Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - A10 Networks, Inc. | exhibit991pressreleaseq117.htm |

| 8-K - 8-K EARNINGS RELEASE Q1'17 - A10 Networks, Inc. | a8-kpressreleaseq117.htm |

YOUR SECURE

APPLICATION

SERVICES COMPANY

First Quarter 2017

Financial Results &

Commentary

April 27, 2017

1

Agenda

Introduction

• Maria Riley, Investor Relations

Results Overview

• Lee Chen, CEO, President and Founder

Q1 2017 Financial Results & Q2 2017 Business Outlook

• Shiva Natarajan, Interim CFO

Q & A

• Lee Chen, CEO, President and Founder

• Shiva Natarajan, Interim CFO

• Ray Smets, EVP – Worldwide Sales

2

Cautionary Statements and Disclosures

3

This presentation and the accompanying oral presentation contain “forward-looking” statements that are based on our management’s beliefs and

assumptions and on information currently available to management, including continued acceptance of A10’s products in the marketplace, growing demand

for ADC security features, meeting our financial goals, the anticipated results of any past or future acquisitions, expanding our total addressable

market, financial results, plans, assumptions, strategy, international growth, business outlook and revenue.

We operate in very competitive and rapidly changing environments, and new risks may emerge from time to time. It is not possible for our management to

predict all risks, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual

results to differ materially from those contained in any forward-looking statements we may make. Forward-looking statements are subject to known and

unknown risks, uncertainties, assumptions and other factors including, but not limited to, those related to continued market adoption of our products, our

ability to successfully anticipate market needs and opportunities, our timely development of new products and features, any loss or delay of expected

purchases by our largest end-customers, our ability to attract and retain new end-customers, continued growth in markets relating to network security, our

ability to hire, retain and motivate qualified personnel, the success of any future acquisitions or investments in complementary companies, products,

services or technologies and the ability to successfully integrate acquisitions such as Appcito, the ability of our sales team to execute well, our ability to

shorten our close cycles, the ability of our channel partners to sell our products, our ability to achieve or maintain profitability while continuing to invest in our

sales, marketing and research and development teams, variations in product mix or geographic locations of our sales, fluctuations in currency exchange rates,

and risks associated with our significant presence in international markets.

These factors, together with those described in our quarterly reports on Form 10-Q, annual reports on Form 10-K and other filings made with the Securities

and Exchange Commission (“SEC”), may cause our actual results, performance or achievements to differ materially and adversely from those anticipated or

implied by our forward-looking statements.

You should not rely upon forward-looking statements as predictions of future events. Although our management believes that the expectations

reflected in our forward-looking statements are reasonable, we cannot guarantee that the future results, levels of activity, performance or events and

circumstances described in the forward-looking statements will be achieved or occur. Moreover, neither we, nor any other person, assume

responsibility for the accuracy and completeness of the forward-looking statements. We disclaim any obligation to update information contained in these

forward-looking statements whether as a result of new information, future events, or otherwise.

Cautionary Statements and Disclosures

4

In addition to the U.S. GAAP financials, this presentation includes certain non-GAAP financial measures. The non-GAAP measures have limitations as

analytical tools and you should not consider them in isolation or as a substitute for an analysis of our results under U.S. GAAP. There are a number of

limitations related to the use of these non-GAAP financial measures versus their nearest GAAP equivalents. For example, other companies may calculate

non-GAAP financial measures differently or may use other measures to evaluate their performance, all of which could reduce the usefulness of our non-

GAAP financial measures as tools for comparison.

A10 Networks considers these non-GAAP financial measures to be important because they provide useful measures of the operating performance of the

company, exclusive of unusual events or factors that do not directly affect what we consider to be our core operating performance, and are used

by the company's management for that purpose.

With the exception of revenue, all financial measures discussed today are on a non-GAAP basis and have been adjusted to exclude certain charges. The

use of non-GAAP measures is further discussed in the accompanying quarterly financial results press release, which has been furnished to the SEC on Form

8-K and posted on A10 Networks’ website. The press release also defines our non-GAAP financial measures.

