Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - FIRST PRIORITY FINANCIAL CORP. | d386757d8k.htm |

Exhibit 99.1

First Priority Financial Corp.

Annual Shareholders’ Meeting

April 27th, 2017

Safe Harbor Regarding Forward Looking Statements

This presentation contains certain forward-looking information about First Priority Financial Corp. that is intended to be covered by the safe harbor for forward-looking statements

provided by the Private Securities Litigation Reform Act of 1995. Forward-looking statements are statements that are not historical facts and can be identified by the use of forward-looking terminology such as the words “believes,”

“expects,” “anticipates,” “estimates,” “plans,” “projects,” “predicts,” “intends,” “seeks,” “will,” “may,” “should,” “would,”

“continues,” “hope” and similar expressions, or the negative of these terms. Such statements are based on current expectations and are subject to risks, uncertainties and changes in condition, significance, value, and effect.

Such risks, uncertainties and changes in condition, significance, value and effect could cause First Priority Financial Corp.’s actual results to differ materially from those anticipated events.

Factors, risks, uncertainties, and contingencies that may cause actual results to differ from those anticipated include, but are not limited to, the following: the strength of the

United States economy in general and the strength of the regional and local economies in which First Priority conducts operations; the effects of changing economic conditions in First Priority’s market areas and nationally; the effects of, and

changes in, trade, monetary, and fiscal policies and laws, including interest rate policies of the Board of Governors of the Federal Reserve System; changes in federal and state banking, insurance, and investment laws and regulations which could

impact First Priority’s operations; inflation, interest rate, market, and monetary fluctuations; First Priority’s timely development of competitive new products and services in a changing environment and the acceptance of such products and

services by customers; the impact of changes in financial services policies, laws, and regulations, and the impact of changes in and interpretations of generally accepted accounting principles; the occurrence of adverse changes in the securities

markets; the effects of changes in technology or in consumer spending and savings habits; armed conflicts involving the United States; regulatory or judicial proceedings; changes in asset quality; and First Priority’s success in managing the

risks involved in the foregoing.

You are cautioned not to place undue reliance on any such forward-looking statements, which speak only as of the date of this

presentation.

April 27, 2017 FPFC Annual Shareholder Meeting

Snapshot First Priority Financial Corp.

Headquarters: 2 W. Liberty Blvd. Malvern, PA

Website: www.fpbk.com

Trading Symbol: FPBK (on OTCQX)

Closing Price on 4/25/2017: $7.99 on 4/25/2016: $6.20

Book Value per Share: $6.96 (3/31/17)

Tangible Book Value per Share: $6.51

(3/31/17) Market Price/TBV = 123%

Total Assets: $603 million (3/31/17)

Total

Shareholders’ Equity: $49 million (3/31/17)

Total Shares Outstanding: 6,540,919 (3/31/17)

Number of Shareholders: 825 (3/10/17)

