9,617 1.8% Home Equity 25,626 12.7% Home Equity 35,243 4.8%

Owner - Occ CRE 26,631 5.0% Owner - Occ CRE 23,172 11.5% Owner - Occ CRE 49,803 6.8%

Other CRE 30,875 5.8% Other CRE 15,840 7.9% Other CRE 46,715 6.3%

Multifamily 17,538 3.3% Multifamily 2,736 1.4% Multifamily 20,274 2.8%

Commercial & Industrial 25,489 4.8% Commercial & Industrial 11,234 5.6% Commercial & Industrial 36,723 5.0%

Consr & Other 209,842 39.2% Consr & Other 53,987 26.8% Consr & Other 263,829 35.8%

Total Loans $534,923 100.0% Total Loans $201,213 100.0% Total Loans $736,136 100.0%

MRQ Yield on Loans: 4.53% MRQ Yield on Loans: 4.80% MRQ Yield on Loans: 4.60%

C&D

3.1%

1-4 Fam

31.0%

HELOC

12.7%

OwnOcc CRE

11.5%

Other CRE

7.9%

Multifam

1.4%

C&I

5.6%

Consr & Other

26.8%

C&D

2.9%

1-4 Fam

37.2%

HELOC

1.8%

OwnOcc CRE

5.0%

Other CRE

5.8%

Multifam

3.3%

C&I

4.8%

Consr & Other

39.2%

C&D

3.0%

1-4 Fam

35.5%

HELOC

4.8%

OwnOcc CRE

6.8%

Other CRE

6.3%

Multifam

2.8%

C&I

5.0%

Consr & Other

35.8%

15

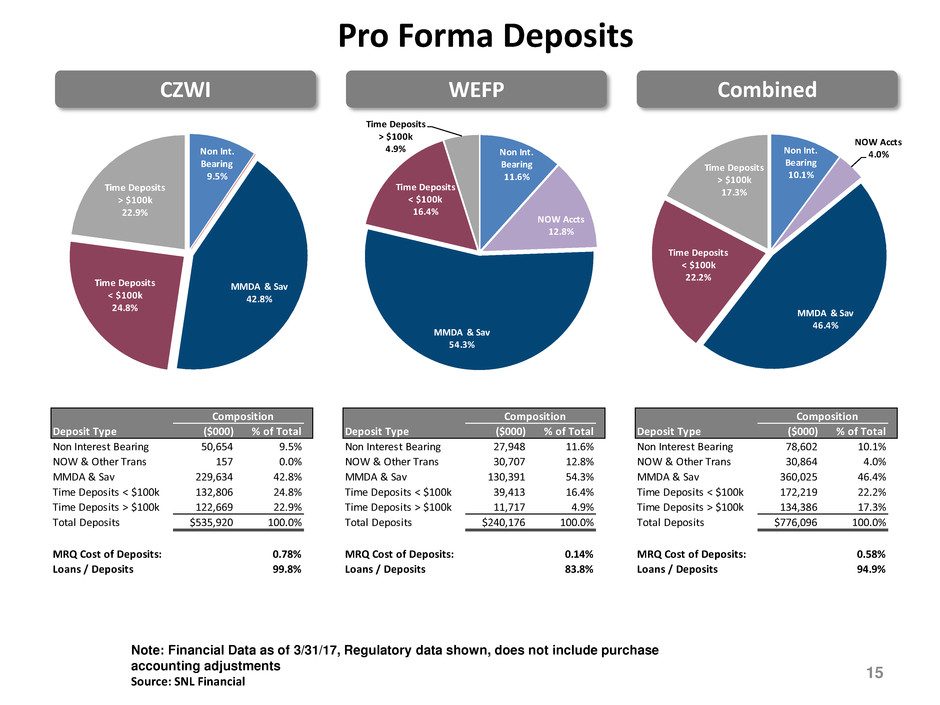

Pro Forma Deposits

CZWI WEFP Combined

Note: Financial Data as of 3/31/17, Regulatory data shown, does not include purchase

accounting adjustments

Source: SNL Financial

Composition Composition Composition

Deposit Type ($000) % of Total Deposit Type ($000) % of Total Deposit Type ($000) % of Total

Non Interest Bearing 50,654 9.5% Non Interest Bearing 27,948 11.6% Non Interest Bearing 78,602 10.1%

NOW & Other Trans 157 0.0% NOW & Other Trans 30,707 12.8% NOW & Other Trans 30,864 4.0%

MMDA & Sav 229,634 42.8% MMDA & Sav 130,391 54.3% MMDA & Sav 360,025 46.4%

Time Deposits < $100k 132,806 24.8% Time Deposits < $100k 39,413 16.4% Time Deposits < $100k 172,219 22.2%

Ti e Deposits > $100k 122,669 22.9% Ti e Deposits > $100k 11,717 4.9% Ti e Deposits > $100k 134,386 17.3%

Total Deposits $535,920 100.0% Total Deposits $240,176 100.0% Total Deposits $776,096 100.0%

MRQ Cost of Deposits: 0.78% MRQ Cost of Deposits: 0.14% MRQ Cost of Deposits: 0.58%

Loans / Deposits 99.8% Loans / Deposits 83.8% Loans / Deposits 94.9%

Non Int.

