Attached files

| file | filename |

|---|---|

| EX-99.2 - EX-99.2 - CDK Global, Inc. | d360338dex992.htm |

| 8-K - 8-K - CDK Global, Inc. | d360338d8k.htm |

Exhibit 99.1

Our Company

We are a leading global provider of integrated information technology and digital marketing solutions to the automotive retail and adjacent industries. Focused on evolving the automotive retail experience, we provide solutions to dealers in more than 100 countries around the world, covering approximately 28,000 retail locations and most original equipment manufacturers (“OEMs”). We have over 40 years of history providing innovative solutions to automotive retailers and OEMs to better manage, analyze, and grow their businesses. Our solutions automate and integrate all parts of the buying process from targeted digital advertising and marketing campaigns to the sale, financing, insuring, parts supply, repair, and maintenance of vehicles. We believe the breadth of our integrated solutions allows us to more comprehensively address the varied needs of automotive retailers than any other single competitor in our industry.

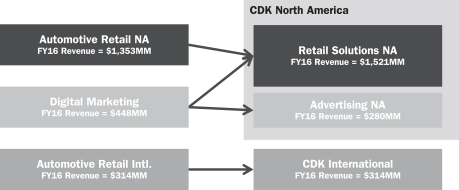

Effective July 1, 2016, we completed a comprehensive plan to streamline our organization that will enable us to deliver an improved customer experience, create significant efficiencies, and better align us to implement our business transformation plan described below. The organizational changes included integrating product management, combining the Digital Marketing and Automotive Retail North America operations into a single organization, creating a single North America sales organization, and forming a global research and development organization.

The Company reorganized into two main operating groups. In connection with this reorganization, our operating segments have changed. Our first operating group is CDK North America which is comprised of two reportable segments, Retail Solutions North America and Advertising North America. The second operating group, which is also a reportable segment, is CDK International.

Below is a graphic representation of CDK Global’s comprehensive reorganization.

1

Our History and Our Spin-off from ADP

We were the Dealer Services business of Automatic Data Processing, Inc. (“ADP”). In 1972, Dealer Services became ADP’s third major business unit, offering accounting, service, management, and inventory processing services to automotive retailers. We have since expanded our role in the industry to encompass the full automotive retail value chain by developing integrated Dealer Management Systems (“DMSs”) and other solutions that help retailers manage and grow their businesses. In 2005, we expanded our international footprint through our acquisition of Kerridge Computer Company Limited (“Kerridge”), which provided us with a multi-country DMS platform in Europe, the Middle East, Asia, Africa, and Latin America and has become the basis for our international business. In 2010, we acquired Cobalt Holding Company (“Cobalt”), a leading provider of automotive digital marketing solutions, which has enabled us to solidify and expand our digital marketing capabilities.

On April 9, 2014, the board of directors of ADP approved the spin-off of the Dealer Services business. On September 30, 2014, the spin-off became effective and ADP distributed 100% of the common stock of the Company to the holders of record of ADP’s common stock as of September 24, 2014 (the “spin-off”).

Operating Segments

Retail Solutions North America

Through our Retail Solutions North America segment, we provide technology-based solutions, including automotive website platforms, that help automotive retailers, OEMs, and other industry participants manage the acquisition, sale, financing, insuring, parts supply, and repair and maintenance of vehicles. Our solutions help our customers streamline their operations, better target and serve their customers, and enhance the financial performance of their retail operations. In addition to providing solutions to retailers and manufacturers of automobiles, we also provide solutions to retailers and manufacturers of heavy trucks, construction equipment, agricultural equipment, motorcycles, boats, and other marine and recreational vehicles.

Advertising North America

Through our Advertising North America segment, we provide advertising solutions, including management of digital advertising spend, for OEMs and automotive retailers. These solutions provide a coordinated offering across multiple marketing channels to help achieve customer marketing and sales objectives and coordinate execution between OEMs and their retailer networks.

CDK International

Through our CDK International segment, we provide technology-based solutions similar to the retail solutions provided in our Retail Solutions North America segment in approximately 100 countries outside of the United States and Canada. The solutions that we provide within this segment allow our customers to streamline their business operations and enhance their financial performance within their local marketplace, and in some cases where we deal directly with OEMs, across international borders. Customers of this segment include automotive retail dealers and OEMs across Europe, the Middle East, Asia, Africa, and Latin America.

Our consolidated revenues were $2,115 million for the fiscal year ended June 30, 2016, compared to total revenues of $2,064 million for the fiscal year ended June 30, 2015. Net earnings attributable to CDK were $239 million for the fiscal year ended June 30, 2016, compared to net earnings attributable to CDK of $178 million for the fiscal year ended June 30, 2015. Adjusted EBITDA was $562 million for the fiscal year ended June 30, 2016 compared to adjusted EBITDA of $462 million for the fiscal year ended June 30, 2015.

2

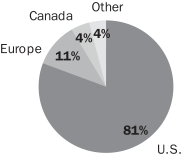

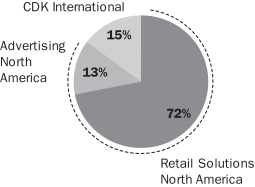

The charts below depict our revenue split by geography and by segment for fiscal year ended June 30, 2016.

| Revenues by Geography: | Revenues by Segment: | |

|

|

Our Market Opportunity

We believe that the following key trends in the automotive retail industry present us with significant business opportunities.

Growing Automotive Sales in North America

North American (United States and Canada) new vehicle sales in 2017 are expected to return to pre-recessionary volumes of 19.3 million annually (after declining to a low of 11.9 million in 2009), according to IHS. We believe that the global economic downturn has created a healthier, right-sized retail structure that benefits both automotive retailers and OEMs. We believe that increased profitability will enable retailers to invest in their businesses and supports the expansion of the information technology and marketing/advertising markets. We believe that there will be continued unit growth in North America due to an aging vehicle population, increased demand for new vehicles by consumers, a better consumer credit environment and the planned introduction of new vehicle models by OEMs.

Significant Growth in Emerging Market Countries

Emerging market countries continue to experience significant growth. For example, new vehicle sales in China in 2017 are expected to be approximately 1% higher than in 2016, according to IHS. New vehicle sales volume in China has eclipsed that of the United States and Japan combined, with 28 million new vehicles sold in China in 2016. New vehicle sales volume in China is anticipated to grow to approximately 30 million in 2020. As a result, many OEMs continue to invest in China in order to gain access to a sizable and growing pool of vehicle buyers. Because automotive retailers in many emerging market countries have not historically invested in their technology solutions, we believe there is an opportunity for us to help retailers in China and other emerging market countries streamline their businesses and more effectively reach their target customers.

Migration to Retail Workflow-Based Solutions

Automotive retailers understand the power of technology to drive every aspect of their business and increasingly demand sophisticated solutions that allow them to manage their entire workflow to drive efficiency, target customers and improve the automotive retail experience. Likewise, consumers increasingly expect a

3

simple, smooth, technologically enabled sales process. Technology-enabled workflow-based solutions can help retailers deliver on this expectation and integrate the consumer’s journey from the web to the in-store retail transaction while utilizing mobile and social media technologies.

Growing Adoption of Data-Based Analytics

We believe that the use of integrated technology solutions across the automotive retail value chain creates a significant opportunity for the pervasive use of data and sophisticated analytics. The ability to provide real-time data analytics, insight and predictive modeling presents a significant business opportunity, as automotive retailers are expected to desire these actionable insights in order to make rapid, informed and effective decisions to win in a competitive marketplace.

Accelerating Shift to Digital Marketing

As with overall advertising spend, automotive advertising is increasingly focused on digital media. According to a 2015 Car Buyer Journey study by Autotrader and IHS, 88% of vehicle buyers now use the internet before purchasing a vehicle. According to a 2016 National Automobile Dealers Association Annual Financial Profile of America’s Franchised New Car Dealerships, automotive retailers allocated 34% of their advertising spend to digital media. The automotive retail industry’s allocation of advertising spend to digital media continues to lag behind consumer shopping behavior and preferences. We expect the share of digital automotive advertising spend to shift to reflect the corresponding share of consumer behavior over time, representing significant future growth potential in digital automotive advertising. By 2020, eMarketer forecasts that annual U.S. digital automotive advertising spend will reach $14.1 billion, representing a 13.7% CAGR from 2014 spend.

