Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - Western Asset Mortgage Capital Corp | wmcq1fy17ex991.htm |

| 8-K - 8-K - Western Asset Mortgage Capital Corp | wmcq1fy178-k.htm |

First Quarter 2017

Investor Presentation

May 3, 2017

We make forward-looking statements in this presentation that are subject to risks and uncertainties. These forward-looking statements

include information about possible or assumed future results of our business, financial condition, liquidity, results of operations, plans and

objectives. When we use the words "believe," "expect," "anticipate," "estimate," "plan," "continue," "intend," "should," "may" or similar

expressions, we intend to identify forward-looking statements. Statements regarding the following subjects, among others, may be forward-

looking: our business and investment strategy; our projected operating results; our ability to obtain financing arrangements; financing and

advance rates for MBS and our potential target assets; our expected leverage; general volatility of the securities markets in which we invest

and the market price of our common stock; our expected investments; interest rate mismatches between MBS and our potential target

assets and our borrowings used to fund such investments; changes in interest rates and the market value of MBS and our potential target

assets; changes in prepayment rates on Agency MBS and Non-Agency MBS; effects of hedging instruments on MBS and our potential

target assets; rates of default or decreased recovery rates on our potential target assets; the degree to which any hedging strategies may or

may not protect us from interest rate volatility; impact of and changes in governmental regulations, tax law and rates, accounting guidance

and similar matters; our ability to maintain our qualification as a REIT; our ability to maintain our exemption from registration under the

Investment Company Act of 1940, as amended; availability of investment opportunities in mortgage-related, real estate-related and other

securities; availability of qualified personnel; estimates relating to our ability to make distributions to our stockholders in the future; our

understanding of our competition; and market trends in our industry, interest rates, real estate values, the debt securities markets or the

general economy.

The forward-looking statements in this presentation are based on our beliefs, assumptions and expectations of our future performance,

taking into account all information currently available to us. You should not place undue reliance on these forward-looking statements.

These beliefs, assumptions and expectations can change as a result of many possible events or factors, not all of which are known to us.

Some of these factors are described in our filings with the SEC under the headings "Summary," "Risk factors," "Management's discussion

and analysis of financial condition and results of operations" and "Business." If a change occurs, our business, financial condition,

liquidity and results of operations may vary materially from those expressed in our forward-looking statements. Any forward-looking

statement speaks only as of the date on which it is made. New risks and uncertainties arise over time, and it is not possible for us to predict

those events or how they may affect us. Except as required by law, we are not obligated to, and do not intend to, update or revise any

forward-looking statements, whether as a result of new information, future events or otherwise.

This presentation is not an offer to sell securities nor a solicitation of an offer to buy securities in any jurisdiction where the offer and sale is

not permitted.

1

Safe Harbor Statement

n WMC corporate goals

n Best-in-class risk and portfolio management practices

n Operational excellence and efficiencies

n Highest standards of financial reporting, disclosure and transparency

n Consistent dividend policy

n WMC is supported by the deep investment experience of the mortgage and asset backed securities

team of Western Asset, as well as its global investment, risk management and operational

infrastructure

n At March 31, 2017 Western Asset had approximately $433 billion in assets under management with

over 850 investment, risk, finance, accounting, legal and compliance, operations and other

professionals in nine offices around the world

n Western Asset’s depth and breadth of fixed income expertise, comprehensive platform, and global

institutional relationships provide WMC a key advantage

2

Corporate Overview

Our long-term objective is to generate a strong total return for our shareholders

through attractive dividends derived from sustainable core earnings and appreciation

in the value of our portfolio.

n GAAP net income of $20.2 million, or $0.48 per share

n Quarterly cash dividend of $0.31 per share

n $10.45 net book value per share as of March 31, 2017(1)

n Economic return on book value was 4.8%(2)

n Core earnings plus drop income(3) of $10.3 million, or $0.25 per share, consists of:

n Core earnings of $0.22 per share, including a $0.01 per share retrospective adjustment

n Drop income of $0.03 per share

n Net portfolio income of $25.4 million(4) consists of:

n Net Interest Income, including cost of hedging, of $13.7 million

n Realized Gain on Investments and Derivatives of $18.3 million

n Unrealized Loss on Investments and Derivatives of $0.3 million

n Other Than Temporary Impairment of $6.3 million

n Net interest margin of 2.01%(5)

n 4.39% adjusted gross yield(5)

n 2.81% fully hedged cost of funds(5)

n Agency RMBS CPR of 10.5% for first quarter (6)

3

Please refer to page 14 for footnote disclosures.

