Attached files

| file | filename |

|---|---|

| EX-31.4 - EX-31.4 - Cornerstone OnDemand Inc | d347534dex314.htm |

| EX-31.3 - EX-31.3 - Cornerstone OnDemand Inc | d347534dex313.htm |

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K/A

(Amendment No. 1)

(Mark One)

| ☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2016

Or

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number: 001-35098

Cornerstone OnDemand, Inc.

(Exact name of registrant as specified in its charter)

| Delaware | 13-4068197 | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification Number) |

1601 Cloverfield Blvd.

Santa Monica, California 90404

(Address of principal executive offices and zip code)

Registrant’s telephone number, including area code: (310) 752-0200

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Name of each exchange on which registered | |

| Common Stock, par value $0.0001 per share | NASDAQ Stock Market LLC (NASDAQ Global Select Market) |

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☒ No ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Securities Exchange Act of 1934 (the “Exchange Act”). Yes ☐ No ☒

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No ☐

Indicate by a check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer | ☒ | Accelerated filer | ☐ | |||

| Non-accelerated filer | ☐ (Do not check if a smaller reporting company) | Smaller reporting company | ☐ | |||

| Emerging growth company | ☐ | |||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. Yes ☐ No ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

The aggregate market value of voting and non-voting common stock equity held by non-affiliates of the registrant, as of June 30, 2016, the last day of the registrant’s most recently completed second fiscal quarter, was $1,265,031,391 (based on the closing price for shares of the registrant’s common stock as reported by the NASDAQ Global Select Market on June 30, 2016).

On March 31, 2017, 56,729,526 shares of the registrant’s common stock, $0.0001 par value, were outstanding.

Table of Contents

CORNERSTONE ONDEMAND, INC.

| Page No. | ||||||

| PART III | ||||||

| Item 10. |

3 | |||||

| Item 11. |

7 | |||||

| Item 12. |

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

36 | ||||

| Item 13. |

Certain Relationships and Related Transactions, and Director Independence |

39 | ||||

| Item 14. |

41 | |||||

| Item 15. |

41 | |||||

| 42 | ||||||

2

Table of Contents

EXPLANATORY NOTE

This Amendment No. 1 to Form 10-K (this “Amendment”) amends the original Annual Report on Form 10-K of Cornerstone OnDemand, Inc. (“Cornerstone,” the “Company,” “we,” or “us”) for the year ended December 31, 2016, originally filed with the Securities and Exchange Commission (the “SEC”) on February 24, 2017 (the “Original Report”). We are filing this Amendment to include the information required by Part III of Form 10-K to be filed as part of the Original Report as we will not be filing our definitive proxy statement within 120 days of the end of our fiscal year ended December 31, 2016. Except as set forth in this Amendment, no other changes have been made to the Original Report. Unless expressly stated, this Amendment does not reflect events occurring after the filing of the Original Report, and does not modify or update in any way the disclosures contained in the Original Report, which speak as of the date of the Original Report. Accordingly, this Amendment should be read in conjunction with the Original Report and the Company’s other SEC filings subsequent to the filing of the Original Report.

Pursuant to Rule 12b-15 under the Exchange Act, this Amendment also contains new certifications pursuant to Section 302 of the Sarbanes-Oxley Act of 2002, which are attached hereto. As no financial statements are included in this Amendment and this Amendment does not contain or amend any disclosure with respect to Items 307 and 308 of Regulation S-K, paragraphs 3, 4, and 5 of the certifications have been omitted.

| Item 10. | Directors, Executive Officers and Corporate Governance |

DIRECTORS

The names of our directors and executive officers and their ages, positions, and biographies as of March 31, 2017 are set forth below. Our executive officers are appointed by, and serve at the discretion of, our board of directors.

| Name |

Age |

Position |

Director Since |

|||||

| Adam L. Miller |

47 | President and Chief Executive Officer, Director(1) |

1999 | |||||

| R. C. Mark Baker |

70 | Director(2) |

2003 | |||||

| Harold W. Burlingame |

76 | Director |

2006 | |||||

| Robert Cavanaugh |

48 | Director |

2015 | |||||

| Joseph P. Payne |

52 | Director |

2013 | |||||

| Kristina Salen |

45 | Director |

2014 | |||||

| (1) | Chairman of our board of directors |

| (2) | Lead Independent Director |

There is no family relationship among any of our directors and/or any of our executive officers. Our executive officers serve at the discretion of our board of directors. Further information about our directors is provided below.

Adam L. Miller founded the Company and has been our President and Chief Executive Officer and a member of our board of directors since May 1999. In addition to strategy, sales and operations, Mr. Miller has led our product development efforts since our inception. Prior to founding Cornerstone, Mr. Miller was an investment banker with Schroders plc, a financial services firm. Since its formation, Mr. Miller has served as the Chairman of the Cornerstone OnDemand Foundation, which leverages Cornerstone’s expertise, solutions and partner ecosystem to help empower communities. Since February 2017, Mr. Miller has served on the board of directors of Mindbody, Inc., a software provider for class- and appointment-based businesses. Mr. Miller also writes and speaks extensively about talent management and on-demand software. Mr. Miller holds a J.D. from the School of Law of the University of California, Los Angeles (UCLA), an M.B.A. from UCLA’s Anderson School of Business, a B.A. from the University of Pennsylvania (Penn) and a B.S. from Penn’s Wharton School of Business. He also earned C.P.A. (inactive) and Series 7 certifications. We believe that Mr. Miller possesses specific attributes that qualify him to serve as a member of our board of directors, including his operational expertise and the historical knowledge and perspective he has gained as our Chief Executive Officer and one of our founders.

R. C. Mark Baker has been a member of our board of directors since October 2003. Mr. Baker is the founder of Touchstone Systems, Inc., a company that supplies voice over internet protocol, or VoIP, international voice termination services and hosted OSS services, and has served as its Chief Executive Officer since September 2003. Mr. Baker has a long history of working in the telecommunications industry, serving as an officer or director of various companies including Ionex Telecommunications, Inc., Birch Telecommunications, USA Global Link GmbH, Keyon Communications Holdings, Inc. and

3

Table of Contents

British Telecom, and held various senior positions with AT&T Corp., including Executive Vice President International, Vice President and General Manager-International Services, Vice President Strategy, as well serving as a member of AT&T’s senior management team. Mr. Baker has also served as a director of British Telecom Satellite Services, British Telecom Marine, NIS (Japan), McCaw Cellular USA, British Telecom Syncordia, AT&T Submarine Systems, Alestra (Mexico) and Telecom Italia. We believe that Mr. Baker possesses specific attributes that qualify him to serve as a member of our board of directors, including his experience leading and managing technology companies and his past service as a director of other technology companies.

Harold W. Burlingame has been a member of our board of directors since March 2006. From December 2004 to July 2010, Mr. Burlingame served as Chairman of ORC Worldwide, Inc., a provider of human resource knowledge and solutions. In addition, since June 1998, Mr. Burlingame has served as a director of UniSource Energy Corporation, an owner of electric and gas service providers. Previously, Mr. Burlingame served as Executive Vice President of Human Resources for AT&T Corp. and as Senior Executive Advisor for AT&T Wireless. Mr. Burlingame received his B.A. in Communications from Muskingum College. We believe that Mr. Burlingame’s extensive experience in human resources and management qualifies him to serve as a member of our board of directors.

Robert Cavanaugh has been a member of our board of directors since April 2015. Mr. Cavanaugh has served as the President of Field Operations of Accolade, Inc., a private company that operates a consumer healthcare engagement platform, since November 2015. Prior to this role, Mr. Cavanaugh served in several roles, including as President Worldwide Enterprise, SMB & Government, at Concur Technologies, Inc., a provider of integrated travel and expense management solutions, from 1999 to April 2015. Prior to joining Concur Technologies, Inc., Mr. Cavanaugh held consulting and implementation management positions at Seeker Software and Ceridian Corporation. Mr. Cavanaugh holds a B.S. in Business Administration from Norwich University. We believe that Mr. Cavanaugh possesses specific attributes that qualify him to serve as a member of our board of directors, including his experience managing technology companies, in the software industry and with SaaS.

