Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - Stagwell Inc | v465233_ex99-1.htm |

| 8-K - 8-K - Stagwell Inc | v465233_8k.htm |

Exhibit 99.2

April 27, 2017 Management Presentation First Quarter 2017 Results

1 FORWARD LOOKING STATEMENTS & OTHER INFORMATION This presentation, including our “ 2017 Financial Outlook”, contains forward - looking statements . The Company’s representatives may also make forward - looking statements orally from time to time . Statements in this presentation that are not historical facts, including statements about the Company’s beliefs and expectations, earnings guidance, recent business and economic trends, potential acquisitions, and estimates of amounts for redeemable noncontrolling interests and deferred acquisition consideration, constitute forward - looking statements . These statements are based on current plans, estimates and projections, and are subject to change based on a number of factors, including those outlined below . Forward - looking statements speak only as of the date they are made, and the Company undertakes no obligation to update publicly any of them in light of new information or future events, if any . Forward - looking statements involve inherent risks and uncertainties . A number of important factors could cause actual results to differ materially from those contained in any forward - looking statements . Such risk factors include, but are not limited to, the following : • risks associated with severe effects of international, national and regional economic conditions ; • the Company’s ability to attract new clients and retain existing clients; • the spending patterns and financial success of the Company’s clients; • the Company’s ability to retain and attract key employees; • the Company’s ability to remain in compliance with its debt agreements and the Company’s ability to finance its contingent pa yme nt obligations when due and payable, including but not limited to those relating to redeemable noncontrolling interests and deferred acquisition consideration; • the successful completion and integration of acquisitions which compliment and expand the Company’s business capabilities; • foreign currency fluctuations; and • risks associated with the one Canadian securities class action litigation claim. The Company’s business strategy includes ongoing efforts to engage in acquisitions of ownership interests in entities in the marketing communications services industry . The Company intends to finance these acquisitions by using available cash from operations and through incurrence of bridge or other debt financing, either of which may increase the Company’s leverage ratios, or by issuing equity, which may have a dilutive impact on existing shareholders proportionate ownership . At any given time the Company may be engaged in a number of discussions that may result in one or more acquisitions . These opportunities require confidentiality and may involve negotiations that require quick responses by the Company . Although there is uncertainty that any of these discussions will result in definitive agreements or the completion of any transactions, the announcement of any such transaction may lead to increased volatility in the trading price of the Company’s securities . Investors should carefully consider these risk factors and the additional risk factors outlined in more detail in the Annual Report on Form 10 - K under the caption “Risk Factors” and in the Company’s other SEC filings .