First Quarter Financial Highlights

Recent Performance

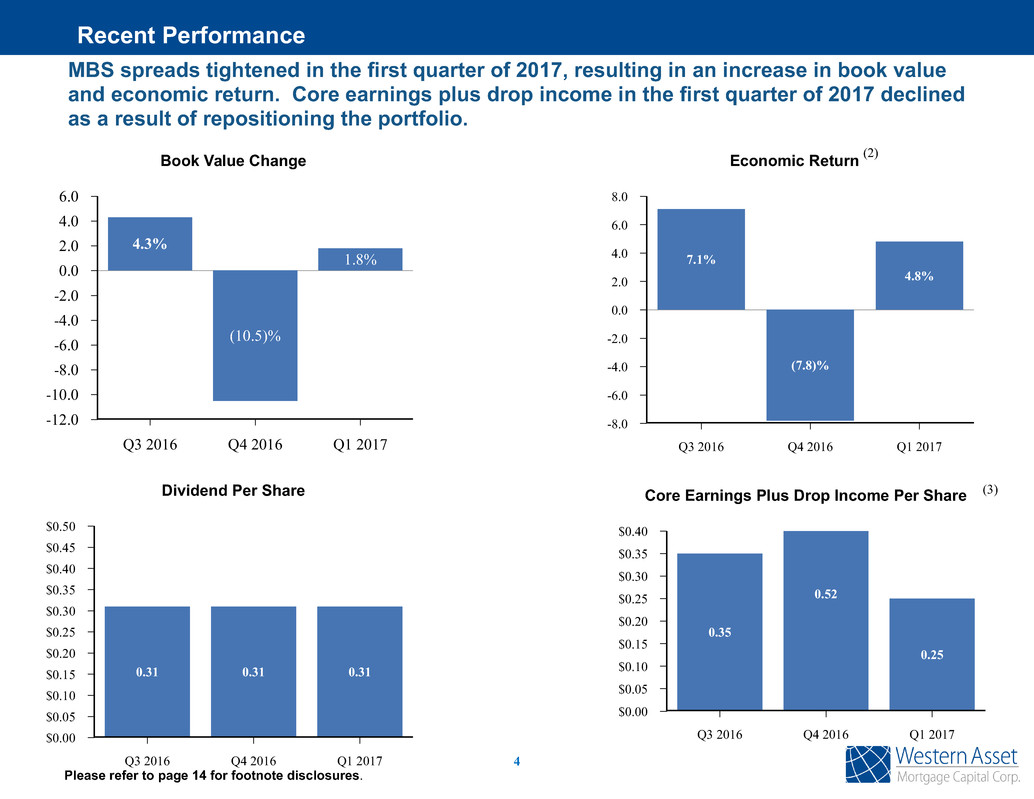

Dividend Per Share

$0.50

$0.45

$0.40

$0.35

$0.30

$0.25

$0.20

$0.15

$0.10

$0.05

$0.00

Q3 2016 Q4 2016 Q1 2017

0.31 0.31 0.31

Economic Return

8.0

6.0

4.0

2.0

0.0

-2.0

-4.0

-6.0

-8.0

Q3 2016 Q4 2016 Q1 2017

7.1%

(7.8)%

4.8%

Book Value Change

6.0

4.0

2.0

0.0

-2.0

-4.0

-6.0

-8.0

-10.0

-12.0

Q3 2016 Q4 2016 Q1 2017

4.3%

(10.5)%

1.8%

Core Earnings Plus Drop Income Per Share

$0.40

$0.35

$0.30

$0.25

$0.20

$0.15

$0.10

$0.05

$0.00

Q3 2016 Q4 2016 Q1 2017

0.35

0.52

0.25

4

(2)

(3)

Please refer to page 14 for footnote disclosures.

MBS spreads tightened in the first quarter of 2017, resulting in an increase in book value

and economic return. Core earnings plus drop income in the first quarter of 2017 declined

as a result of repositioning the portfolio.

5

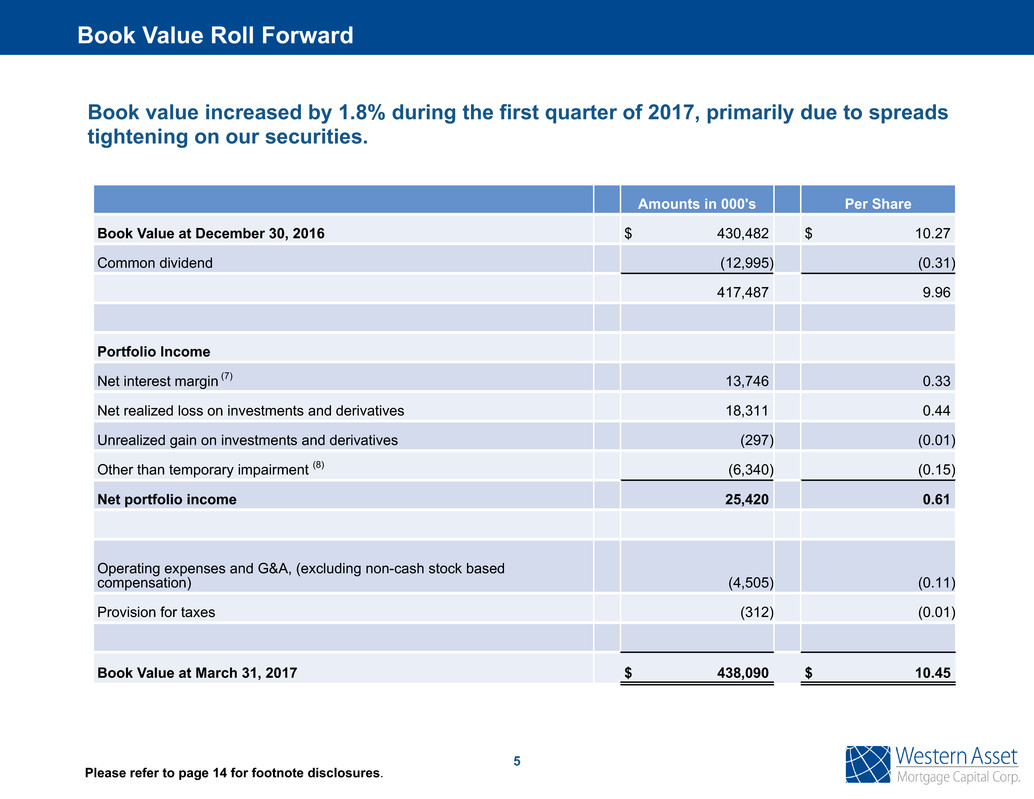

Book Value Roll Forward

Please refer to page 14 for footnote disclosures.

Book value increased by 1.8% during the first quarter of 2017, primarily due to spreads

tightening on our securities.

Amounts in 000's Per Share

Book Value at December 30, 2016 $ 430,482 $ 10.27

Common dividend (12,995) (0.31)

417,487 9.96

Portfolio Income

Net interest margin (7) 13,746 0.33

Net realized loss on investments and derivatives 18,311 0.44

Unrealized gain on investments and derivatives (297) (0.01)

Other than temporary impairment (8) (6,340) (0.15)

Net portfolio income 25,420 0.61

Operating expenses and G&A, (excluding non-cash stock based

compensation) (4,505) (0.11)

Provision for taxes (312) (0.01)

