Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - CRAWFORD & CO | exhibit991033117pressrelea.htm |

| 8-K - 8-K - CRAWFORD & CO | a033120178-k.htm |

May 8, 2017

First Quarter 2017

Earnings Conference Call

//////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////

2

• Forward-Looking Statements

—This presentation contains forward-looking statements, including statements about the expected future financial condition, results of operations

and earnings outlook of Crawford & Company. Statements, both qualitative and quantitative, that are not statements of historical fact may be

"forward-looking statements" as defined in the Private Securities Litigation Reform Act of 1995 and other securities laws. Forward-looking statements

involve a number of risks and uncertainties that could cause actual results to differ materially from historical experience or Crawford & Company's

present expectations. Accordingly, no one should place undue reliance on forward-looking statements, which speak only as of the date on which they

are made. Crawford & Company does not undertake to update forward-looking statements to reflect the impact of circumstances or events that may

arise or not arise after the date the forward-looking statements are made. Results for any interim period presented herein are not necessarily

indicative of results to be expected for the full year or for any other future period. For further information regarding Crawford & Company, and the

risks and uncertainties involved in forward-looking statements, please read Crawford & Company's reports filed with the Securities and Exchange

Commission and available at www.sec.gov or in the Investor Relations section of Crawford & Company's website at www.crawfordandcompany.com.

—Crawford's business is dependent, to a significant extent, on case volumes. The Company cannot predict the future trend of case volumes for a

number of reasons, including the fact that the frequency and severity of weather-related claims and the occurrence of natural and man-made

disasters, which are a significant source of cases and revenue for the Company, are generally not subject to accurate forecasting.

• Revenues Before Reimbursements ("Revenues")

—Revenues Before Reimbursements are referred to as "Revenues" in both consolidated and segment charts, bullets and tables throughout this

presentation.

• Segment and Consolidated Operating Earnings

—Under the Financial Accounting Standards Board's Accounting Standards Codification ("ASC") Topic 280, "Segment Reporting," the Company has

defined segment operating earnings as the primary measure used by the Company to evaluate the results of each of its four operating segments.

Segment operating earnings represent segment earnings, including the direct and indirect costs of certain administrative functions required to

operate our business, but excludes unallocated corporate and shared costs and credits, net corporate interest expense, stock option expense,

amortization of customer-relationship intangible assets, restructuring and special charges, income taxes, and net income or loss attributable to

noncontrolling interests and redeemable noncontrolling interests.

• Earnings Per Share

—The Company's two classes of stock are substantially identical, except with respect to voting rights and the Company's ability to pay greater cash

dividends on the non-voting Class A Common Stock than on the voting Class B Common Stock, subject to certain limitations. In addition, with

respect to mergers or similar transactions, holders of Class A Common Stock must receive the same type and amount of consideration as holders of

Class B Common Stock, unless different consideration is approved by the holders of 75% of the Class A Common Stock, voting as a class.

—In certain periods, the Company has paid a higher dividend on CRD-A than on CRD-B. This may result in a different earnings per share ("EPS") for

each class of stock due to the two-class method of computing EPS as required by ASC Topic 260 - "Earnings Per Share". The two-class method is

an earnings allocation method under which EPS is calculated for each class of common stock considering both dividends declared and participation

rights in undistributed earnings as if all such earnings had been distributed during the period.

• Non-GAAP Financial Information

—For additional information about certain non-GAAP financial information presented herein, see the Appendix following this presentation.

