Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - Cadence Bancorporation | d393991dex991.htm |

| 8-K - 8-K - Cadence Bancorporation | d393991d8k.htm |

Exhibit 99.2

First Quarter 2017 Financial Results

May 8, 2017

Disclaimers

Thiscommunicationcontainsforward-lookingstatementswithinthemeaningofthePrivateSecuritiesLitigationReformActof1995.Theseforward-looking statements reflect our

current views with respect to, among other things, future events and our results of operations, financial condition and financial performance. These statements are often, but not always, made through the use of words or phrases such as may, should,

could, predict, potential, believe, will likely result, expect, continue, will, anticipate, seek, estimate, intend, plan, projection, would and outlook, orthenegativeversionofthosewordsorother comparablewordsofafuture orforward-lookingnature.These

forward-lookingstatementsare not historical facts, and are based on current expectations, estimates and projections about our industry, management’s beliefs and certain assumptions made by management, many of which, by their nature, are

inherently uncertain and beyond our control. Accordingly, we caution you that any such forward-looking statements are not guarantees of future performance and are subject to risks, assumptions and uncertainties that are difficult to predict.

Although we believe that the expectations reflected in these forward-looking statements are reasonable as of the date made, actual results may prove to bemateriallydifferentfromtheresultsexpressedorimpliedbytheforward-lookingstatements.

Suchfactorsinclude,withoutlimitation,the RiskFactors referenced in our Registration Statement on Form S-1 filed with the Securities and Exchange Commission (SEC), other risks and uncertainties listed from time

to time in our reports and documents filed with the SEC, including our Annual Reports on Form 10-K and Quarterly Reports on Form 10-Q, and the

followingfactors:businessandeconomicconditionsgenerallyandinthefinancialservicesindustry,nationallyandwithinourcurrentand futuregeographic market areas; economic, market, operational, liquidity, credit and interest rate risks associated with our

business; lack of seasoning in our loan portfolio; deteriorating asset quality and higher loan charge-offs;the lawsand regulations applicable to our business;our ability to achieveorganic loan anddeposit

growthandthecompositionofsuchgrowth;increasedcompetitioninthefinancialservicesindustry,nationally,regionallyorlocally;ourability tomaintain our historical earnings trends; our ability to raise additional capital to implement our business plan;

material weaknesses in our internal control over financial reporting; systems failures or interruptions involving our information technology and telecommunications systems or third-party servicers; the composition of our management team and our

ability to attract and retain key personnel; the fiscal position of the U.S. federal government and the soundness of other financial institutions; the composition of our loan portfolio, including the identify of our borrowers and the concentration

of loans in energy-related industries andinour specialized industries;the portionofourloanportfolio that iscomprised ofparticipationsandshared national credits; and the amount ofnonperforming and classified assets we hold. Cadence can give no

assurance that any goal or plan or expectation set forth in forward-looking statements can beachieved and readersare cautioned not toplace unduerelianceon such statements. Theforward-looking statementsare made

asofthedateofthiscommunication,andCadencedoesnotintend,andassumesnoobligation, toupdateanyforward-lookingstatementtoreflect events or circumstances after thedate on which the statement is madeor to reflect the occurrence ofunanticipated events or

circumstances, except asrequired byapplicablelaw.

Certainofthefinancialmeasuresandratioswepresentaresupplementalmeasuresthatarenotrequiredby,orarenotpresentedinaccordancewith, U.S.

generallyacceptedaccountingprinciples(GAAP).Werefertothesefinancialmeasuresandratiosas non-GAAPfinancialmeasures. Weconsidertheuseof select non-GAAP financial measures

and ratios to be useful for financial and operational decision making and useful in evaluating period-to-period comparisons. These

non-GAAP financial measures should not be considered a substitute for financial information presented in accordance with GAAP and you should not rely on non-GAAP

financial measures alone as measures of our performance. More information regarding non-GAAP financial measures, including a reconciliation of non-GAAP financial

measures to the comparable GAAP financial measures, is included in our earnings release and in the appendixtothispresentation.

2 Cadence Bank, N.A. Member FDIC

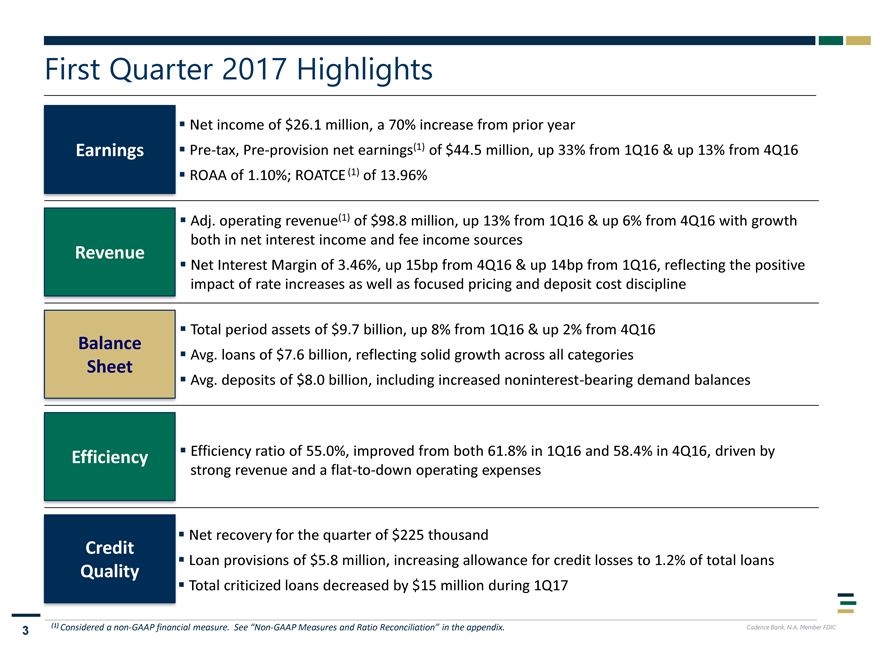

First Quarter 2017 Highlights

Net income of $26.1 million, a 70% increase from prior year

Earnings Pre-tax, Pre-provision net earnings(1) of $44.5 million, up 33% from 1Q16 & up 13% from 4Q16

ROAA of 1.10%; ROATCE(1) of 13.96%

Adj. operating revenue(1) of $98.8 million, up 13%

from 1Q16 & up 6% from 4Q16 with growth

both in net interest income and fee income sources

Revenue

Net Interest Margin of 3.46%, up 15bp from 4Q16 & up 14bp from 1Q16, reflecting

the positive

impact of rate increases as well as focused pricing and deposit cost discipline

Balance Total period assets of $9.7 billion, up 8% from 1Q16 & up 2% from 4Q16

Avg.

