Attached files

| file | filename |

|---|---|

| EX-23.1 - CONSENT - Chee Corp. | consent.htm |

![]()

![]()

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

File №:333-216868

FORM S-1

Amendment 2

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

CHEE CORP.

(Exact name of registrant as specified in its charter)

|

Nevada |

3990 |

32-0509577 | ||

|

(State or Other Jurisdiction of Incorporation or Organization) |

|

(Primary Standard Industrial Classification Number) |

|

(IRS Employer Identification Number) |

|

|

|

|

|

|

Guo Fu Center, No. 18 Qin Ling Road, Laoshan District. Qingdao,

266000, China

Tel: (318) 497-4394

chee.manage@corpchee.com

(Address, including zip code, and telephone number, including area code,

of registrant's principal executive offices)

Business Filings Incorporated

701 S. Carson Street, Suite 200

Carson City, NV 89701

Tel: 800-981-7183

(Address, including zip code, and telephone number, including area code, of agent for service)

|

1 |

Approximate date of proposed sale to the public: As soon as practicable and from time to time after the effective date of this Registration Statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, please check the following box:

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering:

If this Form is a post-effective registration statement filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering:

If this Form is a post-effective registration statement filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering:

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act. (check one):

|

Large accelerated filer |

|

Accelerated filer |

|

|

Non-accelerated filer |

|

Smaller reporting company X |

|

|

|

|

|

|

(Do not check if a smaller reporting company)

|

Calculation of registration fee | ||||||||||||||

|

Title of each class of securities to be registered |

Amount to be registered(1) |

Proposed maximum offering price per share |

Proposed maximum aggregate offering price |

Amount of registration fee | ||||||||||

|

Common Stock $0.001 par value |

4,500,000 |

$ |

0.02(2 |

) |

$ |

90,000 |

$10,43* | |||||||

|

TOTAL |

4,500,000 |

$ |

0.02 |

$ |

90,000 |

$10,43* | ||||||||

(1) In the event of a stock split, stock dividend or similar transaction involving our common stock, the number of shares registered shall automatically be increased to cover the additional shares of common stock issuable pursuant to Rule 416 under the Securities Act of 1933, as amended.

(2) The registration fee for securities to be offered by the Registrant is based on an estimate of the proposed maximum aggregate offering price of the securities, and such estimate is solely for the purpose of calculating the registration fee pursuant to Rule 457(a).

|

2 |

*-The fee was previously paid.

THE REGISTRANT HEREBY AMENDS THIS REGISTRATION STATEMENT ON SUCH DATE OR DATES AS MAY BE NECESSARY TO DELAY ITS EFFECTIVE DATE UNTIL THE REGISTRANT SHALL FILE A FURTHER AMENDMENT WHICH SPECIFICALLY STATES THAT THIS REGISTRATION STATEMENT SHALL THEREAFTER BECOME EFFECTIVE IN ACCORDANCE WITH SECTION 8(A) OF THE SECURITIES ACT OF 1933, OR UNTIL THE REGISTRATION STATEMENT SHALL BECOME EFFECTIVE ON SUCH DATE AS THE COMMISSION, ACTING PURSUANT TO SECTION 8(A), MAY DETERMINE.

The information in this prospectus is not complete and may be amended. The Registrant may not sell these securities until the Registration Statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

|

3 |

PRELIMINARY PROSPECTUS

Chee Corp.

4,500,000 SHARES OF COMMON STOCK

This prospectus relates to the offer and sale of a maximum of 4,500,000 shares (the "Maximum Offering") of common stock, $0.001 par value, by Chee Corp., a Nevada company ("we", "us", "our", "Chee Corp", "Company" or similar terms). There is no minimum for this offering. The offering will commence promptly on the date upon which this prospectus is declared effective by the Securities and Exchange Commission ("SEC") and will continue for 12 months (240 days). We will pay all expenses incurred in this offering. We are an "emerging growth company" under applicable SEC rules and will be subject to reduced public company reporting requirements. We are not a "shell company" within the meaning of Rule 405, promulgated pursuant to Securities Act, because we do have hard assets and real business operations.

The offering of the 4,500,000 shares is a "best efforts" offering, which means that our sole officer and director will use his best efforts to sell the shares and there is no commitment by any person to purchase any shares. The shares will be offered at a fixed price of $0.02 per share for the duration of the offering. There is no minimum number of shares required to be sold to close the offering. Proceeds from the sale of the shares will be used to fund the initial stages of our business development. We have not made any arrangements to place funds received from share subscriptions in an escrow, trust or similar account. Any funds raised from the offering will be immediately available to us for our immediate use.

This is a direct participation offering since we are offering the stock directly to the public without the participation of an underwriter. Our officer and sole director will be solely responsible for selling shares under this offering and no commission will be paid on any sales.

Prior to this offering, there has been no public market for our common stock and we have not applied for the listing or quotation of our common stock on any public market. We have arbitrarily determined the offering price of $0.02 per share in relation to this offering. The offering price bears no relationship to our assets, book value, earnings or any other customary investment criteria. After the effective date of the registration statement, we intend to seek a market maker to file an application with the Financial Industry Regulatory Authority ("FINRA") to have our common stock quoted on the OTC Bulletin Board. We currently have no market maker who is willing to list quotations for our shares of stock. There is no assurance that an active trading market for our shares will develop or will be sustained if developed.

You should rely only on the information contained in this prospectus. We have not authorized anyone to provide you with information different from that contained in this prospectus. The information contained in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or of any sale of our common stock.

|

4 |

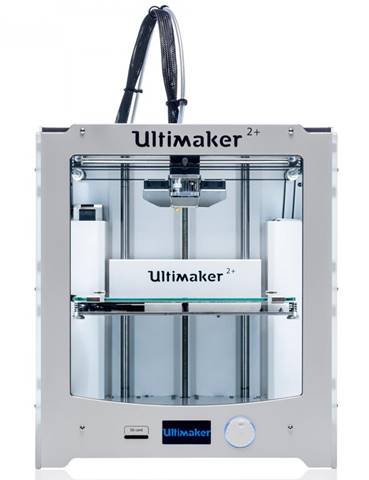

Our business of 3D modeling and 3D print of different types of items and accessories is subject to many risks and an investment in our shares of common stock will also involve a high degree of risk. You should carefully consider the factors described under the heading "Risk Factors" beginning on page 13 before investing in our shares of common stock. Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

Chee Corp. is not a Blank Check company. We have no plans, arrangements, commitments or understandings to engage in a merger with or acquisition of another company.

We are an “emerging growth company” as defined in the Jumpstart Our Business Startups Act (“JOBS Act”).

This prospectus is not an offer to sell these securities and is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

The date of this prospectus is May 8, 2017.