Full Time Equivalent Employees: 70

April 27, 2017 FPFC Annual Shareholder Meeting

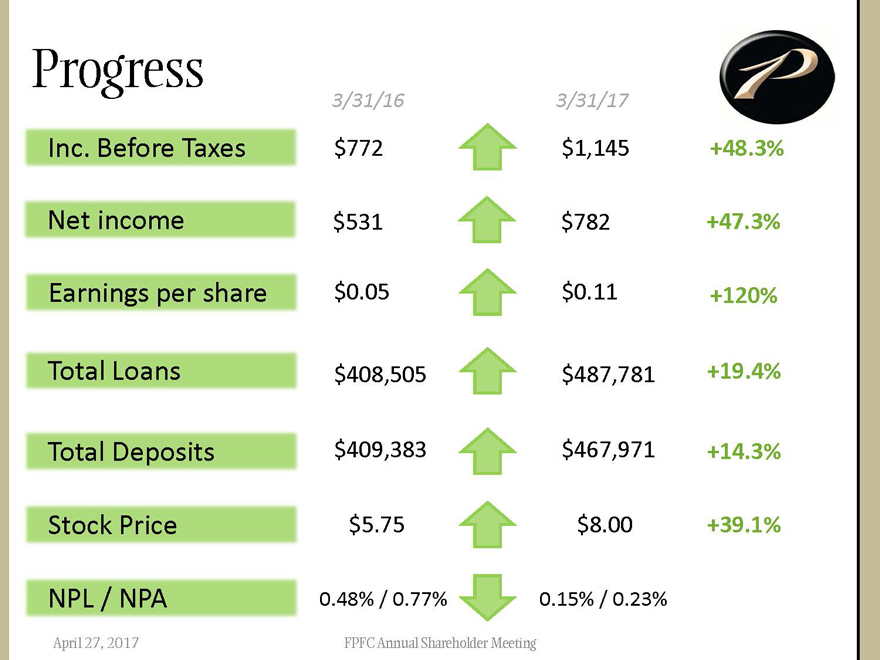

Progress

3/31/16 3/31/17

Inc. Before Taxes $772 $1,145 +48.3%

Net income $531 $782 +47.3%

Earnings per share $0.05 $0.11 +120%

Total Loans $408,505 $487,781 +19.4%

Total Deposits $409,383 $467,971 +14.3%

Stock Price $5.75 $8.00 +39.1%

NPL / NPA 0.48% / 0.77% 0.15% / 0.23%

April 27, 2017 FPFC Annual Shareholder Meeting

Significant Achievements

Pre-tax earnings exceed $1,100,000 per quarter (Q1-2016, and Q1-2017)

Acquired $64MM Loan and Relationship purchase (August, 2016)

Redeemed $6MM of 9% preferred

stock (January, 2016)

LTM Income to Common Shareholders up 58.7%; Net Income up 14.6%

(LTM Net Income $2.55MM)

Total assets reach $600 million (March 31, 2017)

Stock Price reaches $8.00 (March 31, 2017)

LTM Avg. Daily trading volume=4,380 shares / Total

shares traded=1.14 million

Q-1 ROA=.56% ROE=6.53%

Opened Bala Cynwyd LPO (January, 2017)

