Attached files

| file | filename |

|---|---|

| 8-K - 8-K - TRIMAS CORP | trs_03312017x8k.htm |

| EX-99.1 - EXHIBIT 99.1 - TRIMAS CORP | trs_03312017xexhibit991.htm |

First Quarter 2017

Earnings Presentation

April 27, 2017

2

Forward-Looking Statement

Forward-Looking Statement

Any "forward-looking" statements, within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the

Securities Exchange Act of 1934, contained herein, including those relating to the Company’s business, financial condition or

future results, involve risks and uncertainties with respect to, including, but not limited to: the Company's leverage; liabilities

imposed by the Company's debt instruments; market demand; competitive factors; supply constraints; material and energy costs;

intangible assets, including goodwill or other intangible asset impairment charges; technology factors; litigation; government and

regulatory actions; the Company's accounting policies; future trends; general economic and currency conditions; the potential

impact of Brexit; various conditions specific to the Company's business and industry; the Company’s ability to identify attractive

acquisition candidates, successfully integrate acquired operations or realize the intended benefits of such acquisitions; potential

costs and savings related to facility consolidation activities; future prospects of the Company; and other risks that are detailed in

the Company's Annual Report on Form 10-K for the fiscal year ended December 31, 2016. These risks and uncertainties may

cause actual results to differ materially from those indicated by the forward-looking statements. All forward-looking statements

made herein are based on information currently available, and the Company assumes no obligation to update any forward-looking

statements.

Non-GAAP Financial Measures

In this presentation, certain non-GAAP financial measures may be used. Reconciliations of these non-GAAP financial measures to

the most directly comparable GAAP financial measure may be found in the Appendix at the end of this presentation or in the

earnings releases available on the Company’s website. Additional information is available at www.trimascorp.com under the

“Investors” section.

Please see the Appendix for details regarding certain costs, expenses and other amounts or charges, collectively described as

“Special Items,” that are included in the determination of net income, earnings per share and/or cash flows from operating

activities under GAAP, but that management believes should be separately considered when evaluating the quality of the

Company’s core operating results, given they may not reflect the ongoing activities of the business. Management believes that

presenting these non-GAAP financial measures, on an after Special Items basis, provides useful information to investors by

helping them identify underlying trends in the Company’s businesses and facilitating comparisons of performance with prior and

future periods. These non-GAAP financial measures should be considered in addition to, and not as a replacement for or superior

to, the comparable GAAP financial measures.

3

1. Quarter Highlights and Performance

2. Segment Summary

3. Outlook

4. Questions and Answers

5. Appendix

Presenters Include:

• Thomas Amato, President and Chief Executive Officer

• Robert Zalupski, Chief Financial Officer

• Sherry Lauderback, Vice President, Investor Relations

Agenda

Quarter Highlights and Performance

5

• First quarter results are showing positive

signs from actions taken

» Operating under a redefined TriMas Business

Model

• Accelerated business realignment efforts to

drive improved performance

» Leveraged existing locations and exited

facilities in Wolverhampton, UK (Energy);

Reynosa, Mexico (Energy); and Greater Noida,

India (Packaging)

» Approaching optimized manufacturing footprint

for anticipated demand levels

• Focused on achieving or exceeding 2017

Plan

First Quarter Highlights

2017 is off to a solid start…more work to do.

Commitment to

Environmental,

Health & Safety

Annual Goal

Setting &

Measurement

Flawless

Launches

Continuous

Improvement

Talent

Development

TriMas

Business

Model

(TBM)