loans of $7.6 billion, reflecting solid growth across all categories

Sheet Avg. deposits of $8.0 billion, including increased noninterest-bearing demand

balances

Efficiency Efficiency ratio of 55.0%, improved from both 61.8% in 1Q16 and 58.4% in 4Q16, driven by

strong revenue and a flat-to-down operating expenses

Net recovery for the quarter of $225 thousand

Credit

Loan provisions of $5.8 million, increasing allowance for credit losses to 1.2% of total loans

Quality

Total criticized loans decreased by $15million during 1Q17

3 (1) Considered a non-GAAP financial measure. See Non-GAAP Measures and Ratio Reconciliation in the

appendix. Cadence Bank, N.A. Member FDIC

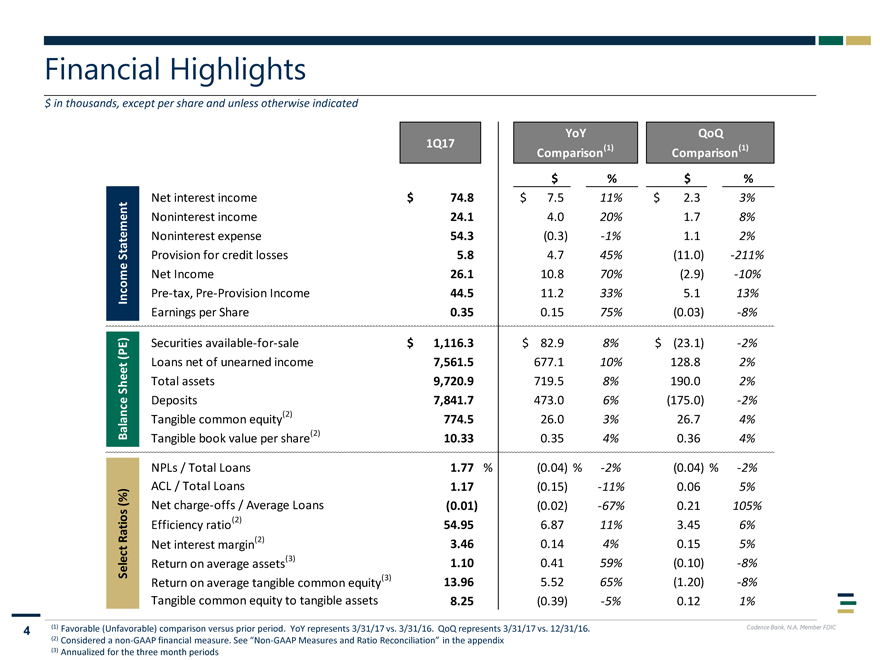

Financial Highlights

$ in thousands, except per share and unless otherwise indicated

YoYQoQ

1Q17(1)(1)

ComparisonComparison

$%$%

Net interest income $ 74.8$7.511%$2.33%

Noninterest income 24.14.020%1.78%

Noninterest

expense 54.3(0.3)-1%1.12%

Provision for credit losses 5.84.745%(11.0)-211%

Net Income 26.110.870%(2.9)-10%

In c o m e Stateme n t Pre-tax, Pre-Provision Income 44.5 11.233%5.113%

Earnings per

Share 0.350.1575%(0.03)-8%

Securities

available-for-sale $ 1,116.3 $82.98%$(23.1)-2%

Loans net of

unearned income 7,561.5 677.110%128.82%

Total assets 9,720.9719.58%190.02%

Deposits 7,841.7473.06%(175.0)-2%

Tangible common

equity(2) 774.5 26.03%26.74%

Balance Sh e et ( PE) (2)

Tangible book value per share 10.33 0.354%0.364%

NPLs / Total

Loans 1.77%(0.04) %-2%(0.04) %-2%

ACL / Total Loans 1.17(0.15)-11%0.065%

Net charge-offs / Average Loans (0.01) (0.02)-67%0.21105%

Efficiency

ratio(2) 54.956.8711%3.456%

Net interest margin(2) 3.460.144%0.155%

Select R atios ( % ) Return on average assets(3) 1.10 0.4159%(0.10)-8%

Return on average tangible common equity(3) 13.96 5.5265%(1.20)-8%

Tangible common equity to tangible assets 8.25 (0.39)-5%0.121%

4 (1)

Favorable (Unfavorable) comparison versus prior period. YoY represents 3/31/17 vs. 3/31/16. QoQrepresents 3/31/17 vs. 12/31/16. Cadence Bank, N.A. Member FDIC

(2)

Considered a non-GAAP financial measure. See Non-GAAP Measures and Ratio Reconciliation in the appendix

(3) Annualized for the three month periods

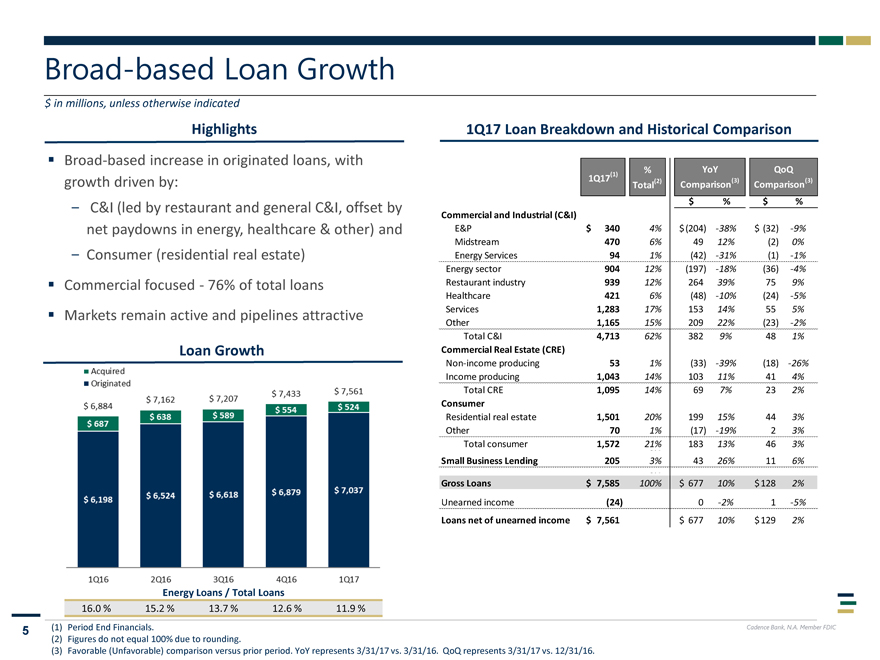

Broad-based Loan Growth

$

in millions, unless otherwise indicated

Highlights

Broad-based increase in

originated loans, with

growth driven by:

C&I (led by restaurant and

general C&I, offset by

net paydowns in energy, healthcare & other) and

Consumer (residential real estate)

Commercial focused—76% of total loans

Markets remain active and pipelines attractive

Loan Growth

Energy Loans /Total Loans

16.0 % 15.2 % 13.7 % 12.6 % 11.9 %

1Q17 Loan Breakdown and Historical Comparison

(1)%YoYQoQ

1Q17 (2)(3)(3)