Book Value at March 31, 2017 $ 438,090 $ 10.45

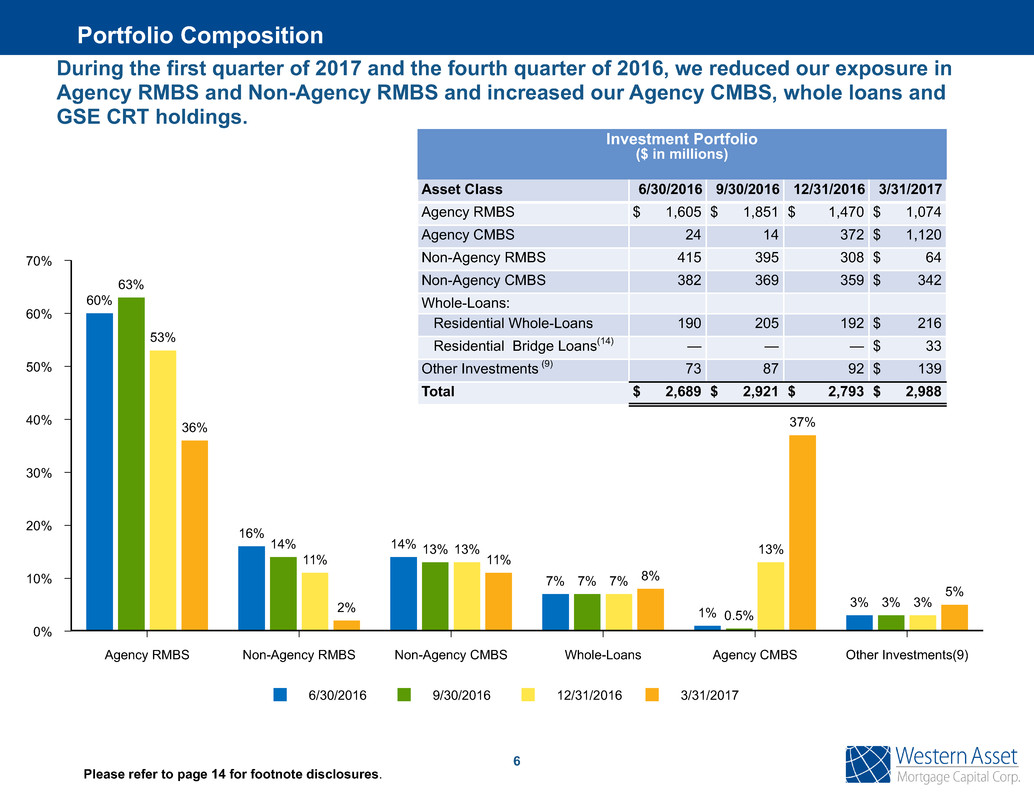

During the first quarter of 2017 and the fourth quarter of 2016, we reduced our exposure in

Agency RMBS and Non-Agency RMBS and increased our Agency CMBS, whole loans and

GSE CRT holdings.

6/30/2016 9/30/2016 12/31/2016 3/31/2017

70%

60%

50%

40%

30%

20%

10%

0%

Agency RMBS Non-Agency RMBS Non-Agency CMBS Whole-Loans Agency CMBS Other Investments(9)

60%

16%

14%

7%

1%

3%

63%

14% 13%

7%

0.5%

3%

53%

11%

13%

7%

13%

3%

36%

2%

11%

8%

37%

5%

6

Investment Portfolio

($ in millions)

Asset Class 6/30/2016 9/30/2016 12/31/2016 3/31/2017

Agency RMBS $ 1,605 $ 1,851 $ 1,470 $ 1,074

Agency CMBS 24 14 372 $ 1,120

Non-Agency RMBS 415 395 308 $ 64

Non-Agency CMBS 382 369 359 $ 342

Whole-Loans:

Residential Whole-Loans 190 205 192 $ 216

Residential Bridge Loans(14) — — — $ 33

Other Investments (9) 73 87 92 $ 139

Total $ 2,689 $ 2,921 $ 2,793 $ 2,988

Please refer to page 14 for footnote disclosures.

Portfolio Composition

7

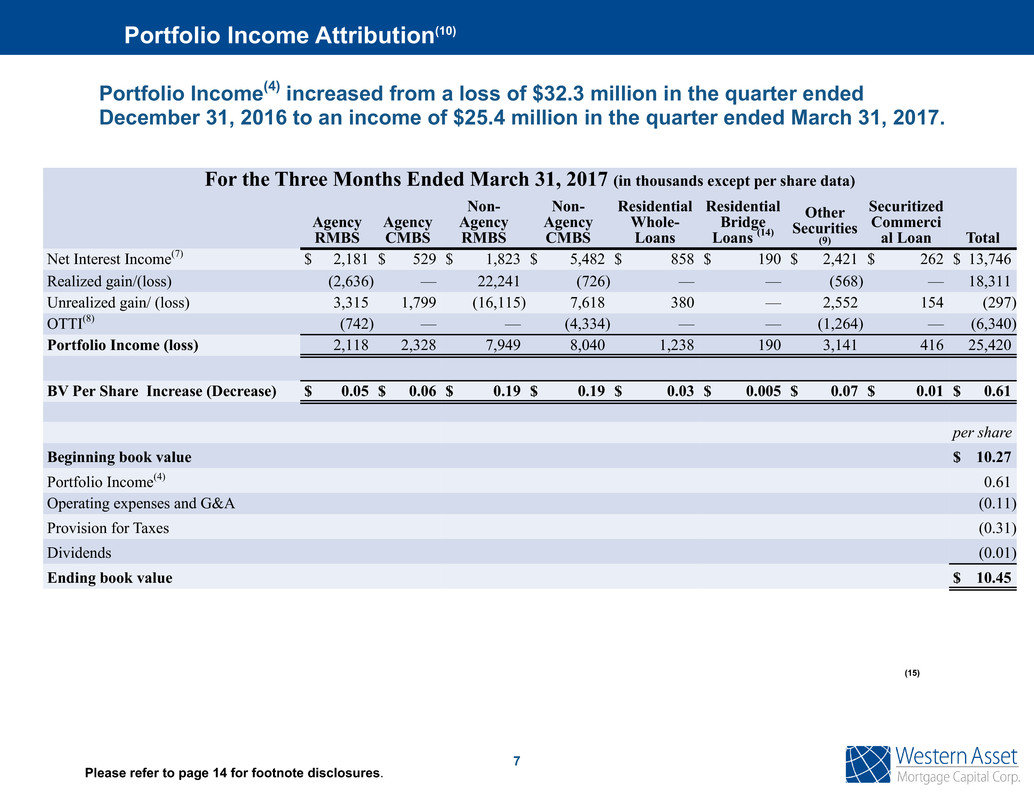

Portfolio Income Attribution(10)

Please refer to page 14 for footnote disclosures.

