Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - Regional Management Corp. | d239589dex991.htm |

| EX-10.6 - EX-10.6 - Regional Management Corp. | d239589dex106.htm |

| EX-10.5 - EX-10.5 - Regional Management Corp. | d239589dex105.htm |

| EX-10.4 - EX-10.4 - Regional Management Corp. | d239589dex104.htm |

| EX-10.3 - EX-10.3 - Regional Management Corp. | d239589dex103.htm |

| EX-10.2 - EX-10.2 - Regional Management Corp. | d239589dex102.htm |

| EX-10.1 - EX-10.1 - Regional Management Corp. | d239589dex101.htm |

| 8-K - 8-K - Regional Management Corp. | d239589d8k.htm |

Exhibit 99.2

REGIONAL TM

MANAGEMENT

1Q 2017 Earnings Call Presentation

May 2, 2017

Safe Harbor Statement

REGIONAL TM

MANAGEMENT

This presentation and the responses to various questions contain forward-looking statements, which reflect our current views with respect

to, among other things, the Company’s operations and financial performance. You can identify these forward-looking statements by the use of words such as “outlook,” “believes,”

“expects,” “potential,” “continues,” “may,” “will,” “should,” “seeks,” “approximately,” “predicts,” “intends,” “plans,”

“estimates,” “anticipates” or the negative version of these words or other comparable words. Such forward-looking statements are subject to various risks and uncertainties. Accordingly,

there are or will be important factors that could cause actual outcomes or results to differ materially from those indicated in these statements. These factors include but are not limited to those described under “Risk Factors” in the

Company’s Annual Report on Form 10-K and Quarterly Reports on Form 10-Q. We cannot guarantee future events, results, actions, levels of activity, performance or

achievements. Neither the Company nor any of its respective agents, employees or advisors undertake any duty or obligation to supplement, amend, update or revise any forward-looking statement, whether as a

result of new information or otherwise.

The information and opinions contained in this document are provided as of the date of this presentation and are subject to

change without notice. This document has not been approved by any regulatory or supervisory authority.

2

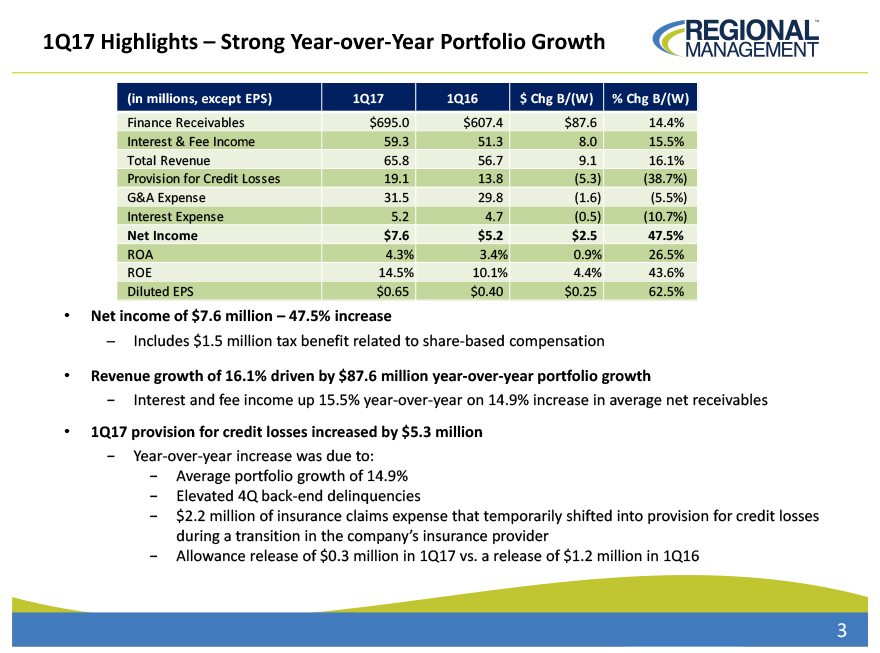

1Q17 Highlights -

Strong Year-over-Year Portfolio Growth

REGIONAL TM

MANAGEMENT

(in millions, except EPS)

