Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K FOR ANNUAL SHAREHOLDER MEETING PRESENTATION - VIDLER WATER RESOURCES, INC. | form8-kfor2017asmslidedeck.htm |

1

PICO Holdings, Inc.

Annual Meeting of Shareholders

May 4, 2017

2 2

SAFE HARBOR STATEMENT

This presentation contains forward-looking statements made pursuant to the “safe

harbor” provisions of the Private Securities Litigation Reform Act of 1995. Forward-

looking statements often address current expected future business and financial

performance, including the demand and pricing for PICO’s real estate and water assets,

the completion of proposed monetization transactions, the return of proceeds to

shareholders, and the reduction of costs, and may contain words such as “expects,”

“anticipates,” “intends,” “plans,“ “believes,” “seeks,” or “will”. All forward-looking

statements included in this presentation are based on information available to PICO as

of the date hereof, and PICO assumes no obligation to update any such forward-looking

statements. Actual results could differ materially from those described in the forward-

looking statements. Forward-looking statements involve risks and uncertainties,

including, but not limited to, economic, competitive and governmental factors outside of

our control, that may cause our business, industry, strategy or actual results to differ

materially from the forward-looking statements. Factors that could cause or contribute

to such differences include, but are not limited to those discussed in detail under the

heading “Risk Factors” in PICO’s periodic reports filed with the U.S. Securities and

Exchange Commission.

3 3

OUR FOCUS

•Monetize assets

• Return proceeds to our shareholders

• Reduce costs

4 4

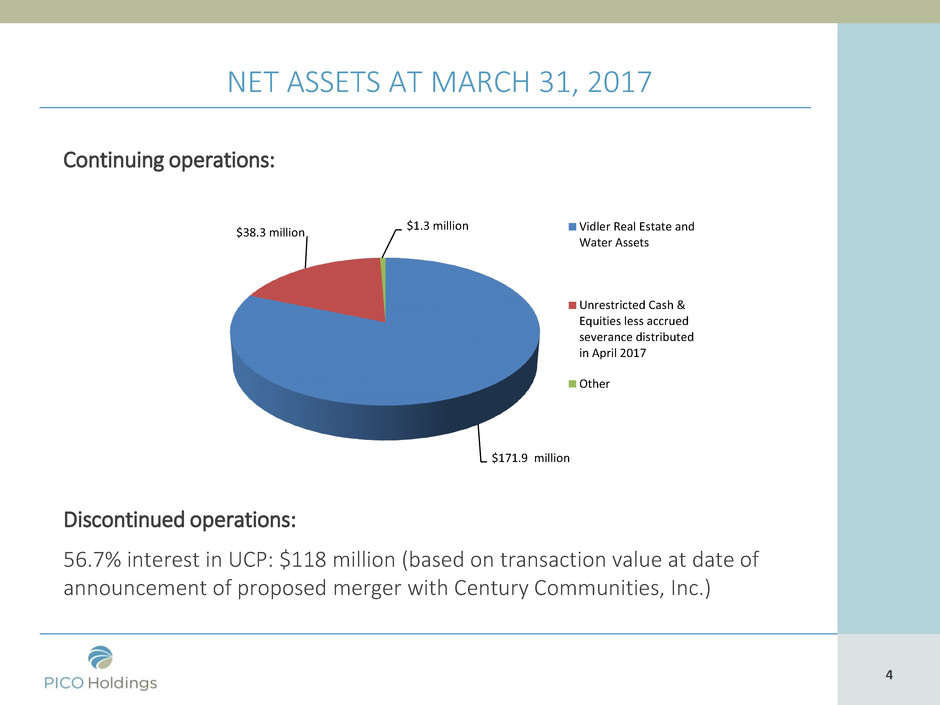

NET ASSETS AT MARCH 31, 2017

Continuing operations:

Discontinued operations:

56.7% interest in UCP: $118 million (based on transaction value at date of

announcement of proposed merger with Century Communities, Inc.)

