Attached files

| file | filename |

|---|---|

| EX-31.4 - EX-31.4 - ALTABA INC. | d367908dex314.htm |

| EX-31.3 - EX-31.3 - ALTABA INC. | d367908dex313.htm |

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K/A

(Amendment No. 1)

| ☑ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2016

OR

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number 000-28018

Yahoo! Inc.

(Exact name of Registrant as specified in its charter)

| Delaware | 77-0398689 | |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

701 First Avenue

Sunnyvale, California 94089

(Address of principal executive offices, including zip code)

Registrant’s telephone number, including area code: (408) 349-3300

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class |

Name of Each Exchange on Which Registered | |

| Common stock, $.001 par value | The NASDAQ Stock Market LLC (NASDAQ Global Select Market) |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☑ No ☐

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☑

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☑ No ☐

Indicate by check mark whether the Registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☑ No ☐

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of Registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☐

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ☑ |

Accelerated filer ☐ | |

|

Non-accelerated filer ☐ (Do not check if a smaller reporting company) |

Smaller reporting company ☐ | |

| Emerging growth company ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the Registrant is a shell company (as defined by Rule 12b-2 of the Exchange Act). Yes ☐ No ☑

As of June 30, 2016, the last business day of the Registrant’s most recently completed second fiscal quarter, the aggregate market value of voting stock held by non-affiliates of the Registrant, based upon the closing sales price for the Registrant’s common stock, as reported on the NASDAQ Global Select Market was $32,522,108,074. Shares of common stock held by each officer and director and by each person who owns 10 percent or more of the outstanding common stock have been excluded in that such persons may be deemed to be affiliates. This determination of affiliate status is not necessarily a conclusive determination for any other purpose.

The number of shares of the Registrant’s common stock outstanding as of April 20, 2017 was 958,131,387.

DOCUMENTS INCORPORATED BY REFERENCE

The following documents (or parts thereof) are incorporated by reference into the following parts of this Form 10-K: None

Table of Contents

EXPLANATORY NOTE

This Amendment No. 1 to Form 10-K (this “Amendment”) amends the Annual Report on Form 10-K for the fiscal year ended December 31, 2016 (the “2016 Form 10-K”) originally filed on March 1, 2017 (the “Original Filing”) by Yahoo! Inc., a Delaware corporation (“Yahoo,” the “Company,” “we,” or “us”). We are filing this Amendment to present the information required by Part III of Form 10-K as we will not file our definitive annual meeting proxy statement within 120 days of the end of our fiscal year ended December 31, 2016. Except as described above, no other changes have been made to the Original Filing. The Original Filing continues to speak as of the date of the Original Filing, and we have not updated the disclosures contained therein to reflect any events which occurred at a date subsequent to the filing of the Original Filing.

This Amendment contains forward-looking statements relating to our strategic and operational plans. Actual results may differ materially from those described in our forward-looking statements as a result of risks and uncertainties, including the important factors set forth under the captions “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in the Original Filing, which is available on the website of the U.S. Securities and Exchange Commission (“SEC”) at www.sec.gov.

In Yahoo’s filings with the SEC, information is sometimes “incorporated by reference.” This means that we refer you to information previously filed with the SEC that should be considered as part of the particular filing. As provided under SEC regulations, the Compensation Committee Report contained in this Amendment specifically is not incorporated by reference into any other filings with the SEC and shall not be deemed to be “filed” with the SEC.

Yahoo!, the Yahoo family of marks, BrightRoll, Altaba, and the associated logos are trademarks and/or registered trademarks of Yahoo! Inc. Other names are trademarks and/or registered trademarks of their respective owners.

2

Table of Contents

PART III

Item 10. Directors, Executive Officers, and Corporate Governance

Current Management

Executive officers are elected by and serve at the discretion of the Board of Directors (the “Board”) of Yahoo. The names of our current executive officers, their ages, and their positions with the Company are set forth in the table below, followed by certain other information about them:

| Name | Age | Position | ||||

| Marissa A. Mayer |

41 | Chief Executive Officer, President, and Director | ||||

| Arthur Chong |

63 | General Counsel and Secretary | ||||

| David Filo |

51 | Co-Founder, Chief Yahoo, and Director | ||||

| Ken Goldman |

67 | Chief Financial Officer | ||||

| Lisa Utzschneider |

48 | Chief Revenue Officer | ||||

Ms. Mayer has served as our Chief Executive Officer, President and a member of our Board since July 2012. Prior to joining Yahoo, Ms. Mayer served as Vice President of Local, Maps, and Location Services at Google Inc., an Internet technology company, and was responsible for the company’s suite of local and geographical products including Google Maps, Google Earth, Zagat, Street View, and local search, for desktop and mobile. Prior to that position, Ms. Mayer served as Google’s Vice President, Search Products and User Experience, and in a variety of other capacities after joining Google in 1999. Ms. Mayer is a member of the board of directors of Walmart, and a member of the boards of trustees of the San Francisco Museum of Modern Art and the San Francisco Ballet.

Mr. Chong became our General Counsel and Secretary in March 2017. He served as an outside legal advisor to Yahoo from October 2016 to March 2017. From June 2016 to October 2016, Mr. Chong served as a special advisor to Sheppard, Mullin, Richter & Hampton LLP, a law firm. From October 2008 to February 2016, Mr. Chong served as Executive Vice President, General Counsel, and Secretary at Broadcom Corporation, a global supplier of semiconductor devices, and was responsible for the legal, corporate secretary, governance, litigation, intellectual property, compliance, and government relations activities for the company. Prior to that position, Mr. Chong served as Executive Vice President and Chief Legal Officer at Safeco Corporation, a property and casualty insurer, from November 2005 to October 2008.

Mr. Filo, a founder of Yahoo and Chief Yahoo, has served as an officer of Yahoo since March 1995 and as a member of our Board since June 2014. Mr. Filo also served as a director of Yahoo from its founding through February 1996. Mr. Filo is involved in guiding Yahoo’s vision, is involved in many key aspects of the business at a strategic and operational level, and is a stalwart of the Company’s employee culture and morale. Mr. Filo co-developed Yahoo in 1994 while working towards his Ph.D. in electrical engineering at Stanford University, and co-founded Yahoo in 1995.

Mr. Goldman became our Chief Financial Officer in October 2012. Prior to joining the Company, Mr. Goldman served as Chief Financial Officer of Fortinet Inc., a provider of unified threat management solutions, from September 2007 to October 2012. From November 2006 to August 2007, Mr. Goldman served as Executive Vice President and Chief Financial Officer of Dexterra, Inc., a provider of mobile enterprise software. From August 2000 until March 2006, Mr. Goldman served as Senior Vice President, Finance and Administration, and Chief Financial Officer of Siebel Systems, Inc., a supplier of customer software solutions and services which was acquired by Oracle Corporation in January 2006. Mr. Goldman serves on the boards of directors of GoPro, Inc., a producer of

3

Table of Contents

mountable and wearable cameras and accessories, NXP Semiconductors N.V., a semiconductor company, TriNet Group Inc., a provider of a comprehensive human resources solution for small to medium-sized businesses, and Yahoo Japan Corporation. Mr. Goldman is also a member of the Standing Advisory Group of the Public Company Accounting Oversight Board.

Ms. Utzschneider has served as our Chief Revenue Officer since July 2015. In this role, she leads Yahoo’s sales organization globally to serve the needs of advertisers worldwide. Ms. Utzschneider also served as our Senior Vice President, Sales, Americas from November 2014 to July 2015, and was responsible for Yahoo’s advertising business across the Americas. Ms. Utzschneider served as Vice President of Global Advertising Sales at Amazon.com, Inc. from September 2008 to October 2014, and was responsible for Amazon.com’s display advertising efforts. Prior to Amazon.com, Ms. Utzschneider spent 10 years at Microsoft Corporation leading strategic and organizational advertising initiatives in product development, sales, and online industry standards. Her most recent position at Microsoft was General Manager of the national sales and service teams.

