Attached files

| file | filename |

|---|---|

| EX-31.4 - EXHIBIT 31.4 - Brookdale Senior Living Inc. | a314.htm |

| EX-31.3 - EXHIBIT 31.3 - Brookdale Senior Living Inc. | a313.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K/A

(Amendment No. 1)

[X] | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2016

or

[ ] | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission File Number 001-32641

BROOKDALE SENIOR LIVING INC.

(Exact name of registrant as specified in its charter)

Delaware (State or Other Jurisdiction of Incorporation or Organization) | 20-3068069 (I.R.S. Employer Identification No.) | |

111 Westwood Place, Suite 400

Brentwood, Tennessee 37027

(Address of Principal Executive Offices)

(Registrant’s telephone number including area code) | (615) 221-2250 |

SECURITIES REGISTERED PURSUANT TO SECTION 12(b) OF THE ACT:

Title of Each Class Common Stock, $0.01 Par Value Per Share | Name of Each Exchange on Which Registered New York Stock Exchange | |

SECURITIES REGISTERED PURSUANT TO SECTION 12(g) OF THE ACT:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes [X] No [ ]

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes [ ] No [X]

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes [X] No [ ]

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes [X] No [ ]

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. [X]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” "smaller reporting company," and "emerging growth company" in Rule 12b-2 of the Exchange Act.

Large accelerated filer [X] | Accelerated filer [ ] | |

Non-accelerated filer [ ] (Do not check if a smaller reporting company) | Smaller reporting company [ ] | |

Emerging growth company [ ] | ||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. [ ]

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes [ ] No [X]

The aggregate market value of common stock held by non-affiliates of the registrant on June 30, 2016, the last business day of the registrant's most recently completed second fiscal quarter, was approximately $2.6 billion. The market value calculation was determined using a per share price of $15.44, the price at which the registrant's common stock was last sold on the New York Stock Exchange on such date. For purposes of this calculation only, shares held by non-affiliates excludes only those shares beneficially owned by the registrant's executive officers, directors and stockholders owning 10% or more of the Company's outstanding common stock.

As of April 24, 2017, 186,199,291 shares of the registrant’s common stock, $0.01 par value, were outstanding (excluding unvested restricted shares).

TABLE OF CONTENTS

BROOKDALE SENIOR LIVING INC.

FORM 10-K/A

FOR THE YEAR ENDED DECEMBER 31, 2016

PAGE | ||

EXPLANATORY NOTE | ||

PART III | ||

Item 10 | ||

Item 11 | ||

Item 12 | ||

Item 13 | ||

Item 14 | ||

PART IV | ||

Item 15 | ||

Item 16 | ||

EXPLANATORY NOTE

This Amendment No. 1 on Form 10-K/A (this “Amendment”) amends the Annual Report on Form 10-K for Brookdale Senior Living Inc. (“Brookdale,” the “Company,” “we,” or “our”) for the fiscal year ended December 31, 2016, which was filed with the Securities and Exchange Commission (the “SEC”) on February 15, 2017 (the “Original Filing”).

We are filing this Amendment to include the information required by Part III and not included in the Original Filing, as we will not file our definitive proxy statement within 120 days of the end of our fiscal year ended December 31, 2016. The reference on the cover page of the Original Filing to our incorporation by reference of certain sections of our definitive proxy statement into Part III of the Original Filing is hereby deleted.

Except as set forth in Part III below, the updates to the List of Exhibits and Index to Exhibits, and the note that a Form 10-K summary is not included pursuant to Item 16, no other changes are made to the Original Filing. The Original Filing continues to speak as of the date of the Original Filing. Unless expressly stated, this Amendment does not reflect events occurring after the filing of the Original Filing, nor does it modify or update in any way the disclosures contained in the Original Filing. Accordingly, this Amendment should be read in conjunction with the Original Filing and our other filings with the SEC.

PART III

Item 10. Directors, Executive Officers and Corporate Governance.

Information Concerning Directors

The Board of Directors is divided into three classes of directors. The current terms of the Class I, Class II and Class III directors will expire at the annual meetings of stockholders to be held in 2017, 2019 and 2018, respectively. Set forth below is certain biographical information for our directors. See “Item 12. Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters” below for a description of securities beneficially owned by our directors.

Name | Age | Position with Brookdale | Class | |||

Daniel A. Decker | 64 | Executive Chairman of the Board | Class I | |||

T. Andrew Smith | 57 | President, Chief Executive Officer and Director | Class I | |||

Frank M. Bumstead | 75 | Director | Class I | |||

Jackie M. Clegg | 55 | Director | Class II | |||

Jeffrey R. Leeds | 71 | Director | Class III | |||

Mark J. Parrell | 50 | Director | Class III | |||

William G. Petty, Jr. | 71 | Director | Class II | |||

James R. Seward | 64 | Director | Class II | |||

Lee S. Wielansky | 65 | Director | Class III | |||

Daniel A. Decker has been investing in the senior living industry for more than 25 years. He joined our Board of Directors in October 2015 as Non-Executive Chairman of the Board, and was appointed as Executive Chairman of the Board effective November 1, 2016. Mr. Decker is the President and owner of CoastWood Senior Housing Partners, LLC, an investment firm specializing in seniors housing and related services, which he founded in 2006. In January 2013, CoastWood joined with KKR and Beecken Petty O'Keefe & Company to acquire the operations of Sunrise Senior Living, one of the leading operators of assisted living properties in the United States. The group sold its interest in Sunrise in 2014. Prior to forming CoastWood, Mr. Decker was a partner from 1990 to 2006 at The Hampstead Group, LLC, a private equity firm with a focus on real estate related, operating intensive businesses such as lodging and seniors housing. Mr. Decker was an attorney at the law firm of Decker, Hardt, Kopf, Harr, Munsch & Dinan (now known as Munsch Hardt Kopf & Harr, P.C.) from 1985 to 1990, which he co-founded in 1985, and was an attorney at Winstead PC from 1980 to 1985. Mr. Decker served on the Boards of Directors of Sentio Healthcare Properties, Inc. (a public, non-listed REIT) from March 2013 until September 2015, during which time he served as a member of the Investment Committee, and Health Care REIT, Inc. from October 2011 until August 2012, during which time he served as a member of the Audit, Investment, Nominating/Corporate Governance and Planning Committees. Mr. Decker also has served on the Boards of Directors of several other public companies, including Omega Healthcare Investors, Inc. (where he served as Executive Chairman and then as Chairman of the Board), Bristol Hotel Company, Wyndham Hotel Company and the Forum Group. Mr. Decker earned his Bachelor of Science in Business Administration degree in economics from the University of Missouri-Columbia, and his J.D. from the University of Missouri-Kansas City. Mr. Decker’s significant experience in the senior living and real estate industries, as well as his extensive strategic, investment and transactional experience, led to the conclusion that he should serve as a member of the Board of Directors.

T. Andrew Smith has over 25 years of experience in seniors housing, mergers and acquisitions, real estate and capital markets transactions, corporate finance and healthcare. Mr. Smith has served as our Chief Executive Officer since February 2013, as our President since March 2016, and as a member of our Board of Directors since June 2014. From October 2006 to February 2013, Mr. Smith served as our Executive Vice President, General Counsel and Secretary. In addition to his role in managing our legal affairs, Mr. Smith was responsible for the management and oversight of our corporate development functions (including acquisitions and expansion and development activity); corporate finance

5

(including capital structure, debt and lease transactions and lender/lessor relations); strategic planning; and risk management. Prior to joining Brookdale, Mr. Smith served as a member of Bass, Berry & Sims PLC's corporate and securities group and as chair of the firm's healthcare group. During his tenure at Bass, Berry & Sims (1985 to 2006), Mr. Smith represented American Retirement Corporation as outside General Counsel. He currently serves as a member of the board of directors of the Nashville Health Care Council, Argentum and the National Investment Center for the Seniors Housing & Care Industry (NIC) and as a member of the executive board of the American Seniors Housing Association (ASHA). Mr. Smith’s knowledge of the senior housing industry and his experience as our Chief Executive Officer, and previously as our Executive Vice President, General Counsel and Secretary, led to the conclusion that he should serve as a member of the Board of Directors.