(15)

Portfolio Income(4) increased from a loss of $32.3 million in the quarter ended

December 31, 2016 to an income of $25.4 million in the quarter ended March 31, 2017.

For the Three Months Ended March 31, 2017 (in thousands except per share data)

Agency

RMBS

Agency

CMBS

Non-

Agency

RMBS

Non-

Agency

CMBS

Residential

Whole-

Loans

Residential

Bridge

Loans (14)

Other

Securities

(9)

Securitized

Commerci

al Loan Total

Net Interest Income(7) $ 2,181 $ 529 $ 1,823 $ 5,482 $ 858 $ 190 $ 2,421 $ 262 $ 13,746

Realized gain/(loss) (2,636) — 22,241 (726) — — (568) — 18,311

Unrealized gain/ (loss) 3,315 1,799 (16,115) 7,618 380 — 2,552 154 (297)

OTTI(8) (742) — — (4,334) — — (1,264) — (6,340)

Portfolio Income (loss) 2,118 2,328 7,949 8,040 1,238 190 3,141 416 25,420

BV Per Share Increase (Decrease) $ 0.05 $ 0.06 $ 0.19 $ 0.19 $ 0.03 $ 0.005 $ 0.07 $ 0.01 $ 0.61

per share

Beginning book value $ 10.27

Portfolio Income(4) 0.61

Operating expenses and G&A (0.11)

Provision for Taxes (0.31)

Dividends (0.01)

Ending book value $ 10.45

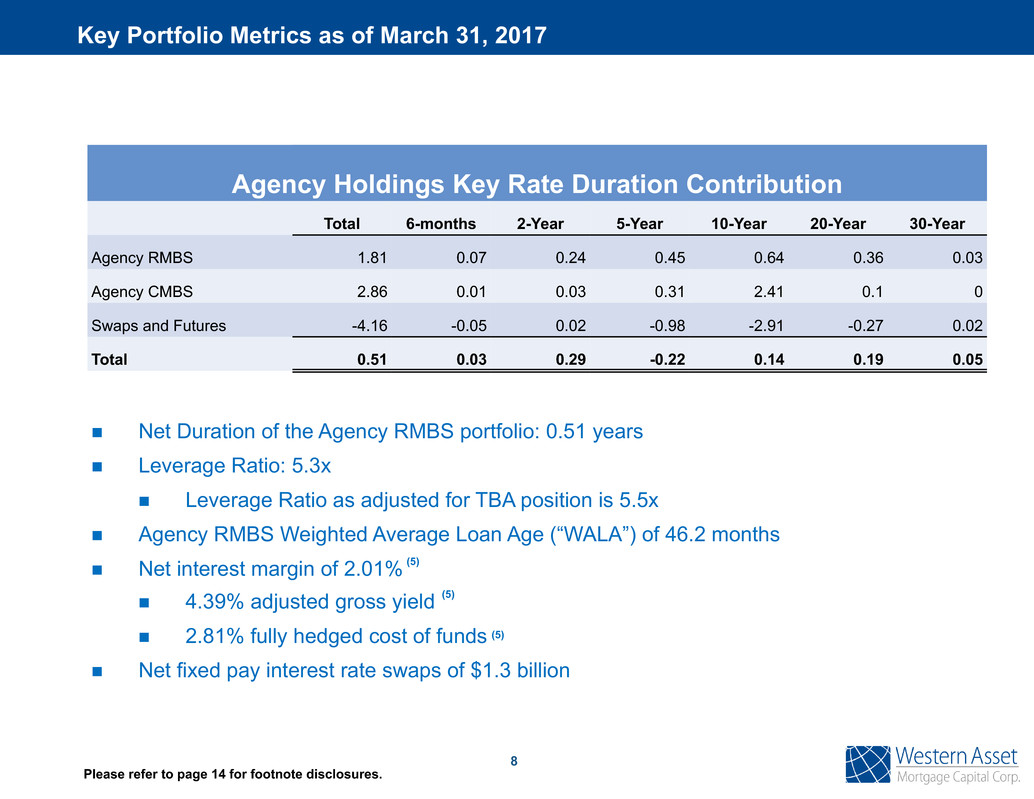

n Net Duration of the Agency RMBS portfolio: 0.51 years

n Leverage Ratio: 5.3x

n Leverage Ratio as adjusted for TBA position is 5.5x

n Agency RMBS Weighted Average Loan Age (“WALA”) of 46.2 months

n Net interest margin of 2.01%

n 4.39% adjusted gross yield

n 2.81% fully hedged cost of funds

n Net fixed pay interest rate swaps of $1.3 billion

8

(5)

Key Portfolio Metrics as of March 31, 2017

Agency Holdings Key Rate Duration Contribution

Total 6-months 2-Year 5-Year 10-Year 20-Year 30-Year

Agency RMBS 1.81 0.07 0.24 0.45 0.64 0.36 0.03

Agency CMBS 2.86 0.01 0.03 0.31 2.41 0.1 0

Swaps and Futures -4.16 -0.05 0.02 -0.98 -2.91 -0.27 0.02

Total 0.51 0.03 0.29 -0.22 0.14 0.19 0.05

Please refer to page 14 for footnote disclosures.