Management of the Company Following the Closing of the Transaction with Verizon

In connection with the proposed sale of our operating business (the “Sale Transaction”) to Verizon Communications Inc. (“Verizon”), our Board has determined that, upon the closing of the Sale Transaction (the “Closing”), the following individuals will serve (or in the case of Mr. Chong continue to serve) in the following capacities for Altaba Inc. (the name of the Company following the Closing):

| Name | Age | Position | ||||

| Thomas J. McInerney |

52 | Chief Executive Officer and Director | ||||

| Arthur Chong |

63 | General Counsel and Secretary | ||||

| Alexi A. Wellman |

46 | Chief Financial and Accounting Officer | ||||

| DeAnn Fairfield Work |

47 | Chief Compliance Officer | ||||

Mr. McInerney has served as a member of Yahoo’s Board since April 2012. Mr. McInerney served as Executive Vice President and Chief Financial Officer of IAC/InterActiveCorp (“IAC”), an Internet company, from January 2005 to March 2012. From January 2003 through December 2005, he also served as Chief Executive Officer of the retailing division of IAC (which included HSN, Inc. and Cornerstone Brands). From May 1999 to January 2003, Mr. McInerney served as Executive Vice President and Chief Financial Officer of Ticketmaster, formerly Ticketmaster Online-CitySearch, Inc., a live entertainment ticketing and marketing company. From 1986 to 1988 and from 1990 to 1999, Mr. McInerney worked at Morgan Stanley, a global financial services firm, most recently as a Principal. Mr. McInerney serves on the boards of directors of HSN, Inc., a television and online retailer, Interval Leisure Group, Inc., a provider of membership and leisure services to the vacation industry, and Match Group, Inc., an online dating resource.

Mr. Chong’s biography is set forth above, under the heading “Current Management.”

Ms. Wellman has served as Vice President, Global Controller of Yahoo since October 2015. From November 2013 to October 2015, she served as Vice President, Finance of Yahoo. From December 2011 to June 2013, Ms. Wellman served as Chief Financial Officer of Nebraska Book Company, Inc., which owned and operated college bookstores. From October 2004 to December 2011, Ms. Wellman served as a Partner at KPMG LLP, an audit, tax and advisory firm.

Ms. Work has served as an outside legal advisor to Yahoo since December 2016. From December 2012 to February 2016, Ms. Work served as Senior Vice President, Senior Deputy General Counsel and Chief Compliance Officer of Broadcom Corporation. From April 2009 to November 2012, Ms. Work served as Vice President and Deputy General Counsel of Broadcom Corporation.

4

Table of Contents

The Board consists of eleven directors. The names of our directors, their ages, and their positions with the Company are set forth in the table below, followed by certain other information about them:

| Name | Age | Position | ||||

| Tor R. Braham |

59 | Director | ||||

| Eric K. Brandt |

54 | Chairman of the Board | ||||

| David Filo* |

51 | Co-Founder, Chief Yahoo, and Director | ||||

| Catherine J. Friedman |

56 | Director | ||||

| Eddy W. Hartenstein* |

66 | Director | ||||

| Richard S. Hill* |

65 | Director | ||||

| Marissa A. Mayer* |

41 | Chief Executive Officer, President, and Director | ||||

| Thomas J. McInerney |

52 | Director | ||||

| Jane E. Shaw, Ph.D.* |

78 | Director | ||||

| Jeffrey C. Smith* |

44 | Director | ||||

| Maynard G. Webb, Jr.* |

61 | Chairman Emeritus of the Board | ||||

| * | Each of David Filo, Eddy W. Hartenstein, Richard S. Hill, Marissa A. Mayer, Jane E. Shaw, Jeffrey C. Smith, and Maynard G. Webb, Jr. has indicated that he or she intends to resign from the Board effective upon the Closing of the Sale Transaction. At that time, the size of the Board will be reduced to five members. We expect that, immediately following the Closing, our continuing directors will be Tor R. Braham, Eric K. Brandt, Catherine J. Friedman, and Thomas J. McInerney. We have initiated a search for a candidate to serve as the fifth member of the Board immediately following the Closing. |

On April 26, 2016, we entered into a settlement agreement (the “Settlement Agreement”) with Starboard LP and certain of its affiliates (“Starboard”) to settle the proxy contest pertaining to the election of directors at the Company’s 2016 annual meeting of shareholders. Pursuant to the Settlement Agreement, our Board appointed Messrs. Braham, Hartenstein, Hill, and Smith (the “Starboard Designees”) to the Board effective April 26, 2016, and we agreed to nominate all of the individuals listed in the table above (including the Starboard Designees) for election to the Board at the 2016 annual meeting. Each of these persons was elected to the Board by our shareholders at the 2016 annual meeting. The Settlement Agreement also included certain voting commitments and normal and customary standstill agreements by Starboard, which expired in February 2017.

Biographical Descriptions

Set forth below is a brief biographical description of each of our directors. The primary experience, qualifications, attributes, and skills of each of our directors that led to the conclusion of the Nominating Committee and the Board that such person should serve as a member of the Board are also described in the following paragraphs.

Mr. Braham has served as a member of our Board since April 2016. Mr. Braham served as Managing Director and Global Head of Technology Mergers and Acquisitions for Deutsche Bank Securities Inc., an investment bank, from 2004 until November 2012. From 2000 to 2004, he served as Managing Director and Co-Head of West Coast U.S. Technology, Mergers and Acquisitions for Credit Suisse First Boston, an investment bank. Prior to that role, Mr. Braham served as an investment banker with Warburg Dillon Read LLC, and as an attorney at Wilson Sonsini Goodrich & Rosati. Mr. Braham currently serves as a member of the board of directors of Viavi Solutions Inc., a network and service enablement and optical coatings company. He previously served on the boards of directors of NetApp, Inc., a computer storage and data management company, from September 2013 to March 2016, and Sigma Designs, Inc., an integrated circuit provider for the home entertainment market, from June 2014 to August 2016. Mr. Braham was selected as a director pursuant to the Settlement Agreement due to his mergers and acquisitions experience and knowledge of the technology industry gained through his experience as an investment banker and legal advisor to technology companies.

5

Table of Contents

Mr. Brandt was elected Chairman of the Board in January 2017 and has served as a member of our Board since March 2016. Mr. Brandt served as the Executive Vice President and Chief Financial Officer of Broadcom Corporation (“Broadcom”), a global supplier of semiconductor devices, from February 2010 until February 2016, and he served as Broadcom’s Senior Vice President and Chief Financial Officer from March 2007 until February 2010. From September 2005 until March 2007, Mr. Brandt served as President and Chief Executive Officer of Avanir Pharmaceuticals, Inc. Beginning in 1999, he held various positions at Allergan, Inc., a global specialty pharmaceutical company, including Executive Vice President of Finance and Technical Operations and Chief Financial Officer. Prior to joining Allergan, Mr. Brandt spent ten years with The Boston Consulting Group, a privately-held global business consulting firm, most recently serving as Vice President and Partner. Mr. Brandt is a director of Lam Research Corporation, a wafer fabrication equipment company, and Dentsply Sirona Inc., a dental products company. Mr. Brandt was selected as a director due to his financial expertise, including as a chief financial officer of a public company, his mergers and acquisitions experience, and his public company board experience.

Mr. Filo’s biography is set forth above, under the heading “Current Management.” Mr. Filo was selected as a director due to his extensive technical and industry expertise and his unique perspective on the Company’s strategic and technical needs.

Ms. Friedman has served as a member of our Board since March 2016. Ms. Friedman has been an independent financial consultant serving public and private companies in the life sciences industry since 2006. Prior to that, Ms. Friedman held numerous positions over a 23-year investment banking career with Morgan Stanley, including Managing Director from 1997 to 2006 and Head of West Coast Healthcare and Co-Head of the Biotechnology Practice from 1993 to 2006. Ms. Friedman is a member of the boards of directors of Innoviva, Inc. (formerly Theravance, Inc.), a royalty management company specializing in respiratory assets, and Radius Health, Inc., a biopharmaceutical company. She previously served as a member of the boards of directors of EnteroMedics Inc., a medical device company, from May 2007 to May 2016, XenoPort, Inc., a biopharmaceutical company, from September 2007 to July 2016, and GSV Capital Corp., a publicly traded business development company, from March 2013 to March 2017. Ms. Friedman was selected as a director due to her financial and transactional experience, her leadership experience, and her public company board experience.