6

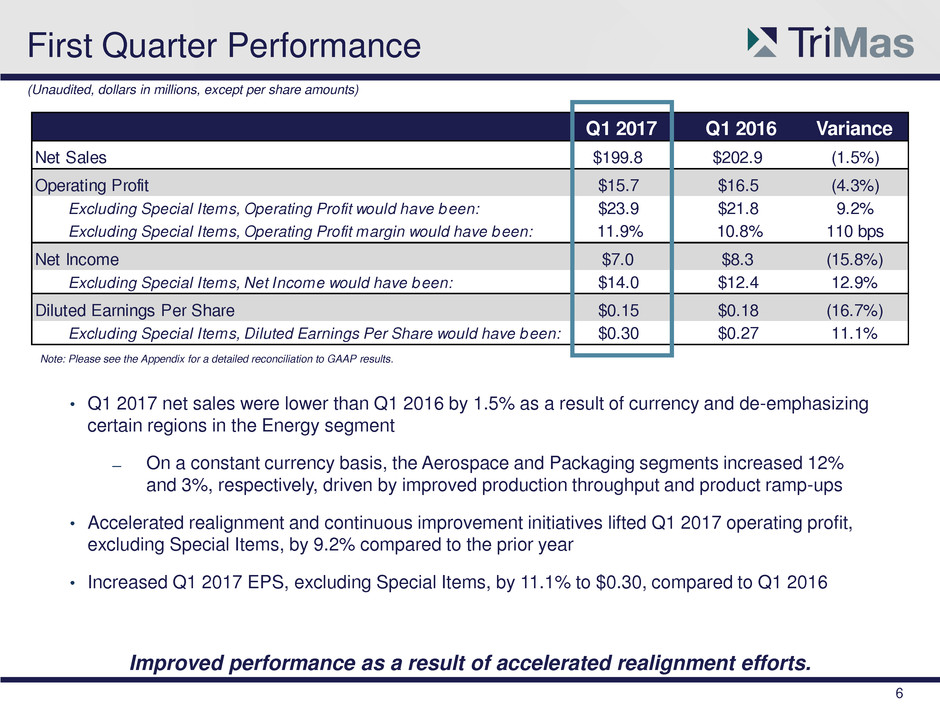

First Quarter Performance

Note: Please see the Appendix for a detailed reconciliation to GAAP results.

(Unaudited, dollars in millions, except per share amounts)

Improved performance as a result of accelerated realignment efforts.

Q1 2017 Q1 2016 Variance

Net Sales $199.8 $202.9 (1.5%)

Operating Profit $15.7 $16.5 (4.3%)

Excluding Special Items, Operating Profit would have been: $23.9 $21.8 9.2%

Excluding Special Items, Operating Profit margin would have been: 11.9% 10.8% 110 bps

Net Income $7.0 $8.3 (15.8%)

Excluding Special Items, Net Income would have been: $14.0 $12.4 12.9%

Diluted Earnings Per Share $0.15 $0.18 (16.7%)

Excluding Special Items, Diluted Earnings Per Share would have been: $0.30 $0.27 11.1%

• Q1 2017 net sales were lower than Q1 2016 by 1.5% as a result of currency and de-emphasizing

certain regions in the Energy segment

̶ On a constant currency basis, the Aerospace and Packaging segments increased 12%

and 3%, respectively, driven by improved production throughput and product ramp-ups

• Accelerated realignment and continuous improvement initiatives lifted Q1 2017 operating profit,

excluding Special Items, by 9.2% compared to the prior year

• Increased Q1 2017 EPS, excluding Special Items, by 11.1% to $0.30, compared to Q1 2016

7

First Quarter Performance

(1) Free Cash Flow is defined as Net Cash Provided by/Used for Operating Activities, excluding the cash impact of Special Items, less Capital

Expenditures.

(Unaudited, dollars in millions)

Note: Please see the Appendix for a detailed reconciliation to GAAP results.

Increased focus on cash flow as a key component of the new TriMas Business Model.

• Reduced Net Debt by $68.2 million to $344.2 million compared to March 31, 2016

• Improved Free Cash Flow(1) by $23.6 million to $17.7 million compared to Q1 2016,

through enhanced focus on performance and net working capital management

• Ended the quarter with cash and available liquidity of approximately $169 million,

and a leverage ratio of 2.5x

Q1 2017 Q1 2016 Variance Q4 2016 Variance

Free Cash Flow(1) $17.7 ($5.9) $23.6 $33.2 ($15.5)

Capital Expenditures $10.7 $6.0 $4.8 $8.9 $1.8

Inventories $159.0 $167.3 ($8.3) $160.5 ($1.5)

Total Debt $366.9 $437.9 ($71.0) $374.7 ($7.8)

Cash $22.6 $25.4 ($2.8) $20.7 $1.9

Net Debt $344.2 $412.4 ($68.2) $353.9 ($9.7)

Segment Summary

9

Packaging Segment

• Sales increased 3% on a constant currency basis

• Growth in the Industrial, Health Beauty & Home Care,

and Food & Beverage end markets

• Operating profit increased slightly, while margins

remained solid

Quarterly Comments

(Unaudited, dollars in millions)

Note: Please see the Appendix for a detailed reconciliation to GAAP results.

