Attached files

| file | filename |

|---|---|

| EX-99.01 - EARNINGS PRESS RELEASE - EL PASO ELECTRIC CO /TX/ | exh99013-31x2017.htm |

| 8-K - FORM 8-K - EL PASO ELECTRIC CO /TX/ | form8k3-31x17.htm |

First Quarter 2017

Earnings Conference Call

May 3, 2017

2

A

A

a

This presentation includes statements that are forward-looking statements made pursuant to the safe harbor provisions of the Section 27A of

the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. This information may involve

risks and uncertainties that could cause actual results to differ materially from such forward-looking statements. Additional information

concerning factors that could cause actual results to differ materially from those expressed in forward-looking statements is contained in EE's

most recently filed periodic reports and in other filings made by EE with the U.S. Securities and Exchange Commission (the "SEC"), and

include, but is not limited to:

Increased prices for fuel and purchased power and the possibility that regulators may not permit EE to pass through all such increased

costs to customers or to recover previously incurred fuel costs in rates

Full and timely recovery of capital investments and operating costs through rates in Texas and New Mexico

Uncertainties and instability in the general economy and the resulting impact on EE’s sales and profitability

Changes in customers’ demand for electricity as a result of energy efficiency initiatives and emerging competing services and

technologies, including distributed generation

Unanticipated increased costs associated with scheduled and unscheduled outages of generating plant

Unanticipated maintenance, repair, or replacement costs for generation, transmission, or distribution facilities and the recovery of

proceeds from insurance policies providing coverage for such costs

The size of our construction program and our ability to complete construction on budget and on time

Potential delays in our construction schedule due to legal challenges or other reasons

Costs at Palo Verde

Deregulation and competition in the electric utility industry

Possible increased costs of compliance with environmental or other laws, regulations and policies

Possible income tax and interest payments as a result of audit adjustments proposed by the IRS or state taxing authorities

Uncertainties and instability in the financial markets and the resulting impact on EE’s ability to access the capital and credit markets

Possible physical or cyber attacks, intrusions or other catastrophic events

Other factors of which we are currently unaware or deem immaterial

EE’s filings are available from the SEC or may be obtained through EE’s website, http://www.epelectric.com. Any such forward-looking

statement is qualified by reference to these risks and factors. EE cautions that these risks and factors are not exclusive. Management cautions

against putting undue reliance on forward-looking statements or projecting any future results based on such statements or present or prior

earnings levels. Forward-looking statements speak only as of the date of this news release, and EE does not undertake to update any forward-

looking statement contained herein.

Safe Harbor Statement

31st Quarter Financial Results

Reported 1st Quarter 2017 net loss of $4.0 million (or $0.10

per share), compared to 1st Quarter 2016 net loss of $5.8

million (or $0.14 per share)

Reported $2.43 per share for the twelve months ended March

31, 2017

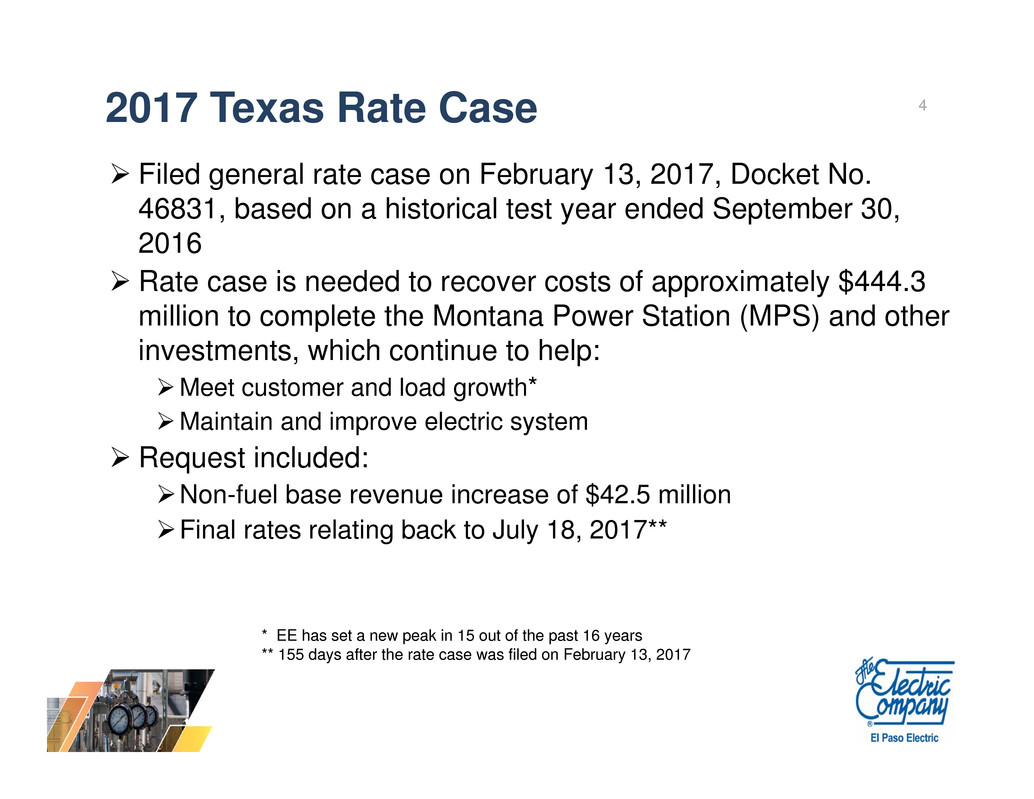

42017 Texas Rate Case

Filed general rate case on February 13, 2017, Docket No.