Mr. Hartenstein has served as a member of our Board since April 2016. Mr. Hartenstein served as the publisher and Chief Executive Officer of the Los Angeles Times Media Group, a print and online media company, from August 2008 to August 2014. He also served in a variety of positions at its parent entity, the Tribune Company, including as co-President, from late 2010 to May 2011, as President and Chief Executive Officer from May 2011 to January 2013, and as Chairman of the board from January 2013 to August 2014. He then served as Chairman of the board of Tribune Publishing Company (subsequently renamed tronc, Inc.) from August 2014, when it was spun off from the Tribune Company, until early 2016 and continues to serve as a director. Previously, Mr. Hartenstein served in a variety of positions at DIRECTV Inc., a provider of digital television entertainment, including as President from its inception in 1990 through 2001, as Chairman and Chief Executive Officer from late 2001 through 2004, and as Vice Chairman of the board of The DIRECTV Group Inc. from late 2003 through 2004. Mr. Hartenstein currently serves on the boards of directors of SIRIUS XM Holdings Inc., a satellite radio broadcaster (where he is the lead independent director); Broadcom Limited, a semiconductor company; and TiVo Corporation (formerly Rovi Corporation), a digital entertainment technology provider. He previously served on the board of directors of SanDisk Corp., a manufacturer of flash memory, from November 2005 to May 2016. Mr. Hartenstein was selected as a director pursuant to the Settlement Agreement due to his extensive senior management experience, including successfully creating and entering new markets, as well as his public company board experience.

Mr. Hill has served as a member of our Board since April 2016. Mr. Hill was Chief Executive Officer and Chairman of the board of directors of Novellus Systems Inc., a maker of integrated circuit fabrication equipment, from 1996 until its acquisition by Lam Research Corporation in June 2012. Before joining Novellus in 1993, he spent 12 years with Tektronix, Inc., an electronics company. Currently, Mr. Hill is Chairman of the board of Tessera Technologies, Inc., which develops technology for electronics applications (where he also served as interim Chief Executive Officer in April and May of 2013), and Chairman of the board of Marvell Technology Group Ltd., a fabless semiconductor provider. In addition, Mr. Hill currently serves as a member of the boards of directors of Arrow Electronics, Inc., an electronic parts supplier; Cabot Microelectronics Corporation, a supplier of polishing slurries and pads for integrated circuit manufacturing; and Autodesk, Inc., a computer-aided design software provider. He previously served as a member of the boards of directors of Planar Systems, Inc., a digital signage technology

6

Table of Contents

company, from June 2013 until November 2015; LSI Corporation, a provider of semiconductors and software for data networks, from 2007 until May 2014; and SemiLEDs Corporation, a LED chip manufacturer, from September 2010 to February 2012. Mr. Hill was selected as a director pursuant to the Settlement Agreement due to his extensive experience in senior executive positions, including his nearly 20 years leading Novellus, coupled with his public company board experience.

Ms. Mayer’s biography is set forth above, under the heading “Current Management.” Ms. Mayer was selected as a director due to her position as the Company’s Chief Executive Officer and President, which gives her in-depth knowledge of the Company’s operations, strategy, financial condition, and competitive position, as well as her extensive experience in Internet technology, design, and product execution.

Mr. McInerney’s biography is set forth above, under the heading “Management of the Company Following the Closing of the Transaction with Verizon.” Mr. McInerney was selected as a director due to his corporate leadership experience at a complex Internet company, his expertise in finance, restructuring, mergers and acquisitions and operations and his public company board and committee experience.

Dr. Shaw has served as a member of our Board since June 2014. Dr. Shaw served as a member of the board of directors of McKesson Corporation from 1992 to 2014. She also served on the board of directors of Intel Corporation from 1993 to 2012, including as its non-executive Chairman of the board from 2009 to 2012. From 1998 to 2005, Dr. Shaw served as the Chairman and Chief Executive Officer of Aerogen, Inc., a company specializing in the development of products for improving respiratory therapy. Dr. Shaw joined the ALZA Corporation, a specialty pharmaceutical company that focused on novel ways of delivering medications to the body, as a research scientist in 1970; she remained with the company for 24 years, serving as President and Chief Operating Officer from 1987 to 1994. She is also a member of the boards of directors of several private and non-profit entities. Dr. Shaw was selected as a director due to her public company board experience, executive leadership and management experience and strong financial background.

Mr. Smith has served as a member of our Board since April 2016. Mr. Smith is a Managing Member, Chief Executive Officer, and Chief Investment Officer of Starboard Value LP, an investment advisory firm he co-founded in March 2011. Previously, Mr. Smith was a Partner and Managing Director of Ramius LLC, an asset management company. Prior to joining Ramius in January 1998, he served as Vice President of Strategic Development and as a member of the board of directors of The Fresh Juice Company, Inc., a producer of non-carbonated beverages. Mr. Smith began his career in the mergers and acquisitions department at Société Générale, a multinational banking and financial services company. Mr. Smith currently serves as Chairman of the board of directors of Advance Auto Parts, Inc., an automotive aftermarket parts provider, and as a member of the board of directors of Perrigo Company plc, a supplier of over-the-counter consumer goods and pharmaceutical products. Previously, he served as Chairman of the board of directors of Darden Restaurants, Inc., a full service restaurant chain, from October 2014 to April 2016. Mr. Smith also previously served as a member of the boards of directors of Quantum Corporation, a global expert in data protection and big data management, from May 2013 to May 2015; Office Depot, Inc., an office supply company, from August 2013 to September 2014; Regis Corporation, which owns and franchises hair salons, from October 2011 until October 2013; Surmodics, Inc., a provider of drug delivery and surface modification technologies to the healthcare industry, from January 2011 to August 2012; and Zoran Corporation, a supplier of integrated circuits for digital imaging devices, from March 2011 until its merger with CSR plc in August 2011. Mr. Smith was selected as a director pursuant to the Settlement Agreement due to his extensive public board experience and experience in a variety of industries together with his management experience in a variety of roles.

Mr. Webb currently serves as Chairman Emeritus of the Board. He has been a member of our Board since February 2012 and served as interim Chairman of the Board from April 2013 to August 2013 and as Chairman of the Board from August 2013 to January 2017. Mr. Webb founded Webb Investment Network, a seed-stage venture capital firm, in June 2010 and serves as its sole Limited Partner. Mr. Webb served as Chairman of the board of LiveOps, Inc., a provider of contact center solutions using the cloud, from December 2008 to December 2013 and served as its Chief Executive Officer from December 2006 to July 2011. He is also a founder and director of Everwise, a cloud-based mentoring platform. Mr. Webb currently serves as a director of salesforce.com, inc., a provider of enterprise cloud computing and social enterprise solutions, and Visa Inc., a global payments technology company. Mr. Webb previously served as a director of AdMob, Inc., a mobile advertising company acquired by Google Inc. in 2009. Mr. Webb was selected as a director due to his extensive senior leadership experience in management, engineering and technical operations, his mobile advertising experience and his deep knowledge of technology company operating environments.

7

Table of Contents

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), requires the Company’s directors, executive officers and, subject to certain exceptions, persons who beneficially own more than 10 percent of the Company’s common stock (collectively, “Reporting Persons”) to file with the SEC initial reports of ownership on Form 3 and changes in ownership of the Company’s common stock on Forms 4 or 5. Reporting Persons are required by SEC regulations to furnish the Company with copies of all Section 16(a) reports they file. Based solely on its review of the copies of such reports received or written representations from certain Reporting Persons that no other reports were required, the Company believes that during its fiscal year ended December 31, 2016 all filing requirements applicable to the Reporting Persons were timely met, with two exceptions: (1) a Form 4 for Ms. Utzschneider was filed one day late reporting automatic share-based tax withholding from an October 2016 RSU (as defined below) vesting event; and (2) a Form 4 for Mr. Hill was filed several months late reporting a May 2016 open-market sale of 38 shares that had been held indirectly in a managed account for the benefit of Mr. Hill’s son.