Bearing

9.5%

MMDA & Sav

42.8%

Time Deposits

< $100k

24.8%

Time Deposits

> $100k

22.9%

Non Int.

Bearing

11.6%

NOW Accts

12.8%

MMDA & Sav

54.3%

Time Deposits

< $100k

16.4%

Time Deposits

> $100k

4.9% Non Int.

Bearing

10.1%

NOW Accts

4.0%

MMDA & Sav

46.4%

Time Deposits

< $100k

22.2%

Time Deposits

> $100k

17.3%

Investing Opportunity Remains;

Stock Price to Tangible Book Value

$5.00

$5.90

$7.25

$8.85 $8.84

$11.18

$13.85

$10.21

$10.68 $10.47

$11.20

$11.72

$11.22 $11.19

$0.00

$3.00

$6.00

$9.00

$12.00

$15.00

FY2011 FY2012 FY2013 FY2014

(As Restated)

FY2015

(As Restated)

FY2016 3/31/2017

Price Reported Tangible Book Value/Share

Price/

TBV

55.2%

Price/

TBV

69.2%

Price/

TBV

79.0%

Price/

TBV

99.6%

Price/

TBV

75.4%

Price/

TBV

49.0%

Price/

TBV

123.8%

16

CZWI Total Return has Outpaced Bank Index

17

Total return includes stock appreciation plus dividends.

Building Franchise and Shareholder Value

• Improve the quantity and quality of earnings through growth,

efficiencies to be recognized from acquisitions and technology

enhancements, and branch rationalization.

• Accelerating commercial banking business while maintaining

strong asset quality metrics.

• Focus on tangible book value growth.

• Commitment to returning capital to shareholders through

increasing dividends.

• Recognition by investors of disciplined approach to execute

against strategic priorities that enhance shareholder value.

18

No Offer or Solicitation and Additional Information

No Offer or Solicitation

This presentation is for informational purposes only and is neither an offer to purchase, nor a solicitation of an offer to sell, any securities in any

jurisdiction pursuant to the proposed transaction or otherwise, nor shall there be any sale, issuance or transfer of securities in any jurisdiction in

contravention of any applicable law. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of

the Securities Act of 1933, as amended.

Additional Information About The Proposed Merger and Where To Find It

Investors are urged to read the Agreement and Plan of Merger between Citizens and Wells Financial Corp. (“Wells”) dated March 17, 2017, for a more

complete understanding of the terms of the transactions discussed herein.

This presentation does not constitute a solicitation of any vote or approval. In connection with the merger, Citizens will be filing with the Securities

and Exchange Commission (“SEC”) a Registration Statement on Form S-4 and other relevant documents. STOCKHOLDERS ARE URGED TO READ THE

REGISTRATION STATEMENT ON FORM S-4 TO BE FILED BY CITIZENS WHEN IT BECOMES AVAILABLE AND ANY OTHER RELEVANT DOCUMENTS FILED BY

CITIZENS WITH THE SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THOSE DOCUMENTS, BECAUSE THEY WILL CONTAIN IMPORTANT

INFORMATION.

The Registration Statement, including the proxy statement/prospectus, and other relevant materials (when they become available), and any other

documents filed by Citizens with the SEC, may be obtained free of charge at the SEC’s website at www.sec.gov. Documents filed by Citizens with the

SEC, including the registration statement, may also be obtained free of charge from Citizens’ website

http://www.snl.com/IRWebLinkX/corporateprofile.aspx?iid=4091023 by clicking the “SEC Filings” heading, or by directing a request to Citizens’ CEO,

Stephen Bianchi at sbianchi@ccf.us.

The directors, executive officers and certain other members of management and employees of Wells may be deemed to be “participants” in the

solicitation of proxies for stockholder approval. Information regarding the persons who may, under the rules of the SEC, be considered participants in

the solicitation of stockholder approval will be set forth in the proxy statement/prospectus and the other relevant documents to be filed with the SEC.

19