Attached files

| file | filename |

|---|---|

| EX-99.1 - FIRST HORIZON CORP | c88324_ex99-1.htm |

| 8-K - FIRST HORIZON CORP | c88324_8k.htm |

Exhibit 99.2

First Horizon Announces Acquisition of Capital Bank May 4, 2017

Disclaimer 2 First Horizon Aarti Bowman, Investor Relations 901 - 523 - 4017; aagoorha@firsthorizon.com Forward - Looking Statements This presentation contains certain “forward - looking statements” within the meaning of the Private Securities Litigation Reform A ct of 1995 with respect to our beliefs, plans, goals, expectations, and estimates. Forward - looking statements are not a representation of historical information, but instead pertain to future operatio ns, strategies, financial results or other developments. The words “believe,” “expect,” “anticipate,” “intend,” “estimate,” “should,” “is likely,” “will,” “going forward,” and other expressions that indi cat e future events and trends identify forward - looking statements. Forward - looking statements are necessarily based upon estimates and assumptions that are inherently subject to significant busin ess, operational, economic and competitive uncertainties and contingencies, many of which are beyond the control of First Horizon and Capital Bank, and many of which, with respect to fut ure business decisions and actions, are subject to change. Examples of uncertainties and contingencies include, among other important factors: global, general, and local economic and business cond iti ons, including economic recession or depression; expectations of and actual timing and amount of interest rate movements, including the slope and shape of the yield curve, which can have a signi fic ant impact on a financial services institution; market and monetary fluctuations, including fluctuations in mortgage markets; inflation or deflation; customer, investor, competitor, regulatory, an d legislative responses to any or all of these conditions; demand for First Horizon’s and Capital Bank’s product offerings; the actions of the Securities and Exchange Commission (SEC), the Financial Ac cou nting Standards Board (FASB), the Office of the Comptroller of the Currency (OCC), the Board of Governors of the Federal Reserve System (Federal Reserve), the Federal Deposit Insurance Corpora tio n (FDIC), the Financial Industry Regulatory Authority (FINRA), the U.S. Department of the Treasury (Treasury), the Municipal Securities Rulemaking Board (MSRB), the Consumer Financial Protecti on Bureau (CFPB), the Financial Stability Oversight Council (Council), the Public Company Accounting Oversight Board (PCAOB), and other regulators and agencies, including in connection with the regula tor y approval process associated with the merger; pending, threatened, or possible future regulatory, administrative, and judicial outcomes, actions, and proceedings; current or future Executive orde rs; changes in laws and regulations applicable to First Horizon and Capital Bank; the possibility that the proposed transaction will not close when expected or at all because required regulatory, share hol der or other approvals are not received or other conditions to the closing are not satisfied on a timely basis or at all; the possibility that the anticipated benefits of the transaction will not be reali zed when expected or at all, including as a result of the impact of, or problems arising from, the integration of the two companies or as a result of the strength of the economy and competitive factors in the areas wh ere First Horizon and Capital Bank do business; the possibility that the transaction may be more expensive to complete than anticipated, including as a result of unexpected factors or events; divers ion of management’s attention from ongoing business operations and opportunities; potential adverse reactions or changes to business or employee relationships, including those resulting from t he announcement or completion of the transaction; First Horizon’s and Capital Bank’s success in executing their respective business plans and strategies and managing the risks involved in the foregoing; and other factors that may affect future results of First Horizon and Capital Bank. Additional factors that could cause results to differ materially from those contemplated by forward - looking statements can be fo und in First Horizon’s Annual Report on Form 10 - K for the year ended December 31, 2016 and in its subsequent Quarterly Reports on Form 10 - Q filed with the SEC and available in the “Investor Relatio ns” section of First Horizon’s website, http://www.firsthorizon.com, under the heading “SEC Filings” and in other documents First Horizon files with the SEC, and in Capital Bank’s Annual Report on Form 10 - K for the year ended December 31, 2016 and in its subsequent Quarterly Reports on Form 10 - Q, including for the quarter ended March 31, 2017, filed with the SEC and available in the “Investo r Relations” section of Capital Bank’s website, http://investor.capitalbank - us.com, under the heading “SEC Filings” and in other documents Capital Bank files with the SEC. Important Other Information In connection with the proposed transaction, First Horizon will file with the SEC a Registration Statement on Form S - 4 that will include a Joint Proxy Statement of First Horizon and Capital Bank and a Prospectus of First Horizon, as well as other relevant documents concerning the proposed transaction. The proposed transactio n i nvolving First Horizon and Capital Bank will be submitted to First Horizon’s shareholders and Capital Bank’s stockholders for their consideration. This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval. SHAREHOLDERS OF FIRST HORIZON AND STOCKHOLDERS OF Capital Bank ARE URGED TO READ THE REGISTRATION STATEMENT AND THE JOINT PROXY STATEMENT/PROSPECTUS REGARDING THE TRANSACTION WHEN IT BECOMES AVAILABLE AND ANY OTHER RELEVANT DOCUMENTS FILED WITH THE SEC, AS WELL AS ANY AMEND MEN TS OR SUPPLEMENTS TO THOSE DOCUMENTS, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. Shareholders will be able to obtain a free copy of the definitive jo int proxy statement/prospectus, as well as other filings containing information about First Horizon and Capital Bank, without charge, at the SEC’s website (http://www.sec.gov). Copie s o f the joint proxy statement/prospectus and the filings with the SEC that will be incorporated by reference in the joint proxy statement/prospectus can also be obtained, without charge, by directing a r equest to Clyde A Billings, Jr., First Horizon National Corporation, 165 Madison, 8th Floor, Memphis, TN 38103, telephone 901.523.5679, or Kenneth A. Posner, 1345 Avenue of the Americas, Suite 2 - 087, N ew York, NY, 10105, telephone 212.399.4020. Participants in the Solicitation First Horizon, Capital Bank, and certain of their respective directors, executive officers and employees may be deemed to be par ticipants in the solicitation of proxies in respect of the proposed transaction. Information regarding First Horizon’s directors and executive officers is available in its definitive proxy stat eme nt, which was filed with the SEC on March 13, 2017, and certain of its Current Reports on Form 8 - K. Information regarding Capital Bank’s directors and executive officers is available in its definitive proxy statement, which was filed with SEC on April 28, 2017, and certain of its Current Reports on Form 8 - K. Other information regarding the participants in the proxy solicitation and a description of their d irect and indirect interests, by security holdings or otherwise, will be contained in the joint proxy statement/prospectus and other relevant materials filed with the SEC. Free copies of this docume nt may be obtained as described in the preceding paragraph. Capital Bank Ken Posner, Investor Relations 212 - 399 - 4020; kposner@cbfcorp.com If you need further information, please contact:

▪ Enhances presence in the high growth Carolinas and Florida markets ▪ Strong operations in Raleigh, Charlotte and Greensboro ▪ Significant opportunity for increased deposit gathering capabilities in Florida ▪ 4 th largest Southeast regional bank, with ~$40 billion in pro forma assets ▪ Adds scale to provide compelling platform for growth ▪ Optimizes First Horizon’s existing operating capabilities ▪ Accelerates realization of Bonefish financial targets (1) ▪ Improves return, profitability and efficiency ratio profile Strategically Compelling Comprehensive Due Diligence ▪ Attractive financial metrics and disciplined pricing ▪ Low premium deal and attractive deployment of excess capital ▪ Clearly identified cost savings potential ▪ ~20% of branches within 2 - mile radius ▪ ~6% combined cost savings (~30% of Capital Bank expense base) 3 ▪ Extensive diligence process with 80+ employees across both firms over a two month period ▪ Strong underwriting standards and process ▪ High quality and attractive lending relationships ▪ Thorough review of compliance, legal and regulatory functions ▪ Leveraging combined integration expertise ▪ Integration planning and readiness underway Financially Attractive Acquisition of a High - Performing $10 billion Commercial Bank Consistent with M&A Strategy First Horizon Announces Acquisition of Capital Bank 1 Please refer to page 17.

4 Transaction Consideration Key Pricing Ratios Approvals & Estimated Closing Board Seats ▪ $40.84 per Capital Bank share; aggregate consideration of $2.2 billion (1) ▪ Fixed exchange ratio of 1.75x and $7.90 per Capital Bank share in cash; approximately 80% stock / 20% cash consideration mix (1) ▪ Cash consideration funded by pro forma internal liquidity sources ▪ 2.0x Price / TBV per share (reported as of March 31, 2017) (2) ▪ 19.1x Price / 2018E EPS (3) ▪ 8% accretion to EPS, fully phased - in for cost savings ▪ 2.2 year incremental / 4.9 year crossover earnback ; TBVPS dilution of 9.5% ▪ IRR 15%+ ▪ Two Capital Bank Board members to join First Horizon Board ▪ Including Capital Bank CEO Gene Taylor, who will become Vice Chairman of First Horizon ▪ Subject to customary regulatory and shareholder vote approvals ▪ Certain Capital Bank shareholders have signed shareholder support agreements ▪ Target closing in Q4 2017 Financial Impact 1 Based on market closing price as of May 3, 2017 and fully diluted shares. 2 Capital Bank’s Reported TBV per share of $20.29. 3 2018E EPS reflect estimates. First Horizon Announces Acquisition of Capital Bank Attractive Financial Metrics & Disciplined Pricing