The following table of contents has been designed to help you find information contained in this prospectus. We encourage you to read the entire prospectus.

|

5 |

|

TABLE OF CONTENTS |

|

|

|

Page |

|

Prospectus Summary |

7 |

|

Risk Factors |

13 |

|

Risk Factors Related to Our Company |

13 |

|

Risk Factors Relating to Our Common Stock |

18 |

|

Use of Proceeds |

24 |

|

Determination of Offering Price |

24 |

|

Dilution |

24 |

|

Description of Securities |

26 |

|

Plan of Distribution |

28 |

|

Description of Business |

31 |

|

Legal Proceedings |

37 |

|

Market for Common Equity and Related Stockholder Matters |

38 |

|

Management's Discussion and Analysis of Financial Condition and Results of Operations |

39 |

|

Directors, Executive Officers, Promoters and Control Persons |

44 |

|

Executive Compensation |

47 |

|

Security Ownership of Certain Beneficial Owners and Management |

48 |

|

Certain Relationships and Related Transactions |

49 |

|

Disclosure of Commission Position on Indemnification for Securities Act Liabilities |

49 |

|

Where You Can Find More Information |

49 |

|

Interests of name experts and counsel |

50 |

|

Changes In and Disagreements with Accountants on Accounting and Financial Disclosure |

50 |

|

Financial Statements |

F-1 |

Please read this prospectus carefully. It describes our business, our financial condition and results of operations. We have prepared this prospectus so that you will have the information necessary to make an informed investment decision.

You should rely only on information contained in this prospectus. We have not authorized any other person to provide you with different information. This prospectus is not an offer to sell, nor is it seeking an offer to buy, these securities in any state where the offer or sale is not permitted. The information in this prospectus is complete and accurate as of the date on the front cover, but the information may have changed since that date.

Until ____________, 2017 (240 business days after the effective date of this prospectus) all dealers that effect transactions in these securities whether or not participating in this offering, may be required to deliver a prospectus. This is in addition to the dealer's obligation to deliver a prospectus when acting as underwriters and with respect to their unsold allotments or subscriptions.

|

6 |

A CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus contains forward-looking statements which relate to future events or our future financial performance. In some cases, you can identify forward-looking statements by terminology such as "may", "should", "expects", "plans", "anticipates", "believes", "estimates", "predicts", "potential" or "continue" or the negative of these terms or other comparable terminology. These statements are only predictions and involve known and unknown risks, uncertainties and other factors, including the risks in the section entitled "Risk Factors," that may cause our or our industry's actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by these forward-looking statements.

While these forward-looking statements, and any assumptions upon which they are based, are made in good faith and reflect our current judgment regarding the direction of our business, actual results will almost always vary, sometimes materially, from any estimates, predictions, projections, assumptions or other future performance suggested herein. Except as required by applicable law, including the securities laws of the United States, we do not intend to update any of the forward-looking statements to conform these statements to actual results.

PROSPECTUS SUMMARY

As used in this prospectus, references to the "Company," "we," "our", "us" or "Chee" refer to Chee Corp. unless the context otherwise indicates.

The following summary highlights selected information contained in this prospectus. Before making an investment decision, you should read the entire prospectus carefully, including the "Risk Factors" section, the financial statements, and the notes to the financial statements.

Our Company

Chee Corp. was incorporated on 26 of October 2016 under the laws of the State of Nevada, for the purpose of the 3D modeling and 3D print of different types of items and accessories.

We are a newly created company that has realized no revenues to date with a net loss of $1,893 as of January 31, 2017. To date we have raised $4,500 through the issuance of 4,500,000 shares of common stock to our sole officer and director Jiang Da Wei. Proceeds from the issuance have been used for working capital. Our independent auditor has issued an audit opinion for our Company, which includes a statement expressing substantial doubt as to our ability to continue as a going concern. The Company's registration location is at Shandong Province, Haiyang City, Environmental Protection District 15, 265100, China and rented office space located at Guo Fu Center, No. 18 Qin Ling Road, Laoshan District. Qingdao, 266000, China. Our telephone number is (318) 217-4394.

We are in the early stages of developing our plan to distribute 3D goods and accessories in China in forms including but not limited to products such as design figure, vase, badges, table plates, chess box, prototypes of future models of the goods or any 3D structural details. If our business is initially successful in the China, then we will focus on other markets. We currently have revenues of $1,800, some operating history, and signed sales agreements with our first customer Gaoxie Trading Co., Ltd. Our plan of operations over the 12-month period following successful completion of our offering is to develop and establish our 3D business by establishing our office, developing our website, attempting to enter into more supply agreements with prospective distributors of 3D products and engage in advertising (See "Business of the Company" and "Plan of Operations").

|

7 |

The reasoning of our sole officer and director to take the Company public is based on his subjective belief that potential investors are more inclined to invest in the Company if the Company is subject to the reporting requirements of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), which provides investors with updated material information about the Company and the ability of the Company's investors to resell securities through the facilities of the securities markets, assuming the Company finds a market maker in order to have its shares of common stock quoted on the OTC Bulletin Board or the OTCQX tier of the OTC Markets. Our sole officer and director believes that the disadvantages of becoming a public company are the continuing reporting costs of being a reporting issuer under the Exchange Act and reluctance of persons qualified to serve as directors of the Company because of a director's exposure to possible legal claims.

We cannot provide any assurance that we will be able to raise sufficient funds from this offering to proceed with our twelve month business plan.

From inception until the date of this filing we have had limited operating activities, primarily consisting of the incorporation of our company, the initial equity funding by our officer and sole director, developing our website, have registration location at Shandong Province, Haiyang City, Environmental Protection District 15, 265100, China and renting our office space that is 42 sq. m. with the following address Guo Fu Center, No. 18 Qin Ling Road, Laoshan District in China, development of our business plan, creating the web-site, buying an equipment, entering into a supply contracts with Yueqing Swai Electronic Co.,Ltd. of China. We received our initial funding of $4,500 from our sole officer and director, Jiang Da Wei, who purchased 4,500,000 shares of our common stock for the same $4,500.

Our financial statements from inception from inception on October 26, 2016, through January 31, 2017, report no revenues and net loss of $1,893. Our independent auditor has issued an audit opinion for our Company, which includes a statement expressing substantial doubt as to our ability to continue as a going concern.

As of the date of this prospectus, there is no public trading market for our common stock and no assurance that a trading market for our securities will ever develop.

We are an "emerging growth company" within the meaning of the federal securities laws. For as long as we are an emerging growth company, we will not be required to comply with the requirements that are applicable to other public companies that are not "emerging growth companies" including, but not limited to, not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act, the reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements and the exemptions from the requirements of holding a nonbinding advisory vote on executive compensation and shareholder approval of any golden parachute payments not previously approved. We intend to take advantage of these reporting exemptions until we are no longer an emerging growth company. For a description of the qualifications and other requirements applicable to emerging growth companies and certain elections that we have made due to our status as an emerging growth company, see "RISK FACTORS-RISKS RELATED TO THIS OFFERING AND OUR COMMON STOCK - WE ARE AN 'EMERGING GROWTH COMPANY' AND WE CANNOT BE CERTAIN IF THE REDUCED DISCLOSURE REQUIREMENTS APPLICABLE TO EMERGING GROWTH COMPANIES WILL MAKE OUR COMMON STOCK LESS ATTRACTIVE TO INVESTORS" on page 18 of this prospectus.

|

8 |

We are not a "shell company" within the meaning of Rule 405, promulgated pursuant to Securities Act, because we do have hard assets and real business operations.

This is a direct participation offering since we are offering the stock directly to the public without the participation of an underwriter. Our sole officer and director Jiang Da Wei will be responsible for selling shares under this offering and no commission will be paid on any sales. He will utilize this prospectus to offer the shares to friends, family and business associates.