46831, based on a historical test year ended September 30,

2016

Rate case is needed to recover costs of approximately $444.3

million to complete the Montana Power Station (MPS) and other

investments, which continue to help:

Meet customer and load growth*

Maintain and improve electric system

Request included:

Non-fuel base revenue increase of $42.5 million

Final rates relating back to July 18, 2017**

* EE has set a new peak in 15 out of the past 16 years

** 155 days after the rate case was filed on February 13, 2017

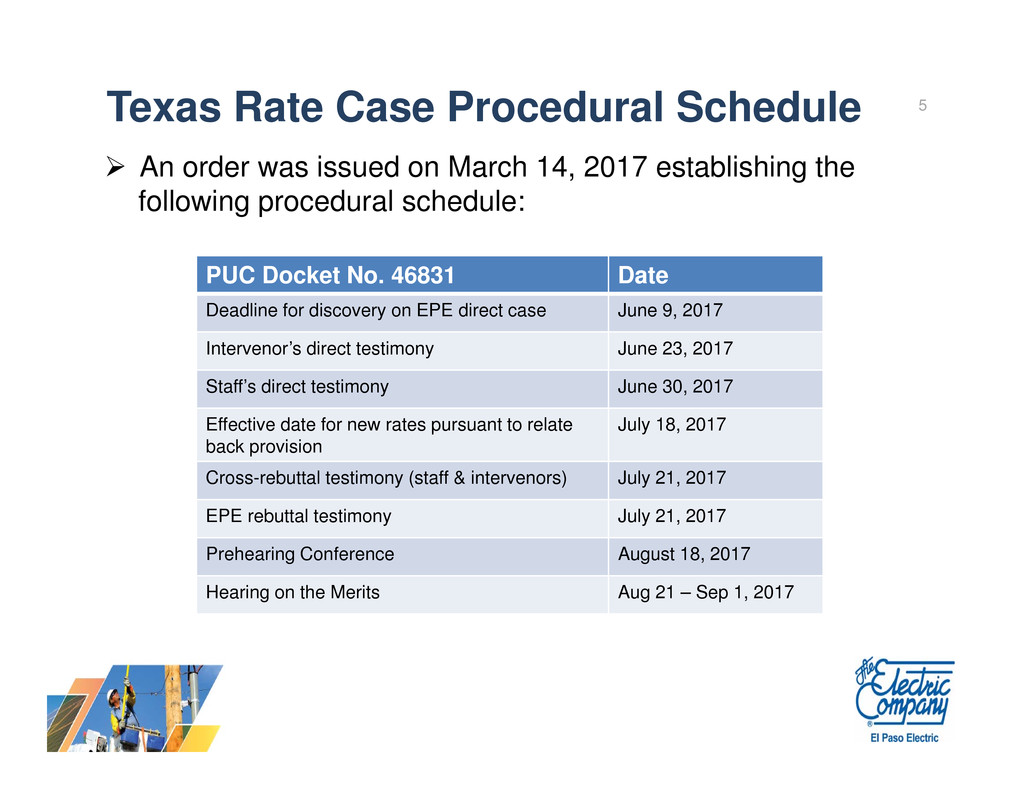

5Texas Rate Case Procedural Schedule

PUC Docket No. 46831 Date

Deadline for discovery on EPE direct case June 9, 2017

Intervenor’s direct testimony June 23, 2017

Staff’s direct testimony June 30, 2017

Effective date for new rates pursuant to relate

back provision

July 18, 2017

Cross-rebuttal testimony (staff & intervenors) July 21, 2017

EPE rebuttal testimony July 21, 2017

Prehearing Conference August 18, 2017

Hearing on the Merits Aug 21 – Sep 1, 2017

An order was issued on March 14, 2017 establishing the

following procedural schedule:

6Recent Developments

On April 12, 2017, the NMPRC approved the request to delay EE’s

New Mexico general rate case filing up to a date no later than July

31, 2019

EE continues to work towards a settlement agreement in the current

fuel reconciliation proceeding in Texas

Expect the Commission to consider a proposed settlement in Q2

2017

EE finalized certain agreements with the Air Force Base for a large

scale solar project at Holloman Air Force Base – 5 MW capacity

Construction is anticipated to be completed in Q4 2017 or early

2018

7Texas Community Solar Program- 3 MW Capacity

100% of the output was subscribed within one month

Allows customers to hedge against certain future rate increases

Subscription is accessible and portable in Texas service territory

Customers enjoy contract flexibility

EE expects to complete

construction of its first large scale

solar project in Q2 2017

Largest utility-owned community

solar facility in Texas

There are approximately 1,500 customers subscribed to the

program

Almost 400 customers are on a waiting list

Customers will be contacted on a first-come-first-served basis if

capacity becomes available

8Economic Growth

Recently announced projects

Restoration of the the Roberts-Banner Building

Renovation of the Blue Flame Building

The Substation Retail Center

The Canyons at Cimarron

Franklin Galleria Mall

Resort at Montecillo

Franklin Avenue Apartments

Miradores at Shadow Mountain

Plaza Del Rey

91st Quarter Key Earnings Drivers

Q1 Basic EPS Description

March 31, 2016 (0.14)$

Changes In:

Allowance for funds used

during construction (AFUDC)

(0.05)

Decreased due to lower construction work in progress balances, primarily due

to MPS Units 3 & 4 being placed in service in May and September 2016,

respectively and a reduction in the AFUDC rate effective January 2017.

O&M at fossil-fuel generating

plants

(0.04)

Increased due to maintenance outages at Newman Units 1, 3, & 4 and

increased routine maintenance at MPS and Rio Grande Power Station (RG).

These costs were partially offset by the sale of EE's interest in the Four

Corners Power Plant and a maintenance outage at RG Unit 7 in 2016.

Interest on long-term debt (0.03)

Increased primarily due to the $150 million principal amount of senior notes

issued in March 2016.

Retail non-fuel base revenues 0.08

Increased primarily due to the recognition of non-fuel base rate increase

related to the final order in the Texas 2015 rate case and the growth in the

average number of retail customers; partially offset by a decrease in kWh

sales from residential customers primarily due to milder weather compared to

same period in 2016.

Depreciation and amortization 0.02

Decreased primarily due to reductions resulting from changes in depreciation

rates as approved by the PUCT and NMPRC in our 2015 Texas and New

Mexico rate cases and the sale of EE's interest in Four Corners Power Plant.

These decreases were offset by an increase in plant, including MPS Units 3 &

4, which were placed in service in May and September 2016, respectively.

Investment and interest income 0.02

Increased primarily due to higher realized gains on securities sold from EE's

Palo Verde decommissioning trusts.

Other revenues 0.02

Increased primarily due to additional miscellaneous service revenues that were

approved by the PUCT and NMPRC in our 2015 Texas and New Mexico rate

cases, and the New Mexico energy efficiency bonus.

Other 0.02

March 31, 2017 (0.10)$

10Historical Weather Summary

1,191

1,030

1,396

1,265

1,159

1,338

958

1,153

1,054

810

0

200

400

600

800

1,000

1,200

1,400

1,600

2008 2009 2010 2011 2012 2013 2014 2015 2016 2017

First Quarter HDD’s

10-Yr HDD

Average – 1,135

First Quarter HDD’s

• 28.6% Below 10-Year Average

• 23.1% Below 1st Quarter 2016

11Q1 Retail Sales and Customers

(1) Percent Change expressed as change in Q1 2017 from Q1 2016

Average No.

of Customers

Percent

Change (1)

MWH

Percent

Change (1)

Residential 365,311 1.5% 545,128 (4.2%)

C&I Small 42,076 3.8% 500,590 0.1%

C&I Large 49 - % 252,998 3.3%

Public Authorities 5,433 1.1% 335,563 (3.1%)

Total Retail 412,869 1.7% 1,634,279 (1.6%)

Cooling Degree Days 72 213%

Heating Degree Days 810 (23.1%)

12Capital Requirements & Liquidity

On March 31, 2017, EE had liquidity of $220.5 million,

including cash and cash equivalents of $5.2 million and

unused capacity under the revolving credit facility

Expended $53.9 million for additions to utility plant for the

three months ended March 31, 2017

Capital expenditures for utility plant in 2017 are expected to

be approximately $215.0 million

Anticipate issuing an all-source request for proposal for

generation resources in 2017

13Capital Requirements & Liquidity (Cont’d)

On January 26, 2017, the Board declared a quarterly cash

dividend of $0.31 per share payable on March 31, 2017 to

shareholders of record as of March 17, 2017

In Q2 2017, EE anticipates raising the annual dividend (beyond

the historical $0.06 annual increase per share) to move towards

achieving an annual 55% to 65% payout ratio by 2020

Two tranches of debt maturing or subject to mandatory tender

for purchase in August and September 2017 for $50.0 million

and $33.3 million, respectively

EE has adequate liquidity to meet all our cash requirements, including

the repayment of these two tranches

14

Q & A