(5)

(5)

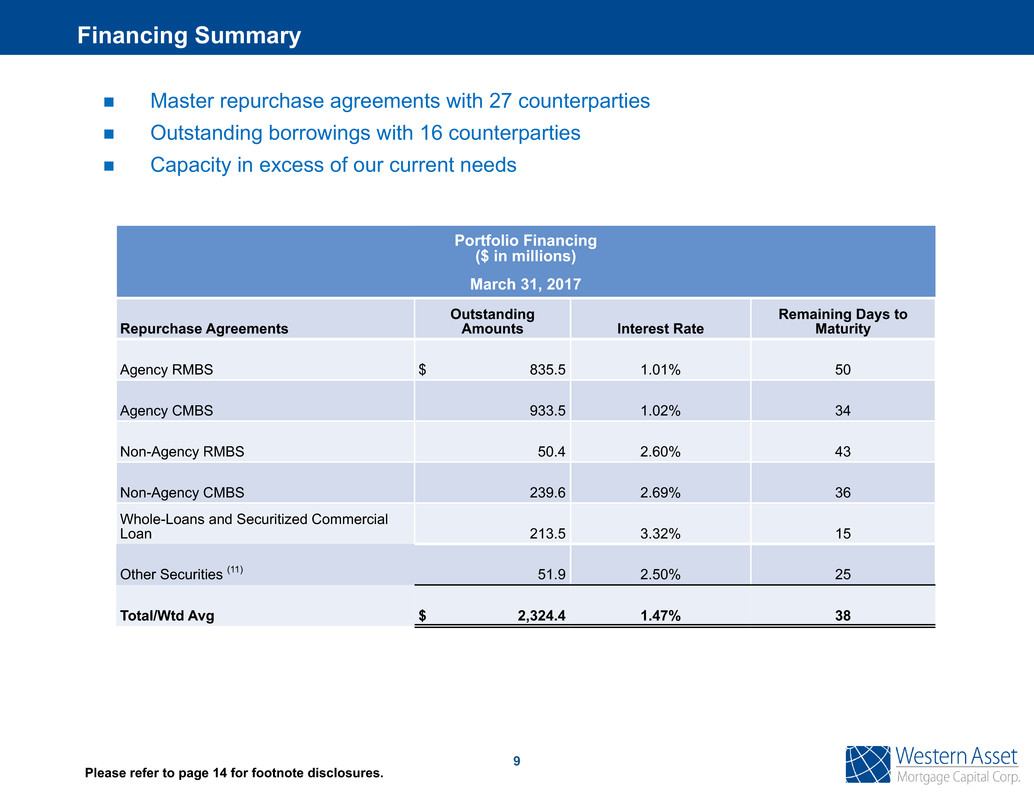

Portfolio Financing

($ in millions)

March 31, 2017

Repurchase Agreements

Outstanding

Amounts Interest Rate

Remaining Days to

Maturity

Agency RMBS $ 835.5 1.01% 50

Agency CMBS 933.5 1.02% 34

Non-Agency RMBS 50.4 2.60% 43

Non-Agency CMBS 239.6 2.69% 36

Whole-Loans and Securitized Commercial

Loan 213.5 3.32% 15

Other Securities (11) 51.9 2.50% 25

Total/Wtd Avg $ 2,324.4 1.47% 38

9

n Master repurchase agreements with 27 counterparties

n Outstanding borrowings with 16 counterparties

n Capacity in excess of our current needs

Please refer to page 14 for footnote disclosures.

Financing Summary

10

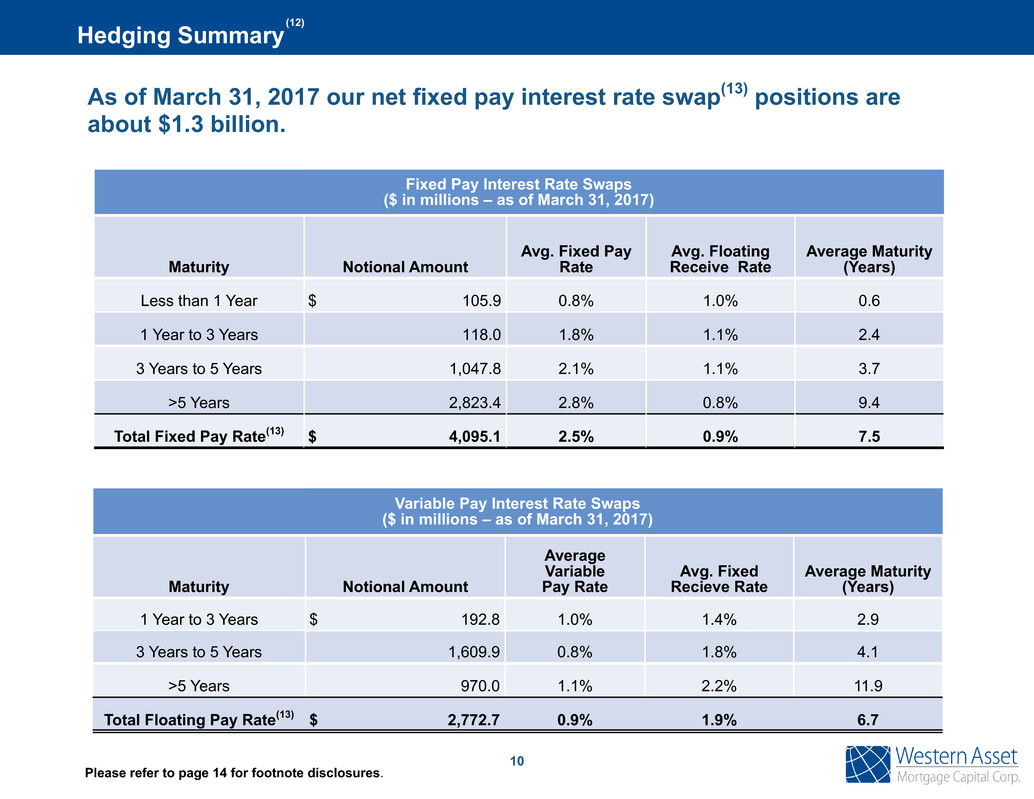

Fixed Pay Interest Rate Swaps

($ in millions – as of March 31, 2017)

Maturity Notional Amount

Avg. Fixed Pay

Rate

Avg. Floating

Receive Rate

Average Maturity

(Years)

Less than 1 Year $ 105.9 0.8% 1.0% 0.6

1 Year to 3 Years 118.0 1.8% 1.1% 2.4

3 Years to 5 Years 1,047.8 2.1% 1.1% 3.7

>5 Years 2,823.4 2.8% 0.8% 9.4

Total Fixed Pay Rate(13) $ 4,095.1 2.5% 0.9% 7.5

Variable Pay Interest Rate Swaps

($ in millions – as of March 31, 2017)

Maturity Notional Amount

Average

Variable

Pay Rate

Avg. Fixed

Recieve Rate

Average Maturity

(Years)

1 Year to 3 Years $ 192.8 1.0% 1.4% 2.9

3 Years to 5 Years 1,609.9 0.8% 1.8% 4.1

>5 Years 970.0 1.1% 2.2% 11.9

Total Floating Pay Rate(13) $ 2,772.7 0.9% 1.9% 6.7

Hedging Summary

Please refer to page 14 for footnote disclosures.