TotalComparisonComparison

$%$%

Commercial and Industrial (C&I)

E&P $3404%$ (204)-38%$ (32)-9%

Midstream

4706%4912%(2)0%

Energy Services 941%(42)-31%(1)-1%

Energy sector 90412%(197)-18%(36)-4%

Restaurant

industry 93912%26439%759%

Healthcare 4216%(48)-10%(24)-5%

Services 1,28317%15314%555%

Other

1,16515%20922%(23)-2%

Total C&I 4,71362%3829%481%

Commercial Real Estate (CRE)

Non-income producing 531%(33)-39%(18)-26%

Income producing 1,04314%10311%414%

Total CRE 1,09514%697%232%

Consumer

Residential real

estate 1,50120%19915%443%

Other 701%(17)-19%23%

Total consumer 1,57221%18313%463%

Small Business

Lending 2053%4326%116%

Gross Loans $7,585100%$67710%$ 1282%

Unearned income (24)0-2%1-5%

Loans net of unearned

income $7,561$67710%$ 1292%

5 (1) Period End Financials. Cadence Bank, N.A. Member FDIC

(2) Figures do not equal 100% due to rounding.

(3) Favorable (Unfavorable) comparison versus

prior period. YoY represents 3/31/17 vs. 3/31/16. QoQrepresents 3/31/17 vs. 12/31/16.

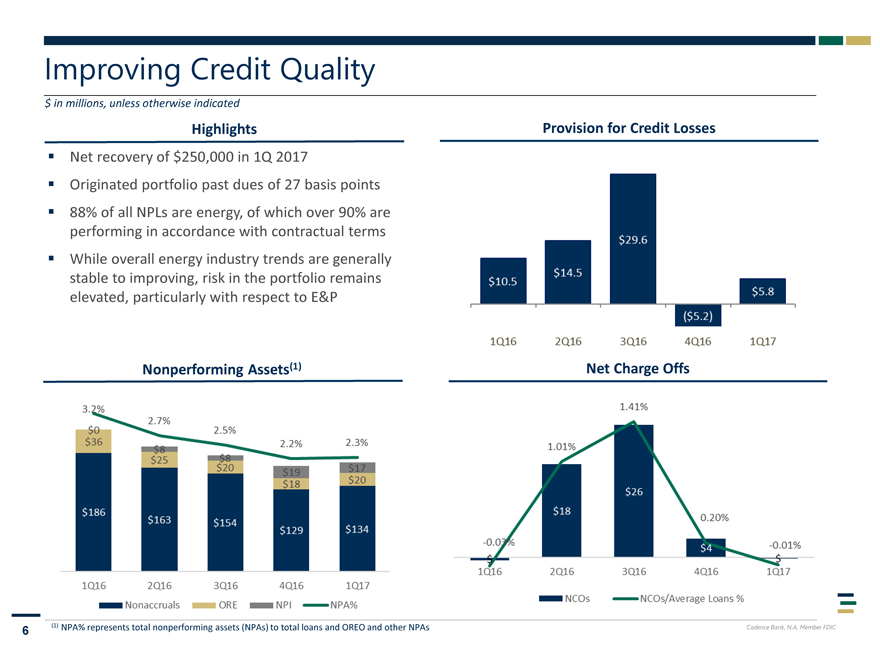

Improving Credit Quality

$ in millions, unless otherwise indicated

Highlights

Provision for Credit Losses

Net recovery of $250,000 in 1Q 2017

Originated portfolio past dues of 27 basis points

88% of all NPLs are energy, of which over

90% are

performing in accordance with contractual terms

While overall energy

industry trends are generally

stable to improving, risk in the portfolio remains

elevated, particularly with respect to E&P

Nonperforming Assets(1)

Net Charge Offs

6 (1) NPA% represents total nonperforming assets (NPAs) to total loans and

OREO and other NPAs

Cadence Bank, N.A. Member FDIC

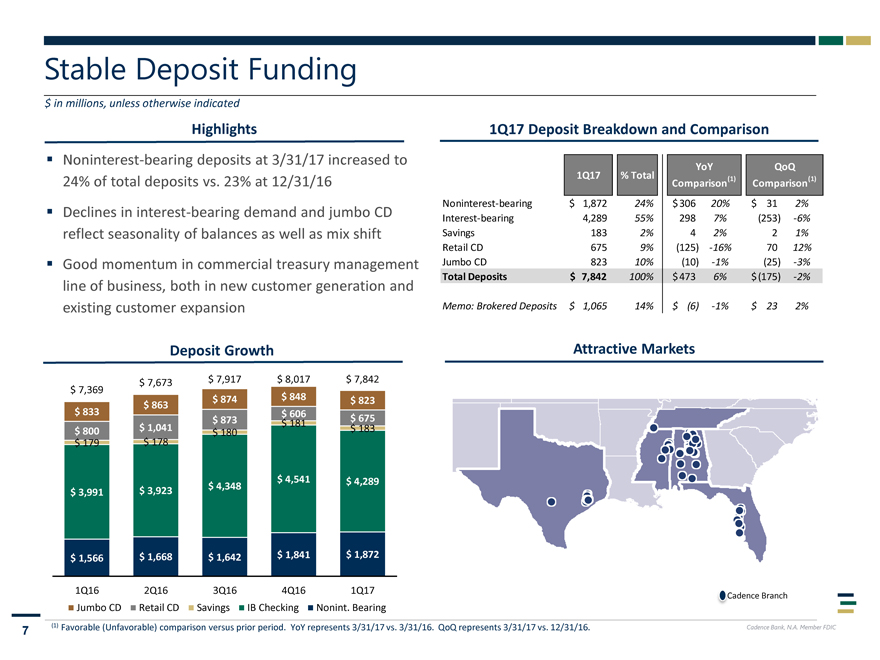

Stable Deposit Funding

$

in millions, unless otherwise indicated

Highlights

Noninterest-bearing

deposits at 3/31/17 increased to

24% of total deposits vs. 23% at 12/31/16

Declines in interest-bearing demand and jumbo CD

reflect seasonality of

balances as well as mix shift

Good momentum in commercial treasury management

line of business, both in new customer generation and

existing customer

expansion

Deposit Growth

1Q17 Deposit Breakdown and

Comparison

YoYQoQ

1Q17% Total(1)(1)

ComparisonComparison

Noninterest-bearing $1,87224%$ 30620%$312%

Interest-bearing 4,28955%2987%(253)-6%

Savings 1832%42%21%

Retail CD

6759%(125)-16%7012%

Jumbo CD 82310%(10)-1%(25)-3%

Total Deposits $7,842100%$ 4736%$(175)-2%

Memo:

Brokered Deposits $1,06514%$ (6)-1%$232%

Attractive Markets

$ 7,673 $ 7,917 $ 8,017 $ 7,842

$ 7,369

$ 863 $ 874 $ 848 $ 823

$ 833 $ 606

$ 873 $ 675

$ 181

$ 800 $ 1,041 $ 183

$ 180

$ 179 $ 178

$ 4,541

$ 4,289

$ 4,348

$ 3,991 $ 3,923

$ 1,566 $ 1,668 $ 1,642 $ 1,841 $ 1,872

1Q16 2Q16 3Q16 4Q16 1Q17

adence Branch

Jumbo CD Retail CD Savings IB Checking Nonint. Bearing

7 (1) Favorable (Unfavorable)

comparison versus prior period. YoY represents 3/31/17 vs. 3/31/16. QoQrepresents 3/31/17 vs. 12/31/16. Cadence Bank, N.A. Member FDIC

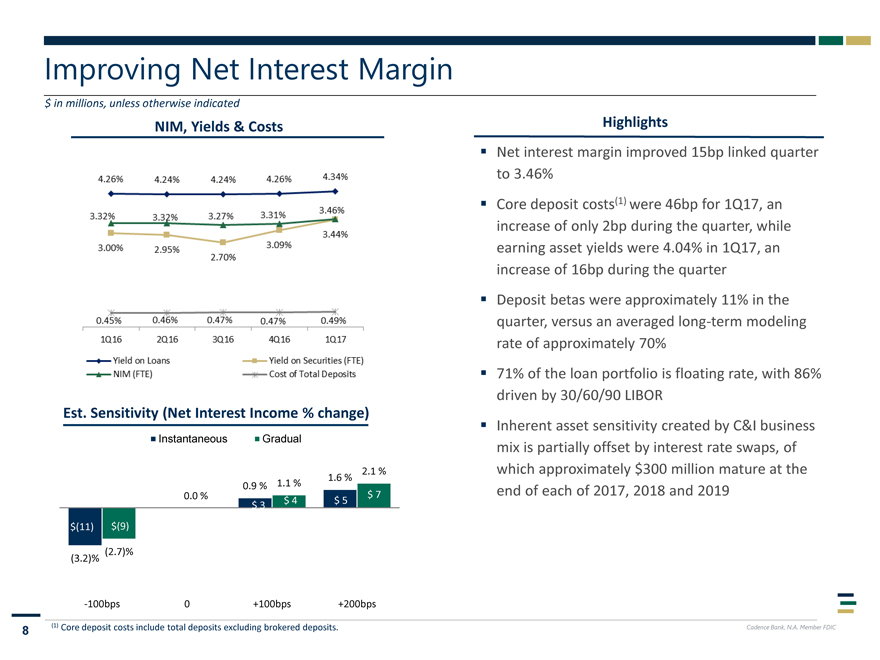

Improving Net Interest Margin

$ in millions, unless otherwise indicated

NIM, Yields & Costs

Est. Sensitivity (Net Interest Income % change)

Instantaneous Gradual

2.1 %

1.6 %

0.9 % 1.1 %

0.0 % $ 7

$ 3 $ 4$ 5

$(11) $(9)

(2.7)% $ 0

(3.2)%

Highlights

Net interest margin improved 15bp linked quarter

to 3.46%

Core deposit costs(1) were 46bp for 1Q17, an

increase of only 2bp during the quarter, while

earning asset yields were 4.04% in 1Q17, an

increase of 16bp during the quarter

Deposit betas were approximately 11% in

the

quarter, versus an averaged long-term modeling

rate of approximately 70%

71% of the loan portfolio is floating rate, with 86%

driven by 30/60/90 LIBOR

Inherent asset sensitivity created by C&I business

mix is partially

offset by interest rate swaps, of

which approximately $300 million mature at the

end of each of 2017, 2018 and 2019

-100bps 0 +100bps +200bps

8 (1) Core deposit costs include total deposits excluding brokered deposits. Cadence Bank, N.A. Member FDIC

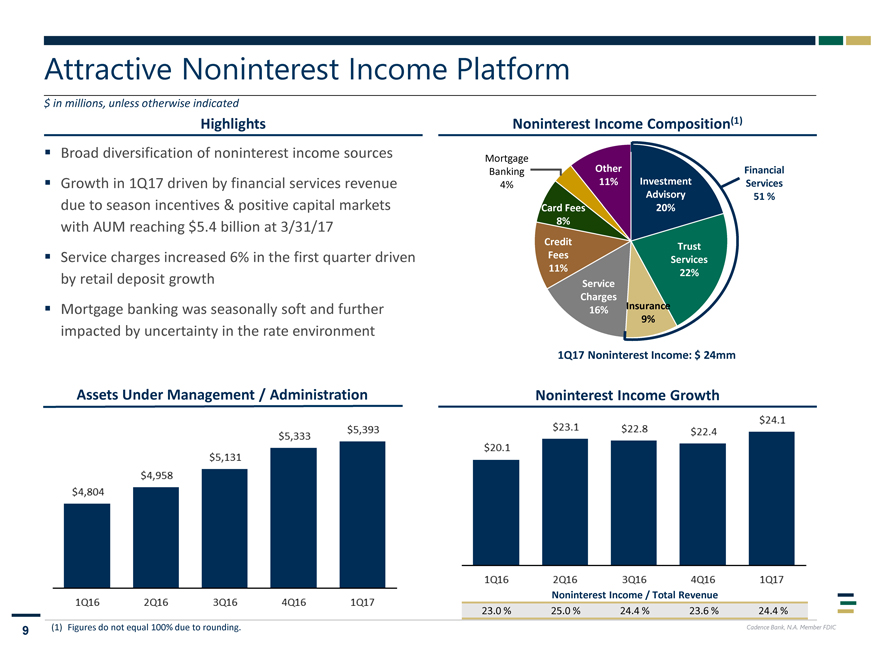

Attractive Noninterest Income Platform

$ in millions, unless otherwise indicated

Highlights

Noninterest Income Composition(1)