There has been no market for our securities and a public market may never develop, or, if any market does develop, it may not be sustained. Our common stock is not traded on any exchange or on the over-the-counter market. After the effective date of the registration statement relating to this prospectus, we hope to have a market maker file an application with the Financial Industry Regulatory Authority ("FINRA") for our common stock to be eligible for trading on the Over-the-Counter Bulletin Board. We do not yet have a market maker who has agreed to file such quotation service or that any market for our stock will develop.

You should rely only on the information contained in this prospectus. We have not authorized anyone to provide you with information different from that contained in this prospectus. The information contained in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or of any sale of our common stock.

Under U.S. federal securities legislation, our common stock will be "penny stock". Penny stock is any equity that has a market price of less than $5.00 per share, subject to certain exceptions. For any transaction involving a penny stock, unless exempt, the rules require that a broker or dealer approve a potential investor's account for transactions in penny stocks, and the broker or dealer receive from the investor a written agreement to the transaction, setting forth the identity and quantity of the penny stock to be purchased. In order to approve an investor's account for transactions in penny stocks, the broker or dealer must obtain financial information and investment experience objectives of the person, and make a reasonable determination that the transactions in penny stocks are suitable for that person and the person has sufficient knowledge and experience in financial matters to be capable of evaluating the risks of transactions in penny stocks. The broker or dealer must also deliver, prior to any transaction in a penny stock, a disclosure schedule prepared by the Commission relating to the penny stock market, which, in highlight form sets forth the basis on which the broker or dealer made the suitability determination. Brokers may be less willing to execute transactions in securities subject to the "penny stock" rules. This may make it more difficult for investors to dispose of our common stock and cause a decline in the market value of our stock. Disclosure also has to be made about the risks of investing in penny stocks in both public offerings and in secondary trading and about the commissions payable to both the broker-dealer and the registered representative, current quotations for the securities and the rights and remedies available to an investor in cases of fraud in penny stock transactions. Finally, monthly statements have to be sent disclosing recent price information for the penny stock held in the account and information on the limited market in penny stocks.

|

9 |

|

THE OFFERING |

|

|

The Issuer |

Chee Corp. |

|

Securities offered: |

4,500,000 shares of our common stock, par value $0.001 per share. |

|

Offering price: |

$0.02 |

|

Duration of offering: |

The 4,500,000 shares of common stock are being offered for a period of 12 months (240 days). |

|

Gross Proceeds from selling 25% of shares |

$22,500 |

|

Gross Proceeds from selling 50% of shares |

$45,000 |

|

Gross Proceeds from selling 75% of shares |

$67,500 |

|

Gross Proceeds from selling 100% of shares |

$90,000 |

|

Net proceeds to us: |

$90,000, assuming the maximum number of shares sold. For further information on the Use of Proceeds, see page 23. |

|

Market of the common stock: |

There is no public market for our shares. Our common stock is not traded on any stock: exchange or on the over-the-counter market. After the effective date of the registration statement relating to this prospectus, we hope to have a market maker file an application with the Financial Industry Regulatory Authority ("FINRA") for our common stock to eligible for trading on the Over The Counter Bulletin Board. We do not yet have a market maker who has agreed to file such application. There is no assurance that a trading market will develop, or, if developed, that it will be sustained. Consequently, a purchaser of our common stock may find it difficult to resell the securities offered herein should the purchaser desire to do so when eligible for public resale. |

|

Shares outstanding prior to offering: |

4,500,000 |

|

|

|

|

Shares outstanding after offering: |

$9,000,000 (assuming all the shares are sold) |

|

Risk Factors: |

The common stock offered hereby involves a high degree of risk and should not be purchased by investors who cannot afford the loss of their entire investment. See "Risk Factors" beginning on page 13. |

|

10 |

SUMMARY FINANCIAL INFORMATION

The tables and information below are derived from our audited financial statements for the period from October 26, 2016 to January 31, 2017. Our working capital as at January 31, 2017, was $500.

|

|

January 31,2017 ($) (Audited) |

||

|

Financial Summary |

|

||

|

Cash |

5,947 |

||

|

Total Assets |

10,207 |

||

|

Total Liabilities |

7,600 |

||

|

Total Stockholder`s Equity |

2,607 |

|

|

Accumulated From October 26,2016 to January 31,2017 ($) (Audited) |

||

|

Statement of Operations |

|

||

|

Total Expenses |

1,893 |

||

|

Net Loss for the Period |

(1,893 |

) | |

|

Net Loss per Share |

(0.00 |

) |

|

11 |

Emerging Growth Company

We are an Emerging Growth Company as defined in the Jumpstart Our Business Startups Act.

We shall continue to be deemed an emerging growth company until the earliest of:

a. the last day of the fiscal year of the issuer during which it had total annual gross revenues of $1,000,000,000 (as such amount is indexed for inflation every 5 years by the Commission to reflect the change in the Consumer Price Index for All Urban Consumers published by the Bureau of Labor Statistics, setting the threshold to the nearest 1,000,000) or more;

b. the last day of the fiscal year of the issuer following the fifth anniversary of the date of the first sale of common equity securities of the issuer pursuant to an effective registration statement under this title;

c. the date on which such issuer has, during the previous 3-year period, issued more than $1,000,000,000 in non-convertible debt; or

d. the date on which such issuer is deemed to be a `large accelerated filer', as defined in section 240.12b-2 of title 17, Code of Federal Regulations, or any successor thereto.

As an emerging growth company we are exempt from Section 404(b) of Sarbanes Oxley. Section 404(a) requires Issuers to publish information in their annual reports concerning the scope and adequacy of the internal control structure and procedures for financial reporting. This statement shall also assess the effectiveness of such internal controls and procedures.

Section 404(b) requires that the registered accounting firm shall, in the same report, attest to and report on the assessment on the effectiveness of the internal control structure and procedures for financial reporting.

As an emerging growth company we are exempt from Section 14A and B of the Securities Exchange Act of 1934 which require the shareholder approval of executive compensation and golden parachutes.

We have irrevocably opted out of the extended transition period for complying with new or revised accounting standards pursuant to Section 107(b) of the Act.

Smaller Reporting Company

Implications of being an emerging growth company - the JOBS Act

We qualify as an emerging growth company as that term is used in the JOBS Act. An emerging growth company may take advantage of specified reduced reporting and other burdens that are otherwise applicable generally to public companies. These provisions include:

|

12 |

· A requirement to have only two years of audited financial statements and only two years of related MD&A;

· Exemption from the auditor attestation requirement in the assessment of the emerging growth company's internal control over financial reporting under Section 404 of the Sarbanes-Oxley Act of 2002;

· Reduced disclosure about the emerging growth company's executive compensation arrangements; and

· No non-binding advisory votes on executive compensation or golden parachute arrangements.

We may take advantage of the reduced reporting requirements applicable to smaller reporting companies even if we no longer qualify as an "emerging growth company."

In addition, Section 107 of the JOBS Act also provides that an emerging growth company can take advantage of the extended transition period provided in Section 7(a)(2)(B) of the Securities Act of 1933, as amended (the "Securities Act") for complying with new or revised accounting standards. We have irrevocably opted out of the extended transition period for complying with new or revised accounting standards pursuant to Section 107(b) of the Act.

