Attached files

| file | filename |

|---|---|

| EX-99.3 - EXHIBIT 99.3 - Zendesk, Inc. | a2017q1tweetexhibitsec.htm |

| 8-K - 8-K - Zendesk, Inc. | zen_8-kxqx1x2017.htm |

| EX-99.1 - EXHIBIT 99.1 - Zendesk, Inc. | zen_8-kxq1x2017xex991x7.htm |

Shareholder Letter

First Quarter 2017

May 04, 2017

Exhibit 99.2

Zendesk Shareholder Letter Q1 2017 - 2

Introduction

The first quarter of 2017 marked a major milestone: We surpassed 100,000 paid customer

accounts worldwide. This number is significant because it demonstrates how Zendesk

and its products continue to appeal to a broad set of businesses of all sizes and across

industries. When we founded the company, we wanted to democratize access to modern,

easy-to-use business software for all organizations. That meant that a local bike shop

could have the same access to the best software as a global brand. We strive to be a core

part of an organization’s customer relationship strategy from the beginning, and we’re

proud that Zendesk’s products are flexible and scalable enough to serve such a broad

spectrum of organizations.

Along with strong account growth, we started 2017 by aggressively pursuing our long-term

growth opportunities, setting ourselves up to meet our financial goals and targets for the

year. In early May, we launched Zendesk Guide, our new and improved knowledge base

product that gives us additional monetization opportunities in self-service. And we are

today announcing our acquisition of Outbound, completed in April, which will significantly

advance our vision for enabling smarter customer messaging and proactive engagement.

We also made significant progress in expanding our market opportunities with new

integrations and partnerships with some of the world’s largest software, Internet, and

ecommerce companies, and we broadened our international operations to support global

growth. All of these moves set us on a course for strong and continued growth in the

coming quarters and years.

Mikkel

Svane

CEO

Elena

Gomez

CFO

Marc

Cabi

Strategy & IR

$93.0M

36%

100,000+

Q1 2017 Revenue

Y/Y Revenue Growth

Paid Customer Accounts

Zendesk Shareholder Letter Q1 2017 - 3

First quarter 2017 financial summary

(in thousands, except per share data)

Three Months Ended March 31,

GAAP Results 2017 2016

Revenue $ 93,007 $ 68,459

Gross profit 64,900 46,943

Gross margin 69.8% 68.6%

Operating loss $ (27,174) $ (26,687)

Operating margin -29.2% -39.0%

Net loss $ (26,994) $ (27,171)

Net loss per share (0.28) (0.30)

Non-GAAP Results

Non-GAAP gross profit $ 68,433 $ 49,955

Non-GAAP gross margin 73.6% 73.0%

Non-GAAP operating loss $ (5,245) $ (6,794)

Non-GAAP operating margin -5.6% -9.9%

Non-GAAP net loss $ (5,065) $ (7,278)

Non-GAAP net loss per share (0.05) (0.08)

In the first quarter, we delivered $93.0 million in revenue, or 36% revenue growth, as compared to

the first quarter of 2016. As expected, first quarter growth was characterized by strong growth in the

low-touch transactional segment of our business, as evidenced by strong results for net new paid

accounts. We ended the first quarter with 101,800 paid customer accounts.

Zendesk Shareholder Letter Q1 2017 - 4

Both the Knowledge Capture app and Answer

Bot are currently in early access programs (EAPs).

Answer Bot will initially launch via email and will

later be available across all channels that

customers use to engage with organizations.

Introducing Guide

Our biggest product news of 2017 so far was

the recent launch of our new smart knowledge

base solution, Zendesk Guide, an evolution

of our Help Center product with new features

and functionality. Forrester reports that 76% of

customers prefer self-service support to find

their own answers as opposed to speaking

with a customer service representative.* Guide

capitalizes on this customer desire to help

themselves by giving customers self-service

support powered by machine learning while

similarly empowering customer service agents to

resolve inquiries with contextual insights.

Along with Zendesk Guide, two complementary

capabilities make the customer service experience

better and more efficient for both customers

and agents.

• With the Knowledge Capture app, available on

our Guide Professional plan, agents can share

their collective knowledge to respond to sup-

port requests more effectively, update outdated

information, and make more self-service

content available over time.

• Answer Bot uses deep learning technology to

improve self-service efficiency by responding to

customers’ questions with relevant knowledge

base articles before they ever reach an agent.

*Forrester blog post, “Online Self Service Dominates Yet

Again. Why? It’s An Effortless Way To Get To Your Answers,”

January 28, 2016, by Kate Leggett.

Zendesk Shareholder Letter Q1 2017 - 5

Acquisition of Outbound

We completed the acquisition of Outbound and welcomed the team into

Zendesk at the end of April. Without requiring a complex, engineering-

heavy implementation, Outbound enables businesses to automate and

deliver relevant messages across web, email, and mobile channels and to

better measure their effectiveness. At a time when customers are inundated

with automated messages, Outbound shifts the focus from the quantity of

messages delivered to the quality of customer interactions.

This is consistent with our core belief that customers today expect

experiences and communication to be built around them, not around

business departments and their siloed needs. Over the past year, our

interactions with and learnings from joint customers led us to conclude

that by combining Outbound’s and Zendesk Connect’s products and

go-to-market (GTM) initiatives, we could together build a differentiated

and better experience for our customers.

Outbound expands the product scope and market opportunity of our

Connect product—currently in an EAP—ultimately accelerating our time

to meaningful revenue. We will continue to market and sell Outbound as

we work to combine the Connect and Outbound products into a single,

multi channel solution.

The acquisition is not expected to have a material impact on our 2017

revenue or our non-GAAP operating loss. The impact of the acquisition on

our GAAP 2017 operating loss is not yet determinable and is subject to the

application of purchase accounting and will include additional expenses,

including amortization of purchased intangibles, expenses associated with

employee retention arrangements, and transaction fees.

Expanding our markets

We pride ourselves on making our products easy to discover, deploy, and

purchase so that any organization, from startup to large enterprise, can realize

their value. A big part of making that possible is extending the reach of our

products through partnerships and integrations with other leading software

platforms and cloud-based services. During the first quarter, we saw major

progress in those efforts.