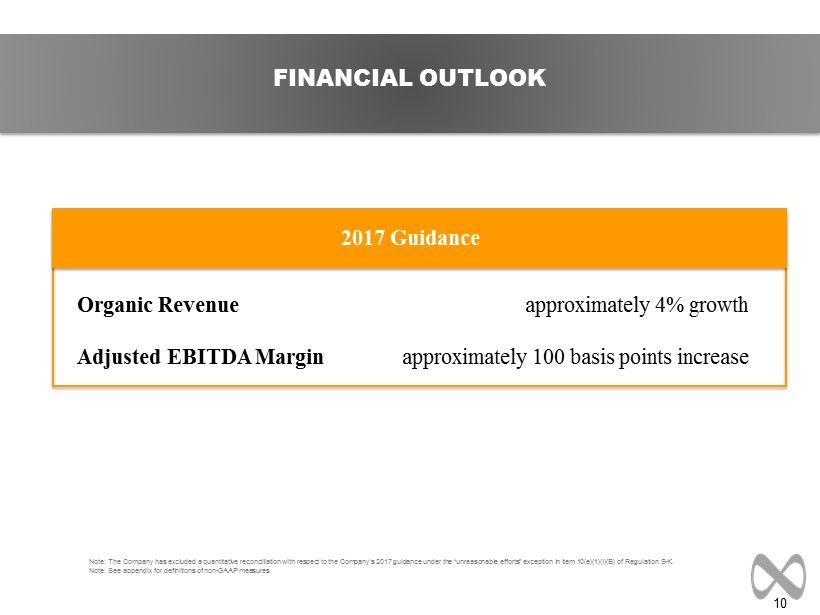

2 FIRST QUARTER 2017 SUMMARY » Solid start to fiscal 2017 » Return to industry - leading organic revenue growth, consisting of very strong growth in U.S. and broad strength across disciplines and client industry verticals » Strong profit trends, with more meaningful pick - up expected in coming quarters » New business success and robust pipeline provides good forward visibility » Previously - disclosed sale of $95 million of Convertible Preference Shares (closed March) and smoothed working capital trends solidifies balance sheet and credit profile » Positioned well to achieve 2017 targets, including approximately 4% organic revenue growth and approximately 100 basis points increase in Adjusted EBITDA margins Note: See appendix for definitions of non - GAAP measures

3 » Revenue increased 11.5% to $344.7 million from $309.0 million » Organic revenue growth of 5.6%, after a 50 basis points benefit from increased billable pass - through costs » Net loss attributable to MDC Partners common shareholders of ($11.1) million versus a loss of ($23.3) million last year » Adjusted EBITDA increased 9.1% to $35.8 million from $32.8 million, with margins of 10.4% versus 10.6% a year ago » Net new business wins of $25.6 million FIRST QUARTER 2017 FINANCIAL HIGHLIGHTS Note: See appendix for definitions of non - GAAP measures

4 CONSOLIDATED REVENUE AND EARNINGS Note: Actuals may not foot due to rounding (US$ in millions, except percentages) 2017 2016 Revenue 344.7$ 309.0$ 11.5 % Operating Expenses Cost of services sold 237.6 211.4 12.4 % Office and general expenses 87.8 77.8 12.9 % Depreciation and amortization 10.9 11.2 (2.9) % Operating Profit 8.4 8.5 NM % Other, net 2.6 15.5 Interest expense and finance charges (16.8) (15.6) Loss on redemption of notes - (33.3) Interest income 0.2 0.2 Income tax (expense) benefit (4.0) 2.0 Equity in earnings (losses) of non-consolidated affiliates (0.1) 0.2 Net loss (9.7) (22.4) Net income attributable to non-controlling interests (0.9) (0.9) Accretion on convertible preference shares (0.5) - Net loss attributable to MDC Partners Inc. common shareholders (11.1)$ (23.3)$ % Change Three Months Ended March 31,

5 » Organic revenue growth of 5.6% in Q1, favorably impacted by 50 basis points from increased billable pass - through costs incurred on clients’ behalf REVENUE SUMMARY 1 Non - GAAP Acquisitions (Dispositions), net consists of $21.1 million of Acquisitions and $0.7 million of Dispositions for the thr ee months ended March 31, 2017. Note: Actuals may not foot due to rounding. (US$ in millions, except percentages) Revenue $ % Change March 31, 2016 $309.0 Foreign Exchange (1.9) (0.6%) Non-GAAP Acquisitions (Dispositions), net (1) 20.4 6.6% Organic Revenue Growth (Decline) 17.2 5.6% Total Change 35.7 11.5% March 31, 2017 $344.7 Three Months Ended

6 REVENUE BY GEOGRAPHY AND SEGMENT » Organic revenue growth led by the U.S. at +8.9% » International impacted by timing of projects and previously - disclosed client loss The Reportable Segment is comprised of our integrated advertising and media specialist agencies as well as public relations f irm s, including Allison + Partners, Anomaly, CPB, Doner , F&B, Hunter PR, KBS, MDC Media Partners, and 72andSunny, among others. All Other comprises our specialist marketing offerings such as direct marke tin g, sales promotion, market research, strategic communications, database and customer relationship management, data analytics and insights, corporate identity, design and branding, product and serv ice innovation. Firms within All Other include Gale Partners, Kingsdale , Relevant, Team, Redscout and Y Media Labs, among others. Note: Actuals may not foot due to rounding (US$ in millions, except percentages) Total Total Organic Revenue Revenue Growth Growth (Decline) United States $274.7 8.9% 8.9% Canada 26.5 (6.8%) (7.6%) North America 301.2 7.3% 7.2% Other 43.5 53.1% (11.1%) Total $344.7 11.5% 5.6% Reportable Segment $286.8 12.9% 5.4% All Other 57.9 5.4% 6.2% Total $344.7 11.5% 5.6% Three Months Ended March 31, 2017

