Attached files

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1/AMENDMENT NO. 1

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933 CURRENT REPORT

Australian Formulated Corporation

(Exact name of registrant as specified in its charter)

Date: May 4, 2017

| Nevada | 5900 | 37-1835143 |

(State or Other Jurisdiction of Incorporation) |

(Primary Standard Classification Code) | (IRS Employer Identification No.)

|

11th Floor, Tung Tex Buillding, 203 Wai Yip Street, Kwun Tong Kowloon, Hong Kong |

Issuer's telephone number: : +852 2389 1232

(Address,

including zip code, and telephone number,

including area code, of registrant’s principal executive offices)

Please send copies of all correspondence to:

V FINANCIAL GROUP, LLC

http://www.vfinancialgroup.com

780 Reservoir Avenue, #123

Cranston, RI 02910

TELEPHONE: (401) 440-9533

FAX: (401) 633-7300

Email: jeff@vfinancialgroup.com

(Name,

address, including zip code, and telephone number,

including area code, of agent for service)

Approximate date of commencement of proposed sale to the public: As soon as practicable after this Registration Statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. |X|

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act of 1933, please check the following box and list the Securities Act registration Statement number of the earlier effective registration statement for the same offering. |_|

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act of 1933, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.|_|

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act of 1933, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.|_|

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company.

| Large accelerated filer |_| | Accelerated filer |_| |

| Non-accelerated filer |_| (Do not check if a smaller reporting company) | Smaller reporting company |X| |

CALCULATION OF REGISTRATION FEE

Title of Each Class of Securities to be Registered |

Amount to be Registered |

Proposed Maximum Offering Price Per Share (1) |

Proposed Maximum Aggregate Offering Price |

Amount of Registration Fee (2) |

Common Stock, $0.0001 par value |

8,530,000 | $0.60 | $5,118,000 | $593.18 |

| (1) | The offering price has been arbitrarily determined by the Company and bears no relationship to assets, earnings, or any other valuation criteria. No assurance can be given that the shares offered hereby will have a market value or that they may be sold at this, or at any price. |

| (2) | Estimated solely for purposes of calculating the registration fee in accordance with Rule 457(o) of the Securities Act of 1933. |

THE REGISTRANT HEREBY AMENDS THIS REGISTRATION STATEMENT ON SUCH DATE OR DATES AS MAY BE NECESSARY TO DELAY OUR EFFECTIVE DATE UNTIL THE REGISTRANT SHALL FILE A FURTHER AMENDMENT WHICH SPECIFICALLY STATES THAT THIS REGISTRATION STATEMENT SHALL THEREAFTER BECOME EFFECTIVE IN ACCORDANCE WITH SECTION 8(A) OF THE SECURITIES ACT OF 1933 OR UNTIL THE REGISTRATION STATEMENT SHALL BECOME EFFECTIVE ON SUCH DATE AS THE COMMISSION, ACTING PURSUANT TO SAID SECTION 8(A), MAY DETERMINE.

THE INFORMATION IN THIS PROSPECTUS IS NOT COMPLETE AND MAY BE CHANGED. WE MAY NOT SELL THESE SECURITIES UNTIL THE REGISTRATION STATEMENT FILED WITH THE SECURITIES AND EXCHANGE COMMISSION IS EFFECTIVE. THIS PROSPECTUS IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT SOLICITING AN OFFER TO BUY THESE SECURITIES IN ANY STATE WHERE THE OFFER OR SALE IS NOT PERMITTED. THERE IS NO MINIMUM PURCHASE REQUIREMENT FOR THE OFFERING TO PROCEED.

PRELIMINARY PROSPECTUS

Australian Formulated Corporation

8,530,000 SHARES OF COMMON STOCK

$0.0001 PAR VALUE PER SHARE

Prior to this Offering, no public market has existed for the common stock of Australian Formulated Corporation Upon completion of this Offering, we will attempt to have the shares quoted on the OTCQB operated by OTC Markets Group, Inc. There is no assurance that the Shares will ever be quoted on the OTCQB. To be quoted on the OTCQB, a market maker must apply to make a market in our common stock. As of the date of this Prospectus, we have not made any arrangement with any market makers to quote our shares.

In this public offering we, “Australian Formulated Corporation” are offering 2,000,000 shares of our common stock and our selling shareholders are offering 6,530,000 shares of our common stock. We will not receive any of the proceeds from the sale of shares by the selling shareholders. The offering is being made on a self-underwritten, “best efforts” basis. There is no minimum number of shares required to be purchased by each investor. The shares offered by the Company will be sold on our behalf by our Chief Executive Officer, Thomas Lashan. Mr. Lashan is deemed to be an underwriter of this offering. The selling shareholders are also deemed to be underwriters of this offering. There is uncertainty that we will be able to sell any of the 2,000,000 shares being offered herein by the Company. Mr. Lashan will not receive any commissions or proceeds for selling the shares on our behalf. All of the shares being registered for sale by the Company will be sold at a fixed price of $0.60 per share for the duration of the Offering. Additionally, all of the shares offered by the selling shareholders will be sold at a fixed price of $0.60 for the duration of the Offering. Assuming all of the 2,000,000 shares being offered by the Company are sold, the Company will receive $1,200,000 in net proceeds. Assuming 1,500,000 shares (75%) being offered by the Company are sold, the Company will receive $900,000 in net proceeds. Assuming 1,000,000 shares (50%) being offered by the Company are sold, the Company will receive $600,000 in net proceeds. Assuming 500,000 shares (25%) being offered by the Company are sold, the Company will receive $300,000 in net proceeds. There is no minimum amount we are required to raise from the shares being offered by the Company and any funds received will be immediately available to us. There is no guarantee that we will sell any of the securities being offered in this offering. Additionally, there is no guarantee that this Offering will successfully raise enough funds to institute our company's business plan. Additionally, there is no guarantee that a public market will ever develop and you may be unable to sell your shares.

This primary offering will terminate upon the earliest of (i) such time as all of the common stock has been sold pursuant to the registration statement or (ii) 365 days from the effective date of this Prospectus, unless extended by our directors for an additional 90 days. We may however, at any time and for any reason terminate the offering.

Currently, our Chief Executive Officer Thomas Lashan owns approximately 83.57% of the voting power of our outstanding capital stock. After the offering, assuming all of his personal shares that are being registered herein and those shares being offered on behalf of the company are sold, Mr. Lashan will have the ability to control approximately 72.98% of the voting power of our outstanding capital stock.

*Thomas Lashan will be selling shares of common stock on behalf of the Company simultaneously to selling shares of his own personal stock from his own account. A conflict of interest may arise between Mr. Lashan’s interest in selling shares for his own account and in selling shares on the Company’s behalf. Regarding the sale of Mr. Lashan’s shares, they will be sold at a fixed price of $0.60 for the duration of the offering.

The Company estimates the costs of this offering at $21,600. All expenses incurred in this offering are being paid for by the Company. For the duration of the offering any and all sellers of the shares being registered herein agree to provide this prospectus to potential investors in its entirety.

The proceeds from the sale of the securities sold on behalf of the Company will be placed directly into the Company’s account; any investor who purchases shares will have no assurance that any monies, beside their own, will be subscribed to the prospectus. All proceeds from the sale of the securities are non-refundable, except as may be required by applicable laws.

The Company qualifies as an “emerging growth company” as defined in the Jumpstart Our Business Startups Act, which became law in April 2012 and will be subject to reduced public company reporting requirements.

THESE SECURITIES ARE SPECULATIVE AND INVOLVE A HIGH DEGREE OF RISK. YOU SHOULD PURCHASE SHARES ONLY IF YOU CAN AFFORD THE COMPLETE LOSS OF YOUR INVESTMENT. PLEASE REFER TO ‘RISK FACTORS’ BEGINNING ON PAGE 5.