Positioning business for product innovation to drive future growth.

• Consolidated Greater Noida location into Baddi, India

facility to streamline infrastructure

• Completed new facility with expanded capacity in San

Miguel, Mexico

• Leveraging innovation resources and support teams in

India, the United Kingdom and the United States to

drive new product growth

Actions Markets, Products & Brands

Financial Summary Q1 2017 Q1 2016 Variance

Sales $81.0 $80.1 1.1%

Operating Profit, excluding

Special Items

$18.5 $18.3 1.1%

Operating Margi , excluding

Special Items

22.9% 22.9% 0 bps

10

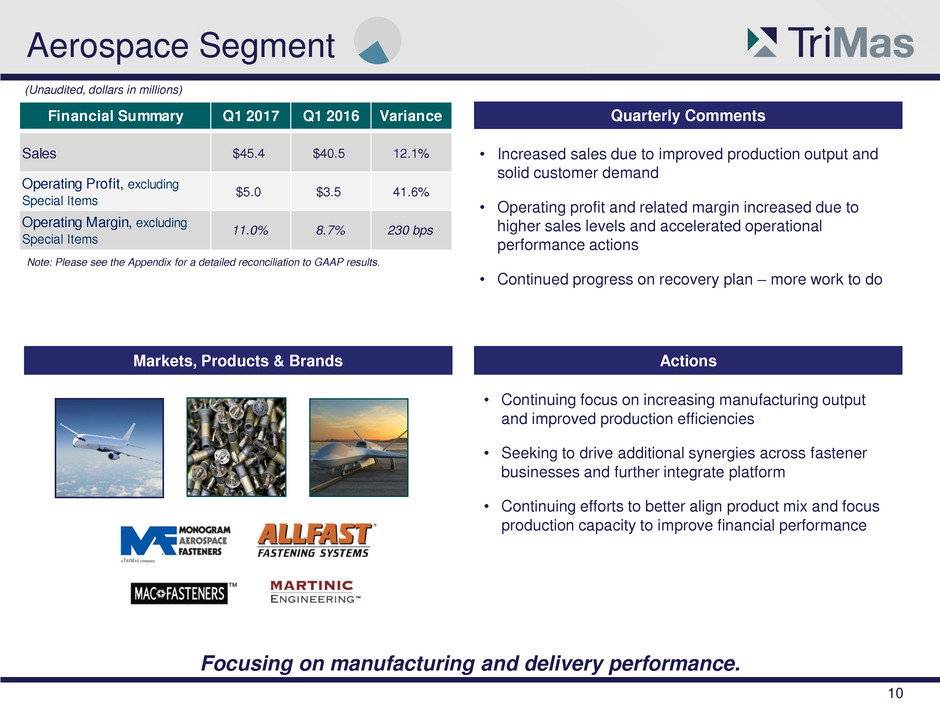

Aerospace Segment

Quarterly Comments

(Unaudited, dollars in millions)

Note: Please see the Appendix for a detailed reconciliation to GAAP results.

Focusing on manufacturing and delivery performance.