FORWARD-LOOKING STATEMENTS AND ADDITIONAL INFORMATION

//////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////

3

GLOBAL BUSINESS SERVICES LEADER

• The world's largest publicly listed

independent provider of global

claims management solutions

• Multiple globally recognized brand

names: Crawford®, Broadspire®,

GCG®

• Clients include multinational

insurance carriers, brokers and

local insurance firms as well as 200

of the Fortune® 500

//////////////////////////////////////////////////////////////////////////

TODAY'S AGENDA

--- Welcome and Opening Comments

--- First Quarter 2017 Financial Review

--- 2017 Guidance and Strategic Initiatives

5

///////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////

FIRST QUARTER 2017 BUSINESS SUMMARY

(1) See Appendix for non-GAAP explanation and reconciliation

Quarter Ended

March 31, March 31,

($ in millions, except per share amounts) 2017 2016 Change

Revenues $267.3 $277.2 (4 )%

Net Income Attributable to Shareholders of

Crawford & Company $7.7 $8.6 (10 )%

Diluted Earnings per Share

CRD-A $0.14 $0.16 (13 )%

CRD-B $0.12 $0.14 (14 )%

Operating Earnings (1) $18.3 $21.7 (16 )%

Operating Margin 6.8 % 7.8 % (100) bps

Adjusted EBITDA (1) $26.6 $30.1 (12 )%

Adjusted EBITDA Margin 10.0 % 10.9 % (90) bps

6

///////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////

FIRST QUARTER 2017 BUSINESS HIGHLIGHTS

• First quarter results were below expectations given the challenges in our

Garden City Group segment

• Expense reduction plan enacted to remove at least $20 million in annual

costs Company wide

• U.S. Services results reflect advertising investments in Contractor

Connection to penetrate insurance direct market

• WeGoLook platform creating innovative and disruptive service offerings

• International segment margin improvement driven by the UK, Asia-Pacific,

Canada, and Hurricane Matthew

• Broadspire saw strong growth in our disability product line and had a

number of notable client wins, which bodes well for the future

• The Garden City Group experienced a slow down in case volume and the

continued run-off of two large projects; focus on returning Garden City

Group to profitability

//////////////////////////////////////////////////////////////////////////

FIRST QUARTER 2017

Financial Review

8

///////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////

Unaudited ($ in thousands, except per share amounts)

Three Months Ended March 31, 2017 2016 % Change

Revenues Before Reimbursements $ 267,267 $ 277,234 (4 )%

Costs of Services Provided, Before Reimbursements 192,554 201,433 (4 )%

Selling, General, and Administrative Expenses 59,992 56,797 6 %

Corporate Interest Expense, Net 2,036 2,768 (26 )%

Restructuring and Special Charges 605 2,417 (75 )%

Total Costs and Expenses Before Reimbursements 255,187 263,415 (3 )%

Other Income 378 117 223 %

Income Before Income Taxes 12,458 13,936 (11 )%

Provision for Income Taxes 4,835 5,307 (9 )%

Net Income 7,623 8,629 (12 )%

Net Loss Attributable to Noncontrolling Interests and

Redeemable Noncontrolling Interests 41 1 nm

Net Income Attributable to Shareholders of Crawford &

Company $ 7,664 $ 8,630 (11 )%

Earnings Per Share - Diluted:

Class A Common Stock $ 0.14 $ 0.16 (13 )%

Class B Common Stock $ 0.12 $ 0.14 (14 )%

Cash Dividends per Share:

Class A Common Stock $ 0.07 $ 0.07 — %

Class B Common Stock $ 0.05 $ 0.05 — %

STATEMENT OF OPERATIONS HIGHLIGHTS

nm = not meaningful

//////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////

9

Revenues by Service Line

($ in millions)

Cases Received by Service Line

(In thousands)

Operating Results (1Q 2017 v. 1Q 2016)

• Revenues of $60.4 million versus $58.5 million

• Operating earnings of $5.5 million versus $9.1 million

• Operating earnings margin of 9.2% versus 15.5%

• Cases received of 128,567 versus 94,472, primarily due to

high-frequency low-complexity WeGoLook cases

Highlights

• Acquisition of WeGoLook ("WGL") completed

• Increase in advertising expense to expand the presence of

Contractor Connection in the consumer repair market

• Mix shift negatively impacted operating margins

U.S. Catastrophe (CAT) Adjuster Activity

• CAT revenues of $13.1 million versus $14.5 million

• Average CAT adjusters deployed of 408 in 2017 vs. 426 in

2016

U.S. SERVICES SEGMENT HIGHLIGHTS

//////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////

10

Revenues by Geographic Region

($ in millions)

Operating Results (1Q 2017 v. 1Q 2016)

• Revenues of $110.6 million versus $117.5 million

• Exchange rates reduced revenues by 5%, or $6.0

million

• Operating earnings of $9.3 million versus $7.0

million

• Operating earnings margin of 8.4% versus 6.0%

• Cases received of 172,021 versus 177,131

Regional Highlights

• Operating earnings increased in the segment due to

margin improvements in the UK, Asia Pacific,

Canada and the impact of Hurricane Matthew

• Revenues were negatively impacted by foreign

exchange rate fluctuations and a decrease in

weather-related claims in the U.K.