NEITHER THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THESE SECURITIES OR PASSED UPON THE ADEQUACY OR ACCURACY OF THE PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

You should rely only on the information contained in this Prospectus and the information we have referred you to. We have not authorized any person to provide you with any information about this Offering, the Company, or the shares of our Common Stock offered hereby that is different from the information included in this Prospectus. If anyone provides you with different information, you should not rely on it.

The following table of contents has been designed to help you find important information contained in this prospectus. We encourage you to read the entire prospectus.

You should rely only on the information contained in this prospectus or contained in any free writing prospectus filed with the Securities and Exchange Commission. We have not authorized anyone to provide you with additional information or information different from that contained in this prospectus filed with the Securities and Exchange Commission. We take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. We are offering to sell, and seeking offers to buy, our common stock only in jurisdictions where offers and sales are permitted. The information contained in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or any sale of shares of our common stock. Our business, financial condition, results of operations and prospects may have changed since that date.

The date of this prospectus is __________________.

- 1 -

In this Prospectus, ‘‘Australian Formulated’’ the “Company,’’ ‘‘we,’’ ‘‘us,’’ and ‘‘our,’’ refer to Australian Formulated Corporation, unless the context otherwise requires. Unless otherwise indicated, the term ‘‘fiscal year’’ refers to our fiscal year ending January 31st. Unless otherwise indicated, the term ‘‘common stock’’ refers to shares of the Company’s common stock.

This Prospectus, and any supplement to this Prospectus include “forward-looking statements”. To the extent that the information presented in this Prospectus discusses financial projections, information or expectations about our business plans, results of operations, products or markets, or otherwise makes statements about future events, such statements are forward-looking. Such forward-looking statements can be identified by the use of words such as “intends”, “anticipates”, “believes”, “estimates”, “projects”, “forecasts”, “expects”, “plans” and “proposes”. Although we believe that the expectations reflected in these forward-looking statements are based on reasonable assumptions, there are a number of risks and uncertainties that could cause actual results to differ materially from such forward-looking statements. These include, among others, the cautionary statements in the “Risk Factors” section and the “Management’s Discussion and Analysis of Financial Position and Results of Operations” section in this Prospectus.

This summary only highlights selected information contained in greater detail elsewhere in this Prospectus. This summary may not contain all of the information that you should consider before investing in our common stock. You should carefully read the entire Prospectus, including “Risk Factors” beginning on Page 5, and the financial statements, before making an investment decision.

The Company

Australian Formulated Corporation, a Nevada corporation (“the Company”) was incorporated under the laws of the State of Nevada on August 4, 2016.

On January 16, 2017, the Company acquired 100% equity interest of AFC ANS Baby Holdings Limited, a company incorporated on January 6, 2017 under the laws of Seychelles. Consideration regarding this acquisition was in the form of cash in the amount of $1.00. AFC ANS Baby Holdings Limited is an investment holding company with 100% equity interest in Australian Formulated Limited, a company primarily concerned with retailing baby formula and incorporated in Hong Kong. Subsequent to the acquisition, both AFC ANS Baby Holdings Limited and Australian Formulated Limited became wholly owned subsidiaries of the Company.

Australian Formulated Corporation is a Company engaged in the retail of baby formula to consumers and wholesalers.

The Company’s executive offices are located at the 11th Floor, Tung Tex Building, 203 Wai Yip Street, Kwun Tong, Kowloon, Hong Kong.

Our activities have been limited to day to day operations pertaining to the sale of our line of baby products, and the development of our future business operations.

We believe we need to raise $1,200,000 to execute our business plan over the next 12 months. The funds raised in this offering, even assuming we sell all the shares being offered, may be insufficient to carry out our intended business operations.

We will receive proceeds from the sale of 2,000,000 shares of our common stock and intend to use the proceeds from this offering to further develop and market our line of baby formula. There is uncertainty that we will be able to sell any of the 2,000,000 shares being offered herein by the Company. The expenses of this offering, including the preparation of this prospectus and the filing of this registration statement, estimated at $21,600.00, are being paid for by the Company. The maximum proceeds to us from this offering ($1,200,000) will satisfy our basic subsistence level, cash requirements for up to 12 months. 75% of the possible proceeds from the offering by the company ($900,000) will satisfy our basic, subsistence level cash requirements for up to 9 months, while 50% of the proceeds (600,000) will sustain us for up to 6 months, and 25% of the proceeds ($300,000) will sustain us for up to 3 months. Our budgetary allocations may vary, however, depending upon the percentage of proceeds that we obtain from this offering. For example, we may determine that it is more beneficial to allocate funds toward securing potential financing and business opportunities in the short terms rather than to conserve funds to satisfy continuous disclosure requirements for a longer period. During the 12 months following the completion of this offering, we intend to continue our current business plan and increase our current level of operations.

- 2 -

We believe that if we are not able to raise additional capital within 12 months of the effective date of this registration statement, we may be adversely effected and may have to curtail operations or continue operations at a limited level that is financially suitable for the Company.

Our Offering

We have authorized capital stock consisting of 600,000,000 shares of common stock, $0.0001 par value per share (“Common Stock”) and 200,000,000 shares of preferred stock, $0.0001 par value per share (“Preferred Stock”). We have 61,030,000 shares of Common Stock and no shares of Preferred Stock issued and outstanding. Through this offering we will register a total of 8,530,000 shares. These shares represent 2,000,000 additional shares of common stock to be issued by us and 6,530,000 shares of common stock by our selling stockholders. We may endeavor to sell all 2,000,000 shares of common stock after this registration becomes effective. Upon effectiveness of this Registration Statement, the selling stockholders may also sell their own shares. The price at which we, the company, offer these shares is at a fixed price of $0.60 per share for the duration of the offering. The selling stockholders will also sell shares at a fixed price of $0.60 for the duration of the offering. There is no arrangement to address the possible effect of the offering on the price of the stock. We will receive all proceeds from the sale of our common stock but we will not receive any proceeds from the selling stockholders.

*The primary offering on behalf of the company is separate from the secondary offering of the selling stockholders in that the proceeds from the shares of stock sold by the selling stockholder’s will go directly to them, not the company. The same idea applies if the company approaches or is approached by investors who then subsequently decide to invest with the company. Those proceeds would then go to the company. Whomever the investors decide to purchase the shares from will be the beneficiary of the proceeds. None of the proceeds from the selling stockholder’s will be utilized or given to the company. Mr. Lashan will clarify for investors at the time of purchase whether the proceeds are going to the company or directly to himself.

*Mr. Lashan will be able to sell his shares at any time during the duration of this offering. Regarding the sale of Mr. Lashan’s shares, they will be sold at a fixed price of $0.60 for the duration of the offering.

*Mr. Lashan will be selling shares of common stock on behalf of the Company simultaneously to selling shares of his own personal stock from his own account. A conflict of interest may arise between Mr. Lashan’s interest in selling shares for his own account and in selling shares on the Company’s behalf. Please note that at this time Mr. Lashan intends to sell the Company’s shares prior to selling his own shares, although he is under no obligation to do so. Mr. Lashan will decide whether shares are being sold by the Company or by Mr. Lashan himself.