The Board has a code of ethics, which is available on the Corporate Governance section of the Company’s Investor Relations website at investor.yahoo.net/documents.cfm.

The Company’s code of ethics applies to the Company’s directors and employees, including our principal executive officer, principal financial officer, principal accounting officer, and controller, and to contractors of the Company. The code of ethics sets forth the fundamental principles and key policies and procedures that govern the conduct of the Company’s business. We intend to disclose any amendment to, or waiver from, the code of ethics for our directors and executive officers, including our principal executive officer, principal financial officer, principal accounting officer, and controller or persons performing similar functions, as may be required by applicable rules of the SEC and NASDAQ Stock Market LLC (“Nasdaq”) by posting such information on our website, at the address and location specified above.

The Company has a separately-designated audit committee established in accordance with Section 3(a)(58)(A) and Section 10A(m) of the Exchange Act. This Audit and Finance Committee (The “Audit Committee”) consists of Mr. Brandt (Chairman), Mr. Braham, and Mr. Smith. The Board has determined that each member of the Audit Committee is an independent director within the meaning of applicable SEC rules and the Nasdaq listing standards. The Board has also determined that Mr. Brandt qualifies as an audit committee financial expert within the meaning of SEC rules and satisfies the financial sophistication requirements of the Nasdaq listing standards.

8

Table of Contents

Item 11. Executive Compensation

Non-Employee Director Compensation Program

We have a non-employee director compensation program currently in place, and we have approved changes that will take effect upon the Closing of the Sale Transaction.

Current Program

Under our current non-employee director compensation program, we pay our non-employee directors annual cash retainer fees and grant them restricted stock units (“RSUs”), as described below.

Cash Compensation. Our non-employee director compensation program includes a basic annual cash retainer for serving as a director, plus additional retainers for members who take on additional roles. All of the cash retainers are paid quarterly in arrears (and are pro-rated for partial periods of service).

| Annualized Cash Retainers for Board Service | ||||||||||||||||||||||||||||||

| Non- Employee |

+ Non- Executive |

+ Chair of the Audit Committee |

+ Chair of the |

+ Chair of the Nominating Committee |

+ Member of the Audit Committee* |

+ Member of the |

+ Member of the |

|||||||||||||||||||||||

| $ | 60,000 | $ | 200,000 | $ | 35,000 | $ | 35,000 | $ | 15,000 | $ | 10,000 | $ | 10,000 | $ | 0 | |||||||||||||||

| * | For committee members other than the chair of such committee. |

Equity Awards in Lieu of Cash Fees. Under the terms of the Yahoo! Inc. Directors’ Stock Plan (the “Directors’ Plan”), each non-employee director may elect to have his or her fees that would otherwise be paid in cash converted into RSUs. Elections need to be made in advance (generally by December 31 of the prior year, or prior to joining the Board in the case of newly-elected or appointed directors) and awards are immediately vested upon grant. Each director who elects RSUs in lieu of cash fees is granted a number of RSUs each quarter equal to the amount of his or her quarterly fee divided by the fair market value (i.e., the closing price) of a share of the Company’s common stock on the grant date, which is generally the last day of the calendar quarter for which the applicable fee would otherwise have been paid.

Annual RSU Award. Our non-employee director compensation program also includes an annual award of RSUs, generally granted on the date of our annual meeting to the directors elected (or re-elected) at the meeting. Under the terms of the Directors’ Plan, the number of annual RSUs is determined by dividing $240,000 by the closing price of the Company’s common stock on the date of grant.

New directors appointed or elected to the Board other than in connection with an annual meeting will receive an initial award of RSUs upon their appointment or election, with the number of RSUs determined as described above and pro-rated based on the portion of the year that has passed since the last annual meeting.

These RSUs granted on the date of the annual meeting are scheduled to vest ratably, on a quarterly basis in arrears, with the final installment scheduled to vest on the first anniversary of the date of grant (or, if earlier, the day before the next annual meeting of shareholders). Vesting is subject to continued service on the Board through the vesting date. The vesting schedule for a pro-rated award to a new director will coincide with the remaining vesting dates of the awards granted on the date of the prior annual meeting.

Under the Directors’ Plan, all vested RSUs—including annual awards and RSUs in lieu of cash fees—are generally paid in an equivalent number of shares of common stock on the earlier of the date the non-employee director’s service terminates and the first anniversary of grant, subject to any valid election by the non-employee director to defer the payment date. Subject to the aggregate share limit set forth in the Directors’ Plan, the Board

9

Table of Contents

may from time to time prospectively change the relative mixture of stock options and RSUs for the initial and annual award grants to non-employee directors and the methodology for determining the number of shares of the Company’s common stock subject to these awards without shareholder approval.

The Directors’ Plan provides certain benefits that are triggered by certain corporate transactions or death or total disability. In the event of the dissolution or liquidation of the Company, consummation of a sale of all or substantially all of the assets of the Company, or consummation of the merger or consolidation of the Company with or into another corporation in which the Company is not the surviving corporation or any other capital reorganization in which more than 50 percent of the shares of the Company entitled to vote are exchanged (a “Corporate Transaction”), options and RSUs granted under the Directors’ Plan will become fully vested, and the Company will provide each director optionee either a reasonable time within which to exercise the option or a substitute option with comparable terms as to an equivalent number of shares of stock of the corporation succeeding the Company or acquiring its business by reason of such Corporate Transaction. Outstanding RSUs will generally be paid in an equivalent number of shares of common stock immediately prior to the effectiveness of such Corporate Transaction. In the event of the director’s death or total disability, options and RSUs granted under the Directors’ Plan will become fully vested and, in the case of RSUs, immediately payable.

In addition, non-employee directors may participate in the Company’s matching charitable awards program, which provides up to $1,000 in matching contributions per calendar year to eligible non-profit organizations. The Company also reimburses its non-employee directors for their out-of-pocket expenses incurred in connection with attendance at Board, committee, and shareholder meetings, and other business of the Company.

Director Compensation after the Closing of the Sale Transaction

The Board has approved changes to the director compensation program that will take effect only upon the Closing of the Sale Transaction. A description of these arrangements is included under the caption “Annex 1—Management of the Fund—Compensation of Officers and Directors” in the Company’s definitive proxy statement soliciting shareholders’ approval of the Sale Transaction, which was filed with the SEC on April 24, 2017.

Director Stock Ownership Guidelines

The Board has adopted stock ownership guidelines for the Company’s non-employee directors as set forth in the Corporate Governance Guidelines with the exact share ownership requirements periodically established by the Board. The current share ownership requirements set by the Board provide that each non-employee director should own shares of the Company’s common stock equal in value to five times the annual Board cash retainer then in effect (or $300,000 in 2016 based on the Board’s current annual cash retainer of $60,000). A non-employee director who does not satisfy the required Company stock ownership level must retain at least 50 percent of the net shares he or she receives upon exercise, vesting, or payment, as the case may be, of Company equity awards. For this purpose, the “net” shares received upon exercise, vesting, or payment of an award are the total number of shares received, less the shares needed to pay any applicable exercise price of the award. Vested but unpaid (or deferred) RSUs count toward satisfaction of this requirement, but unexercised options do not (regardless of whether they are vested). Shares held in a trust established by the director (and/or his or her spouse) for estate or tax planning purposes count toward satisfaction of this requirement if the trust is revocable by the director (and/or his or her spouse) or for the benefit of his or her family members. All of our current directors have satisfied these ownership guidelines as of April 3, 2017.

10

Table of Contents

Director Compensation Table—2016

The following table presents fiscal year 2016 compensation information for Yahoo’s non-employee directors who served during any part of the year. Yahoo’s two employee directors during 2016, Ms. Mayer and Mr. Filo, received no additional compensation for their service on the Board. (For their compensation as employees, see the Summary Compensation Table on page 32.)