We were among the first AWS Partner Network partners to support Amazon

Connect, the new cloud-based contact center service from Amazon Web

Services. We are bringing our contact center expertise to the collaboration

through the integration of Zendesk Support with Amazon Connect. Support

provides organizations with the tools and information they need in one place

to quickly and easily solve customer inquiries when using Amazon Connect

for call center capabilities. The integration joins the more than 35 CTI vendors

available for Zendesk.

We also partnered with Adobe to connect parts of the newly launched Adobe

Experience Cloud—starting with the Adobe Cloud Platform “Launch” tag

management solution—to the Zendesk family of products, combining digital

experiences, support interactions, and marketing campaigns between the

respective platforms. The integration enables the creation of a proactive

Zendesk Chat with pre-defined messaging based on Launch by Adobe’s

behavioral tracking information—for example, automatically starting a chat

when a customer abandons an online shopping cart. The effort also includes

collaboration on a new open industry standard data model to develop a shared

scheme around customer support interactions.

Finally, our previously announced integration of Zendesk Support with

Microsoft Teams—the new chat-based workspace for Office 365—went live

in March as part of the broader Teams launch.

Zendesk Shareholder Letter Q1 2017 - 6

International presence

Our international presence and reach is another important way we expand

our markets and fuel growth. Our commitment to international opportunities

is demonstrated by the fact that 46% of our revenue comes from outside the

United States and 45% of our employees are based outside the U.S.

We see our global business continuing on a very promising trajectory.

In the first quarter of this year, we announced expansions and increased

focus in several regions where we’ve seen strong growth in business and

product development.

In Singapore, we expanded our Chat development center in February,

enlarging our office to accommodate more than 120 employees. This

expansion is supported by a grant from the Singapore Economic

Development Board and allows us to leverage relationships with messaging

companies and innovative customers in the region as we evolve Zendesk

Message and Chat. Singapore also serves as our commercial headquarters

in Asia to support our growth initiative throughout the region, where we saw

a 35% year-over-year growth in paid customer accounts as of the end of

the first quarter.

Our new office in Manila, announced in February, serves as a Customer

Experience Hub for the APAC region. The new office provides capacity for

more than 200 people, and the Metro Manila location provides access to a

local pool of highly skilled talent with strong English language skills capable

of providing highly technical support and assistance for our low-touch,

transactional business in this rapidly growing region.

We continue to expand our investment in France, in terms of both GTM

resources and product development. Our French customer base is

expanding—as of the end of the first quarter, our number of paid customer

accounts in France grew by more than 35% year over year. In March, we

announced that we will move our Paris office to Station F, one of the biggest

startup campuses in the world. Our agreement with Station F not only

provides a great hub for our GTM activities there, but it also provides more

than 45 seats at the campus to incubate local startups. Station F will also

use Zendesk products to provide customer support to the companies in its

3,000-seat campus. Additionally, we unveiled a new office in Montpellier, our

hub for development of Zendesk Explore. The new location is three times the

size of our previous Montpellier office, providing a much more spacious office

environment with room for about 50 employees.

Montpellier ManilaSingapore

Zendesk Shareholder Letter Q1 2017 - 7

1600 1700

Help Center

“Copenhangen”

Google

Play

Advanced

Voice

1000

Automatic

Answers

Channel

Framework

80K

Zendesk

Message

Satisfaction

Prediction

70K

Premium

Live Chat

60K

Facebook

Messenger

Analytics

Analyst

Day

SMS Rebrand

1400

Gartner MQ

Leader

Office 365Pathfinder

Gartner MQ

Visionary

1200

Forrester

Wave

Jan

2015

Jan

2016

Jan

2017

India

Office

Opening

90K

1500

Manila

Office

Opening

100K

AWS

Connect

SDK

Fabric

Montpellier

Office

Opening

Singapore

Office

Opening

Key accomplishments

Timeline not to scale

Zendesk Shareholder Letter Q1 2017 - 8

Customer momentum

Reaching our 100,000 paid customer account

milestone resulted from Zendesk products

appealing to a broad range of organizations.

While our low-touch, transactional business

helps us scale our reach to smaller and high-

growth organizations, we also attract traditional

and larger-sized businesses. We believe the

continued customer momentum demonstrates

our ability to serve both markets.

Among the customers to join us or expand with

us recently include:

• The Save Mart Companies, owner of sever-

al grocery store chains including Save Mart,

Lucky, FoodMaxx, and others

• Udemy, a global online learning platform

• Ebates, a shopping portal that offers coupons

and cashback from online retailers

• WOW air, a low-fare airline based in Iceland

• University of Wisconsin-Madison

Department of Medicine

• inDinero, an online platform for financial

data for small businesses

Zendesk Shareholder Letter Q1 2017 - 9

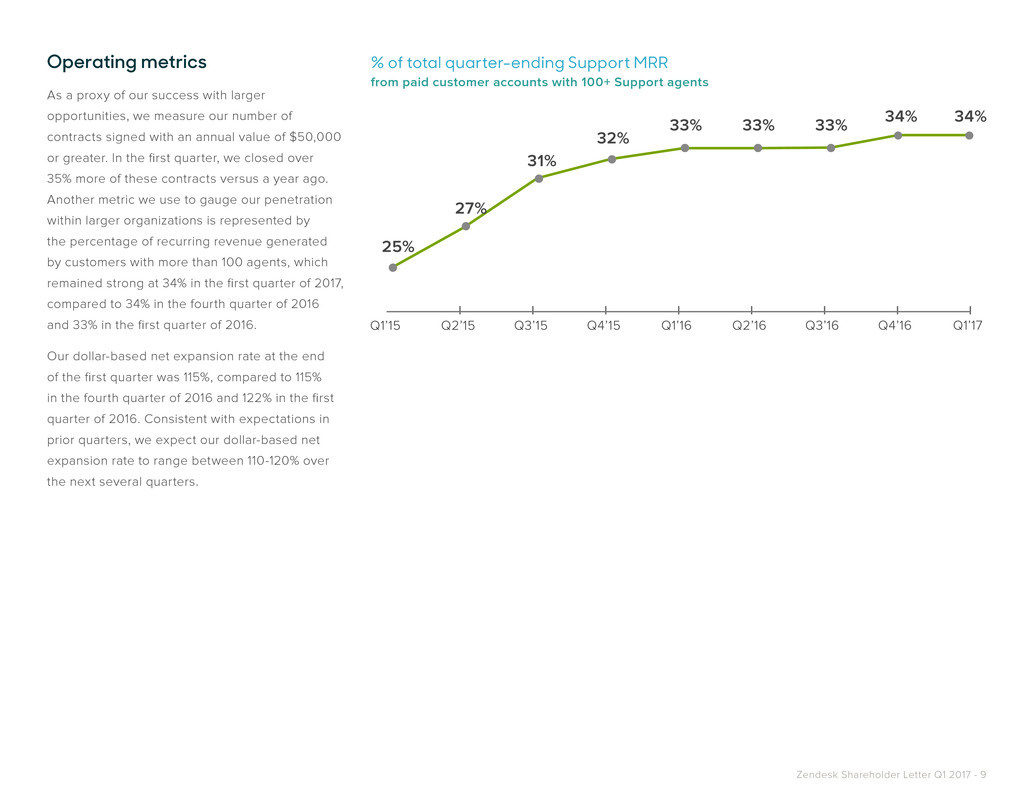

% of total quarter-ending Support MRR

from paid customer accounts with 100+ Support agents

Operating metrics

As a proxy of our success with larger

opportunities, we measure our number of

contracts signed with an annual value of $50,000

or greater. In the first quarter, we closed over

35% more of these contracts versus a year ago.

Another metric we use to gauge our penetration

within larger organizations is represented by

the percentage of recurring revenue generated

by customers with more than 100 agents, which

remained strong at 34% in the first quarter of 2017,

compared to 34% in the fourth quarter of 2016

and 33% in the first quarter of 2016.

Our dollar-based net expansion rate at the end

of the first quarter was 115%, compared to 115%

in the fourth quarter of 2016 and 122% in the first

quarter of 2016. Consistent with expectations in

prior quarters, we expect our dollar-based net

expansion rate to range between 110-120% over

the next several quarters.

Zendesk Shareholder Letter Q1 2017 - 10

Brand awareness and

social responsibility

We further advanced the Zendesk brand through

both industry recognition and events as well

as new community and corporate social

responsibility (CSR) programs around the globe.

Brand recognition

Last October’s redesign of the Zendesk brand

and product family continues to gain accolades,

most recently at the Shorty Awards, which honor

the best of social media from the previous year.

Zendesk’s redesign campaign won the Shorty

Award and the public-voting-based Audience

Honor for “Best Brand Redesign” of 2016. Our

brand has long played a key role in our success,

and our new corporate and product branding

helped us enter the new year with a better

representation of the company we have grown to

become and of our expanding family of products.

On April 27, we hosted our first-ever virtual Relate

event, Relate Live Global. Approximately 1,400

people registered to view four keynotes and nine

breakout sessions live that day or on demand

after the event. Event registrants were added to

our Relate newsletter list, growing our marketable

database for Relate by 10%.

8 e 9 de junho de 2017

Inscrição

Por quê

Comparecer

O Zendesk Presents: São Paulo

é uma experiência desen-

hada para auxiliar empresas

e empreendedores que

procuram explorar a fundo

a complicada natureza dos

relacionamentos. Nossos par-

ticipantes geralmente usam

títulos como: CEO, CTO, CIO,

Diretor de Atendimento ao

Cliente, Diretor de Customer

Success, Diretor de Marketing,

VP de Relacionamento com o

Cliente e Gerentes de Atendi-

mento ao Cliente.

Customer service heroes

can’t escape their destiny.

Join us in São Paulo to take your

customer relationships to the next level.

Ano passado

foi incrível

Em 2016, o Relate Live São

Paulo reuniu 14 líderes reno-

mados internacionamente no

Hotel Unique, em SP para um

público de 1500 pessoas. Veio

o CEO da Zendesk, o prefeito

de São Francisco, a CFO do

Comitê Olímpico e o Wash-

ington Olivetto. Esse ano serão

19 palestrantes e pessoas

vindo de todo lugar do mun-

do para trocar experiências,

contatos e expandir seus

conhecimentos.

Sobre

o Relate

No Zendesk Presents: São

Paulo você irá se reunir com

organizações inovadoras

para discutir novas técnicas,

melhorar a experiência dos

seus cliente e consequent-

emente criar um relacion-

amento mais duradouro. O

evento contará com keynotes

líderes de mercado que já

implementaram e execut-

aram projetos inovadores no

setor de relacionamento com

o cliente, além disso participe

Place

Date

Time

São Paulo

06-07 June

09.00 - 18.00

Inscrição

Zendesk Presents

Microsite concept

N A M E

C O M PA N Y

TOKE NYGAARD

ZENDESK

#relationshapes

N A M E

C O M PA N Y

# R E L AT I O N S H A P E S

Zendesk Shareholder Letter Q1 2017 - 11

Corporate social responsibility

In the first quarter of 2017, the Zendesk Neighbor

Foundation established deeper partnerships with

nonprofits near several of Zendesk’s offices. In

Manila, the Foundation broke ground on a day care

center that will be fully funded by a Foundation

grant and constructed with the help of Zendesk

employees. The Foundation has also committed

to investing $85,000 in local Manila nonprofits.

In Singapore, the Foundation launched a local

chapter of Cycling Without Age, becoming the sixth

Zendesk office engaged in this program aimed at

coaxing seniors out of isolation.

Breaking ground for a day care in Manila

Meanwhile, a top priority for Zendesk in 2017 is to

strengthen and expand our diversity and inclusion

strategy, and Zendesk recently hired its first

diversity and inclusion manager. The company’s

C-level executives also pledged their commitment

to #jamaissanselles (translation: #neverwithouther),

a movement that calls on events and conferences

to have sufficient female representation as speakers

before executives will agree to speak or join a panel.

Finally, the Zendesk CSR team continues to focus

on opportunities to tie its impact efforts to the

company’s products. In the first quarter, Zendesk

launched a partnership with Facebook and the

National Suicide Prevention Lifeline, through which

the Zendesk Message-Facebook Messenger

integration powers and manages the messaging

channel of various suicide prevention hotlines.