*We will notify investors by filing an information statement that will be available for public viewing on the SEC Edgar Database of any such extension of the offering.

| Securities being offered by the Company | 2,000,000 shares of common stock, at a fixed price of $0.60 offered by us in a direct offering. Our offering will terminate upon the earliest of (i) such time as all of the common stock has been sold pursuant to the registration statement or (ii) 365 days from the effective date of this prospectus unless extended by our Board of Directors for an additional 90 days. We may however, at any time and for any reason terminate the offering.

|

| Securities being offered by the Selling Stockholders | 6,530,000 shares of common stock, at a fixed price of $0.60 offered by selling stockholders in a resale offering. As previously mentioned this fixed price applies at all times for the duration of the offering. The offering will terminate upon the earliest of (i) such time as all of the common stock has been sold pursuant to the registration statement or (ii) 365 days from the effective date of this prospectus, unless extended by our Board of Directors for an additional 90 days. We may however, at any time and for any reason terminate the offering. |

| Offering price per share | We and the selling shareholders will sell the shares at a fixed price per share of $0.60 for the duration of this Offering. |

| Number of shares of common stock outstanding before the offering of common stock | 61,030,000 common shares are currently issued and outstanding. |

| Number of shares of common stock outstanding after the offering of common stock | 63,030,000 common shares will be issued and outstanding if we sell all of the shares we are offering. |

| The minimum number of shares to be sold in this offering |

None. |

| Market for the common shares | There is no public market for the common shares. The price per share is $0.60. |

| We may not be able to meet the requirement for a public listing or quotation of our common stock. Furthermore, even if our common stock is quoted or granted listing, a market for the common shares may not develop. | |

| The offering price for the shares will remain at $0.60 per share for the duration of the offering. |

- 3 -

| Use of Proceeds | We intend to use the gross proceeds to us for working capital, marketing, development of new product lines, and increased staff. |

| Termination of the Offering | This offering will terminate upon the earlier to occur of (i) 365 days after this registration statement becomes effective with the Securities and Exchange Commission, or (ii) the date on which all 8,530,000 shares registered hereunder have been sold. We may, at our discretion, extend the offering for an additional 90 days. At any time and for any reason we may also terminate the offering. |

| Terms of the Offering | Our Chief Executive Officer, Thomas Lashan will sell the 2,000,000 shares of common stock on behalf of the company, upon effectiveness of this registration statement, on a BEST EFFORTS basis. |

| Subscriptions: | All subscriptions once accepted by us are irrevocable.

|

| Registration Costs | We estimate our total offering registration costs to be approximately $21,600.

|

| Risk Factors: | See “Risk Factors” and the other information in this prospectus for a discussion of the factors you should consider before deciding to invest in shares of our common stock. |

After the offering, assuming all of his personal shares that are being registered herein and those shares being offered on behalf of the company are sold, Mr. Lashan will have the ability to control approximately 72.98% of the voting power of our outstanding capital stock.

You should rely only upon the information contained in this prospectus. We have not authorized anyone to provide you with information different from that which is contained in this prospectus. We are offering to sell common stock and seeking offers to common stock only in jurisdictions where offers and sales are permitted.

- 4 -

Please consider the following risk factors and other information in this prospectus relating to our business before deciding to invest in our common stock.

This offering and any investment in our common stock involves a high degree of risk. You should carefully consider the risks described below and all of the information contained in this prospectus before deciding whether to purchase our common stock. If any of the following risks actually occur, our business, financial condition and results of operations could be harmed. The trading price of our common stock could decline due to any of these risks, and you may lose all or part of your investment.

We consider the following to be the material risks for an investor regarding this offering. Our company should be viewed as a high-risk investment and speculative in nature. An investment in our common stock may result in a complete loss of the invested amount.

An investment in our common stock is highly speculative, and should only be made by persons who can afford to lose their entire investment in us. You should carefully consider the following risk factors and other information in this report before deciding to become a holder of our common stock. If any of the following risks actually occur, our business and financial results could be negatively affected to a significant extent.

Risks Relating to Our Company and Our Industry

Our success depends on sustaining the strength of our ANS baby formula brand.

The willingness of consumers to purchase our products depends upon our ability to offer attractive brand value propositions. This depends, in part, on consumers attributing a higher value to our products than to alternatives. If the difference in the value attributed to our products as compared to those of our competitors narrows, or if there is a perception of such a narrowing, consumers may choose not to buy our products. If we fail to promote and maintain the brand equity of our products across each of our markets, then consumer perception of our products’ nutritional quality may be diminished and our business could be materially adversely affected. Our ability to maintain or improve our brand value propositions will impact whether these circumstances will result in decreased market share and profitability.

Because we operate in a highly competitive industry, our revenues or profits could be harmed if we are unable to compete effectively.

The pediatric nutrition industry in which we operate, with a particular emphasis on the retail of infant formula, is subject to intense competition. We compete against corporations which offer comparable products, have a longer operating history, which have greater revenue and resources, amongst other advantages. If we cannot compete effectively we may not generate substantive revenue or profits which could negatively impact the value of our common stock.

- 5 -

We are subject to numerous governmental regulations and it can be costly to comply with these regulations. Changes in governmental regulations could harm our business.

As a producer of pediatric nutrition products, our activities are subject to extensive regulation by governmental authorities and international organizations, including rules and regulations with respect to the environment, employee health and safety, hygiene, quality control and tax laws. It can be costly to comply with these regulations and to develop compliant product processes. In addition, regulatory changes or decisions that restrict the marketing, promotion and availability of our products, as well as the manufacture and labeling of our products, could materially adversely affect our business. Our ability to anticipate and comply with evolving global standards requires significant investment in monitoring the global regulatory environment and we may be unable to comply with changes in regulation restricting our ability to continue to operate our business, market or sell our products.

At present the Company is not aware of any pending changes in regulations that could effect operations, however we are subject to Section 17 of the Food Safety Ordinance (Cap. 162) in Hong Kong. Under Section 17 of the Food Safety Ordinance any person who operates a food importation or food distribution business is required to register with the Director of Food and Environmental Hygien (DFEH). Under section 2(1) of the Ordinance, “food distribution business” means a business for which the principal activity is the supply of food in Hong Kong by wholesale. Section 2(2) of the Ordinance further provides that in determining, for the purpose of the definition of “food distribution business” in subsection (1), whether the principal activity of a business is the supply of food in Hong Kong by wholesale, regard must be had only to those activities of the business that are related to the supply of food.

If we were to lose the services of Mr. Lashan or Mr. Lykouras, we may not be able to execute our business strategy.

We currently depend on the continued services and performance of the key members of our management team, including Thomas Lashan, our Chief Executive Officer, and Vasilios Lykouras, our Director. Their leadership has played an integral role in our company. The loss of key members of our management team could disrupt our operations and have an adverse effect on our ability to grow our business. In addition, competition for senior executives and key personnel in our industry is intense, and we may be unable to retain our senior executives and key personnel or attract and retain new senior executives and key personnel in the future, in which case our business may be severely disrupted.

If we are unable to hire qualified personnel and retain or motivate key personnel, we may not be able to grow effectively.

Our future success depends on our continuing ability to identify, hire, develop, motivate and retain skilled personnel for all areas of our organization. Competition in our industry for qualified employees is very competitive. Our continued ability to compete effectively depends on our ability to attract new employees and to retain and motivate our existing employees.

Sales of our products are subject to changing consumer preferences, and our success depends upon our ability to predict, identify and interpret changes in consumer preferences and develop and offer new products rapidly enough to meet those changes.

Our success depends on our ability to predict, identify and interpret the tastes, dietary habits and nutritional needs of consumers and to offer products that appeal to those preferences. If we do not succeed in offering products that consumers want to buy, our sales and market share will decrease, resulting in reduced profitability. If we are unable to predict accurately which shifts in consumer preferences will be long lasting, or to introduce new and improved products to satisfy those preferences, our sales will decline.

Any failure to protect our intellectual property could reduce the value of our brand and harm our business.