Our Competitive Strengths

We believe the following attributes differentiate us from our competitors and have enabled us to become the largest information technology and digital marketing/advertising solutions provider to the automotive retail industry.

Breadth of Integrated Solutions

We offer a broad suite of solutions that enable our automotive retail clients to address technology needs through our offerings to optimize workflows and provide advertising solutions to enhance online presence. We believe the breadth of our integrated automotive retail solutions enables us to function as a strategic partner for our clients globally and allows us to more comprehensively address the varied needs of automotive retailers than any other single competitor in the automotive retail industry. Our product portfolio of software, applications and powerful ancillary services provides integrated solutions across the entire automotive retail value chain. Because of the difficulty in integrating solutions across multiple providers, our ability to provide the broadest solution set is a meaningful differentiator for our clients. Furthermore, our individual offerings are increasingly integrated, improving value for our clients when they purchase multiple solutions from us while increasing overall retention rates.

Innovative, Intuitive and Scalable Technology

Our solutions have been built through decades of focused research, development and investment. These offerings are generally supported by a flexible, secure and scalable infrastructure, and our team of over 1,600 engineers and data scientists is dedicated to developing and enhancing our offerings. In addition, we have augmented many of our offerings by utilizing big data-driven predictive analytics to yield incremental return on investment and a differentiated, optimized client experience for both automotive retailers and OEMs.

4

Our innovative solutions aim to improve the efficiency of the retailer and redefine the way consumers experience automotive retail. For the retailer, our solutions increase the efficiency of workflows, reducing the labor time dedicated to each transaction and improving their sales force effectiveness. For the consumer, we can enhance the purchase process by substantially reducing the number of steps and the wait times throughout the process. In addition, we offer an integrated online, mobile, social and physical experience to meet the evolving demands of consumers. We have invested in dedicated user experience and user interface teams that focus on ensuring that our solutions deliver an intuitive user experience that meaningfully differentiates us from our competitors. Intuitive solutions are easy to use, with low learning curves, reducing training requirements and resulting in a cost effective and efficient solution.

Our business generally utilizes agile product development methodologies to deliver new technology. We are focused on the use of multi-tenant Software-as-a-Service (“SaaS”) and mobile-centric solutions that are highly functional, flexible and fast. With these SaaS and mobile-centric solutions, our clients benefit by moving beyond the limitations associated with traditional on-premises software to highly configurable software solutions that are accessed over the internet. This shift substantially reduces the need for our clients to buy and support a broad range of IT infrastructure, which results in lower total cost of ownership, increased ease of deployment and adoption and improved return on investment. More importantly, this helps to ensure that our solutions are inherently scalable and more readily adapted to the evolving needs of our client base.

Leading Position with Global Capabilities and Local Industry Expertise

We are the largest global provider, both in terms of revenue and geographic reach, of integrated information technology and digital marketing/advertising solutions to the automotive retail industry, with business relationships with automotive retailers and OEMs in over 100 countries with 28,000 DMS client sites and 6,800 Digital Marketing client locations. In the United States, we are the largest provider of Retail Automotive DMS solutions with approximately 40% market share. As a top innovator in the industry across a full suite of solutions, we continue to win new clients around the world in our CDK North America and CDK International businesses and, in the United States, in our Advertising North America business. Our robust technology platforms enable us to take advantage of our scale to more effectively integrate and deliver technology-based solutions that enhance commercial performance on a global basis. As a result, we believe we are uniquely positioned to partner with OEMs on global initiatives and to provide integration across countries while supplying local retail value chain expertise. In addition, we believe that our geographic diversity helps reduce our exposure to business cycles, individual market disruptions and other risks.

Strong Client Relationships with Automotive OEMs and Retail Groups

We have client relationships with some of the largest OEMs in the world and their associated franchised retail networks, which we believe reflect the strength of our solutions and our global scale. We maintain long-standing relationships and high renewal rates with our clients due to the value of the services and solutions we provide. Our clients include 7 of the top 10 largest and 83 of the top 100 largest automotive retailer groups in the United States by total new vehicle sales units. The ability to serve about 28,000 retail locations worldwide creates significant opportunity to expand the scope of our solutions we provide to clients.

The trend of dealership consolidation in the United States has been a tailwind for us as we have relationships with most of the larger dealership groups. So, even though the overall dealership roofs in the United States have remained generally flat, we have been able to pick up additional sites as smaller groups have been consolidated by our clients. We have also leveraged the relationships and execution for our clients to increase our attach rates for additional applications and Customer Relationship Management (“CRM”) solutions.

5

Attractive and Resilient Business Model with a Proven Track Record and Highly Recurring Revenues

We provide highly innovative and mission critical Enterprise Resource Planning (“ERP”) and advertising optimization solutions for customers resulting in low attrition rates and deep, long-standing client relationships. We believe our business model is highly attractive due to the scalability of our solutions, the recurring nature of our revenue, strong operating margins, low capital intensity and high free cash flow conversion. Our global infrastructure and automotive retail focus enables us to provide large-scale technology and service solutions to clients rapidly and cost-effectively. We maintain multi-year contracts with high renewal rates with our customers, resulting in approximately 70% of revenues being generated on a recurring basis. In 2016, we renewed a record of 670 North American dealers, representing approximately 20% of our automotive DMS sites and 10% of all automotive and heavy truck DMS sites. Our recurring revenues have historically been highly resilient, even during cyclical downturns in the automotive industry. For example, during the global economic downturn, our North America revenue (excluding acquisitions) declined by just 4% between fiscal year 2009 and fiscal year 2010, while U.S. car sales volumes declined 20% from calendar year 2008 to 2009 and the entire automotive retail industry experienced a significant decline in profitability. We believe that our significant recurring revenues, combined with our leading market position and new offerings, will continue to contribute to our long-term growth.

Deep and Experienced Management Team

We are led by a talented and experienced global senior management team that has successfully grown our business both organically and through a series of strategic acquisitions and alliances, including the acquisition of Cobalt, which led to our leadership position in digital marketing. The members of our senior management team have a deep understanding of the unique dynamics of the automotive retail industry.

Our Business Strategy

We intend to leverage our broad portfolio, client relationships and industry expertise through various growth initiatives. The key elements of our growth strategy are highlighted below.

Continue to Expand Our Client Base

We have a diversified base of about 28,000 retail locations in over 100 countries. With our acquisition of Cobalt in 2010, we expanded our client value proposition and now address a broader opportunity with sophisticated digital marketing solutions. Through the combination of our leading technology platforms and deep industry expertise, we have built growth platforms that position us to be a more complete partner to our clients and allow us to offer flexible solutions designed to appeal to all retailers. Key elements of this strategy include:

Expand North American Automotive Retailer and OEM Client Base.

In North America, we currently have relationships with approximately 7,350 out of 18,500 franchised automotive retail locations. We believe that there is a substantial opportunity to further penetrate the North American retailer base through network-wide solutions purchased or sponsored by OEMs and through direct sales to automotive retailers. OEMs and automotive retailers are seeking to deliver an efficient and differentiated automotive retail experience that delivers on their brand promise. We intend to leverage our direct channel of over 500 sales professionals, over 1,200 solution delivery experts and over 2,000 client support specialists to take advantage of this opportunity.

6

Expand International OEM Client Base and Achieve Increased Share of Associated Automotive Retailers.

In the international arena, particularly in emerging market countries, OEMs typically have a stronger influence on the retail channel than in North America. As a result, we intend to partner with OEMs, financing partners and other industry participants to deliver OEM-branded or approved solutions and drive adoption of our solutions across those OEMs’ automotive retail networks. As an industry leader, we believe our existing relationships with OEMs provide a powerful platform to help increase our client base internationally.