Zendesk Shareholder Letter Q1 2017 - 12

Financial measures and cash flow

We maintain our measured approach to investing in growth. Our commitment

to demonstrate continued scale through year-over-year margin improvement

was achieved during the first quarter of 2017, despite large investments we

are making in our roll out of cloud infrastructure to supplement our co-located

data center activities and which we previewed in our previous earnings

call. As a result of these investments, our GAAP gross margin declined

quarter-over-quarter to 69.8% in the first quarter of 2017, from 71.1% in the

fourth quarter of 2016. GAAP gross margin improved year over year from

68.6% in the first quarter of 2016. Non-GAAP gross margin declined quarter-

over-quarter to 73.6%, compared to 74.8% in the fourth quarter of 2016, and

improved year over year from 73.0% in the first quarter of 2016.

GAAP operating loss for the first quarter of 2017 was $27.2 million compared

to GAAP operating loss for the fourth quarter of 2016 of $25.1 million. GAAP

operating loss for the first quarter of 2016 was $26.7 million. Non-GAAP

operating loss for the first quarter of 2017 was $5.2 million and compares

to non-GAAP operating loss for the fourth quarter of 2016 of $4.4 million.

Non-GAAP operating loss for the first quarter of 2016 was $6.8 million.

In the first quarter of 2017, GAAP operating margin was -29.2% versus

-28.4% in the fourth quarter of 2016 and -39.0% in the first quarter of 2016.

Non-GAAP operating margin declined quarter-over-quarter to -5.6% in the

first quarter of 2017 from -5.0% in the fourth quarter of 2016. Non-GAAP

operating margin was -9.9% in the first quarter of 2016.

GAAP net loss for the first quarter of 2017 was $27.0 million or $0.28 loss per

share, compared to GAAP net loss of $24.5 million or $0.26 per share in the

fourth quarter of 2016. GAAP net loss was $27.2 million or $0.30 per share

for the first quarter of 2016. Non-GAAP net loss for the first quarter of 2017

was $5.1 million or $0.05 per share, compared to non-GAAP net loss of $3.8

million or $0.04 per share for the fourth quarter of 2016. Non-GAAP net loss

was $7.3 million or $0.08 per share for the first quarter of 2016. Weighted

average shares used to compute both GAAP and non-GAAP net loss per

share for the first quarter of 2017 was 97.5 million.

Non-GAAP results for the first quarter of 2017 exclude $21.0 million in

share-based compensation and related expenses (including $1.4 million

of employer tax related to employee stock transactions and $0.4 million

of amortization of share-based compensation capitalized in internal-use

software), and $0.9 million of amortization of purchased intangibles.

Non-GAAP results for the fourth quarter of 2016 exclude $19.8 million in

share-based compensation and related expenses (including $1.8 million of

employer tax related to employee stock transactions and $0.6 million of

amortized share-based compensation capitalized in internal-use software),

and $0.9 million of amortization of purchased intangibles. Non-GAAP

results for the first quarter of 2016 exclude $19.0 million in share-based

compensation and related expenses (including $0.8 million of employer tax

related to employee stock transactions and $0.5 million of amortized

share-based compensation capitalized in internal-use software), and

$0.9 million of amortization of purchased intangibles.

During the first quarter of 2017, net cash from operating activities was $7.1

million. We ended the first quarter of 2017 with $109.3 million of cash and

equivalents, and we had an additional $138.4 million of short-term marketable

securities and $68.3 million in long-term marketable securities.

Zendesk Shareholder Letter Q1 2017 - 13

Guidance

For the second quarter of 2017, we expect revenue to range between $98.0

and $100.0 million. An estimate for GAAP operating loss for the second

quarter of 2017 is not yet determinable as such estimate would include an

estimate for amortization of purchased intangibles, a portion of which is

subject to the completion and application of purchase accounting for our

acquisition of Outbound. We expect our non-GAAP operating loss for the

second quarter of 2017 to range between $5.0 and $7.0 million, which we

estimate to exclude share-based compensation and related expenses of

approximately $22.1 million and $0.8 million in acquisition-related expenses.

Non-GAAP operating loss also excludes amortization of purchased

intangibles, a portion of which is impacted by our acquisition of Outbound.

For the full year of 2017, we expect revenue to range between $417.0 and

$425.0 million, compared to our original guidance range of $415.0 and

$425.0 million. This range represents growth between 34% and 36% year

over year. An estimate for GAAP operating loss for the full year is not yet

determinable as such estimate would include an estimate for amortization of

purchased intangibles, a portion of which is subject to the completion and

application of purchase accounting for our acquisition of Outbound.

We expect our non-GAAP operating loss to range between $16.0 and $20.0

million, which we estimate to exclude share-based compensation and

related expenses of approximately $90.7 million and $2.2 million in

acquisition-related expenses. Non-GAAP operating loss also excludes

amortization of purchased intangibles, a portion of which is impacted by

our acquisition of Outbound. Our updated full-year guidance reflects our

confidence in being able to maintain a high growth rate in 2017.

We continue to expect net cash from operating activities and free cash

flow to be positive for the full year 2017. This target regarding free cash

flow includes cash used for purchases of property and equipment and

internal-use software development costs. We have not reconciled free cash

flow guidance to net cash from operating activities for this future period

because we do not provide guidance on the reconciling items between

net cash from operating activities and free cash flow, as a result of the

uncertainty regarding, and the potential variability of, these items. The

actual amount of such reconciling items will have a significant impact on

our free cash flow and, accordingly, a reconciliation of net cash from

operating activities to free cash flow for the period is not available

without unreasonable effort.

Finally, we estimate we will have approximately 99.5 million weighted

average shares outstanding for the second quarter of 2017 and 100.0

million weighted average shares outstanding for the full year of 2017,

each based only on current shares outstanding and anticipated activity

associated with equity incentive plans.