Joseph P. Payne has been a member of our board of directors since September 2013. Mr. Payne has served as President and Chief Executive Officer of Code42 Software, Inc., a private company that specializes in endpoint data protection and security for businesses and enterprises, since July 2015. Prior to this role, Mr. Payne served as Chief Executive Officer and a member of the board of directors of Eloqua, Inc., a marketing automation company, from June 2007 until its acquisition by Oracle Corporation in February 2013. Mr. Payne also served as Eloqua’s chairman of the board of directors from August 2011 until February 2013, its president from June 2007 to September 2012, and as its interim president and Chief Executive Officer from January 2007 to June 2007. In October 2006, Mr. Payne served as president of Qualys, Inc., a provider of cloud security and compliance solutions. From April 2005 to October 2006, Mr. Payne served as president and Chief Operating Officer of iDefense, a VeriSign, Inc. company. Mr. Payne currently serves on the board of directors of Code42, and previously served on the board of directors of Dealertrack Technologies, Inc. until it was acquired in October 2015. Mr. Payne holds an A.B. in Public Policy and an M.B.A. from Duke University. We believe Mr. Payne possesses specific attributes that qualify him to serve as a member of our board of directors, including his experience leading and managing technology companies and his service as a director of other technology companies.

Kristina Salen has been a member of our board of directors since July 2014. Ms. Salen served as Chief Financial Officer of Etsy, Inc., an online marketplace, from 2013 until 2017. Prior to that, Ms. Salen led the media, Internet, and telecommunications research group of FMR LLC d/b/a Fidelity Investments, a multinational financial services company, from January 2006 to January 2013. Prior to Fidelity, Ms. Salen worked in various financial and executive roles at several companies, including Oppenheimer Capital LLC, an investment firm, from June 2002 to December 2005; Merrill Lynch & Co., Inc., a financial services corporation acquired by Bank of America Corporation in January 2009, from June 1997 to June 2001; Lazard Freres & Co. LLC, a global financial advisory and asset management firm, from April 1996 to June 1997; and SBC Warburg, an investment bank, from December 1994 to April 1996. Ms. Salen holds a B.A. in Political Science from Vassar College and an M.B.A. from Columbia University. We believe Ms. Salen possesses specific attributes that qualify her to serve as a member of our board of directors, including her financial expertise and her experience leading and managing technology companies.

4

Table of Contents

EXECUTIVE OFFICERS

Biographical data for each of our current executive officers is set forth below, excluding Mr. Miller’s biography, which is included under the heading “Directors” above.

| Name |

Age |

Position | ||

| Brian L. Swartz |

44 | Chief Financial Officer | ||

| Vincent Belliveau |

41 | Executive Vice President and General Manager of Europe, Middle East and Africa | ||

| David J. Carter |

53 | Chief Sales Officer | ||

| Mark Goldin |

55 | Chief Technology Officer | ||

| Kirsten Helvey |

46 | Chief Operating Officer | ||

| Adam Weiss |

39 | Senior Vice President, Administration and General Counsel |

Executive Officers

Brian L. Swartz, has served as our Chief Financial Officer since May 2016. Prior to joining us, Mr. Swartz served as Chief Financial Officer at zulily, one of the largest e-commerce companies in the United States from June 2015 to May 2016. Prior to joining zulily, Mr. Swartz served most recently as Chief Financial Officer at Apollo Education Group, a global private-sector education company, from December 2006 to May 2015. Before his role with Apollo, Mr. Swartz was VP and Corporate Controller at Eagle Picher, an industrial manufacturing and technology company. He began his career in public accounting and earned his C.P.A. (inactive). Mr. Swartz holds a B.A. in Business Administration with an Accounting major from the University of Arizona.

Vincent Belliveau, has served as our Executive Vice President and General Manager of Europe, Middle East and Africa, or EMEA, since November 2015. Prior to this role, Mr. Belliveau held the positions of Senior Vice President and General Manager of EMEA from September 2011 to November 2015 and General Manager of EMEA from June 2007 to September 2011. Prior to joining us, Mr. Belliveau served as the North East Europe Director of the Master Data Management and Information Integration Solutions division of International Business Machines Corporation, a technology systems and services company, from July 2005 to May 2007, and served as its EMEA Sales Director for its WebSphere Product Center Software from September 2004 to July 2005. In addition, from May 2002 until September 2004, Mr. Belliveau served as the European Sales Director at Trigo Technologies, Inc. Early in his career, from November 1997 until January 2000, Mr. Belliveau was a Business Analyst at McKinsey and Company. Mr. Belliveau received his Commerce Baccalaureate (B.Com) from McGill University, where he majored in Accounting and Finance.

David J. Carter, has served as our Chief Sales Officer since November 2015. Prior to this role, Mr. Carter held the positions of Senior Vice President of Sales from September 2011 to November 2015 and Vice President of Sales from June 2008 to September 2011. Prior to joining us, Mr. Carter served as Vice President of Sales at Accenture BPO Services, a wholly owned subsidiary of Accenture LLC, from June 2006 to June 2008, and Savista Corporation, which was acquired by Accenture LLC, from October 2004 to June 2006, both of which were human resource outsourcing services providers. Previously, Mr. Carter served as Vice President of Sales at Ceridian Corporation, a human resource services company, from July 2000 to October 2004. Prior to Ceridian, Mr. Carter was Vice President of Sales at ProBusiness Services, Inc., a provider of payroll and benefits administration solutions. Mr. Carter holds a B.A. in Economics from Clark University.

Mark Goldin, has served as our Chief Technology Officer since June 2010. Prior to joining us, Mr. Goldin served as Chief Technology Officer at DestinationRx, Inc., a healthcare data management company, from September 2009 to June 2010. From August 2005 to September 2008, Mr. Goldin was Chief Operations and Technology Officer at Green Dot Corporation, a financial services company. Prior to Green Dot, from December 1992 to August 2005, Mr. Goldin served as Senior Vice President and Chief Technology Officer at Thomson Elite, a provider of technology solutions for professional services firms and currently part of Thomson Reuters Corporation.

5

Table of Contents

Kirsten Helvey, has served as our Chief Operating Officer since November 2015 and is responsible for overseeing all aspects of the client experience with Cornerstone OnDemand. Prior to this role, Ms. Helvey held the positions of Senior Vice President of Client Success from April 2012 to November 2015, Senior Vice President of Consulting Services from October 2011 to March 2012, Vice President of Consulting Services from April 2006 to September 2011, Director of Global Services from October 2004 to March 2006 and an Account Manager from March 2003 to October 2004. Prior to joining the company, from 2002 to February 2003, Ms. Helvey served as a supply chain operations strategy consultant in the Business Consulting Services group of International Business Machines Corporation, a technology systems and services company. Prior to that, from February 1999 to September 2002, Ms. Helvey was a supply chain operations strategy consultant at PricewaterhouseCoopers LLP. Ms. Helvey holds a B.A. in English Literature from Skidmore College.

Adam Weiss, has served as our Senior Vice President, Administration and General Counsel since April 2016, and is responsible for our legal, human resource, and administration functions worldwide. Prior to this role, Mr. Weiss held the positions of Vice President, Business Affairs and General Counsel from April 2013 to March 2016, and General Counsel from May 2006 to March 2013. Before joining us, from 2003 to April 2006, Mr. Weiss was an associate with the law firm of Lurie, Zepeda, Schmalz & Hogan. Mr. Weiss holds a B.A. in Economics and Political Science from Stanford University and a J.D. from UCLA School of Law.