We could remain an emerging growth company for up to five years, or until the earliest of (i) the last day of the first fiscal year in which our annual gross revenues exceed $1 billion, (ii) the date that we become a "large accelerated filer" as defined in Rule 12b-2 under the Exchange Act, which would occur if the market value of our common stock that is held by non-affiliates exceeds $700 million as of the last business day of our most recently completed second fiscal quarter, or (iii) the date on which we have issued more than $1 billion in non-convertible debt during the preceding three year period.

RISK FACTORS

An investment in our common stock involves a number of significant risks. You should carefully consider the following known material risks and uncertainties in addition to other information in this prospectus in evaluating our company and its business before purchasing shares of our company's common stock. You could lose all or part of your investment due to any of these risks.

RISKS RELATING TO OUR COMPANY

Because we are small and do not have much capital, our marketing campaign may not be enough to attract sufficient number of customers to operate profitably. If we do not make a profit, our operation will be harmed.

Due to the fact we are small and do not have much capital, we must limit our marketing activities and may not be able to make our services known to potential customers. Because we will be limiting our marketing activities, we may not be able to attract enough customers to operate profitably. If we cannot operate profitably and our operation will be harmed.

|

13 |

We have a limited history of operations and accordingly there is no track record that would provide a basis for assessing our ability to conduct successful commercial activities. We may not be successful in carrying out our business objectives.

We were incorporated on October 26, 2016 and to date, have been involved primarily in organizational activities, have registration location at Shandong Province, Haiyang City, Environmental Protection District 15, 265100, China and rented our office space that is 42 sq. m. with the following address Guo Fu Center, No. 18 Qin Ling Road, Laoshan District in China, developed our business plan, created our web-site (www.corpchee.com), bought an equipment, entered into a supply contracts with Yueqing Swai Electronic Co., Ltd. of China. Accordingly, we have limited track record of successful business activities, strategic decision making by management, fund-raising ability, and other factors that would allow an investor to assess the likelihood that we will be successful as a start-up company which produce 3D products. There is a substantial risk that we will not be successful in our activities, or if initially successful, in thereafter generating any operating revenues or in achieving profitable operations.

The sole officer and director of the Company Jiang Da Wei, currently devotes approximately from 10 to 20 hours per week to Company matters. He does not have any public company experience and is involved in other business activities. The Company's needs could exceed the amount of time or level of experience he may have. This could result in his inability to properly manage Company affairs, resulting in our remaining a start-up company with no revenues or profits.

Our sole officer and director is not required to work exclusively for us and does not devote all of his time to our operations. Therefore, it is possible that a conflict of interest with regard to his time may arise based on his employment by other companies. His other activities may prevent them from devoting full-time to our operations which could slow our operations and may reduce our financial results because of the slowdown in operations. It is expected that Jiang Da Wei, our President, will devote between 10 and 20 hours per week to our operations of 3D modeling and 3D print of different types of items and accessories on an ongoing basis, and when required will devote whole days and even multiple days at a stretch if our operations increase. We do not have any written procedures in place to address conflicts of interest that may arise between our business and the business activities of our sole officer and director Jiang Da Wei.

In addition, our sole officer and director Jiang Da Wei lack public company experience, which could impair our ability to comply with legal and regulatory requirements such as those imposed by Sarbanes-Oxley Act of 2002. Our sole officer and director Mr. Jiang has never been responsible for managing a publicly traded company. Such responsibilities include complying with federal securities laws and making required disclosures on a timely basis. Any such deficiencies, weaknesses or lack of compliance could have a materially adverse effect on our ability to comply with the reporting requirements of the Securities Exchange Act of 1934 which is necessary to maintain our public company status. If we were to fail to fulfill those obligations, our ability to continue as a U.S. public company would be in jeopardy in which event you could lose your entire investment in our company.

|

14 |

Current management's lack of experience in and with the sale of 3D products means that it is difficult to assess, or make judgments about, our potential success.

Our sole officer and director Jiang Da Wei has no prior experience with or ever been employed in a job involving the marketing and produce of 3D print products. Additionally, our sole officer and director Mr. Jiang does not have a college or university degrees, or other educational background in a field related to operating a business, which produce 3D print products. With no direct training in the Internet wholesale business, our sole officer and director may not be fully aware of many of the specific requirements related to operating a website for the sale of 3D products through the Internet. Consequently, our operations, earnings, and ultimate financial success could suffer irreparable harm due to our officer and sole director's future possible mistakes, lack of sophistication, judgment or experience in this industry.

Price competition could negatively affect our gross margins.

Price competition could negatively affect our operating results. To respond to competitive pricing pressures, we will have to offer our products at lower prices in order to retain or gain market share and customers. If our competitors offer discounts on products in the future, we will need to lower prices to match the competition, which could adversely affect our gross margins and operating results.

We depend to a significant extent on certain key personnel, the loss of any of whom may materially and adversely affect our company.

We depend entirely on Jiang Da Wei, our sole officer and director, for all of our operations. The loss of Mr. Jiang would have a substantial negative effect on our company and may cause our business to fail. Mr. Jiang has not been compensated for his services since our incorporation, and it is highly unlikely that he will receive any compensation unless and until we generate revenues. There is intense competition for skilled personnel and there can be no assurance that we will be able to attract and retain qualified personnel on acceptable terms. The loss of Mr. Jiang' services could prevent us from completing the development of our plan of operation and our business. In the event of the loss of services of such personnel, no assurance can be given that we will be able to obtain the services of adequate replacement personnel.

We do not have any employment agreements or maintain key person life insurance policies on sole officer and director. We do not anticipate entering into employment agreements with them or acquiring key man insurance in the foreseeable future.

Since all of our shares of common stock are owned by our sole officer and director Jiang Da Wei, our other stockholders may not be able to influence control of the company or decision making by management of the Сompany, and as such, sole officer and director may have a conflict of interest with the minority shareholders at some time in the future.

Our sole officer and director Jiang Da Wei beneficially owns 100% of our outstanding common stock. The interests of our may not be, at all times, the same as that of our other shareholders. Our officer and director is not simply a passive investor but is also the sole executive officer of the Company, and as such his interests may, at times, be adverse to those of passive investors. Where those conflicts exist, our shareholders will be dependent upon our director Mr. Jiang exercising, in a manner fair to all of our shareholders, his fiduciary duties as officer or as member of the Company's board of directors. Also, our sole officer and director Mr. Jiang will have the ability to control the outcome of most corporate actions requiring shareholder approval, including the sale of all or substantially all of our assets and amendments to our Articles of Incorporation. This concentration of ownership may also have the effect of delaying, deferring or preventing a change of control of us, which may be disadvantageous to minority shareholders.

|

15 |

Deterioration in general macro-economic conditions, including unemployment, inflation or deflation, consumer debt levels, high fuel and energy costs, uncertain credit markets or other recessionary type conditions could have a negative impact on our business, financial condition, results of operations and cash flows.

Deterioration in general macro-economic conditions would impact us through (i) potential adverse effects from deteriorating and uncertain credit markets (ii) the negative impact on our suppliers and customers and (iii) an increase in operating costs from higher energy prices.