7 Year - over - Year Growth by Category » Best performing sectors: Communications, Food & Beverage, Automotive » Diversification continues: Top 10 clients declined to 22.0% of revenue in Q1 2017 versus 23.0% a year ago (largest <5%) REVENUE BY CLIENT INDUSTRY Q1 2017 Above 10% Communications, Food & Beverage, Automotive 0% to 10% Consumer Products, Retail, Healthcare Below 0% Financials, Technology * Excludes discontinued operations Note: Actuals may not foot due to rounding. Year - over - year category growth shown on a reported basis. Q1 2017 Mix

8 » Benefits of profitability initiatives expected to become more evident over coming quarters ADJUSTED EBITDA 1 Adjusted EBITDA is a non - GAAP measure. See appendix for the definition. See schedules 2 and 3 the Q1 2017 press release for a re conciliation of Net loss to Adjusted EBITDA. Note: Actuals may not foot due to rounding. (US$ in millions, except percentages) 2017 2016 Advertising and Communications Group 43.3$ 42.8$ 1.3 % Reportable Segment 33.3 34.5 (3.6) % All Other 10.1 8.3 21.7 % Corporate Group (7.5) (10.0) (24.5) % Adjusted EBITDA (1) 35.8$ 32.8$ 9.1 % margin 10.4% 10.6% % Change Three Months Ended March 31,

9 SUMMARY OF CASH FLOW Note: Actuals may not foot due to rounding (US$ in millions) 2017 2016 Net cash used in operating activities ($30.7) ($122.4) Net cash used in investing activities ($11.1) ($8.1) Net cash provided by financing activities $37.1 $92.4 Effect of exchange rate changes on cash and cash equivalents ($0.1) ($1.5) Net decrease in cash and cash equivalents ($4.7) ($39.6) Three Months Ended March 31,

10 FINANCIAL OUTLOOK Organic Revenue Adjusted EBITDA Margin approximately 4% growth approximately 100 basis points increase 2017 Guidance Note: The Company has excluded a quantitative reconciliation with respect to the Company’s 2017 guidance under the “unreasona ble efforts” exception in item 10(e)(1)( i )(B) of Regulation S - K. Note: See appendix for definitions of non - GAAP measures