The recognition and reputation of our brand are integral to our success. The success of our business depends in part upon our continued ability to use our intellectual property to increase brand awareness and further develop our brand.

There may be times in the future we need to resort to litigation to enforce our intellectual property rights. Litigation of this type could be costly, force us to divert our resources, lead to counterclaims or other claims against us or otherwise harm our business or reputation. Failure to maintain, control and protect our intellectual property would adversely affect our business.

- 6 -

Our Principal executive offices are located in Hong Kong and our Company has non-U.S. resident Officers and Directors. As such, it may be difficult to pursue legal action against our Company or Directors.

Due to the fact that our Company’s executive office is located in Hong Kong and our Company has non-U.S. resident Officers and Directors, the enforceability of civil liability provisions of U.S. federal securities laws against the company’s Officers and Directors, and company assets located in foreign jurisdictions, will be limited if possible at all.

A decline in general economic conditions could lead to reduced consumer traffic and could negatively impact our business operations and financial condition. A decline of this nature could have a material adverse effect on our business, financial condition and results of operations.

Our operating and financial performance may be adversely affected by a variety of factors that influence the general economy. Consumer spending habits are affected by, among other things, prevailing economic conditions, levels of unemployment, salaries and wage rates, prevailing interest rates, income tax rates and policies, consumer confidence and consumer perception of economic conditions. In addition, consumer purchasing patterns may be influenced by consumers’ disposable income. In the event of an economic slowdown, consumer spending habits could be adversely affected and we could experience lower net sales than expected on a quarterly or annual basis which could have a material adverse effect on our business, financial condition and results of operations.

We expect our quarterly financial results to fluctuate.

We expect our net sales and operating results to vary significantly from quarter to quarter due to a number of factors, including changes in:

• General economic conditions;

• The demand for our baby formula;

• Our ability to retain, grow our business and attract new clients;

• Administrative costs;

• Advertising and other marketing costs;

As a result of the variability of these and other factors, our operating results in future quarters may be below the expectations of public market analysts and investors.

Currently, Thomas Lashan owns 83.57% of our common stock. After the consummation of this offering Thomas Lashanwill continue to have majority control of the Company’s common stock. As a result, he has a substantial voting power in all matters submitted to our stockholders for approval including:

• Election of our board of directors;

• Removal of any of our directors;

• Amendment of our Certificate of Incorporation or bylaws;

• Adoption of measures that could delay or prevent a change in control or impede a merger, takeover or other business combination involving us.

As a result of his ownership and position Thomas Lashan is able to substantially influence all matters requiring stockholder approval, including the election of directors and approval of significant corporate transactions. In addition, the future prospect of sales of significant amounts of shares held by Thomas Lashan could affect the market price of our common stock if the marketplace does not orderly adjust to the increase in shares in the market and the value of your investment in our company may decrease. Thomas Lashan stock ownership may discourage a potential acquirer from making a tender offer or otherwise attempting to obtain control of us, which in turn could reduce our stock price or prevent our stockholders from realizing a premium over our stock price.

- 7 -

The recently enacted JOBS Act will allow the Company to postpone the date by which it must comply with certain laws and regulations intended to protect investors and to reduce the amount of information provided in reports filed with the SEC.

The recently enacted JOBS Act is intended to reduce the regulatory burden on “emerging growth companies”. The Company meets the definition of an “emerging growth company” and so long as it qualifies as an “emerging growth company,” it will, among other things:

-be exempt from the provisions of Section 404(b) of the Sarbanes-Oxley Act requiring that its independent registered public accounting firm provide an attestation report on the effectiveness of its internal control over financial reporting;

-be exempt from the "say on pay” provisions (requiring a non-binding shareholder vote to approve compensation of certain executive officers) and the "say on golden parachute” provisions (requiring a non-binding shareholder vote to approve golden parachute arrangements for certain executive officers in connection with mergers and certain other business combinations) of The Dodd-Frank Wall Street Reform and Consumer Protection Act (the “Dodd-Frank Act”) and certain disclosure requirements of the Dodd-Frank Act relating to compensation of Chief Executive Officers;

-be permitted to omit the detailed compensation discussion and analysis from proxy statements and reports filed under the Securities Exchange Act of 1934, as amended (the “Exchange Act”) and instead provide a reduced level of disclosure concerning executive compensation; and

-be exempt from any rules that may be adopted by the Public Company Accounting Oversight Board (the “PCAOB”) requiring mandatory audit firm rotation or a supplement to the auditor’s report on the financial statements.

Although the Company is still evaluating the JOBS Act, it currently intends to take advantage of all of the reduced regulatory and reporting requirements that will be available to it so long as it qualifies as an “emerging growth company”. The Company has elected not to opt out of the extension of time to comply with new or revised financial accounting standards available under Section 102(b)(1) of the JOBS Act. Among other things, this means that the Company's independent registered public accounting firm will not be required to provide an attestation report on the effectiveness of the Company's internal control over financial reporting so long as it qualifies as an “emerging growth company”, which may increase the risk that weaknesses or deficiencies in the internal control over financial reporting go undetected. Likewise, so long as it qualifies as an “emerging growth company”, the Company may elect not to provide certain information, including certain financial information and certain information regarding compensation of executive officers, which would otherwise have been required to provide in filings with the SEC, which may make it more difficult for investors and securities analysts to evaluate the Company. As a result, investor confidence in the Company and the market price of its common stock may be adversely affected.

Notwithstanding the above, we are also currently a “smaller reporting company”, meaning that we are not an investment company, an asset-backed issuer, or a majority-owned subsidiary of a parent company that is not a smaller reporting company and have a public float of less than $75 million and annual revenues of less than $50 million during the most recently completed fiscal year. In the event that we are still considered a “smaller reporting company”, at such time are we cease being an “emerging growth company”, the disclosure we will be required to provide in our SEC filings will increase, but will still be less than it would be if we were not considered either an “emerging growth company” or a “smaller reporting company”. Specifically, similar to “emerging growth companies”, “smaller reporting companies” are able to provide simplified executive compensation disclosures in their filings; are exempt from the provisions of Section 404(b) of the Sarbanes-Oxley Act requiring that independent registered public accounting firms provide an attestation report on the effectiveness of internal control over financial reporting; and have certain other decreased disclosure obligations in their SEC filings, including, among other things, being required to provide only two years of audited financial statements in annual reports. Decreased disclosures in our SEC filings due to our status as an “emerging growth company” or “smaller reporting company” may make it harder for investors to analyze the Company’s results of operations and financial prospects.

- 8 -

We are an “emerging growth company” under the JOBS Act of 2012, and we cannot be certain if the reduced disclosure requirements applicable to emerging growth companies will make our common stock less attractive to investors.

We are an “emerging growth company,” as defined in the JOBS Act, and we may take advantage of certain exemptions from various reporting requirements that are applicable to other public companies that are not “emerging growth companies” including, but not limited to, not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act, reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements, and exemptions from the requirements of holding a nonbinding advisory vote on executive compensation and shareholder approval of any golden parachute payments not previously approved. We cannot predict if investors will find our common stock less attractive because we may rely on these exemptions. If some investors find our common stock less attractive as a result, there may be a less active trading market for our common stock and our stock price may be more volatile.

In addition, Section 107 of the JOBS Act also provides that an “emerging growth company” can take advantage of the extended transition period provided in Section 7(a)(2)(B) of the Securities Act for complying with new or revised accounting standards. In other words, an “emerging growth company” can delay the adoption of certain accounting standards until those standards would otherwise apply to private companies. We are choosing to take advantage of the extended transition period for complying with new or revised accounting standards. As a result, our financial statements may not be comparable to those of companies that comply with public company effective dates.