Broad diversification of noninterest income sources

Growth in 1Q17 driven by financial services revenue

due to season

incentives & positive capital markets

with AUM reaching $5.4 billion at 3/31/17

Service charges increased 6% in the first quarter driven

by retail deposit growth

Mortgage banking was seasonally soft and further

impacted by uncertainty in the rate

environment

Assets Under Management / Administration

Mortgage

Banking Other Financial

4% 11% Investment Services Advisory 51 %

Card Fees 20% 8%

Credit

Fees Trust

11% Services 22%

Service

Charges

Insurance

16%

9%

1Q17 Noninterest Income: $ 24mm

Noninterest Income Growth

NoninterestIncome / Total Revenue

23.0 % 25.0 % 24.4 % 23.6 % 24.4 %

9 (1) Figures do not equal 100%

due to rounding. Cadence Bank, N.A. Member FDIC

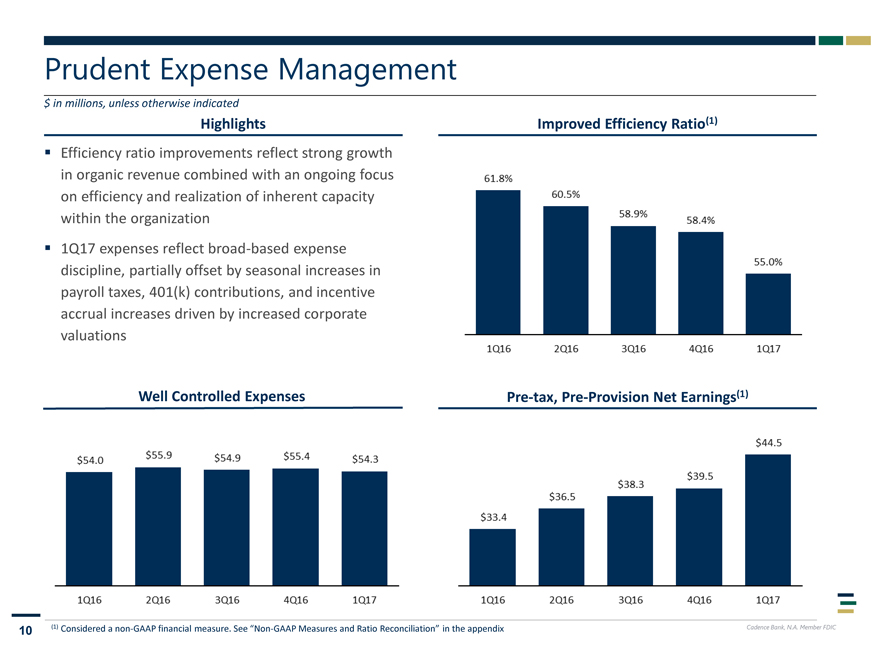

Prudent Expense Management

$ in millions, unless otherwise indicated

Highlights

Improved Efficiency Ratio(1)

Efficiency ratio improvements reflect strong growth

in organic revenue combined with an ongoing focus

on efficiency and realization of inherent

capacity

within the organization

1Q17 expenses reflect broad-based expense

discipline, partially offset by seasonal increases in

payroll taxes, 401(k)

contributions, and incentive

accrual increases driven by increased corporate

valuations

Well Controlled Expenses

Pre-tax, Pre-Provision Net Earnings(1)

10 (1) Considered a non-GAAP financial measure. See Non-GAAP Measures and Ratio Reconciliation in

the appendix

Cadence Bank, N.A. Member FDIC

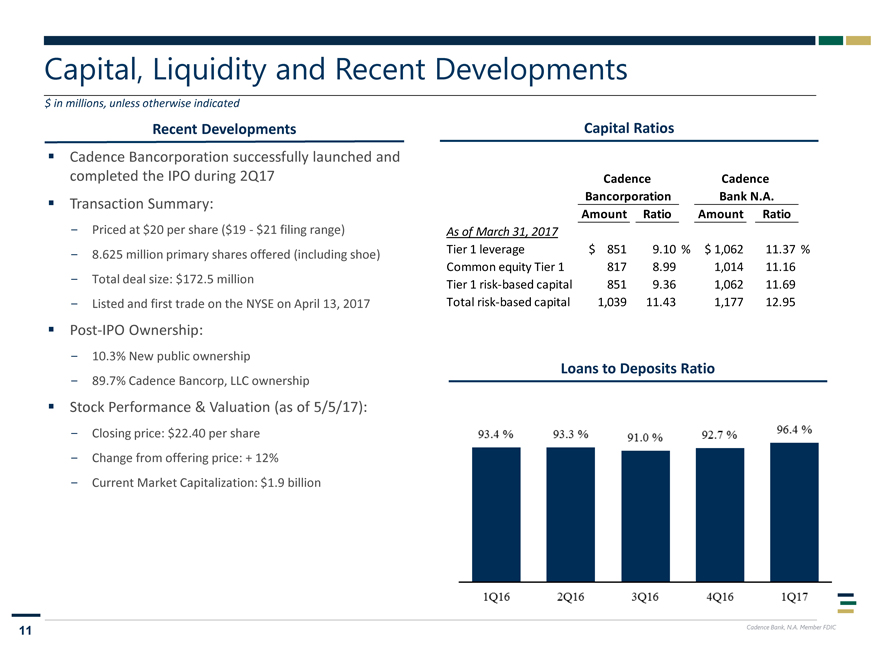

Capital, Liquidity and Recent Developments

$ in millions, unless otherwise indicated

Recent Developments

Cadence Bancorporation successfully launched and

completed the IPO during 2Q17

Transaction Summary:

Priced at $20 per share ($19—$21 filing range)

8.625 million primary shares offered (including shoe)

Total deal size:

$172.5 million

Listed and first trade on the NYSE on April 13, 2017

Post-IPO Ownership:

10.3% New public

ownership

89.7% Cadence Bancorp, LLC ownership

Stock Performance &

Valuation (as of 5/5/17):

Closing price: $22.40 per share

Change from

offering price: + 12%

Current Market Capitalization: $1.9 billion

Capital Ratios

Cadence Cadence

Bancorporation Bank N.A.