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Exchange Act requires our directors and executive officers, and persons who beneficially own more than 10% of our common stock, to file with the SEC reports about their ownership of our common stock and other equity securities. Such directors, officers and 10% stockholders are required by SEC regulations to furnish us with copies of all Section 16(a) forms they file. Based solely on our review of the reports provided to us and on written representations received from our directors and executive officers that no annual Form 5 reports were required to be filed by them, we believe that all of our directors and executive officers, and persons who beneficially own more than 10% of our common stock, complied with all Section 16(a) filing requirements applicable to them with respect to transactions during fiscal year 2016, except that the Form 4 filed by Mark Goldin with the SEC on March 16, 2016 (covering a transaction occurring in 2015), the Form 4 filed by Vincent Belliveau with the SEC on May 15, 2016 and a Form 4 filed with the SEC by each of R. C. Mark Baker, Harold Burlingame, Robert Cavanaugh, Joseph Payne and Kristina Salen on June 14, 2016 was filed late.

Code of Business Conduct and Ethics

We have adopted a code of business conduct that is applicable to all of our employees, officers and directors, including our chief executive, principal financial and principal accounting officers. Our Code of Business Conduct and Ethics is available on the Investor Relations page of our website at investors.cornerstoneondemand.com, under “Governance.” We will post amendments to our code of business conduct or waivers of our code of business conduct for directors and executive officers on the same website.

Audit Committee

Our Audit Committee oversees our corporate accounting and financial reporting process and assists our board of directors in monitoring our financial systems and our legal and regulatory compliance. Our Audit Committee is responsible for, among other things:

| • | overseeing the audit of our financial statements; |

| • | overseeing the organization and performance of our internal audit function and our internal accounting and financial controls; |

| • | appointing our independent registered public accounting firm and reviewing and overseeing its qualifications, independence and performance; and |

| • | overseeing the management of risks associated with our financial reporting, accounting and auditing matters. |

Our Audit Committee consists of Messrs. Baker and Burlingame and Ms. Salen, with Ms. Salen serving as chairperson. Our board of directors has determined that each member of our Audit Committee meets the financial literacy requirements under the listing standards of NASDAQ and the SEC rules and regulations, and Ms. Salen qualifies as our Audit Committee financial expert as defined under SEC rules and regulations. Our board of directors has concluded that the composition of our Audit Committee meets the requirements for independence under the current listing standards of NASDAQ and SEC rules and regulations. We believe that the functioning of our Audit Committee complies with the applicable requirements of NASDAQ and SEC rules and regulations. The Audit Committee met four times during 2016.

6

Table of Contents

| Item 11. | Executive Compensation |

COMPENSATION DISCUSSION AND ANALYSIS

Introduction

This Compensation Discussion and Analysis provides information about the material components of our compensation program for our named executive officers, or NEOs, and is intended to provide a better understanding of our compensation practices and decisions that affected the compensation payable in 2016 to our NEOs.

Our NEOs for 2016 were Adam Miller, our President and Chief Executive Officer; Brian Swartz, our Chief Financial Officer; Perry Wallack, our former Chief Financial Officer; David Carter, our Chief Sales Officer; Vincent Belliveau, our Executive Vice President and General Manager of EMEA; Mark Goldin, our Chief Technology Officer; and Kirsten Helvey, our Chief Operating Officer.

Key Compensation Highlights

The success of our business is driven by rapidly changing technology and the services we can provide to our customers. In order to stay competitive in our industry, our compensation packages are designed to attract, retain and incentivize our executive team and to align our compensation practices with the creation of value for our stockholders. We believe our compensation programs are effectively designed to reward our executives when our business performs well, which in turn strengthens the ties between our performance and stockholder value.

7

Table of Contents

Below, we provide a summary of the key compensation related actions and outcomes from 2016, which we believe in the aggregate demonstrates our strong commitment to pay for performance.

| • | Moderate increases to target cash compensation levels: For fiscal 2016, each NEO besides Mr. Carter and Mr. Wallack received modest base salary increases from 2015 levels. Increases to select executives were made with respect to the individual’s positioning relative to market benchmarks and to reflect the individual responsibilities for each role. |

| • | Enhanced governance practices and process: The Compensation Committee has implemented a number of additional changes in 2016 and 2017 to enhance our governance practices and process, including: |

| • | Adoption of robust stock ownership guidelines for both executives and directors, which also includes a holding requirement to the extent guidelines are not achieved; |

| • | Adoption of a formal compensation clawback policy; |

| • | Engagement of a new, independent compensation consultant; and |

| • | Forbidding hedging and pledging transactions or short sales by executives or directors. |

| • | Redesign of key elements in the annual bonus program: The 2016 Executive Compensation Plan includes a number of changes from previous years, including an increased emphasis on Non-GAAP net income, which now comprises 25% of the weighting of the plan’s performance targets (compared to 5% in 2015). This change was made to align with our strategic focus of achieving profitability during 2016. The plan also features adjusted threshold and maximum payout percentages of 25% and 175% of target, respectively, for each metric in the plan. |

Overview of Our Pay and Performance Alignment

Emphasis on At Risk Compensation

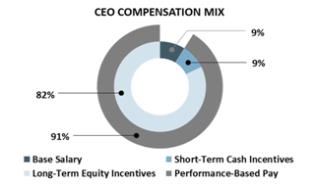

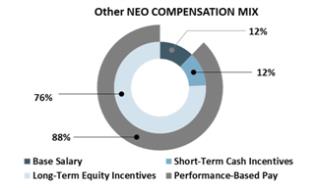

The compensation of our executive officers is weighted towards variable, performance-based incentive awards. In 2016, 91% of total target direct compensation for the CEO consisted of variable compensation (in the form of both short-term cash incentives and long-term equity incentives connected to either financial performance or variations in the Company’s share price). For the other NEOs in aggregate (excluding Mr. Wallack), 88% of total target direct compensation consisted of variable pay.

Realizable Value Aligned with Stockholder Experience

Realizable pay provides another perspective to help demonstrate the alignment of our NEOs’ financial interests with that of our stockholders. Given that shifts in our stock price can cause stock-based awards to have significantly different values over time than their original value on their date of grant, the Compensation Committee considers it important to focus on the amount of pay that is realizable by our NEOs at any point in time. This view of pay and performance helps our Compensation Committee to ensure our executive pay program appropriately aligns with the experiences of our stockholders over time.

8

Table of Contents

As highlighted above, our compensation program delivered more than 85% of target compensation to our NEOs in the form of incentives that are tied to our company’s future financial and stock performance (relative and absolute). As a result, realizable compensation, defined as the value of base salary paid, actual bonuses earned, options and restricted stock valued at the Company’s share price as of December 31, 2016, outstanding performance shares measuring total stockholder return (“TSR”) valued based on the Company’s share price as of December 31, 2016 and outstanding performance shares based on financial performance valued at target will vary from the compensation targeted by the Compensation Committee. Over the three-year period from January 1, 2014 through December 31, 2016 realizable compensation was 39% of target total direct compensation for the CEO and 60% of target total pay, on average, for Messrs. Belliveau, Carter, Goldin and Ms. Helvey (NEOs with three full years of compensation data). The difference in targeted compensation and realizable compensation over the 3-year period can be attributed to a combination of factors, most notably:

| • | Between 2014 and 2016, more than 85% of our targeted compensation was at risk; therefore, realizable pay will more closely align with our actual financial performance and stock price over that same period. |

| • | While revenue has grown 129% over the past three years, our executive cash incentive plans have, on average, paid out at 73% of target. |

| • | Option and performance-based grants made during the 2014 fiscal year were out of the money based on stock price (with respect to stock options) and not eligible to be earned based on performance levels as of December 31, 2016 (with respect to performance-based awards). |

Executive Compensation Governance Practices

We continued our commitment to strong corporate governance practices that ensure our executive compensation program aligns with stockholder interests.

| What we do |

What we don’t do | |||||

| ✓ | Base a significant majority of compensation opportunity on financial and stock price performance | × | Repricing of options without shareholder approval | |||

| ✓ | Set annual and long-term incentive targets based on clearly disclosed, objective performance measures | × | Hedging transactions or short sales by executive officers or directors | |||

| ✓ | Perform and annual compensation risk assessment | × | Significant perquisites | |||

| ✓ | Maintain a clawback policy | × | Tax gross-ups for perquisites | |||

| ✓ | Require executives to hold material positions in Cornerstone through stock ownership guidelines | × | Excise tax gross-ups upon change of control | |||

| × | Pension or supplemental executive retirement plan (SERP) | |||||

Compensation Decision Making Process and Governance Framework

Our Pay Philosophy and Governance Framework

Our compensation philosophy is to provide programs that attract, retain and motivate key employees who are critical to our long-term success. We strive to provide compensation packages to our executives that are competitive, reward the achievement of our business objectives, and align executive and stockholder interests by enabling our executives to acquire equity ownership in our business.