Zendesk Shareholder Letter Q1 2017 - 14

Condensed consolidated

statements of operations

(In thousands, except per

share data; unaudited)

Three Months Ended

March 31,

2017 2016

Revenue $93,007 $68,459

Cost of revenue 28,107 21,516

Gross profit 64,900 46,943

Operating expenses:

Research and development 26,456 21,597

Sales and marketing 47,301 36,172

General and administrative 18,317 15,861

Total operating expenses 92,074 73,630

Operating loss (27,174) (26,687)

Other income (expense), net 218 (70)

Loss before provision for income taxes (26,956) (26,757)

Provision for income taxes 38 414

Net loss $(26,994) $(27,171)

Net loss per share, basic and diluted $(0.28) $(0.30)

Weighted-average shares used to compute

net loss per share, basic and diluted 97,475 90,519

Zendesk Shareholder Letter Q1 2017 - 15

Condensed consolidated

balance sheets

(In thousands, except par

value; unaudited)

March 31, 2017 December 31, 2016

Assets

Current assets:

Cash and cash equivalents $109,258 $93,677

Marketable securities 138,440 131,190

Accounts receivable, net of allowance for

doubtful accounts of $2,264 and $1,269 as

of March 31, 2017 and December 31, 2016,

respectively

39,105 37,343

Prepaid expenses and other

current assets 17,982 17,608

Total current assets 304,785 279,818

Marketable securities, noncurrent 68,320 75,168

Property and equipment, net 60,842 62,731

Goodwill and intangible assets, net 52,699 53,296

Other assets 4,382 4,272

Total assets $491,028 $475,285

Liabilities and stockholders’ equity

Current liabilities:

Accounts payable $5,890 $4,555

Accrued liabilities 18,448 19,106

Accrued compensation and

related benefits 21,664 20,281

Deferred revenue 130,129 123,276

Total current liabilities 176,131 167,218

Deferred revenue, noncurrent 1,989 1,257

Other liabilities 7,511 7,382

Total liabilities 185,631 175,857

Stockholders’ equity:

Preferred stock, par value $0.01 per share - -

Common stock, par value $0.01 per share 991 971

Additional paid-in capital 655,792 624,026

Accumulated other comprehensive loss (3,792) (5,197)

Accumulated deficit (346,942) (319,720)

Treasury stock, at cost (652) (652)

Total stockholders’ equity 305,397 299,428

Total liabilities and stockholders’ equity $491,028 $475,285

Zendesk Shareholder Letter Q1 2017 - 16

Three Months Ended

March 31,

2017 2016

Cash flows from operating activities

Net loss $(26,994) $(27,171)

Adjustments to reconcile net loss to net

cash provided by operating activities:

Depreciation and amortization 7,923 6,526

Share-based compensation 19,213 17,695

Other 697 403

Changes in operating assets and liabilities:

Accounts receivable (2,316) 1,898

Prepaid expenses and other current assets (513) 862

Other assets and liabilities (332) (383)

Accounts payable 1,958 (1,851)

Accrued liabilities 2,524 2,307

Accrued compensation and related benefits (2,596) (2,066)

Deferred revenue 7,585 6,369

Net cash provided by operating activities 7,149 4,589

Cash flows from investing activities

Purchases of property and equipment (4,791) (3,249)

Internal-use software development costs (1,852) (1,351)

Purchases of marketable securities (40,758) (20,795)

Proceeds from maturities of marketable securities 31,654 10,051

Proceeds from sale of marketable securities 8,602 7,604

Net cash used in investing activities (7,145) (7,740)

Cash flows from financing activities

Proceeds from exercise of employee stock options 11,689 1,915

Proceeds from employee stock purchase plan 3,844 3,144

Taxes paid related to net share settlement

of equity awards (154) (189)

Net cash provided by financing activities 15,379 4,870

Effect of exchange rate changes on cash

and cash equivalents 198 (154)

Net increase in cash and cash equivalents 15,581 1,565

Cash and cash equivalents at beginning of period 93,677 216,226

Cash and cash equivalents at end of period $109,258 $ 217,791

Condensed consolidated

statements of cash flows

(In thousands; unaudited)

Zendesk Shareholder Letter Q1 2017 - 17

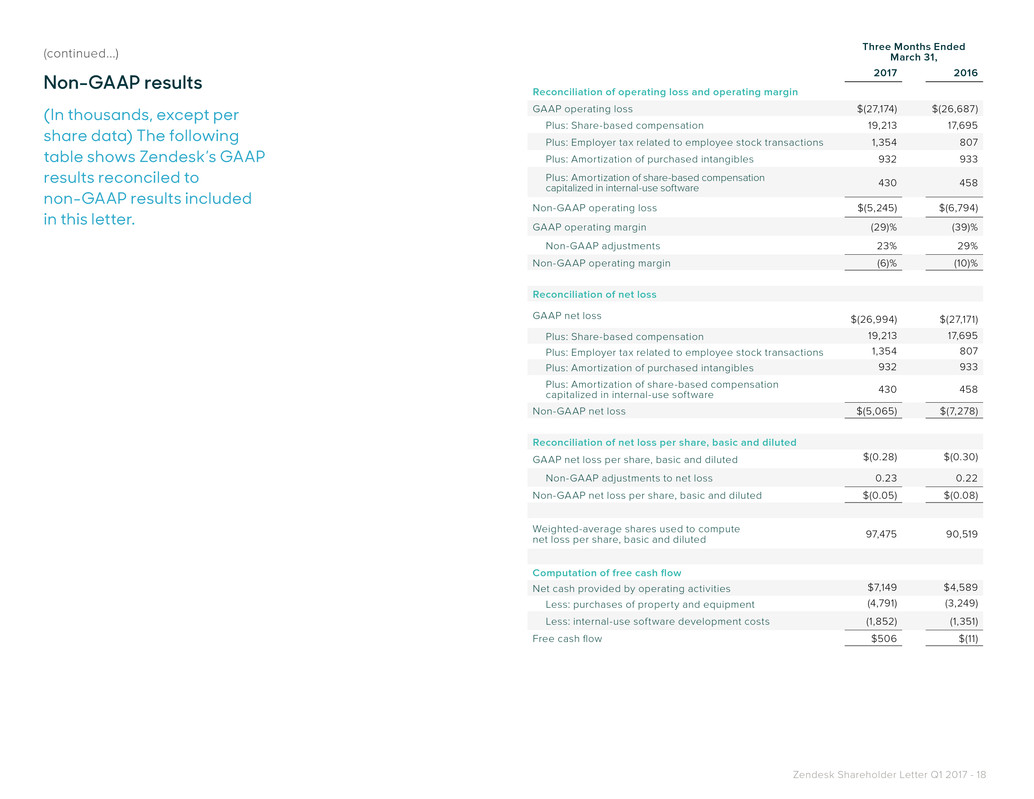

Non-GAAP results

(In thousands, except per

share data) The following

table shows Zendesk’s GAAP

results reconciled to

non-GAAP results included

in this letter.