Frank M. Bumstead has over 40 years’ experience in the field of business and investment management and financial and investment advisory services. He also has represented buyers and sellers in a number of merger and acquisition transactions, including the sale of CMT (now a nationwide cable network) from its previous owners to Gaylord Entertainment, Inc. Mr. Bumstead is the chairman and a principal shareholder of Flood, Bumstead, McCready & McCarthy, Inc., a business management firm that represents artists, songwriters and producers in the music industry as well as athletes and other high net worth clients. He has been with the firm since 1989. From 1993 to December 1998, Mr. Bumstead served as the Chairman and Chief Executive Officer of FBMS Financial, Inc., an investment advisor registered under the Investment Company Act of 1940. Mr. Bumstead joined our Board of Directors in August 2006 and is an independent director. Prior to our acquisition of ARC, Mr. Bumstead served as the Lead Director of ARC, where he had served as a member of the board of directors for 11 years. He served in 2015 as Chairman of the board of directors of the Country Music Association and is also Vice Chairman of the board of directors and Chairman of the Finance and Investment Committee of the Memorial Foundation, Inc., a charitable foundation. He also currently serves on the board of directors of Nashville Wire Products, Inc. Mr. Bumstead has also served as a director and as a member of the Audit Committee of Syntroleum Corporation. He also has previously served on the boards of the Dede Wallace Center, The American Red Cross, ECA, Inc., American Constructors, Inc., American Fine Wire, Inc., Junior Achievement of Nashville, and Watkins Institute. In addition, he previously served as a member of the board of advisors of United Supermarkets of Texas, LLC and was Chairman of its Finance and Audit Committee. Mr. Bumstead received a B.B.A. degree from Southern Methodist University and a Masters of Business Management from Vanderbilt University’s Owen School of Management. Mr. Bumstead’s experience in business management and as a director of several public companies, along with his knowledge of the senior housing industry (through his prior service as a director of ARC), led to the conclusion that he should serve as a member of the Board of Directors.

The Honorable Jackie M. Clegg brings robust transactional and financial experience, along with expertise in corporate governance and public policy, through her work as a strategic consultant, in government service and as a director of a number of public companies. Ms. Clegg joined Brookdale’s Board of Directors in November 2005 as an independent director. Ms. Clegg founded the strategic consulting firm Clegg International Consultants, LLC, and has served as its Managing Partner since 2001. Ms. Clegg was nominated by the President of the United States and confirmed by the U.S. Senate to serve as the Vice Chair of the Board of Directors and First Vice President of the Export-Import Bank of the United States, the official export credit institution of the United States of America, serving from June 1997 through July 2001, and served as Chief Operating Officer from January 1999 to September 2000. In her role with the Export-Import Bank, Ms. Clegg had direct supervisory responsibilities for the financial operations of the Export-Import Bank and was responsible for financing more than $50 billion in U.S. exports and a portfolio of $65 billion, budgeting decisions for the Export-Import Bank’s operational and program budgets and opening Export-Import Bank programs in several countries. Ms. Clegg also served as chair of the Loan and Audit Committees of the Board of Directors and as chair of the Budget Task Force and the Technology and Pricing Committees of the Export-Import Bank. Ms. Clegg had previously served as the Chief of Staff and Special Assistant to the Chairman of the Export-Import Bank from April 1993 through June 1997. Prior to her Export-Import Bank service, Ms. Clegg worked in the U.S. Senate, focusing on international finance and monetary policy, national security and foreign affairs. She was the principal staff member on the U.S. Senate Committee on Banking, Housing and Urban Affairs Subcommittee on International Finance & Monetary Policy. She was responsible for developing strategy and for drafting legislation, including changes to the Export Administration Act, the Credit Reform Act, the Defense Production Act and Fair Trade in Financial Services legislation, among others. She also served as an associate staff member for the Senate Appropriations Committee for approximately ten years. Ms. Clegg also draws on her significant experience in service on the boards of directors of public companies and private organizations. She currently serves on the board of directors and chairs the Audit Committee of the Public Welfare Foundation. She has previously served as a director of IPC Holdings, Ltd., a company that provided property casualty catastrophe insurance coverage, and Blockbuster, Inc., which had over 6,500 retail locations. Additionally, she served as a director of CME Group Inc. (the parent company of the Chicago Mercantile Exchange), the Chicago Board of Trade, Cardiome Pharma Corp. and Javelin Pharmaceuticals, Inc. She previously chaired the Nominating and Corporate Governance Committees of Blockbuster, Inc., IPC Holdings, Ltd. and Cardiome Pharma Corp. and the Audit Committees of the IPC Holdings, Ltd.,

6

Chicago Board of Trade, Cardiome Pharma Corp. and Javelin Pharmaceuticals, Inc. She has also chaired and served on numerous special committees overseeing mergers, acquisitions, and financing transactions and has helped companies through the IPO process. Based on her current and former positions and directorships, Ms. Clegg has gained significant financial, corporate governance, public policy, infrastructure, and real estate experience. Ms. Clegg’s extensive transactional and financial experience, as well as her experience in the public sector and as a director of numerous public companies (including her service as chairman of the foregoing standing and special committees) led to the conclusion that she should serve as a member of the Board of Directors.

Jeffrey R. Leeds is a financial services industry veteran with extensive experience in mergers, acquisitions and dispositions, capital markets and public company management. Mr. Leeds retired as Executive Vice President and Chief Financial Officer of GreenPoint Financial Corporation and GreenPoint Bank in October 2004, having served since January 1999. Prior to that, he was Executive Vice President, Finance and Senior Vice President and Treasurer of GreenPoint. Prior to GreenPoint, Mr. Leeds was with Chemical Bank for 14 years, having held positions as Head of Asset and Liability Management, Proprietary Trading and Chief Money Market Economist. Mr. Leeds has been an independent member of Brookdale’s Board of Directors since November 2005 and served as Non-Executive Chairman of the Board from June 2012 through September 2015. He previously served as a director and chair of the Audit Committee of Och-Ziff Capital Management Group LLC and as a director and Audit Committee member of United Western Bancorp. Mr. Leeds received a B.A. in economics from the University of Michigan and an MBA and M.Ph. from Columbia University. Mr. Leeds’ experience as an executive and principal financial officer, along with his extensive financial industry and transactional expertise, led to the conclusion that he should serve as a member of the Board of Directors.

Mark J. Parrell brings to Brookdale over 20 years of real estate, capital markets, mergers and acquisitions and investment experience. He has served as the Executive Vice President and Chief Financial Officer of Equity Residential, the largest United States apartment real estate investment trust, since October 2007. Mr. Parrell was Senior Vice President and Treasurer of Equity Residential from August 2005 to October 2007, and served in various roles in the company’s finance group since September 1999. He served as the Chair of the Finance Committee of the National Multifamily Housing Council in 2015 to 2016 and is a member of the Urban Land Institute. Mr. Parrell is a member of the B.B.A. Advisory Board for the Ross School of Business at the University of Michigan, his alma mater. Mr. Parrell joined our Board of Directors in April 2015 and is an independent director. He served as a director of Aviv REIT, Inc. from March 2013 until it was acquired on April 1, 2015. Mr. Parrell holds a B.B.A. from the University of Michigan and a J.D. from the Georgetown University Law Center. Mr. Parrell’s extensive real estate, capital markets, mergers and acquisitions and investment experience, including his experience as the principal financial officer of an S&P 500 REIT, led to the conclusion that he should serve as a member of the Board of Directors. On April 10, 2017, Mr. Parrell submitted notice that he will resign from the Board of Directors effective at the close of business on July 24, 2017 (the currently scheduled date of our 2017 annual meeting of stockholders) to dedicate more time to other professional commitments.