11 APPENDIX

12 REVENUE TRENDING SCHEDULE Note: See appendix for definitions of non - GAAP measures Note: Actuals may not foot due to rounding (US$ in thousands, except percentages) Q1 Q2 Q3 Q4 FY Q1 Q2 Q3 Q4 FY Q1 Revenue United States $252,018 $271,375 $270,512 $291,147 $1,085,051 $252,199 $272,992 $274,506 $304,016 $1,103,712 $274,682 Canada 29,826 35,433 29,560 34,221 129,039 28,406 33,614 30,233 31,848 124,101 26,470 North America 281,843 306,807 300,072 325,368 1,214,090 280,605 306,606 304,739 335,864 1,227,813 301,152 Other 20,379 29,799 28,345 33,645 112,168 28,437 30,442 44,515 54,578 157,972 43,548 Total $302,222 $336,606 $328,417 $359,013 $1,326,258 $309,042 $337,048 $349,254 $390,442 $1,385,785 $344,700 % of Revenue United States 83.4% 80.6% 82.4% 81.1% 81.8% 81.6% 81.0% 78.6% 77.9% 79.6% 79.7% Canada 9.9% 10.5% 9.0% 9.5% 9.7% 9.2% 10.0% 8.7% 8.2% 9.0% 7.7% North America 93.3% 91.1% 91.4% 90.6% 91.5% 90.8% 91.0% 87.3% 86.0% 88.6% 87.4% Other 6.7% 8.9% 8.6% 9.4% 8.5% 9.2% 9.0% 12.7% 14.0% 11.4% 12.6% Total 100.0% 100.0% 100.0% 100.0% 100.0% 100.0% 100.0% 100.0% 100.0% 100.0% 100.0% Total Growth % United States 10.1% 11.6% 8.6% 6.9% 9.2% 0.1% 0.6% 1.5% 4.4% 1.7% 8.9% Canada (3.5%) (9.2%) (22.3%) (19.3%) (14.2%) (4.8%) (5.1%) 2.3% (6.9%) (3.8%) (6.8%) North America 8.5% 8.7% 4.5% 3.4% 6.1% (0.4%) (0.1%) 1.6% 3.2% 1.1% 7.3% Other 34.9% 73.3% 27.6% 33.9% 40.8% 39.5% 2.2% 57.0% 62.2% 40.8% 53.1% Total 10.0% 12.4% 6.1% 5.6% 8.4% 2.3% 0.1% 6.3% 8.8% 4.5% 11.5% Organic Revenue Growth (Decline) % United States 6.9% 6.6% 6.1% 5.9% 6.4% (1.2%) (0.1%) 1.0% 4.3% 1.1% 8.9% Canada 3.2% 2.1% (5.5%) (4.3%) (1.4%) 4.5% (0.6%) 2.0% (6.0%) (0.2%) (7.6%) North America 6.5% 6.0% 4.6% 4.5% 5.4% (0.6%) (0.1%) 1.1% 3.2% 1.0% 7.2% Other 23.7% 45.5% 20.0% 39.9% 31.9% 41.4% 4.7% 19.1% 9.5% 16.5% (11.1%) Total 7.4% 8.3% 5.7% 7.2% 7.1% 2.2% 0.3% 2.7% 3.8% 2.3% 5.6% Growth % from Foreign Exchange United States (0.0%) (0.0%) (0.0%) 0.0% (0.0%) 0.0% 0.0% 0.0% (0.0%) (0.0%) (0.0%) Canada (11.2%) (11.3%) (16.8%) (15.0%) (13.7%) (9.3%) (4.6%) 0.3% 0.5% (3.2%) 3.2% North America (1.3%) (1.6%) (2.2%) (2.0%) (1.8%) (1.0%) (0.5%) 0.0% 0.1% (0.3%) 0.3% Other (12.5%) (16.5%) (11.7%) (7.6%) (12.1%) (4.3%) (3.0%) (7.4%) (13.4%) (7.5%) (9.8%) Total (2.0%) (2.4%) (2.9%) (2.4%) (2.5%) (1.2%) (0.7%) (0.6%) (1.2%) (0.9%) (0.6%) Growth % from Acquisitions (Dispositions), net United States 3.2% 5.0% 2.5% 1.0% 2.8% 1.3% 0.7% 0.4% 0.2% 0.6% 0.0% Canada 4.5% 0.0% 0.0% 0.0% 0.9% 0.0% 0.0% 0.0% (1.5%) (0.4%) (2.4%) North America 3.4% 4.3% 2.1% 0.8% 2.6% 1.2% 0.6% 0.4% 0.0% 0.5% (0.2%) Other 23.8% 44.2% 19.3% 1.6% 21.0% 2.4% 0.5% 45.3% 66.1% 31.9% 74.1% Total 4.5% 6.6% 3.4% 0.9% 3.8% 1.3% 0.6% 4.3% 6.2% 3.2% 6.6% 2015 2016 2017

