Attached files

| file | filename |

|---|---|

| 8-K - 8-K - ACNB CORP | a17-11513_48k.htm |

| EX-99.2 - EX-99.2 - ACNB CORP | a17-11513_4ex99d2.htm |

Exhibit 99.1

Annual Meeting of Shareholders May 2, 2017

Special Cautionary Notice Regarding Forward-Looking Statements

David W. Cathell EVP/Treasurer & Chief Financial Officer

Federal Deposit Insurance Corporation Improvement Act of 1991 (FDICIA) The Federal Deposit Insurance Corporation Improvement Act requires that institutions be classified, based on their risk-based capital ratios, into one of five defined categories: well capitalized, adequately capitalized, undercapitalized, significantly undercapitalized, and critically undercapitalized.

Regulation of Bank

Balance Sheet Trends At Year-End in Millions of Dollars

Net Income At Year-End in Millions of Dollars

Net Interest Income At Year-End in Millions of Dollars

Stockholders’ Equity At Year-End in Millions of Dollars

Book Value Per Share At Year-End in Dollars

Share Price vs. Tangible Book Value At Quarter-End in Dollars Per Share

Total Return Performance

Trust Assets At Year-End in Millions of Dollars

Trust Fee Income At Year-End in Thousands of Dollars

Trust Fee Income by Segment At Year-End in Thousands of Dollars

Russell Insurance Group Net Income GAAP Basis at Year-End

Russell Insurance Group EPS Earnings Per Share at Year-End

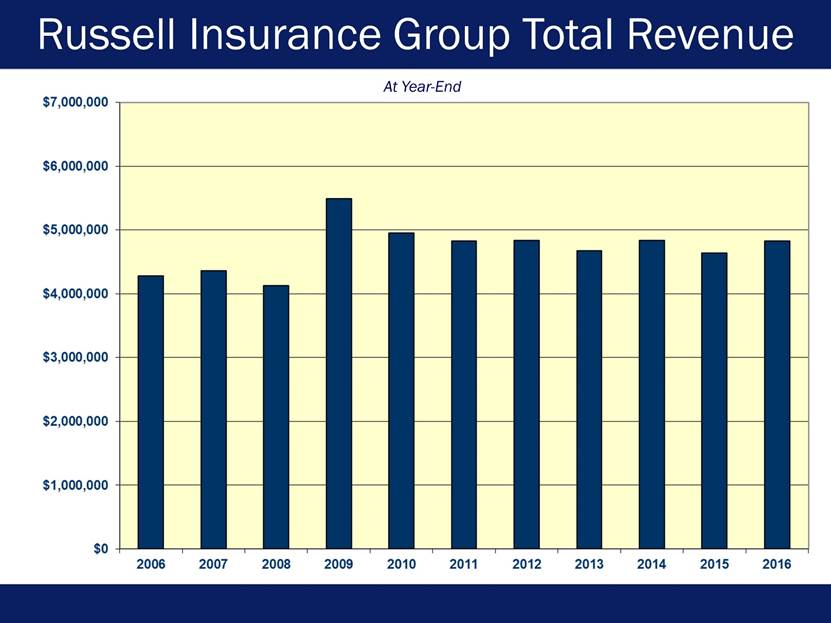

Russell Insurance Group Total Revenue At Year-End

James P. Helt President

Reflecting On Our History We are truly grateful for the determination of a small group of local farmers, mechanics, businessmen and professionals that boldly banded together to form The Farmers’ and Mechanics’ Savings Institution of Adams County on Lincoln Square in 1857. Celebrating 160 Years in 2017!

Largest independent financial institution headquartered in Adams County, PA Founded in 1857 22 Retail Offices and a LPO 14 in Adams County 6 in York County 2 in Franklin County 1 in Cumberland County $1.21 billion in total assets* $908 million in total loans* $968 million in total deposits* $195 million in trust management assets* Russell Insurance Group, Inc. subsidiary with $4.8 million in 2016 revenue ACNB Corporation added to Russell 3000 Index in June 2016 Voted #1 Bank for the second consecutive year in the Hanover Evening Sun Readers’ Choice and Gettysburg Times Pick of the County annual awards * As of December 31, 2016 Our Organization Today

Ranked #1 in Adams County market area with deposit market share of 53.54%*. ACNB Bank has the #1 deposit market share in 6 out of 13 defined market areas*. Gettysburg Carroll Valley Upper Adams East Berlin McSherrystown Newville Strategically positioned in one of the fast growing regions along the East Coast, within a short drive of Baltimore, Philadelphia, and Washington, D.C. The southcentral PA and northern MD markets are home to a diverse mix of businesses and industries. A highly educated workforce and household incomes that are greater than state and national averages. * According to the June 30, 2016 FDIC Deposit Market Share Report Market Overview