William G. Petty, Jr. brings to Brookdale nearly 30 years of experience in the healthcare services industry, as well as extensive operational, investment and transactional experience in the senior living industry, and a robust background in finance. He joined Brookdale’s Board of Directors in December 2014 and is an independent director. Mr. Petty is a partner of Beecken Petty O'Keefe & Company, a private equity management firm he co-founded in 1996, which currently has approximately $1.3 billion under management. Mr. Petty’s prior leadership experience includes service as Chairman of the Board of Directors of Sunrise Senior Living, Inc. from January 2013 to April 2014; as Chief Executive Officer of Alternative Living Services, Inc./Alterra Healthcare Corporation from 1993 to 1996 and as its Chairman from 1993 to 2000; as Chairman, President and Chief Executive Officer of Evergreen Healthcare, Inc. and as a director of that company’s publicly-traded successors (GranCare, Inc. and Mariner Health Care Inc.); and as a director and member of the executive committee of Forum Group, Inc. In 1985, he co-founded Omega Capital Ltd., a private investment fund focused on the healthcare industry, which formed Omega Healthcare Investors, Inc., a healthcare REIT, during his tenure as managing director. In addition, he has served on the boards of directors of several Beecken Petty portfolio companies. Mr. Petty received a B.S. in Business Administration from the University of Illinois. Mr. Petty’s significant executive experience in the senior living and healthcare services industries, as well as his extensive operational, investment and transactional experience, led to the conclusion that he should serve as a member of the Board of Directors.

James R. Seward has extensive experience in senior management and oversight in the investment sector, including significant experience in mergers and acquisitions and capital markets transactions. Mr. Seward is a Chartered Financial Analyst and, since 2000, has been a private investor. Previously, Mr. Seward was Executive Vice President, Chief Financial Officer, and director of Seafield Capital Corporation, a publicly-traded investment holding company. In that capacity, Mr. Seward also served as a director and as a member of the executive committee of LabOne, a provider of health screening and risk assessment services to life insurance companies and clinical diagnostic testing services to healthcare providers, until LabOne was sold to Quest Diagnostics in 2005. Mr. Seward also previously served as Chief

7

Executive Officer and President of SLH Corporation, a spin-off of Seafield Capital Corporation. Mr. Seward joined our Board of Directors in November 2008 and is an independent director. He also currently serves as Chairman of the Board of Trustees and as a member of the Audit Committee of RBC Funds, a registered investment company. He previously served as a director of ARC and has also served as a member of the board of directors and Audit Committee of Syntroleum Corporation. Mr. Seward received a Bachelor of Arts degree from Baker University, a Masters in Public Administration, City Management from the University of Kansas and a Masters in Business Administration, Finance from the University of Kansas. Mr. Seward’s experience and credentials in investing and finance, along with his knowledge of both the senior housing industry (through his prior service as a director of ARC) and the health care industry (through his prior service as a director of LabOne), led to the conclusion that he should serve as a member of the Board of Directors.

Lee S. Wielansky has more than 40 years of commercial real estate investment, management and development experience. Mr. Wielansky currently serves as Chairman and CEO of Midland Development Group, Inc., which was re-started in 2003 and focuses on the development of retail properties in the mid-west and southeast, and as Chairman and CEO of Opportunistic Equities, which specializes in low income housing. Mr. Wielansky was previously President and CEO of JDN Development Company, Inc., which was a wholly-owned subsidiary of JDN Realty Corporation, a publicly-traded REIT with more than $1 billion in assets that was acquired by Developers Diversified Realty Corporation. Before joining JDN, he served as Managing Director – Investments of Regency Centers Corporation, a publicly-traded REIT and a leading owner, operator and developer of shopping centers in the United States, which in 1998 acquired Midland Development Group, a retail properties development company co-founded by Mr. Wielansky in 1983. Mr. Wielansky joined our Board of Directors in April 2015 and is an independent director. He also serves as Lead Trustee of Acadia Realty Trust, a publicly-traded REIT focused on the ownership, acquisition, redevelopment and management of commercial retail properties in the United States, is a director of Isle of Capri Casinos, Inc., and served as a director of Pulaski Financial Corp. from 2005 to 2016. He also serves on the Foundation board of Barnes Jewish Hospital (BJC). Mr. Wielansky received a bachelor's degree in Business Administration, with a major in Real Estate and Finance, from the University of Missouri – Columbia, where he is currently a member of the Strategic Development Board of the college of business. Mr. Wielansky’s real estate investment, management and development experience, as well as his service as a director of several public companies, led to the conclusion that he should serve as a member of the Board of Directors.

Legal Proceedings Involving Directors, Officers or Affiliates

There are no legal proceedings ongoing as to which any director, officer or affiliate of the Company, any owner of record or beneficially of more than five percent of any class of voting securities of the Company, or any associate of any such director, officer, affiliate of the Company, or security holder is a party adverse to us or any of our subsidiaries or has a material interest adverse to us or any of our affiliates.

Audit Committee

We have a separately-designated standing Audit Committee established in accordance with Section 3(a)(58)(A) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). The Audit Committee’s functions include:

• | reviewing the audit plans and findings of the independent registered public accounting firm and our internal audit and risk review staff, as well as the results of regulatory examinations, and tracking management’s corrective action plans where necessary; |

• | reviewing our financial statements (and related regulatory filings), including any significant financial items and/or changes in accounting policies, with our senior management and independent registered public accounting firm; |

• | reviewing our risk and control issues, compliance programs and significant tax and legal matters; |

• | having the sole discretion to appoint annually the independent registered public accounting firm and evaluating its independence and performance, as well as to set clear hiring policies for our hiring of employees or former employees of the independent registered public accounting firm; and |

• | reviewing our risk management processes. |

The Audit Committee is currently chaired by Mr. Seward and also consists of Ms. Clegg and Messrs. Leeds and Parrell. All members are “independent” directors as defined under the listing standards of the NYSE and under section 10A(m)(3) of the Exchange Act. The Board of Directors has determined that each of the current members of the Audit

8

Committee is an “audit committee financial expert” as defined by the rules of the SEC. No member of the Audit Committee simultaneously serves on the audit committees of more than three public companies.

Corporate Governance

The role of the Board of Directors is to ensure that Brookdale is managed for the long-term benefit of our stockholders. To fulfill this role, the Board of Directors has adopted corporate governance principles designed to assure compliance with all applicable corporate governance standards. In addition, the Board of Directors is informed regarding Brookdale’s activities and periodically reviews, and advises management with respect to, Brookdale’s annual operating plans and strategic initiatives.

The Board of Directors has adopted Corporate Governance Guidelines. The Board of Directors has also adopted a Code of Business Conduct and Ethics that applies to all employees, directors and officers, including our principal executive officer, our principal financial officer, our principal accounting officer or controller, or persons performing similar functions, as well as a Code of Ethics for Chief Executive and Senior Financial Officers, which applies to our President and Chief Executive Officer, Chief Financial Officer, Chief Accounting Officer, Treasurer and Controller. These guidelines and codes are available on our website at www.brookdale.com. Any amendment to, or waiver from, a provision of such codes of ethics granted to a principal executive officer, principal financial officer, principal accounting officer or controller, or person performing similar functions, or to any executive officer or director, will be posted on our website.

Changes to Procedures for Stockholder Nominations of Directors

On March 5, 2017, the Board of Directors approved and adopted amendments to our Amended and Restated Bylaws that, among other things, include an adjustment to the time period during which stockholders, who comply with the requirements set forth in our Amended and Restated Bylaws, may submit director nominations to be considered at an annual meeting of stockholders if the date of the annual meeting is more than 25 days before or after the anniversary date of the prior year's annual meeting. As amended, our Amended and Restated Bylaws provide that if the date of the annual meeting is more than 25 days before or after the anniversary date of the prior year's annual meeting, a stockholder's notice of nomination pursuant to the advance notice provisions must be received at our principal executive offices not earlier than the close of business on the 90th day prior to the annual meeting and not later than the close of business on the later of the 60th day prior to the annual meeting or the tenth day following the day on which the date of the annual meeting is announced.

On March 6, 2017, we announced that the Board of Directors has scheduled our 2017 annual meeting of stockholders for July 24, 2017, which represents a change of more than 25 days from the anniversary date of our 2016 annual meeting of stockholders held on June 13, 2016. As a result, the deadlines for stockholders to submit proposals and nominations of directors as set forth in our definitive proxy statement for our 2016 annual meeting of stockholders are no longer effective.