Actions Markets, Products & Brands

• Continuing focus on increasing manufacturing output

and improved production efficiencies

• Seeking to drive additional synergies across fastener

businesses and further integrate platform

• Continuing efforts to better align product mix and focus

production capacity to improve financial performance

• Increased sales due to improved production output and

solid customer demand

• Operating profit and related margin increased due to

higher sales levels and accelerated operational

performance actions

• Continued progress on recovery plan – more work to do

Financial Summary Q1 2017 Q1 2016 Variance

Sales $45.4 $40.5 12.1%

Operating Profit, excluding

Special Items

$5.0 $3.5 41.6%

Operating Margin, xcluding

Special Items

11.0% 8.7% 230 bps

11

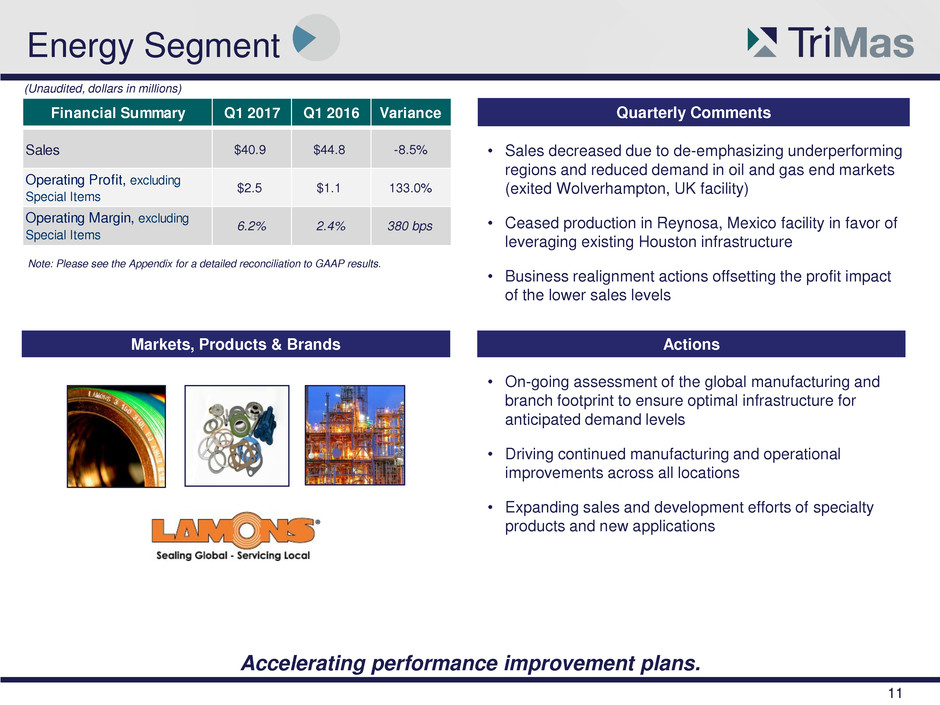

Energy Segment

Quarterly Comments

(Unaudited, dollars in millions)

Note: Please see the Appendix for a detailed reconciliation to GAAP results.

Accelerating performance improvement plans.

Actions Markets, Products & Brands

• Sales decreased due to de-emphasizing underperforming

regions and reduced demand in oil and gas end markets

(exited Wolverhampton, UK facility)

• Ceased production in Reynosa, Mexico facility in favor of

leveraging existing Houston infrastructure

• Business realignment actions offsetting the profit impact

of the lower sales levels

• On-going assessment of the global manufacturing and

branch footprint to ensure optimal infrastructure for

anticipated demand levels

• Driving continued manufacturing and operational

improvements across all locations

• Expanding sales and development efforts of specialty

products and new applications

Financial Summary Q1 2017 Q1 2016 Variance

Sales $40.9 $44.8 -8.5%

Operating Profit, excluding

Special Items

$2.5 $1.1 133.0%

Operating Margin, excluding

Special Items

6.2% 2.4% 380 bps

12

Engineered Components Segment

Quarterly Comments

(Unaudited, dollars in millions)

Note: Please see the Appendix for a detailed reconciliation to GAAP results.

Tight cost management mitigating impact of lower end market volume.

Actions Markets, Products & Brands

• Sales declined due to continued soft industrial end

markets, customer consolidations, and reduced oil and

natural gas well completions

• Flexed cost structure to hold operating profit margin

• Experiencing higher quote activity related to Arrow well

jack engines and compressors

• Continuing to manage through customer consolidations

which impact steel cylinder demand and activity

• Seeking to enter new steel cylinder product-use markets

such as hydrogen fuel cell applications

• Focusing on turning quote activity into additional sales

of Arrow products

Financial Summary Q1 2017 Q1 2016 Variance

Sales $32.5 $37.5 -13.3%

Operating Profit, excluding

Special Items

$5.0 $5.7 -13.1%

Operating Margin, excluding

Special Items

15.3% 15.3% 0 bps

13

Segment Performance Summary

(Unaudited, dollars in millions)

Segment Operating Profit Margin

(excluding Special Items)

Note: Please see the detailed reconciliation to GAAP results in the Appendix.

Net Sales

Improvements driven by accelerated realignment actions.

$203 $200

Q1 2016 Q1 2017

$29

$31

Q1 2016 Q1 2017

14.1% 15.5%

-1.5%

+8.3%

Outlook

15

FY 2017 Outlook

(1) Free Cash Flow is defined as Net Cash Provided by/Used for Operating Activities, excluding the cash

impact of Special Items, less Capital Expenditures.

Reaffirming previously provided full year 2017 outlook.

Note: All of the figures on this slide exclude any current and future Special Items.