• Case volumes decreased due to exiting certain

unprofitable business lines in Asia-Pacific

INTERNATIONAL SEGMENT HIGHLIGHTS

Cases Received

(In thousands)

//////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////

11

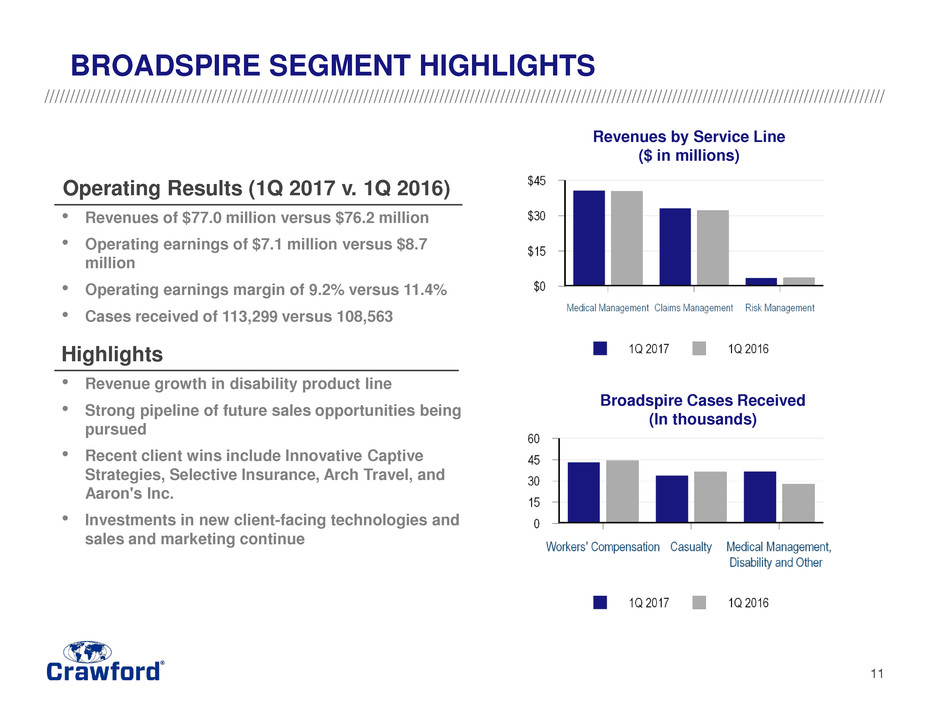

Revenues by Service Line

($ in millions)

Broadspire Cases Received

(In thousands)

Operating Results (1Q 2017 v. 1Q 2016)

• Revenues of $77.0 million versus $76.2 million

• Operating earnings of $7.1 million versus $8.7

million

• Operating earnings margin of 9.2% versus 11.4%

• Cases received of 113,299 versus 108,563

Highlights

• Revenue growth in disability product line

• Strong pipeline of future sales opportunities being

pursued

• Recent client wins include Innovative Captive

Strategies, Selective Insurance, Arch Travel, and

Aaron's Inc.

• Investments in new client-facing technologies and

sales and marketing continue

BROADSPIRE SEGMENT HIGHLIGHTS

//////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////

12

Backlog

($ in millions)

Operating Results (1Q 2017 v. 1Q 2016)

• Revenues of $19.2 million versus $25.0 million

• Operating (loss) earnings of $(0.9) million versus $1.5

million

• Operating (loss) earnings margin of (4.6)% versus 6.0%

• Backlog of $74 million versus $103 million

Highlights

• Low project volume and relative values during the 2017

quarter

• Deepwater Horizon class action settlement project

continues to wind down

• Expense reductions recently made in response to

market trends

GARDEN CITY GROUP SEGMENT HIGHLIGHTS

Revenues

($ in millions)

13

///////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////

Unaudited ($ in thousands)

March 31,

2017

December 31,

2016 Change

Cash and cash equivalents $ 68,797 $ 81,569 $ (12,772 )