As of March 31, 2017 our net fixed pay interest rate swap(13) positions are

about $1.3 billion.

(12)

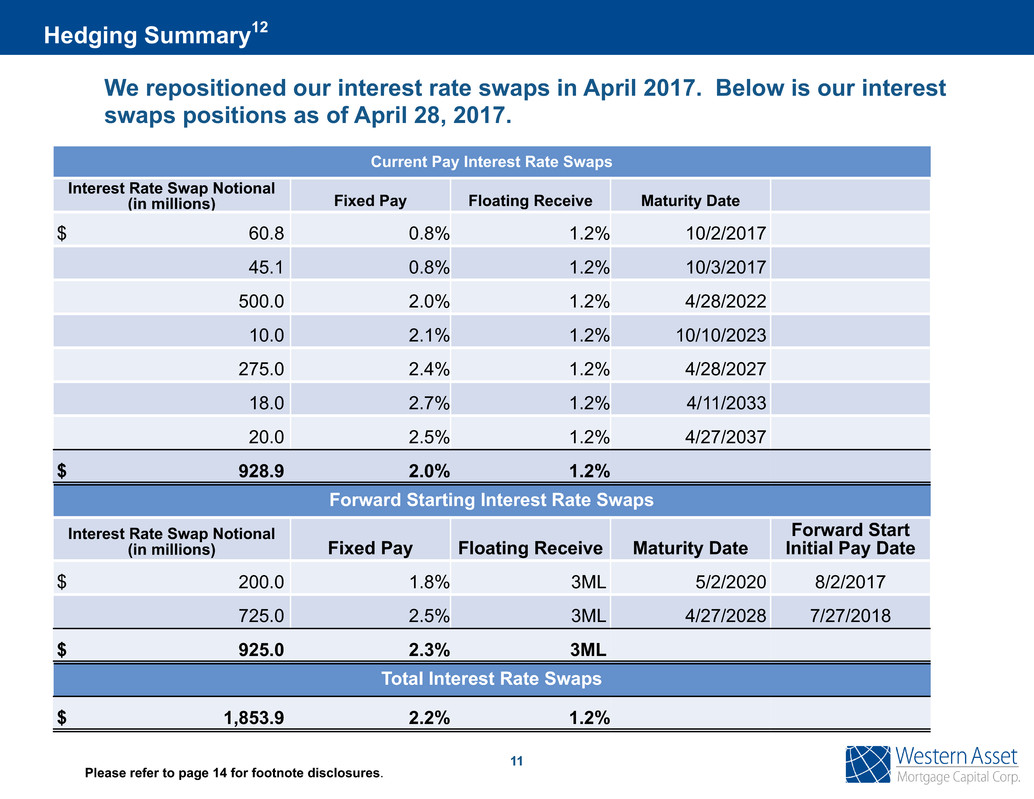

We repositioned our interest rate swaps in April 2017. Below is our interest

swaps positions as of April 28, 2017.

Current Pay Interest Rate Swaps

Interest Rate Swap Notional

(in millions) Fixed Pay Floating Receive Maturity Date

$ 60.8 0.8% 1.2% 10/2/2017

45.1 0.8% 1.2% 10/3/2017

500.0 2.0% 1.2% 4/28/2022

10.0 2.1% 1.2% 10/10/2023

275.0 2.4% 1.2% 4/28/2027

18.0 2.7% 1.2% 4/11/2033

20.0 2.5% 1.2% 4/27/2037

$ 928.9 2.0% 1.2%

Forward Starting Interest Rate Swaps

Interest Rate Swap Notional

(in millions) Fixed Pay Floating Receive Maturity Date

Forward Start

Initial Pay Date

$ 200.0 1.8% 3ML 5/2/2020 8/2/2017

725.0 2.5% 3ML 4/27/2028 7/27/2018

$ 925.0 2.3% 3ML

Total Interest Rate Swaps

$ 1,853.9 2.2% 1.2%

Hedging Summary12

Please refer to page 14 for footnote disclosures.

11

12

n Base case is for steady but unspectacular growth, where spread sectors are likely

to outperform.

n Global economies will continue to experience improving growth but weak by

historical standards.

n U.S. growth and inflation have the potential to increase with fiscal stimulus.

n Central banks are becoming somewhat less accommodative.

n Spread sectors, having rebounded from depressed levels, should continue to offer

attractive returns.

n Consumer and housing fundamentals remain at historically attractive levels.

n We expect elevated volatility in the near-term due to policy uncertainties.

2017 Macroeconomic Outlook

n Residential Whole-loans continue to perform in-line with our expectations.

n We expect to opportunistically increase our exposure to this sector including both non-

QM and bridge loans.

n Commercial mezzanine loan opportunities continue to offer attractive risk-reward

opportunities.

n Lower-rated CMBS spreads remain wide and have lagged the recovery in credit.

n We believe that junior CMBS spreads will tighten over the next year.

n Credit risk transfer spreads, especially in the equity class, remain attractive on a relative basis

and have lagged the broader recovery in the credit sensitive sectors.

n We see attractive opportunities in GSE credit risk transfer securities.

n Legacy Non-Agency RMBS spreads continue to tighten.

n Agency CMBS offers more attractive relative value than Agency RMBS.

n We expect Agency RMBS spreads to widen in the long-term, however we are

constructive in the near-term.

Portfolio View

Credit sensitive mortgage sectors have performed relatively well and are expected to

continue to offer attractive returns. Agency RMBS spreads have widened, while

agency commercial spreads have not.

13

(1) Reflects the $0.31 dividend declared on March 23, 2017 and paid on April 26, 2017.

(2) Economic return, for any period, is calculated by taking the sum of (i) the total dividends declared and (ii) the change in net book value during the period and

dividing by the beginning book value.