Amount RatioAmountRatio

As of March 31,

2017

Tier 1 leverage $ 851 9.10 %$ 1,06211.37 %

Common equity Tier 1 817 8.991,01411.16

Tier 1 risk-based

capital 851 9.361,06211.69

Total risk-based capital 1,039 11.431,17712.95

Loans to Deposits Ratio

11 Cadence Bank, N.A. Member FDIC

Appendix

Cadence Bank,

N.A. Member FDIC

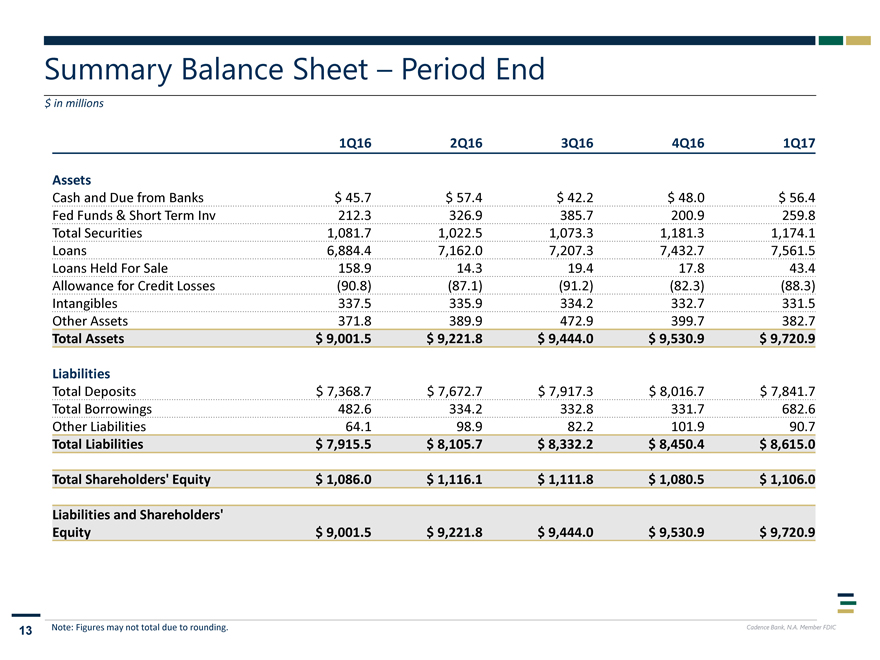

Summary Balance Sheet Period End

$ in millions

1Q16 2Q163Q164Q161Q17

Assets

Cash and Due from Banks $ 45.7 $ 57.4$

42.2$ 48.0$ 56.4

Fed Funds & Short Term Inv 212.3 326.9385.7200.9259.8

Total Securities 1,081.7 1,022.51,073.31,181.31,174.1

Loans 6,884.4 7,162.07,207.37,432.77,561.5

Loans Held

For Sale 158.9 14.319.417.843.4

Allowance for Credit Losses (90.8) (87.1)(91.2)(82.3)(88.3)

Intangibles 337.5 335.9334.2332.7331.5

Other

Assets 371.8 389.9472.9399.7382.7

Total Assets $ 9,001.5 $ 9,221.8$ 9,444.0$ 9,530.9$ 9,720.9

Liabilities

Total Deposits $ 7,368.7 $ 7,672.7$

7,917.3$ 8,016.7$ 7,841.7

Total Borrowings 482.6 334.2332.8331.7682.6

Other Liabilities 64.1 98.982.2101.990.7

Total

Liabilities $ 7,915.5 $ 8,105.7$ 8,332.2$ 8,450.4$ 8,615.0

Total Shareholders’ Equity $ 1,086.0 $ 1,116.1$

1,111.8$ 1,080.5$ 1,106.0

Liabilities and Shareholders’

Equity $ 9,001.5 $ 9,221.8$ 9,444.0$ 9,530.9$ 9,720.9

13 Note: Figures

may not total due to rounding.

Cadence Bank, N.A. Member FDIC

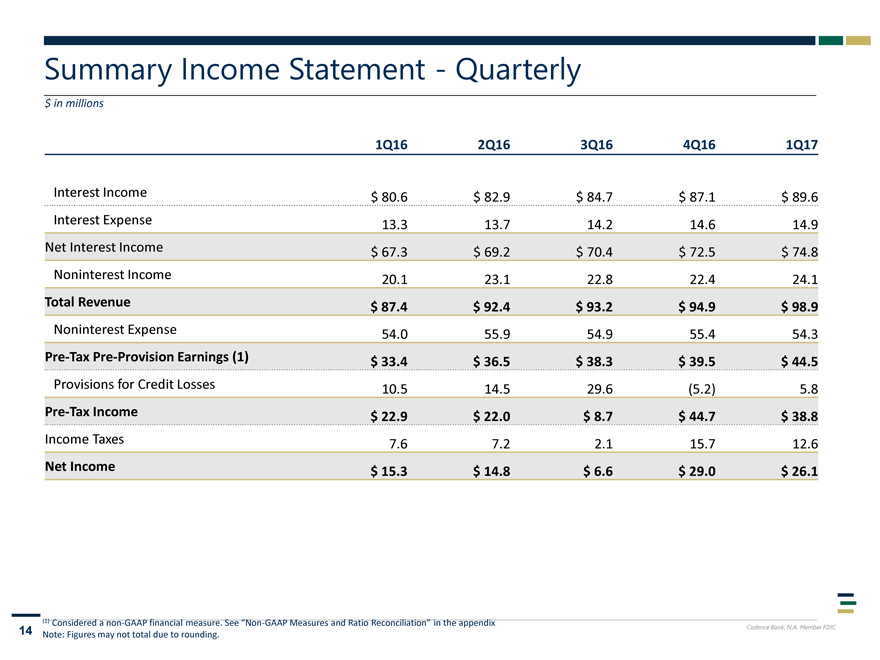

Summary Income Statement—Quarterly

$ in millions

1Q16 2Q16 3Q16 4Q16 1Q17

Interest Income $ 80.6 $ 82.9 $ 84.7 $ 87.1 $ 89.6 Interest Expense 13.3 13.7 14.2 14.6 14.9 Net Interest Income $ 67.3 $ 69.2 $ 70.4 $ 72.5 $ 74.8 Noninterest Income 20.1 23.1

22.8 22.4 24.1

Total Revenue $ 87.4 $ 92.4 $ 93.2 $ 94.9 $ 98.9

Noninterest

Expense 54.0 55.9 54.9 55.4 54.3

Pre-Tax Pre-Provision Earnings (1) $ 33.4 $ 36.5 $

38.3 $ 39.5 $ 44.5

Provisions for Credit Losses 10.5 14.5 29.6 (5.2) 5.8

Pre-Tax Income $ 22.9 $ 22.0 $ 8.7 $ 44.7 $ 38.8

Income Taxes 7.6 7.2 2.1 15.7 12.6

Net Income $ 15.3 $ 14.8 $ 6.6 $ 29.0 $ 26.1

(1) Considered a

non-GAAP financial measure. See Non-GAAP Measures and Ratio Reconciliation in the appendix