Broadened the depth of Cash Management sales

capabilities

April 27, 2017 FPFC Annual Shareholder Meeting

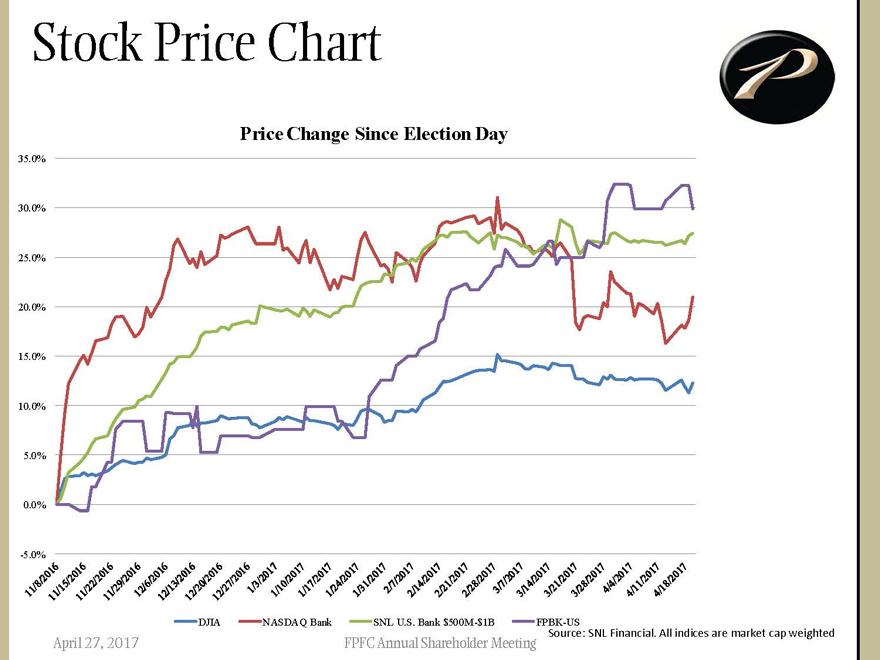

Stock Price Chart

Price

Change Since Election Day

35.0%

30.0%

25.0%

20.0%

15.0%

10.0%

5.0%

0.0%

-5.0%

11/8/2016 11/15/2016 11/22/2016 11/29/2016 12/6/2016 12/13/2016

12/20/2016 12/27/2016 1/3/2017 1/10/2017 1/17/2017 1/24/2017 1/31/2017 2/7/2017 2/14/2017 2/21/2017 2/28/2017 3/7/2017 3/14/2017 3/21/2017 3/28/2017 4/4/2017 4/11/2017 4/18/2017

DJIA NASDAQ Bank SNL U.S. Bank $500M-$1B FPBK-US

Source: SNL Financial. All indices are market cap weighted

April 27,

2017 FPFC Annual Shareholder Meeting

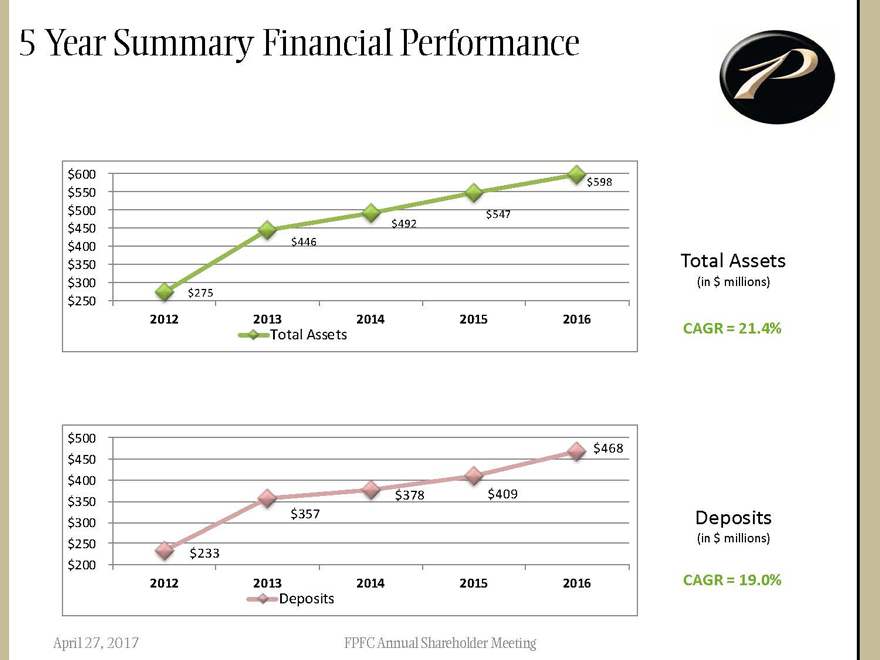

5 Year Summary Financial Performance

$600 $598

$550

$500 $547

$450 $492

$400 $446

$350

$300

$250 $275

2012 2013 2014 2015 2016

Total Assets

Total Assets

(in $ millions)

CAGR = 21.4%

$500 $468

$450

$400

$350 $378 $409

$300 $357

$250 $233

$200

2012 2013 2014 2015 2016

Deposits

Deposits

(in $ millions)