The “Stock Awards” and “Option Awards” columns below present the aggregate grant date fair value of equity awards (as computed for financial accounting purposes) and do not reflect whether the recipient has realized a financial benefit from the awards (such as by vesting in stock or exercising options).

| Name | Fees Earned or Paid in Cash ($)(1) |

Stock ($)(2)(3) |

Option ($)(2)(4) |

All Other ($) |

Total ($) |

|||||||||||||||

| Current Directors: |

||||||||||||||||||||

| Tor R. Braham(5) |

47,692 | 278,751 | 0 | 0 | 326,443 | |||||||||||||||

| Eric K. Brandt(6) |

124,176 | 310,968 | 0 | 0 | 435,144 | |||||||||||||||

| Catherine J. Friedman(7) |

65,989 | 310,968 | 0 | 0 | 376,957 | |||||||||||||||

| Eddy W. Hartenstein(8) |

0 | 326,386 | 0 | 0 | 326,386 | |||||||||||||||

| Richard S. Hill(9) |

40,879 | 278,751 | 0 | 0 | 319,630 | |||||||||||||||

| Thomas J. McInerney |

170,000 | 239,971 | 0 | 0 | 409,971 | |||||||||||||||

| Jane E. Shaw, Ph.D. |

95,000 | 239,971 | 0 | 0 | 334,971 | |||||||||||||||

| Jeffrey C. Smith(10) |

0 | 376,382 | 0 | 0 | 376,382 | |||||||||||||||

| Maynard G. Webb, Jr.(11) |

0 | 510,907 | 0 | 0 | 510,907 | |||||||||||||||

| Former Directors: |

||||||||||||||||||||

| Susan M. James(12) |

41,250 | 0 | 0 | 0 | 41,250 | |||||||||||||||

| Charles R. Schwab(13) |

0 | 6,335 | 0 | 0 | 6,335 | |||||||||||||||

| H. Lee Scott, Jr.(14) |

0 | 34,774 | 0 | 0 | 34,774 | |||||||||||||||

| (1) | Cash amounts differ, in part, because some directors elected pursuant to our director compensation program to receive RSUs in lieu of their quarterly cash fees for Board and committee service (see “—Director Compensation,” above). Amounts in this column exclude fees for Board service earned in the fourth quarter of 2015 and paid on January 8, 2016, and include fees for Board service earned in the fourth quarter of 2016 and paid on January 10, 2017. |

| (2) | As required by SEC rules, the columns “Stock Awards” and “Option Awards” present the aggregate grant date fair value (and the notes below present the individual grant date fair values) of each director’s equity awards computed in accordance with Financial Accounting Standards Board (“FASB”) Accounting Standards Codification™ 718 Compensation—Stock Compensation (“FASB ASC 718”). These amounts do not reflect whether the director has realized a financial benefit from the awards (such as by vesting in stock or exercising options). For information on the valuation assumptions used in these computations, refer to Note 14—“Employee Benefits” in the Notes to Consolidated Financial Statements in our 2016 Form 10-K. |

| (3) | On June 30, 2016, each of the non-employee directors elected at the 2016 annual meeting of shareholders (namely, Ms. Friedman, Dr. Shaw, and Messrs. Braham, Brandt, Hartenstein, Hill, McInerney, Smith, and Webb) was automatically granted an award of 6,389 RSUs under the Directors’ Plan. Each of these awards had a grant date fair value of $239,971. The number of unvested RSUs held on December 31, 2016 by each person listed in the table above was as follows: Mr. Braham (3,195), Mr. Brandt (3,195), Ms. Friedman (3,195), Mr. Hartenstein (3,195), Mr. Hill (3,195), Ms. James (0), Mr. McInerney (3,195), Mr. Schwab (0), Mr. Scott (0), Dr. Shaw (3,195), Mr. Smith (3,195), and Mr. Webb (3,195). The Directors’ Plan provides that non-employee directors may elect to defer payment of RSUs in certain circumstances. The number of vested but unpaid RSUs held on December 31, 2016 by each person listed in the table above was as follows: |

11

Table of Contents

| Mr. Braham (3,194), Mr. Brandt (3,194), Ms. Friedman (5,350), Mr. Hartenstein (5,434), Mr. Hill (4,239), Ms. James (0), Mr. McInerney (3,194), Mr. Schwab (0), Mr. Scott (0), Dr. Shaw (9,810), Mr. Smith (6,594), and Mr. Webb (10,162). |

| (4) | The number of outstanding stock options held on December 31, 2016 by each person listed in the table above was as follows: Mr. Braham (0), Mr. Brandt (0), Ms. Friedman (0), Mr. Hartenstein (0), Mr. Hill (0), Ms. James (0), Mr. McInerney (0), Mr. Schwab (3,118), Mr. Scott (3,291), Dr. Shaw (0), Mr. Smith (0), and Mr. Webb (61,679). |

| (5) | Mr. Braham was appointed to the Board on April 26, 2016. In connection with his appointment, Mr. Braham received an automatic grant of 1,045 RSUs on April 26, 2016, which had a grant date fair value of $38,780. In addition, Mr. Braham received $50,000 from Starboard in 2016 in consideration of his agreement to serve as a nominee of Starboard for election to the Board. |

| (6) | Mr. Brandt was appointed to the Board on March 8, 2016. In connection with his appointment, Mr. Brandt received an automatic grant of 2,156 RSUs on March 8, 2016, which had a grant date fair value of $70,997. |

| (7) | Ms. Friedman was appointed to the Board on March 8, 2016. In connection with her appointment, Ms. Friedman received an automatic grant of 2,156 RSUs on March 8, 2016, which had a grant date fair value of $70,997. In addition to amounts shown above, in May 2016 Ms. Friedman received a payment from Yahoo in the amount of $119,000 for her efforts during the fourth quarter of 2015 preparing to serve on the board of directors of Aabaco Holdings, Inc., a wholly-owned subsidiary of Yahoo which Yahoo had been planning to spin off. |

| (8) | Mr. Hartenstein was appointed to the Board on April 26, 2016. In connection with his appointment, Mr. Braham received an automatic grant of 1,045 RSUs on April 26, 2016, which had a grant date fair value of $38,780. Also, in lieu of cash, Mr. Hartenstein elected to receive his quarterly Board and committee fees for 2016 in the form of RSUs. Accordingly, we granted Mr. Hartenstein an award of 337 RSUs on June 30, 2016, which had a grant date fair value of $12,658; an award of 406 RSUs on September 30, 2016, which had a grant date fair value of $17,499; and an award of 452 RSUs on December 31, 2016, which had a grant date fair value of $17,479. In addition, Mr. Hartenstein received $50,000 from Starboard in 2016 in consideration of his agreement to serve as a nominee of Starboard for election to the Board. |

| (9) | Mr. Hill was appointed to the Board on April 26, 2016. In connection with his appointment, Mr. Hill received an automatic grant of 1,045 RSUs on April 26, 2016, which had a grant date fair value of $38,780. In addition, Mr. Hill received $50,000 from Starboard in 2016 in consideration of his agreement to serve as a nominee of Starboard for election to the Board. |

| (10) | Mr. Smith was appointed to the Board on April 26, 2016. In connection with his appointment, Mr. Smith received an automatic grant of 1,045 RSUs on April 26, 2016, which had a grant date fair value of $38,780. Also, in lieu of cash, Mr. Smith elected to receive his quarterly Board and committee fees for 2016 in the form of RSUs. Accordingly, we granted Mr. Smith an award of 337 RSUs on June 30, 2016, which had a grant date fair value of $12,658; an award of 1,566 RSUs on September 30, 2016, which had a grant date fair value of $67,495; and an award of 452 RSUs on December 31, 2016, which had a grant date fair value of $17,479. |

| (11) | In lieu of cash, Mr. Webb elected to receive his quarterly Board and committee fees for 2016 in the form of RSUs. Accordingly, we granted Mr. Webb an award of 1,860 RSUs on March 31, 2016, which had a grant date fair value of $68,467; an award of 1,797 RSUs on June 30, 2016, which had a grant date fair value of $67,495; an award of 1,566 RSUs on September 30, 2016, which had a grant date fair value of $67,495; and an award of 1,745 RSUs on December 31, 2016, which had a grant date fair value of $67,479. |

| (12) | Ms. James did not stand for re-election at the 2016 annual meeting of shareholders and, accordingly, her Board service ended on June 30, 2016. |

| (13) | Mr. Schwab resigned from the Board effective February 2, 2016. In lieu of cash, Mr. Schwab elected to receive his quarterly Board and committee fees for 2016 in the form of RSUs. Accordingly, we granted Mr. Schwab an award of 218 RSUs on February 2, 2016, which had a grant date fair value of $6,335. |

| (14) | Mr. Scott did not stand for re-election at the 2016 annual meeting of shareholders and, accordingly, his Board service ended on June 30, 2016. In lieu of cash, Mr. Scott elected to receive his quarterly Board and committee fees for 2016 in the form of RSUs. Accordingly, we granted Mr. Scott an award of 509 RSUs on March 31, 2016, which had a grant date fair value of $18,736; and an award of 427 RSUs on June 30, 2016, which had a grant date fair value of $16,038. |