13 ADJUSTED EBITDA TRENDING SCHEDULE (US$ in thousands, except percentages) Q1 Q2 Q3 Q4 FY Q1 Q2 Q3 Q4 FY Q1 ADVERTISING AND COMMUNICATIONS GROUP Revenue $302,222 $336,606 $328,415 $359,013 $1,326,256 $309,042 $337,047 $349,254 $390,442 $1,385,785 $344,700 Operating profit (loss) 26,013 54,372 43,419 13,478 137,282 21,678 36,868 (3,700) 37,703 92,549 16,968 Depreciation and amortization 11,854 13,554 12,749 12,292 50,449 10,823 10,926 11,053 12,059 44,861 10,589 Goodwill impairment - - - - - - - 29,631 18,893 48,524 - Stock-based compensation 3,500 4,863 2,660 4,033 15,056 3,881 4,880 4,623 5,094 18,478 4,346 Acquisition deal costs 284 255 108 58 704 65 402 639 31 1,137 - Deferred acquisition consideration adjustments 2,248 (12,741) 4,927 41,913 36,347 6,327 (299) 11,152 (9,211) 7,969 11,431 Distributions from non-consolidated affiliates 334 176 67 102 679 - - - - - - Adjusted EBITDA (1) $44,233 $60,479 $63,930 $71,876 $240,517 $42,774 $52,777 $53,398 $64,569 $213,518 $43,334 REPORTABLE SEGMENT Revenue $247,494 $273,881 $267,657 $293,183 $1,082,215 $254,106 $270,936 $286,389 $320,509 $1,131,940 $286,805 Operating profit 26,017 41,015 38,816 27,790 133,638 19,498 26,437 20,217 46,001 112,153 11,577 Depreciation and amortization 7,420 8,321 7,798 7,815 31,354 7,060 7,151 9,978 9,299 33,488 8,393 Stock-based compensation 2,147 3,660 1,857 2,468 10,132 3,751 3,979 3,337 3,076 14,143 3,913 Acquisition deal costs 284 216 87 14 601 65 402 639 31 1,137 - Deferred acquisition consideration adjustments 1,371 (6,563) 3,811 20,424 19,043 4,118 1,316 9,866 (8,240) 7,060 9,371 Distributions from non-consolidated affiliates 304 - 30 68 402 - - - - - - Adjusted EBITDA (1) $37,543 $46,649 $52,399 $58,579 $195,170 $34,492 $39,285 $44,037 $50,167 $167,981 $33,254 ALL OTHER Revenue $54,728 $62,725 $60,758 $65,830 $244,041 $54,936 $66,111 $62,865 $69,933 $253,845 $57,895 Operating profit (loss) (4) 13,357 4,603 (14,312) 3,644 2,180 10,431 (23,917) (8,298) (19,604) 5,391 Depreciation and amortization 4,434 5,233 4,951 4,477 19,095 3,763 3,775 1,075 2,760 11,373 2,196 Goodwill impairment - - - - - - - 29,631 18,893 48,524 - Stock-based compensation 1,353 1,203 803 1,565 4,924 130 901 1,286 2,018 4,335 433 Acquisition deal costs - 39 21 44 104 - - - - - - Deferred acquisition consideration adjustments 877 (6,178) 1,116 21,489 17,304 2,209 (1,615) 1,286 (971) 909 2,060 Distributions from non-consolidated affiliates 30 176 37 34 277 - - - - - - Adjusted EBITDA (1) $6,690 $13,830 $11,531 $13,297 $45,348 $8,282 $13,492 $9,361 $14,402 $45,537 $10,080 2015 2016 2017 1 Adjusted EBITDA is a non - GAAP measure. See appendix for the definition. See schedules 2 and 3 the Q1 2017 press release for a re conciliation of Net loss to Adjusted EBITDA. Note: Results for 2016 have been recast to reflect the reclassification of one of our CRM businesses from the Reportable Segm ent to All Other effective January 1, 2017. Note: Actuals may not foot due to rounding.