Experienced Leadership Name/Title Banking Experience Joined ACNB Bank Experience/Disciplines Prior Experience James P. Helt President & CEO Effective May 5, 2017 28 Years 2008 Strategy, Sales, Lending, Credit, Executive FB&T, Financial Trust, CMTY, SUSQ David W. Cathell EVP/Treasurer & CFO 39 Years 2005 Finance, Treasury, Strategy, Executive PA State Bank, Fulton County National Bank, American Trust Bank, Garrett National Bank Lynda L. Glass EVP/Secretary and Chief Risk & Governance Officer 35 Years 1984 Risk, Governance, Strategy, Executive Meridian Laurie A. Laub EVP/Chief Credit & Operations Officer 17 Years 2005 Credit, Risk, Operations, Technology, Executive Waypoint, Sovereign Douglas A. Seibel EVP/Chief Lending & Revenue Officer 35 Years 2008 Lending, Sales, Credit, Executive FB&T, Meridian, Allfirst, M&T, CMTY, SUSQ Thomas R. Stone EVP/Chief Community Banking Officer 36 Years 2009 Retail, Facilities, Marketing, Human Resources, Executive York Bank & Trust Co., Allfirst, M&T, CMTY, SUSQ

2016 ACNB Bank Franchise Completed major interior and exterior renovations at largest retail office – North Gettysburg. Relocated ACNB Bank Trust & Investment Services to North Gettysburg to provide greater convenience and ample parking for clients. Established new Agribusiness Lending function.

2016 ACNB Bank Franchise Completed interior renovations at the Lincoln Square Office. The Bank’s original historic site of founding in 1857.

2016 ACNB Bank Franchise Completed renovations for Executive Offices at the ACNB Corporation Operations Center. Now fully occupy this 56,040 sq. ft. facility completed in 2005 with ACNB Bank Staff. The ACNB Corporation Operations Center now houses: Executive Management & Finance Loan & Deposit Operations Information & Technology Services Human Resources Marketing & Corporate Relations Treasury Management Facilities & Risk Management Retail Banking Management Loan & Credit Administration Customer Contact Center

2016 ACNB Bank Franchise Relocated South Hanover Office to 1801 Baltimore Pike to provide a more convenient banking experience for Hanover area residents and businesses. Located adjacent to the South Hanover Walmart and Sheetz.

2016 ACNB Bank Franchise Retail banking network expanded in York County with the opening of the South York Plaza Office at 201 Pauline Drive. This office complements our existing York Loan Office located at 1601 South Queen Street.

Pending Acquisition New Windsor Bancorp, Inc. Northern Maryland Community Banking Organization On November 21, 2016, ACNB Corporation (ACNB) and New Windsor Bancorp, Inc. (NWID) executed a definitive agreement whereby NWID will be merged with and into ACNB. ACNB Bank will operate in the Maryland market as NWSB Bank, a division of ACNB Bank. Two directors from NWID will join the Boards of ACNB and ACNB Bank, respectively. NWID shareholders will receive 1.10 shares of ACNB common stock or $30.00 cash for each share of NWID common stock. Based on the market close on November 21, 2016, the transaction is valued at $33,294,000 or $33.11 per share. Subject to NWID shareholder approval, regulatory approvals, and other customary closing conditions.

Pending Acquisition ACNB Reasons for Merger Similarity of the Northern Maryland market to existing ACNB market for efficiency of integration and continuity of current marketing strategies. The merger will not result in any immediate branch closures because the markets are tangential and not overlapping. Banking philosophy and community orientation of ACNB and NWID are very similar. Acquisition is expected to lead to EPS accretion which is above ACNB’s expected ordinary EPS growth rate as a stand alone entity. The combination could result in potential annualized cost savings of nearly 27%.

Investment Comparisons ACNB Corporation (ACNB) 2016 Total Assets $1.21B; Total Loans $908M; Total Deposits $968M New Windsor Bancorp, Inc. (NWID) 2016 Total Assets $308M; Total Loans $265M; Total Deposits $280M ACNB 2016 NWID 2016 ACNB 2015 NWID 2015 Net Income $10,869,000* $1,140,000** $11,017,000 $1,516,000 EPS $1.80 $1.14 $1.83 $2.19 ROA .93% .38% .99% .53% ROE 9.17% 5.08% 9.77% 9.30% Cash DPS $.80 $.24 $.80 $.21 Book Value Per Share $19.80 $22.30 $18.99 $21.79 Stock Price (close) $31.25 $31.40 $21.30 $15.40 * Net of Merger Related Expenses of $472,000 ** Net of Merger Related Expenses of $314,000

Post Merger Profile Total assets of $1.52 billion* Total deposits of $1.24 billion* Total loans of $1.17 billion* 29 retail banking offices in Pennsylvania and Maryland Franchise will include 4 counties in southcentral Pennsylvania and 1 contiguous county in northern Maryland – Carroll County Rank among top 20 banks headquartered in Pennsylvania by asset size * Based on financial results as of December 31, 2016

Our Vision Vision Statement To be the independent financial services provider of choice in the core markets served by building relationships and finding solutions. Strategic Focus Enhance revenue sources to deliver continued solid performance to our shareholders. Control operating expenses by utilizing technology to enhance and streamline operations and delivery channels. Expand our customer base by leveraging current infrastructure with emphasis on new lending opportunities. Bank Profile Asset Size: Small-Mid Size Bank ($1 to $5 billion) Footprint: PA/MD Growth: Organic/Opportunistic Acquisitions

[LOGO]