Impact of Credit Market Uncertainty

Significant deterioration in the financial condition of large financial institutions in recent years resulted in a severe loss of liquidity and available credit in global credit markets and in more stringent borrowing terms. Accordingly, we may be limited in our ability to borrow funds to finance our operations. An inability to obtain sufficient financing at cost-effective rates could have a materially adverse effect on our planned business operations and financial condition.

Impact on our Supplier

Our business of 3D printing depends on maintaining a favorable relationship with our supplier and on our supplier's ability and/or willingness to supply 3D materials for us at favorable prices and terms. Many factors outside of our control may harm this relationship and the ability or willingness of our supplier to supply us the products for 3D manufacture on favorable terms. One such factor is a general decline in the economy and economic conditions and prolonged recessionary conditions. These events could negatively affect our supplier's operations and make it difficult for it to obtain the credit lines or loans necessary to finance their operations in the short-term or long-term and meet our product requirements. Financial or operational difficulties that our supplier may face could also increase the cost of the products we purchase from the supplier or our ability to source products from them. We could also be negatively impacted if our supplier experience bankruptcy, work stoppages, labor strikes or other interruptions to or difficulties in the manufacture or supply of the products we purchase from him.

|

16 |

Impact on our Customers

Deterioration in macro-economic conditions may have a negative impact on our customers' financial resources and disposable income. This impact could reduce their willingness or ability to pay for non-essential 3D accessories which results in lower service demand for us.

Our business is currently reliant on one supplier Yueqing Swai Electronic Co., Ltd. If our supplier does not meet our requirements, our ability to supply products to our customers will be materially impaired.

We currently rely on one supplier Yueqing Swai Electronic Co., Ltd with whom we signed the Purchase Agreement on 23rd of December, 2016 and from which we received 3D products to start our business. The Yueqing Swai Electronic Co., Ltd should sell, transfer and deliver the Goods to Chee Corp. The payment should be in USD currency. We have the right to pay owned amount to Yueqing Swai Electronic Co., Ltd in parts. The Goods should be deemed received by Chee Corp. (with registration location at Shandong Province, Haiyang City, Environmental Protection District 15, 265100, China) when delivered to our Company current rented office space at Guo Fu Center, No. 18 Qin Ling Road, Laoshan District. Qingdao, 266000, China.

Until we are able to contract with other suppliers, our business will be entirely dependent upon the relationships with this one supplier. There can be no assurance that we will be able to sustain a relationship with our supplier or that our supplier will be able to meet our needs in a satisfactory and timely manner, or that we can obtain substitute or additional suppliers, when and if needed. Our reliance on a limited number of suppliers involves a number of additional risks, including the absence of guaranteed capacity and reduced control over the distribution process, quality assurance, delivery schedules, production yields and costs, and early termination of, or failure to renew, contractual arrangements. A significant price increase, an interruption in supply from our supplier, or the inability to obtain additional suppliers, when and if needed, could have a material adverse effect on our business, results of operations and financial condition.

If Jiang Da Wei, our current sole officer and director, should resign or die, we will not have a chief executive officer, which could result in the cessation of our operation. If that should happen, you could lose your investment.

We extremely depend on the services of our sole officer and director, Jiang Da Wei, for the future success of our business. The loss of the services of Jiang Da Wei could have an adverse effect on our business performance and financial standing. If he should resign or die, we will not have a chief executive officer. If that should occur, until we find another person to act as our chief executive officer, our operations could be suspended. In that case it is possible you could lose your entire investment.

We may not be able to compete effectively against our competitors.

We expect to face strong competition from well-established companies and small independent companies like our self that may result in price reductions and decreased demand for 3D print products being sold through our website. We will be at a competitive disadvantage in obtaining the facilities, employees, financing and other resources fulfill the demands by prospective customers. Our opportunity to obtain customers may be limited by our financial resources and other assets. We expect to be less able than our larger competitors to cope with generally increasing costs and expenses of doing business.

|

17 |

Because our principal assets are located outside of the United States and Jiang Da Wei, our sole director and officer, resides outside of the United States, it may be difficult for an investor to enforce any right based on U.S. federal securities laws against us and/or Jiang, or to enforce a judgment rendered by a United States court against us or Mr. Jiang.

Our principal operations and assets are located outside of the United States, and Jiang Da Wei, our sole officer and director is a non-resident of the United States. Therefore, it may be difficult to effect service of process on Mr. Jiang in the United States, and it may be difficult to enforce any judgment rendered against Mr. Jiang. Accordingly, it may be difficult or impossible for an investor to bring an action against Jiang Da Wei, in the case that an investor believes that such investor’s rights have been infringed under the U.S. securities laws, or otherwise. Even if an investor is successful in bringing an action of this kind, the laws of China may render that investor as unable to enforce a judgment against the assets of Mr. Jiang. As a result, our shareholders may have more difficulties in protecting their interests through actions against our management, director or major shareholder, compared to shareholders of a corporation doing business and whose officers and directors reside within the United States.

Further, since our assets are located outside the United States, they will be outside of the jurisdiction of United States courts to administer, if we become subject of an insolvency or bankruptcy proceeding. Accordingly, if we declare bankruptcy or insolvency, our shareholders may not receive the distributions on liquidation that they would otherwise be entitled to if our assets were to be located within the United States under United States bankruptcy laws.

RISKS RELATING TO OUR COMMON STOCK

The Offering Price of our Shares is arbitrary.

The offering price of our shares has been determined arbitrarily by the Company and bears no relationship to the Company's assets, book value, potential earnings or any other recognized criteria of value.

The trading in our shares will be regulated by Securities and Exchange Commission Rule 15g-9 which established the definition of a "penny stock." The effective result is that fewer purchasers are qualified by their brokers to purchase our shares, and therefore a less liquid market for our investors to sell their shares.

The shares being offered are defined as a penny stock under the Securities and Exchange Act of 1934, and rules of the Commission. The Exchange Act and such penny stock rules generally impose additional sales practice and disclosure requirements on broker-dealers who sell our securities to persons other than certain accredited investors who are, generally, institutions with assets in excess of $5,000,000 or individuals with net worth in excess of $1,000,000 or annual income exceeding $200,000, or $300,000 jointly with spouse, or in transactions not recommended by the broker-dealer. For transactions covered by the penny stock rules, a broker-dealer must make a suitability determination for each purchaser and receive the purchaser's written agreement prior to the sale. In addition, the broker-dealer must make certain mandated disclosures in penny stock transactions, including the actual sale or purchase price and actual bid and offer quotations, the compensation to be received by the broker-dealer and certain associated persons, and deliver certain disclosures required by the Commission. Consequently, the penny stock rules may make it difficult or impossible for you to resell any shares you may purchase.

|

18 |

Because there is no minimum proceeds the Company can receive from its offering of 4,500,000 shares, Chee Corp. may not raise sufficient capital to implement its planned business and your entire investment could be lost

The Company is making its offering of 4,500,000 shares of common stock on a best-efforts basis and there is no minimum amount of proceeds the Company may receive. Funds raised under this offering will not be held in trust or in any escrow account and all funds raised regardless of the amount will be available to the Company. In the event the company does not raise sufficient capital to implement its planned operations, your entire investment could be lost.