Under our Amended and Restated Bylaws, in order for stockholder proposals, including director nominations, to be presented at our 2017 annual meeting of stockholders (other than by means of inclusion in the proxy materials under Rule 14a-8 under the Exchange Act as described below), we must have received proper notice at our principal executive offices not earlier than the close of business on April 25, 2017 and not later than the close of business on May 25, 2017, addressed to the Secretary of the Company at "Attention: Secretary, Brookdale Senior Living Inc., 111 Westwood Place, Suite 400, Brentwood, Tennessee 37027".

The notice must include all of the information required by our Amended and Restated Bylaws, including setting forth as to each person whom the stockholder proposes to nominate for election as a director, the person's name, age, business and residence address, the person's principal occupation or employment, and the class or series and number of shares of capital stock of Brookdale that are owned beneficially or of record by the person. The notice must also set forth the name and record address of the stockholder, the class or series and number of shares of capital stock of Brookdale that the stockholder beneficially owns or owns of record, a description of all arrangements or understandings between the stockholder and each proposed nominee and any other person or persons (including their names) pursuant to which the nomination(s) are to be made by the stockholder and a representation that the stockholder intends to appear in person or by proxy at the meeting to nominate the persons named in the notice. In addition, the notice must include any other information relating to the stockholder or to the proposed nominee that would be required to be disclosed in a proxy statement or other filings required to be made in connection with solicitations of proxies for election of directors under Section 14 of the Exchange Act and the rules and regulations thereunder and must also be accompanied by a written consent of each proposed nominee to being named as a nominee and to serve as a director if elected. If the Chairman of the Board determines that a nomination was not made in accordance with the foregoing procedures, the Chairman shall

9

declare to the meeting that the nomination was defective and such defective nomination shall be disregarded. A person must own of record shares of Brookdale stock on the date that he or she sends the notice to Brookdale under the procedures above for the nomination to be valid under our Amended and Restated Bylaws.

Stockholder proposals intended for inclusion in our definitive proxy statement for the 2017 annual meeting of stockholders pursuant to Rule 14a-8 under the Exchange Act must have been received at our principal executive offices no later than March 27, 2017 (which we believe is a reasonable time before we begin to print and send our proxy materials), addressed to the Secretary of the Company at "Attention: Secretary, Brookdale Senior Living Inc., 111 Westwood Place, Suite 400, Brentwood, Tennessee 37027."

Executive Officers

Certain information concerning our executive officers is contained in the discussion entitled "Executive Officers of the Registrant" appearing after Item 1 of Part I of the Original Filing.

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Exchange Act requires our directors, executive officers and persons who own more than ten percent of a registered class of our equity securities to file reports of ownership on Form 3 and changes in ownership on Form 4 or 5 with the SEC. Such officers, directors and ten-percent stockholders are also required by SEC rules to furnish us with copies of all Section 16(a) reports they file. We reviewed copies of the forms received by us or written representations from certain reporting persons that they were not required to file these forms. Based solely on that review, we believe that during the fiscal year ended December 31, 2016, our officers, directors and ten-percent stockholders complied with all Section 16(a) filing requirements applicable to them.

10

Item 11. Executive Compensation.

COMPENSATION OF EXECUTIVE OFFICERS

Compensation Discussion and Analysis

This Compensation Discussion and Analysis provides information about the compensation of the following named executive officers:

Named Executive Officers | ||

T. Andrew Smith | President and Chief Executive Officer | |

Labeed S. Diab | Chief Operating Officer | |

Lucinda M. Baier | Chief Financial Officer | |

Bryan D. Richardson | Executive Vice President and Chief Administrative Officer | |

Mary Sue Patchett | Executive Vice President, Community Operations | |

Mark W. Ohlendorf | Former President | |

Mr. Ohlendorf stepped down from his role as President effective March 18, 2016. On such date, Mr. Smith was appointed to the additional role of President. Mr. Ohlendorf’s separation was considered to be a termination by us without cause pursuant to the terms of applicable compensatory plans and agreements.

Compensation Practices–Highlights

What We Do | What We Do Not | ||

– Pay for Performance – A significant portion of our NEOs’ target direct compensation is awarded in the form of variable, at-risk compensation. | – No Above Median Benchmarking – We do not benchmark target compensation above the median of our peer group. | ||

– Caps on Payouts – We cap payouts under our annual cash incentive plan and long term incentive awards (no additional shares beyond target performance). | – No Excessive Guaranteed Compensation – Our annual cash incentive plan and our performance-based restricted stock awards do not have minimum guaranteed payout levels, and therefore this compensation is “at risk.” | ||

– Preserving Tax Deductibility – We structure incentive compensation opportunities with the intent that they will qualify as performance-based compensation under Section 162(m) of the Code to the extent possible. | – No Tax Gross Ups – We do not provide tax gross-ups, except in the limited circumstance of certain re-location expenses. | ||

– Long-Term Equity – We promote retention of NEOs with 4-year time-based restricted stock and performance-based restricted stock with a 3-year and 4-year performance period. | – No Excessive Perquisites – We do not provide excessive perquisites or other benefits. | ||

– Annual Say on Pay – We annually conduct a “say-on-pay” advisory vote (rather than on a less frequent basis) to solicit our stockholders’ views on our executive compensation programs. | – No Defined Benefit Plans – We do not offer pensions or supplemental executive retirement plans (SERPs). | ||

11

– Stock Ownership and Retention Guidelines – We maintain robust stock ownership and retention guidelines (5x base salary for the CEO; 4x base salary for the COO and CFO; 3x base salary/cash retainer for the other NEOs and directors). | – No Pledging or Hedging – Our insider trading policy prohibits executive officers and directors from pledging shares or engaging in short-sale, hedging, or other derivative transactions involving our securities. | ||

– Independent Committee and Consultant – The Committee is comprised solely of independent directors, and it retains F.W. Cook as its independent compensation consultant. | – No Stock Options – We have never granted stock options. | ||

Overview of Compensation Process

The Compensation Committee (the “Committee”) administers our executive compensation program, including overseeing our compensation plans and policies, performing an annual review of executive compensation plans, and reviewing and approving all decisions regarding the compensation of executive officers. At the request of the Committee, our Chief Executive Officer and certain of our other executive officers participate in Committee meetings (excluding executive sessions of the Committee and when their own compensation is determined) and assist the Committee by, for example, providing information to the Committee and making recommendations regarding our compensation program and levels. Our Chief Executive Officer recommends to the Committee the compensation of our other executive officers, subject to the Committee’s ultimate authority and responsibility for determining the form and amount of executive compensation.

At our 2016 annual meeting of stockholders, 90% of the votes cast on the annual vote to approve the compensation of our named executive officers (referred to as “say-on-pay”) supported our executive compensation program. The Committee believes this vote provided positive affirmation of our stockholders’ support of our executive compensation approach and provided assurance that the program is reasonable and well-aligned with stockholder expectations. The Committee values the opinions expressed by stockholders in the annual say-on-pay vote and considers the outcomes of such votes when making executive compensation decisions.

Executive Officer Compensation Philosophy and Objectives

Our executive compensation program is designed to reward performance, align executives’ interests with those of our stockholders, retain key executives responsible for our success and, as needed, attract new executives. To accomplish these objectives, we intend to provide compensation that is competitive externally, fair internally, and tied to performance.