14 ADJUSTED EBITDA TRENDING SCHEDULE (cont.) 1 Adjusted EBITDA is a non - GAAP measure. See appendix for the definition. See schedules 2 and 3 the Q1 2017 press release for a re conciliation of Net loss to Adjusted EBITDA. Note: Results for 2016 have been restated to reflect the reclassification of one of our CRM businesses from the Reportable Se gme nt to All Other effective January 1, 2017. Note: Actuals may not foot due to rounding. (US$ in thousands, except percentages) Q1 Q2 Q3 Q4 FY Q1 Q2 Q3 Q4 FY Q1 CORPORATE GROUP Revenue $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 Operating loss (20,818) (9,890) (19,801) (14,663) (65,172) (13,130) (12,801) (7,051) (11,136) (44,118) (8,569) Depreciation and amortization 446 453 337 538 1,774 397 510 359 319 1,585 309 Stock-based compensation 945 451 606 738 2,740 804 650 605 466 2,525 604 Acquisition deal costs 590 587 620 411 2,208 488 505 167 343 1,503 - Distributions from non-consolidated affiliates 8 112 30 7,122 7,272 - - 1,247 802 2,049 - Other items, net 5,762 (4,718) 7,751 (468) 8,327 1,486 252 (2,463) 371 (354) 135 Adjusted EBITDA (1) ($13,067) ($13,005) ($10,457) ($6,322) ($42,851) ($9,955) ($10,884) ($7,136) ($8,835) ($36,810) ($7,521) TOTAL Revenue $302,222 $336,606 $328,415 $359,013 $1,326,256 $309,042 $337,047 $349,254 $390,442 $1,385,785 $344,700 Operating profit (loss) 5,195 44,482 23,618 (1,185) 72,110 8,548 24,067 (10,751) 26,567 48,431 8,399 Depreciation and amortization 12,300 14,007 13,086 12,830 52,223 11,220 11,436 11,412 12,378 46,446 10,898 Goodwill impairment - - - - - - - 29,631 18,893 48,524 - Stock-based compensation 4,445 5,314 3,266 4,771 17,796 4,685 5,530 5,228 5,560 21,003 4,950 Acquisition deal costs 874 842 728 469 2,912 553 907 806 374 2,640 - Deferred acquisition consideration adjustments 2,248 (12,741) 4,927 41,913 36,347 6,327 (299) 11,152 (9,211) 7,969 11,431 Distributions from non-consolidated affiliates 342 288 97 7,224 7,951 - - 1,247 802 2,049 - Other items, net 5,762 (4,718) 7,751 (468) 8,327 1,486 252 (2,463) 371 (354) 135 Adjusted EBITDA (1) $31,166 $47,474 $53,473 $65,554 $197,666 $32,819 $41,893 $46,262 $55,734 $176,708 $35,813 2015 2016 2017

15 ACQUISITION REVENUE DETAIL 1 For the three months ended March 31, 2017, revenue from acquisitions was comprised of $18.6 million from 2016 acquisitions. 2 Contributions to organic revenue growth (decline) represents the change in revenue, measured on a constant currency basis, re lat ive to the comparable pre - acquisition period for acquired businesses that is included in the Company’s organic revenue growth (decline) calculation. Note: Actuals may not foot due to rounding Reconciliation of Non - GAAP Acquisitions (Dispositions), net to Revenue in the Statement of Operations (US$ in millions) 2015 FY Q1 Q2 Q3 Q4 FY Q1 Revenue from acquisitions (dispositions), net (1) 45.8$ 6.6$ 2.8$ 17.1$ 24.7$ 51.1$ 18.6$ Foreign exchange impact 1.3 0.0 0.0 0.1 1.3 1.5 1.1 Contribution to organic revenue (growth) decline (2) (0.8) (2.8) (0.9) (3.1) (3.3) (10.1) 1.4 Prior year revenue from dispositions - - - - (0.5) (0.5) (0.7) Non-GAAP acquisitions (dispositions), net 46.3$ 3.8$ 1.9$ 14.1$ 22.2$ 42.0$ 20.4$ 2016 2017