First Horizon Actual 2016 First Horizon Long - Term Targets Commentary 10.6% 15.0%+ Enhances profitability & leverages excess capital 0.9% 1.1 – 1.3% Improves core profitability and efficiency 9.9% 8.0 – 9.0% Utilizes ~100bps of excess capital 2.94% 3.25 – 3.50% Improves net interest margins 43% New Target: 30 - 40% (2) Changing Bonefish Target to reflect new business mix Opportunity to improve Capital Bank’s 15 % fee income ratio 72% 60 – 65% Catalyst for significant efficiency improvement 5 ▪ ~$40bn pro forma assets enhances competitive position ▪ Leverages existing infrastructure Strategically and Financially Compelling Combination Consistent with Our M&A Goals Adds Scale Attractive Markets Shared Upside Strengthens Business Mix Risk Mitigants Accelerates Bonefish ▪ Further strengthens footprint in Southeast markets that are wealthier and faster growing ▪ Low premium to long - term relative valuations ▪ Remained disciplined on pricing ▪ 60%+ commercial loans ▪ 94% core deposit funding (1) ▪ Extensive diligence, clean credit, cost savings modeled and revenue synergies identified ▪ Multiyear acceleration in achieving Bonefish targets ▪ Attractive return on capital deployed versus alternatives Transaction Highlights Acceleration of Bonefish Targets 1 Excludes jumbo time deposits. 2 Previous Bonefish target of 40 - 50%. x x x x x CET1 ROA Fee Income / Revenue NIM Efficiency Ratio ROTCE

Buy: 2009 - 2012 Build: 2013 - 2016 ▪ Capitalized with $900mm to acquire troubled banks ▪ Initial 3 FDIC transactions: acquired $1.4bn of assets ▪ Followed by 4 traditional acquisitions: acquired $7.3bn of assets ▪ Built common platform and culture ▪ Reduced CRE and high cost deposits ▪ Upgraded talent, systems and controls ▪ Maintained M&A discipline ▪ CommunityOne : Charlotte, NC based $2.4bn asset bank; 110 years old 33 Years Old Miami, FL 17 Years Old Spartanburg, SC 32 Years Old Miami, FL 126 Years Old Greeneville, TN 4 3 Years Old Naples, FL 21 Years Old Winston - Salem, NC 20 Years Old Raleigh, NC Transformation of Acquired Banks to High - Performing Commercial Bank Capital Bank: Proven Success in Transforming Company Integrated and Built Cohesive Franchise & Culture Source: SNL Financial. 1 Financial data as of March 31, 2017. 2 Growth based on Q4 2013 - Q3 2016; excluding Capital Bank’s CommunityOne acquisition. 3 FDIC data as of June 30, 2016. 6 Current Company Highlights ▪ High performing commercial bank situated in attractive Southeast markets ▪ ROA of ~1% ▪ Generated annual 10% loan growth and 6% deposit growth (2) ▪ Fully integrated eight acquisitions ▪ 5 years of well - executed integration completed ▪ Transformed lending and deposit mix ▪ Strong team with big bank experience across all operational areas, including credit, technology, consumer and finance Geographic Overview CBF (193 Branches) Deposit Overview State Branches Deposits (3) ($ bn ) % of Total NC 95 4.4 56 FL 30 1.6 20 TN 55 1.5 19 SC 12 0.4 5 VA 1 <0.1 <1 Assets $10.1 billion Gross Loans $7.5 billion Deposits $8.1 billion Common Equity $1.3 billion Capital Bank Overview (1)