Deepen Our Relationship with our Existing Client Base

We intend to utilize our broad portfolio of automotive capabilities to deepen our relationships with our existing client base by addressing more of their needs. We are focused on creating deep client relationships and believe that when satisfied clients view us as a strategic partner across the entire automotive retail value chain, they buy more of our solutions. We believe that our growth in average revenue per client location over the last three fiscal years ended June 30, 2016 reflects both the success of our growing solutions portfolio and our commitment to high levels of client satisfaction.

We also believe that our Digital Marketing solutions complement our Automotive Retail solutions and that this presents an additional opportunity to deepen our relationships with our existing Automotive Retail client base. A significant number of our Automotive Retail clients do not use our Digital Marketing solutions, and vice versa. A large cross-selling opportunity exists across the two client bases for our integrated solutions. Through layered application penetration, as we gain a new client we have the opportunity to add additional products and services onto the core. Our applications specific for service area, applications specific for managing inventory, and CRM solutions provide integrated phone solutions that we can offer dealers.

Strengthen and Extend Our Solutions Portfolio

By leveraging our technology platform, industry knowledge and client relationships, we seek to enhance our existing solutions and develop additional solutions that address evolving client demands and provide additional cross-selling opportunities. We will seek to further augment the integration capabilities of our existing solution set, which we believe will further reduce the cost of ownership and increase return on investment for our clients. We will also continue to focus on innovation and delivering solutions that service the unmet needs of the industry. For example, within our Automotive Retail solution set, we engineered our Vehicle Sales solution suite with highly optimized workflow built on a common platform of shared services to help ensure the accuracy of data, simplify the user experience and increase utilization, while at the same time reducing end user training and support needs. In our Digital Marketing business, we are focused on evolving our technology platforms to deliver fully personalized consumer experiences with high conversion to sales results.

We intend to continue investing in our data science capabilities to provide big data-driven predictive analytics and generate actionable insights through all levels of the automotive retail value chain. We believe this area represents a substantial opportunity as our clients require increased differentiation to compete effectively within the global automotive marketplace, and we believe that with our broad reach and deep industry expertise we are well-positioned to provide these data science and predictive technologies.

Selectively Pursue Strategic Acquisitions

We have and expect to continue to acquire assets and businesses that strengthen our value proposition to clients. We have developed internal capabilities to source, evaluate and integrate acquisitions and key partnerships. Since 2000, we have completed 33 acquisitions. These have ranged from acquisitions of small

7

start-up companies that provide a discrete application to a handful of customers, to acquisitions of substantial companies with more mature solutions and a larger customer base, such as our acquisition of Kerridge in 2005, which facilitated our international expansion, and our acquisition of Cobalt in 2010, which is the foundation of our digital marketing and digital advertising business. As part of our ongoing business strategy to expand solutions offerings, acquire new technologies, and strengthen our value proposition to customers, we intend to continue to seek acquisitions and strategic partnerships that provide attractive growth opportunities for our portfolio.

Retail Solutions North America Segment

The table below presents the reconciliation of revenues to constant currency adjusted revenues and earnings before income taxes to constant currency adjusted earnings before income taxes for the Retail Solutions North America segment.

| Years Ended June 30, |

Change |

|||||||||||||||

| 2016 |

2015 |

$ |

% |

|||||||||||||

| Revenues |

$ | 1,521.3 | $ | 1,501.2 | $ | 20.1 | 1 | % | ||||||||

| Internet sales leads revenues |

— | (46.2 | ) | 46.2 | ||||||||||||

|

|

|

|

|

|

|

|||||||||||

| Adjusted revenues |

$ | 1,521.3 | $ | 1,455.0 | $ | 66.3 | 5 | % | ||||||||

| Impact of exchange rates |

13.1 | — | 13.1 | |||||||||||||

|

|

|

|

|

|

|

|||||||||||

| Constant currency adjusted revenues |

$ | 1,534.4 | $ | 1,455.0 | $ | 79.4 | 5 | % | ||||||||

| Earnings before income taxes |

$ | 481.3 | $ | 411.4 | $ | 69.9 | 17 | % | ||||||||

| Margin % |

31.6 | % | 27.4 | % | ||||||||||||

| Stand-alone public company costs |

— | (2.1 | ) | 2.1 | ||||||||||||

| Accelerated trademark amortization |

— | 5.5 | (5.5 | ) | ||||||||||||

| Internet sales leads earnings |

— | (2.5 | ) | 2.5 | ||||||||||||

|

|

|

|

|

|

|

|||||||||||

| Adjusted earnings before income taxes |

$ | 481.3 | $ | 412.3 | $ | 69.0 | 17 | % | ||||||||

| Adjusted margin % |

31.6 | % | 28.3 | % | ||||||||||||

| Impact of exchange rates |

5.4 | — | 5.4 | |||||||||||||

|

|

|

|

|

|

|

|||||||||||

| Constant currency adjusted earnings before income taxes |

$ | 486.7 | $ | 412.3 | $ | 74.4 | 18 | % | ||||||||

The table below presents revenue by type for the Retail Solutions North America segment:

| Years Ended June 30, |

Change |

|||||||||||||||

| 2016 |

2015 |

$ |

% |

|||||||||||||

| Subscription revenue |

$ | 1,191.2 | $ | 1,124.7 | $ | 66.5 | 6 | % | ||||||||

| Transaction revenue |

179.1 | 204.3 | (25.2 | ) | (12 | )% | ||||||||||

| Other revenue |

151.0 | 172.2 | (21.2 | ) | (12 | )% | ||||||||||

|

|

|

|

|

|

|

|||||||||||

| Total |

$ | 1,521.3 | $ | 1,501.2 | $ | 20.1 | 1 | % | ||||||||

Revenues. Retail Solutions North America revenues for fiscal 2016 increased $20.1 million as compared to fiscal 2015. Retail Solutions North America revenues were unfavorably impacted by the strength of the U.S. dollar against the Canadian dollar on a constant currency basis, which contributed to a decrease of $13.1 million. In addition, Retail Solutions North America revenues were unfavorably impacted by the internet sales leads business, which was sold on May 21, 2015, and contributed $46.2 million in revenues during fiscal 2015. The internet sales leads business contributed to a decrease in revenues of approximately 4 percentage points.

Subscription revenues grew due to an increase in average revenue per DMS customer site of 5% , which resulted from a combination of increased sales of new or expanded solutions to our existing customer base and pricing. Additionally, DMS customer site count as of June 30, 2016 was 14,533 sites compared to 14,219 sites as of June 30, 2015, an increase of approximately 2%. This was partially offset by a reduction in the number of websites. On a combined basis, the increase in DMS customer sites and average revenue per DMS customer site contributed $66.5 million of revenue growth that includes an unfavorable currency impact of $11.8 million. Transaction revenues contributed a decrease in revenues of $25.2 million primarily due to the sale of the internet sales leads business. Without the impact of the internet sales leads business, transaction revenues grew $21.0 million due to vehicle registrations, which include the effect of revenues contributed by the AVRS acquisition. Other revenue items contributed a decrease in revenues of $21.2 million that includes an unfavorable currency impact of $1.3 million primarily due to a reduction in hardware sales.

8

Acquisitions contributed approximately 2 percentage points of adjusted Retail Solutions North America revenue growth.

Earnings before Income Taxes. Retail Solutions North America earnings before income taxes for fiscal 2016 increased $69.9 million as compared to fiscal 2015. Margin increased from 27.4% to 31.6%. The impact of foreign exchange rates on Retail Solutions North America earnings before income taxes was a decrease of $5.4 million, or approximately 1 percentage point. During fiscal 2015, the effect of the accelerated trademark amortization was partially offset by the effect of the internet sales leads business and stand-alone public company costs on earnings before income taxes.