$171.9 million

$38.3 million

$1.3 million Vidler Real Estate and

Water Assets

Unrestricted Cash &

Equities less accrued

severance distributed

in April 2017

Other

5 5

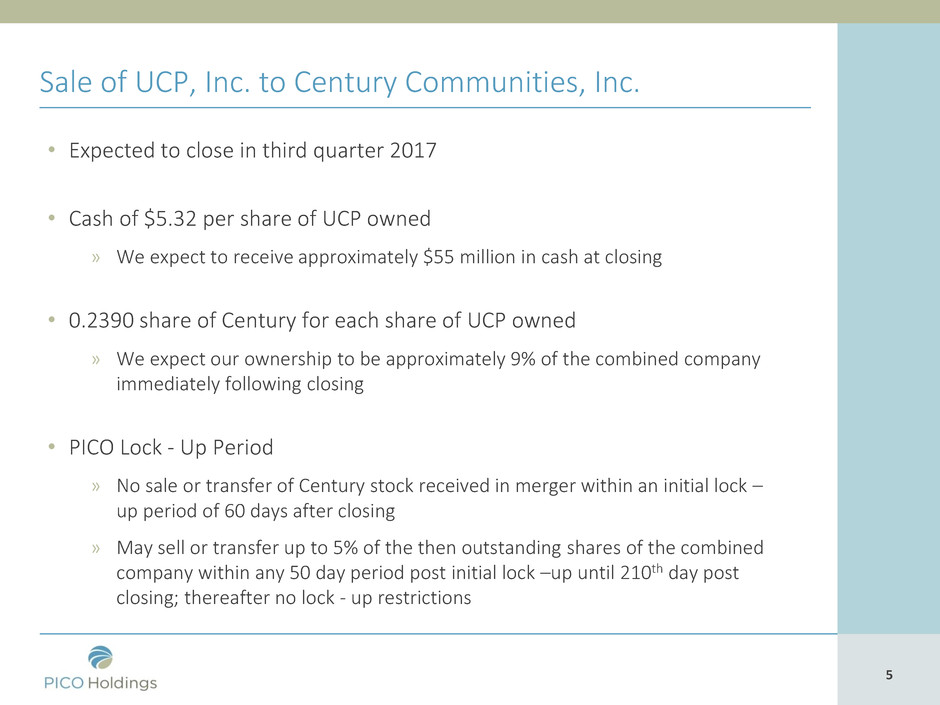

Sale of UCP, Inc. to Century Communities, Inc.

• Expected to close in third quarter 2017

• Cash of $5.32 per share of UCP owned

» We expect to receive approximately $55 million in cash at closing

• 0.2390 share of Century for each share of UCP owned

» We expect our ownership to be approximately 9% of the combined company

immediately following closing

• PICO Lock - Up Period

» No sale or transfer of Century stock received in merger within an initial lock –