We will remain an “emerging growth company” for up to five years, although we will lose that status sooner if our revenues exceed $1 billion, if we issue more than $1 billion in non-convertible debt in a three year period, or if the market value of our common stock that is held by non-affiliates exceeds $700 million.

Due to the fact that we are a publicly reporting company we will continue to incur significant costs in staying current with reporting requirements. Our management will be required to devote substantial time to compliance initiatives. Additionally, the lack of an internal audit group may result in material misstatements to our financial statements and ability to provide accurate financial information to our shareholders.

Our management and other personnel will need to devote a substantial amount of time to compliance initiatives to maintain reporting status. Moreover, these rules and regulations, which are necessary to remain as an SEC reporting Company, will be costly because an external third party consultant(s), attorney, or firm, may have to assist us in following the applicable rules and regulations for each filing on behalf of the company.

We currently do not have an internal audit group, and we may eventually need to hire additional accounting and financial staff with appropriate public company experience and technical accounting knowledge to have effective internal controls for financial reporting. Additionally, due to the fact that our officers and director have limited experience as an officer or director of a reporting company, such lack of experience may impair our ability to maintain effective internal controls over financial reporting and disclosure controls and procedures, which may result in material misstatements to our financial statements and an inability to provide accurate financial information to our stockholders.

Moreover, if we are not able to comply with the requirements or regulations as an SEC reporting company, in any regard, we could be subject to sanctions or investigations by the SEC or other regulatory authorities, which would require additional financial and management resources.

Our officers and director lack experience in, and with, the reporting and disclosure obligations of publicly-traded companies.

Our officers and director lack experience in, and with, the reporting and disclosure obligations of publicly-traded companies and with serving as an officer and or director of a publicly-traded company. This lack of experience may impair our ability to maintain effective internal controls over financial reporting and disclosure controls and procedures, which may result in material misstatements to our financial statements and an inability to provide accurate financial information to our stockholders. Consequently, our operations, future earnings and ultimate financial success could suffer irreparable harm due to our officers’ and director’s ultimate lack of experience in our industry and with publicly-traded companies and their reporting requirements in general.

- 9 -

Risks Relating to the Company’s Securities

We do not intend to pay dividends on our common stock.

We have no intention to declare or pay any cash dividend on our capital stock. We currently intend to retain any future earnings and do not expect to pay any dividends in the foreseeable future.

Our securities have no prior market and an active trading market may not develop, which may cause our common stock to trade below the initial public offering price.

Prior to this offering there has been no public market for our common stock. The initial public offering price for our common stock is fixed at $0.60 per share. This offering is being made on a self-underwritten, “best efforts” basis. The fixed price that our common stock is offered at pursuant to this offering is not indicative of the market price of our common stock after this offering. If you purchase shares of our common stock, you may not be able to resell those shares at or above the initial public offering price. We cannot predict the extent to which investor interest in us will lead to the development of an active trading market on or otherwise or how liquid that market might become. An active public market for our common stock may not develop or be sustained after the offering. If an active public market does not develop or is not sustained, it may be difficult for you to sell your shares of common stock at a price that is attractive to you, or at all.

We may never have a public market for our common stock or may never trade on a recognized exchange. Therefore, you may be unable to liquidate your investment in our stock.

There is no established public trading market for our securities. Our shares are not and have not been listed or quoted on any exchange or quotation system.

In order for our shares to be quoted, a market maker must agree to file the necessary documents with the National Association of Securities Dealers, which operates the OTCQB. In addition, it is possible that such application for quotation may not be approved and even if approved it is possible that a regular trading market will not develop or that if it did develop, will be sustained. In the absence of a trading market, an investor may be unable to liquidate their investment.

We may, in the future, issue additional shares of our common stock, which may have a dilutive effect on our stockholders.

Our Certificate of Incorporation authorizes the issuance of 600,000,000 shares of common stock, of which 61,030,000 shares are issued and outstanding as of May 4, 2017. The future issuance of our common shares may result in substantial dilution in the percentage of our common shares held by our then existing stockholders. We may value any common stock issued in the future on an arbitrary basis. The issuance of common stock for future services or acquisitions or other corporate actions may have the effect of diluting the value of the shares held by our investors, and might have an adverse effect on any trading market for our common stock.

We may issue shares of preferred stock in the future which may adversely impact your rights as holders of our common stock.

Our Certificate of Incorporation authorizes us to issue up to 200,000,000 shares of preferred stock. Accordingly, our board of directors will have the authority to fix and determine the relative rights and preferences of preferred shares, as well as the authority to issue such shares, without further stockholder approval. At this time we have no shares of preferred stock issued and outstanding.

Our preferred stock does not have any dividend, conversion, liquidation, or other rights or preferences, including redemption or sinking fund provisions. However, our board of directors could authorize the issuance of a series of preferred stock that would grant to holders preferred rights to our assets upon liquidation, the right to receive dividends before dividends are declared to holders of our common stock, and the right to the redemption of such preferred shares, together with a premium, prior to the redemption of the common stock. To the extent that we do issue such additional shares of preferred stock, your rights as holders of common stock could be impaired thereby, including, without limitation, dilution of your ownership interests in us. In addition, shares of preferred stock could be issued with terms calculated to delay or prevent a change in control or make removal of management more difficult, which may not be in your interest as holders of common stock.

- 10 -

Risks Relating to this Offering

Investors cannot withdraw funds once invested and will not receive a refund.

Investors do not have the right to withdraw invested funds. Subscription payments will be paid to Australian Formulated Corporation and held in our corporate bank account if the Subscription Agreements are in good order and the Company accepts the investor’s investment. Therefore, once an investment is made, investors will not have the use or right to return of such funds.

Mr. Lashan will be able to sell his shares at any time during the duration of this offering. This may pose a conflict of interest since Mr. Lashan is also selling shares on behalf of the company in this offering. It is possible that this conflict of interest could affect the ultimate amount of funds raised by the Company. This could negatively affect your investment.

Mr. Lashan is going to be selling shares on behalf of the Company in this offering. Mr. Lashan will be able to simultaneously sell shares of stock for his own accord that are registered for resale pursuant to this offering. This conflict of interest could divert Mr. Lashan’s time and attention in selling shares on behalf of the Company since he will also be able to sell his own shares. This could result in less capital raised by the company, and a lessened desire for investors to purchase shares. As a result of this potential conflict of interest your investment could be adversely affected.

Our stock price may be volatile or may decline regardless of our operating performance, and you may not be able to resell your shares at, or above, the initial public offering price and the price of our common stock may fluctuate significantly.

After this offering, the market price for our common stock is likely to be volatile, in part because our shares have not been traded publicly. In addition, the market price of our common stock may fluctuate significantly in response to a number of factors, most of which we cannot control, including:

- changes in general economic or market conditions or trends in our industry or the economy as a whole and, in particular, in the leisure travel environment;

- changes in key personnel;

- entry into new geographic markets;

- actions and announcements by us or our competitors or significant acquisitions, divestitures, strategic partnerships, joint ventures or capital commitments;

- fluctuations in quarterly operating results, as well as differences between our actual financial and operating results and those expected by investors;

- the public’s response to press releases or other public announcements by us or third parties, including our filings with the SEC;

- announcements relating to litigation;

- guidance, if any, that we provide to the public, any changes in this guidance or our failure to meet this guidance;

- changes in financial estimates or ratings by any securities analysts who follow our common stock, our failure to meet these estimates or failure of those analysts to initiate or maintain coverage of our common stock;

- the development and sustainability of an active trading market for our common stock;

- future sales of our common stock by our officers, directors and significant stockholders; and

- changes in accounting principles.