Accounts receivable, net 164,073 153,566 10,507

Unbilled revenues, net 108,868 101,809 7,059

Total receivables 272,941 255,375 17,566

Goodwill 115,764 91,750 24,014

Intangible assets arising from business acquisitions, net 103,864 86,931 16,933

Goodwill and intangible assets arising from business acquisitions 219,628 178,681 40,947

Deferred revenues 65,316 63,340 1,976

Pension liabilities 100,371 105,175 (4,804 )

Short-term borrowings and current portion of capital leases 6,685 1,012 5,673

Long-term debt, less current portion 237,273 187,002 50,271

Total debt 243,958 188,014 55,944

Total stockholders' equity attributable to Crawford & Company 163,205 153,883 9,322

Net debt (1) 175,161 106,445 68,716

Nonredeemable noncontrolling interests 7,187 — 7,187

(1) See Appendix for non-GAAP explanation and reconciliation

BALANCE SHEET HIGHLIGHTS

14

///////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////

Unaudited ($ in thousands) 2017 2016 Variance

Net Income Attributable to Shareholders of Crawford &

Company $ 7,664 $ 8,630 $ (966 )

Depreciation and Other Non-Cash Operating Items 11,517 10,847 670

Unbilled and Billed Receivables Change (15,025 ) (7,918 ) (7,107 )

Working Capital Change (20,388 ) (12,146 ) (8,242 )

U.S. and U.K. Pension Contributions (4,283 ) (4,565 ) 282

Cash Flows from Operating Activities (20,515 ) (5,152 ) (15,363 )

Property & Equipment Purchases, net (695 ) (1,535 ) 840

Capitalized Software (internal and external costs) (5,432 ) (4,513 ) (919 )

Free Cash Flow (1) ($26,642 ) ($11,200 ) ($15,442 )

For the year-to-date period ended March 31,

OPERATING AND FREE CASH FLOW

(1) See Appendix for non-GAAP explanation

15

///////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////

Crawford & Company is reaffirming its guidance for 2017 as follows:

YEAR ENDING DECEMBER 31, 2017 Low End High End

Consolidated revenues before reimbursements $1.10 $1.13 billion

After expected restructuring and special charges, net income attributable to

shareholders of Crawford & Company $34.0 $39.0 million

Diluted earnings per share--CRD-A $0.63 $0.73 per share

Diluted earnings per share--CRD-B $0.55 $0.65 per share

Consolidated operating earnings $90.0 $100.0 million

Consolidated adjusted EBITDA $130.0 $140.0 million

Before expected restructuring and special charges, net income attributable

to shareholders of Crawford & Company on a non-GAAP basis $43.0 $48.0 million

Diluted earnings per share--CRD-A $0.78 $0.88 per share

Diluted earnings per share--CRD-B $0.71 $0.81 per share

2017 GUIDANCE

The Company expects to incur restructuring and special charges in 2017 totaling approximately $13.0 million pretax. This is

expected to be comprised of $3.0 million related to the Company's Global Business Services Center in Manila, Philippines

and Global Technology Services Center in Pune, India (the "Centers") and $10.0 million related to other restructuring

activities.

16

///////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////

2017 STRATEGIC INITIATIVES

• Having a strong financial foundation

Implement cost reduction initiatives to drive margin expansion

• Building an entrepreneurial culture

Identify attractive markets for expansion

• Enhancing global capabilities

Explore strategic M&A opportunities

• Delivering excellence in execution

Increase speed of doing business enterprise wide

• Being a sales and service driven organization

Form a robust sales funnel and capitalize on cross-selling

• Providing new products and services that matter

Deliver customized value propositions to clients

//////////////////////////////////////////////////////////////////////////

Appendix

FIRST QUARTER 2017

//////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////

18

Measurements of financial performance not calculated in accordance with GAAP should be considered as

supplements to, and not substitutes for, performance measurements calculated or derived in accordance with

GAAP. Any such measures are not necessarily comparable to other similarly-titled measurements employed by

other companies.