Our executive compensation program consists of these key elements:

• | Base Salary—To attract and retain our key executives, we provide a base salary that reflects the level and scope of responsibility, experience and skills of an executive, as well as competitive market practices. |

• | Annual Cash Incentive Opportunity—The purpose of the annual cash incentive opportunity is to motivate and reward executives for their contributions to our performance through the opportunity to receive annual cash compensation based on the achievement of company and individual performance objectives for the year. The Committee intends to set targets that are challenging, but generally based on the Company’s business and operating plans so as to avoid encouraging excessive risk-taking. |

• | Long-Term Incentive Compensation—The purpose of long-term incentive compensation is to align executives’ long-term goals with those of our stockholders. The Committee has utilized a mix of time- and performance-based restricted stock as the forms of long-term incentive compensation awarded to our executives. The Committee believes that the use of restricted stock appropriately aligns the interests of our executives with those of our stockholders and encourages employees to remain with the Company. |

12

Market Data Review

Competitive market practices, including those of a self-selected peer group, are one of many factors the Committee considers in making executive compensation decisions. The Committee reviews market data to provide an external frame of reference on range and reasonableness of our compensation levels and practices, but not as a primary or determinative factor. The Committee’s objective is, over the long-term, to target executive compensation at or slightly below the median of our peer group for comparable positions, with potential upside opportunity if supported by company financial and operating performance.

The Committee engaged F.W. Cook & Co., Inc. (“F.W. Cook”) in 2016 to review and, if advisable, recommend updates to, the peer group used by the Committee for reviewing our executive compensation program, and to conduct an independent market analysis using that peer group. The peer group used for 2016 executive compensation decisions remained unchanged from the prior year and included 18 companies in the health care facilities, healthcare services, managed healthcare, healthcare REIT, hospitality and restaurant industries. The companies contained in the peer group were chosen to be reflective of our levels of revenue, market capitalization and enterprise value, and number of employees. The peer group was comprised of the following companies:

2016 Compensation Peer Group | ||

Centene Corporation | Omnicare, Inc. | |

Community Health Systems, Inc. | Quest Diagnostics Incorporated | |

Darden Restaurants, Inc. | Select Medical Holdings Corporation | |

HealthSouth Corporation | Starwood Hotels & Resorts Worldwide, Inc. | |

Hyatt Hotels Corporation | Tenet Healthcare Corporation | |

Kindred Healthcare, Inc. | The Ensign Group, Inc. | |

Laboratory Corporation of America Holdings | Universal Health Services, Inc. | |

LifePoint Health, Inc. | Welltower Inc. | |

National HealthCare Corporation | Wyndham Worldwide Corporation | |

F.W. Cook reported directly to the Committee and did not provide any services to the Company other than services provided to the Committee. The Committee conducted a specific review of its relationship with F.W. Cook, and determined that its work for the Committee did not raise any conflicts of interest, consistent with the guidance provided under the Dodd-Frank Act of 2010 by the SEC and by the NYSE.

Annual Risk Assessment

In accordance with its charter, the Committee conducts an assessment annually of the relationship between our risk management policies and practices, corporate strategy and our compensation arrangements. As part of this assessment, the Committee evaluates whether any incentive and other forms of pay encourage unnecessary or excessive risk taking. For our 2016 executive compensation program, the Committee concluded that the program, including the performance goals and targets used for incentive compensation, is appropriately structured not to encourage unnecessary or excessive risk taking.

2016 Named Executive Officer Compensation Decisions

When considering our 2016 executive compensation program, the Committee indicated that it would continue to target executive compensation at or slightly below the median of our peer group for comparable positions, with potential upside opportunity if supported by company financial and operating performance. F.W. Cook completed a market analysis and reported that the increases to base salary and long-term incentive awards made in 2015 had brought the target total direct compensation for our named executive officers closer to the median of our peer group for similarly titled roles, though Mr. Smith’s and Mr. Richardson’s target total direct compensation was lower than the median of the peer group for comparable positions, primarily due to considerably lower target long-term

13

incentive compensation. F.W. Cook also indicated that the design of our short-term incentive plan, including the performance criteria and amounts, and relative weighting thereof, were generally consistent with peer practices. Further, F.W. Cook advised on long-term incentive performance measures that are used in practice, including relative total shareholder return, which was not used by the peer companies for purposes of long-term incentive compensation.

When evaluating base salaries and target short term incentive opportunities of the named executive officers, the Committee reviewed comparative market data presented by F.W. Cook. Mr. Smith requested that his base salary not be increased for 2016, and the Committee noted that Mr. Diab and Ms. Baier were hired in the fourth quarter of 2015, and that Ms. Patchett’s base salary had been increased in connection with her promotion in the fourth quarter of 2015. As a result, the Committee determined not to increase the base salary of the named executive officers, with the exception of Mr. Richardson, whose base salary was increased by 2.5% for 2016. The Committee further determined that the target annual cash incentive opportunity for 2016 would remain at 125% of base salary for Mr. Smith and 100% of each of the other named executive officers. The Committee also determined under the annual cash incentive plan to continue to use the relative weighting of company and individual performance measures, and to begin using resident fee revenue as a performance measure in lieu of year-over-year same community senior housing net operating income growth used in prior years. When evaluating the individual objectives component of the annual cash incentive plan, the Committee determined to use a more rigorous process in setting goals, identifying achievement criteria and scoring goal achievement to improve the pay-for-performance nature of the individual objectives and to differentiate results among executives and their objectives.

The Committee reviewed comparative market data provided by F.W. Cook when setting target amounts of long-term incentive compensation, noting that Mr. Diab and Mses. Baier and Patchett were hired or promoted during the fourth quarter of 2015. In light of F.W. Cook’s report showing that Mr. Smith’s and Mr. Richardson’s target total direct compensation amounts were below the median amounts of the peer group, primarily due to their target long-term incentive compensation being considerably lower than the peer group, the Committee determined to increase the grant date fair value of long-term incentive awards for Messrs. Smith and Richardson by 10%, or approximately $475,000 and $80,000, respectively. The Committee did not grant long-term incentive awards to Mr. Ohlendorf due to the timing of his termination without cause effective March 18, 2016.

The table below sets forth the target total direct compensation approved by the Committee for each of Messrs. Smith, Diab and Richardson and Mses. Baier and Patchett for 2016. Mr. Ohlendorf is not included due to his termination of employment effective March 18, 2016. Performance-based opportunities are presented at target and long-term incentive awards are presented at grant date fair value. The table below excludes amounts reported in the “All Other Compensation” column in the Summary Compensation Table for 2016, which generally include employer matching contributions to our 401(k) Plan, premiums on Company-provided life and disability insurance, and the incremental cost of relocation benefits for Mr. Diab and Ms. Baier.

2016 Target Total Direct Compensation | ||||||||||

Base Salary | Annual Cash Incentive | Performance-Based Long-Term Equity | Time-Based Long-Term Equity | Target Total Direct Compensation | ||||||

T. Andrew Smith | $950,000 | $1,187,500 | $2,612,503 | $2,612,503 | $7,362,507 | |||||

Labeed S. Diab | $585,000 | $585,000 | $750,002 | $750,002 | $2,670,005 | |||||

Lucinda M. Baier | $550,000 | $550,000 | $750,002 | $750,002 | $2,600,005 | |||||

Bryan D. Richardson | $430,500 | $430,500 | $440,003 | $440,003 | $1,741,007 | |||||

Mary Sue Patchett | $425,000 | $425,000 | $352,498 | $352,513 | $1,555,011 | |||||

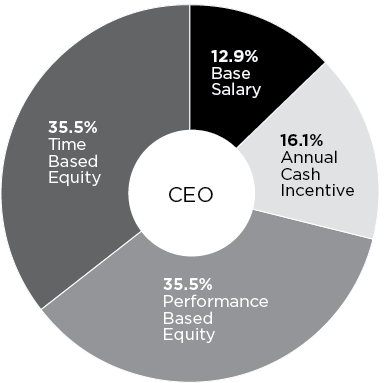

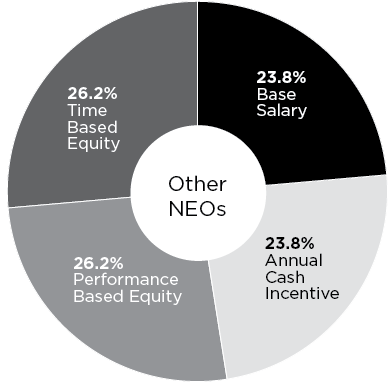

Consistent with our compensation philosophy, the 2016 pay mix for our named executive officers is heavily weighted towards performance-based, at risk, compensation, as illustrated by the charts below that reflect target total

14

direct compensation for Mr. Smith and the average for our other named executive officers as a group (other than Mr. Ohlendorf).