up period of 60 days after closing

» May sell or transfer up to 5% of the then outstanding shares of the combined

company within any 50 day period post initial lock –up until 210th day post

closing; thereafter no lock - up restrictions

6 6

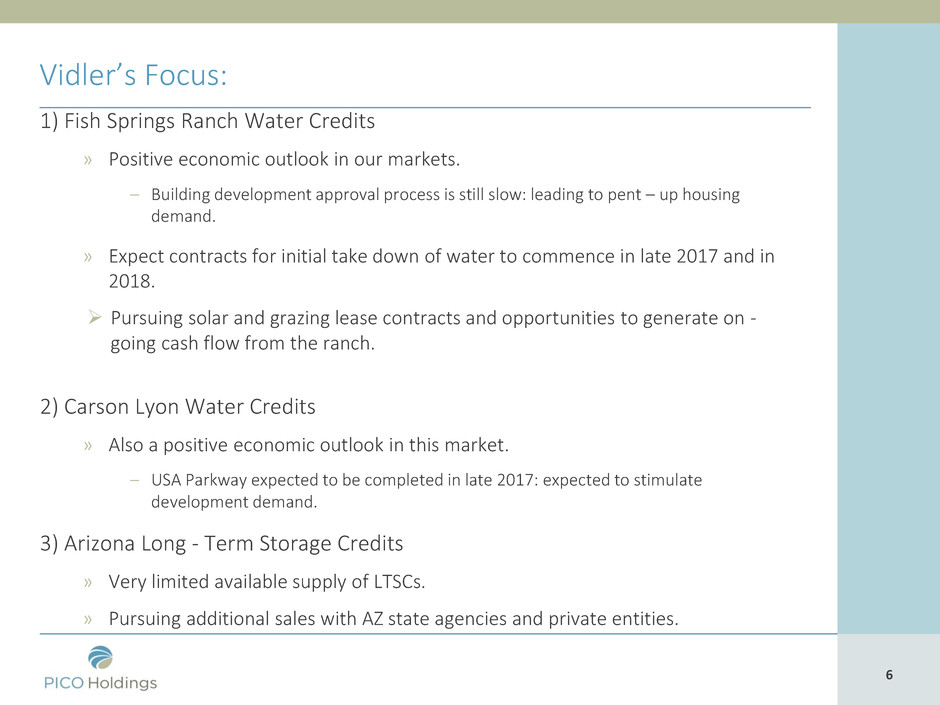

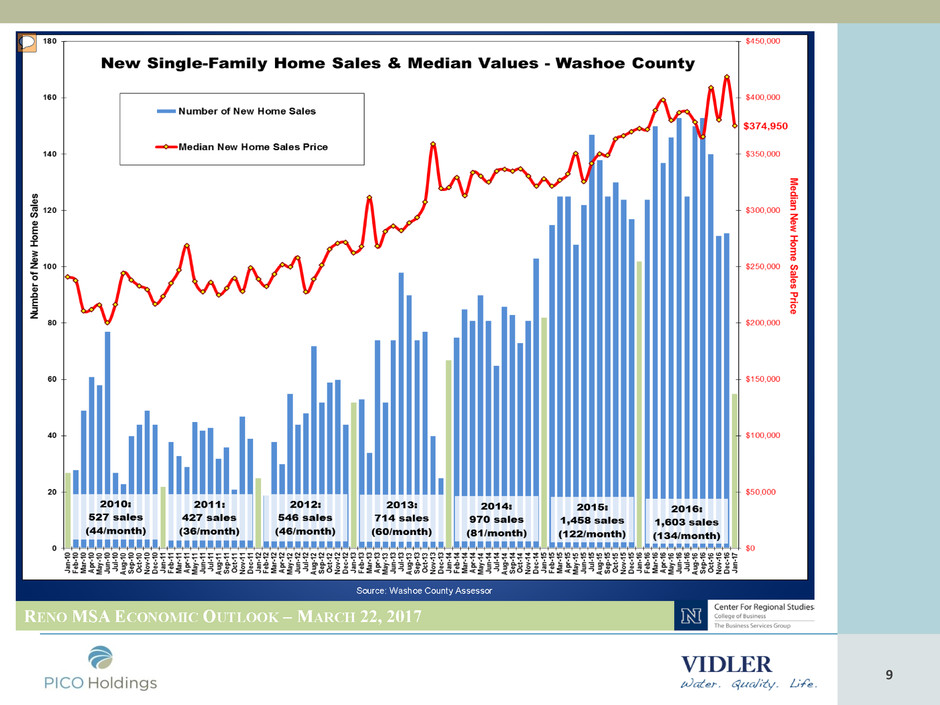

Vidler’s Focus:

1) Fish Springs Ranch Water Credits

» Positive economic outlook in our markets.

– Building development approval process is still slow: leading to pent – up housing

demand.

» Expect contracts for initial take down of water to commence in late 2017 and in

2018.

Pursuing solar and grazing lease contracts and opportunities to generate on -

going cash flow from the ranch.

2) Carson Lyon Water Credits

» Also a positive economic outlook in this market.

– USA Parkway expected to be completed in late 2017: expected to stimulate

development demand.

3) Arizona Long - Term Storage Credits

» Very limited available supply of LTSCs.

» Pursuing additional sales with AZ state agencies and private entities.