CAGR = 19.0%

April 27, 2017 FPFC Annual Shareholder Meeting

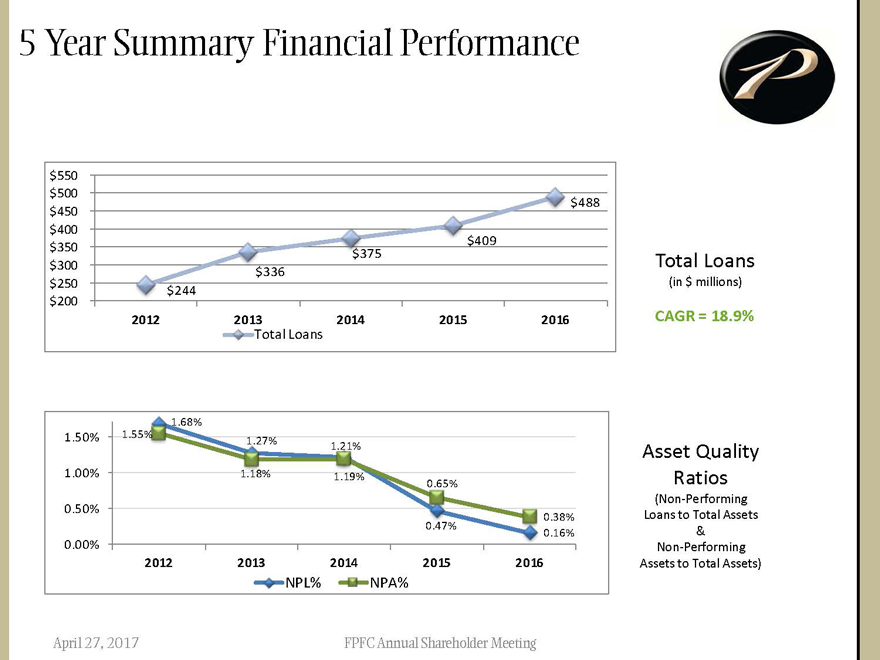

5 Year Summary Financial Performance

$550

$500

$450 $488

$400

$409

$350 $375

$300 $336

$250 $244

$200

2012 2013 2014 2015 2016

Total Loans

Total Loans

(in $ millions)

CAGR = 18.9%

1.68%

1.50% 1.55% 1.27% 1.21%

1.00% 1.18% 1.19% 0.65%

0.50% 0.38%

0.47% 0.16%

0.00%

2012 2013 2014 2015 2016

NPL% NPA%

Asset Quality Ratios

(Non-Performing Loans to Total

Assets & Non-Performing Assets to Total Assets)