2016 Target Total Direct Compensation Mix (% of Total) | |

|  |

2016 Realized Compensation and Summary of Compensation Results

So that our stockholders may better understand the results of our 2016 executive compensation program, the following table sets forth the amount of compensation actually realized by our named executive officers who served the full year 2016. The amount of realized compensation includes the actual salary earned, actual payments under our 2016 annual cash incentive plan, the value of restricted stock awards that vested during 2016 and the amount of all other compensation reported in the Summary Compensation Table for 2016 (other than $299,180 and $211,774 for relocation assistance for Mr. Diab and Ms. Baier, respectively, during 2016). The amounts realized are significantly lower than the target total direct compensation for 2016 as shown above, and also significantly lower than the amounts reported in the Summary Compensation Table for 2016 below, as calculated in accordance with SEC rules. For comparison purposes, the following table also sets forth the amount of compensation actually realized by our named executive officers for 2014 and 2015 who served a full year and were named executive officers during such years.

Realized Compensation | ||||||||||||

Year | Salary | Annual Cash Incentive Earned | Value upon Vesting of Long-Term Incentive Awards | All Other Compensation (excluding relocation assistance) | Total Compensation Realized | |||||||

T. Andrew Smith | 2016 | $953,654 | $418,594 | $1,258,572 | $11,339 | $2,642,159 | ||||||

2015 | $953,654 | $276,094 | $2,022,015 | $8,929 | $3,260,691 | |||||||

2014 | $841,216 | $714,580 | $1,622,198 | $11,025 | $3,189,019 | |||||||

Labeed S. Diab | 2016 | $587,250 | $219,375 | $371,177 | $5,504 | $1,183,307 | ||||||

Lucinda M. Baier | 2016 | $552,115 | $222,750 | $136,988 | $5,723 | $917,576 | ||||||

Bryan D. Richardson | 2016 | $432,115 | $159,500 | $384,391 | $9,829 | $985,836 | ||||||

2015 | $421,616 | $124,110 | $916,815 | $8,534 | $1,471,074 | |||||||

2014 | $367,631 | $274,996 | $981,541 | $10,239 | $1,634,407 | |||||||

Mary Sue Patchett | 2016 | $426,635 | $145,350 | $174,037 | $7,811 | $753,833 | ||||||

15

With respect to the annual cash incentive opportunity, during 2016 we failed to achieve the threshold level of performance of the Adjusted Cash From Facility Operations (“Adjusted CFFO”) per share performance measure, and we achieved 105% of the target level of performance of the resident fee revenue performance measure. Mr. Smith achieved 78% of his individual performance goals, and the other named executive officers shown in the table achieved between 79% and 100% of their individual performance goals. As a result, Mr. Smith earned 35.3% and the other named executive officers shown in the table earned between 34.2% and 40.5% of their target annual cash incentive opportunity.

In addition, shares of performance-based restricted stock granted to the named executive officers in 2013 were eligible to vest on February 27, 2016, dependent on the level of achievement of performance targets based on our three-year compound annual growth rate (“CAGR”) of Cash From Facility Operations (“CFFO”) per share measured based on our CFFO per share in 2015 versus a 2012 base year. We failed to achieve the threshold performance for this measure, and as a result the shares eligible to vest on such date were forfeited (Mr. Smith––48,828 shares; Mr. Richardson––9,837 shares; and Ms. Patchett––5,026).

During 2016, the named executive officers realized the amounts shown in the table above upon the vesting of time-based restricted stock granted in 2012 through 2015 (Mr. Smith––53,829 shares; Mr. Diab—32,588 shares; Ms. Baier—12,027 shares; Mr. Richardson––21,906 shares; and Ms. Patchett––12,173 shares), and performance-based restricted stock. Shares of performance-based restricted stock granted in 2012 were eligible to vest on February 27, 2016 dependent upon the level of achievement of performance targets based on our 2015 return on investment (“ROI”) on all Program Max projects approved in 2012 and completed prior to the end of 2013. Our actual ROI exceeded the target performance level and, therefore, each of the named executive officers vested with respect to 100% of the shares eligible to vest on such date (Mr. Smith––6,158 shares; Mr. Richardson––4,622 shares; and Ms. Patchett––677 shares). In addition, Mr. Smith’s 26,871 shares of performance-based restricted stock granted during 2015 and eligible to vest on February 27, 2016 vested on such date upon the Committee’s determination that the performance goals established by the Committee based on integration initiatives related to our acquisition of Emeritus had been met.

We believe the amount of compensation realized by our named executive officers demonstrates the pay-for-performance nature of our executive compensation program, as our actual level of performance for 2016 resulted in our paying significantly less to our named executive officers than the amounts targeted by the Committee and amounts reported in the Summary Compensation Table for 2016.

2016 Base Salaries

As described above, the Committee approved a base salary increase only for Mr. Richardson for 2016. The 2015 and 2016 base salaries were as follows:

Annual Base Salary | ||||||

2015 | 2016 | Percent Change | ||||

T. Andrew Smith | $950,000 | $950,000 | – | |||

Labeed S. Diab | $585,000 | $585,000 | – | |||

Lucinda M. Baier | $550,000 | $550,000 | – | |||

Bryan D. Richardson | $420,000 | $430,500 | 2.5% | |||

Mary Sue Patchett | $425,000 | $425,000 | – | |||

Mark W. Ohlendorf | $540,000 | $540,000 | – | |||

2016 Annual Cash Incentive Compensation

During 2016, each of the named executive officers participated in the annual cash incentive plan applicable to members of our senior management executive committee. Under this program, each of the named executive officers

16

was eligible to receive cash incentive compensation based on company and individual performance during 2016. The cash incentive opportunities based on company and individual objectives were denominated as separate cash-settled performance awards under our 2014 Omnibus Incentive Plan, which was approved by our stockholders, so that amounts paid based on such objectives to individuals who are subject to the deduction limitation under Section 162(m) of the Internal Revenue Code could qualify as performance-based compensation under Section 162(m). As approved by our stockholders, the aggregate maximum payout to an individual for the 2016 annual cash incentive plan was $2,000,000. The annual cash incentive opportunity and results under the annual cash incentive plan are described below.

2016 Annual Cash Incentive Opportunity

The 2016 target total cash incentive opportunity for each of our named executive officers, calculated as a percentage of 2016 base salary, was as follows:

2016 Target Total Annual Cash Incentive Opportunity | ||||

Percentage of 2016 Base Salary | Amount | |||

T. Andrew Smith | 125% | $1,187,500 | ||

Labeed S. Diab | 100% | $585,000 | ||

Lucinda M. Baier | 100% | $550,000 | ||

Bryan D. Richardson | 100% | $430,500 | ||

Mary Sue Patchett | 100% | $425,000 | ||

Mark W. Ohlendorf | 100% | $540,000 | ||

As a percentage of base salary, the 2016 target total cash incentive opportunity was the same for each of Messrs. Smith, Richardson, and Ohlendorf as the 2015 opportunity. Pursuant to their offer letters in connection with their hiring in the fourth quarter of 2015, each of Mr. Diab’s and Ms. Baier’s target total cash incentive opportunity was set at 100% of base salary. Ms. Patchett’s target total cash incentive opportunity was increased from 80% in 2015 to 100% in 2016 as a percentage of her base salary, reflecting her membership on our senior management executive committee beginning in the fourth quarter of 2015.

The company performance components of the cash incentive opportunity were to be paid following the end of the fiscal year, dependent on our 2016 Adjusted CFFO per share and resident fee revenue. The company performance objectives applicable to our named executive officers were developed by management and approved by the Committee. The Committee determined to use Adjusted CFFO per share (which represents CFFO per share as adjusted for integration, transaction, transaction-related and strategic project costs) as the primary company performance objective for 2016 because the metric was used by management and the Board of Directors in its budgeting process, in the Company’s forward-looking earnings guidance provided to the investment community, and in its evaluation of our financial and operating performance. The Committee determined to use 2016 resident fee revenue (which represents resident fee revenue less entry fee amortization) as an objective for the same reasons and because it provides a top-line measurement of the performance of our senior housing and ancillary services businesses.