Peer Group and Its Use

In determining the appropriate level and form of compensation for 2016, our Compensation Committee reviewed publicly available market data relating to the cash and equity compensation of a peer group of publicly-held software companies of similar size and business focus. Our Compensation Committee reviewed and considered the data presented by Semler Brossy, which served as the Compensation Committee’s independent compensation consultant in 2016, but did not engage in any benchmarking or targeting of any specific levels of pay.

9

Table of Contents

Our Compensation Committee reviewed the peer group in early 2016 for evaluating 2016 compensation decisions. The following companies comprised the peer group for compensation purposes in 2016:

| Aspen Technology, Inc. | NetSuite Inc. | |

| athenahealth, Inc. | RealPage, Inc. | |

| Benefitfocus, Inc. | Splunk Inc. | |

| Bottomline Technologies, Inc. | SPS Commerce, Inc. | |

| Callidus Software Inc. | Tableau Software, Inc. | |

| Demandware, Inc. | The Ultimate Software Group, Inc. | |

| FireEye, Inc. | Veeva Systems | |

| Guidewire Software Inc. | Zendesk Inc. | |

| Marketo Inc. |

The 2016 peer group was determined after taking into account, as applicable, the following criteria:

| • | Industry and business model comparability: SaaS and other application systems and/or systems software companies; |

| • | Size and scale comparability: Companies within a general revenue range of .5 - 2.5 times our revenue and market cap range of .33 - 3 times our market cap; and |

| • | Growth dynamics: Companies with revenue growth near 20% or more year-over-year, designed to ensure that growth trajectories and expected future scales or peers are comparable to us. |

Quantitative screens were primarily used as guides to inform our decision process on reviewing current or potential peers. Companies not explicitly meeting the quantitative screening criteria were additionally reviewed from a business fit perspective to ensure that they would be an appropriate company within the peer group.

As compared to the our peer group in 2015, Bottomline Technologies, Inc., PROS Holdings, Inc., ServiceNow, Inc., Shutterstock, Inc., SolarWinds Inc., Yelp, Inc. and Zillow were removed due to size. Athenahealth, Inc., Benefitfocus, Inc., Callidus Software Inc., Marketo Inc., Veeva Systems and Zendesk Inc. were added to the 2016 peer group after taking into account the factors outlined above.

Under the direction of our Compensation Committee, Semler Brossy provided competitive market data to review our compensation programs, identify trends in executive cash and equity compensation and make recommendations as to appropriate levels of compensation for 2016. While Semler Brossy’s analysis and recommendations were a strong factor in determining 2016 compensation levels, our Compensation Committee used its discretion in setting appropriate compensation levels and, in some cases, selected compensation levels that were different from those recommended by Semler Brossy.

Role of Compensation Committee

Our Compensation Committee is composed of the following individuals: R. C. Mark Baker, Harold W. Burlingame and Robert Cavanaugh. Our Compensation Committee operates under a written charter that establishes the duties and authority of our Compensation Committee. Our Compensation Committee reviews the terms of its charter annually, and its charter was most recently updated in April 2013. The fundamental responsibilities of our Compensation Committee include the following:

| • | Providing oversight of our executive compensation policies, plans and benefit programs; |

| • | Assisting the board of directors in discharging its responsibilities relating to (i) oversight of the compensation of our Chief Executive Officer and other key employees including officers reporting under Section 16 of the Securities Exchange Act of 1934, as amended, (ii) approving and evaluating our executive officer compensation plans, policies and programs and (iii) evaluating and approving director compensation; |

| • | Assisting the board of directors in administering our equity compensation plans for our employees, directors and other service providers; and |

| • | Overseeing the management of risks associated with the Company’s compensation policies and practices. |

10

Table of Contents

Role of Independent Compensation Consultant

Our Compensation Committee has the authority to engage its own advisors to assist it in carrying out its responsibilities and engaged Semler Brossy to serve as its independent advisor with respect to its compensation programs, including the reasonableness of cash compensation and long-term incentive grants for NEOs and other senior executives, advising on the market compensation environment, appropriate peer companies, compensation trends, and advising non-employee director compensation levels and program design. Semler Brossy reported directly to our Compensation Committee and only interacted with management, as necessary. Semler Brossy did not perform work for us other than pursuant to its engagement by our Compensation Committee. Semler Brossy’s fees were paid by us. In April 2016, the Compensation Committee assessed the independence of Semler Brossy and concluded that its work had not raised any conflict of interest.

Role of Management

Members of our management team attend our Compensation Committee meetings when invited. At the outset of the 2016 annual compensation decision process, our CEO reviewed the compensation of our executive management team (including the NEOs other than himself) and made recommendations to the members of our Compensation Committee with respect to base salary, bonus and commission targets for the executives (but not for his own compensation). Our Compensation Committee retains the authority to accept or reject the CEO’s compensation recommendations for all executive officers, and, where it deems appropriate, make adjustments to the CEO’s recommendations when determining appropriate compensation levels. All decisions regarding the CEO’s compensation for 2016 were reviewed and approved by our Compensation Committee outside of his presence.

Outcome of Our 2015 Say-on-Pay Vote

At our annual meeting of stockholders in June 2015, we held a non-binding advisory stockholder vote on the compensation of our NEOs, commonly referred to as a say-on-pay vote. Approximately 32.1% of stockholder votes were cast in favor of our 2015 say-on-pay proposal. In response to this vote and direct feedback from stockholders, the Compensation Committee undertook several actions in 2015 and 2016, some of which are described in more detail in this document:

| • | Made no equity grant to our CEO in fiscal year 2015; |

| • | Implemented share ownership guidelines in 2016; |

| • | Introduced a formal clawback policy in 2016; |

| • | Committed to formal ongoing stockholder engagement; |

| • | Engaged new independent compensation consultant starting in 2016; and |

| • | Enhanced CD&A disclosure |

We believe that these changes, together with our existing compensation practices, have addressed the stockholder concerns that have been shared with us, and demonstrate our commitment to a compensation program designed to help drive the Company’s long-term value creation.

We will hold say-on-pay votes every three years, as approved by our stockholders in a non-binding advisory vote at our annual meeting of stockholders in June 2012. We will hold the next say-on-pay vote at the 2018 annual meeting of stockholders.

Although we do not hold a formal say-on-pay vote this year, as part of our normal and ongoing investor outreach efforts, we meet on a frequent basis with many of our stockholders and held several meetings with our largest stockholders. Specifically, in 2016 we met multiple times during the year with at least 80% of our largest 15 stockholders which represents approximately 50% of our shares outstanding. These meeting were focused on continuing to have an open dialogue with our most influential stockholders concerning the Company, its strategy, governance practices and executive compensation program. In years when we do not have a formal say-on-pay vote, we believe these meeting are important to understand key concerns of stockholders.