Three Months Ended

March 31,

2017 2016

Reconciliation of gross profit and gross margin

GAAP gross profit $64,900 $46,943

Plus: Share-based compensation 2,104 1,633

Plus: Employer tax related to employee stock transactions 169 90

Plus: Amortization of purchased intangibles 830 831

Plus: Amortization of share-based compensation

capitalized in internal-use software 430 458

Non-GAAP gross profit $68,433 $49,955

GAAP gross margin 70% 69%

Non-GAAP adjustments 4% 4%

Non-GAAP gross margin 74% 73%

Reconciliation of operating expenses

GAAP research and development $26,456 $21,597

Less: Share-based compensation (6,914) (6,627)

Less: Employer tax related to employee stock transactions (548) (295)

Non-GAAP research and development $18,994 $14,675

GAAP research and development as percentage of revenue 28% 32%

Non-GAAP research and development as percentage of revenue 20% 21%

GAAP sales and marketing $47,301 $36,172

Less: Share-based compensation (5,633) (5,439)

Less: Employer tax related to employee stock transactions (367) (227)

Less: Amortization of purchased intangibles (102) (102)

Non-GAAP sales and marketing $41,199 $30,404

GAAP sales and marketing as percentage of revenue 51% 53%

Non-GAAP sales and marketing as percentage of revenue 44% 44%

GAAP general and administrative $18,317 $15,861

Less: Share-based compensation (4,562) (3,996)

Less: Employer tax related to employee stock transactions (270) (195)

Non-GAAP general and administrative $13,485 $11,670

GAAP general and administrative as percentage of revenue 20% 23%

Non-GAAP general and administrative as percentage of revenue 14% 17%

Zendesk Shareholder Letter Q1 2017 - 18

(continued...)

Non-GAAP results

(In thousands, except per

share data) The following

table shows Zendesk’s GAAP

results reconciled to

non-GAAP results included

in this letter.

Three Months Ended

March 31,

2017 2016

Reconciliation of operating loss and operating margin

GAAP operating loss $(27,174) $(26,687)

Plus: Share-based compensation 19,213 17,695

Plus: Employer tax related to employee stock transactions 1,354 807

Plus: Amortization of purchased intangibles 932 933

Plus: Amortization of share-based compensation

capitalized in internal-use software 430 458

Non-GAAP operating loss $(5,245) $(6,794)

GAAP operating margin (29)% (39)%

Non-GAAP adjustments 23% 29%

Non-GAAP operating margin (6)% (10)%

Reconciliation of net loss

GAAP net loss $(26,994) $(27,171)

Plus: Share-based compensation 19,213 17,695

Plus: Employer tax related to employee stock transactions 1,354 807

Plus: Amortization of purchased intangibles 932 933

Plus: Amortization of share-based compensation

capitalized in internal-use software 430 458

Non-GAAP net loss $(5,065) $(7,278)

Reconciliation of net loss per share, basic and diluted

GAAP net loss per share, basic and diluted $(0.28) $(0.30)

Non-GAAP adjustments to net loss 0.23 0.22

Non-GAAP net loss per share, basic and diluted $(0.05) $(0.08)

Weighted-average shares used to compute

net loss per share, basic and diluted 97,475 90,519

Computation of free cash flow

Net cash provided by operating activities $7,149 $4,589

Less: purchases of property and equipment (4,791) (3,249)

Less: internal-use software development costs (1,852) (1,351)

Free cash flow $506 $(11)

Zendesk Shareholder Letter Q1 2017 - 19

About Zendesk

Zendesk builds software for better customer relationships. It empowers organizations to im-

prove customer engagement and better understand their customers. More than 101,000 paid

customer accounts in over 150 countries and territories use Zendesk products. Based in San

Francisco, Zendesk has operations in the United States, Europe, Asia, Australia, and South

America. Learn more at www.zendesk.com.

Forward-Looking Statements

This press release contains forward-looking statements, including, among other things,

statements regarding Zendesk’s future financial performance, its continued investment to

grow its business, and progress towards its long-term financial objectives. The words such as

“may,” “should,” “will,” “believe,” “expect,” “anticipate,” “target,” “project,” and similar phrases

that denote future expectation or intent regarding Zendesk’s financial results, operations, and

other matters are intended to identify forward-looking statements. You should not rely upon

forward-looking statements as predictions of future events.

The outcome of the events described in these forward-looking statements is subject to

known and unknown risks, uncertainties, and other factors that may cause Zendesk’s actual

results, performance, or achievements to differ materially, including (i) adverse changes in

general economic or market conditions; (ii) Zendesk’s ability to adapt its products to chang-

ing market dynamics and customer preferences or achieve increased market acceptance of

its products; (iii) Zendesk’s expectation that the future growth rate of its revenues will decline,

and that, as its costs increase, Zendesk may not be able to generate sufficient revenues to

achieve or sustain profitability; (iv) Zendesk’s limited operating history, which makes it difficult

to evaluate its prospects and future operating results; (v) Zendesk’s ability to effectively

manage its growth and organizational change; (vi) the market in which Zendesk operates is

intensely competitive, and Zendesk may not compete effectively; (vii) the development of

the market for software as a service business software applications; (viii) Zendesk’s ability to

introduce and market new products and to support its products on a shared services plat-

form; (ix) Zendesk’s ability to integrate acquired businesses and technologies successfully or

achieve the expected benefits of such acquisitions; (x) breaches in Zendesk’s security mea-

sures or unauthorized access to its customers’ data; (xi) service interruptions or performance

problems associated with Zendesk’s technology and infrastructure; (xii) real or perceived

errors, failures, or bugs in its products; (xiii) Zendesk’s substantial reliance on its customers

renewing their subscriptions and purchasing additional subscriptions; and (xiv) Zendesk’s

ability to effectively expand its sales capabilities.