1Q17 1Q16 $ Chg B/(W) % Chg B/(W)

Finance Receivables $695.0

$607.4 $87.6 14.4%

Interest & Fee Income

59.3 51.3 8.0

15.5%

Total Revenue

65.8 56.7 9.1 16.1%

Provision for Credit Losses

19.1 13.8 (5.3) (38.7%)

G&A Expense

31.5 29.8 (1.6) (5.5%)

Interest Expense

5.2 4.7 (0.5) (10.7%)

Net Income

$7.6 $5.2 $2.5 47.5%

ROA

4.3% 3.4% 0.9% 26.5%

ROE

14.5% 10.1% 4.4% 43.6%

Diluted EPS

$0.65 $0.40 $0.25 62.5%

Net income of $7.6 million - 47.5% increase

- Includes $1.5 million tax benefit related to share-based compensation

Revenue growth of 16.1% driven by $87.6 million

year-over-year portfolio growth

-

Interest and fee income up 15.5% year-over-year on 14.9% increase in average net receivables

1Q17 provision for credit losses increased by $5.3 million

- Year-over-year increase was due to:

- Average portfolio growth of 14.9%

-

Elevated 4Q back-end delinquencies

- $2.2 million of insurance claims expense that temporarily shifted into

provision for credit losses during a transition in the company’s insurance provider

- Allowance release of $0.3 million in 1Q17 vs. a release of $1.2 million

in 1Q16

3

Strategic Updates

REGIONAL TM

MANAGEMENT

Nortridge Loan Management System Implementation

-

Conversion to NLS progressing

-

Successfully built enhanced functionality (texting, imaging, and customer portal)

-

Plan to resume state conversions in 2Q17 and to convert remaining states throughout 2017

Marketing

/ De Novo Branches

- Rolled out improved targeting and segmentation in direct mail campaigns

- Plan to increase marketing spend to drive traffic into branches through remainder of 2017

- Hybrid growth model

-

Increase receivable growth within existing branch footprint

-

Maintain plans to open 10-15 de novo branches in Virginia in 2017; 5 have been opened as of March 31,

2017

Online Lending Update

- Continue to utilize test-and-learn approach

- LendingTree Partnership:

- Continues to show positive results

- Working toward full system integration with LendingTree

- Plan to integrate online system with NLS once state conversions are complete

Centralized Collections

-

Strong results from limited testing in Texas, North Carolina, and South Carolina

-

Expand centralized collections test in other geographies starting 2Q17

4

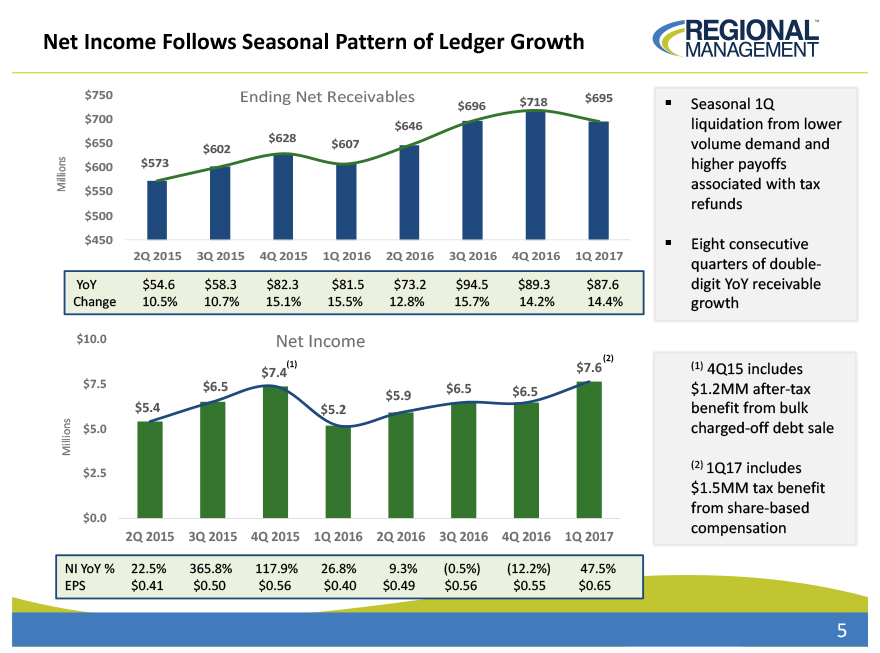

Net Income Follows Seasonal Pattern of Ledger Growth

REGIONAL TM

MANAGEMENT

Millions

$750 $700 $650 $600 $550 $500 $450

Ending Net Receivables $573 $602 $628 $607 $646 $696 $718 $695

2Q 2015 3Q 2015 4Q 2015 1Q 2016

2Q 2016 3Q 2016 4Q 2016 1Q 2017

YoY $54.6 $58.3 $82.3 $81.5 $73.2 $94.5 $89.3 $87.6

Change 10.5% 10.7% 15.1% 15.5% 12.8% 15.7% 14.2% 14.4%

Millions

$10.0 $7.5 $5.0 $2.5 $0.0

Net Income $5.4 $6.5 $7.4(1) $5.2 $5.9 $6.5 $6.5 $7.6 (2)

2Q 2015 3Q 2015 4Q 2015 1Q 2016 2Q 2016 3Q 2016 4Q 2016 1Q 2017

NI YoY %

22.5% 365.8% 117.9% 26.8% 9.3% (0.5%) (12.2%) 47.5%

EPS $0.41 $0.50 $0.56 $0.40 $0.49 $0.56 $0.55 $0.65

Seasonal 1Q liquidation from lower volume demand and higher payoffs associated with tax refunds

Eight consecutive quarters of double-digit YoY receivable growth

(1) 4Q15 includes

$1.2MM after-tax benefit from bulk charged-off debt sale

(2) 1Q17 includes

$1.5MM tax benefit from share-based compensation

5

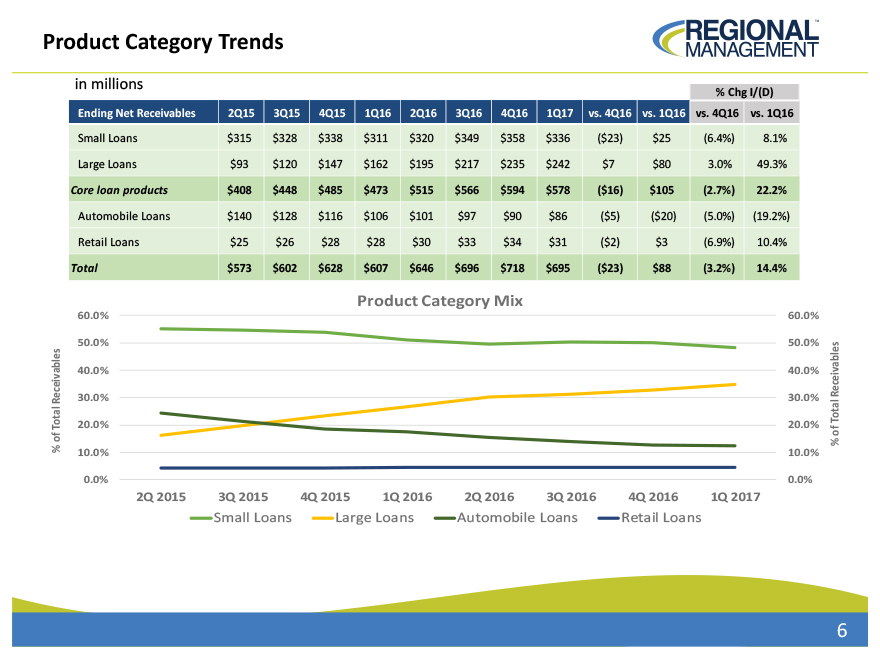

Product Category Trends REGIONAL MANAGEMENT TM

in millions % Chg I/(D)

Ending Net Receivables 2Q15 3Q15 4Q15 1Q16 2Q16 3Q16 4Q16 1Q17 vs.