Full Year Outlook

(as of 4/27/17)

Sales Growth

2% – 4%

Earnings Per Share, diluted $1.35 – $1.45

Free Cash Flow(1) > 100% of net income

16

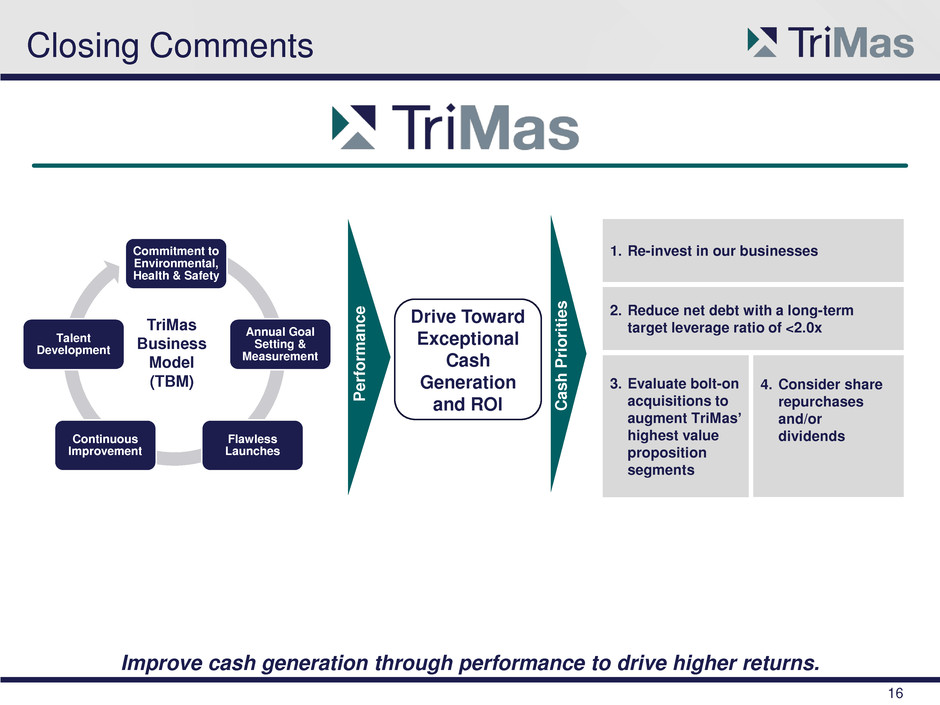

Closing Comments

Drive Toward

Exceptional

Cash

Generation

and ROI

Improve cash generation through performance to drive higher returns.

P

e

rf

o

rm

a

nc

e

Ca

s

h

P

rior

itie

s

Commitment to

Environmental,

Health & Safety

Annual Goal

Setting &

Measurement

Flawless

Launches

Continuous

Improvement

Talent

Development

TriMas

Business

Model

(TBM)

1. Re-invest in our businesses

2. Reduce net debt with a long-term

target leverage ratio of <2.0x

3. Evaluate bolt-on

acquisitions to

augment TriMas’

highest value

proposition

segments

4. Consider share

repurchases

and/or

dividends

Questions and Answers

Appendix

19

Condensed Consolidated Balance Sheet

(Dollars in thousands)

March 31, December 31,

2017 2016

(unaudited)

Assets

Current assets:

Cash and cash equivalents............................................... 22,640$ 20,710$

Receivables, net.............................................................. 119,240 111,570

Inventories...................................................................... 159,010 160,460

Prepaid expenses and other current assets....................... 7,980 16,060

Total current assets...................................................... 308,870 308,800

Property and equipment, net................................................ 184,000 179,160

Goodwill............................................................................. 316,110 315,080

Other intangibles, net........................................................... 209,100 213,920

Other assets....................................................................... 34,810 34,690

Total assets................................................................. 1,052,890$ 1,051,650$

Liabilities and Shareholders' Equity

Current liabilities:

Current maturities, long-term debt..................................... 13,770$ 13,810$

Accounts payable............................................................ 76,850 72,270

Accrued liabilities............................................................ 40,880 47,190

Total current liabilities................................................... 131,500 133,270

L ng-term d bt, net............................................................. 353,110 360,840

Deferred income taxes........................................................ 8,070 5,910

Other long-term liabilities...................................................... 50,130 51,910

Total liabilities.............................................................. 542,810 551,930

Total shareholders' equity............................................. 510,080 499,720