11

Table of Contents

Components of Our NEO Compensation

The compensation program for our NEOs consists of:

| • | Base salary; |

| • | Short-term incentives, specifically sales commissions and milestone bonuses for commissioned NEOs (Messrs. Carter and Belliveau) and annual bonuses for non-commissioned NEOs (Messrs. Miller, Swartz, Wallack and Goldin and Ms. Helvey); |

| • | Long-term incentives (equity awards); |

| • | Broad-based employee benefits; and |

| • | Severance and change of control benefits. |

We believe the combination of these elements provides a compensation package that attracts and retains qualified individuals, links individual performance to the performance of our business, focuses the NEOs’ efforts on the achievement of both our short-term and long-term objectives as a company, and aligns the NEOs’ interests with those of our stockholders. Our Compensation Committee determines the appropriate use and weight of each component of NEO compensation based on its views of the relative importance of each component in achieving our overall objectives and position-specific objectives relevant to each NEO.

Base Salaries

We provide a base salary to our NEOs to compensate them for services rendered on a day-to-day basis. The base salaries of our NEOs are reviewed on an annual basis. The following table provides the base salaries of our NEOs for 2015 and 2016:

| Named Executive Officer | 2015 Base Salary |

2016 Base Salary |

% Increase | |||||||||

| Adam Miller |

$ | 425,000 | $ | 500,000 | (1) | 17.6 | % | |||||

| Brian Swartz |

n/a | $ | 425,000 | n/a | ||||||||

| Perry Wallack |

$ | 325,000 | $ | 325,000 | — | % | ||||||

| David Carter |

$ | 290,000 | $ | 290,000 | — | % | ||||||

| Vincent Belliveau |

$ | 262,900 | (3) | $ | 268,158 | (4) | 2.0 | % | ||||

| Mark Goldin |

$ | 335,000 | $ | 350,000 | (2) | 4.5 | % | |||||

| Kirsten Helvey |

$ | 335,000 | $ | 350,000 | (2) | 4.5 | % | |||||

| (1) | 2016 base salary became effective as of July 1, 2016. This was increased from a base salary of $450,000, which was effective as of March 16, 2016. |

| (2) | 2016 base salary became effective as of March 16, 2016. |

| (3) | This amount reflects a base salary of €250,000, which has been converted into U.S. Dollars at a rate of $1.0516 Dollars per Euro, the exchange rate in effect on January 1, 2017. |

| (4) | 2015 base salary became effective as of March 17, 2015. The amount in the table reflects the 2016 base salary of €255,000, which has been converted into U.S. Dollars at a rate of $1.0516 Dollars per Euro, the exchange rate in effect on January 1, 2017. |

For fiscal 2016, Mr. Carter’s and Mr. Wallack’s base salary did not increase from 2015 levels. In March 2016, the Compensation Committee approved moderate increases to base salary levels for select NEOs (other than Mr. Carter and Mr. Wallack). Excluding Messrs. Carter, Miller and Wallack the average salary increase for the NEOs receiving increases was approximately 3.8%. After having no salary increases from January 1, 2012 through December 31, 2015, Mr. Miller’s salary was increased to an annualized amount of $450,000 in March 2016 following an initial review of executive’s cash compensation levels. After a more thorough review of total compensation levels in July 2016, the Compensation Committee approved an additional increase of $50,000 to Mr. Miller’s base salary. The 17.6% increase from 2015 was made to acknowledge Mr. Miller’s positioning relative to the peer group, in recognition of him not having a base salary increase in three years and for his sustained leadership and responsibilities in leading our Company.

In reviewing the salaries of our executives, our Compensation Committee reviewed and considered various market data presented by Semler Brossy as well as the factors described above under the heading “—Compensation Discussion and Analysis — Compensation Decision Process.” We did not engage in any benchmarking or targeting of any specific levels of pay when determining base salary levels. In connection with its review of 2016 base salaries, our Compensation Committee determined that an adjustment of the NEOs’ base salary (other than Mr. Wallack’s and Mr. Carter’s salary) was necessary based on individual performance and the market data provided by Semler Brossy. The Compensation Committee did not adjust Mr. Wallack’s or Mr. Carter’s base salary because it felt their base salaries were appropriate in light of market data.

12

Table of Contents

Short-Term Incentives (Cash Bonuses and Sales Commissions)

Our short-term incentive program seeks to balance our NEOs’ focus on our company goals as well as reward their individual performance through the use of an executive compensation plan and separate sales commission plans, as appropriate for each NEO’s position. Each of Messrs. Miller, Swartz, Wallack and Goldin and Ms. Helvey participated in an executive compensation plan under which bonuses were eligible to be earned upon our achievement of specified performance goals. Considering their sales position within our organization, Mr. Carter and Mr. Belliveau participated in individualized sales commission plans that are similar to the plans used for all of our sales employees, as described below. Our executive compensation plan and our executive sales commission plans are treated as “non-equity incentive plan compensation” for purposes of the Summary Compensation Table and Grants of Plan-Based Awards Table below.

2016 Executive Compensation Plan

For 2016, our Compensation Committee established an executive compensation plan for Messrs. Miller, Swartz, Wallack, Goldin and Ms. Helvey (the “2016 Executive Compensation Plan”). Under the terms of the 2016 Executive Compensation Plan, each NEO (other than Messrs. Carter and Belliveau) was entitled to receive a bonus that would vary in size depending on our success in meeting certain performance thresholds and targets with respect to a number of different performance metrics: revenue, free cash flow and non-GAAP net income or loss. The 2016 Executive Compensation Plan also directs the Compensation Committee to review achievement under the plan if the U.S. dollar to British pound currency exchange rate fluctuates by more than seven-and-one-half percent during fiscal 2016, and make appropriate adjustments in light of said currency fluctuations. These metrics are used because they directly measure our ability to execute on our strategic imperatives of expanding market share while achieving appropriate levels of profitability. We believe successful performance on these metrics will drive sustainable long-term stockholder value creation. Under this plan, no bonus payout for a particular performance metric would be earned unless the performance threshold for that metric was met, and bonus payouts would be calculated linearly for achievement between the performance thresholds and targets.

The following table shows the performance metrics and weighting established by our Compensation Committee for the 2016 Executive Compensation Plan:

| Performance Metric | Weighting(1) | |||

| Revenue |

65 | % | ||

| Free cash flow(2) |

10 | % | ||

| Non-GAAP net income (loss)(3) |

25 | % | ||

| (1) | The amount payable with respect to each metric may be greater or less than the assigned weighting depending on the extent to which our performance exceeded or fell short of the applicable target. |

| (2) | Free cash flow is generally defined as operating cash flow minus capital expenditures and capitalized software. However, the Company initially defined its measure of free cash flow as operating cash flow minus capital expenditures as part of setting the 2016 free cash flow target for the 2016 Executive Compensation Plan, which the Compensation Committee approved. |

| (3) | Non-GAAP net income (loss) is net loss adjusted to exclude expenses related to stock-based compensation, amortization of intangible assets, accretion of debt discount and amortization of debt issuance costs and unrealized fair value adjustment on strategic investment. |

The following tables show the target, minimum and maximum levels of performance and the bonus percentages corresponding with such levels of achievement for each NEO established by our Compensation Committee in March 2016 for the 2016 Executive Compensation Plan:

| Minimum(1) | Target | Maximum | ||||||||||

| Revenue |

$ | 421,000,000 | $ | 433,000,000 | $ | 442,000,000 | ||||||

| Free cash flow |

$ | 30,900,000 | $ | 47,500,000 | $ | 71,250,000 | ||||||

| Non-GAAP net income (loss) |

$ | (5,700,000 | ) | $ | 1,000,000 | $ | 8,200,000 | |||||

| (1) | No bonus payment for the applicable performance metric will be eligible to be earned unless the performance threshold for that performance metric is met. |