A reconciliation between GAAP and non-GAAP measures for historical periods can also be found in the appendix to this document, in the accompanying

press release and on the trended quarterly financial statements posted on the company’s website. A reconciliation of non-GAAP guidance measures to

corresponding GAAP measures on a forward-looking basis is not available, due to high variability and low visibility with respect to the charges which

are excluded from these non-GAAP measures.

Lee Chen

CEO, President and Founder

5

First Quarter 2017 Summary

First Quarter Revenue of $60.3 M, up 12% y/y

• Achieved product revenue of $39.7 M, up 9% y/y

• Growth driven by continued demand for our cloud & security solutions across cloud provider, service

provider and web-scale customers

• 20% y/y growth in Japan

• 52% y/y growth in APAC, excluding Japan

• Record deferred revenue of $93.1 M, which grew 24% y/y

Continued Bottom-Line Improvement

• Achieved non-GAAP net income of $0.7 M or $0.01 on a per share basis, compared with a loss of

$0.06 per share in last year’s first quarter

6

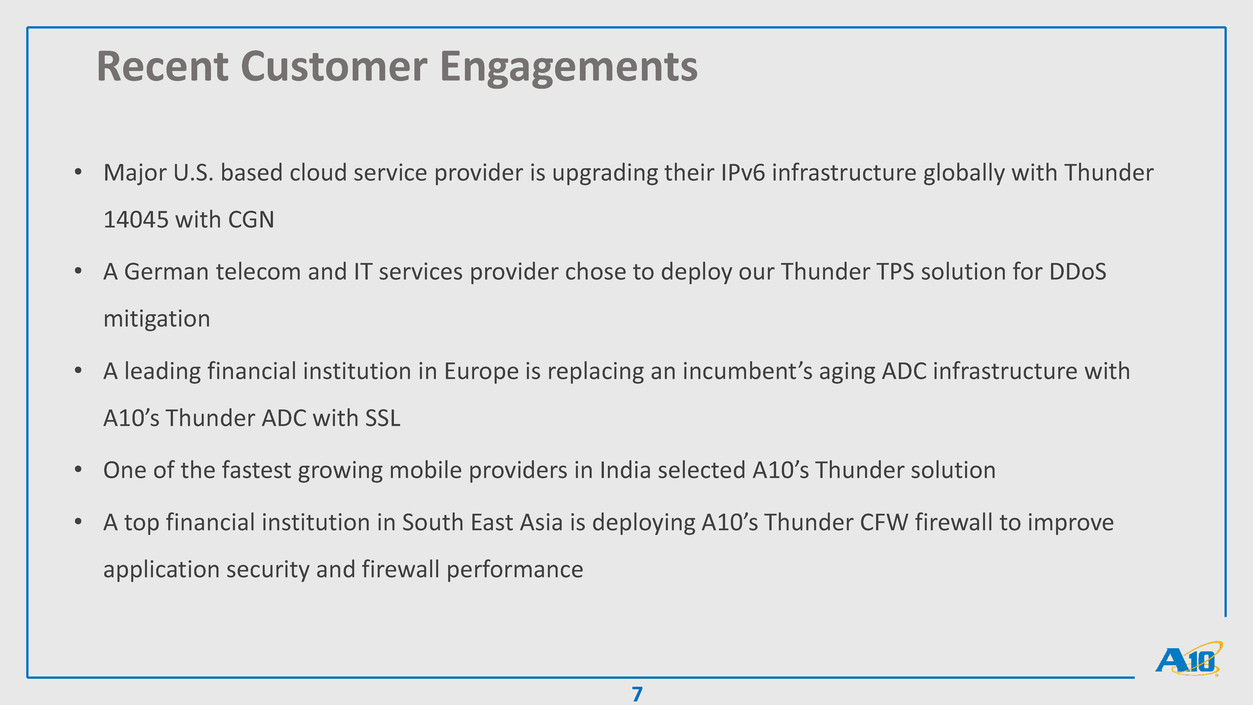

Recent Customer Engagements

• Major U.S. based cloud service provider is upgrading their IPv6 infrastructure globally with Thunder

14045 with CGN

• A German telecom and IT services provider chose to deploy our Thunder TPS solution for DDoS

mitigation

• A leading financial institution in Europe is replacing an incumbent’s aging ADC infrastructure with