4Q16 vs. 1Q16 vs. 4Q16 vs. 1Q16

Small Loans $315 $328 $338 $311 $320 $349 $358 $336 ($23) $25 (6.4%) 8.1%

Large Loans $93 $120 $147 $162 $195 $217 $235 $242 $7 $80 3.0% 49.3%

Core loan products $408

$448 $485 $473 $515 $566 $594 $578 ($16) $105 (2.7%) 22.2%

Automobile Loans $140 $128 $116 $106 $101 $97 $90 $86 ($5) ($20) (5.0%) (19.2%)

Retail Loans $25 $26 $28 $28 $30 $33 $34 $31 ($2) $3 (6.9%) 10.4%

Total $573 $602 $628 $607

$646 $696 $718 $695 ($23) $88 (3.2%) 14.4%

Product Category Mix

% of Total

Receivables

60.0% 60.0%

50.0% 50.0%

40.0% 40.0%

30.0% 30.0%

20.0% 20.0%

10.0% 10.0%

0.0% 0.0%

% of Total Receivables

2Q 20153Q 2015 4Q 2015 1Q 2016 2Q 2016 3Q 2016 4Q 2016 1Q 2017

Small Loans Large Loans

Automobile Loans Retail Loans

6

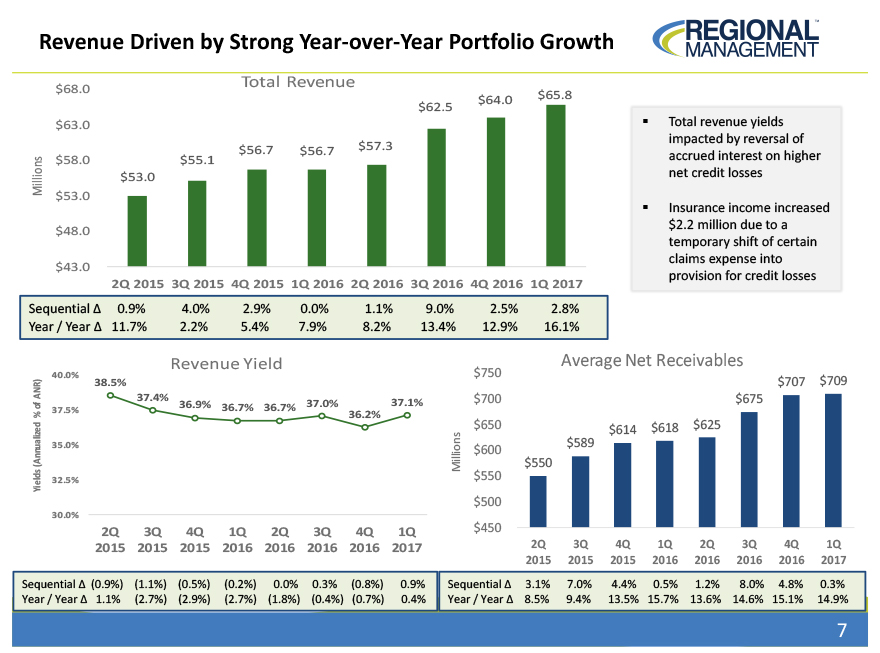

Revenue Driven by Strong Year-over-Year Portfolio Growth

REGIONAL MANAGEMENT TM

Total Revenue

Millions

$68.0 $63.0 $58.0 $53.0 $48.0 $43.0

$53.0 $55.1 $56.7 $56.7 $57.3 $62.5 $64.0 $65.8

2Q 2015 3Q 2015 4Q 2015 1Q 2016 2Q 2016 3Q

2016 4Q 2016 1Q 2017

Sequential 0.9% 4.0% 2.9% 0.0% 1.1%9.0%2.5%2.8%

Year /

Year 11.7% 2.2% 5.4% 7.9% 8.2%13.4%12.9%16.1%

Total revenue yields impacted by reversal of accrued interest on higher net credit losses