Retail Solutions North America earnings before income taxes were favorably impacted by operating efficiencies inclusive of revenue growth as discussed above and benefits obtained from ongoing initiatives under our business transformation plan, primarily related to lower headcount and geographic labor mix, a vendor-related contractual obligation established during fiscal 2015 and extinguished in the first quarter of fiscal 2016, a prior year non-recurring severance accrual, and the sale of the internet sales leads business, which was a lower margin business. The favorable effects of these items were partially offset by increased costs associated with the migration of hosting facilities, an increase in employee-related costs, primarily related to incentive compensation, a reduction of our accounts receivable allowances in fiscal 2015 as a result of a change in estimate, and stand-alone public company costs.

Advertising North America

The table below presents the reconciliation of revenues to constant currency revenues and earnings before income taxes to constant currency adjusted earnings before income taxes for the Advertising North America segment.

|

Years Ended June 30, |

Change |

|||||||||||||||

| 2016 |

2015 |

$ |

% |

|||||||||||||

| Revenues |

$ | 279.7 | $ | 243.1 | $ | 36.6 | 15 | % | ||||||||

| Impact of exchange rates |

0.1 | — | 0.1 | |||||||||||||

|

|

|

|

|

|

|

|||||||||||

| Constant currency revenues |

$ | 279.8 | $ | 243.1 | $ | 36.7 | 15 | % | ||||||||

| Earnings before income taxes |

$ | 27.5 | $ | (0.8 | ) | $ | 28.3 | n/m | ||||||||

| Margin % |

9.8 | % | (0.3 | )% | ||||||||||||

| Accelerated trademark amortization |

— | 10.1 | (10.1 | ) | ||||||||||||

|

|

|

|

|

|

|

|||||||||||

| Adjusted earnings before income taxes |

$ | 27.5 | $ | 9.3 | $ | 18.2 | 196 | % | ||||||||

| Adjusted margin % |

9.8 | % | 3.8 | % | ||||||||||||

| Impact of exchange rates |

0.1 | — | 0.1 | |||||||||||||

|

|

|

|

|

|

|

|||||||||||

| Constant currency adjusted earnings before income taxes |

$ | 27.6 | $ | 9.3 | $ | 18.3 | 197 | % | ||||||||

Revenues. Advertising North America revenues for fiscal 2016 increased $36.6 million as compared to fiscal 2015. The impact of foreign exchange rates on Advertising North America revenues was a decrease of $0.1 million. The overall increase in revenues was due to an increase in OEM driven local marketing association internet advertising placements.

Earnings before Income Taxes. Advertising North America earnings before income taxes for fiscal 2016 increased $28.3 million as compared to fiscal 2015. Margin increased from (0.3%) to 9.8%. The effect of the accelerated trademark amortization during fiscal 2015 contributed a significant increase in earnings before taxes. The impact of foreign exchange rates on Advertising North America earnings before income taxes was a decrease of $0.1 million, or 1 percentage point. Advertising North America earnings before income taxes were also favorably impacted by growth in revenues, including higher margin advertising revenues, and operating efficiencies from lower expenses as a result of headcount scale, geographic labor mix, and labor-related costs and benefits obtained from ongoing initiatives under our business transformation plan. The favorable effects of these items were partially offset by a reduction of our accounts receivable allowances in fiscal 2015 as a result of a change in estimate.

9

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Board of Directors and Stockholders of

CDK Global, Inc.

Hoffman Estates, Illinois

We have audited the accompanying consolidated balance sheets of CDK Global, Inc. and subsidiaries (the “Company”) as of June 30, 2016 and 2015, and the related consolidated and combined statements of operations, comprehensive income, equity, and cash flows for each of the two years in the period ended June 30, 2016. These financial statements are the responsibility of the Company’s management. Our responsibility is to express an opinion on these financial statements based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, such consolidated and combined financial statements referred to above present fairly, in all material respects, the financial position of the Company and subsidiaries as of June 30, 2016 and 2015, and the results of their operations and their cash flows for each of the two years in the period ended June 30, 2016, in conformity with accounting principles generally accepted in the United States of America.

As discussed in Note 1 to the consolidated and combined financial statements, prior to September 30, 2014 the accompanying combined financial statements were derived from the consolidated financial statements and accounting records of Automatic Data Processing, Inc. (“ADP”). The accompanying combined financial statements include expense allocations for certain corporate functions historically provided by ADP. These allocations may not be reflective of the actual expenses which would have been incurred had the Company operated as a separate entity apart from ADP during the periods prior to September 30, 2014.

/s/ DELOITTE & TOUCHE LLP

Chicago, IL

August 9, 2016 (May 5, 2017 as to the effects of the change described in Note 18)

10

CDK GLOBAL, INC.

Consolidated and Combined Statements of Operations

(In millions, except per share amounts)

| Years Ended |

||||||||

| 2016 |

2015 |

|||||||

| Revenues |

$ | 2,114.6 | $ | 2,063.5 | ||||

| Expenses: |

||||||||

| Cost of revenues |

1,243.4 | 1,273.2 | ||||||

| Selling, general and administrative expenses |

448.5 | 431.1 | ||||||

| Restructuring expenses |

20.2 | 2.4 | ||||||

| Separation costs |

— | 34.6 | ||||||

|

|

|

|

|

|||||

| Total expenses |

1,712.1 | 1,741.3 | ||||||

|

|

|

|

|

|||||

| Operating earnings |

402.5 | 322.2 | ||||||

| Interest expense |

(40.2 | ) | (28.8 | ) | ||||

| Other income, net |

6.8 | 6.5 | ||||||

|

|

|

|

|

|||||

| Earnings before income taxes |

369.1 | 299.9 | ||||||

| Provision for income taxes |

(122.3 | ) | (113.6 | ) | ||||

|

|

|

|

|

|||||

| Net earnings |

246.8 | 186.3 | ||||||

| Less: net earnings attributable to noncontrolling interest |

7.5 | 7.9 | ||||||

|

|

|

|

|

|||||

| Net earnings attributable to CDK |

$ | 239.3 | $ | 178.4 | ||||

|

|

|

|

|

|||||

| Net earnings attributable to CDK per common share: |

||||||||

| Basic |

$ | 1.52 | $ | 1.11 | ||||

| Diluted |

$ | 1.51 | $ | 1.10 | ||||

| Weighted-average common shares outstanding: |

||||||||

| Basic |

157.0 | 160.6 | ||||||

| Diluted |

158.0 | 161.6 | ||||||

See notes to the consolidated and combined financial statements.

11

CDK GLOBAL, INC.

Consolidated and Combined Statements of Comprehensive Income

(In millions)

|

Years Ended |

||||||||

| 2016 |

2015 |

|||||||

| Net earnings |

$ | 246.8 | $ | 186.3 | ||||

| Other comprehensive (loss) income: |

||||||||

| Currency translation adjustments |

(45.8 | ) | (34.1 | ) | ||||

|

|

|

|

|

|||||

| Other comprehensive (loss) income |

(45.8 | ) | (34.1 | ) | ||||

|

|

|

|

|

|||||

| Comprehensive income |

201.0 | 152.2 | ||||||

| Less: comprehensive income attributable to noncontrolling interest |

7.5 | 7.9 | ||||||

|

|

|

|

|

|||||

| Comprehensive income attributable to CDK |

$ | 193.5 | $ | 144.3 | ||||

|

|

|

|

|

|||||

See notes to the consolidated and combined financial statements.

12

CDK GLOBAL, INC.