(3) Core earnings is a non-GAAP measures which includes the cost of interest rate swaps, interest income on IOs and IIOs classified as derivatives, net interest

income on foreign currency swaps and total return swaps. Drop income is income derived from the use of ‘to-be-announced’ forward contract (“TBA”) dollar roll

transactions which is a component of our gain (loss) on derivative instruments on our consolidated statement of operations, but is not included in core earnings.

Drop income was approximately $1.04 million for the three months ended March 31, 2017.

(4) Non-GAAP measure which includes net interest margin (as defined in footnote 7), realized and unrealized gains or losses in the portfolio and other than temporary

impairment.

(5) Non-GAAP measures which include interest income, interest expense, the cost of interest rate swaps and interest income on IOs and IIOs classified as derivatives,

foreign currency swaps and total return swap, and are weighted averages for the quarter ended March 31, 2017.

(6) First quarter weighted average Constant Prepayment Rate for the company’s Agency RMBS portfolio on an annualized basis.

(7) Non-GAAP measure which includes net interest income, interest income on IO's, IIO's, foreign currency swaps and total return swap classified as derivatives less

cash hedging costs.

(8) Includes other than temporary impairment on IO's and IIO's accounted for as derivatives.

(9) Other investments include ABS, GSE Credit Risk Transfer securities and a securitized commercial loan.

(10) Portfolio income attribution uses total income defined as the sum of net interest income, realized gain, unrealized gain and other than temporary impairment.

(11) Other securities includes ABS and GSE Credit Risk Transfer securities.

(12) While we use hedging strategies as part of our overall portfolio management, these strategies are not designed to eliminate all risks in the portfolio. There can be

no assurance as to the level or effectiveness of these strategies.

(13) At March 31, 2017 the Company has $3.4 billion notional value of pay-fixed interest rate swaps, excluding forward starting swaps of $660 million (approximately

7.6 months forward), which have variable maturities between October 2, 2017 and February 12, 2044, and $2.3 billion notional value of pay-variable interest rate

swaps, excluding forward starting swaps of $456 million (approximately 3.2 months forward), which have variable maturities between February 5, 2020 and

February 5, 2045.

(14) The residential bridge loans are reflected at amortized costs which approximate fair value.

14

Footnotes

Appendix

¹ Other investments includes ABS, GSE Credit Risk Transfer securities and securitized commercial loan.

2 Lower loan balance pools generally consist of loans below $150,000.

3 Other includes low WALA and Investor loans.

4 Commercial Real Estate Mortgage Mezzanine Loans.

5 Residential Bridge Loans are reflected at amortized costs which approximate fair value at March 31, 2017.

16

Portfolio Breakdown

Total Investment Portfolio ($ in millions)

March 31, 2017

Agency RMBS $ 1,074

Agency CMBS 1,120

Non-Agency RMBS 64

Non-Agency CMBS 342

Residential Whole-Loans 216

Residential Bridge Loans 5 33

Other Investments1 139

Total $ 2,988

Agency & Non-Agency CMBSAgency RMBS Non-Agency RMBS, Whole-loans &CRT Securities

Select Sector Categories

Agency RMBS Agency CMBS Non-Agency RMBS

Non-Agency CMBS Whole-Loans Other Investments

35.9%

37.5%

2.2%

11.4%

8.3%4.7%

Lower Loan Balance

MHA/HARP High LTV

Other

69.0%

12.0%

19.0%

Non-Agency RMBS

Residential Whole-loans

CRT Securities

14.2%

55.1%

30.7%

Legacy CMBS New Issue CMBS

CRE Mezzanine Agency CMBS

13.5%

7.4%

2.5%

76.6%

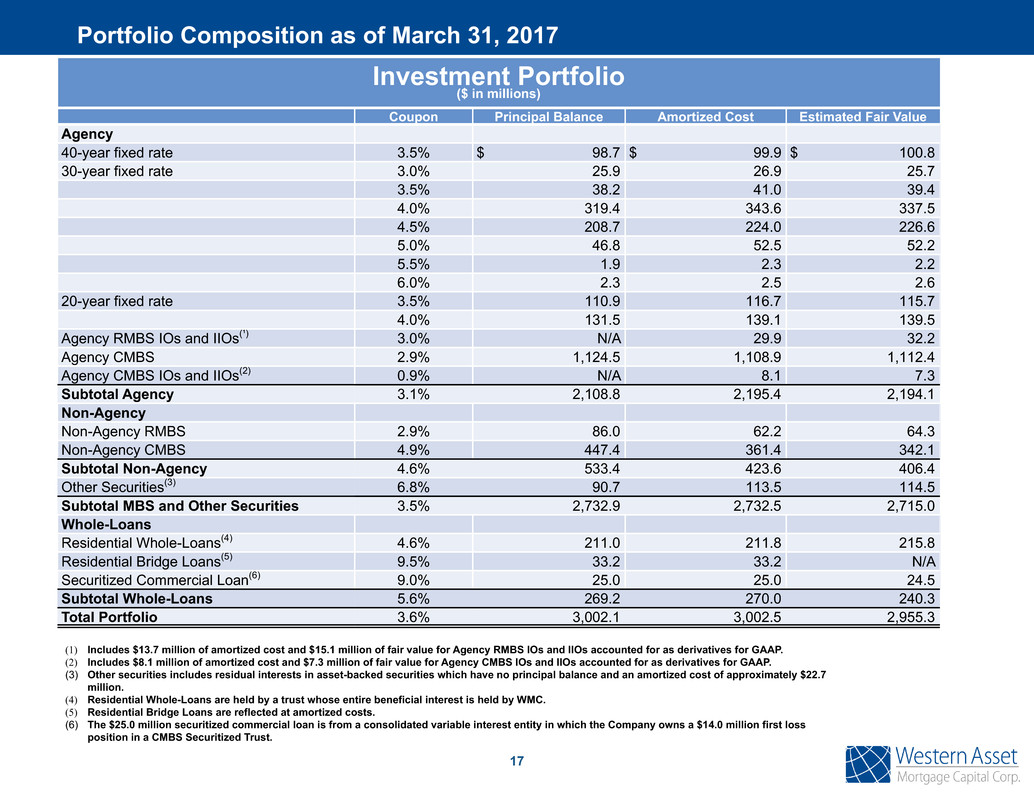

(1) Includes $13.7 million of amortized cost and $15.1 million of fair value for Agency RMBS IOs and IIOs accounted for as derivatives for GAAP.