The forward-looking statements contained in this press release are also subject to additional

risks, uncertainties, and factors, including those more fully described in Zendesk’s filings with

the Securities and Exchange Commission, including its Annual Report on Form 10-K for the

year ended December 31, 2016. Further information on potential risks that could affect actual

results will be included in the subsequent periodic and current reports and other filings that

Zendesk makes with the Securities and Exchange Commission from time to time, including its

Quarterly Report on Form 10-Q for the quarter ended March 31, 2017.

Forward-looking statements represent Zendesk’s management’s beliefs and assumptions

only as of the date such statements are made. Zendesk undertakes no obligation to update

any forward-looking statements made in this press release to reflect events or circumstances

after the date of this press release or to reflect new information or the occurrence of unantici-

pated events, except as required by law.

About Non-GAAP Financial Measures

To provide investors and others with additional information regarding Zendesk’s results, the

following non-GAAP financial measures were disclosed: non-GAAP gross profit and gross

margin, non-GAAP operating expenses, non-GAAP operating loss and operating margin,

non-GAAP net loss, non-GAAP net loss per share, basic and diluted, and free cash flow.

Specifically, Zendesk excludes the following from its historical and prospective non-GAAP

financial measures, as applicable:

Share-based Compensation and Amortization of Share-based Compensation Capitalized

in Internal-use Software: Zendesk utilizes share-based compensation to attract and retain

employees. It is principally aimed at aligning their interests with those of its stockholders

and at long-term retention, rather than to address operational performance for any particular

period. As a result, share-based compensation expenses vary for reasons that are generally

unrelated to financial and operational performance in any particular period.

Employer Tax Related to Employee Stock Transactions: Zendesk views the amount of

employer taxes related to its employee stock transactions as an expense that is dependent

on its stock price, employee exercise and other award disposition activity, and other factors

that are beyond Zendesk’s control. As a result, employer taxes related to its employee stock

transactions vary for reasons that are generally unrelated to financial and operational perfor-

mance in any particular period.

Amortization of Purchased Intangibles: Zendesk views amortization of purchased intangible

assets, including the amortization of the cost associated with an acquired entity’s developed

technology, as items arising from pre-acquisition activities determined at the time of an

acquisition. While these intangible assets are evaluated for impairment regularly, amortization

of the cost of purchased intangibles is an expense that is not typically affected by operations

during any particular period.

Acquisition-Related Expenses: Zendesk views acquisition-related expenses, such as transac-

tion costs, integration costs, restructuring costs, and acquisition-related retention payments

as events that are not necessarily reflective of operational performance during a period. In

particular, Zendesk believes the consideration of measures that exclude such expenses can

assist in the comparison of operational performance in different periods which may or may

not include such expenses.

Zendesk provides disclosures regarding its free cash flow, which is defined as net cash from

operating activities, less purchases of property and equipment and internal-use software

development costs. Zendesk uses free cash flow, among other measures, to evaluate the

ability of its operations to generate cash that is available for purposes other than capital

expenditures and capitalized software development costs. Zendesk believes that informa-

tion regarding free cash flow provides investors with an important perspective on the cash

available to fund ongoing operations.

Zendesk’s disclosures regarding its expectations for its non-GAAP operating margin include

adjustments to its expectations for its GAAP operating margin that exclude the expected

share-based compensation and related expenses and amortization of purchased intangibles

excluded from its expectations for non-GAAP operating loss as compared to its expectation

for GAAP operating loss for the same period.

Zendesk’s disclosures regarding its expectations for its non-GAAP gross margin include

adjustments to its expectations for its GAAP gross margin that exclude share-based com-

pensation and related expenses in Zendesk’s cost of revenue and amortization of purchased

intangibles related to developed technology. The share-based compensation and related

expenses excluded due to such adjustments are primarily comprised of the share-based

compensation and related expenses for employees associated with Zendesk’s platform

infrastructure, product support, and professional service organizations.

Zendesk Shareholder Letter Q1 2017 - 20

Zendesk does not provide a reconciliation of its non-GAAP gross margin guidance to GAAP

gross margin for future periods because Zendesk does not provide guidance on the rec-

onciling items between GAAP gross margin and non-GAAP gross margin, as a result of the

uncertainty regarding, and the potential variability of, these items. The actual amount of such

reconciling items will have a significant impact on Zendesk’s non-GAAP gross margin and,

accordingly, a reconciliation of GAAP gross margin to non-GAAP gross margin guidance for

the period is not available without unreasonable effort.

Zendesk uses non-GAAP financial information to evaluate its ongoing operations and for

internal planning and forecasting purposes. Zendesk’s management does not itself, nor does

it suggest that investors should, consider such non-GAAP financial measures in isolation

from, or as a substitute for, financial information prepared in accordance with GAAP. Zendesk

presents such non-GAAP financial measures in reporting its financial results to provide inves-

tors with an additional tool to evaluate Zendesk’s operating results. Zendesk believes these

non-GAAP financial measures are useful because they allow for greater transparency with

respect to key metrics used by management in its financial and operational decision-making.

This allows investors and others to better understand and evaluate Zendesk’s operating

results and future prospects in the same manner as management.

Zendesk’s management believes it is useful for itself and investors to review, as applicable,

both GAAP information that may include items such as share-based compensation and

related expenses, amortization of purchased intangibles, transaction costs related to acqui-

sitions, and the non-GAAP measures that exclude such information in order to assess the

performance of Zendesk’s business and for planning and forecasting in subsequent periods.

When Zendesk uses such a non-GAAP financial measure with respect to historical periods,

it provides a reconciliation of the non-GAAP financial measure to the most closely compara-

ble GAAP financial measure. When Zendesk uses such a non-GAAP financial measure in a

forward-looking manner for future periods, and a reconciliation is not determinable without

unreasonable effort, Zendesk provides the reconciling information that is determinable

without unreasonable effort and identifies the information that would need to be added or

subtracted from the non-GAAP measure to arrive at the most directly comparable GAAP

measure. Investors are encouraged to review the related GAAP financial measures and the

reconciliation of these non-GAAP financial measures to their most directly comparable GAAP

financial measure as detailed above.

About Operating Metrics

Zendesk reviews a number of operating metrics to evaluate its business, measure

performance, identify trends, formulate business plans, and make strategic decisions. These

include the number of paid customer accounts on Zendesk Support, Zendesk Chat, and its

other products, dollar-based net expansion rate, monthly recurring revenue represented by

its churned customers, and the percentage of its monthly recurring revenue from Support

originating from customers with more than 100 agents on Support.