A10’s Thunder ADC with SSL

• One of the fastest growing mobile providers in India selected A10’s Thunder solution

• A top financial institution in South East Asia is deploying A10’s Thunder CFW firewall to improve

application security and firewall performance

7

8

Enabling Application Agility

ACOS ACOS

Application Delivery & Security

Appliance & SDN

Virtualization / NFV

Lightweight ADC

Secure Application Services

Containers & Microservices

On Premise Cloud

S TA B I L I T Y & P E R F O R M A N C E A G I L I T Y & F LU I D I T Y

ANALYTICS

API CONFIGS

APPLICATIONS APPLICATIONS

Controller

9

ANY USER. ANY APP. ANY WHERE.

PRIVATE

CLOUD

DATA

CENTER

HACKER

DDOS

ATTACK

HOME

OFFICE

REMOTE

USER

PUBLIC

CLOUD

SAAS

CLOUD

AVAILABILITY

SECURITY VISIBILITY

A10’s Harmony Vision

Shiva Natarajan

Interim CFO

10

Revenue Trend

QUARTERLY

$M

$179

$199

$230

2014 2015 2016

ANNUAL

$M

Annual

$48

$51

$57

$54

$57

$55

$64

$60

Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1

2015 2016

11

2017

Revenue Mix

$ MILLIONS / % REVENUE

Product Geography Verticals

Numbers may not total to 100% due to rounding.

12

Non-GAAP Gross Profit

*Non-GAAP rounded financial measures. For reconciliation see Appendix.