Total liabilities and shareholders' equity.......................... 1,052,890$ 1,051,650$

20

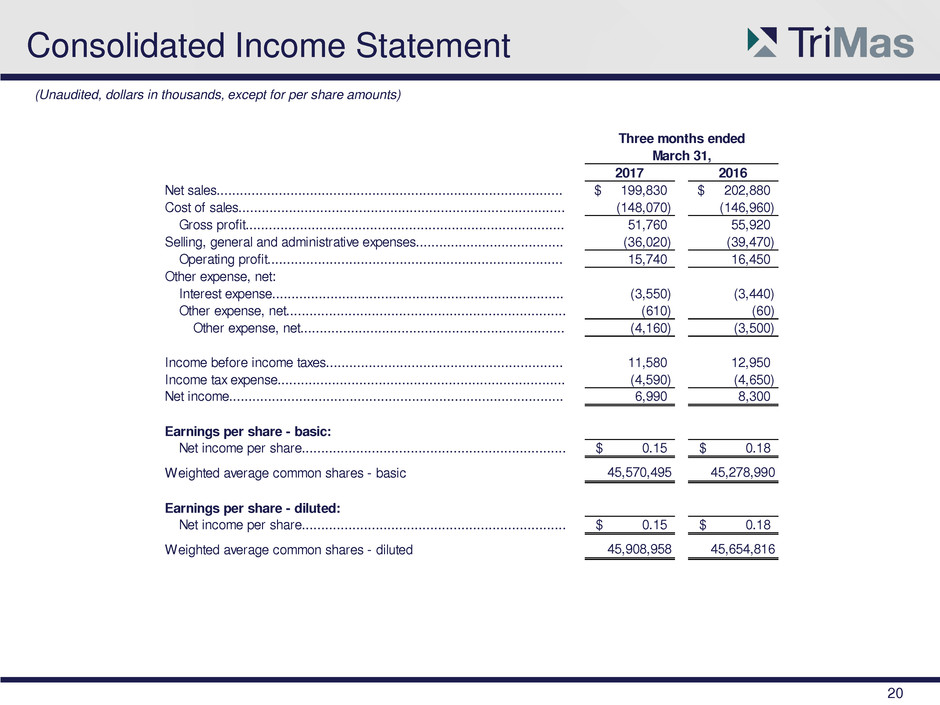

Consolidated Income Statement

(Unaudited, dollars in thousands, except for per share amounts)

Three months ended

2017 2016

Net sales......................................................................................... 199,830$ 202,880$

Cost of sales.................................................................................... (148,070) (146,960)

Gross profit.................................................................................. 51,760 55,920

Selling, general and administrative expenses...................................... (36,020) (39,470)

Operating profit............................................................................ 15,740 16,450

Other expense, net:

Interest expense........................................................................... (3,550) (3,440)

Other expense, net........................................................................ (610) (60)

Other expense, net.................................................................... (4,160) (3,500)

Income before income taxes............................................................. 11,580 12,950

Income tax expense.......................................................................... (4,590) (4,650)

Net income...................................................................................... 6,990 8,300

Earnings per share - basic:

Net income per share.................................................................... 0.15$ 0.18$

Weighted average common shares - basic 45,570,495 45,278,990

Earnings per share - diluted:

Net income per share.................................................................... 0.15$ 0.18$

Weighted average common shares - diluted 45,908,958 45,654,816

March 31,

21

Consolidated Statement of Cash Flow

(Unaudited, dollars in thousands)

2017 2016

Cash Flows from Operating Activities:

Net income..................................................................................................................... 6,990$ 8,300$

Adjustments to reconcile net income to net cash provided by (used for) operating activities:

Loss on dispositions of assets...................................................................................... 4,170 590

Depreciation............................................................................................................... 5,800 5,940

Amortization of intangible assets................................................................................... 4,990 5,100

Amortization of debt issue costs.................................................................................... 350 340

Deferred income taxes................................................................................................. 1,870 (20)

Non-cash compensation expense.................................................................................. 1,470 1,970

Tax effect from stock based compensation.................................................................... - 620

Increase in receivables................................................................................................ (7,590) (11,210)

(Increase) decrease in inventories................................................................................ (420) 330

Decrease in prepaid expenses and other assets............................................................ 8,070 7,700

Decrease in accounts payable and accrued liabilities..................................................... (3,160) (23,660)

Other operating activities.............................................................................................. (570) 660