The individual performance components of the annual cash incentive opportunity were to be paid following the end of the fiscal year, dependent on the level of achievement of certain objectives established for each individual for 2016. The individual performance objectives for each named executive officer other than Mr. Smith were recommended by Mr. Smith and approved by the Committee. Mr. Smith’s individual performance objectives were approved by the Committee and reviewed with the Board of Directors.

The target annual cash incentive opportunities for the company and individual performance objectives weighted as a percentage of the target total annual cash incentive opportunity were as follows:

17

2016 Target Annual Cash Incentive Weighting by Objective | ||||||

Adjusted CFFO per Share | Resident Fee Revenue | Individual Objectives | ||||

T. Andrew Smith | 60% | 15% | 25% | |||

Other NEOs | 60% | 10% | 30% | |||

Adjusted CFFO per Share. The targeted level of Adjusted CFFO per share for 2016 under the annual cash incentive plan was $2.59, which was consistent with our initial 2016 budget and business plan approved by the Board in January 2016 and significantly higher than our actual 2015 Adjusted CFFO per share results. Payouts as a percentage of target based on our 2016 Adjusted CFFO per share performance are shown below. Payout percentages were to be interpolated between the steps shown below.

2016 Adjusted CFFO per Share Targets and Payout Percentages | ||

Adjusted CFFO per Share Targets | Percentage Payout of Target Opportunity | |

$2.74 or more | 200% | |

$2.72 | 190% | |

$2.70 | 180% | |

$2.68 | 170% | |

$2.66 | 160% | |

$2.64 | 150% | |

$2.63 | 140% | |

$2.62 | 130% | |

$2.61 | 120% | |

$2.60 | 110% | |

$2.59 | 100% | |

$2.49 | 90% | |

$2.48 | 80% | |

$2.46 | 60% | |

$2.44 | 40% | |

$2.42 | 20% | |

Below $2.42 | 0% | |

Resident Fee Revenue. For purposes of the cash incentive plan, resident fee revenue was to be based on our resident fee revenue less entrance fee amortization. The targeted level of resident fee revenue under the cash incentive plan represented year-over-year growth of 1.5% for 2016. The target level of resident fee revenue could be adjusted by the Committee to account for acquisitions and dispositions. Payouts as a percentage of target based on our resident fee revenue are shown below. Payout percentages were to be interpolated between the steps shown below.

2016 Resident Fee Revenue Targets and Payout Percentages | ||

Resident Fee Revenue Targets | Percentage Payout of Target Opportunity | |

$4,365,546,696 or more | 200% | |

18

$4,352,489,228 | 190% | |

$4,339,470,816 | 180% | |

$4,326,491,342 | 170% | |

$4,313,550,690 | 160% | |

$4,300,648,743 | 150% | |

$4,287,785,387 | 140% | |

$4,274,960,506 | 130% | |

$4,262,173,984 | 120% | |

$4,249,425,707 | 110% | |

$4,236,715,560 | 100% | |

$4,226,123,771 | 90% | |

$4,215,558,462 | 80% | |

$4,205,019,566 | 60% | |

$4,194,507,017 | 40% | |

$4,184,020,749 | 20% | |

Below $4,184,020,749 | 0% | |

Individual Objectives. The individual objectives for 2016 were intended to focus executives on key strategic initiatives supporting our business plan, based on their roles in achieving such initiatives. The objectives were designed to be reasonably achievable, but because they would require significant additional efforts on behalf of each of the executives, the cash incentive opportunity linked to individual performance was at risk. The level of achievement of the individual objectives for each named executive officer other than Mr. Smith was to be determined by the Committee following the end of the fiscal year upon the recommendation of Mr. Smith. The level of achievement of Mr. Smith’s individual objectives was to be determined by the Committee and reviewed with the Board of Directors. Achievement of the targeted level of performance would have resulted in 100% of this component of the opportunity of the being paid, which represented the maximum amount payable to an executive with respect to the individual performance objectives of the 2016 cash incentive opportunity.

2016 Individual Objectives | |

Mr. Smith | • Refine analysis of our portfolio and develop and execute on disposition plan by the end of 2016 and fully explore the range of possible alternatives for our ancillary services business to maximize intermediate and long-term shareholder value • Develop, gain the Board’s consensus regarding, and deliver to the Board, a long-term strategic plan • Realize targeted merger-related cost synergies • Solidify our sales performance management system and performance by driving consistent and effective use of our sales playbooks, implementing improved, simplified and consistent sales management reporting and accountability processes, and ensuring full adoption of newly developed lead scoring tool • Strengthen our community teams through the reduction of turnover of key community-level leadership positions • Focus the company on the importance of net promoter score and improve net promoter scores across our consolidated communities |

19

Mr. Diab | • Implement our Brookdale Excellence Standards Tool (BEST) as a management tool, launch an audit format to standardize quality expectations and simplify the day-to-day community management and operations • Refocus our use of community quality system to have one system to document and follow-up on actions plans for BEST, site visits, and other program implementation tools • Solidify our sales performance management system and performance by driving consistent and effective use of our sales playbooks, implementing improved, simplified and consistent sales management reporting and accountability processes, and ensuring full adoption of newly developed lead scoring tool • Develop a plan for a new streamlined organizational structure, implement a quarterly talent management review and develop a mentorship program • Strengthen our community teams through the reduction of turnover of key community-level leadership positions • Focus the company on the importance of net promoter score and improve net promoter scores across our consolidated communities |

Ms. Baier | • Benchmark best practices for finance processes with peer companies and identify and develop plan to capitalize on priorities, and implement plan for budgeted general and administrative expense savings in 2017 • Restructure our finance organization and create pricing team and complete pricing pilot • Create, and obtain Board approval of, our capital allocation strategy and articulate that strategy to the market • Maintain appropriate controls with no significant deficiencies or material weaknesses • Provide support for improving operations, including through driving cost reduction initiatives where appropriate, creating and delivering standardized management reports, and providing models to improve the effectiveness of our sales team |

Mr. Richardson | • Realize targeted merger-related cost synergies • Benchmark capital expenditures with peer companies, reduce 2016 capital expenditures versus budget at a specified amount, and develop a multi-year capital expenditure plan to normalize per-unit capital expenditures • Implement customer relationship management and website project, develop and implement a process to solicit and compile cost savings and best practices from the organization, and develop projects for 2017 to generate cost savings at a specified amount |

• Restructure our information technology group, with success measured based on improvements to customer satisfaction, technology simplification and cost savings, improved security, completion of integration activity and increased allocation of resources to support strategic initiatives and innovation | |

Ms. Patchett | • Implement BEST as a management tool, launch an audit format to standardize quality expectations and simplify the day-to-day community management and operations • Refocus our use of community quality system to have one system to document and follow-up on actions plans for BEST, site visits, and other program implementation tools • Strengthen our community teams through the reduction of turnover of key community-level leadership positions • Focus the company on the importance of net promoter score and improve net promoter scores across our consolidated communities • Re-establish brand recognition for our Clare Bridge programming and ensure implementation of Clare Bridge standards in all programs, measured by the increase in average occupancy for memory care units • Restructure operations oversight in select communities |

20

Mr. Ohlendorf | • Develop, gain the Board’s consensus regarding, and deliver to the Board, a long-term strategic plan |

2016 Annual Cash Incentive Results

The results and payouts under the company and individual objectives for the 2016 annual cash incentive plan are described below. The total payment to each of our named executive officers under the 2016 annual cash incentive plan was as follows:

Actual 2016 Total Payment under 2016 Annual Cash Incentive Plan | ||||||

Actual Payment | Target Opportunity | Actual Payment as a Percentage of Target Opportunity | ||||

T. Andrew Smith | $418,594 | $1,187,500 | 35.3% | |||

Labeed S. Diab | $219,375 | $585,000 | 37.5% | |||

Lucinda M. Baier | $222,750 | $550,000 | 40.5% | |||

Bryan D. Richardson | $159,500 | $430,500 | 37.0% | |||

Mary Sue Patchett | $145,350 | $425,000 | 34.2% | |||

Mark W. Ohlendorf | $47,206 | $116,557 | 40.5% | |||

As a result of his termination without cause during 2016, Mr. Ohlendorf was eligible to receive payment under the 2016 annual cash incentive plan (to the extent earned), pro-rated based on the number of days he was employed. The amounts of Mr. Ohlendorf's actual payment and target opportunity reflect his service through the effective date of his termination, or March 18, 2016.