April 27, 2017 FPFC Annual Shareholder Meeting

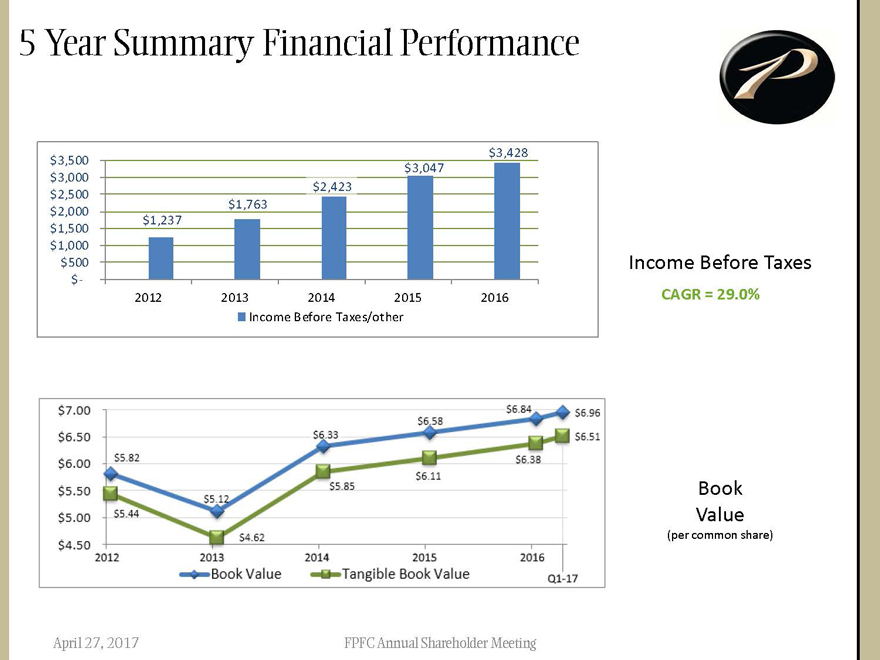

5 Year Summary Financial Performance

P

$3,428

$3,500 $3,047

$3,000

$2,500 $2,423

$2,000 $1,763

$1,500 $1,237

$1,000

$500

$-

2012 2013 2014 2015 2016

Income Before Taxes/other

Income Before Taxes

CAGR = 29.0%

$7.00 $6.50 $6.00 $5.50 $5.00 $4.50

$5.82 $5.44 $5.12 $4.62 $6.33 $5.85 $6.58 $6.11 $6.84

$6.38 $6.96 $6.51

2012 2013 2014 2015 2016

Book Value Tangible Book Value Q1-17

Book Value

(per common share)

April 27, 2017 FPFC Annual Shareholder Meeting

Our Environment: Headwinds

P

Market Saturation: Size / Share, and the competitive situation

Changing customer preferences

Need for size and relevance

Regulatory climate

Maintain discipline

April 27, 2017 FPFC Annual Shareholder Meeting

Our Environment: Tailwinds

P

Consolidation

Market saturation reduction

Availability of more qualified and experienced Bankers

Market valuations

Availability of capital

Leveling of technology playing field

De-Novo drought

April 27, 2017 FPFC Annual Shareholder Meeting

The New Community Bank

P

$1B - $5B Asset Size

Serving multiple communities

Capital strength, Access to capital markets

Broad mix of financial services

Levering cost base

Strategic Optionality

April 27, 2017 FPFC Annual Shareholder Meeting

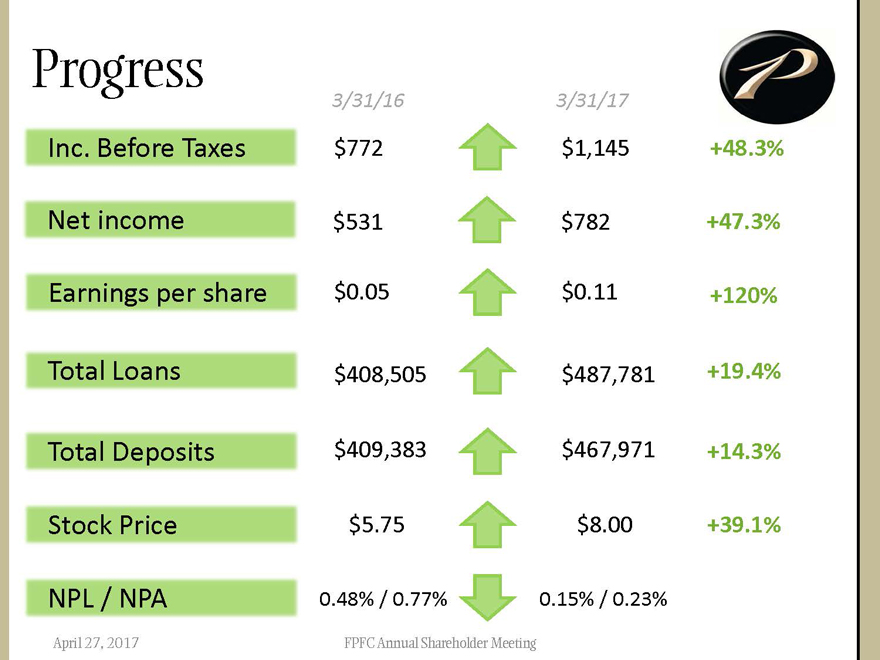

Progress

P

3/31/16 3/31/17

Inc. Before Taxes $772 $1,145 +48.3%

Net income $531 $782 +47.3%

Earnings per share $0.05 $0.11 +120%

Total Loans $408,505 $487,781 +19.4%

Total Deposits $409,383 $467,971 +14.3%

Stock Price $5.75 $8.00 +39.1%

NPL / NPA 0.48% / 0.77% 0.15% / 0.23%

April 27, 2017 FPFC Annual Shareholder Meeting