16 RECONCILIATIONS Note: Actuals may not foot due to rounding (US$ in millions) Q1 Q2 Q3 Q4 FY Q1 Q2 Q3 Q4 FY Q1 Other items, net SEC investigation and class action litigation expenses 5,762$ 3,882$ 2,722$ 1,340$ 13,706$ 1,486$ 1,359$ 767$ 454$ 4,066$ 339$ SEC final settlement payment - - - - - - - - 1,500 1,500 - D&O insurance proceeds - - - (1,000) (1,000) - (1,107) (3,230) (1,583) (5,920) (204) CEO repayment for certain perquisites and expenses - (8,600) (1,877) (808) (11,285) - - - - - - CEO and CAO termination related expenses - - 6,906 - 6,906 - - - - - - Total other items, net 5,762$ (4,718)$ 7,751$ (468)$ 8,327$ 1,486$ 252$ (2,463)$ 371$ (354)$ 135$ Capital expenditures, net Capital expenditures (5,656)$ (3,848)$ (8,161)$ (5,910)$ (23,575)$ (5,539)$ (7,909)$ (6,275)$ (9,709)$ (29,432)$ (9,413)$ Landlord reimbursements 356 36 1,259 805 2,456 - 871 248 3,651 4,770 75 Total capital expenditures, net (5,300)$ (3,812)$ (6,902)$ (5,105)$ (21,119)$ (5,539)$ (7,038)$ (6,027)$ (6,058)$ (24,662)$ (9,338)$ Cash interest, net & other Cash interest paid (367)$ (25,401)$ (590)$ (26,308)$ (52,666)$ (25,703)$ (1,212)$ (1,063)$ (36,692)$ (64,670)$ (999)$ Bond interest accrual adjustment (12,403) 12,403 (12,403) 12,403 - 11,995 (15,680) (14,625) 20,800 2,490 (14,625) Adjusted cash interest paid (12,770) (12,998) (12,993) (13,905) (52,666) (13,708) (16,892) (15,688) (15,892) (62,180) (15,624) Interest income 119 105 114 129 467 178 203 218 209 808 227 Other - - - - - - - - - - - Total cash interest, net & other (12,651)$ (12,893)$ (12,879)$ (13,776)$ (52,199)$ (13,530)$ (16,689)$ (15,470)$ (15,683)$ (61,372)$ (15,397)$ Miscellaneous other disclosures Net income attributable to the noncontrolling interests 2,380$ 2,841$ 2,122$ 1,711$ 9,054$ 859$ 1,254$ 1,059$ 2,046$ 5,218$ 883$ Cash taxes 540$ 175$ 685$ 487$ 1,887$ 143$ 664$ 1,991$ 97$ 2,895$ 1,293$ Acquisition deal costs 874$ 842$ 728$ 469$ 2,913$ 553$ 907$ 806$ 374$ 2,640$ 234$ 2015 2016 2017

17 AVAILABLE LIQUIDITY 1 1 Subject to available borrowings under the Credit Facility. Note: Actuals may not foot due to rounding (US$ in millions) March 31, 2017 December 31, 2016 Commitment Under Facility $325.0 $325.0 Drawn 4.9 54.4 Undrawn Letters of Credit 4.8 4.4 Undrawn Commitments Under Facility $315.3 $266.2 Total Cash & Cash Equivalents 23.2 27.9 Liquidity $338.5 $294.1

18 CURRENT CREDIT PICTURE 1 These ratios and measures are not based on generally accepted accounting principles and are not presented as alternatives mea sur es of operating performance or liquidity. Some of these ratios and measures include, among other things, proforma adjustments for acquisitions, one - time charges, and other items, as defined in the Credit Agreement. They are presented here to demonstrate compliance with the covenants in the Credit Agreement, as non - compliance with such covenants could have a material adverse effect on the Company. 2 Covenant EBITDA is a measure that includes pro forma adjustments for acquisitions, one - time charges, and other items, as defined in the Credit Agreement. 3 Total Senior Leverage is a measure that includes borrowings under the Credit Agreement, outstanding letters of credit, less c ash held in depository accounts, as defined in the Credit Agreement 4 Net Debt is a measure that includes borrowings under the Credit Agreement, the Senior Notes, other outstanding debt and lette rs of credit, less cash held in depository accounts, as defined in the Credit Agreement. Net Debt does not include Deferred Acquisition Consideration with the exception of certain fixed components ( $3.9 million as of March 31, 2017 and $2.8 million as of December 31, 2016), and it does not include minority interest. 5 Based on borrowings as of March 31, 2017. Excludes capital leases, other outstanding debt and letters of credit, and Deferred Ac quisition Consideration. Note: Actuals may not foot due to rounding Current Debt Maturity Profile (5) $325 million Credit Facility Covenants (1) (US$ in millions) March 31, December 31, 2017 2016 Covenants I. Total Senior Leverage Ratio 0.0 0.3 Maximum per covenant 2.0 2.0 II. Total Leverage Ratio 4.7 5.0 Maximum per covenant 5.5 5.5 III. Fixed Charges Ratio 3.2 2.0 Minimum per covenant 1.0 1.0 IV. Covenant EBITDA (2) $191.9 $190.4 Minimum per covenant $105.0 $105.0 Debt Calculation Total Senior Leverage, net (3) $5.2 $53.7 Net Debt (4) $909.8 $956.9 Twelve Months Ended