Adjusted CFFO per Share. We achieved Adjusted CFFO per share of $2.33 for 2016, which was below the threshold performance of $2.42 per share. Accordingly, the Committee determined that no portion of the opportunity based on Adjusted CFFO per share performance would be paid, as shown below. Mr. Ohlendorf's target amount reflects his service through March 18, 2016.

Actual CFFO per Share Objective Payment | ||||||

Target Amount | Achievement | Payment | ||||

T. Andrew Smith | $712,500 | 0% | – | |||

Labeed S. Diab | $351,000 | 0% | – | |||

Lucinda M. Baier | $330,000 | 0% | – | |||

Bryan D. Richardson | $258,300 | 0% | – | |||

Mary Sue Patchett | $255,000 | 0% | – | |||

Mark W. Ohlendorf | $69,934 | 0% | – | |||

Adjusted CFFO per share is a financial measure that is not calculated in accordance with generally accepted accounting principles, or GAAP, and should not be considered in isolation from, as superior to or as a substitute for net income (loss), income (loss) from operations, cash flows provided by or used in operations, or other financial measures determined in accordance with GAAP. During 2016, we ceased presenting Adjusted CFFO per share in our earnings releases, documents filed with the SEC and other investor relations materials, and we ceased to include within our definition of CFFO our proportionate share of CFFO of our unconsolidated ventures. The following reconciliation shows how we calculated Adjusted CFFO per share for 2016, and it reflects the aggregate of our reported 2016 Adjusted CFFO and our proportionate share of CFFO of unconsolidated ventures, divided by the weighted average number of shares outstanding.

21

Year Ended | ||

(in thousands, except per share data) | December 31, 2016 | |

Net cash provided by operating activities | $ | 365,732 |

Changes in operating assets and liabilities | 76,252 | |

Proceeds from refundable entrance fees | 3,083 | |

Refunds of entrance fees | (3,984) | |

Lease financing debt amortization with fair market value or no purchase options | (57,502) | |

Loss on facility lease termination | 11,113 | |

Distribution from unconsolidated ventures from cumulative share of net earnings | (23,544) | |

Recurring capital expenditures, net | (58,583) | |

Integration, transaction, transaction-related and strategic project costs | 62,131 | |

Adjusted CFFO | $ | 374,698 |

Brookdale's proportionate share of CFFO of unconsolidated ventures | 58,000 | |

Adjusted CFFO | $ | 432,698 |

Weighted average shares used in computing basic net income (loss) per share | 185,653 | |

Adjusted CFFO per share | $ | 2.33 |

Resident Fee Revenue. We achieved resident fee revenue, excluding entrance fee amortization, of $4,164 million for 2016, which was below the threshold level of performance for this component of the annual cash incentive plan. However, due to the impact of dispositions and contributions of communities to unconsolidated ventures of 85 communities completed prior to the end of fiscal 2016, including those associated with our portfolio optimization initiative, the Committee exercised its discretion under our 2014 Omnibus Incentive Plan to equitably adjust the targets to exclude $197.3 million of 2015 resident fee revenue attributable to such communities. The Committee further equitably adjusted the payout based on our 2016 resident fee revenue to reflect our actual 2016 results excluding $124.1 million of 2016 resident fee revenue attributable to such communities. As a result, our 2015 resident fee revenue as adjusted for dispositions (and excluding entrance fee amortization) was $3,977 million, and the adjusted target level of 2016 resident fee revenue was $4,036 million, which represented 1.5% growth over the 2015 adjusted amount, and the other performance targets were likewise adjusted. For 2016 we achieved resident fee revenue as adjusted for dispositions (and excluding entrance fee amortization) of $4,042 million, representing year-over-year growth of 1.65%. This level of performance corresponded to the 105% level of performance compared to the adjusted targets. Accordingly, the Committee determined to pay 105% of the target opportunity based on such performance, as shown below. The target and payment amounts for Mr. Ohlendorf reflect his service through March 18, 2016.

Actual Resident Fee Revenue Objective Payment | ||||||

Target Amount | Achievement | Payment | ||||

T. Andrew Smith | $178,125 | 105% | $187,031 | |||

Labeed S. Diab | $58,500 | 105% | $61,425 | |||

Lucinda M. Baier | $55,000 | 105% | $57,750 | |||

Bryan D. Richardson | $43,050 | 105% | $45,203 | |||

Mary Sue Patchett | $42,500 | 105% | $44,625 | |||

Mark W. Ohlendorf | $11,656 | 105% | $12,239 | |||

Individual Objectives. Following the conclusion of the 2016 fiscal year, the Committee determined that Mr. Smith had achieved 78% of his individual performance objectives. In addition, based upon Mr. Smith’s

22

recommendation and the Committee’s own evaluation of each named executive officer’s performance against the individual performance objectives that had been previously established, the Committee determined the level of achievement of the other named executive officers. The level of achievement of the named executive officers’ individual performance objectives and associated payouts are shown below. The target and payment amounts for Mr. Ohlendorf reflect his service through March 18, 2016.

Actual Individual Objectives Bonus Payment | ||||||

Target Amount | Achievement | Payment | ||||

T. Andrew Smith | $296,875 | 78.0% | $231,563 | |||

Labeed S. Diab | $175,500 | 90.0% | $157,950 | |||

Lucinda M. Baier | $165,000 | 100.0% | $165,000 | |||

Bryan D. Richardson | $129,150 | 88.5% | $114,298 | |||

Mary Sue Patchett | $127,500 | 79.0% | $100,725 | |||

Mark W. Ohlendorf | $34,967 | 100.0% | $34,967 | |||

2016 Long-Term Incentive Awards

The grant date fair value (calculated in accordance with ASC 718) of the long-term incentive awards granted to our named executive officers in 2016 were as follows (other than Mr. Ohlendorf, who did not receive long-term incentive awards due to the timing of his termination without cause effective March 18, 2016). The number of shares of restricted stock granted to each named executive officer was based on $14.49, the closing price of our common stock on February 26, 2016, the date of grant.

2016 Long-Term Incentive Awards | ||||||

Annual Grant of Time-Based Restricted Stock | Annual Grant of Performance-Based Restricted Stock | Total | ||||

T. Andrew Smith | $2,612,503 | $2,612,503 | $5,225,007 | |||

Labeed S. Diab | $750,002 | $750,002 | $1,500,005 | |||

Lucinda M. Baier | $750,002 | $750,002 | $1,500,005 | |||

Bryan D. Richardson | $440,003 | $440,003 | $880,007 | |||

Mary Sue Patchett | $352,513 | $352,498 | $705,011 | |||

The restricted share agreements associated with such long-term incentive awards contain non-competition, non-solicitation, non-disparagement and confidentiality covenants. With respect to any termination of a named executive officer’s employment, treatment of the restricted stock awards will be as provided in the applicable award agreement governing such awards, as described under “Potential Payments Upon Termination or Change in Control.” Each of the named executive officers will also be entitled to receive dividends on unvested shares, to the extent that any such dividends are declared in the future.

Annual Awards of Time-Based Restricted Stock. The annual awards of time-based restricted stock vested or will vest ratably in four annual installments beginning on February 27, 2017, subject to continued employment.

Annual Awards of Performance-Based Restricted Stock. Seventy-five percent (75%) of the annual awards of performance-based restricted stock are scheduled to vest on February 27, 2019 and twenty-five percent (25%) are scheduled to vest on February 27, 2020, in each case subject to continued employment and dependent upon the level of achievement of performance goals established for each tranche by the Committee. Any performance-based shares which do not vest in either tranche will be forfeited. Management viewed the performance targets to be challenging.

23