We are selling this offering without an underwriter and may be unable to sell any shares. Unless we are successful in selling a number of the shares, we may have to seek alternative financing to implement our operations and you may suffer a dilution to, or lose, your entire investment.

This offering is self-underwritten, that is, we are not going to engage the services of an underwriter to sell the shares; we intend to sell them through our sole officer and director Jiang Da Wei, who will receive no commissions. Mr. Jiang will offer the shares to friends, relatives, acquaintances and business associates. However, there is no guarantee that he will be able to sell any of the shares.

There is no guarantee all of the funds raised in the offering will be used as outlined in this prospectus.

We have committed to use the proceeds raised in this offering for the uses set forth in the “Use of Proceeds” section. However, certain factors beyond our control, such as increases in certain costs, could result in the Company being forced to reduce the proceeds allocated for other uses in order to accommodate these unforeseen changes. The failure of our management to use these funds effectively could result in unfavorable returns. This could have a significant adverse effect on our financial condition and could cause the price of our common stock to decline.

Due to the lack of a trading market for our securities, you may have difficulty selling any shares you purchase in this offering.

There is presently no demand for our common stock and no public market exists for the shares being offered in this prospectus. We plan to contact a market maker immediately following the effectiveness of this Registration Statement to file an application to have our shares quoted on the OTC Electronic Bulletin Board (OTCQB). The OTCQB is a regulated quotation service that displays real-time quotes, last sale prices and volume information in over-the-counter (OTC) securities. The OTCQB is not an issuer listing service, market or exchange. Although the OTCQB does not have any listing requirements per se, to be eligible for quotation on the OTCQB, issuers must remain current in their filings with the SEC or applicable regulatory authority. Market Makers are not permitted to begin quotation of a security whose issuer does not meet this filing requirement. Securities already quoted on the OTCQB that become delinquent in their required filings will be removed following a 30 or 60 day grace period if they do not make their required filing during that time. We cannot guarantee that our application will be accepted or approved or that our stock will be quoted for sale. As of the date of this filing, there have been no discussions or understandings between the Company nor anyone acting on our behalf with any market maker regarding participation in a future trading market for our securities. If no market is ever developed for our common stock, it will be difficult for you to sell any shares you purchase in this offering. In such case, you may find that you are unable to achieve any benefit from your investment or liquidate your shares without considerable delay, if at all. In addition, if we fail to have our common stock quoted on a public trading market, your common stock will not have a quantifiable value and it may be difficult, if not impossible, to ever resell your shares, resulting in an inability to realize any value from your investment.

|

19 |

You will incur immediate and substantial dilution of the price you pay for your shares.

Our existing stockholder acquired his shares at a cost of $0.001 per share, a cost per share substantially less than that which you will pay for the shares you purchase in this offering. Accordingly, any investment you make in these shares will result in the immediate and substantial dilution of the net tangible book value of those shares from the $0.02 you pay for them.

There is no guarantee all of the funds raised in the offering will be used as outlined in this prospectus.

We have committed to use the proceeds raised in this offering for the uses set forth in the "Use of Proceeds" section. However, certain factors beyond our control, such as increases in certain costs, could result in the Company being forced to reduce the proceeds allocated for other uses in order to accommodate these unforeseen changes. The failure of our management to use these funds effectively could result in unfavorable returns. This could have a significant adverse effect on our financial condition and could cause the price of our common stock to decline.

Our director Jiang Da Wei will continue to exercise significant control over our operations, which means as a minority stockholder, you would have no control over certain matters requiring stockholder approval that could affect your ability to ever resell any shares you purchase in this offering.

After the completion of this offering, if we are able to sell all of the shares being offered, our executive officer and director Mr. Jiang will own 50% of our common stock. He will have a significant influence in determining the outcome of all corporate transactions, including the election of directors, approval of significant corporate transactions, changes in control of Chee Corp. or other matters that could affect your ability to ever resell your shares. Mr. Jiang interests may differ from the interests of the other stockholders and thus result in corporate decisions that are disadvantageous to other stockholders.

|

20 |

The Company has a lack of dividend payments.

The Company Chee Corp. has paid no dividends in the past and has no plans to pay any dividends in the foreseeable future.

We may, in the future, issue additional common stock, which would reduce investors' percent of ownership and may dilute our share value.

Our Articles of Incorporation authorize the issuance of 75,000,000 shares of common stock. As of the date of this prospectus, the Company had 4,500,000 shares of common stock outstanding. Accordingly, we may issue up to an additional 70,500,000 shares of common stock. The future issuance of common stock may result in substantial dilution in the percentage of our common stock held by our then existing shareholders. We may value any common stock in the future on an arbitrary basis. The issuance of common stock for future services or acquisitions or other corporate actions may have the effect of diluting the value of the shares held by our investors, and might have an adverse effect on any trading market for our common stock.

We intend to become subject to the periodic reporting requirements of the Securities Exchange Act of 1934, as amended, which will require us to incur audit fees and legal fees in connection with the preparation of such reports. These additional costs will negatively affect our ability to earn a profit.

Following the effective date of the registration statement in which this prospectus is included, we will be required to file periodic reports with the Securities and Exchange Commission pursuant to the Securities Exchange Act of 1934 and the rules and regulations thereunder. In order to comply with such requirements, our independent registered auditors will have to review our financial statements on a quarterly basis and audit our financial statements on an annual basis. Moreover, our legal counsel will have to review and assist in the preparation of such reports. Although we believe that the approximately $45,000 we have estimated for these costs should be sufficient for the 12 month period following the completion of our offering, the costs charged by these professionals for such services may vary significantly. Factors such as the number and type of transactions that we engage in and the complexity of our reports cannot accurately be determined at this time and may have a major negative affect on the cost and amount of time to be spent by our auditors and attorneys. However, the incurrence of such costs will obviously be an expense to our operations and thus have a negative effect on our ability to meet our overhead requirements and earn a profit.

However, for as long as we remain an "emerging growth company" as defined in the Jumpstart Our Business Startups Act of 2012, we intend to take advantage of certain exemptions from various reporting requirements that are applicable to other public companies that are not "emerging growth companies" including, but not limited to, not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act, reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements, and exemptions from the requirements of holding a nonbinding advisory vote on executive compensation and shareholder approval of any golden parachute payments not previously approved. We intend to take advantage of these reporting exemptions until we are no longer an "emerging growth company." We will remain an "emerging growth company" for up to five years, or until the earliest of (i) the last day of the first fiscal year in which our annual gross revenues exceed $1 billion, (ii) the date that you become a "large accelerated filer" as defined in Rule 12b-2 under the Exchange Act, which would occur if the market value of our common stock that is held by non-affiliates exceeds $700 million as of the last business day of our most recently completed second fiscal quarter, or (iii) the date on which we have issued more than $1 billion in non-convertible debt during the preceding three year period.

|

21 |

After, and if ever, we are no longer an "emerging growth company," we expect to incur significant additional expenses and devote substantial management effort toward ensuring compliance with those requirements applicable to companies that are not "emerging growth companies," including Section 404 of the Sarbanes-Oxley Act.

We are not a "shell company" within the meaning of Rule 405, promulgated pursuant to Securities Act, because we do have hard assets and real business operations.