Consolidated Balance Sheets

(In millions, except per share par value)

| June 30, |

||||||||

| 2016 |

2015 |

|||||||

| Assets |

||||||||

| Current assets: |

||||||||

| Cash and cash equivalents |

$ | 219.1 | $ | 408.2 | ||||

| Accounts receivable, net of allowances of $7.1 and $6.8, respectively |

365.5 | 314.6 | ||||||

| Other current assets |

154.1 | 162.4 | ||||||

|

|

|

|

|

|||||

| Total current assets |

738.7 | 885.2 | ||||||

| Property, plant and equipment, net |

118.6 | 100.0 | ||||||

| Other assets |

217.2 | 224.1 | ||||||

| Goodwill |

1,182.7 | 1,209.9 | ||||||

| Intangible assets, net |

107.8 | 99.3 | ||||||

|

|

|

|

|

|||||

| Total assets |

$ | 2,365.0 | $ | 2,518.5 | ||||

|

|

|

|

|

|||||

| Liabilities and Equity |

||||||||

| Current liabilities: |

||||||||

| Current maturities of long-term debt and capital lease obligations |

$ | 26.8 | $ | 13.0 | ||||

| Accounts payable |

38.8 | 21.7 | ||||||

| Accrued expenses and other current liabilities |

165.3 | 154.4 | ||||||

| Accrued payroll and payroll-related expenses |

115.3 | 123.2 | ||||||

| Short-term deferred revenues |

177.2 | 186.1 | ||||||

|

|

|

|

|

|||||

| Total current liabilities |

523.4 | 498.4 | ||||||

| Long-term debt and capital lease obligations |

1,190.3 | 971.1 | ||||||

| Long-term deferred revenues |

157.7 | 162.9 | ||||||

| Deferred income taxes |

46.9 | 58.2 | ||||||

| Other liabilities |

70.5 | 43.8 | ||||||

|

|

|

|

|

|||||

| Total liabilities |

1,988.8 | 1,734.4 | ||||||

|

|

|

|

|

|||||

| Equity: |

||||||||

| Preferred stock, $0.01 par value: Authorized, 50.0 shares; issued and outstanding, none |

— | — | ||||||

| Common stock, $0.01 par value: Authorized, 650.0 shares; issued, 160.3 and 161.3 shares, respectively; outstanding, 150.1 and 160.2 shares, respectively |

1.6 | 1.6 | ||||||

| Additional paid-in-capital |

640.7 | 686.5 | ||||||

| Retained earnings |

238.3 | 81.2 | ||||||

| Treasury stock, at cost: 10.2 and 1.1 shares, respectively |

(526.6 | ) | (50.7 | ) | ||||

| Accumulated other comprehensive income |

5.8 | 51.6 | ||||||

|

|

|

|

|

|||||

| Total CDK stockholders’ equity |

359.8 | 770.2 | ||||||

| Noncontrolling interest |

16.4 | 13.9 | ||||||

|

|

|

|

|

|||||

| Total equity |

376.2 | 784.1 | ||||||

|

|

|

|

|

|||||

| Total liabilities and equity |

$ | 2,365.0 | $ | 2,518.5 | ||||

|

|

|

|

|

|||||

See notes to the consolidated and combined financial statements.

13

CDK GLOBAL, INC.

Consolidated and Combined Statements of Cash Flows

(In millions)

| Years Ended |

||||||||

| 2016 |

2015 |

|||||||

| Cash Flows from Operating Activities: |

||||||||

| Net earnings |

$ | 246.8 | $ | 186.3 | ||||

| Adjustments to reconcile net earnings to cash flows provided by operating activities: |

||||||||

| Depreciation and amortization |

64.0 | 76.5 | ||||||

| Deferred income taxes |

(3.6 | ) | (25.3 | ) | ||||

| Stock-based compensation expense |

36.4 | 30.4 | ||||||

| Pension expense |

— | 0.8 | ||||||

| Other |

(5.6 | ) | (12.6 | ) | ||||

| Changes in operating assets and liabilities, net of effects of acquisitions: |

||||||||

| Increase in accounts receivable |

(57.0 | ) | (16.9 | ) | ||||

| Decrease (increase) in other assets |

3.0 | (24.3 | ) | |||||

| Increase in accounts payable |

15.3 | 3.0 | ||||||

| Increase in accrued expenses and other liabilities |

20.8 | 50.0 | ||||||

|

|

|

|

|

|||||

| Net cash flows provided by operating activities |

320.1 | 267.9 | ||||||

|

|

|

|

|

|||||

| Cash Flows from Investing Activities: |

||||||||

| Capital expenditures |

(50.8 | ) | (44.0 | ) | ||||

| Proceeds from sale of property, plant and equipment |

1.1 | 0.9 | ||||||

| Capitalized software |

(13.5 | ) | (19.9 | ) | ||||

| Acquisitions of businesses, net of cash acquired |

(18.1 | ) | (36.6 | ) | ||||

| Proceeds from the sale of a business |

— | 24.5 | ||||||

| Contributions to investments |

(10.0 | ) | (22.9 | ) | ||||

| Proceeds from investments |

9.7 | 16.6 | ||||||

| Proceeds from (advances on) notes receivable from ADP and its affiliates |

— | 40.6 | ||||||

|

|

|

|

|

|||||

| Net cash flows used in investing activities |

(81.6 | ) | (40.8 | ) | ||||

|

|

|

|

|

|||||

| Cash Flows from Financing Activities: |

||||||||

| Repayments of notes payable to ADP and its affiliates |

— | (21.9 | ) | |||||

| Borrowings on notes payable to ADP and its affiliates |

— | — | ||||||

| Net transactions of parent company investment |

— | (240.8 | ) | |||||

| Proceeds from long-term debt |

250.0 | 1,750.0 | ||||||

| Repayments of long-term debt and capital lease obligations |

(20.0 | ) | (759.5 | ) | ||||

| Dividend paid to ADP at spin-off |

— | (825.0 | ) | |||||

| Dividends paid to stockholders |

(82.3 | ) | (58.2 | ) | ||||

| Repurchases of common stock |

(561.0 | ) | (50.0 | ) | ||||

| Proceeds from exercise of stock options |

6.7 | 9.8 | ||||||

| Excess tax benefit from stock-based compensation awards |

8.9 | 11.2 | ||||||

| Withholding tax payments for stock-based compensation awards |

(8.7 | ) | (0.9 | ) | ||||

| Dividend payments of CVR to noncontrolling owners |

(5.0 | ) | (5.4 | ) | ||||

| Payments of deferred financing costs |

(2.1 | ) | (9.2 | ) | ||||

| Acquisition-related payments |

(6.2 | ) | — | |||||

| Recovery of dividends paid (Note 1D) |

0.4 | — | ||||||

|

|

|

|

|

|||||

| Net cash flows used in financing activities |

(419.3 | ) | (199.9 | ) | ||||

|

|

|

|

|

|||||

| Effect of exchange rate changes on cash and cash equivalents |

(8.3 | ) | (21.8 | ) | ||||

|

|

|

|

|

|||||

| Net change in cash and cash equivalents |

(189.1 | ) | 5.4 | |||||

| Cash and cash equivalents, beginning of period |

408.2 | 402.8 | ||||||

|

|

|

|

|

|||||

| Cash and cash equivalents, end of period |

$ | 219.1 | $ | 408.2 | ||||

|

|

|

|

|

|||||

| Supplemental Disclosure: |

||||||||

| Cash paid for: |

||||||||

| Income taxes and foreign withholding taxes, net of refunds |

$ | 109.4 | $ | 120.8 | ||||

| Interest |

37.8 | 19.2 | ||||||

| Non-cash transactions: |

||||||||

| Non-cash consideration issued for acquisitions (Note 4) |

13.5 | 8.5 | ||||||

See notes to the consolidated and combined financial statements.

14

CDK GLOBAL, INC.