7 7

8 8

9 9

10 10

11 11

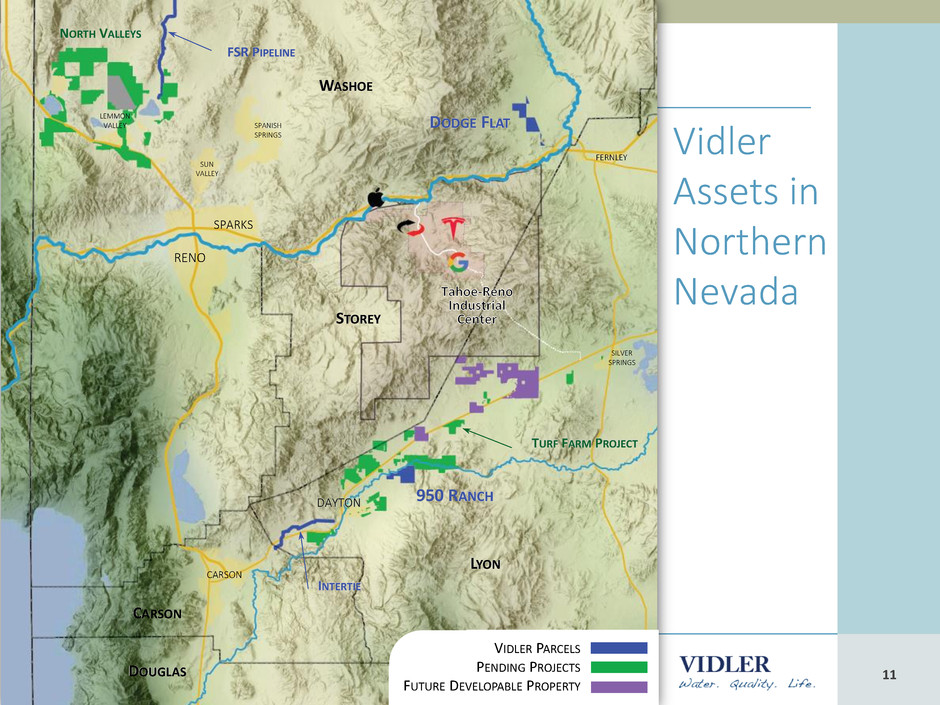

Vidler

Assets in

Northern

Nevada

VIDLER PARCELS

PENDING PROJECTS

FUTURE DEVELOPABLE PROPERTY

WASHOE

TURF FARM PROJECT

DODGE FLAT

RENO

SPARKS

FERNLEY

DAYTON

CARSON

950 RANCH

NORTH VALLEYS

STOREY

LYON

DOUGLAS

CARSON

SPANISH

SPRINGS

SUN

VALLEY

SILVER

SPRINGS

LEMMON

VALLEY

FSR PIPELINE

INTERTIE

12 12

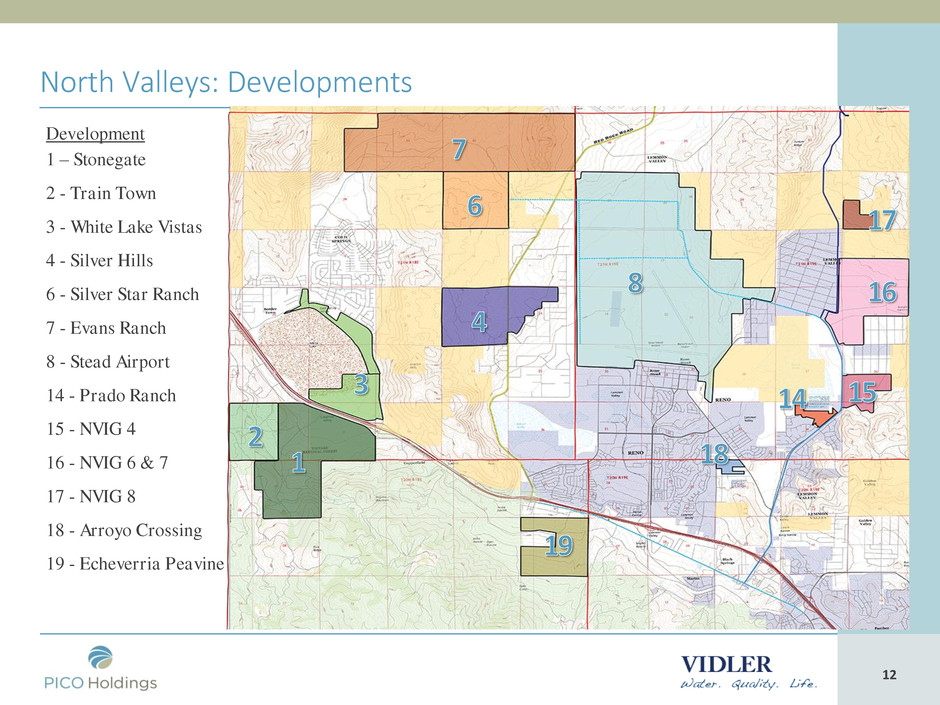

North Valleys: Developments

Development

1 – Stonegate

2 - Train Town

3 - White Lake Vistas

4 - Silver Hills

6 - Silver Star Ranch

7 - Evans Ranch

8 - Stead Airport

14 - Prado Ranch

15 - NVIG 4

16 - NVIG 6 & 7

17 - NVIG 8

18 - Arroyo Crossing

19 - Echeverria Peavine

13 13

North Valleys Estimated Transaction Schedule

Area Development Area

Single Family

Units

Commercial /

Industrial Acres

Revised Date

Estimated for

Initial Contract

Estimated Water Usage

Total Project

(AF)

1

Stonegate (fka

Heinz Rch)

3,815 235 Dec 2018 2,026

2 Train Town 1,300 - Jan 2022 736

3 White Lake Vistas 324 342 Jan 2020 300

4 Silver Hills 1,600 - Jul 2018 640

6 Silver Star Ranch 1,600 - Dec 2018 449

7 Evans Ranch 5,679 62 Dec 2018 2,612

8 Stead Airport - 1,700

14

Prado Ranch

(fka NVIG 2)

145

264 Multi-Family

5 Ac Commercial

May 2018 90

15 NVIG 4 -

264 Multi-Family

250 Ac Commercial

May 2018 300

16 NVIG 6 & 7 3,529 - Jan 2019 1,270

17 NVIG 8 238 - May 2020 86

18 Arroyo Crossing 236 - Oct 2017 94

19

Echeverria

Peavine

1,380 80 Dec 2019 550

TOTAL 9,153

Based on most recent conversations with area developers

14 14

Arizona Update

“Report: Colorado River in Peril.” The Wall Street Journal – April 12th 2017

“Drought and the growing population of the U.S. Southwest have

combined to make the lower part of the Colorado River the most

endangered river in America…”

“Horseshoe Bend” by Prayitno (https://www.flickr.com/photos/prayitnophotography) is licensed under CC BY 2.0 / Edited

from Original

15 15