12

Table of Contents

COMPENSATION DISCUSSION AND ANALYSIS

This Compensation Discussion and Analysis (“CD&A”) describes our executive compensation program for 2016 and the goals that drive the design of the program. Our Board’s Compensation and Leadership Development Committee (the “Compensation Committee”) is responsible for reviewing our executive compensation program and approving the compensation arrangements for our executive officers.

Pay Decision Highlights

In July 2016, the Company announced the sale of its operating business to Verizon Communications Inc. Since the announcement, the Company has been working expeditiously to execute the Sale Transaction, including obtaining regulatory approvals, working on a proxy statement to obtain the required stockholder approval, and planning post-closing integration with Verizon. In 2016 and early 2017, the Company also disclosed certain security incidents, the findings of an investigation by an independent committee of the Board into such security incidents, and actions taken by the Company in response to those findings, as well as, regulatory and litigation matters related to such security incidents, all as described in the Original Filing of the Company’s Form 10-K for the year ended December 31, 2016 (under the caption “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Recent Events—Security Incidents”). In February 2017, the Company and Verizon agreed to certain amendments to the Sale Transaction agreements as a result of such security incidents, including a reduction in the purchase price and certain sharing of liabilities. The following compensation decisions related to our Named Executive Officers resulted from, or were made in the context of, the foregoing events:

| • | Made no increases to base salaries or target annual bonuses. |

| • | Awarded no annual bonus to our CEO (Ms. Mayer) for 2016. |

| • | Accepted the voluntary resignation of our General Counsel (Mr. Bell) with no right to an annual bonus for 2016, forfeiture of all outstanding unvested equity, and no severance. |

| • | Awarded annual bonuses for 2016 of 130 percent of target to Ms. Utzschneider and 100 percent of target to Mr. Goldman based on achievement of pre-established company financial goals and individual contributions during the year. |

| • | Granted new long-term incentive value to our CEO of $12 million in 2016, as contemplated by her hiring agreement.* |

| • | Granted new long-term incentive value to our other Named Executive Officers in 2016 based on market data and considerations related to individual performance and retention, including $5 million for Ms. Utzschneider and $10 million for Mr. Goldman.* |

| • | Made no 2017 annual equity award to our CEO pursuant to her offer to forgo an award and the Board’s acceptance of her offer. |

| • | Made a long-term incentive grant of $3.5 million to Ms. Utzschneider in 2017* and provided Mr. Goldman with additional monthly cash payments of $100,000 from April 2017 to the Closing of the Sale Transaction in lieu of a new 2017 grant. |

| * | Long-term value is presented according to customary grant-date valuation principles by multiplying the total number of shares subject to new awards approved by the Compensation Committee by the fair market value of a share of our common stock on the date of the Compensation Committee’s approval, with the performance-based portion of the award valued at the target level. |

13

Table of Contents

Named Executive Officers

Our Named Executive Officers are the executive officers listed in the Summary Compensation Table on page 32. They include the following current officers:

| • | Marissa A. Mayer, Chief Executive Officer and President; |

| • | Ken Goldman, Chief Financial Officer; |

| • | David Filo, Co-Founder and Chief Yahoo; and |

| • | Lisa Utzschneider, Chief Revenue Officer. |

Under SEC rules, our Named Executive Officers for 2016 also include our former General Counsel and Secretary, Ronald S. Bell, who resigned on March 1, 2017.

As a founder, Mr. Filo has a significant ownership interest in Yahoo (he owned 7.4 percent of our issued and outstanding common stock as of April 3, 2017); he receives an annual base salary of $1 and did not receive a cash incentive or equity award during 2016. Except where expressly noted, references to “Named Executive Officers” in this CD&A generally do not include Mr. Filo.

2016 Shareholder Say-On-Pay Vote

Yahoo annually offers shareholders the opportunity to cast an advisory vote on our executive compensation program. This annual vote is known as the “say-on-pay” vote. We value and regularly seek shareholder input in order to ensure that shareholder views are considered in the design of our compensation program. At our annual meeting in June 2016, approximately 80 percent of votes cast were in favor of our executive compensation program for 2015. The Compensation Committee believes these results reflect shareholders’ support for the performance-based compensation programs that we began implementing in late 2012.

Compensation Goals and Practices

Our core executive compensation philosophy is to:

| • | Attract and retain the most talented people in an extremely competitive marketplace. |

| • | Compensate key executives at competitive but responsible levels. |

| • | Provide equity-based compensation to align executives’ interests with those of our shareholders. |

| • | Provide performance-based compensation to enhance the focus on particular goals and to reward those who make the greatest contributions to our performance when the goals are achieved. |

We also believe shareholder interests are further served by other executive compensation-related practices that we follow. These practices include:

| ✓ | We tie pay to performance: our annual cash incentive bonuses and long-term incentive equity awards are tied to the achievement of performance goals and the ultimate value of the long-term incentive equity awards is tied to our stock price, aligning with shareholder interests. |

| ✓ | Our equity awards in 2016 reflect a balance between multiple short- and long-term incentives. |

| ✓ | We do not have minimum payment levels for our cash-incentive bonus plan or for our performance-based equity awards. |

| ✓ | We do not provide material perquisites, though we do provide certain personal security arrangements for Ms. Mayer and her immediate family (which we consider necessary and for the Company’s benefit). |

| ✓ | We do not pay taxes on our executives’ behalf through “gross-up” payments (other than for a business-related relocation). |

| ✓ | Our change-in-control policy has a double-trigger provision (benefits require both a change in control and termination of employment) rather than a single-trigger provision (under which benefits are triggered automatically by any change in control). |

14

Table of Contents

| ✓ | We do not reprice “underwater” stock options (stock options where the exercise price is below the then-current market price of our stock) without shareholder approval. |

| ✓ | Our executive officers are subject to a stock ownership policy, which requires them to retain a portion of newly vested equity awards until they have satisfied the policy. |

| ✓ | We have a recoupment (or “clawback”) policy that allows the Board to recover cash- and equity-based incentive awards from executives (including all of the Named Executive Officers) in certain circumstances if Yahoo has to restate its financial results. |

| ✓ | We prohibit pledging of, and hedging against losses in, Yahoo securities in our insider trading policy, which is applicable to all employees, including our executive officers. |

| ✓ | Our Compensation Committee retains an independent compensation consultant for independent advice and market data. |

| ✓ | We seek annual shareholder feedback on our executive compensation program. |

| ✓ | We carefully monitor and take into account the dilutive impact of our equity awards. |

The Compensation Committee is responsible for determining the appropriate compensation for the Chief Executive Officer and our other Named Executive Officers. To determine compensation for our Chief Executive Officer, the Compensation Committee confers with the Board (which, for 2016, decided not to pay certain bonuses as described in this CD&A). To determine the compensation for the other Named Executive Officers, the Compensation Committee considers, among other factors, the Chief Executive Officer’s recommendations (for officers other than herself).