Consolidated and Combined Statements of Equity

(In millions)

| Common Stock |

Additional Capital |

Retained |

Treasury |

Net

Parent |

Accumulated |

Total

CDK |

Non- controlling |

Total |

||||||||||||||||||||||||||||||||

| Shares Issued |

Amount | |||||||||||||||||||||||||||||||||||||||

| Balance as of June 30, 2014 |

— | — | — | — | — | 1,712.2 | 85.7 | 1,797.9 | 11.4 | 1,809.3 | ||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

| Net earnings |

— | — | — | 139.4 | — | 39.0 | — | 178.4 | 7.9 | 186.3 | ||||||||||||||||||||||||||||||

| Foreign currency translation adjustments |

— | — | — | — | — | — | (34.1 | ) | (34.1 | ) | — | (34.1 | ) | |||||||||||||||||||||||||||

| Net distributions to Parent |

— | — | — | — | — | (271.8 | ) | — | (271.8 | ) | — | (271.8 | ) | |||||||||||||||||||||||||||

| Dividend paid to ADP |

— | — | — | — | — | (825.0 | ) | — | (825.0 | ) | — | (825.0 | ) | |||||||||||||||||||||||||||

| Reclassifications of net parent company investment to common stock and additional paid-in-capital in conjunction with the spin-off |

160.6 | 1.6 | 652.8 | — | — | (654.4 | ) | — | — | — | — | |||||||||||||||||||||||||||||

| Stock-based compensation expense |

— | — | 17.5 | — | — | — | — | 17.5 | — | 17.5 | ||||||||||||||||||||||||||||||

| Common stock issued for the exercise and vesting of stock-based compensation awards, net |

0.7 | — | 8.9 | — | — | — | — | 8.9 | — | 8.9 | ||||||||||||||||||||||||||||||

| Excess tax benefit from stock-based compensation awards |

— | — | 7.3 | — | — | — | — | 7.3 | — | 7.3 | ||||||||||||||||||||||||||||||

| Cash dividends paid to stockholders |

— | — | — | (58.2 | ) | — | — | — | (58.2 | ) | — | (58.2 | ) | |||||||||||||||||||||||||||

| Repurchases of common stock |

— | — | — | — | (50.7 | ) | — | — | (50.7 | ) | — | (50.7 | ) | |||||||||||||||||||||||||||

| Dividend payments of CVR to noncontrolling owners |

— | — | — | — | — | — | — | — | (5.4 | ) | (5.4 | ) | ||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

| Balance as of June 30, 2015 |

161.3 | 1.6 | 686.5 | 81.2 | (50.7 | ) | — | 51.6 | 770.2 | 13.9 | 784.1 | |||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

| Net earnings |

— | — | — | 239.3 | — | — | — | 239.3 | 7.5 | 246.8 | ||||||||||||||||||||||||||||||

| Foreign currency translation adjustments |

— | — | — | — | — | — | (45.8 | ) | (45.8 | ) | — | (45.8 | ) | |||||||||||||||||||||||||||

| Stock-based compensation expense and related dividend equivalents |

— | — | 31.7 | (0.3 | ) | — | — | — | 31.4 | — | 31.4 | |||||||||||||||||||||||||||||

| Common stock issued for the exercise and vesting of stock-based compensation awards, net |

— | — | (32.6 | ) | — | 30.6 | — | — | (2.0 | ) | — | (2.0 | ) | |||||||||||||||||||||||||||

| Excess tax benefit from stock-based compensation awards |

— | — | 8.9 | — | — | — | — | 8.9 | — | 8.9 | ||||||||||||||||||||||||||||||

| Cash dividends paid to stockholders |

— | — | — | (82.3 | ) | — | — | — | (82.3 | ) | — | (82.3 | ) | |||||||||||||||||||||||||||

| Repurchases of common stock |

— | — | (53.8 | ) | — | (506.5 | ) | — | — | (560.3 | ) | — | (560.3 | ) | ||||||||||||||||||||||||||

| Dividend payments of CVR to noncontrolling owners |

— | — | — | — | — | — | — | — | (5.0 | ) | (5.0 | ) | ||||||||||||||||||||||||||||

| Correction of common stock issued in connection with the spin-off and dividends paid (Note 1D) |

(1.0 | ) | — | — | 0.4 | — | — | — | 0.4 | — | 0.4 | |||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

| Balance as of June 30, 2016 |

160.3 | $ | 1.6 | $ | 640.7 | $ | 238.3 | $ | (526.6 | ) | $ | — | $ | 5.8 | $ | 359.8 | $ | 16.4 | $ | 376.2 | ||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

See notes to the consolidated and combined financial statements.

15

CDK GLOBAL, INC.

Notes to the Consolidated and Combined Financial Statements

(Tabular amounts in millions, except per share amounts)

Note 1. Basis of Presentation

A. Spin-off

On April 9, 2014, the board of directors of Automatic Data Processing, Inc. (“ADP”) approved the spin-off of the Dealer Services business of ADP. On September 30, 2014, the spin-off became effective and ADP distributed 100% of the common stock of CDK Global, Inc. (the “Company” or “CDK”) to the holders of record of ADP’s common stock as of September 24, 2014 (the “spin-off”).

Concurrent with the spin-off, the Company and ADP entered into several agreements providing for transition services and governing relationships between the Company and ADP. Refer to Notes 8 and 17 for further information.

B. Description of Business

The Company is a leading global provider of integrated information technology and digital marketing solutions to the automotive retail and adjacent industries. The Company’s solutions automate and integrate all parts of the buying process from targeted digital advertising and marketing campaigns to the sale, financing, insuring, parts supply, repair, and maintenance of vehicles.

Effective July 1, 2016, the Company executed a comprehensive reorganization to streamline its organization to enable it to deliver an improved customer experience, create significant efficiencies, and better align it to implement the ongoing business transformation plan discussed in Note 5. The Company reorganized into two main operating groups. In connection with the reorganization, the Company’s operating segments were changed. The company’s first operating group is CDK North America which is comprised of two reportable segments, Retail Solutions North America (“RSNA”) and Advertising North America (“ANA”). The second operating group, which is also a reportable segment, is CDK International (“CDKI”). In addition, the Company has an Other segment, the primary components of which are corporate allocations and other expenses not recorded in the segment results. Refer to Note 18 for further information.

C. Basis of Preparation

The financial statements presented herein represent (i) results of operations, cash flows, and statement of equity for periods subsequent to the spin-off and the balance sheets as of June 30, 2016 and 2015 with the Company reporting as a separate publicly-traded company (referred to as “consolidated financial statements”), and (ii) the results of operations, cash flows, and statement of equity for periods prior to the spin-off when the Company was a wholly owned subsidiary of ADP (referred to as “combined financial statements”). References to the “financial statements” mean the “consolidated and combined financial statements,” unless the context indicates otherwise.

The accompanying financial statements have been prepared in accordance with accounting principles generally accepted in the United States (“GAAP”). The preparation of the financial statements in conformity with GAAP requires management to make estimates and assumptions that affect assets, liabilities, revenues, and expenses that are reported in the accompanying financial statements and footnotes thereto. Actual results may differ from those estimates. These financial statements present the consolidated and combined results of operations of the Company, which was under common control and common management by ADP until the spin-off. The historical financial results in the accompanying financial statements presented may not be indicative of the results that would have been achieved had the Company operated as a separate, stand-alone entity.

16

Prior to the spin-off, the financial statements of the Company included costs for facilities, functions, and services used by the Company at shared ADP sites and costs for certain functions and services performed by centralized ADP organizations and directly charged to the Company based on revenues and headcount. Following the spin-off, the Company performs these functions using internal resources or purchased services, certain of which were provided by ADP during a transitional period that ended September 30, 2015 pursuant to the transition services agreement. Refer to Note 17 for further information on the agreements entered into with ADP as a result of the spin-off. The expenses allocated to the Company for these services are not necessarily indicative of the expenses that would have been incurred if the Company had been a separate, independent entity and had otherwise managed these functions. The financial statements of the Company include the following transactions with ADP or its affiliates:

Separation Costs. The financial statements of the Company include certain incremental costs that are directly attributable to the spin-off. Prior to the spin-off, separation costs were paid by ADP and allocated to the Company. These costs related to professional services and amounted to $34.6 million for the year ended June 30, 2015 (“fiscal 2015.”) The Company did not incur any separation costs during the year ended June 30, 2016 (“fiscal 2016”).