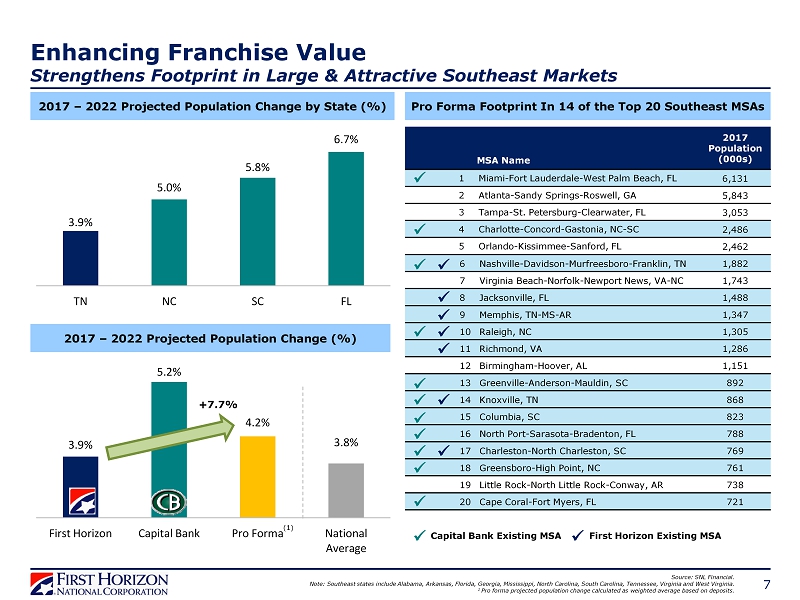

3.9% 5.2% 4.2% 3.8% First Horizon Capital Bank Pro Forma National Average 2017 – 2022 Projected Population Change by State (%) Enhancing Franchise Value Strengthens Footprint in Large & Attractive Southeast Markets 7 Pro Forma Footprint In 14 of the Top 20 Southeast MSAs Source: SNL Financial . Note: Southeast states include Alabama, Arkansas, Florida, Georgia, Mississippi, North Carolina, South Carolina, Tennessee, V irg inia and West Virginia. 1 Pro forma projected population change calculated as weighted average based on deposits. MSA Name 2017 Population (000s) 1 Miami - Fort Lauderdale - West Palm Beach, FL 6,131 2 Atlanta - Sandy Springs - Roswell, GA 5,843 3 Tampa - St. Petersburg - Clearwater, FL 3,053 4 Charlotte - Concord - Gastonia, NC - SC 2,486 5 Orlando - Kissimmee - Sanford, FL 2,462 6 Nashville - Davidson - Murfreesboro - Franklin, TN 1,882 7 Virginia Beach - Norfolk - Newport News, VA - NC 1,743 8 Jacksonville, FL 1,488 9 Memphis, TN - MS - AR 1,347 10 Raleigh, NC 1,305 11 Richmond, VA 1,286 12 Birmingham - Hoover, AL 1,151 13 Greenville - Anderson - Mauldin, SC 892 14 Knoxville, TN 868 15 Columbia, SC 823 16 North Port - Sarasota - Bradenton, FL 788 17 Charleston - North Charleston, SC 769 18 Greensboro - High Point, NC 761 19 Little Rock - North Little Rock - Conway, AR 738 20 Cape Coral - Fort Myers, FL 721 First Horizon Existing MSA Capital Bank Existing MSA x x x x x x x x x x x x 2017 – 2022 Projected Population Change (%) (1) 3.9% 5.0% 5.8% 6.7% TN NC SC FL +7.7% x x x x x x x x

FL Total Total Assets Deposits Rank Name ($ Bn ) ($ Bn ) 1 BB&T 221 161 2 SunTrust 206 163 3 Regions 125 99 4 First Horizon Pro Forma 40 32 4 First Citizens 34 29 5 Synovus 31 25 6 First Horizon 30 24 7 BankUnited 28 20 8 IBERIABANK (2) 28 22 9 Hancock (2) 27 22 10 Pinnacle (2) 19 16 11 Bank of the Ozarks 19 16 12 United Bankshares (2) 19 15 13 BancorpSouth (2) 17 14 14 Arvest 17 14 15 South State (2) 14 12 16 Home BancShares (2) 14 10 17 Trustmark 13 10 18 United Community (2) 11 9 19 Capital Bank 10 8 20 WesBanco 10 7 Compelling Value Proposition Unique Combination of Big Bank Capabilities with Community Bank Look & Feel 8 Note: SNL Financial . 1 Southeast states include Alabama, Arkansas, Florida, Georgia, Louisiana, Mississippi, North Carolina, South Carolina, Tenness ee , Virginia, and West Virginia; excludes national banks. 2 Includes assets and deposits from pending acquisitions. 3 FDIC data as of June 30, 2016. 4 Deposit market share reflects pro forma First Horizon / Capital Bank. Top 20 Southeast Regional Banks (1) ▪ Significantly enhances Carolina footprint ▪ Raleigh MSA – Ranked 7 th with $1.4bn of deposits and 16 branches (4) ; currently ranked 14 th ▪ Charlotte MSA – Ranked 9 th with $674mm of deposits and 15 branches ▪ Greensboro MSA – Ranked 8 th with $519mm of deposits and 12 branches ▪ Deploy metro / community market strategy ▪ Enhances #1 leadership position in Tennessee ▪ Integrate Middle and East Tennessee into existing First Horizon operations ▪ Further expansion in Nashville, TN with $4bn in pro forma deposits ▪ Entry into Clarksville, TN with $89mm in total deposits and 5 branches ▪ Significant branch optimization opportunities ▪ Capital Bank operates 30 branches with $1.6bn in total deposits throughout Florida, with the majority of its branch network concentrated in Key West, Miami and Cape Coral ▪ Ranked #2 in Key West MSA with 9 branches and $498mm in deposits ▪ South Florida deposit market size of $280bn ▪ 2x existing total Tennessee deposit market ($138bn) First Horizon Branch Capital Bank Branch Enhancing First Horizon’s Franchise in High Growth Markets (3) TN SC NC Total Deposits: $21.3bn Total Branches: 208 Total Deposits: $5.3bn Total Branches: 115 Total Deposits: $1.6bn Total Branches: 31