14 Note: Figures may not total due to rounding.

Cadence Bank, N.A. Member FDIC

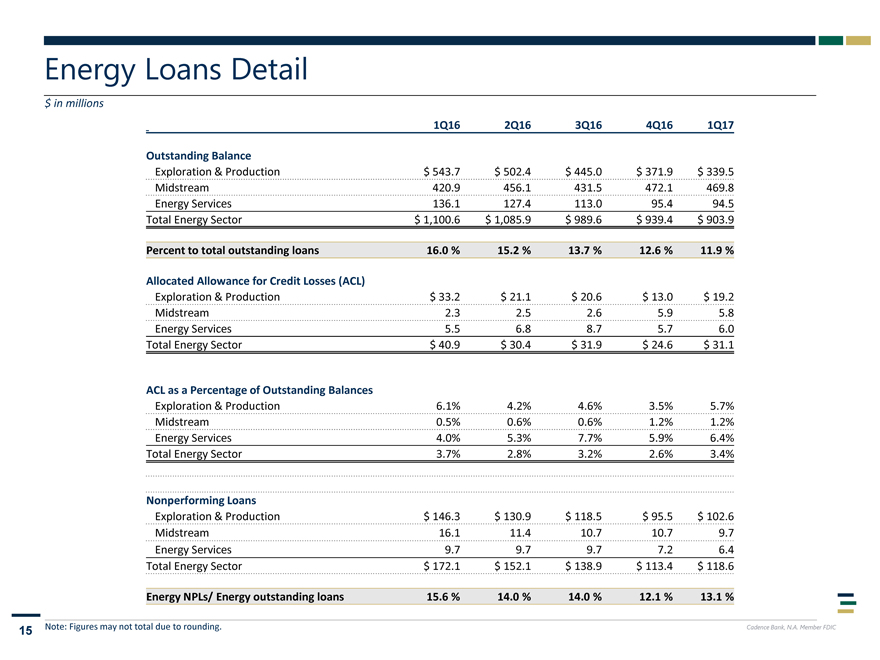

Energy Loans Detail

$ in

millions

1Q16 2Q16 3Q16 4Q16 1Q17

Outstanding Balance

Exploration & Production $ 543.7 $ 502.4 $ 445.0 $ 371.9 $ 339.5 Midstream 420.9 456.1 431.5 472.1 469.8 Energy Services 136.1 127.4 113.0 95.4 94.5 Total Energy Sector $

1,100.6 $ 1,085.9 $ 989.6 $ 939.4 $ 903.9

Percent to total outstanding loans 16.0 % 15.2 % 13.7 % 12.6 % 11.9 %

Allocated Allowance for Credit Losses (ACL)

Exploration & Production $ 33.2 $ 21.1 $

20.6 $ 13.0 $ 19.2 Midstream 2.3 2.5 2.6 5.9 5.8 Energy Services 5.5 6.8 8.7 5.7 6.0 Total Energy Sector $ 40.9 $ 30.4 $ 31.9 $ 24.6 $ 31.1

ACL as a Percentage of

Outstanding Balances

Exploration & Production 6.1% 4.2% 4.6% 3.5% 5.7% Midstream 0.5% 0.6% 0.6% 1.2% 1.2% Energy Services 4.0% 5.3% 7.7% 5.9% 6.4% Total

Energy Sector 3.7% 2.8% 3.2% 2.6% 3.4%

Nonperforming Loans

Exploration & Production $ 146.3 $ 130.9 $ 118.5 $ 95.5 $ 102.6 Midstream 16.1 11.4 10.7 10.7 9.7 Energy Services 9.7 9.7 9.7 7.2 6.4 Total Energy Sector

$ 172.1 $ 152.1 $ 138.9 $ 113.4 $ 118.6

Energy NPLs/ Energy outstanding loans 15.6 % 14.0 % 14.0 % 12.1 % 13.1 %

15 Note: Figures may not total due to rounding. Cadence Bank, N.A. Member FDIC

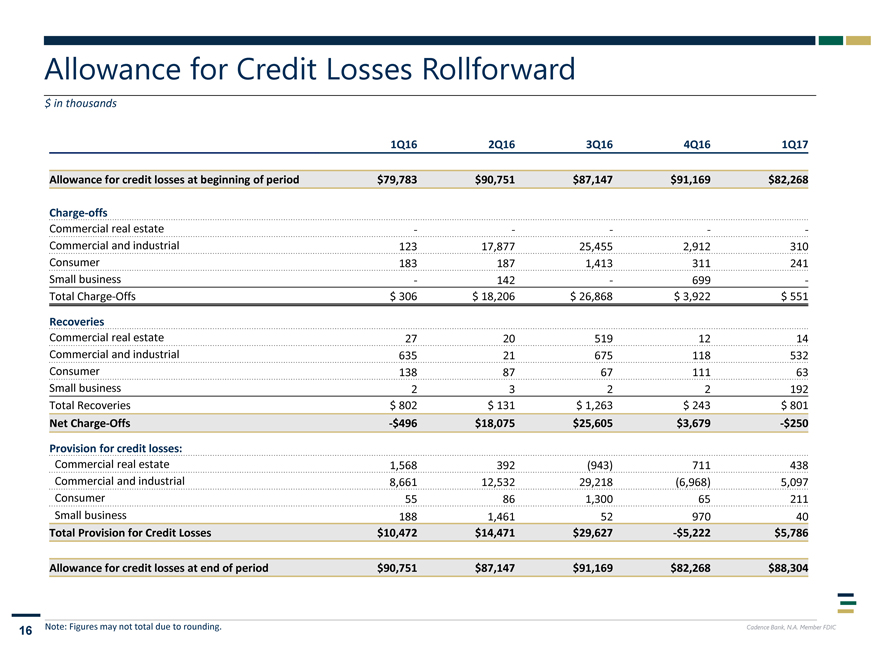

Allowance for Credit Losses Rollforward

$ in thousands

1Q16 2Q16 3Q16 4Q16 1Q17

Allowance for credit losses at beginning of period $79,783 $90,751 $87,147 $91,169 $82,268

Charge-offs

Commercial real estate — — -Commercial and industrial

123 17,877 25,455 2,912 310 Consumer 183 187 1,413 311 241 Small business—142—699 -Total Charge-Offs $ 306 $ 18,206 $ 26,868 $ 3,922 $ 551

Recoveries

Commercial real estate 27 20 519 12 14 Commercial and industrial 635 21 675 118 532 Consumer 138 87 67 111 63 Small business 2 3 2 2 192 Total Recoveries $ 802 $

131 $ 1,263 $ 243 $ 801

Net Charge-Offs -$496 $18,075 $25,605 $3,679 -$250

Provision for credit losses:

Commercial real estate 1,568 392 (943) 711 438

Commercial and industrial 8,661 12,532 29,218 (6,968) 5,097 Consumer 55 86 1,300 65 211 Small business 188 1,461 52 970 40

Total Provision for Credit Losses

$10,472 $14,471 $29,627 -$5,222 $5,786

Allowance for credit losses at end of period $90,751 $87,147 $91,169 $82,268 $88,304