13

Table of Contents

Bonus Percentages for NEOs

The table below shows each NEO’s (other than Mr. Carter and Mr. Belliveau) bonus opportunity as a percentage of their respective base salaries that corresponds with the achievement of the performance targets above. For example, the 25% minimum in the “Revenue” column below represents that upon achievement of minimum performance with respect to the revenue metric, the individual’s bonus will be calculated based on 25% achievement of that particular performance metric.

| Revenue | Non-GAAP Free Cash Flow | Non-GAAP net income (loss) | ||||||||||||||||||||||||||||||||||

| Minimum | Target | Maximum | Minimum | Target | Maximum | Minimum | Target | Maximum | ||||||||||||||||||||||||||||

| Adam Miller |

25 | % | 100 | % | 175 | % | 25 | % | 100 | % | 175 | % | 25 | % | 100 | % | 175 | % | ||||||||||||||||||

| Brian Swartz |

18 | % | 70 | % | 123 | % | 18 | % | 70 | % | 123 | % | 18 | % | 70 | % | 123 | % | ||||||||||||||||||

| Perry Wallack |

18 | % | 70 | % | 123 | % | 18 | % | 70 | % | 123 | % | 18 | % | 70 | % | 123 | % | ||||||||||||||||||

| Mark Goldin |

18 | % | 70 | % | 123 | % | 18 | % | 70 | % | 123 | % | 18 | % | 70 | % | 123 | % | ||||||||||||||||||

| Kirsten Helvey |

18 | % | 70 | % | 123 | % | 18 | % | 70 | % | 123 | % | 18 | % | 70 | % | 123 | % | ||||||||||||||||||

To increase focus on operating results and to align the NEOs’ interests with those of our stockholders, our Compensation Committee determined that these performance metrics were appropriate measurements of our performance, as revenue measures our growth rates, non-GAAP operating cash flow measures the cash profitability and margin potential of our business, and non-GAAP net loss measures our execution on expenditures relative to our revenue growth.

The following table shows the minimum, target, and maximum bonus amounts under the 2016 Executive Compensation Plan for each of Messrs. Miller, Swartz, Wallack, Goldin and Ms. Helvey. To the extent that our achievement was greater or less than the specified targets, the bonus amounts payable to each individual would be increased or decreased, respectively, although our Compensation Committee retained discretion to adjust bonus payments in its sole discretion. Our Compensation Committee determined these target bonus amounts based on the reasons below and the compensation factors described above under the heading “— Compensation Discussion and Analysis — Compensation Decision Process.”

| Minimum Bonus Amount(1) |

Target Bonus Amount(2) |

Maximum Bonus Amount(3) |

||||||||||||||||||||||

| $ | % of Base Salary |

$ | % of Base Salary |

$ | % of Base Salary |

|||||||||||||||||||

| Adam Miller |

11,875 | 2.5 | 475,000 | 100 | 831,250 | 175 | ||||||||||||||||||

| Brian Swartz(4) |

199,692 | 70.0 | 199,692 | 70 | 244,622 | 123 | ||||||||||||||||||

| Perry Wallack |

5,688 | 1.8 | 227,500 | 70 | 398,125 | 123 | ||||||||||||||||||

| Mark Goldin |

6,125 | 1.8 | 245,000 | 70 | 428,750 | 123 | ||||||||||||||||||

| Kirsten Helvey |

6,125 | 1.8 | 245,000 | 70 | 428,750 | 123 | ||||||||||||||||||

| (1) | Represents the minimum bonus amount payable if we met only our performance threshold for non-GAAP free cash flow, the metric with the lowest weighting. No bonus was payable if we failed to meet the performance threshold for at least one metric. |

| (2) | Represents the bonus amount payable if we achieved our full performance target with respect to each performance metric. |

| (3) | Represents the maximum bonus amount payable in aggregate, if we achieved the maximum target with respect to each performance metric. |

| (4) | Represents bonus amounts payable to Mr. Swartz pro-rated to reflect approximately eight months of service. Annualized for the full year, the target and maximum bonus amount would be $297,500 and $520,625, respectively. For 2016, Mr. Swartz’s minimum bonus amount was set to match the target bonus amount. |

The NEOs’ 2016 target bonus amounts as a percentage of base salary remained the same as the 2015 target bonus amounts. Mr. Miller’s target bonus amount was increased to $475,000 from $425,000 as a result of the increase of his base salary of $500,000 being pro-rated for 2016. Mr. Goldin’s and Ms. Helvey’s target bonus amounts were increased to $245,000 from $234,500 as a result of the respective increases of their base salaries. Our Compensation Committee determined that these bonus targets were appropriate based on its review of the compensation practices of our peer group and that they enabled us to appropriately proportion our NEOs’ total cash compensation with respect to performance-based compensation.

14

Table of Contents

In early 2016, our Compensation Committee reviewed the 2016 performance metrics to determine the level of achievement relative to each performance target and threshold amount. The 2016 achievement levels for the performance targets were as follows:

| 2016 Actual Performance | 2016 Constant Currency Performance |

Effect on Calculation of Bonuses | ||||||||

| Revenue |

$ | 423,124,000 | $ | 438,600,000 | Bonus calculated linearly for achievement between the target and maximum levels | |||||

| Free cash flow(1) |

$ | 12,615,000 | n/a | No bonus payment assigned to this performance metric as minimum performance threshold not achieved | ||||||

| Non-GAAP net income |

$ | 6,432,000 | n/a | Bonus calculated linearly for achievement between the target and maximum levels | ||||||

| (1) | In the 2016 Executive Compensation Plan, the non-GAAP free cash flow target was $47.5 million, due to the exclusion of the adjustment for capitalized software. Accordingly, the achievement level for this performance target was calculated as $29.0 million for 2016, which still resulted in no bonus payment being assigned to this metric. For 2017, capitalized software is not excluded from this performance metric. |

Incorporated at the inception of the plan, the 2016 Executive Compensation Plan directs the Compensation Committee to review financial performance achievement if the U.S. dollar to British pound currency exchange rate fluctuates by more than seven-and-one-half percent during the fiscal year and to make appropriate adjustments in light of said currency fluctuations. If the results for 2016 were fully adjusted for the impact of currency fluctuations, the payout would have been approximately 134% of target. However, after considering the broader company performance in 2016, the Compensation Committee approved a lower payout of 110%, reflecting only a partial adjustment for currency fluctuations. For 2017, financial performance will be automatically adjusted for currency exchange rate fluctuations.

Individual payments under the 2016 Executive Compensation Plan were as follows:

| Name | 2016 Bonus Amount |

|||

| Adam Miller |

$ | 522,500 | ||

| Brian Swartz |

$ | 219,661 | ||

| Perry Wallack |

$ | 250,250 | ||

| Mark Goldin |

$ | 269,500 | ||

| Kirsten Helvey |

$ | 269,500 | ||

Sales Commission Plan

Because much of Mr. Belliveau’s and Mr. Carter’s responsibilities are focused on sales of our solutions, our Compensation Committee determined that it would be more appropriate for Mr. Belliveau and Mr. Carter to participate in a sales commission plan with terms that correspond to the results achieved by their respective teams rather than in the 2016 Executive Compensation Plan described above. Mr. Belliveau and Mr. Carter therefore earned commissions based on the sales of their respective direct sales teams, with Mr. Belliveau’s commissions based on sales in Europe, the Middle East and Africa, and Mr. Carter’s commissions based on total direct sales in the United States, North America and Latin America. The commission targets were determined by our Compensation Committee based in part on the recommendations of our CEO, which took into account the compensation factors described above under the heading “Compensation Discussion and Analysis — Compensation Decision Process.” Our Compensation Committee designed Mr. Belliveau’s and Mr. Carter’s commission structure both to reward them for their past success and to support our retention efforts.