9 ▪ First Horizon commercial products sold to Capital Bank clients ▪ Utilize full product suite ▪ Higher lending capacity across Capital Bank footprint ▪ Geographic opportunity from new, high growth markets ▪ Expand treasury management services and clients Enhancing Franchise Value Significant Opportunities to Leverage the Strengths of Both Banks ▪ Increased deposit gathering focus at Capital Bank ▪ Increase branch size - economies of scale ▪ Reduce cost of funds ▪ Private client / wealth management expansion ▪ Leverage mortgage platform Key Products Commercial x x Business Banking x x Asset Based Lending x Loans to Mortgage Co’s x Franchise Finance x Healthcare x Equipment Finance x Treasury Management x Retail x x Credit Cards x x Wealth Management x x Mortgage Banking x x Fixed Income x Brokerage / Securities x Key Focus Areas Complementary Set of Products / Capabilities Commercial Consumer Other Commercial Consumer

Disciplined M&A Process Comprehensive Due Diligence 10 Thorough Due Diligence Process ▪ Comprehensive due diligence process led by broad senior management team ▪ Constructed a detailed bottoms - up five year financial forecast model incorporating assumptions from business due diligence teams ▪ Identified cost savings opportunities ▪ Extensive credit due diligence ▪ Reviewed top 100 commercial relationships, 75%+ of criticized and classified loans, 100% of ORE portfolio and extensive sample of other commercial and consumer loans ▪ Thorough review of all compliance, legal, regulatory and operational functions ▪ First Horizon management and employees have significant integration experience ▪ Successfully completed and integrated 5 transactions since 2013 ▪ First Horizon’s retail operations are efficient and productive ▪ Utilize existing fully scalable technology platform ▪ Diversified balance sheet with pro forma CRE concentration well - below regulatory guidance ▪ Well - capitalized on a pro forma basis Well - Positioned As An Acquiror Compliance Review ▪ Capital Bank’s BSA / AML program is well designed and effective ▪ Diligence findings conclude no material issues related to CRA / Fair Lending ▪ No significant risks or internal control issues or concerns have been identified

Key Transaction Assumptions 11 Cost Savings Revenue Synergies Merger & Integration Costs ▪ Credit mark: Gross credit mark of 1.5% ($115mm pre - tax) and net credit mark of 1.0% ▪ Rate mark: Mark down on loans of 0.4% ($30mm pre - tax) ▪ Remaining Capital Bank accretable yield: Mark up on loans of 0.8% ($59mm pre - tax) ▪ Trust Preferred Securities: Mark up of $59mm pre - tax ▪ Core deposit intangible: 1.5% amortized over 10 years (SOYD) ▪ Expected to be approximately $65mm pre - tax (fully phased - in); ~6% of combined or ~30% of Capital Bank’s core non - interest expense base ▪ Expected to be ~$120mm pre - tax ▪ Expected annual Capital Bank lost revenue / incremental expense of $8mm pre - tax related to crossing $10bn in assets ▪ Revenue enhancements identified but not modeled into pro forma metrics Durbin Amendment Fair Market Value Adjustments