These and other factors may lower the market price of our common stock regardless of our actual operating performance. As a result, our common stock may trade at prices significantly below the initial public offering price.

If an active, liquid trading market for our common stock does not develop, you may not be able to sell your shares quickly or at or above the initial offering price.

There has not been a public market for our common stock. An active and liquid trading market for our common stock may not develop or be sustained following this offering. The lack of an active market may impair your ability to sell your shares at the time you wish to sell them or at a price that you consider reasonable. The lack of an active market may also reduce the fair market value of your shares. An inactive market may also impair our ability to raise capital to continue to fund operations by selling shares and may impair our ability to acquire other companies or technologies by using our shares as consideration. You may not be able to sell your shares quickly or at or above the initial offering price. The initial public offering price will be determined by negotiations with the representatives of the underwriters. This price may not be indicative of the price at which our common stock will trade after this offering, and our common stock could trade below the initial public offering price.

We may be subject to the penny stock rules which will make shares of our common stock more difficult to sell.

We may be subject now and in the future to the SEC’s “penny stock” rules if our shares of common stock sell below $5.00 per share. Penny stocks generally are equity securities with a price of less than $5.00. The penny stock rules require broker-dealers to deliver a standardized risk disclosure document prepared by the SEC which provides information about penny stocks and the nature and level of risks in the penny stock market. The broker-dealer must also provide the customer with current bid and offer quotations for the penny stock, the compensation of the broker-dealer and its salesperson, and monthly account statements showing the market value of each penny stock held in the customer’s account. The bid and offer quotations, and the broker-dealer and salesperson compensation information must be given to the customer orally or in writing prior to completing the transaction and must be given to the customer in writing before or with the customer’s confirmation.

In addition, the penny stock rules require that prior to a transaction, the broker dealer must make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser’s written agreement to the transaction. The penny stock rules are burdensome and may reduce purchases of any offerings and reduce the trading activity for shares of our common stock. As long as our shares of common stock are subject to the penny stock rules, the holders of such shares of common stock may find it more difficult to sell their securities.

- 11 -

We are selling the shares of this offering without an underwriter and may be unable to sell any shares.

This offering is self-underwritten, which means that we are not going to engage the services of an underwriter to sell the shares. We intend to sell our shares through our Chief Executive Officer Thomas Lashan, who will receive no commissions. There is no guarantee that he will be able to sell any of the shares. Unless he is successful in selling all of the shares of our Company’s offering, we may have to seek alternative financing to implement our business plan.

Due to the lack of a trading market for our securities you may have difficulty selling any shares you purchase in this offering.

We are not registered on any market or public stock exchange. There is presently no demand for our common stock and no public market exists for the shares being offered in this prospectus. We plan to contact a market maker immediately following the completion of the offering and apply to have the shares quoted on the OTCQB. The OTCQB is a regulated quotation service that display real-time quotes, last sale prices and volume information in over-the-counter securities. The OTCQB is not an issuer listing service, market or exchange. Although the OTCQB does not have any listing requirements per se, to be eligible for quotation on the OTCQB, issuers must remain current in their filings with the SEC or applicable regulatory authority.

If we are not able to pay the expenses associated with our reporting obligations we will not be able to apply for quotation on the OTCQB. Market makers are not permitted to begin quotation of a security whose issuer does not meet this filing requirement. Securities already quoted on the OTCQB that become delinquent in their required filings will be removed following a 30 to 60 day grace period if they do not make their required filing during that time. We cannot guarantee that our application will be accepted or approved and our stock listed and quoted for sale.

As of the date of this filing, there have been no discussions or understandings between the Company and anyone acting on our behalf, with any market maker regarding participation in a future trading market for our securities. If no market is ever developed for our common stock, it will be difficult for you to sell any shares you purchase in this offering. In such a case, you may find that you are unable to achieve any benefit from your investment or liquidate your shares without considerable delay, if at all. In addition, if we fail to have our common stock quoted on a public trading market, your common stock will not have a quantifiable value and it may be difficult, if not impossible, to ever resell your shares, resulting in an inability to realize any value from your investment.

We will incur ongoing costs and expenses for SEC reporting and compliance. Without revenue we may not be able to remain in compliance, making it difficult for investors to sell their shares, if at all.

The estimated cost of this registration statement is $21,600. After the effective date of this prospectus, we will be required to file annual, quarterly and current reports, or other information with the SEC as provided by the Securities Exchange Act. We plan to contact a market maker immediately following the close of the offering and apply to have the shares quoted on the OTCQB. To be eligible for quotation, issuers must remain current in their filings with the SEC. In order for us to remain in compliance we will require future revenues to cover the cost of these filings, which could comprise a substantial portion of our available cash resources. The costs associated with being a publicly traded company in the next 12 months will be approximately $21,600. If we are unable to generate sufficient revenues to remain in compliance it may be difficult for you to resell any shares you may purchase, if at all. Also, if we are not able to pay the expenses associated with our reporting obligations we will not be able to apply for quotation on the OTCQB.

- 12 -

SUMMARY OF OUR FINANCIAL INFORMATION

The following table sets forth selected financial information, which should be read in conjunction with the information set forth in the “Management’s Discussion and Analysis” section and the accompanying financial statements and related notes included elsewhere in this Prospectus.

AUSTRALIAN FORMULATED CORPORATION

CONSOLIDATED BALANCE SHEET AS OF JANUARY 31, 2017

(Currency expressed in United States Dollars (“US$”), except for number of shares)

(AUDITED)

| As of January 31, 2017 | ||

| (Audited) | ||

| ASSETS | ||

| CURRENT ASSETS | ||

| Inventory on hand | $ | 23,905 |

| Inventory on consignment | 4,795 | |

| Trade receivables | 150 | |

| Cash and cash equivalents | 63,431 | |

| TOTAL CURRENT ASSETS | 92,281 | |

| TOTAL ASSETS | $ | 92,281 |

| LIABILITIES AND STOCKHOLDERS’ EQUITY | ||

| CURRENT LIABILITIES | ||

| Amount due to a related company | $ | 5,161 |

| Accrued expenses and other payables | 9,106 | |

| Amount due to a director | 1,097 | |

| TOTAL CURRENT LIABILITIES | 15,364 | |

| TOTAL LIABILITIES | 15,364 | |

| STOCKHOLDERS’ EQUITY | ||

| Preferred stock – Par value $0.0001; | ||

| Authorized: 200,000,000 | ||

| None issued and outstanding | - | |

| Common stock – Par value $ 0.0001; | ||

| Authorized: 600,000,000 | ||

| Issued and outstanding: 61,030,000 shares as of January 31, 2017 | 6,103 | |

| Additional paid-in capital | 102,897 | |

| Accumulated deficit | (32,083) | |

| TOTAL STOCKHOLDERS’ EQUITY | $ | 76,917 |

| TOTAL LIABILITIES AND STOCKHOLDERS’ EQUITY | $ | 92,281 |

AUSTRALIAN FORMULATED CORPORATION

CONSOLIDATED STATEMENT OF INCOME

FROM AUGUST 4, 2016 (DATE OF INCEPTION) TO JANUARY 31, 2017

(Currency expressed in United States Dollars (“US$”), except for number of shares)

(AUDITED)

| From August 4, 2016 (Date of Inception) to January 31, 2017 | |||||

| REVENUE | $ | 1,493 | |||

| COST OF REVENUE | (630) | ||||

| GROSS PROFIT | 863 | ||||

| GENERAL AND ADMINISTRATIVE EXPENSES | (32,946) | ||||

| LOSS BEFORE INCOME TAX | (32,083) | ||||

| INCOME TAX PROVISION | - | ||||

| NET LOSS | $ | (32,083) | |||

| Net loss per share- Basic and diluted | (0.00) | ||||

| Weighted average number of common shares outstanding – Basic and diluted | 28,745,082 | ||||

The Company is electing to not opt out of JOBS Act extended accounting transition period. This may make its financial statements more difficult to compare to other companies.