13

2015 2016 2017

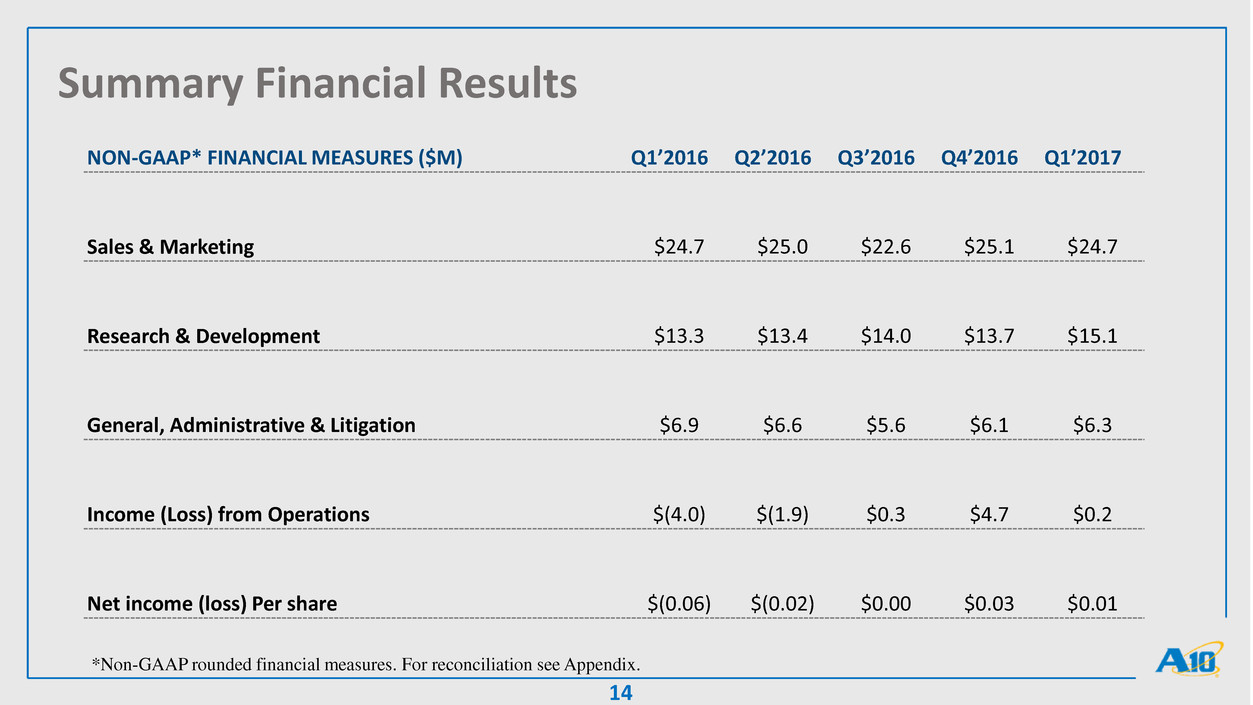

Summary Financial Results

NON-GAAP* FINANCIAL MEASURES ($M) Q1’2016 Q2’2016 Q3’2016 Q4’2016 Q1’2017

Sales & Marketing $24.7 $25.0 $22.6 $25.1 $24.7

Research & Development $13.3 $13.4 $14.0 $13.7 $15.1

General, Administrative & Litigation $6.9 $6.6 $5.6 $6.1 $6.3

Income (Loss) from Operations $(4.0) $(1.9) $0.3 $4.7 $0.2

Net income (loss) Per share $(0.06) $(0.02) $0.00 $0.03 $0.01

*Non-GAAP rounded financial measures. For reconciliation see Appendix.

14

Balance Sheet & Cash Flow

SELECTED GAAP FINANCIAL MEASURES ($M) Q1’2016 Q2’2016 Q3’2016 Q4’2016 Q1’2017

Cash and Marketable Securities $107.5 $113.7 $116.8 $114.3 $116.2

Accounts Receivable $41.9 $39.3 $48.9 $66.8 $61.8

Deferred Revenue (total) $74.8 $75.8 $83.2 $92.9 $93.1

Cash Flow Provided by (Used in) Ops $10.4 $8.8 $2.0 $(2.4) $0.5

15

Q2 2017 Business Outlook

Management will host a conference call to discuss A10’s financial results for its first quarter of 2017 and the current outlook

for the second quarter of 2017 on April 27, 2017 at 4:30 p.m. Eastern time / 1:30 p.m. Pacific time.

Open to the public, investors may access the call by dialing 1-844-792-3728 or 1-412-317-5105. A live audio webcast of the

conference call will be accessible from the “Investors” section of A10 Networks website at investors.a10networks.com. The

webcast will be archived for a period of one year. A telephonic replay of the conference call will be available one hour after

the call and will run for five business days and may be accessed by dialing 1-412-317-0088 or 1-877-344-7529 and entering

the passcode 10103323.

Please refer to page #3 for information regarding forward looking statements.