Market Premium / (Discount) (2.9%) Price / TBV per share (reported as of March 31, 2017) 2.0x Price / Capital Bank’s 2018E EPS (2) 19.1x Transaction Financials 12 First Horizon Pro Forma Est. Close As of March 31, 2017 (3) December 31, 2017 (4) TCE / TA 7.3% 6.8% CET 1 Ratio 10.2% 9.0% Tier 1 Leverage 9.3% 8.2% Tier 1 Capital Ratio 11.3% 9.8% Total Risk Based Capital Ratio 12.3% 11.1% Transaction Multiples (1) Financial Impact Capital Ratios 2019E EPS Accretion (Fully Phased - In) 8% IRR 15%+ Tangible Book Value Dilution 9.5% TBV Earnback Period (Crossover) 4.9 years TBV Earnback Period (Incremental) 2.2 years 1 Based on market closing price as of May 3, 2017. 2 2018E EPS reflect estimates. 3 Holding Company capital ratios are estimates; excludes pro forma impact of Coastal Securities acquisition. 4 Assumes no share repurchases prior to close.

Strong Commitment to Our Communities Recognized for Community Investments, Workforce Diversity & Culture 13 ▪ First Tennessee provided 520 community grants totaling ~$9mm through its Foundation and Community Development Fund in 2016 ▪ In 2016, the combined companies provided $965 million in lending and investment activities to support low to moderate income communities ▪ First Tennessee will add $15mm to its existing Community Development Fund to continue its important community initiatives ▪ First Tennessee employees volunteered over 23,000 hours and donated ~$500,000 impacting 1,000+ organizations in 2016 ▪ First Tennessee employees serve as board members of over 130 nonprofit organizations ▪ Partnership with Operation Hope provides free financial education and counseling to youth, adults and small businesses at 11 Hope Inside locations, with an additional 4 planned for 2017 OPERATION HOPE

Strategically and Financially Compelling Combination Attractive Value Proposition for Investors, Customers, Employees, and Communities 14 x Creates unique and compelling franchise with big bank capabilities and community bank look and feel x Accelerates realization of Bonefish targets x Enhances First Horizon’s footprint in faster growing metro markets in the Carolinas and Florida x Leverages First Horizon’s proven business model of delivering strong organic growth and expanding fee income x Financially compelling transaction with strong earnings accretion x Strong pro forma capital generation to support future growth and dividend x Diversifies balance sheet and provides meaningful enhancement to First Horizon’s existing customer base x Proven execution capabilities across both franchises

APPENDIX 15

Pro Forma Loan & Deposit Composition Source: SNL Financial. Financial data per regulatory filings as of December 31, 2016. Note: Jumbo deposits defined as time deposits > $100k. First Horizon Capital Bank Pro Forma First Horizon Capital Bank Pro Forma 1 - 4 Family 30% Inv. CRE & Multi. 17% Owner - Occ. CRE 18% C&D 6% C&I 20% Consumer 6% Other 3 % 1 - 4 Family 27% Inv. CRE & Multi. 10% Owner - Occ. CRE 13% C&D 4% C&I 25% Consumer 3% Other 18% 1 - 4 Family 26% Inv. CRE & Multi. 7% Owner - Occ. CRE 11% C&D 3% C&I 28% Consumer 2% Other 24% Yield: 3.81% Balance: $19,702mm Savings & MMDA 48% Demand 25% Retail Time 14% Jumbo Time 13% Savings & MMDA 58% Demand 36% Retail Time 3% Jumbo Time 3% Savings & MMDA 55% Demand 33% Retail Time 6% Jumbo Time 6% Cost: 0.39% Balance: $7,884mm Cost: 0.22% Balance: $22,673mm Cost: 0.26% Balance: $30,557mm Yield: 4.54% Balance: $7,406mm Balance: $27,108 Yield: 4.01% Pro Forma Loan Composition Pro Forma Deposit Composition 16 Loans / Deposits Ratio : 87% Loans / Deposits Ratio : 94% Loans / Deposits Ratio : 89%

17 First Horizon Bonefish Targets Focused on Growing Our Company Selectively and Profitably While Positioning Our Balance Sheet for Sustainable, Higher Returns in the Long Term Risk Adjusted Margin Total Assets Earning Assets Pre-tax Income Tax Rate Annualized Net Charge-Offs 0.20% - 0.60% % Fee Income 30% - 40% Efficiency Ratio 60% - 65% Return on Tangible Common Equity 15%+ Equity / Assets Common Equity Tier 1 8% - 9% Return on Assets 1.10% - 1.30% Net Interest Margin 3.25% - 3.50% 1 Previous Bonefish target of 40 - 50%. (1)