19 TEMPORAL PUT OBLIGATIONS AND IMPACT ON EBITDA 1 This amount is in addition to ( i ) $44.1 million of options to purchase only exercisable upon termination not within the control of the Company, or death, and (i i) the excess of the initial redemption value recorded in Redeemable Noncontrolling Interests over the amount the Company would be required to pay to the hol ders should the Company acquire the remaining ownership interests. Note: Actuals may not foot due to rounding Incremental (US$ in millions) Cash Stock Total Income in Period 2017 $3.2 $0.0 $3.2 $2.8 2018 2.6 0.0 2.6 0.9 2019 2.3 0.1 2.4 0.0 2020 2.7 0.0 2.7 1.1 Thereafter 1.5 0.0 1.5 0.0 Total $12.3 $0.1 $12.4(1) $4.8 Effective Multiple 2.6x Estimated Put Impact at March 31, 2017 Payment Consideration

20 DEFINITION OF NON - GAAP MEASURES In addition to its reported results, MDC Partners has included in its earnings release and supplemental management presentati on certain financial results that the Securities and Exchange Commission defines as "non - GAAP financial measures." Management believes that such non - GAAP financial m easures, when read in conjunction with the Company's reported results, can provide useful supplemental information for investors analyzing period t o p eriod comparisons of the Company's results. Such non - GAAP financial measures include the following: Organic Revenue: Organic Revenue: “Organic revenue growth” and “organic revenue decline” refer to the positive or negative results, respective l y, of subtracting both the foreign exchange and acquisition (disposition) components from total revenue growth. The acquisition (disposition) c omp onent is calculated by aggregating prior period revenue for any acquired businesses, less the prior period revenue of any businesses that were dispo sed of during the current period. The organic revenue growth (decline) component reflects the constant currency impact of (a) the change in revenue of the partner fir ms which the Company has held throughout each of the comparable periods presented, and (b) “non - GAAP acquisitions (dispositions), net”. Non - GAAP acquisitions (dispositions), net consists of ( i ) for acquisitions during the current year, the revenue effect from such acquisition as if the acquisition had been owned durin g t he equivalent period in the prior year and (ii) for acquisitions during the previous year, the revenue effect from such acquisitions as if they had been owned durin g t hat entire year (or same period as the current reportable period), taking into account their respective pre - acquisition revenues for the applicable periods, and (iii) for dispositions, the revenue effect from such disposition as if they had been disposed of during the equivalent period in the prior year. Net New Business: Estimate of annualized revenue for new wins less annualized revenue for losses incurred in the period. Adjusted EBITDA: Adjusted EBITDA is a non - GAAP measure that represents operating profit (loss) plus depreciation and amortization, stock - based compensation, deferred acquisition consideration adjustments, distributions from non - consolidated affiliates, and other items. P rior to 2017, Adjusted EBITDA included an additional adjustment for acquisition deal costs. Beginning with 2017, on a prospective basis we no longer includ e t he acquisition deal cost adjustment but we continue to disclose this metric for your reference. Included in the Company’s earnings release and supplemental management presentation are tables reconciling MDC Partners’ repo rte d results to arrive at certain of these non - GAAP financial measures. We are unable to reconcile our projected 2017 organic revenue growth to the corresponding GAAP measure because we are unable to predict the 2017 impact of foreign exchange due to the unpredictability of future changes in foreign exchange r ate s and because we are unable to predict the occurrence or impact of any acquisitions, divestitures or other potential changes. We are unable to reconcile ou r p rojected 2017 increase in Adjusted EBITDA margin to the corresponding GAAP measure because the amount and timing of many future charges that impact these measur es (such as amortization of future acquired intangible assets, foreign exchange transaction gains or losses, impairment charges, and provision or benefit fo r income taxes) are variable, uncertain, or out of our control and therefore cannot be reasonably predicted without unreasonable effort, if at all. As a re sul t, we are unable to provide reconciliations of these measures. In addition, we believe such reconciliations could imply a degree of precision that might be confusing or misleading to investors. Note: A reconciliation of non - GAAP to US GAAP reported results has been provided by the Company in the tables included in the earnings release issued on April 27, 2017.

MDC Partners Innovation Center 745 Fifth Avenue, Floor 19 New York, NY 10151 646 - 429 - 1800 www.mdc - partners.com