Pursuant to the JOBS Act of 2012, as an emerging growth company the Company can elect to opt out of the extended transition period for any new or revised accounting standards that may be issued by the PCAOB or the SEC. The Company has elected not to opt out of such extended transition period, which means that when a standard is issued or revised and it has different application dates for public or private companies, the Company, as an emerging growth company, can adopt the standard for the private company. This may make comparison of the Company’s financial statements with any other public company which is not either an emerging growth company nor an emerging growth company which has opted out of using the extended transition period difficult or impossible as possible different or revised standards may be used.

Emerging Growth Company

The recently enacted JOBS Act is intended to reduce the regulatory burden on emerging growth companies. The Company meets the definition of an emerging growth company and so long as it qualifies as an “emerging growth company,” it will, among other things:

| · | be temporarily exempted from the internal control audit requirements Section 404(b) of the Sarbanes-Oxley Act; |

| · | be temporarily exempted from various existing and forthcoming executive compensation-related disclosures, for example: “say-on-pay”, “pay-for-performance”, and “CEO pay ratio”; |

| · | be temporarily exempted from any rules that might be adopted by the Public Company Accounting Oversight Board requiring mandatory audit firm rotation or supplemental auditor discussion and analysis reporting; |

| · | be temporarily exempted from having to solicit advisory say-on-pay, say-on-frequency and say-on-golden-parachute shareholder votes on executive compensation under Section 14A of the Securities Exchange Act of 1934, as amended; |

| · | be permitted to comply with the SEC’s detailed executive compensation disclosure requirements on the same basis as a smaller reporting company; and, |

| · | be permitted to adopt any new or revised accounting standards using the same timeframe as private companies (if the standard applies to private companies). |

Our company will continue to be an emerging growth company until the earliest of:

| · | the last day of the fiscal year during which we have annual total gross revenues of $1 billion or more; |

| · | the last day of the fiscal year following the fifth anniversary of the first sale of our common equity securities in an offering registered under the Securities Act; |

| · | the date on which we issue more than $1 billion in non-convertible debt securities during a previous three-year period; or |

| · | the date on which we become a large accelerated filer, which generally is a company with a public float of at least $700 million (Exchange Act Rule 12b-2). |

- 13-

MANAGEMENT’S DISCUSSION AND ANALYSIS

Our cash and cash equivalents is $63,431 as of January 31, 2017. Our cash balance is not sufficient to fund our limited levels of operations for any period of time. In order to implement our plan of operations for the next twelve-month period, we require further funding.

Results of operations for the period ended January 31, 2017

Revenues

From August 4, 2016 to January 31, 2017, the Company has generated revenue of $1,493, which came from the sale of our baby formula.

General and Administrative Expenses

From August 4, 2016 to January 31, 2017 we have had general and administrative expenses in the amount of $32,946, which were mainly related to rent and storage, sales promotions, salary, incorporation fees and audit fees.

Net Loss

We recorded a net loss of $32,083 as a result of our aforementioned general and administrative expenses.

Liquidity and Capital Resources

Cash Used In Operating Activities

From August 4, 2016 to January 31, 2017, net cash used in operating activities was $46,666. The cash used in operating activities was primarily for the purchase of inventory and payments relating to general and administrative expenses.

Cash Provided From Financing Activities

From August 4, 2016 to January 31, 2017, net cash provided from financing activities was $110,097.

On August 4, 2016, Thomas Lashan purchased 100,000 shares of restricted common stock, each with a par value of $.0001 per share, from the Company. The $10.00 in proceeds went directly to the Company as working capital.

On November 7, 2016, Thomas Lashan and Greenpro Asia Strategic SPC-Greenpro Asia Strategic Fund SP purchased respectively 50,900,000 and 9,000,000 shares of restricted common stock, each with a par value of $.0001 per share, from the Company. The $5,990 in proceeds went directly to the Company as working capital.

As of January 31, 2017, the Company has sold a total of 1,030,000 restricted common stock to 2 shareholders at a price of $0.1 per share. The total proceeds to the Company amounted to a total of $103,000 and will be used as working capital.

In regards to all of the above transactions we claim an exemption from registration afforded by Section 4(a)(2) and/or Regulation S of the Securities Act of 1933, as amended (“Regulation S”) for the above sales of the stock since the sales of the stock were made to non-U.S. persons (as defined under Rule 902 section (k)(2)(i) of Regulation S), pursuant to offshore transactions, and no directed selling efforts were made in the United States by the issuer, a distributor, any of their respective affiliates, or any person acting on behalf of any of the foregoing.

As of January 31, 2017, the Company has borrowed a total of $1,097 from our director, Thomas Lashan, to fund business operations.

Plan of Operations

Over the course of the twelve months following this offering we plan to utilize any and all funds that we generate through the sale of company shares in several ways. The company plans to allocate the bulk of the proceeds towards the purchase of inventory and advertising and marketing costs. In the event we sell all of our shares this will amount to $360,000 and $495,000 respectively, however if only 25% of the shares are sold this amount would decrease to $60,000 and $120,000 respectively. The company believes that these two initiatives are integral to the future success of our business, because if we cannot acquire an adequate inventory to meet the demand we hope to create through marketing initiatives then our material results may suffer. The expenditure of these funds will be an ongoing process throughout the twelve months preceding this offering and will include the acquisition of inventory for sale, cost of online advertising, possible expenditures towards hiring marketing professionals to assist with our marketing efforts, and various advertising methods that have not, at this point in time, been entirely identified and will depend upon the number of shares we can sell.

Funds for day to day operations will be determined as time passes and our business progresses, but we anticipate this money will be utilized all throughout the year for various business expenses that cannot, at this time, be fully determined. We will also allocate some of our proceeds towards hiring additional staff, which we believe will help us to keep pace with the demand we hope to create for our products. This will occur, we anticipate, no sooner than six months subsequent to the offering, as we anticipate that is the time when we will require additional employees. While the majority of our operations will be in flux based upon the amount of shares that are sold, the $21,600 we will allocate towards the offering expenses will remain stagnant no matter how many shares we sell because the expenses inherent in the offering remain fixed.

With the sole exception of our offering expenses, all of the uses for the proceeds we hope to generate through the sale of our shares will remain the same, but the scale upon which they are implemented will vary. As a result, if we are not able to allocate enough funds towards our operating initiatives in the next twelve months the results of our operations may materially suffer.

This section includes market and industry data that we have developed from publicly available information; various industry publications and other published industry sources and our internal data and estimates. Although we believe the publications and reports are reliable, we have not independently verified the data. Our internal data, estimates and forecasts are based upon information obtained from trade and business organizations and other contacts in the market in which we operate and our management’s understanding of industry conditions.

As of the date of the preparation of this section, these and other independent government and trade publications cited herein are publicly available on the Internet without charge. Upon request, the Company will also provide copies of such sources cited herein.

Pediatric Nutrition Industry

The pediatric nutrition industry has experienced substantial growth, however we will focus primarily upon the global demand for powdered infant formula which has increased significantly over the past few years. We will analyse China, as our primary consumer market, primarily, where this huge demand is driven by several key factors, some of which apply all throughout the developed world. The first of which relates to China specifically and is the fact that China is the world's top dairy importer. Imports of milk powder (including infant formula) represented 33 percent of the global market in 2012, rising to 38 percent in 2013, based on HSBC’s research in 2013. This huge demand has resulted from, primarily, several high profile domestic scandals relating to milk production that began in 2008. High levels of the industrial chemical Melamine were found in milk and infant formulas in 2008 and in return six infants was killed and thousands of babies were hospitalized. This tragedy has shaken consumer confidence in domestic dairy products and, to date, it has yet to recover.