During 2016, Mr. Belliveau and Mr. Carter were eligible to receive commissions based on total sales in their respective sales territories. The rate at which commissions are earned by each sales executive is highest in the first year of each client agreement and decreases each year thereafter and depends on whether the client agreement is a new agreement or a renewal. For 2016, our Compensation Committee established a sales quota for each of the sales executives. Mr. Belliveau’s total quota for 2016 was $70,000,000 in total revenue from sales in assigned territories, and Mr. Carter’s quota for 2016 was $157,500,000 in total revenue from sales in assigned territories. To the extent that a sales executive exceeded his quota for revenue in 2016, such sales executive’s commission rate was increased with respect to revenue invoiced and received by us in excess of the quota.

15

Table of Contents

In addition, each sales executive was also eligible for a bonus if he met certain milestone sales targets by the dates specified in each executive’s commission plan. If Mr. Belliveau achieved specified milestones by specified dates, he would be eligible to receive a bonus of $21,032 upon completion of each milestone (based on a $1.0516 U.S. Dollar to Euro exchange rate as of January 1, 2017). If Mr. Carter achieved all specified milestones by specified dates, he would be eligible to receive a total bonus of $20,000 upon completion of all milestones.

For 2016, the following table shows the targets and amounts earned by Mr. Belliveau and Mr. Carter under his 2016 sales commission plan:

| Target 2016 Commission |

Target 2016 Bonus |

2016 Commission Earned(4) |

Target 2016 Bonus Earned(6) |

|||||||||||||

| Vincent Belliveau |

$ | 336,000 | (1) | $ | 21,032 | (3) | $ | 222,907 | (5) | $ | 5,652 | (5) | ||||

| David Carter |

$ | 374,850 | (2) | $ | 20,000 | $ | 249,801 | $ | 5,000 | |||||||

| (1) | This amount represents the total performance-based commissions that would be earned under the commission plan if (i) Mr. Belliveau achieved the sales quota established under his commission plan and (ii) the percentage of the sales quota attributable to software revenue and service revenue, respectively, is consistent with the Company’s projections. |

| (2) | This amount represents the total performance-based commissions that would be earned under the commission plan if (i) Mr. Carter achieved the sales quota established under his commission plan and (ii) the percentage of the sales quota attributable to software revenue and service revenue, respectively, is consistent with the Company’s projections. |

| (3) | Mr. Belliveau’s target 2016 bonus was €20,000. Amounts have been converted into U.S. Dollars at a rate of $1.0516 Dollars per Euro, the exchange rate in effect on January 1, 2017. |

| (4) | This amount represents the total performance-based commissions earned by Mr. Belliveau and Mr. Carter under the 2016 commission plan, including incremental revenue from renewals. Each executive also earned additional commissions for second-year revenue and third-year revenue received by us in 2016 with respect to client agreements entered into in prior years under sales commission plans established in such years for each such executive, which commission amounts are not reflected in this amount. For the commissions earned in 2016 under the 2016 sales commission plan and under plans established for prior years, see the non-equity incentive plan compensation column of the Summary Compensation Table below. |

| (5) | Amount represents the sum of payments made to Mr. Belliveau converted from Euros into U.S. Dollars at the exchange rates in effect when the payments were made. |

| (6) | Represents milestone bonuses paid upon the achievement of certain milestone sales targets. |

Long-Term Incentives

We grant equity awards to motivate and reward our NEOs for achieving long-term performance goals as reflected in the value of our common stock, which we believe aligns the interests of our NEOs with those of our stockholders. Such awards typically are granted once per year. Historically, the equity awards we have granted pursuant to our equity incentive plans have been limited to stock options and restricted stock units. In 2016, the Compensation Committee also granted performance-based restricted stock units to further incentivize our executives to drive long-term growth and promote alignment of our stockholders’ interests with the financial interests of our NEOs.

In determining equity incentive awards for our NEOs, our Compensation Committee considered a number of factors, including the executive’s position with us and his or her total compensation package as well as the executive’s contribution to the success of our financial performance and the equity compensation practices of our peer group. Our Compensation Committee granted equity awards to reward both the achievement of long-term goals and to provide a powerful retention tool. Stock options and performance-based restricted stock units increase stockholder value and reward achievement of our long-term strategic goals since the value of these awards are directly related to the value of our common stock while restricted stock units provide individuals with immediate retention value because they have no purchase price (but are subject to vesting).

16

Table of Contents

2016 Grants

In connection with our entry into an employment agreement with Mr. Swartz, on May 2, 2016, our board granted Mr. Swartz a stock option to purchase 50,000 shares of our common stock and granted an award of 50,000 restricted stock units covering shares of our common stock. Each stock option has an exercise price equal to the fair market value of our common stock on the date of grant as determined by our board of directors and is scheduled to vest over a four-year period with 1/4th of the shares subject to the stock option scheduled to vest on the first anniversary of the grant date and 1/48th of the shares subject to the option scheduled to vest monthly thereafter, in all cases subject to Mr. Swartz continuing to provide services to us through each such date. The restricted stock units will be fully vested over a four-year period with 1/4th of the restricted stock units scheduled to vest on each of the first four anniversaries of the grant date, in all cases subject to Mr. Swartz continuing to provide services to us through each such date. Mr. Swartz was also granted a supplemental award of 40,000 restricted stock units covering shares of our common stock. This supplemental award was granted in consideration of Mr. Swartz forfeiting equity awards granted by his prior employer when transitioning to Cornerstone. The supplemental restricted stock units will be fully vested over a two-year period with one-half of the restricted stock units scheduled to vest on each of the first two anniversaries of the grant date, in all cases subject to the individual continuing to provide services to us through each such date.

On July 1, 2016, we granted Messrs. Miller, Carter, Belliveau, Goldin and Ms. Helvey awards of restricted stock units and performance-based restricted stock units (“PBRSUs”). For Mr. Miller, we targeted an equity mix of 40% RSUs and 60% PBRSUs, and for Messrs. Carter, Belliveau, Goldin and Ms. Helvey, we targeted an equity mix of 67% RSUs and 33% PBRSUs.

The restricted stock units will be fully vested over a four-year period with 1/4th of the restricted stock units scheduled to vest on each of the first four anniversaries of the grant date, in all cases subject to the individual continuing to provide services to us through each such date.

The performance-based restricted stock units will measure performance during the three-year period from January 1, 2016 through December 31, 2018, and will become fully vested based on actual performance on July 1, 2019. Performance will be based on three-year average revenue growth and three-year average free cash flow margin. The Compensation Committee granted these incentive awards to our NEOs to provide an additional, long-term incentive and retention tool and to align our compensation practices with the creation of value for our stockholders by tying vesting of the performance-based restricted stock units to the Company’s financial performance growth targets measured over a three-year period. The Compensation Committee believes that strong combined performance on these metrics is vital for the Company’s long-term success.

| Performance-based Restricted Stock Units | ||||||||||||||||

| Name | Restricted Stock Units (#) |

Threshold (#) | Target (#) | Maximum (#) | ||||||||||||

| Adam Miller |

45,100 | 16,875 | 67,500 | 202,500 | ||||||||||||

| David Carter |

29,200 | 3,650 | 14,600 | 43,800 | ||||||||||||

| Vincent Belliveau |

29,200 | 3,650 | 14,600 | 43,800 | ||||||||||||

| Mark Goldin |

29,200 | 3,650 | 14,600 | 43,800 | ||||||||||||

| Kirsten Helvey |

29,200 | 3,650 | 14,600 | 43,800 | ||||||||||||

COMPENSATION GOVERNANCE

Stock Ownership Guidelines

In 2016, we adopted formal stock ownership guidelines for certain employees, including our NEOs. Under our ownership guidelines, our CEO is expected to accumulate and hold a number of shares of the Company’s common stock with a value equal to ten times his annual base salary, and our other NEOs are expected to accumulate and hold a number of shares of the Company’s common stock with a value equal to three times his or her annual base salary. The NEOs are expected to satisfy the ownership guidelines within five years from the adoption of the guidelines (or the individual’s date of hire for individuals hired after the effective date). For the purposes of these guidelines, stock ownership includes shares owned outright by the NEO or his or her immediate family members; shares held in trust, limited partnerships, or similar entities for the benefit of the NEO or his or her immediate family members, but beneficially owned by the NEO; shares held in retirement or deferred compensation accounts for the benefit of the NEO or his or her immediate family members; shares subject to restricted stock units or other full-value awards (“Full-Value Awards”) that have vested, but for which the NEO has elected to defer the settlement of the award to a date beyond the date of vesting; and shares subject to Full-Value Awards that are unvested and for which the only requirement to earn the award is continued service to the Company. In addition, in the event the applicable ownership threshold is not satisfied as of or following the applicable deadline, NEOs are required to hold 50% of net after-tax shares until the applicable guideline has been met. All of our NEOs currently meet their respective ownership requirements under the stock ownership guidelines.