Reimbursements for Out-of-Pocket Expenses

In the normal course of our business, our operating segments incur certain out-of-pocket expenses that are thereafter reimbursed by our clients. Under

GAAP, these out-of-pocket expenses and associated reimbursements are required to be included when reporting expenses and revenues, respectively,

in our consolidated results of operations. In this presentation, we do not believe it is informative to include in reported revenues the amounts of

reimbursed expenses and related revenues, as they offset each other in our consolidated results of operations with no impact to our net income or

operating earnings. As a result, unless noted in this presentation, revenue and expense amounts exclude reimbursements for out-of-pocket expenses.

Net Debt

Net debt is computed as the sum of long-term debt, capital leases and short-term borrowings less cash and cash equivalents. Management believes

that net debt is useful because it provides investors with an estimate of what the Company's debt would be if all available cash was used to pay down

the debt of the Company. The measure is not meant to imply that management plans to use all available cash to pay down debt.

Free Cash Flow

Management believes free cash flow is useful to investors as it presents the amount of cash the Company has generated that can be used for other

purposes, including additional contributions to the Company's defined benefit pension plans, discretionary prepayments of outstanding borrowings

under our credit agreement, and return of capital to shareholders, among other purposes. It does not represent the residual cash flow of the Company

available for discretionary expenditures. The reconciliation from Cash Flows from Operating Activities is provided on slide 14.

Segment and Consolidated Operating Earnings

Operating earnings is the primary financial performance measure used by our senior management and chief operating decision maker to evaluate the

financial performance of our Company and operating segments, and make resource allocation and certain compensation decisions. Management

believes operating earnings is useful to others in that it allows them to evaluate segment and consolidated operating performance using the same

criteria our management and chief operating decision maker use. Consolidated operating earnings represent segment earnings including certain

unallocated corporate and shared costs, but before net corporate interest expense, stock option expense, amortization of customer-relationship

intangible assets, restructuring and special charges, income taxes, and net income or loss attributable to noncontrolling interests.

APPENDIX: NON-GAAP FINANCIAL INFORMATION

//////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////

19

Adjusted EBITDA

Adjusted EBITDA is used by management to evaluate, assess and benchmark our operational results and the Company believes that adjusted

EBITDA is relevant and useful information widely used by analysts, investors and other interested parties. Adjusted EBITDA is defined as net income

with adjustments for depreciation and amortization, interest expense-net, income tax provision, restructuring and special charges, and non-cash stock-

based compensation expense. Adjusted EBITDA is not a term defined by GAAP and as a result our measure of adjusted EBITDA might not be

comparable to similarly titled measures used by other companies.

Non-GAAP Adjusted Net Income and Diluted Earnings per Share

Included in non-GAAP adjusted net income and diluted earnings per share are restructuring and special charges, which arise from non-core items not

directly related to our normal business or operations, or our future performance. Management believes it is useful to exclude these charges when

comparing net income and diluted earnings per share across periods, as these charges are not from ordinary operations.

APPENDIX: NON-GAAP FINANCIAL INFORMATION (continued)

//////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////

20

Quarter Ended Quarter Ended Full Year

March 31, March 31, Guidance

Unaudited ($ in thousands) 2017 2016 2017 *

Revenues Before Reimbursements

Total Revenues $ 279,530 $ 290,908 $ 1,183,000

Reimbursements (12,263 ) (13,674 ) (68,000 )

Revenues Before Reimbursements $ 267,267 $ 277,234 $ 1,115,000

Costs of Services Provided, Before Reimbursements

Total Costs of Services $ 204,817 $ 215,107

Reimbursements (12,263 ) (13,674 )

Costs of Services Provided, Before Reimbursements $ 192,554 $ 201,433

Revenues, Costs of Services Provided, and Operating Earnings

Quarter Ended Quarter Ended Full Year

March 31, March 31, Guidance

Unaudited ($ in thousands) 2017 2016 2017 *

Operating Earnings:

U.S. Services $ 5,542 $ 9,054

International 9,288 7,034

Broadspire 7,096 8,705

Garden City Group (891 ) 1,495

Unallocated corporate and shared costs (2,742 ) (4,618 )

Consolidated Operating Earnings 18,293 21,670 $ 95,000

(Deduct) add:

Net corporate interest expense (2,036 ) (2,768 ) (11,000 )

Stock option expense (417 ) (90 ) (1,575 )

Amortization expense (2,777 ) (2,459 ) (11,700 )