Colorado River: Lower Basin Structural Deficit

“Normal” Release

8.23 MAF

Ted Cooke,

CAP General Manager

“The bottom line: the net

annual loss to Lake Mead is

about 1.2 MAF.”

“The result is a ‘structural

deficit’ that causes Lake Mead’s

elevation to drop 12 feet every

year, drought or no drought”

Source: CAP BLOG – 12/2/2015

www.cap-az.com/public/blog

CA = 4.4 .

AZ = 1.8 .

NV = 0.3 .

Mexico = 1.5 .

Total = 9.0 MAF

Lake Mead

Evaporation Losses

0.6 MAF

(Half of Treaty Obligation)

There are tributary inflows and

system losses below Lake Mead

that also play into this accounting

16 16

Vidler’s Major Assets : Summary

Arizona Long - Term Storage Credits

» Resource driven: Pent – up demand exists due to the Colorado River Lower

Basin structural deficit and the lack of other significant sources of available

LTSCs.

Northern Nevada assets (North Valleys, Reno and Dayton corridor areas)

» Market driven: Pent – up demand due to housing crunch and lack of available

water in the North Valleys and Dayton corridor: BUT actual monetization and

timing of sales is highly dependent on new residential demand occurring as part

of the “Reno Growth” story.

17 17

Reducing Costs

We continue to reduce costs where feasible:

» We expect significant simplification of operations following the expected sale of

UCP.

» Considerable reductions in executive compensation and headcount since 2016.

» Ongoing consideration of certain benefit plans.

» Reduction in professional fees.

» Reduction in directors’ fees.

» Wind - down of oil and gas operations: reduced operating costs.

» Reduction of certain development costs at Vidler.

18 18

Return of Monetization Proceeds to Shareholders

Considering multiple possible approaches each with benefits and

considerations:

» Purchases of our stock on the open market ($50 million Board

authorized program)

Repurchase programs currently in place

» Self - tender offer

» Special cash dividend

» Distribution of non – cash asset

19 19

Q. & A.