Pay for Performance

The Compensation Committee, based on shareholder input and our commitment to a disciplined pay-for-performance approach to executive compensation, established rigorous, performance-oriented compensation programs for 2016. The three key pillars of this approach are:

| • | recruit great talent to build the next generation of products that will grow revenue, and build shareholder value over the long-term; |

| • | motivate and retain that talent by developing compensation packages that reward performance in a manner the Compensation Committee believes is responsible and in line with market norms; and |

| • | deliver the majority of executive compensation in stock to align the long-term interests of management with our shareholders. |

In addition, the Compensation Committee seeks to align the Company’s performance-based compensation with the interests of our shareholders. For example, the Compensation Committee provided that the payout of our Named Executive Officers’ annual bonuses and performance-based RSUs for 2016 would be subject to a cap based on our total shareholder return for the year as described in more detail below.

Executive Compensation Program Elements

To attract key people and keep them invested in Yahoo’s future, we strive to offer them market-competitive “total direct compensation,” which refers to the combination of the executive’s base salary, annual cash bonus opportunity, and annualized long-term incentive equity award value based on customary grant-date valuation principles.

Mix of Compensation to Emphasize Performance

We provide base salaries that the Compensation Committee believes are competitive. The Compensation Committee believes, however, that our executives will be encouraged to make their greatest contribution to Yahoo if a substantial portion of their compensation is tied to Yahoo’s stock price or other performance goals. To that end, we design annual cash bonuses and long-term equity incentives that reward executives for attaining performance goals and creating shareholder value. These incentives make up the majority of each executive’s total direct compensation opportunity. Because these incentives depend on Yahoo’s performance, our executives’ actual compensation could be significantly less—or more—than the targeted levels.

15

Table of Contents

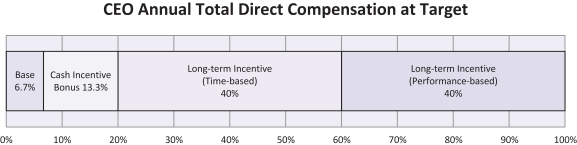

Our emphasis on equity- and performance-based compensation is reflected in the following chart which shows that 93.3 percent of the intended mix of Ms. Mayer’s target annual total direct compensation for 2016 is performance-based and/or dependent upon the value of our common stock.

Ms. Mayer’s intended mix of annual total direct compensation for 2016 includes:

| • | base salary (6.7 percent of target annual total direct compensation); |

| • | target cash incentive bonus (13.3 percent of target annual total direct compensation); and |

| • | grant date value of annual equity awards (80 percent of target annual total direct compensation) of which 50 percent have time-based vesting and 50 percent have both time-based and performance-based vesting. |

Ms. Mayer’s annual total direct compensation for 2016, as illustrated in the above chart, includes the annual equity awards that the Compensation Committee approved for Ms. Mayer in 2016. The chart does not include awards made to Ms. Mayer in prior years that have tranches vesting based on 2016 performance (see “CEO Equity Awards” immediately below). For purposes of the above chart, the grant date value of annual equity awards is presented by multiplying the total number of shares subject to the awards approved by the Compensation Committee in 2016 by the fair market value of a share of our common stock on the date of the award, with the performance-based portion of the award presented at the target level.

CEO Equity Awards

Ms. Mayer’s stock and option totals for 2016 as reported in the Summary Compensation Table on page 32 relate to multiple awards. Some of them are performance-based awards that our Compensation Committee approved in prior years, for which a portion (or “tranche”) of the award is allocated to and vests based upon our 2016 financial performance. Those 2016 performance-based tranches of prior awards are categorized as 2016 compensation for purposes of the Summary Compensation Table. The accounting value of those tranches as reported in the Summary Compensation Table can be significantly higher than their value when they were originally approved by the Compensation Committee due to the significant appreciation in our stock price between the original approval date and the date on which the 2016 performance goals were established (which is the valuation date for accounting purposes). For example, our stock price increased 117 percent between July 16, 2012 (the date on which Ms. Mayer’s performance-based option was originally approved by the Compensation Committee) and March 7, 2016 (the date on which the option’s 2016 tranche was valued for reporting purposes). That option tranche had an original approval value of $3 million in 2012, and a reported value of over $13 million in 2016, due to our intervening stock price appreciation (which benefits executives and shareholders alike). In the aggregate, the equity awards included in Ms. Mayer’s 2016 Summary Compensation Table row had an original value of $15 million when the Compensation Committee approved them, but they are reported with a value of nearly $25 million in our Summary Compensation Table due to the appreciation in our stock price between their respective approval dates and accounting valuation dates. (For more information, see footnote (7) to the Summary Compensation Table.)

Determining Compensation Levels

In setting specific salary, target annual cash bonus, and equity award levels for each Named Executive Officer and our other senior officers, the Compensation Committee considers and assesses, among other factors it may consider relevant:

| • | The compensation levels at our peer companies for comparable positions. |

16

Table of Contents

| • | Various subjective factors relating to the individual recipient—the executive’s scope of responsibility, prior experience, past performance, advancement potential, impact on results, and compensation level relative to other Yahoo executives. |

| • | As to equity awards, the executive’s historical total compensation, including prior equity grants, the number and value of unvested shares, and the timing of vesting of those awards. |

The Compensation Committee gives no single factor any specific weight. Each executive’s compensation level, as well as the appropriate mix of equity award types and other compensation elements, ultimately reflects the Compensation Committee’s business judgment in consideration of these factors and shareholder interests. Executive compensation levels and elements of our executive compensation program are not targeted to specific market or peer group levels.

Elements of Compensation

The current elements of our executive compensation program are described below.

| Element | Rationale | |||

| Base Salary |

Ensure a fixed level of annual cash compensation for our executives. | |||

| Annual Cash Bonus |

Focus executives’ efforts on—and reward them for achieving—short-term goals that we believe are important to long-term success. | |||

|

Long-Term Incentive Equity Awards |

• Typically make up the greatest portion of an executive’s total direct compensation opportunity to help ensure alignment between our executives’ interests and shareholders’ interests, and to enhance long-term executive retention.

• May be in the form of RSUs or stock options, and may have time-based or performance-based vesting.

• All equity grants are made under the Yahoo! Inc. Stock Plan (the “Stock Plan”), which has been approved by our shareholders. | |||

|

è

è |

RSUs With Performance-Based Vesting Requirements

RSUs With Time- Based Vesting Requirements |

• Vested RSUs are payable in shares of our common stock and further link recipients’ interests with those of our shareholders.

• Under customary grant-date valuation principles, the grant-date value of a stock option is less than the grant-date value of an RSU award covering an equal number of shares. Thus, fewer RSUs are awarded (when compared with stock options) to convey the same grant-date value. The Compensation Committee makes these distinctions, in its judgment, to help minimize the dilutive effect of the awards on our shareholders.

• RSUs with performance-based vesting (“performance” awards) vest only to the extent that certain performance goals established by the Compensation Committee are met, encouraging executives to focus on specific goals for a particular period (and performance awards include a time-based element too, in that executives generally must remain employed through the performance-determination date in order to vest). Maximum vesting is 200 percent of the shares subject to the award.

• RSUs with time-based vesting offer more predictable value than options and are particularly attractive as a retention incentive. | ||

17

Table of Contents

| Element | Rationale | |||

| è |

Stock Options With Performance- Based Vesting Requirements |

• No new stock options were granted to our Named Executive Officers in 2016, though certain options previously granted to Ms. Mayer (as part of her 2012 recruitment package) remained outstanding.

• Exercise price cannot be less than the closing price of our common stock on the grant date.

• We believe that all options have a performance-based element because the option holder realizes value only if our shareholders also realize value.

• Options that vest based on performance vest only if certain performance goals established by the Compensation Committee are met (and only if the executive remains employed through the vesting date), encouraging executives to focus on specific goals for a particular period. Maximum vesting is 100 percent of the shares subject to the award. | ||

| Other Compensation Arrangements |

• 401(k) plan available to U.S. employees generally, with Company matching contributions of up to $4,500 in 2016, but we do not provide pensions or other retirement benefits for our executive officers.

• No material perks for any executives, except for certain personal security arrangements for Ms. Mayer and her immediate family.