Restructuring and special charges (605 ) (2,417 ) (13,165 )

Income taxes (4,835 ) (5,307 ) (20,960 )

Net loss (income) attributable to non-controlling interests and redeemable

noncontrolling interests 41 1 (100 )

Net Income Attributable to Shareholders of Crawford & Company $ 7,664 $ 8,630 $ 36,500

RECONCILIATION OF NON-GAAP ITEMS

* Midpoints of Company's Guidance, reaffirmed May 8, 2017

//////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////

21

RECONCILIATION OF NON-GAAP ITEMS (continued)

Adjusted EBITDA

Quarter Ended Full Year

March 31, March 31, Guidance

Unaudited ($ in thousands) 2017 2016 2017 *

Net income attributable to

shareholders of Crawford &

Company $ 7,664 $ 8,630 $ 36,500

Add:

Depreciation and amortization 10,180 10,294 47,375

Stock-based compensation 1,296 729 6,000

Net corporate interest expense 2,036 2,768 11,000

Restructuring and special

charges 605 2,417 13,165

Income taxes 4,835 5,307 20,960

Adjusted EBITDA $ 26,616 $ 30,145 $ 135,000

* Midpoints of Company's Guidance, reaffirmed May 8, 2017

//////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////

22

RECONCILIATION OF NON-GAAP ITEMS (continued)

Net Debt

March 31, December 31,

Unaudited ($ in thousands) 2017 2016

Net Debt

Short-term borrowings $ 6,037 $ 30

Current installments of capital leases 648 982

Long-term debt and capital leases, less current installments 237,273 187,002

Total debt 243,958 188,014

Less:

Cash and cash equivalents 68,797 81,569

Net debt $ 175,161 $ 106,445

//////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////

23

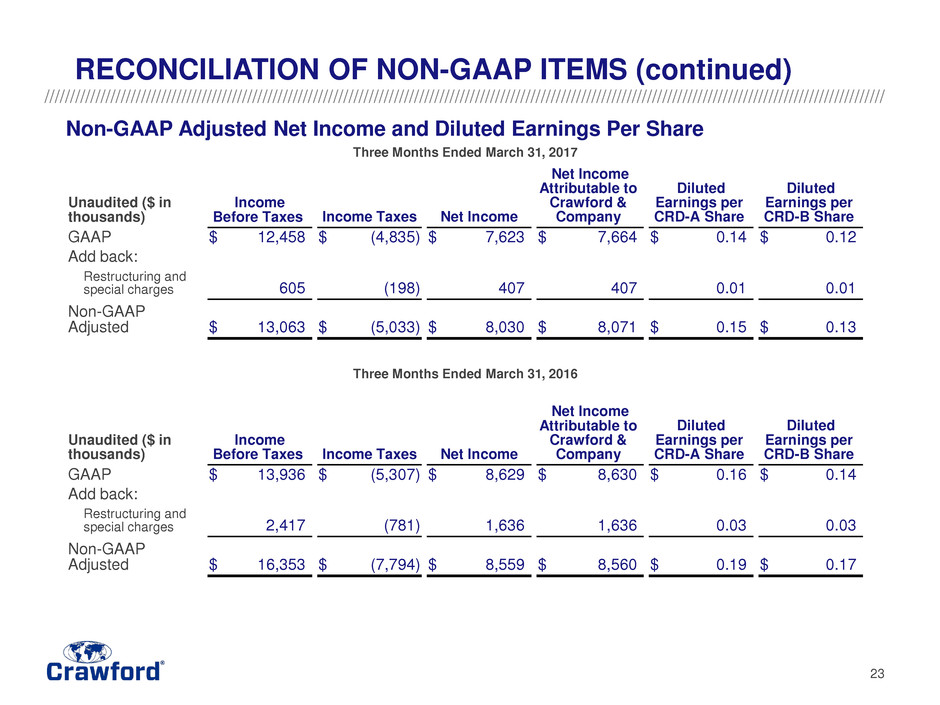

RECONCILIATION OF NON-GAAP ITEMS (continued)

Non-GAAP Adjusted Net Income and Diluted Earnings Per Share

Three Months Ended March 31, 2017

Unaudited ($ in

thousands)