16

Question & Answer Session

LEE CHEN

CEO, President

and Founder

SHIVA NATARAJAN

Interim CFO

RAY SMETS

EVP Worldwide Sales

17

QUARTERLY Q1’16 Q2’16 Q3’16 Q4’16 Q1’17

Gross Profit Margin (GAAP) 75% 75% 76% 77% 77%

SBC included in COGS 1% 1% 1% —% —%

Gross Profit Margin (Non-GAAP) 76% 76% 77% 78% 77%

* SBC = stock-based compensation

QUARTERLY ($M) Q1’16 Q2’16 Q3’16 Q4’16 Q1’17

Gross Profit (GAAP) $40.6 $42.9 $42.1 $49.5 $46.1

SBC included in COGS $0.3 $0.2 $0.3 $0.2 $0.3

Gross Profit (Non-GAAP) $40.9 $43.1 $42.4 $49.7 $46.4

*Non-GAAP rounded financial measures

Non-GAAP Reconciliation – Gross Profit

18

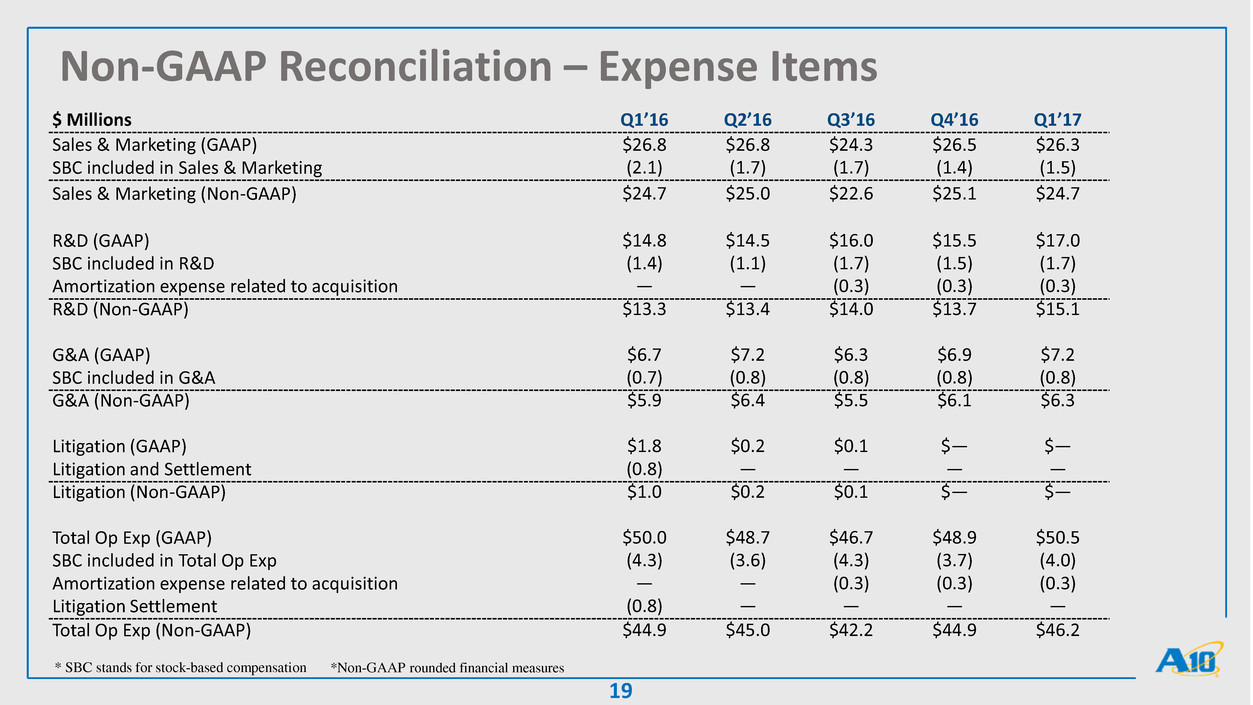

Non-GAAP Reconciliation – Expense Items

$ Millions Q1’16 Q2’16 Q3’16 Q4’16 Q1’17

Sales & Marketing (GAAP) $26.8 $26.8 $24.3 $26.5 $26.3

SBC included in Sales & Marketing (2.1) (1.7) (1.7) (1.4) (1.5)

Sales & Marketing (Non-GAAP) $24.7 $25.0 $22.6 $25.1 $24.7

R&D (GAAP) $14.8 $14.5 $16.0 $15.5 $17.0

SBC included in R&D (1.4) (1.1) (1.7) (1.5) (1.7)

Amortization expense related to acquisition — — (0.3) (0.3) (0.3)

R&D (Non-GAAP) $13.3 $13.4 $14.0 $13.7 $15.1

G&A (GAAP) $6.7 $7.2 $6.3 $6.9 $7.2

SBC included in G&A (0.7) (0.8) (0.8) (0.8) (0.8)

G&A (Non-GAAP) $5.9 $6.4 $5.5 $6.1 $6.3

Litigation (GAAP) $1.8 $0.2 $0.1 $— $—

Litigation and Settlement (0.8) — — — —

Litigation (Non-GAAP) $1.0 $0.2 $0.1 $— $—

Total Op Exp (GAAP) $50.0 $48.7 $46.7 $48.9 $50.5

SBC included in Total Op Exp (4.3) (3.6) (4.3) (3.7) (4.0)

Amortization expense related to acquisition — — (0.3) (0.3) (0.3)