16 Note: Figures may not total due to rounding.

Cadence Bank, N.A. Member FDIC

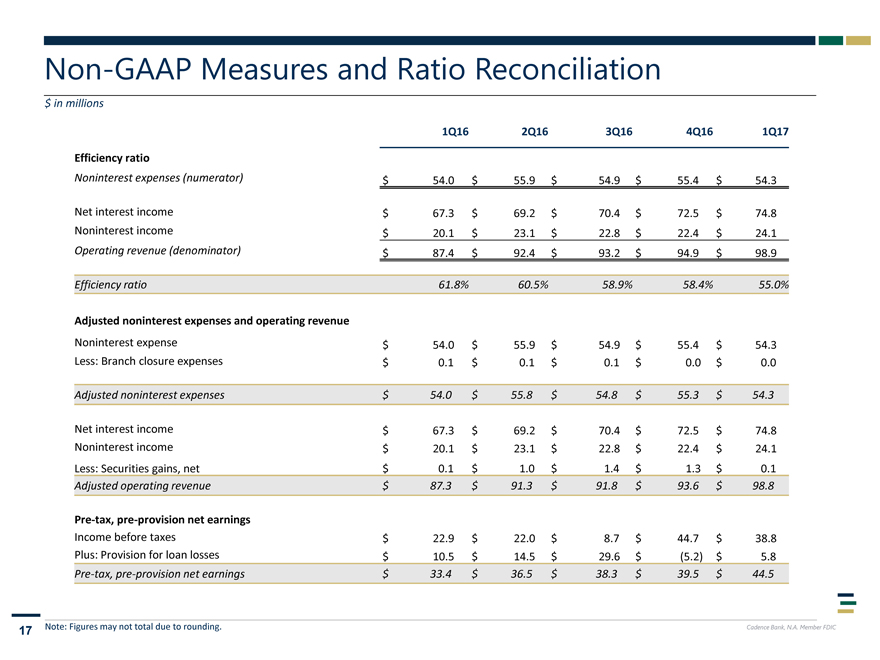

Non-GAAP Measures and Ratio Reconciliation

$ in millions

1Q16 2Q16 3Q16 4Q16 1Q17

Efficiency ratio

Noninterest expenses (numerator) $ 54.0 $ 55.9

$ 54.9 $ 55.4 $ 54.3

Net interest income $ 67.3 $ 69.2 $ 70.4

$ 72.5 $ 74.8 Noninterest income $ 20.1 $ 23.1 $ 22.8 $ 22.4 $ 24.1 Operating revenue (denominator) $ 87.4 $ 92.4

$ 93.2 $ 94.9 $ 98.9

Efficiency ratio 61.8% 60.5% 58.9% 58.4% 55.0%

Adjusted noninterest expenses and operating revenue

Noninterest expense $ 54.0

$ 55.9 $ 54.9 $ 55.4 $ 54.3 Less: Branch closure expenses $ 0.1 $ 0.1 $ 0.1 $ 0.0 $ 0.0

Adjusted noninterest expenses $ 54.0 $ 55.8 $ 54.8 $ 55.3 $ 54.3

Net interest income $67.3 $ 69.2 $ 70.4 $ 72.5 $74.8 Noninterest income $ 20.1 $ 23.1 $ 22.8 $ 22.4 $ 24.1

Less: Securities gains, net $0.1 $ 1.0 $ 1.4 $1.3 $0.1

Adjusted operating revenue $ 87.3 $ 91.3 $ 91.8 $ 93.6

$ 98.8

Pre-tax, pre-provision net earnings

Income before taxes $ 22.9 $ 22.0 $ 8.7 $ 44.7 $ 38.8 Plus: Provision for loan losses $ 10.5

$ 14.5 $ 29.6 $ (5.2) $ 5.8

Pre-tax,

pre-provision net earnings $ 33.4 $ 36.5 $ 38.3 $ 39.5 $ 44.5

17 Note: Figures may not total due to rounding.

Cadence Bank, N.A. Member FDIC

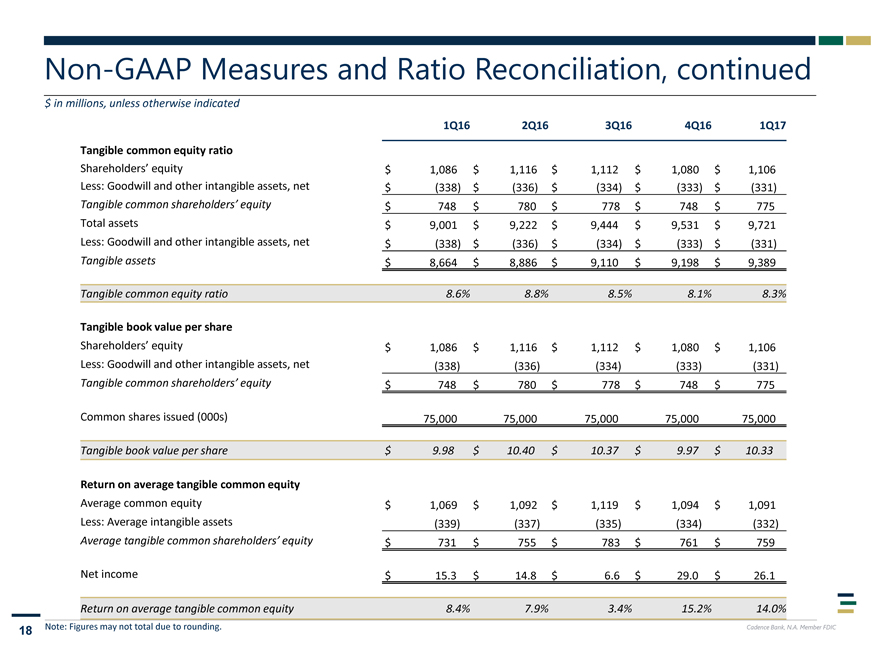

Non-GAAP Measures and Ratio Reconciliation, continued

$ in millions, unless otherwise indicated

1Q16 2Q16 3Q16 4Q16 1Q17

Tangible common equity ratio

Shareholders’ equity $ 1,086 $ 1,116

$ 1,112 $ 1,080 $ 1,106 Less: Goodwill and other intangible assets, net $ (338) $ (336) $ (334) $ (333) $ (331) Tangible common shareholders’ equity

$ 748 $ 780 $ 778 $ 748 $ 775 Total assets $ 9,001 $ 9,222 $ 9,444 $ 9,531 $ 9,721 Less: Goodwill and other intangible assets, net $ (338) $ (336) $ (334)

$ (333) $ (331) Tangible assets $ 8,664 $ 8,886 $ 9,110 $ 9,198 $ 9,389

Tangible common equity ratio 8.6% 8.8% 8.5% 8.1% 8.3%

Tangible book value per

share

Shareholders’ equity $ 1,086 $ 1,116 $ 1,112 $ 1,080 $ 1,106 Less: Goodwill and other intangible assets,

net (338) (336) (334) (333) (331) Tangible common shareholders’ equity $ 748 $ 780 $ 778 $ 748 $ 775

Common

shares issued (000s) 75,000 75,000 75,000 75,000 75,000

Tangible book value per share $ 9.98 $ 10.40 $ 10.37 $ 9.97

$ 10.33

Return on average tangible common equity

Average common equity $ 1,069 $ 1,092 $ 1,119 $ 1,094 $ 1,091 Less: Average intangible assets (339) (337) (335) (334)

(332)

Average tangible common shareholders’ equity $ 731 $ 755 $ 783 $ 761 $ 759

Net income $ 15.3 $ 14.8 $ 6.6 $ 29.0 $ 26.1

Return on average tangible common equity 8.4% 7.9% 3.4% 15.2% 14.0%

18 Note: Figures may not

total due to rounding. Cadence Bank, N.A. Member FDIC