Income

Before Taxes Income Taxes Net Income

Net Income

Attributable to

Crawford &

Company

Diluted

Earnings per

CRD-A Share

Diluted

Earnings per

CRD-B Share

GAAP $ 12,458 $ (4,835 ) $ 7,623 $ 7,664 $ 0.14 $ 0.12

Add back:

Restructuring and

special charges 605 (198 ) 407 407 0.01 0.01

Non-GAAP

Adjusted $ 13,063 $ (5,033 ) $ 8,030 $ 8,071 $ 0.15 $ 0.13

Three Months Ended March 31, 2016

Unaudited ($ in

thousands)

Income

Before Taxes Income Taxes Net Income

Net Income

Attributable to

Crawford &

Company

Diluted

Earnings per

CRD-A Share

Diluted

Earnings per

CRD-B Share

GAAP $ 13,936 $ (5,307 ) $ 8,629 $ 8,630 $ 0.16 $ 0.14

Add back:

Restructuring and

special charges 2,417 (781 ) 1,636 1,636 0.03 0.03

Non-GAAP

Adjusted $ 16,353 $ (7,794 ) $ 8,559 $ 8,560 $ 0.19 $ 0.17

//////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////

24

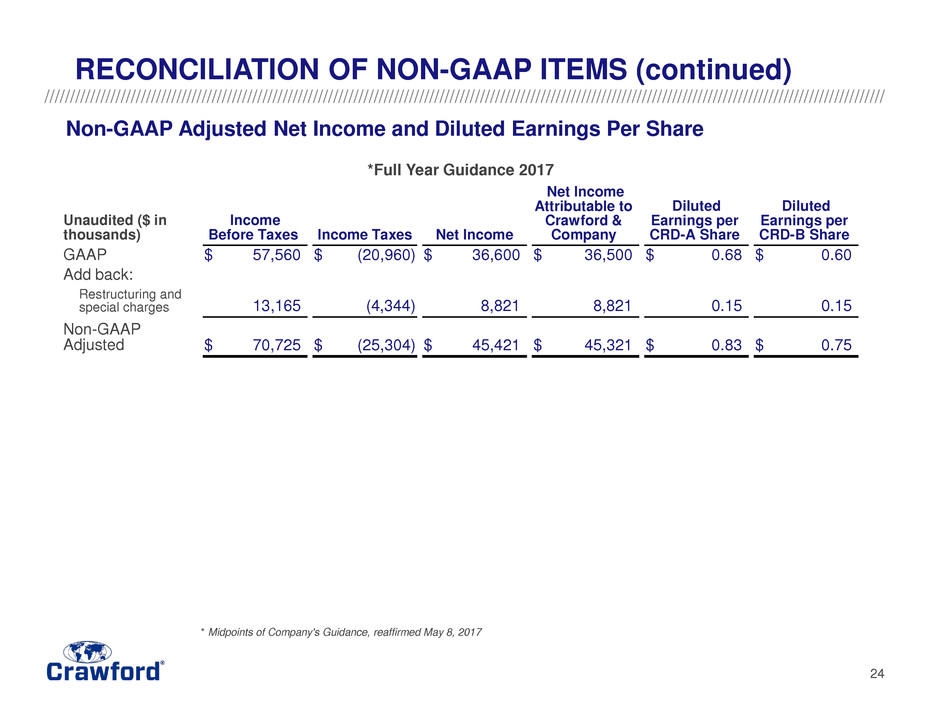

RECONCILIATION OF NON-GAAP ITEMS (continued)

Non-GAAP Adjusted Net Income and Diluted Earnings Per Share

*Full Year Guidance 2017

Unaudited ($ in

thousands)

Income

Before Taxes Income Taxes Net Income

Net Income

Attributable to

Crawford &

Company

Diluted

Earnings per

CRD-A Share

Diluted

Earnings per

CRD-B Share

GAAP $ 57,560 $ (20,960 ) $ 36,600 $ 36,500 $ 0.68 $ 0.60

Add back:

Restructuring and

special charges 13,165 (4,344 ) 8,821 8,821 0.15 0.15

Non-GAAP

Adjusted $ 70,725 $ (25,304 ) $ 45,421 $ 45,321 $ 0.83 $ 0.75

* Midpoints of Company's Guidance, reaffirmed May 8, 2017