Insurance income increased $2.2 million due to a temporary shift of certain claims expense into provision for credit losses

Revenue Yield

Yields (Annualized % of ANR)

40.0% 37.5% 35.0% 32.5% 30.0%

38.5% 37.4% 36.9% 36.7% 36.7% 37.0% 36.2% 37.1%

2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q

2015 2015 2015 2016 2016 2016 2016 2017

Sequential (0.9%) (1.1%) (0.5%) (0.2%) 0.0% 0.3% (0.8%) 0.9%

Year / Year 1.1% (2.7%) (2.9%)

(2.7%) (1.8%) (0.4%) (0.7%) 0.4%

Average Net Receivables

Millions $750 $700

$650 $600 $550 $500 $450

$550 $589 $614 $618 $625 $675 $707 $709

2Q 3Q 4Q 1Q

2Q 3Q 4Q 1Q

2015 2015 2015 2016 2016 2016 2016 2017

Sequential 3.1% 7.0% 4.4%

0.5% 1.2% 8.0% 4.8% 0.3%

Year / Year 8.5% 9.4% 13.5% 15.7% 13.6% 14.6% 15.1% 14.9%

7

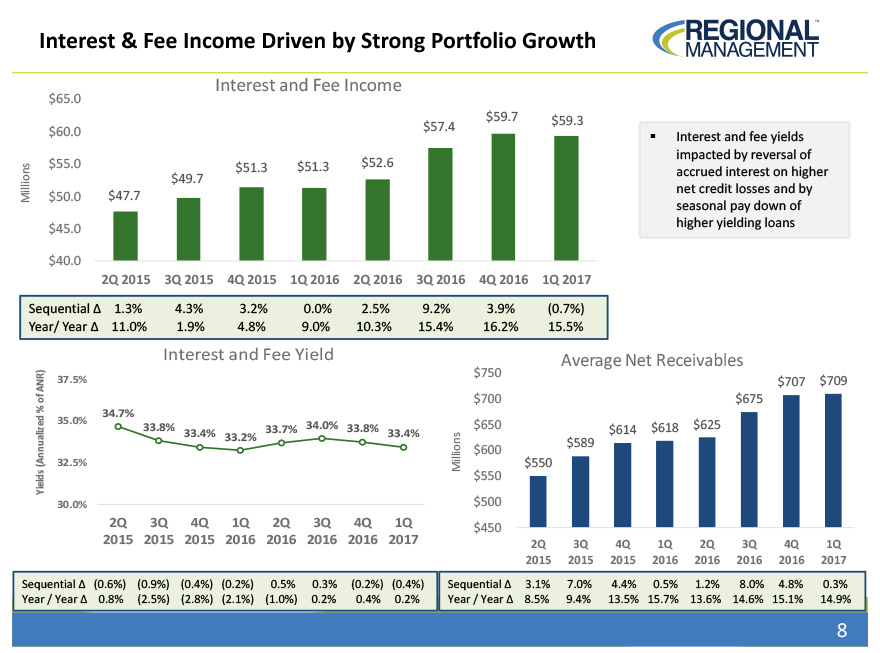

Interest & Fee Income Driven by Strong Portfolio Growth

REGIONAL TM

MANAGEMENT

Interest and Fee Income

Millions

$65.0 $60.0 $55.0 $50.0 $45.0 $40.0

$47.7 $49.7 $51.3 $51.3 $52.6 $57.4 $59.7 $59.3

2Q 2015 3Q 2015 4Q 2015 1Q 2016 2Q 2016 3Q 2016 4Q 2016 1Q 2017

Sequential

1.3% 4.3% 3.2% 0.0% 2.5% 9.2% 3.9% (0.7%)