We are an "emerging growth company" and we cannot be certain if the reduced disclosure requirements applicable to emerging growth companies will make our common stock less attractive to investors.

We are an "emerging growth company," as defined in the Jumpstart our Business Startups Act of 2012, and we may take advantage of certain exemptions from various reporting requirements that are applicable to other public companies, including, but not limited to, not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act, reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements, and exemptions from the requirements of holding a nonbinding advisory vote on executive compensation and shareholder approval of any golden parachute payments not previously approved. We cannot predict if investors will find our common stock less attractive because we will rely on these exemptions. If some investors find our common stock less attractive as a result, there may be a less active trading market for our common stock and our stock price may be more volatile.

Under the Jumpstart Our Business Startups Act, "emerging growth companies" can delay adopting new or revised accounting standards until such time as those standards apply to private companies. We have irrevocably elected not to avail ourselves to this exemption from new or revised accounting standards and, therefore, we will be subject to the same new or revised accounting standards as other public companies that are not "emerging growth companies."

We are not a "shell company" within the meaning of Rule 405, promulgated pursuant to Securities Act, because we do have hard assets and real business operations.

Anti-takeover effects of certain provisions of Nevada state law hinder a potential takeover of our company.

Though not now, in the future we may become subject to Nevada's control share law. A corporation is subject to Nevada's control share law if it has more than 200 stockholders, at least 100 of whom are stockholders of record and residents of Nevada, and it does business in Nevada or through an affiliated corporation. The law focuses on the acquisition of a "controlling interest" which means the ownership of outstanding voting shares sufficient, but for the control share law, to enable the acquiring person to exercise the following proportions of the voting power of the corporation in the election of directors:

|

22 |

(i) one-fifth or more but less than one-third, (ii) one-third or more but less than a majority, or (iii) a majority or more. The ability to exercise such voting power may be direct or indirect, as well as individual or in association with others.

The effect of the control share law is that the acquiring person, and those acting in association with it, obtains only such voting rights in the control shares as are conferred by a resolution of the stockholders of the corporation, approved at a special or annual meeting of stockholders. The control share law contemplates that voting rights will be considered only once by the other stockholders. Thus, there is no authority to strip voting rights from the control shares of an acquiring person once those rights have been approved. If the stockholders do not grant voting rights to the control shares acquired by an acquiring person, those shares do not become permanent non-voting shares. The acquiring person is free to sell its shares to others. If the buyers of those shares themselves do not acquire a controlling interest, their shares do not become governed by the control share law.

If control shares are accorded full voting rights and the acquiring person has acquired control shares with a majority or more of the voting power, any stockholder of record, other than an acquiring person, who has not voted in favor of approval of voting rights is entitled to demand fair value for such stockholder's shares.

Nevada's control share law may have the effect of discouraging takeovers of the corporation.

In addition to the control share law, Nevada has a business combination law which prohibits certain business combinations between Nevada corporations and "interested stockholders" for three years after the "interested stockholder" first becomes an "interested stockholder," unless the corporation's board of directors approves the combination in advance. For purposes of Nevada law, an "interested stockholder" is any person who is (i) the beneficial owner, directly or indirectly, of ten percent or more of the voting power of the outstanding voting shares of the corporation, or (ii) an affiliate or associate of the corporation and at any time within the three previous years was the beneficial owner, directly or indirectly, of ten percent or more of the voting power of the then outstanding shares of the corporation. The definition of the term "business combination" is sufficiently broad to cover virtually any kind of transaction that would allow a potential acquiror to use the corporation's assets to finance the acquisition or otherwise to benefit its own interests except the interests of the corporation and its other stockholders.

The effect of Nevada's business combination law is to potentially discourage parties interested in taking control of our company from doing so if it cannot obtain the approval of our board of directors.

|

23 |

USE OF PROCEEDS

Chee Corp. public offering of 4,500,000 shares is being made on a self-underwritten basis: no minimum number of shares must be sold in order for the offering to proceed. The offering price per share is $0.02. The following table sets forth the uses of proceeds assuming the sale of 25%, 50%, 75% and 100%, respectively, of the securities offered for sale by the Company. There is no assurance that we will raise the full $90,000 as anticipated.

|

|

25%of shares sold |

50%of shares sold |

75%of shares sold |

100%of shares sold |

|||||||||||

|

Gross Proceeds from this Offering(1): |

$ |

22,500 |

$ |

45,000 |

$ |

67,500 |

$ |

90,000 |

|||||||

|

Legal and Accounting fees |

$ |

8,000 |

$ |

8,000 |

$ |

8,000 |

$ |

8,000 |

|||||||

|

SEC reporting and compliance |

$ |

8,000 |

$ |

8,000 |

$ |

8,000 |

$ |

8,000 |

|||||||

|

Net proceeds |

$ |

6,500 |

$ |

29,000 |

$ |

51,500 |

$ |

74,000 |

|||||||

|

Net proceeds will be used as follows | |||||||||||||||

|

Website development |

- |

$ |

800 |

$ |

1,600 |

$ |

2,500 |

||||||||

|

Additional 3D printing equipment and additional 3D parts and suppliers |

$ |

4,000 |

$ |

18,000 |

$ |

32,000 |

$ |

37,000 |

|||||||

|

Marketing and Advertising(2) |

$ |

1,000 |

$ |

3,000 |

$ |

5,200 |

$ |

6,800 |

|||||||

|

Lease expenses |

- |

$ |

1,200 |

$ |

3,000 |

$ |

6,200 |

||||||||

|

Establishing an office |

- |

$ |

1,000 |

$ |

2,200 |

$ |

6,000 |

||||||||

|

Miscellaneous expenses |

$ |

1,500 |

$ |

3,000 |

$ |

4,500 |

$ |

8,000 |

|||||||

|

Salaries |

- |

$ |

2,000 |

$ |

3,000 |

$ |

7,500 |

||||||||

|

TOTALS |

$ |

22,500 |

$ |

45,000 |

$ |

67,500 |

$ |

90,000 |

|||||||

(1) Expenditures for the 12 months following the completion of this offering. The expenditures are categorized by significant area of activity.

(2) Includes travel costs to trade shows and exhibits.

Please see a detailed description of the use of proceeds in the "Plan of Operation" section of this prospectus.

DETERMINATION OF THE OFFERING PRICE

The offering price of the 4,500,000 shares being offered has been determined arbitrarily by us. The price does not bear any relationship to our assets, book value, earnings, or other established criteria for valuing a privately held company. In determining the number of shares to be offered and the offering price, we took into consideration our cash on hand and the amount of money we would need to implement our business plan. Accordingly, the offering price should not be considered an indication of the actual value of the securities.

DILUTION

The price of our offering of 4,500,000 shares is fixed at $0.02 per share. This price is significantly higher than the $0.001 price per share paid by Jiang Da Wei, or President and a Director, for the 4,500,000 shares of common stock he purchased on October 26, 2016.

|

24 |

Dilution represents the difference between the offering price and the net tangible book value per share immediately after completion of this offering. Net tangible book value is the amount that results from subtracting total liabilities and intangible assets from total assets. Dilution arises mainly as a result of our arbitrary determination of the offering price of the shares being offered. Dilution of the value of the shares you purchase is also a result of the lower book value of the shares held by our existing stockholders. The following tables compare the differences of your investment in our shares with the investment of our existing stockholders.