Overhead Expenses. Prior to the spin-off, the financial statements of the Company included an allocation of certain general expenses of ADP and its affiliates, which were in support of the Company, including departmental costs for travel, procurement, treasury, tax, internal audit, risk management, real estate, benefits, and other corporate and infrastructure costs. The Company was allocated overhead costs related to ADP’s shared functions of $7.1 million for fiscal 2015. The Company was not allocated any overhead costs related to ADP’s shared functions following the spin-off. These costs were reported in selling, general and administrative expenses on the consolidated and combined statements of operations. These allocations were based on a variety of factors. The allocation of travel department costs was based on the estimated percentage of travel directly related to the Company. The allocation of benefits was based on the approximate benefit claims or payroll costs directly related to the Company as compared to ADP’s total claims and payroll costs. The allocation of real estate management costs was based on the estimated percentage of square footage of facilities for the Company’s business that was managed by the ADP corporate real estate department in relation to ADP’s total managed facilities. All other allocations were based on an estimated percentage of support staff time or system utilization in comparison to ADP as a whole. Management believes that these allocations were made on a reasonable basis.

Royalty Fees. Prior to the spin-off, the financial statements included a trademark royalty fee charged by ADP to the Company based on revenues for licensing fees associated with the use of the ADP trademark. The Company was charged trademark royalties of $5.7 million and for fiscal 2015. The Company was not charged trademark royalty fees following the spin-off. These charges were included in selling, general and administrative expenses on the consolidated and combined statements of operations. Management believes that these allocations were made on a reasonable basis.

Services Received from Affiliated Companies. Prior to the spin-off, certain systems development functions were outsourced to an ADP shared services facility located in India. This facility provides services to the Company as well as to other ADP affiliates. The Company purchased $5.5 million of services from this facility for fiscal 2015. These functions were no longer outsourced to an ADP shared services facility following the spin-off. The charges for these services were included within cost of revenues on the consolidated and combined statements of operations.

Notes Receivable from ADP and its Affiliates and Notes Payable to ADP and its Affiliates. Prior to the spin-off, notes receivable from ADP and its affiliates and notes payable to ADP and its affiliates were settled; therefore, there were no outstanding notes receivable from or payable to ADP and its affiliates in the accompanying consolidated balance sheets as of June 30, 2016 and 2015. Interest income on notes receivable from ADP and its affiliates was $0.2 million for fiscal 2015. The Company recorded interest income on notes receivable from ADP and its affiliates within other income, net on the consolidated and combined statements of

17

operations. Interest expense on notes payable to ADP and its affiliates was $0.2 million for fiscal 2015. The Company recorded interest expense on notes payable to ADP and its affiliates within interest expense on the consolidated and combined statements of operations. There was no interest income or interest expense under similar arrangements following the spin-off.

Other Services. Prior to the spin-off, the Company received other services from ADP and its affiliates (e.g., payroll processing services). The Company was charged primarily at a fixed rate per employee per month for such payroll processing services. Expenses incurred for such services were $0.4 million for fiscal 2015. The Company did not incur expenses for such services following the spin-off. These expenses were included in selling, general and administrative expenses on the consolidated and combined statements of operations.

D. Spin-off Common Stock Issued

During the three months ended September 30, 2015, the Company became aware that 1.0 million shares of common stock were inadvertently issued and distributed to ADP at the spin-off with respect to certain unvested ADP equity awards. The Company previously reported that 160.6 million shares were issued in connection with the spin-off, which was overstated by 1.0 million shares. In addition, dividends paid to stockholders in fiscal 2015 were overstated by $0.4 million. The Company assessed the materiality and concluded that the impact was not material to previously reported results of operations, financial condition, or cash flows. During the three months ended September 30, 2015, the Company and ADP took corrective action to cancel the 1.0 million shares of common stock effective as of September 30, 2014 and the Company recovered the $0.4 million of cumulative dividends paid on such shares, thereby increasing the Company’s retained earnings. The effects of these adjustments were reflected in the accompanying financial statements for the fiscal year ended June 30, 2016.

Note 2. Summary of Significant Accounting Policies

A. Consolidation

The financial statements include the accounts of the Company and its wholly owned subsidiaries. In addition, the financial statements include the accounts of Computerized Vehicle Registration, Inc. (“CVR”) in which CDK holds a controlling financial or management interest. Intercompany transactions and balances between consolidated CDK businesses have been eliminated.

The Company’s share of earnings or losses of non-controlled affiliates, over which the Company exercises significant influence (generally a 20% to 50% ownership interest), are included in the consolidated and combined operating results using the equity method of accounting. Equity method investments were not significant for fiscal 2016 and 2015.

B. Business Combinations

The purchase price allocations for acquisitions are based on estimates of the fair value of tangible and intangible assets acquired and liabilities assumed. The Company engages independent valuation specialists, when necessary, to assist with purchase price allocations and uses recognized valuation techniques, including the income and market approaches, to determine fair value. Management makes estimates and assumptions in determining purchase price allocations and valuation analyses, which may involve significant unobservable inputs. The excess of the purchase price over the estimated fair values of the underlying assets acquired and liabilities assumed is allocated to goodwill. In certain circumstances, the determination of the purchase price and allocation to assets acquired and liabilities assumed are based upon preliminary estimates and assumptions. Accordingly, the allocation may be subject to revision during the measurement period, which may be up to one year from the acquisition date, when the Company receives final information, including appraisals and other analyses. Measurement period adjustments are recorded to goodwill in the reporting period in which the adjustments to the provisional amounts are determined.

18

Assets acquired and liabilities assumed in business combinations are recorded on the Company’s consolidated balance sheets as of the respective acquisition dates based upon their estimated fair values at such dates. The results of operations of businesses acquired by the Company are included in the Company’s consolidated and combined statements of operations since their respective acquisition dates.

C. Restructuring

Restructuring expenses consist of employee-related costs, including severance and other termination benefits calculated based on long-standing benefit practices and local statutory requirements, and contract termination costs. Restructuring liabilities are recognized at fair value in the period the liability is incurred. In some jurisdictions, the Company has ongoing benefit arrangements under which the Company records the estimated severance and other termination benefits when such costs are deemed probable and estimable, approved by the appropriate corporate management, and if actions required to complete the termination plan indicate that it is unlikely that significant changes to the plan will be made or the plan will be withdrawn. In jurisdictions where there is not an ongoing benefit arrangement, the Company records estimated severance and other termination benefits when appropriate corporate management has committed to the plan and the benefit arrangement is communicated to the affected employees. A liability for costs to terminate a contract before the end of its term is recognized at fair value when the Company terminates the contract in accordance with its terms. Estimates are evaluated periodically to determine whether an adjustment is required.

D. Revenue Recognition

The Company recognizes software revenues in accordance with Accounting Standards Codification (“ASC”) 985-605, “Software—Revenue Recognition,” and non-software related revenue, including Software-as-a-Service (“SaaS”), in accordance with ASC 605, “Revenue Recognition” (“ASC 605”).

The Company generates revenues from four categories: subscription, digital advertising, transactional services, and other. Taxes collected from customers and remitted to governmental authorities are presented on a net basis; that is, such taxes are excluded from revenues.

Subscription. In the Retail Solutions North America (“RSNA”) and CDK International (“CDKI”) segments, CDK provides software and technology solutions for automotive retailers and original equipment manufacturers (“OEMs”), which includes:

| • | Dealer Management Systems (“DMSs”) and layered applications, where the software may be installed onsite at the customer’s location, or hosted and provided on a SaaS basis, including ongoing maintenance and support; |

| • | Interrelated services such as installation, initial training, and data updates; |

| • | Websites, search marketing, and reputation management services (RSNA only); and |

| • | Hardware on a service basis, meaning no specific assets are identified or a substantive right of substitution exists. |

Revenues for term licenses are recognized ratably over the software license term, as vendor-specific objective evidence of the fair values of the individual elements in the sales arrangement does not exist. Revenue recognition commences at the installation dates, when customer acceptance has occurred, and collectability of a determinable amount is probable. In the case of hosted applications, the customer does not have the contractual right to take possession of the software and the items delivered at the outset of the contract (e.g., installation, training, etc.) do not have value to the customer without the software license and ongoing support and maintenance. Any upfront fees charged in the case of hosted arrangements are recognized ratably over the expected benefit period of the arrangement, typically five years. The unrecognized portion of these revenue elements is recorded as deferred revenue.