Zendesk defines the number of paid customer accounts at the end of any particular period

as the sum of (i) the number of accounts on Support, exclusive of its legacy Starter plan, free

trials or other free services, (ii) the number of accounts using Chat, exclusive of free trials or

other free services, and (iii) the number of accounts on all of its other products, exclusive

of free trials and other free services, each as of the end of the period and as identified by

a unique account identifier. Use of Support, Chat, and Zendesk’s other products requires

separate subscriptions and each of these accounts are treated as a separate paid customer

account. Existing customers may also expand their utilization of Zendesk’s products by

adding new accounts and a single consolidated organization or customer may have multiple

accounts across each of Zendesk’s products to service separate subsidiaries, divisions, or

work processes. Each of these accounts is also treated as a separate paid customer account.

Zendesk’s dollar-based net expansion rate provides a measurement of its ability to increase

revenue across its existing customer base through expansion of authorized agents

associated with a paid customer account, upgrades in subscription plans, and the purchase

of additional products as offset by churn, contraction in authorized agents associated with a

paid customer account, and downgrades in subscription plans. Zendesk’s dollar-based net

expansion rate is based upon monthly recurring revenue for a set of paid customer accounts

on its products. Monthly recurring revenue for a paid customer account is a legal and

contractual determination made by assessing the contractual terms of each paid customer

account, as of the date of determination, as to the revenue Zendesk expects to generate

in the next monthly period for that paid customer account, assuming no changes to the

subscription and without taking into account any one-time discounts or any platform usage

above the subscription base, if any, that may be applicable to such subscription. Monthly

recurring revenue is not determined by reference to historical revenue, deferred revenue,

or any other United States generally accepted accounting principles, or GAAP, financial

measure over any period. It is forward-looking and contractually derived as of the date of

determination.

Zendesk calculates its dollar-based net expansion rate by dividing the retained revenue

net of contraction and churn by Zendesk’s base revenue. Zendesk defines its base

revenue as the aggregate monthly recurring revenue across its products for customers

with paid customer accounts on Support or Chat as of the date one year prior to the date

of calculation. Zendesk defines the retained revenue net of contraction and churn as the

aggregate monthly recurring revenue across its products for the same customer base

included in the measure of base revenue at the end of the annual period being measured.

The dollar-based net expansion rate is also adjusted to eliminate the effect of certain

activities that Zendesk identifies involving the transfer of agents between paid customer

accounts, consolidation of customer accounts, or the split of a single paid customer account

into multiple paid customer accounts. In addition, the dollar-based net expansion rate

is adjusted to include paid customer accounts in the customer base used to determine

retained revenue net of contraction and churn that share common corporate information with

customers in the customer base that are used to determine the base revenue. Giving effect

to this consolidation results in Zendesk’s dollar-based net expansion rate being calculated

across approximately 84,700 customers, as compared to the approximately 101,800 total

paid customer accounts as of March 31, 2017.

To the extent that Zendesk can determine that the underlying customers do not share

common corporate information, Zendesk does not aggregate paid customer accounts

associated with reseller and other similar channel arrangements for the purposes of

determining its dollar-based net expansion rate. While not material, Zendesk believes the

failure to account for these activities would otherwise skew the dollar-based net expansion

metrics associated with customers that maintain multiple paid customer accounts across

its products and paid customer accounts associated with reseller and other similar channel

arrangements.

Zendesk does not currently incorporate operating metrics associated with its analytics

product into its measurement of dollar-based net expansion rate.

For a more detailed description of how Zendesk calculates its dollar-based net expansion

rate, please refer to Zendesk’s periodic reports filed with the Securities and Exchange

Commission.

Zendesk Shareholder Letter Q1 2017 - 21

Zendesk calculates its monthly recurring revenue represented by its churned customers

on an annualized basis by dividing base revenue associated with paid customer accounts

on Support that churn, either by termination of the subscription or failure to renew, during

the annual period being measured, by Zendesk’s base revenue. Zendesk’s monthly

recurring revenue represented by its churned customers excludes expansion or contraction

associated with paid customer accounts on Support and the effect of upgrades or

downgrades in subscription plan. The monthly recurring revenue represented by its churned

customers is adjusted to exclude paid customer accounts that churned from the customer

base used that share common corporate information with customer accounts that did not

churn from the customer base during the annual period being measured. While not material,

Zendesk believes the failure to make this adjustment could otherwise skew the monthly

recurring revenue represented by its churned customers as a result of customers that

maintain multiple paid customer accounts on Support.

Zendesk’s percentage of monthly recurring revenue from Support that is generated by

customers with 100 or more agents on Support is determined by dividing the monthly

recurring revenue from Support for paid customer accounts with more than 100 agents on

Support as of the measurement date by the monthly recurring revenue from Support for all

paid customer accounts on Support as of the measurement date. Zendesk determines the

customers with 100 or more agents on Support as of the measurement date based on the

number of activated agents on Support at the measurement date and includes adjustments

to aggregate paid customer accounts that share common corporate information.

Zendesk determines the annualized value of a contract by annualizing the monthly recurring

revenue for such contract.

Zendesk does not currently incorporate operating metrics associated with products other

than Support into its measurement of monthly recurring revenue represented by its churned

customers or the percentage of monthly recurring revenue from Support that is generated by

customers with 100 or more agents on Support.

About Customer Metrics

March

31, 2016

June

30, 2016

September

30, 2016

December

31, 2016

March

31, 2017

Paid customer accounts on

Zendesk Support (approx.) 39,900 43,700 47,400 50,800 54,900

+ Paid customer accounts on

Zendesk Chat (approx.) 35,700 37,800 40,000 41,300 44,000

+ Paid customer accounts on

other Zendesk products (approx.) 800 1,300 1,700 2,200 2,900

= Approximate number of

paid customer accounts 76,400 82,800 89,100 94,300 101,800

Source: Zendesk, Inc.

Contact:

Investor Contact

Marc Cabi, +1 415-852-3877

ir@zendesk.com

Media Contact

Natalia Wodecki, +1 415-694-9413

press@zendesk.com