(2) Includes $8.1 million of amortized cost and $7.3 million of fair value for Agency CMBS IOs and IIOs accounted for as derivatives for GAAP.

(3) Other securities includes residual interests in asset-backed securities which have no principal balance and an amortized cost of approximately $22.7

million.

(4) Residential Whole-Loans are held by a trust whose entire beneficial interest is held by WMC.

(5) Residential Bridge Loans are reflected at amortized costs.

(6) The $25.0 million securitized commercial loan is from a consolidated variable interest entity in which the Company owns a $14.0 million first loss

position in a CMBS Securitized Trust.

17

Investment Portfolio

($ in millions)

Coupon Principal Balance Amortized Cost Estimated Fair Value

Agency

40-year fixed rate 3.5% $ 98.7 $ 99.9 $ 100.8

30-year fixed rate 3.0% 25.9 26.9 25.7

3.5% 38.2 41.0 39.4

4.0% 319.4 343.6 337.5

4.5% 208.7 224.0 226.6

5.0% 46.8 52.5 52.2

5.5% 1.9 2.3 2.2

6.0% 2.3 2.5 2.6

20-year fixed rate 3.5% 110.9 116.7 115.7

4.0% 131.5 139.1 139.5

Agency RMBS IOs and IIOs(¹) 3.0% N/A 29.9 32.2

Agency CMBS 2.9% 1,124.5 1,108.9 1,112.4

Agency CMBS IOs and IIOs(2) 0.9% N/A 8.1 7.3

Subtotal Agency 3.1% 2,108.8 2,195.4 2,194.1

Non-Agency

Non-Agency RMBS 2.9% 86.0 62.2 64.3

Non-Agency CMBS 4.9% 447.4 361.4 342.1

Subtotal Non-Agency 4.6% 533.4 423.6 406.4

Other Securities(3) 6.8% 90.7 113.5 114.5

Subtotal MBS and Other Securities 3.5% 2,732.9 2,732.5 2,715.0

Whole-Loans

Residential Whole-Loans(4) 4.6% 211.0 211.8 215.8

Residential Bridge Loans(5) 9.5% 33.2 33.2 N/A

Securitized Commercial Loan(6) 9.0% 25.0 25.0 24.5

Subtotal Whole-Loans 5.6% 269.2 270.0 240.3

Total Portfolio 3.6% 3,002.1 3,002.5 2,955.3

Portfolio Composition as of March 31, 2017

18

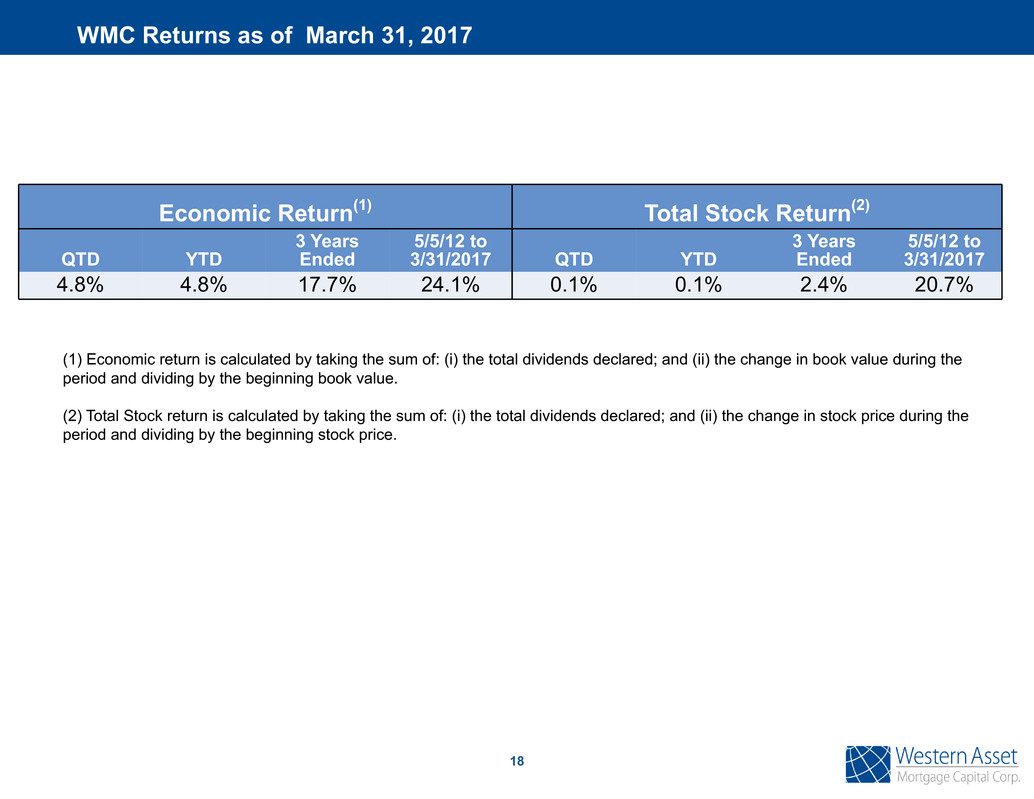

Economic Return(1) Total Stock Return(2)

QTD YTD

3 Years

Ended

5/5/12 to

3/31/2017 QTD YTD

3 Years

Ended

5/5/12 to

3/31/2017

4.8% 4.8% 17.7% 24.1% 0.1% 0.1% 2.4% 20.7%

WMC Returns as of March 31, 2017

(1) Economic return is calculated by taking the sum of: (i) the total dividends declared; and (ii) the change in book value during the

period and dividing by the beginning book value.

(2) Total Stock return is calculated by taking the sum of: (i) the total dividends declared; and (ii) the change in stock price during the

period and dividing by the beginning stock price.

Western Asset Mortgage Capital Corporation

c/o Financial Profiles, Inc.

11601 Wilshire Blvd., Suite 1920

Los Angeles, CA 90025

www.westernassetmcc.com

Investor Relations Contact:

Larry Clark

Tel: (310) 622-8223

lclark@finprofiles.com

Contact Information