Demand for imported infant formula has been exceptionally high in the past few years as consumers have increasingly traded up to higher-end infant formula products. (See the below survey conducted by ECOVIS, Beijing in 2014) China’s self-sufficiency in milk production declined over the past years as consumers turned to dairy imports, as evidenced by the below table. These are expected to increase by roughly 20 percent by 2022. The largest exporters, by far, are New Zealand and Australia which together account for almost 60 percent of dairy exports to China.

Figure: Relation of China’s Milk Powder Production to Import Volume

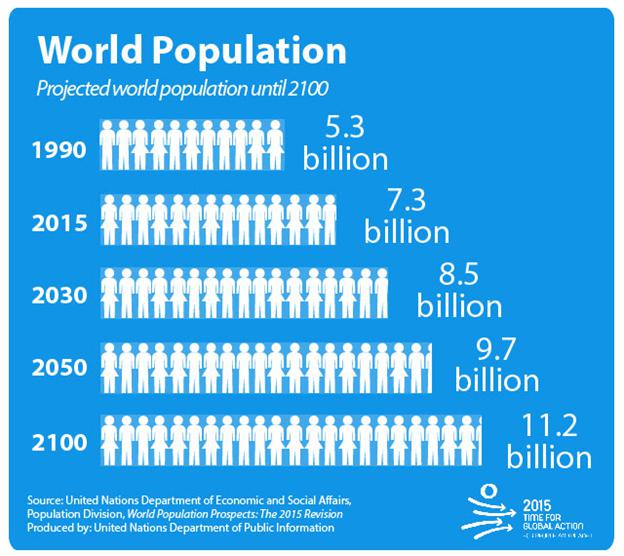

Additionally, according to the United Nations, the world’s current population of 7.3 billion is projected to increase by one billion over the next 12 years and reach 9.7 billion by 2050. The world’s constantly expanding population is, in turn, helping to drive global demand for infant milk formula. In fact, the global infant milk formula market is reportedly projected to double to $25 billion by the year 2017. Particularly, demand for infant milk powder is very strong as China’s government made the decision to end the three-decade policy and allow one couple to have two children at the end of October 2015. This decision has offered a boost in consumers for embattled dairy producers.

While the timing of the full implementation of the policy remains to be seen, it is believed that this will have a strong, direct impact on the infant formula market. The assumption is that there will be a 16.6% average increase in newborn babies annually over the five years following the full implementation of the ‘One Couple, Two Kids’ policy. Assuming that the current breastfeeding ratio of 28% remains unchanged for the second child it is estimated that the Infant Milk Formula market could be boosted by about the same 16.6% a year—equivalent to about 117,000 tonnes/year (based on Euromonitor data of 704k tonnes in 2014).

- 14 -

This prospectus contains forward-looking statements that involve risk and uncertainties. We use words such as “anticipate”, “believe”, “plan”, “expect”, “future”, “intend”, and similar expressions to identify such forward-looking statements. Investors should be aware that all forward-looking statements contained within this filing are good faith estimates of management as of the date of this filing. Our actual results could differ materially from those anticipated in these forward-looking statements for many reasons, including the risks faced by us as described in the “Risk Factors” section and elsewhere in this prospectus.

Corporate History

Australian Formulated Corporation, a Nevada corporation (“the Company”) was incorporated under the laws of the State of Nevada on August 4, 2016.

On August 4, 2016 Thomas Lashan was appointed as Chief Executive Officer, President, Secretary and Treasurer, and as a member of our Board of Directors. Also on August 4, 2016, Mr. Lashan purchased 100,000 shares of restricted common stock, each with a par value of $.0001 per share, from the Company. The $10.00 in proceeds went directly to the Company as working capital.

On November 7, 2016, Thomas Lashan and Greenpro Asia Strategic SPC- Greenpro Asia Strategic Fund SP purchased 50,900,000 and 9,000,000 shares of restricted common stock respectively, each with a par value of $.0001 per share, from the Company. The $5,990 in proceeds went directly to the Company as working capital.

On December 30, 2016, the Company sold shares to one shareholder who resides in Australia. A total of 1,000,000 shares of restricted common stock were sold at a price of $0.1 per share. The total proceeds $100,000 will be used as working capital.

On January 16, 2017, the Company acquired 100% equity interest of AFC ANS Baby Holdings Limited, a company incorporated on January 6, 2017 under the laws of Seychelles. Consideration regarding this acquisition was in the form of cash in the amount of $1.00. AFC ANS Baby Holdings Limited is an investment holding company with 100% equity interest in Australian Formulated Limited, a company primarily concerned with retailing baby powder and incorporated in Hong Kong. Subsequent to the acquisition, both AFC ANS Baby Holdings Limited and Australian Formulated Limited became wholly owned subsidiaries of the Company.

On January 19, 2017, the Company sold shares to a corporation, which is incorporated in the British Virgin Islands. A total of 30,000 shares of restricted common stock were sold at a price of $0.1 per share. The total proceeds to the Company amounted to a total of $3,000. The proceeds will be used as working capital.

On January 20, 2017, Lykouras Vasilios was appointed as a member of our Board of Directors.

Overview

Australian Formulated Corporation was incorporated in the State of Nevada on August 4, 2016. We are a development-stage company with a fiscal year end of January 31. At this time we operate exclusively through our wholly owned subsidiary, AFC ANS Baby Holdings Limited, and share the same business plan of our subsidiary which is the sale of infant baby powder.

Our primary business objective is to distribute our various baby formulas, which we will be discussing in greater detail further into this business summary, to various retailers in Hong Kong. We have sold our products, at present, exclusively to various pharmacies, mother and baby focused stores and retailers located in Hong Kong who have business connections with our Director. Additionally, at present four of these customers make up 54% of our Company’s sales.

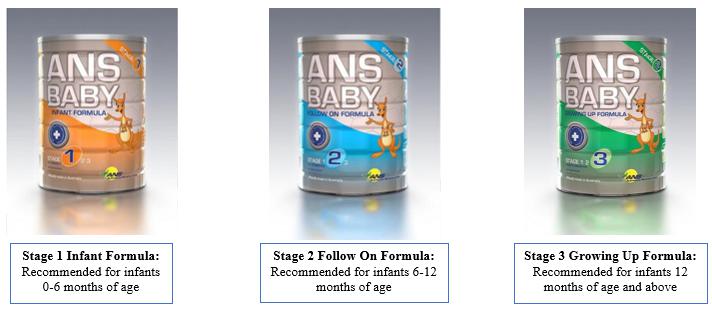

ANS BABY is a premium quality, all Australian infant formulated range of products appropriate for newborns, infants from six months to twelve months, and also for twelve months and older based upon the different formulas we have available. The age range for these formulas are based on the World Health Organisation (WHO) recommendation. Each formula is appropriate for a different stage in life whereby vitamin levels are changed based on age groups and nutritional requirements.

Our current inventory of baby formulas is as follows:

We acquire the ANS BABY formula from a related party Company owned by our Chief Executive Officer Thomas Lashan. We do not conduct any manufacturing efforts internally. Our range of unique formulations are based on the inspiration of breast milk and developed to nutritionally support the immune system.

The Australian Dairy Industry has been recognized and heralded as an industry leader through their commitment, innovation and dedication to the application of the World Best Practices. Australia is a leading industry expert in formula development, state of the art technology in manufacturer and stringent Food safety and Quality Systems to ensure that all products meet the highest international and Country Specific Standards.