Year/ Year 11.0% 1.9% 4.8% 9.0% 10.3% 15.4% 16.2% 15.5%

Interest and fee yields impacted by reversal of accrued interest on higher net credit losses and by seasonal pay down of higher yielding loans

Interest and Fee Yield

Yields (Annualized % of ANR)

37.5% 35.0% 32.5% 30.0%

34.7% 33.8% 33.4% 33.2% 33.7% 34.0% 33.8% 33.4%

2Q 2015 3Q 2015 4Q 2015 1Q 2016 2Q 2016 3Q 2016 4Q 2016 1Q 2017

Sequential (0.6%) (0.9%)

(0.4%) (0.2%) 0.5% 0.3% (0.2%) (0.4%)

Year / Year 0.8% (2.5%) (2.8%) (2.1%) (1.0%) 0.2% 0.4% 0.2%

Average Net Receivables

Millions

$750 $700 $650 $600 $550 $500 $450

$550 $589 $614 $618 $625 $675 $707 $709

2Q 2015 3Q 2015 4Q 2015 1Q 2016 2Q 2016 3Q 2016 4Q 2016 1Q 2017

Sequential 3.1% 7.0% 4.4% 0.5%

1.2% 8.0% 4.8% 0.3%

Year / Year 8.5% 9.4% 13.5% 15.7% 13.6% 14.6% 15.1% 14.9%

8

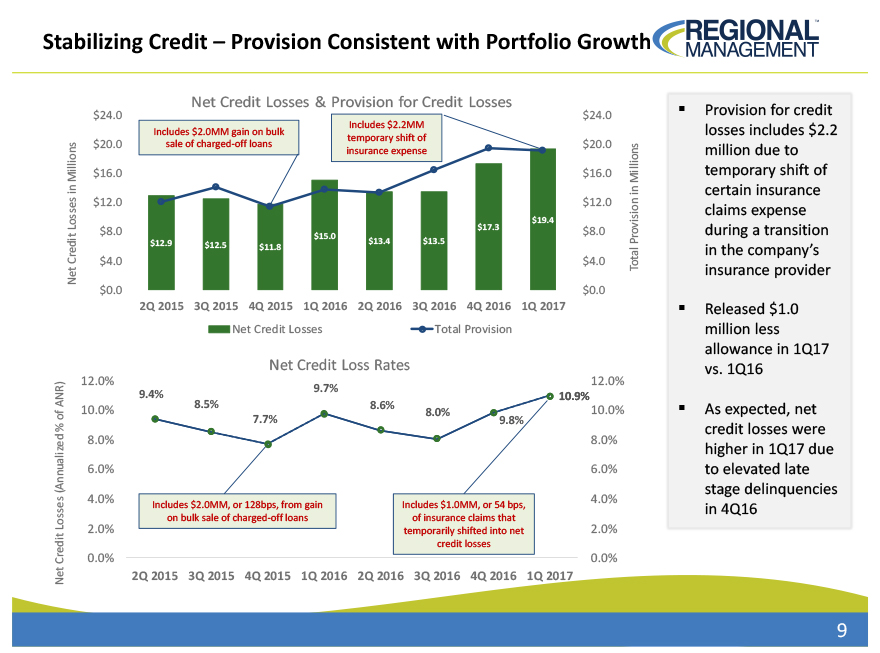

Stabilizing Credit – Provision Consistent with Portfolio Growth

REGIONAL TM

MANAGEMENT

Net Credit Losses & Provision for Credit Losses

Net Credit Losses in Millions

$24.0 $20.0 $16.0 $12.0 $8.0 $4.0 $0.0

$24.0 $20.0 $16.0 $12.0 $8.0 $4.0 $0.0

Includes $2.0MM gain on bulk sale of charged-off loans

Includes $2.2MM temporary shift of

insurance expense

$12.9 $12.5 $11.8 $15.0 $13.4 $13.5 $17.3 $19.4

2Q 2015 3Q

2015 4Q 2015 1Q 2016 2Q 2016 3Q 2016 4Q 2016 1Q 2017

Total Provision in Millions

Net Credit Losses Total Provision

Net Credit Loss Rates

Net Credit Losses (Annualized % of ANR)