As of January 31, 2017 the net tangible book value of our shares of common stock was $2,607 or $0.001 per share based upon 4,500,000 shares outstanding.

Existing Stockholders if all of the Shares are Sold

|

Price per share |

$ |

0.001 |

|

|

Net tangible book value per share before offering |

$ |

0.001 |

|

|

Potential gain to existing shareholders |

$ |

90,000 |

|

|

Net tangible book value per share after offering |

$ |

0.0085 |

|

|

Increase to present stockholders in net tangible book value per share after offering |

$ |

0.0075 |

|

|

Capital contributions |

$ |

4,500 |

|

|

Number of shares outstanding before the offering |

4,500,000 |

||

|

Number of shares after offering held by existing stockholders |

4,500,000 |

||

|

Percentage of ownership after offering |

50 |

% |

Purchasers of Shares in this Offering if all Shares Sold

|

Price per share |

$ |

0.02 |

|

|

Dilution per share |

$ |

0.0115 |

|

|

Capital contributions |

$ |

90,000 |

|

|

Percentage of capital contributions |

95 |

% | |

|

Number of shares after offering held by public investors |

4,500,000 |

||

|

Percentage of ownership after offering |

50 |

% |

The computation of the dollar amount of dilution per share in this scenario is based upon the Gross Proceeds from this Offering of $90,000 less offering costs of $16,000 plus the net tangible book value of our shares of common stock of $2,607 and resulting in a net tangible book value of $76,607 or $0.0085 per share, resulting in a dilution of $0.0115 for new shareholders.

|

Purchasers of Shares in this Offering if 75% of Shares Sold |

|

|

|

Price per share |

$0,02 |

||

|

Dilution per share |

$ |

0.0131 |

|

|

Capital contributions |

$ |

67,500 |

|

|

Percentage of capital contributions |

94 |

% | |

|

Number of shares after offering held by public investors |

3,375,000 |

||

|

Percentage of ownership after offering |

99.9 |

% |

|

25 |

The computation of the dollar amount of dilution per share in this scenario is based upon the Gross Proceeds from this Offering of $67,500 less offering costs of $16,000 plus the net tangible book value of our shares of common stock of $2,607 and resulting in a net tangible book value of $54,107 or $0.0069 per share, resulting in a dilution of $0.0131 for new shareholders.

|

Purchasers of Shares in this Offering if 50% of Shares Sold |

|

|

|

Price per share |

$0,02 |

||

|

Dilution per share |

$ |

0.0153 |

|

|

Capital contributions |

$ |

45,000 |

|

|

Percentage of capital contributions |

91 |

% | |

|

Number of shares after offering held by public investors |

2,250,000 |

||

|

Percentage of ownership after offering |

33.3 |

% |

The computation of the dollar amount of dilution per share in this scenario is based upon the Gross Proceeds from this Offering of $45,000 less offering costs of $16,000 plus the net tangible book value of our shares of common stock of $2,607 and resulting in a net tangible book value of $31,607 or $0.0047 per share, resulting in a dilution of $0.0153 for new shareholders.

|

Purchasers of Shares in this Offering if 25% of Shares Sold |

|

|

|

Price per share |

$0,02 |

||

|

Dilution per share |

$ |

0.0184 |

|

|

Capital contributions |

$ |

22,500 |

|

|

Percentage of capital contributions |

83 |

% | |

|

Number of shares after offering held by public investors |

1,125,000 |

||

|

Percentage of ownership after offering |

20 |

% |

The computation of the dollar amount of dilution per share in this scenario is based upon the Gross Proceeds from this Offering of $22,500 less offering costs of $16,000 plus the net tangible book value of our shares of common stock of $2,607 and resulting in a net tangible book value of $9,107 or $0.0016 per share, resulting in a dilution of $0.0184 for new shareholders.

DESCRIPTION OF SECURITIES

GENERAL

There is no established public trading market for our common stock. Our authorized capital stock consists of 75,000,000 shares of common stock, with $0.001 par value per share. As of January 31, 2017 there were 4,500,000 shares of our common stock issued and outstanding that is held by one stockholder of record, and no shares of preferred stock issued and outstanding.

|

26 |

COMMON STOCK

The following is a summary of the material rights and restrictions associated with our common stock. This description does not purport to be a complete description of all of the rights of our stockholders and is subject to, and qualified in its entirety by, the provisions of our most current Articles of Incorporation and Bylaws, which are included as exhibits to this Registration Statement.

The holders of our common stock currently have (i) equal ratable rights to dividends from funds legally available therefore, when, as and if declared by the Board of Director of the Company; (ii) are entitled to share ratably in all of the assets of the Company available for distribution to holders of common stock upon liquidation, dissolution or winding up of the affairs of the Company (iii) do not have pre-emptive, subscription or conversion rights and there are no redemption or sinking fund provisions or rights applicable thereto; and (iv) are entitled to one non-cumulative vote per share on all matters on which stock holders may vote.

Our Bylaws provide that on all other matters, except as otherwise required by Nevada law or the Articles of Incorporation, a majority of the votes cast at a meeting of the stockholders shall be necessary to authorize any corporate action to be taken by vote of the stockholders. We do not have any preferred stock authorized in our Articles of Incorporation, and we have no warrants, options or other convertible securities issued or outstanding.

NEVADA ANTI-TAKEOVER LAWS

The Nevada Business Corporation Law contains a provision governing "Acquisition of Controlling Interest." This law provides generally that any person or entity that acquires 20% or more of the outstanding voting shares of a publicly-held Nevada corporation in the secondary public or private market may be denied voting rights with respect to the acquired shares, unless a majority of the disinterested stockholders of the corporation elects to restore such voting rights in whole or in part. The control share acquisition act provides that a person or entity acquires "control shares" whenever it acquires shares that, but for the operation of the control share acquisition act, would bring its voting power within any of the following three ranges: (1) 20 to 33 1/3%, (2) 33 1/3 to 50%, or (3) more than 50%. A "control share acquisition" is generally defined as the direct or indirect acquisition of either ownership or voting power associated with issued and outstanding control shares. The stockholders or board of directors of a corporation may elect to exempt the stock of the corporation from the provisions of the control share acquisition act through adoption of a provision to that effect in the Articles of Incorporation or Bylaws of the corporation. Our Articles of Incorporation and Bylaws do not exempt our common stock from the control share acquisition act. The control share acquisition act is applicable only to shares of "Issuing Corporations" as defined by the act. An Issuing Corporation is a Nevada corporation, which; (1) has 200 or more stockholders, with at least 100 of such stockholders being both stockholders of record and residents of Nevada; and (2) does business in Nevada directly or through an affiliated corporation.

At this time, we do not have 100 stockholders of record resident of Nevada. Therefore, the provisions of the control share acquisition act do not apply to acquisitions of our shares and will not until such time as these requirements have been met. At such time as they may apply to us, the provisions of the control share acquisition act may discourage companies or persons interested in acquiring a significant interest in or control of the Company, regardless of whether such acquisition may be in the interest of our stockholders.

|

27 |