17

Table of Contents

Anti-Hedging and Pledging Policy

Our insider trading policy includes an anti-hedging policy, which prohibits our executive officers and directors from engaging in transactions in publicly-traded options, such as puts and calls, and other derivative securities with respect to the Company’s securities unless otherwise permitted by our board of directors. This prohibition extends to any hedging or similar transaction designed to decrease the risks associated with holding Company securities. Stock options, stock appreciation rights, and other securities issued pursuant to Company benefit plans or other compensatory arrangements with the Company are not subject to this prohibition.

Our insider trading policy also includes an anti-pledging policy, which prohibits our executive officers and directors from pledging Company securities as collateral for loans.

Compensation Recovery Policies

In April 2016, we adopted a clawback policy applicable to our executive officers. If a majority of the independent members of our board of directors determines that an officer’s misconduct caused us to materially restate all or a portion of our financial statements, the board may require the officer to repay incentive compensation that would not have been payable absent the material restatement. This policy applies to all incentive compensation, excluding equity awards granted prior to the adoption of the policy, based on financial statements filed during the three years prior to the material restatement. Our Compensation Committee intends to revisit our clawback policy after the SEC adopts final rules implementing the requirements of Section 954 of the Dodd-Frank Wall Street Reform and Consumer Protection Act.

Employment Contracts, Termination of Employment and Change-In-Control Agreements

Our board of directors believes that maintaining a stable and effective management team is essential to our long-term success and achievement of our corporate strategies, and is therefore in the best interests of our stockholders. We have entered into employment agreements or Change of Control Severance Agreements with each of our NEOs that provide for, in certain instances, base salary, bonuses and/or sales commissions, employee benefit plan participation, and severance or other payments upon a qualifying termination of employment or change of control. These agreements provide the NEOs with assurances of specified severance benefits in the event that their employment is terminated and such termination is a qualifying termination. For more detail, see “Offer Letters and Employment Agreements; Potential Payments Upon Termination, Change in Control or Upon Termination Following Change in Control.”

We recognize that these severance benefits may be triggered at any time. Nonetheless, we believe that it is imperative to provide these individuals with these benefits to secure their continued dedication to their work, notwithstanding the possibility of a termination by us, and to provide them with additional incentives to continue employment with us. In determining appropriate severance payment and benefit levels for our NEOs, our Compensation Committee and our board of directors relied on a number of factors, including their experience with and understanding of current market practice, relative severance packages within the Company, and current severance arrangements. The level of benefits and triggering events to receive such benefits were chosen to be broadly consistent with our Compensation Committee’s and our board of directors’ view of prevailing competitive practices. The final severance payment and benefit levels were determined after extensive negotiations with each NEO and were evaluated in terms of the overall compensation packages for each NEO.

We also recognize the possibility that we may in the future undergo a change in control, and that this possibility, and the uncertainty it may cause among our NEOs, may result in their departure or distraction to the detriment of our company and our stockholders. Accordingly, our board of directors and Compensation Committee decided to take appropriate steps to encourage the continued attention, dedication and continuity of certain key executives to their assigned duties without the distraction that may arise from the possibility or occurrence of a change in control. As a result, we have entered into agreements with certain of our NEOs that provide additional benefits in the event of a change in control. For more detail, see “Offer Letters and Employment Agreements; Potential Payments Upon Termination, Change in Control or Upon Termination Following Change in Control.”

18

Table of Contents

We consider these severance protections to be an important part of our NEOs’ compensation. These arrangements are consistent with our overall compensation objectives because we believe such arrangements are competitive with arrangements offered to executives by companies with whom we compete for executives and are critical to achieve our business objective of management retention. We believe that this severance protection is competitively necessary to retain our NEOs and is imperative to (i) secure the continued dedication and objectivity of our NEOs, including in circumstances where we may undergo a change of control, and (ii) provide the NEOs with an incentive to continue employment with us and motivate them to maximize our value for the benefit of our stockholders.

In addition, in connection with his resignation as the Company’s Chief Financial Officer, Mr. Wallack entered into a transition agreement, or Retirement Agreement, with the Company, dated May 1, 2016, pursuant to which Mr. Wallack released all claims he may have against the Company and affirmed his obligations regarding confidential information as stated in his Proprietary Information and Inventions Agreement entered into with the Company. The Retirement Agreement also provides for additional severance benefits to Mr. Wallack. For more detail, see “Offer Letters and Employment Agreements; Potential Payments Upon Termination, Change in Control or Upon Termination Following Change in Control.”

Compensation Risk Assessment

In establishing and reviewing our overall compensation program, our Compensation Committee and our board of directors consider whether the compensation program and its various elements encourage or motivate our NEOs or other employees to take excessive risks. We believe that our compensation program and its elements are designed to encourage our employees to act in our long-term best interests and are not reasonably likely to have a material adverse effect on our business. In particular, our Compensation Committee has reviewed the elements of our executive compensation to determine whether any portion of executive compensation encouraged excessive risk taking and concluded:

| • | our allocation of compensation between cash compensation and long-term equity compensation, combined with our typically 48-month vesting schedule, discourages short-term risk taking; |

| • | our approach of goal setting, setting of targets with payouts at multiple levels of performance, and evaluation of performance results assist in mitigating excessive risk-taking; |

| • | our compensation decisions include subjective considerations, which restrain the influence of formulae or objective factors on excessive risk taking; and |

| • | our business does not face the same level of risks associated with compensation for employees at financial services (traders and instruments with a high degree of risk). |

Benefits and Tax Considerations

Broad-Based Employee Benefits

Our compensation program for our NEOs also includes employee benefits that are generally available to our other employees. These benefits include medical, dental, vision, long-term disability and life insurance benefits, as well as flexible spending accounts. We also periodically provide meals on premise to employees in our offices. Our NEOs receive these benefits on the same basis as our other full-time U.S. employees. Offering these benefits serves to attract and retain employees, including our NEOs. We anticipate that we will periodically review our employee benefits programs in order to ensure that they continue to serve these purposes and remain competitive.

We have established a tax-qualified Section 401(k) retirement savings plan for our employees generally, subject to standard eligibility requirements. Under this plan, participants may elect to make pre-tax contributions to the plan of up to a certain portion of their current compensation, not to exceed the applicable statutory income tax limitation. We provide for a match of employees’ contributions in an amount equal to 50% of an employee’s contributions up to $2,400 per year. Matching amounts vest over four years, beginning at the employee’s employment start date. Accordingly, all matching amounts will have fully vested on the fourth anniversary of the start date, regardless of when the matching amounts were contributed. The plan currently qualifies under Section 401(a) of the Internal Revenue Code, such that contributions to the plan, and income earned on those contributions, are not taxable to participants until withdrawn from the plan.

We have also established the 2010 Employee Stock Purchase Plan, or ESPP, which our board of directors has adopted and which our stockholders approved. Our NEOs are eligible to participate in the ESPP on the same basis as our other full-time U.S. employees.

19

Table of Contents

Tax Considerations