• Certain severance benefits, described below under “Severance and Change-in-Control Severance Benefits” and “Potential Payments Upon Termination or Change in Control,” are provided to compete for key executives and preserve the stability of the executive team. | |||

2016 Executive Compensation Program

2016 Base Salaries

In March 2016, the Compensation Committee reviewed the base salaries of our Named Executive Officers who were then serving as executive officers and kept them at their 2015 levels: $1.0 million for Ms. Mayer, and $600,000 for each of Mr. Goldman, Mr. Bell, and Ms. Utzschneider. The base salaries of Ms. Mayer and Mr. Goldman were negotiated in their offer letters in 2012 and have not been increased since then. Ms. Utzschneider’s base salary was negotiated in her offer letter in 2014 and has not increased since then. The Compensation Committee determined in its judgment that these salary levels continued to be appropriate based on its assessment of the factors identified under “Determining Compensation Levels,” above.

18

Table of Contents

2016 Annual Cash Bonuses under the Executive Incentive Plan

In keeping with Yahoo’s performance-based compensation philosophy, the Compensation Committee approved the 2016 short-term cash-incentive bonus plan for the Named Executive Officers, which we call our “Executive Incentive Plan,” in March 2016. Bonuses under the Executive Incentive Plan are determined by multiplying an executive’s target bonus opportunity by a Company Performance Factor, and by an Individual Performance Factor, within an overall limit, as shown by this diagram:

There is no minimum bonus payment guaranteed under the plan, and the Compensation Committee has discretion under the plan to reduce (including to $0) the amount of any bonus otherwise payable to a participant based on performance. We believe that Compensation Committee discretion to reduce the amount of any bonus is appropriate to help mitigate the risks associated with the short-term nature of annual bonus plans. Each executive’s maximum bonus under the Executive Incentive Plan was capped at 200 percent of the executive’s target bonus amount (or, if less, a percentage of our adjusted EBITDA for the year as described below).

Target Bonus. The Compensation Committee assigned each Named Executive Officer a target bonus expressed as a percentage of annual base salary. In March 2016, the Compensation Committee reviewed the target bonus levels for each Named Executive Officer and kept them at their 2015 levels: 200 percent of base salary for Ms. Mayer, and 90 percent of base salary for each of Mr. Goldman, Mr. Bell and Ms. Utzschneider. Mr. Filo was also eligible to participate in the Executive Incentive Plan; however, he was not assigned a target bonus by the Compensation Committee and the Compensation Committee did not exercise its discretion to consider him for a 2016 bonus after the year ended. The Compensation Committee determined in its judgment that these target bonus levels were appropriate based on its assessment of the factors identified under “Determining Compensation Levels,” above.

Company Performance Factor. The Compensation Committee decided that the Company Performance Factor under the plan would be determined based on the Company’s attainment of financial goals as well as the Committee’s assessment of the Company’s operational performance.

The financial performance measures selected by the Compensation Committee for 2016 were as follows:

| • | revenue as determined under GAAP (or “revenue”); |

| • | GAAP revenue less traffic acquisition costs (or “revenue ex-TAC”); and |

| • | income from operations before depreciation, amortization, restructuring charges (and reversals), impairment charges, and stock-based compensation expense (or “adjusted EBITDA”). |

The Compensation Committee chose revenue and revenue ex-TAC as financial metrics for the 2016 Executive Incentive Plan because growing revenue (both through our owned and operated sites and through our distribution network) was considered the most critical strategic imperative for the Company. The Company uses both these measures in evaluating the business and generally gives quarterly guidance on both to investors. Revenue ex-TAC is the revenue we retain after paying traffic acquisition costs (or “TAC”) to our distribution network. The Compensation Committee also chose to use adjusted EBITDA as a financial metric to promote profitable growth and help ensure that revenue growth is not pursued to the detriment of earnings.

The Compensation Committee further provided that, for purposes of calculating the overall financial performance payout factor, a payout percentage would be determined by averaging the payout percentages for revenue, revenue ex-TAC, and adjusted EBITDA (with each metric given equal weight and with the result rounded to the nearest whole percent). This average payout percentage would, however, be subject to a cap based on our total shareholder return (“TSR”) for 2016. If the average payout percentage exceeded 100 percent, the excess over 100 percent would be capped at the Company’s positive TSR for 2016 (rounded to the nearest whole percent). For example, if the average payout percentage was 140 percent and the Company’s TSR for 2016 was 10 percent, the financial performance payout percentage would be capped at 110 percent. Conversely, if the Company’s TSR for 2016 was zero or negative, the financial performance payout percentage would be capped at 100 percent. The

19

Table of Contents

Compensation Committee believed in adopting this structure that it would further align our executives’ incentives under the 2016 Executive Incentive Plan with the interests of our shareholders.

The Committee set goals for each metric based on the Company’s Board-approved 2016 financial plan and equal to the mid-point of the 2016 business outlook range announced on our February 2, 2016 earnings call. Specifically, the performance goals were $4.5 billion for revenue, $3.5 billion for revenue ex-TAC, and $0.75 billion for adjusted EBITDA.

The Committee further provided for revenue, revenue ex-TAC, and adjusted EBITDA to be determined on an adjusted basis to mitigate the financial statement impact of certain types of events not contemplated by our 2016 financial plan. Specifically, the Executive Incentive Plan provided for adjustments to eliminate the financial statement impact of certain acquisitions and divestitures, changes in accounting standards, legal settlements, changes in how we report any portion of revenue (i.e., whether on a gross or net (after TAC) basis), costs associated with the Company’s exploration of strategic alternatives (including the sale of the operating business), changes in foreign exchange rates, and costs associated with a potential proxy contest. The purpose of these adjustment provisions was to mitigate extraordinary events that may occur during the year and align bonus payouts with measures that reflect management’s actual performance during the year.

Concurrently with its adoption of the Executive Incentive Plan in March 2016, the Compensation Committee established the following payout scales for the financial performance component of the plan:

| Performance Metric (and weighting) |

Target Performance Goal |

Payout Schedule* | ||||

| Overall Financial Performance: |

||||||

| Revenue (1/3) |

$4.5 billion | • achievement ³ 110% of goal: 200% payout

• achievement = 100% of goal: 100% payout

• achievement £ 90% of goal: 0% payout

| ||||

| Revenue ex-TAC (1/3) |

$3.5 billion | • achievement ³ 110% of goal: 200% payout

• achievement = 100% of goal: 100% payout

• achievement £ 90% of goal: 0% payout

| ||||

| Adjusted EBITDA (1/3) |

$0.75 billion | • achievement ³ 120% of goal: 200% payout

• achievement = 100% of goal: 100% payout

• achievement £ 80% of goal: 0% payout

| ||||

| * | For achievement between the stated percentages, payout is determined by linear interpolation. Actual performance levels are discussed later in this CD&A. |

The Compensation Committee also retained discretion to assess our operational performance at the end of the year. No specific operational goals were adopted by the Compensation Committee for 2016.

Bonus Limit. As noted above, bonuses under the 2016 Executive Incentive Plan were capped at 200 percent of the executive’s target bonus. In addition to this cap, aggregate bonuses payable to the Named Executive Officers were subject to a maximum of three percent of our adjusted EBITDA for 2016. This additional performance-based limit on bonuses was intended to help preserve Yahoo’s tax deduction for bonuses paid under the plan, and was allocated among the Named Executive Officers. Under this framework, Ms. Mayer’s maximum bonus was capped at 1.4 percent of our 2016 adjusted EBITDA, and the maximum bonus for each of our other Named Executive Officers (including Mr. Filo) was capped at 0.4 percent of our 2016 adjusted EBITDA. In setting each executive’s final bonus, the Compensation Committee could exercise only downward discretion from these limits. Our 2016 adjusted EBITDA (adjusted in accordance with the Executive Incentive Plan as described above) was approximately $979 million. This framework resulted in a maximum bonus for each of these Named Executive Officers that was greater than 200 percent of the executive’s target bonus. Accordingly, each executive’s potential bonus was capped at 200 percent of the executive’s target bonus amount.

20

Table of Contents

2016 Executive Incentive Plan Payout. On March 8 2017, the Compensation Committee determined the 2016 Executive Incentive Plan bonuses to be paid to our Named Executive Officers other than Ms. Mayer and Mr. Bell as follows.