Litigation Settlement (0.8) — — — —

Total Op Exp (Non-GAAP) $44.9 $45.0 $42.2 $44.9 $46.2

* SBC stands for stock-based compensation

19

*Non-GAAP rounded financial measures

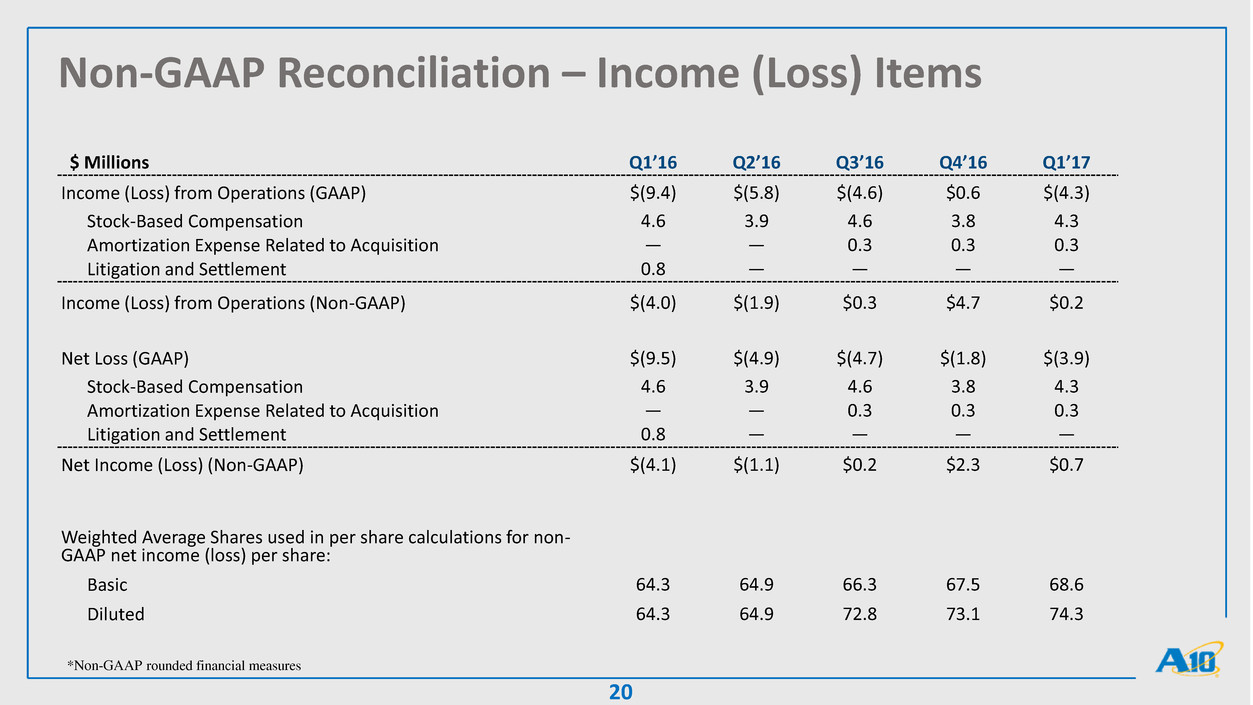

Non-GAAP Reconciliation – Income (Loss) Items

$ Millions Q1’16 Q2’16 Q3’16 Q4’16 Q1’17

Income (Loss) from Operations (GAAP) $(9.4) $(5.8) $(4.6) $0.6 $(4.3)

Stock-Based Compensation 4.6 3.9 4.6 3.8 4.3

Amortization Expense Related to Acquisition — — 0.3 0.3 0.3

Litigation and Settlement 0.8 — — — —

Income (Loss) from Operations (Non-GAAP) $(4.0) $(1.9) $0.3 $4.7 $0.2

Net Loss (GAAP) $(9.5) $(4.9) $(4.7) $(1.8) $(3.9)

Stock-Based Compensation 4.6 3.9 4.6 3.8 4.3

Amortization Expense Related to Acquisition — — 0.3 0.3 0.3

Litigation and Settlement 0.8 — — — —

Net Income (Loss) (Non-GAAP) $(4.1) $(1.1) $0.2 $2.3 $0.7

Weighted Average Shares used in per share calculations for non-

GAAP net income (loss) per share:

Basic 64.3 64.9 66.3 67.5 68.6

Diluted 64.3 64.9 72.8 73.1 74.3

20

*Non-GAAP rounded financial measures

Thank You

www.a10networks.com