19

Advertising services. In the Advertising North America (“ANA”) segment, the Company receives revenues from the placement of internet advertising for automotive retailers and OEMs. Advertising revenues are recognized when the services are rendered.

Transaction revenues. In the RSNA segment, the Company receives fees per transaction for providing auto retailers interfaces with third parties to process credit reports, vehicle registrations, and automotive equity mining. Revenue is recognized at the time the services are rendered. Transaction revenues are recorded in revenues gross of costs incurred for credit report processing, vehicle registrations, and automotive equity mining as the Company is contractually responsible for providing the service, software, and/or connectivity to the customers, and therefore, the Company is the primary obligor under ASC 605.

Other. The Company provides consulting and professional services and sells hardware such as laser printers, networking and telephony equipment, and related items. These revenues are recognized upon their delivery or service completion.

E. Income Taxes

Income tax expense is recognized for the amount of taxes payable or refundable for the current year. Deferred tax assets and liabilities are recognized for the expected future tax consequences of temporary differences between the financial reporting and tax bases of assets and liabilities, and for operating losses and tax credit carryforwards. Management must make assumptions, judgments, and estimates to determine the provision for income taxes, taxes payable or refundable, and deferred tax assets and liabilities. The Company’s assumptions, judgments, and estimates take into consideration the realization of deferred tax assets and changes in tax laws or interpretations thereof. The Company’s income tax returns are subject to examination by various tax authorities. A change in the assessment of the outcomes of such matters could materially impact the Company’s consolidated and combined financial statements.

The Company records a valuation allowance to reduce deferred tax assets to the amount that is more likely than not to be realized. In determining the need for a valuation allowance, the Company considers future market growth, forecasted earnings, future taxable income, and prudent and feasible tax planning strategies. In the event the Company determines that it is more likely than not that an entity will be unable to realize all or a portion of its deferred tax assets in the future, the Company would increase the valuation allowance and recognize a corresponding charge to earnings in the period in which such a determination is made. Likewise, if the Company later determines that it is more likely than not that the deferred tax assets will be realized, the Company would reverse the applicable portion of the previously recognized valuation allowance. In order to realize deferred tax assets, the Company must be able to generate sufficient taxable income of the appropriate character in the jurisdictions in which the deferred tax assets are located.

The Company recognizes tax benefits for tax positions that are more likely than not to be sustained upon examination by tax authorities. The amount recognized is measured as the largest amount of benefit that is greater than 50 percent likely to be realized upon ultimate settlement. Unrecognized tax benefits are tax benefits claimed in the Company’s income tax returns that do not meet these recognition and measurement standards. Assumptions, judgments, and the use of estimates are required in determining whether the “more likely than not” standard has been met when developing the provision for income taxes.

If certain pending tax matters settle within the next twelve months, the total amount of unrecognized tax benefits may increase or decrease for all open tax years and jurisdictions. Audit outcomes and the timing of audit settlements are subject to significant uncertainty. The Company continually assesses the likelihood and amount of potential adjustments and adjusts the income tax provision, the current taxes payable and deferred taxes in the period in which the facts that give rise to a revision become known.

Prior to the spin-off, the Company computed the provision for income taxes under the Separate Return Method, which applies the accounting guidance for income taxes to the stand-alone financial statements “as if”

20

the Company were a separate taxpayer and a stand-alone enterprise for the periods presented. For tax periods prior to the spin-off, the Company’s operations were included in the income tax returns of ADP for United States (“U.S.”) federal income tax purposes and for certain consolidated, combined, unitary, or similar group filings for U.S. state and local and foreign tax jurisdictions. Subsequent to the spin-off, the Company files its own U.S. federal, state, and foreign income tax returns.

F. Stock-Based Compensation

Certain of the Company’s employees (a) have been granted stock options to purchase shares of the Company’s common stock and (b) have been granted restricted stock or restricted stock units under which shares of the Company’s common stock vest based on the passage of time or achievement of performance and market conditions.

The Company recognizes stock-based compensation expense in net earnings based on the fair value of the award on the date of the grant. The Company determines the fair value of stock options issued using a binomial option-pricing model. The binomial option-pricing model considers a range of assumptions related to volatility, dividend yield, risk-free interest rate, and employee exercise behavior. Expected volatilities utilized in the binomial option pricing model are based on a combination of implied market volatilities and historical volatilities of peer companies. Similarly, the dividend yield is based on historical experience and expected future dividend payments. The risk-free rate is derived from the U.S. Treasury yield curve in effect at the time of grant. The binomial option pricing model also incorporates exercise and forfeiture assumptions based on an analysis of historical data. The expected life of a stock option grant is derived from the output of the binomial model and represents the period of time that options granted are expected to be outstanding.

The grant date fair value of restricted stock and restricted stock units that vest upon achievement of service conditions is based on the closing price of the Company’s common stock on the date of grant. The Company also grants performance-based awards that vest over a performance period. Certain performance-based awards are further subject to adjustment (increase or decrease) based on a market condition defined as total shareholder return of the Company’s common stock compared to a peer group of companies. The fair value of performance-based awards subject to a market condition is determined using a Monte Carlo simulation model. The principal variable assumptions utilized in determining the grant date fair value of performance-based awards subject to a market condition include the risk-free rate, stock volatility, dividend yield, and correlations between the Company’s stock price and the stock prices of the peer group of companies.

G. Cash and Cash Equivalents

Investment securities with an original maturity of three months or less at the time of purchase are considered cash equivalents. Prior to the spin-off, the Company participated in a centralized approach to cash management and financing of operations governed by ADP. The Company’s cash was available for use and was regularly “swept” by ADP. Transfers of cash both to and from ADP are reflected as a financing activity in the consolidated and combined statements of cash flows for fiscal 2015.

H. Accounts Receivable, Net

Accounts receivable, net is comprised of trade receivables and lease receivables, net of allowances. Trade receivables consist of amounts due to the Company in the normal course of business, which are not collateralized and do not bear interest. Lease receivables primarily relate to sales-type leases arising from the sale of hardware elements in bundled DMS or other integrated solutions. Lease receivables represent the current portion of the present value of the minimum lease payments at the beginning of the lease term. The long-term portion of the present value of the minimum lease payments is included within other assets on the consolidated balance sheets. The Company considers lease receivables to be a single portfolio segment.

21

The accounts receivable allowances for both trade receivables and lease receivables are estimated based on historical collection experience, an analysis of the age of outstanding accounts receivable, and credit issuance experience. Receivables are considered past due if payment is not received by the date agreed upon with the customer. Write-offs are made when management believes it is probable a receivable will not be recovered.

I. Deferred Costs

Costs to deliver services are expensed to cost of revenues as incurred with the exception of specific costs directly related to transition or installation activities, including payroll-related costs for the Company’s implementation and training teams, as well as commission costs for the sale. These costs are deferred and expensed proportionately over the same period that deferred revenues are recognized as revenues. Deferred amounts are monitored regularly to ensure appropriate asset and expense recognition. Current deferred costs classified within other current assets on the consolidated balance sheets were $104.0 million and $105.3 million as of June 30, 2016 and 2015, respectively. Long-term deferred costs classified within other assets on the consolidated balance sheets were $135.5 million and $144.7 million as of June 30, 2016 and 2015, respectively.

J. Time Deposits

From time to time, the Company enters into various time deposit agreements whereby certain funds on deposit with financial institutions may not be withdrawn for a specified period of time. Time deposits with original maturity periods greater than three months are included within other current assets on the consolidated balance sheets. There were no time deposits as of June 30, 2016 and $5.8 million time deposits as of June 30, 2015.

K. Property, Plant and Equipment, Net

Property, plant and equipment, net is stated at cost and depreciated over the estimated useful lives of the assets using the straight-line method. Leasehold improvements are amortized over the shorter of the term of the lease or the estimated useful lives of the improvements. The estimated useful lives of assets are primarily as follows:

| Buildings |