12.0% 10.0% 8.0% 6.0% 4.0% 2.0% 0.0%

12.0% 10.0% 8.0% 6.0% 4.0% 2.0% 0.0%

9.4% 8.5% 7.7% 9.7% 8.6% 8.0% 9.8% 10.9%

Includes $2.0MM, or 128bps, from gain on bulk sale of charged-off loans

Includes $1.0MM, or 54

bps, of insurance claims that temporarily shifted into net credit losses

2Q 2015 3Q 2015 4Q 2015 1Q 2016 2Q 2016 3Q 2016 4Q 2016 1Q 2017

Provision for credit losses includes $2.2 million due to temporary shift of certain insurance claims expense during a transition in the company’s insurance provider

Released $1.0 million less allowance in 1Q17 vs. 1Q16

As expected, net credit

losses were higher in 1Q17 due to elevated late stage delinquencies in 4Q16

9

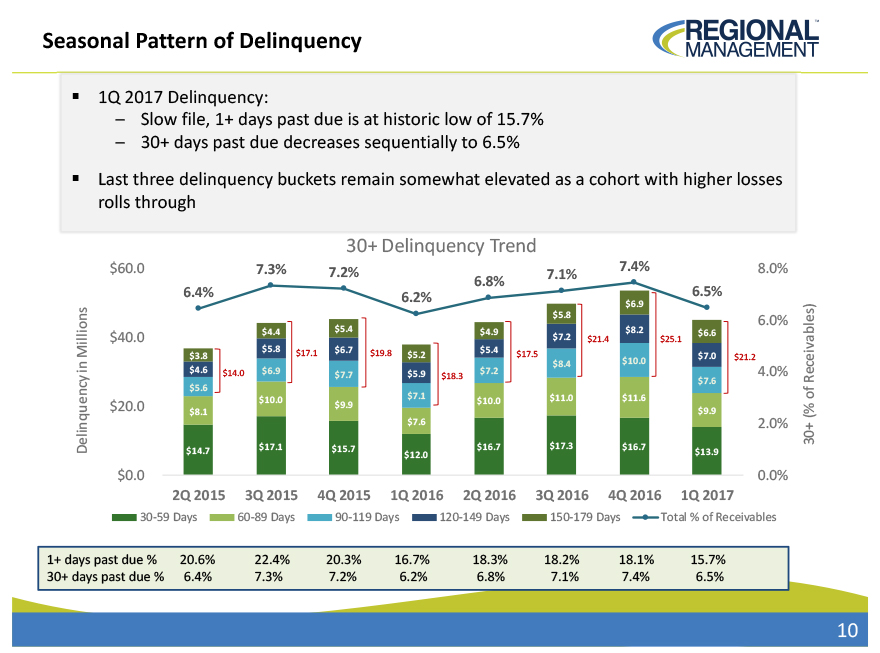

Seasonal Pattern of Delinquency

REGIONAL TM

MANAGEMENT

1Q 2017 Delinquency:

- Slow file, 1+ days past due is at historic low of 15.7%

- 30+ days past due decreases sequentially to 6.5%

Last three delinquency buckets remain

somewhat elevated as a cohort with higher losses rolls through

30+ Delinquency Trend

Delinquency in Millions

$60.0

7.3%

7.2%

7.1%

7.4%

8.0%

6.8%

6.4%

6.2%

6.5%

$6.9

$5.8

6.0%

$4.4

$5.4

$4.9

$8.2

$6.6

$40.0

$7.2 $21.4

$25.1

$3.8

$5.8 $17.1

$6.7 $19.8 $5.2

$5.4

$17.5

$7.0

$21.2

$8.4

$10.0

$4.6 $14.0 $6.9

$7.7

$5.9

$18.3

$7.2

4.0%

$7.6

$5.6

$10.0

$7.1

$10.0

$11.0

$11.6

$20.0

$8.1

$9.9

$9.9

$7.6

2.0%

$14.7

$17.1

$15.7

$16.7

$17.3

$16.7

$13.9

$12.0

$0.0

0.0%

2Q 2015

3Q 2015

4Q 2015

1Q 2016

2Q 2016

3Q 2016

4Q 2016 1Q 2017

30-59 Days

60-89 Days

90-119 Days

120-149 Days

150-179 Days

Total % of Receivables

1+ days past due % 20.6% 22.4% 20.3% 16.7% 18.3% 18.2% 18.1% 15.7%

30+ days

past due % 6.4% 7.3% 7.2% 6.2% 6.8% 7.1% 7.4% 6.5%

30+ (% of Receivables)

10

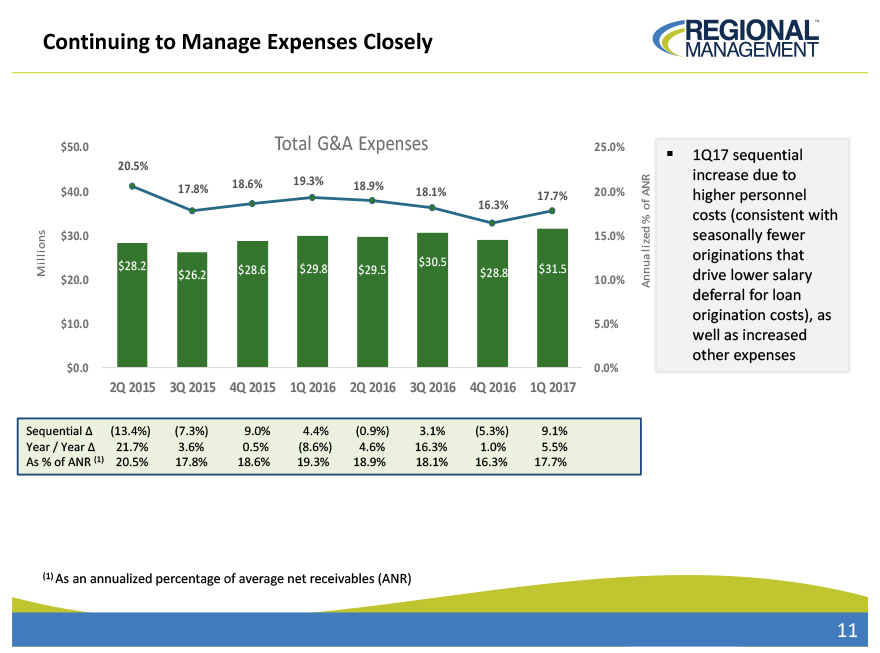

Continuing to Manage Expenses Closely

REGIONAL TM

MANAGEMENT

Millions

$50.0

Total G&A Expenses

25.0%

20.5%

$40.0

17.8%

18.6%

19.3%

18.9%

18.1%

20.0%

17.7%

16.3%

$30.0

15.0%

$28.2

$29.8

$29.5

$30.5

$31.5

$26.2

$28.6

$28.8

$20.0

10.0%

$10.0

5.0%

$0.0

0.0%

2Q 2015

3Q 2015

4Q 2015

1Q 2016

2Q 2016

3Q 2016

4Q 2016

1Q 2017

Annualized % of ANR

Sequential

(13.4%)

(7.3%)

9.0%

4.4% (0.9%)

3.1%

(5.3%)

9.1%

Year / Year

21.7%

3.6%

0.5%

(8.6%) 4.6%

16.3%

1.0%

5.5%

As % of ANR (1)

20.5%

17.8%

18.6%

19.3% 18.9%

18.1%

16.3% 17.7%

1Q17 sequential increase due to higher personnel costs (consistent with seasonally fewer originations that drive lower salary deferral for loan origination costs), as well as

increased other expenses

(1) As an annualized percentage of average net receivables (ANR)

11