Net cash provided by (used for) operating activities................................................ 21,970 (3,340)

Cash Flows from Investing Activities:

Capital expenditures.................................................................................................... (10,740) (5,980)

Net proceeds from dispositions of property and equipment............................................. 30 120

Net cash used for investing activities...................................................................... (10,710) (5,860)

Cash Flows from Financing Activities:

Repayments of borrowings on term loan facilities........................................................... (3,470) (3,470)

Proceeds from borrowings on revolving credit and accounts receivable facilities............... 186,640 117,130

Repayments of borrowings on revolving credit and accounts receivable facilities.............. (191,760) (97,220)

Shares surrendered upon options and restricted stock vesting to cover taxes................... (450) (650)

Other financing activities.............................................................................................. (290) (620)

Net cash provided by (used for) financing activities................................................. (9,330) 15,170

Cash and Cash Equivalents:

Net increase for the period........................................................................................... 1,930 5,970

At beginning of period.................................................................................................. 20,710 19,450

At end of period....................................................................................................... 22,640$ 25,420$

Supplemental disclosure of cash flow information:

Cash paid for interest............................................................................................... 3,050$ 2,980$

Cash paid for taxes.................................................................................................. 1,230$ 1,780$

March 31,

Three months ended

Three months ended

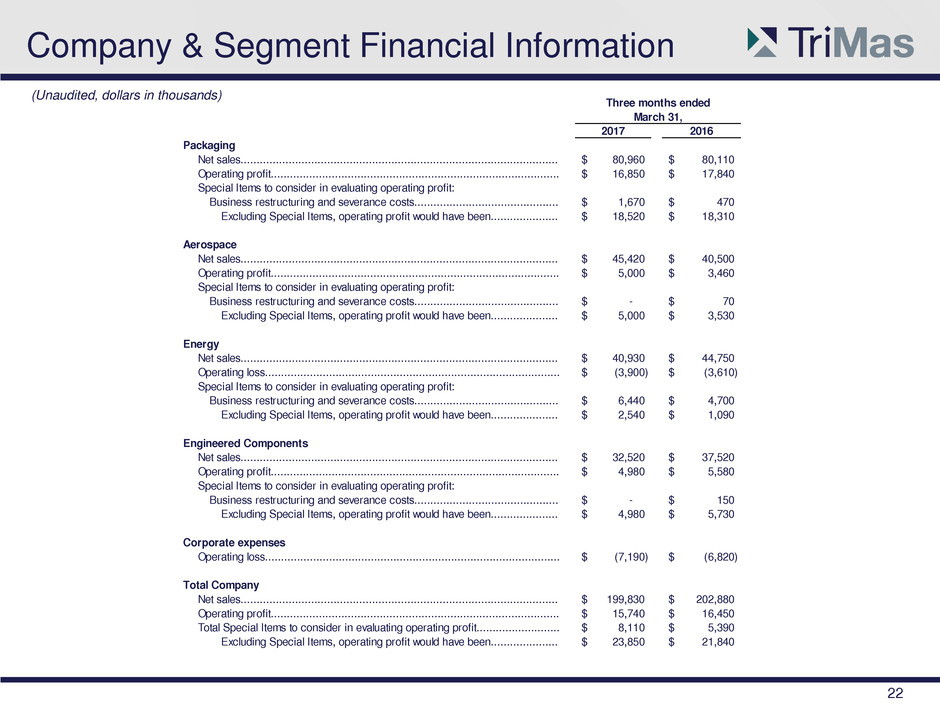

2017 2016

Packaging

Net sales................................................................................................... 80,960$ 80,110$

Operating profit.......................................................................................... 16,850$ 17,840$

Special Items to consider in evaluating operating profit:

Business restructuring and severance costs............................................. 1,670$ 470$

Excluding Special Items, operating profit would have been..................... 18,520$ 18,310$

Aerospace

Net sales................................................................................................... 45,420$ 40,500$

Operating profit.......................................................................................... 5,000$ 3,460$

Special Items to consider in evaluating operating profit:

Business restructuring and severance costs............................................. -$ 70$

Excluding Special Items, operating profit would have been..................... 5,000$ 3,530$

Energy

Net sales................................................................................................... 40,930$ 44,750$

Operating loss............................................................................................ (3,900)$ (3,610)$

Special Items to consider in evaluating operating profit:

Business restructuring and severance costs............................................. 6,440$ 4,700$

Excluding Special Items, operating profit would have been..................... 2,540$ 1,090$

Engineered Components

Net sales................................................................................................... 32,520$ 37,520$

Operating profit.......................................................................................... 4,980$ 5,580$

Special Items to consider in evaluating operating profit:

Business restructuring and severance costs............................................. -$ 150$

Excluding Special Items, operating profit would have been..................... 4,980$ 5,730$

Corporate expenses

Operating loss............................................................................................ (7,190)$ (6,820)$

Total Company

Net sales................................................................................................... 199,830$ 202,880$

Operating profit.......................................................................................... 15,740$ 16,450$

Total Special Items to consider in evaluating operating profit.......................... 8,110$ 5,390$

Excluding Special Items, operating profit would have been..................... 23,850$ 21,840$

March 31,

22

Company & Segment Financial Information

(Unaudited, dollars in thousands)

23

Additional Information Regarding Special Items

(Unaudited, dollars in thousands, except for per share amounts)

Three months ended

March 31,

2017 2016

Net income, as reported......................................................................................................... 6,990$ 8,300$

After-tax impact of Special Items to consider in evaluating quality of net income:

Business restructuring and severance costs........................................................................... 7,000 4,090

Excluding Special Items, net income would have been....................................................... 13,990$ 12,390$

Three months ended

March 31,

2017 2016

Diluted earnings per share, as reported................................................................................. 0.15$ 0.18$

After-tax impact of Special Items to consider in evaluating quality of EPS:

Business restructuring and severance costs........................................................................... 0.15 0.09

Excluding Special Items, EPS would have been.................................................................. 0.30$ 0.27$

Weighted-average shares outstanding .............................................................................. 45,908,958 45,654,816

2017 2016

Operating profit (excluding Special Items).............................................................................. 23,850$ 21,840$

Corporate expenses (excluding Special Items)........................................................................ 7,190 6,820

Segment operating profit (excluding Special Items)............................................................... 31,040$ 28,660$

Segment operating profit margin (excluding Special Items).................................................... 15.5% 14.1%

March 31,

Three months ended

24

Additional Information Regarding Special Items

(Unaudited, dollars in thousands)

As reported Special Items

Excluding

Special Items As reported Special Items

Excluding

Special Items

Net cash provided by (used for) operating activities.................. 21,970$ 6,490$ 28,460$ (3,340)$ 3,440$ 100$

Less: Capital expenditures...................................................... (10,740) - (10,740) (5,980) - (5,980)

Free Cash Flow...................................................................... 11,230 6,490 17,720 (9,320) 3,440 (5,880)

Net income............................................................................ 6,990 7,000 13,990 8,300 4,090 12,390

Free Cash Flow as a percentage of net income........................ 161% 127% -112% -47%

Three months ended March 31,

2017 2016

March 31, December 31, March 31,

2017 2016 2016

Current maturities, long-term debt.......................................................................... 13,770$ 13,810$ 13,840$

Long-ter debt, net.............................................................................................. 353,110 360,840 424,010

Long-term Debt.................................................................................................... 366,880 374,650 437,850

Less: Cash and cash equivalents........................................................................... 22,640 20,710 25,420

Net Debt.............................................................................................................. 344,240$ 353,940$ 412,430$

25

LTM Bank EBITDA and Ratios

(Unaudited, dollars in thousands)

(1) As defined in the Credit Agreement dated June 30, 2015.

March 31, December 31,

2017 2016

(41,110)$ (39,800)$

Interest expense.................................................................................. 13,830 13,720

Depreciation and amortization.............................................................. 44,610 44,860

Extraordinary non-cash charges........................................................... 98,900 98,900

Non-cash compensation expense.......................................................... 6,440 6,940

Other non-cash expenses or losses....................................................... 12,070 8,180

Non-recurring expenses or costs ......................................................... 13,700 11,400

Acquisition integration costs................................................................. 690 1,460

149,130$ 145,660$

Net loss for the twelve months ended……………………………...................

Bank EBITDA - LTM Ended (1)…………………………………………………………………

March 31, December 31,

Key Ratios: 2017 2016

Bank LTM EBITDA……………………………………………………………………………….……………………………………… 149,130$ 145,660$

Interest Coverage Ratio 12.03 x 11.94 x

Leverage Ratio……………………………………………………...………………... 2.52 x 2.63 x